From the Desk of Mitchell Morgan:

As the Founder and CEO of Morgan Properties, it brings me great pleasure to share with you a brief overview of all that our organization has grown to be. As we near the 40th anniversary of our company, there is so much that I am proud to reflect upon in our history, but also so much anticipation for what the future has in store.

Morgan Properties started from humble beginnings. I founded this company in 1985 with the purchase of three apartment communities in the suburbs of Philadelphia - all of which we still own today. Now, nearly four decades later, we have grown to be one of the most active multifamily owners and operators in the country. Along the way, we have benefited from strong partnerships with a great many stakeholders. Credibility and accountability are core components of our prosperity, and honoring our commitments to those who have invested alongside us is paramount. In 39 years, we’ve never defaulted on a loan or failed to live up to our obligations to our investors.

The multifamily industry has evolved dramatically over the years since Morgan Properties was founded. The needs and expectations of our customers are increasingly elevated, the competitive landscape is more dynamic, and technological advancements offer the prospect of efficiency with added complexity. Thus, we are compelled to routinely evaluate our approach in anticipation of what the future will bring. As we move forward, we do so with the recognition that we have a profound responsibility to the hundreds of thousands who choose to call one of our communities “home.”

Central to our success and longevity is ensuring that we have the right talent in place to capture opportunities as they arise and continuously maximize value for our residents and investors alike. I have always encouraged our team to think big and never settle for “good enough.” I’m certain that our achievements are a direct result of our people and culture, and I’m grateful for their efforts.

Please enjoy the first edition of our 2023—2024 Perspectives and know that this is only a sample of the impact Morgan Properties can provide. We remain humble, but always hungry.

Sincerely,

King of Prussia, PA

Forge Gate Apartment Homes Lansdale, PA

Brookside Manor Apartments & Townhomes Lansdale, PA

Forge Gate Apartment Homes Lansdale, PA

Brookside Manor Apartments & Townhomes Lansdale, PA

Morgan Properties was founded in 1985 with the purchase of three properties in Montgomery County, Pennsylvania: Kingswood, Brookside, and Forge Gate by Mitchell (Mitch) Morgan, its Founder and CEO. Morgan Properties and its affiliates currently own and manage a multifamily portfolio comprising over 90,000 units across more than 340 communities in 19 states. Mitch’s sons, Jonathan and Jason Morgan, now represent the next-generation leaders growing the platform and overseeing the business operations. The company is the nation’s largest private multifamily owner and the third-largest apartment owner in the United States. With over 2,400 employees, Morgan Properties prides itself on its quick decision-making capabilities, strong capital relationships, and proven operational expertise.

Mitchell Morgan and former partner purchase first three multifamily communities, Kingswood in King of Prussia and Brookside Manor and Forge Gate in Lansdale, PA - all of which Morgan Properties still owns today.

Mitchell Morgan takes sole ownership of the company and renames it Morgan Properties.

Morgan Properties buys 17,000-unit Westminster Management portfolio from Kushner Cos. for $1.9B.

Jonathan Morgan joins the family business and launches the Joint Venture platform, setting the stage for future company growth.

Morgan Properties completes its largest transaction to date at $1.9B, acquiring more than 18,000 units from unaffiliated Morgan Communities in Rochester, NY; becoming the fifth largest multifamily owner in the U.S.

Jason Morgan joins the family business, launches Morgan Properties’ Special Situations platform to invest in fixed income securities, equity recapitalizations, and other alternative investment opportunities.

Morgan Properties closes on $2.5B of transactions, acquiring three property portfolios and expanding geographic footprint across 20 states; becoming the secondlargest multifamily owner in the nation according to NMHC’s annual rankings.

Morgan Properties remains among top 3 largest multifamily owners in U.S. closing on $604M in transactions, expanding into Midwest and the Carolinas, while entering BTR market in Texas. Strategically sells $1.2B of real estate.

AJonathan Morgan PRESIDENT, MORGAN PROPERTIES JV

AJonathan Morgan PRESIDENT, MORGAN PROPERTIES JV

s we reflect on the past year and look forward to the future, we are filled with gratitude and optimism.

2023 demonstrated our teams’ strategic capabilities and dedication to excellence. Our focus on growing revenue while tempering operating expenses in response to the fluctuating multifamily landscape underscored our commitment to operational efficiency and fiscal responsibility. The selective acquisitions in burgeoning and supply-constrained markets like Indianapolis, Indiana, and Columbus, Ohio, coupled with strategic dispositions, have further positioned our portfolio for longterm stability and growth.

We’re pleased to report that the breadth and expertise of our management teams has never been greater than it is today. In 2023, we increasingly leveraged our internal asset management department to allow for nimble and tactical decisionmaking amidst rapidly shifting market dynamics. This, paired with the infusion of fresh leadership talent, has been instrumental in delivering favorable Net Operating Income and Value growth for our investors through 2023’s challenging interest rate and operating environment.

As a family-owned business, we take pride in cultivating a diverse and stable employee base that is centered around results and shares in our success as an organization –we currently have over 130 team members in our Employee Partnership Program. Similarly, we continue to strengthen our partnerships with charitable organizations, reflecting our longstanding promise to give back to the communities where we operate.

Moving forward, we remain steadfast in our commitment to be responsive, accurate, and transparent with our investors. It is intentional that, (despite our size), we do not have a formal “Investor Relations” department that stands between our partners and those closest to their investments. Rather, our Asset Management, Investment Management, and Executive Teams are readily accessible to satisfy the needs of our various partners. Likewise, we appreciate the fluid dialogue with our partners, as it ensures that our collective interests remain aligned.

While we have much to celebrate, we have set big goals for the future and are wellpositioned to execute them.

In 2024, we remain committed to seizing opportunities, while navigating market uncertainties with prudence and foresight. Our firm’s strong financial footing, bolstered by the quality and diversity of our communities, credit investment platforms, and favorable debt portfolio, provides a solid foundation for strategic action in the face of evolving market conditions.

Despite the rapid rise in interest rates, we have not observed many instances of “distress” across the multifamily landscape. This stands as further testament to the resiliency of multifamily in times of economic volatility and bodes well for continued long-term value growth. Indeed, while pockets of the U.S. are currently absorbing a record amount of new supply, (which will abate sharply after the next two years), the U.S. will remain grossly undersupplied in terms of housing even as demand continues to increase. It is this ongoing supply / demand imbalance that appears to have kept a ceiling on cap rates despite the rising cost of debt.

While disagreement among buyers and sellers on cap rates has stalled the transaction market, the gap appears to be narrowing, with cap rates coalescing in the general range of 5.25% and 5.75%. As that consensus firms, we hope to see transaction activity increase in 2024.

As we await larger opportunities, we continue to execute on select acquisitions as they present themselves, invest through our K-series and Preferred Equity programs, and seek efficiencies across our operating platform. As operations and technology become further intertwined, technological innovation remains at the forefront of our operational strategy, and our partnership with early-stage PropTech investor, Wilshire Lane Capital, gives us early insight into nascent technology advancements that can enhance our future operating capabilities.

Finally, our dedication to resident satisfaction continues to be a core focus. The accolades received in recent industry rankings is evidence of our commitment to providing best-in-class living experiences for our residents. These achievements motivate us to strive for even higher standards of service and excellence in 2024 and beyond.

As we embark on this next chapter, our path is clear. We are committed to leveraging our strengths, embracing innovation, and maintaining our focus on sustainable growth. We are poised to navigate the future with confidence, guided by our vision, values, and the unwavering support of our employees, investors, residents, and industry partners.

19 STATES

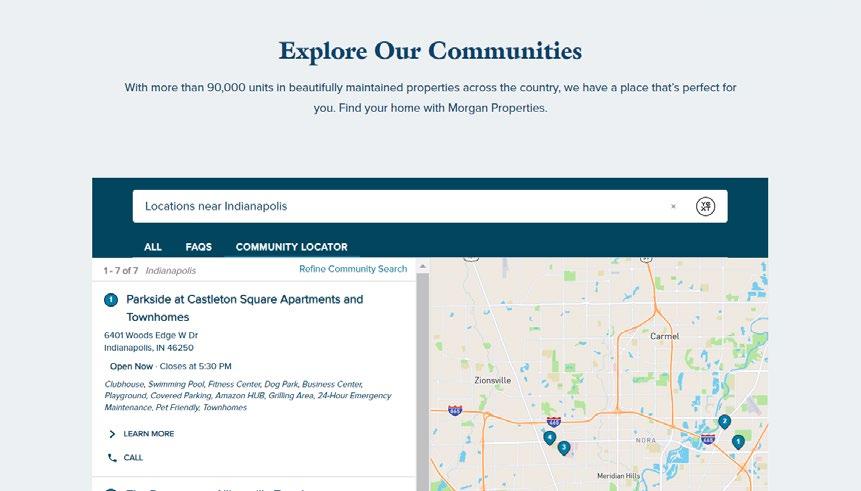

Morgan Properties does things differently, providing superior housing and services to exceed every expectation. With more than 90,000 units in beautifully maintained properties across the country, we have a place that’s perfect for everyone.

Rochester, NY

King of Prussia, PA

Auburn Creek

Apartment Homes

Victor, NY

Auburn Creek

Apartment Homes

Victor, NY

Executive Vice President, Acquisitions & Capital Markets

Industry Experience: 22 Years

Oversees: Acquisitions, Financing & Dispositions

We finished 2023 with a $17 billion portfolio of real estate investments under management. While cap rates expanded in the last 12 months, significant NOI growth in our multifamily portfolio largely offset the value impact of the cap rate expansion. We were very selective on the acquisition front in 2023 and completed only a handful of small transactions that complemented our existing portfolio in high-growth Midwest markets. Limited buyer competition now allows us to focus on acquisition projects with lower execution risk: newer assets in better locations with simpler value-add strategies.

“In 2024, we expect to see attractive opportunities in a subset of primary and secondary markets that are not overburdened with excessive new supply and are poised for continued healthy rent growth.”

In 2023, our credit investment portfolio grew to $1.5 billion. We continue to benefit from preferential access to purchase Freddie Mac K-series B-piece securities in the primary market. Our current portfolio of B-pieces is collateralized by 1,164 multifamily loans across 47 states. Furthermore, in 2023, we launched a preferred equity platform and started making preferred equity investments behind Freddie Mac and Fannie Mae first mortgages. Agency debt coupled with Morgan Properties’ preferred equity offers an attractive solution to borrowers who need to refinance existing debt in the current high-rate environment.

Although 2024 presents a challenging financing environment for the real estate industry overall, Morgan Properties is well positioned to withstand current stress in the financing markets. Our portfolio of multifamily assets is primarily financed by Freddie Mac and Fannie Mae mortgage debt.

In 2023, we sold 8 assets (1,985 units) at a weighted average cap rate of 3.7% and a total value of $214 million. This slower disposition year follows a peak sale period during which we sold $1.25 billion of smaller inefficient assets at the top of the market. These strategic dispositions allowed us to refocus our management expertise on larger assets in high-growth areas that have greater long-term value creation potential. We expect disposition volume to continue to decrease in 2024.

While we are looking to refinance 19 assets (6% of our portfolio) with debt maturing in 2024, this seasoned portfolio is sizing well for agency refinance due to conservative inplace leverage of 64% and a weighted average debt yield of 9.5%.

The past few years have been an exciting time for our acquisition efforts, and Morgan Properties has continued to expand its portfolio and family. With the addition of new properties in key national geographies - including the Mid-West, the Sun Belt, the Carolinas, and Texasour family of communities represents over 90,000 units nationwide.

Here are a sampling of our recent acquisitions.

Location: Chicago, IL

Property Names:

Blackhawk

Gates of Deer Grove

Lakes of Schaumburg

Unit Count: 1,003

Location: McKinney, TX

Property Name:

Elevate at Skyline

Unit Count: 136

Location: Indianapolis, IN

Property Names:

Astoria Park Apartments

The Boardwalk at Westlake

Parkside at Castleton Square

Lakeside Crossing at Eagle Creek

The Elliott at College Park

Lakeshore Reserve Off 86th

The Preserve on Allisonville

Unit Count: 2,573

Location: Columbus, OH

Property Names:

Eastpointe Lakes

Wexford Lakes

Unit Count: 600

Location: Fayetteville, NC

Property Names:

Westlake at Morganton

The Preserve at Grande Oaks

Unit Count: 642

Location: Tampa & West Palm, FL

Property Name:

Melrose on the Bay

Park at Lake Magdalene

Reserve at Lake Pointe

Savannah Place

Somerset Place

Tuscany Pointe (Boca)

Tuscany Pointe (Tampa)

Village Place

Windward at the Village

Royal St. George

Unit Count: 3,071

Since 2017, Morgan Properties has been an active investor in the multifamily credit space, with our core credit strategy being the acquisition of Freddie Mac K-series B-pieces. Freddie Mac K-series is a securitization program utilized by Freddie Mac to sell their multifamily loans into the market. Freddie Mac aggregates pools of multifamily mortgages and issues securities backed by those pools of mortgages. The securities are tranched into senior bonds, which are guaranteed by Freddie Mac, and a non-guaranteed, firstloss B-piece security. Freddie Mac restricts the sale of Bpieces on the primary market to a select group of buyers who have experience as credit investors, experience as Freddie Mac borrowers, and experience as owner/ operators of multifamily real estate. Morgan Properties has become one of the most active members of this group, having purchased 38 B-pieces with an aggregate purchase price of $1.6 billion from 2017 through 2023.

Morgan Properties completes an extensive due diligence process for each K-series transaction that encompasses a multifaceted analysis of each underlying loan to identify potential credit risks. The process for each underlying loan includes:

9 location analysis

9 physical site inspections

9 independent valuation

Wesley Newcomer Vice President, Credit Investments

Wesley Newcomer Vice President, Credit Investments

9 review of sponsorship history and qualifications

9 P&L re-underwriting

The Morgan Properties team draws on our experience as a multifamily owner/operator and credit investor to identify potential credit concerns. Should any concerns arise, Morgan Properties retains the right to remove loans from the pool before purchasing the B-piece. Credit performance with K-series deals has been very strong, with a loss rate of approximately 2-bps across all K-series transactions through December 2023 and zero credit losses within deals owned by Morgan Properties through year-end 2023.

In 2023, Morgan Properties launched a preferred equity platform to originate preferred equity investments in multifamily assets financed by Freddie Mac and Fannie Mae senior mortgages. We are targeting assets owned by experienced sponsors in primary and secondary markets. The investments are capped at 85% LTV and offer attractive risk-adjusted returns. This new product has been well received in the market due to our flexible current pay provisions and our experience working with Freddie Mac and Fannie Mae, which allows us to close transactions quickly.

Palmer House Apartment Homes New Albany, OH

Park West 205 Apartment Homes Pittsburgh, PA

933 the U Apartment Homes Rochester, NY

Park West 205 Apartment Homes Pittsburgh, PA

933 the U Apartment Homes Rochester, NY

Morgan Properties is also the lead investor and strategic partner in NewPoint Impact, a Proprietary Affordable Housing Lending Platform that was launched in partnership with NewPoint Real Estate Capital in July 2022. The platform offers an innovative set of affordable housing lending solutions. The partnership is led by NewPoint CEO David Brickman, former CEO of Freddie Mac, and Jason Morgan, President of the Morgan Properties Special Situations platform. The platform is targeting double-digit tax-exempt returns for investors.

Morgan Properties has established a strategic partnership with Wilshire Lane Capital, an early-stage PropTech fund specializing in high-performing sectors like multifamily technology and single-family rentals. This mutually beneficial partnership provides collaboration between Wilshire Lane portfolio companies and Morgan Properties’ Innovation Team.

Working closely with Wilshire Lane provides Morgan Properties with early visibility into the newest technology platforms being introduced into the multifamily space and the ability to stay ahead of its competition in the fast-moving real estate technology arena.

Executive Vice President, Chief Financial Officer

Industry Experience: 32 Years

Oversees: Financial Management & Accounting

2023 was a year focused on driving increased cash flow from our portfolio, evaluating our existing processes, and continuing to find ways to deploy technology to help drive efficiencies. As of year-end, our asset valuation is approximately $17 billion, and our nationwide property portfolio generated over $1.7 billion of net revenue.

Bad debts have continued to improve during 2023, as we ended the year at 3.2% across the portfolio vs 4.1% in the prior year. This is a result of several factors:

• Implementing more stringent financial qualifications on prospective tenants.

• Engaging in the eviction process in a timelier matter – the court backlog subsided from the influx when the eviction moratorium ended.

• Utilizing Artificial Intelligence (AI) tools to support our rent collection efforts.

As strategic, long-term asset holders, Morgan Properties invested over $220 million of capital expenditures in our 340+ property portfolio with the goals of asset preservation, value-add repositioning, and unit upgrades. We also continued successfully executing on our rehabilitation plans on newly acquired properties, which is typically performed over a 3–5-year period. Investing back into our properties generates long-term value that we can capitalize on. We are then able to enhance the marketability of the assets and increase revenues on upgraded units. Taking care of the capital needs of our assets reduces future capital needs and maximizes their value and lifespan, as well as generating operating efficiencies. Additionally, our track record of maintaining our physical assets is recognized and rewarded by our insurance carriers and lenders, contributing to exceptionally favorable rates and terms.

“As of year-end, our nationwide property portfolio generated over $1.7B of net revenue.”

During 2023, we were able to evaluate some of our key processes. As a result, we are investing in a treasury management system, as well as a new system for contracting, budgeting, and projecting cash flow timing needs for our capital projects. The treasury management system will further automate our cash management reporting and enhance controls. The new contracting software will allow us to improve our controls over contracts and provide a more robust capital budgeting tool, which will increase our ability to project the timing of future cash flow capital needs. While the front-end contracting portion of the contracting tool was implemented in 2023, the remaining budget and forecasting modules will be implemented in 2024, as well as the treasury management system.

Investing in our people and unique cultures is something that Morgan Properties is focused on and representative of the “D” for diversity in our PRIDE values. I am proud to serve as the Executive Sponsor of our Diversity, Equity, & Inclusion (DEI) Council that was established in 2022. Our council is made up of a group of multi-cultural, cross-functional employees with a diverse mix of backgrounds from across our geographical footprint and all levels of the organization. As the voice of our employees and the communities they serve, the DEI Council serves as advocates and champions for the areas most important to our employees.

A shout out to the team and the programs they spearhead – be sure to learn more about what they have accomplished and where we are heading in 2024 in the Our Culture section on page 46.

Arbors of Battle Creek Apartments and Townhomes Battle Creek, MI

Villas at Bryn Mawr Apartment Homes Bryn Mawr, PA

Villas at Bryn Mawr Apartment Homes Bryn Mawr, PA

Executive Vice President, Facilities

Industry Experience: 24 Years

Oversees: Facilities, Capital Improvement & National Accounts

In 2023, we completed over 8,000 capital projects worth $220 million across our assets, including major exterior renovations, domestic water re-pipes, structural issues, and asbestos abatement. Over half of the planned capital expenditures were directed to asset preservation measures to proactively manage building code issues, health and safety, property structure, windows, roofs, concrete, asphalt, and other major repairs needed or anticipated. We work to strategically plan and budget asset preservation capital to protect our assets and maintain our properties in solid condition.

Our apartment renovations program continued to improve our portfolio value and deliver an upgraded product to our residents. This included a wide range of upgrades, as outlined below.

We also expanded our occupied unit renovation strategy to solidify it as a core competency for our team and contractors.

As the broader multifamily market shifted our company focus away from growth through acquisition, we looked inward to focus on tightening operations, growing and building teams, enhancing processes, and implementing improvements to strengthen our base and prepare for future growth.

“We concluded our search for a best-in-class solution for capital process management and implemented solutions from Banner Technologies that will serve as our longterm capital management system.”

We completed physical due diligence on multiple assets with significant deferred capital and remain ready when our company focus shifts back to portfolio growth.

In this inflationary environment, our Facilities and Procurement teams worked to aggressively bid and contract for unit turnover services, resulting in over 1,250 new contracts for these services at our properties. Early results are promising, and we have seen gains made by controlling overages and extra services that greatly increase turnover expense by including projected services (at reduced rates) in the base price of the agreements. We will continue to look for opportunities for expense control and reduction.

Safety remains a focus in everything that we do. We were excited to begin implementation of FireAvert, a stovetop fire prevention device, throughout our portfolio – with approximately 30,000 apartments completed by yearend 2023. We have already prevented several kitchen fires with this product, and we are dedicated to completing implementation to our entire portfolio in the near future.

With planned capital spend of over $220 million for 2024, our teams will be engaged in drafting detailed specifications for capital projects and intensive project management throughout the year. We will be focused on mechanical upgrades to ensure our communities are ready for each season, organized capital projects to reduce work orders for our maintenance teams, and property and landscaping enhancements to ensure our properties are ready for prime leasing season. The timing of our efforts is carefully determined to provide maximum impact for our residents and our communities, and our teams remain flexible to respond nimbly to the challenges property management throws our way.

BEFORE AFTER

Lincoya Bay Apartments and Townhomes | East Nashville, TN

Lincoya Bay Apartments and Townhomes | East Nashville, TN

494 FI NISH PACKAGES

1,137

TOTAL DESIGN PACKAGES

192 CAPITAL SIGNAGE PACKAGES

361 FURNITURE, FIXTURES & EQUIPMENT (FF&E) PACKAGES

51 SCHEMATIC PLANS

39 FULL DESIGN PLANS WITH FINISHES/FF&E

Lafayette, LA

Industry Experience: 28 Years

Oversees: Operations, Asset Management, Marketing, Tal ent Acquisition & Development

For 2023, we realized average NOI growth of just over 10% across our entire 340+ asset portfolio. Some assets and portfolios managed to exceed 20% NOI growth, while others’ growth was more tempered. Results were dependent on the specific asset or characteristics of the portfolio and what stage of the business plan they were in. Overall, it was an admirable bottom-line growth rate by any measure and a testament to our teams’ ability to create value amidst a turbulent economic backdrop. NOI gains were largely the result of sustained rent growth fueled by our physical upgrades, improvement in collections, and the ongoing rollout of our bulk internet program, all of which allowed us to achieve revenue growth greater than what market conditions might have suggested in 2023. This revenue growth more than offset the inflationary impact on expenses that have challenged the multifamily industry since 2022.

Ideally, we’d like to be at about 95% occupancy in any given community. That’s the pocket where we’re going to be most efficient in managing vacant inventory from a marketing, pricing, and make-ready perspective.

Occupancy below the 93% level can put the on-site and pricing teams into a defensive posture, particularly on larger assets.

But it can be difficult to fight the tide. Occupancy levels began softening in Q3 2022 and, in response, effective asking rents throughout the country

have fallen consistently for 18 straight months as we closed out 2023.

Occupancies and rent growth are more fragile in the Sun Belt region, which has experienced the bulk of new supply, while the Midwest and Northeast remain on more solid footing.

“Fortunately, renter demand remains quite robust due to population growth and the increasing unaffordability of home ownership.”

Indeed, prospective renter applications for our communities in 2023 was 3.6% greater than 2022, which is encouraging as we head into 2024.

Christopher Wren Apartments & Townhomes Wexford, PA Christopher Wren Apartments & Townhomes Wexford, PA

We entered the new year with a national occupancy rate hovering around 94% and rents trending down. Some industry forecasts are calling for negative NOI growth, but I’m not so pessimistic. Morgan Properties is built to successfully manage through “difficult” or “recessionary” market conditions. We resist the “one size fits all” approach to property management. There is no singular plan for 2024. Instead, there are 340+ individual plans – all subject to refinement, as each asset has its own unique challenges and opportunities that are always evolving.

Our Asset Management team ensures that we take a tactical investor approach to each asset, which enables us to make pragmatic adjustments to our business plans in response to changing market conditions. Rent levels, marketing, staffing, and capital plans are evaluated on a routine (often weekly) basis by our Asset Managers with direct input from the site and regional teams that have their fingers on the pulse of the activity in our communities.

I expect our Asset Management and Operations teams will need to be quite nimble in 2024, particularly in the Sun Belt where new apartment deliveries are expected to peak this year. Globally speaking, superior customer service, further improvements on collections, incremental gains in occupancy, and efficient use of our on-site personnel will be the keys to our success in 2024.

I’m looking forward to it!

In addition to its large multifamily portfolio, Morgan Properties currently owns and manages close to 223,000 square feet of office space, nearly 170,000 square feet of retail space, and a portfolio of 17 cell tower leases. Morgan Properties’ Commercial division works with commercial brokers to secure new tenants, negotiate commercial leases, oversee tenant improvements, and maximize revenue from our non-residential portfolio by providing exceptional customer service.

The Commercial division also drives initiatives to create value through real estate entitlement and development projects. The team is working with the Borough of Conshohocken in Pennsylvania to find a mutually beneficial development option for the vacant land on the Conshohocken riverfront, which is adjacent to Morgan Properties’ future corporate headquarters. We are also working with the city of Alexandria to protect and expand our development rights at the Mark Center communities in Virginia.

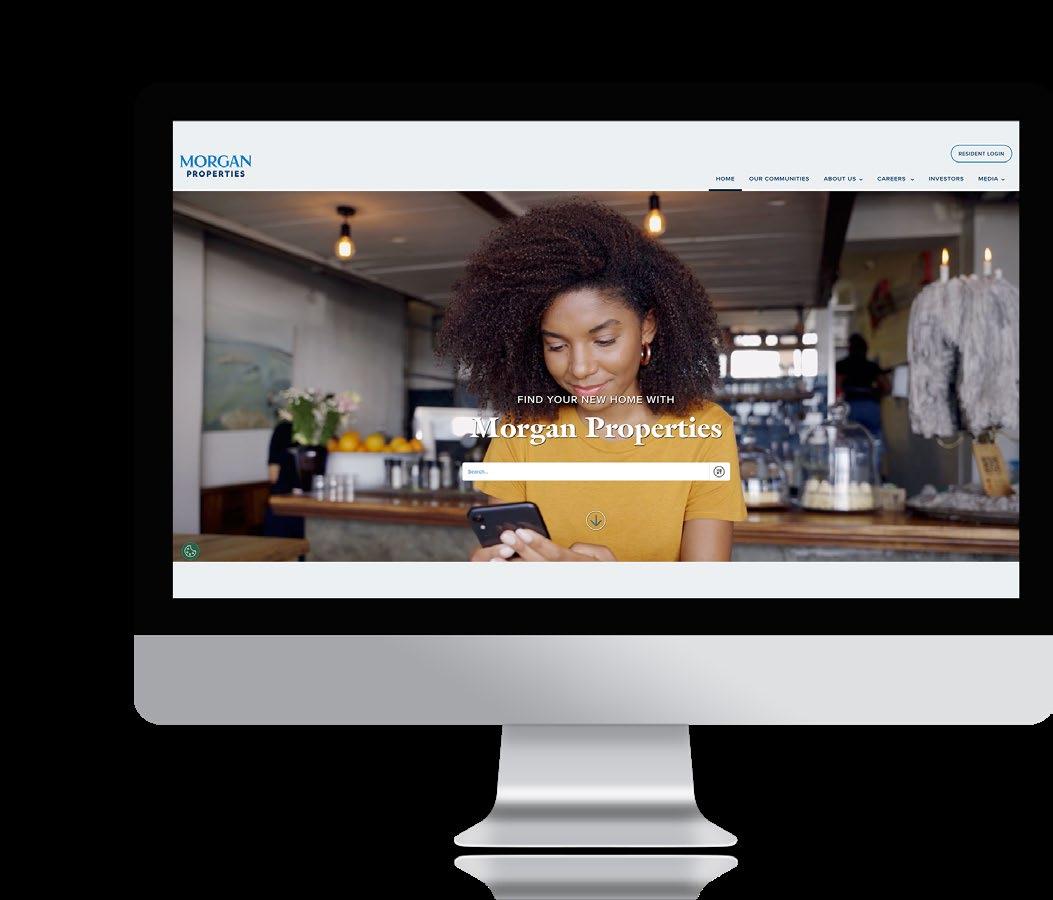

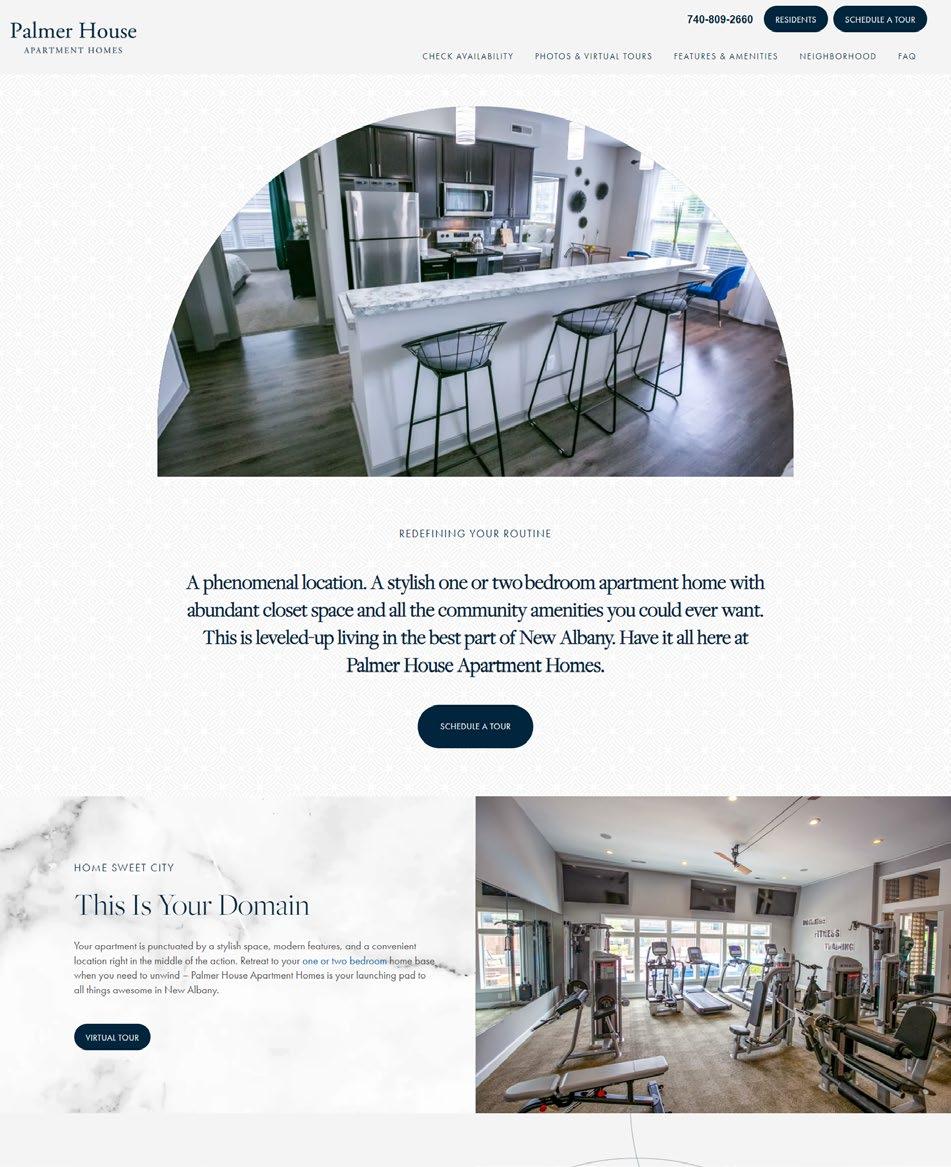

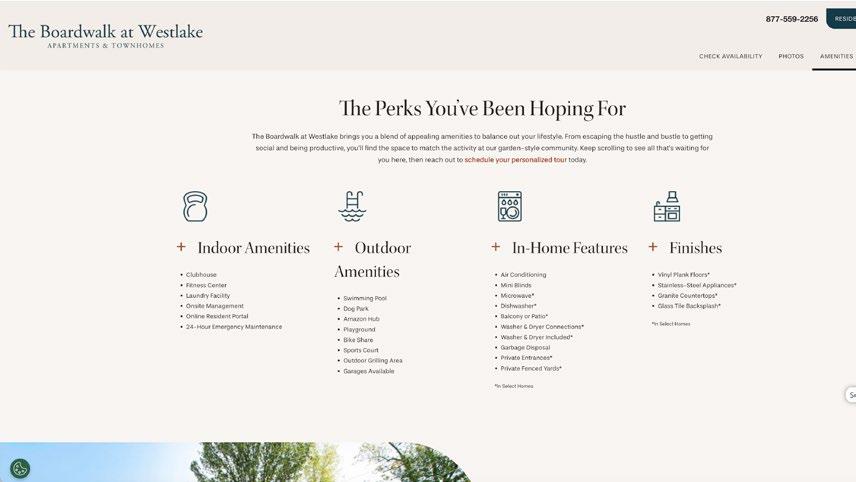

Morgan Properties’ corporate digital presence, along with its community websites, recently went through a major innovative transformation. After our exponential growth in 2021-22, our marketing team desired to maintain a cohesive brand and experience for our residents, while still giving each community elements of its own unique look and feel. Highlighted by a dramatic website redesign for all of our communities and

our online corporate presence, the team completed multiple projects in 2022-23 that increased resident attraction and streamlined processes.

Our marketing team worked to maximize visibility and improve lead quality by rebranding all property websites, which were further optimized with Smart SEO, SEM, and cross-device responsiveness. The team also created seven new website designs to better target property class and user demographics. With 340+ properties across 19 states, there is no one-size-fits-all design style that appeals to tens of thousands of diverse renters. Based on the portfolio’s unique segments, seven custom profiles were developed - each with insight driven designs to inspire action.

Kim Boland Director, Digital Marketing

Kim Boland Director, Digital Marketing

Together, Morgan Properties’ marketing team and its partners remained focused on the common goal and produced incredible results – never sacrificing functionality for sheer creativity. Prospective and current residents’ first impression with Morgan Properties and booking an apartment tour remotely proved to be a frictionless experience.

“We collaborated with industry-leading designer G5 (now part of RealPage) and integrated site enhancements from partners including Engrain, Yext, Yardi, BetterBot, and LCP Media to create a seamless user experience for prospective residents,” said Kim Boland.

The foundation has now been established to continue our evolution of the resident experience through website interaction, with additional improvements planned for 2024 and beyond.

7 Unique Website Styles:

• ASPIRE

• BOLD

• BALANCED

• CAPTIVATE

• STUDENT

• ACTIVE LIVING

• RESORT

• Search for a home.

• Select the property that best meets your needs.

• View photos, amenities, neighborhood info & FAQ.

• Explore community maps & apartment types.

• Check availability.

• View interactive floorplans.

• Schedule a tour.

• Select move-in date & lease terms.

• Apply directly online.

Westlake at Morganton

Apartment Homes

Fayetteville, NC

Westlake at Morganton

Apartment Homes

Fayetteville, NC

A robust venture capital market has led to the proliferation of PropTech startups (and its close cousin, FinTech) seeking to deliver tools for owners to increase efficiency or enhance the resident experience. 2023 saw this technology space shift into overdrive with the expectation that Generative AI will lead to even more powerful and practical applications for multifamily operators. While the current state of the Generative AI space, as it pertains to apartment operators, can be best characterized as nascent and “noisy,” the promise is exciting. We have already begun to use AI-enhanced platforms to assist with large-scale communications focused on leasing, rent payment, and marketing.

Determined to be leaders in the technology space, our teams are continuously evaluating, testing, and piloting numerous platforms. We have been early adopters of smart home technology (2018), security deposit alternatives (2021), flexible payment and positive credit reporting platforms for our renters (2021), and resident screening technology (2022) – all programs that are just now becoming more widely utilized in our industry.

Most recently, we deployed Colleen AI throughout our portfolio to assist residents with rent payment, ensure they don’t incur unnecessary late fees, and reduce our firm’s exposure to bad debt. Additionally, we are piloting no fewer than four AI-driven Virtual Leasing Assistants that we anticipate will replace the traditionally limited (and often unsatisfying) chatbots. Chatbots are an increasingly common customer service tool and decrease our reliance on third-party call centers.

As AI platforms improve their ability to engage in increasingly complex conversations, they will continue to assist in streamlining many time-consuming and repetitive tasks, which will ultimately reduce our reliance on human capital. How much so remains to be seen – stay tuned!

Executive Vice President, Chief Administrative Officer & General Counsel

Industry Experience: 33 Years

Oversees: Legal, Risk Management, Information Technology & Human Resources

Unlike some of our competitors, we have long believed in the value of having a small number of in-house lawyers, who can efficiently leverage external legal services for our properties to ensure consistency on compliance related advice. Several large multi-jurisdiction property owners outsource their online leasing and local law compliance to a technology company, which would cost us more than $400,000 annually. We created our own form of lease, accessible through our online leasing platform, that is customized for each of our jurisdictions at an annual cost of under $25,000. Our ability to control the form of lease and leasing platform gives us the flexibility to update our leases, typically within 48 hours, to respond to unexpected issues and new regulations. In 2023, a team comprised of members of the IT, Operations and Legal departments modified an eviction module within our Yardi property management system, extending its functionality to more jurisdictions and reducing the cost of an eviction by up to 50%.

In recent years, the insurance industry has paid billions of dollars in property damage claims due to extreme weather events and massive wildfires. In addition, commercial real estate owners (and their insurance companies) have been subject to costly lawsuits alleging failures by landlords to prevent crimes at their properties. As a result, the cost of insurance has risen throughout the multifamily industry by 8% annually from 2017 through 2022, at which point the costs skyrocketed – increasing by over 20% a year in both 2022 and 2023.

We recognized the insurance trends early and began developing strategies to ensure our insurance premiums would grow at a more moderate rate. After building consensus internally, we began to implement our new strategies in 2023.

Reduced the cost of future insurance premiums by creating a Risk Management department to help ‘bend the curve’ on insurable losses. 2

Thoughtfully took on additional risk through self-insurance.

The Risk Management Department was created to take a more holistic approach to reducing our insurance cost by:

• Improving safety and security practices at our properties.

Result: protecting our residents and employees by reducing the number of accidents and other insurable incidents.

• Developing a comprehensive approach to settle claims earlier in the process. Result: more money being paid to injured residents, but at a lower cost to us by avoiding expensive litigation.

• Ensuring that every one of our residents obtains a resident insurance policy.

Result: by collaborating with the Ancillary Services group, this protects us from tenant negligence, enabling us to collect from a resident insurance policy (as opposed to our insurance policy).

At Morgan Properties, we pride ourselves on having a keen understanding of risk and, through our large balance sheet, can internally manage sizeable portions of our risk when appropriate. This past year, we decided to self-insure a significant portion of our risk, as we believe the insurance companies have fundamentally mispriced our insurance.

“In a market where insurance premiums have been increasing by more than 20%, in 2023 we were able to reduce our total costs by just over 2%.”

Our company success ultimately depends on our ability to collect, manage, and understand data. We use data to determine the right price for our apartments, appropriate staffing levels at our properties, and to help us collect our rents. Our Operations, Facilities, Accounting, and Asset Management departments collect and analyze data to provide accurate reports to our lenders and partners, and data analysis enables our corporate officers to make informed business decisions. Last year, we collected data on over 13 million discrete financial transactions.

Our Information Technology department is tasked with managing our existing sophisticated data collection and analysis system, while continually evaluating new technologies. Our goal has always been to identify the best technological tools available, so we can ensure that our employees are as productive as possible by integrating advanced technology into our core business processes. At the same time, we want to avoid being on the so-called “bleeding edge,” where tech companies use their customers to find out what works and what doesn’t. In 2023, we conducted full tests of over 10 alternative software products and ultimately rolled out 3 new products, including Colleen AI to assist in collections and Forecast IQ to help assemble property budgets.

People & Culture: At Morgan Properties, we recognize that our people are integral to our success. Our Human Resources department is dedicated to fostering a culture of engagement among all team members that starts with our core “PRIDE”

Values: Passion, Respect, Integrity, Diversity & Entrepreneurial Spirit. The mission of our HR team includes a commitment to continually enhance and cultivate a people-centric workplace that is diverse, equitable, and inclusive.

In 2023, we examined and revamped several of our benefit programs, including enhanced time off to accommodate individual and family needs and encourage a greater sense of work-life balance. In 2024, we continue to focus on the health and well-being of our workforce. We are introducing additional wellness services and on-demand resources for employees, their families, and their managers that include personalized access to care with 12 options for employees to connect to mental health treatment.

Process: By embracing technological advancement in 2023, our HR department took the lead in implementing a companywide transition of our Payroll and Human Resources Information System (HRIS) from ADP Workforce Now to Ceridian Dayforce.

While Dayforce is commonly associated with time tracking and payroll processing, it is also a comprehensive Human Capital Management (HCM) platform. Morgan Properties will leverage Dayforce to seamlessly integrate various functions, such as recruiting, onboarding, performance management, compensation, benefits, payroll services, engagement, succession planning, analytics, and reporting.

During 2024, the HR Department will be introducing additional Dayforce modules, which will transform how our managers oversee and engage with their teams. We believe Dayforce can empower our management team to play a more active role in the day-to-day people management and development of their team members.

In recent years, Morgan Properties has added new roles within our organizational structure to strengthen our position within the multifamily industry and assist with addressing the needs of our growing company.

At the start of 2022, we hired our long-time outside counsel, Pelayo Coll, to become our Deputy General Counsel, Real Estate & JV’s. In his role and since 2004, Pelayo has been involved in our major acquisitions, dispositions, joint ventures, and financings, and remains a key legal advisor to our company leadership.

“We have been transforming the leadership of our legal department over the past few years, and I’m excited to be a part of that. We have the sophistication and creativity to successfully structure acquisitions, joint ventures, and dispositions, and the depth of talent to operate our properties in compliance with local laws throughout the country.”

As Vice President of Treasury, John leads all treasury operations for Morgan Properties. His oversight includes banking, cash forecasting, treasury systems, employee savings/ investing plans, and compliance reporting. John’s immediate impact can be felt through his extensive work to improve our treasury management system and enhance vendor payment processing; leading to immediate improvements in cash reconciliation, cash flow projections, and data rendering.

“ In navigating the complex currents of financial landscapes, our treasury philosophy is anchored in foresight, agility, and precision. We don’t just manage cash; we orchestrate a symphony of strategic decisions, ensuring our financial harmony reverberates with stability and growth.”

As Head of Transformation, Andrew is responsible for leading the planning and execution of strategic initiatives designed to transform the company’s operations with the goal of enhancing property performance, customer experience, and employee satisfaction. His first priority and current focus is centralized leasing, where he has been reimagining one of our core business practices and overseeing the architecting and eventual implementation of Morgan Properties’ future-state leasing operation.

“ My focus is to transform the front office of our multifamily operations across 19 states. What does that mean exactly? I’m looking for ways to leverage AI-powered technology to both complement and empower our leasing teams in their day-to-day jobs, allowing them more time for the tasks they enjoy and that require a true human touch – like engaging and building relationships with prospective residents and addressing their needs .”

As Director of Communications, Tina leads the company’s overall efforts in messaging strategy and support with external media constituents. She has the significant responsibility of helping define and position Morgan Properties in the public eye; collaborating on strategies to raise awareness, increase thought leadership, and amplify the mission of our growing company.

“As Morgan Properties continues to grow and evolve, I’m excited about the future of the company and will continue to look for creative and compelling ways to educate, inform, and inspire our multiple audiences about the great work we’re doing – from the business, employee, and resident perspectives.”

As Director of Screening, Nate will head up a newly created department focused on screening and fraud prevention. As Nate quickly learned, grew, and succeeded in his first role at Morgan Properties as Revenue Manager, he leveraged his prior skills in screening analytics to provide guidance in changing our screening policies and procedures. In his new role, Nate will provide ongoing analysis and recommendations to adjust our screening policies, collaborate with site teams to combat fraud proactively, anticipate restrictive legislation, and innovate new solutions, ensuring that Morgan Properties remains at the forefront of screening and fraud prevention solutions. Additionally, Nate will work to test and implement various fraud solutions to combat the ever-adapting fraud landscape.

“ In 2023, Morgan Properties achieved a 58% reduction in new resident delinquency within the first year of their residency compared to the prior year. I look forward to continuing to implement solutions that protect our company and our communities.”

As Director of Risk Management, Amanda is responsible for procuring and managing the company’s commercial insurance program while supporting best-in-class claims management. In this role, she also leads safety and compliance for crisis/emergency responses and will focus on identifying, evaluating, and mitigating risk across Morgan Properties’ portfolio.

“At Morgan Properties, we believe there are three critical elements of mitigating and managing insurance cost; these include having a strong broker relationship, practicing strong risk control measures, and closely monitoring claims management.”

Culture is dynamic and constantly evolving, and it’s not one single thing but the sum of many moving parts. If you ask Laurie McGarvey, our Director of Employee Engagement, she’ll tell you, “Culture is how people and teams behave when no one is looking.”

Laurie McGarvey Director, Employee Engagement

Laurie McGarvey Director, Employee Engagement

Since 1985, Morgan Properties has aimed to provide value to our residents by creating living spaces where they can experience a sense of belonging and feel at home. We hold the same commitment to our employees as we are invested in creating a culture of respect and value for their diverse perspectives. We believe that Diversity, Equity & Inclusion is far beyond a one-

time initiative, and instead is foundational for our strategic objective of continuing to strengthen our company. We strongly believe that opportunities for inclusivity can be addressed by continuing to remain true to our PRIDE values.

• Our DEI Vision: Together, we want to create a workplace culture where each employee feels connected, empowered, and heard.

In 2022, Morgan Properties established a DEI Council, made up of a group of multicultural, cross-functional employees with a diverse mix of backgrounds from across our geographical footprint and all levels of the organization. To help ensure everyone’s voice is heard, the DEI Council is informed about the results of our on-going employee culture surveys, so employees companywide can give feedback and list their thoughts and concerns. These surveys are the driving force behind what the Council focuses on. Learn more about our DEI Journey on our website.

Acknowledging that some of our HR professionals currently invest significant time in administrative tasks, many of which will be automated as Dayforce is established, our plan is to remodel the HR Department into key areas. These include HR Centers of Excellence focusing on Employee Relations, Payroll, Compensation & Benefits, and Employee Engagement.

Led by Megan Shank, the Employee Relations department will consist of Regional HR Business Partners who will strategically consult on various HR processes designed to optimize business unit performance. We will create a shared services team to handle routine, transactional HR tasks and questions,

thereby creating consistency in delivery across the organization. The ultimate goal is to empower our front-line management teams to become more effective overall managers of our people and properties.

Megan Shank Director, Employee Relations

Megan Shank Director, Employee Relations

“With the introduction of Dayforce, we will streamline processes, automate repetitive tasks, and empower our leaders and employees by minimizing distractions – enabling them to focus on professional development and driving organizational growth.”

Jessica Sachs Vice President, Talent Acquisition & Development

Jessica Sachs Vice President, Talent Acquisition & Development

With more than 2,400 employees across 19 states, Morgan Properties’ comprehensive talent development initiatives, offered through Morgan University (“MorganU”), are designed to help employees develop new skills through a variety of training, mentorship, and career development opportunities – giving employees the confidence and courage needed to advance their careers.

In early 2023, Morgan Properties updated its organizational structure to reflect an evolving industry and employer environment and Jessica Sachs was promoted to Vice President of Talent Acquisition & Development. She now oversees talent acquisition for our 340+ property teams, in addition to leading the talent development team and our award-winning training department. Our experienced team of leadership and training professionals oversee Morgan University – offering professional development trainings and resources for employees at every level. “We’re happy to be able to offer our Professional Development Program, Leadership Academy and Morgan Mentor Program”, expressed Jessica Sachs. As a cumulative result of these efforts, Morgan Properties has seen overall employee retention increase by 5%, which can be correlated to our company performance.

Caring is deeply rooted in Morgan Properties’ culture, and we are passionate about positively impacting the lives of our communities. Morgan Properties believes that making a positive social impact in the communities that we serve is a critical component to our long-term success. That’s why Morgan Properties invests in its people and its local neighborhoods through a program called Caring. Sharing. Giving. Its purpose is to care for those around us by sharing our time and resources and giving to those in need.

Through our partnerships and by demonstrating our PRIDE values, Morgan Properties is able to create meaningful change in our communities by being a force for good. Morgan Properties supports positive change by participating in difference-making volunteerism and giving back at every level of the company. The company provides financial support and encourages volunteerism through a wide range of non-profit partners to strengthen the diverse communities our employees and residents call home.

Morgan Properties, along with both employee and resident volunteers, supports these causes through a combination of traditional fundraising efforts, often with a corporate matching element. In terms of social impact in 2023, the Caring. Sharing. Giving. program supported over 30 charitable causes through corporate giving of more than $275,000 and fundraised an additional $50,000 with the help of employees and residents nationwide, resulting in countless smiles and warm hearts.

1,000+ VOLUNTEER HOURS

30+ CHARITABLE PARTNERS

150+ EDUCATION HOURS

Top

In 2023, Morgan Properties earned 196 award wins, highlighting our dedication to outstanding service, innovative marketing, and continued growth. We take great pride in the recognition we receive on a national and regional scale as a real estate company, an employer, and a leader in the multifamily industry.

Top

SPECIAL THANKS TO:

Creative Design (In-House)

Daria Kapitonova-Papadimitriou | Senior Graphic Designer

Alexandria Friscia | Marketing Coordinator

Copyrighting & Content Development

Michael Hand | VP, Marketing

Tina Malek | Director, Communications

Gregory FCA | PR Agency

Additional Contributors

Jeffrey Callan | SVP & Chief Information Officer

Krista Reynolds | SVP, Human Resources

Drew Gravina | SVP, Facilities

Lauren Werkiser | VP, Interior Design & Architecture

Stephanie McDonnell | Director, Asset Management

Greater Charlotte Apartment AssociationBRAVO Awards Greater Columbia, SC Apartment Association Brilliance Awards Pennsylvania Apartment Association (Philadelphia) Best of Apartment Living Awards NorthernOhioApartment Association KeyAwardsGala AcadianaAssociationApartmentElite Awards New Jersey Apartment Association Garden State Awards Pennsylvania Apartment Association (Pittsburgh) Best of Apartment Living Awards Property Management Association (Washington, D.C.) PACE & Marketing and Advertising Excellence Awards Delaware Apartment Association Diamond State Awards Pennsylvania Apartment Association (Central PA) Best of Apartment Living Awards Morgan Properties Marketing Team Titan Business Award Winner MarylandMulti-Housing Association StarAwards