As spring rolls in, the Mopar Masters Guild is already in full gear preparing for our upcoming fall mee ng this October in Orlando.

We’re excited to bring everyone together once again for meaningful conversa ons, valuable connec ons, and con nued collabora on with our partners at Mopar. Be sure to mark your calendars—you won’t want to miss it!

We also want to highlight a special moment this season: our very first vendor trip with Helm. A huge thank you to the Helm team for hos ng us in Moab and organizing an unforge able trail ride on Seven Mile Rim with our affiliate partners. It was not only a blast, but also a great opportunity to build rela onships and get some hands-on insight.

A special thank you goes out to Jill and Don for all of their help and behind-the-scenes work planning for Orlando. And Don—thank you especially for your con nued leadership and for always keeping the group moving forward.

We look forward to seeing you all in Orlando this October—and as always, thank you for being part of the Guild.

Best regards,Cody

Cody Eckhardt - President - Mopar Masters Guild Service Director - Ken Garff CDJRF - W. Valley City UT - Codye@kengar

ff

.com

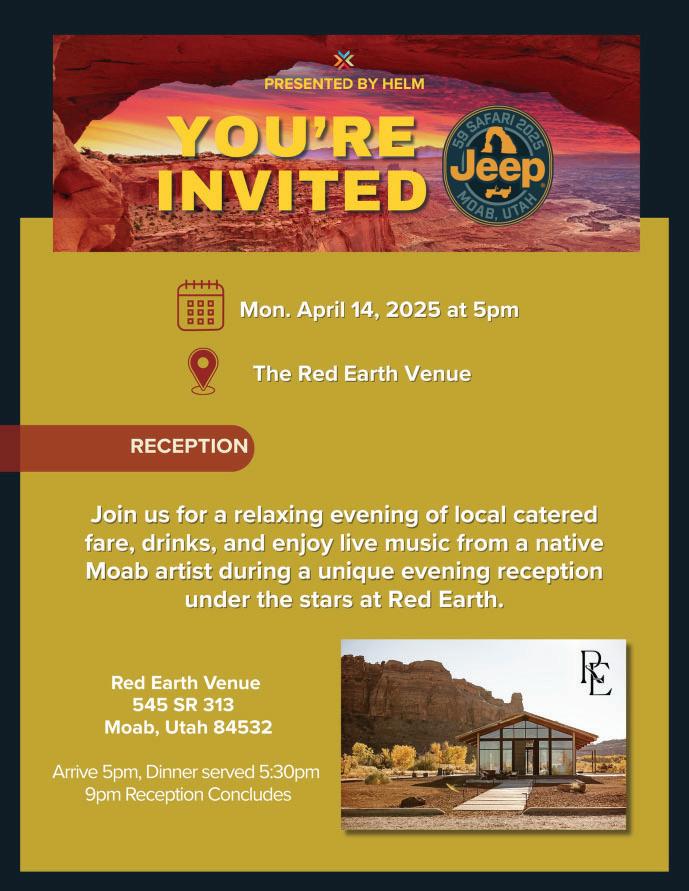

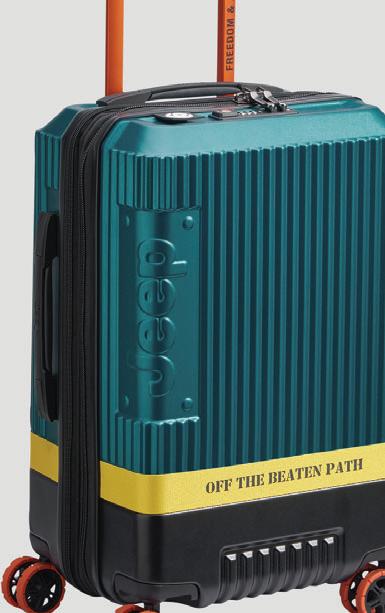

MMG Supporting Vendor Hosts Jeep Afficianados at Event

The Team at Helm, Inc. invited MMG members, among others to par cipate in the Annual Moab event in Utah.

“Having Helm host our first vendor meet with them was awesome,” says MMG President Cody Eckhardt. “Bringing all these a endees together is not an easy task. I want to thank Ryan Maguire and his Team from Helm for all their dedica on and hard work to put this event together and have the Mopar Masters Guild members be par cipants in Moab,” he con nued.

When going 4-wheeling, people can either go alone or join up in a group. Groups usually meet up early in the day, at a certain loca on in the city. First waivers are signed and collected, then the drivers are given instrucon and told to comply with any and all Bureau of Land Management regulations (i.e. stay on the trail, avoid walking on protected soil, etc )

Continued on Page 4

The exchange of information by like sized dealers in a non-competitive environment.

Continued from Page 3

Groups will then head out to the trails for the day. Once a group arrives at a trail, they will partially deflate («air down») their tires to get better traction on sand or slick rock Once the air down is completed they will begin through the trail and depending on the trail and the number of stops, it can take anywhere from a few hours to all day

Many groups do radio introduc ons, over the CB radio, where a person (o en the driver) will introduce his/ her self and any passengers in the car. They may also tell if they have driven the trail before, or if it’s their first me. When a group approaches a really difficult obstacle, a few will get out and act as a spo er to ensure everyone makes it up or down safely.

Groups usually stop around noon or 1:00 P.M. for a lunch break. Drivers and passengers usually chat, take pictures, or do some work on their Jeep/4X4 vehicle. Once lunch is completed, they will take off again.

Continued on Page 5

Continued from Page 4

Says Chris Messer, Vice President / Group Publisher · Endeavor Business Media Publishing, “Easter Jeep Week in Moab is no joke! Ge ng to spend quality me with our valued Endeavor Business Media customers from Bproautoparts and the Mopar Masters Guild makes it all that much sweeter. Thanks to the good people at Helm Promo ons for organizing the event and being such gracious hosts!”

Continued on Page 6

The exchange of information by like sized dealers in a non-competitive environment.

Continued from Page 5

Continued on Page 7

Continued from Page 6

Continued on Page 8

Continued from Page 7

Continued on Page 9

Continued from Page 8

Continued on Page 10

Continued from Page 9

Continued on Page 11

Continued from Page 10

The Mopar Masters Guild would like to thank Ryan Maguire and his team at Helm for hos ng this event! We had a great me!

With Kat Monteiro

Hello to all my faithful readers! Today is Sunday - Easter Sunday - I hope all of you are enjoying this day with family, friends and loved ones. Whether you are celebra ng this day in a way of Faith, or it is just another Sunday - Sunday seems to be a day of bringing family and friends together. A day to gather around good food, or a day at the beach, or a morning hike. They don’t call Sunday “Sunday Fun Day” for no reason.

Today, Rick, myself, and Rick’s long me (we are talking high school!) friend Randy, are here at our home in Escondido - we just got home yesterday from a 3 week stay at our house in Mazatlán, Mexico. We enjoy being in Mexico, but it feels good to be home. Rick went out to the store this morning and bought our tradi onal ham, potatoes, and asparagus for our Easter dinner and brought me home a Krispy Kream Donut with an Easter bunny face on it. I am nibbling at it now as I write this, and it is delicious! With Easter comes Spring! I love this me of the year! All the beau ful flowers blooming, the freshness in the air, the weather here in San Diego is a perfect 70 degrees with sunny blue skies. My only complaint is that this me of the year does not last long enough! Seems like we make the extreme jump into hot summers earlier and earlier every year. I encourage everyone to get out and enjoy it while you can. It’s a beau ful World out there.

I men oned we just got home from 3 weeks in Mexico. It is a privilege for us to have a house down there. We are not ocean front, but we are along a wide canal that leads out to the ocean about a mile away. Mornings are especially nice to wake up and go sit outside our back door and look out at the peaceful calm water. It is literally like glass first thing in the morning, before the boats start their trips going up and down the channel to and from the ocean. Then the entertainment starts! So many different types of boats to watch!

Continued on Page 13

Continued from Page 12

Big boats, party boats, fishing boats, fancy yachts, small boats, pangas, small li le speed boats that the tourists rent up the channel at the El Cid Marina, Jet Skis! Don’t get me wrong here, it’s not a constant flow of boats, they are usually sprinkled out throughout the day. But I do love watching them go by. And at night it is almost like a light parade because all the fancy boats are all lit up and many have blue lights along the bo om that light up the water and looks so beauful. And at mes you can hear these boats coming before you can see them with their loud party music playing! So, it is cheap entertainment and I love it!

Mazatlán is really a beau ful place with miles of beaches and a very old history. It was first colonized in 1531 and even before that there were na ve people living there. Mazatlán is a Nahuatl word meaning “place of deer”. All the sports teams call themselves the Venados - which means deer. And there are numerous deer statues throughout the city. The city is also known for its rich cultural scene that includes theater, art galleries and museums. The El Faro Lighthouse is one of the highest ac ve lighthouses in the world. You can hike to the top of the mountain where the lighthouse sits for the view of a life me. This mountain is the same mountain you see on a can of Pacifico Beer, (Mazatlán is where Pacifico beer was developed.) If you are adventurous you can hike to the lighthouse and ride the zip-line down from the top of the mountain, out and over the Pacific Ocean for .79 miles and land at the historical Observatory built in 1873 - a definite highlight and must-see place. The city of Mazatlán took advantage of their oceanfront loca on and made it accessible to the people when they developed the El Malecon. This is a boardwalk that gives people the space to walk or bike along the coast safely separated from the busy traffic. The Malecon stretches out for over 13 miles and is one of the largest boardwalks in the world.

Continued on Page 14

The exchange of information by like sized dealers in a non-competitive environment.

Continued from Page 13

If you love FRESH-from-the-boat seafood, Mazatlán is the place for you! Known as Shrimp Capital of the World, they serve up shrimp in more ways than Bubba Gump can think of! Fishing is a big industry down there and you can sit at beach side restaurants and watch pangas pull up on the beach and fishermen bring their just caught fish in coolers up to the restaurant! When Rick and Randy go fishing, we bring the fish to the restaurant and have them prepare it for us. They cook it in several different styles, and it is always so amazingly good!

And of course there is golf! They have three 9-hole courses within our development where our house is at. Rick has made friends with a gentleman named Eugene who lives in Ohio but spends a lot of me in Mazatlán at his meshares within the El Cid Marina, and they got together 3 mes this trip to play. So that is nice for Rick to have someone to play with.

This trip we were fortunate to have 2 different couples come down and visit with us. The first week we had Mark and Susie - who we have known for years but have just started spending more me with. They are actually the parents of our daughter Terra’s best friend from high school. This was nice because Mark and Rick played a couple rounds of golf while Susie and I were content being by the pool or hanging out reading our books. We enjoyed showing them around to see all the highlights and of course taking them out for some amazing food!

The second week Omar and Irene came down. We have known this couple for almost 40 years! Omar was a service writer back in the old, original, Kearny Mesa Dodge days when we all worked together! I was actually the service cashier and probably drove him crazy, always calling him to the cashier’s window to help me out with a problem customer! We have been friends for many years, but had really fallen out of touch the last dozen or so years ll recently and have now been spending more me together again, and it is so nice. Our friend Randy joined us down there halfway through. Him and Rick went fishing only one day on this trip but Rick reeled in a good size Marlin, so it was a good day.

Rick s ll found me to sit at the table and do his work for Jack Powell. What a nice place to work with the view of the channel and our resident Iguana, he calls Max.

Continued on Page 15

Continued from Page 14

Now we are home. And it is good to be home. Now we need to sit down and plan what is next! The main plan is to get out and visit friends and family, because when it all comes down to it that is what matters most, the people in our lives, and when we are together it just makes life be er - don’t ya think?

I hope you enjoyed my li le touch of Mazatlán history, because that is really all it was, just a touch. There is so much to see and explore! I hope that you find it interes ng enough to go explore it for yourself someday - shoot me a message if you need any ideas of what to see and do!

While auto tariffs and a growing trade war between the U S and China have grabbed much of the world’s attention, some suppliers say the Trump administration’s steel and aluminum tariffs are the cause of their biggest worries.

The 25 percent tariffs cover the metals themselves and a list of “deriva ve” products made of foreign steel and aluminum, including many auto parts. Importers must determine the foreign steel or aluminum content in those products. That value is taxed at 25 percent.

Calcula ng that number is difficult and me-consuming. Companies some mes need to drill several layers deep into their supply chains to figure out the source of steel or aluminum in their products and how much those metals are worth.

And in another complica on, the list of tariffed products is not sta c. It is expected to grow in the coming months.

“If you ask me what’s keeping me up at night, it’s the steel and aluminum deriva ves,” said an execu ve at a major supplier, who asked not to be named given the sensi ve poli cal nature of the topic.

Continued on Page 17

Continued from Page 16

Auto manufacturers grapple with ‘fog of war’ on tariffs

The swi implementa on of the expanded steel and aluminum tariffs and the confusion they’ve created throughout the supply chain are emblematic of the broader impact of the Trump administration’s levies on the auto industry Companies are scrambling to keep up with quickly changing, some mes opaque rules and trying to determine just how much tariffs will cost them, some mes with li le luck.

“Visibility right now is extremely low, and the fog of war is very thick,” said Felix Stellmaszek, global leader of Boston Consul ng Group’s automo ve and mobility prac ce.

The steel and aluminum tariffs expand on the du es President Donald Trump implemented during his first term.

In 2018, Trump put 25 percent tariffs on steel imports and 10 percent du es on aluminum, but both his and the Biden administra ons would later exempt metals from many countries. The aluminum tariffs jumped to 25 percent March 12, and country-level exemp ons also ended that day.

Trump’s recent tariff orders greatly expanded the list of deriva ve products that are subjected to the tariffs.

Nearly $150 billion in goods are subject to the steel and aluminum deriva ve tariffs across 289 product categories, ranging from screws and bolts to outdoor furniture and baseball bats. They apply to about $25.7 billion in annual imports of aluminum car, truck, bus and tractor parts, as well as $7.1 billion in iron and steel wire, stampings and forgings and $6.5 billion in iron and steel screws, bolts, nuts and rivets.

Automo ve products subject to the deriva ve tariffs include aluminum door hinges, bumper parts and body and suspension components. Some machines, including those used for the manufacturing of semiconductors, are also included.

Importers of those products are required to pay a 25 percent tariff only on the value of the foreign steel or aluminum in the part. Those du es stack on top of the 25 percent auto parts tariff scheduled to come into effect by May 3.

Steel, aluminum tariff calcula ons prove to be difficult

Calcula ng the value of the aluminum and steel in those products can be a complicated process, par cularly for parts comprised of many sub-components. Suppliers need visibility deep into their supply chains that they o en don’t have and didn’t need to have un l now, said Michael Robinet, vice president of forecast strategy at S&P Global Mobility.

“It’s difficult to pull this informa on out,” he said. “Some mes the informa on streams are not available. Vehicles have thousands of parts with thousands of processes on those parts. Some mes where those processes occur isn’t immediately apparent.”

It can be par cularly difficult for smaller suppliers, who might lack the resources or dedicated teams to monitor the latest tariff developments and to calculate sourcing figures.

“You’ve got to be able to be educated, but it’s tough when you’re a small, 100-man shop,” said Laurie Harbour, a partner at advisory firm Wipfli who works with tool and die companies and smaller suppliers.

Continued on Page 18

The exchange of information by like sized dealers in a non-competitive environment.

Continued from Page 17

It’s in a company’s financial interest to determine the value of the steel and aluminum in a product, par cularly on more expensive parts. According to guidance issued by U.S. Customs and Border Protec on, du es must be paid on the value of the en re part if the value of the foreign steel or aluminum content is unknown. Trump’s execu ve orders also direct the agency to assess penal es if the steel and aluminum values are listed incorrectly.

“It’s been difficult, if not impossible, to get clarity across the value chain, and I expect that to be quite a challenge for suppliers given the complexity of this,” said Wilfried Aulbur, senior partner at Roland Berger. “It’s going to be hard for companies to fully comply.”

Calcula ons for steel and aluminum tariffs mirror those automakers and suppliers are tasked with for the 25 percent auto tariffs. Vehicles and parts imported from Canada and Mexico that comply with the United StatesMexico-Canada Agreement’s regional content rules are subject to a 25 percent duty only on the non-U.S. content in the vehicle.

Again, figuring out that figure is o en easier said than done. Tariffs require companies to get into “a lot of granularity,” Magna CEO Swamy Kotagiri said.

“Just imagine the me that is going into dealing with this stuff now,” he said at an April 15 Automo ve Press Associa on event. “It’s monumental.”

Trump’s execu ve orders direct the Commerce Department to establish a process for including addi onal deriva ve products by May 11.

The rapidly evolving tariffs require automakers and suppliers to be as nimble as possible and as transparent with each other as they can be, BCG’s Stellmaszek said.

“At the moment, it’s a bit of a mad scramble,” he said.

Reuters contributed to this report.

Source: www.autonews.com

Two suppliers were honored for their partnerships with Audi AG and Stellan s to develop an intelligent digital taillamp and a heating, ventilation and air conditioning system for three-row vehicles

Marelli and Mahle Industries received Automo ve News Innova on Partnership Awards during the annual PACE Awards program April 15 The partnership awards spotlight unique collaborations between automakers and suppliers that lead to innovations that neither could have done alone.

PACE Awards judges recognized Audi AG for its role in facilita ng the collabora on between Marelli and OLEDWorks to pioneer so ware-controlled rear ligh ng and develop the intelligent taillamp. Audi leveraged its experience with organic light-emi ng diode technology and teamed with OLEDWorks and Marelli to overcome cost, performance and packaging challenges and add vehicle-to-everything communica ons to the rear ligh ng mission.

Audi used a collabora ve ecosystem approach, effec vely integra ng hardware, so ware, systems valida on and produc on capabili es across the three companies.

The lights weren’t designed only to be aesthe cally pleasing. There’s also a safety element.

Continued on Page 20

The exchange of information by like sized dealers in a non-competitive environment.

Continued from Page 19

“The car can now communicate to the people behind you in a way that they never could before,” Michael Boroson, co-founder of OLEDWorks, told Automo ve News. “When you are following a car, you didn’t know they were hi ng the brake un l they hit the brake. Now, the car can warn you I’m going to hit the brake, but I haven’t hit it yet, so you can back off before the car hits the brake, which is going to save lives. That’s actually the most important thing is the safety features. Yes, it’s cool. Yes, it looks great, but the safety features are going to save lives.”

The idea for the digital OLED taillight emerged around a decade ago. Bringing the vision to life “took a lot of blood, sweat and tears,” said Steve Muench, Marelli’s senior vice president of Americas.

Cesar Muntada, Audi’s head of light design, said: “We decided in those days this would be the right thing to do, not only to create lights that are beau ful, but lights that have a meaning, a sense. Why do we want these lights to be like this? We said, ‘Because the world can be be er, can be safer.’ ”

Mahle’s new high-performance HVAC system for three-row vehicles requires an upfront commitment to enable integra on into the vehicle design, which isn’t the case for other systems that are o en sourced late in development.

Stellan s was willing to do that and worked closely with Mahle to design ductwork and vents, while integra ng Mahle’s mul zone control so ware into the Jeep Grand Cherokee user interface.

Stellan s benefited through significant cost and weight savings, while offering customers a quieter, more energy-efficient system.

“The whole point of the high-performance system was combining the front and the rear unit [to] make one high-performance system, so it was really about saving costs,” said Jeff Kinmar n, engineering manager and head of concept development at Mahle Industries. “But there were a lot of things that we built off of that. The mass savings and then there were energy savings, then there were a lot of synergies, where we were combining some other technologies with the ductwork and even with the controls and the so ware.”

Stellan s believes “the best ideas do not happen in isola on,” but rather through “daring ac ons and strong partnerships,” said Marijana Cestaric, vice president of engine systems and HVAC.

“The high-performance HVAC system in the Jeep Grand Cherokee isn’t just about be er thermal management, it’s a leap forward in efficiency, performance and sustainability,” Cestaric said. “Our teams at Stellan s and Mahle successfully delivered this system while naviga ng another challenge, as much of this development and launch was done during COVID.”

Source: www.AutoNews.com

Ladies and Gentlemen,

Good morning, good a ernoon and good evening to all of you here in Amsterdam and everyone who is connected remotely.

Let me start by saying that 2024 was not a good year for Stellan s. The reasons for this were partly of our own making, which made this even more disappoin ng. In addi on, the misalignment between the Board and our CEO Carlos Tavares led him to leave the Company at the beginning of December 2024. Since then, the Interim Execu ve Commi ee, which the Board asked me to chair, has been working with all our teams in the day-today management of our Company.

Important and decisive ac ons have been taken to ensure that Stellan s is in the strongest possible posi on when our new CEO is appointed. The ming of that appointment will be in the first half of 2025.

Among other steps, we have been reducing our inventories, empowering our Regions, and working closely with our dealers, our suppliers and our unions. As a Company, we are laser-focused on the launch of new products and improving our opera ons in a very difficult environment in our two largest markets.

In Europe and the United States, policy and regulatory choices have put our industry under extreme pressure, while China is on another trajectory.

This year, the Chinese automobile market is set for the first me ever to be larger than the American and European markets combined. In the United States, the car industry is severely affected by tariffs. On top of the 25% tariff imposed on vehicles, we are impacted by layer upon layer of addi onal compounding tariffs including those on aluminum, steel, and parts.

In Europe, the CO2 emissions regula ons have imposed an unrealis c path to electrifica on, disconnected from market reali es. In fact, governments in Europe – some mes abruptly – withdrew purchase incen ves, and the charging infrastructure remains inadequate.

As a result, consumers are slow to transi on to electric vehicles. With the current path of painful tariffs and overly rigid regula ons, the American and European car industries are being put at risk. That would be a tragedy as car manufacturing is a source of jobs, innova on and strong communi es.

But it’s not too late if the US and Europe take the necessary urgent ac ons to promote an orderly transi on. We are encouraged by what President Trump indicated yesterday on tariffs for the car industry.

Before I conclude, I would like to say that in these months it has been my privilege to spend significant me inside our Company with so many extraordinary people whom I’d like to thank, as I’d like to thank you, our shareholders, for your con nuing support. And rest assured we are focused on bringing to the market the best products with the best brands.

Now I will hand over to Doug Osterman, our CFO, who will take you through a summary of 2024.

About Stellan s Stellan s N.V. (NYSE: STLA / Euronext Milan: STLAM / Euronext Paris: STLAP) is a leading global automaker, dedicated to giving its customers the freedom to choose the way they move, embracing the latest technologies and crea ng value for all its stakeholders. Its unique por olio of iconic and innovave brands includes Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, FIAT, Jeep®, Lancia, Masera , Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. For more informa on, visit www.stellan s. com

The exchange of information by like sized dealers in a non-competitive environment.

Our Supporting Vendors: Support those who support you .

Our

Support those who support you

M. Parese is a partner at the New Haven-based firm of Buckley Wynne & Parese

Recently imposed sweeping tariffs are likely to impact your business. As a board-cer fied econometristerixter, I thought it only prudent to offer some unsolicited observa ons.

Tariffs are essen ally taxes imposed by one country on imported goods. They can profoundly affect global trade, influencing everything from consumer prices to produc on costs.

For the U.S. auto body industry, tariffs are especially significant due to the industry’s heavy reliance on foreign-made parts and materials and its posi on within the global automo ve supply chain. The sweeping tariffs announced on April 2, 2025, will likely affect the U.S. auto body industry, from cost increases to shi ing manufacturing strategies.

The U.S. auto body industry is one part of the complex, globalized supply chain, where automakers o en rely on imported components, such as steel, aluminum, electronics, and other cri cal parts.

A typical modern vehicle contains roughly 30,000 individual components, including everything from the engine block to the smallest nuts and bolts. Imposing tariffs on the imports of vehicles and vehicle parts is inevitably going to affect your business. In 2018, when the U.S. imposed tariffs on imported steel and aluminum, for example, those tariffs par cularly impacted the auto industry, which consumes a significant por on of the na on’s steel and aluminum.

President Trump argues that the tariffs will protect domes c industries, create more factory jobs, shrink the federal deficit, lower food prices, and boost the U.S. economy. Opponents fear that tariffs will disrupt free trade, raise the cost of produc on and the cost of consumer goods, and poten ally send our economy into a recession. In either scenario or some combina on of these eventuali es, the auto body industry will likely have to contend with rising material costs and uncertainty about future trade policies.

One of the most immediate effects of tariffs on the auto industry will likely be the increase in produc on costs. U.S. automakers that rely on foreign suppliers for cri cal parts such as engine components, airbags, or electronic systems are likely to face higher expenses. A significant por on of automo ve parts and supplies comes from countries like China, Mexico, and Canada, all of which are now subject to new tariffs.

When tariffs are applied to materials such as steel and aluminum, that usually leads to price hikes that ripple through the en re supply chain. Even though U.S. automakers could look to alterna ve suppliers, doing so o en results in higher costs or diminished supply reliability, further complica ng their opera ons.

As a result, some economists fear that U.S. manufacturers will have no choice but to pass on these increased costs to consumers.

Continued on Page 25

Continued from Page 24

The current global nature of the auto body supply chain means that tariffs can have cascading effects on manufacturers, especially those that operate in a just-in- me inventory system. In the auto industry, parts and materials are o en shipped and delivered on a ght meline to maintain efficient produc on schedules. Tariffs have a dis nct way of disrup ng this system, crea ng delays in shipments and increasing the overall costs of inventory. Automakers who depend on just-in- me produc on to keep costs low may find themselves facing produc on bo lenecks and longer lead mes.

For smaller suppliers or auto body shops that rely on imported parts, tariffs can create financial strain. These smaller players o en cannot absorb the higher costs of tariffs as easily as larger manufacturers. As a result, they might be forced to pass those costs onto consumers or make difficult decisions about whether to maintain opera ons, adjust pricing, or find alterna ve suppliers, further exacerba ng disrup ons in the market.

Part delivery delays could also mean longer cycle mes and greater storage fees. We have seen insurers become more obdurate, refusing to pay reasonable storage fees (o en without any jus fica on or cause). This kind of pushback will only get worse if delays cause greater storage fees. You can protect your business by ge ng ahead of this problem by u lizing proper legal documents and transparently discussing your charges with customers and insurers.

The impact of these tariffs is likely to be mul faceted, influencing everything from produc on costs to consumer prices and global supply chains. Tariffs will have significant implica ons for the auto body industry. As a boardcer fied econometristerixter, I can say with some confidence that we all need to keep an eye on this evolving picture and be prepared to make adjustments as necessary to stay sharp.

I wish you and your families good health and happiness as we welcome warmer weather.

John M. Parese, Esq. is a Partner with the law firm of Buckley Wynne & Parese and serves as General Counsel to the Auto Body Associa on of Connec cut. Buckley Wynne & Parese maintains offices in New Haven, Har ord and Stamford, and services clients throughout all of Connec cut. The opinions set forth in A orney Parese’s ar cles are for educa on and entertainment purposes only, and should not be construed as legal advice or legally binding. If you have any ques ons or concerns about the content of this or any of A orney Parese’s ar cles, you are encouraged to contact A orney Parese directly.

The exchange of information by like sized dealers in a non-competitive environment.

The CollisionLink and RepairLink parts order management platforms allow your parts department to navigate smoother streets when connecting with shops & buyers. This makes it easier to drive parts sales, increase order accuracy, communicate with customers, and increase efficiency in your wholesale operations.

Leverage easy-to-access customer sales trends & reports, turnkey marketing campaigns, secure parts transactions, and streamlined DMS integrations – all through RepairLink and CollisionLink!

Eliminate the one-way streets between systems with seamless integration between your DMS and OEC solutions. Plus, DMS Connect enhances data consistency & accuracy while reducing manual order entry.

Experience a secure, quick, and cost-effective way to clear the delays that disrupt your parts transactions! OEC Payments helps you manage your wholesale business with secure payments, low fees, automated refunds on returns, and the ability to charge a restocking fee — all through RepairLink!

Open the express lanes for seamless customer marketing campaigns with professionally crafted email messaging that targets your existing shops based on buying behaviors, driving engagement & retention.

Avoid inefficient detours when accessing customer trends and sales data. A business intelligence platform, PSXLink is designed specifically for parts wholesales and provides clear visibility into sales activities, customer interactions, and KPIs.

Thebproautopartsportfoliocontinuestogrowandoffersgreatoptionfor usedcarreconditioning,serviceretentionandwholesalemechanical penetration.Formoreinformationorin-dealershipsupport,contactour NationalDirector–JoshGreenplatejgreenplate@helm.com/(717)818-9055

The bproauto parts portfolio continues to grow and offers great option for used car reconditioning, service retention and wholesale mechanical penetration For more information or in-dealership support, contact our National Director – Josh Greenplate jgreenplate@helm com / (717) 818-9055

Betterservice=morevehiclesserviced,moresalespotentialand increasedprofitability.People,ProcessandProductisthenameofthis game.Letustuneupyourretailserviceexperience.ContactourNational Director–DaveLongdlong@helm.com/(520)269-0563

Better service = more vehicles serviced, more sales potential and increased profitability People, Process and Product is the name of this game Let us tune up your retail service experience Contact our National Director – Dave Long dlong@helm com / (520) 269-0563

TheDealereStoreisyourone-stop-shopforallyourbrandedmerchandise andpromotionalproductneeds.Whetherforinternalorexternaluse,we cansourceandbrandanyproductsyouneed.Formoreinformationor customrequests,contactourAccountManager–AngieMcCluskey amccluskey@helm.com/(734)468-3635

The DealereStore is your one stop shop for all your branded merchandise -and promotional product needs Whether for internal or external use, we can source and brand any products you need For more information or custom requests, contact our Account Manager – Angie McCluskey amccluskey@helm com / (734) 468-3635

Looking to increase your gross profit per vehicle, customer retention and retail parts sales? FlexCare Vehicle Protection is the factory-backed solution your customers want and trust. Contact our VP of Sales – Reed King rking@helm.com / (585) 734-8777

Lookingtoincreaseyourgrossprofitpervehicle,customerretentionand retailpartssales?FlexCareVehicleProtectionisthefactory-backed solutionyourcustomerswantandtrust.ContactourVPofSales–Reed Kingrking@helm.com/(585)734-8777

IncreasegrossprofitpervehicleandbrandloyaltywithMopar AccessoriesandJeepPerformanceParts.Ourfieldteamisheretohelp yourdealershipwithproductknowledge,processandsalestrainingto increaseyourpartssalesandprofitability.ContactourNational Director–JeffPrattjpratt@helm.com/(248)392-8861

Built for dealerships, Activator’s evolved Customer Data Platform (CDP) brings your customer data to life. That means every customer who ever visited your dealership feels like you truly know them — their needs, their history, their next move.

This isn't just marketing at scale, this is customer connection at scale.

1.First the CDP with Data Management Layer, works to identify, organize, and connect customer data. Activator identifies and groups duplicate records to link every sale and interaction and into a single, living customer profile — so you always have the full story, not just scattered snapshots.

2.Old, forgotten records? They’re not lost. We breathe new life into your database, uncovering hidden opportunities and reactivating customers you already paid to earn.

3.When you know your customers, you can talk to them — their way. Multichannel Marketing lets you deliver relevent messages at the right time, whether it’s email, social, text, or direct mail.

With Automation and Journey Building, those conversations don’t stop after one interaction.

•They’re nurtured through personalized audience marketing that move customers closer to sales and service — automatically.

•Every click, open and action taken continues to builds up the customer profile and contact preferences.

•And when you’re ready to run something unique? Our Custom Campaigns give you the flexibility to connect in ways that feel personal, not cookie cutter marketing.

Ready to turn your data into real relationships? Early access pricing is live now: www.activator.ai/cdp-early-access

The exchange of information by like sized dealers in a non-competitive environment.

JANUARY 2025

To announce program enhancements and dealer incentives for the advance core harvesting (supplemental service procedure) of the 62TE transmissions on 2019 – 2021 Ram Promaster (VF).

This procedure supports transmission core returns BEFORE receipt of the new (replacement) transmission.

The Core Harvesting Supplemental Service procedure is outlined in Warranty Bulletin D-23-24 revised on January 17, 2024 as well as TSB 21-033-23 or STAR Online S2321000011.

This procedure and the associated LOP (21-00-06-CH) reimburses an extra 3.1 hours of labor in addition to the current Transmission Replacement LOP (21-00-06-13). The 3.1 hours includes securing the engine and moving the vehicle.

This procedure is applicable for all Safety (S), Warranty (W), Mopar (M) and MVP (F) claims.

2025)

The advanced core pull process is NOT an exchange order part process; however, Special Handling Orders (with inputted VINs) associated to an advanced pull core return for the R8453637AB will be prioritized above all other Special Handling orders on that part number. Note: Recall transmissions, part# CSPM44A4AA cannot be prioritized and will be addressed FIFO.

The advance core pull process will now become the most expeditious process to receive a transmission for all Promaster customers requiring part# R8453637AB.

DEALER INCENTIVE (JANUARY 2025)

In addition to the 3.1 hours of incremental labor time and the core reimbursement of $2,500, dealer personnel will receive incentive payments to the Service Manager (position code 09) and Parts Manager (position code 08) of $250 each (total of $500 ). This will be paid to the Rewarding Excellence card the month following the received core return . Dealer employee must be active with a valid SID, and a current mailing address in MyPersonnel within DealerConnect. See FAQ for details. Payment questions can be directed to the Rewarding Excellence Hotline at 888-887-6192.

Dealers must continue to utilize the Critical Core Return process outlined further in the document and also in the warranty bulletin. VIN entry for the core return is required. It is also critical that the dealer orders a transmission as Special Handling with a VIN included (or VIN specific for the campaign part - CSPM44A4AA).

March 1 –September 30, 2025 are the days to enter! 1

DETAILS:

Purchase a Mopar® Powertrain unit from your local Mopar dealer between March 1 – September 30, 2025, and submit an entry form to be entered for a chance to win one of five Grand Prize Trips to SEMA 2025!

THERE WILL BE FIVE WINNERS:

Each winner can bring one guest.

Airfare, hotel stay, and two entry passes for each winner and one guest per winner are all included. Trip dates are November 4 – 6, 2025.

Just order a Powertrain unit from your local Mopar Powertrain dealer and submit your entry at AERgiveaway.com!

With over 75 years of combined experience in the automotive in Warranty Reimbursement, Warranty Claims Processing, and De reflected in our three core business areas, each designed to dri

ndustry, QB Business Solutions is a leader in aler Analytics. Our expertise and dedication are ve dealership growth and operational efficiency:

Y CLAIMS

SSING:

ssion 97% or above

ys or less

uired Training iciency

ns due to employee tion, illness. etc.

Discover Hidden Revenue Opportunities

Parts Matrix and Labor Grid Utilization

Predictive Analytics

Data-Driven Decision Making

Menu Parts Calculator

It’s no secret that Fixed Ops is the heartbeat of the dealership. Yet many dealers unknowingly leave thousands— —on the table each year due to but the invisible issues buried inside your data. at the advisor level that mask opportunity and weaken pricing decisions

These issues add up— — built for all brand dealerships.that -driven pricing strategies.

And if your dealership is also interested in our the RealCustomerLabor and parts

Access for margins

This is the same $999 with our Warranty Reimbursement service.

One average we see CDJR stores have a within 60 days of using our suggested strategy. In Labor we saw due to outdated op codes/overrides—

This isn’t extra work—it’s about

Schedule a quick 15-

The exchange of information by like sized dealers in a non-competitive environment.

Finding and keeping the best employees requires me, structure, growth, and opportuni es. Everyone wants the superstar in their company. I hear it all the me, “hire the superstar, you want a superstar.” But as a shop owner who talks to a lot of other shop owners, it seems very few want the responsibility to cul vate an environment to develop a star, let alone create a galaxy that a superstar needs to shine in. A star in space needs a certain mass and a perfect balance of elements to not burn out. Your team needs a similar structure inside your walls. Not only for the rising stars, but also the superstars.

You may have people in your company that don’t shine brightly right now but could if their roles were defined directly. Take me to examine if there are missing elements inside of your establishment that could be er support them.

Do you have educa on in place, clear job expecta ons, benefits to excite them, good energy around you, and bays full of work? Do you have an exci ng place to show up to? These things ma er greatly to upcoming and top performers. If you have those stars already shining brightly in your facility, they could dim if you don’t protect and evolve their energy and space. So how do we, as shop owners, do that?

In the hiring process, so many of us pass over the future star to find a shinier one. When in fact, you may have the next brightest star in front of you, but you are ignoring them because they don’t fit your “ideal solar system” at this moment. I urge you to take some me to listen to the people you interview. They will tell you what they need to shine brighter.

Continued on Page 47

Continued from Page 46

I’ve heard it many mes from poten al employees, “no one listened to me, my ideas were ignored” or “I had no future.” Another common one is, “I wanted to learn, but they didn’t offer training.” These are cries for betterment. The star wanted more energy to burn brighter and the shop they worked for fell flat. You could be the one to ignite their flame and get them burning for your shop, but you will need to put some work in for them. Maybe they need educa on in certain areas, or a shop mentor to pair with for extra support for a while. It may be worth spending the me cul va ng someone if the result is a superstar. When you have someone in front of you willing to rise to the occasion, consider rising to the occasion for them. Reciprocity is important in a working rela onship, and you can either help that star burn to its full poten al, or let it fizzle out. You are the cul vator and keeper of your stars.

If you already have a superstar, you will need to ensure they stay burning. These people will thrive inside of well laid plans and details. These stars will shine and shine unless you abuse their stardom. You cannot expect them to do an outstanding job daily, and not con nually cul vate them because you assume they will con nue shining independently.

Remember, when the element balance is off, a star will start to dim. Some mes they break apart, and somemes they just die out. Keeping your workspace full of controlled challenges and opportuni es will keep the superstars glowing in a produc ve manner. Coaching in the way they prefer to be coached, eleva ng their skills with con nual advanced educa on, and offering them a secure future in your solar system is a way to keep your skies shining brightly. And again, listen to their needs. It will sound different than the budding stars, but they will tell you what they need to shine on.

I had a mentor tell me, “people are what you make them,” and I think that’s true. I find people can grow to extraordinary measures if they are interested enough in what they are doing and well educated in the area. But we are no longer in the hiring genera on of handing people jobs and standing blindly by as owners. People want and need opportuni es that come with structure, leadership, advancement, and support. They want promises that come to frui on and the ability to fill a void in a meaningful way inside their workplace. With some internal reflec on on how your business moves and develops people, you can create and a ract the superstars that will level up your establishment.

However, you must guide the ship with process prepara on, implementa on, and diligence.

You can do this, you’re the star gatherer.

Source: www.RatchetandWrench.com

Ar cle by Lola Schmidt

Stellan s says its new hands-free and eyes-off-the-road driving system would let users temporarily watch movies and engage in other non-driving tasks at lower speeds, a possibility that prompted warnings from some safety advocates.

The company, however, said it has decided not to make the system available right now.

The system, designed for use at speeds up to 37 mph, would be geared toward condi ons such as stop-and-go traffic during commutes, according to a company news release that said it could be adapted for global markets across Stellan s-branded vehicles.

Although it wasn’t ini ally clear how soon the company, which owns the Jeep, Ram, Chrysler, Dodge and Fiat brands, might make the system available, a spokesperson indicated that STLA AutoDrive 1.0 would not be launched at this me. It’s the company’s first ‘in-house-developed automated driving system.’

‘Our Level 3 technology is fully developed and ready for deployment, but the current market for autonomous driving at this level remains very limited. We have made the strategic decision not to launch it at this me. Once the market matures and condi ons become more favorable, we will evaluate the path to commercializaon,’ according to a company statement provided by spokesman Frank Matyok.

Level 3 refers to a 0 to 5 classifica on system for driving automa on.

The company’s ini al news release frames the system as an answer to me-was ng commutes.

‘Ideal for commuters in dense urban areas, STLA AutoDrive will allow drivers to temporarily engage in nondriving tasks such as watching a movie, catching up on emails, reading a book or simply looking out the window, reclaiming valuable me.’

The system, according to the release, no fies drivers when the me is right.

Continued on Page 49

Continued from Page 48

‘When traffic and system condi ons are right on a highway in a traffic jam and with good visibility, simply press a bu on and let STLA AutoDrive take charge,’ according to the narrator in a video posted on the company’s corporate website.

The system is supposed to maintain safe distances, adjust its speed and ‘manage steering and braking seamlessly based on traffic flow,’ the release said, no ng that the ‘system feels smooth, predictable and human-like in real-world condi ons.’

The announcement also promises automated sensor cleaning and notes that the system ‘con nuously monitors its surroundings through an advanced suite of sensors to ensure high-precision awareness and reliable opera on, even at night or in challenging weather condi ons such as light rain or road spray.’

Future over-the-air updates could poten ally offer ‘hands-free and eyes-off ’ opera on at speeds of up to 59 mph as well as off-road automa on. It’s designed currently to provide lower levels of driver assistance funcons, including adap ve cruise control, lane centering and hands-off-the-wheel op ons, at higher speeds.

If the system is ul mately deployed on Stellan s vehicles, it would appear to be a leap above what most other automakers currently offer. Asked whether he knew of any other systems currently promo ng ‘eyes-off ’ tech, Sam Abuelsamid, vice president of market research at Telemetry Insights, pointed to only one in this country.

‘Currently in the U.S. market, the only op on is the Mercedes-Benz Drive Pilot system on the S-class and EQS. In Europe, BMW offers a similar system on the 7 series, and back in 2021, Honda built a limited run of the Legend sedan (formerly sold here as Acura RLX) with an L3 eyes-off system.’

Mercedes-Benz notes on a company website that ‘Drive Pilot is cer fied to perform on major freeways in California and parts of Nevada.’

The abili es of advanced driver assistance and so-called self-driving systems have been highly promoted in recent years, but they haven’t come without issues. The Na onal Highway Traffic Safety Administra on upgraded an inves ga on into Ford Motor Co.’s BlueCruise system earlier this year connected to ‘two fatal crashes involving all-electric Mustang Mach-E vehicles when the technology was in use,’ according to earlier Free Press repor ng.

Tesla’s Autopilot and General Motors’ former Cruise self-driving subsidiary have also dealt with crashes. Abuelsamid advised drivers who might choose to use AutoDrive to beware.

‘Consumers should not even consider using such a system unless the automaker accepts liability for when things go wrong (because they will). Mercedes accepts liability if a crash happens while using Drive Pilot, and I believe BMW does as well. Tesla does not accept liability when using FSD (Full Self-Driving), pu ng it all on the driver,’ Abuelsamid said.

Michael Brooks, execu ve director of the advocacy group Center for Auto Safety, said he envisions the same safety issues with STLA AutoDrive that have plagued supervised vehicle autonomy.

‘When a crash is imminent or the computer inevitably experiences a failure, drivers who have bought into the ‘eyes-free, hands-free’ marke ng and used these features to the point of reliance will not be sufficiently engaged in vehicle opera on to avoid crashes,’ Brooks said.

Source: Detroit Free Press

Ar cle by Eric D. Lawrence

The exchange of information by like sized dealers in a non-competitive environment.

2 0 2 5 M o p a r M a s t e r s G u i l d

Officers:

O f f i c e r s & C o m m i t t e e s

President Cody Eckhardt - Ken Garff CDJRF - W. Valley City UT

V. Pres - Jim Jaeger – Bosak Motors – Merrillville, IN

Secretary - John Russo - Dallas DCJ - Dallas, TX

Treasurer – Chris Hojnacki – Serra CDJR – Lake Orion, MI

Executive Committee - All Officers Including:

Dan Hutton - Tom O’Brien DCJR - Greenwood, IN

Alan Yancey - Hayes CDJ - Alto, GA

Rick Cutaia - Rick Hendrick DCJR – Charleston, SC

Steve Hofer – Park Chrysler Jeep – Burnsville, MN

Susan McDaniel – Bill Luke CJD – Phoenix, AZ

Joe McBeth - Dallas DCJ - Dallas, TX

Guild Committees

MMG Annual Meeting 2025

Jill Vance - Apogee Event Agency

Cody Eckhardt - Ken Garff CDJRF - W. Valley City UT

Finance Committee

Chris Hojnacki - Serra CDJR – Lake Orion, MI

Susan McDaniel - Bill Luke CJD – Phoenix, AZ

Don Cushing – MMG Magazine

Newsletter/Website/Social Media

Don Cushing – MMG Magazine

Vendor Committees

Reynolds & Reynolds

Rick Cutaia - Rick Hendrick DCJR – Charleston, SC (Co-Chair)

Susan McDaniel – Bill Luke CJD – Phoenix, AZ (Co-Chair)

Joe Handzik - Bettenhausen Auto - Tinley Park, IL

Randy Rogers - Huffines CJDR - Plano, TX

Kent Cogswell - Jack Phelan CDJR - Countryside, IL

*David Kiser - Spartanburg CDJR - Spartanburg, SC

*Chris Hojnacki - Serra CDJR – Lake Orion, MI

CDK Global

Joe McBeth - Dallas DCJ – Dallas, TX (Chair)

Ian Grohs – Stateline CDJR – Fort Mill, SC

Robert Chatwin - Larry Miller DCJR - Sandy, UT

Dan Hutton - Tom O’Brien DCJR - Greenwood, IN

*Steve Hofer – Park Chrysler Jeep – Burnsville, MN

*Jim Jaeger - Bosak Auto Group - Merrillville, IN

OEConnection

Dan Hutton - Tom O’Brien CJD – Greenwood, IN (Chair)

John Russo - Dallas DCJ – Dallas, TX

Jim Jaeger - Bosak Motors - Merrillville, IN

Chris Hojnacki - Serra CDJR – Lake Orion, MI

*Steve Hofer – Park Chrysler Jeep – Burnsville, MN

Snap On Business Solutions

Cody Eckhardt - Ken Garff CDJRF - W. Valley City UT (Chair)

Randy Rogers - Huffines CJDR - Plano, TX

*Steve Hofer – Park Chrysler Jeep – Burnsville, MN

AER Manufacturing

Robert Chatwin - Larry Miller DCJR - Sandy, UT (Chair)

Ted Hawkins - Cerritos Dodge - Cerritos. CA

Chris Hojnacki - Serra CDJR – Lake Orion, MI

*Josh Gouldsmith - Gladstone CDJR - Gladstone, MO

*Joe Handzik - Bettenhausen Auto - Tinley Park, IL

Elite EXTRA - Epicor

Joe McBeth - Dallas DCJ - Dallas, TX

Alan Yancey - Hayes CDJ - Alto, GA

Chris Hojnacki – Serra CDJR – Lake Orion, MI

Steve Anderson - Tonkin Parts Center - Portland, OR

Steve Hofer – Park Chrysler Jeep – Burnsville, MN

Vendor Chairs

Susan McDaniel - Bill Luke CJD – Phoenix, AZ

Cody Eckhardt - Ken Garff CDJRF - W. Valley City UT

*Alternate

“The exchange of information by like-size dealers in a non-competitive environment”