INDIAN WOMEN TAKE CENTRE STAGE

The power of womanhood has long been celebrated in poetry and prose both ancient and contemporary. Across centuries and civilizations, women have played a vital role in shaping societies, nurturing innovation, and driving progress. Yet, much of their contribution has remained unacknowledged or overlooked. The under representation of women in public spaces, leadership roles, and economic participation continues to be a pressing concern. Beyond issues of fairness and equality, this gap comes at a significant cost to our nation’s development and growth. Numerous studies have pointed to the immense economic value that women's full participation could unlock. The time has come to not only acknowledge this potential but to act decisively and inclusively. We must envision a world where women are not merely included but are integral to shaping policies, designing services, and influencing change. A world where equal pay, equal opportunity, and equal respect are not aspirations, but realities. It is no longer about waiting for a seat at the table it is about reshaping the table itself. The time has come for women to lead boldly, change the game, and accelerate progress.

In this context, MMA organized a thoughtprovoking session on the theme of the book “Nari Shakti: Indian Women Take Centre Stage” on 27 January 2025 at the MMA Management Center. We were honoured to have Ms. Arundhati Bhattacharya, Former Chairperson, State Bank of India and Chairperson & CEO, Salesforce India, as the Chief Guest. Her powerful insights and inspiring words

made the session a memorable one.

I am pleased to present a special feature on this engaging event in this issue. I encourage you to read through the article and watch the session video it may very well spark a new perspective on the path to true empowerment. Click here to watch the video.

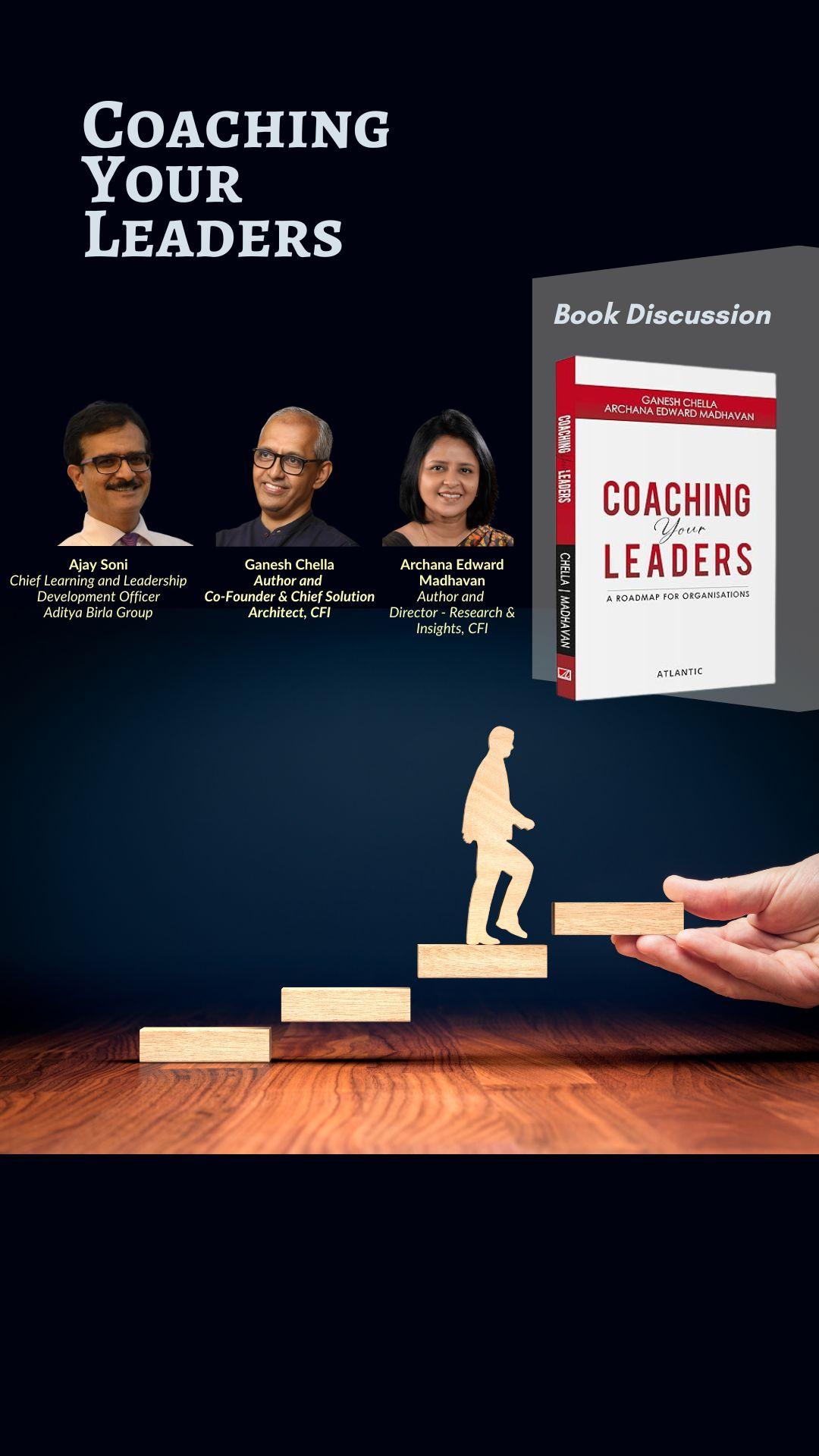

I am also pleased to share, in this issue, a selection of inspiring articles that delve into some of the most relevant themes shaping today’s professional and organizational landscape. Explore insights on sustainable finance, discover strategies in play to potential, understand innovation through the lean start-up, and uncover practical guidance in "Coaching your leaders: A roadmap for organizations."

Each piece offers valuable takeaways to inspire reflection, spark action, and support your personal and professional growth.

Read on and get inspired.

As always, we would be happy to hear your views, comments and suggestions.

I wish you a Happy Tamil New Year’s Day! Happy Reading!

The Trump comeback is redefining global politics, shifting policies, power dynamics, and public discourse in ways that could influence the world for years to come.

A N Neew w N Noorrmmaal l o or r a a T Teemmppoorraarry y SSttoorrmm? ?

K Kumar

Retired Partner of Deloitte, India

Acouple of weeks ago, Fareed Zakaria remarked that the new Trump Presidency has been nothing short of breath-taking. Every morning, we wake up to a fresh tweet, executive order, or announcement each more startling and unprecedented than the last. From wanting to back Greenland or the Panama Canal, to making Canada the 51st state, imposing tariffs, redefining citizenship, pulling out of the Paris Accord, the ICC, and the WHO it's been a whirlwind. Even ideas like building a riviera in Gaza have been floated. The pace and

intensity of change is unlike anything we’ve seen in our lifetimes.

MARKETS IN FLUX

Why is it so important for us to understand this? First, from an economic standpoint, and second, from a geopolitical one. Let’s start with the economics. The United States accounts for 25% of global GDP, but a staggering 75% of global market capitalisation. Less than a decade ago, that figure was closer to 50%. Over the past six or seven years, that number has shot up and of that 75%, just 10 companies account for nearly half. That’s a huge concentration of capital. And the fact that many of their leaders were standing beside Trump during his inauguration is not just symbolic it could fundamentally reshape global trade, commerce, and industry.

This makes it essential to not only understand broad policies, but to zoom into how these few dominant companies are aligning with the

Another concern: capital flight. Foreign Institutional

Investors have been pulling out funds from India in large volumes.

administration. Just recently, Vice President Vance made a speech in Paris. He claimed to champion small businesses, but his statements were music to the ears of oligarchs. Clearly, the proximity between big business and the White House is tighter than ever.

What does this mean for investors? It creates massive uncertainty. No rational investor would commit capital to building a supply chain today when, with a stroke of a pen, the rules of the game can change overnight. In India, private investment has already been sluggish over the last 4–5 years. This kind of unpredictability only makes it worse. It doesn’t inspire confidence it stifles the so-called animal spirits.

Another concern: capital flight. Foreign Institutional Investors have been pulling out funds from India in large volumes. You wake up at night in a cold sweat wondering have we hit bottom, or is there more pain ahead? No one knows if this volatility will last two months or stretch to six.

With the U.S. being the de facto safe haven, capital is flowing out, weakening currencies like the rupee. In just a few months, the INR has lost significant value. According to experts, the rupee might still be overvalued by 9%. Will we see a steep correction in the short term, or a slow depreciation of 3–4% per year over the next few years? Either scenario wreaks havoc

If Vice President Vance’s comments on AI are implemented where the U.S. essentially dictates terms and expects the world to follow or face consequences.

on our fiscal planning and budget projections.

Then there’s tech. If Vice President Vance’s comments on AI are implemented where the U.S. essentially dictates terms and expects the world to follow or face consequences. That’s a chilling proposition for a country like India. For instance, 50% of Infosys’s revenue comes from the U.S. market. For some firms, it’s as high as 60%; even the lowest is around 40%. If this uncertainty continues, our pride which is our tech industry will face serious headwinds.

RETREAT OF A SUPERPOWER

For decades, U.S. dominance in economy, military and through soft power made it the world’s stabilizer. But now, we see them withdrawing from multilateral institutions, most of which they helped create the Paris Accord, WHO, NATO, and others. This creates a power vacuum. Every country has made serious green energy commitments based on the Paris accord. If the U.S. pulls out, what happens to global efforts on climate change? The WHO may have faltered during COVID, but it’s still the only global health institution we’ve got. Without U.S. funding, it’s weakened.

Gopal Ratnam

Journalist based in Washington, D.C.,

Iwill cover three major themes: first, explain the domestic political context in the U.S. and how, if institutions function properly, some of Trump’s more extreme moves could be restrained. Second, I’ll explore what Trump 2.0 could mean for India and the world. Third, I’ll briefly touch on why Trump seems bent on dismantling institutions, both global and domestic institutions that have traditionally been the bedrock of U.S. strength.

Trump isn’t behaving like a President elected to lead a democratic government. He’s acting more like a medieval conqueror wielding executive orders like swords, aiming to dismantle and dominate institutions. While the headlines are often terrifying, the actual impact of some moves has so far been less dramatic but that may not last.

Let’s run through what Trump has done in just the past month. He’s signed a flurry of executive orders. Now, in the U.S., executive orders don’t have the weight of law they can be challenged in courts or reversed by future presidents. Trump has done both: rolling back Biden’s orders and issuing his own. One

USAID has been gutted, 75,000 government employees have been laid off, and diversity programs across federal agencies are being dismantled.

major move was an attempt to withhold nearly $3 trillion in federal assistance from the $10 trillion annual budget. States sued, and courts blocked the move.

Then it was followed by the widely-circulated executive order to end birth right citizenship, which understandably alarmed immigrant communities. But this right is enshrined in the U.S. Constitution’s 14th Amendment, passed after the Civil War. A President cannot revoke it. Only children of foreign diplomats are exempt, because they aren't subject to U.S. jurisdiction. Again, the courts stepped in and blocked the order.

Trump also threatened to slap tariffs on Mexico and Canada. Both countries, already managing issues like migration and drug trafficking, appeared to appease him so he delayed the tariffs. Then there was a proposal to slash $4 billion from the National Institutes of Health (NIH), a key agency responsible for major breakthroughs, including the funding of mRNA vaccine research during COVID. That, too, was blocked in court.

Still, some changes have gone through. USAID has been gutted, 75,000 government employees have been laid off, and diversity programs across federal agencies are being dismantled. Legally, Trump can’t shut down agencies like USAID outright because

Congress created them. Republicans control both the House and the Senate, and the opposition are wary of opposing him, they aren't exercising their checks and balances.

IS THERE A RESTRAINING FORCE?

Now, the big question: Was Trump actually elected to do all this? Did voters give him a mandate? Mandates are usually judged by vote share. In the U.S., the President isn’t elected by popular vote, but through the Electoral College. Even by the popular vote count, Trump got just 49.8%, while Kamala Harris got 48.3%. That’s a plurality, not a majority.

In poll after poll, voters said their top concerns were inflation and the economy. Trump promised to address inflation on Day One. But nearly a month in, inflation hasn’t been tackled. In fact, it’s rising. His executive actions don’t seem to address voter concerns at all. Is there anything that might restrain him? Possibly. In the House of Representatives, Republicans hold a slim three-seat majority 218 to 215. In the Senate, they hold 53 seats to the Democrats’ 47. These thin margins mean that even a small group of Republicans breaking ranks could limit Trump’s actions. But whether that happens is still an open question.

Congressional elections in the U.S. take place every two years. The next round is due in November 2026, when all 435 seats in the House of Representatives the lower house will be up for election. In the Senate, one-third of the 100 seats come up for re-election every six years, which means 33

A recent Brookings study found that the areas most intensely impacted by Chinese retaliatory tariffs are concentrated in... Trump supporting states.

Senate seats will be contested in 2026.

Of those 33 Senate seats, 20 are currently held by Republicans. Many of those senators are eager to get re-elected, so they’re likely to be cautious about supporting Trump policies like tariffs or budget cuts that could cause economic pain to their own constituents. But it also depends heavily on how effective the Democratic opposition is at presenting an alternative narrative to voters. These are pressure points that foreign governments are well aware of and in some cases, actively exploit.

CHINA’S STRATEGIC MOVES

Take China, for example. Trump has imposed tariffs on Chinese goods, and China has retaliated. But their retaliation has been strategic: they’ve targeted American sectors located primarily in Republican strongholds. A recent Brookings Institution study found that the areas most intensely impacted by Chinese retaliatory tariffs are concentrated in energy and manufacturing-heavy counties across states like North Dakota, Indiana, Ohio, Kentucky, Alabama, and West Virginia all of which are strong Trumpsupporting regions. So China’s countermeasures are designed to maximize political pressure on Trump and his allies. Meanwhile, Trump has also threatened to roll back electric vehicle (EV) incentives introduced

Rather than directly addressing economic grievances, the party often shifts the conversation to cultural and identity issues.

by the Biden administration. That’s already causing unease in the auto industry. Many of Trump’s economic actions could end up hurting his own voter base through rising unemployment, higher inflation, and declining industrial investment.

THE ART OF DISTRACTION

In a normal political environment, this would be a recipe for electoral disaster. But the Republican Party has, over time, mastered the art of voter distraction. Rather than directly addressing economic grievances, the party often shifts the conversation to cultural and identity issues. There’s an old political saying: politics only has two buttons hope and fear. And the modern Republican strategy is all about pushing the fear button.

They’ve demonised immigrants, invoked foreign threats, targeted LGBTQ+ communities, and stirred up anxieties around race and religion all to distract voters from the fact that Republican economic policies are often detrimental to working-class Americans. And it's worked remarkably well for them. Now, voters aren’t the only constituency the Republican Party serves. The other major one is the ultra-wealthy donor class and corporate lobbyists many of whom surround Trump and bankroll his campaigns.

CROSSING THE BUDGET HURDLE

That brings us to the next big political moment coming up: Congress has to pass the federal budget for 2025. On one side, there are hardliners who are deeply opposed to increasing the national debt which currently stands at $36 trillion. On the other side, there are factions that want to extend these tax breaks regardless of the fiscal cost.

To reconcile the two positions, they’d have to slash spending, especially on social welfare programs. But that would hurt low-income voters who rely on these government services. At the same time, there’s another Republican faction pushing to increase defence spending, which is already at $900 billion annually. That means the national debt will grow quickly. You can’t make all of this add up without internal conflict over how to balance the books.

MANUFACTURING THREATS

To make matters worse, Trump and his allies keep manufacturing new threats. Just last week, Trump designated several Mexican drug cartels as foreign terrorist organizations. What that label means is the U.S. could theoretically send military forces into Mexico to confront these gangs essentially creating another war. But not everyone in the Republican Party supports that kind of aggressive foreign policy. There are isolationists within the party who want nothing to do with overseas military operations they just want America to be left alone.

Now, if the Democratic Party in opposition can stay united, it will be difficult for Trump to push

Americans have historically shown very little interest in foreign policy. But there is one foreign policy issue that resonates deeply with American voters and that’s immigration...

through his entire agenda without at least some bipartisan support. And if no compromise is reached, that could once again lead to a government shutdown. In fact, the longest shutdown in U.S. history 35 days occurred during Trump’s previous term.

RECIPROCAL TARIFFS

Trump has also issued a new executive order on reciprocal tariffs, which would impose the same tariff rates on foreign goods that those countries apply to American goods. But it’s still unclear how this would work in practice. Implementing such a policy could become incredibly complex and messy. The outcome could be rising prices for consumers, more inflation, and increased economic pain for Republican candidates heading into next year’s elections. So right now, there’s a lot of internal fighting within the Republican Party, and how these contradictions get resolved remains to be seen. Things might become clearer in the coming months.

THE MESSAGE FOR INDIA AND THE WORLD

What does all this mean for India and the rest of the world? Well, in general, Americans have historically shown very little interest in foreign policy. But there is one foreign policy issue that resonates

India does not want to just buy foreign-made weapons it wants to manufacture them locally under the ‘Make in India’ initiative.

deeply with American voters and that’s immigration. And that’s why Trump constantly hammers on undocumented immigrants and paints them as a threat. This narrative has huge political mileage, even though it isn’t actually grounded in fact. Ironically, Barack Obama not Trump still holds the record for the most deportations in U.S. history. In fact, he was often referred to as the ‘Deporter-in-Chief.’ The other foreign policy matters like the Russia–Ukraine war, the Israel–Hamas conflict, or the growing threat from China do not interest the average American voter. They don’t prioritise them at the ballot box.

INDIA’S DEFENCE TIES

Prime Minister Modi recently visited Washington. After his meeting at the White House, Trump announced that India would be buying billions of dollars’ worth of U.S.-made weapons. One of the items reportedly under discussion was the advanced F-35 fighter jet. There’s a lot of friction between the two sides over how this should work. India does not want to just buy foreign-made weapons it wants to manufacture them locally under the ‘Make in India’ initiative. However, the U.S. is very reluctant to transfer sensitive technology. Most of their advanced systems come with what’s known as a ‘black box,’ a sealed system that can't be opened or replicated. On

Historian Timothy Snyder has an interesting take. He says Trump is a ‘weak strongman’ not a wolf in sheep’s clothing, but a sheep in wolf’s clothing.

top of that, U.S. defence deals include a strict and intrusive inspection regime. Modi and Trump also said in their joint press conference that they had agreed to collaborate on cutting-edge technologies including semiconductors, quantum computing, and artificial intelligence. But in reality, these collaborations have already been underway for several years. So this wasn’t a ground-breaking announcement but more of a continuation of existing efforts.

A WEAK STRONGMAN?

What does all this mean for global alliances? Well, the U.S.-led post–World War II global order has been unravelling for some time now. Trump’s running mate, JD Vance, recently said that Ukraine should not expect to regain its 2014 borders, effectively conceding territory to Russia. That’s a clear signal that Trump administration might accept Putin’s land grabs in violation of international law.

Trump has a long history of admiring Vladimir Putin. Historian Timothy Snyder has an interesting take. He says Trump is a ‘weak strongman’ not a wolf in sheep’s clothing, but a sheep in wolf’s clothing. Someone who acts tough but caves in front of actual strongmen like Putin. If the United States under Trump begins to support ideas like taking the Panama Canal or Greenland by force, or if it fails to oppose

Russia taking Ukrainian territory, then it loses all moral authority to oppose, say, China taking Taiwan by force. It sets a dangerous precedent where any powerful country could feel emboldened to invade its weaker neighbours without fear of international backlash. Honestly, I think they could get a lot worse, starting domestically and then spiralling outward to the rest of the world. So far, many of Trump’s more extreme executive orders have been checked by the courts. But they’re laying the groundwork for a legal and constitutional argument that the President can ignore court orders. If that happens, and if Congress is also unwilling to act as a check, then you have a situation where the entire system of government could collapse. The U.S. Constitution was built on a balance of three co-equal branches: the President, the Congress, and the courts each designed to check and balance the others.

THE AMERICAN SUPPORT CONUNDRUM

Do Americans actually support this level of institutional destruction both at home and globally?

And if they do, why? To understand that, we need to take a step back and look at the broader social and economic context in which Trumpism has taken root.

There is a deep and long-standing rage and anger in large parts of American society rage that Trump taps into and channels. Let me just outline a few major trends. First, there is massive income inequality. The top 5% of Americans own two-thirds of the national wealth. The U.S. has a per capita GDP of $82,000, but that number hides huge disparities. For example: 12% of urban residents live in poverty. A

When free trade and market-driven capitalism led many of the biggest American companies to move their factories overseas. What they left behind were hollowed-out communities.

shocking 30% of rural Black Americans live below the poverty line defined as $15,000 per year. In some rural counties in Georgia, there’s not a single maternal healthcare physician for miles, forcing women to travel nearly 100 miles for basic prenatal care. In Alabama, raw sewage still bubbles up in Black families’ backyards. In Detroit, large numbers of poor residents have been exposed to lead poisoning from contaminated water. This deep suffering often goes unreported, but it’s real, and it’s widespread. A lot of this has roots in the economic shifts of the 1970s and 1980s, when free trade and market-driven capitalism led many of the biggest American companies to move their factories overseas. What they left behind were hollowed-out communities.

This economic devastation has had very real human consequences: drop in life expectancy; rising drug overdoses; spike in suicides, especially from gun violence and a chronic lack of access to affordable healthcare. This is the social and emotional soil in which Trumpism has taken root. It’s not just about ideology it’s about dislocation, desperation, and a loss of meaning for millions of Americans.

But while all of this was unfolding in small-town America, there were also America’s disastrous wars in the aftermath of 9/11. In Afghanistan and Iraq, the U.S. spent a staggering $5.2 trillion, lost thousands of

soldiers, and saw tens of thousands more return home physically and psychologically wounded. Both wars ended in failure. What’s worse is that no one was held accountable. Many senior generals misled the public. And yet, none of them faced consequences. Meanwhile, on the civilian side, you all probably remember the 2008 financial crisis. Americans lost an estimated $13 trillion in household wealth. One in four families lost at least 75% of their wealth. But again not a single Wall Street executive responsible for creating and selling those worthless mortgagebacked securities was ever punished.

People ask, "Why is the American voter so angry?"

There’s a deep sense among millions of Americans that the system is rigged, that they’re being left behind, while the well-educated elites especially those living along the coasts, including immigrants continue to prosper from the stock market and the tech boom. All of this has been amplified by social media. This anger isn’t just economic. There’s also a clear racial component. There is real resentment among parts of white America that black and brown people, including educated immigrants, are succeeding and there's a perception that their success comes at the expense of white Americans.

Barack Obama’s election was a turning point, jolting many white voters into a fear that their social and political dominance was eroding. Demographers project that white Americans could become a minority within the next 10 years. Trump exploited these fears. So we’re in a very dangerous and complicated moment, both for American democracy and for the world order that has existed since World War II.

Q&A

Air Marshal M Matheswaran: The stark inequality in the United States becomes visible if you travel through the central part of the country The U S is a massive geographical space three times the size of India but has a population of just about 300 million, compared to our 1.4 billion. And yet, the hostility towards immigrants continues, despite the vastness and the availability of resources.

The disparity in living standards is glaring. This creates deep social divisions. Trump has exploited this inequality and redirected people's frustration into misplaced anger particularly around race and immigration. He has convinced a large portion of Americans that these are the real problems, rather than the structural issues rooted in the economy.

A Recurring Pattern

Now, I want to pivot from there to something broader. The United States has been the global hegemon since 1945. If you've read Paul Kennedy’s "The Rise and Fall of the Great Powers," you’ll recognise a recurring pattern: every hegemon eventually overextends itself. Once a power rises and dominates the global order, it cannot simply get down. It must continue to stretch its influence, often beyond sustainable limits.

The U.S. did this by creating systems like the

petrodollar and by ensuring the dollar became the global reserve currency. But this dominance demands constant maintenance. Today, the U.S. maintains 902 military bases across the globe. It’s combined spending on defence, security, and homeland protection is $1.6 trillion a year. To fund all this, it keeps printing dollars, and the rest of the world essentially pays for maintaining this hegemony by buying and holding dollars.

But this order is now under serious threat. Two major events—the Russia‐Ukraine war and the Gaza conflict— have exposed the fragility of U.S. dominance. The global South is increasingly disillusioned. Many countries now believe the U.S. has weaponised the dollar, using sanctions and economic pressure not just as policy tools but as instruments of coercion. The trust in America as a reliable guarantor of global public goods is eroding.

The Role of the Deep State

Much of the continuity in U.S. foreign policy, regardless of who is president, comes from the so‐called ‘deep state.’ Thinkers like Michael Hudson or journalists like Chris Hedges argue that Trump’s actions are more theatrical than consequential. The only real alternative is for the U.S. to acknowledge a multipolar world.

Look at what’s happening with BRICS. The very idea of de‐dollarisation has prompted threats from Trump, who said he'd come down on them like a ton of bricks. But here's the truth: he may no longer be able to stop it. In 2001, the dollar made up 75% of global reserves. Today, that number is down to 59%, and it's declining rapidly. Meanwhile, U.S. domestic debt has ballooned

to $36 trillion. These are not numbers you can ignore.

Gopal Ratnam: Whether Trump can be stopped, or at least slowed down, really depends on how domestic politics unfolds Of course, people are saying all sorts of extreme things like Trump might refuse to leave office or cancel elections altogether. These are worst‐case scenarios, and while unlikely, if something like that were to happen, then all bets are off.

Air Marshal Matheswaran: Trump is essentially a businessman, and now he’s surrounded himself with many tech oligarchs. Have these individuals essentially taken over?

Gopal Ratnam: Elon Musk has been given free access, which is unprecedented. That’s a matter of concern. When it comes to other tech giants Zuckerberg, Sundar Pichai, Jeff Bezos I don’t think they’re interested in governance. They mostly just want to be left alone to make money, and Trump seems to be offering exactly that. I have a strong feeling that in the coming months, a major clash between Musk and Trump is inevitable.

Air Marshal Matheswaran: A couple of economic points I want to raise. One key issue is how China seems to have prepared itself strategically for Trump’s possible return. Unlike last time, when their response to Trump’s tariffs and trade war was somewhat reactive, this time their approach is much more calibrated and forward‐looking.

The CFO’s role in sustainable finance is evolving, integrating ESG principles, digitalization, and strategic investments to drive long‐term value, regulatory compliance, and environmental responsibility in corporate decision‐making.

Ihave divided my presentation into two parts: the basics, which cover the theoretical aspects, and the specifics of what we do in our organisation. There are ten important trends shaping the future of finance:

* Raising the bar from a trusted business partner to a steward of value creation

* Dynamic financial planning

* Cash is king (again)

* AI becoming the real deal

* A new era of ESG begins

* Operational excellence

* System and data modernisation

* Future-proofing the finance organisation

* Building the dream team

* Knowing your investor and becoming your own activist

Cash has once again become king. At TVS Motor Company, we used to offer credit, but after COVID-19, we decided to adopt a cash and carry model. Initially, there was resistance from the sales and marketing team, but today, we are generating positive free cash flow. For finance professionals, cash is always a crucial element.

Our internal audit process is now almost entirely AI-driven. As we transitioned towards digitalisation, we evaluated our manual processes and aimed to eliminate them. While we haven't achieved complete automation, we have made significant progress. We have yet to fully eliminate Excel, which, despite being useful, can be dangerous. Sometimes it misleads. I'm not questioning Excel's utility, but it is a manual intervention tool.

Aside from ESG, the most important aspect is building a strong organization and talent pool. The opportunities for finance professionals are immense, and we must relearn many new skills. The final phase

involves investor relations, a portfolio I've been handling for some time. Investors' expectations have significantly changed. Some institutions now request discussions about our ESG initiatives.

ESG might seem like an expense, but we should think beyond traditional accounting. Although it may not provide immediate payback, ESG is an investment for the future. From an accounting perspective, we might write off ESG as an expenditure, but I always consider it a future investment, creating something unique for the future. This provides a background on ESG.

THE THREE EQUITIES

Sustainability hinges on three core equities: environmental, social, and economic. The crucial principle is that consumption must not outpace replenishment, and pollution should remain within the limits of nature's restorative capacity. We have a responsibility to protect and actively replenish natural resources. Social equity ensures that basic human needs are met, while economic equity focuses on value creation throughout a well-governed value chain.

In our company, we strive to deliver quality vehicles that offer value to the end customer. Our dealers are expected to uphold governance principles and treat customers fairly. Our suppliers must adhere to ESG (Environmental, Social, and Governance) considerations. By integrating ESG principles across the entire value chain, we foster significant positive economic activity. This holistic approach embodies the evolution of the triple equity framework.

SUSTAINABLE FINANCE

Sustainable finance involves integrating and embedding ESG (Environmental, Social, and Governance) aspects into financial figures, whether through investment decisions or capital allocation. Green investment refers to investing in initiatives that promote a favourable natural environment, conserve natural resources, and reduce carbon emissions. Such investments should not be viewed merely as costs but as opportunities for significant future benefits.

Regarding risks, there are two main types: financial risks and regulatory risks. Financial risks involve uncertainties, as it is not always certain that benefits will be realised. These investments are strategic, with the potential to deliver long-term rewards. In contrast, those who do not follow ESG principles may be more competitive in the short term but face long-term implications.

Regulatory risks arise from compliance requirements. Regulators sometimes offer incentives, such as benefits for customers purchasing electric vehicles, PLI benefits for manufacturers, and GST reductions. Non-compliance can result in carbon taxrelated penalties. Thus, while there are risks associated with ESG activities, they can be mitigated with a broader outlook on long-term benefits.

INCREASE IN THE BOTTOM LINE

ESG considerations must be incorporated into planning processes, scenario planning, capital expenditure (CapEx) decisions, and performance dialogues. Nowadays, even performance incentives are

The concept of linking performance appraisals to ESG achievements, especially at senior

levels, is gaining traction.

linked to ESG deliverables. Establishing processes and systems, monitoring them, ensuring controls, and proper reporting are very important. The concept of linking performance appraisals to ESG achievements, especially at senior levels, is gaining traction.

Quantification and communication are essential. Merely undertaking ESG-related work is insufficient; effective communication both internally and externally about the actions taken and the future benefits is necessary. Questions about ESG initiatives and investments made in each and every quarter are common from both investors and regulators. It is our responsibility to ensure ESG considerations are adequately addressed.

Revenue generation should be highlighted as well. Operating cost savings, productivity improvements, and reductions in quality, energy, interest, and other costs can enhance the bottom line. Failure to act may result in lost opportunities or penalties. Tax incentives associated with ESG investments should be factored into investment decisions. Today, customers are often willing to pay a premium for compliance with ESG principles.

Investors have expectations. And it is our duty to clearly communicate our ESG (Environmental, Social, and Governance) considerations and the value we derive from sustainability initiatives. I personally

believe that, if properly implemented, these efforts could result in a 3% to 5% increase in EBITDA. In digitalization, we can achieve a 2% increase. The advantages may come in the form of energy savings or waste recycling.

ESG INITIATIVES IN TVS

In our organisation, we ensure that our factories and scrap yards are so clean and well-organised that one could comfortably dine in these places. We clearly demarcate reusable items and ensure that every reusable item is brought back into the production system.

Water Treatment: With around 12,000 people in our factory, we implement effective water management which is crucial due to the high costs of water involved. There are tangible, quantifiable benefits that increase profits and impact the P&L statement.

Measuring ROA: Direct financial returns can come in the form of top-line increases, productivity improvements, or absolute cost savings. Effective ESG (Environmental, Social, and Governance) management can potentially reduce insurance premiums. Addressing climate risk is essential, as a 2% increase in temperature can severely impact the economy, demand, productivity, and consumption. Maintaining and enhancing our brand and reputation, built over 100 years, is critical, as ESG compliance significantly boosts brand value. Although brand and reputation are not easily quantifiable, they are crucial for longterm success.

In India, green loans and bonds accounted for around 70%, with utilities and finance industries leading the way.

Investors expect market stability and value government incentives. For example, the GST on electric vehicles (EVs) is 5%, compared to 28% for conventional vehicles. PLI benefits are substantial, and government incentives should be considered in project decisions and long-term financing.

Financing Options:

We have green bonds or sustainable loan bonds. A loan or bond represents an agreement between a banker/lender and an entity, also known as a transition bond, where the use of funds is defined for ESG investments. Sustainabilitylinked bonds do not have an end-use link. We have the leverage to renegotiate the bond terms when ESGrelated KPIs are achieved.

The global bond market, which was $38 billion in 2014, has now surpassed $4 trillion. In the first half of FY 23-24, 11% of bonds issued were in ESG format. In India, green loans and bonds accounted for around 70%, with utilities and finance industries leading the way. The government is also a significant borrower of ESG-related bonds.

ESG funding is possible for every company. In India, 60% of EV two-wheeler funding depends on retail funds, with NBFCs playing a crucial role. With increasing EV penetration, NBFCs can access concessional funds, which can be passed on to end customers.

Suppliers: ESG-compliant suppliers can provide better working capital-related funding. Sustainable finance is similar to traditional products, with no extra documentation or negotiation. It offers a diversified lender base and access to long-term lenders who are more like investors. Loans of up to 30 years term are possible, offering potential pricing benefits and longterm funding, enabling our commitment to sustainability.

Governance: We must maintain the highest corporate governance standards, emphasising accountability, responsibility, and reliability. Our organisation has a dedicated committee to monitor ESGs, ensuring focus and commitment.

Double Materiality Assessment:

Our process involves a double materiality assessment, asking key questions about the impact and materiality of ESG considerations on the industry and company. We assess the financial impact of ESG actions, both positive and negative. For example, in climate change and decarbonisation, we ask: a) How significant is it for our company and industry? b) What are the implications of considering or not considering it? Proper water management is crucial, and we evaluate its importance and associated costs.

Circular Economy: The production process generates a significant amount of waste, making the circular economy critically important. We recycle EV batteries. Many people wonder what happens to the batteries. Contrary to popular belief, batteries do not end up in landfills and create pollution. Lithium-ion cells are imported and used in battery packs, which have a life of three to eight years, with an average of

Today, 97% of the energy we consume comes from renewable sources, up from 45% seven years ago.

five years. After their first life, batteries are brought back for segregation and given a second life of another three years. Through mechanical and chemical processes, 90% of battery materials can be recycled and reused.

Biodiversity and Nature: Believe it or not, we have a forest inside our factory. We undertake various projects and investments in clean transportation, including EVs and alternate fuel vehicles. We always ensure zero direct tailpipe emissions. Even in our conventional vehicles, we achieve CO2 emission reductions.

Renewable Energy: Today, 97% of the energy we consume comes from renewable sources, up from 45% seven years ago. We ensure everything is clean and focus on efficient energy usage. This includes the installation and maintenance of energy-efficient machines to save on energy costs. We have converted our fuel-based cooking vessels to fully electric operation. While cooking with electricity can be challenging, we have successfully automated the process to cater to 12,000 people every day.

Green Mobility Leadership: At TVS, we take pride in our leadership in green mobility. Our journey with electric vehicles (EVs) has been fascinating. Our first electric vehicle was launched long ago, and when we relaunched it, it was extremely well received. Today,

EV sold saves 0.15 tons of CO2 per year. In the last three years, we have saved 300,000 tons of CO2 with less than 5% EV penetration.

we hold a market share of close to 25%. Initially, there were concerns about the range, weight capacity, and chargeability of our EVs. However, these concerns are a thing of the past now. EV penetration is gradually increasing in India, starting in urban areas with the scooter segment. In the next five to seven years, we expect significant EV penetration.

Quality and Partnerships: For the last seven or eight years, we have been rated number one by JD Power for quality in most of our products. We have a strong relationship with BMW, starting as a contract manufacturer and now designing, manufacturing, and developing for them. Total Quality Management (TQM) and sustainability are two sides of the same coin. We strongly believe in TQM, which is essentially discipline. We follow the PDCA (Plan, Do, Check, Act) cycle and prepare QC stories to ensure that problems do not recur.

Visiting our factory and interacting with our 10,000-strong workforce energises me. Their ownership and involvement in the process, including ESG considerations, amaze me.

Environmental Impact: Every EV sold saves 0.15 tons of CO2 per year. In the last three years, we have saved 300,000 tons of CO2 with less than 5% EV penetration. By 2030 or 2032, we estimate that 30% to 35% of all two-wheelers in the country will be EVs,

resulting in substantial emission savings.

Inclusivity: We have employed many individuals, physically challenged and with speaking disabilities. In 2021, we hired 22 such individuals, and now we have 250 in various departments, including finance, factory, and production support. Our team members are learning their language and way of communication. Our chairman has set a target to employ a certain percentage of people from this category. We recognise their intelligence and efficiency.

CSR Activities: We have cleaned 21 channels, desilted 283 ponds, planted 750,000 trees, and developed 14,000+ acres. Our 65,000 women in selfhelp groups generate $12 million annually. We have renovated schools and health centres, with a dedicated team working on CSR activities.

Sustainable Practices: Since 1990, we have implemented rainwater harvesting in our factory and housing projects, ensuring water savings, increased greenery, and taken measures for extensive electricity savings. 25% to 30% saving using natural light is achieved in our housing projects. ESG considerations are integral to our real estate business.

At TVS, our vision is to transform the quality of life by providing mobility solutions that are exciting, responsible, sustainable, and safe. ESG is in our DNA. What we give back to society matters deeply, and our Chairman Emeritus and current Managing Director are highly focussed on this. We have complete freedom regarding ESG-related investments, with the objective of giving back to society in some form. Thanks to their guidance and support, we have achieved significant

As CFOs, we are uniquely positioned with significant responsibilities. We are fortunate to have financial qualifications and analytical skills. With the advent of digitalisation and AI, we are well-placed to take forward the issues, as part of strategic integration.

Deepak Jayaraman, Author & Leadership Coach, in conversation with Bama Balakrishnan, SVP Finance, Sundaram Finance & Director, Dvara Research Foundation, and Dr. Sathya Sriram, Independent Advisor

Bama Balakrishnan: Deepak, it would be great if you could tell us about your podcast, ‘Play to Potential.’

Deepak Jayaraman: I started the Play to Potential podcast in 2016 when I left my previous role nine years ago. When I set out on my own, I realised one important thing: there would no longer be a corporate Learning and Development (L&D) function to take care of my growth. In a corporate environment, the L&D function typically organises various training programs as part of your professional journey. However, I understood that outside of that system, I would need to architect my learning journey myself. So, in a way, the podcast represents my personal exploration of curiosity.

Prior to this, I worked as a recruitment consultant with a firm called Egon Zehnder for six years, and before that, I was with McKinsey. The podcast was driven by two key questions I was curious about: How do people decide where to go? And how do they figure out how to grow? In the world of business strategy,

organisations often ponder "Where to play?" and "How to win?" I wanted to translate that strategic thought process to individuals.

I began interviewing people from various domains to bring in diverse perspectives. Initially, I had conversations with corporate leaders in India, both men and women. I then connected with thinkers in the US from institutions such as Harvard, Wharton, and Kellogg. Over time, I also expanded the scope to include individuals from other fields, like sports, art, stand-up comedy, and so on. This podcast remains a journey of learning and curiosity for me.

When you're a student, life is relatively simple. Back in the 1980s and 1990s, the focus was often on health and academics. But life has a ‘long middle’ from your 30s to your 60s and 70s where multiple dimensions come into play. There’s family, children, spouses, parents, siblings, and the pulls and pressures that come with these relationships. You also face several transitions during this time. There’s the financial aspect, along with the challenges of the everchanging world of work, including volatility in jobs. It

is crucial to have a meaningful framework to navigate these complexities.

What do you think about potential?

The earliest understanding of potential comes from physics. There’s potential energy, which can be converted into kinetic energy. Potential, in this context, refers to stored energy that can be transformed into action and outcomes. When I worked at Egon Zehnder, we used to evaluate candidates at three levels. First, what the person has done; second, their competencies how they achieve results, drive strategy, build teams, collaborate, and so on. The third aspect we assessed was the runway the person has the capacity for future growth.

“I

want to be remembered as someone who did what he could with what he had.” -- Thurgood Marshall

My real understanding of potential, however, came from my first guest on the podcast: Vijay Amritraj, the legendary tennis player from Chennai. At the end of each conversation on the podcast, I ask my guests what the phrase Play to Potential means to them. Vijay shared two thoughts that have stayed with me.

First, he told me about an interview he conducted with Buzz Aldrin, the second man on the moon. At Buzz’s home, he noticed a small plaque on the wall that read: “Who said the sky's the limit when I have set my feet on the moon?” It’s a powerful reminder that potential is often limited only by our imagination it’s virtually infinite.

Second, Vijay referenced Thurgood Marshall, the first African-American Chief Justice of the United States. When asked how he would like to be remembered, Marshall replied, “I want to be remembered as someone who did what he could with what he had.” I find this to be a profound definition of potential. Each of us is dealt a unique set of cards our genetics, the family we’re born into, the country, the economic circumstances, the education we receive, and the society we’re exposed to. These cards form the context of our lives. The key question is: Given these cards, what’s the best game you can play?

It’s futile to compare ourselves to someone in a

completely different context. Potential is deeply personal and situational. Most importantly, it’s often constrained only by the boundaries of our own imagination.

A decade or so ago, "potential" was mostly understood in the context of professional or intellectual achievements. Today, I see people thinking about potential in contexts that go beyond just professional success or a fulfilling career.

Deepak Jayaraman: Yes, we have potential across so many dimensions of life whether it's in extracurricular activities, health, personal pursuits, or in the communities we live in. It extends far beyond the boundaries of work.

Sathya Sriram: The first transition I experienced in my professional journey was deciding to finish my PhD and step away from academic research. Initially, I was driven by my deep love for biology and a personal setback in my family my grandmother was diagnosed with Alzheimer’s disease. As a teenager, I was fuelled by the passion to cure the disease, and that motivation carried me through college and my PhD. However, over time, I realised that I didn’t find as much joy in the process of scientific discovery itself. Instead, I became more excited by the impact that science could have on the world.

I was fortunate to have the opportunity to work with McKinsey & Company in healthcare consulting. This allowed me to bridge my background in science with the business side of healthcare working with providers, payers, medical device companies, and pharma firms to bring those insights to life. This

My entire career up until that point had been centered around healthcare sciences and consulting. However, the opportunity to transform a media group with a strong voice intrigued me, so I took the leap.

marked a significant transition for me not as walking away from science, but rather becoming a translator, so to speak, between science, medicine, clinicians, and the business world.

Another key transition came when I decided to join The Hindu Group, a media house down the road. This was a major change because I had no prior experience in media. My entire career up until that point had been centered around healthcare sciences and consulting. However, the opportunity to transform a media group with a strong voice intrigued me, so I took the leap.

In this transition, I realised that industry-specific expertise isn’t always necessary. Other transferable skills often come to the forefront problem-solving, breaking down complex problems, crafting solutions, bringing diverse people together, fostering collaboration, and offering fresh perspectives. It’s also critical to balance these new ways of thinking with the wisdom and expertise that already exist in an industry or company. I learned to use my ignorance as a tool for curiosity asking questions, understanding ‘why,’ and building expertise quickly. This approach allowed me to integrate my skills and contribute effectively. These transitions, among others, have defined my journey.

Deepak Jayaraman: One of the terms I often use in

I encourage people to take their identity a little lightly because, more often than not, we tend to associate very strongly with our titles.

my coaching work is, "Don't wear your identity too tightly." I encourage people to take their identity a little lightly because, more often than not, we tend to associate very strongly with our titles. We say, "I'm an accountant," "I'm an engineer," or "I'm a consultant." While these labels are useful, they can sometimes become a cage that limits the world of possibilities.

If instead, we adopt a more open-ended perspective saying, for example, "I'm good at solving problems" or "I have a strong understanding of numbers" we can extract the core strength from that identity. This shift opens up a world of opportunities by allowing us to explore beyond the confines of rigid labels.

With longer lifespans, we have longer careers. How do you think transitions are evolving in that sense? How is it changing?

Deepak Jayaraman: Reflecting on career transitions, I often think about my father, who worked at Indian Bank for 40 years, and my father-in-law, who served in the Indian Army for 35 years. Their professional journeys were like motorways straight roads where you drive steadily forward. To do well in such a long race on a straight path, the most important component is the engine. Back then, transitions were fewer and more predictable.

When I look at our generation, perhaps we go through three, four, five, or six career transitions more branches in the road compared to the previous generation. But for today's teenagers and young professionals, the world looks less like a motorway and more like a maze, filled with twists, turns, and unexpected detours. In this context, I believe the auto component that becomes most relevant is the steering wheel. Of course, the engine matters, but the best engine alone won't win the race. Without a good steering wheel, you'll likely crash somewhere along the way.

What do I mean by the steering wheel? It’s selfawareness. In a world that's increasingly volatile and chaotic, self-awareness becomes more crucial than ever. We often hear terms like VUCA (Volatility, Uncertainty, Complexity, and Ambiguity) and other abbreviations that describe the unpredictability of the world. But the one insight I've gained is that as external chaos grows, it demands greater internal stillness. Self-awareness isn't new, but its importance has multiplied exponentially in a world full of options and moving parts.

I’m reminded of Barry Schwartz’s book ‘The Paradox of Choice.’ He explains that in a world with abundant options, you might expect people to be happier. But paradoxically, decision-making becomes more complex, and fear of missing out (FOMO) escalates. Take entertainment as an example when I was growing up, Doordarshan was the only channel. Sundays at 10 a.m. were ritualistic in our home: onion sambar, rice, potato curry, and Mahabharat on TV.

In careers, this abundance creates similar challenges. Decision-making gets tougher, and FOMO becomes pervasive.

Today, we have hundreds of channels, countless OTT platforms, YouTube, TikTok, WhatsApp, and more. But are consumers necessarily happier now than they were 30 years ago? Barry Schwartz argues that they might not be.

In careers, this abundance creates similar challenges. Decision-making gets tougher, and FOMO becomes pervasive. Without clarity about who you are, what you want, what drives you, what you're passionate about, and where your strengths lie, it’s easy to feel lost. You might constantly wonder, “Should I have taken that turn instead?” and end up in confusing or unintended places.

Sathya spoke about different transitions and mentioned triggers at different points in time. In many cases, we are forced to act, and sometimes we choose to work our way up. How do you find the inputs needed to make those decisions? Where do you find those inputs?

Deepak Jayaraman: One of the people I spoke to on the podcast was Lynda Gratton, a professor at London Business School and author of ‘The 100-Year Life.’ She shared an interesting perspective on building skills and making transitions. For a long time, we often thought of ourselves in terms of the letter "T." The vertical line represents depth in a single subject, while the horizontal line allows us to apply that depth in multiple contexts for example, healthcare knowledge

applied in media, hospitals, or other industries. However, she suggests that as we progress, the metaphor starts looking more like the Greek letter " π " (pi). At some stage, it might even resemble a caterpillar with multiple legs. One leg of π is straight while the other is slightly curved. The straight leg symbolises your depth, while the curved leg represents the new skills and capabilities you’re building as you pivot to new opportunities. Her key insight was: don’t stand on just one leg develop multiple legs to keep yourself balanced and adaptable.

To illustrate this, I recall my conversation with Amish Tripathi, the renowned author. Many might not know that he is an alumnus of IIM Calcutta. He began his career at IDBI and worked there for several years, even rising to senior management. However, despite his success, he found himself lacking fulfilment in that journey. From childhood, he had always been passionate about mythology his family would often discuss mythological characters over dinner.

Amish mentioned that he comes from a middleclass family and didn’t have the luxury of abandoning everything to pursue writing. Instead, he dedicated 10–20% of his time to writing while continuing his job. After publishing his first book and then his second, he finally made the leap into full-time writing when the royalties surpassed his pay check.

Each of us needs to find a way to nurture our tree in the shadows, to make space for passions and side hobbies while balancing current commitments. For some, these pursuits may remain hobbies for years; for others, they might eventually gain critical mass

and evolve into a main career path the very "leg" upon which the π symbol pivots.

How did you find the courage to make the shift? How did you prepare for it? What steps did you take, and what kind of skills or muscles did you develop to move forward?

Sathya Sriram: Most often, we hold back from taking the road less travelled. As a fairly analytical person, I found that I had to create a framework for myself every time I faced a major crossroad. Over time, I realised that the cost of stagnation staying in the status quo can actually be greater than the risk of change. Recognising that helped me calibrate my decisions. I’d ask myself, ‘If I continue to stay where I am, will this puddle keep getting murkier? Is this really where I want to be? Or is this the moment to take a leap whether or not there’s a visible bridge to land on?’

Mapping out a framework of pros and cons for staying in the same place versus moving on gave me clarity and comfort when it was time to take a risk. Of course, there were several opportunities where I consciously chose to stay where I was, but having this structured approach helped me decide when the leap was truly worth it.

In terms of preparation, when I transitioned from academia to McKinsey, I benefited significantly from their professional development program. They put us through what they called a mini MBA, which helped us grasp the foundational principles. Over time, though, much of the learning happened on the job.

When I transitioned into media, I didn’t have the

advantage of a structured program like that. So I relied on self-study going back to the basics, diving into the media world, and reading enough literature to get up to speed.

Another crucial part of my preparation was reaching out to people who had navigated similar transitions before me. Talking to them gave me a clearer understanding of what I was stepping into. I made sure my eyes were as wide open as possible. For example, during my move into consulting, I leaned on my husband, who was already a consultant. I could ask him all my questions, express doubts and fears, and get honest answers without any judgment. By the time I transitioned into media, I was fortunate enough to have built a broader network of people to lean on. Consulting them helped me anticipate challenges and allayed many of my fears.

So for me, the process involved a mix of structured learning, self-driven study, and leveraging the wisdom and experience of my network. These elements combined to help me navigate the uncertainty of new terrains.

Deepak Jayaraman: If I look at transitions from a mental model perspective, the ‘trapeze’ analogy comes to my mind. Think of a circus artist holding on to the next trapeze before letting go of the current one. It’s like Tarzan swinging from one branch to another. During my time as a recruitment consultant, I often encountered candidates saying, "I have this job and this job what should I choose?" My response was usually, "Are you sure these are the only two options available to you? Could there be something else that makes even more sense?" This highlights a common

tendency, especially in senior leadership roles, to remain tethered to the immediate options visible from where we currently stand. By doing so, we may inadvertently limit the world of possibilities.

People who make significant breakthroughs, however, often pause to explore what else might be out there. Take, for example, our classmate Sumeet Mehta. He now runs a unicorn company that partners with low-income schools, providing them with the technological backbone needed to deliver high-quality education. His company is currently valued at around a billion dollars. But years ago, he was a midmanagement leader at Procter & Gamble in Singapore. At some point, he said to himself, ‘I’m not making the impact I want to.’ He took a six-month break to reflect and eventually decided to tackle a problem he was passionate about. That decision marked the beginning of a remarkable journey.

Often, people hesitate to take such leaps because letting go of the familiar is daunting. This reminds me of a memorable scene from Indiana Jones and the Last Crusade. Harrison Ford’s character faces a chasm he must cross to retrieve medicine for his dying father. The paradox is that he has to take a leap of faith only then does the bridge reveal itself. Similarly, at senior levels, transitions may require letting go of the safety net.

While the prospect can be frightening, most of us have networks, savings, and other resources to lean on. By being honest about our context, many of us are in a position to afford a sabbatical or pause. Often, such a step can open up entirely new worlds of opportunity.

In all our journeys and transitions, we are all looking for our ikigai, but we need a map to get there. You have coined a term 'Flavour.' Tell us more about that.

Deepak Jayaraman: Ikigai is a powerful concept built around four circles: what you're good at, what you enjoy, what the world needs, and what the world will pay you for. If you operate at the intersection of these four circles, you’re set it’s like drilling for oil. But while inspiring, I find Ikigai to be a bit abstract and high-level. A compass might point you to true north, but following it blindly without looking for a swamp on the way leads nowhere.

I believe life is a team sport, with the team often being your family. Family means different things to different people, and life’s personal forces often push and pull us in various directions. For example, I returned from the US to India in 2008 to support my father during his cancer treatment. These family dimensions are inescapable and an integral part of life.

The second aspect I notice in people reaching their full potential is the ability to connect with what they truly love. While some might find this fulfilment at work, most thrive by nurturing a passion outside of work a hobby like playing an instrument, gardening, trekking, running, or community service. These activities serve as a recharge, rejuvenating us for life’s demands.

Next is aspiration, not ambition. Each of us wears multiple hats, with each hat representing an identity. Aspiration is about balancing these roles thoughtfully.

Another critical element is recognising and utilising your unique value while seeking opportunities. Each of us has a distinct set of skills, networks, and relationships that we can leverage to make meaningful contributions. For instance, homemakers often make invaluable contributions to the world, even though families can be low-feedback, low-gratitude environments. This is an observation I’ve come across.

The next piece is self-awareness and selfinvestment taking care of your physical health, mental well-being, and building capabilities. Lastly, relationships are vital not just friendships but also broader connections with those you wish to engage with more meaningfully. These dimensions came together for me as the word 'Flavour': Family, Love, Aspiration, Value, Opportunity, Investment in yourself and Relationships. It’s a framework that I believe provides a grounded and holistic map for navigating transitions and finding meaning in life.

A discussion on the book "Unlocking Wealth: Secrets to Getting Rich at any Age" was organised on January 21, 2025, at the Madras Management Center. Chandu Nair, Entrepreneur, Advisor & Facilitator, was in conversation with Rohit Sarin, Author & Co‐Founder of Client Associates, and Nagappan V, Founding Trustee of the Foundation for Financial Freedom, Independent Director at Sasvitha Home Finance Ltd, and Past President of the Hindustan Chamber of Commerce.

Rohit Sarin: I believe the next 10 years could be India's best in this century. Our economy is growing at an average of 6-7% annually, with inflation around 5%. This means, in nominal terms, our GDP is growing at approximately 11-12% annually. Compounding this growth over 10 years will triple our GDP.

When a country grows, it creates opportunities. Some businesses will grow 4x, others 5x, and outstanding ones even 6-7x in this period. This growth phase will generate jobs and affluence in society. I felt it was the right time to share my 25-year journey as a wealth entrepreneur. I've learned valuable lessons from India's wealth creators that I believe every Indian should know.

Historically, wealth creation in India was seen as a negative pursuit. However, if we are to become

wealthy, we must embrace wealth creation. With the market expansion, every business has the potential to grow significantly in the next 10 years. My book has three parts:

Why Wealth?: This section explains why wealth is important for individuals, societies, and countries, supported by global data and anecdotes. Laws of Wealth Creation: Here, I share principles I've learned from India's finest wealth creators, which are relatable and implementable; and Protecting and Growing Wealth: This section discusses how to safeguard and continue growing the wealth you create. It emphasises that our individual wealth contributes to the national wealth.

Chandu Nair: Many clients create wealth, but many struggle with it. Is it because of a scarcity mindset or circumstances? What exactly creates the mindset of abundance?

Rohit Sarin: We live in a middle-income country with a per capita income of around $2,700. Despite

Those focussed solely on profit may compromise their purpose, leading to eventual failure.

this, there are inspiring case studies of people from humble backgrounds becoming some of the richest families in India, like Mr. Dhirubhai Ambani. Wealth creation starts with a mindset. If you believe you can't create wealth, you won't. But if you decide to be a wealth creator despite your circumstances, you will be. It begins with a thought, which leads to an idea, action, and ultimately destiny.

Chandu Nair: You have a mission to improve financial literacy. What are the stumbling blocks people in India face in understanding money and creating wealth?

Nagappan: Two main factors are mindset and the ecosystem. There's often a mental block that people can't understand numbers. In certain regions of India, people are involved in business and wealth creation even in high school or college. The second reason is the purpose of creating wealth. Some people create wealth for themselves, while others do it for a greater cause. If people understand these reasons and overcome the mental block on number crunching, it can change their mindset.

Chandu Nair: There's a fine distinction between hunger and greed. Hunger gives purpose, while greed can be destructive. How does one distinguish between the two and maintain a hungry state of mind?

Rohit Sarin: There's a fine line between hunger and greed. Hunger is being focussed and driven by your purpose and actions. For example, a passionate doctor is driven by healing people. Greed, on the other hand, is driven by the desire for output and revenue. In the short term, a greedy person may see faster growth, but over time, trust breaks down, and they fall. Staying focussed on your purpose and solving problems for society will lead to sustainable wealth creation. Businesses that focus on solving problems for more people will scale and create wealth. Those focussed solely on profit may compromise their purpose, leading to eventual failure.

Chandu Nair: Many people are employees with fixed incomes and limited time. How can an employee break out of this trap to create wealth?

Rohit Sarin: The basic concept is the same whether you're running a business or working as an employee adding value. As an employee, you're solving problems for the organisation, which compensates you. Building trust with stakeholders and exceeding expectations can make you invaluable, leading to greater responsibilities and compensation. For example, the current Tata Group chairman started from a humble background and earned the trust of stakeholders over decades, eventually leading to his role. This shows that even as an employee, you can create wealth by adding value and building trust.

Chandu Nair: Many people think there are shortcuts to financial success, but usually, the short term results are disastrous. How does one maintain discipline and not be tempted by shortcuts?

Nagappan: It's challenging but achievable. Hunger is easier to satiate than greed. Greed often comes from comparing oneself to others and wanting to show off. Even top CEOs sometimes fall into this trap. The family system and ecosystem play a crucial role in instilling the right values. It's essential to focus on ethics and long-term goals rather than short-term gains.

Chandu Nair: How can individuals create a system to generate wealth, even if they have a regular job?

Rohit Sarin: Take the example of a plumber or an electrician. Initially, they earn daily wages, but over time, they can scale by forming teams and taking on contracts. Wealth creation is about adding value at scale. By growing beyond individual contributions and enhancing their ability to serve more customers, they can increase their earnings. This principle applies to any business or individual. Scaling up leads to greater wealth creation.

Chandu Nair: I want to take this question further and include the approach of certain mercantile communities, of which you are a part. How does this mindset impact financial decisions?

Nagappan: In working with self-help groups, we teach financial discipline. For instance, in a small village near Cuddalore, a bank lent money to a women's self-help group. The bank suggested investing the unused funds in a mutual fund promising 1% per month. When the market declined, the NAV dropped, causing losses. We educate them on avoiding such pitfalls.

Growing up, my father emphasised that " a penny

Financial discussions are often avoided in families.

Usually, one member handles finances, and if something happens to them, the rest are unprepared.

saved is a penny earned plus interest." Financial literacy is crucial, and it should start young. For example, my father made me handle bank transactions when I was 12. Such lessons are vital for financial responsibility. Many middle-class families protect their children from financial responsibilities, even filling out college applications for them. We need to make them responsible early on. Even if they make mistakes, they'll learn and grow.

Chandu Nair: I've observed that, unlike mercantile communities, most Indians are emotional about money rather than logical. Discussions about money within families often lead to conflicts. How can we encourage rational and logical financial discussions within families?

Rohit Sarin: This is a critical topic. Financial discussions are often avoided in families. Usually, one member handles finances, and if something happens to them, the rest are unprepared. My advice is to involve your spouse and, later, your children in financial matters. This ensures continuity and preparedness. Children should be introduced to financial management once they're of age and working. Succession planning isn't just for businesses; it's essential for families too. More families are opening up about finances, but there's still a long way to go.

Chandu Nair: In extended families, financial discussions become even more challenging. How can larger families manage these discussions practically?

Nagappan: In large families, the mindset is to listen to the leader, making it somewhat easier. In nuclear families, it's more challenging. Growing up, we lived a simple lifestyle, unaware of our wealth. This simplicity helped us distinguish between wants and needs. Today, there's a tendency to justify wants as needs, driven by societal competition. Living simply and focussing on genuine needs can reduce financial strain.

Chandu Nair: What are the common pitfalls in wealth creation and management?

Nagappan: In wealth creation, everything starts with earnings, which require necessary skill sets. Continuous skill development is crucial. Once you earn, managing needs versus wants is vital. Savings should start early, and spending should be controlled. Social pressure and easy access to online shopping make it challenging to save. We have moved from delayed gratification to BNPL or "buy now, pay later," posing a significant challenge.

Rohit Sarin: The most common misconception is that people believe they cannot be wealth creators. This belief can occur at any age due to various reasons like limited resources or thinking it's too late. Everyone can be a wealth creator, regardless of their background or stage in life.

Chandu Nair: Many people have a block or inability to figure out how to participate in India's wealth creation story, especially the middle class with limited

disposable income. How can they benefit?

Nagappan: Expenses often expand to fill the available money. The key is to save more by spending less. Financial literacy is crucial, and involving the entire family in financial decisions is important. The middle class can create wealth by prioritising savings and managing their expenses wisely.

Chandu Nair: How can small, regular investments like SIPs lead to significant outcomes over the long term? How can people embrace delayed gratification and maintain discipline?

Rohit Sarin: The motivation for delayed gratification is the benefit of compounding. Warren Buffett is a prime example, with most of his net worth earned after his 60s due to compounding over decades. Historically, recurring deposits in post offices were popular savings instruments in India. The concept is to pay yourself first by saving a portion of your earnings regularly. Over 10-25 years, this accumulation surprises you with substantial growth. For example, at a 15% annual growth rate, your investment doubles in five years, becomes four times in 10 years, and 33 times in 25 years. This compounding effect can make us significantly wealthier over time.

Chandu Nair: In financial literacy, concepts like compounding sound nice, but people struggle with the discipline. How do you convince them to stick with it and see the benefits?

Nagappan: It takes time and conviction. The "fill it, shut it, forget it" approach is outdated due to rapid technological changes. Regular monitoring is essential,

but not on a daily basis. Financial literacy programs and resources from regulators like IRDA, SEBI, NCFE, and RBI are helpful. Involving the entire family in financial planning is crucial. Tools like financial calculators can help people realise the importance of saving and goal-based planning. Once they see the benefits, change happens more naturally.

Chandu Nair: Will these strategies work for the new generation, who face different challenges and live separately from their parents?

Rohit Sarin: Understanding that the joint family system had its advantages is essential. Without it, creating a supportive ecosystem becomes more challenging. The new generation must plan for themselves, but financial principles remain the same. Creating a simple lifestyle and focussing on genuine needs rather than wants can help. Establishing a supportive ecosystem, even if it's not a traditional family structure, is crucial.

Nagappan: The new generation should understand the importance of financial discipline and planning. While challenges may differ, the principles of saving, investing, and managing expenses remain the same. Resources and financial education programs can guide them in building a secure financial future.

Rohit Sarin: The previous generation often worked for government or quasi-government organisations, benefitting from forced savings like PF and pensions. Today's generation, living independently, lacks this support and must build their own PF corpus. With rising expenses, financial discipline is even more crucial for the younger generation.

Nagappan: Social security is almost non-existent for the middle class in India, making financial discipline vital. The job market has changed, with no guarantees of job security. The current generation is confident and spends more, but this can lead to psychological problems if they lose their jobs and lack savings. Hence, financial discipline is essential.

Chandu Nair: A Swamiji once said, "You spend half your life earning wealth, then spend more than half your wealth trying to get back your health." Balancing wealth creation with health, family, and social connections is crucial. When does enough become ‘enough’? How do you balance these aspects of life?

Rohit Sarin: Balancing wealth creation with health, family, and social connections requires defining what "enough" means for you. Wealth should be a means to achieve a fulfilling life, not the sole goal. Maintaining a simple lifestyle, focussing on genuine needs, and prioritising health and relationships can help achieve this balance.

Nagappan: It's important to create an ecosystem that supports you, financially and emotionally. The new generation must understand that financial discipline and planning are essential for a secure future. Resources and financial education programs can guide them in building a balanced and successful life.

Rohit Sarin: There are two important milestones in wealth creation. The first is achieving financial freedom, where you have enough wealth to meet all your needs for the rest of your life. This involves financial planning to determine how much wealth you