• DRILLING AND BLASTING: FROM RISK TO PRECISION

• DRONES MAKE INSPECTIONS IN GPS-DENIED AREAS POSSIBLE

• AI IN MINERAL RECOVERY: A NECESSITY, NOT AN OPTION

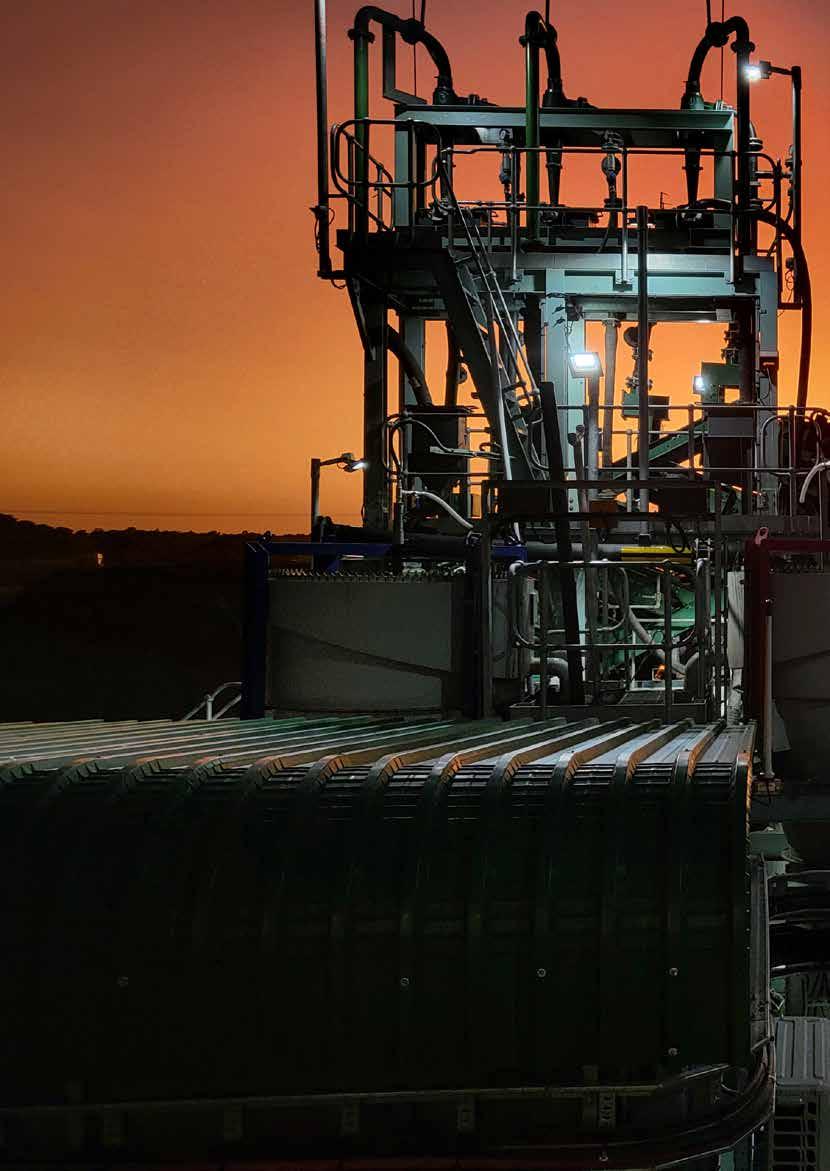

Cover Image: DELTASCAN

STORY: PG 04

Rewriting the rules of mining

Technologies are revolutionising mining operations. The combination of professional engineering insights and digital tools ensures technology serves decision making – not the other way around.

Smart Materials & Wear Technology REWRITING THE RULES OF MINING

Editor

Nick Barnes

editor@miningbusinessafrica.co.za

+27 10 055 3356

Writers

Jimmy Swira

Jimmy@miningbusinessafrica.co.za

+ 27 10 055 3356

Abigail Calata

abigail.calata@miningbusinessafrica. co.za

Sales and Marketing

Winnie Sentabire

winnie@miningbusinessafrica.co.za

Empowering Africa’s Mines with Precision

Making Inspections in GPSDenied Areas Possible

Angeline Ntobeng

angien@miningbusinessafrica.co.za

+ 27 078 322 5938

+ 27 010 055 3356

Accounts

Precious Chirunga

accounts@miningbusinessafrica.co.za

+ 27 10 055 3356

Art Director/Layout

Augustine Ombwa

Arobia Creative Consultancy

austin@arobia.co.ke

+254 772 187 334

The African mining sector is at a critical crossroad. It can no longer rely on minerals that have traditionally generated revenue, like coal, iron or even gold. Africa needs to pivot and invest more in the minerals needed in clean energy technologies. And there is no shortage of those on our mineral-rich continent.

The demand for such minerals is expected to triple by 2030 and quadruple by 2040. Demand for lithium is set to increase fivefold by 2040. Cobalt demand will double by then. The total market value of key energy transition minerals is projected to more than double in 15 years’ time.

It is likely to surpass revenue from coal production by more than 50%. This while coal output in Africa is expected to decline by 12.5% between 2024 and 2029 because of reduced investment.

Africa can play a key role in the energy transition, but in order to capitalise on this advantage, it must invest in not only the mining but also the processing of these minerals. By adding value through processing, it will ensure that it can exchange its begging bowl for a seat at the table with those who have traditionally and are currently exploiting its natural resources for their benefit and their benefit alone.

Nick Barnes editor@miningbusinessafrica.com

Circulation/Sales info@miningbusinessafrica.co.za

+ 27 10 055 3356

Published By Media Icon (Pty) Ltd

Pan African posts record-smashing results

Pan African Resources announced recordbreaking results for the financial year ended 30 June 2025.

The group’s profit for the year increased by 78.4% to a record US$140.6 million (FY24: US$78.8 million). This meant it was able to declare a final dividend of ZA 37.00000 cents per share (or US 2.08451 cents per share at an indicative exchange rate of US$/ZAR:17.75), an increase of 68% (FY24: ZA 22 cents per share).

Revenue increased by 44.5% to US$540.0 million (FY24: US$373.8 million)

Andrada shows strong operational performance

Namibian miners, Andrada reported improved operations for its second quarter, which it believes places the company in a good position for continued growth in the upcoming half-year.

Highlights from the second quarter include a 17% year-on-year (YoY) increase in tin concentrate production. Contained tin increased 14% YoY to 273 tonnes, while the tin recovery rate improved to 73% in the Quarter (Q1 FY2026: 69%).

Gemfields posts interim loss

The Gemfields Group reported a net loss of $24.6 million in the half-year ended 30 June 2025.

This is compared to the $13.7 million net profit the gem producer recorded in the same period last year. It further posted a loss from operations of $21.3 million (2024: $27.4 million profit) and a loss before interest, taxation, depreciation and amortization of $4.9 million (2024: $50.3 million profit).

Ivanhoe’s Kamoa-Kakula produced 316,393 t of copper so far this year

Ivanhoe Mines produced 71 226 t of copper at his Kamoa-Kakula Complex in the Democratic Republic during its third quarter, bringing the total mined so far this year to 316,393 t of copper.

It also reported that stage two dewatering activities are over 20% complete, with underground water levels on the eastern side of the Kakula Mine declining by over 20 metres since the beginning of September.

Furthermore, operations at the KamoaKakula smelter, the largest in Africa, will start in early November.

AngloGold Ashanti announced the appointment of Marcus Randolp as an independent non-executive director. Randolph will serve as a member of the Compensation and Human Resources Committee and the Social, Ethics and Sustainability Committee.

He has over 40 years of experience in the mining and processing industries. He was most recently CEO and President of Ecobat, a global leader in battery recycling. Prior to that Marcus was Executive Chairman of Boart Longyear, the world’s largest supplier of drilling services and equipment to the minerals industry.

“This quarter should mark a turning point in operations, as we anticipate higher grades from Kakula’s western side from next month. We are on track to restore Kamoa-Kakula towards its previous copper production levels as we rehabilitate the existing workings and develop new high-grade areas across this Tier-One ore body,” said Robert Friedland, Ivanhoe founder and co-chairman. “We’re on the cusp of starting operations at Africa’s largest and greenest, direct-to-blister copper smelter, which is expected to drive lower cash costs as we complete its ramp-up,” he added.

Botswana, the world’s largest diamond producer by value, will join the next meeting of the African Diamond Producers Association (ADPA) as an observer.

This is one of the outcomes of a recent meeting between Botswana’s Minister of Minerals and Energy, Bogolo Kenewendo, and her South African counterpart, Gwede Mantashe.

ADPA membership will allow Botswana “to work with other (diamond) producers to address challenges such as market volatility, illicit trade, and evolving regulations while amplifying its voice in global forum,” the South African Ministry of Mineral and Petroleum Resources said.

The Ghana Gold Board in partnership with local refineries and the Bank of Ghana has started refining its own gold in October.

The Board also announced plans for the establishment of a wholly state-owned refinery next to the Kotoka International Airport in the

capital, Accra.

Ghana is the highest-ranking African country in terms of worldwide gold production, sharing the number six ranking with Mexico and Kazakhstan. Gold exports contributed US$580 million to Ghana’s gross domestic product.

With demand for natural diamonds in decline since late 2022, countries like Botswana, whose economy heavily depends on the export of these stones, have to take various steps to mitigate the adverse effects of the slump in the sale of natural diamonds.

The role of diamonds in the history of Botswana cannot be overestimated. They lifted a country that was among the poorest in the world at the time of its independence in 1966 to a middle-class country, which not only produced that winning 2025 4x100m men’s World Champions, but also Olympic Champion, Letsile Tobogo, winner of the 200m race at the 2024 Paris Olympics.

The diamond industry accounts for close to 30% of Botswana’s GDP and 80% of its exports. It is through the sale of natural diamonds that Botswanans benefit from free education for children and free universal healthcare. The industry employs thousands of Botswanans directly and supports various industries, like hospitality, making Botswana the highest per capita GDP on the African continent.

Botswana’s fight back

In recent years diamond sales have slumped significantly, motivating the government of Botswana to embark on various initiatives to safeguard its economy, that’s so heavily dependent on diamond production.

Earlier in the year it announced details of the new 10-year deal with its partner in diamond production – De Beers. This agreement stipulates that the government will get a 30% share of rough diamond sales for the first five years, increasing to 40% in the subsequent five years, with a potential five-year extension that could lead to a 50% share of sales. In return De Beers, a subsidiary of the Anglo Teck Group’s, mining rights are extended for another 25 years to 2054.

The agreement also includes the establishment of the Diamond for Development Fund. De Beers Group will invest up to Pula

10 billion (equivalent to almost 4 percent of 2023 GDP) over 10 years in the Diamond for Development Fund with an initial contribution of Pula 1 billion (US$75 million). The main aim of the fund is to promote economic diversification with the fund investing in sectors such as agriculture, tourism, water, and energy.

Botswanan president, Duma Boko, also announced plans to introduce legislation that will ensure that diamonds are cut and polished before being exported. Currently only 10% of diamonds mined in the country are processed, while raw diamonds make up the vast majority of diamond exports. Botswana is the world’s largest exporter of diamonds in terms of value and only second to Russia in terms of volume.

The sale of rough diamonds started to decline in 2022 following a post-pandemic rebound. By the end of 2023 sales were 50% lower than they were the previous year and things haven’t improved in the two years since then. Lower demand for luxury goods in key markets like China begins to explain the decline. This is driven by increased inflation and living costs as well as changes in consumer behaviour. People are less likely to get married. They also generally prefer to buy experiences instead of things.

Then there is rise of synthetic diamonds. Labgrown diamonds are more socially acceptable and more affordable due to advances in their production. They are also perceived to be ecofriendlier and more ethical than natural diamonds. These characteristics make them more appealing to younger consumers, who take such things into consideration when spending their hard-earned money.

Increased tariffs have further impacted the diamond trade and for as long as the uncertainty around them persist commodities like diamond will increasingly come under pressure.

There are two processes by which manmade diamonds are produced. The first mimics the conditions under which the stones naturally form, but instead of the process taking place over millions of years near the earth’s core, it takes a few days in a laboratory. The high-pressure high temperature (HPHT) process sees a thin slice of diamond (seed – either natural or synthetic) put in a chamber with crystallised carbon. The high temperature and pressure cause the carbon to melt and attach to the diamond seed. As the mixture cools down a diamond is formed. The diamonds formed like this were initially not very big and mostly used for industrial purposes. However, technological advances have made the production of bigger stones possible and now said stones can be used to make jewelry too. This method has been used to produce synthetic diamonds since 1960.

The chemical vapour deposition method is newer, having only been commercially viable since 1980. A gas mixture of carbon and hydrogen (methane) is placed in a vacuum chamber. The gas is heated to form a plasma using microwaves. Carbon particles are liberated during this process, and these particles attach themselves to a diamond seed, thus growing the diamond.

Synthetic diamonds are the same as natural diamonds physically, chemically and optically. The difference is one is grown in the earth and mined, while the other is grown in a laboratory. Synthetic diamonds distinguish themselves from simulant gemstones, like cubic zirconias, which seek to imitate diamonds not sharing any of the properties natural diamonds have.

With demand for natural stones in steep decline, Botswana has nothing to lose and everything to gain by diversifying its economy away from diamond production, but also by processing the raw stones before they are exported the country ensures that it extracts maximum value from this precious commodity that has sustained economic growth in the country for so long.

Sources: www.naturaldiamonds.com, www.africanews.com, https://www. elibrary.imf.org, www.jewellersnetwork. co.za, www.diamondion.com, https:// www.britannica.com/.

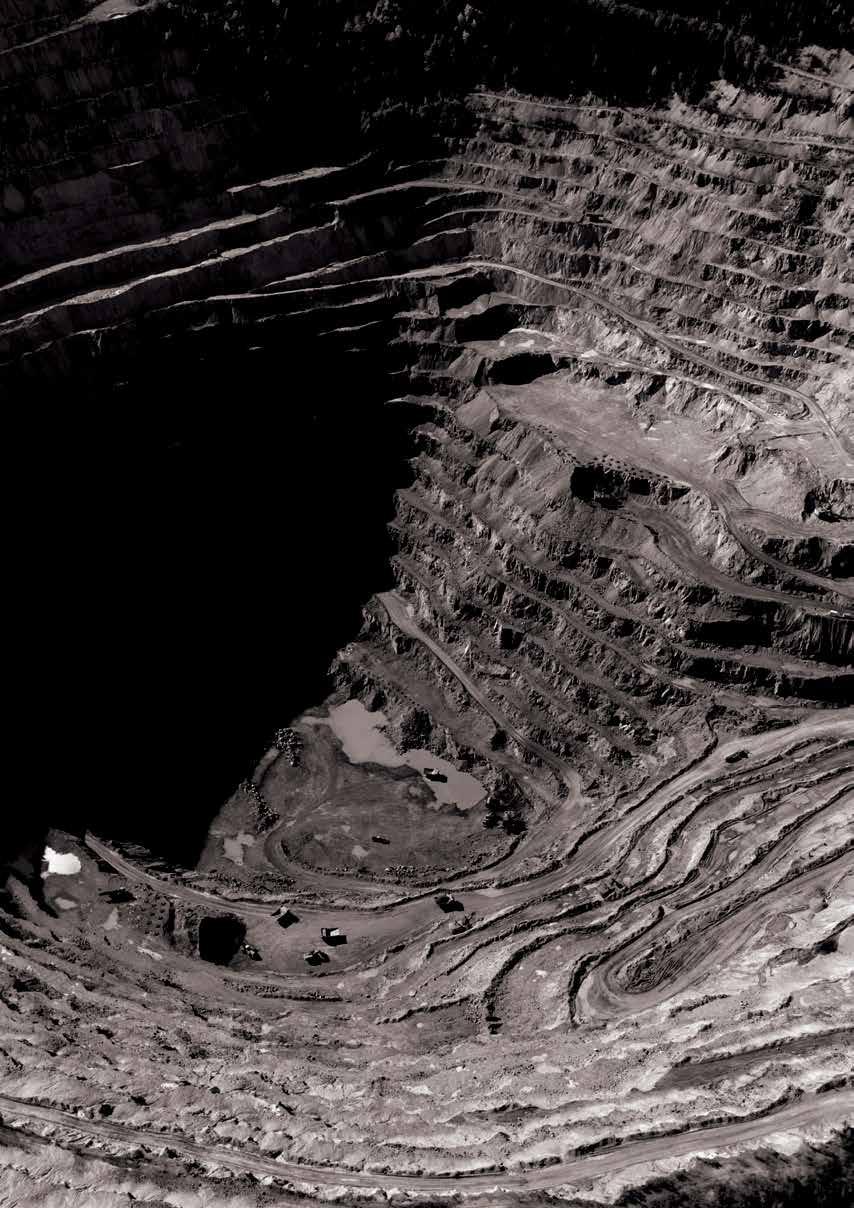

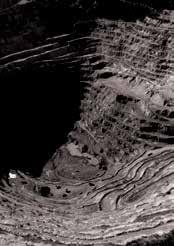

It’s dark, dusty, and dangerous. For decades, the underground mining environment has tested not only machines but also the people who enter it. Shafts stretch kilometers into the earth, ore passes erode with age, and concrete linings crack under strain. Inspections in these spaces have always been risky, expensive, and slow — demanding days of preparation, downtime, and human exposure.

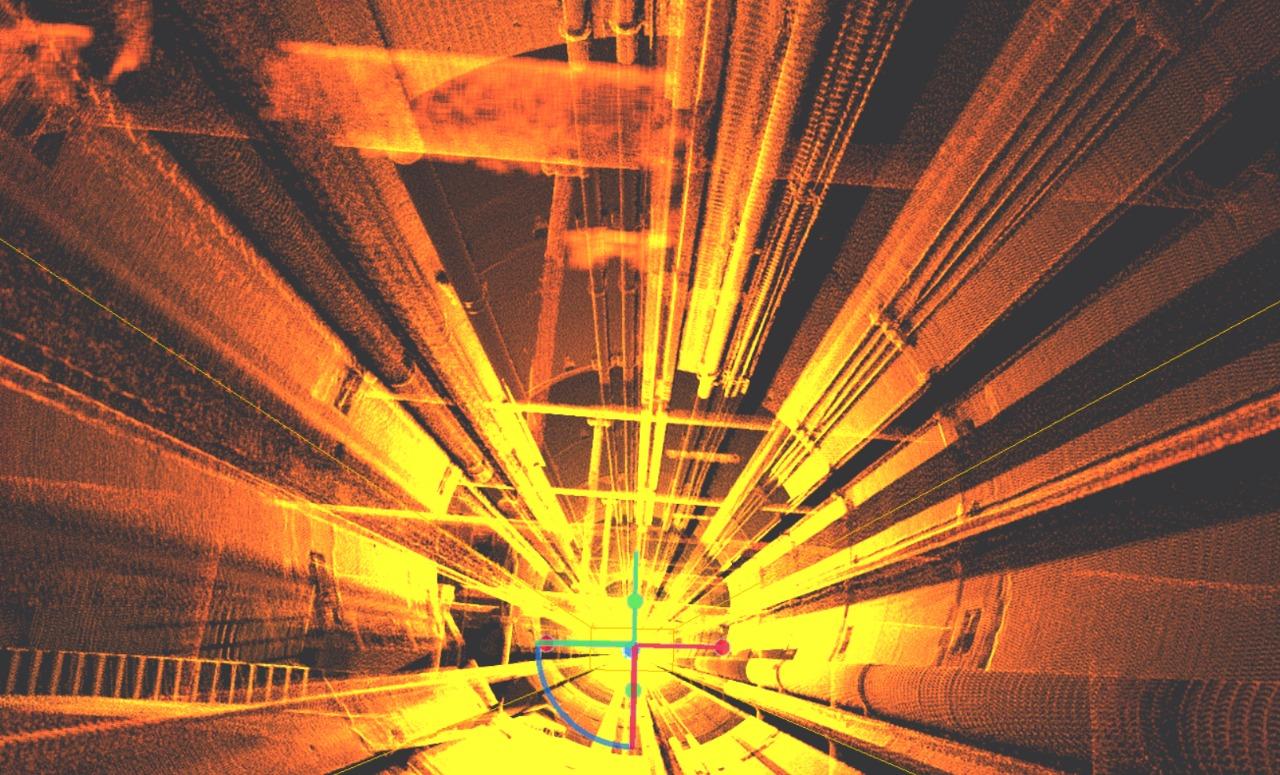

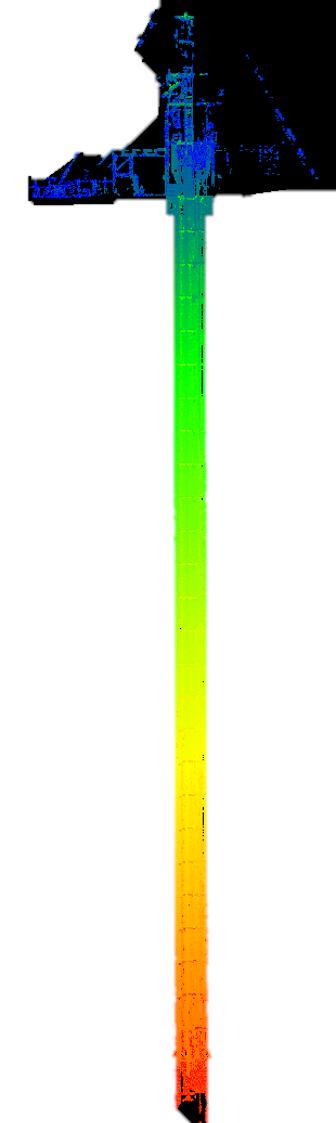

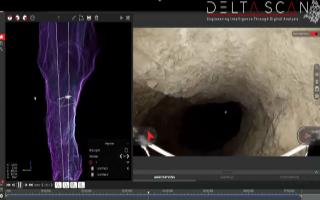

Today, however, the industry is shifting. Robotics, drones, and digital twins are rewriting the rules. And one company leading that transformation is Delta Scan, a South African-born engineering technology firm now operating across three continents. Their mission: to eliminate risk, cut downtime, and unlock precision insights through advanced digital capture and analytics.

“Flying a drone or lowering a camera doesn’t solve engineering problems. Those are just enablers,” says Darryl Epstein, Pr Eng., Founder and CEO of Delta Scan. “The real breakthrough is in how you transform raw data into decisions that change outcomes underground.”

The mining industry has long relied on traditional inspection methods — manual entry into voids, rope access in shafts, and handheld survey instruments. The challenges were clear:

- Safety hazards: People exposed to poor ventilation, loose ground, or unexpected collapses.

- Inefficiency: Weeks of downtime to access shafts and ore passes.

- Limited accuracy: Conventional methods often missed micro-defects or provided incomplete coverage.

- Compliance pressure: Regulators and insurers now demand traceable, auditable, high-precision reports.

The result? High costs, high risks, and low confidence. Mining companies needed a new approach.

As one client put it:

“We estimated hourly production losses of R180,000, meaning that inspections requiring a full shift could exceed a million rand per day in lost revenue. With digital-driven technologies , Delta Scan completed the full inspection in just a third of the time, gaining substantial value far beyond the status quo.”

Founded in 2018, Delta Scan was built on the idea that mining needed more than “cameras in the sky.” The team combines professional engineering insight with digital tools, ensuring technology serves decision-making — not the other way around.

Hardware-Agnostic Philosophy

Unlike many competitors who commit to one platform, Delta Scan is hardware agnostic. They deploy drones, robotics, and LiDAR interchangeably — selecting the right tool or, more often, a combination of tools — to capture the best possible dataset.

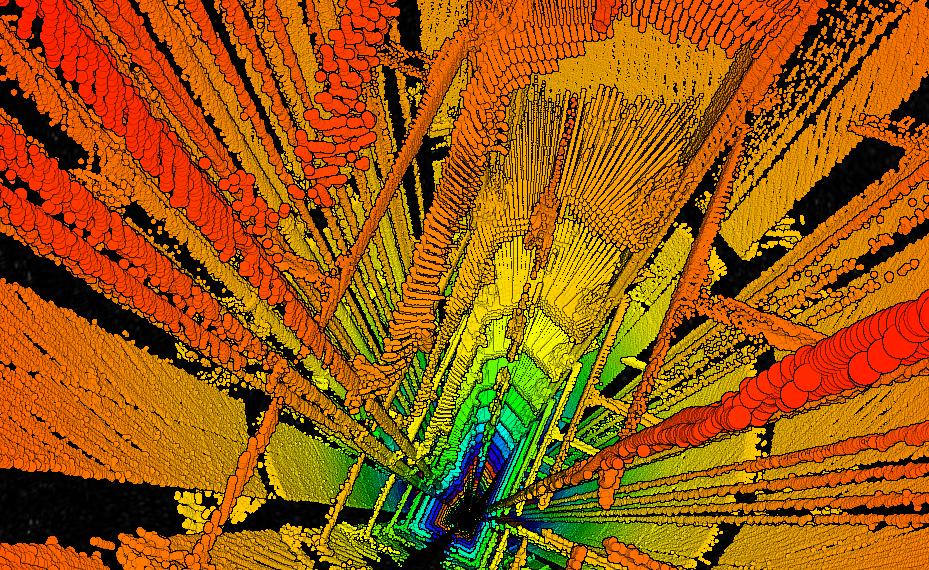

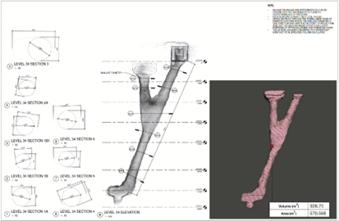

The captured data flows into Delta Cloud, a proprietary platform that transforms point clouds, imagery, and LiDAR into intelligence. Engineers then analyse defects, simulate stress responses, and quantify rehabilitation needs.

Outputs go beyond visuals:

- Immersive digital twins for collaboration.

- Bills of Quantities and tender-ready documentation.

- Material-accurate structural models used in design and rehabilitation planning.

As Epstein explains:

“It’s not about the data capture itself. It’s about what happens after. Our value is in transforming millions of points and images into actionable insight that an engineer or mine manager can use immediately.”

Clients agree. One noted:

“A proposal we reviewed for a structural inspection showed scaffolding and engineering time five times higher than the cost at which Delta Scan successfully completed the entire inspection.”

Ore Passes and Tunnels

Ore passes are notorious for wear, clogging, and collapse. Historically, inspections required weeks of shutdown and dangerous manual checks.

Delta Scan was the first in Africa to deploy the Elios 3 confined-space drone. The system can enter openings as small as 500 mm, capturing survey-grade LiDAR and 4K video. The data is processed into statutory drawings, clearance tolerances, and volumetrics.

Case Study: Major South African operation

An ore pass previously requiring weeks of manual entry and rope access was mapped by Delta Scan in less than 1 hour, with zero entry risk. The digital outputs not only satisfied statutory compliance but also guided rehabilitation, cutting total project cost by 60%.

Another client highlighted the financial impact:

“On average, our services enable mines to save around 30% on repair costs by avoiding overestimation and inaccuracies in bills of quantities.”

SIMM Audits (Structural Inspection and Maintenance Management)

Above and below ground, SIMM audits combine high precision LiDAR and inspection drones. Plants and underground chambers that once took weeks to survey are now digitised in hours.

Deliverables include LOD300 BIM-compliant as-builts, structural replicas, and defect overlays. Engineers can see cracks, deformation, and material degradation in immersive 3D — with measurements accurate to the millimetre.

“With SIMM audits, we’ve shifted from reactive inspection to predictive asset management,” says Epstein. “It’s not just about detecting what’s wrong today. It’s about planning interventions before they become failures.”

Real-world examples back this up. At a platinum mine, detailed silo audits using scan-to-BIM enabled accurate maintenance planning.

The results:

- Shutdown costs reduced by R5 million per day over 5 days.

- Avoided rope access and scaffolding costs of R1 million per day for 10 days.

- Savings of R2.5 million per structure in reduced rework and waste.

- Total cost saving: R50 million for annual structural audits and maintenance across 7 silos.

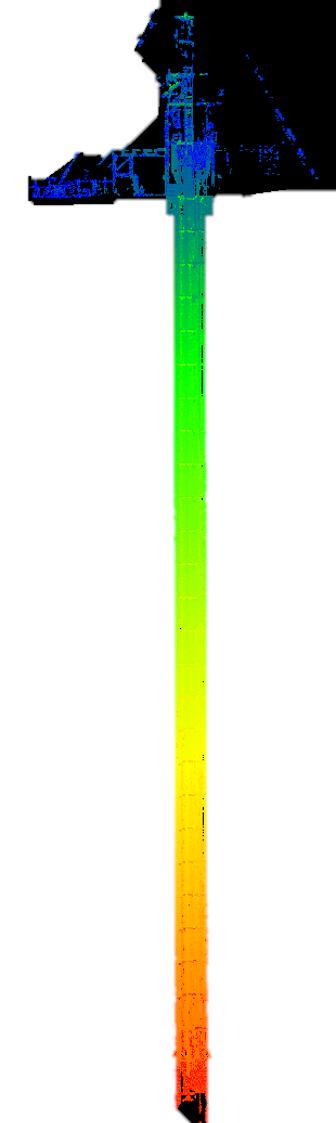

Perhaps the biggest breakthrough is Delta Scans “Yet to be named” shaft scanner, which is a proprietary tool used for vertical shaft scanning.

Key innovations include:

- Almost Zero-drift LiDAR capture for depth accuracy over kilometres.

- High-powered lighting arrays illuminating every detail.

- Panorama cameras capturing 360° shaft imagery.

- AI defect detection engine aligned with international codes.

The result is a full-coverage shaft scan, processed into compliance reports aligned with both South African and international standards.

Impact Example: A shaft that once required a 12person team over 3 days for inspection is now scanned in a matter of hours, with zero entry risk. The digital twin supports maintenance planning, compliance audits, and rehabilitation design.

- Safety: No human entry is needed. Inspections in unstable or confined voids are now fully remote.

- Speed: Downtime is reduced from weeks to days. Mines return to production faster.

- Accuracy: Millimetre-grade precision allows early defect detection, reducing costly surprises.

- Compliance: Digital models and reports meet statutory and international standards, providing auditable records for insurers, regulators, and boards.

- Sustainability: Faster, more precise inspections reduce downtime, energy use, and environmental impact — aligning with ESG commitments.

The numbers tell the story. At one diamond mine, aerial surveys for tailings and pit monitoring avoided potential fines and remediation costs, saving R3 million annually. At another platinum operation, prerehabilitation ore pass inspections reduced material variance from 30–40% to as low as 2–5%, cutting rehab costs of R10–15 million per 10m section dramatically.

Delta Scan’s work is not static. The company continues to push boundaries with AI-driven analytics, including:

- Automated defect detection.

- Defect quantification algorithms measuring spalling, corrosion, and deformation.

- Integration with digital mine planning platforms for real-time monitoring.

Epstein believes this is just the beginning:

“The future of mining inspections isn’t about hardware — it’s about insight. When you can see, measure, and simulate every condition underground, you move from uncertainty to control. That’s the true revolution.”

For an industry that has always measured progress in tonnes moved and metres advanced, Delta Scan is introducing a new metric: insight.

In the dark, complex voids beneath the earth, that insight means safer operations, reduced costs, and greater resilience. As underground mining grows deeper and more complex, companies like Delta Scan are ensuring that what lies below ground is no longer a mystery — but a measurable, manageable digital reality.

Ore sorting and water management are some areas in mineral recovery that have leveraged on the convenience of AI.

By Jimmy Swira

The use of artificial intelligence in African mining is not the future, it is the present. One of the areas where this is prevalent is in mineral recovery in underground mining projects.

Of course, as with any other revolution, there are always the conservative lot who ignore reality and stick to the familiar line: “This way has worked for decades, why the change?”

However, for one thing: AI is reshaping how mineral processing is done, and we are yet to witness more.

At a time when there are changes in the mining space with huge implications on operations in the long term, there is no better timing in the emergence of AI, considering the current burdens.

Indeed, AI has introduced much-needed efficiency at a time when the mining sector is facing challenges, not least the following:

i. Depletion of High-Grade Ore

In the context of South Africa, at shallow levels there is depletion of high-grade ore, especially in the gold and platinum group metals (PGMs) mining sectors. This has prompted mining companies in this area to take underground projects deep, in some cases even ultra-deep. And at those levels, the cost of mining does not come any cheap. It becomes a drag and drain on

resources, not least the cost of energy, which is one of the biggest factors in mining.

This calls for investment in alternative mineral recovery methods that can enable them offset the financial burden of venturing deep level.

ii. The High Cost of Compliance

Compliance, for all its benefits, can be - in fact it is - viewed as a grudge obligation. While mining companies are sold on its significance to their operations, unavoidably, it takes a lot of resources to achieve. This is especially in an area of ESG reporting compliance, which entail investment in sound environmental practices, being seen to be a good corporate citizen, and devotion to tenets of good governance.

In the previous edition of Mining Business Africa, Jameel Essop, a specialist in end-to-end sustainability and Partner at PricewaterhouseCoopers South Africa (PwC SA), mentioned that, while ESG reporting compliance is a business mandate, he acknowledged that achieving it needs a lot of investment. He also advised mining companies to leverage on the convenience of AI and deep learning in sustainability initiatives.

Another persistent issue is the need for compliance with health and safety regulations, the Mine Health and Safety Act (MHSA) and Occupational Health and Safety Act (come to mind) with respect to South Africa.

iii.

Typically, mining companies are located in waterscarce areas. Besides, drought conditions put a strain on already limited water sources. This

renders prudent water management in a critical process like mineral recovery a necessity, not an option.

However, the challenge is that traditional water management methods are time-consuming and not always accurate. Even using smart meters alone does not guarantee efficient water usage.

For this reason, the adoption of AI can help mining companies ensure that water used in mineral recovery processes is managed sustainably.

Selected Applications in Mineral Processing

Recent advances, demonstrating the feasibility of AI in ore sorting and water management, are some of the ways that could help underground mining operations cope with the abovementioned challenges.

AI has not just changed the game in ore sorting, it is the game. One of the leading players in this field, TOMRA, has introduced CONTAIN™, an AI-powered software sorting platform. This enables mining companies to classify complex inclusion-type ores that traditional sorting methods miss, resulting in misclassification or excessive product loss. These are ores with complex mineralisation, such as tungsten, nickel, and tin.

By analysing X-Ray imagery in real time, CONTAIN™ identifies visual patterns in these rocks based on the probability of subsurface ore mineral inclusions. It gives operators precise control over sorting.

To address this issue, TalboAnalytics, a Software as a Service (SaaS) platform, enables mines to ensure that every water drop in critical processes is make to good use as efficiently as possible. It integrates data from smart meters that monitor water volume, quality, and system performance.

Through machine learning (sensors, IoT, and AI), it identifies patterns, detects anomalies, and generates predictive insights for water systems in mining and industrial companies. This helps to manage and optimise water use and treatment processes.

Currently, mining companies are contending with increasing operational costs, ore depletion, and the heavy burden of compliance. Encouragingly, AI technologies are offering the hope of a viable solution, delivering measurable results in ore sorting and water optimisation.

CONTAI N™ is TOMRA Mining’s newest deep learning technology – an AI-powered sorting system accurately detects inclusion-type ores such as tin, tungsten, nickel, copper and sulfi des. Uncover hidden value – reveal even the smallest inclusions and make them count.

Works perfectly with TOMRA’s XRT sorters

Anton Paar innovation and process instrumentation elevates mining performance across the continent.

As Africa’s mining activities intensify to meet surging global demand for minerals – spanning gold, copper, lithium, cobalt, and platinum – the imperative for operational efficiency, sustainability, and cost competitiveness grows ever stronger. In this context, process instrumentation (PI) is not just supportive, it is foundational. Anton Paar stands out among the leading innovators in PI, offering high-precision solutions tailored to the challenges of African mining.

From Data to Decisions: PI as the Functional Backbone Mining today faces declining ore grades, extending operations to remote terrains, and ever-tightening environmental oversight. Navigating these pressures demands real time, accurate measurement across the production chain, from ore preparation and flotation to leaching and tailings management. PI systems – integrating sensors, inline analysers, rheometers, and automation-translate critical metrics (flow, density, pH, reagent concentration) into actionable intelligence, optimising recovery, reducing downtime, and cutting reagent and energy costs.

Anton Paar: Precision Instruments for African Mining

Anton Paar offers a wide-ranging portfolio of advanced measurement solutions relevant to mining applications:

• L Dens Inline Density Meter: A compact, accurate inline device for measuring concentration in precious metals refineries. It supports improved recovery by maintaining optimal density and integrates seamlessly into pipelines using durable materials like Hastelloy and Tantalum.

• L Sonic 5100 Inline Sound Velocity Concentration Meter: Delivers maintenance free, highly accurate (±0.02 %) inline concentration readings of acids and bases. Its robust design, featuring 24 k gold plating or Hastelloy, ensures durability in harsh mining environments. It is ideal for monitoring lixiviant or reagent concentration in gold, copper, uranium, and platinum processing.

• L Cor Coriolis Flowmeter: Estimates mass flow and density of fluids with precision, enabling tight control or automation of chemical dosing (e.g. cyanide or NaOH). This supports real time optimization of reagent usage and enhances gold recovery while reducing waste

Combined, these instruments improve process control, reduce labor-intensive sampling, and minimize reagent waste—boosting both efficiency and profitability.

More Than Analytics: Advanced Lab and Process Integration

Beyond inline sensors, Anton Paar’s lab and engineering solutions enable holistic process control. Its process systems and integration involve turnkey, skid mounted modules that combine sampling, monitoring, analysis, and control. Pre configured and factory tested for easy deployment, they integrate Anton Paar’s sensors into streamlined process workflowseven in challenging operational conditions. The laboratory & analytical instrumentation spans density, refractive index, CO2, rheometry, viscometry, and sample prep systems, supporting both upstream R&D and QA in mining operations. Coal and raw materials analysis incorporate specialised tools such as microwave digestion systems and electrokinetic analysers, supporting environmental monitoring and control of raw material quality in coal and mineral applications.

For African mines Anton Paar innovations yield tangible advantages. Optimised reagent use & recovery use real time measurement of leach solutions or acid concentrations ensures precise chemical dosing-critical in the face of volatile reagent costs. Automation & day night continuity eliminate inline meters’ dependence on laboratory sampling, enabling 24/7 operation and reducing response times to process shifts. Robust field ready designs employ wear resistant materials (Hastelloy, gold plating) and compact form factors designed for harsh mining environments. Anton Paar Southern Africa has expanded significantly, with branches in Johannesburg, Western Cape, KwaZulu Natal, and technical coverage across Tanzania, Ethiopia, and Cameroon. Their 70 plus person team provides sales, applications support, certification grade service, and training - ensuring smooth integration and ongoing operation of their PI systems.

Anton Paar’s sensors serve as the data foundation for broader digital ambitions in African mining. Advanced process control (APC) becomes feasible through real time feedback loops from inline measurement systems. Predictive maintenance is enabled through integrated PI data, feeding into health monitoring systems. Sustainability tracking means process emissions, water usage, chemical efficiency can be quantified and managed more precisely. Remote monitoring is increasingly critical for geographically dispersed operations; Anton Paar’s robust inline sensors empower control-room oversight.

For African operators and investors, the message is clear – process instrumentation is not an optional add-on, it is a strategic enabler of operational excellence. When combined with Anton Paar’s precision measurement tools, integrated process systems, and regional support capability, it forms a powerful platform to enhance recovery, reduce costs, and strengthen sustainability. By embedding Anton Paar’s advanced PI into the heart of mining operations, Africa’s mining sector can not only compete but lead in the increasingly demanding global mineral economy.

Rudolf Niemoller, CEO

FineTech Minerals uses its InverSep® flowsheet and patented BerthaSep® separators to effectively recover ultra-fine mineral particles left behind by conventional processes.

Mining is a three-stage materials handling process: excavation, liberation and separation. After the ore has been excavated, comminution takes place to liberate the valuable mineral particles from the gangue, whereafter any one of several separation methods are used to separate valuable particles from gangue. No matter how well-optimised the comminution circuit, some valuable particles will always be over-ground, thus creating the many inevitable fragments that are too fine for conventional technologies to effectively recover.

Invert, always invert.

Rudy Niemoller, FineTech’s geologist and

founder, formulated FineTech’s InverSep® process trying to answer the question: how does one unlock the remaining value in the massive tailing dumps seen around Gauteng and the North West, where the expensive excavation and liberation have already been done? It soon became clear to him that the remaining value in both historic, and current-arising tailings lies within the ultra-fine fraction, where valuable particles smaller than 100 microns pass through conventional processes directly to tailings.

Starting out in a tiny, rented laboratory, Rudy developed FineTech’s novel flowsheet, planning to use commercially available separators in a novel manner. It soon became clear that conventional separators would not be effective, and the long-time Charlie Munger fan invented the BerthaSep© separator, an inverted up-flow separator, forming the cornerstone of FineTech’s IP.

FineTech’s proprietary technology targets the ultra-fine fraction that conventional plants cannot. The patented BerthaSep® separator, designed for selective recovery of particles under 106 microns, consistently delivers chromite recoveries above 75%. These modular, plugand-play plants operate alongside host facilities, requiring no additional feed or excavation — only slurry, water, and power. The result: new revenue streams at no capital cost to the resource owner, plus reduced environmental footprint and rehabilitation liability.

FineTech’s first commercial-scale plant, commissioned at Clover Alloys’ Rietfontein Chrome Plant, has proven both technically and commercially successful. The plant also doubles as a profitable test bed, where ongoing refinements to the InverSep® process drive even greater efficiency.

At its Pretoria research facility, FineTech continues to refine its process through extensive

laboratory and pilot-scale test work. Numerous trial campaigns have been completed across commodities such as UG2 and LG6 chromite, cassiterite, iron ore, and ferrochrome tailings. This pipeline of ongoing R&D ensures that FineTech’s plants remain at the cutting edge, delivering ever-higher recoveries while lowering environmental impact.

The company’s commitment to operational excellence is also evident in its partnerships. FineTech works hand-in-hand with resource owners to design flowsheet solutions tailored to each site’s mineralogy and tailings profile. This approach not only maximises technical performance but also ensures commercial viability for both parties.

FineTech believes in true alignment with its partners. Rather than charging for technology access, the company provides fully-funded solutions or joint venture partnerships that share both risk and reward. Host mines supply slurry, water, and power — FineTech brings the process, the plant, and the operational expertise.

This “skin in the game” model means resource owners can unlock immediate value from ultra-fine tailings without incurring upfront capital expenditure. In return, FineTech benefits from long-term revenue sharing agreements that reflect actual plant performance. The result is a partnership structure where both sides are invested in sustainable success.

With successful commercial operations already in place and technical collaborations underway with leading players across the Bushveld Igneous Complex, FineTech is positioning itself as a strategic partner in Africa’s mining future. By converting waste into value, the company not only strengthens profitability but also supports the sector’s ESG commitments — reducing waste, lowering rehabilitation liabilities, and ensuring more efficient use of mined resources.

For African mining operators, the message is clear: in a world of rising costs and tighter margins, the next frontier of value lies not in new ore, but in what has already been mined. FineTech Minerals is unlocking that frontier.

At FineTech Minerals, we're redefining what’s possible in fine mineral recovery.

Our innovative process recovers ultra-fine minerals that would otherwise be lost to tailings — delivering increased yield, reduced environmental impact, and real economic returns.

With our initial focus on chromite – we have achieved recoveries of over 75% in the -75 micron fraction for over three years at industrial scale.

We are currently developing flowsheets for:

• Cassiterite

• Wolframite

• Iron Ore

• Tantalum

• Mineral Sands

Rudolf Niemoller | CEO

+27 (0) 83 287 8218

rudolf@finetechminerals.co.za CONTACT US:

www.finetechminerals.co.za.

Despite regulatory hurdles in some countries, drone adoption is adding a new dimension to how mining is conducted across Africa.

By Jimmy Swira

There is a perception – amongst some suppliers of products and services – that mining companies are not the most dynamic of clients when it comes to embracing new technologies that can add value to their operations. Arguably, this could be the case with other products, but not in the usage of unmanned aerial vehicles (UAVs), commonly known as drones.

Unprecedented Growth

Notably, in the area of UAVs, there has been unprecedented growth in their usage in the past decade in Africa. UAVs are being deployed across the entire mining cycle – from exploration, daily operations, to mine closure and rehabilitation.

This trend is more or less similar to other mining jurisdictions globally. However, on the continent, mines are using drones to address unique challenges in their respective operations.

And strong indications are that more is yet to come.

Based on recent activities on the continent, a vivid picture of the various applications of UAVs throughout the mining cycle emerges –conspicuously in the following areas:

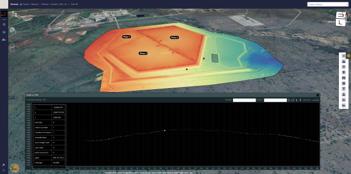

i. Mapping and Surveying

Specialised UAVs equipped with LiDAR and high-resolution cameras are able to produce accurate 2D and 3D maps and generate models for surface and underground operations. This eliminates the need to send personnel to manually inspect areas that would otherwise expose them to hazards.

In South Africa, Palabora Copper Mine uses UAVs for LiDAR scans of underground voids. This enables surveyors to work from a safe distance of up to 100 metres.

At Exxaro’s Grootegeluk mine, Rocketmine

uses UAVs for surveying and mapping. This ensures that surveyors can avoid hazardous areas, significantly increase data accuracy, and improve turnaround time by providing real-time data on a shift-by-shift basis.

ii. Volumetric Measurements

By conducting frequent aerial surveys, UAVs can rapidly and accurately calculate the volume of stockpiles and help determine the movement of material.

Exxaro Resources Group, in partnership with Johannesburg UAV service provider Rocketmine, uses UAVs for a wide range of activities at Grootegeluk mine – among them are stockpile inspection and blast monitoring.

Rocketmine UAVs monitor stockpile movement at Rössing Uranium mine in Namibia, providing accurate data.

iii.

UAVs perform a range of tasks, such as visual inspections of machinery. The data collected

helps in instituting suitable maintenance programmes. In the end, this prevents failure and enhances asset availability.

In addition, UAVs are used in the inspection of infrastructure like haul roads and hazardous areas such as tailings dams. This helps mining companies take suitable measures to mitigate accidents.

In South Africa, Kumba Iron Ore uses UAVs to survey drilling sites and monitor overall site conditions.

The scourge of illegal mining is becoming a challenge for gold mining companies and authorities on the continent. Illegal miners, who are mostly armed and will stop at nothing to get their way, are encroaching on designated areas, vandalising infrastructure, accessing minerals, and threatening the lives of employees and surrounding communities.

A case in point is Ghana, where the Minerals Commission has implemented a system that uses 28 UAVs and an AI-powered control room to monitor illegal mining hotspots.

The use of UAVs in environmental monitoring has been phenomenal.

UAVs gather data to help monitor the impact of mining activities on the environment. These include – but may not be confined to – assessing reclamation efforts, monitoring land cover, and tracking water quality and sediment flow.

Through the abovementioned, among some of the applications, UAVs bring benefits to mining operations once regarded as unattainable –mostly in the following ways:

1. Improved Safety

Safety is, without doubt, a major driver of adoption through removing employees from some of the hazardous and dangerous tasks on mine sites.

2. Increased Efficiency and Cost Savings

Efficiency and cost savings are the buzzwords in mining operations. The use of UAVs plays a part in making this a reality.

Manual or helicopter-based surveying is time-consuming and costly. In contrast, UAVs cut down the time and expenses usually associated with these methods. Eventually, this leads to operational improvements and a reduction in costly downtime.

3. Confidence

With traditional methods, there are always questions about the accuracy of data, as an element of human error could be factored in. There is always a possibility that conditions under

which the data was collected have changed.

Instead, by providing more accurate and frequent data, UAVs give more confidence and lend more credibility to the data. This allows for better decision-making in the respective applications where they are used.

Data provided by UAVs is securely stored in cloud-based platforms. This makes it easy to process and share.

There is no question that the growth niche of UAVs in African mining is unprecedented –bringing about many benefits – and set to add more to the range.

There is a blot, though – if you ask any UAV operator, getting the necessary paperwork to operate can be frustrating – sometimes, unnecessarily so.

While a free-for-all scenario is not good for operations, there is a perception that strict UAV licensing regulations are a barrier that prevents industry access and involvement in activities that grow economies.

For instance, one UAV solutions provider at a recent exhibition lamented the strict UAV licensing regulations in South Africa, where noncompliance can lead to fines and legal issues.

For one thing, this disconnect between innovation and regulation is worrying: it highlights the need for a more enabling environment that balances safety, accountability, and access.

Once this barrier is removed, there is no question that UAV adoption can continue flying African mining to new heights – supporting growth and transformation.

A drone on duty at a surface mine

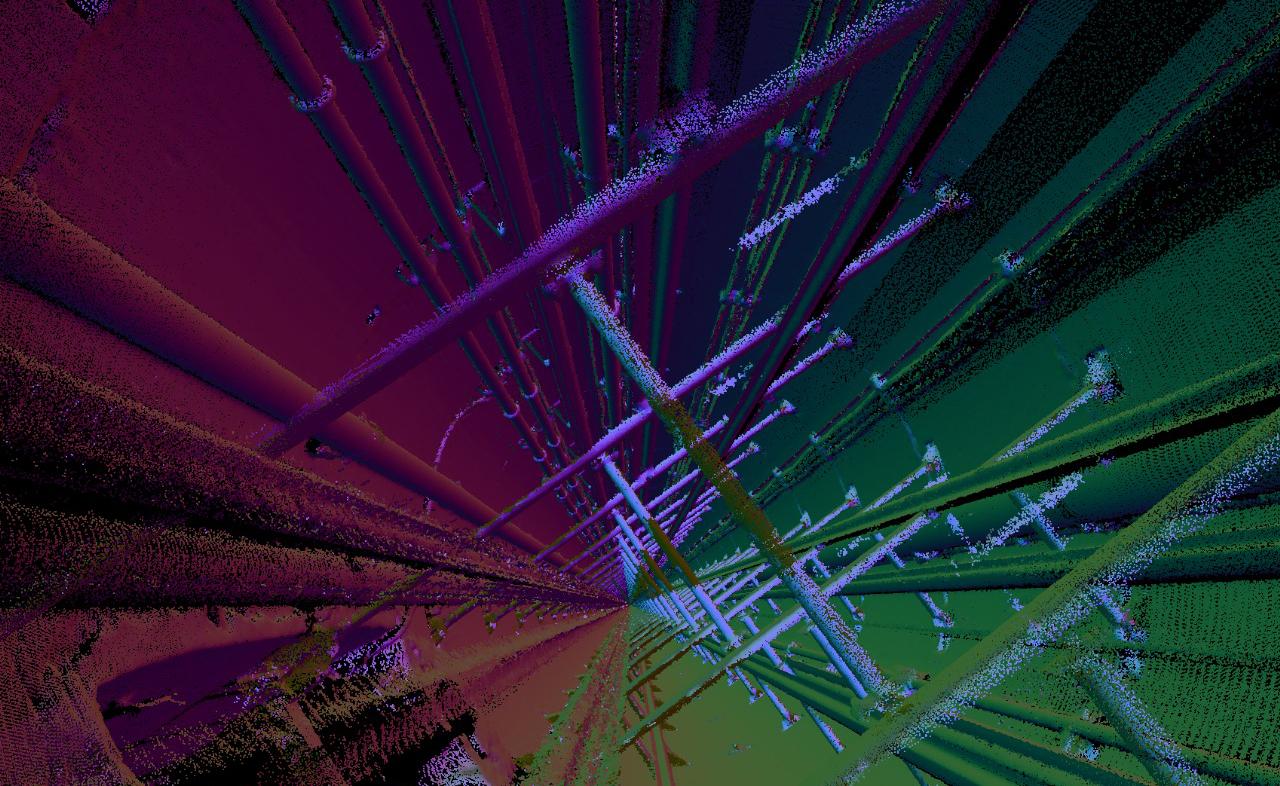

In order to conduct inspections in tight spaces, such as Boilers, Vessels, Tanks and Structures, scaffolding or rope access is recommended. However, this can be a time-consuming and costly exercise. Besides, there is the risk of exposing personnel assigned for inspections to hazards.

Alternatively, using its Elios technology, Steinmüller Africa offers autonomous inspections in areas where GPS signals cannot be picked, and eliminates the use of scaffolding or Rope Access. It has clientele in diverse sectors across Africa.

By Jimmy Swira

Ideally, mines expect the drone services they procure for safety and maintenance, inspections, and post-incident investigations in all environments to operate smoothly: delivering data as and when needed. However, the reality is different: frustratingly, most GPS-guided drones on the market fall short in complex, confined, and dangerous spaces – particularly around buildings, structures, and other landmarks – not delivering at all.

This is a problem that Steinmüller Africa has ensured that its Elios technology addresses, as two of the company’s technical team, Fanie Smuts and Carel van Aswegen, assure mining operations.

Challenges with GPS-guided drones

To underline the relevance of Steinmüller’s Elios technology, first demonstrate the challenges with GPS-guided drones when deployed in tight spaces. Van Aswegen: “When inspecting certain mining areas for safety and maintenance

purposes, particularly where there are buildings, structures, and others, the GPS signal cannot be picked. The loss of signal has significant implications: the drones would then not be able to locate its current position. This could result in the loss or damage of the drone.”

Steinmüller’s Elios Drone Solution

In addressing this challenge, Steinmüller’s Elios drone solution does not make use of GPS coordinates as a navigation tool. Instead, it employs an optimised radio frequency, FlyAware SLAM Engine, and LiDAR mapping software to track and see surroundings, as well as for its autonomous ‘Return to Home’ function.

Enabled by a Wide Range of Features

Smuts points out that the Elios drone is able to function effectively in such a challenging environment due to the wide range of features and technologies it incorporates. Specifically, these include but are not isolated to:

• Built-in: Visual inspection payload

• Add-Ons: UT, Surveying, RAD, Flammable Gas Sensor

• LiDAR-based Stabilization

• Live Situational Awareness

• Location-Tagged Data

• Collision-Resilient

• Confined Space Access

• GPS-Denied Flights

• 4K Camera (Built-In):

• Sensor: 12.3 MP, 1/2.3” CMOS

• Video Resolution: 4K / 30 fps

• GSD Resolution: Up to 0.18 mm/ pix

• Focal Lens: 2.71 mm

• FOV: 180° Tiltable Camera Pod

• Thermal Radiometric Camera:

• Sensor: Lepton 3.5 FLIR

• Resolution: 160 x 120

• Accuracy: ±5°C or ±5%

• Frame Rate: 9 fps

• Thermal Sensitivity: ≤50 mK T

• • Lighting System:

• Light Output: 16,000 Lumens

• Modes: Normal, Dustproof Lighting, Oblique Lighting

• Surveying Payload (Add-On):

• Sensor: Configuration Ouster OS0

128 Beams REV 7

• Accuracy: From 0.1% Drift

• Precision: 1σ +/- 6 mm, 2σ +/- 12 mm

• Range: Up to 100 m

• Scanning Rate: 1.3 M pts/sec

• Photon Sensitivity: 10x

• Handheld Functionality

• In Post-Processing:

• Software: FARO Connect (Partner Solution)

• Features: Data Alignment, Georeferencing, Point Cloud Filtering

• Export Formats: LAZ, LAS, E57

Using this revolutionary technology, Steinmüller Africa currently offers confined space inspections for areas where scaffolding or rope access would be required. This is in Boilers, Vessels, Tanks and Structures.

Worth mentioning, the drone can be flown in areas where a permit for entry is not yet issued,

This continues to prove its effectiveness in tight spaces, helping clients meet their respective objectives in inspections. A case in point is a project where the Elios drone was recommended and successfully deployed.

Previously, the client lost time waiting for entry permits and Scaffold/Sky-Climber/Rope Access. This resulted in a higher time and cost lost.

In the complex mining environment, clients have unique requirements. And this project was no exception for the Steinmüller technical team. The team saw the need to implement a faster way of identifying and inspecting hard-toreach/dangerous places without putting any employees in harm’s way. Accordingly, Steinmüller Africa conducted a thorough research in the area, then based on the results, recommended confined space drone inspections.

“We obtained the Flyability Elios 1 and presented the idea to the client. From there, the drones were used more and more, and

meaning time for inspections is significantly reduced. This makes it up to the task, stresses van Aswegen:

“The drone cuts cost and time significantly.”

Steinmüller is always eager to increase the scope of solutions offered to clients. Currently, it is busy working with software that is compatible with the drone software, in aim to provide services like stock yard measurements and detailed 3D mapping of components to be able to measure location deviations, etc.

There were notable improvements observed after the adoption of the Elios drone. This was evident in significant time and cost-cutting, and in keeping employees out of the hazards of conducting physical inspections.

Achieving milestones in projects and seeing clients satisfied encourages Steinmüller Africa to pursue more opportunities and long-term advantages of implementing this solution.

“We believe that in the long term more drone inspections will be done and that manned inspections in dangerous environments will be significantly reduced. We also see it as a way to save our clients money and time by reducing time delays and costly scaffolding erections that sometimes are done at the wrong areas due to the unknown. Ultimately, we see using the Elios as turning the unknown and uncertain into the known and certain,” Smuts states.

Functions effectively in challenging environments due to the wide range of features and technologies it incorporates.

Steinmüller Africa is a B-BBEE level 1 contributor.

Built-in

Add-Ons:

LiDAR-based Stabilisation

Live Situational Awareness

Location-Tagged Data

Collision-Resilient

Confined Space Access

GPS-Denied Flights

4K Camera (Built-In)

Worldwide, traditional drilling and blasting methods are facing increasing scrutiny due to safety, environmental, and economic risks. In response, mines across the continent - particularly in South Africa - are embracing data-driven technologies, automation, and precision blasting techniques to good effect.

The saying: “Necessity is the mother of innovation” aptly illustrates the current trends in blasting and drilling projects in African mining. In the sector, increasingly, alternative techniques are being adopted to access and extract minerals, and are becoming mainstream. Nowhere is this better illustrated than in South Africa, based on recent developments.

Just like in other tasks from mine to mill, pit to port, there is increased obligation on mining companies to improve safety, enhance environmental compliance, and boost efficiency in their respective drilling and blasting projects. This has created a compelling business case for methods that can enable precision and efficiency.

So, what is wrong with the supposedly ‘tried and tested’ traditional techniques in drilling and blasting? One may ask: if it’s not broken, why fix it?

Doubtless, traditional techniques have been serving the purpose - and still do in operation in some projects - if not most cases. However, times have changed and the stakes are higher. The reality is that they fall short of meeting contemporary obligations.

The SAIMM has identified the following risks inherent in traditional blasting methods:

• Flyrock: These are rock fragments that can cause potentially severe injury and death.

• Misfires of explosives that fail to detonate at the correct time, only to explode later during subsequent activities, catching teams unawares.

• Toxic fumes, such as nitrogen oxides (NOx) and carbon monoxide (CO), produced during blasting, can cause asphyxiation and respiratory challenges, which can result in death.

• Ground vibrations can damage nearby buildings and critical infrastructure. In addition, frequent exposure to air blasts can cause hearing damage to blasting personnel.

• Inhaling respirable crystalline silica from dust generated by blasting increases the risk of lung diseases like

silicosis. A case in point of the severity of the exposure is the plight of afflicted ex-mine workers in South Africa that has been widely reported.

• If misfiring is a problem, premature detonation is equally a risk. Its main causes are improper handling of explosives and faults in the detonation system, among others.

• Premature detonation can catch the blast personnel unawares—an explosion occurring before measures to secure the area are taken.

Besides safety risks, environmental risks increase the burden of compliance in traditional blasting. This factor has been highlighted in reports. The following are the most cited issues:

• The release of particulate matter into the atmosphere.

• Concerns from communities near mines about noise from explosions. In addition, conservationists highlight that it scares wildlife.

• Explosive chemicals can pollute waterways.

• Repeated blasting in some areas can cause rockfalls. Further increase in instability can cause land subsidence.

Effects of traditional blasting can hit mining operations where it hurts the most: the bottom line. Specifically, this manifests in the following ways:

• The ensuing fragmentation can result in blockages and affect efficiency

in loading, hauling, and crushing. Eventually, this can result in high energy consumption—energy constitutes the biggest part of operating expenses.

• The cost of accidents goes beyond fatalities: colossal cost in damages as a result of litigation from the affected parties and fines from regulators. What’s worse is the damage to reputation, which becomes difficult to address.

• The damage blasting causes to homes and infrastructure, and the health risks of fumes, can strain a mine’s relationship with the community.

• Explosives are one of the most critical blasting consumables that have to be used prudently. Yet, misfires can result in wastage. If one factors in several cases of misfires during blasting, the wasted explosives would be high.

Clearly, sustaining their operations while bearing the abovementioned risks is an enormous challenge. For this reason, mining companies have no other option but to take on board new innovations as a necessity.

True to form, in a report, the SAIMM has noticed new technologies in drilling and blasting increasingly being embraced in South African mining. Similarly, this is also happening in other African countries.

This indicates an industry committed to keeping abreast, thinking long-term in pursuit of precision and efficiency in drilling and blasting.

In drilling, some of the techniques that have gained traction are longhole drilling and drop raising.

Extensively practised in South Africa, this method involves drilling long, large-diameter holes over the full length of an excavation, which are then charged and blasted from the bottom upwards.

South African mines are integrating automated and robotic equipment in drilling and cutting — tasks that are labour-intensive. Hence, they are enhancing safety and efficiency by removing

personnel from high-risk areas.

Employing GPS and advanced guidance systems, autonomous drilling rigs enable precise hole placement and optimise drilling patterns. In this way, human error is reduced significantly, increasing efficiency.

In blasting, mining companies have taken aboard the following measures or practices:

a. Pre-splitting

In blasting, the common methods include presplitting, smooth blasting, and cushion blasting. In South African mining projects, pre-split blasting (pre-splitting) has been adopted as one of the ways of achieving efficiency and precision. The Southern African Institute of Mining and Metallurgy (SAIMM) explains how this is applied and its relevance: “This technique involves drilling a row of closely spaced, lightly charged holes along the perimeter of an excavation. Firing these holes creates a fracture curtain that limits shockwave propagation and control of the main blast, reducing flyrock and improving fragmentation.”

The other two methods are also at the disposal of mines in blasting projects.

Similar to pre-splitting, this method creates a smooth, finished wall with controlled detonation, reducing excavation needs.

Cushion Blasting is a technique that reduces

the impact of ground vibrations on nearby structures, protecting them from blast damage.

In cushion blasting, precise hole placement and controlled detonations are used to minimise ground vibrations and overbreak. Through the use of precise hole placement and controlled detonations, ground vibrations and overbreak are reduced.

What has become prominent is the use of real-time data. The integration of AI and data analytics with geological and operational data allows for more precise blast designs (in particular, square patterns, bottom holes first).

Hard to ignore is the dominance of electronic detonation systems.

Advanced initiation systems like BME’s AXXIS have become standard. By programming detonators within milliseconds, they allow for precise timing and sequencing of delays, which improves shockwave interaction between blast holes. Ultimately, this, together with data-driven optimised blast designs, enhances the interaction of shockwaves. This produces smaller, more uniform rock fragments.

d. Remote-Controlled Blasting

Remote-controlled blasting is being utilised as another alternative.

Typically, in remote-controlled blasting, sessions are managed from a safe distance using advanced control systems. Significantly, this minimises human exposure to hazards like fumes, noise, flying rock, and misfires.

On the whole, the massive gains of these innovations are evident, particularly in the following areas:

i. Efficiency

There is improvement in blast outcomes like smaller, more uniform rock fragments. This increases throughput in downstream crushers (maximised mineral recovery) and reduces energy consumption.

ii. Enhanced Safety

Automation and robotics reduce direct human exposure to hazardous activities. This improves safety.

Another aspect - pre-split blasting - helps in controlling blast intensity. This prevents excessive ground vibration and the generation of flyrock and dust carrying carcinogenic particulate matter.

iii. Environmental

There is less vibration and damage to infrastructure, low fumes produced, and minimal disruption of wildlife in its natural habitat.

In gold mining, time is money. Every hour waiting on assay results delays exploration, resource estimates, and mine planning. For decades, the bottle roll assay has been the industry’s workhorse for determining recoverable gold—vital for feasibility studies and grade control. But it has always been constrained by one problem: time.

A standard bottle roll test, based on the Elsner equation for gold dissolution, usually requires 24–48 hours to reach maximum extraction. This lag creates a bottleneck across the mining cycle, from early exploration through to operational decision-making.

That bottleneck is now obsolete. Mineral Process Control (MPC) Pty Ltd has redefined assay practice with LeachWELLTM 60X—a proprietary accelerant that doesn’t just speed up bottle rolls, it transforms them.

The Bottleneck: Time and Variability

Bottle roll assays simulate full-scale leaching to predict potential recovery of gold and silver. They inform plant design, economics, and resource reporting. But confidence has always meant waiting until the leaching curve flattens. Stopping early risks underestimating recoveries; waiting too long wastes valuable lab time.

Ore variability complicates this further. With nuggety gold, large samples—500 g to 2 kg—are required to ensure representativity. This makes time and consistency even more critical. LeachWELLTM 60X resolves both problems at once.

The Solution: LeachWELLTM 60X’s Transformative Kinetics

LeachWELLTM 60X is more than an additive—it’s a catalytic accelerator that changes the kinetics of cyanidation.

The Dual Advantage:

1. Speed: It accelerates the dissolution of gold and silver by up to 60 times. Tests that once took 48 hours now achieve maximum recovery in just 1–2 hours. This reduction in turnaround time is the single greatest efficiency gain available to labs.

2. Consistency and Cyanide Efficiency: The formula suppresses cyanide losses to competing reactions (e.g. sulphides), preserving free cyanide for gold dissolution. The result: higher recoveries, greater repeatability, and confidence that results are both reliable and fast.

It’s no surprise that “LeachWELL assay” is now often used interchangeably with “bottle roll” in exploration reports and corporate disclosures worldwide.

To ensure consistency and safety in the lab, MPC has developed AssayTabsTM —a simple, pre-measured tablet that combines LeachWELLTM 60X with sodium cyanide. Instead of handling powders or liquids, operators can now drop a tablet directly into the bottle roll. This innovation delivers three critical benefits:

• Safety: Eliminates manual handling of cyanide powders and reduces operator exposure.

• Accuracy: Each tab contains the precise reagent dose required for a standard bottle roll, ensuring consistent results across batches.

• Efficiency: Simplifies preparation, standardizes workflow, and ensures laboratories adopt best-practice methodology with minimal training.

AssayTabs are now regarded as the safest and most effective way to apply LeachWELLTM in routine bottle roll assays, making high-speed, high-precision testing both accessible and sustainable.

Real-World Impact: Proof in the Field

The transition from traditional fire assays and

slow bottle rolls to LeachWELLTM methods— particularly with AssayTabs—has delivered tangible benefits across projects worldwide.

A gold explorer in Mali re-analysed drilling samples using a 2 kg LeachWELLTM bottle roll with residue fire assay, comparing it to a 50 g fire assay.

• Fire Assay Result: 5 m @ 3.75 g/t Au from 84 m

• LeachWELLTM Result: 5 m @ 6.14 g/t Au from 84 m

The larger, faster LeachWELLTM sample captured coarse free gold missed by fire assay, boosting recovery by 150%. This directly increased the reported resource base and improved project economics.

A Canadian project adopted a 1,000 g LeachWELLTM bottle roll with AssayTabs for grade control in a high-grade starter pit. Results included:

• High Repeatability – confirming mineralization continuity

• High Recovery – 96.5% gold and 69.3% silver

The speed, safety, and precision enabled better grade selectivity, lower dilution, and tighter mine scheduling—essential for the project’s early production phase.

The Benchmark for Modern Assay Practice

LeachWELLTM 60X, delivered via AssayTabsTM , allows labs to test larger, more representative samples (up to 2 kg) with unprecedented speed, accuracy, and safety. Whether refining exploration targets or setting daily plant throughput, mining decisions can now be based on the most reliable and timely data possible. When project viability hinges on rapid, accurate recoverable metal data, there is only one choice: LeachWELLTM 60X with AssayTabs. The future of bottle roll assaying is here.

Mineral Process Control (MPC) Pty Ltd today to optimize your lab efficiency and accelerate your path to discovery.

Don’t miss the world’s premier mineral exploration and mining convention

27,000+ attendees

400+ hours of programming

1,300+ exhibitors

Delegates from 125+ countries

Meet investors & senior executives

Unrivaled networking

Mining operations present some of the harshest working conditions imaginable, where safety and efficiency are paramount. These environments demand equipment and components that can withstand relentless vibration, heavy loads, and exposure to corrosive substances. Fastening solutions are critical in ensuring the integrity and reliability of mining machinery, and selecting the right fasteners is not just a choice but a necessity for the smooth operation of mining activities.

In the mining industry, equipment must endure vibrations from drilling, crushing, and milling processes. These vibrations can loosen bolts and other fasteners, leading to equipment failure and costly downtime. Therefore, the bolts used in mining must possess superior resistance to vibrational loosening. Swagefast’s vibrationresistant fasteners, such as the Swagebolt Pin and Collar is designed to maintain their integrity even under intense and continuous vibration, ensuring machinery and components remain securely assembled.

Heavy loads are another significant challenge in mining environments. The immense weight of materials handled by mining machinery places substantial stress on their fastening systems. Fasteners used in this context need to have exceptional tensile and shear strength to handle these loads without deforming or failing. Swagefast provides high-strength fasteners made from durable materials that can support heavy loads and enhance the longevity and safety of mining equipment.

Exposure to corrosive substances is a common issue in mining operations, particularly in environments where machinery is subjected to moisture, chemicals, and abrasive materials. Corrosion can significantly weaken fasteners, leading to premature failure. Swagefast offers corrosion-resistant fasteners with different surface coatings, to provide long-term durability in harsh, corrosive environments.

To maximise the lifespan and reliability of fastening solutions in mining equipment, regular maintenance and timely replacement are crucial. Best practices for fastener maintenance include periodic inspections to check for signs of wear, corrosion, and loosening. Implementing a scheduled replacement program for critical fasteners can prevent unexpected failures and maintain operational efficiency.

Furthermore, improved fastening technology play a vital role in ensuring worker safety, minimal downtime and improved regulatory compliance, these systems contribute to Environmental, Social, and Governance (ESG) goals by reducing waste, supporting other fastener standards such as ISO 9001 for example.

Swagefast’s comprehensive range of fastening solutions are tailored to meet the demanding needs of the mining industry. By choosing the right fasteners and adhering to best maintenance practices, mining operations can enhance safety, reduce downtime, and achieve greater efficiency.

Visitors to WearCheck’s Lubrigard platform gain insight into the FLAC strategy: a comprehensive focus on Fuels, Lubricants, Air, and Coolants. WearCheck’s holistic approach utilises data mining and targeted analysis to highlight contamination in key systems early, before it impacts performance or causes breakdowns.

WearCheck, Africa’s premier condition monitoring specialist, is pleased to announce the official launch of the website for Lubrigard, its dedicated lubricant management division.

Built in collaboration with WearCheck, the Lubrigard platform clearly demonstrates the company’s commitment to LubricantEnabled Reliability (LER) - the principle that maintaining lubricants in peak condition promotes optimal asset performance, extended equipment life and reduced operational costs.

Lubrigard division manager, Chris Hattingh, has been with WearCheck for more than 15 years, specialising in LER for the past five. He views the new Lubrigard website as a pivotal growth point in Lubrigard’s journey, an extension of his team’s offering, and an important source of information about LER processes, which aids customers with decision-making.

With the new website serving as an efficient business tool, Hattingh is pleased to be able to offer clients clear and simple solutions once key objectives are established, cutting through

complexity. Clients now have direct access to Lubrigard’s value propositions in one place, with immediate ability to engage and requested tailored, online support, eliminating the wait for proposals.

‘What’s more,’ says Hattingh, ‘visitors to the new website gain insight into Lubrigard’s FLAC strategy - a comprehensive focus on Fuels, Lubricants, Air and Coolants. Our holistic approach utilises data mining and targeted analysis to highlight contamination in key systems early, before it impacts performance or causes breakdowns.

‘Using advanced sensory technologies and oil analysis data, the Lubrigard team provides real-time insights into the health of both the lubricant and the components it serves. We also offer a range of specialised products tailored to specific applications. Our unique techniques allow us to monitor not only the condition of the oil and fuels, but also the performance of the machinery through improved WearCheck oil analysis data.

‘Furthermore, at Lubrigard, we use RPVOT (rotating pressure vessel oxidation test) testing to measure lubricant oxidation resistanceespecially crucial for turbine oils - demonstrating the depth of its technical capabilities.

‘An added component of Lubrigard is iGard, an IoTbased system, which integrates sensory technology, historical oilanalysis trends and realtime data. The result: a fully integrated view of asset health, early wear warning and proactive maintenance planning.

‘Our site also features Lubrigard’s range of precision-engineered components and best-practice lubrication tools. These include filtration systems for lowpressure systems; a variety of breathers - disposable, rebuildable, desiccant and spinon types; sampling valves engineered for accurate, reliable oil-sampling in diverse environments, and adaptor kits to streamline lubricant handling - from drum or IBC (intermediate bulk container) transfer to connection with filtration units.’

Hattingh adds that Lubrigard emphasises its broader capability in customer training and support - building on WearCheck’s reputation for quality training courses and customer-focused

reporting platforms. Lubrigard’s online courses make training convenient for customers who have dedicated training classrooms on site. Certificates are issued following the successful completion of each Lubrigard course, many of which are accredited through the ICML (International Council for Machinery Lubrication). Courses include machine lubrication technician I, machine lubrication analyst I and II, and machinery inspection & verification of lube programmes. Additional courses cover topics ranging from fundamentals and base oils to contamination control, degradation and turbines. Hattingh states that the website launch marks a key point in Lubrigard’s trajectory to reach a wider customer base, with a larger product and service offering. ‘The website not only consolidates our service portfolio - LER strategy, FLAC framework, iGard platform and robust product suite - it also brings transparency and confidence to clients seeking reliable lubricationmanagement partners’

Visit the new Lubrigard site now at https://lubrigard.co.za/ to explore its services and solutions and book training courses.

WCK Mining 180 x 130mm_bleed 5mm.pdf 1 2025/05/22 15:39:47

Every minute of downtime can have significant financial consequences, which is why proactive maintenance is crucial in this high-stakes environment.

WearCheck’s advanced oil, fuel, and coolant analysis enables you to identify hidden issues before they escalate. By detecting early signs of wear, mechanical , we help you reduce maintenance costs, extend equipment life, and

Partner with us today — and keep your operation

Less downtime. More production.

marketing@wearcheck.co.za

Froth flotation stands as one of the greatest innovations in mining—and at the forefront of its modern evolution is the Jameson Cell: one of the most efficient, flexible, and highperforming flotation technologies in the world.

The Jameson Cell was developed in 1985 when Mount Isa Mines asked Professor Graeme Jameson to improve flotation performance in their zinc circuit. His breakthrough—the downcomer—showed that effective particle recovery occurred in an intense mixing zone, leading to the creation of a compact, highefficiency flotation cell.

Over the next 40 years, the Jameson Cell underwent continuous improvement. Key milestones included the introduction of the External Recycle Mechanism (ERM) in the 1990s, which fundamentally improved the process stability.

In 2007, Glencore Technology, in conjunction with Professor Graeme Jameson, conducted a series of internal trade-offs between the Jameson Cell and the Concorde Cell, with the hope of further improving fine bubble recovery. The evaluation revealed that the Concorde Cell delivered lower performance, and when coupled with operational complexity, had higher capital and operating costs. The Concorde Cell was not pursued and returned to Professor Jameson. This decision reaffirmed Glencore Technology’s commitment to the Jameson Cell for decades to come. As the capacity of Jameson Cell’s has increased to around 4000 tph, a recent lower-

profile configuration was adopted, which doesn’t compromise performance or functionality, but significantly reduces installation costs.

Now with over 500 installations across 30 countries, the Jameson Cell continues to deliver unmatched performance and reliability.

Unlike conventional cells, the Jameson Cell generates fine bubbles consistently without the need for external equipment blowers or spargers. This ensures optimal particle-bubble contact and recovery with a lower capital cost. Its intense mixing and rapid flotation occur without mechanical agitation, delivering superior energy efficiency and significantly lower operating costs.

Adam Price, Glencore Technology’s Manager of Jameson Cell Technology, highlights the key advantages driving its global success.

“The Jameson Cell consistently delivers improved performance whilst providing huge savings on both OPEX and CAPEX. There’s a reason they’re so widespread.”

Compact yet powerful, the Jameson Cell achieves high throughput in a remarkably small footprint, while froth washing maximizes concentrate grade in a single flotation stage.

“The Jameson Cell punches well above its weight. High throughput, great grades, and simple to run,” Price adds. “No moving parts, no fuss, just reliable performance no matter the conditions. It’s a smarter investment from day one.”

This has kept the Jameson Cell firmly at

the top, outperforming newer technologies and reinforcing its position as the industry’s most effective flotation solution.

While newer technologies emerge as alternative options, they remain far less proven, with very few full-scale installations compared to the Jameson Cell’s 500 and counting.

A recent independent study by Ausenco confirmed that the Jameson Concentrator—a complete flotation circuit built entirely with Jameson Cells—was a more cost-effective and sustainable flowsheet compared to tank cell flotation circuits. The Jameson Concentrator achieved a 24% lower installed capital cost compared to tank cells, driven by its compact footprint and significantly reduced structural requirements. Costs were nearly half, with power consumption and consumables drastically reduced due to the Jameson Cell’s simplified, no-moving-parts design.

From an environmental standpoint, the Jameson Cell also leads by example. The study found that the Jameson Concentrator produces 40% fewer operational carbon emissions and uses half the concrete and one-third the steel during construction, making it the clear ESG front-runner. Over a 15-year mine life, the cumulative emissions from a Jameson Cell plant are significantly lower than those of a conventional setup—helping operations meet sustainability targets without compromising performance.

These advantages are further amplified by the Jameson Cell’s ongoing evolution and exciting future, a point highlighted by Glencore Technology Director of Growth & Solutions, Glenn Stieper:

“The Jameson Cell is in a unique phase—it has 40 years of refinement behind it, yet we’re still uncovering its full potential across flowsheets and commodities. Recently, we’ve seen outstanding results in PGMs, reverse silica in iron ore, and as a full-circuit solution with the Jameson Concentrator. It’s personally rewarding to know we’re driving the industry to innovatepushing for lower energy, lower cost, and higher performance solutions that help tackle the global challenges mining companies face today.”

• Register for MEI’s Flotation ‘25 to meet the Glencore Technology team and discover why the Jameson Cell remains the industry’s benchmark in flotation performance and innovation.

The mining industry is having to contend with more stringent environmental demands and ever more scarce resources. As a result of increasing energy and raw material prices, sensor-based sorting is gaining in importance as a substitute for or in combination with other processes. This technology enables valuable commodities in raw material to be cost-effectively enriched, taking the strain off downstream process stages. Pre-concentrated ore reduces mine-to-plant transport, as well as process water and energy consumption.

By combining up to four sensors, STEINERT’s sorting systems maximise precision. These technologies greatly reduce operating costs, increase the value of the output material and are environmentally friendly. This makes mining companies able to comply with ever more stringent ESG criteria (environmental, social, governance) while also operating at a profit, which in turn has a positive impact on local communities.

The general shortage of resources is leading to increasing prices for energy, consumption of the natural environment and of certain raw materials obtained through mining. This shift is boosting the inherent advantages of sensorbased sorting beyond the processes commonly used to date.

The benefits of combined sensors

Sorting technology delivers a multitude of benefits in mining. Unlike wet processing, water does not have to be stored or treated. This also eliminates the need of tailings. In many cases, pre-concentration can be set up under ground. This cuts the costs of transport because some of the excavated material does not have to be brought to the surface. Compared with wet separation, dry sorting is generally cheaper and less harmful to the environment. Sorting specialist STEINERT has produced a multisensor response to the increasingly complex requirements of sorting depth, energy efficiency