Misty, our local David Weekley Homes Internet Advisor in Salt Lake City, is ready to answer any questions you may have about our homes and the communities we’re building in. Plus, she can tell you more about our available Quick Move-in Homes to see if they suit your Clients’ needs:

$614,990 The Eastlake in Cottage Courts at Daybreak 7064 W. Swansea Drive 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage $614,990 The Bitterbrush in Paired Villas at Daybreak 7079 W. Swansea Drive 4 Bedrooms, 3 Full Baths, 1 Half Bath, 2-car Garage $649,990 The Bismark in The Homestead 12777 S. Emmas Well Lane 2 Bedrooms, 2 Full Baths, 2-car Garage $624,990 The Coppell in The Carriages at Ridgeview 10034 N. Loblobby Lane 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage Ready Now! $589,990 The Clipper in Envision at Daybreak 6901 W. Meadow Grass Drive 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage Ready Now! Ready Now! $559,990 The Coppell in The Carriages at Ridgeview 4819 W. Washoe Court 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage Ready Now! $609,990 The Sunflower in Cottage Courts at Daybreak 11097 S. Fordman Way 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage Ready Now! Ready Now! Ready Now! $984,606 The Hawthorne in Prestbury Cove 1539 North 1430 West Street 4 Bedrooms, 3 Full Baths, 1 Half Bath, 5-car Garage Ready Now! See a David Weekley Homes Sales Consultant for details. Prices, plans, dimensions, features, specifications, materials, and availability of homes or communities are subject to change without notice or obligation. Illustrations are artist’s depictions only and may differ from completed improvements. Copyright © 2024 David Weekley Homes - All Rights Reserved. Salt Lake City, UT (SLC-24-001156) Contact Misty to find your Clients’ dream home by calling 385-530-2071 Our Internet Advisor Is Ready to Help You Find Your Clients’ Dream Home

April Fool-Proof Your Deals. Turning Houses into Homes® SecurityNational Mortgage Company complies with Section 8 of RESPA and does not offer marketing services in exchange for referrals or the expectation of referrals. This is not a commitment to make a loan. Loans are subject to borrower and property qualifications. Contact loan originator listed for an accurate, personalized quote. Interest rates and program guidelines are subject to change without notice. SecurityNational Mortgage Company is an Equal Housing Lender NMLS 3116. HelpYourClient@snmc.com Don’t leave your clients at the whim of amateurs who can’t keep things straight. You can trust us to close the deal. It’d be foolish to go elsewhere.

The Salt Lake REALTOR® (ISSN 2153 2141) is published monthly by Mills Publishing, located at 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106. Periodicals Postage Paid at Salt Lake City, UT. POSTMASTER: Send address changes to: The Salt Lake REALTOR,® 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106-4618. April 2024 volume 84 number 4 This Magazine is Self-Supporting Salt Lake Realtor® Magazine is self-supporting. The advertisers in this magazine pay for all production and distribution costs. Help support this magazine by advertising. For advertising rates, please contact Mills Publishing at 801.467.9419. The paper used in Salt Lake Realtor® Magazine comes from trees in managed timberlands. These trees are planted and grown specifically to make paper and do not come from parks or wilderness areas. In addition, a portion of this magazine is printed from recycled paper. Table of Contents slrealtors.com Features 8 National Association of Realtors® Reaches Agreement to Resolve Nationwide Claims The National Association of Realtors® 10 If You're Buying or Selling a House, Read This The Salt Lake Board of Realtors® 13 How Proposed Changes in Real Estate Commissions Will Actually Impact You as a Buyer or Seller The Lighter Side of Real Estate 18 The New American Dream Home Includes a Rental Suite Dave Anderton 22 184 Things Realtors® Do to Earn Their Commission The Lighter Side of Real Estate Columns 5 Now is the Time to Tell Our Value Dawn Stevens – President’s Message Departments 6 Happenings 6 In the News 28 Housing Watch 4 | Salt Lake Realtor ® | April 2024 On the Cover: Cover Photo: jonbilous©/Adobe Stock 8 National Association of Realtors® Reaches Agreement to Resolve Nationwide Claims 18 The New American Dream Home Includes a Rental Suite 22 184 Things Realtors® Do to Earn Their Commission Salt L ake REALTOR® Magazine slrealtors.com

Stock

Susanti©/Adobe

Stock Nuthawut©/Adobe

Photo Credit: Dave Anderton

First

Claire Larson Woodside Homes of Utah LLC

Second Vice President

Jodie Osofsky

Summit Sotheby's Treasurer

Amy Gibbons KW South Valley Keller Williams

Past President

Rob Ockey

Berkshire Hathaway CEO

Curtis Bullock DIRECTORS

Janice Smith

CB Realty (Union Heights)

Laura Fidler Summit Sotheby's (Draper)

Jenni Barber Berkshire Hathaway

J. Scott Colemere Colemere Realty Assoc.

Chris Anderson Windermere Real Estate - Utah

Morelza Boratzuk RealtyPath (South Valley)

Michael Rowe

CB Realty (SL-Sugarhouse)

Eric Santistevan Engel & Volkers (Holladay)

Hannah Cutler CB Realty (Union Heights)

Michael (Mo) Aller Equity RE (Advantage)

Linda Mascher Realtypath LLC (Advisors)

Now is the Time to Tell Our Value

In light of recent media coverage of the class-action settlement with the National Association of Realtors® (NAR), real estate professionals are confronting a flood of negative publicity. Misinformation and sensationalized headlines are confusing home buyers and sellers. Amidst this turmoil, there arises a call to reclaim the narrative and underscore the true essence of the profession.

Realtors® have always navigated challenges, yet the current situation necessitates a united effort to transition the emphasis from self-promotion to client-focused service. Across the industry, there’s a strong push to highlight the significant, positive impact Realtors® have on their clients’ lives.

The prevailing message among Realtors® is clear: “NOW IS THE TIME TO TELL OUR VALUE.” This appeal is not for self-praise or to flaunt sales achievements but to sincerely reflect on the deep connections established and the families supported throughout their journeys.

The Salt Lake Board of Realtors® has proactively engaged in educating the public through media stories and social media posts about the settlement’s implications for home buyers and sellers. This edition of Salt Lake Realtor® magazine includes several articles that examine the anticipated changes.

I urge you to rethink your marketing and branding strategies, shifting from declarations of financial triumphs to genuine stories of client empowerment and the realization of homeownership dreams. As Realtors®, it’s imperative that we more effectively communicate the narratives of the families we’ve assisted and the transformative effect of homeownership on their lives.

542-8840

The demand for unity is unmistakable. I encourage you to set aside competitive boundaries and unite in transforming public perception of the industry. Collectively, we have the power to instigate change and reshape the conversation about the critical role Realtors® play in the real estate transaction process.

Realtors® are experts of real estate transactions—a domain that, for most consumers, is infrequent and complex. The crucial role of real estate agents is often underestimated; they engage in a detailed, regulated, and state-licensed endeavor that requires continuous education and training. Now is the moment to reshape the narrative, to reassert the value of Realtors®, and to showcase our dedication to serving clients with integrity and compassion.

April 2024 | Salt Lake Realtor ® | 5

Salt Lake Board of REALTORS® is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin. The Salt Lake REALTOR is the monthly magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS® Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication. Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated. October 2005 OFFICIAL PUBLICATION OF THE SALT LAKE BOARD OF REALTORS ® REALTOR is a registered mark which identifies a professional in real estate who subscribes to a strict Code of Ethics as a member of the NATIONAL ASSOCIATION OF REALTORS Graphic Design Ken Magleby Patrick Witmer Office Administrator Cynthia Bell Snow Sales Staff Paula Bell Dan Miller Managing Editor Dave Anderton Publisher Mills Publishing, Inc. www.millspub.com President Dan Miller Art Director Jackie Medina Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com Salt Lake Board:

President

Stevens Presidio Real Estate

The

(801)

e-mail: dave@saltlakeboard.com Web Site: www.slrealtors.com

Dawn

(Canyons)

Vice

President

Salt L ake REALTOR® Magazine slrealtors.com

Dawn Stevens President

Happenings

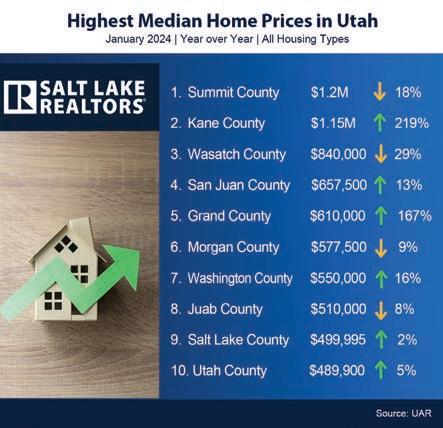

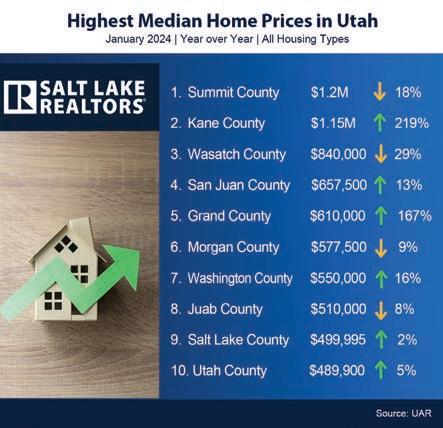

Highest Median Home Prices by County

Home prices continued to rise in most regions across Utah in January. During the month, the median home price in the state reached $485,950, marking a 7% increase from January 2023’s median of $455,000. Summit County recorded the highest prices at $1.2 million, though this represented an 18% decline from the previous year. Kane County, known as the gateway to three national parks, ranked second with a median price of $1.15 million. Wasatch County featured the third highest home prices among the state’s 29 counties, with a median of $840,000. The median home price in Salt Lake County was the ninth highest at $499,995, reflecting a 2% increase from the previous year.

Utah Governor Spencer Cox has expressed concern that the escalating cost of housing poses the single largest threat to the state’s future prosperity. The governor is creating a fund to provide low-interest loans for developers looking to build in Utah.

Cox wants to see 35,000 new starter homes built across Utah. “A qualified development is one that has 60 percent of the homes at the affordable ratio,” Cox said at a March press event. “We’re targeting $350,000 statewide for a detached single-family home.”

If You’re Buying or Selling a Home, Read This

The Salt Lake Board of Realtors® was recently featured in a sponsored article on KSL.com outlining the coming changes because of a national class-action settlement. “The settlement isn’t really what the media have portrayed it to be,” said Dawn Stevens, president of the Salt Lake Board of Realtors. “The absence of a buyer’s agent leaves the buyer to navigate an intricate process of drafting offers, negotiating repairs, and signing legal contracts. Conversely, homeowners seeking to bypass the buyer’s agent commission might find themselves significantly reducing their asking price to attract buyers. It really is going to hurt buyers and sellers in the end.” Contrary to media reports, the settlement has nothing to do with commission rates. Real estate agents have the flexibility to set their commission rates or fees according to their discretion. There are no standard or fixed charges in the industry, a policy that has always been in place and will continue indefinitely.

In the News

Millennials are Largest Home Buying Group

Millennials have surged ahead to become the largest group of home buyers, marking a significant shift in the housing market’s demographic landscape, according to the latest report from the National Association of Realtors®.

The 2024 Home Buyers and Sellers Generational Trends report, which examines the similarities and differences among recent home buyers and sellers across generations, found that the combined share of millennials, both younger (ages 25 to 33) and older (ages 34 to 43), now make up a combined 38% of the home buying market, a substantial increase from 28% last year. Baby boomers, comprising both younger boomers (ages 59 to 68) and older boomers (ages 69 to 77), saw their share decrease from 39% to 31%, relinquishing their position as last year’s largest demographic of home buyers.

Clarification

Scott Steadman, a branch broker with Windermere Utah Real Estate’s Draper office, was inadvertently omitted from the 2023 Realtor® 500 Hall of Fame award list published in the March issue of Salt Lake Realtor® magazine. Scott has earned the Hall of Fame Award and achieved the Realtor® 500 designation consistently since its inception in 2019. He has contributed $9,080 in lifetime investments to the Realtors® Political Action Committee (RPAC). Scott began his involvement in RPAC through an initiative by the Young Professionals Network, committing to an annual investment of $1,000 for 10 years. In 2016, he was recognized as one of the “30 under 30” by the National Association of Realtors®, an accolade highlighting young, rising stars in the real estate profession. Currently, Scott serves as an ambassador for Inman News, a position that involves encouraging participation in real estate events. He resides and works in Draper and has been a Realtor® since 2011.

6 | Salt Lake Realtor ® | April 2024

Studio Romantic©/Adobe Stock

Electrify every drive with the BMW iX and i4. A generation of electric vehicles built like no other.

Confidently get behind the wheel of the 100% electric BMW iX. The new standard of electric driving, defined by elegant detailing, capability and premium experience.

Or experience a futuristic take on timeless style in the 100% electric BMW i4. With dynamic driving capabilities and advanced technology like the BMW Curved Display, you’re set up to take on any adventure.

That’s what you’d expect from the Ultimate Electric Driving Machine. Visit BMW of Murray or BMW of Pleasant Grove today for a test drive.

BMW of Murray

4735 S. State Street

Murray, Utah

801-262-2479

bmwofmurray.com

BMW of Pleasant Grove

2111 West Grove Parkway

Pleasant Grove, Utah

801-443-2000

bmwofpg.com

©2023 BMW of North America, LLC. The BMW trademarks are registered trademarks.

THE BMW iX & i4. 100% ELECTRIC. THE iX THE i4

National Association of Realtors® Reaches Agreement to Resolve Nationwide Claims

NAR has agreed to put in place a new MLS rule prohibiting offers of broker compensation on the MLS.

By The National Association of Realtors®

The National Association of REALTORS® (NAR) on March 15 announced an agreement that would end litigation of claims brought on behalf of home sellers related to broker commissions. The agreement would resolve claims against NAR, over one million NAR members, all state/territorial and local Realtor® associations, all association-owned MLSs, and all brokerages with an NAR member as principal that had a residential

transaction volume in 2022 of $2 billion or below.

The settlement, which is subject to court approval, makes clear that NAR continues to deny any wrongdoing in connection with the Multiple Listing Service (MLS) cooperative compensation model rule (MLS Model Rule) that was introduced in the 1990s in response to calls from consumer protection advocates for buyer representation. Under the terms

8 | Salt Lake Realtor ® | April 2024

of the agreement, NAR would pay $418 million over approximately four years.

“NAR has worked hard for years to resolve this litigation in a manner that benefits our members and American consumers. It has always been our goal to preserve consumer choice and protect our members to the greatest extent possible. This settlement achieves both of those goals,” said Nykia Wright, Interim CEO of NAR. Two critical achievements of this resolution are the release of most NAR members and many industry stakeholders from liability in these matters and the fact that cooperative compensation remains a choice for consumers when buying or selling a home. NAR also secured in the agreement a mechanism for nearly all brokerage entities that had a residential transaction volume in 2022 that exceeded $2 billion and MLSs not wholly owned by Realtor® associations to obtain releases efficiently if they choose to use it.

NAR fought to include all members in the release and was able to ensure more than one million members are included. Despite NAR’s efforts, agents affiliated with HomeServices of America and its related companies—the last corporate defendant still litigating the Sitzer-Burnett case—are not released under the settlement, nor are employees of the remaining corporate defendants named in the cases covered by this settlement.

In addition to the financial payment, NAR has agreed to put in place a new MLS rule prohibiting offers of broker compensation on the MLS. This would mean that offers of broker compensation could not be communicated via the MLS, but they could continue to be an option consumers can pursue off-MLS through negotiation and consultation with real estate professionals. Offers of compensation help make professional representation more accessible, decrease costs for home buyers to secure these services, increase fair housing opportunities, and increase the potential buyer pool for sellers. They are also consistent with the real estate laws in the many states that expressly authorize them.

Further, NAR has agreed to enact a new rule that would require MLS participants working with buyers to enter into written agreements with their buyers. NAR continues, as it has done for years, to encourage its members to use buyer brokerage agreements that help consumers understand exactly what services and value will be provided, and for how much. These changes will go into effect in mid-July 2024.

“Ultimately, continuing to litigate would have hurt members and their small businesses,” said Ms. Wright. “While there could be no perfect outcome, this agreement is the best outcome we could achieve in the circumstances. It provides a path forward for our industry, which makes up nearly one fifth of the American economy, and NAR. For over a century, NAR has protected and advanced the right to real property ownership in this country, and we remain focused on delivering on that core mission.”

“NAR exists to serve our members and American consumers, and while the settlement comes at a significant cost, we believe the benefits it will provide to our industry are worth that cost,” said Kevin Sears, NAR President. “NAR is focused firmly on the future and on leading this industry forward. We are committed to innovation and defining the next steps that will allow us to continue providing unmatched value to members and American consumers. This will be a time of adjustment, but the fundamentals will remain: buyers and sellers will continue to have many choices when deciding to buy or sell a home, and NAR members will continue to use their skill, care, and diligence to protect the interests of their clients.”

The National Association of Realtors® is America’s largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries.

April 2024 | Salt Lake Realtor ® | 9

Susanti©/Adobe Stock

If You’re Buying or Selling a House, Read This

By The Salt Lake Board of Realtors®

A recent class-action settlement by the National Association of Realtors® (NAR) in March brings to light some changes for both home buyers and sellers in the real estate market. Fortunately for buyers and sellers in Utah, most of the required changes are already being done by local Realtors®.

“The settlement isn’t really what the media have portrayed it to be,” said Dawn Stevens, president of the Salt Lake Board of Realtors®. “The absence of a buyer’s agent leaves the buyer to navigate an intricate process of drafting offers, negotiating repairs, and signing legal contracts. Conversely, homeowners seeking to bypass the buyer’s agent commission might find themselves significantly reducing their asking price to attract buyers. It really is going to hurt buyers and sellers in the end.”

Here are nine things you need to know about the settlement:

1. Does the Settlement Force Real Estate Agents to Slash Their Commissions? No. The settlement

has nothing to do with commission rates. Real estate agents have the flexibility to negotiate their commission rates or fees according to their discretion. There are no standard or fixed charges in the industry, a policy that has always been in place and will continue indefinitely. Traditionally, when a house is sold, the listing agent (the seller’s agent) gets their payment from the sale’s proceeds. Out of this payment, they also cover the buyer’s agent’s fee. This method of paying buyers’ agents started in the 1990s in response to consumer advocates to ensure that buyers, too, had representation in real estate transactions. Before the 1990’s, the concept of “buyer beware” prevailed, leaving buyers without representation and vulnerable to exploitation.

2. Does the Settlement Require Sellers to No Longer Pay a Commission to the Buyer’s Agent? No.

According to the settlement, details about how much a buyer's agent will be paid cannot be listed on the Multiple Listing Service (MLS). However, this

10 | Salt Lake Realtor ® | April 2024

Studio Romantic©/Adobe Stock

doesn't mean that sellers can't compensate the buyer's agent. They're still allowed to do so outside of the MLS, through other means like direct marketing, negotiations, or discussions with real estate professionals. Not being able to list commission details on the MLS doesn't take away the importance of compensating the buyer's agent. Offering a commission to the buyer's agent can be crucial in making your property more affordable for many buyers who wish to have professional representation on one of the largest investments of their life. Without a commission offer, if buyers must cover the cost of professional representation themselves — on top of their down payment and closing costs — the dream of home ownership could become unattainable for many.

3. Will Buyers Need to Sign a Formal Agreement with Their Agent? Yes. Starting in July, pending court approval, home buyers will be required to sign a formal Buyer Broker Agreement prior to touring properties with a Realtor®. The agreement will clearly define the compensation that the buyer'/85s agent is to receive. Utah Realtors® have been required by Utah law to use Buyer Broker Agreements for years, so this isn’t much of a change. Signing an agreement with a buyer’s agent, which includes compensation terms, formalizes the relationship, ensuring clarity on the

4. Will the Settlement Lower Housing Costs? No. If a real estate commission were lowered by 1%, would a $500,000 home automatically be worth $495,000? No. A seller would not reduce the sale price to $495,000 simply because the commission was lowered. The market value of the home is dictated by the real estate market itself. Housing costs have soared over the past several years due to an underbuilding gap of more than 5.5 million housing units in the U.S. The housing shortfall has been exacerbated by an even larger decrease in the supply of entry-level single-family homes, or starter homes (1,400 square feet or less), according to Freddie Mac. Until there is an all-of-government approach to a historic lack of inventory in communities across the country, the dream of homeownership will remain out of reach for millions of middle-class Americans.

5. Are Commissions in Real Estate Transactions

Fixed? No. Commissions have never been fixed and never will be. The range of a commission can vary significantly, spanning from as low as a flatfee of $300 for listing services to as high as 7%-8%, with numerous options in between. Real estate commissions will continue to be negotiable going forward under the settlement terms. Alternatively, homeowners have the option to sell their property independently at no cost. The current landscape

a multitude of diverse business models available. It’s worth noting that consumers should not be compelled to pay for services they neither desire nor utilize. In the realm of real estate, homeowners have the freedom to decide whether to engage a real estate agent, just as they have the option to handle their taxes without hiring a CPA or fix a leaking faucet without calling a plumber. The power of choice remains firmly in the hands of consumers.

6. How Does the MLS Benefit Consumers?

UtahRealEstate.com or the MLS remains the preferred choice for most consumers, primarily due to its unparalleled accuracy, extensive reach, and overall superiority. UtahRealEstate.com is one of the largest MLS’s in the United States, serving more than 8 million consumers each year. Utilizing the MLS typically results in sellers finding qualified buyers in the shortest possible time frame and maximizing their financial returns from the transaction. In the end, the consumer benefits significantly.

7. Why Do Nine in 10 Home Sellers Hire a Realtor®?

The Wall Street Journal suggested that the real estate market is not a genuine free market, but a “rigged game” that pads the pockets of Realtors® at the expense of consumers. Critics argue that the role of a real estate agent is merely to fill out “paperwork.” Yet, nine in 10 home sellers today hire a real estate agent to sell their home. Why? Because the process of buying or selling a home often represents the most significant financial transaction in people’s lives.

As the real estate landscape has grown increasingly complex and litigious, people rely on Realtors® to

guide them through legal contracts, disclosure law, property security, and negotiations.

8. Do Real Estate Agents Make Too Much Money?

It is ironic that class-action attorneys, who stand to make 30% to 40% of any judgment or settlement, are accusing Realtors® of charging a 5% to 6% commission. Class-action attorneys will take hundreds of millions of dollars from their clients at the end of the day, leaving them with just a fraction of the winnings, sometimes just a few dollars. Remember, there are more than 500,000 plaintiffs in the Sitzer-Burnett lawsuit. A report by TLR, a Texas-based organization that discourages non-meritorious lawsuits or outrageous claims for damages, examined eight years of consumer class actions in federal court and found that consumers received only a tiny fraction of the money awarded in cases while plaintiff lawyers frequently claimed a bigger share of the settlement than their clients. While attorneys make millions, the median annual wage for real estate sales agents was $49,980 as of May 2022, according to the most recent statistics by the U.S. Bureau of Labor Statistics.

9. Will Realtors® Continue to Play a Crucial Role in the Real Estate Transaction? Yes. Realtors® are experts of the real estate transaction – a process that, for most consumers, is rare and filled with complexities. For instance, agents advise clients on disclosure law, competitive bidding situations, earnest money deposits, property security, and stipulated deadlines. Some oversimplify the vital role of real estate agents, who engage in an intricate, regulated, and state-licensed activity that demands ongoing education and training. Remember, Realtors® only get paid if the house sells.

About the Salt Lake Board of Realtors®

The Salt Lake Board of Realtors® is the Wasatch Front's voice of real estate and the No. 1 source for housing market information. The Salt Lake Board of Realtors® is the largest shareholder of UtahRealEstate.com, one of the leading Multiple Listing Services (MLS) in the United States. Since 1917, the Salt Lake Board of Realtors® has been a leader in promoting homeownership and protecting private property rights. The Salt Lake Board of Realtors® empowers its members to better serve the public by providing continuing education, advocacy, and a professional code of ethics.

About UtahRealEstate.com

Founded in 1994, UtahRealEstate.com is the leading provider of real estate technology in Utah and one of the largest multiple listing services in the United States. The company provides one of the top-ranked real estate websites in the country, serving more than 8 million consumers each year. It also provides multiple listing services to approximately 20,000 real estate professionals, accounting for nearly 97% of all Realtors® in the state of Utah.

12 | Salt Lake Realtor ® | April 2024

Image licensed by Ingram Image

How Proposed Changes in Real Estate Commissions Will Actually Impact You as a Buyer or Seller

Don’t expect agents to be willing or able to work for a much lower commission.

According to recent data, the average agent earns between $44,951 and $58,528.

By The Lighter Side of Real Estate

You’ve probably heard the news that there are changes coming in terms of how real estate commissions are paid.

This might sound exciting and like a potential gamechanger for you as a home seller or buyer, with headlines proclaiming things like:

• “Real estate commissions are being slashed!”

• “Selling your house will now be less expensive!”

• “No more paying 6% to real estate agents!”

But you’re also probably not sure exactly what it all means, how it will work, or how you’ll benefit from the changes.

Unfortunately, even if you ask the most informed agents

on the planet, you probably aren’t going to get many answers. It isn’t because agents don’t want to answer your questions; it’s because they don’t even know exactly how the changes are going to work.

The settlement happened seemingly overnight. There was no advance warning or discussion with agents. They found out by reading a bunch of headlines you probably saw at the same time they did.

On top of that, most of the headlines are misleading, because nobody knows exactly how things are going to play out. Any claims that the media makes that commissions will be cut in half, or any specific number of dollars will be saved by consumers, remains to be

April 2024 | Salt Lake Realtor ® | 13

BalanceFormCreative©/ Adobe Stock

seen. The changes might reduce commissions. On the other hand, they could increase them. As with many things the government or court system touches, there’s always the possibility that it could create more issues than it solves.

But, for the time being, as much as you might want or expect your local agent to be able to give you specifics, please understand that they can’t. For starters, it’s a proposed settlement, not yet accepted by the courts, and if it’s approved, the changes won’t start until July.

Here’s What Matters to Buyers and Sellers in a Nutshell

Unless you’re in the business, you probably have no desire to read through all the court documents or proposed settlement. You just want to know what changes will possibly impact you. So here’s an excerpt from a National Association of Realtors® (NAR) press release, highlighting the changes that will most likely affect you:

“In addition to the financial payment, NAR has agreed to put in place a new MLS rule prohibiting offers of broker compensation on the MLS. This would mean that offers of broker compensation could not be communicated via the MLS, but they could continue to be an option consumers can pursue off-MLS through negotiation and consultation with real estate professionals. Offers of compensation help make professional representation more accessible, decrease costs for home buyers to secure these services, increase fair housing opportunities, and increase the potential buyer pool for sellers. They are also consistent with the real estate laws in the many states that expressly authorize them.

Further, NAR has agreed to enact a new rule that would require MLS participants working with buyers to enter into written agreements with their buyers. NAR continues, as it has done for years, to encourage its members to use buyer brokerage agreements that help consumers understand exactly what services and value will be provided, and for how much. These changes will go into effect in mid-July 2024.”

Again, unless you’re in the business, that may not even be all that clear of an explanation. So, to put it in simpler terms:

• Sellers and their agents won’t be allowed to offer a commission to buyers’ agents within their MLS listing.

• However, that doesn’t mean that a seller isn’t allowed to pay buyers’ agents a commission. It just can’t be published in the listing.

• And buyers will now be required to sign a written agreement with an agent to work with them, which will likely require them to agree to a certain amount of compensation. That doesn’t necessarily mean the compensation has to be paid out of the buyers’ pocket; it could be an agreed upon amount that will be negotiated into the purchase price paid for through the proceeds of the sale.

Basically, it allows sellers to choose to not offer or agree to pay a commission to buyers’ agents when they list their house for sale and allows buyers to choose to not work with a buyers’ agent when they buy, in hopes of saving money. But before you do that, there are some things you should keep in mind.

Here Are Some Things to Keep in Mind if You’re Selling a House

• It doesn’t mean that you can’t offer a commission to buyers’ agents.

• Although you can’t publish how much you’re willing to offer or agree to on your listing, in most cases, it will still benefit sellers to offer and be willing to offer commissions to buyers’ agents to get the most exposure for their home, and ultimately the best offers possible.

• There’s a good chance that buyer agent commissions will likely still be paid through the proceeds of the sale, as they have been for many years.

• If you’re selling to a buyer who doesn’t have an agent representing them, they’ll likely expect you to drop your price accordingly since you’re not paying another agent. In other words, if your house was worth $300,000, and buyers perceive that a buyers’ agent commission would have been 3% — even though it rarely was in reality… but that’s what the public and media have often perceived it to be — then the buyer will want a $9,000 reduction on your price below what they already want to negotiate as the fair market value.

• It could cause more risk and lawsuits that may directly involve you and your property. Dual agency, which is when an agent represents both the buyer and the seller, is one of the leading causes of lawsuits in the industry. This new way of doing business could create a lot more situations where consumers don’t have their own independent representation, which could lead to either the buyer or seller feeling like their interests weren’t entirely represented.

Here Are Some Things to Keep in Mind if You’re Buying a House

• The way buyers’ agents have been paid is a result of originally trying to protect buyers decades ago. Years ago, buyers didn’t have an agent dedicated to representing their interests and were often unaware that the seller’s agent didn’t represent their interests as well. So, rules and laws were passed to change that, and listing agents were compelled to offer buyers agents a percentage of the commission if they represented a buyer on a house they were listing. This gave buyers more choice in who represented them, and the ability to compensate their agent without having to pay out of pocket. So, for many buyers, this isn’t that great of a change for you unless you cherish the idea of representing yourself and figuring out how to do everything that needs to get done.

14 | Salt Lake Realtor ® | April 2024

• You will now have to choose a buyer’s agent and sign an agreement with them. This has always been an option, and it could be argued that it should always have been required, but most buyers’ agents didn’t want to seem too pushy or aggressive, so they never asked for one. Now you’ll need to sign a contract to work with them.

• Don’t expect agents to be willing or able to work for a much lower commission than they’ve been working for in the past. According to recent data from NAR, the average agent earns between $44,951 and $58,528. And they work long and hard to even earn that much. There is rarely a day off, let alone a vacation, and they easily work more than 40 hours per week. Will you be able to find an agent who will work for lower rates? Perhaps. But as is the case in any industry, sometimes going with the lowest cost option ends up costing you more in the end.

• While you may expect sellers to drop their price because they don’t have to pay a buyers’ agent, don’t be surprised if they dig in their heels and expect to get as much or more than similar houses have recently sold for. They will still be basing the market value of their house from data that had buyer agent commissions factored in.

• If you go it alone, go in knowing that finding the right house, understanding market values, negotiating the best deals, and handling everything involved throughout the process from contract to closing isn’t as easy as it may sound. There is more to buying a house than just finding it online, making an offer, and then going to a closing. You will have to do the work your agent would have done and know what needs to be done in the first place. The sellers’ agent won’t be doing the work of the non-existent buyers’ agent.

While it’s impossible to predict exactly how everything will play out, those are a few things to keep in mind whether you’re buying or selling.

The best thing to do if you’re curious or concerned about the coming changes is to reach out to your local agent and ask them for their perspective, insights, advice, and to keep you in the loop as the changes get finalized.

The Takeaway:

While the headlines about changing real estate commission structures might sound exciting and like a potential game-changer for you as a home seller or buyer, they are misleading, because nobody knows exactly how things are going to play out. While it’s true that commissions may shift, the details remain uncertain.

If the proposed settlement is accepted by the courts, sellers won’t be able to advertise agent commissions, however they will still be allowed to offer them, just not within their listing. In many cases this will still benefit the seller to do so in order to get the most exposure for their house and sell it for the most money possible.

Buyers will be given the option to not work with a buyer’s agent, however that could come with some unexpected downsides and difficulties and may not produce the savings they anticipate. Fortunately, you will still be able to hire your own representation and have an agent looking out for your interests and helping you through the process.

Lighter Side of Real Estate is a content marketing platform for real estate agents to build a personal brand. Check out their content marketing services at lightersideofrealestate.com

April 2024 | Salt Lake Realtor ® | 15

gstockstudio©/ Adobe Stock

Park City Brokers Park City International Diamond Society #1 Small Team Mike Lindsay Union Heights International Society of Excellence #1 Individual The Schlopy Family Park City International President's Circle #1 Large Team Mike Gooch Provo/Orem International President's Premier Shelly Tripp South Valley International Society of Excellence Adrian Hicks Station Park International President's Elite Gian Sexsmith Union Heights International President's Elite Jason Melton South Valley International President's Elite Katie Olsen Union Heights International President's Elite Sandra Sweetland Salt Lake Sugar House International President's Elite Dawn Houghton Salt Lake Sugar House International President's Elite Kristi Durrant Union Heights International President's Elite Kim Chatterton Station Park International President's Elite Neil Glover Salt Lake Sugar House International President's Elite Linda Martinez Station Park International President's Elite Chris Hunlow South Valley International President's Elite William Stelzer Provo/Orem International President's Elite Lauren McMullin Paula Higman Michael Cregar Shauna Larson Tammi Nordfors Estela Lewis Christin Parks Debbie Abbott Raeanne Stranc Amanda House Jeffery Neal Micah Ladel Ken Murdock Jenny Tian Michelle Adams Susie Spainhower Sara Norris Marsha Elmore Trent Phippen Lynda Coleman Robert Wathen Laxmi Connelley Jimmy Wu Michelle Koch Grant Evans Lynn Butterfield Sophia Wu 143 Real Estate Team Team Ei8ht International dIAMOND sOCIETY South Valley 801.307.9400 11650 S State St Draper, UT 84020 Union Heights 801.567.4000 7730 Union Park Ave 675 Midvale, UT 84047 Station Park 801.295.2700 172 N East Promontory Farmington, UT 84025 Park City 435.602.4800 1153 Center Dr. G200 Park City, UT 84098 Kanab 801.488.5300 323 S 100 E Kanab, UT 84741 *Based on the 118 year history of the Coldwell Banker Brand and the transaction longevity compared to other national Real Estate Brands. WE’VE GUIDED MORE HOMEBUYERS AND SELLERS THAN ANY OTHER COMPANY IN THE HISTORY OF AMERICA.*

Dawn McKenna Group

Leslie Neebling Salt Lake Sugar House International President's Circle Rome Legg Station Park International President's Circle Mary Siler Provo/Orem International President's Circle Todd Feld South Valley International President's Circle Julia Splan Salt Lake Sugar House International President's Circle Jenny Scothern Ogden/South Ogden International President's Circle Bill Spangler Ogden/South Ogden International President's Circle Steven Feder Salt Lake Sugar House International President's Circle Jeffrey Farrell South Valley International President's Circle Susan Davis Salt Lake Sugar House International President's Circle Deb McFarlane Salt Lake Sugar House International President's Circle Adonna Geddes Provo/Orem International President's Circle Brian Olsen Provo/Orem International President's Circle Jody Kimball Park City International President's Circle John Shupe Ogden/South Ogden International President's Circle Kathy Campbell Provo/Orem International President's Circle Lori Khodadad Union Heights International President's Circle ©2024 Coldwell Banker. All Rights Reserved. Coldwell Banker and the Coldwell Banker logos are trademarks of Coldwell Banker Real Estate LLC. The Coldwell Banker® System is comprised of company owned offices which are owned by a subsidiary of Anywhere Advisors LLC and franchised offices which are independently owned and operated. The Coldwell Banker System fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Keri Keele Whitney Foley Cody Strate Thomas Staples Melanie Borgenicht Nadine Jensen Alfredo Gonzalez Travis Skinner Jonathan Elggren Brian Clark Mary Hurlburt Helene Kepas-Brown Lucy Littlewood Pati Tauti Chris Bush Duane Hansen Janene Ihler Christina Schmidt Sally Domichel Edward Federov Gina Koziatek Miriam Taylor Robyn Christensen Janice Smith The C&C Team The Home Team Dan Nix Real Estate The Lee Team C4 Real Estate Team Elev8 Real Estate Group Marissa Miller Vanessa Griffith Shoree Boyd Beckie Meisenheimer Brenda Horrocks Edward Pratt Janet Marroquin Vicki Rhoads International Sterling society Kristy Dimmick Provo/Orem International President's Circle Karen Curtis Provo/Orem International President's Circle Frances Hays Salt Lake Sugar House International President's Circle Linda Mandrow Union Heights International President's Circle Jessika Long Salt Lake Sugar House International President's Circle Jann Bassett Union Heights International President's Circle Salt Lake Sugar House 801.488.5300 2180 S 1300 E Ste 140 SLC, UT 84106 Provo-Orem 801.434.5100 354 W Center St Orem, UT 84057 South Ogden 801.476.2800 1104 Country Hills Dr 300 Ogden, UT 84403 Heber 435.602.4800 2 S Main St Ste 2F Heber, UT 84032

The New American Dream Home Includes a Rental Suite

Builders are increasingly incorporating ADUs into new homes, helping buyers access more spacious properties while easing the housing crunch.

By Dave Anderton

The escalating housing shortage and Utah’s soaring home prices are prompting builders to offer built-in rental suites or accessory dwelling units (ADUs). This innovative solution offers dual benefits: alleviate Utah’s intensifying housing scarcity and enable homeowners to mitigate living expenses through rental income.

According to Dejan Eskic, chief economist for the Salt Lake Board of Realtors® and senior research fellow at the Kem C. Gardner Policy Institute, Utah has a housing shortage of roughly 37,000 housing units.

“A housing shortage occurs when growth in households exceeds growth in housing units,” according to a report by the Kem C. Gardner Institute. “Each additional household creates demand for an additional housing unit, whether that household comes from net inmigration, a marriage, a divorce, or a child leaving home to live on his/her own.”

Utah’s housing shortage grew from 2010 to 2017, as fewer new housing units were built despite soaring

growth in new households. From 2018 through 2022, the housing shortage eased as builders ramped up production. In the past two years, the increase in housing units has once again sagged, not keeping pace with Utah’s population growth.

Now, in response to the housing shortage and a recent Utah law simplifying the process for homeowners to create ADUs by making approvals easier, some builders are offering new homes with ADUs.

“Every home we build is designed to include one or two private suites in the basement. You can rent out a suite to help cover your mortgage, or if preferred, integrate them for your family’s use, allowing the entire home to be open and connected. We call this FLEX-ADU,” said Al Rafati, CEO of Utah-based R5 Homes. “Life is not always the same. Today you’re living a certain way. Tomorrow, conditions may change—economically, socially, or perhaps your family grows. We build homes designed for those changes.”

18 | Salt Lake Realtor ® | April 2024

More builders are offering finished rental suites in new homes, like this home in Lehi.

Photo Credit: Fieldstone Homes

FieldstoneHomes.com | 801.895.3526 RENTAL SUITE/ADU ADD AN APARTMENT FOR RENTAL INCOME OR FOR YOUR FAMILY. NOW AVAILABLE IN 6 COMMUNITIES LEHI | SARATOGA SPRINGS | EAGLE MOUNTAIN | CLEARFIELD | MAPLETON | ST. GEORGE FINANCIAL BENEFITS INCREASES INCOME TO QUALIFY FOR A NEW LOAN RENTAL INCOME TO REDUCE MORTGAGE PAYMENTS TAX BENEFITS ADU ABOUT ADU’S ADU MODEL HOME IN SARATOGA SPRINGS ACCESSORY DWELLING UNITS AVAILABLE RAMBLER & 2-STORY PLAN ADU OPTIONS AVAILABLE!

R5 Homes develops its own land and builds fully finished homes, currently in Eagle Mountain and Spanish Fork. The company offers a 3,100-square-foot home starting around $600,000, which includes a completed rental suite. According to Rafati, after renting it out, the mortgage payment on this home could be in the low $2,000 range. The company also offers homes starting in the $550,000s for buyers who want an ADUready home to finish on their own.

“Our tradition has always been to highly value our relationship with Realtors® and pay a buyer agent 3% commission,” Rafati added.

A 2020 Freddie Mac report found that between 2009 and 2019, the number of first-time ADU listings across the country averaged 8.6% in year-over-year growth. The report found that the scarcity of affordable housing in high-cost areas of the country has resulted in the passing of ordinances aimed at reducing restrictive zoning in some jurisdictions. But demand for ADUs is strongest in a concentrated number of states: More than half of the nation’s ADUs can be found in California, Florida, Texas, and Georgia.

In Saratoga Springs, Fieldstone Homes is presenting a variety of home designs, with sizes reaching up to 4,400 square feet, featuring finished basements and rental suites priced from the $700,000s. These suites, ranging

between 800 to 1,100 square feet, include an exterior entrance, nine-foot ceilings, a kitchen, bathroom, bedroom, family area, and laundry room. Fieldstone Homes also builds homes with ADUs in Clearfield, Eagle Mountain, Lehi, Mapleton, and St. George. In Clearfield, homes with ADUs start in the $500,000s.

“It’s a full apartment,” said Kellie Little, vice president of marketing for Fieldstone Homes. “This is what you would expect in a condominium.”

Fieldstone Homes also offers monthly seminars for Realtors® on the benefits of ADUs and how it may help their clients qualify for more home.

In September 2023, Megan Hansen bought a home from Fieldstone Homes in Saratoga Springs for $800,000, which included an ADU. She quickly found a tenant for the ADU, charging $1,200 monthly for its one-bedroom, one-bathroom layout, which also features a kitchen and laundry room. Hansen, a single mom, finds the extra income vital. “It’s a good situation because I’m a single mom,” she remarked. “Having the additional income helped me get into a nicer home,” she said.

Blake Bench, a loan officer at First Colony Mortgage, explained that both conventional and FHA mortgages are now accommodating proposed rental income from

20 | Salt Lake Realtor ® | April 2024

Al Rafati, CEO of R5 Homes.

Photo Credit: Dave Anderton

ADUs in their loan assessments. Appraisers conduct rent analyses for similar-sized apartments in the area to estimate potential ADU rental income. Lenders can consider 75% of this estimated rental income towards mortgage income qualifications.

Bench highlighted the significant impact of this change, noting that it has facilitated the closure of more than 20 deals in just a few communities. This approach has been instrumental in helping more people qualify for mortgages by incorporating ADU rental income into their financial evaluations.

Under the new Utah law, several conditions must be met for an ADU:

1. ADU Types and Size: The law distinguishes between attached ADUs, which are secondary dwelling units attached to the main house, and detached ADUs, which are freestanding but located on the same property. There’s often a size cap for ADUs, typically no more than 35% of the size of the main house.

2. Parking Requirements: Local governments in Utah may have different parking requirements for ADUs. Most areas may require additional parking spaces for ADUs off street or a third-car garage.

3. Owner Occupancy: Either the main house or the ADU must be occupied by the owner. This rule aims to prevent speculative investment and maintain neighborhood stability.

4. Separate Entrance: ADUs must have a separate entrance from the primary residence. This aligns with the general trend in ADU design and regulation, aiming to make these units functional and selfcontained living spaces.

Elaine Zambos, associate broker with Utah Key Real Estate in Midvale, is building a custom home in Draper. Zambos’s plans include an ADU in her basement.

“As I get older, I may need some assistance,” Zambos said. “The ADU allows me options for future care or assistance. I have a furnished ADU in my current home in Murray. I designed it for my parents and family members in case they needed assistance. I have rented it to several of my clients – buyers and sellers – while they were building or searching for a home. An ADU can be a good source of extra income.”

Dave

April 2024 | Salt

Realtor ® | 21

Lake

Anderton is communications director at the Salt Lake Board of Realtors®.

TJ Buckley, sales manager Fieldstone Realty, and Kellie Little, vice president of marketing Fieldstone Homes, inside a new model ADU home.

Photo Credit: Dave Anderton

184 Things Realtors® Do to Earn Their Commission

Surveys show that many homeowners and homebuyers are not aware of the true value a Realtor® provides during the course of a real estate transaction.

By The Lighter Side of Real Estate

Listed here are 184 typical actions, research steps, procedures, processes, and review stages in a successful residential real estate transaction that are normally provided by full service real estate brokerages in return for their sales commission. Depending on the transaction, some may take minutes, hours, or even days to complete, while some may not be needed.

More importantly, they reflect the level of skill, knowledge and attention to detail required in today’s real estate transaction, underscoring the importance of having help and guidance from someone who fully understands the process – a Realtor®.

Pre-Listing Activities

• Make appointment with seller for listing presentation

• Send seller a written or email confirmation of listing appointment and call to confirm

• Review pre-appointment questions

• Research all comparable currently listed properties

• Research sales activity for past 18 months from MLS and public records databases

• Research average Days on Market (DOM) for this property of this type, price range and location

• Download and review property tax roll information

• Prepare Comparable Market Analysis (CMA) to establish fair market value

• Obtain copy of subdivision plat/complex lay-out

• Research property’s ownership & deed type

• Research property’s public record information for lot size & dimensions

22 | Salt Lake Realtor ® | April 2024

Nuthawut©/Adobe Stock

• Research and verify legal description

• Research property’s land use coding and deed restrictions

• Research property’s current use and zoning

• Verify legal names of owner(s) in county’s public property records

• Prepare listing presentation package with above materials

• Perform exterior “Curb Appeal Assessment” of subject property

• Compile and assemble formal file on property

• Confirm current public schools and explain impact of schools on market value

• Review listing appointment checklist to ensure all steps and actions have been completed

Listing Appointment Presentation

• Give seller an overview of current market conditions and projections

• Review agent’s and company’s credentials and accomplishments in the market

• Present company’s profile and position or niche in the marketplace

• Present CMA results to seller, including comparables, solds, current listings & expireds

• Offer pricing strategy based on professional judgment and interpretation of current market conditions

• Discuss goals with seller to market effectively

• Explain market power and benefits of Multiple Listing Service (MLS)

• Explain benefits of web marketing & IDX

• Explain the work the brokerage and agent do behind the scenes and agent’s availability on weekends

• Explain agent’s role in taking calls to screen for qualified buyers and protect seller from curiosity seekers

• Present and discuss strategic master marketing plan

• Explain different agency relationships and determine seller’s preference

• Review and explain all clauses in listing contract & addendum and obtain seller’s signature once property is under listing agreement

• Review current title information

• Measure overall and heated square footage

• Measure interior room sizes

• Confirm lot size via owner’s copy of certified survey, if available

• Note any and all unrecorded property lines, agreements, easements

• Obtain house plans, if applicable and available

• Review house plans and make copy

• Order plat map for retention in property’s listing file

• Prepare showing instructions for buyers’ agents and agree on showing time window with seller

• Obtain current mortgage loan(s) information: companies and & loan account numbers

• Verify current loan information with lender(s)

• Check assumability of loan(s) and any special requirements

• Discuss possible buyer financing alternatives and options with seller

• Review current appraisal if available

• Identify Home Owner Association (HOA) manager if applicable

April 2024 | Salt Lake Realtor ® | 23

Image licensed by Ingram Image

• Verify HOA fees with manager – mandatory or optional and current annual fee

• Order copy of HOA bylaws, if applicable

• Research electricity availability and supplier’s name and phone number

• Calculate average utility usage from last 12 months of bills

• Research and verify city sewer/septic tank system

• Water system: calculate average water fees or rates from last 12 months of bills

• Well water: confirm well status, depth and output from well report

• Natural gas: research/verify availability and supplier’s name and phone number

• Verify security system, current term of service and whether owned or leased

• Verify if seller has transferable termite bond

• Ascertain need for lead-based paint disclosure

• Prepare detailed list of property amenities and assess market impact

• Prepare detailed list of property’s “inclusions & conveyances with sale”

• Compile list of completed repairs and maintenance items

• Send “vacancy checklist” to seller if property is vacant

• Explain benefits of homeowner warranty to seller

• Assist sellers with completion and submission of homeowner warranty application

• When received, place homeowner warranty in property file for conveyance at time of sale

• Have extra key made for lockbox

• Verify if property has rental units involved. And if so:

* Make copies of all leases for retention in listing file

* Verify all rents & deposits

* Inform tenants of listing and discuss how showings will be handled

• Arrange for installation of yard sign

• Assist seller with completion of Seller’s Disclosure form

• “New listing checklist” completed

• Review results of curb appeal assessment with seller and provide suggestions to improve salability

• Review results of interior decor assessment and suggest changes to shorten time on market

• Load listing into transaction management software program

Entering Property in Multiple Listing Service Database

• Prepare MLS profile sheet — agent is responsible for quality control and accuracy of listing data

• Enter property data from profile sheet into MLS database

• Proofread MLS database listing for accuracy, including proper placement in mapping function

• Add property to company’s active listings list

• Provide seller with signed copies of listing agreement and MLS Profile sheet data form within 48 hours

• Take additional photos for upload into MLS and use in flyers. Discuss efficacy of panoramic and/or drone photography

Marketing The Listing

• Create print and Internet ads with seller’s input

• Coordinate showings with owners, tenants, and other Realtors®. Return all calls – weekends included

• Install electronic lock box if authorized by owner. Program with agreed-upon showing time windows

• Prepare mailing and contact list

• Generate mail-merge letters to contact list

• Order “Just Listed” labels & reports

• Prepare flyers

• Review comparable MLS listings regularly to ensure property remains competitive in price, terms, conditions and availability

• Prepare property marketing brochure for seller’s review

• Arrange for printing or copying of supply of marketing brochures or fliers

• Place marketing brochures in all company agent mail boxes

• Upload listing to company and agent Internet site, if applicable

• Mail out “just listed” notice to all neighborhood residents

• Advise network referral program of listing

• Provide marketing data to buyers coming through international relocation networks

• Provide marketing data to buyers coming from referral network

• Provide “special feature” cards for marketing, if applicable

• Submit ads to company’s participating Internet real estate sites

• Price changes conveyed promptly to all Internet groups

24 | Salt Lake Realtor ® | April 2024

Image licensed by Ingram Image

• Reprint/supply brochures promptly as needed

• Loan information reviewed and updated in MLS as required

• Feedback requests sent to buyers’ agents after showings

• Review weekly market study

• Discuss feedback from showing agents with seller to determine if changes will accelerate the sale

• Place regular weekly update calls to seller to discuss marketing & pricing

• Promptly enter price changes in MLS listing database

The Offer and Contract

• Receive and review all offers

• Evaluate offer(s) and prepare a “net sheet” on each for the owner for comparison purposes

• Counsel seller on offers. Explain merits and weakness of each component of each offer

• Contact buyers’ agents to review buyer’s qualifications and discuss offer

• Submit seller’s disclosure to buyer’s agent or buyer upon request and prior to offer if possible

• Confirm buyer is pre-approved by calling loan officer

• Obtain pre-approval letter on buyer from loan officer

• Negotiate all offers on seller’s behalf, setting time limit for loan approval and closing date

• Prepare and convey any counteroffers, acceptance or amendments to buyer’s agent

• Submit copies of contract and all addendums to closing attorney or title company

• When offer is accepted and signed by seller, send to buyer’s agent

• Record and promptly deposit buyer’s earnest money in escrow account

• Disseminate “under-contract showing restrictions” as seller requests

• Submit copies of signed contract to seller

• Submit copies of signed contract to selling agent

• Submit copies of signed contract to lender

• Provide copies of signed contract for office file

• Advise seller in handling additional offers to purchase submitted between contract and closing

• Change status in MLS to “Sale Pending”

• Update transaction management program show “Sale Pending”

• Review buyer’s credit report results — Advise seller of worst and best case scenarios

• Provide credit report information to seller if property will be seller-financed

• Assist buyer with obtaining financing, if applicable and follow-up as necessary

• Coordinate with lender on discount points being locked in with dates

• Deliver unrecorded property information to buyer

• Order septic system inspection, if applicable

• Receive and review septic system report and assess any possible impact on sale

• Deliver copy of septic system inspection report lender & buyer

April 2024 | Salt Lake Realtor ® | 25

• Deliver well flow test report copies to lender & buyer and property listing file

• Verify termite inspection ordered

• Verify mold inspection ordered, if required

Tracking the Loan Process

• Confirm verifications of deposit & buyer’s employment have been returned

• Follow loan processing through to the underwriter

• Add lender and other vendors to your management program so agents, buyer and seller can track progress of sale

• Contact lender weekly to ensure processing is on track

• Relay final approval of buyer’s loan application to seller

Home Inspection

• Coordinate buyer’s professional home inspection with seller

• Review home inspector’s report

• Enter completion into transaction management tracking software program

• Explain seller’s responsibilities with respect to loan limits and interpret any clauses in the contract

• Ensure seller’s compliance with home inspection clause requirements

• Recommend or assist seller with identifying and negotiating with trustworthy contractors to perform any required repairs

• Negotiate payment and oversee completion of all required repairs on seller’s behalf, if needed

The Appraisal

• Schedule appraisal

• Provide comparable sales used in market pricing to appraiser

• Follow-up on appraisal

• Enter completion into transaction management program

• Assist seller in questioning appraisal report if it seems too low

Closing Preparations and Duties

• Contract is signed by all parties

• Coordinate closing process with buyer’s agent and lender

• Update closing forms & files

• Ensure all parties have all forms and info needed to close

• Select location where closing will be held

• Confirm closing date and time and notify all parties

• Assist in solving any title problems (boundary disputes, easements, etc.) or in obtaining death certificates

• Work with buyer’s agent in scheduling and conducting buyer’s final walk-thru prior to closing

• Research all tax, HOA, utility and other applicable prorations

• Request final closing figures from closing agent (attorney or title company)

• Receive & carefully review closing figures to ensure accuracy of preparation

• Forward verified closing figures to buyer’s agent

• Request copy of closing documents from closing agent

• Confirm buyer and buyer’s agent have received title insurance commitment

• Provide homeowners warranty for availability at closing

• Review all closing documents carefully for errors

• Forward closing documents to absentee seller as requested

• Review documents with closing agent (attorney)

• Provide earnest money deposit check from escrow account to closing agent

• Coordinate this closing with seller’s next purchase and resolve any timing problems

• Have a “no surprises” closing so that seller receives a net proceeds check at closing

• Refer sellers to one of the best agents at their destination, if applicable

• Change MLS status to Sold. Enter sale date, price, selling broker and agent’s ID numbers, etc.

• Close out listing in management program

Follow Up After Closing

• Answer questions about filing claims with Home Owner Warranty company if requested

• Attempt to clarify and resolve any conflicts about repairs if buyer is not satisfied

• Respond to any follow-on calls and provide any additional information required from office files.

Why Was This List Prepared?

Surveys show that many homeowners and homebuyers are not aware of the true value a Realtor® provides during the course of a real estate transaction.

The list here is just a baseline since the services may vary within each brokerage and each market. Many Realtors® routinely provide a wide variety of additional services that are as varied as the nature of each transaction.

By the same token, some transactions may not require some of these steps to be equally successful. However, most would agree that given the unexpected complications that can arise, it’s far better to know about a step and make an intelligent, informed decision to skip it, than to not know the possibility even existed.

Based on a list prepared by Belton Jennings, CEO of the Orlando Regional Realtors® Association. The document is provided online as part of the NATIONAL ASSOCIATION OF Realtors® Surround Sound Campaign. Reprinted with permission of The Lighter Side of Real Estate. Check out their content marketing services at lightersideofrealestate.com.

26 | Salt Lake Realtor ® | February 2024

February 2024

Home Sales, Prices, and Listings are on the Rise

In February, Salt Lake County home sales experienced a notable increase. Existing home sales rose to 874 units of all housing types sold, up by 11.3% year over year, according to UtahRealEstate.com. The increase in sales is attributed in part to a notable drop in mortgage rates in the final months of 2023 and January, which spurred buyer activity.

The median sold price of all housing types increased to $528,000 in Salt Lake County, up 6.67% over a median price of $495,000 a year earlier. The median sold price of single-family home rose to $593,500, up 4.1% year over year. In addition, the median sold price of multi-family homes fell to $412,500, down 2.3% from February 2023.

In neighboring Davis County, home sales in February fell to 268 units sold, down 0.7% from 270 units sold last year. The median sold price of all housing types climbed to $510,000, up 8.51% compared to the price a year earlier.

According to UtahRealEstate.com, properties in Salt Lake County typically remained on the market for 37 days in February, down from 42 days in February 2023. New listings in the county increased to 1,179, up 24.0% compared to 951 new listings in February 2023.

Existing-home sales climbed in February, according to the National Association of Realtors®. Among the four major U.S. regions, sales jumped in the West, South and Midwest, and were unchanged in the Northeast. Year-over-year, sales declined in all regions.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – bounced 9.5% from January to a seasonally adjusted annual rate of 4.38 million in February. Year-over-year, sales slid 3.3% (down from 4.53 million in February 2023).

“Additional housing supply is helping to satisfy market demand,” said NAR Chief Economist Lawrence Yun. “Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”

The median U.S. existing-home price for all housing types in February was $384,500, an increase of 5.7% from the prior year ($363,600). All four U.S. regions posted price increases.

Across the nation, first-time buyers were responsible for 26% of sales in February, down from 28% in January and 27% in February 2023. NAR’s 2023 Profile of Home Buyers and Sellers –released in November 20234 – found that the annual share of first-time buyers was 32%.

All-cash sales accounted for 33% of transactions in February, up from 32% in January and 28% one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 21% of homes in February, up from 17% in January and 18% in February 2023.

Distressed sales – foreclosures and short sales – represented 3% of sales in February, virtually unchanged from last month and the previous year.

“Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”

Lawrence Yun

Chief Economist National Association of Realtors®

28 | Salt Lake Realtor ® | April 2024

April 2024 | Salt Lake Realtor ® | 29 Local Market Update for February 2024

UtahRealEstate.com Salt Lake County KEY METRICS NO. OF SALES MEDIAN SOLD MEDIAN PRICE NEW LISTINGS PRICE PER SQ. FT All Housing Types 874 $528,000 $248.76 1179 Single Family 603 $593,500 $240.45 739 Multi Family 260 $412,500 $270.32 403 COMPARISON TO LAST YEAR 2023 All Housing Types 785 $495,000 $235.63 951 Single Family 573 $570,000 $231.27 628 Multi Family 200 $422,000 $258.80 305 COMPARISON TO LAST YEAR -% DIFFERENCE All Housing Types 11.34% 6.67% 5.57% 23.97% Single Family 5.24% 4.12% 3.97% 17.68% Multi Family 30.00% -2.25% 4.45% 32.13% 11.37% 23.97% -11.90% 6.67% 874 785 NO. OF SALES ALL HOUSING TYPES FEB. 2023 ALL HOUSING TYPES FEB. 2024 ALL HOUSING TYPES FEB. 2024 ALL HOUSING TYPES FEB. 2024 ALL HOUSING TYPES FEB. 2024 ALL HOUSING TYPES FEB. 2023 ALL HOUSING TYPES FEB. 2023 ALL HOUSING TYPES FEB. 2023 NEW LISTINGS MEDIAN CDOM MEDIAN SOLD PRICE 951 1179 42 37 $528,000 $495,000

Source:

Come see what our Marketing Team is cooking up, For you. winutah.com/joinus Miriem Boss BUSINESS DEVELOPMENT 949.836.4029 / miriemboss@winutah.com Grady Kohler PRINCIPAL BROKER 801.815.4663 / grady@winutah.com 4615 Idlewild Rd, Salt Lake City Listed by: Daimon Bushi & John Holt