Helping you unlock Environmental, Social and Governance success beyond the policies

ESG considerations have an increasing impact on all organisations. We know that ESG is about more than just laws and policies. It ultimately needs to form a central part of the way in which your company does business. It starts with your corporate structure and financing, to your supply chain and procurement. It covers how your business manages its employees and internal affairs, to your investments and innovations. It ends with what your business produces and sells, to your customer relations and social impact.

No matter where you are in your ESG journey, Mills & Reeve can help you. For more information on how our multi-disciplinary ESG experts can support you, please get in touch.

compliance and Biodiversity and natural capital

The adoption of renewable energy sources and associated net zero objectives is now commonplace. No longer is there debate about emissions but some commentators regard renewables and net zero as the economic opportunity of the 21st century. Indeed, one of the stated missions of the new UK Government is to make the UK a clean energy superpower.

We advise clients on a full range of ESG-aligned infrastructure and energy projects, including renewables and key technologies for the energy transition. Our work includes advising on energy transition-related opportunities across onshore and offshore wind, solar, carbon capture, clean hydrogen, battery storage, EV infrastructure, heat networks and nuclear. We have experience of clean air projects, carbon trading schemes and other projects with a net zero aspiration.

Recent work:

• Advising on several projects in the fast-growing Heat Network sector, including urban/city centre schemes with aspirations to provide low carbon heat to public and private sector offtakers, utilising ground, air and water source heat solutions.

• Advising one of the UK’s leading solar and energy storage developers on a range of projects, including advising on EPC, O&M, subsidy, power supply and optimisation contracts.

• Panel legal advisor for Sellafield Limited and the UK Atomic Energy Authority.

• Providing regulatory advice to a scale up a production business in the Hydrogen sector.

• Advising on the UK's largest biomass project involving the rollout of 179 biomass boilers.

There has been a growing drive by financial institutions and investors to incorporate ESG considerations into investment decisions: increased regulatory scrutiny and transparency of "green" finance, shareholder demands and the need to transition to a carbon neutral and just future are just some of the key reasons. This growth has also seen the development of new and innovative finance products linked to sustainability.

We have been at the forefront of helping clients align their sustainability goals with their financing arrangements, enabling organisations to achieve green, social, sustainable and sustainability-linked bonds and financing. In addition, we can advise on finance deals that aren't linked to sustainability on day one but have the potential to become sustainability linked over time

Recent work:

• Advising social housing group Flagship Group in issuing its debut £250 million green-listed bond.

• Advising University of Hull on its ambitious goal of becoming a carbon neutral campus by 2027 with both a green private placement and sustainability linked bank facility.

• Advising Adnams PLC on a sustainability linked bank facility with environmental performance targets linked to an interest margin ratchet.

• Advising Nesta on the creation and close of a £20 million arts and culture investment debt fund. A mix of public, private and philanthropic investors – Arts Council England, the National Lottery Heritage Fund, Big Society Capital, Bank of America, the Esmée Fairbairn Foundation and Nesta itself – invested in the fund via loans and grants.

Sustainable and socially responsible investment plays an increasingly important role in the financial industry and the incorporation of sustainability factors in investment decisions has become a key focus of investors around the world. We advise clients in creating funds/pooled investment vehicles (often with innovative and first of its kind structure in the market) and in making direct investments with sustainable/impact investment objectives. We advise on the potential conflicts between purpose and profit, on striking a balance between doing social good and achieving financial performance, and on navigating a complex myriad of cross-jurisdictional regulatory changes applicable to investment funds, including the implementation of the UK Sustainability Disclosure Requirements (SDR) and the EU Sustainable Finance Disclosure Regulation (SFDR) requirements. We frequently advise institutional investors (universities, charities and government departments) on their investment funds, often with cross border regulatory and ESG/impact investment elements.

Dona Ardeman Partner

+447570671328

dona.ardeman@mills-reeve.com

Recent work:

• Advising Carbon Order in restructuring one fund and setting up a second, to invest in Carbon Engineering Ltd, a Canadian company which has developed direct air capture technology that strips CO2 from the atmosphere.

• Acting for Elbow Beach Ventures Limited in the creation and launch of two funds which will invest in UK based early-stage climate transition tech companies.

• Confidentially advising a government department on investing in a global infrastructure debt fund raising over US$200m to date, to provide financing for sustainable infrastructure in emerging markets, addressing climate challenges and reducing social inequalities in clean and renewable energy, sustainable mobility, health, water and sanitation.

• Advising The Big Issue on the creation of a £30 million European Social Entrepreneurship Fund, backed by Better Society Capital. The fund is the first of its kind focused on outcomes-based investments.

Cindy Wong Principal Associate

+4477767682663

cindy.wong@mills-reeve.com

With the built environment responsible for almost 40% of global carbon emissions, the real estate and construction industries have a critical role to play in the achievement of net zero. ESG considerations need to be taken into account throughout the life cycle of a building, from conception and contract stage through to operation and ultimately demolition or repurposing. We work with clients across a broad range of asset classes including supporting with the sustainable management of their property portfolios and addressing their ESG concerns. We advise on decarbonising assets, sustainable retrofit and redevelopment and enhancing social value. We work with our clients to achieve their ESG KPIs in investment and funding real estate acquisitions and development. We support them to achieve their operational targets through the incorporation of green contract provisions.

Recent work:

• Advising Orchard Street Social and Environmental Impact Fund on the acquisition and management of properties in £400m impact fund focused on decarbonisation, community investment and wellness

• Advising Carbon Energy Fund on the installation and long-term operation of a new energy facility at Addenbrooke's Hospital including advising on all relevant project documents.

• Advising the University of East Anglia on contracts to create an electricity generation facility to make the campus a net exporter of energy, with an Offtake Agreement to supply surplus energy into the National Grid.

• Building Towards Net Zero, our report on net zero in the construction and property industries with Professor Sean Smith of the University of Edinburgh.

Organisations cannot afford to ignore their environmental compliance obligations: apart from prison sentences and potentially unlimited fines, failure to comply with environmental legislation can trigger severe damage to a business’ reputation. Emerging environmental risks, such as ‘forever chemicals’, mean that the regulatory landscape is evolving continually.

Our knowledgeable environmental lawyers specialise in advising clients as to what the law requires, how it applies to their businesses or activities, how to comply with their obligations, the risks of non-compliance, and how best to respond if someone alleges that they have not complied. Their expertise includes contaminated land, water pollution, environmental permits and licences, and waste management.

Recent work:

• Advising DB Schenker in relation to contaminated land and litigation.

• Advising the Defence Infrastructure Organisation on environmental liability transfer advice.

• Advising on the transfer and management of permits relating to a heavy industry chemicals manufacturer.

• Assisting a large-scale landed estate on stockpiling and management of materials and waste, including CL:AIRE guidelines, material management plans, permit and exemption advice, landfill and stockpiling management.

• Advising a cleantech energy provider on the regulatory framework applicable to the production, storage and transportation of hydrogen.

• Advising on extensive remediation strategy for the treatment and removal of PFAS chemicals.

Biodiversity enhancement has rapidly become a key ESG issue for many organisations. Human activity and climate change have resulted in irreversible biodiversity loss and the government are taking steps to mitigate further decline, including through biodiversity net gain targets to ensure that development leads to a positive impact on biodiversity.

We support clients in managing environmental issues and harnessing opportunities, in relation to biodiversity, nutrient neutrality, habitat creation and management, natural capital and natural resources. We provide guidance on the legal and policy frameworks and best practices for environmental management, including assessments, auditing, reporting, due diligence and liability. In the BNG marketplace we advise on planning agreements, conservation covenants, joint ventures and lease structures, acting for BNG promoters and landowners.

Recent work:

• Advising habitat providers on deregistration and release of land from Biodiversity Net Gain off-site provision schemes.

• Acting for a collective of landowners on the establishment of a corporate vehicle and development of constitutional documents in furtherance of a landscape recovery scheme.

• Prepared template facility and intercreditor documentation for a nature charity for loans to be granted to borrowers for the purpose of enhancing biodiversity and other nature-based indices of land.

• Advising a corporate development vehicle on offsite ecological mitigation in connection with its promotion of a largescale residential development.

An increasing number of organisations are incorporating sustainability objectives into procurement policies and practices, using their purchasing power to help advance wider societal goals. Procurement functions have an important role to play in defining ESG objectives and ensuring their implementation in supply chain contracting. They can facilitate best practice on sustainability and human rights across the supply chain. We support clients to achieve their sustainability goals and ensure high standards of ethical practices are adopted in supply chains. We advise on Modern Slavery Act due diligence, ethical labour policies, supplier codes of conduct and conflict minerals risks. We also assist our clients to comply with their obligations in relation to packaging producer responsibility (including the new extended producer responsibility requirement), plastic packaging tax and waste electrical and electronic equipment.

Recent work:

• Preparing template framework manufacturing and supply agreement (incorporating compliance obligations around ethical labour and sustainability standards) for use with manufacturers based in high-risk countries.

• Bespoke training to a client’s board on the importance of modern slavery and putting in place appropriate anti-modern slavery policies and procedures.

• Advising a range of retail and manufacturing sector clients on emerging regulatory areas, such as the UK Plastic Packaging Tax, EU and UK

CBAM, Extended Producer Responsibility (EPR), WEEE, and Ecodesign.

Alison Ross Eckford Partner +447585996143 alison.rosseckford@mills-reeve.com

Biddlecombe

ESG factors continue to significantly influence developments in employment law. Much of this is driven by changing expectations on employers by the workforce itself, investors, customers and regulators. Employees and prospective employees are increasingly expecting purposeful employers committed to delivering change.

Employment law naturally dovetails with many ESG issues, particularly around the social and governance aspects. Our employment lawyers support clients to keep in line with broader societal change and progress, thereby supporting their ESG strategies and policies. This encompasses areas such as diversity, equality, inclusion and wellbeing, job satisfaction and rewards, pay equity and gaps, working conditions, health and safety, data protection, whistleblowing procedures, and employee engagement.

Recent work:

• Incorporating ESG friendly clauses and provisions into employment contracts and policies, including advice on incorporating ESG values into KPIs and performance metrics.

• Supporting clients with DE&I and wellbeing agendas, including managing menopause as a workplace challenge to mitigate risks of discrimination claims.

• Drafting family friendly policies and delivering training for international clients on new and evolving employee rights to ensure they are ahead of the curve.

• Advising clients on ESG strategy in the context of investigating grievances and settling disputes, in particular with focus on the appropriate use of NDAs and confidentiality obligations.

Andrew Secker Partner

+447918747492

andrew.secker@mills-reeve.com

Remziye Ozcan Principal Associate +447774617426

remziye.ozcan@mills-reeve.com

It is estimated that to achieve net zero by 2050, $3-6tn must be invested globally every year from now until then. A significant proportion of this investment will be in innovation, including new technologies, improvements to existing technologies, new data, new know-how and methodologies and new ways of influencing behaviours. The winners from this net zero transformation will be those who invest intelligently and then maximise the value of that investment.

Recent work:

• Advising a global FMCG leader on its IP strategy, focusing on sustainable innovation and marketing, to support its growth and profitability ambitions.

• Acting for Mode Labs, a deeptech spinout from the University of Oxford developing sophisticated water quality sensors, in its £3m seed investment and all associated IP matters.

We provide proactive, extensive advice on intangibles strategies and frameworks; white-space and third-party IP risk discovery and mitigation; IP asset protection and monetisation; IP exploitation models; IP licensing, transactions and collaborations; and enforcement and litigation.

• Supporting Illumion, a deeptech spinout from the University of Cambridge supporting the development of more efficient battery storage, on its £2.1m seed investment and customer contracts.

• IP landscape discovery and freedom-to-operate searches and advice in relation to hydrogen and alternative protein.

• IP strategy and disputes for an EV platform manufacturer.

• Brand protection strategy for an integrated renewables investment and delivery company.

• Advising a global standard-setting organisation on its certification trade marks and associated member policies.

ESG legislation is proliferating worldwide and regulator, investor, consumer and employee attention is increasing. There is also a burgeoning industry of activist litigation against public and private sector institutions, to exert pressure in favour of greater sustainability progress. The market for litigation funding has also exploded – in the UK alone, there is more than £1bn of capital available to fund large-scale litigation.

We help clients to identify and mitigate their key forms of ESG risk and respond to issues when they do arise. These risks may arise directly from operations (such as dangerous or abusive conditions), inadequate or incorrect ESG disclosures, greenwashing in advertising or corporate reports, breaches of ESG regulations, competition law breaches, the changing insurance market and employee pay disputes.

Recent work:

• Defending an agricultural standards certifier in an Advertising Standards Authority investigation into alleged greenwashing.

• Representing a recyclability certifier in a CMA investigation in relation to the packaging

• Advising a leading asset manager on its ESG risk register and risk mitigation.

• Advising on the ESG litigation risks of a joint emissions reduction project.

• Verification of various retail-sector advertising campaigns to avoid greenwashing and unlawful green claims.

• Providing training to a range of clients on ESG litigation and greenwashing risk.

The rise in ESG reporting requirements is a global trend. Recent legislation such as the UK’s Climate-related Financial Disclosures legislation, the EU Corporate Sustainability Reporting Directive and the Corporate Sustainability Due Diligence Directive emphasise the need for extensive data points. Effective governance helps to ensure high-quality ESG disclosures, promoting transparency, accountability, and alignment with stakeholder interests. It also promotes good ESG outcomes in response to proliferating ESG-related legislation and rising stakeholder expectations.

We assist clients by highlighting that ESG reporting goes beyond mere compliance; it's about fostering long-term value and encouraging sustainable practices. We also offer governance reviews designed to facilitate ESG transformation, ESG audits to pinpoint gaps and opportunities, and legal reviews of non-financial reports to mitigate risks of greenwashing, as well as financial and reputational damage.

Recent work:

• Advising global companies on their ESG disclosure obligations.

• Undertaking ESG audits, including for an international professional membership body and a luxury goods retailer.

• Reviewing and advising on ESG disclosures made as part of M&A transactions.

• Assessing the legal accuracy of sustainability reports.

• Assisting companies with the B Corp certification process.

• Providing training to a range of clients on governance and reporting obligations.

• Advising a Russell Group University on various governance, corporate law and IP issues in relation to the potential spinout of a social enterprise focused on the voluntary carbon market.

Stay informed on the latest news, trends, and insights regarding ESG issues and opportunities

Meet our ESG lawyers and explore our tools and resources to help you navigate and make smart ESG decisions.

A series of reports to assist organisations in proactively addressing ESG issues.

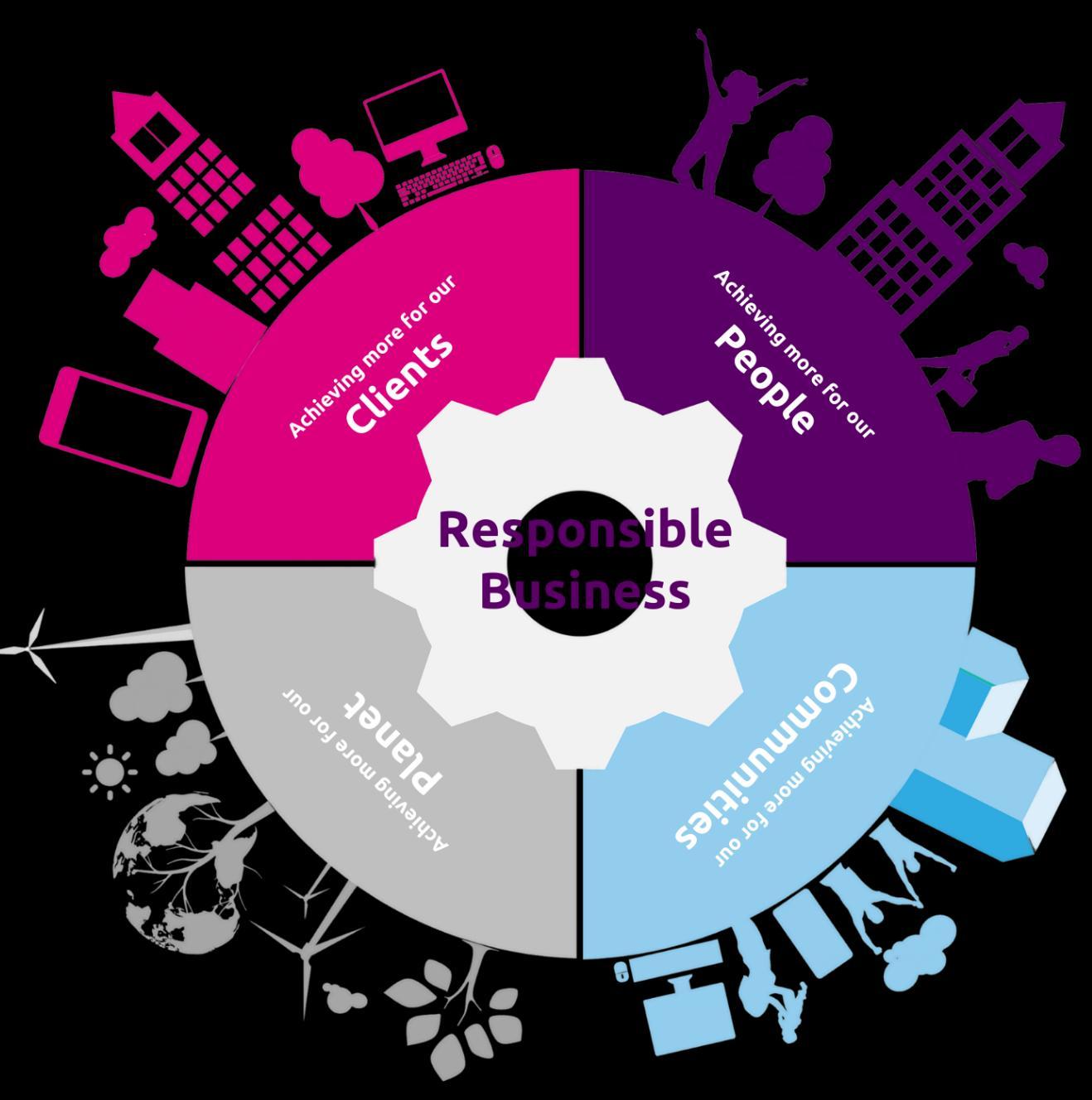

From small individual actions to radical collaborations, we are invested in creating shared value and impactful outcomes – for our clients, our people, our planet, and our communities. We will:

• Use our legal expertise to help clients to mitigate ESG risks and navigate change

• Increase representation of marginalised groups, enhance inclusion and embed good wellbeing

• Achieve our net-zero targets, reduce our environmental impact, and invest in nature restoration and biodiversity

• Use the skills and experience of our people and the resources of our business to drive positive social impact in our communities

For more information on how we’re encouraging responsible business at Mills & Reeve visit ‘Achieving more for our world’.