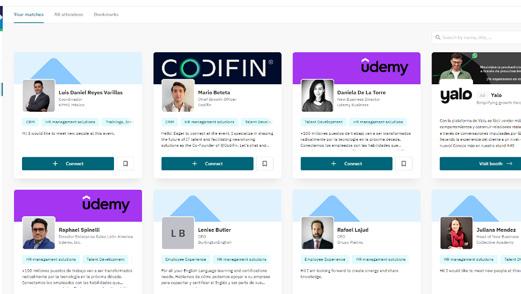

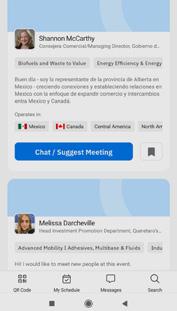

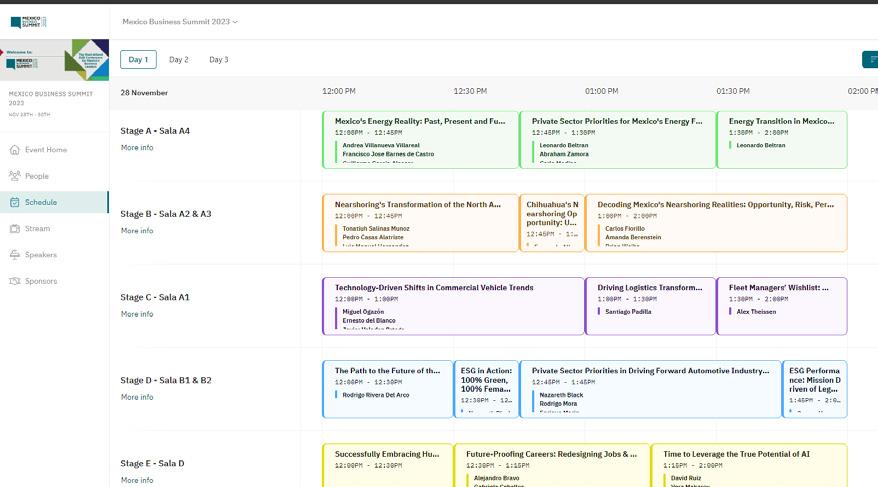

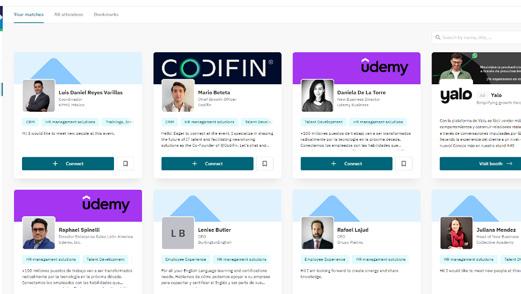

Matchmaking

Mexico’s leading B2B conference organizer uses a customized app to deliver an unparalleled experience

The MBE App delivered AI-powered intent-based matchmaking to the Mexico Business Summit 2023 attendees

MBE A pp Impact

231 participants

2,256 matchmaking communications

292

1:1 meetings conducted

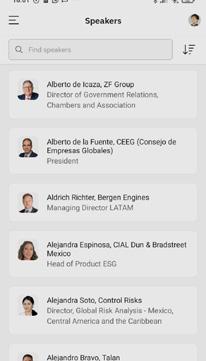

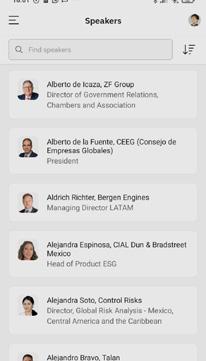

51 speakers

2nd Edition

Conference social media impact

9,774 direct impressions during MNS

9 sponsors

4,263 visitors to the conference website

Pre-conference social media impact

85,880 direct pre-conference LinkedIn impressions

7.24% click through rate during MNS 3.61% pre-conference click through rate

9.6% conference engagement rate 3.19% pre-conference engagement rate Total

Matchmaking intentions

991

2,575

4

31% CEO / CM / DG 24% Manager / Head of Division 17% Government Affairs Representative / Chamber of Commerce 16% VP / President / Partner 12% Manager / Consultant

Trading 17 Recruitment 41 Investment

Networking 32 Mentoring

1,494

• Achilles Group

• ADELAT

• Aggreko

• Agon

• Albaa Legal Tech

• ALLUX

• AME

• American Society of Mexico

• AMSoC

• Arendal S de RL de CV

• ARMo R-IIMAK México

• Asociación Mexicana de Gas Natural (AMGN)

• Asolmex

• ATCo Energía

• Axis Energy

• Ayuntamiento de toluca

• AZ Industries SA de CV

• BBVA

• Bepensa

• BLUE GLo BAL ENERGy

• BME Shipping

• BoSCH

• British Embassy

• Brose Group

• Burns & McDonell

• Business Director

• Caffécito

• Caliza

• Camara de diputados

• CANACINTRA

• CANACINTRA EDo MEX

• Cancún Cards

• Capwatt

• Carl Zeiss de México, S.A. de C.V.

• CATEM

• Catenon

• Centro de Investigación y Desarrollo CARSo

• CFE

• China Chamber of Commerce and Technology Mexico

• Compusoluciones

• Concamin

• Connecting Mexico by GEP

• Consejo de Empresas Globales en México

• Consultoría G2H

• Continental Automotive

• Co PARMEX CDMX

• Corporativo Enciso

• CyDSA

• Delegación General de Quebec en México

• Doxia

• Edison Energy

• Enel

• Energía Real

• Engie

• ERGoSo LAR

• ESCo

• E y Mexico

• FedEx Express México

• Fibra MT y

• Framecrete Holding Worldwide

• Frontier Industrial by Artha Capital

• Gasoducto de Morelos

• GE Grid Solutions

• GEM

• Generadora Fénix

• Gensler

• Gobierno de Durango

• Gobierno del estado de Coahuila

• Gobierno del Estado de Guanajuato

• Gobierno del Estado de México

• Governor of Aguascalientes

• Grupo Constructor Industrial

• Grupo Imperial

• Grupo IPS

• Grupo JETLoG

• Grupo PEo

• Grupo Valoran

• Hitachi Energy México

• Holcim Mexico

• Holland & Knight

• Holland House Mexico

• Hooman

• HSBC

Co MPAN y A TTENDANCE 5

• Iberdrola

• IBH

• INA

• Infor

• Ingredion Mexico

• International Business Solutions

• J2W

• Kiewit

• LDR Solutions

• Livingston International Mexico

• Logicalis

• Lo NGi

• Luupa AI

• Magna Formex

• Marcos y asociados

• Marketing 4 Sunset Group, S.A. DE c.v.

• MEGAFLUX

• Misumi México

• MRII Capital

• MURGUIA

• Naturgy

• oca Global

• oracle de Mexico

• Paola´s Bakery

• Parks Industrial

• Phoenix Contact

• Picarro

• Pontones y Ledesma

• PRIMA.IA

• Procoahuila

• ProColombia

• Proistmo

• PRo MPERÚ en México

• Proterra Capital

• Protexa

• Quartux Mexico

• Representación del Gobierno del Estado de SLP en CDMX

• Risoul

• Roa

• Satyam Venture Eng Services

• Secretaria Desarrollo Económico

• Sempra Infraestructura

• Sener

• Shacman Trucks

• Sherwin WIlliams

• Siemens

• Sika

• Solfium

• Source Latam FS

• Speakap

• Spencer Stuart

• SSA Mexico

• State Government of Estado de Mexico

• Stragia

• Strategic Projects Manager

• Thomson Reuters

• Toyota Motor Mexico

• TREBoTTI

• Turner & Townsend

• Utilities Director

• Vidialsa

• Vitesco Technologies Mexico

• We Connect International

• Willscot Mexico

• Wood Mackenzie

• Work one Solutions

• WTS Energy

• ZF

Co MPAN y A TTENDANCE 6

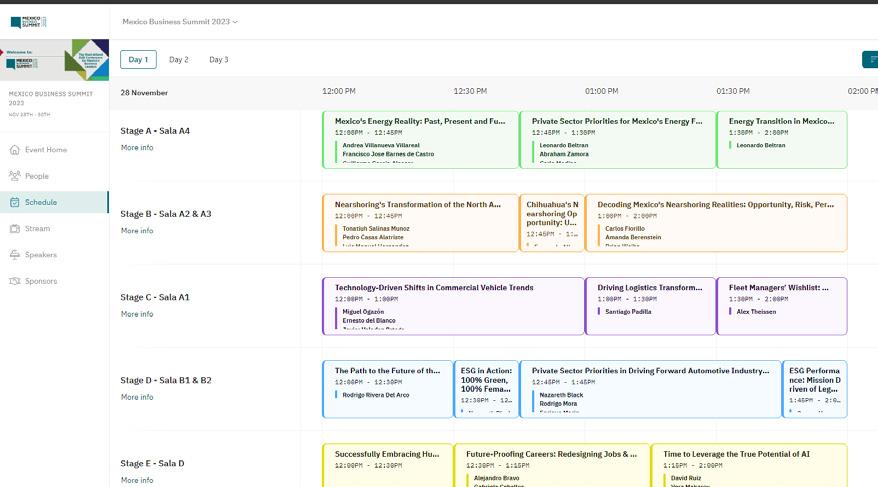

09:00

09:15

TIME TO CAPITALIZE ON MEXICO’S NEARSHORING MOMENTUM

Speaker: Marco Antonio del Prete, AMSDE

VITAL VECTORS TO MEXICO’S NEARSHORING COMPETITIVENESS: ENERGY, INFRASTRUCTURE, TALENT

Moderator: Armando Zúñiga, Co PARMEX CDMX

Panelists: Roberto Arechederra, State Government of Jalisco

Ulises Fernández, State Government of Chihuahua

Arturo Ortiz, SEDECo Durango

Enrique Nachón, State Government of Veracruz

11:30 THE ENERGY FACTOR: DECARBONIZING MEXICO’S AUTOMOTIVE INDUSTRY

Moderator: Andrés Friedman, Solfium

Panelists: Ivette Castillo, GE Grid Solutions

Edgardo Perea, Brose Group

Juan Manuel Cerdeira, SEV Mexico

12:15

12:30

BEATING GRID LIMITATIONS TO ENSURE ENERGY SUPPLY SUCCESS

Speaker: Mario Cavazos, Aggreko

INDUSTRY PERSPECTIVES ON ENERGY INFRASTRUCTURE DEVELOPMENT FOR MANUFACTURING GROWTH

Moderator: Rodolfo Rueda, Holland & Knight LLP

Panelists: Gonzalo Azcárraga, SENER

Victor Mejía, Energía Real

Marco Cosío, Siemens

Josefa Casas, Doxia

15:00

THE FUTURE OF NATURAL GAS AND LNG IN MEXICO’S ECONOMY

Moderator: Malvin Delgado, Picarro

Panelists: Ana Ludlow, ENGIE Mexico

Vania Laban, Asociación Mexicana de Gas Natural

Sergio Romero, Sempra Infrastructure

Mauro Juárez, Naturgy Mexico

16:00

UNLEASHING SOLAR POTENTIAL TO GUARANTEE SUSTAINABLE ENERGY SUPPLY

Moderator: Nelson Delgado, ASoLMEX

Panelists: Alessandra Amaral, ADELAT

Ricardo Zúñiga, CapWatt

Iván Reyes, Lo NGi

Jorge Musalem, CFE

16:45

17:00

AME: STRATEGIC VISION 2030

Speaker: Gumersindo Cué, AME

CATEM’S ROLE: TAKING ADVANTAGE OF NEARSHORING IN MEXICO

Speaker: José Carlos Saavedra, CATEM

P R o GRAM D A y 1 7

09:00

THE MEXICO OPPORTUNITY IN THE GLOBALIZATION OF THE CHINESE AUTOMOTIVE AND ENERGY INDUSTRIES

Speaker: Carolina Núnez, China Chamber of Commerce and Technology Mexico

09:15

CHINESE AUTOMOTIVE OEM ACHIEVEMENTS AND AMBITIONS IN MEXICO

Moderator: Carolina Nuñez, China Chamber of Commerce and Technology Mexico

Panelists: Ari Ben Saks, E y

Carlos Pardo, Shacman Trucks

Sergio Chavarría, LDR Solutions

10:00

EXPLORING THE ADVANTAGES OF THE STATE OF MEXICO IN FACE OF NEARSHORING

Speaker: Laura González, State Government of State of Mexico

10:20 THE INTEGRATION OF MEXICAN MANUFACTURING INTO NORTH AMERICAN SUPPLY CHAINS

Speaker: Andrés Díaz, Co NCAMIN

11:30 MEXICO, US AND CHINA: TARIFFS, TALENT, ENERGY, SECURITY AND THE FUTURE OF NEARSHORING INVESTMENT

Moderator: Mauricio Jaramillo, Mexico Texas-European Chamber of Commerce

Panelists: Kenneth Smith, Agon

Larry Rubin, American Society of Mexico

Pablo Gopp, Thomson Reuters

12:30

12:50

SECURITY MODELS AND MORAL CHOICES: THE HUMAN FACTOR

Speaker: Jorge Uribe, Grupo IPS

THE FUTURE OF ELECTROMOBILITY: THE IMPORTANCE OF DEVELOPING ELECTRIC POWERTRAIN

Speaker: Antonio Rodríguez, Vitesco Technologies

13:10

TECHNOLOGICAL TALENT: STRATEGIC FACTOR FOR MEXICO’S FUTURE COMPETITIVENESS

Speaker: David Pineda, Continental

15:00

SUPPLY CHAIN PRIORITIES AT TIMES OF AUTOMOTIVE INDUSTRY TRANSFORMATION

Moderator: Armando Cortés, INA

Panelists: Jorge Luis Torres, FedEx Express México

Emanuel Soto, ZF Group

Alejandro Luna, INFo R

16:00

THE VALUE OF NEARSHORING: OPTIMIZING ELECTRIFIED VEHICLE PRODUCTION FOR AN ELECTRIFIED MEXICO

Speaker: Luis Lozano, Toyota Motor de México

16:30

AGUASCALIENTES: IDEAL DESTINATION FOR NEARSHORING

Speaker: Teresa Jiménez, State Government of Aguascalientes

8 PR o GRAM DA y 2

9

10

TIME TO CAPITALIZE ON MEXICO’S NEARSHORING MOMENTUM

Mexico finds itself at the forefront of nearshoring investment considerations for businesses seeking to optimize their supply chains and enhance operational efficiency. Recognizing the significance of this opportunity, economic development ministers from various states are doubling down on efforts to showcase the unique advantages and investment potential of their respective regions.

Marco Antonio Del Prete, President of the Association of Mexican Ministers of Economic Development (AMSDE), highlighted the unprecedented opportunity that nearshoring presents to Mexico and its constituent states. Focused on the imperative of harnessing this momentum, Del Prete underscored the concerted efforts of economic development ministers across Mexico to attract investments, foster connections, and address the needs of companies considering relocation to th e country.

Del Prete explained that nearshoring is not a new phenomenon to Mexico, citing its historical utilization during the 1970s and 1980s when maquiladoras flourished, capitalizing on Mexico’s lower labor costs. However, nearshoring has adapted to contemporary challenges, notably during the CoVID-19 pandemic, which disrupted global supply chains and prompted companies to seek closer proximity to their markets. This strategic shift has allowed businesses to reduce time and costs, leverage local talent, and avoid compounding challenges such as the container crisis.

“We have to promote our capabilities, encourage exports, ensure the best infrastructure and boost renewable energy projects to promote Mexico’s economic and sustainable development”

Marco Antonio del Prete President, AMSDE

Del Prete emphasized that nearshoring is increasingly influenced by climate change, as companies strive to minimize their carbon footprint by decreasing export distances. This trend is incentivizing businesses to establish closer relationships with both suppliers and customers, enabling them to pursue net-zero goals more eff ectively.

“Nearshoring involves more than just relocating plants; it encompasses the relocation of entire processes. While other strategies like friendshoring prioritize alliances, nearshoring primarily addresses logistical considerations. This presents a significant opportunity for Mexico, given its strategic geographic location between the Atlantic and Pacific oceans, its proximity to the United States, a competitive labor force, and numerous trade agreements facilitating smooth business operations for foreign companies, ” said Del Prete.

Economic development ministers are keenly aware of these strengths and are actively promoting them to prospective investors. However, amidst the promising prospects of nearshoring, several challenges loom on the horizon including those related to energy infrastructure, availability of industrial real estate, legal certainty, and a skilled workforce to boost competitiveness.

In the realm of energy, efforts are underway to bolster infrastructure and ensure a reliable supply to support industrial growth. Initiatives aimed at enhancing vocational training and upskilling programs are being rolled out to meet the demand for skilled labor in key sectors. “We have to promote our capabilities, encourage exports, ensure the best infrastructure and boost renewable energy projects to promote Mexico’s economic and sustainable development,” said Del Prete.

The holistic approach taken by economic development ministers underscores a shared

Co NFERENCE H IGHLIGHTS 11

commitment to unlocking Mexico’s full potential as a premier nearshoring destination. By listening to the needs of businesses and proactively addressing challenges, these ministers are paving the way for sustained economic growth and prosperity across the country.

Furthermore, the minister aims for Mexico not only to leverage new technologies but also to be at the forefront of their creation.

“We cannot persist solely as maquiladoras, reliant solely on foreign investment. It is imperative that we invest in technology, innovation, and the development of local suppliers, not just to provide solutions, but to originate them from the ground up.”

As Mexico continues to capitalize on its nearshoring momentum, the role of economic development ministers remains paramount as it will facilitate inter-government coordination.

VITAL VECTORS TO MEXICO’S NEARSHORING COMPE TITIVENESS

To ensure sustained growth and competitiveness amidst Mexico’s nearshoring transformation, companies must develop a strategy that encompasses energy, infrastructure, and talent, according to industry experts. Addressing these aspects holistically is imperative for businesses aiming to fortify their positions in Mexico’s nearshoring ecosystem. This approach serves as a proactive means to navigate the challenges and opportunities that lie ahead.

In the pursuit of nearshoring excellence, fostering a strategy centered on innovation becomes paramount. This involves not only leveraging technological advancements but also cultivating a collaborative environment where energy efficiency, infrastructure development, and talent cultivation converge. By strengthening these elements, companies can effectively capitalize on synergies between these vital vectors, thereby enhancing their competitive edge and positioning themselves as frontrunners in the nearshoring arena.

This necessitates a comprehensive understanding of the unique advantages inherent in each region, explains Armando Zúñiga, President, Co PARMEX CDMX. He emphasizes the geographical diversity across regions, emphasizing the need to capitalize on these differences through the formation of regional blocs to maximize investment opportunities. However, Zúñiga underscores the importance of states collaborating to attract investments and address common challenges prevalent in

Mexico’s nearshoring landscape. “State strategies,” he asserts, “must encompass not just energy accessibility, but also focus on renewable energy, robust transmission infrastructure, and the cultivation of skilled talent, shifting away from reliance solely on low-cost labor,” Zúñiga added.

Energy

Luis Roberto Arechederra, Minister of Economic Development, State Government of Jalisco, underscores the pressing need for states to align with decarbonization policies driven by large corporations. He emphasizes that an established decarbonization pathway is essential for states to fully meet the expectations of these corporations. “This strategy,” Arechederra asserts, “must permeate the entire supply chain and be reinforced through the adoption of energy-efficient practices and technological investments.” By aligning with these corporate sustainability initiatives, states can not only attract investment but also foster a more sustainable business ecosystem.

Drawing from the experiences in Veracruz, Enrique Nachón García, Minister of Economic and Port Development, emphasizes the necessity of a triple helix approach involving government, industry, and academia to harness synergies in energy infrastructure development. Nachón highlights the increasing adoption of Environmental, Social, and Governance (ESG) guidelines by companies, underscoring the importance

Co NFERENCE H IGHLIGHTS 12

of aligning governmental policies and academic research with corporate sustainability objectives.

Veracruz’s significant energy surplus, producing three times more energy than it consumes, positions it as a compelling destination for industries seeking reliable energy sources. Nachón emphasizes the potential of energy surplus in Veracruz as a magnet for industrial relocation. Furthermore, he stresses the significance of infrastructure development projects, such as the Tehuantepec isthmus project, as crucial opportunities for regional collaboration. This project, while promising, requires coordinated efforts with neighboring states like oaxaca, highlighting the necessity for interregional cooperation in infrastructure development. Arechederra adds, “For effective collaboration under the triple helix model, governments must take proactive steps to deploy relevant public policies that integrate all stakeholders.”

Talent

The availability and quality of talent are paramount in shaping the infrastructure planning and development crucial for successful nearshoring operations, especially within energy-intensive industries. A highly skilled workforce not only drives innovation but also significantly impacts the design and optimization of infrastructure tailored to meet the diverse needs of various sectors. Therefore, companies must prioritize talent development initiatives alongside infrastructure investments to cultivate a conducive environment for sustainable growth and operational efficiency.

In this context, the state of Durango has grappled with talent outflow. Arturo o rtiz Galán, Vice Minister of Economy, State Government of Durango, highlights that approximately 45% of the state’s talent migrates elsewhere in pursuit of opportunities. He identifies the historical underutilization of investment attraction as a key factor contributing to this trend, albeit presenting a newfound opportunity.

“Despite missing out on investment opportunities for two decades,” Galán notes, “this gap has transformed into an advantage.”

Conversely, Durango boasts a wealth of available talent, supported by 72 universities and 78 technical schools. Galán underscores that these educational institutions equip professionals with the requisite skills to capitalize on opportunities within the state. Furthermore, he emphasizes Durango’s potential to strategically shape and diversify its industrial landscape, leveraging its abundant ta lent pool.

Triple Helix

Government support plays a pivotal role in fostering a holistic approach to infrastructure development and talent cultivation essential for Mexico’s nearshoring activities. By implementing policies that promote energy efficiency and workforce development, governments can create an enabling environment conducive to nearshoring ventures. Collaborative efforts between the public and private sectors are imperative to address infrastructure gaps, enhance regulatory frameworks, and

Co NFERENCE H IGHLIGHTS 13

establish industry standards that ensure the long-term viability of nearshoring ventures.

“In Veracruz we recognized that to act the most important thing was to first have a diagnosis and we also learned a lot from other states. Another strategy that worked in our state was to pay special attention to the paperwork process and create a unit that united the different people involved in these processes so that when the investments arrive, we all listen to the projects at the same time and find ourselves on the same page,” said Nachón.

The consensus among government officials underscores the significance of actively engaging with companies and guiding the orderly development of the industry. Implementing public policies that foster a triple helix model—embracing collaboration among government, private sector, and academia—is deemed essential. Ulises Fernández, Minister of Innovation and Economic Development, State Government of Chihuahua, identifies the circular economy as a promising avenue for decarbonization and industry development. He highlights the potential of repurposing industrial surpluses and optimizing processes to foster sustainability and resource e fficiency.

“There are important issues of use within companies to develop a circular economy. For example, surpluses from industries such as the automotive industry can be reincorporated, or industrial processes can be circumscribed for the use of other industries, that is an interesting strategy to explore,” said Fernández.

Capitalizing on Strengths

From Chihuahua, Fernández elucidates that nearshoring is not merely viewed as a solution but as a profound opportunity to strategically direct new investments and cultivate the business ecosystems of the future. “In Chihuahua,” Fernández explains, “we have implemented intelligent specialization strategies, focusing on key automotive sectors such as electronics, aerospace, automotive, and medical equipment. Capitalizing on the development of specialized talent in these sectors is paramount.” Fernández emphasizes the importance of retraining personnel to adapt to evolving operational processes, ensuring alignment with the demands of incoming industries.

In the central region of the country, San Luis Potosí emerges as a vital logistical hub. Salvador González, Head Representative, Government of San Luis Potosí in Mexico City, highlights the state’s recent resurgence in investment activity. González attributes this resurgence to the state’s strategic geographical location at the heart of the country, facilitating crucial processes within the industrial production chain. “With these investments in mind, we have promoted infrastructure on the priority agenda and established a commitment to various sectors, generating direct communication with users of the industrial sector to attract more investments and develop satellite companies, the productive chain,” says Gonzalez.

Furthermore, government ministries underscore the importance of crafting

Co NFERENCE H IGHLIGHTS 14

State Development Plans that articulate clear strategies for orderly economic development, leveraging the unique strengths and opportunities of each state. Additionally, Zúñiga acknowledges that despite potential differences in political affiliations, economic development

ministries across Mexican states are collaboratively steering efforts to maximize the benefits of nearshoring. This concerted approach aims to harness valuable knowledge and experience to propel regional development during this critic al period.

THE ENERGY FACTOR: DECARBONIZING MEXICO’S AUTOMOTIVE INDUSTRY

With estimates suggesting that electric vehicles (EVs) could constitute up to 75% of automotive sales by 2030, the imperative to decarbonize Mexico’s automotive sector becomes increasingly apparent, as highlighted in discussions at Mexico Nearshoring Summit 2024. Decarbonization, however, does not only refer to electrification but to how the electricity consumed by vehicles is generated.

Experts shed light on the pressing need to reduce carbon emissions, particularly in Mexico’s automotive industry as it accounts for a significant portion of Co2 emissions. o ne of the pivotal discussions revolved around the role of energy consumption.

According to Ivette Castillo, General Manager of GSI LAM, GE Grid Solutions, the adoption of electric vehicles (EVs) is pivotal in reducing Co2 emissions. “In less efficient energy generation matrices, EVs can reduce emissions by approximately 25%. This can surpass 75% with more effective matrices,” says Castillo.

Juan Cerdeira, General Manager, SEV Mexico, emphasized the importance of offering comprehensive ecosystems to end-users, including solar panels, inverters, batteries, and affordable EVs, given that up to 80% of owners charge their cars at home. “By providing accessibility to EVs priced below MX$300,000 (US$17,850), consumers can not only reduce their carbon footprint but also generate the energy they consume, thereby contributing significantly to decarbonization efforts’’.

Edgardo Pereida, Director of Infrastructure, Bose Group, highlighted the global shift

toward carbon footprint reduction policies, with European legislation mandating the phasing out of internal combustion engine vehicles by 2035. Highlighting the scarcity of providers offering 100% clean energy in Mexico, the discussion pivoted toward combined-cycle power plants as the next viable option. “However, constraints within legislation regarding generation, distribution, and final delivery pose significant challenges for those seeking alternative solutions,” says Pereida.

Despite the momentum toward decarbonization, challenges persist. Castillo pointed out the bottleneck in energy transmission due to limited infrastructure. Resolving this issue requires long-term integrated planning and substantial investments in infrastructure to ensure widespread benefits.

Addressing the constraints posed by saturated energy networks, Cerdeira emphasized the importance of small-scale, self-sufficient generation units. “Even larger infrastructure projects, such as charging stations, are hindered by the capacity constraints of CFE across different regions of Mexico,” he says.

Nearshoring presents a significant opportunity for Mexico’s automotive industry and its decarbonization goals. However, achieving these objectives by 2030 and 2050 demands substantial investments and clear strategic planning, agree experts. As Pereida stated, decarbonization is not merely an option but an obligation for Mexico’s automotive sector, demanding a swift transition to clean, renewable, and sustainable energy sources.

Co NFERENCE H IGHLIGHTS 15

BEATING GRID LIMITATIONS TO ENSURE ENERGY SUPPLY SUCCESS

While enthusiasm for nearshoring in Mexico is evident from the influx of capital, it has yet to materialize into commensurate energy infrastructure development—a critical component for nearshoring success among companies. In an exploration of the intricacies surrounding energy infrastructure and supply chain dynamics, Mario Cavazos, Business Development Manager at Aggreko, offers insights into innovative strategies aimed at overcoming grid limitations and ensuring a dependable energy supply for industries.

one of Cavazos’ key takeaways underscores the significance of producing goods close to the final consumer. This strategy not only reduces transportation costs but also mitigates vulnerabilities associated with lengthy supply chains. The concept of nearshoring, often synonymous with Mexico, transcends mere relocation of operations to neighboring countries. It encompasses optimizing supply chains to efficiently fulfill consumer demands while diversifying investments across various regions.

“Nearshoring is not confined to Mexico alone; countries like the Philippines, Vietnam, and Brazil also reap substantial benefits from this phenomenon”

Mario Cavazos Business Development Manager, Aggreko

noted Cavazos, underscores the nation’s burgeoning industrial landscape.

Mexico has experienced a significant influx of investment in recent years, largely attributed to the nearshoring trend. While states in the northern region have garnered the highest levels of investment, notable investments have also been made in southeastern states such as yucatán and Veracruz. Key sectors attracting substantial investment include the automotive sector, accounting for 34%, followed by the manufacturing sector at 19%, and the logistics and distribution sector at 12%. “Amidst ongoing market restructuring, nearshoring emerges as the primary catalyst reshaping supply chains within the automotive industry,” observed Cavazos.

However, Mexico has emerged as a focal point for nearshoring investment in recent years, particularly in its northern states, attracting substantial capital influx. The proliferation of new industrial parks exemplifies the country’s dedication to fostering industrial development. Key sectors such as automotive, manufacturing, and logistics have witnessed significant investments, contributing to economic growth and job creation. “The remarkable increase in the number of industrial parks in Mexico by 50% from 2019 to 2022,”

However, despite the promising growth trajectory, challenges persist, particularly in the realm of energy infrastructure. The limited expansion of the national transmission network, as highlighted by data from the Secretariat of Energy (SENER) and the Mexican Institute for Competitiveness (IMC o ), underscores the urgency of addressing infrastructure constraints. Instances of alert and emergency operational states due to network failures, lack of infrastructure, and adverse weather conditions underscore the critical need for investment in energy infrastructure. Therefore, it is well acknowledged that among the primary challenges of nearshoring are access to electrical energy, availability of clean energy, waiting time for access to the network, continuity and quality of electrical supply, water supply, road and port infrastructure, and security.

“The lack of infrastructure and failures in the National Transmission Network, coupled with climatic issues in some cases, lead to increased intermittency and variability in frequencies and voltages. This results in production losses for companies working with thermoformed plastics or fiberglass industries,” said Cavazos.

Co NFERENCE H IGHLIGHTS 16

Given the substantial energy demand anticipated, infrastructure poses a significant concern for investors. An analysis of projects directed by the Ministry of Energy (SENER) for the national transmission network, as reported by the Mexican Institute for Competitiveness (IMC o), reveals minimal growth. Between 2020 and 2022, the length of transmission lines increased by only 0.17%, totaling 110,685 kilometers in 2022 compared to 110,497 kilometers in 2020. Furthermore, from 2015 to 2022, SENER instructed the CFE Transmission on 192 projects for expansion and modernization of the National Transmission Network (RNT), and 126 projects for expansion and modernization of the General Distribution Network (RGD) to CFE Distribución.

Aggreko offers customized solutions to tackle these challenges head-on. From balancing seasonal demands to bridging power gaps during scheduled maintenance or unexpected shutdowns, Aggreko delivers flexible and dependable power generation solutions. Leveraging its expertise in energy consulting, Aggreko assists in identifying opportunities for cost savings and facilitates the transition to more efficient generation assets. This not only enhances energy resilience but also reduces operational costs.

Despite Mexico’s significant strides in attracting nearshoring investment, there persist areas of concern, notably legal uncertainty, competitiveness, and the adoption of renewable energy. As Mexico consolidates its position as a pivotal trading partner with the United States, addressing these challenges becomes imperative to fully harness the potential of the nearshoring phenomenon. “It is not merely about rhetoric but about decisive action,” emphasized Cavazos.

ENERGY INFRASTRUCTURE DEVELOPMENT FOR MANUFACTURING GROWTH

Mexico stands at the forefront of the next generation of manufacturing in the world where the strategic development of energy infrastructure emerges as a pivotal element for ensuring sustained growth. By addressing critical considerations and leveraging lessons from successful global investments, Mexico can navigate challenges and capitalize on opportunities to propel its manufacturing sector forward.

Strategic planning for energy infrastructure in manufacturing necessitates careful consideration to prevent energy constraints from impeding economic growth in Mexico. The country faces a constrained grid that limits interconnection and subsequently hinders its capacity to support larger renewable energy projects. This grid limitation has led the government to restrict solar projects, prompting a need for alternative solutions such as distributed generation, albeit with a current limit of 500KW.

In the context of nearshoring in Mexico, Rodolfo Rueda, Partner, Holland & Knight LLP, explains: “A well-structured nearshoring scheme is paramount for driving Mexico’s energy transition. Without this transition, the development of grid transmission infrastructure will be hindered, ultimately impeding investment opportunities.” He adds that “without the generation of an appropriate nearshoring scheme, there will be no transition; without transition, there will be no transmission, and without transmission, there will be no investment.”

Despite the 500 KW limit, Víctor Mejía, Chief Commercial o fficer, Energía Real, sees it as an opportunity, stating: “The 500kW limit for distributed generation is no longer a barrier. Renewable energy certificates offer proof of commitment, and even isolated supply can count towards installed capacity.” The 500KW limit can be surpassed with storage systems as long as there is no grid injection—a

Co NFERENCE H IGHLIGHTS 17

solution showcasing a commitment to decarbonization. o perational continuity batteries and energy backup systems can also be profitable investments, contributing to sustainability. The evolution we see is in a mix of technologies to address energy issues so that companies can be more competitive and demonstrate a path to susta inability.

“Another challenge lies in the issue of government administrations, as it changes every 6 years. Integrating long-term strategic planning of infrastructure that encompasses logistics and provides a basis for continuity is essential. Volatility needs to change and necessitates having a roadmap for at least 25 years,” said Gonzalo Azcárraga, General Director Mexico, SENER.

Experts stress that addressing these limitations is crucial to leverage the opportunity that nearshoring represents. Moreover, federal energy policy, influenced by the factors mentioned above, has also focused on rescuing state companies such as PEMEX and CFE, leading to cheaper fossil-fueled energy. However, this presents another concern for the industry as offtakers increasingly demand cleaner energy sources.

Planning

Strategic planning for energy in the manufacturing industry, particularly in the automotive sector, entails careful consideration during a transitional period toward decarbonization. Mexico’s path to ensuring energy supply at this juncture involves advancing toward renewable

energies and decarbonization. Priorities include capacity for evacuation and transmission. However, energy needs extend beyond electricity; they also encompass port infrastructure, railways, airports, transportation, and logistics, which still heavily rely on fossil fuels.

As Mexico emerges as a nearshoring hub for manufacturing, especially in the automotive sector, planning becomes paramount. Priorities encompass not only planning but also devising a financing scheme as the transition requires significant investment, borne by the market. The challenge lies in planning the transition while ensuring a continuous energy supply and managing investment costs,” emphasizes Josefa Casas, Senior Associa te, Doxia.

“Sustainability encompasses more than decarbonization and environmental impact; it extends to the communities where infrastructure is developed, encompassing social, economic, and environmental aspects. It involves considering the entire supply chain, not just focusing on the plant area. Logistics, for instance, significantly impact carbon footprints. It’s about caring for the entire process, involving every sector and ensuring supply chain integrity,” said Casas.

Short-term v. Long-term P riorities

In the current scenario, it is imperative for companies to prioritize investments in diverse energy sources and technologies to mitigate risks associated with supply shortages or price volatility. Additionally,

Co NFERENCE H IGHLIGHTS 18

enhancing energy efficiency measures and promoting renewable energy integration can bolster resilience and competitiveness within the manufacturi ng sector.

Achieving a balance between short-term energy needs and long-term growth objectives requires a multifaceted approach. While immediate energy requirements must be met to sustain manufacturing operations, simultaneous efforts should focus on implementing sustainable practices and infrastructure upgrades. This involves investing in advanced technologies, fostering innovation, and collaborating with stakeholders to develop comprehensive energy strategies aligned with long-term growth trajectories.

Marco Cosío, Vice President for Smart Infrastructure, Siemens Mexico, Central America & Caribbean, emphasizes the role of technology in this endeavor: “The constant interaction makes digitization essential. We utilize technology such as software and AI to achieve reductions. Digitization enables dynamism, equipping companies with capabilities to make intelligent decisions. Technology must have a purpose and be based on digitization.”

As highlighted by experts, Mexico’s energy market is relatively new, with solar energy rapidly advancing as the cheapest energy source globally. This shift underscores the decreasing need for subsidies and highlights the importance of strategic investments in renewable energy to drive decarbonization efforts within the Mexican energy sector.

Lessons From Abroad

Mexico can glean invaluable insights from successful investments in grid and electrical infrastructure across the globe. Emphasizing robust planning processes, streamlined execution, and effective ongoing management are paramount. By studying best practices from countries with advanced energy infrastructures, Mexico can enhance project efficiency, optimize resource allocation, and mitigate potential pitfalls, thereby accelerating the pace of development and improving overall system reliability.

The attraction of private investments for energy infrastructure projects presents both challenges and opportunities. While financial barriers may deter private sector involvement, collaborative efforts between the public and private sectors can mitigate risks and unlock opportunities for investment. Public-private partnerships (PPPs) can offer innovative financing mechanisms, risk-sharing frameworks, and regulatory incentives to attract private capital. By fostering an enabling environment for investment and promoting transparency, Mexico can harness the potential of private sector participation to drive energy infrastructure development and support the growth of its manufacturing sector.

“The problem lies in finding these sources of financing, in PPPs, changes in laws that are not within our control. The acceleration or speed would be different if investment in PPPs were opened up,” said Cosío.

ADEQUATE, CLEAN, AFFORDABLE ENERGY: XÓCH ITL GÁLVEZ

The current state of the energy sector cannot sustain the wave of nearshoring due to the closure of opportunities for private investment, as highlighted by Fernando Zendejas, Deputy General Energy Coordinator, Board for Xóchitl Gálvez during the Mexico Nearshoring Summit. This closure represents a significant barrier

to economic growth and innovation within the sector.

“We are committed to fostering a fair energy transition, streamlining processes, and enhancing competition within the energy sector to effectively address the evolving demands of both the market and

Co NFERENCE H IGHLIGHTS 19

the populace,” said Zendejas. However, he underscored the challenges posed by the current administration’s policies, citing that 97% of alerts generated within the energy sector are attributed to faults in transmission and distribution networks.

Even though Mexico has a unique opportunity presented by the current geopolitical climate, there are significant hurdles within Mexico’s energy policy framework, such as bureaucratic processes that delay projects and a lack of safety. To overcome these challenges, it is imperative to uphold the rule of law, as emphasized by Zendejas. This serves as a stark reminder that disregarding established processes not only impedes progress but also deters private investment—a critical issue compounded by “outdated perspectives reminiscent of the 1970s.”

“We need to ensure an efficient and sustainable nearshoring scheme to meet the needs of companies, while also protecting the constitutional integrity of the process to promote the development and transparency of the industry”

Fernando Zendejas General Deputy Coordinator of the Energy Board for Xóchitl Gálvez

“We need to ensure an efficient and sustainable nearshoring scheme to meet the needs of companies, while also protecting the constitutional integrity of the process to promote the development and transparency of the industry,” said Zendejas.

The energy transformation proposals from Xóchitl Gálcez presented during the conference regarding the importance of ensuring sufficient, secure, and affordable energy as we transition towards cleaner sources—a goal that necessitates simplified and enhanced competition within the sector.

Renewable energy and the sustainability of state companies stand out as prominent proposals advocated by Gálvez. These initiatives are intricately linked with overcoming bureaucratic obstacles that impede market expansion, all with the overarching goal of enhancing the economic development of Pemex and CFE. In 2023, state companies attracted investments amounting to MX$2.5 trillion, equivalent to 10% of GDP.

However, despite this substantial investment, sustainable production remains elusive. As highlighted by Zendejas, CFE’s current production capacity stands at 53GW, whereas 25GW is deemed necessary to adequately support nearshoring initiatives.

THE FUTURE OF NATURAL GAS AND LNG IN MEXICO ’S ECONOMY

The transition fuel, liquefied natural gas (LNG), is playing a pivotal role in Mexico’s natural gas industry, offering diverse opportunities for businesses to thrive amidst evolving market dynamics. In the same manner that the country stands as a nearshoring hub, its crucial location positions Mexico as a central hub for LNG and LNG exports, says Vania Laban, President, Mexican Association of Natural Gas (AMGN).

Mexico possesses access to the most affordable natural gas globally, a critical advantage as nations endeavor to transition their economies and industries towards

cleaner energy sources while maintaining reliability and productivity, as highlighted by Laban. However, Mexico’s primary challenge lies in bridging the gap within its gas infrastructure.

Natural gas generates 50% fewer emissions than oil in power generation. Reliable and affordable energy is also susceptible to disruptions stemming from unforeseen factors, including geopolitical conflicts or health emergencies, as evidenced by events over the past five years. In light of these benefits, LNG emerges as a promising alternative to mitigate such potential disruptions.

Co NFERENCE H IGHLIGHTS 20

Ana Ludlow, VP Chief Government Affairs & Sustainability o fficer, ENGIE Mexico, emphasized the unique characteristics of LNG, stressing the need for tailored taxation policies. Instead of applying conventional fuel taxation to LNG, Ludlow proposes incentivizing its adoption and utilization. “Advancing in the pursuit of decarbonization alternatives requires leveraging the potential of gas,” she asserted. “This entails not only attracting new investors through nearshoring but also enhancing the competitiveness of the industry already established in the country.”

Understanding the significance of natural gas and exploring avenues for diversification within this sector are essential for companies aiming to enhance resilience and capitalize on emerging market opportunities. By delving into key market dynamics, infrastructure development, policy implications, and collaborative strategies, businesses can navigate the complexities of Mexico’s natural gas landscape and position themselves for sustainable growth.

Sergio Romero, Regional Vice President of Regulation and Public Affairs at Sempra Infraestructura, emphasized that the government bears the responsibility of establishing regulatory frameworks, while the decision to investment lies with stakeholders. “With over 28 years of sustained investment, our dedication is rooted in the industry’s strong foundation and the inevitable surge in energy demand fueled by offshoring. Nevertheless, it is crucial to acknowledge that private investment ought to complement public

initiatives, thereby forming a unified strategy to tackle the dynamic energy landscape.”

Infrastructure development plays a crucial role in unleashing the full potential of natural gas and LNG in Mexico. “We need infrastructure because we are missing opportunities not only in the energy sector but across the country. Where we need the most investment is in lastmile infrastructure,” said Alejandro Peón, Country Manager Mexico, Naturgy Mexico.

He emphasized that investments in pipeline networks, storage facilities, and liquefaction terminals are vital for facilitating the efficient transportation and distribution of natural gas resources. Companies have the opportunity to contribute and capitalize on this development by collaborating with government entities and industry stakeholders to streamline infrastructure projects and enhance connectivity across the sup ply chain.

Existing and evolving policies and regulations significantly impact the future trajectory of natural gas and LNG in Mexico. Companies must proactively navigate this regulatory landscape by advocating for favorable policies, complying with regulatory requirements, and mitigating potential risks associated with regulatory changes. Adopting a proactive approach to policy engagement enables businesses to align their strategies with evolving market dynamics and regulatory frameworks, fostering long-term sustainability and growth.

Co NFERENCE H IGHLIGHTS 21

“Public policies have the potential to significantly bolster infrastructure development. With collective agreement and alignment, these policies can be further refined and strengthened. Armed with stable and dynamic regulatory frameworks, companies are empowered to concentrate their efforts on the strategic deployment of infrastructure, thereby fostering the growth and vitality of development parks,” said Peón.

The future of natural gas and LNG in Mexico’s economy is influenced by various market dynamics, including fluctuating global energy demand, geopolitical factors such as the Ukraine war, and technological advancements. Companies must remain agile in response to these dynamics, embracing innovation and flexibility to adapt to changing market conditions swiftly. By staying abreast of market trends and consumer preferences, businesses can identify niche opportunities and tailor their offerings to meet evolving demands effectively.

Collaboration and partnerships are integral to fostering a more integrated and

sustainable natural gas ecosystem in Mexico. Across various stages from exploration and production to distribution and consumption, companies can capitalize on collaborative initiatives to optimize resource utilization, improve operational efficiency, and foster innovation throughout the value chain. Encouraging a culture of collaboration and knowledge exchange within businesses can generate synergies that positively impact all stakeholders, thereby advancing the growth and development of Mexico’s natural gas industry.

“ With vast opportunities ahead, including unmatched access, infrastructure, and potential for extensive transportation networks, our regulatory market must evolve to foster collaboration between stakeholders and regulators. Effective communication is crucial in this pivotal sector, as we strive to elevate natural gas beyond its traditional role and harness its potential for sustainability. It is our responsibility to expedite this transition, accelerating progress towards a greener future,” said Laban.

UNLEASHING SOLAR POTENTIAL TO GUARANTEE SUSTAINABLE ENE RGY SUPPLY

Solar energy emerges as a promising solution within Mexico’s energy sector, providing a viable pathway toward sustainability. Through an examination of Mexico’s present standing in solar energy, coupled with technological advancements and the potential for distributed generation and energy storage, stakeholders are set to unlock the full potential of solar energy, thereby guaranteeing a sustainable and dependable energy supply for the future. Prevailing challenges, such as infrastructure constraints, however, have limited the utilization of these energy generation systems.

Mexico continues to grapple with critical infrastructure constraints, particularly concerning the expansion and modernization of its electrical grid to

guarantee a reliable electricity supply. This issue becomes especially imperative in regions characterized by robust industrial development, where there is a notable uptick in energy demand. Furthermore, in underdeveloped areas, improving this infrastructure has the potential to act as a catalyst for heightened industrial investment.

Currently, Mexico possesses abundant solar resources, making it an ideal candidate for solar generation. Embracing solar energy not only contributes to sustainability but also reduces dependence on fossil fuels and mitigates environmental impacts associated with traditional energy sources. Empowering the end-user to make decisions regarding their energy consumption marks a significant shift, driven by technological advancements. “In a country where 90% of households are

Co NFERENCE H IGHLIGHTS 22

domestic, reducing dependency on the grid is inevitable,” said Jorge Musalem, Strategic Projects Manager, CFE.

The increased utilization of solar is key for Mexico to advance in its energy transition, but also to ensure the continued harnessing of the benefits that nearshoring has brought to the national economy. “Mexico is in a particular condition not only due to nearshoring but also because its generation matrix relies on fossil fuels,” said Nelson Delgado, General Manager, AS o LMEX. “If we are not capable of generating solar energy, nearshoring will slip away from us,” added Zúñiga.

To enhance the adoption of solar energy and improve Mexico’s energy supply, stakeholders must prioritize the implementation of solar projects and invest in infrastructure to support distributed generation.” If we generate and store energy at the point of consumption, rather than transporting it, costs are reduced. It is only a matter of time before users start to opt out of the grid,” said Musalem.

“We want to power industrial parks, yet we see almost 100% of the rooftops empty. There is very limited photovoltaic solar generation,” said Ricardo Zúñiga, Country Manager, CapWatt.

Another challenge facing the solar industry in Mexico is the lack of transmission infrastructure to accommodate the growing demand for renewable energy. To address this issue, DG has appeared as a crucial alternative. These systems have experienced significant growth, notably led by Jalisco,

marking its most successful year to date. Despite limitations such as a maximum capacity of 0.5MW per installation, which falls short compared to Brazil’s 5MW capacity, the sector has seen a remarkable surge of 49% since 2019. This highlights a notable shift toward renewable energy participation, despite initial governmental reservations. By the end of 2023, DG had attracted investments totaling US$4.5 billion, with an installed capacity of 3,300MW, according to CRE.

From a technological standpoint, significant advancements have been made in the implementation of photovoltaic projects in Mexico. Innovations in solar panel efficiency, energy storage systems, and grid integration technologies are revolutionizing the solar industry, rendering solar energy more accessible and cost- effective.

“Efficiency rates of modules have surpassed 20%, compared to previous standards, utilizing less space and incorporating bifacial technology. These advancements have led to increased efficiency, reduced degradation, and maintained high performance over time,” said Iván Reyes, Utilities Director, LoNGi Solar. By leveraging these advancements, stakeholders can overcome technical barriers and accelerate the deployment of solar projects, driving the sustainable energy transition across the country. Moreover, the solar industry must educate stakeholders on the economic benefits of various technologies, extending beyond installations up to 500kW, according to Musalem. Furthermore, incentivizing industrial adoption through diverse business

Co NFERENCE H IGHLIGHTS 23

models is crucial for widespread acceptance, explained Zúñiga.

The economic viability of solar energy presents an attractive proposition for industry development. According to a report by the Mercom Capital Group on corporate financing within the solar sector in 2023, there was a notable 42% yearon-year increase in global financing. This report meticulously tracks venture capital, public market, and debt financing activities, revealing a substantial total of US$34.3 billion raised across 160 deals in 2023. This represents a significant surge compared to the US$24.1 billion raised through 175 transactions in 2022, marking the highest level of corporate financing within the solar sector in the past decade.

AME: STRATEGIC VISION 2030

The Mexican Energy Association (AME) unveiled its strategic vision for the nation’s electric industry in 2030, emphasizing the imperative of investing in addressing energy transmission and distribution challenges. This vision was articulated by Gumersindo Cué, Executive Director of AME.

AME is comprised of 22 electric energy generating companies, boasting a collective capacity of 37,240 Megawatts, with an accumulated investment of US$30 billion over time.

Additionally, the consortium encompasses 15 affiliated entities specializing in clean energy generation, technology, consulting, law firms, and engineering services. Notably, approximately 65% of the energy generated by AME is derived from combined cycle methods, with wind energy contributing 16% and solar-photovoltaic contributing 11%. The remaining 8% encompasses various sources including cogeneration, gas turbines, thermoelectric processes, internal gas combustion, and battery technology.

“AME companies possess the requisite expertise, robust resources, advanced technologies, and comprehensive market

Solar photovoltaic generation holds immense potential to guarantee a sustainable energy supply in Mexico. By embracing solar energy solutions, leveraging technological advancements, promoting distributed generation, and addressing infrastructure constraints, stakeholders can unlock the full benefits of solar energy and pave the way for a cleaner, more resilient energy future, agree experts.

“All that is new requires adaptation, especially when it comes to such an essential service as electricity. Now, meeting the transition is imperative, with numerous challenges and hurdles ahead,” said Alessandra Amaral, Executive Director, ADELAT.

penetration across all facets of the value chain, essential for championing and bolstering Mexico’s energy transmission,” said Gumersindo Cué, Executive Director, AME.

A primary role of AME in the electric sector is to contribute to its development by identifying areas in the electric grid design that require strengthening. This is particularly crucial as the sector plays a pivotal role in enabling nearshoring policies for foreign companies in Mexico. This importance is underscored by the estimation of the Inter-American Development Bank, which suggests that leveraging Mexico’s potential in this regard could yield approximately US$75 billion for the country.

Identified areas of development encompass the provision of ‘accessible, clean, reliable, competitive, and affordable energy,’ with a paramount emphasis on traceability. This entails ensuring that energy sources are verifiable and certified as sustainable,” according to Gumersindo Cué.

Additionally, there exist significant regulatory opportunities. According to an exploratory study by Morgan Stanley, as

Co NFERENCE H IGHLIGHTS 24

many as 74% of companies indicate that regulatory procedures in the electric sector need to be streamlined. This finding resonates with a broader trend across industries where regulatory frameworks are being reevaluated to accommodate technological advancements and evolving market demands.

“AME companies possess the requisite expertise, robust resources, advanced technologies, and comprehensive market penetration across all facets of the value chain, essential for championing and bolstering Mexico’s energy transmission”

Gumersindo Cué Executive Director, AME

adopting new technologies, and fostering close collaboration between the private and public sectors in the electric sector. While the total capacity of the electric grid is 88 gigawatts, not all capacity is available at all times. In 2023, a historic demand of 53,000 megawatts was reached, with available capacity at that time being 57,000 MW, dangerously close to the infrastructure’s reliability limit.

The study also concluded that four major needs must be addressed to enhance electric transmission competitively. These include increasing generation capacity, investing in transmission and distribution networks,

According to estimates from Morgan Stanley, there is a need to increase the country’s energy capacity by 65% to cover up to 56 MW. Additionally, an extra 12.8 GW of capacity increase will be necessary within the next five years due to natural demand growth. However, to capitalize on the opportunities and needs presented by nearshoring policies, another 25 GW will be required within the same period. In summary, the country’s energy generation capacity must increase by at least 37 GW by 2029. Failure to address the country’s transmission and distribution problems could result in congestion costs equivalent to a loss of US$50 0 million.

CATEM’S ROLE: TAKING ADVANTAGE OF NEARSHORING IN MEXICO

Nearshoring presents both opportunities and challenges for Mexico’s labor force. Recognizing the importance of proactive engagement, Mexico’s Autonomous Confederation of Workers and Employers (CATEM) is playing a pivotal role in advocating for the rights and interests of workers amid the influx of investment and job opportunities associated with nearshoring.

At the core of CATEM’s mission is the empowerment of workers and the promotion of fair labor practices. Focused on harnessing the potential of nearshoring to benefit workers and communities, José Carlos Saavedra, Secretary of Foreign Relations, CATEM, underscored the confederation’s commitment to ensuring that labor rights are upheld and that workers are empowered in this shifting economic landscape.

Saavedra emphasized the need for collaboration between labor organizations, government agencies, and businesses to ensure that nearshoring initiatives translate into tangible benefits for workers. This includes advocating for fair wages, safe working conditions, and opportunities for skills development and career advancement.

CATEM is actively involved in fostering dialogue and cooperation between labor unions and companies to address the evolving needs of the labor market. By facilitating constructive engagement and negotiations, CATEM aims to strike a balance between the interests of workers and the imperatives of economic development.

Saavedra identifies three key conditions enabling the success of nearshoring in Mexico regarding talent:

Co NFERENCE H IGHLIGHTS 25

Mexico’s ratification of International Labor o rganization (IL o ) Convention 98 on freedom of association in 2018.

The 2019 Labor Reform in Mexico, which established conditions for operationalizing and implementing freedom of association, fundamentally altering the labor landscape

The enforcement of USMCA and its dispute resolution mechanism, which significantly impacted nearshoring decisions. This mechanism allows labor violations to be addressed, potentially resulting in trade sanctions against non-compliant labor centers, thus emphasizing the importance of considering evolving labor conditions for companies investing in Mexico.

“Mexico’s labor laws are among the world’s most modern, promoting extensive worker freedoms. However, these laws also impose greater responsibilities on unions, forcing them to uphold the standards outlined in the Labor Reform and USMCA. Failure to do so jeopardizes both jobs and investments,” states Saavedra.

Saavedra emphasizes the importance of Chapter 23, focusing on labor rights, and Chapter 31, addressing dispute resolution, in USMCA. He underscored the need for ongoing scrutiny of these chapters during the USMCA revision.

In addition to advocating for labor rights, CATEM is also focused on promoting inclusive growth and social development in communities affected by nearshoring activities. This entails supporting initiatives aimed at enhancing education, healthcare, and infrastructure to uplift the standard of living for workers and their families.

Despite the opportunities presented by nearshoring, CATEM remains vigilant against potential threats to workers’ rights and well-being. This includes concerns related to job insecurity, precarious employment arrangements, and the erosion of labor standards. By monitoring developments in the labor market and advocating for robust legal protections, CATEM seeks to safeguard the interests of workers in an ever-changing economic landscape.

THE MEXICAN GATEWAY TO GLOBAL CHINESE AUTO AND ENERGY INDUSTRIES

The arrival of Chinese automotive companies in Mexico marks a significant milestone in the globalization of the automotive industry. China, as a major player in the global automotive market, presents Mexican companies with opportunities for partnerships, investments, and technology transfers amidst the famous nearshoring trend.

Doing business with China has become increasingly accessible despite language differences, geographical remoteness, and prevailing prejudices”

Carolina Núnez Director General, China Chamber of Commerce and Technology Mexico

Carolina Núñez, Director General, China Chamber of Commerce and Technology Mexico, explains that doing business with China has become increasingly accessible despite language differences, geographical remoteness, and prevailing prejudices. The world is gradually recognizing China’s economic importance, which holds significant implications for Mexico.

China’s major economic hubs, including the yangtze River Delta, Beijing-Tianjin-Hebei, Chengdu-Chongqing Economic Circle, and the Guangdong-Hong Kong-Macau Greater Bay Area, serve as examples of long-term regional planning and development. The Greater Bay Area, celebrating its 10th anniversary, exemplifies China’s strategic planning, transforming former fishing outposts into bustling technological hubs

Co NFERENCE H IGHLIGHTS 26

like Shenzhen, often referred to as the Silicon Valley of Asia.

Translating China’s strategic development plans to Mexico’s context, Núñez emphasizes the potential benefits for Mexico’s automotive industry. Mexico’s strategic location, skilled labor force, established supply chains, and favorable trade agreements position it as an attractive destination for Chinese automotive companies seeking international expansion.

China’s automotive industry boasts global experience and market share dominance, representing 31% of the global automotive market. With explosive growth in recent years, China offers valuable expertise in electric vehicles (EVs), battery technology, and renewable energy—a potential source of technology transfer and knowledge exchange for Mexican companies.

Expanding on China’s EV industry growth, Núñez underscores the importance of communication and marketing strategies, which have enabled Chinese companies to capture significant market shares in Mexico. Leveraging Chinese practices, Mexico can optimize infrastructure development to support the adoption of new automotive

technologies, including charging stations and battery recycling facilities.

Núñez highlights the importance of fostering partnerships and collaboration between Chinese and Mexican businesses to capitalize on shared opportunities and address common challenges. By facilitating dialogue and cooperation, the China Chamber of Commerce and Technology Mexico aims to create a conducive environment for investment and growth in both sectors.

While recognizing the opportunities presented by Chinese automotive companies, Núñez also acknowledges the challenges, including regulatory compliance and cultural differences. overcoming these complexities requires a reevaluation of prejudices and a concerted effort to deepen the Mexico-China relationship.

To strengthen this relationship, Núñez suggests leveraging formal incentives for industry development, addressing energy challenges, ensuring good governance, and upholding the rule of law. Triangulating US-Mexico-China trade relationships presents an opportunity for Mexico to maximize its benefits from this pa rtnership.

CHINESE AUTOMOTIVE OEM ACHIEVEMENTS AND AMBITIONS IN MEXICO

Representatives from Chinese automotive o EMs deliberated on their achievements, challenges, and aspirations for entering and establishing a foothold in the Mexican market. They emphasized integration into Mexican production lines and the growing acceptance of EV vehicles due to their quality and continuously improving postsale s service.

In the realm of heavy-duty trucks, a profound shift has unfolded over the past three years within Mexico’s automotive landscape, driven by the entry of Chinese manufacturers. Carlos Pardo, Executive Managing Director, SHACMAN Mexico, emphasizes the strides in safety and quality

achieved by Chinese brands in the Cab over segment. Pardo asserts that these brands, utilizing globally recognized components akin to their European counterparts, now stand on par with leading industry standards.

Echoing Pardo’s sentiments, Sergio Chavarría, After-sales Corporate Director, LDR Solutions, reaffirms the ascendancy of Chinese-made vehicles to worldclass status. Chavarría highlights China’s shift towards prioritizing cutting-edge technology, a strategy resonating well with the Mexican market. He contrasts warranty durations, with Chinese manufacturers offering warranties surpassing seven years,

Co NFERENCE H IGHLIGHTS 27

outpacing their American counterparts by a considerable margin.

With Mexico boasting 2 million jobs in the automotive sector and over 600 autoparts companies, 30% of which are tier 1 suppliers, along with 26 R&D centers and over 15,000 engineers across 15 states, the appeal for Chinese automotive companies in our country is undeniable.

Experts like Ari Saks, Associate Partner, E y, elucidate the pivotal achievements of Chinese original equipment manufacturers (o EMs) in Mexico. Saks accentuates the trifecta of high-quality vehicles, competitive pricing, and exemplary service, alongside the ready availability of spare parts. Moreover, Chinese companies view Mexico as an ideal hub for future automotive exports, leveraging the nation’s extensive trade agreements.

Despite these successes, challenges persist. Chavarría identifies market penetration as a paramount obstacle, compounded by entrenched incumbents and the imperative for localized parts procurement. Nonetheless, he underscores the receptiveness of o EMs towards local suppliers. “The o EMs have no problem with local suppliers as long as they align with the required quality standard,” says Sergio Chavarría.

Acknowledging the significance of post-sale services and cultural integration, companies

have implemented robust mechanisms to ensure customer satisfaction. Additionally, talent acquisition poses a multifaceted challenge, balancing the availability of skilled labor with specialized expertise. Collaboration between industry players, educational institutions, and government entities emerges as imperative to bridge this gap.

“Talent in Mexico exists, but it is not sufficient for all companies, so o EMs will need to work hand in hand with authorities and educational institutions to create and implement technical schools or specialized careers to meet the demand for these types of positions. We are practically hiring them as soon as they graduate because we need them,” says Ari Saks.

Carolina Nuñez, General Director, China Chamber of Commerce & Technology in Mexico, underscores the Chinese business community’s proclivity towards long-term planning. “They do not like short or mediumterm investment, but once the decision is made, their development is overwhelming,” says Carolina Nuñez.

With a keen eye on expansion, Chinese oEMs are strategically positioning themselves to leverage Mexico’s automotive capabilities, as highlighted by Carlos Perea. “Mexico can supply what they need and they want to create a logistics center for their automotive industry in Latin America and eventually enter the US market,” he says.

EXPLORING THE ADVANTAGES OF THE STATE OF MEXICO IN FACE OF N EARSHORING

Mexico stands at a significant juncture, poised to harness potential profits exceeding US$168 billion from nearshoring initiatives over the next five years. While attracting investment remains paramount for states, the State of Mexico offers advantageous features such as readily available labor force, logistical efficiency, and ample land availability, reports SEDECo

Laura Teresa González, Minister of Economic Development for the State of Mexico (SEDECo), underscored the state’s pivotal role as the country’s second-largest contributor to national GDP, representing 9% of the total. Moreover, it leads the nation in the number of economic units, boasting over 701,000 establishments, constituting 13% of the country’s total. Additionally, the state

Co NFERENCE H IGHLIGHTS 28

ranks second in terms of GDP contribution from the manufacturing sector.

The State of Mexico boasts an extensive infrastructure network, including more than 16,000km of highways, 1,300km of railway network, and two international airports: the recently inaugurated Felipe Angeles International Airport (AIFA) and the Toluca International Airport. The state also enjoys proximity to the Mexico City International Airpor t (AICM).

In terms of industrial parks, the state stands out with over 161 parks hosting more than 2,779 companies, providing employment to over 230,600 people. According to González, these industrial parks comprise 75 municipal, 84 private, and two governmentowned facilities.

González emphasized the State of Mexico’s highly skilled labor force, equipped to meet industry-specific demands, as it hosts 1,139 higher education institutions with over 565,567 students. Additionally, the state boasts over 4.1 million students across basic to postgraduate levels. “There is no other state in Mexico with such a skilled labor force, tailored to the industry’s needs,” she remarked, highlighting the state’s labor stability, free from strikes for over 13 years.

Regarding exports, the United States dominates with over 70.9%, followed by Germany with 4.1%, and Colombia with 3%. Transportation equipment leads the export sectors with 30%, followed by machinery and equipment (23.1%) chemicals (13.5%), and metallic products (8.7%).

The State of Mexico shines as a leader in manufacturing, automotive, commerce, and services sectors in terms of economic units. With 11 manufacturing plants for light and heavy vehicles, and motors, the state hosts major companies such Ford, General Motors, Stellantis, and Daimler, among others.

González highlighted the recent recognition of the State of Mexico as the premier state for the logistics sector, attributed to the presence of key companies such as Amazon, Mercado Libre, Walmart, and Shein, which have established distribution centers in the state. The state’s strategic location facilitates connectivity with the Pacific o cean, the Gulf of Mexico, the Bajio region, as well as western and central Mexico, she noted.

González announced that the local government will unveil seven development hubs for strategic sectors in June 2024. These development poles will include land use zoning, land availability, connectivity, water, energy, and labor force availability. “We will work closely with companies through SEDEC o , guiding them in their paperwork and other requirements from project inception to completion,” she added.

González highlighted that the local administration aims to continue growing in the manufacturing, logistics, and automotive sectors, while also targeting expansion in the aerospace, textile, chemical, and food and beverage industries. As part of this objective, since assuming office in September 2023, the local administration has prioritized improvements in housing, environment, infrastructure maintenance, and enhancing security.

Co NFERENCE H IGHLIGHTS 29

“There are only a few states in the country that can offer all these features together to attract every kind of investment,” said

González, mentioning ongoing discussions with the federal government to develop incentive packages.

INTEGRATING MEXICAN MANUFACTURING IN NORTH AMERICAN SUPPLY CHAINS

In 2023, the United States made more purchases of goods from Mexico than from China, marking the first occurrence in two decades, according to the US Commerce Department. The value of goods imported by the United States from Mexico witnessed a nearly 5% increase from 2022 to 2023, surpassing US$475 billion. Meanwhile, the value of Chinese imports experienced a 20% decline, reaching US$427 billion. The last time Mexican goods imported by the United States exceeded the value of Chinese imports was in 2002.

“This presents a significant opportunity for many to prosper in Mexico, except for Mexicans themselves, due to the lack of integration of Mexican companies into value chains,” stated Andrés Díaz, Vice President of the young Industrialists Commission, C o NCAMIN, during the conference “The Integration of Mexican Manufacturing into North American Supply Chains” at the Mexico Nearshoring Summit 2024.

When China joined the World Trade o rganization in 2001, it saw an influx of foreign investment known as offshoring. However, companies seeking to establish operations in China had to comply with the country’s joint venture policy, which involved majority Chinese employee representation, integration of local suppliers within three years, and responsibility for specialized employee training, as outlined by Díaz.

“This presents a significant opportunity for many to prosper in Mexico, except for Mexicans themselves, due to the lack of integration of Mexican companies into value chains”

Andrés Díaz Vice President of the Young Industrialists Commission,CONCAMIN

Challenges such as delays in quoting and incomplete responses to inquiries hinder progress. Additionally, the absence of a coherent national strategy for foreign direct investment was highlighted, leading to a scenario where states vie for investment opportunities, leaving room for exploitation by external entities, particularly Chinese firms.

“This scenario does not bode well for Mexico and will not change without guidelines for responsible foreign investment in the country,” Díaz emphasized. However, as the United States shifts its focus away from China, Mexico stands to benefit from its strategic location, proximity to major global markets, robust infrastructure and trade agreements, highly skilled labor force, and strong manufacturing capabilities, solidifying its position as a key trad e partner.

According to S&P Global, Mexico has emerged as a leader in manufacturing reshoring, both from the United States and mainland China, a trend that began with the inception of NAFTA in 1994 and gained momentum with the reformation of NAFTA as USMCA in 2020. Mexico’s strengths primarily lie in assembly, with the automotive sector dominating exports at 29.1% in 2022. Additionally, exports of computers, predominantly servers, contributed 8.4%, while other consumer electronics and electricals accounted for 9.5%.

The integration of local suppliers from companies originating in other countries emerged as a focal point. Participants stressed the need to eliminate exploitative intermediaries and bring visibility to local businesses. Market diversification was emphasized as a strategy to enhance

Co NFERENCE H IGHLIGHTS 30

margins, foster development, raise wages, and increase value-added outputs.

There is an urgent need to streamline processes and level the playing field with China, according to Díaz. “We are at Mexico’s most competitive juncture in the

last 40 years, not only to participate but to lead the global export market and integrate local companies into supply chains.” However, Mexico must develop a strategy to incorporate local companies into supply chains to retain nearshoring benefits within the country.

MEXICO, US, CHINA: TARIFFS, TALENT, ENERGY, NEARSHORING FUTURE

The intricate interplay of tariffs, talent availability, trade agreements, energy infrastructure, security concerns, and the rule of law is fundamentally reshaping nearshoring investments among Mexico, the United States, and China. These factors, bolstered by data-driven insights, are not merely influencing manufacturing decisions but also restructuring strategic alliances and competitive landscapes across the region.

Kenneth Smith, Partner, Agon, and Former Chief Negotiator for the modernization of NAFTA, elucidated that the confluence of factors shaping post-pandemic global trade represented a “perfect storm.”

Logistical costs and the US-China trade war contributed to Mexico attracting record levels of foreign direct investment, underscoring the success of the USMCA.

Delving into the trade conflict between the United States and China, Mauricio Jaramillo, President, Mexico Texas-European Chamber of Commerce, elucidated that the tariffs levied on China vis-à-vis free trade between the United States and Mexico presented a competitive commercial advantage. Smith concurred, noting Mexico’s role in

replacing China as a trading partner due to its tariff advantage and world-class production platform established over 30 years of NAFTA.

However, Larry Rubin, President, American Society of Mexico (AMSoC), cautioned that a review of the USMCA looms on the horizon, with discussions anticipated regardless of the outcome of the next US elections. He highlighted concerns among US lawmakers regarding China’s influence in Mexico, forecasting a potential renegotiation of the USMCA under the sunset clause in 2026 to address these issues.