IMPACT REPORT

THANKS TO ALL OUR SPONSORS

OVERALL SPONSORS

Networking Coffee Break Sponsor

AEROS PACE TRACK

Silver Sponsor

Silver Sponsors

Networking Cocktail Sponsor

INDU STRY TRACK

Silver Sponsors

INDU STRY TRACK

Silver Sponsor

TA LENT TRACK

Platinum Sponsor

EN ERGY TRACK

Platinum Sponsors Gold Sponsors

Silver Sponsor

AUTOMO TIVE TRACK

Platinum Sponsor

Gold Sponsors

Silver Plus Sponsors

NATURAL GAS TRACK

Platinum Sponsor

Gold Sponsor

Gold Sponsors

Silver Sponsor

NEARSHO RING TRACK

STRATEGIC ALLIANCES

The Mexican economy finds itself at a pivotal, yet contradictory, crossroads. On one hand, Mexico has surged to become the largest trading partner of the United States, displacing China and cementing its position as a leading contender for nearshoring opportunities to reach the world’s most important consumer market. On the other hand, this rapid ascent has exposed critical vulnerabilities. Inadequate infrastructure is struggling to support the significant interest and evolving needs of global supply chains. Furthermore, geopolitical factors and the United States’ shifting its trade policy from globalization to a more protectionist stance are fostering caution among investors, raising questions about the long-term safety and stability of establishing manufacturing operations in Mexico.

While nearshoring is not a new phenomenon, but a trend that started with the signing of the North American Free Trade Agreement (NAFTA), experts have long warned that Mexico has not and is not fully capitalizing on the advantages of having a deep integration with the United States. Despite decades of operating under NAFTA and the subsequent USMCA, Mexico has historically failed to translate its geographic and trade advantages into the necessary long-term investments in infrastructure, energy security, and workforce specialization.

The USMCA’s 2026 review adds a further layer of complexity to this equation, introducing a period of inevitable political and trade uncertainty. However, the Mexican business community is viewing this challenge not as a deterrent, but as a source of opportunity. Companies understand the urgent need to start working with the country’s existing assets to build a stronger economy and demonstrate that Mexico is a reliable, mature, and capable partner for sustained North American integration.

It was within this context that the second edition of the Mexico Business Summit was held in Monterrey, Nuevo Leon. Business and political leaders gathered not only to dissect the challenges Mexico presents for national and foreign investors, but also to share actionable insights on how to better navigate the Mexican context. The primary goal was to define strategies that successfully deliver value, not only to final consumers and global supply chains, but also to drive national economic and social development.

411 companies

633 conference participants

152 speakers

2nd edition

30 sponsors

47,877 visits to the conference website

Breakdown by job title Conference social media impact Pre-conference social media impact

direct impressions during MBS

direct pre-conference LinkedIn impressions 4% click through rate during MBS

pre-conference click through rate

Matchmaking

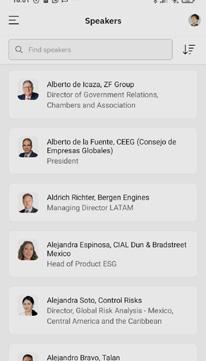

Mexico’s leading B2B conference organizer uses a customized app to deliver an unparalleled experience

The MBE App delivered AI-powered intent-based matchmaking to Mexico Business Summit 2025 attendees

MBE App Impact

440 participants

3,097 matchmaking communications

528 1:1 meetings conducted

Matchmaking intentions Total

4,047 2,562 Trading 1,485 Networking

• 3C Metrology

• 5 Steps H eadhunting

• 99 Minutos

• Abitat

• ACCEL

• ACCIO NA ENErGIA

• Acclaim Energy

• Accudyn

• ActionCOACH

• AECOM

• AeroVant

• Agencia Danesa de Energia

• Agencia Estatal de Energías renovables

• Agencia Estatal de Energías renovables de Nuevo León

• AGENCIA rOJAS VELA Y ASOCIADOS

• Aggreko

• AIFA

• Air Charter Service

• Alian Plastics

• Alliance

• ALPEK-NEG

• Altamira Terminal Multimodal

• AMACArGA

• AMAr A NZErO

• AmCham Mexico - Monterrey Chapter

• AMCHAM Northeast Chapter

• AMDEE

• AME

• AMECH / H uman Staff

• AMENEEr

• AMGN

• AMITI

• AMSCA

• Anchor relocation Worldwide

• ANPACT

• APM Terminals

• Apymsa

• Area Industrial

• ArTIG r AF

• Ar ZYZ

• Atlantica

• Atlas renewable Energy

• AUMOVIO

• Autoliv

• AUTOZONE MEXICO

• Baker McKenzie

• Banco Base

• Banregio

• BBVA

• Becerril, Coca & Becerril

• BErGEN ENGI NES MEXICO

• Beyond Logistics

• BID Invest

• Biocinergia

• BioWare

• BNSF

• BN SF railway

• Borealix

• B r ENNTAG

• B rIO Energia

• B rIO SUMINISTr ADOS ENErGETICA

• BTX GLOBAL LOGISTICS

• Bulkmatic de México

• business 2 Connect

• Business Sweden

• C.H robinson

• CAINTr A

• Caliza

• Cámara Nacional de la Industria de Transporte Marítimo (C AMEINTr AM)

• CAMAr A NACIONAL DE MANUFACTU r AS ELECTrICAS

• CAMEXA

• CANACAr

• CANAME - Cámara Nacional de Manufacturas Eléctricas

• Canopia Carbon

• Capwatt México

• C ardiotrack

• CArGA-AEr EA.com

• Cargo Weld

• C aterpillar

• CCE

• Ceat Design and Manufacturing Systems S. de r L. de C.V.

• C H robinson

• CHI rON Mexico

• cinco soluciones

• CLAUT (Cluster Automotriz de N uevo León)

• CLEBEr

• Click M akers, LLC

• Clúster Energético

• Clúster Energético de Nuevo León

• CMIC

• CNW

• Co-Production International

• Coba Technologies, Inc

• Cobra IH/ TEDAGUA (G rUPO COB r A)

• COGEN Er A mexico

• Colegio de Profesionistas y Asesores en Comercio Exterior y Aduanas COPACEA

• Colliers

• Comercial El Molino Azteca

• ConalepNL

• Conecta

• Consulado general de Canadá

• Consulate General of Canada in Monterrey

• COPACEA

• COPACHISA

• Corey Solar

• Corredor Interoceánico del Istmo de Tehuantepec (CIIT)

• COSCO Shipping Lines

• Csoftmty

• Cuatrecasas

• Cubico Sustainable Investments

• Cushman and Wakefield

• Deacero

• Deloitte

• Denso

• DHL

• DHL Global Forwarding México

• DICKA LOGISTICS

• Diprem S.A

• Diram

• Distributed Power Solutions

• DMSolar

• DOW

• DP World

• D rIVEN / CLAUT Innovation Center

• Drivin

• Dubai Chambers

• E3

• Ekolabs

• Electriz / Cogenera Mexico

• ELEIA México

• Element Materials Technology Monterrey

• Elite Last Mile Industrial Parks

• Embassy of Sweden in Mexico

• EN-Tr EGA

• Enegence

• ENErGEX

• ENErGI

• Energía Solario

• Energy Efficiency Hub

• Energy Expert

• Enestas

• EN GIE México

• ENTErGI

• EPI rOC México

• Equinix

• Er A G rOUP

• Esentia Energy Systems

• ESM INDUSTrIES

• Estafeta

• Esvicon

• EU r EKA

• Evonik

• EVOTECH

• FCO Group | Lideres Mexicanos

• FedEx Express México

• FEMIA

• Ferrer & Asociados

• Ferrovalle (Ferrocarril y Terminal del Valle de México)

• Fibra Danhos

• Fibra MTY

• Finergy

• FINSA

• Finsolar

• Forefront Power

• Fr8Technologies

• FUMEC

• GArOCE

• GE Vernova Gas Power

• Genertronics Mexico, S. A. de C.V.

• Geotab

• Girasolve Energy

• G labaltranz

• GLego roup

• global Logistics Consulting

• G lobalTranz

• GM

• G NP Seguros

• Gobierno de Monterrey

• Government of Canada

• Government of Monterrey

• Government of Nuevo Leon

• GP Logistics

• Great Place to Work® México

• G r EEN KIIN

• GreenLux

• Grupo Aeroportuario Centro N orte (OMA)

• G rupo Amson

• Grupo ATC

• G rupo CIITA

• G rupo Clisa

• Grupo Comercial Control

• Grupo DEACErO

• Grupo Empresarial Interesse Odessa

• Grupo Estrategia Política

• G rupo Eulen

• Grupo Eulen / AMECH

• Grupo Financiero Banorte

• Grupo Gentor

• Grupo Mexico Servicios de Ingenieria

• Grupo Pochteca

• Grupo Tarmex

• Grupo Valoran

• GS Desarrollo en Tecnologia (G lobalSoft)

• GT LOGISTICS

• GVD LOGISTICS

• HASKELL

• Hermes Infraestructura

• Hexagon

• Hitachi Energy

• HO LDIN GAINS

• Holland & Knight México, S.C.

• Human Quality

• IATA

• Iberdrola México

• IBM

• IDS Geo radar

• Impulsora

• Inc Monterrey

• Inclusive logistics LLC

• incMTY - Tec de Monterrey

• INDEX Monterrey

• Industria Nacional de Autopartes (INA)

• Industrias Lowe

• INGENIErIA Y EQUIPOS DE FILTr ACIÓN, INGEFISA SA DE CV

• Instituto de Mexicanas y Mexicanos en el Exterior

• Intermex

• International SOS México Emergency Services S de r L de CV.

• Interpuerto Monterrey

• Invest Monterrey

• InvestMx

• IOS Offices

• IsoCindu

• JA Del río

• JAMCO

• Jinko Solar

• JLL

• Johnson Controls

• KEPLEr CO NSTrUCTO r A

• Keymex Energy

• Kia México

• Kiewit

• Kin Energy Internacional

• KINENErGY

• KLN México

• Korn Ferry

• KPMG

• Kroll

• KUKA

• Kuren Industrial

• Legand

• Levu Executives

• LexisNexis risk Solutions

• Liffe group

• Living Healthy & Active LLC

• Livoltek

• Longi

• Lottus Education

• Loyalty Logistics

• LUXEM

• Luxem Energía

• Manpower LATAM

• MAr KSMAN XBF LLC - SOCIO COMErCIAL DE COBA TECHNOLOGIES, INC

• Matri

• Mazmobi

• MEDITErr ANEAN SHIPPING COMPANY DE MEXICO

• METAL ONE DE MÉXICO

• Metalsa

• Mexican Association of Data Centers (MEXDC)

• Mexican Association of Qualified Suppliers (AMSCA)

• MFG Solutions Inc

• MI DEA MEXICO

• MITSUI & CO. INFr ASTrUCTU r E SOLUTIONS SA DE CV

• Mitsui & Co., Global Strategic Studies Institute

• Monterrey Aerocluster

• Motive

• Mundi

• Municipio de San Pedro Garza García

• MyShipper

• MYVISA Monterrey

• Naturgy Mexico

• NEG

• N EG NATU r AL

• Newmont

• NextGen Intelligence

• Ngrenta

• NO rOC

• Nueva Imagen Design

• nutriADN

• NXT

• Oasis Global Consulting

• Oca Global

• Oil and Gas Alliance

• OMA G rOUP

• Omnitracs MExico

• On.Energy

• ONE MÉXICO

• ONE Ocean Network Express

• Onest Logistics

• Open it

• PC r INTEr NATIONAL

• Pérez-Llorca

• Plante Moran

• Platzi

• PNM

• Portalia

• Prolec ge

• PrOMINOX

• PrOM OLOGISTICS

• Prosolia

• Protexa

• Puerto Verde Global Trade Bridge

• Pulpo

• PwC

• Quartux

• r .H. SHIPPING & CHArTErING

• radiocare

• r AGASA INDUSTrIAS

• r AME Autotransportes

• reach

• redBox Innovation

• reducto

• reducto /Daysitek

• relyon

• rhenus Germany

• rhenus Logistics

• rOCA Desarrollos

• rockwell Automation

• rOMESA BUSINESS & Tr ADING SOLUTIONS

• S&E TECHNOLOGY S.A DE C.V

• Sally beauty

• Sambol

• SAMPOL INGENIErIA Y OB r AS SA DE CV

• Santos & Becker, S.C.

• Santos Elizondo

• Schunk Carbon Technology

• Secretaría de Economía

• Secretaría de Economía de Nuevo León

• Secretaría de Igualdad e Inclusión

• Secretaría de Medio Ambiente del Estado de Nuevo León

• Secretary of Economic Development of Monterrey, NL

• SEISA

• Seisa energía

• SENADO

• Senate of Mexico

• Sener

• Shipper Express

• Siemens Energy

• Siemens SW

• Sierra Latam

• SISAT (Sistemas de información satelital)

• SLLM

• SMBC

• SoEnergy

• SOLAr DEC

• SOLENSA GAS

• Solera Omnitracs

• Solfium

• Solventa Energía | ENHO

• Square Energy

• State Government of Nuevo Leon

• Stiva

• Sumitomo Mitsui Banking Corporation

• SUSE

• Tasvalúo / AMECH

• Tec de Monterrey/incMTY

• TECMA

• Tecnológico de Monterrey

• Tecsir

• TENSEC

• Tent Partnership for refugees

• Tequilera de Arandas

• Ternium

• Tesla

• The 1% Financial Leaders

• ThermoFisher

• Total Cloud

• Toyota de México

• Tractian

• Tramontina

• Transmontes

• Tren Maya S. A. de C.V.

• Trimble

• TUBACErO

• Turner & Townsend

• Tuto Power

• TUVACE

• UANL

• Uber Freight

• UKG

• UMD Automated Systems

• UNAQ

• UNHC r

• Universal robots

• University of Monterrey (UDEM)

• VA Design

• Valia Energía

• Veolia

• Vértice Worldwide

• Viva El Sol

• Viwala

• Von Wobeser y Sierra

• VYNMSA

• Walmart

• WEECOMPANY

• Wefor Life

• Why Loyalty

• Wood Mackenzie Power & renewables

• XENON Automation

• Xepelin

• ZF Group

• ZrG PArTNErS

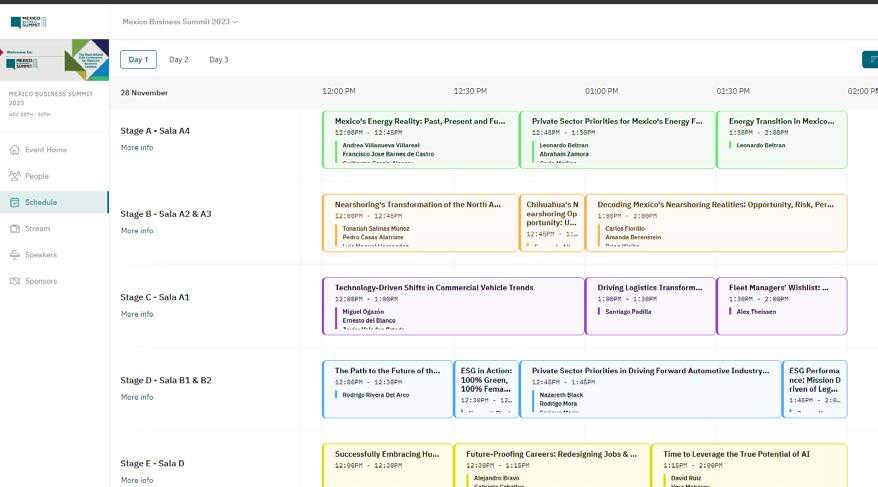

TUESDAY, OCTOBER 28

MEXICO

BUSINESS STAGE

09:00 SHARED PROSPERITY, A VISION FROM THE SENATE’S ECONOMIC COMMISSION

Speaker: Emmanuel Reyes, Senate of Mexico

09:20 INCMTY INNOVATION FOR GROWTH: DEVELOPMENT OF INNOVATION, ENTREPRENEURSHIP, AND INVESTMENT HUBS TO ACCELERATE BUSINESSES

Speaker: Josué Delgado, IncMTY

10:00 THE POWER OF THREE: A NEW ERA FOR NORTH AMERICAN PARTNERSHIP

Speaker: Juan Bringas, Government of MTY

Lorenzo Barrera, AMCHAM Northeast Chapter and President, Banco BASE

Annabelle Larouche, Consul General of Canada in Monterrey

10:30 NUEVO LEON: PREMIER NEARSHORING DESTINATION

Speaker: Betsabé Rocha, State Government of Nuevo Leon

11:15 RESHAPING AUTOMOTIVE SUPPLY CHAINS THROUGH TRADE, TECHNOLOGY ADOPTION

Moderator: Julio Galván, Industria Nacional de Autopartes (INA)

Panelists: Felipe Villarreal, Alian Plastics

Manuel Montoya, CLAUT (Cluster Automotriz de Nuevo León)

12:30 SWEDEN’S GROWING FOOTPRINT: INVESTMENT AND SUPPLY CHAIN SYNERGIES IN THE MEXICAN AUTOMOTIVE INDUSTRY

Moderator: Helena Carlsson, Business Sweden

Panelists: Alexander Peyre, Embassy of Sweden

Kevin Fox, Autoliv Paolo Veglio, Hexagon

NEARSHORING STAGE

11:15 BALANCING THE ENERGY MIX: NATURAL GAS AND RENEWABLES FOR SUSTAINABLE MANUFACTURING GROWTH

Moderator: Daniel Salazar, Cogenera México

Panelists: Mauricio Herrera, AMDEE

Roberto de la Garza, Mexican Association of Qualified Suppliers (AMSCA)

Julio Valle, AME

Jorge Sandoval, AMGN

12:00 MEXICO’S ENERGY EQUATION: PRODUCERS, OFFTAKERS, AND THE PRICE OF POWERING GROWTH

Moderator: Eduardo Robledo, Tuto Power

Panelists: Alejandro Peón Peralta, Naturgy

Norma Rodríguez, ArZYZ

Alejandro De Keijser, Deacero

Javier Pastorino, Siemens Energy

Jonathan Pinzón, Valia Energía

13:00 GROWTH PERSPECTIVES FOR NORTH AMERICA’S POWER MARKETS: WHAT ARE THE CHALLENGES AHEAD?

Speaker: Juan Pablo Londoño, Wood Mackenzie Power & renewables

MADE IN MEXICO DOME

11:15 KEY TRENDS SHAPING AIR CARGO AND AIRPORT INFRASTRUCTURE IN MEXICO

Moderator: Victor Cruz, Asociación Mexicana de Agentes de Carga (AMACArGA)

Panelists: Jorge Torres, FedEx Express México

Ricardo Dueñas, Grupo Aeroportuario Centro Norte (OMA)

Tte. Coronel Ing. Industrial Héctor Reyes Vega, AIFA

12:00 OCEAN FREIGHT: MEXICO’S GATEWAY TO THE WORLD

Moderator: Ing. José Manuel Urreta, Cámara Mexicana de la Industria del Transporte Marítimo (CAMEINTrAM)

Panelists: Beatriz Yera, APM Terminals

Emmanuel Neri, Corredor Interoceánico del Istmo de Tehuantepec (CIIT)

Jiawei Mei, COSCO Shipping Lines

12:45 MEXICO’S MULTIMODAL CAPABILITIES FOR NORTH AMERICAN INTEGRATION

Moderator: Sergio Castañeda, BTX Global Logistics

Panelists: Francisco Fabila, Ferrovalle (Ferrocarril y Terminal del Valle de México)

Rodrigo Morales, AECOM

Alejandro Doria, Bulkmatic de México

MEXICO BUSINESS STAGE

15:00 THE TECH-DRIVEN LOGISTICS REVOLUTION: HOW TECHNOLOGY IS REDEFINING MEXICO’S SUPPLY CHAINS

Moderator: Paris Guzmán, Solera Omnitracsn

Panelists: José Liborio Calderón, Geotab

Rodolfo Morales Lagos, Drivin

Marco Serrato, MyShipper

Evaristo Babé, Pulpo & PulpoPay

16:00 THE EVOLVING LOGISTICS PLAYBOOK: CHARTING NEW STRATEGIES FOR THE LOGISTICS MARKET OF TOMORROW

Moderator: Paulo Biazotti , Ocean Network Express (ONE) Mexico

Panelists: Jean Paul Sarrapy, GP Logistics

Luis Angel Mera, Vertice Worldwide

José Antonio García, Onest Logistics

NEARSHORING STAGE

15:00 MEXICO’S MANUFACTURING POWERHOUSE: TODAY’S PRIORITIES TO ENSURE TOMORROW’S COMPETITIVENESS

Moderator: Zelina Fernández , INDEX Nuevo León

Panelists: Julio Galván, INA

Luis Manuel Azúa, FEMIA

Miguel Ogazón, ANPACT

16:00 REENGINEERING THE FACTORY FLOOR: TECHNOLOGY RESHAPING MANUFACTURING, COMPETITIVENESS

Moderator: Cecilia Díaz, rockwell Automation

Panelists: Uriel Fraire, Universal robots

Alejandro Canela, Siemens SW

Christopher Hernández, KUKA

Gerardo Pazos, SUSE Mexico & rest of Latin America

MADE IN MEXICO DOME

15:00 TRANSFORMING THE FUTURE OF RETAIL TALENT

Speaker: Yolanda Rodríguez, Walmart

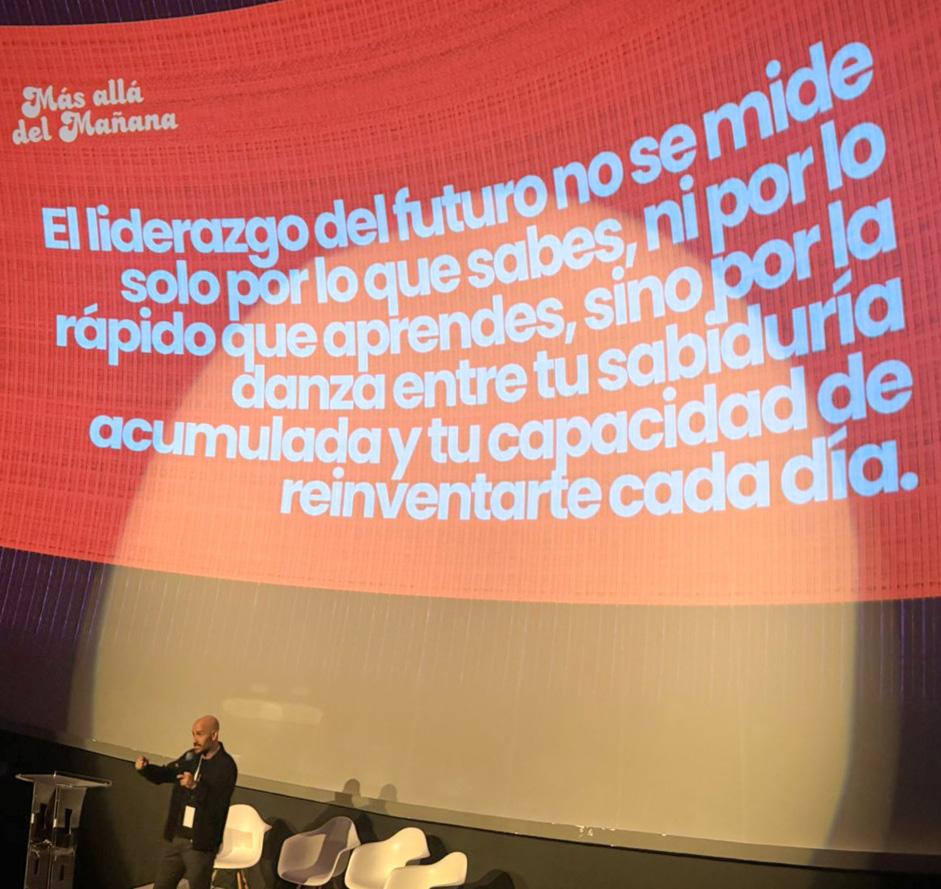

15:20 BEYOND TOMORROW

Speaker: Gonzalo Díaz-Báez, Wefor Life

15:40 THE TRUST EFFECT

Speaker: Renán González, Great Place to Work

16:00 TENT PARTNERSHIP FOR REFUGEES: THE WIN-WIN OF HIRING REFUGEES AND MIGRANTS

Speaker: Arturo Rocha, Tent Partnership for refugees

16:40 UNLOCKING POTENTIAL: THE FUTURE OF NEARSHORING

Speaker: Paulina Aguilar, Mundi

WEDNESDAY, OCTOBER 29

MEXICO BUSINESS STAGE

09:00 MEXICO’S ELECTRICITY MARKET: INSIDE PERSPECTIVES ON SUPPLY, DEMAND, TECHNOLOGY & FINANCE

Moderator: Yolanda Villegas, Energy Expert

Panelists: Diego Arriola, NXT

José Buganza, Enegence

Leopoldo Salinas, Capwatt Mexico

09:45 FROM POTENTIAL TO POWERHOUSE: ACCELERATING SOLAR DEPLOYMENT IN MEXICO

Moderator: Ian de la Garza, Finsolar

Panelists: Alberto Cuter, Jinko Solar

Juan Pablo Sáenz, Atlas renewable Energy

Luis Quero, Atlantica

Miguel Medina, Corey Solar

NEARSHORING STAGE

09:00 INDUSTRIAL INFRASTRUCTURE IN MEXICO: CORNERSTONE FOR ADVANCED MANUFACTURING GROWTH

Moderator: Diego Sánchez-Labrador, SLLM

Panelists: Salomon Noble, Intermex

Javier Lomelin Anaya, Colliers Mexico

Luis Montes de Oca, Elite Last Mile Industrial Parks

09:50 BUILDING MEXICO’S NEXT-GEN INDUSTRIAL INFRASTRUCTURE

Moderator: Mario Salazar, CMIC

Panelists: Guillermo Luna Hornelas, IsoCindu

Javier Llaca, Fibra MTY

Eduardo Orozco, Trimble

Juan Paulo Mendoza, JLL

MADE IN MEXICO DOME

09:00 OPTIMIZING FREIGHT MOVEMENT: THE FUTURE OF INTERMODAL LOGISTICS IN MEXICO

Moderator: Augusto Ramos, rAME Autotransportes

Panelists: Omar Camacho, Motive

Verónica González, CH robinson

Walter Campos, GlobalTranz

09:30 UNLOCKING MEXICO’S RAIL LOGISTICS POTENTIAL IN THE ERA OF GLOBAL SUPPLY CHAIN TRANSFORMATION

Moderator: Francisco Fabila, Association of Mexican railroads

Panelists: Paul Hirsch, BNSF railway

Emmanuel Neri, Corredor Interoceánico del Istmo de Tehuantepec (CIIT)

MEXICO BUSINESS STAGE

10:30 SMART FACTORIES, SMARTER TALENT: BRIDGING THE DIGITAL SKILLS GAP FOR ADVANCED MANUFACTURING

Moderator: Rodrigo García, GArOCE

Panelists: Pablo Sillas, Grupo DEACErO

Rodrigo Piña, Ternium

Rafael Navarro, Human Quality

Rodrigo Carrasco, UKG

11:15 THE HUMAN CAPITAL IMPERATIVE: HOW HOLISTIC WELL-BEING DRIVES BUSINESS RESILIENCE AND GROWTH

Moderator: Beatriz Robles, Manpower LATAM

Panelists: Óscar G. Zato, Grupo Eulen

José Manuel Bas, GNP Seguros

Juan Carlos Meade, Secretary of Equality and Inclusion of Nuevo Leon

Alejandro Hernández, Grupo Comercial Control

12:00 ECONOMIC IMPACT OF LATINOS ABROAD

Speaker: Tatiana Clouthier, Instituto de Mexicanas y Mexicanos en el Exterior

NEARSHORING STAGE

10:40 NORTH AMERICAN SUPPLY CHAINS: MASTERING CROSS-BORDER LOGISTICS AND STRATEGIC RESILIENCE

Moderator: Grace Lingow, AmCham Mexico - Monterrey Chapter

Panelists: Alfonso Ortiz, rhenus Logistics

Rómulo Mejía, CANACAr

Alonso Pedrero, Puerto Verde Global Trade Bridge

MADE IN MEXICO DOME

10:00 POWERING INDUSTRIAL GROWTH: STRATEGIC ENERGY SOLUTIONS FOR MEXICO’S MANUFACTURERS

Moderator: Edmond Grieger, Von Wobeser y Sierra

Panelists: Eugenio Fernández, Legand

Guadalupe Paredes, LUXEM

10:40 RELIABLE POWER FOR INDUSTRIAL PARKS

Speaker: Aldrich Richter, Bergen Engines

Facundo Gatica, Sampol

11:00 OPTIMIZING PROJECT DEVELOPMENT FOR MEXICO’S NEXT GENERATION ENERGY INFRASTRUCTURE

Moderator: Pedro Aznar, Prosolia

Panelists: Alejandro Villarreal, Esvicon

Fernando Tovar, Mitsui & CO Infrastructure Solutions

Santiago Ramos, SMBC SOFOM

11:40 HYBRID ENERGY: TRANSFORMING MINING PROJECTS FOR A SUSTAINABLE FUTURE

Speaker: Nicté Ovando, Aggreko

12:00 EXPANDING GAS AVAILABILITY FOR REGIONAL INDUSTRIAL GROWTH

Moderator: Gabriel Ruiz, Holland & Knight

Panelists: Juan Paulo Cervantes, SOLENSA

Napoleón Cantú, TUBACErO

Carlos Boone de Nova, Enestas

Sergio Charles, Protexa

12:45 DRIVING DECARBONIZATION VALUE CREATION THROUGH ENERGY EFFICIENCY, RENEWABLES AND CARBON CREDITS

Moderator: José González , AMENEEr

Panelists: Francisco Villarreal, Kinenergy

Andrés Friedman, Solfium

Aquiles López, CANAME - Cámara Nacional de Manufacturas Eléctricas

MEXICO BUSINESS STAGE

12:30 MEXICO’S AVIATION FRONTIER: FORGING CONNECTIVITY FOR GROWTH

Moderator: Carlos Campillo, Sierra Latam

Panelists: Tte. Coronel Ing. Industrial Héctor Reyes Vega, AIFA

Ricardo Dueñas, Grupo Aeroportuario del Centro Norte (OMA)

Cintya Martinez, IATA

NEARSHORING STAGE

11:30 GROW WITHOUT INVESTORS

Speaker: Javier García Iza, IOS Offices

11:50 THE GEOPOLITICAL PUZZLE: GLOBALIZATION, REGIONALIZATION, NEARSHORING & TARIFFS

Moderator: Armando De Lille, Deloitte

Panelists: Francisco Flores, Grupo Financiero Banorte

Martin Toscano, CAMEXA

Jorge Sánchez, KPMG Mexico

12:50 ARTIFICIAL INTELLIGENCE: OPERATIONAL EFFICIENCY FOR BUSINESS

Speaker: Bruno Pancica, IBM

13:10 INTEGRAL DEVELOPMENT OF THE PROJECT TREN MAYA

Speaker: Gral. Brig. E.M. Germán Redondo Suárez, Tren Maya

MEXICO BUSINESS STAGE

15:00 BRIDGING THE TALENT GAP: CRAFTING HIGH-PERFORMANCE STRATEGIES FOR MEXICO’S FUTURE WORKFORCE

Moderator: Gustavo Solares, Korn Ferry

Panelists: Óscar Santos, Santos&Becker

Enrique Gerardo Sosa, Universidad Aeronáutica en Querétaro (UNAQ)

Carlos Atoche, University of Monterrey (UDEM)

Juan Rebolledo, Lottus Education

15:45 MEXICO’S BLUEPRINT FOR ADVANCED MANUFACTURING R&D AND INNOVATION

Moderator: Eugenio Marín, FUMEC

Panelists: Jorge A. Vázquez, ZF Group

Ricardo Apaez, DrIVEN / CLAUT Innovation Center

Rebeca Parra, ArTIGrAF Group

NEARSHORING STAGE

15:00 CHALLENGES AND OPPORTUNITIES FOR THE DATA CENTER SECTOR IN MEXICO

Speaker: Adriana Rivera Cerecedo, Mexican Association of Data Centers (MEXDC)

15:30 CRITICAL SUCCESS FACTORS BEHIND NUEVO LEON’S NEARSHORING SUCCESS

Moderator: Héctor Díaz-Santana, KPMG Mexico

Panelists: Irma Leon, Industrias Lowe

Zelina Fernández, INDEX Monterrey

Elisabet Zuñiga, Invest Monterrey

Nancy Sánchez, The LEGO Group

SHARED PROSPERITY, A VISION FROM THE SENATE’S ECONOMIC COMMISSION

The Mexican Senate’s Economy Commission, chaired by Sen. Emmanuel reyes Carmona, is advocating for a national economic strategy centered on Shared Prosperity (Prosperidad Compartida). This vision, a key pillar of the “second floor of the Fourth Transformation” under President Claudia Sheinbaum, aims to position Mexico as a global economic power. Its core philosophy is that prosperity must be shared: Development cannot benefit only a few, and wealth must be distributed to those with the fewest resources, r eyes Carmona said.

The Four Pillars of the ‘Plan Mexico’ Strategy

“Plan Mexico” is the comprehensive strategy designed to consolidate Mexico as a highvalue-added exporting power, leveraging the country’s geographic position, talent, and opportunities created by nearshoring.

The strategy is structured around four fundamental axes:

+ reindustrialization with Technological Innovation: This pillar focuses on strengthening value chains and attracting high-value-added investment. It prioritizes national production, fosters innovation, and strengthens economic self-sufficiency.

+ Balanced regional Development: The goal is to drive development from within the country by creating poles of wellbeing (polos de bienestar) and productive infrastructure across all territories.

+ Economic and Social Inclusion: This ensures that women, youth, and small businesses are incorporated into development opportunities.

+ Sustainability and Energy Transition: The plan guarantees that economic growth is compatible with environmental protection.

“Businesses are actively collaborating with the Ministry of Economy and state governments in the development of Plan México, ” reyes noted. “This is the strategy for the country to become an economic and exporter powerhouse. The ultimate goal is for Mexico to reach the 10th position among global economies,” he added.

The “Plan Mexico” introduces two key tools intended to organize economic development, strengthen private investment, and ensure territorial justice:

Key Tools for Economic Development

1. Economic Development Poles for Wellbeing (Polos de Desarrollo Económico para el Bienestar): These poles serve as the foundation of regional development strategy, envisioned as integrated productive ecosystems where the state promotes investment, strengthens local capabilities, and facilitates public and logistical services.

“Through these 16 development poles, we aim to promote development across the country,” noted reyes.

The poles will include:

+ Targeted fiscal incentives based on regional productive vocation, encouraging investment in innovation and r&D

+ Administrative facilities

+ Energy and infrastructure viability

The strategy encourages business relocation, expands high-value local supply chains, and increases national and regional content through import substitution. The first stage includes the goal of generating 300,000 jobs and securing an investment equivalent to 1.5% of the GDP during the

current administration. Key strategic sectors prioritized for these poles include Automotive and Electromobility, Aerospace, Electronics and Semiconductors, Energy, and Logistics.

2. relaunch of ‘Hecho en México’

The government has updated the national seal of origin to strengthen domestic industry. To use the seal, products must be manufactured, assembled, or processed in Mexico and meet a minimum threshold

INCMTY INNOVATION FOR GROWTH: INVESTMENT HUBS FOR BUSINESSES

Monterrey is emerging as a strategic hub for technology, talent, and entrepreneurship. Yet despite its expanding entrepreneurial ecosystem, challenges persist in creating coordinated connections between startups, corporations, investors, and research institutions. This fragmentation limits the potential for technology transfer, market scaling, and knowledge exchange, ultimately constraining the region’s ability to fully leverage its talent and research base.

To address these challenges, initiatives are increasingly focusing on structured platforms that facilitate collaboration, attract diverse stakeholders, and enable measurable economic and innovation outcomes. The goal is to create an integrated ecosystem where entrepreneurship, corporate innovation, and investment converge to drive sustainable regional growth.

incMTY, an initiative of Tecnológico de Monterrey, serves as a central platform connecting innovation actors, entrepreneurship programs, and investment channels. “incMTY aims to stimulate the region’s development by connecting major companies and innovators through open innovation challenges,” said Josué Delgado, CEO and Co-Founder, incMTY, at Mexico Business Summit 2025. The platform’s mission is to attract, empower, and articulate a diverse range of participants, including startups, corporations, investors, and

of national content—for example, 60% or more of national inputs, according to recent regulations. “Today, 80% of products mentioned on USMCA do not have tariffs. Our goal is for the remaining 20% to be exempt from those tariffs,” the senator said.

“As of September 2025, 2,634 companies had been authorized to use the seal. “Our work on USMCA, as Minister of Economy Marcelo Ebrard said, will ensure the agreement endures for the long term.”

researchers, while generating local and global impact.

The initiative aligns with the Monterrey Innovation District (DI), structured around three indicators of a knowledge-based economy: the attraction of entrepreneurs and scientific or technological companies, the creation of innovation-intensive jobs, and technology transfer through intellectual and industrial property development. “The knowledge economy is built on three elements: the construction of networks, the use of physical spaces, and the leverage of economic elements to attract visionaries and startups,” explained Delgado. These principles support the district’s efforts to build a cohesive and high-impact innovation ecosystem.

Strategy and Pillars

incMTY operates through four main components that serve as vehicles for amplification:

+ Open Innovation Challenges, designed to facilitate collaboration between corporates and startups;

+ incMTY Festival, a flagship annual event promoting networking, visibility, and ecosystem growth;

+ Future Now: Tech and Talent Fair, focused on talent acquisition, career development, and recruitment of highimpact researchers and innovators; and

+ Community Programs, building sustained engagement and collaboration among ecosystem participants.

Since its inception in 2013, incMTY has connected nearly 100,000 attendees and over 130,000 community members. The platform has supported startups, corporates, and investors through acceleration programs, high-impact events, and competitions offering millions in resources and prizes. “incMTY connects and powers Monterrey and Mexico’s entrepreneurial ecosystem,” emphasized Delgado, underscoring the initiative’s role as a catalyst for regional innovation.

Beyond fostering collaboration, incMTY is also promoting intelligent specialization to amplify the region’s strengths. “Intelligent specialization enables us to leverage the strengths of a place to build up talent,” noted Delgado. This approach allows Monterrey to channel its industrial capabilities and academic resources toward sustainable innovation and human capital development.

The initiative’s partnerships also extend internationally. “The World Bank is working to make supply chains more efficient and

incorporate more small producers. We worked with it to map these small producers and launch a pilot project,” shared Delgado, highlighting incMTY’s global impact. “We are also working with Meta to help its AI tool, Llama, to use our insights to help innovators and startups,” he added, illustrating the organization’s commitment to advancing digital and AI-driven innovation.

incMTY leverages Tecnológico de Monterrey’s global network, with partnerships in over 40 countries, to connect Mexico’s ecosystem with international innovation and investment opportunities. Focus industries include fintech, healthtech, mobility, advanced manufacturing, and sustainability, with increasing emphasis on corporate innovation and artificial intelligence.

By combining targeted strategy, multidisciplinary programs, and global connectivity, incMTY exemplifies how a central innovation platform can accelerate regional economic development while fostering sustainable corporate and startup growth. Through its vision and partnerships, Monterrey is positioned to become one of Latin America’s leading technology and innovation hubs, says Delgado.

THE POWER OF THREE: A NEW ERA FOR NORTH AMERICAN PARTNERSHIP

Since its implementation in 2020, USMCA has been instrumental in shaping North America’s economic landscape. However, the recent return of US President Donald Trump and his shifts in trade policy have introduced uncertainty about the agreement’s future. As USMCA approaches its scheduled 2026 review, Canada and Mexico are actively working to strengthen their bilateral partnership. However, experts agree that all parties stand to benefit from reaching a consensus to ensure continued stability and growth in the region.

“We can take advantage of USMCA to build an integrative, innovative, and resilient economy,” said Juan Bringas, Director of Entrepreneurship and Promotion, Ministry

of Economic Development of Monterrey, at Mexico Business Summit 2025.

In 2023, trilateral trade under USMCA hit US$1.88 trillion, growing by double digits and making the region one of the world’s most active economic blocs. Trade between the three countries averaged US$3.6 million every minute. In the same year, Mexico and Canada overtook China as the United States’ top trading partners for the first time since 2002. By early 2024, North American trade with the United States was 195% higher than trade with China, driven by higher tariffs on Chinese imports and stronger regional cooperation.

“USMCA is more than a commercial agreement; it is a collaboration framework that

has contributed to the economic development of North America” said Annabelle Larouche, Consul General of Canada in Monterrey.

USMCA increased the region’s appeal for FDI, especially in greenfield projects and supply chain realignment. Greenfield investment in North America rose by 136% between 2020 and 2023, reaching US$190 billion in 2023. In 1Q24 alone, the region attracted US$94 billion in new investment, with strong momentum in artificial intelligence, electric vehicles, semiconductors, and infrastructure.

“Whatever happens during the USMCA renegotiation, Mexico will continue to be favored over any other country thanks to its large advantages”

Juan Bringas Director of Investments and Technological Innovation / Secretary of Economic Development | Government of Monterrey

trade has surged, Mexico has struggled to fully capitalize on investment flows. In 2023, it received US$37 billion in FDI, about half from the United States and Canada. However, only 13% of this investment came from new ventures, suggesting caution among investors due to regulatory uncertainty and institutional hurdles.

In the United States, USMCA has reinforced efforts to reduce reliance on Chinese supply chains while securing critical imports. US exports to Canada include vehicles, machinery, electronics, and agricultural goods, while imports from Mexico center on auto parts, computers, and farm produce. In 2023, the United States attracted US$311 billion in FDI, maintaining its status as the world’s top investment destination. Wilson Center highlighted the strengthening of labor enforcement mechanisms and supply chain resilience as major wins under the agreement.

Labor rights remain a key pillar of the agreement. From May 2021 through June 2024, 25 labor complaints were filed under the rapid response Labor Mechanism (rrM), mostly involving Mexico’s automotive sector. These procedures have led to improvements in working conditions, including better wages and the reinstatement of dismissed workers. Despite this progress, labor protection still varies widely across sectors, particularly in Mexico’s informal economy.

USMCA: Basis for regional Integration

Mexico’s role in this integration has grown significantly. In 2024, the country became the United States’ largest goods supplier, driven by strong exports of vehicles, machinery, electronics, and agricultural products. On the import side, Mexico increased its purchases of US gasoline, corn, machinery, and medical instruments. “Over 1 million people cross the Mexico-US border every day, generating over US$1 billion per hour,” said Lorenzo Barrera, President, AMCHAM Northeast Chapter, and President, Banco BASE. While

Canada also plays a central role in North American trade. In 2024, it remained the top destination for US exports, particularly in energy, machinery, and aerospace. At the same time, Canada imported several volumes of US agricultural goods and technology components. It attracted US$50 billion in FDI in 2023, underpinned by its strong institutional framework and competitive market. Nonetheless, trade tensions remain. Disputes around dairy quotas and agricultural access are expected to dominate discussions in the 2026 review of the agreement.

Trade Deficits and Global Economic Context

As USMCA approaches its six-year milestone, officials from all three countries have reaffirmed their commitment to deeper economic integration. However, uncertainty remains as the US administration has signaled plans to renegotiate the agreement, citing unmet expectations.

As the current administration reviews potential changes to USMCA or its longterm direction, C.J. Mahoney, Former Deputy Trade representative in the United

States, emphasizes that a key consideration will be whether the agreement has fulfilled the core objectives set during its original negotiation under President Trump’s first term. When measured by investment growth, job creation, and supply chain resilience, Mahoney says USMCA has delivered tangible and verifiable results.

The US International Trade Commission’s latest report on the USMCA’s provisions highlights that the tightening of rules of origin has effectively reduced US imports of motor vehicle engines and transmissions from nonUSMCA countries. This shift has resulted in increased employment, higher wages, greater capital expenditures, and improved revenues for US-based producers in these sectors.

Nevertheless, some critics argue that USMCA has not succeeded in reducing the United States’ trade deficits with Mexico and Canada. While this criticism is valid to some extent, Mahoney emphasizes that trade balances are largely influenced by broader global economic dynamics. He explained that the United States is among a group of major economies that consistently run persistent trade deficits. Some attribute these enduring imbalances to fiscal and industrial policies in surplus countries that distort global trade dynamics, ultimately to the detriment of US labor markets and manufacturing sectors.

Trade data shows that the US trade deficit with Mexico rose from US$111 billion in 2020 to US$172 billion in 2024. In contrast, the

deficit with Canada increased more modestly, from US$14 billion to US$63 billion over the same period. Despite these widening gaps, Mahoney emphasized that neither Mexico nor Canada are the primary contributors to the US trade imbalance.

Trump’s Tariff Announcements and USMCA renegotiation Plans

Previously, President Donald Trump announced plans to renegotiate USMCA in an effort to prioritize US jobs, signaling a potential shift away from regional cooperation. “I think the president is absolutely going to renegotiate USMCA, but that is a year from today,” said US Commerce Secretary Howard Lutnick, referring to the upcoming scheduled review in July 2026. “He wants to protect American jobs,” Lutnick added. “He does not want cars built in Canada or Mexico when they can be built in Michigan and Ohio. It is simply better for American workers.”

In addition to existing USMCA provisions, President Trump has threatened several new tariffs. This move forms part of a broader strategy aimed at addressing what he views as inadequate progress on border security and the fentanyl crisis. In a letter, Trump asserted, “Mexico has been helping me secure the border, BUT what Mexico has done is not enough. Mexico still has not stopped the cartels who are trying to turn all of North America into a narco-trafficking playground.”

As Trump’s tariff threats resurface, Canada and Mexico are taking steps to protect their shared trade interests. Mexican President Claudia Sheinbaum and Canadian Minister Mark Carney recently met to discuss coordinated responses. “We both agreed that USMCA must be respected, and we shared our experiences about the letter we received from President Trump,” Sheinbaum said.

While Canada and Mexico pursue deeper bilateral relations due to the tariffs, the United States’ tariffs on both countries remain comparatively lower than those imposed on other partners. “Mexico has a tariff rate of about 4% with the United States, while

the European Union has a 9% and China a 40% rate,” said Barrera. This reflects stronger integration supported by exemptions maintained under USMCA, providing a key incentive for both countries to negotiate and reach agreements with the US administration.

“Whatever happens during the USMCA renegotiation, Mexico will continue to be favored over any other country thanks to its large advantages,” said Bringas.

“USMCA is more than a commercial agreement; it is a collaboration framework that has contributed to the economic development of North America”

Annabelle Larouche Consul General of Canada in Monterrey

broader renegotiation of USMCA appears unlikely in the short term. “USMCA helps to bring companies from all over the world, which can take advantage of the region’s robust industrial ecosystem,” said Larouche. “The region is the safest and most competitive economic bloc in the world.”

The anticipated continuation of the agreement aligns with recent remarks from US Treasury Secretary Scott Bessent, who clarified that “America First,” President Donald Trump’s slogan, does not mean “America alone.” Instead, Bessent emphasized, it calls for deeper collaboration and mutual respect among trade partners. Looking ahead, BofA projects that any significant revisions to USMCA will likely occur in 2026, when mandatory review mechanisms take effect. Until then, Canada and Mexico are expected to remain key partners in US trade, despite mounting pressures from Washington.

Canada and Mexico represent 32% and 41% of US trade-related GDP respectively, this reinforces their motivation to stay aligned with US trade regulations. More so, as a

“We have to take advantage of North America’s strengths to position the region as one of the strongest blocks in the world,” said Larouche.

As Mexico collectively aims to become a prime destination for nearshoring, local governments are actively competing to attract Foreign Direct Investment (FDI). Among all states, Nuevo Leon currently stands out as the national leader in receiving FDI within this nearshoring context. Despite facing significant challenges, the state government is focused on infrastructure and talent development to maintain its top position.

Betsabé rocha, Minister of Economy of Nuevo Leon, noted that the state holds the first position nationwide in attracting FDI, totaling US$110 billion. The state is also ranked first in the creation of new companies, totalling 3,914 new employers between October

NUEVO LEON: PREMIER NEARSHORING D ESTINATION

2021 and December 2024. Employment creation totaled 385,000 new jobs from January to April 2025. The unemployment rate stood at 2.8%, the lowest level recorded in the last 20 years. Furthermore, the state records the lowest labor informality in the country at 33.7%.

rocha noted that Nuevo Leon’s economic activity grew by 1.3% in 1Q25 compared to 1Q24. Nuevo Leon was the second entity with the highest contribution to national economic growth in that period. Industrial activity registered growth of 4.5% during 1H25. Exports totaled US$27.7 billion during 1H25, a growth of 3.4% compared to the same period in 2024. The state also ranks first in the reduction of extreme poverty, decreasing from 2.1% to 0.5% between 2020 and 2024. Security-related metrics show a 72.9% reduction in high-impact crimes.

The state confirmed 382 FDI projects between October 2021 and September 2025. This represents 192 new ventures and 190 expansions. The announced investment totaled US$90 billion and is expected to generate over 385,000 jobs. “Nuevo Leon grows at twice the rate of the rest of the country, despite holding only 4% of its population,” rocha said at Mexico Business Summit 2025.

The distribution of FDI by sector demonstrates a focus on industrial and technological areas: Manufacturing accounts for 39%, followed by the automotive sector at 24%. Logistics accounts for 8%, while IT & software and services each account for 6%. Appliances account for 5%, and machinery and equipment account for 4%. The origin of active projects as of September 2025 is led by the United States with 130 projects, followed by Asia with 124 projects, and Europe with 59 projects. The remaining 70 come from various countries, including Argentina, Canada, the UAE, and Tunisia, among others.

Nuevo Leon’s competitive position relies on its infrastructure, location, and talent pool. Monterrey is located only 153 miles from the nearest United States border crossing.

The state features over 250 industrial parks. Logistics are supported by the Port of Colombia-Laredo crossing, which is the second most important border crossing in Mexico. The customs process at the Port of Colombia allows trade with the United States in an estimated 20 minutes, compared to the estimated 5 hours required at other standard ports. The state’s industrial development is fostered by 15 industry clusters that involve the state government, the private sector, and universities.

The state is an educational center, hosting over 150 universities and ranking first in Mexico for dual education. The largest engineering school in northern Mexico is located in the state (UANL). The government is also promoting the Supply Chain Hub, a digital platform that connects over 1,500 registered local suppliers 32 with purchasing companies.

The state government is addressing infrastructure needs through public works investment, projecting a total of MX$105 billion (US$5.7 billion) in infrastructure spending. Projects include the construction of new highways to connect the state, such as the new Nuevo Periferico highway and the new road to the International Airport. A total of MX$37 billion has been invested in the new Metrorrey monorail lines, L4 and L6, intended to connect the metropolitan area and serve an estimated 250,000 daily users. Improvements to the public bus transport system involve an investment of MX$269 billion and have completed the bidding for 1,300 new bus units.

FIFA World Cup an Opportunity for

Nuevo Leon

The local government considers the FIFA World Cup 2026 to be a strategic opportunity for value and employment creation. The event is projected to generate an economic spillover across Mexico exceeding MX$10 billion. Monterrey, as a host city, is estimated to see an economic impact of around US$5 billion and the creation of 7,000 direct jobs.

RESHAPING AUTOMOTIVE SUPPLY CHAINS THROUGH TRADE, TECHNOLOG Y ADOPTION

Mexico is consolidating its position as a strategic hub for North American automotive production amid geopolitical uncertainty and ongoing supply chain challenges. The country has become a top nearshoring destination, supported by the USMCA.

However, the industry faces regulatory and trade pressures. According to INEGI, vehicle production fell 6.1% and exports decreased 0.3% in September 2025, reflecting tariff impacts and weaker US demand. “About 87% of Mexican automotive production is exported, and most of it goes to the United States,” said Julio Galván, Economic Studies Manager, INA, during the Mexico Business Summit 2025.

Mexico’s automotive sector is tightly integrated with the US market. “Every vehicle manufactured in Mexico crosses the border eight times before reaching the final consumer,” said Felipe Villarreal, CEO, Alian Plastics, highlighting the need for flexible supply chains and strategic planning.

The 2026 USMCA review is expected to tighten rules of origin and reduce reliance on Chinese components, increasing compliance demands and reshaping supply strategies. “Tariffs are pushing OEMs to replace imports with local products,” said Manuel Montoya, CEO, CLAUT. He added that sourcing raw materials from the EU or Asia is becoming costlier and more complex, making supply chain flexibility essential.

At the same time, the revised framework is expected to strengthen Mexico’s trade

advantages, deepen regional integration, and prioritize North American content. “regionalizing supply chains is complex and can take one and a half to two years. Starting now is crucial,” said Villarreal.

The sector is also embracing AI, automation, and data-driven operations. “A solid manufacturing base is needed before implementing AI or digitalization,” said Montoya. “Investments in AI must go hand in hand with investments in human talent,” added Villarreal.

Digital integration is increasing exposure to cyber risks. “For suppliers, cybersecurity investments can determine whether they remain Tier 1 partners,” said Galván.

Electrification is transforming Mexico’s industry. Domestic EV sales grew from 24,000 units in 2020 to over 124,000 in 2024, with projections exceeding 130,000 in 2025, according to Latam Mobility. OEMs are expanding EV assembly, and electronics manufacturing services are expected to grow at a 10.6% CAGr through 2030. Developing a local EV supply chain, particularly for batteries, power electronics, and storage systems, remains a priority. “EV adoption will drive the expansion of charging infrastructure,” said Montoya.

Despite challenges, Mexico maintains strong competitive advantages, including a skilled workforce, predictable costs, modern clusters, and proximity to the US market, said Odracir Barquera Salais, Director General, AMIA.”

SWEDISH INVESTMENT STRENGTHENS MEXICO’S AUTOMOTIV E INDUSTRY

Sweden views Mexico as a strategic partner and a key market in the region, says Alexander Peyre, Counselor at the Embassy of Sweden. Swedish companies continue to expand operations in Mexico, deepening supply chain integration and strengthening collaboration in advanced manufacturing and automotive technologies.

“By

sharing best practices and participating in trade programs, we can build a future-ready manufacturing industry in Mexico”

Paolo Veglio Country Manager | Hexagon

in trade programs, we can build a futureready manufacturing industry in Mexico.” He highlights that Mexico’s manufacturing ecosystem provides ideal conditions for developing high-value solutions.

Mexico is now Sweden’s second-largest export market in Latin America. The EU-Mexico Free Trade Agreement and USMCA have boosted trade flows and encouraged new investment, particularly in sectors where Sweden is globally competitive, including automotive, energy, IT, and healthcare. Mexico’s skilled workforce, cost competitiveness, and strategic location continue to attract Swedish companies seeking access to both North and South American markets.

According to the Ministry of Economy, Sweden’s cumulative investment in Mexico reached US$3.047 billion between 1999 and 2024, almost evenly split among new investments, reinvested earnings, and intercompany accounts. In 2024 alone, Swedish firms invested US$42.2 million, with Chihuahua (US$11.9 million), Aguascalientes (US$6.65 million), and Puebla as the primary destinations. More than half of these investments—54%—were directed to manufacturing, particularly transport equipment.

“The Swedish industry is synonymous with innovation and sustainability,” says Helena Carlsson, Trade Commissioner and Country Manager for Mexico, Central America, and the Caribbean at Business Sweden. She notes that this focus aligns closely with Mexico’s push for competitive and responsible industrial growth. “Behind every machine and technology, there are people,” she adds, emphasizing the role of human capital in productivity and collaboration.

“Our challenge is twofold: investing in both technology and talent,” explains Paolo Veglio, Country Manager, Hexagon. “By sharing best practices and participating

Companies such as Autoliv have established a strong manufacturing presence. Autoliv, a global leader in automotive safety systems, operates seven plants in Mexico. “Autoliv invests in Mexico to remain cost competitive. The country is a model for our supply chain,” says Kevin Fox, President, Autoliv Americas. He adds that Mexico’s competitive business environment and collaboration between Swedish and local suppliers have strengthened regional supply chains.

Hexagon, specializing in digital reality and industrial metrology, also regards Mexico as a strategic base for innovation and production, operating two plants serving automotive and aerospace clients.

Bilateral trade reflects these industrial ties. In 2024, Mexico exported US$20.2 million in machinery and data processing units to Sweden, while Sweden imported US$128 million in automobiles and passenger vehicles—9.06% of Sweden’s total global imports in this category.

Peyre emphasizes that the partnership goes beyond investment. “Swedish companies in Mexico uphold the high standards of their home country, supporting the green

transformation of Mexican industry,” he says, highlighting shared commitments to sustainable manufacturing, responsible business practices, and technology-driven productivity.

Mexico’s broader investment climate reinforces this collaboration, with total FDI

reaching a record US$36.87 billion in 2024, up 1.1% from the previous year.

“We were welcomed in Mexico with open arms, reflecting the country’s commitment to innovation,” adds Fox, underlining the longterm alignment between Swedish firms and Mexico’s industrial policies.

BALANCING THE ENERGY MIX FOR SUSTAINABLE MANUFACTUR ING GROWTH

As Mexico accelerates its industrial expansion under the nearshoring wave, the country’s energy system faces a defining test: how to meet rising manufacturing demand without compromising affordability, reliability, or climate goals. For a country where natural gas fuels nearly 60% of total electricity generation, the debate is no longer about replacing fossil fuels overnight but about finding a sustainable balance between gas and renewables that secures growth while advancing decarbonization.

“We are in a new stage in Mexico’s energy history,” said Julio Valle, General Director, Mexican Energy Association (AME) during his participation in the “Balancing the Energy Mix: Natural Gas and renewables for Sustainable Manufacturing Growth” panel at Mexico Business Summit. “We see it with optimism because there are now clear tools that provide opportunities to invest and solve structural issues. The government is learning from these mechanisms too, and everything indicates we will be able to take them where they are most needed. What’s missing is better communication and faster processes, so they are not constrained by rigid structures that no longer follow today’s market logic.”

Mexico’s energy transition is unfolding in real time. renewables accounted for just 21.6% of total generation in 2024, with solar and wind contributing less than 12%. Yet even at these levels, their contribution has already helped offset gas imports worth hundreds of millions of dollars annually. The government’s goal of reaching 45% clean power generation by 2030 reflects both environmental ambition and

economic necessity. However, the speed of industrial growth, particularly in automotive, electronics, and manufacturing corridors, has strained an electricity grid still heavily dependent on imported US gas. To achieve this goal, Mexico’s Ministry of Energy (SENEr) recently launched an open call for private investment in renewable energy projects aimed at adding 5,970 megawatts (MW) of new power generation capacity across six priority regions. The initiative seeks to attract approximately US$7.14 billion in investment.

Mexico’s challenge lies in infrastructure. While generation capacity has expanded, transmission and distribution networks have not kept pace with demand. Grid congestion, especially in the Bajío and northern regions, is limiting the ability to connect new renewable capacity. “The most urgent gap lies in transmission and distribution,” said Mauricio Herrera, Executive Director, Mexican Wind Energy Association (AMDEE). “There is no other way around it. Without sufficient investment, we cannot increase installed capacity, and we won’t be able to deliver energy to where it’s most needed.”

Distributed generation has emerged as a practical solution, allowing industrial users to generate electricity on-site or nearby. regulatory reforms now make it easier for

companies to develop self-supply projects between 0.7MW and 20MW, while smaller installations are exempt from permitting. This decentralization could prove vital to relieving grid stress and enhancing energy security at the local level. Yet scaling these solutions will require faster permitting, streamlined interconnection, and clearer coordination between regulators, utilities, and investors.

“It includes changes in consumption patterns, energy efficiency, and adopting low-emission technologies, concepts that natural gas addresses perfectly as a bridge for the energy transition.”

Jorge Sandoval Director | Mexican Natural Gas Association

and those can only come from natural gasbased projects.”

At the same time, renewables are proving increasingly cost-competitive and geopolitically advantageous. Analysts argue that pairing gas-fired flexibility with renewable capacity and battery storage could deliver a resilient, lower-emission model suited to Mexico’s industrial future. This would also allow the country to meet decarbonization targets while preserving manufacturing competitiveness under evolving global supply chain standards that prioritize clean energy inputs.

“There’s already some light at the end of the tunnel with CFE’s expansion plan,” Herrera added. “It includes an investment of around US$8 billion in transmission, but the question is whether that investment will be enough and whether it’s focused on the regions that need it most.”

The next phase of Mexico’s transition hinges on achieving the right mix between gas and renewables. Natural gas remains indispensable for ensuring reliability, providing stable baseload power that supports manufacturing operations and complements intermittent renewable generation. Since 2009, gasfired plants have steadily expanded their share, now accounting for 58% of electricity output. More than half of that gas is imported from the United States, a dependency that exposes Mexico to cross-border supply and pricing risks.

“What we most urgently need in the next two or three years is reliability in the grid, because we are in a tight spot right now,” said roberto de la Garza, Partner, Mexican Association of Qualified Suppliers (AMSCA). “The government recognizes this and is making significant efforts, but their results will take around five years. For now, what we need are one- to two-year solutions,

“Energy is no longer an issue handled by the maintenance department,” said Daniel Salazar, President, Cogenera México. “Today, it is a topic discussed at CEOs’ tables and is directly linked to overall business development. The government knows this, recognizes it, and is eager to ease the energy stress our country is facing.”

For policymakers and companies alike, the question is not whether to phase out natural gas, but how to use it more strategically. Advocates describe gas as a “transition fuel,” one that can sustain industrial reliability while buying time to expand renewable infrastructure. “The energy transition goes beyond simply switching from fossil sources to renewables,” said Jorge Sandoval, Director, Mexican Natural Gas Association. “It includes changes in consumption patterns, energy efficiency, and adopting low-emission technologies, concepts that natural gas addresses perfectly as a bridge for the energy transition.”

Mexico holds enough proven and probable gas reserves to meet four decades of current demand, but underdeveloped production and storage infrastructure limit its potential to serve domestic needs. “In the natural gas sector, we identify three critical areas: pipeline development, storage, and last-mile distribution networks,” Sandoval added. “The lack of infrastructure is a key issue. Once this development takes place, you’ll see economic growth in the regions where

gas becomes available, creating incentives for further investment.”

reinforcing gas pipelines, storage terminals, and interconnections could reduce import dependence and provide a firmer base for renewable integration. However, environmental scrutiny is intensifying. Methane emissions, which have up to 80 times the heat-trapping power of CO2 over 20 years, are undermining gas’s transitional credentials. Industry leaders are increasingly emphasizing the need for better leak detection, flaring reduction, and carbon accounting to align natural gas operations with global sustainability standards.

The convergence of gas and renewables is reshaping corporate and investment strategies. Utilities are testing hybrid models that combine combined-cycle gas plants with co-located solar or wind capacity, while industrial offtakers are exploring long-term power purchase agreements (PPAs) that blend renewable and gas-backed supply. Advances in energy storage are accelerating this shift, offering the flexibility needed to balance variable solar output and stabilize the grid during demand peaks.

Battery energy storage systems (BESS) are poised to play a central role. By displacing

fossil generation during peak hours and smoothing renewable integration, they could substantially enhance grid stability. CFE’s transmission modernization plan, worth over MX$164 billion, includes digital grid controls, fiber optic networks, and predictive maintenance systems designed to accommodate these new technologies.

Mexico’s ability to sustain industrial growth through 2030 will depend on coordinated planning between the public and private sectors. The nearshoring-driven manufacturing boom has magnified energy demand in regions where infrastructure is weakest. Addressing this imbalance will require new pipelines, transmission lines, and storage facilities, investments that hinge on regulatory clarity and predictable returns.

Think tanks such as the Mexican Institute for Competitiveness (IMCO) are calling for a trinational North American strategy to map critical energy corridors, finance interconnections, and secure gas and power flows for industrial hubs. Expanding pipeline capacity to southern states, developing at least five days of national gas storage, and modernizing cross-border links could help Mexico build the resilience needed for sustained growth.

MEXICO’S ENERGY EQUATION: PRODUCERS, OFFTAKERS, POWER ING GROWTH

Mexico’s electricity system is confronting an inflection point in which producers, industrial offtakers, regulators, and investors must re-think pricing, contracts, and regulations if growth is to be powered affordably and sustainably. The marketplace is being reshaped by recent reforms, evolving demand patterns, and new risk dynamics, all of which are likely to dominate conversation among energy experts in the near term.

As Alejandro Peón, Country Manager, Naturgy, noted during the “Mexico’s Energy Equation: Producers, Offtakers, and the Price of Powering Growth: panel at Mexico Business Summit, “We need to stay positive because we are living in a moment of opportunity. Demand is growing, and it is growing because the market for goods and products is seeing new potential driven by nearshoring and the U.S. market.”

The design of Mexico’s electricity market today strongly influences pricing for largescale generation and distributed generation (DG). Under the Electricity Sector Law (LSE), the government mandates that CFE provides at least 54% of generation injected into the national grid, reserving the remainder for private and mixed investment. Private sector participation is still allowed, but under more constrained structures, including mixedinvestment schemes, long-term contracts

focused on delivery through or to CFE, or self-supply/self-consumption models subject to tighter conditions.

Today we have alternatives we didn’t have before. The policies opened in recent years have allowed us to see energy as something where we can actually reduce costs.”

Norma Rodríguez Energy & Project Procurement Manager | ARZYZ

“the key lies in implementation and in publicprivate collaboration. It is said that 29GW must be installed by 2030, clearly, the public sector alone cannot do it. The private sector will have to collaborate strongly, but for that, we need a system-level plan that ensures the entire system meets its stated goals.”

According to Jonathan Pinzón, VP of External Affairs and Business Development, Valia Energía, “We cannot ignore that the current legal framework redefines how generation capacity expands, introducing binding planning while keeping successful mechanisms like selfconsumption, long-term producer models, and the wholesale market. right now, we have a series of patches, self-consumption works and solves some short-term needs, but we really need to reactivate large-scale investment engines that bring the competitiveness the industrial sector requires.”

The permit exemption threshold for small DG systems has been raised from 0.5MW to 0.7MW, offering modest regulatory relief. Meanwhile, storage systems are now recognized expressly under the new regulatory framework as strategic assets, allowed to participate in the wholesale electricity market, provide ancillary services, and help with system reliability. These legal changes are intended to give some clarity and stability, yet many investors remain cautious because regulatory authority has been centralized under the new National Energy Commission (CNE) and the reforms carry new obligations around permitting, interconnection, and plan alignment with government energy planning instruments. Sources suggest that financing, project structuring, and risk of policy reversal are top of mind.

Javier

Pastorino,

For industrial offtakers, the changing market design is not a passive background; it is actively shaping demand profiles and energy procurement behavior. Many large consumers are building in more flexibility, combining grid power with localized DG (solar, combined heat power, small gas-fired plants or self-supply), often with storage, so that continuity, cost, and carbon goals can be met more reliably.

“The vocation of companies has always been to lower costs, it’s in our DNA,” said Norma rodríguez, Energy & Project Procurement Manager, Arzyz. “Today we have alternatives we didn’t have before. The policies opened in recent years have allowed us to see energy as something where we can actually reduce costs.”

Because of newer rules, surplus energy from self-generation projects (especially those connected to the grid) must often be sold only to CFE under terms defined by the regulator, limiting flexibility but creating clearer counterparties. These offtakers are increasingly demanding contracts that lock in price stability, incorporate fuel or input cost escalators, allow firm availability under reliability metrics, and account for intermittency risk in their supply mix. They favor hybrid supply models in which DG plus storage work together, rather than relying on a single source.

Managing Director of Siemens Energy Latam North,

stressed that

“The key technologies right now, cogeneration, distributed generation, hybrid systems, are not perfect solutions, but they are what we have,” added Peón. “We are in a complex world full of opportunities and deficiencies, and the best we can do is cluster solutions among industries so we find shared efficiencies across logistical hubs rather than isolated fixes for each factory.”

The willingness to invest in DG is rising, especially for industrial users motivated by supply risk, cost volatility, and ESG pressures. Producers and offtakers are co-developing contractual innovations and risk-sharing frameworks to manage uncertainties around permitting, fuel/gas supply, and the inherent variability of renewables.

Alejandro de Keijser, Energy and Sustainability Director, Deacero, pointed out that “one pending issue is enforcing coverage requirements. Each load-responsible entity must guarantee its contracts. Even with binding planning, there is still a market mechanism and contracting freedom. Both sellers and buyers must meet certain obligations for the system to function. Enforcing coverage obligations is essential to guarantee reserve margins and avoid over-contracting.”

“The key lies in implementation and in publicprivate collaboration. It is said that 29GW must be installed by 2030, clearly, the public sector alone cannot do it. The private sector will have to collaborate strongly, but for that, we need a system-level plan that ensures the entire system meets its stated goals.”

Javier Pastorino Managing Director Latam North | Siemens Energy

Long-term PPAs (power purchase agreements) with take-or-pay or minimum delivery obligations are being renegotiated to include clauses addressing force majeure, delays in transmission or interconnection, fuel price variation, or dispatch priority. Some contracts now consider capacity payments, or fixed availability payments, to ensure a baseline revenue stream even when dispatch is low.

In distributed generation or self-supply, agreements may include shared risk on surplus energy valuation, curtailment, or penalty for under-performance. Hybrid deals that bundle DG plus storage or onsite generation help smooth the supply variability, and risk exposure is typically shared between

the producer (who must ensure availability or maintain redundancy) and the industrial offtaker (who must accept certain flexibility or sometimes pay premiums for guaranteed reliability).

Green Premiums: Viable or Not?

The growing corporate focus on decarbonization and ESG compliance is transforming the conversation about energy pricing in Mexico. Many industrial offtakers are increasingly willing to accept, or even budget for, a green premium for clean energy, especially if the premium can be tied to recognized instruments (clean energy certificates, carbon credits) and if there is transparency in pricing. This is particularly the case for companies with export exposure or supply chains in North America or Europe, where ESG metrics affect market access, cost of capital or brand value. The presence of policy incentive tools, clean energy obligations, or regulation that mandates use of cleaner energy or penalizes high carbon intensity make the green premium more credible. Producers respond by designing renewables projects, hybrid plants, or DG offerings whose financing can be justified by this premium, especially when terms allow higher long-term stability or risk-sharing that mitigates technology or regulatory uncertainty.

Strategic investments and policy alignments across the energy ecosystem are essential if Mexico is to deliver competitive, sustainable industrial power. Critical among these are streamlining and clarifying permitting and interconnection rules, ensuring that transmission is expanded where load centers (industrial corridors) are growing, and that grid investment keeps pace with decentralized generation and storage. r egulators must offer stable rules for DG, storage participation, surplus energy valuation, and environmental permitting. Producers need to invest in resilient fuel logistics, flexible generation plants, hybrid systems, digital tools for forecasting and operations optimization. Offtakers should be capable of participating in energy markets or negotiating contracts that reward reliability, carbon performance, and flexibility.

GROWTH PERSPECTIVES FOR NORTH AMERICA’S POW ER MARKETS

As North America enters a decade defined by electrification and surging industrial demand, the region’s power markets are facing a complex mix of opportunity and constraint. In his presentation, “Growth Perspectives for North America’s Power Markets: What are the challenges ahead?”, Juan Pablo Londoño, Principal Analyst for the Americas Power Markets, Wood Mackenzie, examines how structural shifts, from new federal policies to accelerating large-load growth, are reshaping the outlook for generation, storage, and investment across the continent.

Wood Mackenzie’s latest power market outlook projects steady demand growth in the United States, driven by new industrial projects, data centers, and electric vehicle infrastructure. More than 147GW of highprobability new load, equivalent to roughly 20% of current US peak demand, is now in advanced development or near-term forecasts. Utilities have already committed to over 17GW of large loads under construction and another 99GW in the pipeline. This rapid acceleration is testing the flexibility of regional grids, with markets like MISO and SPP better positioned to absorb new demand than more capacity-constrained regions such as PJM, SErC, and ErCOT.

The report also highlights how supply chain constraints are becoming a defining challenge for new generation projects. Global gas turbine manufacturing capacity is now stretched thin, leading to delivery times of up to five years for orders placed in 2024. This tightness limits the ability of North American utilities to bring new gasfired capacity online through the rest of the decade, raising concerns about reliability and reserve margins amid growing demand.

At the same time, clean energy development is being reshaped by US policy. The passage of the One Big Beautiful Bill Act (OBBBA) has muted the near-term outlook for renewables, cutting Wood Mackenzie’s solar forecast by 12%, or about 60 GW, over the next decade.

The onshore wind outlook also declined by 21% after the law ended production tax credits for projects placed in service after 2027. However, developers are racing to meet remaining tax credit deadlines, pushing a near-term surge in installations through 2027 and 2030. For storage, the story is more nuanced: demand remains strong, but the sector faces a major supply chain shift as FEOC restrictions take effect, incentivizing the move toward domestic manufacturing.

The storage market, in particular, illustrates the transition underway. With new tax incentives for domestic content and sustained eligibility for the investment tax credit (ITC), utility-scale and residential systems alike are gaining ground. Developers are accelerating projects to secure Chinese components before tariffs tighten, while United Statesbased suppliers race to ramp up production. Wood Mackenzie forecasts storage additions holding steady even under more restrictive conditions, supported by continued demand growth and renewable integration needs.

Mexico, meanwhile, presents a different but equally complex landscape. Peak demand there is expected to climb from 51GW in 2024 to 90GW by 2050, a 2.6% compound annual growth rate, requiring a balanced mix of new thermal and renewable capacity to maintain CENACE’s planning reserves and clean energy targets. Natural gas generation continues to dominate Mexico’s power mix, but renewables are set to gain traction over the next decade. Still, with turbine delivery backlogs and uncertain compensation mechanisms for grid-injected surpluses under the new Electricity Sector Law (LESE), developers face a challenging investment environment.

There are, however, signs of a more collaborative approach taking shape. “We’re seeing a much more open attitude toward private participation from the government, a real willingness to invite the private sector to collaborate with CFE and ensure that supply

strategies are ready and available on time,” said one industry observer. “It represents a positive change. Much progress has been made, though there are still pieces that need to be fully understood.”

Another key factor underpinning Mexico’s energy outlook is its privileged access to low-cost natural gas, one of the cheapest in the world, thanks to strong commercial ties with the United States. “While that does carry a degree of geopolitical risk, it’s a manageable one that also highlights areas of the industry still needing attention, such as the development of strategic gas storage,” said the same source. “Natural gas will remain a fundamental pillar, not only for new installed capacity but also in how it supports renewable operations. Even as storage becomes an essential part of the market, expected to reach around 30% of

new capacity compared with wind and solar, natural gas, increasingly flexible and efficient, will continue to play a central role in helping the Mexican system integrate clean capacity.”