Matchmaking

Mexico’s leading B2B conference organizer uses a customized app to deliver an unparalleled experience

The MBE App delivered AI-powered intent-based matchmaking to Mexico Energy Forum 2025 attendees

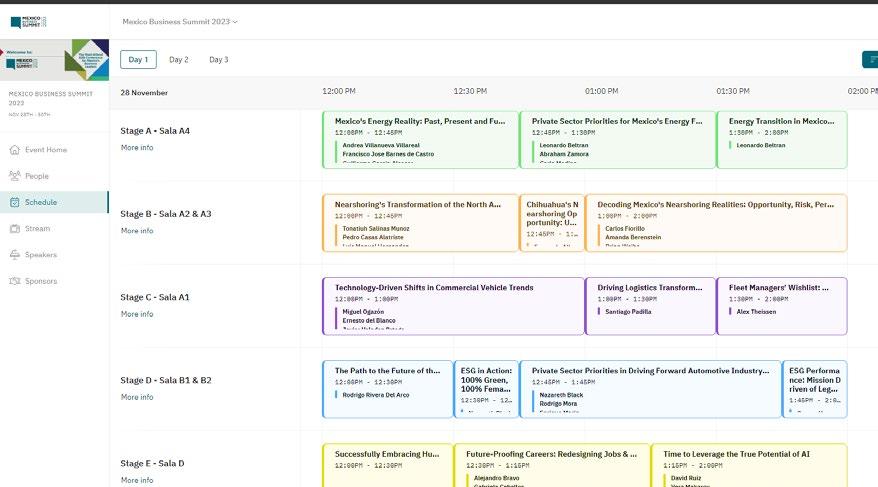

MBE App Impact

258 participants

1,205 matchmaking communications

247 1:1 meetings conducted

32 speakers

16th Edition

Conference social media impact

3,014 direct impressions during MEF

10 sponsors

11,637 visitors to the conference website

Pre-conference social media impact

102,022 direct pre-conference LinkedIn impressions

12% click through rate during MEF 9.1% pre-conference click through rate 26.79% conference engagement rate

pre-conference engagement rate

Matchmaking intentions

Total

2,162

703 Networking

1,459 Trading

• AB Energy Mexico

• ABConsulting

• ADEE

• AES

• Agencia de Energía de Nuevo León

• Aggreko

• ALLECTRO

• Alliance

• Alliance Energy

• Alvarez & Marsal

• AMDEE

• AMERGY MEXICANA

• AMERIC

• AMESPAC

• AMGN

• AMGNV

• AMSCA

• ANES

• Area Industrial

• Asesor Independiente

• Asociación de Empresarios y Ciudades Hermanas

• Asociación Mexicana de Hidrógeno (H2 México)

• ASOLMEX

• Atlantica Sustainable Infrastructure

• Atlas Professionals

• Audi de Mexico

• Baker McKenzie Mexico

• Balam Energy

• B BVA México

• Becerril, Coca & Becerril

• Bergen Engines Mexico

• Blue Global Energy

• Brimex Energy

• British Embassy

• Business Finland

• Business France

• Caliza

• Cámara Española de Comercio

• Camara Verde

• CANACINTRA

• CANACINTRA ESTADO DE MÉXICO

• Canadian Embassy in Mexico

• Capwatt México

• Catenon

• CBI

• CFE

• China Chamber Mexico

• Climate Action Week Mexico

• Cluster de Energía del Estado de Querétaro

• Clúster Energético de Puebla

• Cluster Espacial Mexico

• CN Biogas

• Co Energía

• COGENERA

• COMENER

• CONCAMIN

• ConceptPR

• ContourGlobal

• Coparmex

• Cosmos

• Cross Energy México

• Cross Solutions LLC

• Deacero

• Delegación General de Québec en México

• DIPREM

• DIPREM MX

• Director

• DNV

• DSS+

• Ecozona Centro Cuernavaca

• EGADE Business School

• ELECTRIZ

• Eleia Mexico

• ELEMENTAL MEDIA

• Embajada de Suecia

• EMPÁTICO Group

• Enel Mexico

• ENERGi

• Energía INFRA

• Energía Real

• Energía-WeTeam

• Energy Agency of the State of Campeche

• Energy by 5

• ENERGYEAR / IBADVISOR

• Énestas

• ENGIE

• EN GIE Mexico

• Ennova America

• Equipos Especializados en Renta NG

• ESTRATEGAS DE MÉXICO

• Evonik Industries

• Fenix

• Finergy

• Finsolar

• FORTALEZA ENERGY

• FRV

• Ftech

• Fundación Minera de Chile

• Galicia

• GE Vernova

• Generac México

• Gontrecapital

• Green Chamber México

• GRI Club

• Grunbee

• G RUPO CIITA

• Grupo Cobra México

• Grupo Desarrollo Infraestructura

• Grupo Enersun

• Grupo Gasadi

• Grupo Imperial Corporativo

• Grupo NXT

• GSquare Capital Advisors

• HBGSMART

• Hitachi Energy

• Holland House Mexico

• How2Go

• IAJ

• IMSS

• INA

• INDMEX / Agencia de Energía

• Institute of the Americas

• International SOS México Emergency Services

• Invest Hong Kong

• iPS Power ful People

• ISEBSA /COMCE SUR

• Israel Economic Office to Mexico

• ITAM

• KEPLER CO NSTRUCTORA

• Keymex Energy

• Kiewit

• K IIN Energy

• Kino Energía - Comité de Energía CanCham

• KOTRA

• K PMG México

• La Frutología

• La Frutología México

• Luxem Energía de México

• Masari

• Max4 Solar

• Mayacaste Oil & Gas

• METRON

• Mexico, Central America & Caribbean MSS

• Ministry of Economy

• Ministry of Foreign Affairs of Denmark

• Mitsui & Co.

Infrastructure Solutions

• Multiva

• Naturgy Mexico

• Newmont

• Nextracker

• Ngrenta

• Nosotrxs

• NX Buena Energía

• Nxtlab

• NXTview

• Oca Global

• OCEAMAR USA

• Pandener

• POWERCHINA

• Pro Chile

• Prosolia Energy México

• PROTER RA CAPITAL

• Proyener

• Prysmian Mexico

• Quantum energia

• QUARTUX MÉXICO

• R EGULUS 333

• REPSA

• RER Energy

• Retssop

• Riverstone Holdings

• Schneider Electric

• SECRETARIA DE DESARROLLO ENERGÉTICO DE TAMAULIPAS

• Secretaria de Desarrollo Económico EDOMEX

• Secretaría de Economía

• SEDECO ESTADO DE MÉXICO

• SENER MEX ENERGY

• Seraphim Solar Energy

• Siemens Mexico, Central America and the Caribbean

• Signum

• Skysense

• SMART IoT

• SOLARIG

• Solea

• Solensa

• Solfium

• Solventa Energía

• Source Latam Financial Services

• South Pole

• SUJIO

• Sun Light Energy

• SUSTENTABILIDAD EMPRESARIAL Y VALO R AGREGADO

• Texas European Chamber of Commerce

• TRAC SA Energía

• Trina Solar

• Trio Advisory

• Tuto Power

• U.S. Commercial Service

• U.S. Embassy in Mexico

• U.S. Embassy-Commercial Service Office

• Universidad Panamericana

• V&A Ambiental y Legal, S.C.

• Vansertec Green Energy

• Vesta Industrial Real Estate

• Vive Energía

• Von Wobeser y Sierra

• Walmart Mexico

• We Team

• WTW

• Young AI Leaders

• ZNShine Solar

• Zuma Energia

WEDNES DAY,JUNE 4

09:00 MEXICO PLAN: ENERGY JUSTICE, AND THE PROMOTION OF THE MADE IN MEXICO SEAL

Speaker: Diana León, Ministry of Economy

09:30 TODAY’S ENERGY PRIORITIES FOR MEXICO’S LONG-TERM SUCCESS

Moderator: Guillermo García, ITAM, CRE

Panelists: Carlos Hernández, Coparmex

Carla Medina, ASOLMEX

Juan Acra, COMENER

Vania Laban, AMGN

Gerardo Pérez, AMDEE, EDF

10:15 ENERGY INFRASTRUCTURE INVESTMENT OPPORTUNITIES IN THE SOUTH

Moderator: Leonardo Beltrán, Institute of the Americas

Panelists: Beatriz Marcelino, ADEE

Carlos García, Energy Agency of the State of Campeche

12:00 CEO ROUND TABLE: ENERGY SECTOR PRIORITIES TO UNLEASH INVESTMENT

Moderator: Fernando Tovar, Mitsui & Co Infrastructure Solutions

Panelists: Luis Quero, Atlantica

Alejandro Peón, Naturgy Mexico

Pedro Cañamero, ENEL Mexico

César Cornejo, ENGIE

Eva Ribera, ContourGlobal

13:15 DEMAND OUTLOOK, ENERGY MARKET DYNAMICS & OFFTAKER PRIORITIES

Moderator: Andrea Lozano, AMSCA

Panelists: Marco Cosío, Siemens Mexico, Central America and the Caribbean

Gabriel Padilla, INA

Gerardo Pandal, ELEIA Mexico

Diego Arriola, Nxtlab

Cecilia Alvarado, ENGIE Mexico

15:15 EPCS IN THE DG ERA: ADAPTING PORTFOLIOS FOR A DECENTRALIZED MARKET

Moderator: Nelson Delgado, ASOLMEX

Panelists: Humberto García, KIIN Energy

Carla Ortiz, RER Energy

David Hebrero, Trina Solar

Edmond Grieger, Von Wobeser y Sierra

16:00 RISK & REWARD: THE FUTURE OF ENERGY FINANCE IN MEXICO

Moderator: Omar Castillo, BBVA Mexico

Panelists: Jason Potts, Finsolar

Juan Pablo Visoso, Riverstone LATAM

Ricardo Zúñiga, CapWatt

Pablo Linares, Energía Real

19:00 END OF MEXICO ENERGY FORUM 2025

MEXICO PLAN: ENERGY JUSTICE, MADE IN M EXICO SEAL

In 2025, under President Claudia Sheinbaum’s leadership, Mexico relaunched the Hecho en México (Made in Mexico) seal as a cornerstone of the broader Plan México. This initiative aims to position the country as a leading industrial hub, enhancing economic sovereignty and reducing reliance on imports, while boosting the development of the local supply chain in different industries, including energy generation.

According to Diana León, Head of the Energy Program, Ministry of Economy, the Hecho en México seal is more than a branding effort; it is a strategic move to strengthen Mexico’s industrial base. By encouraging the use of domestic inputs and recognizing products that meet high-quality standards, the initiative seeks to boost the national economy and integrate Mexican businesses into global value chains, hoping to capitalize on the nearshoring effect. As of May 2025, over 600 companies have registered nearly 2,000 products across various sectors, including automotive, aerospace, electronics, and textiles.

León stressed the importance of the energy sector within this context, as one of the Plan México goals is to generate 25% of Mexico’s energy coming from renewable sources. This objective also aligns with the federal government’s goal to ensure energy justice, which León defined as ensuring equitable and sustainable access to energy for everyone. It

seeks to guarantee that all people, regardless of their geographic location or socioeconomic status, have reliable and sustainable access to the energy they require. “Energy should not be a luxury, but rather it should reach the places most in need,” she added.

Global Growth for Local Suppliers

While nearshoring has been a buzzword in recent years, its full potential in Mexico has been hindered by legislative uncertainties and infrastructure limitations. However, the Sheinbaum administration has taken steps to clarify sectoral regulations and foster dialogue with the private sector during the first months of her term. “I truly believe that together, we will see our sovereignty reflected, and Mexico will become sustainable and more productive. with your support, by 2030 we will have many more results,” León added, stressing the importance of publicprivate collaboration.

The federal efforts aim to create a more conducive environment for investment and capitalize on Mexico’s strategic advantages, such as its skilled labor force and proximity to major markets. León noted that acquiring the Hecho en México distinctive creates various opportunities for companies, as they will be registered in Mexico’s suppliers and providers catalogue, which will be the main source of consultation to provide products and services for new companies setting up factories in the country. “It is important to generate synergies between registered companies and new investments,” she added.

León said that among other benefits, those obtaining the Hecho en México seal will enjoy increased consumer preference, achieve greater market differentiation, and enhance their brand’s value and prestige. The government will facilitate networking opportunities and inclusion in national supply chains. Furthermore, companies gain access to training programs, discounts on registration with the Mexican Institute of Industrial Property (IMPI). Meanwhile,

MSMEs can access NAFIN financing at preferential rates. This distinction also allows companies to showcase their commitment to sustainability, as it requires them to align with at least one of the UN’s Sustainable Development Goals (SDGs).

León stressed that the government is drafting the rules for service providers to obtain this distinction. Despite not having manufacturing processes, León says these companies can use the distinction for advertising purposes.

Opportunities Amid Uncertainty

Mexico’s trade relations, particularly with the United States, have faced challenges due to protectionist policies and tariff impositions. Despite these hurdles, Mexico remains a competitive manufacturing destination, with

TODAY’S ENERGY PRIORITIES FOR MEXICO’S LONG-TE RM SUCCESS

Mexico’s current energy transition is defined by both continuity and adaptation. After a six-year period marked by the rollback of the 2014 Energy Reform, the arrival of a new administration under President Claudia Sheinbaum has provided fresh clarity to the trajectory of national energy policy. While the foundational principles of energy sovereignty and CFE-led development remain intact, a more pragmatic tone is emerging. This shift has reopened the door, though in a more structured and selective fashion, for private sector participation in service of national objectives.

nearly 90% of its trade with the US being tariff-free under the USMCA. The Hecho en México seal reinforces the country’s commitment to producing high-quality goods that meet international standards, thereby opening doors to new markets in South America and Europe.

The initiative also emphasizes the importance of human capital in driving industrial growth. León highlighted the role of education and innovation in achieving energy sovereignty and sustainability. “We want to promote that more engineers graduate every day because energy plays a fundamental role in our country,” she states. By aligning educational curricula with industry needs, the government aims to equip the workforce with the skills necessary for the evolving industrial landscape.

Compared to the previous administration, Claudia Sheinbaum’s government has maintained the social focus of the energy transition, while opening the industry up to collaboration with the private sector. According to Carla Medina, President, ASOLMEX, it is crucial for companies to understand this new vision, where energy is seen as a right, rather than just a product, and how the private sector fits within it to create more harmonious cooperation.

“Only those players who agree to accompany the state in its vision toward 2030 will

participate,” says Medina. “That, to me, sets the most important challenge in terms of the mindset of companies of different sizes, so they can optimize and capitalize on the opportunities opened by the new legal framework.”

“I

would communicate the advantages that exist in renewable energy and how private entities, without having to get involved in transmission issues, can participate more in that. In other words, we could find mixed participation schemes”

matter what. That is what we (companies) have to do, more transmission pipelines, to have that firm source of energy with which to promote the development of renewable energies.”

Change Leads to New Opportunities, Challenges

Gerardo Pérez President and Country Manager |

AMDEE and EDF

Mexico’s energy sector today must respond to overlapping pressures. Nearshoring and foreign direct investment have created a surge in energy demand, particularly in manufacturing and logistics corridors. Simultaneously, global supply chain realignments and clean energy commitments demand more resilient and diversified infrastructure. Under Sheinbaum’s government, strategic collaboration is likely to define the new normal. Joint ventures and specialized partnerships are expected to become the key mechanism for reconciling state control with private sector agility and expertise.

These partnerships and collaboration will require open dialogues between the private and public sector. For Juan Acra, President, COMENER, it is crucial for the private sector to emphasize the importance of new technologies and energies for the energy transition. Similarly, it is key to position Mexico as an active player in the global energy market, such as through a higher production of gas within the country.

“Mexico must be involved in global energy discussions,” says Acra. “The formula for carrying out an accelerated energy transition is to expand the gas sector in the country. No

Unlike the liberalization push that followed the 2014 Energy Reform, the current environment encourages private engagement through tailored roles that align with CFE’s priorities. Companies that offer technical solutions in grid stability, distributed energy resources, storage, and demand-side management are finding more traction than those solely focused on utility-scale generation. The limitations on private generation persist, but there is growing space for private firms to integrate technologies, financing models, and operational strategies that strengthen public infrastructure and expand access.

One of the main limitations for the private sector is time, however. With the government having the goal of 25% renewable generation by 2030, combined with increasing demand, the need to maintain energy independence while moving forward with the energy transition calls for alternative ways of generating energy within the country. For Vania Laban, President, AMGN, gas will continue to be a key piece in this tight schedule for the country’s energy transition.

“My concern is time; it is the sense of urgency,” says Laban. “Despite our dependence on the United States, we continue to bet on (gas) because it makes sense. No, it is not a blind gamble. We have to find a way to increase our own production, to balance that matrix, but gas is going to continue being an extremely important player.”

“We have to start extracting natural gas in an environmentally friendly way to put it to work for the benefit of Mexicans. That is where we are going to become more competitive,” says Carlos Hernandez, President of the Energy Commission, COPARMEX. Citing a national security emergency law, they (the

United States) could shut off the natural gas supply on us … We cannot talk about sovereignty if we keep importing 70% of the natural gas in our country.”

Today’s framework does not revert fully to the pre-2014 paradigm, but it clearly diverges from the post-reform liberal market model. Instead, it seeks a middle ground where state-led planning is complemented by selective and strategic participation from private players. This includes opportunities in energy efficiency services, co-generation at industrial sites, infrastructure financing, and technology deployment, especially where CFE lacks bandwidth or experience. Nevertheless, one of the main questions still in the mind of the private sector is what the future of private-public partnerships beyond generation might look like. For Gerardo P érez, President and Country Manager, AMDEE and EDF, having an open dialogue with the government on how companies can contribute to the energy transition beyond the supply of electricity is essential.

“I would try to share (with the government) the vision that we entrepreneurs in the

wind sector have,” says P érez. “I would communicate the advantages that exist in renewable energy and how private entities, without having to get involved in transmission issues, can participate more in that. In other words, we could also find mixed participation schemes.”

One of the challenges for private stakeholders is to move beyond a generation-centric view and embrace a systems-level perspective that includes services, infrastructure, integration, and co-investment. While large-scale renewable projects have slowed, there are still viable pathways for utility-scale development. These include hybrid projects with transmission support from CFE, industrial offtakers in energy-intensive regions, and regional initiatives aligned with federal decarbonization goals. Understanding where CFE is willing to co-invest or where transmission infrastructure will expand is becoming essential for identifying viable projects.

Beyond the regulatory challenges, Hernández believes that there are three main additional obstacles for companies and investors when it comes to the energy sector in Mexico: making sure that the private sector promotes the existing generation scheme, understanding and navigating the new judicial reform, and having real talks about energy sovereignty.

Looking forward to this new era for the energy sector, Guillermo Garcia, Professor, ITAM and former Chair, CRE, believes that the new system, more open to dialogue and private-public collaboration and partnerships symbolizes a bright future full of opportunities for the industry.

“There is a new model where there is collaboration with the public sector, and where not everything is market-driven, nor controlled by the state. I think we have to find those definitions and those bridges where collaboration can happen,” says Alcocer. “This is an attractive model, one that can be worked on, and we have to collaborate with the government so they can be successful and so we can provide the energy that the industry needs.”

ENERGY INFRASTRUCTURE INVESTMENT OPPORTUNITIES IN THE SOUTH

Southern Mexico is emerging as a key focus area for national energy development, but persistent infrastructure gaps continue to pose barriers for investment and industrialization. Plan México aims to boost this region with infrastructure and talent development to reach a 27,000MW goal by 2030.

“Campeche has complied with the technical and legal requirements to be designated a development hub. The main challenge is infrastructure and ensuring access to renewable energy and natural gas,” says Carlos Adrián García, Director General of the Energy Agency, State of Campeche. He noted that recent milestones, such as the signing of the Silvaplaya port dredging project reflect a shift toward enabling infrastructure that can support industrial and residential demand.

Southern states such as Campeche, Yucatan, and Oaxaca remain disconnected from national energy corridors. Limited transmission capacity, high reliance on fossil fuels, and weak connectivity increase costs and reduce reliability for businesses and residents. “We need to stop seeing Campeche solely as an extractive region,” García says, noting the state’s potential to diversify through agribusiness, industrial logistics, and electrified mobility initiatives.

Leonardo Beltrán, Non-Resident Fellow, Institute of the Americas, addressed the

need for cross-sector coordination. “There is an opportunity in the South-Southeast within the framework of Plan México to involve both the public and private sectors. Consolidating Mexico’s leadership in clean energy will require clearer roadmaps for how these development hubs will access and distribute energy,” he says.

Projects under discussion include electrification for industrial parks, distributed generation for rural zones, and natural gas infrastructure extensions. According to García, Campeche is preparing for future demand by developing gas distribution lines and power corridors. “The Lerma thermoelectric plant will use aeroderivative turbine technology, while a 100% electric light rail system is under development to connect key urban areas,” he noted.

“We are moving slowly, but we are moving,” says Beatriz Marcelino, President, ADEE. “The private sector is starting to participate in industrial development projects. “There is strong opportunity for investment in Oaxaca, Yucatan, and Campeche, especially in sustainable industrial parks with water treatment, circular economy practices, and energy solutions.”

Despite the momentum, regulatory and logistical challenges remain, says Beltrán. Complex permitting, social resistance, and

fragmented coordination among federal and state actors hinder progress. García explains that successful deployment requires collaboration across southern states. “If we do not act as a bloc, we will not reach the 27,000MW of renewable energy by 2030 under Plan México.”

Another pressing issue is the lack of skilled labor. Marcelino pointed to a shortage of trained workers and local suppliers. “We

developed 33 local companies as providers in coordination with project operators, but there is still a gap in technical workforce and supplier development,” she says. Strengthening talent development is essential for consolidating a long-term energy system in the region, Beltrán adds.

“There are natural resources, there is land, and there is technical planning. What we need now is the willingness to invest,” García says.

CEO ROUND TABLE: ENERGY SECTOR PRIORITIES TO UNLEASH INVESTMENT

As energy costs rise and infrastructure bottlenecks persist, businesses in Mexico face growing pressure to rethink their energy strategies. Industrial users, particularly those operating in manufacturing hubs and emerging logistics corridors, are finding that securing reliable, cost-efficient, and compliant energy supply is no longer a backoffice concern but a boardroom priority. This evolving reality is compelling companies to engage more actively with energy markets, often requiring levels of technical and regulatory understanding they had not previously needed.

In this context, businesses must become energy experts. The rise of energy suppliers, aggregators, and specialized consultants is helping companies manage complexity without diverting resources from their core operations. These players are enabling industrial users to navigate distributed

generation, PPAs, energy efficiency solutions, and regulatory compliance, while offering integrated services that translate technical challenges into business value.

As the world increasingly demands more energy, Alejandro Peón Peralta, Country Manager, Naturgy Mexico, believes that the perspective of energy companies should change to listen more closely to the specific needs of the clients to not just provide energy, but a holistic service composed of new ideas and technologies. “The client does need to at least understand the basics and, depending on how much energy costs represent in their processes, they do need to develop areas of expertise because it will be a driver for the future,” says Peralta. “Companies dedicated to energy also need to serve the client. We need to provide information, reliability, analysis, and value in the service. We must not just deliver energy but be willing to invent new things.”

The business case for alternative energy investment is also evolving. For many companies, renewables and energy-as-aservice models are no longer just driven by ESG commitments alone, but by economics. Rising grid tariffs, reliability issues, and growing investor scrutiny are pushing companies toward on-site generation, clean energy procurement, and smarter load management. “Large corporations in Mexico have to meet ESG goals and sustainability objectives,” says Luis Quero, Mexico Country Manager at Atlantica. “They are under pressure from investors and clients, and they have to opt for alternative energies.”

Battery storage is also becoming part of these conversations, but opinions remain divided. Technological readiness is no longer in question, especially for commercial and industrial-scale applications. However, the economic situation is still maturing, often dependent on access to financing, supportive regulation, and volatility in grid reliability or pricing. While large-scale batteries can enhance grid stability and reduce peak charges, their deployment in Mexico is still in its early stages. Clearer policy signals and incentive mechanisms will be critical for unlocking broader adoption.

“Companies dedicated to energy also need to serve the client. We need to provide information, reliability, analysis, and value in the service. We must not just deliver energy but be willing to invent new things”

Alejandro Peón Country Manager | Naturgy Mexico

will be regulated and how they will fit into the industry economically is crucial.

“As with any kind of technology, in the initial stage the price is going to be a bit higher,” says Cañamero. “You have to look at what these batteries are used for and whether the regulatory framework allows you to make those investments in the long term.”

Meanwhile, grid code enforcement continues to shape how projects are developed and operated. More companies are recognizing compliance not only as a legal obligation, but as a gateway to future-proofing operations. However, the level of preparedness remains uneven, with some industrial users underestimating the technical and financial implications of non-compliance. Integrators and energy service providers are stepping in to fill this gap, offering turnkey solutions that include compliance assessments and technical upgrades.

Compliance also demands that the grid code remains stable and without regulatory fluctuations. For Eva Ribera, CEO Mexico and Caribbean, Contour Global, making sure that there is long term planning is key to guaranteeing a profitable, secure and reliable electricity supply.

“There has to be, first and foremost, longterm planning that does not shift, regardless of which political party is in power,” says Ribera. “There must be regulatory and legal certainty that gives investors the confidence that they will receive an adequate return. And then, of course, it also depends on what the government wants in terms of providing incentives to support one kind of energy and promote its development.”

The potential for batteries within Mexico’s energy market is something that Pedro Cañamero, Country Manager, ENEL Mexico, believes is just scratching the surface. Beyond bringing resilience and stability to the system, they have the potential to be crucial investments and evolve with technology as the grid is modernized. However, understanding how these assets

Another crucial aspect that must be considered to maximize the financial benefits for both generators and consumers is optimization of generation systems. “On the generator side, that optimization and pursuit of efficiency translates to competitiveness,” says César Cornejo, Managing Director Renewable Mexico and Vice President Operations Renewable Latin America, ENGIE. “To be competitive, we

need to ensure that we produce or extract the greatest amount of energy possible from the sun or the wind when it is their time. It is in our DNA to be competitive to lower the price of energy as much as we can.”

Ultimately, the new energy reality in Mexico is demanding a deeper level of engagement from private actors. Whether through direct

investment, partnerships with suppliers, or reliance on third-party expertise, business leaders agree that companies are becoming critical stakeholders in the country’s energy transition. Those that embrace this role stand to gain a competitive edge, not only through cost savings, but through resilience, innovation, and alignment with a more complex but opportunity-rich energy environment.

DEMAND OUTLOOK, ENERGY MARKET DYNAMICS & OFFTAKER PRIORITIES

As nearshoring accelerates and industrial activity expands, Mexico’s energy market is experiencing mounting pressure. This growth, led by sectors such as automotive, aerospace, and logistics, is straining the country’s transmission infrastructure and forcing both energy producers and consumers to reassess procurement models, risk management, and investment priorities, according to Andrea Lozano, President, AMSCA.

“Transmission bottlenecks and interconnection delays are becoming more frequent,” says Lozano. “This directly impacts how offtakers plan their energy sourcing and infrastructure timelines.”

For industrial users operating on tight delivery schedules and energy-dependent production lines, this pressure introduces significant risk. To address it, companies are increasingly adopting risk mitigation strategies such as load-shifting, backup generation, and energy storage. These

approaches allow for continuity of service even when grid performance falters.

“In OEM production costs, energy may represent 3% to 5%, but throughout the supply chain, this can increase to 5%–10%, and even reach up to 15% downstream. In today’s competitive landscape, this commercial environment energy users must become active energy managers,” says Gabriel Padilla, Director General, INA.

Cecilia Alvarado, Chief Commercial Officer, ENGIE Mexico, noted that power producers are responding by diversifying generation portfolios. “We are designing hybrid models that combine renewable generation with storage and flexible dispatch capabilities,” she explains. “This allows us to better meet offtakers’ evolving requirements.”

The regulatory landscape, restrictions and uncertainty have complicated grid-based development, prompting large users to

explore isolated supply models and behindthe-meter generation, according to Diego Arriola, Partner, Nxtlab. “Energy users today want control over their supply, not just in terms of price, but reliability and sustainability,” said Arriola. “The regulatory environment needs to catch up with these needs.”

While storage is still subject to regulatory gaps, it is increasingly seen as a critical component for industrial autonomy. Power purchase agreements (PPAs) are also being restructured. Traditional long-term, fixedprice contracts are giving way to modular agreements, flexible pricing mechanisms, and, in some cases, virtual PPAs that support multinational procurement strategies.

Marco Cosío, Vice President of Smart Infrastructure, Siemens Mexico, Central

EPCS

America and the Caribbean, highlights the trend toward dynamic contract structures. “We are seeing more indexing to market conditions and contracts that evolve with project phases or capacity expansions.”

As energy becomes increasingly intertwined with industrial competitiveness, both producers and consumers are moving beyond transactional relationships, experts say. “This is no longer just about selling or buying electricity,” says Gerardo Pandal, CEO, ELEIA Mexico. “It is about building a resilient operational model around energy.”

Padilla added that energy strategy is now a core business consideration. “For our industry, energy is a driver of productivity, and without a stable and scalable supply, growth is limited.”

IN THE DG ERA: ADAPTING PORTFOLIOS IN A DECENTRALI ZED MARKET

The rise of distributed generation (DG) has catalyzed a fundamental transformation in the strategies and operations of Engineering, Procurement, and Construction (EPC) companies. In the wake of the country’s shifting regulatory priorities and the continued central role of CFE in the national grid, EPCs are finding opportunities in smaller-scale, decentralized projects that respond directly to industrial and commercial demand for energy reliability, autonomy, and sustainability.

Transformation has been swift and strategic. EPCs are increasingly shifting from large utility-scale developments, largely frozen under the policy direction of the last administration, to tailor-made DG solutions under the 500kW cap. These systems offer businesses a cost-effective hedge against price volatility, blackouts, and regulatory uncertainty. For EPCs, this has meant a reconfiguration of business models that prioritize agility, sector-specific customization, and streamlined permitting

processes. Recently, this cap was increased to 700kW, a modest increase but an important business opportunity to update the installed base.

Nelson Delgado, Director General, ASOLMEX, notes that over the past years, DG has been the segment experiencing the most significant growth. He highlighted that by the end of 2024, installed DG capacity in the country surpassed the 1GW mark, with 1,082MW from DG projects having been added during that year alone. Delgado also pointed out that in Mexico, most DG projects are focused on smaller capacities, typically below 30kW. “Solar has been technically the primary engine for renewable energy growth in Mexico in recent years. We have seen solar DG capacity double from 2GW to 4GW. This 4GW now stands at nearly half of the approximately 8GW installed in utility-scale renewable projects nationwide,” adds Carla Ortiz, Country Manager Mexico, RER Energy, stating that one key incentive was lower prices and shorter return of investment times.

“The market has focused too much on the product aspect, but we have found that the main differentiator is service. This encompasses having well-prepared people, installation teams with extensive experience, and clear overall service capabilities”

Humberto García CEO | KIIN Energy

and food processors to logistics hubs and retail chains, all of which are driven by rising electricity prices, sustainability mandates, and the desire for greater operational control. EPCs that succeed in this space are those capable of translating technical offerings into business value, highlighting payback periods, ESG advantages, and longterm savings.

Local EPCs, in particular, have leveraged their understanding of regional dynamics, regulatory nuances, and customer behavior to edge out multinational competitors. Their ability to navigate permitting bottlenecks, grid access challenges, and procurement complexities has made them more nimble and responsive to market signals. In contrast, multinationals often contend with centralized processes and slower adaptation to the fragmented, DG-oriented terrain. “The market has focused too much on the product aspect, but we have found that the main differentiator is service. This encompasses having well-prepared people, installation teams with extensive experience, and clear overall service capabilities,” says Humberto García, CEO, KIIN Energy.

Strategically, successful EPCs are investing in commercial intelligence to target industries that are both energy-intensive and underserved. Some are partnering with financing platforms to offer lease or PPA models that reduce upfront investment for clients. Others are bundling energy storage, energy management systems, and monitoring software to increase the value proposition and enhance performance tracking.

Edmond Grieger, Partner, Von Wobeser y Sierra, believes that from a legal standpoint, DG is in a period rich with opportunities. Amid an evolving regulatory environment, there is noticeable interest in securing contracts for DG. This trend, he adds, is partly due to larger-scale projects often facing delays or awaiting more legal certainty.

DG is no longer the exclusive terrain of hightech firms or export-driven manufacturers. Today, offtakers range from agribusinesses

Drivers for DG Growth

David Hebrero, Head of Latam, Trina Solar, notes that energy security is the main driver for demand in the sector. He points out that overcoming hurdles related to regulation, capital acquisition, and infrastructure development will increasingly demand more time and effort.

“Since 2023, challenges such as blackouts and peak-hour operational restrictions for

companies have elevated energy security to the foremost priority. It is no longer primarily about ESG goals or savings achieved through solar; it is now fundamentally about ensuring operational continuity and enabling growth, particularly as some industrial zones are already reaching their capacity limits,” Ortiz adds.

Grieger notes that consumers are increasingly extending DG benefits to other entities within their production chains, such as assisting them with solar rooftop installations. Grieger emphasized that these users are proactively seeking ways to involve more actors. He suggests that this trend reflects a practical application of energy justice driven by private companies themselves as they identify value in supporting key partners within their operational network.

Grieger notes that another way to help the sector to grow comes from lawyers, as they can play a key role in making contracts simpler, streamlining purchasing processes. “Clients in the DG space require swift implementation and streamlined negotiations. That is why we are focused on creating contract models that are much simpler to navigate while ensuring they contain solid, protective clauses,” he says, adding that lawyers could reach industry associations to work on simplified and standardized contracts tailored to the sector ’s needs.

Experts note that for the sector to continue growing, financing is key, as Mexico still has high interest rates. Similarly, García notes that while larger companies have models like PPAs and Energy-as-a-Service (EaaS) models, the residential segment heavily relies on personal credits.

RISK & REWARD: THE FUTURE OF ENERGY FINANCE IN MEXICO

As Mexico’s energy sector adapts to a new federal administration, renewed focus on energy sovereignty, and persistent infrastructure constraints, the question of how to fund the country’s energy transformation is taking center stage. Investors, developers, and financial institutions are navigating a landscape marked by both regulatory uncertainty and growing industrial demand, testing the boundaries of what constitutes a viable, bankable project.

“The market is so big that even if the needle moves just a little with the United States, in the end, the market is immense. In Mexico, we have a bit of everything, which is a big advantage”

Ricardo Zúñiga Country Manager | CapWatt

business models are rising to the top of funding pipelines. Industrial clients seeking distributed generation and hybrid solutions, often with integrated storage or efficiency technologies, are viewed as more attractive, particularly when their energy consumption aligns with predictable patterns and strong financial profiles. For financiers, viability is no longer just about technology or scale, but about risk containment, clarity of legal standing, and revenue certainty.

Distributed generation in particular stands out as an attractive investment due to its continued history within the Mexican energy market. According to Jason Potts, CFO, Finsolar, investing in distributed generation is no longer the uncertain bet it was a few years ago.

Investor interest has not disappeared, but it has become more selective. Energy projects that can demonstrate offtaker reliability, clear regulatory compliance, and resilient

“The market has matured in such a way that, fortunately, we now have data. There is a track record that really makes investors take a look at these projects,” says Potts. “What this track record allows is to have a standardized, or rather, more precise quantitative analysis of the customer profile, helping us to rely on evidence and not assumptions.”

Mexico’s energy landscape is heavily populated by SMEs, which often lack the credit history or collateral required by traditional financial institutions. As a result, investors are increasingly exploring alternative structures that can mitigate risk while unlocking opportunity. Tailored credit assessments, Energy-as-a-Service models, and risk-sharing frameworks are gaining traction, especially when paired with trusted technology providers and EPC partners.

Investing in SMEs requires finding the right mix of elements. Juan Pablo Visoso, Managing Director, Riverstone LATAM, believes that you need partners who genuinely understand their sector, a solid and realistic business plan, strong drive and motivation, and a clear path for growth. This combination is what ultimately sets successful investments apart.

“You can buy shares of Bimbo or of Cemex, but the real exponential growth happens when you invest in an SME that has the right team, is in a growth sector, is well-capitalized, and does not have a regulatory aspect limiting its growth,” says Visoso.

“It is a balance between risk and profitability, and it has to make economic sense,” says Pablo Linares, CFO, Energía Real. “Thoroughness and rigor in the analysis is fundamental as we look for companies that can truly survive in the long term.”

Nowadays, the banking sector has been evolving and adapting to become more

specialized. According to Omar Castillo, Sr. Vice President Energy Industry GTB CIB, BBVA, this has allowed the banking sector to understand what these smaller and medium scale projects can bring to the table.

“Projects that once seemed small or not very viable, because the ticket is not large, or attractive, or does not have the most complex financing structure, are now getting attention,” says Castillo. “People are starting to say, ‘Hey, this project, which is just getting started and precisely needs more guidance and support, can actually bring a lot of success.’”

ESG criteria, once seen as a primary differentiator, are evolving in importance. While regulatory signals in the United States suggest a shift away from ESG mandates, in Mexico the topic retains significance, particularly among international investors, multilateral institutions, and large corporations with global compliance standards. ESG, when combined with sound economics, continues to unlock preferential financing conditions and expand access to international capital.

“The market is so big that even if the needle moves just a little with the United States, in the end, the market is immense. In Mexico, we have a bit of everything, which is a big advantage,” says Ricardo Zúñiga, Country Manager, CapWatt. “I do not think the appetite for renewable and clean energy projects is going to drop significantly. The conversations we are having with clients today are very much aligned with renewable projects.”