IMPACT REPORT

OVERALL SPONSORS

Platinum Sponsor

Matchmaking Sponsor Gold Sponsor

Networking Lunch Sponsors

Silver Sponsors

Networking Coffee Break Sponsors

Charging Pole Sponsor

Platinum Sponsor

Matchmaking Sponsor Gold Sponsor

Networking Lunch Sponsors

Silver Sponsors

Networking Coffee Break Sponsors

Charging Pole Sponsor

Platinum Sponsor

Sponsors

Gold Sponsors

Sponsors

Sponsors

Sponsors

Sponsors

Silver Silver Gold Silver Silver424 companies

740 conference participants

140 speakers

1st Edition

Breakdown by job title Conference social media impact

30.4% Director/VP/ COO/CFO

27.8% Manager/Executive/ Associate

19.8% CEO/DG/President/ Country Manager

12.0% CISO/CTO/CIO

8.7% Founder/CoFounder

direct impressions during MBF

click through rate during MBF

conference engagement rate

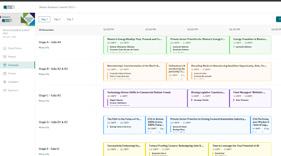

mexico’s leading B2B conference organizer uses a customized app to deliver an unparalleled experience

the m B e app delivered aI-powered intent-based matchmaking to the mexico Business Summit 2023 attendees

M atchmaking

534 participants

3,740 matchmaking communications

728 1:1 meetings conducted

24 sponsors

16,690 visitors to the conference website

social media impact

direct pre-conference LinkedIn impressions

pre-conference click through rate

pre-conference engagement rate

Matchmaking intentions

Trading

Networking

• 500 Global

• 99minutos

• a& a Business Consulting

• a3Sec

• actinver

• addem Capital

• adistec

• adyen

• afluenta

• albaa

• alcon Laboratories

• alibaba Cloud

• alima

• almabrands

• aloi

• altair

• aM d

• american e xpress

• aM e XC aP

• ammper

• aMVo

• ancient - the Wisdom of technology

• angel Ventures

• apolloCom

• Árbitro operativo Medios de Pago

• arces.mx

• arcos dorados / Mcdonald’s

• arkangeles

• aro y Chaz

• aSaM eP

• a sociación de Internet MX

• a sociación Mexicana de data Centers (M e XdC)

• a straZeneca

• at&t

• atalait

• attom Capital

• auronix

• aVIS

• avon

• Bamba

• Ban Bajio

• Banbajío

• Banca Mifel

• Banco a zteca

• Banco Compartamos

• Banco de Crédito del Perú

• BanCoppel

• Banngu Mexico

• BaNo B raS

• Banorte

• Banxico

• Baubap

• Bayer

• Bayport

• BBVa

• BeClever

• Belvo

• Benotto

• Beyond technology

• BIC

• Birdie.mx

• Bitso

• Blooms

• BMC

• BNP Paribas

• Boletia

• Bolsa Institucional de Valores (BIVa)

• Bolsa Mexicana de Valores

• Bono

• Brain food

• Bright minds

• Broxel

• Buo

• Bvlgari

• C12

• Caja Inmaculada

• Cakao Studio

• CancunCards

• Capsula

• CapWatt

• Cecoban

• Cerveceria de Colima

• Chevez ruiz Zamarripa

• Cicada technology

• Cinépolis

• Circulo de Belleza

• Citibanamex

• Clara

• Clearsale

• Clip

• Closer

• Club de rotarios

• CMX Partnerships

• CNBV

• Cobee

• CodeCo

• Coldview

• Cometa

• Complif

• Concepto Móvil

• Conecta

• Conekta

• Connectif

• Consubanco

• Content-oh!

• Coppel

• Crabi

• Cracks education

• Cradlepoint

• Creai

• Creditas

• Crowdlink

• CyberIIot

• Cybersec

• CyCSaS

• data4Sales

• daWa

• debiti

• dell technologies

• deloitte

• delta Protect

• dentons Global advisors

• design banking

• deUNa

• dHL Global forwarding

• dIL a Capital

• dIN code

• directo

• dLocal

• doopla

• ebanx

• eGlobal

• el ojo en la Bola

• el Palacio de Hierro

• elektra

• embassy of Belgium

• embassy of Canada

• embassy of Switzerland

• endeavor

• energyrecharge!

• eNSo fintech

• envases Universales

• envíoclick

• e strategia MIC

• eteK

• eureka

• evolutive agency

• e xitus credit

• eyS equipo y Soluciones

• f5

• fairplay

• feedzai

• femsa

• feMSa Ventures

• financiera Contigo

• fintech Mexico

• fINto NIC

• finvero

• fiserv

• fitzer Hard Seltzer

• fJ Labs

• forma Pro LLC

• fortinet

• fraudection

• freedompay

• freSSI

• frIaLSa

• GBM

• Getin

• Global University Systems Canada

• Goliath Group

• Google Cloud

• Government of ontario

• Grupo Bal

• Grupo BIMBo

• Grupo BMV

• Grupo Coppel

• Grupo Cynthus

• Grupo envases

• Grupo IaMSa

• Grupo Jumex

• Grupo Samaredi

• GS1 México

• Guidance research

• Guros

• H2o.ai

• HaM oC

• Healf

• Hefesto a sesores

• Herdez

• Hermes Capital

• Hi Ventures

• Hikvision

• Holland House Mexico

• Homie

• Hooman

• Hootsuite

• Hospitales MaC

• Houlihan Lokey

• HSBC

• Hugo Boss

• Iberdrola

• IGNIa Partners

• iLab

• Imperva

• Indeplo

• Index

• Industrias de Hule Galgo

• Infomedia

• InfraCommerce

• Ingenico

• Ingredion

• Insurtech México

• Intelligent Networks

• Intrare

• Investplaybook

• IronVest

• Izzi

• JaaK

• Japan International Cooperation agency

• Jelou

• Juniper Networks

• Kalto

• Kapital

• Kaszek

• K ayaK

• Kinsu

• Klar

• Knotion

• Koin

• Konfío

• Kontempo

• Koval

• KPMG

• Kurios

• Kushki

• Kyndryl

• La Comer

• Lacoste

• Latin eMart

• Leapfinancial

• Legal Sync Consulting

• LegoSoft

• Lightech

• Linio

• Liverpool

• LKL Pay

• Lumen

• M2Crowd

• MaB e

• Mamafoods

• ManpowerGroup

• Maqui

• Mastercard Mexico

• Masu

• Matt-ambrose.com

• McKinsey

• Meda fintech

• Melonn

• Mendel

• Merama

• Mercado Libre

• Mercado Pago

• M eta

• Mexican Internet a ssociation

• Mezubo

• Michelin Connected fleet

• Microsoft Corporation

• Miniso

• Minsait Payments

• Minu

• Miramar Capital

• Misumi México

• Mo Credit Management Platform

• Monai

• Mondelez

• Moova

• Mora Mora

• Mundo Mondo

• Naesco

• Nativa tulum

• Natura & avon

• Nazca

• N eK t

• N eK t Group

• Netrum-SIta

• Nido Ventures

• Novax

• Now By Invex

• Nu

• Nvio Pagos

• Ny U Stern School of Business

• odeSSa

• o ffice depot México y Centroamérica

• o fficeMax Mexico

• okticket

• oneCarNow

• openfinance

• openPass

• PagaPhone SmartPay

• Palenca

• PaLo It

• Payretailers

• Pedrote

• Peñaranda

• Peñoles

• Pérez Correa González

• Pilou

• Pixza

• Planet Halo Security

• Plata

• Plenna

• Pontones y Ledesma

• Prestadero

• Productos Chata

• Proofpoint

• ProSa

• Provident

• Provident Mexico

• Pulpo

• Q ed Investors

• Qualitas

• r 2

• rankmi

• rappi

• rappiCard

• regus

• reservamos SaaS

• reversso

• revie

• rich it

• rintin

• routefusion

• rU fI

• runa

• Samsonite

• Samsung electronics

• Scotiabank

• Sekura

• Shake again

• SH eIN

• Shell & Quaker State

• Sherwin Williams

• Silent4Business

• Simpliroute

• Sisley

• SkillNet

• SoftBank

• Solu

• Speakap

• Splunk

• Storecheck

• Stori

• StP

• Stragia

• Surexs

• Surrey Board of trade

• Surtidora departamental

• Swarovski

• Swatch Group Mexico

• t 7 International Group

• tec de Monterrey

• technisoft

• techsinergy

• telecable

• telecom televisa Univision

• tenable

• texas european Chamber of Commerce

• thales Group

• the 1% of finacial Leaders

• the Body Shop

• the e stée Lauder Companies México

• this Week in fintech

• thomson reuters

• tienda Pago

• tiendanube

• tM f Group

• toSSa

• total Cyber-Sec

• towa software

• tricia Consulting

• troquer

• trully

• truora

• tu Identidad

• t V a zteca

• Ualá

• UNaM Semillero de talento

• Undostres

• Unilever

• Universidad Panamericana

• UPa X

• VegaPay

• Vertebra

• Ve XI

• Vezmé

• Vfo Mexico

• Vinneren

• VISa

• Voximplant

• Walmart Mexico

• WebCX

• Weber Shandwick

• Weinen 2000

• Weiner Lab

• Whirpool

• Wiener Lab

• Wow factor Pr

• W tS energy

• X design

• Xaldigital

• X aPIeNS

• Xepelin

• yaax Capital

• yalo

• yave

• yofio

• Zebras

• Zenda.la

• Zendesk

• Zumit tech

WEDNESDAY , APRIL 24

09:00 TECH FOR ALL AGES: INTEGRATING ELDERS INTO MODERN FINANCE

Speaker: Aurora Torres, CNBV

09:30 CYBERDOME, THE ANTI-RANSOMWARE STRATEGY

Speaker: Francisco Sandoval, total Cyber-Sec

10:00 AI: REVOLUTIONARY MILESTONE IN CONNECTION GENERATION

Speaker: Marco Casarin, Meta

10:30 DISRUPTING THE NORM: FINTECH’S ROLE IN BUSINESS MODERNIZATION

Speaker: Adolfo Babatz, Clip

12:00 FINTECH REVOLUTION IN MEXICO: REDEFINING CONSUMER EXPECTATIONS

Moderator: Othón Moreno, BaNXICo

Panelists: Neri Tollardo, Plata

Luis Pineda, Now by INVe X Banco

Stefan Moller, Klar

Iván Canales, Nu Mexico

12:45 MEXICO’S FINANCIAL LANDSCAPE: FISERV’S VISION FOR FUTURE-READY SOLUTIONS

Speaker: Luis Brauer, fiserv

13:15 THE EVOLUTION OF CUSTOMER PERSONALIZATION IN FINANCE THROUGH AI

Moderator: Sergio Torres, BBVa

Panelists: Ximena Salgado, Nu Mexico

Louis Zaltzman, rappiCard

Joaquín Domínguez, Ualá

Santiago Benvenuto, Walmart Mexico and Central america

STAGE A3

12:00 CONNECTING THE DOTS: MAPPING CONSUMER JOURNEYS

Moderator: Miguel Ángel Ruiz, Kyndryl

Panelists: Carlos Marín, Liverpool

Anastasia Zdoroviak, rappi

Alejandro Caballero, Mercado Libre México

12:45 RETAIL STRATEGY 3.0: THE NEW ROLE OF BRICK & MORTAR

Speaker: Sofía Escamilla, the Body Shop

13:15 CUSTOMER PATHWAYS WITH AI-POWERED PERSONALIZATION

Moderator: Martín Ascar, H2o.ai

Panelists: Albert González, Samsung

Juan José Piñeiro, el Palacio de Hierro

Marco Gelosi, Swarovski

Juan Vallejo, Google Mexico

STAGE A2

12:00 SURVIVING THE DIGITAL REALM: CYBERSECURITY FOR SMES AND STARTUPS

Moderator: Víctor Lima, Undostres

Panelists: Paolo Rizzi, Minu

Omar Herrera, Stori

Andrew Devlyn, fairplay

Enrique Besa, rankmi

12:45 QUANTIFY CYBER RISK AND OPTIMIZE CYBERSECURITY INVESTMENTS

Speaker: Juan Carlos Cortés, Netrum-SIta

13:15 SECURITY SIMPLIFIED: STRATEGIES FOR A LEANER, SAFER TECHNOLOGY STACK

Moderator: Santiago Fuentes, delta Protect

Panelists: Rafael Verduzco, Zenda.la

Erik Johannessen, Xepelin

Federico Cedillo, financiera Contigo

13:45 WHERE BAD IDEAS FIND LOVE

Speaker: Víctor Moctezuma, iLab

STAGE A4

15:30 FUTURE-PROOFING E-COMMERCE: OMNI-CHANNEL, PERSONALIZATION, AND CONVERSIONS

Moderator: Omar Pérez, Splunk

Panelists: Rolando López, o fficeMax Mexico

Edgar Embriz, Swatch Group Mexico

Fabricio Moreno, adyen

16:15 LEVERAGING REVERSE LOGISTICS IN ECOMMERCE FOR A SUSTAINABLE GROWTH

Speaker: Javier Dolcet, dawa

16:45 NAVIGATING THE BLEND OF BRICK-AND-MORTAR AND DIGITAL FRONTIERS

Moderator: Cristian Campos, Samsonite

Panelists: Marco Di Santo, Bvlgari

Laura Torres, Hugo Boss

STAGE A3

15:30 SYSTEMIC VULNERABILITIES IN INTERCONNECTED FINANCIAL NETWORKS

Moderator: Santiago Gutiérrez, deloitte Mexico and Latam

Panelists: Francisco García, BNP Paribas

Eduardo Amaya, Grupo Cynthus

Roman Baudrit, thales Group

16:15 HOW TO USE IA FOR LEVERAGING THE BUSINESS

Speaker: Pablo Corona, Mexican Internet association

16:45 INCIDENT RESPONSE MASTERY: PROTECTING CRITICAL SERVICES

Moderator: Claudio Querol, McKinsey & Company

Panelists: Arturo Rivera, Banca Mifel

Rafael Chávez, f5

STAGE A2

15:30 EMPOWERING AI AND CLOUD: LATIN AMERICAN ENTREPRENEURS COMPETING IN A GLOBAL ARENA

Moderator: Christine Kenna, IGNIa Partners

Panelists: Courtney McColgan, runa H r

Luis Barrios, arkangeles

Javier Mata, yalo

Maite Muñiz, truora

16:15 AI FOR ALL: EMPOWERING WOMEN IN THE AGE OF INNOVATION

Speaker: Anaid Sustaita, Google Cloud México

16:45 AI-POWERED VENTURES: TRANSFORMING THE STARTUP LANDSCAPE AND VC FUNDING CRITERIA

Moderator: María Fernanda González, Hi Ventures

Panelists: Rafa de Haro, Cometa VC

Antonia Rojas, attom Capital

Alejandro Diez, dIL a Capital

Juan Franck, SoftBank

THURSDAY , APRIL 25

STAGE A4

09:00 PREDICTIVE ANALYTICS STRATEGIES FOR MARKET DISRUPTION

Moderator: Jorge Mandujano, Beyond technology

Panelists: Gabriel Fernández, at&t México

Dario García, ManpowerGroup L ata M

Diego Sánchez, Mabe

09:45 AI: IMPORTANCE, ADOPTION & FUTURE

Speaker: Francisco Aguirre, dell technologies

10:15 MASTERING DATA MONETIZATION FOR BUSINESS GROWTH

Moderator: Ignacio Madrid, Citibanamex

Panelists: Iván González, Grupo Jumex

Juan José Denis, BMC Mexico

Denis Génova, Xaldigital

Alejandro Correa, aBInBev-Grupo Modelo

STAGE A3

09:00 THE FINTECH FRONTIER IN MEXICO: NAVIGATING THE NEW LANDSCAPE OF COMPETITION

Moderator: Pamela Ceballos, VISa Mexico

Panelists: Vincent Speranza, endeavor Mexico

Gabriela Estrada, Vexi

Héctor Cárdenas, Conekta

Gerardo Obregón, Prestadero

09:45 THE KEYS TO PROFITABILITY: DIGITALIZATION OF FINANCIAL PROCESSES

Speaker: Luis López Albajara, o K tICKet México

10:00 CLOSING THE FINANCING GAP

Speaker: Mónica Ajarrista, addem Capital

10:15 CREDIT IN MEXICO: THE RACE TO STAY AHEAD

Moderator: Alberto Bonetti, yofio

Panelists: René Saúl, Kapital

Manolo Atala, fairplay

Gabriela Rolón, Creditas

Leonardo Ramos, Clara

STAGE A2

09:00 TECHNOLOGY CHALLENGES OF HYPERCONNECTING COMMERCE

Moderator: Julia Urbina-Pineda, o ffice depot

Panelists: Adrian Valencia, at&t México

Edmundo Lozano, Whirlpool

Raúl Cornejo, elektra

09:45 TIPPING THE SCALES IN OUR FAVOR

Speaker: Rene Aguero, Splunk

12:00 RISK-BASED VULNERABILITY MANAGEMENT: PRIORITIZING RESILENCE

Moderator: Juan Carlos Carrillo, tenable

Panelists: Enrico Belmonte, Peñaranda

Óscar Caballero, KPMG Mexico

Erwin Campos, Grupo Bimbo

Eduardo Salmerón, Silent4 Business

12:45 START YOUR JOURNEY TO PROACTIVE CYBERSECURITY

Speaker: Praveen Sengar, eteK

13:15 THIRD-PARTY CYBERSECURITY RISK ASSESSMENTS AND NEGOTIATION

Moderator: Marco Antonio Castilla, aVIS Mexico

Panelists: Felipe Absalon, Bayer

Mauricio Amaro, Grupo IaMSa

Jenny Mercado, odeSSa

12:00 E-COMMERCE RENAISSANCE: LATIN AMERICAN STARTUPS AND THE VC IMPERATIVE

Moderator: Mariano Bomaggio, Kaszek

Panelists: Ytzia Belausteguigoitia, troquer

Quinto Van Peborgh, rintin

Felipe Delgado, Merama

Héctor Sepúlveda, Nazca

12:45 FROM POTENTIAL TO POWERHOUSE, MERAMA: RETAIL & ECOMMERCE GROWTH IN LATAM

Speaker: Domingo Cruzat, Merama

13:15 FORMULATING SUCCESS IN OMNICHANNEL COMMERCE

Moderator: Lorena Montaño, Mundo Mondo

Panelists: Alejandro García, Miniso

Daniel Navas, Mora Mora

Alexis Patjane, 99 minutos

Carolina Arreola, Zendesk

STAGE A2

12:00 TECH-DRIVEN FINANCE: NAVIGATING TRANSFORMATION IN LATIN AMERICA

Moderator: Ana Cristina Gadala-Maria, Q ed Investors

Panelists: Myriam Cosío, Clip

Jorge Cabrera, Mercado Pago

Alejandro Servín, BBVa

Ana Carolina Blanco, BanBajío

12:45 ECONOMY AND PROFITABILITY WITH GENERATIVE ARTIFICIAL INTELLIGENCE

Speaker: Martín Ascar, H2o.ai

Favio Vázquez, H2o.ai

13:15 AI IN B2B FINANCIAL SERVICES: TRANSFORMING THE INSTITUTIONAL CUSTOMER EXPERIENCE

Moderator: Patricio Diez, Banco Compartamos

Panelists: Juan Manuel Andrade, Banco a zteca

Jorge González, actinver

Armando Herrera, Konfío

Daniel Garbuglio, H2o.ai

STAGE A4

15:30 NAVIGATING MEXICO’S VENTURE CAPITAL: TRENDS AND INSIGHTS

Speaker: Liliana Reyes, aM e XC aP

13:15 LATAM STARTUPS’ QUEST FOR INVESTMENT

Moderator: Alvaro Vértiz, dentons Global advisors

Panelists: Ana Carolina Mexia, Nido Ventures

Cecilia Ezquerro, 500 Global

Andrea de la Garza, Pilou

Constantino Matouk, Grupo Bimbo

STAGE A3

15:30 PROTECTING THE CLOUD: CNAPP AND IDENTITY MANAGEMENT FOR THE EXTENDED ATTACK SURFACE

Speaker: Alejandro Dutto, tenable

16:00 AI-OFFENSIVE: THREAT HUNTING IN THE CLOUD

Moderator: David Varela, Izzi

Panelists: Asgard León, t V a zteca

Chava Valades, a straZeneca

Jonny López, Cradlepoint

Eduardo Verboonen, Hospitales MaC

STAGE A2

16:00 NEW PAYMENT PARADIGMS: EVOLVING TRANSACTIONS

Moderator: José Barrera, Natura & avon

Panelists: Sebastián De Lara, fintech Mexico

Héctor Meza, Ingenico

Analicia García, Mastercard Mexico

Estephany Ley, Coppel

With an estimated 16.4 million adults aged 60 and above projected by 2024, constituting 12% of the total population, addressing the challenges faced by this demographic is imperative. a significant challenge highlighted by a urora torres, d irector General of a uthorizations for the f inancial System, CNBV, is the digital divide affecting older adults’ access to and utilization of technology, especially in financial contexts. Issues like lack of familiarity, debt aversion, anxiety, and disinterest impede older adults’ technology adoption. addressing the challenges faced by older adults in adopting technology, especially in financial contexts, is crucial, urges torres.

In Mexico, the demographic landscape is evolving, with 13.5 million individuals aged 60 and above, as reported by the National Population Council (C o N a P o). factors such as declining mortality rates and increased life expectancy contribute to this demographic shift, with further increases expected by 2030.

elderly individuals in Mexico benefit from robust regulatory measures, as explained by torres. She highlights one of the fundamental rights enshrined in the constitution, which is access to employment and the economy for senior citizens. However, various societal factors contribute to a technology access gap for older individuals. additionally, across different regions of Mexico, there is limited access to financial institutions. only 8.2% of Mexican users making digital payments fall

within the 55 to 64 age bracket, according to Ve Por Mas.

f inancial institutions are increasingly transitioning to technological platforms, which may pose challenges for elderly individuals, making the financial system less accessible and user-friendly for them. “While technology is often associated with youth, it is important to recognize that older adults will also utilize this technology,” she emphasizes.

torres urges decision-makers to deploy user-friendly strategies directed toward senior citizens as it is a matter of inclusion. t his goes in line with avoiding an oftenoverlooked type of violence older people face: economical and financial violence. She highlights the role of the National Institute of o lder adults (IN a Pa M) as an institution that advocates for inclusion and the development of the elderly. Nonetheless, the support from financial institutions to actively bridge this gap is essential, she says.

torres believes that there are opportunities to narrow this gap by sensitizing technology developers to the unique challenges faced by older adults and designing user-friendly interfaces, incorporating features like larger fonts, visual cues, and voice assistance. “Inperson support at bank branches should prioritize empathy and patience, with staff trained to effectively assist older adults, including offering alternatives to fingerprint authentication.”

In the financial sector, there are specific opportunities to enhance accessibility for older adults, according to CNBV. f or example, at Ms can provide clear instructions and prompts, accompanied by alerts signaling transaction completion. Mobile apps can offer simple instructions and assistance, while in-person support at bank branches should prioritize empathy and patience, with staff trained to effectively assist older adults, including

offering alternatives to fingerprint authentication. Collaboration between decision-makers, regulatory bodies, and

financial institutions is vital to bridge the technology gap and ensure financial inclusion for older adults, adds torres.

r ansomware attacks pose a significant threat to businesses worldwide, with the average financial impact of a data breach reaching US$4.54 million, as per IBM’s “Cost of a data Breach 2022” report. these attacks have far-reaching consequences for business operations, reputation, finances, and legal standing. francisco Sandoval, d irector General of total Cyber-Sec, underscores the necessity for proactive and comprehensive solutions to address this threatening landscape.

Given the extensive ramifications of a successful attack, total Cyber-Sec has introduced Cyber d ome 360°, a comprehensive cybersecurity solution designed to effectively counter ransomware attacks and shield businesses from their adverse effects. By employing a multilayered approach that integrates various technologies and services, total CyberSec aims to provide comprehensive protection against ransomware and other cyber threats. “Israel’s Iron d ome has a 90% effectiveness. However, it only covers air menacing attacks, not land or sea; a multilayered system is essential, not only in physical security, but also in cybersecurity,” Sandoval added, referring to the recent Iranian air attacks on Israel.

Sandoval said the prevalence of ransomware attacks underscores the pressing need for robust cybersecurity measures, as

cybercrime is now massified, targeting even smaller companies. “ t here are two types of attacks, targeted and opportunistic. the latter comes as criminal organizations seek to massify attacks, ensuring the monetization of ransom payments,” Sandoval noted.

With organizations increasingly dependent on interconnected systems and data-driven operations, the risk of disruptive cyber incidents continues to grow. Solutions like Cyber d ome 360°, not only address immediate threats but also contribute to strengthening the resilience of businesses against evolving cyber risks, says Sandoval. a s businesses embrace digital transformation and expand their online presence, the importance of investing in comprehensive cybersecurity solutions cannot be overstated.

Sandoval highlighted the different layers of Cyberdome 360° and how they contribute to the complete protection of organizations.

t his layer focuses on the identification and assessment of an organization’s critical assets, including sensitive data, key systems, and vital resources, allowing the identification of vulnerabilities and weaknesses that could be exploited by attackers. t he solutions included in this layer, such as e ndpoint Management,

r isk and Compliance, and Identity Perspective Guidance, help to effectively manage and protect these critical assets. Sandoval emphasized the importance of regularly updating gadgets and apps, highlighting that hackers’ technology constantly evolves.

t his layer focuses on educating users about safe cybersecurity practices, as well as implementing detection and response solutions on devices to identify and neutralize threats before they cause harm. “How can we communicate to the administration, support, and marketing departments the importance of being cautious when clicking on emails? We need to educate them based on their profiles, in a friendly manner to ensure good understanding,” Sandoval noted.

Privilege escalation is a technique commonly used by attackers to gain unauthorized access to sensitive systems and data. this layer focuses on logging and monitoring the activities of privileged users, as well as implementing multi-factor authentication measures to ensure that only authorized individuals can access critical resources. f eatured solutions in this layer include privileged user management and multifactor authentication.

Critical servers are prime targets for ransomware attacks due to their importance in an organization’s infrastructure. this layer focuses on implementing micro-segmentation techniques to isolate and protect servers, as well as implementing edr for servers, operating system hardening, and intrusion prevention systems. Sandoval noted that intrusion prevention systems are crucial since all internet threats present behavior patterns. recognizing and understanding these behavior patterns is crucial for any

organization’s survival. He underscored the growing significance of artificial intelligence in identifying these patterns to detect threats from viruses, malware, individuals, or other risk factors.

a s early threat detection is crucial to mitigating the impacts of an attack, this layer focuses on implementing services and solutions that actively monitor the network for indicators of compromise and patterns of malicious behavior. advanced technologies such as artificial intelligence sensors, traps, and continuous monitoring of the Security o perations Center (S o C) are used to quickly detect and respond to emerging threats. In addition, a highly trained incident response team is in place to effectively manage and mitigate attacks. Key solutions in this layer include aI sensors, traps, S o C monitoring, incident response teams, and threat simulation.

Immutable backups are the last line of defense against ransomware, enabling data recovery in the event of a successful attack. this is why the last layer focuses on implementing robust backup and recovery processes that protect the integrity and availability of the organization’s critical data through technologies and practices that ensure the invulnerability of backups to tampering or deletion attempts by attackers.

r ansomware attacks are expected to continue to evolve in complexity and sophistication. However, Sandoval said that with solutions such as total CyberSec’s Cyberdome, enterprises can be better prepared to meet these ongoing challenges and protect against growing cyber threats. “No strategy guarantees 100% effectiveness; human error and evolving technology are constant challenges. Preparation is key, having a tested backup strategy and recovery processes is essential, highlighted by the need for simulations,” Sandoval concluded.

aI is experiencing unprecedented growth, with North a merica leading the charge as the epicenter of innovation and investment. While the technology promises boundless opportunities and transformative advances across various sectors worldwide, its potential to foster human connection can be equally large.

Meta, formerly known as facebook, has been a pivotal player in shaping meaningful connections, allowing 3.8 billion people worldwide to interact, says Marco Casarin, Country Manager Mexico, Meta. “Still, there are 4 billion people left who need the same opportunities to integrate. It is a huge responsibility,” he says.

t hrough the integration of a I across its platforms, Meta is revolutionizing the way individuals and brands connect and grow together, marking a significant milestone in the evolution of social media and digital interaction

“It is about providing an experience that is significant to the user. The key is to understand how to make it meaningful, and that requires analytics and ultra-human volumes of data capacity, transforming it into information, and turning that information into relevant, timely, and high-impact action.”

Marco Casarin Country Manager Mexico | Metait closer to companies of all sizes, not just those with the largest marketing budgets.

“Meta’s solutions ecosystem is a platform geared toward entrepreneurs and SMes. It is the same platform, opportunity, challenge, and tool for SM e s and big enterprises. It puts any idea, project, or scenario on the same level of competitiveness, exposure, generating meaningful connections, and succeeding,” says Casarin.

Meta’s suite of tools, known as Meta a dvantage, empowers advertisers with automation capabilities, leading to a 32% increase in r eturn on a d Spend ( roa S) for advantage shopping campaigns, a 9% improvement in cost per action, and a 14% boost in incremental purchases per dollar spent, says Casarin. the aI Sandbox further enhances creative endeavors by generating text variations, creating backgrounds, and adjusting images, saving advertisers more than five hours per week on average.

Meta Business Messaging has also yielded remarkable results, with a 61% average increase in lead generation compared to traditional solutions, says Casarin. Conversion rates soar with Meta Business Messaging, surpassing 53% for SMS, 61% for email, and a staggering 87% for other apps. Businesses also witness a 22% increase in order value, a 54% improvement in agent productivity, and a significant uptick in customer retention rates.

Meta leverages its a I-powered engine for discovery, security, and integrity efforts.

“a I has allowed us for over a decade to continuously optimize the way people find and connect with what is relevant to them,” says Casarin. Meta now offers virtual reality (V r ), conversational commerce, and advertising systems. Integrating a I is not merely a technological feat; it is a game-changer in optimizing campaign performance and user experience, he adds. By incorporating this tool, Meta is putting

“Meta invested in a I to empower users throughout the complete path, from someone discovering something they consider could lead to a meaningful connection, to generating some type of transaction, and from there, building a community,” says Casarin.

Meta’s impact extends beyond demand generation; it facilitates conversions across the entire customer journey. Meta’s full-funnel solutions are increasingly being adopted by the market, with 58% of consumers affirming

Meta as the go-to platform for building brand relationships, 46% crediting Meta’s technology for facilitating purchases, and 70% discovering new products or brands through Meta’s technologies. a bout 1 billion people engage with businesses via Messenger, Instagram, and Whatsapp every week, highlighting the reach and influence of Meta’s platforms. Casarin also underscores its commitment to inclusivity with language translation capabilities that encompass over 1,100 languages.

“We seek to connect people, who have ideas and experiences that are enriched

through others, and that is our mission: to connect people in a meaningful way, and to do it increasingly better. t hat is why we invest in a I,” says Casarin.

the market for aI is growing exponentially, with North a merica boasting the largest market size globally, according to the a I r PM. t he United States commands an estimated market size between US$87.18 billion and US$167.3 billion. Projections suggest that by 2032, the global a I market could surpass US$2.5 trillion, driven by a compound annual growth rate (C aG r) of 19%.

Clip, a prominent provider of commerce solutions for micro, small, and mediumsized merchants in Mexico, attributes its success to four core pillars, according to C eo adolfo Babatz at the Mexico Business forum 2024.

f irstly, the company’s end-to-end commerce platform offers intuitive, modern solutions tailored to empower merchants. Secondly, its unique go-to-market model enables rapid and cost-effective expansion across Mexico. t hirdly, Clip prioritizes delivering a seamless and efficient customer experience. Lastly, its distinctive culture fosters continuous innovation, ensuring sustained growth and relevance in the competitive market landscape.

Clip’s market strategy, which emphasizes a robust distribution network and strong brand loyalty, has fueled its rapid expansion throughout Mexico.

“It is about solving a very simple problem that has become very complicated”

Adolfo Babatz CEO | Clip

despite initial financial challenges, Clip has demonstrated its ability to scale rapidly, employing a blitzscaling strategy. “ the very first fundraising check Clip received, when it was still called iPay, was for US$50,000,” Babatz recalls. “Money is necessary because you need to scale.”

Subsequent successful fundraisings reflected the company’s commitment to blitzscaling, reaching a milestone in Mexico’s history with a $1.5 million acquisition in its first round of financing in 2013.

Clip’s dedication to innovation is evident in its focus on transaction security, as highlighted by Babatz: “at that time, we had a serious problem with card cloning, we spent a lot of money on designing the hardware to make it safe.”

as the company has grown, it has surpassed traditional banks in customer acquisition and registered transactions. “In 2018, we surpassed all banks in Mexico in terms of registered merchants and transactions,” Babatz emphasized.

this exponential growth has been driven by a world-class team dedicated to the company’s vision and culture. “ t he company’s management team is a world-class team,

formed by people from all over the world who have very diverse experiences,” noted Babatz.

Looking ahead, Clip remains steadfast in its mission to simplify payments for all,

from small businesses to large enterprises.

“What we wanted to do is extremely simple: ensure that any business or person could accept any payment method in one place,” Babatz concluded.

t he landscape of financial services in Mexico is undergoing a seismic shift, driven by the rapid rise of fintech companies.

t hese innovative startups are not only redefining traditional banking norms but are also reshaping consumer expectations, particularly among the youth and unbanked population. a s the fintech revolution gathers momentum, traditional banks find themselves in a fierce competition to adapt and cater to the evolving demands of consumers.

younger demographics, in particular, are gravitating towards fintech solutions for their convenience, accessibility, and tailored services. o thón Moreno, d irector of Payments Systems and Market Infrastructure Policy and research, Banxico, highlights how, just as fintech companies and SofIPos came to change the landscape of finance in Mexico, now it is the clients who are beginning to dictate new trends.

“It is no longer the same to serve a 60-yearold man as it is to serve a 17-year-old girl. the way they understand financial services is fundamentally different in terms of immediacy and privacy.”

Iván Canales, director General, Nu México, identifies that the client in Mexico has learned to have better digital products and have access to global services, also leading them to demand better customer service.

“Historically in Mexico, banking institutions have been characterized by being difficult to navigate. Now, the user has access to more tools and consequently demands better attention.”

In response to this changing landscape, traditional banks are partnering or acquiring fintech companies, allowing banks to leverage the agility and innovation of startups while retaining their expertise and infrastructure. By integrating fintech solutions into their service offerings, banks can cater to a broader range of consumer needs and stay competitive in the evolving market.

Neri tollardo, C eo , Plata, points out that “curiously”, new generations have largely been the driving force behind the emergence of platforms such as fintechs, since “consumer expectations regarding their banks have driven innovation.”

tollardo highlights three main ways in which traditional financial institutions have had to respond to new user expectations. f irst, banks have improved the quality of their products with digital services. Second, they have had to add value because it has never been easier for clients to migrate between financial services. finally, the culture of the financial sector has changed in terms of the paperwork process due to the immediacy that the client expects.

f intech companies have employed various strategies to capture the younger

demographic in Mexico. By offering gamified experiences, personalized financial management tools, and social media integration, fintechs have created engaging platforms that resonate with the digital-native generation. additionally, the use of data analytics and aI-driven insights enables fintechs to offer targeted products and services that cater to the specific preferences and needs of young consumers.

However, Luis Pineda, C eo , Now by Invex, recognizes that much of the boom in the adoption of fintech was due to the pandemic. But thanks to the adoption of digital solutions, clients are now not willing to endure traditional processes. Pineda explains that the revolution in the adoption of fintechs has occurred in three main stages. first, the landscape changed with the arrival of these new digital players. then, the client has become an educated and banked consumer. t hird, fintechs and S of IP o S now must evolve because being first in the game is no longer enough to continue being competitive. “We owe the market more sophisticated mechanisms,” he adds.

to effectively compete for this crucial market segment, traditional banks must embrace a similar mindset of innovation and customer-centricity. By leveraging their brand reputation and extensive customer base, banks can introduce innovative digital solutions and personalized experiences that appeal to the younger demographic.

d espite the focus on the customer and their experience, fintechs must also take into account their cost schemes and how the implementation of these innovative strategies affects them. Stefan Moller, C eo , Klar, explains that competitiveness also lies in the cost structure and its comparability with other players within the sector. Moller highlights the importance of understanding that, as part of the digital d N a of fintechs and S of IP o S, their cost structure should be seen as that of digital or software companies, rather than traditional financial entities. t his implies that digital financial services companies have a great advantage, since when considered as software companies, costs per user tend to be minimal. a lthough this makes the sector competitive, Moller recognizes that traditional financial companies still have the capacity to continue developing their presence in digital services, anticipating greater competition on their part.

While the fintech revolution presents immense opportunities, it also brings regulatory challenges that impact the transformation of the Mexican financial landscape. e xperts agree that regulation is a large part of the success of financial institutions, whether traditional or digital. t hey anticipate that users will continue to be more demanding in terms of security and data protection, and will continue to be demanding in terms of intuitiveness and ease of use of the services. While the costs of opening and maintaining clients remain competitive for fitechs, banking entities have a great capacity to catch up in this competitive environment. f urthermore, a crucial issue regarding customer expectations will be the expectation of remuneration for keeping money in accounts, a gamechanger for the industry that increases competitiveness even more.

despite the advances made in recent years, a significant portion of Mexico’s population

remains excluded from formal financial services, with 53% of adults lacking bank

accounts as of 2021, according to the National Baking and Stock Commission (CNBV). a mid these challenges lies an opportunity fueled by the emergence of fintech platforms.

t he Mexican financial landscape is undergoing a transformation driven by the convergence of fintech innovation and traditional financial institutions. the CNBV reports that fintech platforms are driving a 32% increase in the adoption of digital financial products, presenting a promising pathway toward broader financial access. Cutting-edge technology will play a key role in fostering financial inclusion and enhancing consumer experiences, says Luis Brauer, d irector of Business d evelopment and Strategy, fiserv.

With seven out of every ten people lacking access to credit and over half of the population without a bank account, according to CNBV, the adoption of electronic money becomes imperative to drive up transaction volume. the emergence of aggregators, players, and comparators has accelerated financial inclusion, making services more accessible and relevant to an increasingly active population. However, open banking regulation will be key in fueling financial digitalization, says Brauer.

according to a study made by the fintech a ssociation of Mexico, three key verticals drove the evolution of fintech and financial

institutions in 2022, explains Brauer. t he first, “ fintech as a Service,” pertains to the essential infrastructure and digitalization solutions for financial entities. t he next is the “ digital Payments” vertical, facilitating seamless money transfers and transaction processing across digital platforms. finally, the “Lending” vertical leverages online platforms to streamline credit access for individuals and businesses, catalyzing economic growth and entrepreneurship.

the fintech association of Mexico surveyed 700 fintechs and found that between 13.4% and 17.6% of their growth in clients and market share came through strategies focusing on operational agility, profitability, and data analytics.

“ d ata analytics empowers and enables hyper-personalization. What a fintech company is seeking, in addition to profitability, is to provide experiences that differentiate how to reach a market. Moreover, customers are becoming increasingly demanding, requiring that such experiences be accompanied by agility and precision,” says Brauer.

User experience is of paramount importance in shaping strategic initiatives within fintech, says Brauer. from seamless digital interactions to personalized services, consumers demand agility, reliability, and innovation in their financial engagements. fiserv leads the charge in global processing and core banking solutions, says Brauer, delivering unparalleled reliability and efficiency.

t hrough signature offerings like the f irstVision platform, f iserv enables endto-end management of payment products, bolstered by real-time data analytics and adaptive a I models. a ligning with these expectations, fiserv champions a customercentric approach, epitomized by its cuttingedge firstVision International Payments-asa-Service Platform. this platform currently handles over 200 million transactions in Mexico, and is available in 33 countries worldwide.

Cloud banking solutions also play a pivotal role in driving operational agility and customer-centricity. f iserv’s Signature Next International Cloud Banking Solution thus emerges as a game-changer, says Brauer, offering a modern technology stack equipped with re S t ful a PIs and microservices. With seamless integration across public, private, hybrid, or multi-cloud environments, f iserv empowers financial institutions to deliver unparalleled digital experiences tailored to modern consumer expectations, he adds.

“In the technological and financial ecosystem we find ourselves in, agility is key, finance needs to be embedded,

and openness should prevail. t his fully cloud-based core banking ecosystem represents over 37 years of evolution since f iserv began its services in Latin a merica. We are very proud to present for the first time the evolution of this platform because it signifies the evolution of the digital bank into a completely new stack. e verything is already supported as processing as a service through a mechanism that, being fully native to the cloud, will allow a fintech, financial entity, or bank to offer differentiated values by embedding finance and services focused on investment and loans of all kinds to integrate with any processing platform,” says Brauer.

t he finance industry is undergoing a profound transformation in its approach to customer personalization. at the forefront of this revolution is the integration of artificial intelligence ( a I) technologies, enabling finance companies to deliver tailored experiences that resonate with individual needs and preferences.

finance companies are increasingly harnessing the power of aI to personalize the customer experience across various touchpoints. By analyzing vast amounts of data, including transaction history, browsing behavior, and demographic information, aI algorithms can generate insights into individual preferences, financial goals, and risk tolerance levels. this allows companies to deliver targeted recommendations, personalized product offerings, and customized communication channels, thereby enhancing customer engagement and satisfaction.

Nonetheless, a I is not new to the sector, affirms Ximena Salgado, Head of Product, Nu. Salgado explains how Nu has leveraged this technology to gain competitiveness in a sector that used to be very traditional and hard to access. She explains that Nu has used a I to accelerate the process of customer learning to help them access the

market. “a I has been used for decades, it helped greatly at the very beginning when we were not known to cater to a wide variety of clients through aI models that allowed for credit granting.”

Mexico Business forume xperts agree on aI uses to customize their product and services offering to clients. to fully embrace a I capabilities, Louis Zaltzman, Chief Growth o fficer, r appiCard, recommends seeing a I as a whole, integral system and deeply understand what are the problems it seeks to solve. Zaltzman explains that aI can help to adapt to each client. “Before deploying these systems we must truly understand the whole journey you need it to solve. It is not solely about having the best data set or having the most advanced process, but rather employing aI to solve problems while adding value.”

However, leveraging aI for personalization comes with its own set of challenges. e nsuring data privacy and security, maintaining algorithm transparency and fairness, and addressing ethical concerns are paramount considerations for finance companies. Moreover, integrating a I into existing systems and processes requires significant investment in technology

infrastructure, talent acquisition, and ongoing training, posing implementation challenges for many organizations.

Joaquín d omínguez, Chief Credit o fficer, Ualá, explains how aI can be used to push for the right products for the right clients, while Zaltzman concurs adding that this personalization also leads to greater product use and lower costs, as strategies have the best outcome possible while reducing efforts. d omínguez explains that Ualá uses aI models to determine product attractiveness for both active and inactive clients. Based on past transactional behavior, it can also understand whether a client is inclined toward investment products or purely transactional ones, allowing the company to focus marketing strategies accordingly.

In the credit domain, companies can deploy different strategies like with scoring, which involves analyzing transactional, credit bureau, and onboarding information to create a model that predicts the likelihood of a client taking up a credit product and understanding their delinquency level. this allows us to efficiently contact clients with a high likelihood of default and avoid bothering those who are only a day or two late, says domínguez.

aI plays a central role in fintech strategies to personalize the customer experience.

t hrough the deployment of advanced machine learning algorithms and predictive analytics, companies can analyze customer data to gain deep insights into their behavior, preferences, and needs. t hese insights inform the development of personalized product recommendations, targeted marketing campaigns, and proactive customer support initiatives, aimed at enhancing satisfaction and loyalty. from a unique perspective, Santiago Benvenuto, Senior director of digital Wallet, Walmart, emphasizes the significant advantage Walmart’s Cash has due to its affiliation with Walmart as a retailer.

However, a I cannot be discussed without first understanding the needs for financial inclusion and finding strategies that make sense with the company’s operations. “ five million people enter our stores daily, with a significant portion paying in cash. financial exclusion often stems from a lack of information within the system, hindering access to a I-driven scoring models and other tools. Beyond enhancing the shopping experience, in Mexico, we have a great opportunity to create records for individuals without a digital footprint, enabling risk scoring and improving retail offerings for better financial inclusion. Given the large number of Mexicans we serve, we play a vital role in supplying transactional information to these models, impacting not only those who are already banked,” says Benvenuto.

e nsuring data quality and accuracy is crucial to the effectiveness of aI algorithms. f inance companies must invest in robust data governance frameworks, data cleansing processes, and data validation techniques to maintain the integrity of their datasets. Moreover, navigating regulatory compliance requirements, particularly concerning data privacy and security, requires careful attention and adherence to evolving regulations. a dditionally, addressing the scalability and interoperability of aI systems across different platforms and channels is essential for ensuring seamless integration and consistent user experiences.

d omínguez explains that three main points are critical for processing vast amounts of data: the quantity of data points to strengthen the models does not necessarily mean they are all important, centralizing the data source is crucial, and having a technologically scalable architecture is essential. “Constantly changing the technological architecture to accommodate a growing number of clients is necessary.” Salgado adds that data quality is as much if not more important than quantity, especially when thinking of data privacy and cybersecurity. a nother focal point is recognizing a I’s shortcomings regarding biases. “ talking about the gender gap, for instance, we

need to actively intervene and drive inclusion. a I has helped democratize the process, but close monitoring remains important,” she says.

a s finance companies continue to embrace a I-driven personalization, the ability to deliver tailored experiences at scale will become a critical differentiator in an increasingly competitive market landscape. By leveraging a I technologies effectively, addressing key challenges, and measuring the impact on business outcomes, finance companies can unlock new opportunities for growth, innovation, and customer satisfaction in the evolving digital economy.

to excel in integrating new technologies like aI tools and multi-level marketing (MLMs), companies must prioritize the end-user and ensure transparency in acquiring goods and services, according to Miguel Ángel r uiz, C to, Kyndryl, during the Mexico Business forum 2024.

Customer journeys, encompassing every interaction a customer has with a brand, service, or product, have been transforming due to emerging technologies that are currently reshaping the landscape. t he implementation of customer and retail data, a I-enhanced tools, and biometric

identification are some of the approaches that companies are taking to further personalize experiences.

today, personalization must go beyond getting customers’ names right in advertising pitches, having complete data at the ready when someone calls customer service, or tailoring a web landing page with customer-relevant offers, according to the Harvard Business r eview. It is the design target for every physical and virtual touch-point, and it is increasingly powered by a I, which has increased revenues of 6% to 10% and an increase in net incremental revenue attributable to personalization initiatives of anywhere from 40% to 100%.

“ the focus of personalization must extend beyond customer’s favorite products to include variations based on the day of the week and time of day, addressing different use cases,” said a nastasia Zdotoviak, Customer experience Vice President, rappi. algorithms within apps gather names and billing information to target videos, ads, and messages based on user habits and interests, improving the likelihood of purchases.

a I plays a crucial role in identifying consumption patterns and optimizing

product positioning to engage with specific demographics, according to a lejandro Caballero, Senior director of Commerce at Mercado Libre Mexico. “aI tools assist sellers in maximizing their earnings by leveraging upper or lower funnel strategies tailored to their audience.”

While technology enables faster problemsolving, its effectiveness hinges on actionable insights derived from data, says Iztul Girón, C eo, Knowsy aI. Without clear KPIs and a strategy for data utilization, technology becomes redundant. Personalizing customer profiles based on cataloged data can lead to a twelve-fold increase in sales.

Companies are now shifting focus to unified commerce after achieving customer engagement across multiple channels, noted

Carlos Marin rangel, Ceo of Liverpool. the strategy involves interconnected interactions and seamless delivery of experiences across channels without disruptions.

In multinational companies, leveraging data collected worldwide may be constrained by each country’s regulations. In Mexico, privacy laws governing data protection restrict companies from selling data to third parties without user consent or for purposes other than those expressly agreed upon.

Mexico’s online retail market surged to a market value of MX$658.3 million in 2023, marking a 24.6% increase compared to the previous year. t his growth trajectory establishes Mexico as a global leader in the pace of sector expansion, according to data from the Mexican association of online Sales (aMVo).

e scamilla highlighted the shift in shopping habits from millennials—who were the first to grow up with e-commerce—to Generation Z members, who, d espite being digital natives, Gen Z members show a preference for physical store experiences. regardless of the non-stop growth of online sales, this shift underscores the need for retailers to adapt and rethink the role of their physical outlets.

“These campaigns act as a silent salesperson, another team member, connecting with the customer much more effectively”

Sofía Escamilla Country Manager México | The Body Shop

“Physical stores remain relevant,” Sofía e scamilla, Country Manager, t he Body Shop in Mexico states, pointing out the need for having the right product at the right place and time. She emphasizes focusing on the experience and connection with the customer, which are critical in a

heterogeneous marketplace where online and in-store shopping coexist.

to continue captivating customers, t he Body Shop has turned to multisensory experiences. By engaging customers’ senses of smell, touch, and sight, the retailer has distinguished itself from competitors. “these are key to how we speak to and connect with our customers,” e scamilla explains.

t he Body Shop has been meticulously analyzing in-store traffic—tracking how many people enter, stay, and make purchases—similar to how website visits are monitored. t his data collection has been crucial in evaluating the success of marketing campaigns and identifying areas of opportunity.

a dapting stores to local customs and traditions has also been a focal point for the retailer, ensuring that visual tools are in place to support this strategy effectively. according to escamilla, the execution of these strategies poses significant challenges, which have led to a focus on proper training for store personnel, especially in emotional intelligence.

t he importance of the sales associate in making a personal connection with customers was underscored as vital for the Body Shop’s success. to enhance this, the company implemented a training program focused on emotional intelligence for all store leaders. this aims to help employees understand and regulate their emotions to better connect with consumers.

Looking ahead, e scamilla suggests a shift in how retail success is measured, moving away from sales figures to focus on the media impact within consumer culture and

ensuring outreach to potential customers. Proper management of customer engagement in stores, particularly how they interact with multisensory experiences and respond to marketing strategies, is crucial for providing enduring experiences that benefit all sales channels.

t his new approach by t he Body Shop illustrates a broader trend in retail where the role of physical stores is being reimagined not just to sell products but to create meaningful, lasting connections with consumers.

Companies across industries are devising strategies to leverage artificial intelligence (aI) to personalize and streamline customer experiences. With a I-powered tools that collect data, personalization becomes paramount for enhancing customer engagement, translating into increased income and sustainability, according to Martin a scar, Sales d irector for Mexico, the Caribbean, and Central a merica at H2 o .ai, speaking at the Mexico Business forum 2024.

In the e-commerce and retail sectors, a Ipowered tools can gather, analyze, and organize data to offer targeted product recommendations, unique promotions, and even assist with post-purchase support.

However, a I does not replace decisionmaking but aids in user accompaniment to enhance the likelihood of loyalty. “ t he key is relevance. t here should be no limit to product personalization. a I assists in screening, but when d eep Learning is employed, it becomes about the individual user, making it a highly personalized decision,” remarked Marco Gelosi, former Managing d irector for Mexico and Latin america at Swarovski.

Companies are employing collaborative filtering and recommendation systems with a I to deliver consumers a more personalized shopping experience. f or instance, a mazon’s latest tool within its mobile app utilizes generative a I (Gen a I) to address user inquiries about products. However, reinforcement learning (r L) and deep reinforcement learning ( dr L) hold promise in tailoring products, services, and recommendations to individual customers, thereby enhancing engagement, loyalty, and revenue generation.

t hese technologies enable companies to hyper-personalize products during the design phase by identifying common trends and ensuring engagement while maintaining the company’s brand identity. “aI is indispensable for product design, and branding leverages artificial intelligence for personalization. Understanding customer behavior with their everyday items is vital

for delivering value,” said albert Gonzalez r amirez, Gerente de o peraciones, Samsung Mexico.

Some challenges in implementing this technology for retail and e-commerce personalization include integration hurdles and concerns about data quality and the ethics of the use of this information. Integrating a I-powered tools requires substantial investment, although it offers a

potential 4x return on investment, according to Juan Vallejo, r etail Sector Leader, Google Mexico.

“With this technology, we can predict the future. We can focus on customer value, identifying high-value target customers and strategizing initiatives to drive purchases becomes feasible,” added Juan José Piñeiro, d igital & ecommerce d irector, e l Palacio de Hierro.

Compared to large enterprises, startups and SM e s often encounter limitations in cybersecurity resources and capabilities, rendering them more vulnerable and appealing targets. t his disparity in cybersecurity preparedness underscores the importance of identifying the challenges and opportunities such organizations have in the realm of cybersecurity.

Mexico is the country that experienced the most cyberattacks in Latin a merica, according to f ortinet, a trend that is expected to continue. the primary targets are frequently private companies, with SMes comprising 99.8% of this demographic, as reported by IN eGI in 2019. Given their cumulative economic significance, it is imperative that SMes and startups in Mexico prioritize cybersecurity. d espite strides made in creating awareness regarding cybersecurity importance within these

entities, substantial challenges persist.

“a s the value of SM e data increases, they become much more enticing for attackers. as they grow technologically, they inevitably have more external integrations in their daily operations, and their entire technology stack becomes much more fragmented,” says Paolo rizzi, Co- founder and director of technology, Minu.

SM e s in Mexico are vital economic engines as they generate about 75 percent of jobs and contribute more than 50% of the G d P. Hence, the urgency for a culture of cybersecurity, starting with owners and decision-makers, as well as each employee who uses a computer for any activity within the company, as previously reported by MBN.

Víctor Lima, C to , Un d ostres, says SM e s and startups often struggle to survive a cyberattack due to their size. SM e s have limited capital, so knowing how to focus it is crucial. He adds that SM e s and startups must ask how they can mitigate as much damage as possible with the least amount of spending.

o perating on tighter budgets, these SM e s often lack dedicated cybersecurity teams or adequate resources. this constraint has a cascading effect, hindering their ability to invest in training, procure comprehensive cybersecurity tools and solutions, and comply with regulatory requirements and industry standards such as the Personal

d ata Held by Private Parties (L f P d PPP). a s a result, these challenges significantly impede SM e s’ capacity to safeguard themselves in an ever-evolving threat landscape.

If left unaddressed, SM e s risk being marginalized or left behind, underscoring the urgent need for proactive measures to bolster their cybersecurity resilience. d espite their limited resources, however, o mar Herrera, CIS o , Stori, notes that SM e s and startups can leapfrog several generations in terms of infrastructure to tackle cyber threats if guided properly. “ o n the other hand, larger companies

may have more and thick cybersecurity layers that may not always be up to date. It is much more difficult to protect something that is not new,” adds a ndrew James devlyn, Co- founder and director of operations, fairplay.

experts emphasize the crucial role of proper training for SM e s’ workforce. enrique, Ceo, r ankmi, says that startups can even be more secure than larger companies initially. However, as they grow, this can change. In many cases, leaks are not due to the services used but to human errors. there is a much greater need for management, and technology already exists to address this.

Quantifying cyber risk is a critical process for companies of all sizes, enabling them to gain a deeper understanding and effectively manage exposure to potential adverse events impacting their operations, finances, and reputation. Methods like qualitative and quantitative analysis, the faIr (factor a nalysis of Information r isk) framework, and specialized tools have streamlined this process, ensuring operational integrity.

In an era of rapid digitization, companies confront escalating cyber threats that jeopardize critical assets, financial wellbeing, and customer trust. Without a clear

grasp and efficient management of these risks, organizations face substantial financial losses, reputational harm, and diminished competitive edge.

a ccording to a survey conducted by accenture, 68% of companies do not have a system in place to quantify cyber risks. In addition, a study by HISC oX revealed that 72% of cybersecurity decision-makers do not have a complete view of risk within their organizations. responding to this need, Netrum, in collaboration with CIS o s and CIos, proposes the implementation of SIta , a platform designed to revolutionize the understanding and management of cyber risk.

SI ta provides CIS o s with a powerful tool to determine appropriate security investments,” explains Juan Carlos Cortés, Senior Sales Consultant, Netrum. “this helps strike the optimal balance between risk objectives and budgetary needs.”

SI ta offers two primary approaches: Professional and e nterprise. t he former delivers insights and security operation reports, while the latter features a patented model based on best practices but simplified for organizational use.

“ t he initial approach focuses on asset identification, pinpointing inherent risk

points based on the asset, its vulnerabilities, internal or external threats, and the threat landscape,” elaborates Cortés.

Moreover, SI ta addresses risk beyond assets by managing risks associated with human errors and misuse within the organization. t he platform not only scrutinizes digital infrastructure but also considers the human element, a significant cybersecurity vulnerability. It assesses staff behavior and potential failures in internal processes.

“We can gauge user contribution to estimated asset risk levels through 40 to 45 questions.

t his allows us to reduce risk effectively,” notes Cortés.

additionally, the platform facilitates estimating the return on investment for each implemented control point, making it comprehensible for management and illustrating the benefits of cybersecurity investment.

While implementing SIta presents challenges like integration into existing enterprise systems and staff training, its adoption is anticipated to become standard practice for companies aiming to safeguard their assets in an increasingly complex and menacing digital landscape.

technology stacks, which combine various technology products and services, have become fundamental elements essential to running an efficient business for companies of all sizes in Mexico. However, amid the rapid pace of digitization, technology stacks have grown increasingly complex, bringing forth significant security risks.

t hese risks range from vulnerabilities stemming from outdated software to challenges in timely implementing security

updates, presenting ongoing challenges for companies striving to safeguard the integrity and confidentiality of their systems and data. “We tend to adopt new technologies, which can sometimes lead to a larger attack surface, especially when lacking a well-defined strategy,” said, rafael Verduzco Vázquez, Cofounder and Cto, Zenda.la.

t hese risks have spurred efforts within companies to simplify their technology stacks. yet, achieving this goal is not without its challenges. t he primary challenges of this endeavor include the integration of legacy systems, ensuring interoperability and compatibility, and overcoming internal resistance to change. “It is important to have good architecture. a structure that is too dispersed and not uniform does not allow for control. It is necessary to standardize all the technologies in use,” said federico Cedillo, CI o and C to, financiera Contigo.

to effectively mitigate associated security risks, enterprises can reduce complexity and standardize the platforms and tools they use. a dopting approaches such as containers, microservices, and Infrastructure-as-Code (IaC) presents an efficient strategy for simplifying technology stacks, offering flexibility, scalability, and notably, enhanced security. By prioritizing

a leaner, standardized technology stack, organizations can optimize their resources and diminish the attack surface for potential vulnerabilities.

It is imperative to engage all stakeholders from the outset and foster effective communication to proactively address these challenges. Moreover, companies must prioritize conducting comprehensive security audits and establishing clear processes to ensure business continuity throughout the transition.

In today’s ever-changing business environment, the ability to adapt and innovate is essential for achieving success. However, companies often encounter obstacles when trying to adopt new technologies and unconventional methods, such as limited resources, knowledge gaps, or resistance to change.

“It is no secret that artificial intelligence has been a hot topic for the past 18 months, and it shows no signs of slowing down”

Víctor Moctezuma CEO | iLab

to tackle these challenges head-on, iLab Solutions offers a holistic consulting approach that blends technological innovation with disruptive methods. “What we need are a series of hypotheses that allow us to establish a framework. t hings are a bit more complex because it is not just one competitor; it is a series of variables,” explains Víctor Moctezuma, C eo , iLab. t his strategic approach enables organizations to pinpoint areas for improvement and implement solutions that set them apart in the market and drive value creation.

Implementing these solutions comes with its own set of challenges. r esistance to

Santiago fuentes, Co-founder and Ceo, delta Protect, believes that companies’ evolution in their tech ecosystem and standardization should stem from internal initiative, rather than just for compliance, which is becoming increasingly relevant.

Greater collaboration is anticipated among service providers to offer integrated and simplified solutions that address the specific needs of the Mexican market, thus promoting a more secure and efficient technology ecosystem.

change, resource constraints, and the need for proper training may arise. Moctezuma acknowledges this, stating, “ o ur horizons are very short-term, and almost all decisions are made on an annual basis. Very few companies still have plans for the next three to five years, and practically none for ten years.” Nevertheless, iLab Solutions provides tailored training programs and ongoing support to help overcome these obstacles.

a daptability and innovation are pivotal for business success in a rapidly evolving landscape. “It is no secret that artificial intelligence has been a hot topic for the past 18 months, and it shows no signs of slowing down,” remarks Moctezuma. He emphasizes that companies must grasp emerging trends to strategically plan their futures and avoid being left behind.

Moreover, iLab Solutions underscores the importance of understanding market trends. “It is about navigating the conditions and analyzing what is necessary for growth,” points out Moctezuma. t he company not only delivers solutions but also aims to educate its clients on the tools and processes required for success.

“It is not about blindly copying what competitors are doing; it is about comprehending the tools, processes, business models, and environments in which they thrive,” added Moctezuma.

In today’s digital era, customers engage with brands across various physical and digital platforms, but expect consistent and streamlined experiences across all channels. to achieve this, retailers are implementing solutions that leverage customer and retail data to enhance conversion rates. armed with market insights and consumer behavior data, retailers can optimize pricing strategies, product assortment, and promotional activities.

t he integration of several platforms, known as an omnichannel strategy, has become vital in influencing purchasing choices, according to the Mexican o nline Sales a ssociation (a MVo). t his strategy benefits from advanced data analysis, which enables retailers to better understand consumer behavior, optimize inventory, and improve operational efficiency. t his not only translates into greater profitability but also fosters a more satisfying shopping experience for customers.

But before discussing omnichannel, it is crucial to fully understand the potential customer, says edgar embriz, Ceo, Swatch. “ the challenge lies in understanding each customer, because omnichannel works only when the customer is understood. technology is a means to an end, and it should adapt to the customer’s needs at each touchpoint with different brands,” says embriz.

technology allows retailers to analyze consumer behavior data to optimize pricing strategies, product assortment, conversion rates, and promotional activities. additionally, precise demand prediction, using both past and present data, facilitates effective inventory control, minimizing both excess inventory and stockouts, according to turing.

a nother challenge lies in a consumer that is becoming increasingly demanding, says fabricio Moreno, Country Manager, adyen.

t hese customers not only demand more features but also a simple, streamlined experience across all of them, which can pose problems to companies of all sizes. “o ur survey showed that 56% of customers claim to be more loyal to a brand that allows online purchases with easy returns. However, despite seeming easy, integrating back-office systems with separate systems and different stocks poses a significant challenge for the industry. It is essential to check if systems are connected, if suppliers are the same, and if there is the same stock to reduce friction and enhance the experience,” says Moreno.

technology can be a solution for these problems. a Microsoft and I d C report found that in late 2023, over 70% of US businesses leveraged a I, with 92% of a I implementations completed in less than a year. Companies witnessed returns on their aI investments within 14 months, found the study. on average, for every US$1 invested in aI, businesses are experiencing a return of US$3.5.

e nsuring that customer and business information is protected at all times is another challenge, especially as the use of technology becomes prevalent. “ t he challenge across industries is consolidating information, data, and platforms into one place to integrate digital and physical channels end-to-end for complete visibility. However, in terms of technology, cybersecurity, including biometrics, poses another significant challenge as integration is necessary to enhance security and the user experience,” says o mar Pérez, regional Sales d irector Mexico and North Latam, Splunk.

Biometric data, as a means to verify customer identity, is gaining traction in the retail industry, promising to streamline transactions, bolster resilience, and mitigate fraud. this technology also has the potential to differentiate stores and enhance revenue,

as customers are drawn to novel shopping experiences.

“Improving technology experience relies on understanding the customer. Incorporating biometrics is applicable as customers seek speed and security. Customer trust in the brand depends on their needs. t he tool implemented depends on the customer type. from the company’s perspective, fraud prevention and data management are vital and relevant to technology departments,” says embriz.

“The challenge lies in understanding each customer, because omnichannel works only when the customer is understood. Technology is a means to an end, and it should adapt to the customer’s needs at each touchpoint with different brands ”

Edgar Embriz CEO, Swatch Group Mexicoexperiences and generate campaigns for both physical and digital channels,” says López.

d espite the increasing volumes of data collected by retailers, including workforce metrics and customer and sales analytics, only 36% of companies feel confident in their capacity to safeguard customer information from cyberattacks, according to own data. this discrepancy persists even as the number of companies implementing data strategies grows exponentially.

“Changes in payment methods have completely transformed experiences, making payment processes transparent and frictionless. However, reducing information and clicks for smoother processes compromises anti-fraud measures due to less customer data. there must be a balance, and biometrics play a role. In Mexico, where 55% of people have experienced fraud, preventing it is crucial to ensuring a good experience and reducing fraud for both companies and users,” says Moreno.

In June 2023, fraud pressure and attempts against merchants surged by 68% compared to a pril of the same year, making a 106% increase compared to May 2022, reports the Mexican online Sales a ssociation (aMVo).

d igital fraud prevention engines play a crucial role. Without a physical card present, identifying the buyer becomes challenging, contributing to Mexico’s high fraud rates. tools like fraud prevention engines, powered by a I, validate transactions and determine whether to proceed, explains rolando López, director e-commerce and o mnichannel, Grupo o primax (o ffice Max & Par ty City).

“Platforms using aI offer a better shopping experience in digital channels. In physical security, biometrics and blacklists are essential. even with prevention systems, there is always a risk of theft. However, with fraud prevention systems and biometrics, stores can deter it. Video analytics and biometrics, with the agreement of customers, can be used to improve shopping