An Introduction to External Investment

Why Raise Funding

Key Reasons for Fundraising

To fund something beyond your means

To grow your business faster

Because you’ve run out of money

To reduce risk

Key Takeaways

To increase shareholder value

• There are many reasons why a company may raise money

• The main purpose of raising money is to increase shareholder value

What To Think About When Raising Funding

Where do I want this fundraise to take the business?

How much money do I need to get there?

Fundraising Considerations

How much risk am I willing to take?

Will I have to give up control in my business?

What level of equity will an investor want?

What time commitment will I need to give to the business?

Do I want or need anything more than money from an investor?

Key Takeaways

How much and

what sort of information will I provide?

What will it cost me?

• Founders need weigh-up the pros and cons of bringing in external investment

• Fundraising is often about more than just raising money

What type of fundraising is right for my business?

Where To Raise Funding From

Key Sources of Fundraising Bank loans / debt

Sweat Equity –work for no pay

Institutional investors (VC / PE)

Key Takeaways

Friends and family investment Crowdfunding

• There are lots of different funding options available to founders

• Different funding options are better suited to different businesses

Incubators / Accelerators

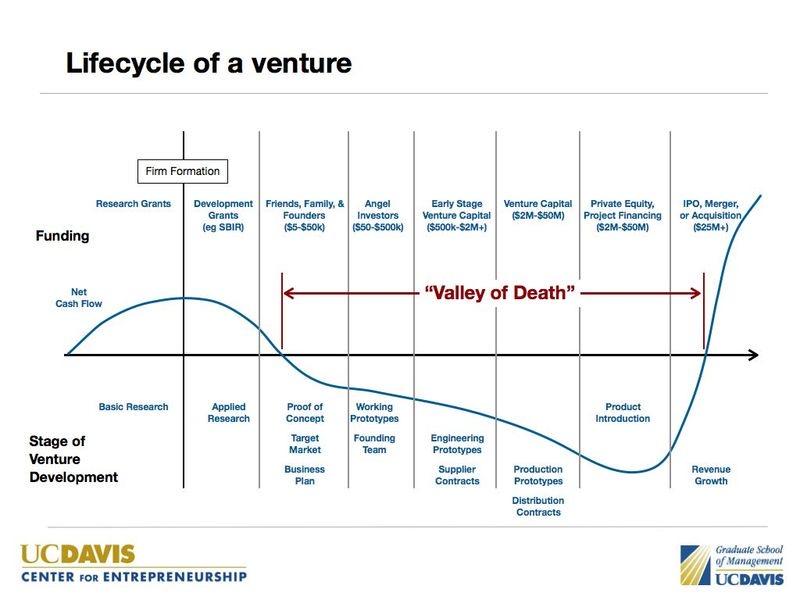

When to Raise Funding

Self-financed

Friends & Family Grants

Self-financed Friends & Family Incubators

Angel Investors

Venture Capital Grants

Crowdfunding

Angel Investors

Venture Capital Loans Grants

Crowdfunding

Venture Capital Corporates Loans

Seed / Startup

Pre-seed

Key Takeaways

Venture Capital

Private Equity Public Markets

Increasing value

Late Stage

• Funding amounts, valuations and sources of funding all vary by business

• Planning ahead is important

Longer-Term Equity Planning

Key Questions

How much will the business need to raise over time?

People

Key Considerations

Shareholdings at formation represent historic contribution

Additional shares are granted to motivate / reward contributors for continuing to add value

Who is involved now?

Who will we need to recruit and how will they be incentivized?

Key Takeaways

Who will remain involved?

Many factors have an impact on value at exit e.g., time, number of funding rounds, market, performance

Would you rather have a bigger slice of a small pie, or a smaller slice of a big pie?

• It is important to consider today’s equity round in the context of longer-term plans

• Planning ahead is important

• Share value is all theoretical until an exit event

What Do Investors Look For?

Ideas are easy, execution is everything

- John Doerr, Chairman Kleiner Perkins

Different Investors Look For Different Things

Investment can be a long and time-consuming process

Beauty is in the eye of the beholder

Look for investors who invest in similar areas to yours

Be honest about the stage of development and whether that fits the funders investment criteria.

Key Takeaways

• Do your homework before contacting investors

• A no from one investor doesn’t mean others won’t be interested

5 Areas For Venture Capital

• Be honest about where you are today – VCs don’t expect everything to be perfect

Key Takeaways

• Make it exciting

• It’s not all about valuation – at this stage investors are deciding whether to invest at all

People

Backable CEO and Chair

Engaged founders

Team with a track record

Suitable Board and advisors

Appropriate hiring plan

Key Takeaways

• VCs want to see you’ve thought about these things

• The right investor can help with connections

Technology

Differentiated

Clear development plan

Strong IP position and strategy

Suitable IP arrangements

Key Takeaways

• Be able to translate your technology for people who are not experts

• Be realistic about the stage of technology development and what still needs to be done

• Show investors you are thinking about the customer

Key Takeaways

• Be specific about the subset of market the business it initially focused on

• Provide proof that your target subset needs your solution

Business Model

Domain-knowledge-led route to market

Product:market fit

Evidence of real traction Revenue model

Competition

Clear, measurable plan

Key Takeaways

• Don’t Let “Perfect” Be the Enemy of “Good”

• Make sure what you measure what actually matters

• Investors are looking for validation of the business plan

Return

Sensible Cap Table

Realistic valuation

Sensible raise amount

Equity journey and value inflexion points

Use of funds

Exit potential

Key Takeaways

• Decisions you make now impact the future

• Articulate how the money you’re raising will be used to increase business value

• Investors use scenario models to look at different possible outcomes

Innovate UK Support for Life Sciences

SME’s

Dr Samana Brannigan Head of Health Technologies

Dr Samana Brannigan Head of Health Technologies

Innovate UK

§ We are the UK’s innovation agency

§ We support business-led innovation in all sectors, technologies and UK regions

§ A key delivery body of the Government’s Innovation Strategy

Our Mission

To help UK businesses grow through the development and commercialisation of new products, processes, and services, supported by an outstanding innovation ecosystem that is agile, inclusive, and easy to navigate.

Future Economy

Innovate UK Health & Life Sciences 22/23 – 24/25

£675m

Total Managed Expenditure

Biomedical Catalyst Health Managed Programmes

AMR

Transforming Medicine

Manufacturing

Cancer Therapeutics

Mental health (Mindset)

Dementia

Advancing Precision Medicine

DHSC Vaccine

DHSC AMR

DWP

Accelerating Detection of Disease

Healthy Aging

Data to Early Diagnosis & Precision Medicine Other

Engineering Biology

TMF

National Biofilm Centre

Fast Start

Innovate UK Products & Services

Non-cash Support

• Challenge Fund: programme in a strategic area of importance

• Catalyst: thematic investment across the full range of technology or market maturities

• Smart: topic agnostic grant funding competition

• Launchpad: topiccentric investment to strengthen business capability in a particular location

• Women in Innovation Awards

• Young Innovators Awards

• Feasibility studies: short projects to test an early-stage idea to establish its merit

• Innovation Loan: a business loan supporting late-stage research and development

• Investor Partnership: programme aligning public grant and private enterprise equity investment

Contracts

Skills

• SBRI (Small Business Research Initiative): research and development procurement driven by government policy objectives

• Design Foundations: early-stage humancentred design project

• Future Leader Fellowship: strategic investment in an individual with highpotential innovation ideas

• Knowledge Transfer Partnership: transfers knowledge through the movement of people (usually from academia into business)

• Innovate UK EDGE: bespoke growth services for companies looking to grow and scale

• ICURe: decision-making and company launch support for early-stage researchers

• Analysis for Innovators: metrology support to solve product quality or production problems

• Catapults: create a critical mass of expertise and equipment in a priority area

Collaborators

• Collaborative research and development: longer projects with partners to develop an idea in a useful direction (can incl Grant)

• Innovation and knowledge centres: university-based innovation centres, acting as nucleating points for an emerging industry

• Innovation networks: communities of practice in a given area, convened by the Knowledge Transfer Network

• Innovate UK KTN: builds innovation communities and networks

• Eureka: network supporting global research and development and innovation collaboration (incl grants & non-cash)

• Global Business Innovation Programmes: help high growth businesses explore global innovation opportunities

• Global Expert Missions: deep dives to scope future global innovation opportunities

• Global Incubator Programme: immersion programme to equip high growth businesses for international markets

Biomedical Catalyst

Biomedical Catalyst

§ Primary Innovate UK grant funding mechanism for supporting UK health & life sciences SMEs

§ Technology agnostic and open to any human health and life science SME with an innovative idea

§ >£320 million committed to date

Programme Budget- £140m FLAGSHIP PROGRAMME

Biomedical Catalyst - New Structure

v Maintains a technology agnostic stream with a portfolio approach

v Therapeutics

v Med Tech

v Digital Health

v Maximise funding availability through leveraging private investment

v Provides an ecosystem beyond grant funding

• increase spin-outs in thematic areas-commercialisation of research base

• Support early-stage innovators

Biomedical Catalyst- Structure

Industry Led R&D

• Grant funding for innovative R&D projects

• Technology Agnostic Investment Partnership

• Grant Funding

• Aligned VC and Angel equity investment

• Technology Agnostic Accelerator/ Feasibility

• Grant funding for early stage innovation

• Ecosystem for innovators

• Thematic

Biomedical Catalyst- Industry Led R&D

Technology Agnostic

Transformational Grant Funding

• Project costs £150k-£4m

• Grant up to £2m

• 70% grant support for SMEs

• Projects duration of 6 to 36 months

Therapeutics

• Innovative Drug Discovery & Delivery

• Therapeutic and medicine development

• Advanced Therapies

Health Technology

• Diagnostics

• Imaging

• Medical

Technology and Devices

• Sensors Robotics

Digital Health

• Data Driven Health

• AI in Health

• Independent living and wellbeing

Next Call planned to open- 17th June 2024

Examples of Projects Funded

Intelligent Foetal Health Monitoring

Regenerative dermal scaffold for wound reconstruction

Paediatric Musicbased Audiometry

AI for protecting vision in macular disease

Stem cell therapy for hearing loss

Fall prevention exergaming

Early lung cancer detection test

Small molecule inhibitors for brain tumours

Platform informatics for data-driven neuromodulation

Multitarget gene therapy for Neurodegenerativ e Diseases

Novel blood test for the early diagnosis of

Pancreatic Cancer

Wearable brain imaging for pointof-care stroke diagnosis

Clinical trial of peanut allergy

immunotherapy in children

Cell-Free Regenerative Medicine

Innovative biocompatible hip resurfacing system

Battery technology for miniature medical implants

Novel therapy against C. difficile

Intra-operative cancer detection technology

Novel Melanoma Treatments

Novel treatment of dementia

Next-generation Biologics

SEPSIS Alert Test

Improved asthma management

Nanoparticle for Pancreatic Cancer Treatment

Biomedical Catalyst: Investment Partnership

Investor Partnerships

Innovate UK

§ Validate early-stage R&D projects

§ Non-dilutive finance

§ Access to UK wide companies

§ Monitoring of projects

Independent Assessment of Project Grant funding

Investor Partner

§ Validates quality companies

§ Equity finance

§ Access to markets

§ Influence on company

Maximise Impact

Reduce Risk

Due Diligence on Company

Equity Finance

Portfolio of SMEs

§ Strong, commercially exploitable asset

§ Good team with aptitude for growth

§ Structure to support scalability

Investor Partnerships

Delivery in pilot, ISCF and regional angel programmes between 2017 and 2022:

• £42.8m grants committed

• 162 SMEs supported

• £123m in aligned investment (>2.5x)

• 28 lead investor partners

• £373m in follow-on funding (>8.5x)

§ £80m commitment 22/23 to 24/25

§ > 100 investment partners

onboarded IUK-080124InnovateUKInvestorPartners.pdf (ukri.org)

OFFICIAL-SENSITIVE

Investor Partnerships

Life Sciences Specific Investment Partnerships

§ Total no. of Projects funded - 74

§ Total grant - £19.7m

§ Aligned investment - £41.4m

§ Further investment - £211m

§ BMC Investment Partnerships

§ Total no. of Projects funded -19

§ Total grant -£10.9m

§ Aligned investment -£25.6m

§ Further investment -£6.7m

Innovate UK Investor Partnerships: SME round 6

Closes: Tuesday 27 February 2024 11:00am

Biomedical Catalyst: Accelerator/Feasibility

Early-stage SME’s/start-ups

Funding Continuum

Innovation Ecosystem- industry/regulator/catapults/clinician/investor

Academic

Promising latestage translational projects

Pre-Development Programme

• Evaluation of business idea from industry experts

• Gaps / strengths / weaknesses

Accelerator Phase Feasibility Funding

• Value proposition and commercial feasibility

• IP & regulatory plan

• Route to revenue realisation

Biomedical Catalyst- Feasibility / Accelerator

STAGE 1

Ø Thematic- Focus on emerging sectors

Ø Duration: 6 months;

Ø Support: 30 companies

Ø 10-12 through an intensive support

Ø Supporting Ecosystem for Innovators

Ø Provide Innovation framework and tools

Ø Support Diversity and Inclusion

Ø Access to ecosystem and private investment for all UK regions

STAGE 2

Ø Feasibility funding closed competition

Ø

£100k funding at 100%

Ø Simplified application and process and faster funding decision

Ø Support the application process

Female Health Technologies

§ Area Selection

§ Emerging area

§ Significantly underfunded in the BMC

§ Significant health care need across therapeutics, diagnostics, date gathering and female health data etc.

§ Female Health has significant global market

§ Low historic private investment

Current Open Competitions

UK-Switzerland CR&D Round 2

Budget £4 million

Closes: Wednesday 1 May 2024 11:00am

Innovate UK Smart grants: January 2024

Budget £25 million

Closes- Wednesday 24 April 2024 11:00am

Innovate UK innovation loans future economy: round 13

Budget £25 million

Closes: Wednesday 6 March 2024 11:00am

www.ukri.org/councils/innovate-uk/

The importance of being “pitch ready”

Overview

• Outline of who Start Codon are

• What you need to be pitch ready

• Points to follow to quickly summarise your offering

What is Start Codon all about?

Venture capital

Investment of a pool of capital into a business that exits (sold or IPOs) with proceeds shared

Venture Builders

(£5 -£50k) (£50-£500k) (£500 -£2m+) (£2m -£50m) (£2m -£50m) (£50m+)

Helping translate science into impact and returns

Start Codon is a venture-building fund that Discovers, Nurtures and Advances next-generation healthcare and life science companies.

Start Codon was founded in 2019 to revolutionise the way life science and health-tech is spun-out, developed and commercialised. As of today, we’ve invested in 25 companies, to help translate ground-breaking innovations into disruptive and successful startups. The team works hand-in-hand with founders, providing bespoke support through our START Programme to build and accelerate their businesses, to increase their chances of success.

Data shown is unaudited data, as at October 2023.

Audited data for the period ending 30 March 2023 available on request.

What do you need to be pitch ready?

Misconception

Presenting directly to investors? X Rarely happens

Investors are extremely busy

Due diligence

Evaluate the VC’s portfolio

Identify portfolio competitors

Try and gain an introduction

Breakdown of pitch

1. Title Slide

2. Executive summary and your “Ask”

3. Problem

4. Solution / Technology

5. Product/ Platform

6. Team

7. Why now?

8. Market

9. Competition

10. Business model

11. Financials + Key Metrics

12. Fundraising amount, use of proceeds and milestones/goals for the next 18 months

13. Thank you slide with compelling statement on who you are again

Importantly, you should make sure the title of each slide conveys the message on each slide and not just name each slide "Problem", "Solution" etc.

Elevator Pitch

Remember the title- always be “pitch ready”

• Introduce yourself

• State the mission of your company

• Explain your company’s value proposition

• Finish with a call to action + card or ask to connect on LinkedIn

Things to avoid

• Don’t speak for more than 30 secs

• Don’t use jargon

• Don’t speak in a monotone

Summary

• Generate a pitch deck that doesn’t require your presence to understand

• Make sure your pitch covers those key points I’ve outlined

• Always be prepared to deliver an elevator pitch