2024/25 Annual Report and Consolidated Financial Statement

Registration number: 09928547

J

S

R

MDC location: Based in Alderley Park, Cheshire

MDC

Discovery

(MDC)

Chief Executive Officer Medicines Discovery Catapult

Section

Medicines Discovery Catapult (MDC) delivers a national life sciences service whose performance this year reflects its high impact and strategic role in supporting UK biotech: reshaping drug discovery for patient benefit and securing fresh investment in its best young companies

MDC delivers this service to the nation in three distinct ways: de-risking new drug discovery technologies and techniques that drive productivity, de-risking private investments in biotech companies, and developing and running national research and development (R&D) programmes.

Since its inception, MDC has actively helped over 300 organisations across the UK and over 200 companies secure

£1.34bn in private R&D investment into the economy.

The Financial Year (FY) 2024/25 has seen some recovery in the life sciences sector following a reduction in inflation and a limited return in fundraising. However, as MDC’s 2024 State of the Discovery Nation report showed, the return in funding has been to fewer, later-stage companies, which leaves earlier-stage companies starved of resources to translate their ideas into investible drug candidates. MDC has, therefore, continued to provide unique combinations of R&D advice, technology access and now early seed capital into these companies. This approach, called 'Fit to Fund', is part of a wider set of capabilities MDC will now deploy even further next year.

Despite the market challenges, MDC has maintained its commercial revenues and developed a strong future pipeline. This is in large part due to the success of its long-term investment in imaging and radiopharmaceuticals, exemplified by multinational relationships, including Champions Oncology. It is also investing directly into start-up businesses whose long-term success and sustainability MDC can share.

MDC serves the UK’s strategic life sciences sector by supporting national programmes that bring industry, academia, and charities together for purposeful, collaborative, translational R&D.

MDC is supporting the launch of the Dame Barbara Windsor Dementia Goals Programme one of the government’s three national platforms in dementia, mental health, and obesity.

The National total body PET Imaging Platform (NPIP) has delivered its first scanner in London, with another to be launched in FY 25/26, and has stimulated funding for two new machines to be deployed in other areas of the UK.

The long-running multinational Psychiatry Consortium has been engaging widely with the sector, supported by industry and the Wellcome Trust, to shape its next ambitious phase.

The PACE initiative tackling Antimicrobial Resistance (AMR), has a portfolio of 11 projects and is recognised as a globally leading approach for supporting early-stage companies for this global threat.

The Intracellular Drug Delivery (IDDC) programme, co-delivered with its sister Catapult in High Value Manufacturing, has worked with the regulator, the Medicines and Healthcare products Regulatory Agency (MHRA), to provide important guidance for developers of novel, highly targeted therapeutics and vaccines.

The Cystic Fibrosis Antimicrobial Resistance (CF-AMR) Syndicate has secured additional funding and received awards for both industry collaboration and patient engagement.

MDC’s many services to the community across the UK were recognised in March 2024 by the award of ‘Non-Profit Life Sciences Enabler of the Year’ by the Cambridge-based One Nucleus group and in March 2025 as ‘Business Support of the Year’ by the Northern region’s Bionow group. These services are augmented by the publication of valuable data and insight through scientific papers in globally recognised journals, UK-wide primary sector research reports, start-up biotech webinar series and blogs.

MDC’s responsibility to its employees and the environment has been reflected in the continued hiring of new skills and capacity at all levels despite the challenging financial environment. MDC’s Environment, Social and Governance (ESG) strategy has been embraced by its employees and is seen in a wide range of activities, from its school engagement programme to international recognition for its laboratory energy-saving approach. Importantly, it has also been awarded the ISO45001 accreditation for health and safety.

MDC begins FY 2025/26 with a strong foundation of skilled and committed people, using experience and cutting-edge technologies in support of the UK life sciences community. It continues to serve the whole UK and looks to strategic international partners who will help it support the development of future medicines and their makers.

for the Year Ended 31 March 2025

Catapult’s vision is to reshape drug discovery for patient benefit, delivering on its purpose to transform great UK science into better treatments through partnership.

At the frontier of drug discovery, Medicines Discovery Catapult (MDC) works with the sector to make every move count. It validates their ideas, de-risks investments, and feeds insights back into the sector to drive productivity and impact.

Drug discovery involves high-risk science, and innovators often lack the funding and resources to move forward. MDC creates momentum through its unique blend of discovery expertise, technology, insights, and sectorleading partnerships. Where there is an unmet patient need, MDC stimulates innovation through the National R&D Programmes it has helped develop and supports.

MDC has established a unique and vital presence within the UK medicines discovery community, working in collaboration with the sector, from SME therapeutic developers, technology innovators, large pharma, and biotech companies, to academics and charities. Partnership is at the heart of driving innovation and creating impact.

As an independent, not-for-profit, commercially driven organisation, MDC reinvests in the life sciences sector. It is in the second year of its second Grant Funding Agreement (GFA) with Innovate UK, and its impact is evident.

Despite the continuing challenges impacting the life sciences sector, MDC’s overall contribution to medicines discovery in the UK continues to grow. Its approach to drug discovery, driving the adoption of productive new technology, delivers game-changing breakthroughs and improves patients’ lives.

MDC delivers impact through de-risking assets – be they potential new medicines, technologies, or diagnostics - and unlocking investment in them. Its approach helps innovators by combining deep sector know-how and cutting-edge technology to generate critical data to validate ideas, create the right partnerships and help them secure the funding required for long-term success.

Initiate and run impactful R&D partnerships across global ecosystems to effect meaningful sector change 2 Provide access to technologies, skills, and knowledge to enrich drug R&D pipelines

3

Reinvest in our sector to drive further growth 1

This year, MDC continues to increase its focus and capabilities to meet unmet needs and opportunities in the sector, across key areas:

• Expanding the range of its therapeutic modalities through the development and adoption of new technologies supporting mRNA therapeutics, vaccines, and radiopharmaceuticals.

• Addressing significant unmet needs in the development of precision approaches in neuroscience and infectious disease (including pandemic preparedness), in addition to supporting six strategic, high-impact national R&D programmes across AMR, psychiatry, dementia, cystic fibrosis, clinical total body PET imaging and complex medicines.

• Enhancing focus on the role that immune biology plays in a wide range of diseases. MDC’s approach is working.

£1.34bn

investment funding secured by SMEs post engagement

£126.2m grant income raised in collaboration with MDC

The culmination of MDC’s influence since its inception is making a key impact on the sector.

Social impact Knowledge exchange

10

assays supporting clinical development and delivery

£300m

SME licensing deal enabled with multinational pharma

Largest diagnostics laboratory testing project in UK history, contributing to the creation of 900 jobs

311 organisations supported

3 partner products to market

5 compounds supported into the clinic

£50.8m

public sector funding secured by supported SMEs post-engagement

Kick-starting economic growth and supporting an ecosystem fit for the future, this year, MDC has:

• Started 68 partner projects.

• Worked with 64 partners.

• Partners who have worked with MDC have subsequently raised £262m in R&D investment.

MDC has met or exceeded all its performance-related KPIs for the year FY 2024/25. Since its inception, MDC has worked with over 300 organisations across 11 countries and three continents in all key markets. MDC’s interventions work. Organisations it has supported have gone on to raise £1.34bn of R&D investment.

19 cross-organisation reports

Stimulating innovation through 6

National R&D Programmes

331 partnered R&D projects International collaborations across 11 countries and 3 continents

15 national award wins

Commercial exploitation of new drugs and technology to improve health outcomes.

Improved UK capabilities to respond to national and global health challenges.

Improved R&D productivity in the UK industry, driving economic growth in the sector.

By transforming drug discovery in partnership, MDC is increasing the impact of the UK life sciences sector, creating a healthier society and economy, and improving patients’ lives.

The life sciences are a growth industry in which the UK is world-leading. It has over 7,910 businesses, 70-80% of which are SMEs. Collectively, life sciences companies employed over 304,200 people and generated £108.1 billion in turnover in 2021. The biopharmaceutical subsector accounts for 43% of the total turnover generated across the life sciences industry.

Early-stage SMEs and university spinouts discover a significant number of new medicines in the global pipeline, translating academic research into commercial outputs. Large pharmaceutical companies and SMEs of all sizes play an essential role in the life sciences discovery ecosystem, contributing new therapeutic candidates and bringing innovative tools and approaches to the medicines development pipeline.

The sector continues to forge new paths into high-impact therapeutic areas and innovative new types of drugs. It rests on a strong scientific base and is itself a seedbed and fertiliser for the growth of established companies. It has also made good use of the increased flow of post-pandemic life sciences financing.

However, MDC’s analysis of the life science sector in its State of the Discovery Nation 2024 report has confirmed that a combination of increased costs, difficulty accessing funding and lab space, specialist resources and skills shortages has continued to create a particularly challenging environment for innovators.

MDC has worked extensively this year to support innovators amidst the external funding landscape. Despite the challenges, overall income has remained consistent year-on-year. This includes the increase in MDC’s translational imaging services and its offering in the rapid advancement of a growing class of radiopharmaceutical therapies and theranostics.

Strategically, MDC continues to deploy cutting-edge science-based technologies that enable partners to progress their assets to the clinic and to develop new technologies to market in the UK. It also focuses on supporting national sector collaborations to deliver long-term growth. It delivers impact through the integrated deployment of these advanced lab and partnership platforms:

MDC continues to invest in its advanced lab capabilities in:

MDC provides a critical role through:

• Virtual R&D advisory services, providing strategic guidance, experimental design, and problem-solving to accelerate high-quality R&D programmes.

• National R&D programme portfolio, by supporting national programmes, MDC unifies the community to address national and global challenges, creating enabling environments to meet unmet patient needs.

It provides advanced translational platforms to test drug molecules or novel technologies in vitro in vivo ex vivo and in

Whilst MDC supports partners working across all disease areas, a strategic focus on selected disease areas and drug modalities enhances its capabilities further.

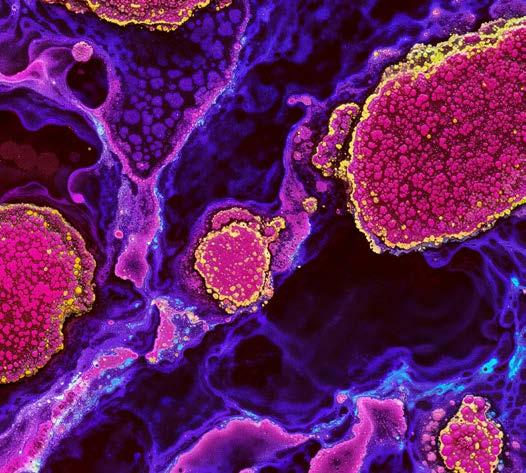

MDC provides specialised lab-based support in key areas of focus in neuroscience, immune biology and oncology, and plays a leadership role in infectious disease and through its

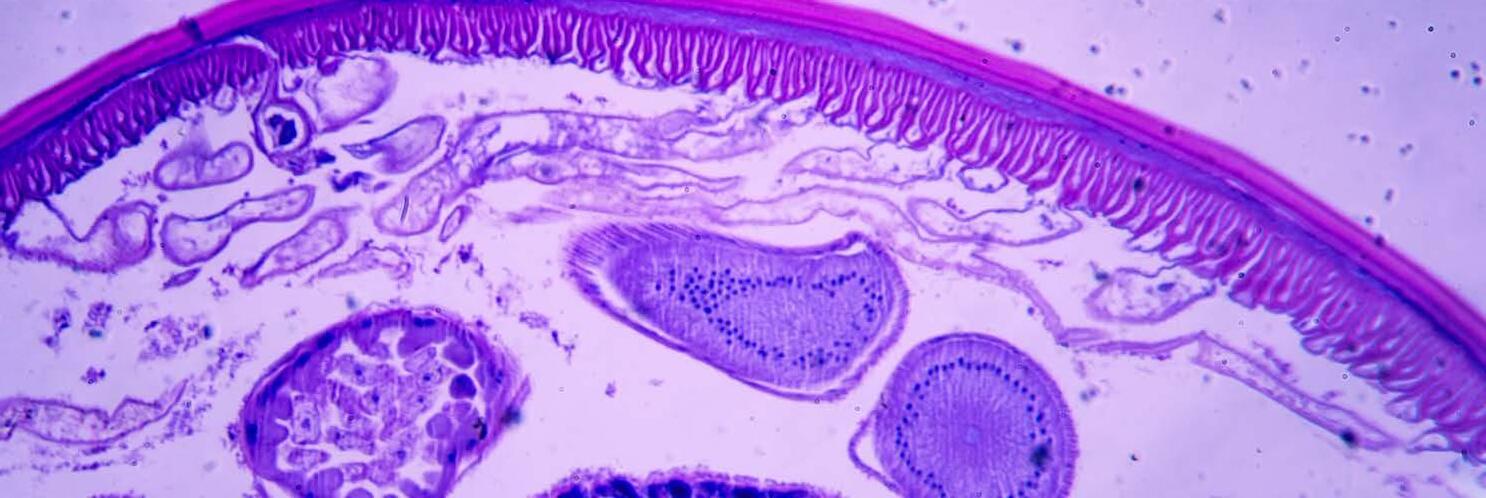

While MDC has the capability to assess any drug modality, a comprehensive platform has been established to support the characterisation of the latest wave of ‘complex medicines,’ which typically comprise a delivery moiety and an active drug cargo such as RNA, DNA, protein, or cytotoxic small molecules.

MDC’s unique combination of connected resources, expertise, and networks enables the delivery of bespoke solutions for its partners and addresses global challenges that span pre-clinical to some clinical settings, creating a lasting impact.

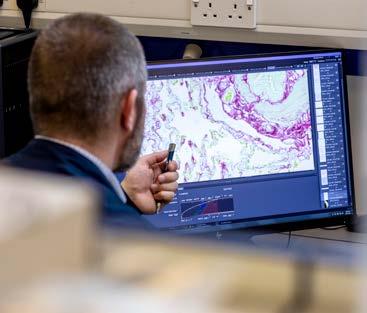

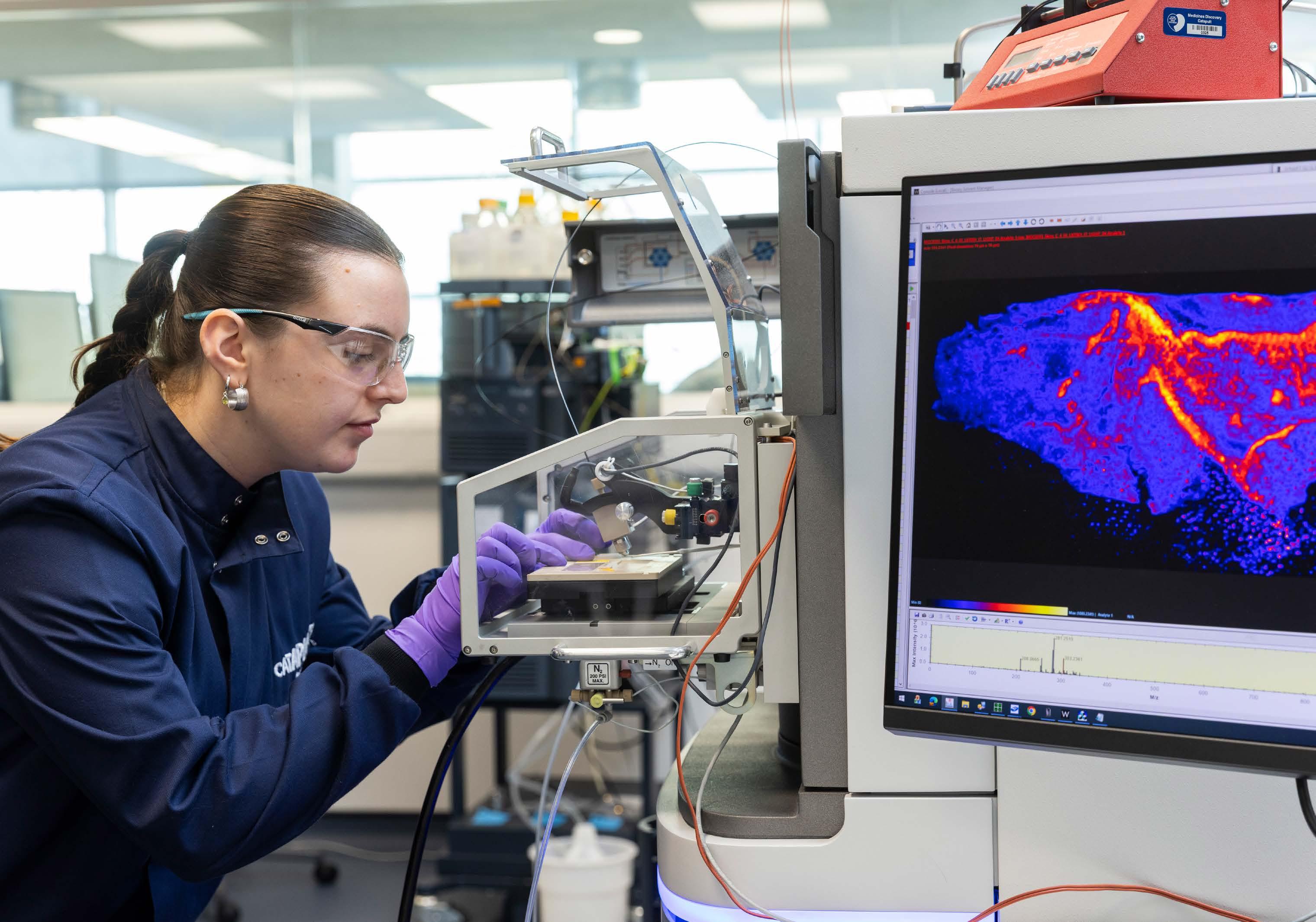

Translational Imaging is key to understanding how drug candidates will behave in the body and, therefore, the suitability of candidate drugs to progress into clinical development.

MDC has established a comprehensive pre-clinical imaging technology platform, augmented by a radiochemistry capability, through which cutting-edge imaging studies are delivered in support of our partners’ projects. Focusing on establishing translation from in vivo to human settings, these capabilities enable the generation of important pre-clinical data, which is much needed by innovators and aids their decision-making.

This year has seen a spotlight on radiopharmaceutical therapy. Responding to the rapid advance of a growing class of therapeutics – radiopharmaceutical therapies (RPT) and theranostics – MDC has developed a significant pipeline and portfolio of projects, working with a series of large industry partners and SMEs to radiolabel their lead molecules and assess them for efficacy in oncology models. Recent advancements in alpha and beta-particle-emitting radiopharmaceuticals have demonstrated the therapeutic potential of targeted radionuclide therapy, presenting an opportunity to redefine oncology therapeutic options and to set new standards in patient care.

Key activities

Expanded suite of in vivo disease models deployed in translational imaging projects.

Supported partners to characterise their complex medicines in vivo, including delivery of the Intracellular Drug Discovery Centre (IDDC) project goals.

Developed strategic partnerships with a specific focus on collaboration with United Kingdom National Nuclear Laboratory.

Developed a robust, pre-clinical, in vivo model to test new therapeutic approaches for glioblastoma, closely mirroring the translational journey of the patient.

Led the centralised NPIP hub developing new opportunities and a growing project pipeline.

Built a diverse portfolio of radiopharmaceutical projects, including establishing radioisotope labelling protocols.

Chaired the UK MHRA Radiopharmaceutical Trusted Advisor Group to embed a community of trust and provide a clear regulatory path.

Underpinning this work, MDC has established a strategic partnership with Champions Oncology, aligning MDC’s expertise in radiochemistry and pre-clinical imaging to Champions Oncology’s advanced capability in pre-clinical oncology models.

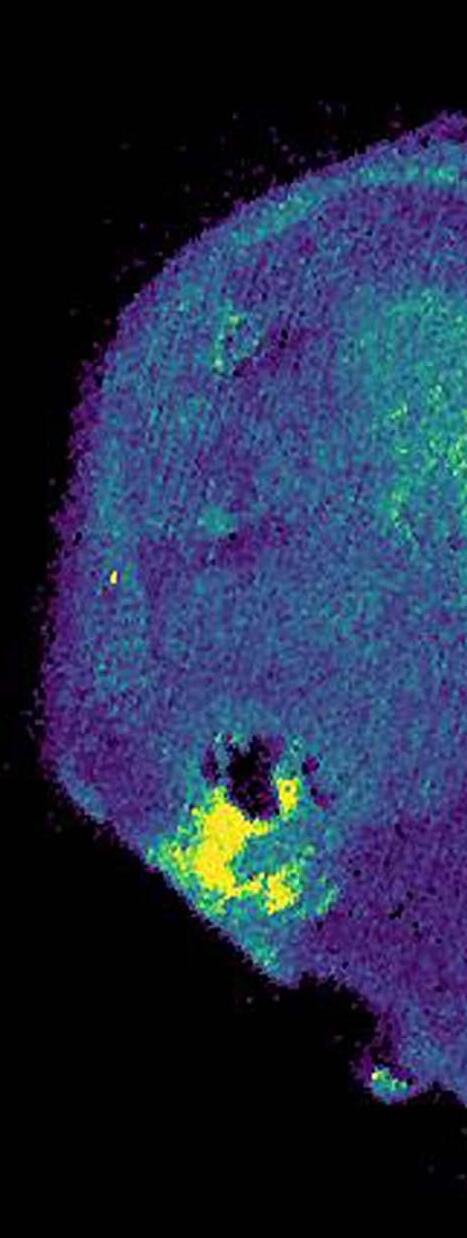

In addition, this year, MDC established its radiopharmaceutical labelling capability at its headquarters in Alderley Park. The labelling of antibodies, peptides and other molecules with the alpha and beta-particle emitters that underpin radiopharmaceuticals has been added to the suite of laboratory facilities available on-site. Bespoke informatics tools for analysing in vivo biodistribution data and drug dosimetry support the RPT project portfolio further by predicting human tissue exposure.

Also in this space, MDC announced a collaboration with United Kingdom National Nuclear Laboratory (UKNNL) to drive innovative approaches for new cancer treatments. Funding from UKRI was received as part of its Sustainable Medicines Manufacturing programme, to finalise the case to scale up the harvesting of precision nuclear medicines from the UK’s spent nuclear material. This provides global nuclear and healthcare leadership with sovereign capacity in this important therapeutic sector.

Driving the national conversation to create an enabling environment for innovators, MDC has worked with the MHRA and stakeholders across the UK. It chaired an advisory group for radiopharmaceuticals to facilitate the transition of novel approaches into the clinical setting.

To augment its pre-clinical capability, MDC continues to drive NPIP, the UK’s national total body PET imaging platform, developed in partnership with the Medical Research Council (MRC) and Innovate UK (page 22). This allows UK innovators to carry out exploratory clinical research, using the probes and learnings from pre-clinical research. NPIP is available for national access and use, with MDC playing a central role in identifying and enabling the projects to run on the platform.

Science and Technology Officer

This is a highly rewarding project for UKNNL, and indeed the nuclear sector. We are utilising the science and technologies that we have developed to process nuclear materials to extract these sought-after radionuclides. It is a credit to the teams of scientists and engineers behind these break throughs in both organisations, and it is such an incredibly positive application of nuclear science to benefit society.

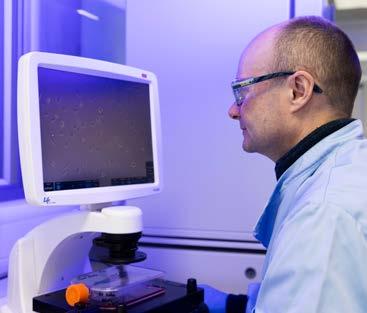

Biomarker-enabled drug development programmes have a higher success rate than those without biomarkers. They provide a comprehensive understanding of a candidate drug’s impact on biological processes, de-risking their progression from pre-clinical studies, enabling key data to inform clinical strategy and enhance the success of clinical trials. MDC experts have continued to support a diverse range of projects, expanding the use of biomarker approaches into disease areas where they are not yet routinely applied, such as neurodegeneration.

Drug development projects often fail because they were not tested on patient-relevant material early enough to understand likely biological responses.

Supported partners by providing key biomarker data through bespoke assay development and multi-omic analysis of biological samples.

Leveraged cutting-edge platforms to expand pre-clinical and exploratory clinical biomarker pipeline, supporting partners’ drug development programmes.

Built evidence for pre-clinical model-to-human translation.

Extended into new disease and therapy areas, with a priority on neuroscience, leveraging advanced capabilities to deepen understanding of drug mechanisms and disease biology.

Applied robust and streamlined processes for clinical sample analysis, ensuring compliance with Good Clinical Lab Practice (GCLP).

MDC is recognised as being at the forefront of technological advances in high-resolution biomarker technology. This is complemented by its proven ability to source biosamples through partnerships with leading clinical centres and its network of private providers.

MDC has also established the lab capability and associated processes to support exploratory clinical trial sample analysis using advanced technologies, including mass spectrometry and spatial transcriptomics. This molecular biomarker analysis provides insights to enable its partners to gain a deeper understanding of their drug candidates and to shape their clinical strategy.

In the emerging fields of spatial biology and liquid biopsy profiling, MDC enables the creation of new, co-developed biomarker signatures suitable for supporting medicines in clinical development. MDC provides key data to UK drug innovators, using biomarkers as a key tool to improve clinical success.

This year saw the progression of our largest clinical biomarkers study to date, with an oncology SME. In support of their early-phase clinical trial, MDC’s experts developed and applied a critical pharmacodynamic assay in patient blood samples to generate early target engagement data, to help shape and support their clinical strategy.

Established partnerships with leading biosample providers, engaging with the community.

Working with MDC brings an integrated team effort to Vitarka’s project. The scientific know-how is value-added to our drug development efforts. The data generated so far has enabled us to develop a roadmap for identifying lead therapeutic assets, which will further progress Vitarka’s pipeline to clinical trials.

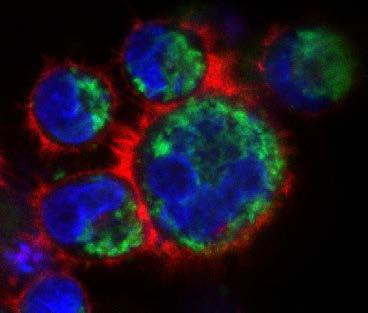

Demonstration of cellular target engagement - linking potential medicines to their intended target and downstream effectsis crucial for target validation, understanding potential disease response and characterising the mechanism of action required for progressing any new therapeutic. To address these needs, MDC develops and optimises preclinical cell models and assays with disease relevance to guide translational research. It provides access to these cell models and assays for the evaluation of therapeutics, target validation, and target engagement studies.

Deployed in vitro human cell models and advanced analytical technologies to support partners across neuroscience, oncology, immune biology and complex medicine projects.

Supported the delivery of the Intracellular Drug Delivery Centre (IDDC), focused on the characterisation and development of lipid nanoparticle formulations.

Developed MDC’s proprietary target engagement assay to extend application to disease-relevant cells/tissue for translational impact.

MDC supports partners by deploying a suite of human cell models and associated analytical methods, with a focus on neuroscience, oncology, immune biology, and complex medicine analysis.

Supporting the IDDC collaborative programme, which encompasses two Catapults and three academic centres of excellence, MDC has evaluated a large number of novel lipid nanoparticle (LNP) formulations. The most promising LNP candidates are now progressing to testing in more complex pre-clinical systems (Page 23).

Highlights from this year include the development and externalisation of a proprietary target engagement assay, external partnerships with vendors and Contract Research Organisations (CROs) aimed at introducing new microscopy methods for complex medicine analysis, and ex vivo analysis of immune cell populations to support translational projects and delivery of decision-making data.

Developed novel reporter assays by combining CRISPR gene editing technology and live cell imaging to evaluate biology in real-time.

Developed and fostered academic collaborations to enable increased impact in the sector.

Working with MDC on Innovate UK Biomedical Catalyst grants has given us the chance to explore new technologies and gain expertise that would be hard to access on our own as an SME. We've been able to use advanced PET imaging in our pre-clinical studies and dive deeper into multi-omics for biomarker discovery. This partnership has helped us explore more innovative and quicker clinical trial designs, and it could also lead to significant knowledge gains for the Huntington Disease research community through potential publications. Overall, collaborating with MDC has been a rewarding experience for both sides.

Donna Finch

MDC’s partnership reach is extensive, connecting the community across the length and breadth of the nation, driving regional impact in other key areas. Examples include:

Accelerate@Babraham;

MDC has provided early-stage discovery ventures with strategic support for success, via a start-up competition run by the Cambridge-based Babraham Research Campus

Science and Technologies

Facilities Council (STFC) Health Tech Business Incubation Centre (BIC): Launched by the Liverpool City Region Innovation Zone, MDC provides support to help commercialise businesses in health and life science research

The UK is globally renowned for the strength of its fundamental research. Academia is a fantastic source of innovation and translatable science, and the source of many SME start-ups.

In FY 2024/25, MDC was granted eligibility for research council funding, allowing it to collaborate as a project partner on academic grants. MDC has developed and implemented a strategy for academic outreach and engagement, resulting in the co-development of grant applications and partnerships with multiple groups.

Highlights from this year include the completion of a project with the University of Southampton. Analysis and 3D reconstruction of idiopathic pulmonary fibrosis lung patient samples were constructed through the delivery of spatial transcriptomic and proteomic data for people with rare lung conditions.

An expert cross-functional MDC team organised an impactful workshop, ‘Transforming Therapeutic Delivery to the CNS.’ It convened experts from across the field to identify key challenges and prioritise solutions that will drive progress.

Mark Jones

Professor of Respiratory Medicine University of Southampton

Pioneer Group – AI in Health accelerator programme:

MDC provides expert input into scientific advisory board sessions and supports upskilling

ONE BioHub:

MDC provides strategic input into an upskilling initiative with therapeutic companies that have completed the iCure discover programme

There is a huge unmet need for patients with lung fibrosis. In this study, for the first time, we have been able to generate a map of lung fibrosis in 3D at the tissue scale. Our collaboration with MDC has been key to its success. Working in partnership, their expertise has supported the successful integration of state-of-the-art technologies, establishing a valuable new resource for the lung fibrosis community.

MDC remains committed to supporting skills development in the sector. It has developed a holistic strategy that connects MDC with its sector partners. Examples include:

A National Institute for Health and Care Research-funded Biomedical Research Centre/MRC Clinical Fellow PhD studentship was appointed, in collaboration with The Christie NHS Foundation Trust and the University of Manchester, to initiate a project aimed at identifying non-genomic biological drivers of non-small cell lung cancer.

Researcher-inresidence projects initiated with academics at the University of Liverpool and the University of Huddersfield. Internships with PhD students from the University of Nottingham and the University of Sheffield.

More widely, MDC manages a school's engagement outreach programme as part of its ongoing commitment to ESG.

A key strength of MDC is its ability to respond quickly to areas of need and address national and global challenges in medicine discovery.

The fragmented UK drug discovery community benefits from MDC's commitment as an independent connector to ensure its potential is realised. MDC leads the identification and implementation of strategic national R&D programmes, creating enabling environments that support innovators from across charities, patients, clinical key opinion leaders, industry, and academia, to address high-risk future patient, technology, and sector needs. It does so via its partnership teams and enabling its strategic levers, working holistically across MDC's capabilities and technologies, underpinned by its experts. MDC continues to drive impact in this space with a portfolio of national and international strategic R&D initiatives.

Psychiatry Consortium

Psychiatry Consortium

Addressing the unmet therapeutic needs of people living with mental health conditions.

The Psychiatry Consortium, managed by MDC, is a strategic collaboration of leading medical research charities, pharmaceutical companies and CROs. It focuses on the challenge of identifying and validating novel drug targets to address the unmet therapeutic needs of people living with mental health conditions.

Highlights this year include the launch of the Mental Health Award in collaboration with Wellcome to support mental health drug innovators and hosting a sandpit event with attendees from industry, academia, and charities.

Dame Barbara Windsor Dementia Goals Programme

Addressing the pressing needs of patients and industry by leveraging the UK's world-leading position in dementia research.

A national initiative to harness the UK’s rich academic, clinical and treatment infrastructure to speed up the development and adoption of new dementia treatments. The programme brings together stakeholders from across the landscape, including government, industry, academia, medical research charities and regulators.

This year, MDC has led the set-up of the Neurodegeneration Initiative, a public-private collaboration that can deliver many of the programme’s objectives. It is designed to help the industry tackle the global challenges of dementia, with patient, societal, and economic benefits to the UK.

Antimicrobial Resistance (AMR)PACE (Pathways to Antimicrobial Clinical Efficacy)

Addressing the global threat of AMR.

A £30m initiative driven by MDC, LifeArc and Innovate UK. PACE is supporting a diverse portfolio of projects aimed at developing treatments for some of the world's most threatening drug-resistant bacteria.

Projects were identified from a funding round that received applications from SMEs and academics globally, receiving both funding and advisory support from PACE. PACE has partnered with multiple organisations, including UKHSA, VOCAL and a network of 17 delivery partners, to help secure delivery of the portfolio.

Cystic Fibrosis Antimicrobial Resistance Syndicate (CF-AMR Syndicate)

Meeting unmet patient needs through collaboration.

A cross-sector initiative brought together by MDC, in partnership with LifeArc and the Cystic Fibrosis Trust. It aims to accelerate the translation of Cystic Fibrosis (CF) antimicrobials to the clinic and bring new and effective treatment options and diagnostics to people with CF.

This year, the Collaborative Discovery Programme provided £3m funding (provided by LifeArc) to support early-stage drug discovery projects.

In recognition of the Syndicate's efforts, it was named the Winner of the OBN Award ‘Most Impactful Industry Collaboration of the Year’ and achieved the Gold Standard from the Patient Partnership Index.

Head of Research

Cystic Fibrosis Trust

It’s an honour to win this award, recognising the CF AMR Syndicate’s work to bring together new research and develop treatments with the potential to benefit people with CF. AMR is a risk for everyone, but people living with CF are particularly vulnerable as they rely on antimicrobial medicines to treat lung infections. There’s still so much more to do to stop cystic fibrosis damaging and shortening lives.

National PET Imaging Platform (NPIP)

Patients benefit from game-changing full-body scans to provide a richer picture of human health for clinical research.

The UK’s first-of-its-kind national total-body PET imaging platform for drug discovery research was launched in partnership between MDC, MRC and Innovate UK. Its national network of cutting-edge total-body PET scanners is helping researchers detect and treat diseases earlier.

This year saw the installation of the first scanner at Kings College Hospital in London, and its launch by The Secretary of State for Science, Innovation and Technology, Rt Hon Peter Kyle MP, and Secretary of State for Health and Social Care, Rt Hon Wes Streeting MP. They met with the first patient to be scanned and praised the cutting-edge technology’s potential to unlock medical breakthroughs. The programme will launch its second instrument in FY 2025/26.

Cutting-edge scanners like these and the intelligence they provide can help UK patients live longer, healthier lives while easing the pressure on our NHS.

Ultimately, these kinds of medical advancements will quite literally save lives – through earlier detection, faster diagnoses, and more effective treatment in complex illnesses like cancer, dementia, and heart disease.

Ensuring our world-leading researchers have access to the most advanced technology is key to them unlocking the next medical breakthroughs, in turn improving the lives of people across the UK and beyond, while also growing our economy.

Novel Intracellular Drug Delivery Centre drives innovative discovery.

In partnership with CPI, MDC, the Universities of Strathclyde, Liverpool, and Imperial College London, the IDDC helps develop novel drug delivery technologies and supports promising RNA vaccines and therapeutics.

This year, with the MHRA, IDDC created a new regulatory roadmap for innovators developing new RNA therapies and vaccines to simplify the journey from research to commercialisation.

This financial year has seen the start of recovery for the sector; however, funding has been driven into a smaller number of later-stage companies. To ensure MDC continues to support the sector, it has strengthened R&D consultancy and laboratory support. MDC has grown its radiochemistry offering to ensure that the sector is supported to advance their offering in this space.

MDC has maintained revenue levels this year in what has been a difficult trading year. However, MDC continues to be loss making with planned losses of £1,029k (23/24 £1,195k) in the year. Planned losses are primarily driven by investment in future development through investment in our people. MDC is well positioned, due to our strong cash position, going into 2025/26 to continue supporting the sector and ensure that the UK life sciences sector is ‘Fit to Fund’.

Expenditure from continuing operations increased £1,373k to £21,780k (FY 23/24 £20,407k), reflecting an increase in pay costs and the costs of participation in the COVID-19 public inquiry. Pay costs grew in the year by £964k to £12,308k (FY 23/24 £11,344k), reflecting the full year impact of investment in our people in the prior year, such as an increase in headcount and private medical insurance. The costs of participation in the COVID-19 public inquiry have increased by £400k year on year (FY 23/24 £36k). Whilst MDC anticipates that these costs will be recovered, the benefit will not be recognised until the 25/26 financial year.

Funding: £13,037k

Income: £2,850k

R&D:

MDC has seen an increase in turnover of £864k to £18,693k (FY 23/24 £17,829k). This is predominantly due to continuing growth in its national programmes' grant income, such as IDDC, NPIP, PACE and the Dementia Goals Programme. Other income is largely due to research and development expenditure credit (‘RDEC’). RDEC has reduced to £330k (FY 23/24 £368k).

Interest income increased again in FY 2024/25 to £1,815k from £1,131k, which is the full year impact of investment activity on MDC’s reserves.

Group net assets for the year were £39,234k (FY 23/24 £40,263k), a decrease of £1,029k, reflecting the loss made in the year. The majority of the net asset position continues to be held in cash, which remained flat year on year, £38,999k (FY 22/23 £38,991k).

MDC has a robust five-year planning process that considers potential scenarios to stress-test its planning. Financial sustainability is a key pillar of its strategy and is crucial in ensuring that MDC can continue to build on its ambition to invest in its own innovation and within our sector. MDC has a prudent reserves policy in place to ensure it is managing ongoing access to internal funding for investment.

MDC has shown over FY 24/25 that it is investing in the people and science that serve the sector, and it will continue to do that over the coming five years. It will continue to diversify income streams and generate earnings for reinvestment to amplify the potential of UK life sciences.

MDC operates a robust risk framework that seeks to mitigate risk to acceptable levels. The broader environment continues to introduce uncertainty regarding access to funding and cost pressures, along with the risk of not realising appropriate levels of returns. The following major risks are reviewed and monitored by the Board on a regular basis.

Long-term funding from Innovate UK

• A reduction in government funding or a change in policy continues to be a risk to MDC. This would significantly impact its ability to continue to support innovation in the sector.

• Failure to deliver against KPIs agreed under the Grant Funding Agreement.

Reduction in collaborative R&D grant and commercial income:

MDC is reliant on a diversified portfolio of revenue streams to ensure we can deliver our ambitions. Reductions in accessible, suitably funded research and commercial contracts would impact MDC’s ability to deliver its strategy.

Inflation and cost growth:

Whilst inflation has reduced over the past 12 months, the inflation rate is still at a higher rate than the targeted 2%. MDC is also experiencing cost growth whilst it continues to invest in its science and support the sector.

• Ongoing monitoring of delivery against Key Performance Indicators (KPIs).

• Continuing support from central government and recognition of the importance of Catapults as part of the long-term UK innovation ecosystem.

• A reserves strategy which allows maintenance of an appropriate level of cash to provide MDC with a short-term buffer against external changes in funding.

• Innovate UK carry out annual financial and governance compliance audit (last successfully completed in November 2024).

• Co-operation with key grant bodies to ensure MDC can access a variety of funding sources to progress innovation.

• An attractive commercial proposition which provides access to cutting-edge technology and science with an ethos of collaboration and delivery excellence.

• A reserves strategy which allows MDC to maintain an appropriate level of cash to provide it with a short-term buffer against externally led changes in revenue.

• Diversification of income streams to include licensing income from Intellectual Property assets.

• Equipment is a significant element of our costs - continually review equipment usage.

• Business case processes to ensure that any costs are justified and are supported by a commercial opportunity.

• Engaging in Green Lab practices to reduce ancillary energy costs and waste.

• Continually reviewing MDC’s cost base and ensuring that it has value for money at the heart of decision-making and a strong business case ethos.

• Refreshed procurement policy to reflect the Procurement Act 2023 with detailed supporting processes to manage costs and drive value for money.

The current instability of the national and global economic climate in terms of geopolitics and trade tariffs may impact national funding, inflation, and wider investment insecurity.

Investment risk:

MDC has significant cash reserves, which are part of its plans to continue to build on the financial sustainability of its business model. MDC plans to invest these funds via:

• Treasury investment of cash.

• Investment in MDC internal assets.

• Investment in the sector through investing in third parties.

• The Investment Committee, an Executive subcommittee, oversees key investments using MDC reserves.

• Adherence to MDC Treasury strategy to support effective investment of reserves to serve the needs of the organisation.

• Appointment of Cazenove to manage MDC’s treasury activities.

• Regular monitoring of the investment portfolio.

Cyber

Cybersecurity is of critical importance. It is important that MDC’s customers and partners can be confident that their data is safe and that MDC maintains its service levels.

People

• Ability to attract and retain key skills in MDC in a competitive employment market.

• Skills shortage in specific areas of AMR and complex medicines.

• Lack of high-quality succession for key roles.

• Strong relationships with national and sector funding bodies.

• Clear strategy and communication of skills and capabilities to aid resilience to external change.

• Growth of international connections, customers, and profile to reduce national risk.

• Greater balance between grant and non-grant income to build stability and resilience.

• Routine monitoring of market conditions to enable flexibility of approach.

• Regular independent cyber audits to test MDC’s defences against cyber-attacks.

• Implementation of a data management approach that ensures all data is securely backed up and accessible.

• A business continuity and disaster recovery policy and plan that ensures MDC tests regularly, so it is as prepared as it can be for incidents if they arise.

• Cyber insurance in place, including active incident management support.

• Focus on developing and progressing internal talent.

• Increase organisational and individual leadership effectiveness.

• Focus on future sector skills initiatives in scarce skill areas such as AMR and complex medicines.

• Development of more detailed succession planning.

MDC is a not-for-profit company limited by guarantee, established in December 2015, with a grant from Innovate UK. Its principal activity is to transform the UK's capability for innovation in drug discovery, by supporting the drug discovery community - including large, medium, and small biotech companies - operating in the life sciences sector with their innovative research and development. MDC does this by identifying the barriers facing UK life-science businesses and developing strategic interventions to address these challenges.

MDC operates two wholly owned UK subsidiaries: Medicines Discovery Catapult Services Commercial Limited, through which it provides scientific services to third parties for commercial revenues, and Medicines Discovery Ventures Limited, through which it invests in third-party entities in the sector, in line with MDC’s goals and purpose.

MDC's governance structure ensures that it can achieve its strategic ambitions in a transparent, sustainable, and risk-assessed way. The senior governing body for MDC is its Board of Directors, and to aid in the delivery of its duties, the Board has established three core Board sub-committees: the Audit and Risk Management Committee, the Portfolio and Impact Committee and the Remuneration and Nominations Committee. The Board and each of the Board sub-committees carries out an effectiveness review of its operations and performance each year, aligned to their respective duties and terms of reference documents.

Supervises internal and external audit and overseas the risk and governance framework to safeguard MDC’s systems and ensure a robust risk framework is in place.

The sub-committee meets at least four times a year.

Provides assurance that the programmes and projects selected by the Executive are aligned to corporate objectives and applicable governance processes.

The sub-committee meets at least two times a year.

Responsible for setting remuneration policy and remuneration of individual Directors and senior executives. Also regularly reviews the structure, size and composition of the Board (including skills, knowledge, experience and diversity) and recommends changes to the Board.

The sub-committee meets at least two times a year.

Develops strategies, plans and budgets for approval by the Board of Directors. Assists the Chief Executive Officer in managing MDC to achieve its strategic aims and objectives.

The Executive meet monthly.

The Board of Directors has overall responsibility for ensuring that MDC fulfils its mission and strategy, and complies with its incorporation documentation, the GFA and all relevant legislation and regulations. It also expressly determines those matters to be reserved for direct Board oversight, and those delegated to management and the level of management at which key decisions can be made.

As of 31 March 2025, the Board of Directors comprised one Executive Director, the Non-Executive Chairman and 10 independent Non-Executive Directors. This includes the appointment of two new Non-Executive Directors to further enhance the Board in line with the retirements of three members in June 2025.

Dr Robin

Appointed: July 2018

Role: Chairman of the Board

Appointed: November 2016

Role: Chief Executive Officer

Alistair Macdonald

Appointed: April 2020

Role: Chair of Portfolio and Impact Committee

Professor Chris Reilly

Appointed: June 2016

Retired: June 2025

Role: Chair of Remuneration and Nominations Committee

Paul Beastall

Appointed: November 2022

Role: Member of Portfolio and Impact Committee, Renumeration and Nominations Committee (and Chair effective June 2025) and Innovate UK Nominated Director

Professor Carole Longson MBE

Appointed: June 2016

Retired: June 2025

Role: Deputy Chair of the Board and a member of both Audit and Risk Management Committee and Portfolio and Impact Committee

Graham Clarke

Appointed: April 2020

Role: Member of Audit and Risk Management Committee and Remuneration and Nominations Committee

Susan Wallcraft

Appointed: April 2020

Role: Member of Audit and Risk Management Committee

Professor Sir Alex Markham

Appointed: June 2016

Retired: June 2025

Role: Member of Portfolio and Impact Committee

Lynne Robb

Appointed: January 2019

Role: Chair of Audit and Risk Management Committee

Professor Sir Mike Ferguson

Appointed: January 2025

Role: Member of Portfolio and Impact Committee

Professor Sir John Burn

Appointed: January 2025

Role: Member of Portfolio and Impact Committee and Audit and Risk Management Committee

The Executive team, which includes the Chief Executive Officer, is responsible for the day-to-day management of MDC, in accordance with the duties delegated by the Board under the MDC Delegation of Authority Policy. It develops the strategy, financial and operational plans for the MDC group, as overseen by the Board.

This year, MDC has strengthened its Executive team with the appointment of a Chief Commercial Officer and its first Managing Director (MD). Responsible for providing organisational leadership and driving the delivery success of MDC, the MD role will oversee the development and execution of business strategies and lead the senior leadership team to create further impact in the life sciences sector.

As of 31 March 2025, the Executive team is comprised of the following members:

MDC’s people are key to delivering its impact for the sector. It is committed to building a great place to work and an exceptional employment experience where valuing each other and our communities is paramount.

MDC’s values – Innovation, Excellence, Community, and Integrity – are embedded throughout everything it delivers. And its success is held within the specialist niche skills, knowledge and experience our people bring.

Areas of focus include:

Talent

Attracting and retaining the best people

Focusing on leaders who develop their people, focus on their contribution, and develop high-performing teams

This year, MDC published its first ESG progress report. Aligned to its corporate vision and purpose, MDC seeks to build sustainable and ethical practices into everything it does, while delivering on its purpose responsibly.

MDC is working on a wide range of initiatives to support its ESG strategy to deliver meaningfully against its goals. The full scope is detailed in its Vision and Commitment to ESG Strategy document.

Reshaping drug discovery for patient benefit, by transforming great UK Science into better treatments through partnership.

Build sustainable and ethical practices into everything MDC does, to enhance its reputation, culture and delivery of its purpose, through positive environmental, people and decision-making actions.

To understand and sustainably manage the impact MDC has on the environment, the community and the people who work for and with MDC.

1. Drive sustainability for a better future.

2. Be an open, inclusive organisation and a great place to work.

3. Operate responsibly, ethically and with transparency.

Career development

Focusing on our people, their development, and future careers

MDC has a committed workforce, as demonstrated by an employee engagement metric of 61% and employee survey participation rate of 87%.

Sector skills

Developing an approach to support future skills in drug discovery

MDC’s attrition is 8%, down by 2 percentage points year-on-year, with stable employee numbers year-on-year. The organisational gender split is 66% female, 34% male, with an Executive team comprising 50% female, 50% male.

Across its ESG initiatives, highlights include:

MDC’s participation in a global energy-saving competition for laboratories, and placing in the top 20% of participants in its first year.

Highlighting the importance of role models in STEM careers, through a range of activities for International Day of Women and Girls in Science, British Science Week, and its ongoing schools’ programmes.

Achieving ISO 45001 accreditation, an international standard for health and safety management.

MDC is committed to building on our ESG approach and publishing our progress, to ensure we can deliver more sustainable, higher impact across our sector.

The Directors present their report and the consolidated Group financial statements for the year ending 31 March 2025.

of the Company

The Directors who held office during the year were as follows:

R J Brown

C M Longson (retired)

A F Markham (retired)

C R Molloy

C Reilly (retired) L Robb

V

The Group's business environment and risks, together with details of monitoring undertaken by the Directors and future developments, are dealt with elsewhere in the Strategic Report.

The Directors are responsible for preparing the Strategic Report, Directors’ Report and the financial statements in accordance with applicable law and regulations.

Beastall J Burn M Ferguson M Parsons (resigned)

Medicines Discovery Catapult (MDC) is designed to reinvest any profit within the Company to ensure maximum resources are used to support its purpose. As governed by the Memorandum of Association, no portion of the income of the Company shall be paid or transferred to any Members of the Company except where it is payment in good faith for remuneration for services rendered or repayment of out-of-pocket expenses to Directors.

MDC is an inclusive employer providing a workplace that values and respects the diversity of its employees. It is a place where individuals of all backgrounds, abilities, and identities feel welcomed, supported, and included. Everyone has an equal opportunity for growth, development, and success, regardless of their race, gender, age, sexual orientation, disability, and/or other characteristics.

Company Secretary R Sherville-Payne

Company law requires the Directors to prepare financial statements for each financial year. Under that law the Directors have elected to prepare the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards and applicable law). Under company law the Directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the group and company and of the surplus or deficit of the group for that period. In preparing these financial statements, the Directors are required to:

The forecasts indicate that the Group will have sufficient cash reserves for all its future anticipated activities. Based on this information, the Directors consider it appropriate to prepare the financial statements on a going concern basis.

There have been no significant events affecting the company since the balance sheet date.

Each Director has taken the steps that they ought to have taken as a Director to make themselves aware of any relevant audit information and to establish that the Company's auditor is aware of that information. The Directors confirm that there is no relevant information that they know of and of which they know the auditor is unaware.

The auditor, Beever and Struthers will be proposed for reappointment in accordance with section 485 of the Companies Act 2006.

Approved by the Board on

23/07/2025

and signed on its behalf by:

Dr R J. Brown, Director

Make judgements and accounting estimates that are reasonable and prudent

Select suitable accounting policies and apply them consistently

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the group’s and the company’s transactions and disclose with reasonable accuracy at any time the financial position of the group and the company and enable them to ensure that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the group and the company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

State whether applicable UK Accounting Standards have been followed, subject to any material departures disclosed and explained in the financial statements

Prepare the financial statements on the going concern basis unless it is inappropriate to presume that the group and company will continue in business

We have audited the financial statements of Medicines Discovery Catapult Limited (the ‘parent company’) and its subsidiaries (the ‘group’) for the year ended 31 March 2025 which comprise the consolidated statement of comprehensive income, consolidated statement of financial position, company statement of financial position, consolidated statement of changes in equity, company statement of changes in equity, consolidated statement of cash flows and the related notes, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards, including FRS 102, The Financial Reporting Standard applicable in the UK and Republic of Ireland (United Kingdom Generally Accepted Accounting Practice).

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law

In our opinion the financial statements:

• Give a true and fair view of the state of the group’s and of the parent company’s affairs as at 31 March 2025 and of the group’s loss for the year then ended;

• Have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practice;

• Have been prepared in accordance with the requirements of the Companies Act 2006.

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the auditor’s responsibilities for the audit of the financial statements section of our report. We are independent of the group in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

In auditing the financial statements, we have concluded that the directors’ use of the going concern basis of accounting in the preparation of the financial statements is appropriate.

Based on the work we have performed, we have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the group’s or the parent company’s ability to continue as a going concern for a period of at least twelve months from when the financial statements are authorised for issue.

Our responsibilities and the responsibilities of the directors with respect to going concern are described in the relevant sections of this report.

The other information comprises the information included in the annual report, other than the financial statements and our auditor’s report thereon. The directors are responsible for the other information. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

• The information given in the strategic report and the directors’ report for the financial year for which the financial statements are prepared is consistent with the financial statements; and

• The strategic report and the directors’ report have been prepared in accordance with applicable legal requirements.

In the light of the knowledge and understanding of the group and the parent company and its environment obtained in the course of the audit, we have not identified material misstatements in the strategic report or the directors’ report.

We have nothing to report in respect of the following matters in relation to which the Companies Act 2006 requires us to report to you if, in our opinion:

• Adequate accounting records have not been kept by the parent company, or returns adequate for our audit have not been received from branches not visited by us; or

• The parent company financial statements are not in agreement with the accounting records and returns; or

• Certain disclosures of directors’ remuneration specified by law are not made; or

• We have not received all the information and explanations we require for our audit.

As explained more fully in the directors’ responsibilities statement, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the group’s and the parent company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the group or the parent company or to cease operations, or have no realistic alternative but to do so.

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion.

Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

Irregularities, including fraud, are instances of non-compliance with laws and regulations. We design procedures in line with our responsibilities, outlined above, to detect material misstatements in respect of irregularities, including fraud. The extent to which our procedures are capable of detecting irregularities, including fraud, is detailed below:

We identified areas of laws and regulations that could reasonably be expected to have a material effect on the financial statements based on our understanding of the Company and through discussion with the Directors and other management (as required by auditing standards).

To assist with identifying and assessing risks associated with material misstatements, including fraud and non-compliance of laws and regulations, we carried out the following procedures;

• The engagement partner ensured that the engagement team collectively had the appropriate competence, capabilities and skills to identify or recognise non-compliance with applicable laws and regulations;

• We identified the laws and regulations applicable to the company through discussions with directors and other management, and from our commercial knowledge and experience of the industry and supply sector;

• We assessed the extent of compliance with the laws and regulations identified above through making enquiries of management and inspecting legal correspondence; and

• dentified laws and regulations were communicated within the audit team regularly and the team remained alert to instances of non-compliance throughout the audit.

• We assessed the susceptibility of the company’s financial statements to material misstatement, including obtaining an understanding of how fraud might occur, by:

• Making enquiries of management as to where they considered there was susceptibility to fraud, their knowledge of actual, suspected and alleged fraud.

To address the risk of fraud through management bias and override of controls, we:

• Performed analytical procedures to identify any unusual or unexpected relationships;

• Tested journal entries to identify unusual transactions;

• Assessed whether judgements and assumptions made in determining the accounting estimates were indicative of potential bias; and

• nvestigated the rationale behind significant or unusual transactions.

In response to the risk of irregularities and non-compliance with laws and regulations, we designed procedures which included, but were not limited to:

• Agreeing financial statement disclosures to underlying supporting documentation;

• Reading the minutes of meetings of those charged with governance; and

• Enquiring of management as to actual and potential litigation and claims.

There are inherent limitations in the audit procedures described above. We did not identify any such irregularities, however, as with any audit, there remained a higher risk of non-detection of irregularities due to fraud, as these may involve deliberate concealment, collusion, forger, intentional omissions, misrepresentations, or the override of internal controls. Material misstatements that arise due to fraud can be harder to detect than those that arise from error as they may involve deliberate concealment or collusion.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website at frc.org.uk/auditorsresponsibilities

This description forms part of our auditor’s report.

This report is made solely to the group’s members, as a body, in accordance with chapter 3 of part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the group’s members those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the group and the group’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Suzanne Lomax BA FCA (Senior Statutory Auditor)

For and on behalf of Beever & Struthers Chartered accountants and statutory auditor

The Beehive, Lions Drive Shadsworth Business Park Blackburn, BB1 2QS

Financial Statements for the Year Ended 31 March 2025

for the Year Ended 31 March 2025

Financial Statements for the Year Ended 31 March 2025

for the Year Ended 31 March 2025

Consolidated Statement of Cash Flows Consolidated Statement of Changes in Equity Statement of Changes in Equity

to

for the Year Ended 31 March 2025

The company is a company limited by guarantee, incorporated in England and Wales, and consequently does not have share capital. Each of the members is liable to contribute an amount not exceeding £1 towards the assets of the company in the event of liquidation.

The address of its registered office is:

Block 35G Mereside

Alderley Park

Alderley Edge

Macclesfield

Cheshire SK10 4ZF

Summary of significant accounting policies and key accounting estimates

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated.

Statement of Compliance

These financial statements have been prepared in accordance with Financial Reporting Standard 102‘The Financial Reporting Standard applicable in the UK and Republic of Ireland’ and the Companies Act 2006.

Basis of Preparation

These financial statements have been prepared using the historical cost convention.

The presentational currency of the financial statements is Pounds Sterling, being the functional currency of the primary economic environment in which the company operates. Monetary amounts in these financial statements are rounded to the nearest Pound.

Summary of Disclosure

Medicines Discovery Catapult Limited meets the definition of a qualifying entity under FRS 102 and has therefore taken advantage of the disclosure exemptions available to it in respect of its separate financial statements. Exemption has been taken in relation to the preparation of a statement of cash flows.

The consolidated financial statements consolidate the financial statements of the company and its subsidiary undertakings drawn up to 31 March 2025. No Profit and Loss account is presented for the company as permitted by section 408 of the Companies Act 2006.

A subsidiary is an entity controlled by the company. Control is achieved where the company has the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities.

The results of subsidiaries acquired or disposed of during the year are included in the Profit and Loss Account from the effective date of acquisition or up to the effective date of disposal, as appropriate. Where necessary, adjustments are made to the financial statements of subsidiaries to bring their accounting policies into line with those used by the group.

Inter-company transactions, balances and unrealised gains on transactions between the company and its subsidiaries, which are related parties, are eliminated in full.

After reviewing the group’s forecasts and projections, the Directors have a reasonable expectation that the group has adequate resources to continue in operational existence for the foreseeable future with the continued funding from Innovate UK. The group therefore continues to adopt the going concern basis in preparing its financial statements.

Critical Accounting Judgements and Key Sources of Estimation Uncertainty

In the application of the group’s accounting policies, the Directors are required to make judgements, estimates and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects only that period, or in the period of the revision and future periods if the revision affects both current and future periods.

for the Year Ended 31 March 2025

Critical Accounting Judgements

The convertible loan notes have been included in the financial statements as a current financial asset. The asset has been fully provided.

Key Sources of Estimation

These are disclosed in the various accounting policies below.

Dilapidations Provisions

Determining the value of the dilapidation’s provisions included in the balance sheet requires estimation of future costs for restoring the premises to their original condition. These estimates are specific to each facility and based on independent third party advice.

Revenue Recognition

Turnover comprises the fair value of the consideration received or receivable for the provision of services in the ordinary course of the group’s activities. Turnover is shown net of sales/value added tax, returns, rebates and discounts and after eliminating sales within the group.

The group recognises revenue when the amount of revenue can be reliably measured, it is probable that future economic benefits will flow to the entity, upon completion of a contract and specific criteria have been met for each of the group’s activities.

Government Grants

Government grants are recognised based on the accrual model and are measured at the fair value of the asset received or receivable. Grants are classified as relating either to revenue or to assets. Grants relating to revenue are recognised in income over the period in which the related costs are recognised. Grants relating to assets are recognised over the expected useful life of the asset. Where part of a grant relating to an asset is deferred, it is recognised as deferred income.

Foreign Currency Transactions and Balances

Transactions in foreign currencies are initially recorded at the functional currency rate prevailing at the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are retranslated into the respective functional currency of the entity at the rates prevailing on the reporting period date.

The tax expense for the period comprises current and deferred tax. Tax is recognised in the profit and loss account, except that a charge attributable to an item of income or expense recognised as other comprehensive income is also recognised directly in other comprehensive income.

The current income tax charge is calculated on the basis of tax rates and laws that have been enacted or substantively enacted by the reporting date in the countries where the group operates and generates taxable income.

Deferred income tax is recognised on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements and on unused tax losses or tax credits in the group. Deferred income tax is determined using tax rates and laws that have been enacted or substantively enacted by the reporting date.

The carrying amount of deferred tax assets are reviewed at each reporting date and a valuation allowance is set up against deferred tax assets so that the net carrying amount equals the highest amount that is more likely than not to be recovered based on current or future taxable profit.

Research and development tax credits are recorded gross within operating income with the respective tax charge in the tax account. Where claims have yet to be submitted to HMRC, estimates are used based on a review of project activity in the reporting period.

Intangible assets are stated at cost less accumulated amortisation and accumulated impairment losses. Amortisation is calculated, using the straight line method, to allocate the depreciable amount of the assets to their residual values over their estimated useful lives, as follows: External Licenses: 5 years

The assets are reviewed for impairment where market conditions indicate that the residual value, useful life or amortisation rate have changed.

Tangible assets are stated in the balance sheet at cost, less any subsequent accumulated depreciation and subsequent accumulated impairment losses.

The cost of tangible assets includes directly attributable incremental costs incurred in their acquisition and installation.

The Financial Statements for the Year Ended 31 March 2025

Depreciation

Depreciation is charged so as to write off the cost of assets over their estimated useful lives, as follows:

Provisions are recognised when the group has an obligation at the reporting date as a result of a past event, it is probable that the group will be required to settle that obligation and a reliable estimate can be made of the amount of the obligation.

Contingent assets are not recognised. Contingent assets are disclosed in the financial statements when an inflow of economic benefits is probable.

Investments

Investments in equity shares, relating to subsidiaries, are measured at cost less impairment.

Cash and Cash Equivalents

Cash and cash equivalents comprise cash on hand and call deposits, and other short-term highly liquid investments that are readily convertible to a known amount of cash and are subject to an insignificant risk of change in value.

Debtors

Trade debtors are amounts due from customers for services performed in the ordinary course of business.

Trade debtors are recognised initially at the transaction price. All trade debtors are repayable within one year and hence are included at the undiscounted cost of cash expected to be received. A provision for the impairment of trade debtors is established when there is objective evidence that the group will not be able to collect all amounts due according to the original terms of the debtors. Creditors

Creditors are obligations to pay for goods or services that have been acquired in the ordinary course of business from suppliers. Accounts payable are classified as current liabilities if the group does not have an unconditional right, at the end of the reporting period, to defer settlement of the creditor for at least twelve months after the reporting date. If there is an unconditional right to defer settlement for at least twelve months after the reporting date, they are presented as non-current liabilities.

Creditors are recognised initially at the transaction price, and all are repayable within one year and hence are included at the undiscounted amount of cash expected to be paid.

Leases in which substantially all the risks and rewards of ownership are retained by the lessor are classified as operating leases. Payments made under operating leases are charged to profit or loss on a straight-line basis over the period of the lease.

A defined contribution plan is a pension plan under which fixed contributions are paid into a pension fund and the group has no legal or constructive obligation to pay further contributions even if the fund does not hold sufficient assets to pay all employees the benefits relating to employee service in the current and prior periods.

Contributions to defined contribution plans are recognised as employee benefit expense when they are due. If contribution payments exceed the contribution due for service, the excess is recognised as a prepayment.

A financial asset or a financial liability is recognised only when the entity becomes a party to the contractual provisions of the instrument.

Basic financial instruments are initially recognised at the transaction price.

Financial assets that are measured at cost are reviewed for objective evidence of impairment at the end of each reporting date. If there is objective evidence of impairment, an impairment loss is recognised in profit or loss immediately.

For all equity instruments regardless of significance, and other financial assets that are individually significant, these are assessed individually for impairment. Other financial assets are either assessed individually or grouped on the basis of similar credit risk characteristics.

Any reversals of impairment are recognised in profit or loss immediately, to the extent that the reversal does not result in a carrying amount of the financial asset that exceeds what the carrying amount would have been had the impairment not previously been recognised.

Financial Statements for the Year Ended 31 March 2025

Included in turnover is amounts of £262,718 (2024: £206,709) relating to turnover outside of the United Kingdom.

Other operating income primarily relates to gross income received under the research and development expenditure credit scheme (RDEC).

Statements for the Year Ended 31 March 2025

5.Operating (deficit)/surplus

Statements for the Year Ended 31 March 2025

8.Staff Costs Group

The aggregate payroll costs (including Directors’ remuneration) were as follows:

The average number of persons employed by the group (including Directors) during the year, analysed by category was as follows:

and Similar Expenses

for the Year Ended 31 March 2025

9.Directors Remuneration

Financial Statements for the Year Ended 31 March 2025

for the Year Ended 31 March 2025

The Financial Statements for the Year Ended 31 March 2025 The Financial Statements for the Year Ended 31 March 2025

Financial Statements for the Year Ended 31 March 2025