How global trends are shaping our local business environment.

Kiwi exporters can plan and adapt now we have some tariff certainty.

How global trends are shaping our local business environment.

Kiwi exporters can plan and adapt now we have some tariff certainty.

-Sean Doherty

Sir Paul Callaghan famously declared: “New Zealand is poor because it choosest to be.” Nearly 15 years on, with the decision to dissolve Callaghan Innovation the agency bearing his name, these words ring truer than ever in 2025.

At this turning point, New Zealand must decide: Will we finally address the innovation deficit by embracing high-value manufacturing, or continue on a path of slow, incremental change?

The productivity trap

Cutting red tape to encourage productivity.

New Zealanders are admired for their work ethic and creativity. Yet, the nation continues to lag behind its global peers in productivity and prosperity. The key reason? An overreliance on low-value, commodity-driven industries rather than advancing technology-rich, high-value sectors.

Despite technological progress worldwide, New Zealand’s per-capita prosperity growth has not matched high-value, knowledge-led economies over the past two decades.

International comparisons

• Israel, Singapore, and Ireland are cited as examples of nations that have transformed through purposeful investment in advanced research, tech-enabled manufacturing, and robust support for innovation and entrepreneurship.

• These countries consistently invest in science, technology, and high-value manufacturing, creating dynamic economies with sustained prosperity.

Sir Paul Callaghan stressed that true prosperity can only be achieved by focusing national efforts on innovation-intensive sectors.

Efforts to “pick winners” in areas like biotech, agritech, and clean tech have delivered mixed

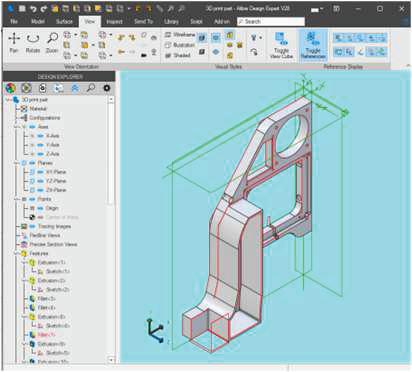

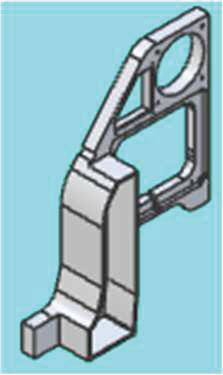

Sheetmetal Parts

continued on Page 21 includes, Getting under the hood of Kiwi manufacturing.

12 18 19 7

In the following article from the UK there is some good learning to be had for NZ Manufacturers, and if they are listening, Government (MBIE particularly Small Business & Manufacturing), and other key stakeholders on the importance of a solid strategic approach to achieve higher levels of productivity using technology.

The UK’s Industrial Strategy, that was released this year, is focused on Advanced Manufacturing with a significant growth target to be achieved with significant investment in the sector growing from the current business investment of £21bn to £39bn in 2035.

Clearly not the sort of investment we could compete with in NZ but does demonstrate that investing in Smart Manufacturing is worthwhile for economic prosperity.

Within the article are a series of logical steps that can be applied to any industry sector to prepare for and use technology to be a smarter manufacturer.

The article is written by James Watson, Parter with Argon & Co, along with Rachel Noll, Manager of Data/AI at IRIS.

With a fresh 10-year blueprint for economic growth, the UK’s Industrial Strategy puts advanced manufacturing at the heart of its ambitions. James Watson and Rachel Noll at Argon & Co explore how smarter use of data, automation, and robotics can help manufacturers unlock productivity, resilience and long-term growth

The UK Government’s newly launched Industrial Strategy was long in the making, but has arrived with bold ambitions. Its 10-year roadmap for economic growth has a firm bet on advanced manufacturing as one of the eight high-potential industries in the UK, along with sectors like financial services, clean energy, and life sciences.

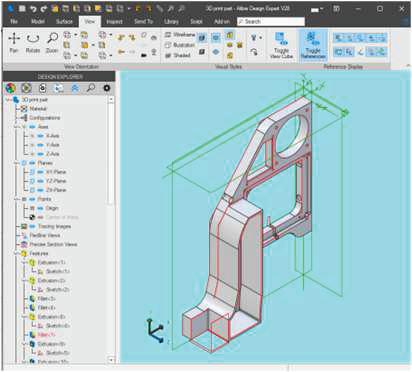

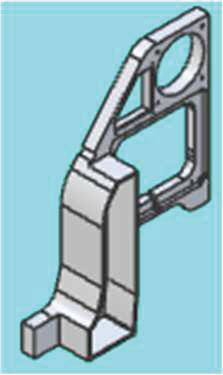

2D Drawings

Secons

Developments

Exploded views

30-day free trial available Solid Parts

Export files for CNC 3D Design Solid Modelling Soware Powerful, easy-to-learn and use.

For many operating in this sector, this support couldn’t have arrived soon enough. Manufacturing has been pushed from disruption to disruption, hampered by inflation, persistent labour shortages, and global supply chain crises. Businesses have been urgently calling for tools to help them do more with less, and, against this backdrop, the Government’s commitment to invest in digital transformation and skills has been

Buy it and own it, no subscripon or cloud. Most cost affecve 3D CAD program to own.

continued on Page 21

3D Printer + Discounted Alibre Design bundle offer. Design and print prototypes and producon parts.

Largest selecon of 3D Printers and materials for Hobbies and Commercial Producon

Contact: Bay CAD Services Ltd - Napier NZ Contact: Formtech Ltd—Christchurch NZ www.baycad.xyz 0274847464 www.formtech.co.nz 0274940250

Secure supply of energy and data to moving industrial equipment.

• Large size range

• Vertical travels

• Energy tubes

• Hygienic chains

• Solutions for long travel

• Guide troughs

• Readychain

• Robotic, 3D

• Circular movement

HUGE range of high quality flexible cables

• Control cables

• Single cores

• Data cables

• Sensor/Actuator

• Intrinsically Safe

• VSD/EMC cables

• Halogen Free cables

• High temperature

• Harsh Conditions

• Crane cables

• Profibus cables

• Bus/DeviceNet

• Solar cables

• Instrumentation

• Flat cables

• Curly cords

Largest range of flexible conduits for cable protection

• Conduits

• Conduit fittings

• Divisible systems

• Jumbo systems

• Conduit Accessories

• Braided cable protection

• Fire barrier solutions

• Food and beverage

• EMC systems

• Ex, ATEX, IEC EX

Industrial connectors for many industries

• Rectangular multipole connectors from ILME

• Single pole Powerline connectors from TEN47

• EPIC connectors from Lapp Group

• M23 circular connectors from Hummel

• Circular connectors specifically for the entertainment/stage lighting industry from Socapex

Safety engineering solutions from EUCHNER

• Multifunctional Gate Box MGB

• Transponder-coded safety switches

• Electromechanical safety switches

• Magnetically coded safety switches

Sensor technologies for automation

• High-Precision Laser Distance Sensors

• Ultrasonic Sensors

• Inductive Sensors

• Fluid Sensors

www.nzmanufacturer.co.nz

www.womengoingplaces.net

www.jezmedia.net

www.australianmanufacturingnews.com

www.smartmanufacturingtoday.com

www.foodinnovationist.com

www.asiamanufacturingnewstoday.com

www.themirrorinspires.com

LEAD

New Zealand is poor because it chooses to be.

Smart manufacturing and the UK government’s industrial strategy.

BUSINESS NEWS

How global trends are shaping our local business environment.

Reflections from my North American trip as a tech founder serving manufacturers.

EMA-COMPANY PROFILE

Artisan skill and technology a successful brew at Zealong Tea Estates.

SMART MANUFACTURING

Stronger, cheaper titanium a ‘leap forward’ for industry.

On the ground, in the regions: Supporting manufacturing and more across Aotearoa.

Digital upskilling for the future.

Construction 4.0 Technologies. Dispatches from Europe -a guide for New Zealand manufacturing leaders.

Cutting red tape to encourage productivity.

COMPANY PROFILE

South Waikato Precision Engineering.

SUSTAINABILITY

Make your emissions reporting easier with spend-based emission factors.

2025 KIWINET AWARDS FINALISTS.

WORKSHOP TOOLS

80% lower CO2 footprint: igus switches to recycled material for energy chain series E2.1.

ARS200 rugged waterproof outdoor computer for extreme environments.

ATX Motherboard with Intel Core Ultra 200S for industrial edge computing.

DEVELOPMENTS

Uplift in construction industry confidence. Solar energy course to meet EWRB requirements.

COMPANY PROFILE

Sutton Tools have staff who never want to leave

THE LAST WORD

Innovation stalled.

Ian Walsh

Ian Walsh is a leading expert in designing and implementing transformational improvement programmes, with over 30 years of experience helping businesses drive operational excellence and long-term success. A Six Sigma Master Black Belt, he has worked with both New

Zealand’s top organisations and global multinationals including Kimberley Clark, Unilever, Guinness to unlock productivity, reduce costs, and optimise business performance. Ian has been at the forefront of operational improvement, working at all levels—including Boards—to deliver high-impact change. Ian continues to play a key role in advancing business excellence, supporting Auckland University and The Icehouse with expert insights on productivity, operational improvement, and best-practice methodology.

Dr Barbara Nebel

CEO thinkstep-anz

Barbara’s passion is to enable organisations to succeed sustainably. She describes her job as a ‘translator’ – translating sustainability into language that businesses can act on.

and Manufacturing.

Mark Devlin

Having owned food manufacturing and distribution businesses for a decade, Mark Devlin now runs Auckland public relations agency Impact PR. Mark consults to several New Zealand manufacturing firms including wool carpet brand Bremworth, aircraft exporter NZAero and cereal maker Sanitarium.

Insa Errey

Insa’s career has been in the public and private sectors, leading change management within the energy, decarbonisation, and sustainability space. Insa holds a Chemical and Biomolecular BE (Hons) from Sydney University. She is a member of the Bioenergy Association of NZ and has a strong passion for humanitarian engineering, working with the likes of Engineers Without Boarders Australia.

Insa is a member of Carbon and Energy Professionals NZ, been an ambassador for Engineering NZ's Wonder Project igniting STEM in Kiwi kids and Engineers Australia Women in Engineering, increasing female participation in engineering.

6 10 11 13 16 18 19 22

Jane Finlayson is Head of Advanced Manufacturing at the EMA, and has 25-years’ experience in business and economic development. She is passionate about empowering businesses to grow, innovate and embrace Te Ao Māori.

PUBLISHER

Media Hawke’s Bay Ltd, 121 Russell Street North, Hastings, New Zealand 4122.

MANAGING EDITOR

Doug Green

T: 027 348 1234

E: publisher@xtra.co.nz

CONTRIBUTORS

Holly Green, EMA,

Business East Tamaki, Ian Walsh, Adam Sharman, Mark Devlin, Nicholas Russell, Jane Finlayson, David Altena, Rob Bull, Chris Penk

Dr. Troy Coyle,Scott Adams, John Luxton

ADVERTISING

T: 027 348 1234

E: publisher@xtra.co.nz

DESIGN & PRODUCTION

:kim-jean:

E: kim.alves@xtra.co.nz

WEB MASTER

Julian Goodbehere

E: julian@isystems.co.nz

PUBLISHING SERVICES

On-Line Publisher

Media Hawke’s Bay Ltd

DIGITAL SUBSCRIPTIONS

E: publisher@xtra.co.nz

Free of Charge.

MEDIA HAWKES BAY LTD

T: 027 348 1234

E: publisher@xtra.co.nz

121 Russell Street North, Hastings NZ Manufacturer ISSN 1179-4992

Vol.17 No.7 August 2025

We don’t have a Productivity Commission and we don’t have Callaghan Innovation anymore.

No time to be sentimental but, who would run an Economic Reform Roundtable – like the one being held in Canberra this week, with a focus on Productivity? Because we badly need one.

We have the determination of EMA, HERA, NZCTU, ECANZ, IPENZ, VANZ to look after their members, assist them to get ahead and open opportunities. The Chambers of Commerce do the same. Technology groups talk the talk for their members as well.

But the negotiating aspect, the financial aspect, is needed to build on the 70% of export earnings coming in from the primary sector and ensure that manufacturing from the workshop, science and technology increase their market share on overseas markets.

And, of course, it asks the question: “What came out of the Investment Conference held earlier this year in Auckland?

Probably a good time to have another look on You Tube at: Sir Paul Callaghan - StrategyNZ: Mapping our Future - March 2011

As a decisionmaker, a leader in your company, you are welcome to share with readers your path to success and what the future looks like.

Enjoy the read.

Doug Green, Publisher

When I stepped away from my global executive role at Fisher & Paykel Healthcare, I wasn’t entirely sure what I wanted to do next, only that I didn’t want more of the same. I created space by completing an MBA, and by the end of my studies, I knew I wanted to start my own Leadership Practice.

I’ve always been passionate about creating a world of work where people know how they contribute and feel genuinely valued.

That led me to focus my Practice on leadership impact, building and sustaining high-performance teams, and helping organisations bridge strategy to execution.

My approach is based on the belief that leadership must be measurable, just like other parts of the business whether it’s finance, projects, customer satisfaction etc.

When we understand our inner game of leadership our strengths, blind spots, motives, and values, we improve our outer game: team outcomes, strategic results, leadership impact, and culture. Measurement brings insight; insight enables action; action drives results.

One of the biggest challenges I see today is what I call the “Busy Olympics.” The world of work has become fast, demanding, and always-on. Technology was supposed to make things easier, but often it just means we’re available 24/7. There’s an unspoken competition to be the busiest, but all this busyness is eroding clarity. And without clarity, it’s hard to

-Deb Bailey, Coach, Facilitator, Speaker, Author

prioritise what matters most, at work or in life. Clarity takes courage and discipline. It means being willing to ask the big questions: Where am I going? What am I here to do? What matters most right now? When we have that clarity, we’re able to say ‘no’ to the noise and distractions and yes to the things that make the biggest difference.

I believe business success is fundamentally about the quality of its leadership. Yet, we often promote people for their technical skills and expect them to automatically become great leaders.

We hand them teams and say, “good luck,” with little to no development. This sets people up to struggle. The more senior someone gets, the less likely they are to admit they need support, especially if the culture rewards knowing rather than learning. At its heart, setting a clear mission in business means identifying the problems you solve, who you serve, and why it matters.

It’s about living the organisation’s values, not as posters on the wall, but as behaviours people experience every day. Culture isn’t something dictated from the top; it’s co-created through daily actions and decisions.

Loving what you do matters. When your work aligns with your values and the contribution you want to make, it doesn’t feel like a grind, even on hard days. Much of my work involves helping leaders integrate life and business.

Often, I see people who are achieving outward

success, but their personal lives are out of sync. Relationships suffer. Energy drops. The spark disappears.

That’s why I wrote Navigate Your Impact: How to Achieve Goals That Really Matter. It’s a decision-making guide that helps people understand where their time, energy, and money are going, and whether those investments align with the life they want to lead. It’s about tuning out the noise and focusing on what’s truly important.

I love helping leaders get clear, gain confidence, and act with conviction. Impact comes from taking action, not just knowing what to do, but actually doing it.

Leadership isn’t about perfection; it’s about progress. Sometimes our experiments won’t work, but we learn, adapt, and move forward.

In a rapidly changing business landscape, leaders need practical tools, not more complexity. The biggest challenges they face? Knowing what matters, cutting through the noise, engaging others, and aligning strategy with reality.

That includes balancing new initiatives with current capacity, something often overlooked.

Leadership, done well, creates clarity, builds trust, and drives meaningful results. It’s an honour to walk alongside leaders as they navigate their path with impact and purpose.

-By John Luxton. RegenerationHQ

1. Introduction

Many New Zealand SME owners are finding that pressures once considered “global issues” are now showing up in their bank statements, delivery schedules and customer orders. Whether it’s shifting supply chains, falling export demand or volatile currency, international trends are making local decisions harder.

This article belongs to Pillar 1 - The Economic Reality. Its purpose is to explain in plain English how global economic forces are filtering through to affect small and medium-sized businesses in Aotearoa. We’ll explore China’s slowdown, currency shifts, international inflation and supply chain disruptions. Most importantly, we’ll focus on what you can do about it.

2. Representative Narrative

Brian runs a medium-sized furniture wholesaling business based in Nelson. He sources parts from Malaysia and China, assembles them locally and supplies to retailers across the North Island.

Until recently, he’d felt confident managing rising costs. But in the last six months, he’s had delays in shipments from China, a 15 percent increase in freight charges and a noticeable drop in orders from two big retail clients. One told him consumer confidence is down.

Brian wasn’t sure whether this was a pricing issue or something broader. He called me, RegenerationHQ; I had helped him during the early days of COVID disruption. I asked him, “What’s changed upstream for your suppliers and what’s changing downstream for your customers?” That question reframed the issue completely.

Understand your exposure to China

China’s economy is slowing, driven by property sector instability and weak domestic demand. If your business exports to China, expect reduced orders. If you rely on Chinese components, build in longer lead times and have a backup plan.

Monitor currency movements

The NZ dollar has been volatile, which affects import and export prices. A weaker dollar means higher costs for imported materials and parts. Track exchange rates monthly if your cost base relies on foreign currencies.

Stay alert to global inflation and rate policies

While inflation is easing in many countries, it remains persistent in services and energy. If the US Federal Reserve or the European Central Bank cuts rates, it could ease global funding conditions and eventually benefit New Zealand. But don’t plan on it happening quickly.

Reassess your supply chain strategy

Diversifying suppliers across more than one country can reduce your risk. Consider holding slightly higher stock levels for critical items if delays have become frequent.

Stay connected with customers and distributors

Retailers and wholesalers in NZ are being squeezed by falling consumer demand. Frequent, open communication can help you understand their pressures and adjust your offer accordingly.

After our conversation, Brian took a closer look at the freight invoices and noticed his margins had been eroding without being fully passed on. He contacted his two key suppliers and negotiated split shipments to reduce congestion-related fees.

He also sat down with one of his retailers and offered them more flexible payment terms to maintain order volume. With guidance from John, he built a three-month rolling cash flow forecast that included currency risk and import delay buffers.

The steps were not dramatic, but they turned uncertainty into planning. Brian now feels better equipped to explain cost movements to his team and customers alike.

5.

Red Flag 1

- Assuming international shocks are temporary Mitigation

- Track long-term patterns and build in operational flexibility

Red Flag 2

- Passing on all cost increases without dialogue Mitigation

- Collaborate with customers to maintain volume and loyalty

Red Flag 3

- Single-sourcing key inputs from one country Mitigation

- Explore alternatives and build local partnerships if possible

6. HR Best Practice

Global pressures can quietly increase stress for your team.

Delayed stock means frustrated customers. Unpredictable workload can lead to uneven rosters.

Good HR practice in these conditions includesCommunicating clearly about delays and how the business is responding.

Being transparent about inflation-related wage constraints Involving staff in operational

improvement ideas, such as reducing waste or reworking timelines.

Offering stability where you can, even if growth is off the table for now.

As I often sas, staff who understand why a decision is being made are more likely to support how it’s implemented.

7. Psychological Perspective

Global uncertainty can make local owners feel small or powerless. You can’t control interest rates in Europe or factory slowdowns in Asia. But you can control how you respond.

One of the most mentally freeing things is separating what’s within your influence from what’s beyond your control. John encourages owners to build this distinction into their weekly check-ins. It sharpens focus and protects energy.

8. Recommended Owner’s Mindset

Adopt a mindset of global awareness, local control. You are not at the mercy of world events, even if they matter. Understand how they shape your environment, then make intentional choices with what you can influence.

How reliant am I on international suppliers and do I have viable alternatives?

Have I reviewed how exchange rates are affecting my costs or margins?

What are my customers telling me about their own pressures?

Have I built in realistic lead times and buffers for global disruption?

Who do I speak to regularly to help make sense of these broader trends?

Subscribe to monthly updates from NZTE or the BusinessNZ network

Map your supply chain with a basic risk rating by country

Set up regular check-ins with key suppliers and customers

Review your forex exposure and speak to your bank about hedging if needed

Meet quarterly with a business advisor like John Luxton to review your positioning

Critical Takeaway - Global trends shape the pressure, but your local decisions shape the outcomeawareness allows action.

www.regenerationhq.co.nz/contact

Dominic Sutton, Founder, Stock Trim

As the founder of StockTrim, an inventory forecasting SaaS, I recently returned from a productive trip across Canada and the US, engaging with partners and customers. This journey offered valuable insights into the global manufacturing and tech landscape, which I share below:

In-Person connections outshine virtual ones

After months of emails and Zoom calls, face-to-face meetings with partners over coffee or dinner yielded unmatched progress. Every discussion sparked questions like, “How can we collaborate further?”

This engagement is rare online. Personal connections build trust and likability, critical for business. For tech founders eyeing international growth, prioritising in-person visits can be transformative.

Political uncertainty impacts growth

Tariff discussions and shifting political priorities have slowed growth for StockTrim and our partners. In 2025’s first half, customers pivoted from scaling to focusing on supplier selection and margins, dampening expansion hopes.

This mirrors challenges for New Zealand exporters, underscoring the need for agile supply chain strategies to navigate uncertainty effectively.

Funding models shape priorities

I observed stark contrasts between VC-backed and bootstrapped partners. VC-funded firms chased aggressive targets, often sacrificing stability, while bootstrapped companies prioritised balance.

This highlights how capital sources—external investment versus internal funds—influence strategy. New Zealand manufacturers considering growth funding should weigh the trade-off between speed and sustainability, as funding models noticeably affect priorities and decision-making. And stress levels.

Traditional SEO and go-to-market funnels are losing traction as generative AI reshapes how customers discover solutions. At StockTrim, AI enhances our offerings and alters prospect information flows.

With disruptions to SEO and Google PPC, strategic partnerships and retention are gaining importance. While top-of-funnel traffic declines, leads remain steady as prospects arrive more informed and intent-driven – there are lessons here that manufacturers adopting tech can adapt to as well.

Large players like Shopify are launching POS and ERP modules for manufacturing and B2B ecommerce, targeting mid-market share. This horizontal and vertical expansion threatens established players but also creates opportunities.

Partners noted the high cost-to-serve and low average contract value of SMEs, yet their market size remains attractive. Success lies in optimizing operations to transition to the mid-market, where profitability scales. This upward shift is enticing, but it is important to stay relevant to our core markets.

Engaging with partners across various states and provinces revealed unique local dynamics, reinforcing the value of in-person interactions. The American entrepreneurial spirit and optimistic “cup half full” mentality was energising. The scale and opportunities are easy to forget or overlook when ‘parked up’ here in NZ.

These reflections, drawn from my July 2025 travels, highlight the power of human connection, adaptability to political shifts, strategic funding choices, evolving marketing landscapes, competitive pressures, SME potential, and global engagement. Despite concerns about travel disruptions, I found US border processes slightly more efficient than in past visits, with eight flights and multiple border crossings proving seamless.

These insights will guide StockTrim’s strategy as we continue serving small- medium sized manufacturers worldwide.

With 48 hectares of certified organic Camellia sinensis growing in the heart of the Waikato, Zealong Tea Estate is New Zealand’s only commercial tea estate.

You can tour the estate and sculpture walk, sample a high tea at their Tea Room, have a luxurious French-inspired meal at their Camellia Restaurant prepared by a chef plucked from the Michelin-starred kitchens of Paris, or take part in a traditional tasting of their internationally awarded teas.

As a visitor destination, it’s a major asset to the region and the teas have been served to the likes of China’s President Xi Jinping and Her Majesty Queen Camilla during official events, and the estate has been filmed for the BBC Earth documentary One Cup, a Thousand Stories, which highlighted the estate’s quality-based approach to producing certified organic tea.

Behind the scenes, the process of manufacturing its teas blends artisan skill and technology. The EMA’s Nicholas Russell sat down with Zealong General Manager Sen Kong to find out where they have used technology to improve efficiency but also how the human touch remains irreplaceable.

Zealong has invested heavily in both people and technology. Why is the human touch still so crucial in your industry?

Sen Kong: Technology plays a huge role in streamlining parts of our operation, such as processing, drying and quality control, but when it comes to the actual picking of the tea, the human hand is still superior.

Machines aren’t yet sophisticated enough to distinguish the top three leaves from the rest of the plant, and that matters. Those top three leaves are the most tender and flavour rich. A machine might take too much, or damage the plant, which affects secondary growth.

A trained picker knows exactly how to pluck, preserving both the leaf quality and the health of the bush.

In addition, tea making is a specialised skill passed down through generations. Our tea experts have often worked in China, Taiwan and Sri Lanka –regions with centuries of tea heritage.

They travel the world during peak harvest seasons and bring a wealth of traditional knowledge. In New Zealand, our harvesting season is November, January, and March and during this time their expertise is invaluable.

It’s not just about knowing the science, it’s about sensing the leaf’s potential and guiding it through each phase with care.

What are the challenges of manufacturing tea in the Waikato?

Sen Kong: We have a temperate climate, fertile soil, and abundant rainfall in the Waikato and this creates ideal conditions for growing high-quality tea. The region’s unique combination of hot days and cool nights provides the moisture and temperature variations that tea plants thrive in.

However, unlike many other tea producers, we built a state-of-the-art glass house where tea is laid out on mats for withering in a temperature and humid-

ity-controlled environment, complete with fans and ventilation.

Withering involves reducing the moisture content of tea leaves, making them pliable for further processing.

New Zealand weather is too unpredictable to do this outside as is done in traditional tea-making areas. It also helps us ensure strict food safety standards during this crucial step. Zealong is the only tea in the world that satisfies the ISO 22000 food safety standards from farm all the way to finished product. Every stage, from cultivation to processing, meets ISO22000/HACCP and Biogro Organic certified standards.

Is producing tea difficult?

Sen Kong: Oolong tea is what we’re best known for, and for good reason. It’s a tea that demands both technical know-how and a deeply intuitive understanding of the leaves.

Oolong requires a carefully timed oxidation process, where enzymes in the leaf interact with oxygen to develop the tea’s complex flavour. Too much oxidation and the tea will lose its brightness; too little and it remains subtle and delicate .

Oxidation, or browning of the leaves, begins after withering when the leaves are bruised, exposing enzymes to oxygen. The oxidation process is stopped by roasting the leaves. Judging the correct time for roasting the tea leaves requires extensive experience in tea processing.

After oxidation is halted, the leaves go through rolling and drying. Rolling is where the leaf is twisted into small, tight bundles that unfurl beautifully in the cup. For oolong, this rolling is done up to 80 times over 12 hours to create that iconic flavour bomb.

Drying then follows, which must reduce moisture to just the right level, usually around 3–5%. Here, our equipment gives us exact readings, but our tea experts also use their senses and experience to monitor the process and achieve the desired flavour.

How do you balance tradition and innovation in your operations?

Sen Kong: That’s at the heart of what we do. We honour centuries-old techniques because they work. But we also embrace technology where it makes sense. For instance, our custom drying rooms allow us to replicate ideal conditions year-round, despite New Zealand’s unpredictable climate.

But even with this tech, our tea experts are the final judges. Their hands and eyes are irreplaceable.

How has Zealong worked with the EMA to drive success?

Sen Kong: We host the EMA’s Hamilton Member Briefing three times a year at our conference centre, and it usually draws the largest crowd. It’s a great opportunity to get together with businesses from around the region, get an update on the latest economic, policy and legal changes in New Zealand and to network with our peers.

Development of our people is extremely important at Zealong and we have built a team of more than 25 cultures to bring diversity, different perspectives and fresh ideas into our business.

Through the EMA, we have put our staff though health and safety representative training, and we use their webinars and in-person events to stay up to date on the latest employment relations and legislative changes such as 90-day trials, and trade developments such as the UAE free trade deal.

Where do you see Zealong heading next?

Sen Kong: We’re focused on sharing New Zealand-grown, organic tea with more of the world. Export is growing steadily, especially in markets like Japan, Europe and the United States that appreciate high-quality teas.

But our ethos won’t change. Whether it’s served in a Michelin-starred restaurant or enjoyed at home, every cup of Zealong tea is a testament to the people behind it.

By EMA Manufacturing Programme Manager Sheenal Jokhan

Industry 4.0 is reshaping the manufacturing landscape, offering New Zealand businesses tangible gains in efficiency, productivity and innovation. Yet despite its potential, some manufacturers remain cautious about adopting these technologies over concerns such as return on investment, workforce readiness, and a lack of clear guidance on the best way forward.

As part of our ASB Manufacturers Workshops, which the EMA ran with facilitation by LMAC, we took factory tours and offered manufacturers a chance to see these technologies in action, meet with their peers in the industry and pick their brains on the best way forward. This real-world approach provided confidence in the relevance and value of smart manufacturing.

Our recent tours of Hansa Products in Hamilton and Donovan Group in Whangarei were excellent examples of Kiwi businesses tackling challenges head-on while adapting to a fast-evolving global manufacturing landscape. But what’s equally important is how these visits reminded attendees that these companies didn’t begin as tech giants. They started small, experimented, made mistakes and kept going.

Watching a robotic welding system in action at Hansa or hearing about Donovan Group’s journey toward file-to-factory automation provides insight that attendees can take back to their own operations. Hansa’s story particularly resonated with visitors to our recent workshop. A family-run business founded

in 1980, it has grown into a global leader in the design and manufacture of high-performance wood and brush chippers.

Its approach to lean manufacturing, smart inventory systems, and visual process management is a textbook case of innovation driven by necessity. Their bespoke information system didn’t come off the shelf, it was built to solve specific problems. That’s a critical takeaway: there’s no one-size-fits-all solution, but there is a pathway. Hearing how others navigated it helps demystify the process.

At Donovan Group, the scale and sophistication of their operation left our workshop attendees inspired. Structural systems such as DonoBrace and DonoBeam cut carbon emissions and cost while also unlocking new possibilities in building design.

Their digital tools, like construction design package AirBuildr, show how software and engineering can intersect to streamline production.

Yet what stood out wasn’t just the technology, but the mindset. It’s not just about having smarter machines, it’s about fostering a culture of collaboration, data-driven decision making, and continuous

improvement.

These tours shine a light on the human side of Industry 4.0, which is an often overlooked but essential part of the journey. Technology only delivers results when people are empowered to use it. Staff need training, encouragement, and a shared vision for what digital transformation means. Without buy-in from the shop floor to the boardroom, the best-laid tech plans will stall. Both Hansa and Donovan emphasised this: success came not just from investing in tools, but from investing in people. It’s a reminder that digital transformation is as much about culture as it is about code.

There’s also a broader industry benefit to these behind-the-scenes experiences. They help spark conversations, build networks, and foster a stronger sense of community among manufacturers. Too often, businesses work in silos, facing similar challenges but solving them in isolation.

Factory tours help break that cycle. They show what’s possible, but more importantly, they make continued on next page

innovation feel accessible and achievable.

Looking ahead, the EMA has tours to Salus Aviation and Facteon Group, which promise to deepen that impact. At Salus Aviation, aircraft maintenance, parts, manufacturing, and component engineering come together to support helicopter and fixed-wing aircraft worldwide.

A world-class aviation manufacturer and exporter at the forefront of Industry 4.0, attendees can discover how advanced technologies and integrated manufacturing processes drive their global export success, from precision engineering and aircraft maintenance to international fleet support and training.

It’s a rare opportunity to see digital transformation in action and connect with fellow exporters and manufacturers in a high-tech, high-impact setting. Facteon Group’s factory tour will be focused on energy efficiency. The machinery that it designs and manufactures is built with energy efficiency at its core.

This visit is intended to spark open, practical conversations about where improvements could be made in areas such as energy use and fuel switching. In an industry where the pace of change is only increasing, real-world exposure to innovation is invaluable.

It builds confidence, nurtures collaboration, and

empowers Kiwi manufacturers to take the next step, however big or small, on their Industry 4.0 journey. When you get under the hood of Kiwi manufacturing, what you find isn’t just smart machines or advanced systems. You find people solving problems, innovating, pushing boundaries and shaping the future.

And sometimes, all it takes to start your own transformation is to walk through someone else’s door.

To find out more about our upcoming events, visit: ema.co.nz/events

By EMA Head of Membership & Export Simon Devoy

New Zealand exporters were dealt a tough blow at the start of August as the United States confirmed an unexpected increase in tariffs on our goods, from a widely predicted 10% to 15%.

It appeared the New Zealand government and our trade negotiators had been working on the assumption that the rate would be held at 10%, but that understanding evaporated with a decision made directly by President Donald Trump.

The shift reflects Washington’s new trade-first, numbers-driven approach, which leaves little room for nuance or negotiation.

In this worldview, a trade surplus equals punishment, and despite New Zealand’srelatively modest NZ$500 million surplus with the US, we found ourselves in the higher tariff bracket while competitors such as Australia and Chile remained at 10% thanks to deficits in recent months.

Minister for Trade and Investment Todd McClay, accompanied by New Zealand’s top trade negotiator Vangelis Vitalis, is in Washington to press the case for a reversal.

They are there to register concern, seek an explanation for the extra 5%, highlight the strain this places on New Zealand–US relations, and explore a path back to a lower rate.

However, the message from the US side has been blunt: the Trump administration believes America has been “ripped off” in past trade arrangements and is determined to redress what it sees as imbalances. For New Zealand, the reality is we have limited leverage.

One example of an avenue we could go down is strategic procurement, such as directing some of our planned defence upgrades towards US manufacturers to help offset the surplus. While not a quick fix, such moves could be part of a wider diplomatic and economic strategy.

Despite the blow, the latest announcement at least brings certainty after monthsof speculation and shifting signals.

Exporters can now plan around a known number, rather than bracing for a moving target.

While the increase will impose significant costs – few can absorb a full 15% without passing some on –exporters are already negotiating with partners to share the burden.

One New Zealand exporter told us they had struck a deal to absorb 10%, with their US distributor carrying the remaining 5%. Inevitably, higher price points will flow through to American consumers, and some products could be priced out of the market where viable domestic alternatives exist.

For those facing this risk, diversification into alternative markets may become essential.

This is where history is firmly on our side: New Zealand exporters have repeatedly shown an ability to adapt to global challenges, finding innovative ways to deliver premium products to the world. From responding to biosecurity threats to navigating previous trade barriers, our exporters have consistently demonstrated resilience and creativity. This moment is no different. It’s another opportunity to showcase the quality and distinctiveness of New

Zealand goods.

The tariff hike is just one part of a broader shift in US trade policy. The early suspension of the De Minimis exemption, which allowed goods under US$800 to enter tariff-free, will now take effect on 29 August 2025, two years earlier than expected. The US had already suspended this for China and Hong Kong in April and is now extending it globally.

Implementation details remain murky, so exporters should brace for potential delays, added costs, and uncertainty at the border.

Meanwhile, the ongoing Section 232 investigations threaten further disruptions, with Trump floating a 100% tariff on semiconductors and reviewing pharmaceuticals and timber. Timelines are loose, and announcements could come suddenly.

MFAT and Minister McClay will continue high-level talks in Washington in the coming weeks. The EMA and ExportNZ are supporting these efforts, but the new global trade environment demands both realism and agility.

The certainty of a 15% tariff may not be ideal, but it gives New Zealand businesses the ability to plan, adapt, and turn the challenge into another example of how our exporters excel under pressure, reinforcing our reputation for resilience, innovation, and world-class quality on the international stage.

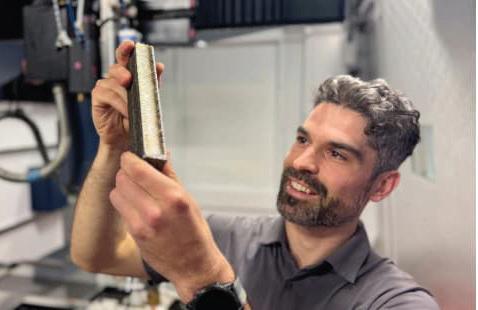

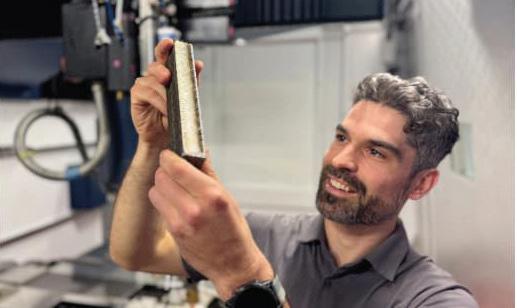

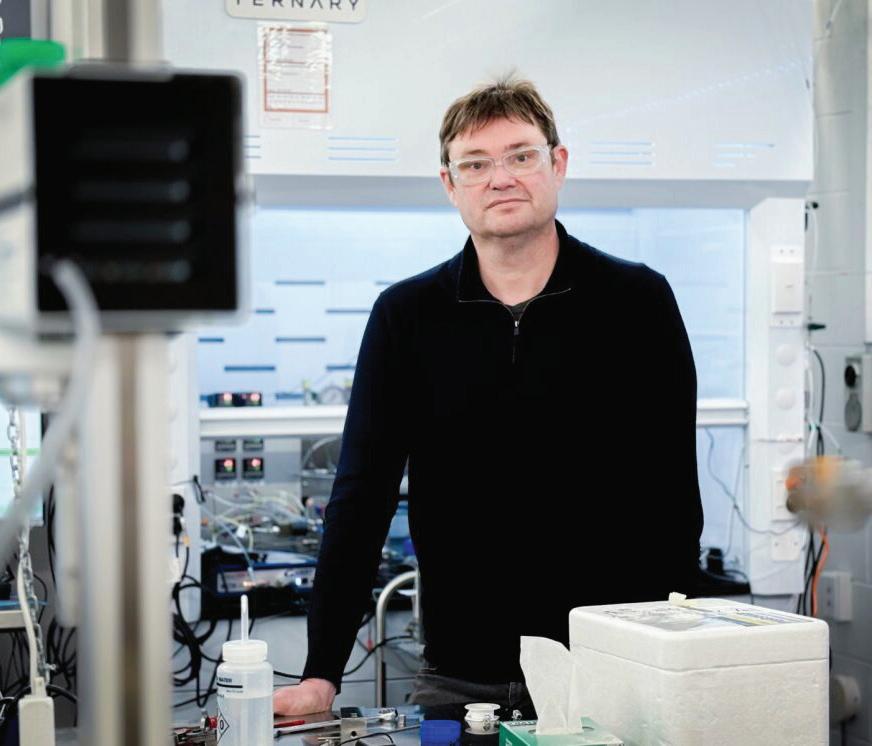

Engineers from RMIT University have produced a new type of 3D-printed titanium that’s about a third cheaper than commonly used titanium alloys.

The team used readily available and cheaper a lternative materials to replace the increasingly expensive vanadium.

RMIT has filed a provisional patent on their innovative approach, which has also been outlined in Nature Communications, as the team considers commercial opportunities to develop the new low-cost approach for aerospace and medical device industries.

RMIT’s Centre for Additive Manufacturing (RCAM) PhD candidate and study lead author Ryan Brooke said testing of their alloy showed improved strength and performance compared to standard 3D-printed titanium alloys (Ti-6Al-4V).

Brooke, who has just accepted a Research Translation Fellowship at RMIT to investigate the next steps of commercialising the technology, said the area of 3D-printed titanium alloys was ripe for innovations.

“3D printing allows faster, less wasteful and more tailorable production yet we’re still relying on legacy alloys like Ti-6Al-4V that doesn’t allow full capitalisation of this potential. It’s like we’ve created an aeroplane and are still just driving it around the streets,” he said.

“New types of titanium and other alloys will allow us to really push the boundaries of what’s possible with 3D printing and the framework for designing new alloys outlined in our study is a significant step in that direction.”

The latest study outlines a time- and cost-saving method to select elements for alloying, to take advantage of emerging 3D-printing technology. This work provides a clearer framework for predicting the printed grain structure of metallic alloys in additive manufacturing.

It has already been used to achieve impressive results: the team’s alloy, while not presented in the study for commercial reasons, is 29% cheaper to produce than standard titanium.

Through this design framework, the metal also prints more evenly, avoiding the column-shaped microstructures that lead to uneven mechanical properties in some 3D printed alloys.

“By developing a more cost-effective formula that avoids this columnar microstructure, we have solved two key challenges preventing widespread adoption of 3D printing,” said Brooke, who recently completed market validation as part of CSIRO’s ON Prime program talking to aerospace, automotive and MedTech industry representatives about their needs.

“What I heard loud and clear from end users was that to bring new alloys to market, the benefits have to not just be minor incremental steps but a full leap forward, and that’s what we have achieved here,” he said.

“We have been able to not only produce titanium alloys with a uniform grain structure, but with reduced costs, while also making it stronger and more ductile.”

Study corresponding author Professor Mark Easton said RCAM was focused on creating new collaborations to further develop the technology.

“We are very excited about the prospects of this new alloy, but it requires a team from across the supply chain to make it successful. So, we are looking for partners to provide guidance for the next stages of development,” he said.

Samples were produced and tested at RMIT’s cutting edge Advanced Manufacturing Precinct.

‘Compositional criteria to predict columnar to equiaxed transitions in metal additive manufacturing’ is published in Nature Communications (DOI: 10.1038/ s41467-025-60162-0).

Taking steps to become more energy efficient and making the switch to clean energy can have plenty of benefits for your bottom line. It doesn’t have to be costly to implement, either.

EECA provides free tools and advice to help your business take the next step – including energy efficiency checklists, energy calculators and advice on the best clean and clever tech on the market.

Discover more at eeca.govt.nz/manufacturing

-Caliber Design

New Zealand’s manufacturing strength lies in its regions. From ports and processing plants to R&D labs and machine shops, great engineering is happening up and down the country—and we’re proud to be part of it.

In our 10th year as a company, we’ve deepened our regional presence—recruiting engineers in Wellington and Invercargill, and opening an office for our team in Tauranga.

These aren’t fly-in-fly-out contractors—they’re local, full time Caliber employees. People who live in the community, understand the context, and work face-to-face with the businesses driving regional industry.

Caliber provides experienced mechanical engineers on demand—working onsite under client direction to deliver projects, boost capacity, and keep things moving.

In Auckland (where Caliber was founded ten years ago), we continue to support engineering-led businesses across the city—particularly in marine, aerospace, and automated materials handling at the moment.

These sectors are driving strong demand for mechanical design, systems integration, and asset maintenance support. While food and beverage manufacturing remains an important part of the regional economy, we’ve seen less direct project work in that space this year.

There’s been less construction-driven mechanical work, but energy efficiency, sustainable upgrades, and operational improvements are still generating opportunity.

In the Waikato and Bay of Plenty, the engineering and manufacturing ecosystem continues to punch above its weight—driven by a culture of innovation and export ambition.

From high-performance mowing systems used on PGA golf courses to precision-engineered components for alternative fuel networks, the region is full of examples where smart engineering meets global demand. Our Hamilton-based team is busy working across multiple sectors—supporting manufacturers, product developers, and industrial businesses to design, deliver, and optimise.

Tauranga may not be a manufacturing centre in the traditional sense, but its role as a freight, logistics, and infrastructure hub is undeniable. The Port of Tauranga (New Zealand’s busiest) is undergoing a significant expansion, and projects like the Stella Passage development and Tauriko Business Estate are creating strong demand for mechanical design, automation, and systems integration.

With a local office and engineers embedded in the region, we’re seeing firsthand the scale of what’s coming. From handling systems to infrastructure upgrades, it’s work that requires both technical depth and onsite delivery capability.

In Wellington, the closure of Callaghan Innovation has left a noticeable gap. LocalR&D businesses are adjusting, and the early-stage deep-tech space is under pressure. But there’s still high-value work happening—particularly where engineering expertise can help teams maintain momentum through change.

In Nelson, forestry has softened, hitting local engineering firms that once relied on steady maintenance and support work. But the marine sector—particularly open-ocean aquaculture—has grown to help fill the gap, bringing opportunity to firms working on marine handling systems, vessels, and specialist equipment.

Canterbury is buoyant. Machine builders supplying global markets are seeing solid export activity, and from our vantage point, the tariff concerns raised earlier in the year seem to be settling into workable territory. We’re also excited about the recently announced Aerospace Strategy—it’s injected fresh momentum into Christchurch’s thriving aerospace industry, with firms like Dawn Aerospace, Kea, and SPS at the forefront.

From manufacturing plants to fishing ports, logistics hubs to R&D labs, we’re there. We’re proud to support regional New Zealand not just as an idea, but in practice. By being on the ground and helping great engineering-led businesses design, deliver and grow.

Business leaders realise the gap between their companies’ tech workers and their nontech colleagues must shrink.

The emergence of digital technologies, especially the rapid rise of AI over the past two years, comes with immense promise to unleash growth and productivity.

But companies will not see those benefits if their employees are not up to speed.

Now more than ever, for organisations to perform at their best, all employees need to be techies. Executives, too, need to become more tech-savvy. Business leaders are increasingly responsible for delivering tech-enabled products, which requires a broader and stronger technical foundation.

Depending on their business, they may need to know where the company is on its cloud migration journey to understand the true costs of new products. They may need enough enterprise architecture knowledge to understand the trade-offs between custom-developed and off-the-shelf solutions.

They may need sophisticated insights into cybersecurity risks. Strong data governance relies on stewards who understand what data is needed, what it means, and how to leverage analytics and machine learning.

With greater technical knowledge, business leaders can prioritise rewiring their organisations—deeply integrating technology across all core processes—to gain competitive advantages.

This reality is compelling companies to take new approaches in enhancing employees’ technical skills to improve their flexibility, productivity, and performance, as well as to retain top talent.

Rather than rolling out one-size-fits-all training efforts, the companies that are most successful in upskilling prioritise targeted efforts that close skills gaps for talent in areas that are critical to their long-term strategy.

They meet learners where they are, offering a variety of virtual and in-person programs tailored to remote and hybrid workforces—and they take learning beyond the classroom into the real world. They create cultures of continuous learning and improvement that keep current employees engaged and motivated while attracting new talent who strive to develop in their careers. And they tie learning to critical business outcomes, incentivising leaders to establish effective upskilling programs and holding them accountable for results.

The need to focus on skill building is not new, but it has taken on greater urgency as labor markets tighten and companies have greater demand for people who can keep up with new technologies that are reshaping how work gets done.

Companies that are slow to launch skill-building efforts risk missing out on important benefits for their people and for the organisation itself.

In this rapidly evolving environment, companies urgently need to help their employees enhance their tech skill sets and better understand both their industries and their organisations.

To meet this moment, companies can take five steps to begin investing in and developing their upskilling efforts:

Identify skills that are most important to long-term

strategy and align business leaders. Companies can’t upskill in every area of work. Business leaders should prioritise the skills that will help their organisations win against the competition, close their biggest gaps, and attract and retain top talent.

Ensure that upskilling is a shared priority among senior leaders and that they serve as role models to reinforce its importance for the organisation. Create a holistic upskilling strategy. Learn from organisations that have succeeded with upskilling and craft a strategy that will work for your team. Start by piloting ideas with small and open groups and scale from there. Build support within the organisation as you adopt certain initiatives to make sure they stick.

Develop learning experiences quickly and iteratively. Leverage analytics, gen AI, and partners such as universities and reputable learning providers to swiftly deliver upskilling and retooling curricula to meet business needs. Reimagine curricula with a greater emphasis on teaching practical applications, embedding real-time feedback into tasks, and leveraging new tools.

Put the learner in the driver’s seat. Build a culture of learning and ownership. Help employees understand their roles in upskilling and integrate learning into day-to-day work to develop an always-on approach, enabling them to take charge of their journeys rather than waiting for formal training. Reinforce the value of learning throughout the employee life cycle. Explicitly link skill building to employees’ goal setting, incentives, and career development. Ensure that managers provide employees with appropriate time and support to learn. Encourage managers to be teachers as employees apply their new skills beyond the classroom.

Skills gaps fall into three main categories: technical foundations, technical expertise, and business fundamentals.

Technical foundations for all

Enhance employees’ baseline fluency on relevant tech-related topics to help them develop strong learning mindsets and adjust quickly as technology changes. The top basic tech skills include gen AI and other emerging technologies, agile methodologies, data fluency, and engineering.

Successful companies tend to work with learning partners to develop these skills virtually through live or on-demand courses.

For organisation-specific needs, they augment readily available courses with customized content that is cocreated by external learning and development professionals and internal subject matter experts.

In one example, a global consumer-packaged-goods company developed a digital academy that enrolled 3,000 employees to help the company build skills needed for a digital transformation of its manufacturing and supply chain operations.

The senior-leadership team kicked off the process by aligning on a vision for the company’s digital transformation. They then developed more than 100 hours of learning content, which employees accessed through self-paced online courses as well as remote

and in-person workshops.

Content was tailored for specific roles, including frontline workers, change teams, and senior leaders. Importantly, the learning journey extended beyond the classroom to fundamentally change ways of working in the frontline-operations team.

In the first 18 months after the launch of the digital academy, the company achieved a 20 to 40 percent increase in throughput and productivity within the team.

Companies can help employees develop deeper technical knowledge and experience in their roles to address urgent business needs. These include areas such as AI and machine learning, cloud technology, product management, cybersecurity, and architecture. Successful organizations rapidly develop and customize training programs for these next-level tech skills—and they often provide learning opportunities through employee-led pathways (programs designed around individuals’ aspirations and goals) and external certification channels.

Which advanced tech skills companies prioritise in their upskilling efforts depends on their strategy and their digital maturity. Established, low-growth organisations tend to be the least advanced in their digital capabilities and have dated tech stacks, so they often focus on skills that will help them modernise.

Stable organisations that are growing in low- to mid-single digits and have started on their digital journeys focus on unlocking new growth by embracing product management and strengthening connections between technology and the business. Tech-focused companies, at the forefront of embracing new technologies, emphasize building skills that enhance the customer experience and accelerate growth.

Employee-led upskilling initiatives work well when they prioritise skills that help the organisation develop a long-term competitive advantage and retain highly skilled talent.

Just as business leaders need to understand tech, tech employees need to understand business. Employers can assist employees in tech roles with developing their business acumen, organisational knowledge, and the soft skills required to influence change across the company.

These include complex problem-solving, creative thinking, communications and storytelling, stakeholder engagement, people management, and conflict resolution.

Companies that excel in helping upskill tech employees in these areas take a cross-functional approach to the content and tailor it for the tech organisation, providing tangible examples to help employees apply it to their own day-to-day context. The three categories of skills gaps described above affect people at all levels of organisations. Tech employees need upskilling in all three areas— foundational knowledge of how technology works in their organizations, deeper skills in their technical discipline to deliver cutting-edge work, and a fundamental understanding of how their work fits continued on Page 28

Sandra Lukey

Sandra Lukey is the founder of Shine Group, a consultancy that helps science and technology companies accelerate growth. She is a keen observer of the tech sector and how new developments create opportunity for future business.

Sean O’Sullivan

Has a B Com (Hons) Otago University. In 2000 - 2001 introduced PCs on the workshop floor and job and staff tracking and a productivity software App to Fletcher Aluminium Group and 100 manufacturers NZ nationwide.

Founding Director Empower Workshop Productivity & Scheduling Software App.

Johnathan Prince

Jonathan Prince is a Director at Caliber Design, a project-based mechanical engineering consultancy with engineers all around the country. With a background in product commercialisation, sustainable design, and business strategy, Jonathan is passionate about helping Kiwi companies turn ideas into reality and building engineering capability within New Zealand Inc.

Adam Sharman

Is CEO at LMAC for the APAC region. With a background in technology implementation, manufacturing and strategy, Adam and the team at LMAC are on a mission to transform manufacturing productivity by combining expertise in operational excellence, manufacturing digitisation and strategy definition and delivery.

Patrick McKibbin

CEO – Hutt Valley Chamber of Commerce

Patrick joined the Hutt Valley Chamber of Commerce in September 2021. His passion is identifying and connecting with manufacturing & technology businesses, other businesses, local government, central government and industry associations.

By Dr. Troy Coyle, CEO, HERA

The construction industry is undergoing a major transformation thanks to new digital technologies, a shift often called Construction 4.0. Inspired by the smart technologies that revolutionised manufacturing, these innovations are now changing how buildings and infrastructure are designed, built, and managed.

This overview highlights some of the key technologies shaping this change and considers their potential for New Zealand’s construction sector.

The emerging technologies research theme of HERA’s Ngākopa Construction 4.0 project, led by Prof Robert Amor from the University of Auckland, aims to identify the technologies that can support a transition to construction 4.0.

Building Information Modelling (BIM) is a way of creating detailed 3D digital models of buildings that everyone involved in a project can use. Instead of relying on flat blueprints, BIM lets architects, engineers, and builders work from the same interactive model, reducing mistakes and improving teamwork.

It also helps plan costs, timelines, and even assists with managing buildings after construction.

The Internet of Things (IoT) connects sensors, tools, vehicles, and even workers on a construction site, collecting real-time information about everything from weather conditions to equipment status. This data helps managers improve safety, avoid delays, and make better decisions by keeping track of what’s happening on site at all times.

Augmented Reality (AR) allows project teams to view digital designs overlaid onto the real world using mobile devices or special glasses. This makes it easier to spot design problems early, estimate costs accurately, and manage quality directly on site.

Knowledge-based systems use smart computer programs to analyse risks, project timelines, and safety issues, helping teams make better decisions by understanding complex data and uncertainties.

Computer vision uses cameras and drones to watch construction sites, automatically spotting safety risks or structural defects faster and more accurately than manual inspections. By combining visual data with AI, it can track progress and flag potential problems in real time.

Digital Twins create a virtual version of a construction project or asset that updates continuously with

real-world data. This helps teams simulate different scenarios, optimise workflows, and spot issues before they happen, leading to safer and more efficient building processes.

3D printing is being used to build complex shapes and parts of structures that would be difficult or wasteful with traditional methods. It offers environmental benefits by reducing material waste and can speed up construction, though it is still growing in its use on large-scale projects.

4D printing takes this a step further by producing materials that can change shape or adapt in response to heat, moisture, or other conditions, opening up exciting possibilities for smarter, more adaptable buildings.

Smart robotics are increasingly handling tasks such as bricklaying, demolition, or aerial site inspections. These robots can perform repetitive or dangerous jobs faster and more precisely, helping to address labour shortages and improve safety.

Natural Language Processing (NLP) helps computers understand and summarise large amounts of written information, such as safety reports. This can identify patterns in incidents or risks that might otherwise be missed.

Process mining analyses digital records of project activities to identify delays, bottlenecks, or inefficiencies. This data-driven approach allows managers to optimise workflows and improve collaboration.

Information fusion combines data from multiple sensors and sources to give a clearer, more complete picture of what’s happening on a site, helping to detect risks and make better decisions.

Blockchain technology provides a secure, transparent way to record transactions and share information among all project partners, reducing disputes and automating processes like payments through smart contracts.

Many of these technologies are even more powerful when combined. For example, a digital twin can incorporate data from BIM models, IoT sensors, and computer vision systems to give a live, detailed picture of a project’s status.

Robots and drones can gather visual data feeding into AI systems that monitor safety and progress. Together, they create a smart, connected construction environment that improves efficiency, safety, and sustainability. Construction 4.0 requires the following:

• inter-operable systems;

• real time data connectivity; and

• Automated workflows and decision support across the lifecycle of a project, from design to construction and end-of-life disassembly.

What this means for construction in Aotearoa New Zealand

Among these technologies, digital twins, smart robotics, and computer vision stand out as

Adam Sharman, CEO LMAC Group APAC

Having recently spent time on the ground with our team in Europe, it has been interesting to reflect on the common trends and differing approaches to industry support across Europe.

Whilst different countries face some of their own unique challenges, priorities, constraints and policy backstops, one thing is clear; across Europe the manufacturing playbook is being rewritten.

For New Zealand manufacturing, having an eye on the commonalities and practical differences in the European markets matter as much as the headline trend words (AI, reshoring, decarbonisation).

In this article, we reflect on what’s really happening on the ground across the UK, France and Germany— and what we can learn in New Zealand.

The UK: fast-to-adopt, policy-energised, skills-constrained

UK manufacturers are pushing hard on data, AI and automation as the primary levers for productivity — driven by government programmes (Made Smarter), trade and tax incentives, and a recent policy pivot to a long-term industrial strategy that backs advanced manufacturing and skills investment.

That policy momentum is prompting many UK firms to accelerate AI/ML pilots, invest in connected-factory programmes and consider reshoring for resilience. Yet adoption is uneven: SMEs still cite awareness, skills and access to capital as the highest barriers.

Leaders should therefore prioritise scalable pilots that deliver measurable OEE (overall equipment effectiveness) gains, pair technology buys with rapid upskilling, and actively use available regional funding and schemes to lower implementation risk.

France: state-led modernisation and selective reindustrialisation

France combines a deliberately interventionist industrial policy with long-term programmes — “Industrie du Futur” and targeted investment funds — to modernise medium-sized sites and attract strategic projects (gigafactories, batteries, critical supply chains).

The French state has used subsidy schemes and coordinated “Team France” efforts to push digitalisation, decarbonisation and on-shoring where it judges national interest. For leaders, that means attractive grant opportunities and a predictable policy partner when projects align with

particularly promising for Aotearoa New Zealand’s construction industry right now.

They can help tackle common challenges such as labour shortages, safety risks, and the need to build more sustainably and cost-effectively.

Digital twins support better planning and resource use, aligning well with Aotearoa New Zealand’s goals for economic resilience and environmental responsibility. Robotics can automate labour-intensive

national priorities (strategic supply, green tech). But firms must be ready for tighter regulatory expectations around sustainability and local content, and they should design proposals that tie productivity, jobs and decarbonisation into one business case.

Germany: technologically advanced but squeezed by energy and export headwinds

Germany remains a global leader in automation, machine tools and platform-driven Industry 4.0 practices, backed by a dense supplier ecosystem and standards work. Yet its sector has faced a tougher macro picture: weak export demand, high energy costs for energy-intensive production, and cyclical weakness in autos and capital goods have constrained investment and output.

Policymakers and industry platforms continue to push digital standards and decarbonisation measures, but many firms are shifting CAPEX toward energy efficiency and supply-chain diversification rather than large scale expansion.

For leaders, the German lesson is that excellence in engineering and process innovation is necessary but not sufficient — energy strategy (contracts, flexibility, local generation) and market diversification are now core strategic priorities.

Digital + people = the activation equation. Across all three countries, leaders report that tech alone doesn’t deliver value unless paired with new operating models and skills pipelines.

Targeted training, short-cycle pilots and metrics that tie digital projects to margin or lead-time wins are non-negotiable.

Resilience beats lowest-cost sourcing. Geopolitical risk and logistics fragility have made reshoring/ nearshoring options commercially viable — but only when combined with automation to offset higher labour or energy costs.

Decarbonisation is now a cost and a market filter. Energy transition policies and corporate buyers are pushing manufacturers to invest in emissions

reduction; those that lead will win contracts and finance more easily, but the short-term burden is material — especially in Germany.

The energy transition also opens product-market opportunities (green steel, battery systems, circular services).

Take a data-driven approach to prioritisation: using analysis of production and enterprise data, shortlist 3–5 projects (one productivity, one resilience, one sustainability), estimate payback, and secure an executive sponsor.

Make energy strategy part of manufacturing strategy: procure flexible tariffs, evaluate on-site generation and demand-response, and model product margins under different energy scenarios.

Invest in modular workforce programmes: micro-credentials, apprenticeships, and industry partnerships that convert tech pilots into repeatable capability across sites.

Invest in AI to support agility and rapid analytics: Pick a practical use case, experiment with agentic AI tools to address the use case and use the use case to build capability.

The UK is prioritising agility and strong policy tailwinds for digital adoption; France is prioritising direct state support for targeted modernisation and strategic projects; Germany is developing the deepest engineering ecosystem but faces near-term macro and energy headwinds.

For New Zealand’s manufacturing ecosystem, organisations and government shouldn’t bet on one “best” approach — a combination of prioritise, including digital experiments and AI like the UK; state-supported strategic plants like in France; engineering-intensive exports and energy-efficient modernisations like in Germany to support cross-border resilience in supply footprint.

and hazardous tasks, improving productivity and safety.

Computer vision offers precise, automated monitoring that helps reduce waste and manage complex sites, especially in varied terrains.

While other technologies like augmented reality, 4D printing, and blockchain show potential, they are still developing and need more time and investment before widespread use.

Digital innovation is reshaping construction in exciting ways. Technologies like BIM, IoT, AI, and robotics are helping make building safer, faster, and greener. For Aotearoa New Zealand, embracing these tools offers a clear path to a stronger, more sustainable construction industry that meets future challenges with confidence and skill.

By Chris Penk, Minister for Small Business and Manufacturing

Among the many things I’ve come to appreciate in this job is just how challenging it can be to run a small business in New Zealand’s regulatory maze – no matter the industry.

In the wise words of our Prime Minister, “we can have more growth, more exports, more jobs, and higher wages for every New Zealander – we just have to say yes to letting it happen.”

It’s clear to me that, like so many other businesses, manufacturers want to spend more time making things and creating jobs, and far less time buried in paperwork.

Too often businesses tell me unclear or outdated regulations stand in the way. For example, machine guarding rules can clash with food safety standards, or exposure limits might fail to reflect the real risks on the ground.

Many manufacturers have faced the frustrating reality that rigid rules cost time, money and productivity – without always delivering better safety outcomes.

That’s why this Government is pushing ahead with work to clear out the sticky red tape that gums up the works.

I want to acknowledge my colleague, Workplace Relations and Safety Minister Brooke van Velden, who has spent recent months engaging with manufacturers across the country.

From sawmills to commercial bakeries, businesses have been upfront with Minister van Velden, as they have been with me, about the frustration of navigating grey areas and impractical requirements that tie them in knots.

One example that stands out came from a business owner who shared how identical machine guarding passed inspection by WorkSafe in Auckland yet failed in Christchurch.

When the same piece of equipment is treated differently depending on who shows up on site, it’s obvious something needs to change.

We’re taking that feedback seriously. Outdated machine guarding rules are being simplified to keep workers safe without piling on endless compliance costs.

Workplace exposure standards are also under review for things like softwood dust, hardwood dust, welding fumes and flour dust. These rules must protect workers’ health and be practical, measurable and aligned with how modern businesses operate.

It was a submission from commercial bakers, shared

through the Government’s Red Tape Tipline, which sparked WorkSafe’s move to review the Workplace Exposure Standard for flour dust. Bakers warned that the current limit is so strict it risks shutting down businesses altogether. One bakery spent millions retrofitting air conditioning, buying new industrial vacuums, and ramping up deep cleaning – yet still found it almost impossible to comply.

Costs like these flow through the entire supply chain and push up prices at the checkout. At a time when some families feel the pinch just buying a loaf of bread, that’s simply unacceptable.

Our goal is to get these settings right so businesses can trust they’re working to clear, sensible rules –without second-guessing inspectors or shelling out for endless workarounds. This is part of a wider effort to bring back New Zealand’s practical, can-do spirit.

When businesses have certainty, they’re more likely to invest, grow their teams and deliver better products at better prices.

The online tipline gives every Kiwi a way to shine a light on pointless, confusing or outdated rules. We want to hear from manufacturers about the other regulatory headaches slowing them down.

If you’re reading this and have an example, I encourage you to jump online and share it.

New Zealand manufacturers already do extraordinary things every day. Our job is to back them – not bind them up in barriers. By putting common sense at the heart of the rules, we hope to help local businesses keep Kiwis in good jobs for years to come.

Fiona Schroeder, General Manager, South Waikato Precision Engineering.

How are you finding current business conditions?

Business has been tough over the last 12 months, across the board, our customers have been “down” and experiencing lower demand.

However, it would seem there are some green shoots which will hopefully mean that we have hit the bottom and are now looking forward to a period of gradual growth.

What are the main activities of your company?

South Waikato Precision Engineering is a manufacturing engineering business.

We design and manufacture KNAPP spreader bars, lifting beams, man cages, skid steer attachments and excavator attachments including thumbs.

We also manufacture parts for other New Zealand Manufacturers. With 11 CNCs and offline programming, we machine a wide variety of precision parts including tooling steels.

We also have fabrication and welding, giving us the capability to manufacture welded parts that require machining in one place rather than having to use two separate suppliers.

Our assembly team assemble manufactured parts into sub-assemblies for customers to streamline their manufacturing production.

Where are future opportunities for growth, for your company?

From a production manufacturing perspective, South Waikato Precision Engineering is partnering with New Zealand manufacturers to produce parts and provide sub-assemblies with the goal to reduce production costs and increase efficiencies to ensure our customers remain competitive in the global market.

We believe this approach of assisting our manufacturing customers to reduce costs and use an external supplier to change fixed costs to variable costs will continue to create opportunities for growth both for South Waikato Precision Engineering and our customers.