Tomasz Pańczyk, Editor-in-Chief Food from Poland Magazine

Tomasz Pańczyk, Editor-in-Chief Food from Poland Magazine

The private label market in Europe is growing in importance. Faced with high inflation, changing consumer tastes and the search for value for money, retailers are becoming increasingly bold in developing their own product lines. Western Europe has been a mature private label market for years - in countries such as Germany, Spain and the UK, private label products account for more than 40% of the shopping basket, and in some categories - such as dairy, dry goods and frozen foods - as much as 60%. Poland, which has been perceived as a market with a moderate share of private label, is catching up dynamically. The increase in the share of private label in modern trade, especially in discount chains and supermarkets, goes hand in hand with rising product quality and growing consumer confidence. More and more Poles are realising that private label products often do not differ from na-

market insight

10 The private label market – global trends and outlook

28 Private label market – the producers’ view

Polish companies

19 ROS-SWEET and the Moreso Brand at PLMA 2025 in Amsterdam

22 Sushi&FoodFactor – 10 years of flavor, innovation, and global success

interview

24 Małgorzata Ryttel, President of the Management Board of PPH Maxpol

food sector

34 Poles’ nutritional trends

40 What sweets do Poles love?

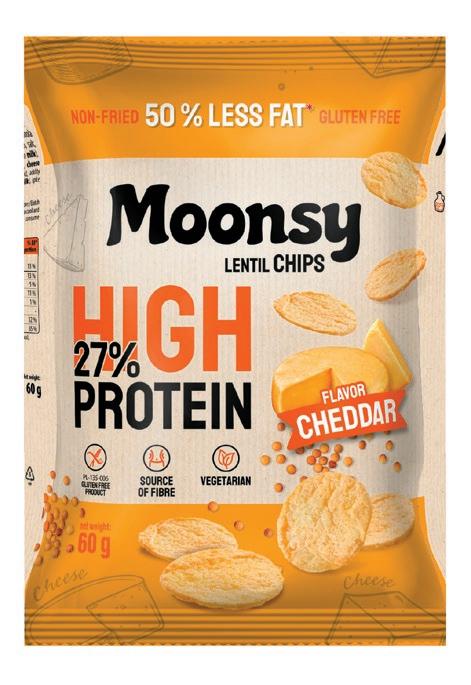

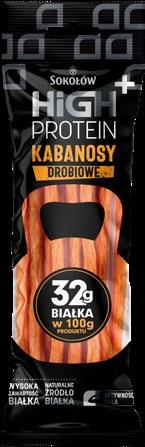

42 High-protein products enter the big stage

commentary

32 Poland’s Private Label Market Insight

tional brands in terms of taste, safety or nutritional value. Polish food producers play a key role in this process. Our country has become a production base not only for domestic retail chains, but also for European retail giants. Polish processing plants - especially in the dairy, meat, fruit and vegetable and bakery sectors - combine modern technologies, high quality standards and operational flexibility. As a result, they are increasingly being chosen as production partners by chains from across the continent. It should be stressed that Poland’s growing role in the European private label market is not only the result of competitive costs, but above all of a strategic approach to quality, innovation and logistics. For the Polish food sector, this is an opportunity to expand, diversify its order portfolio and strengthen its position on the demanding European market.

39 The retailers’ perspective 44

Editor-In-Chief

Tomasz Pańczyk t.panczyk@foodfrompoland.pl

Managing Editor Monika Książek m.ksiazek@foodfrompoland.pl

Advertisement Office Phone: +48 22 847 93 67

Paciorek

Editorial Office Bagno Street 2/218 00-112 Warsaw, Poland Phone: +48 22 828 93 66 redakcja@foodfrompoland.pl www.foodfrompoland.pl

Fischer Trading Group Ltd.

CEO: Tomasz Pańczyk t.panczyk@ftgroup.pl

In recent years, the private label market has grown in importance worldwide and has become an integral part of the business strategies of major retail chains.

Magdalena Chajzler Editor

Once mainly associated with budget products, private labels are increasingly seen by consumers as a viable alternative to branded products. Once associated with lower quality and simpler products, they now represent a rapidly growing market segment, covering a wide range of products from basic groceries to premium products.

Private label offers benefits to both retailers and manufacturers. For retailers, they are a way to reduce operating costs, increase margins and build customer loyalty. For manufacturers, it is an opportunity to broaden

their offering and create additional revenue streams by partnering with retailers. Global economic changes such as rising inflation or changing consumer preferences, as well as the development of new production and distribution technologies, are making private labels increasingly attractive in markets around the world.

The rise in popularity of private label products, especially in an era of growing consumer awareness and the need to save money, is no coincidence. The modern FMCG market increasingly values the high quality of these products, which are becoming more technologically advanced and adapted to global trends such as healthy food, organic products and premium offerings. In addition, retailers have invested in creating strong, recognisable brands that offer a wide range of products to

meet the diverse needs of consumers.

The future of the private label market looks promising, especially in the context of the development of e-commerce, the growing importance of ESG (environmental, social and governance) products, and the continued increase in interest in premium products. The private label market is not only growing in strength, it is also changing its face, adapting to the expectations of the modern consumer.

Private labels are playing an increasingly important role in the retail sector, driven by changing consumer preferences and retailer strategies. Retailers have recognised them not only as a way to reduce costs and increase margins, but also as a tool to build customer

loyalty and strengthen their market position. In the past, they were mainly associated with lower prices and lower quality. Today, thanks to investment in development, innovation and unique recipes, they can compete with, and often outperform, branded products.

Rising inflation and the cost of living are driving consumers to look for savings without compromising on quality. Private label fills this gap by offering products that are competitive on both price and value. By cutting out the middleman, retailers can better control quality, tailor their offer to customer expectations and introduce premium products in the private label segment. Private labels are increasingly offering products that are organic, gluten-free, vegan or bio, in response to growing consumer health and environmental awareness.

For retailers, the development of private label also means greater independence from brand manufacturers and the ability to better manage the supply chain. Increased investment in research, new production technologies and innovative distribution methods means that private label products are increasingly being chosen by customers not only for their price, but also for their high quality. As a result, retail chains are building long-term relationships with consumers, who are more likely to return to stores that offer proven and attractively priced private label products.

As a result, private label has become a key element of many retailers’ sales strategy. Their growing popularity is the result of a market

evolution in which quality, innovation and price must co-exist to effectively attract and retain customers.

The development of private label in the FMCG market varies from region to region due to many factors such as consumer culture, shopping preferences, purchasing power and the level of development of the retail sector in a given country. In Western Europe, private label has achieved a strong position, particularly in countries such as the UK, Germany, France and Spain, where it is an important part of the store offer. In the UK, private labels account for 40-50% of the FMCG market, and consumers treat them as a fully-fledged alternative to premium brands. High quality, innovation and product variety make British shoppers eager to choose private label products.

In Germany , private label, especially in chains such as Aldi and Lidl, is synonymous with good quality at an affordable price. These chains dominate the market and offer private label products as a basic part of their range. German consumers value products that combine simplicity, quality and value for money, and private label fully meets these needs.

In southern European countries such as Spain and Italy, private labels are also widely available and growing in popularity, but the situation is still different from Western Europe. Spain, thanks to chains such as Car-

In the UK, private labels account for 40-50% of the FMCG market, and consumers treat them as a fullyfledged alternative to premium brands.

In Germany, private label, especially in chains such as Aldi and Lidl, is synonymous with good quality at an affordable price.

refour and E.Leclerc, offers a wide range of private label products, characterised by competitive prices and quality.

Italy, with its strong culinary traditions, prefers branded products, especially in categories such as wine, delicatessen and food related to local culture.

The American private label market is growing faster than in the past, but it still lags behind Europe. In the US, despite their presence in most stores such as Walmart and Costco, private label products are still seen as a cheap alternative rather than a premium choice, especially in the food, beverage and luxury goods segments. However, private label is gaining ground in segments such as health, organic and beauty.

In developing countries such as China, India and Brazil, the private label segment is gaining momentum. As purchasing power increases and the retail sector develops, private label products are beginning to be seen as a cheaper but equally valuable alternative to more expensive branded products. In China and India, where e-commerce is growing

Differences in the popularity of private labels are due to many factors, including local preferences, purchasing power, consumer culture and the level of development of retail chains.

in popularity, private label is an attractive option for consumers looking to save money. In Brazil, private label is gaining popularity as more consumers focus on saving money, although its market presence is still smaller than in developed countries.

In developed countries such as Canada and Australia, private label is growing in popularity due to the wide range of organic and natural products available. Retailers such as Loblaw in Canada and Coles and Woolworths in Australia are continually expanding their private label ranges to meet the growing demand for healthy, organic and environmentally friendly products. In countries with smaller markets, such as New Zealand, the presence of private label is growing, particularly among younger consumers who are more likely to opt for cheaper but higher quality products.

Differences in the popularity of private labels are due to many factors, including local preferences, purchasing power, consumer culture and the level of development of retail chains. In developed countries, private labels are an integral part of the FMCG market, while in developing countries their popularity is growing, indicating further potential for development in the coming years.

In Poland, retail chains such as Biedronka (Jeronimo Martins) and Lidl Polska dominate the private label market.

The development of private labels in the FMCG sector is reflected in the strategies of many global and local retail chains, which have recognised the opportunity to reduce costs, increase customer loyalty and differentiate their offering. Private label is now one of the key elements of commercial strategies, both in discount chains and in supermarkets and premium stores. Examples of selected retail chains that are successfully developing their own brands illustrate this trend perfectly.

In Poland , retail chains such as Biedronka (Jeronimo Martins) dominate the private label market, offering a wide range of products including both food and everyday items. Biedronka develops many private label brands such as Dada (baby products), Pilos (dairy products), Go Vege (vegetarian products) and Świeże Smaki (sausages and ready meals). These products are very popular because they are competitively priced and of good quality.

Biedronka is also investing in the development of premium lines, offering brands such as Jeronimo Martins - a line of premium products that meets the growing expectations of consumers looking for higher quality food.

Another chain that is consistently developing its own brands in Poland is Lidl, an international leader in the discount segment. In Poland, Lidl develops not only economy brands, but also premium lines. Examples include the Deluxe brand, which offers higher quality food products, as well as Alesto (snacks and delicacies) and Cien (cosmetics). With these brands, Lidl attracts customers who are looking for high-quality products at affordable prices. In addition, the chain is intensively developing the organic and natural products segment in response to the growing trend towards a healthy lifestyle.

In Europe, many chains have also invested heavily in developing their own brands, each tailoring their offer to the specific needs of the market. German discount giant Aldi is one of the pioneers of private label in Europe. The chain offers almost 100% private label products, the quality of which is highly appreciated by consumers. Aldi has brands such as Moser Roth (chocolate) and Lacura (cosmetics), which have become synonymous with high quality at a competitive price. Thanks to innovative approaches to production and distribution, Aldi is able to offer its customers attractive prices without compromising on quality.

In Europe, many chains have also invested heavily in developing their own brands, each tailoring their offer to the specific needs of the market.

Another European leader in private label is Tesco in the UK, which has an extensive range of private label products. The Tesco brand is divided into three main lines: Tesco Value (value products), Tesco Standard (standard products) and Tesco Finest (premium products). This allows Tesco to reach a wide range of consumers by offering both value for money everyday items and exclusive food. The chain is also expanding its organic food range in response to the growing demand for healthy food.

In the US market, one of the leaders in private label is Walmart, which offers a wide range of private label products. Brands such as Great Value (groceries) and Equate (toiletries and cosmetics) are synonymous with low prices and good quality. Walmart has gained recognition from consumers who are happy to choose private label products without compromising on quality. In addition, Walmart, like other chains in the US, is focusing on developing organic and healthy products in response to the growing health trend in the country.

Costco, a chain that has become very popular thanks to its wholesale model, is developing its own brand, Kirkland Signature. This brand covers a wide range of products,

from groceries to household chemicals and cosmetics. Kirkland Signature products are particularly popular because of their high quality and attractive prices. Costco successfully combines its own brands with attractive prices, which attracts many loyal customers, especially those who want to save money by buying in bulk.

Canada is not lagging behind when it comes to private label development. Canadian retailer Loblaw offers the President’s Choice brand, which includes both premium and standard products. President’s Choice is particularly popular with consumers who value high quality at reasonable prices. Products are available in many categories, including food, beverage and cosmetics, and the chain continues to expand its offering with innovative solutions such as organic and plant-based foods.

In Australia, Coles and Woolworths are developing their own brands to meet the needs of consumers looking for high quality, healthy and environmentally friendly products. Both chains offer a wide range of products, including organic foods, cosmetics and cleaning products. The chains’ own brands are highly regarded and are perceived as competitive with traditional brands.

The development of private labels in the FMCG sector is the result of many factors influencing retailers’ strategies and changing consumer preferences. Initially perceived mainly as a cheaper alternative to branded products, private label is now becoming a full-fledged competitor in almost all market segments - from economy to premium, organic and health products.

One of the key factors accelerating the development of private label is changing consumer behaviour. Today’s shoppers are increasingly aware of both product composition and value for money. Many people no longer focus solely on brand loyalty, but rather base their choice on an analysis of the composition, origin, nutritional value or transparency of production. Private labels are successfully responding to these expectations by offering high quality at an affordable price, attracting a growing number of conscious consumers.

Another important factor influencing the development of private labels is inflationary pressure and the rising cost of living. Faced with rising prices, consumers are increasingly looking for cheaper alternatives to branded products, especially if they offer comparable quality. By cutting out the middleman,

retail chains can significantly reduce production costs and offer more attractive prices. In countries with high inflation, such as some European markets and Latin America, private label products have gained in popularity and have become the first choice for many families looking to save money without compromising on quality.

Another important aspect of private label development is innovation and the development of the premium segment. Until recently, private label products were mainly associated with cheaper substitutes for branded products. Today, retail chains are increasingly investing in quality and innovation. They are launching premium, organic, gluten-free and functional lines that compete with the most prestigious brands. Consumers looking for healthy and value-for-money products are increasingly turning to private label products, which often offer a better composition than their branded counterparts, making them even more attractive.

Consumers’ growing environmental awareness is also important. More and more people are paying attention to the origin of products, their carbon footprint, packaging and production methods. Retail chains are developing their own brands with sustainability in mind to meet these expectations. They offer products in biodegradable packaging, sourced from certified farms or produced in an environmentally friendly way. Ecological solutions are becoming a key factor in purchasing decisions, especially among younger consumers, who are increasingly choosing

More and more retail chains are choosing to sell their products online, allowing them to reach a wide range of customers, especially those who prefer to shop online.

Retail chains often work with reputable manufacturers to produce products under their own brands. In addition, retailers are increasingly forming strategic partnerships with suppliers to develop unique recipes and products that are not available from competitors.

brands that offer planet-friendly products.

Changing production strategies and working with suppliers is another important element. Contrary to popular belief, private labels are not produced by anonymous factories. Retail chains often work with reputable manufacturers to produce products under their own brands. In addition, retailers are increasingly forming strategic partnerships with suppliers to develop unique recipes and products that are not available from competitors. Thanks to these partnerships, private labels can differentiate themselves from tradi-

tional brands by offering, for example, exclusive cosmetics lines, innovative food products or functional items tailored to specific consumer needs.

The development of e-commerce has also had a huge impact on the growth of private labels. More and more retail chains are choosing to sell their products online, allowing them to reach a wide range of customers, especially those who prefer to shop online. The increase in private label sales through e-commerce platforms, as well as the development of the subscription model, makes these products more accessible and competitive in the market. In some cases, retailers are even developing dedicated online stores exclusively for their private labels, allowing them to build stronger relationships with their customers and respond even better to their needs.

In summary, the development of private labels in the FMCG sector is the result of changing consumer habits, economic pressures, innovation, growing environmental awareness and the development of online retailing. This means that private labels are no longer just a cheaper alternative, but are becoming full-fledged market players, adapting to the changing expectations of the modern consumer.

The myth that private labels are produced by anonymous, low-quality companies is false. In fact, many private label products are made in the factories of reputable man-

ufacturers who produce goods for premium brands. Working with reputable companies helps to improve the quality of private label products, enabling them to compete effectively in the FMCG market. As a result, private labels are growing in popularity and becoming full-fledged players in many market segments.

For brand manufacturers, cooperation with retail chains in the production of private labels is profitable. It allows for better utilisation of production capacity, increased profitability and the provision of stable, longterm contracts. For large companies, private

The cooperation between chains and manufacturers does not end with the production of standard products under their own brand. Retailers are involved in the creation of unique recipes that make their offer stand out in the market. Exclusive cosmetics lines, organic, vegan and functional foods, as well as dietary supplements and protein-rich foods are becoming more common. Many chains are also investing in research and development, working with laboratories and research centres to develop innovative products that meet the growing needs of consumers.

Sustainability is becoming another key

sult, private label is setting new standards in the FMCG market and adapting to changing consumer expectations.

The private label market will continue to grow dynamically as retailers and manufacturers adapt their strategies to changing consumer expectations and global market trends. The growing importance of private label is already evident in many countries, and the segment is forecast to strengthen its position in food and other FMCG categories. The desire to meet the growing needs

label production can be an important part of their strategy, allowing them to diversify their revenues and hedge against fluctuations in demand for their branded products.

Retailers benefit by being able to offer their customers high quality products made in factories that meet the highest production standards. This collaboration allows them to introduce innovative products that match and sometimes exceed the quality of their branded counterparts. By eliminating the costs associated with brand awareness and promotion, retailers can offer products at more attractive prices, making them more competitive.

element of this collaboration. Retail chains are increasingly focusing on transparency, informing customers about the origin of their private label products. Some are highlighting the fact that their products come from reputable manufacturers on the packaging, building consumer trust and loyalty. In addition, some chains are introducing certification and quality control schemes to assure consumers of the highest standard of goods on offer. Working with branded manufacturers is becoming a key element in the success of private label, allowing them not only to grow in popularity, but also to develop increasingly advanced and innovative products. As a re-

of consumers who expect high quality products at attractive prices, as well as increasing market competition, will drive the development of private labels.

One of the main directions of development will be their further premiumisation. Retail chains are increasingly offering private label products that can compete with premium brands in terms of taste, quality of ingredients and attractiveness of packaging. Consumers are becoming more demanding and expect not only a good price but also unique recipes, natural ingredients and modern design. In response to these demands, many private labels are expanding their portfolios

Consumers are becoming more environmentally aware, which means that private label brands need to adapt their offerings to meet environmental requirements.

to include exclusive delicatessen, organic, vegan and functional product lines that meet the growing interest in healthy lifestyles.

The development of e-commerce and digitalisation is another key trend for the future of the private label market. The rise of online shopping, especially post-pandemic, is changing the way consumers make purchasing decisions. Retailers are investing in the development of online platforms and mobile applications that facilitate the sale of private label products. In addition, the use of advanced data analytics and artificial intelligence makes it possible to personalise the offer and recommend private label products to consumers based on their previous purchases. This allows online stores to be more responsive to customer needs and private label brands to reach a wider range of consumers.

Another important trend is sustainability, which is becoming a priority for both manufacturers and consumers. Consumers are becoming more environmentally aware,

which means that private label brands need to adapt their offerings to meet environmental requirements. Retail chains are investing in environmentally friendly packaging, eliminating plastic and improving supply chain transparency. Private label products are increasingly being certified as organic, vegan, GMO-free and sustainable in production and transport. Consumers, who are increasingly guided by sustainability values when making purchases, expect private labels to offer products that are not only good quality, but also ethical and environmentally friendly.

In terms of innovation, private labels are not limited to basic products such as food and beverages, but are also developing segments related to health, beauty and nutritional supplements. Retail chains are investing in research into new product categories such as plant-based foods, meat alternatives, functional foods and dietary supplements. In addition, retailers are starting to introduce technological innova -

tions such as smart packaging, which extends the shelf life of products and enables better freshness management, which is very important in the food industry.

The globalisation of the private label market is leading to increased competition between retailers and global brand manufacturers. As retail chains become stronger, they will increasingly compete with traditional FMCG manufacturers not only on price, but also on quality and innovation. Private label brands, once associated mainly with cheaper alternatives, are also beginning to attract consumers with their exceptional quality and unique products. In the future, many private label brands can be exported to new international markets, enabling further growth for retailers who are becoming strong players in the global market.

It is also worth noting that the future of the private label market is segmented: from budget products to exclusive premium lines. Consumers can choose from private label brands tailored to their preferences - from affordable products to those with exceptional quality, composition and packaging. The development of the organic, plant-based and health segments is a response to changing market needs, but also an active shaping of new trends set by retailers.

In the context of technological innovation, the personalisation of offers through artificial intelligence, the introduction of smart packaging, the development of online sales and the implementation of sustainable solutions will be crucial for the future of the private label market. Consumers are increasingly choosing products that are not only cheaper, but also reflect their environmental and ethical values. In the coming years, private labels have the opportunity to grow and strengthen their position as a major player in the FMCG market.

No longer just an alternative to branded products, private labels are becoming consumers’ first choice, especially in the context of rising inflation, changing shopping habits and growing environmental awareness. Their future is therefore very promising, and their success will depend on their ability to adapt to changing market trends and consumer expectations.

ROS-SWEET, the manufacturer of, among others, nut-based snacks, nut butters, and caramel-coated nuts, will present its products portfolio at the prestigious PLMA’s "World of Private Label" trade show, taking place on 20–21 May 2025 in Amsterdam. e event will be an excellent

only its extensive private label production capabilities but also the development potential of products under the well-known MORESO brand.

During this year's edition of the show, visitors to the ROS-SWEET stand will have the opportunity to explore a wide

products tailored to diverse market needs. Visitors will also be able to learn more about the company's wide range of packaging solutions, enabling exible options adapted to individual client and retailer requirements.

With nearly 20 years of market experience, ROS-SWEET has established itself as a trusted business partner, complying with the highest quality standards and holding essential certi cations that con rm its commitment to food safety and production excellence. A modern machinery park, the use of cutting-edge production technologies, and a exible approach to private label projects enable the company to deliver innovative product and packaging

Moreover, as a direct importer of raw materials, ROS-SWEET o ers highly competitive pricing without compromising on the superior quality of its products.

This year, Sushi&Food Factor proudly celebrates its 10th anniversary. What began in 2015 as a small factory in Robakowo, near Poznań, Poland, has evolved into a leading producer of ready-to-eat sushi and Asian cuisine, supplying products to 15 European countries.

Sushi&Food Factor started with humble beginnings—employing just 30 people and focusing on basic sushi sets. However, innovative technologies, such as liquid nitrogen cryogenic cooling and modified atmosphere packaging, allowed the company to quickly surpass its competitors by offering extended shelf-life products without compromising freshness or quality.

Today, the company produces 170,000 trays of sushi daily, along with a wide range of other Asian-inspired dishes, onigiri and sweet onigiri, bao, ramen, chirashi sushi, and bento. All products are crafted at the Robakowo facility, emphasizing the local character of a globally recognized brand.

From the very beginning, our goal was to create sushi that is delicious, healthy, and easily accessible. Today, Sushi&Food Factor is more than just a factory – it is a place where people’s dedication meets cutting-edge technology to deliver the highest quality products.

Dariusz Tubacki, co-owner of the company

Sushi&Food Factor is a leading producer of ready-to-eat sushi and Asian-inspired dishes in Europe. Founded in 2015 in Robakowo, Poland, the company delivers fresh, high-quality, and innovative products to consumers across 15 European countries daily. By combining local roots with a global vision, Sushi&Food Factor continues to revolutionize the ready-to-eat Asian cuisine market, making premium sushi more accessible to millions of consumers.

Sushi&Food Factor combines business growth with strong social responsibility. The company actively supports local initiatives, including Poznań’s Judo Academy, and engages with communities by organizing culinary workshops for children, seniors, and local residents. In 2024, the company adopted a red panda from the Poznań Zoo, further emphasizing its commitment to sustainability and wildlife conservation.

One of its latest ventures includes the opening of GOKO Express, a gastronomic point in Kamionki, offering exclusive products not available in retail chains, showcasing the company’s expertise in culinary innovation.

Sushi&Food Factor is set on further expanding its presence in international markets while strengthening its position in smaller Polish towns and in the Europe. The com pany is also committed to developing new products that fuse traditional Japanese cui sine with modern flavors and premium quality standards.

„Our 10th anniversary is a moment of reflection but also a source of inspi ration for future growth. We aim to not only remain a market leader but also a company that brings people to gether through flavor and culture,” adds Anna Tubacka.

Thanks to the dedication of our team and the trust of our customers, we have not only become the leader in the readyto-eat sushi category but also an innovator in the world of Asian cuisine.

Anna Tubacka, CEO of Sushi&Food Factor

Małgorzata Ryttel President of the Management Board of PPH Maxpol Sp. z o.o.

35 years in the market is a unique anniversary that demonstrates strong foundations and the ability to adapt to changing business realities. How did Maxpol start and what were the biggest challenges you faced in the early years?

Yes, 35 years is indeed a special anniversary. We entered the exhibition market in May 1990 when we started our family business. The beginnings were not easy - at that time we had only a few employees and concentrated on organising exhibitions abroad, mainly in the countries of the former Soviet Union. The first exhibition we organised was in Lviv under the name LEOPOL. This event marked the beginning of our exhibition activity, which has been developing dynamically ever since. At that time we were facing a difficult economic and political situation in Poland. Organising trips for Polish companies to Ukraine or Russia, e.g. Moscow, was a big challenge. However, we managed to establish friendly relations with the most important fair organisers in each country, which enabled us to expand our activities in Ukraine, Lithuania, Latvia, Estonia and Russia.

Over three and a half decades, Maxpol has organised trade fairs on almost every continent, supporting the development of Polish exports. Which of your international projects would you consider

to be groundbreaking or particularly important for the development of your company, and why?

It is true that we have organised trade fairs on all continents. We consider ISM in Cologne, the world’s largest confectionery trade fair, and PLMA in Amsterdam to be milestones in our history. In the beginning, we only had two companies and a small stand. It was also a valuable experience for us in terms of working with organisers from Western Europe. Today, at this year’s PLMA show, for example, we are already servicing 50 exhibitors, which shows how far we have come.

Your motto is: ‘Exhibitions are the best direct marketing tool’. How do you think the role and perception of exhibitions is changing in the era of digital transformation, the growth of e-commerce and the dominance of social media?

I agree - exhibitions remain the most effective direct marketing tool. The opportunity for direct contact between the manufacturer and potential customers is irreplaceable. Face-to-face meetings allow you to get detailed information about the product and agree on pricing and logistics, which often leads to contracts being signed. Despite the development of e-commerce and social media, physical presence and personal relationships still play a key role. We believe that trade

shows will remain an important part of an effective marketing strategy for many years to come.

You have worked with hundreds of Polish companies over the years. What are the expectations and needs of exhibitors who decide to participate in trade fairs today, and how have these needs evolved over the past decades?

Over the past 35 years we have seen a significant change in the approach of exhibitors. We have moved from modest stands with display cases to advanced, custom-built structures equipped with screens, monitors and other modern visual communication tools. Today’s stands must not only present the product, but also attract the attention of visitors and build the brand image. Our aim is to create elegant, modern and functional stands that support our clients’ business objectives.

Maxpol was one of the first industrial exhibition organisers to open up to the Eastern European markets, including the countries of the former USSR. What was and is the importance of these markets for the development of Polish exports, especially in the context of changing geopolitical conditions?

We were one of the first trade fair organisers to open up to Eastern European markets. We started by reviving the pre-war fair in Lviv, where we were accompanied by a large group of about 30 companies, which was quite a lot at that time. Later we expanded our activities to Kiev, Dnipropetrovsk, Kryvyi Rih, Kaliningrad and Moscow, where we organised large automotive shows, mainly in the spare parts segment. Poland has long had a strong position as a producer of parts for cars and trucks. Unfortunately, changing geopolitical conditions are currently limiting the opportunities for further cooperation in these markets.

by both national and international organisations. We are a member of the Polish Chamber of Exhibition Industry, we have the title of Leader of Trade Fair Services and numerous recommendations and awards, including the title of Polish Food Export Ambassador. We believe that the strength of the Polish export offer lies in the excellent price/quality ratio, product innovation and the flexibility of producers to adapt to the needs of different markets.

Like many other sectors, the exhibition industry is currently facing dynamic changes, from technological challenges to new models of participation. What are the main trends shaping the exhibition market today and how is Maxpol adapting to these changes?

Rather than talking about revolutionary trends, it is worth paying attention to the development of technology, especially multimedia, which is increasingly appearing on stands. Screens, video presentations and interactive elements effectively attract visitors’ attention. We also adapt our offer to these changes by encouraging exhibitors to use modern means of communication. In the food industry, especially in the confectionery and meat segments, Poland has many well-known brands and successes on foreign markets.

We do not limit ourselves to organising exhibitions. We offer comprehensive support – from stand design and technical support to organising the transport of exhibits.

Maintaining a leading position for 35 years requires not only consistency but also the ability to develop continuously. What values and skills do you think are key to building a brand with a strong position in such a competitive and volatile market?

Maxpol does not limit itself to organising trade fairs - it also offers full support in stand design, logistics and technical services. What distinguishes your approach to comprehensive exhibitor services and building long-term relationships with customers?

We do not limit ourselves to organising exhibitions. We offer comprehensive support - from stand design and technical support to organising the transport of exhibits. We also help with hotel bookings and flights. From the very first contact, we work with the exhibitor to design the stand and determine its appearance, materials and product presentation. Our priorities are timeliness, quality of workmanship and a partnership approach to each client. This is why many exhibitors stay with us for years.

You have received numerous awards for your contribution to the promotion of the Polish economy on foreign markets. In your opinion, what makes Polish exports attractive, especially in the context of the food and industrial sectors?

We are proud that our activities have been recognised many times

Maintaining our leadership position for 35 years has been possible thanks to the consistency, reliability and hard work of the entire team. Our people are our greatest asset - they deliver projects, manage client relationships and are responsible for the success of the business. Building a strong brand requires honesty, responsibility and commitment at every stage of the business. We believe that these foundations will enable us to celebrate many more anniversaries in the future.

Finally, an anniversary is not only a time for reflection, but also an opportunity to look to the future. What are your development plans for the coming years? Can we expect new areas of expansion, services or innovations from Maxpol?

We are optimistic about the future. We are convinced that exhibitions will remain the basis for effective marketing. We are currently considering two directions: developing our business or optimising our existing offer. Regardless of the final decision, we plan to develop our presence in markets less explored by Polish exhibitors, such as Africa and South America. Our show schedule already includes events in these regions and we encourage companies to take advantage of these new opportunities.

Thank you.

Tomasz

Pańczyk, Editor-In-Chef

Ewa Muchowska Director of Private Label Sales and Export Iglotex

Maciej Herman Managing Director

Lotte Wedel

Piotr Jaroszewski National Sales Director Komodo Energy Drink Poland

Małgorzata Wesołowska-Rucińska Marketing

Manager

LEVANT FOODS

Małgorzata Cebelińska Vice-President of the Management Board

SM Mlekpol

Private label products are successfully finding their place on store shelves and in consumers’ homes, outperforming global brands. Of course, attractive prices continue to play a key role, but they are not the only factor driving purchases. Retail chains are keen to invest in their brands, which is also important.

Virtually every chain, regardless of sector, now has its own brand, which it develops and promotes, building an increasingly strong position in the market.

Today’s consumers have increasingly high expectations and make conscious choices, paying attention to the quality, composition and labelling of the products they buy.

Customers are keen to use blogs and influencer channels and are interested in their opinions. They use reviews on quality, how to use products and inspiring recipes.

A key challenge is to balance high quality with competitive pricing. Private label products tend to have lower margins, and modern production needs to adapt to consumer preferences, changing legislation and the challenges of sustainable production, which often results in higher costs.

Wedel’s position on the domestic market is good, we are one of the 3 major players on the Polish chocolate market. The company is currently allocating considerable resources to investment in development. On an ongoing basis, we are automating and modernising internal operational processes and investing in the creation of new production lines. We have recently constructed two new buildings. One of them will house a place unique in Europe – the E.Wedel Chocolate Factory museum, which will invite everyone to a unique world of chocolate, teaching and entertaining. This project will not only become part of the capital’s urban fabric and emphasise the local roots of our company but will also make it possible to invite visitors from all over the world to join us on a chocolate journey. The remaining spaces will enable us to further develop the Wedel range, increasing efficiency and production capacity.

Private label brands offered by retailers and distributors have become a key element of the food market, competing with branded products not only in price but also in quality and innovation. Amid rising living costs, consumers are increasingly opting for more affordable alternatives, placing the Private Label sector at the forefront of the industry.

One of the key challenges for private label brands is building consumer trust through continuous quality improvement and transparency in composition and production processes. There is also a growing emphasis on sustainable development and eco-friendly packaging, requiring additional investments.

The opportunity for Private Label lies in the increasing acceptance of these products in the Polish, European, and global markets. Functional, health-oriented, and premium products are gaining traction, opening new possibilities for manufacturers.

As a producer of the Komodo Energy Drink private label brand, we offer a wide variety of flavors in 250 ml cans, catering to diverse market needs. Our products stand out due to the highest quality ingredients, innovative formulas, and meticulously developed production processes, ensuring exceptional taste and effectiveness. We are planning further expansion both in Poland and internationally.

The dynamic growth of private label brands presents both challenges and tremendous opportunities.

An international presence is of strategic importance to us. Step by step we are building our position and brand awareness in selected markets – we are present in more than 60 countries and exports currently account for around 10% of the company’s turnover. We want – and we are doing everything – to make sure that not only the domestic market tastes our chocolate, but that the E.Wedel brand is known in countries all over the world. Wedel’s biggest growth opportunities are the unique and high-quality chocolate products that have been made in our factory for more than 170 years. What is important for our customers – we are a company that is flexible, innovative and open to dynamic cooperation. A mixture of these qualities allows us to achieve our goals and cultivate the traditional values that were introduced to the company by its founders – the Wedel family. The main threat, in my opinion, is the rising prices of raw materials, mainly cocoa. It is worth noting that they have increased several times over the last few months, making cocoa more expensive than copper. Other risks include the dynamic change of other costs (employees, energy). Of long-term importance are the challenges of climate change, political and legislative changes (still not very business-friendly in terms of assumptions and implementation time). Also relevant is the issue of proliferating armed conflicts, which also destabilise many areas of business operations. However, we do our best to turn threats into opportunities and develop the E.Wedel brand in even the most unfavourable conditions.

The key to success lies in flexibility, investment in quality, and close cooperation with retail chains and distributors to deliver products that meet the expectations of modern consumers.

Currently, as a milk producer, Poland ranks fourth in Europe, with a positive growth rate of 8% in the first half of 2024. Due to natural conditions, our country still has great potential for the development of milk production, provided that dairy farmers are provided with favourable and stable conditions for their further development and investment. This depends both on the policy of the European Union as a whole and the adaptation of available resources to local conditions, as well as on decisions taken at national level.

The growing popularity of private labels is mainly due to attractive prices, better quality, wider availability and changing consumer perceptions.

The most significant changes that have contributed to the rise of private labels in the market include:

Increased Trust in Quality

Consumers are increasingly aware that private label products are often manufactured by the same suppliers as branded products. Retailers also invest in certifications like organic or fair trade, which helps build trust in the quality.

Value for Money

Especially in times of inflation and rising living costs, consumers are seeking smart, rational purchases. Private labels are often seen as the smart choice.

Improved Design

Private label packaging has become more attractive, modern, and even premium. Retail chains are creating their own premium sub-brands to further improve perception.

Generational Shift

Younger generations are less loyal to traditional brands and more open to trying private labels as long as they meet their expectations in terms of quality, sustainability, and value.

In 2023, private label product sales in Europe reached €352 billion, with an average FMCG market share of around 38% (NIQ, PLMA).

The Mlekpol Dairy Cooperative is one of the leaders in the dairy industry in Poland. It owns many popular brands and has an extensive portfolio of high quality dairy products. Its modern production facilities, which include fourteen highly specialised plants, as well as its operations under the cooperative model, ensure the company’s stable position on both domestic and foreign markets. Currently, 30% of our production is exported, mainly to EU countries, but also to the most distant markets of the Americas, Asia or Africa. Thanks to the high quality of our products and the scale of our production, we are able to meet the expectations of different markets and guarantee foreign partners stable cooperation based on flexibility and understanding of their needs. One of our current priorities is to improve the company’s energy efficiency and reduce its carbon footprint, tasks that are part of our sustainable development strategy. By investing in green energy, Mlekpol aims to ensure maximum energy security and respond to the expectations of modern consumers. As for risks, we certainly see them in the unstable international situation and legislative risks in Poland and abroad. The ongoing armed conflicts and their recent escalation are not conducive to trade, and not only because of the lengthened supply chains, but also the protectionist customs policies, subsidies and other administrative decisions of numerous countries, which means that many regions will continue to face worsening food crises. At the same time, legislative changes that are too rapid or too far-reaching add to the burdens along the supply chain. Nonetheless, as a responsible company, we strive to be flexible in our approach to our business and adapt our production and product range to the needs of our partners in different corners of the world on an ongoing basis.

This is a strong trend that is changing the market and making space for new solutions for large-scale, though at the cost of a weakening position for traditional branded products.

Beata Fabia-Hołda Co-founder and co-owner Adalbert’s Ltd.

It is with great pleasure that I share what is currently happening in our company and our plans for the future. I am extremely proud of our achievements, as Adalbert’s Tea has become one of the most popular premium tea brands in Poland, which brings us immense satisfaction. Moreover, we see great potential in expanding internationally, especially in Europe, where our products are gaining increasing interest.

Growing popularity of private labels is noticeable during every visit to a grocery store. The main reason behind it may be rising cost of living, and consequently the need to make more thoughtful purchases. Of course, this is not the only factor in expanding presence of private labels on the shelves. Other important elements influencing decisions at the points of sale are respectively, perceived quality of products (once lower, now higher) and the breadth of the offer - e.g. price, assortment of flavors and grammages, as well as attractive and modern packaging. In addition, private label products are being constantly developed, resulting in adaptation to a more demanding target group (gluten-free or organic). In short, consumers not only find what they like in the offer of private labels, but they pay less for it. It can be predicted that the private label market will only extend in time. Consumers have become convinced by the quality and wide range of private labels, while for retail chains this is one of the tools used to shape customer loyalty and the image of the store’s brand. For suppliers, on the other hand, such market is both an opportunity and a threat. Therefore, from the producer’s point of view, it is crucial to maintain a healthy balance between their brands and private labels.

Karol Pilaciński Export Director Bogutti

What sets Adalbert’s Tea apart is, above all, the passion with which we create our products. Our tea comes from plantations in Sri Lanka, a country renowned for producing the highest quality teas. We create our products with love and passion, inspired by the beauty and richness of Ceylon’s nature. Every step of production—from handpicking to traditional processing methods—is carried out with respect for the centuries-old traditions of Sri Lanka and its greatest treasure, tea. This allows us to ensure a unique taste and aroma that captures the spirit of this extraordinary island. Our elegant packaging further emphasizes the exclusive character of our products, making them exceptional in both taste and aesthetics.

In the near future, we have many ambitious plans. We are working on new, unique flavours and planning to introduce innovative editions of our teas, which will surely interest our loyal customers and attract new ones. We are also focusing on developing partnerships with international distributors to bring our products to additional markets. Of course, international expansion comes with certain challenges. Each market is different and requires a tailored approach. In Europe, the competition is strong, which is why we emphasize the highest quality of our products, their unique flavour, and exclusive character.

Łukasz Knapowski

Commercial Director

Our goal in the coming period is to continue growing both domestically and internationally. We are also deeply committed to consumer education – we want people to not only savour the taste of our teas but also understand their tradition. We aim for a cup of Adalbert’s Tea to become a daily ritual, celebrated with joy and pleasure.

As in the rest of Europe, the share of private label is growing rapidly in Poland. The quality of private label products has improved significantly in recent years, but remains uneven. The most important criterion for the chains is always price, which is why they often outsource part of their production to manufacturers who offer lower prices at the expense of lower quality. The advantage of private labels therefore remains the guarantee of product origin, raw materials, taste and quality. Consumers are also increasingly concerned not only with good prices and quality, but also with other values such as place and tradition, which private labels cannot offer. Given the dynamic nature of these relationships, we are constantly investing in the recognition and quality of our flagship brands, while at the same time selectively partnering with retailers to produce selected categories under their own brands, thereby enhancing their quality. It remains crucial for us to maintain a balance that ensures both profitability for the milk suppliers of the Mlekpol dairy cooperative and a satisfactory offer for consumers. We are also systematically expanding our product portfolio and offering it to all distributors, giving Polish consumers the opportunity to try trendy new products of very high quality.

Bogutti Company successfully exports its products to more than 50 countries on all continents, achieving a global reach. In my opinion, the current situation of the company is very positive. We are regularly attracting new customers and developing our offer with new product lines. Our diverse customer base enables us to manage our product range effectively and deal with local crises more efficiently. The key for us is that we are not dependent on one strategic customer, which gives us greater flexibility and stability. We see great opportunities for growth through ongoing investments, such as the purchase of new production lines. This will allow us to significantly expand our range and increase our production capacity, which will enable us to both attract new partners and increase sales with existing customers. We are particularly interested in developing the sugar-free segment, which is enjoying growing interest. However, volatile raw material prices are a significant threat. In recent years, we have noticed drastic increases in the prices of sugar, milk, butter and chocolate, which significantly hinders sales planning and an effective pricing policy. Price spikes pose a particular challenge, especially when signing annual product supply contracts.

Małgorzata Cebelińska Vice-President of the Management Board Mlekpol Dairy Cooperative

For many years we have been observing the dynamic growth of private labels of retail chains and distributors.

Their share in consumer spending exceeded PLN 50 billion in 2023. Private labels allow chains to optimise costs and offer products at attractive prices, which perfectly meets consumers’ needs in view of the rising cost of living.

Initially, they were mainly associated with the simplest and cheapest products, aimed at the most price-sensitive consumers. Over time, however, chains recognised the potential of this category and began to develop their own brand offerings in the premium segment to reach a wider range of customers. Today, it is possible to fill almost the entire shopping basket with private label products alone. The biggest challenge for manufacturers remains maintaining competitive prices, especially in the context of rising raw material and logistics costs and pressure from buyers. For strategic trading partners, this often means looking for savings and giving up some of their margin.

Łukasz Knapowski

Commercial Director Aksam

Another challenge is rapidly changing consumer preferences - they expect constant innovation and product improvement. The life cycle of many products is becoming shorter and shorter, and products come and go from the market very quickly. Despite this, private label is still most often associated with a basic range of products with high sales potential. In the case of in-out sales, the volume required to complete a project can be a problem.

Beskidzkie is one of the leading brands in the snacks category in Poland. Thanks to its recognition, wide range of products and high quality, the brand maintains a strong position in the market. Our Pretzel Sticks, Pretzels, Bagels, Snack Mixes or Crackers, are available in most retail chains and are very popular among consumers. This is due to both, traditional nature of the brand, together with company’s 100% Polish origin, and our ability to introduce innovations, at the same time. As despite the strong position, we still see areas for development, like interesting flavours, new consumer deals or the ever-growing trend for simple, natural ingredients. Apart from being main player in domestic market, we are reliable supplier to the international markets. Currently, Aksam supplies its snacks to 30 countries around the world – on almost every continent. Although we mainly produce under Beskidzkie brand, we also have an international brand, Soleo, available in places like South Africa, Ireland or Italy. We have established long-term partnerships abroad, thanks to the high quality of the products (raw materials, certificates including IFS, BRC, Sedex), the excellent level of service as well as the open-mindedness and flexibility. But that does not stop us from constantly growing, by looking for new markets and expanding our product offer. We see many opportunities in the increasing global demand for snacks, which are an attractive choice in terms of the wide range but also affordable price. Besides, consumers are paying more and more attention to what they eat. And in this matter, Aksam cares about the quality of the raw materials and their sources. For instance, we use only rapeseed oil and have dispensed with glucose-fructose syrup. However, just like other industries the trade of savoury snacks, with its’ specifity, have risks for the development. Among them, are unstable situation in the raw materials and energy markets. Climate change and political instability may further adversely affect the availability of raw materials, production and distribution costs and demand in certain markets. In addition, customers are increasingly focusing on whether a company is developing within the concept of sustainability, and this requires manufacturers to adapt their operations and offer to meet these expectations. Therefore, it seems crucial to strike a balance between ESG and maintaining the financial health of companies.

In summary, the share of private labels is growing at the expense of brands, and manufacturers are facing price pressure and the need to adapt quickly. At the same time, private labels will not completely replace branded products, but they are an important and evolving element of the modern FMCG market.

Karol Pilaciński Export Director Bogutti

In conclusion, we are striving to spread the joy of crunching around the world, and the satisfaction of customers is the best reward for our hard work.

Michał Sawosz Chief Commercial Officer – CCO Brand Distribution

Julita Sipa Export Manager

Brześć Sipa

Maciej Herman Managing Director

Paweł Tokarczyk Commercial Director Gold Drop

Private label development is one of the biggest challenges, but also one of the driving forces behind change in FMCG retail. As Brand Distribution Group, we not only distribute brands from global manufacturers, but we also develop our own brands - Voll and Triumf - which meet the needs of modern consumers. We have noticed that customers in Poland, as well as in other countries, are increasingly guided by value for money rather than brand recognition alone.

Private label has undergone a huge transformation - it is now a segment that often sets standards in terms of quality, innovation and packaging. Further growth in consumer awareness, the development of premium segments and eco-friendly and functional products represent opportunities. Private label can also be a great tool for building customer loyalty and competitive advantage.

The challenges? Cost pressures, rising quality expectations and logistical constraints. We also see that competition for shelf space is becoming increasingly fierce. Success in private label today requires excellent market knowledge, operational flexibility and a consistent brand strategy.

Wedel’s position on the domestic market is good, we are one of the 3 major players on the Polish chocolate market. The company is currently allocating considerable resources to investment in development. On an ongoing basis, we are automating and modernising internal operational processes and investing in the creation of new production lines. We have recently constructed two new buildings. One of them will house a place unique in Europe – the E.Wedel Chocolate Factory museum, which will invite everyone to a unique world of chocolate, teaching and entertaining. This project will not only become part of the capital’s urban fabric and emphasise the local roots of our company but will also make it possible to invite visitors from all over the world to join us on a chocolate journey. The remaining spaces will enable us to further develop the Wedel range, increasing efficiency and production capacity. An international presence is of strategic importance to us. Step by step we are building our position and brand awareness in selected markets – we are present in more than 60 countries and exports currently account for around 10% of the company’s turnover. We want – and we are doing everything – to make sure that not only the domestic market tastes our chocolate, but that the E.Wedel brand is known in countries all over the world. Wedel’s biggest growth opportunities are the unique and high-quality chocolate products that have been made in our factory for more than 170 years. What is important for our customers – we are a company that is flexible, innovative and open to dynamic cooperation. A mixture of these qualities allows us to achieve our goals and cultivate the traditional values that were introduced to the company by its founders – the Wedel family. The main threat, in my opinion, is the rising prices of raw materials, mainly cocoa. It is worth noting that they have increased several times over the last few months, making cocoa more expensive than copper. Other risks include the dynamic change of other costs (employees, energy). Of long-term importance are the challenges of climate change, political and legislative changes (still not very business-friendly in terms of assumptions and implementation time). Also relevant is the issue of proliferating armed conflicts, which also destabilise many areas of business operations. However, we do our best to turn threats into opportunities and develop the E.Wedel brand in even the most unfavourable conditions.

Private label brands are gaining popularity due to their attractive price-to-quality ratio, making them a viable alternative to branded products, especially in times of inflation and rising living costs. Opportunities for further growth include increasing consumer trust, expanding product ranges (e.g., premium or eco-friendly items), and better control over quality and logistics. Challenges involve maintaining quality under price pressure, meeting sustainability regulations, and competing with premium brands. In recent years, consumers have increasingly chosen private labels by preference, not necessity. Growing environmental awareness and the rise of e-commerce further support this trend. Private labels have strong potential to compete even more with global brands, provided continued investment in quality and innovation.

Gold Drop is a manufacturer of household chemicals that has been on the market since 1991. At present, our portfolio includes more than 1,000 articles in the field of household chemicals and washable cosmetics. Throughout our existence, we have actively developed cooperation with retailers in the area of private label production. Currently, private labels account for over 60% of our company’s total production. Over the many years that private labels have been on the market, there have been significant changes in the way they are perceived by both customers and brand owners. Initially, they were perceived more through the prism of low price and low quality. Today, the situation is very different. Private Label owners and manufacturers pay a lot of attention to the products they create. Very often they are high quality products that meet all European standards and the high expectations of customers. More and more often, we have the pleasure of designing products for our partners that are innovative in terms of the technology used, as well as environmentally friendly solutions that are backed by certificates. The current challenge for Private Label manufacturers is to present a comprehensive offer that includes not only the product itself, but also a wide range of services, including legal and logistical support, etc. We observe that the Private Label market is constantly evolving and there is certainly still a lot to be done.

Currently, as a milk producer, Poland ranks fourth in Europe, with a positive growth rate of 8% in the first half of 2024. Due to natural conditions, our country still has great potential for the development of milk production, provided that dairy farmers are provided with favourable and stable conditions for their further development and investment. This depends both on the policy of the European Union as a whole and the adaptation of available resources to local conditions, as well as on decisions taken at national level.

Małgorzata Cebelińska of the Management Board

SM Mlekpol

Ksenia

Siakas Category Director Greek Trade

Private label products are increasingly competing with branded products, not only on price but also on quality. With the rising cost of living, consumers are more willing to choose cheaper but proven alternatives. This is a huge opportunity for the private label segment, but also a challenge as expectations of quality, transparency of ingredients and sustainable production are rising. We are also seeing a dynamic increase in interest in functional, organic and nutritionally tailored products. At Greek Trade, we are actively supporting retail chains and distributors to create strong private labels by offering products that meet these needs. The potential of the sector - on the Polish, European and global markets - is significant, but to fully exploit it requires flexibility, innovation and the ability to respond quickly to changing trends. With over 30 years of experience, modern production facilities and comprehensive services - from recipe development to logistics - we effectively support our partners in building modern, competitive private labels.

The Mlekpol Dairy Cooperative is one of the leaders in the dairy industry in Poland. It owns many popular brands and has an extensive portfolio of high quality dairy products. Its modern production facilities, which include fourteen highly specialised plants, as well as its operations under the cooperative model, ensure the company’s stable position on both domestic and foreign markets. Currently, 30% of our production is exported, mainly to EU countries, but also to the most distant markets of the Americas, Asia or Africa. Thanks to the high quality of our products and the scale of our production, we are able to meet the expectations of different markets and guarantee foreign partners stable cooperation based on flexibility and understanding of their needs. One of our current priorities is to improve the company’s energy efficiency and reduce its carbon footprint, tasks that are part of our sustainable development strategy. By investing in green energy, Mlekpol aims to ensure maximum energy security and respond to the expectations of modern consumers. As for risks, we certainly see them in the unstable international situation and legislative risks in Poland and abroad. The ongoing armed conflicts and their recent escalation are not conducive to trade, and not only because of the lengthened supply chains, but also the protectionist customs policies, subsidies and other administrative decisions of numerous countries, which means that many regions will continue to face worsening food crises. At the same time, legislative changes that are too rapid or too far-reaching add to the burdens along the supply chain. Nonetheless, as a responsible company, we strive to be flexible in our approach to our business and adapt our production and product range to the needs of our partners in different corners of the world on an ongoing basis.

Beata Fabia-Hołda Co-founder and co-owner Adalbert’s Ltd.

In recent years, private label food products have really taken off in Poland, Europe, and globally, creating new opportunities for retailers and distributors. Private labels typically bring in higher profit margins than branded products. As retailers have more control over their private label, they have options to customize and offer more flexibility to adjust to trends such as changes in packaging, taste, ingredients and how to create brand strategies. Private label products are no longer just budget options as retailers have identified an opportunity to expand their portfolios with a premium selection of products targeting increasingly more health conscious and environmentally aware consumers. That gives an opportunity to enter multiple market segments with their own brands. Retailer responsiveness to customers’ needs and expectations are key to the further development of the private label sector. Consumers continue to seek price for value in their purchases and need help balancing their preferences against price and quality. A big challenge for the private label food sector has been brand loyalty, with customers loyal to a branded product. One of the bigger challenges for private label foods is that many customers tend to stick with branded products. If retailers can stay adaptable, build customer loyalty, and respond to changing preferences, they’re likely to keep growing in the retail market worldwide.

It is with great pleasure that I share what is currently happening in our company and our plans for the future. I am extremely proud of our achievements, as Adalbert’s Tea has become one of the most popular premium tea brands in Poland, which brings us immense satisfaction. Moreover, we see great potential in expanding internationally, especially in Europe, where our products are gaining increasing interest.

What sets Adalbert’s Tea apart is, above all, the passion with which we create our products. Our tea comes from plantations in Sri Lanka, a country renowned for producing the highest quality teas. We create our products with love and passion, inspired by the beauty and richness of Ceylon’s nature. Every step of production—from handpicking to traditional processing methods—is carried out with respect for the centuries-old traditions of Sri Lanka and its greatest treasure, tea. This allows us to ensure a unique taste and aroma that captures the spirit of this extraordinary island. Our elegant packaging further emphasizes the exclusive character of our products, making them exceptional in both taste and aesthetics.

Sales Manager Private Label XL Energy Marketing

In the near future, we have many ambitious plans. We are working on new, unique flavours and planning to introduce innovative editions of our teas, which will surely interest our loyal customers and attract new ones. We are also focusing on developing partnerships with international distributors to bring our products to additional markets. Of course, international expansion comes with certain challenges. Each market is different and requires a tailored approach. In Europe, the competition is strong, which is why we emphasize the highest quality of our products, their unique flavour, and exclusive character.

Our goal in the coming period is to continue growing both domestically and internationally. We are also deeply committed to consumer education – we want people to not only savour the taste of our teas but also understand their tradition. We aim for a cup of Adalbert’s Tea to become a daily ritual, celebrated with joy and pleasure.

There is no doubt that private labels are becoming increasingly important.

The choice between developing independently or selling quickly to chains is a difficult one. We are witnessing a steady increase in consumer awareness, which is significantly influencing interest in turkey meat, which is perceived as a healthier alternative to pork and beef. This is a sales development opportunity for our company, Polskie Mięso i Wędliny Łukosz, which, thanks to its own turkey slaughterhouse and two production plants, ensures continuity in the production and supply chains for meat and turkey products. Consumer interest in high-quality, ready-to-eat or easy-to-prepare products is enabling us to develop both our sales of cold cuts and our range of convenience products made from turkey, which includes frozen, breaded whole muscle products such as nuggets, strips, escalopes and chilled sous-vide turkey products.

Working with retail chains has many benefits for the producer. It ensures consistent volumes, which guarantee stable sales, enabling large-scale production, market-driven margins and cost efficiency. Large-scale production for private labels allows the plant to utilise its processing capacity and ensure continuity of production. However, the development of private label brands also poses a number of challenges for manufacturers. The biggest threat, which has a huge impact on the stability of the factory’s operations, is the low margins resulting from the high bargaining power of the retail chains. Very often, there is also a lack of control over the brand, as the producer is no longer able to build awareness of its own brands and its position is dependent on the decisions of the retail chain.

Karol Pilaciński Export Director Bogutti

Bogutti Company successfully exports its products to more than 50 countries on all continents, achieving a global reach. In my opinion, the current situation of the company is very positive. We are regularly attracting new customers and developing our offer with new product lines. Our diverse customer base enables us to manage our product range effectively and deal with local crises more efficiently. The key for us is that we are not dependent on one strategic customer, which gives us greater flexibility and stability. We see great opportunities for growth through ongoing investments, such as the purchase of new production lines. This will allow us to significantly expand our range and increase our production capacity, which will enable us to both attract new partners and increase sales with existing customers. We are particularly interested in developing the sugar-free segment, which is enjoying growing interest. However, volatile raw material prices are a significant threat. In recent years, we have noticed drastic increases in the prices of sugar, milk, butter and chocolate, which significantly hinders sales planning and an effective pricing policy. Price spikes pose a particular challenge, especially when signing annual product supply contracts.

The private label sector is gaining importance not only in the Polish market, but also globally, thanks to the growing demand for high-quality products at attractive prices. Consumers are increasingly turning to private label, especially as the cost of living rises. In addition, the development of innovations such as organic, vegan and health products is becoming key to attracting new customers. The main challenges for the sector are competition from global brands with larger marketing budgets and the need to adapt the product range to the different preferences of consumers in different markets. In addition, compliance with regulatory and labelling standards in different markets requires flexibility and rigorous quality management. Nevertheless, the private label sector has great potential for growth, provided that investment is made in innovation and the changing needs of the market are adequately addressed.

Łukasz Knapowski

Commercial Director Aksam