Reimagining the Road Ahead in Automotive Retail

Tim Smith, Chief Strategy Officer at Keyloop, explains how the Fusion platform is redefining automotive retail for today’s connected customer.

UNLOCKING SAFER PAYMENTS WITH AI

Explore how GBM is elevating payment security with innovative AI solutions Our advanced approach addresses modern fraud, boosts accuracy, and ensures secure, seamless transactions. Stay ahead of fraudsters and safeguard your payments with smarter, more resilient strategies.

Introduction

Introduction

Welcome to this special issue of MEA Business, dedicated to celebrating the MEA Business Achievement Awards. At MEA Business, we are committed to delivering comprehensive business news across the Middle East and Africa. Our mission is to provide a dynamic platform where business leaders can share ideas, engage in meaningful debates, and forge strategic partnerships that will shape the future of the region.

Our goal is to equip business leaders and professionals with the skills and insights they need to thrive in these dynamic regions. By focusing on positive news stories, detailed case studies, and inspiring interviews, we aim to foster a narrative of growth and success.

MEA Business magazine offers clear and concise information through various sections, including up-to-the-minute news, market updates, and exclusive CEO interviews. Our readers benefit from a comprehensive blend of our printed magazine, e-magazine, and social media content, providing coverage on the latest developments in the Middle East and Africa.

Additionally, MEA Business proudly features several sector specials throughout the year, tailored to coincide with major industry exhibitions and events.

We hope you find this issue both informative and inspiring.

Kenneth Mitchen Publisher, MEA Business

Kenneth Mitchen Publisher, MEA Business

partners with Nikki Beach Global to bring branded waterfront residences to Ras Al Khaimah

Air signs global distribution agreement with Amadeus in preparation for take-off

WEB: www.mea-biz.com www.mea-hr.com

EMAIL: info@cme-media.com

WEB: www.mea-biz.com www.mea-hr.com

EMAIL: info@cme-media.com

PUBLISHED BY: Creative Middle East Media FZ LLE, 19th Floor, Creative Tower, Fujairah Creative City, PO Box 4422, Fujairah, UAE

Middle East

EXECUTIVE DIRECTOR AND PUBLISHER : Kenneth Mitchen

FZ LLE, 19th Floor, Creative Tower, Fujairah Creative City, PO Box 4422, Fujairah, UAE

Email: ken.mitchen@mea-finance.com

EXECUTIVE DIRECTOR AND PUBLISHER : Kenneth Mitchen

Email: ken.mitchen@mea-finance.com

British digital logistics company Zencargo launches operations in the UAE to expand in MENA

region saw 14 IPOs raise US$2.5b in Q2 2025

Annual Gala Evening is

AI and SoftBank Robotics Launch Robot as a Service to Transform Facilities Management

Qatar Financial Centre (QFC) Publishes Landmark Report on Digital Assets Policy with Global Stratalogues

SkyCargo advances its digital customer experience with CargoAi

celebrates milestone achievement of reaching 50 retail stores across the MEA

Cargo ramps up cargo capacity for China

In this convergence, we see a glimpse of the future of wealth management.

Islamic finance is not playing catch-up, it is leading the way Forecasts from S&P Global estimate Sukuk issuance could reach USD 200 billion in 20251, up sharply from USD 140 billion in 2025 2 . This is not a marginal uptick, but signals deep structural growth, driven by the GCC countries, Malaysia, Indonesia, and increasingly by investors who want their capital to serve more than short-term gain.

Christophe Lalandre, Senior Executive Officer, Lombard Odier Abu Dhabi Global Market Branch

aged 18 to 40, that figure remains just as high. In fact, more than half of next-gen wealth in the region is already allocated to Shariah-compliant assets.

This is not a symbolic gesture. It is a redefinition of what wealth means and

Major infrastructure developments in these countries, along with new industrial investments, are increasing financing requirements. The Sukuk market is well positioned to benefit and grow in response. New opportunities are also emerging in the Islamic finance market through sustainable investments and renewable energy projects. In 2021, ReNIKOLA Solar issued a USD 83 million green Sukuk to fund solar power in Malaysia1. This year, UAE-based Tabreed raised USD 700 million via a green Sukuk to finance sustainable cooling3 similarity. of philosophies for both prosperity At Lombard building decade.

Shariah-compliant Since then, of Islamic discretionary Equity Fund partnership multi-asset In June Lombard Fund, officially Advisors. reflects our performance should go balance growth investing Shariah-approved

Riyadh Air signs global distribution agreement with Amadeus in preparation for take-off

The strategic partnership will enable Riyadh Air access to one of the largest global networks of travel sellers

Riyadh Air, Saudi Arabia’s new national carrier, has entered into a global distribution agreement with Amadeus, a leading technology provider for the travel industry. The partnership grants Riyadh Air access to one of the world’s largest networks of travel sellers, supporting its ambitious expansion strategy and advancing the Kingdom’s wider transformation goals under Vision 2030.

By joining the Amadeus Travel Platform, Riyadh Air will connect to travel agencies and sellers in more than 190 countries, ensuring that its offers are accessible to travelers worldwide. This will be instrumental in attracting inbound tourism, promoting Saudi Arabia as a compelling global destination, and helping position the Kingdom as a leading aviation and tourism hub.

Vincent Coste, Chief Commercial Officer at Riyadh Air, commented:

“Our mission is to create a truly world-class airline that reflects the ambition of Saudi Arabia. Partnering with Amadeus gives us the global reach, distribution power, and retailing capabilities needed to support our goal of flying to over 100 destinations by 2030. This partnership is not only about enabling seamless travel experiences, but also about contributing to the broader national vision of economic diversification, tourism growth, and enhanced global connectivity”.

As part of the agreement, Amadeus will also distribute Riyadh Air’s future NDC (New Distribution Capability) content, allowing the airline to deliver

more dynamic, personalized offers to travelers and to take greater control of its indirect sales strategy. These advanced capabilities will further optimize Riyadh Air’s ability to deliver modern, flexible, and customer-centric retailing.

Maher Koubaa, Executive Vice President, Travel Unit and Managing Director EMEA, Amadeus, said:

“The launch of Riyadh Air represents a major milestone for the Kingdom’s aviation industry, and we are proud to be their trusted technology partner from the very beginning. Amadeus brings not only global reach, but also advanced retailing, merchandising, and data-driven tools that will help Riyadh Air differentiate itself on the

global stage. We are excited to support Riyadh Air’s contribution to Vision 2030 and the Kingdom’s aspirations to become a global tourism and travel leader.”

Backed by the Public Investment Fund (PIF) and unveiled by His Royal Highness Crown Prince Mohammed bin Salman bin Abdulaziz in 2023, Riyadh Air is set to play a pivotal role in advancing Saudi Arabia’s Vision 2030, which seeks to diversify the Kingdom’s economy, stimulate investment in tourism and infrastructure, and create a globally competitive aviation sector. The airline is expected to contribute over USD 20 billion to the Kingdom’s non-oil GDP and generate more than 200,000 direct and indirect jobs

Riyadh Air, the new national carrier of Saudi Arabia, has signed a global distribution agreement with Amadeus, a global technology provider for the travel industry. Image Courtesy: Riyadh Air

MENA region saw 14 IPOs raise

US$2.5b in

Q2 2025

KSA drove the region’s IPO boom in Q2 2025 with 13 listings worth US$1.9 billion, while the UAE marked a milestone with the Dubai Residential REIT raising US$584 million. The momentum is set to continue, with 14 more companies preparing to go public across MENA in the second half of the year.

According to the latest EY MENA IPO Eye report, markets in the MENA region saw 14 IPOs during Q2 2025, raising US$2.5b in proceeds. This marks a 4% increase in capital raised when compared to Q1 2025, demonstrating sustained investor appetite and the resilience of regional capital markets.

In the Kingdom of Saudi Arabia (KSA), the second quarter’s largest IPO was flynas, which debuted on the Tadawul Main Market and accounted for 44% of Q2’s total proceeds. This was followed by Specialized Medical Company, which raised US$500m, and United Carton Industries Company with US$160m.

In the United Arab Emirates (UAE), the Dubai Financial Market (DFM) welcomed Dubai Residential REIT, which raised US$584m. The listing marks a significant milestone as the largest Real Estate Investment Trust (REIT) by market capitalization in the GCC and the first pure play residential leasing REIT in the region.

Brad Watson, MENA EY Parthenon Leader, says:

“The second quarter of this year has reinforced the MENA region’s position as a resilient and dynamic IPO market. In spite of investors practicing caution, we have seen strong growth. The diversity of sectors represented, along with

Gregory Hughes, MENA EY-Parthenon IPO Leader. Image courtesy: EY

milestone listings such as Dubai Residential REIT, highlights the depth of opportunities across the region. With a healthy pipeline for the remainder of 2025, we expect this momentum to continue.”

While after market performance varied, with 10 of the 14 IPOs closing below their offer price on debut, five listings recorded gains, reflecting a cautious investor sentiment. Companies are increasingly strategic about market timing, carefully assessing investor sentiment and macroeconomic conditions before going public.

In terms of equity market performance, the Boursa Kuwait Premier Market Index led regional gains in Q2 2025, rising 17.2%, while other markets posted mixed results.

Shift toward secondary listings

The nature of IPO proceeds in Q2 2025 reflects a notable shift, with secondary listings accounting for 64.3% of all IPOs, up from 35.7% in Q1 2025. This suggests a preference among issuers for shareholder exits over new capital raising, further demonstrating a more cautious approach amid ongoing market uncertainty.

Gregory Hughes, MENA EY-Parthenon IPO Leader, says: “KSA continues to set the pace for IPO activity in the MENA region, attracting strong interest across multiple sectors. At the same time, landmark transactions in the UAE show how regional exchanges are evolving to meet the needs of a broadening investor base. This diversity, combined with continued enhancements in market governance, is key to sustaining long term growth.”

The outlook for MENA IPOs in the second half of 2025 remains strong, supported by a healthy pipeline of 14 planned listings across a range of sectors. KSA continues to lead with 10 anticipated offerings, while upcoming activity from Egypt, Tunisia, and Morocco highlights the region’s expanding market depth and diversification

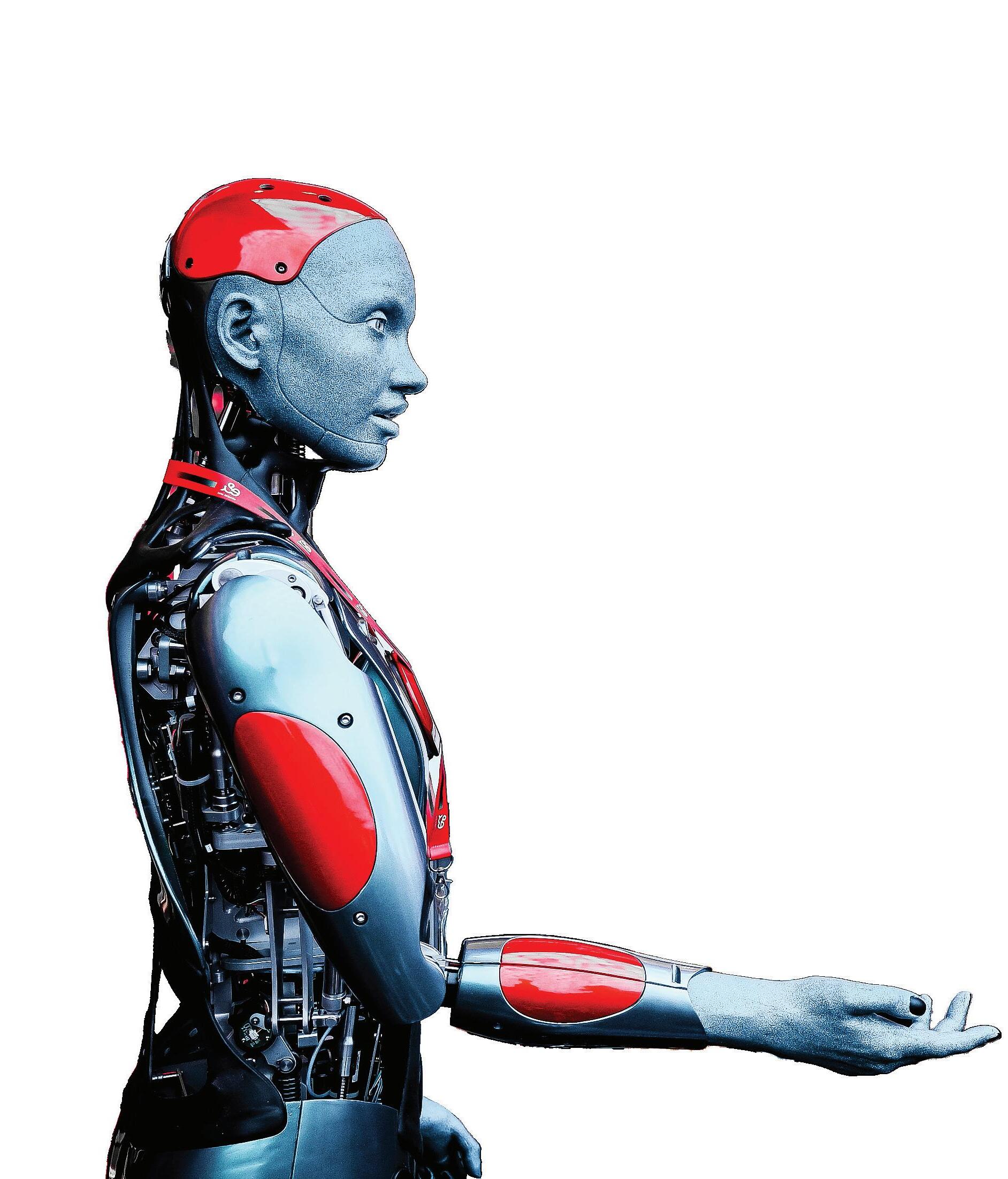

HITEK AI and SoftBank Robotics Launch Robot as a Service to Transform Facilities Management

In a landmark collaboration, HITEK AI integrates SoftBank’s advanced cleaning robots with its CAFMTEK platform, delivering an automated, data-driven facilities management solution for businesses in the UAE and Saudi Arabia.

HITEK AI, a leading provider of AI-driven solutions in the Middle East, and part of the Farnek group of companies, has launched its Robot as a Service (RaaS) offering in partnership with SoftBank Robotics UK (SBR).

This innovative service integrates SoftBank’s advanced robotic cleaning solutions with HITEK AI’s CAFMTEK platform, providing a comprehensive, automated facilities management (FM) solution designed to enhance efficiency, reduce costs, and improve operational performance across industries.

The new RaaS solution is aimed at providing businesses in the UAE and Saudi Arabia with cutting-edge robotic technologies that can be seamlessly integrated into their existing FM operations. Through this collaboration, HITEK AI combines SoftBank Robotics’ state-of-the-art robots with its CAFMTEK platform to offer a unified service that includes both robotic automation and traditional FM, all managed through a single, intuitive interface.

“Our partnership with SoftBank Robotics aims to bring the future of automated FM to businesses across the UAE and Saudi Arabia,” said Javeria Aijaz, Managing Director of HITEK AI. “This integration will empower organisations to operate more efficiently, reduce operational costs, and ensure high standards of service, all while contributing to government goals for digital transformation and innovation.”

SoftBank will be providing two robot types. Whiz, is a commercial collaborative robot vacuum, powered by BrainOS, the advanced commercial operating system from robotics industry leader Brain Corp. This determines the best route given the surrounding environment, continuous operation for up to three hours and can cover up to 1,500 sqm. Whiz is also equipped with sensors and mechanisms that enable

obstacle detection, fall prevention and anomaly impact detection.

Another robot, Phantas, is a powerful tool that helps human teams clean better, faster, and more cost-effectively, vacuuming, sweeping, scrubbing, and dust mopping, up to 5,000 sqm per hour.

Once integrated with HITEK AI’s CAFMTEK platform, facility managers will be able to schedule and monitor routine and ad-hoc cleaning tasks performed by SoftBank’s robots. The robots are activated for each new project site with a unique ID and mapped to the specific zones and locations in the facility.

Integrated with CAFMTEK’s analytics dashboard, SoftBank robots send real-time data on cleaning performance, including task completion times, battery levels, and maintenance needs.

Facility managers can use this data to track the robots’ performance, identify potential issues, and make data-driven decisions to optimize resource allocation and maintenance schedules. The system can automatically generate service requests when the robots need assistance,

ensuring seamless operation with minimal downtime.

HITEK AI’s CAFMTEK system also tracks the service performance of robots, including uptime, task completion rates, and service requirements.

This allows facility managers to monitor the robots’ performance alongside traditional assets, ensuring that all resources are operating at peak efficiency. Performance data from robots will be visible in both CAFMTEK’s mobile app and web interface, providing real-time insights for facility management teams.

“By combining SoftBank Robotics’ cutting-edge robotic solutions with HITEK AI’s advanced CAFMTEK platform, this launch marks a significant step forward in the digital transformation of facilities management. With a focus on efficiency, automation, and data-driven decisionmaking, HITEK AI’s Robot as a Service offering is poised to redefine the facilities management landscape in the UAE,” added Aijaz

WHATEVER THE FUTURE HOLDS. WE’RE WITH YOU ALL THE WAY.

For the good times and the bad.

For the unexpected and the planned - we’re here for you.

Because Shari’a-inspired banking is transparent and fair by design.

Our kind of banking simplifies lives. Making goals easier to achieve. Built around mutual trust and mutual benefit. Which means that it’s good for you – and good for us.

So here is our simple promise to you:

We’ll make a lifelong commitment to partner with you. A partnership built upon the values of honesty and fairness. We’ll put you at ease, listen – and lead. And we’ll provide you with hospitable banking that helps you succeed.

Because life is to be lived. So welcome to ADIB – your lifelong partner.

Qatar Financial Centre (QFC) Publishes Landmark Report on Digital Assets Policy with Global Stratalogues

Inaugural Policy Roundtable Emphasises Clarity Amid Complexity for Interoperable and Transparent Regulation

As the global race to tokenize real-world assets accelerates—forecast to reach $16 trillion by 2030— Qatar is positioning itself not just as a participant, but as a potential architect of tomorrow’s financial infrastructure.

Qatar Financial Centre (QFC) has published a landmark report produced in partnership with the think tank Global Stratalogues, offering a roadmap for inclusive, interoperable, and forward-looking digital asset markets. Based on insights from the Inaugural Digital Assets Policy Roundtable—hosted by QFC alongside the 2025 Qatar Economic Forum in collaboration with the Global Blockchain Business Council (GBBC)—the report reflects consensus from global regulators, technologists, legal scholars, and financial leaders.

Patrick Tan, General Counsel of ChainArgos and co-author of the report, noted:

“This report distills global expertise on tokenisation, reflecting the collective intelligence of industry stakeholders from international thought leaders, financial experts, and regulators, to capture key insights to help lay the policy foundations for inclusive and interoperable digital asset markets worldwide.”

From Promise to Practice: The Case for Tokenisation

Speakers at the Inaugural Digital Assets Policy Roundtable hosted by Qatar Financial Centre alongside Qatar Economic Forum.

From Left: Patrick Tan (HELIX), Zane Suren (Zodia Custody), Shaun Swan (QFCRA), Mohammel Al-MXXX) Heinz Konzett (Lichtenstein), Henk J. Hoogendoorn (QFC), Arjun Vir Singh (ADL), Saloi Benbaha (XDC Network), Giovanni Everduin (CBI), Sandra Ro (GBBC), Jorge Carrassco (FTI), Tanvi Singh (GBBC), Michal Gromek (Global Coalition to Fight Financial Crime), Maha Al-Saadi (QFC), Oscar Wendel (Global Stratalogues), Bashir Kazour (Taurus)

Tokenisation—the conversion of physical or traditional financial assets into blockchain-based digital representations—has the potential to revolutionize how markets function, increasing liquidity, transparency, and access. Yet despite its promise, the report makes clear that scalability and trust cannot be achieved without policy coherence. The findings stress that when tokenisation is embedded within a

coherent regulatory ecosystem, it can significantly expand market access, enhance financial inclusion, and deliver tangible economic value. However, the global picture is currently fragmented.

Legal definitions of tokens, compliance protocols, and licensing requirements differ widely across jurisdictions, complicating crossborder investment, enforcement, and consumer protection. This

fragmentation presents a major challenge for financial institutions and regulators seeking to scale token-based solutions globally.

Yousuf Mohamed Al-Jaida, Chief Executive Officer, QFC, stated:

“Tokenisation can unlock real value by making assets more accessible and easier to transfer. To realise this potential, we need a clear system that combines robust regulation, secure custody, and practical application. This will create a trusted environment that enables institutional adoption and drives sustainable market growth.”

A Tale of Two Trends and the Mirage of Convergence

Shaun Swan, Director of Policy at the Qatar Financial Centre Regulatory Authority (QFCRA), offered a grounded lens on regulatory evolution that challenged popular assumptions.

Tokenisation can unlock real value by making assets more accessible and easier to transfer. To realise this potential, we need a clear system that combines robust regulation, secure custody, and practical application. This will create a trusted environment that enables institutional adoption and drives sustainable market growth.

— Yousuf Mohamed Al-Jaida, Chief Executive Officer, QFC

“If you go back 12 years, there was no fragmentation because there was simply no regulation,” Swan pointed out. Those were the “wild west” days, when pioneering jurisdictions like Singapore and the UAE stepped into the void with the first serious attempts at crypto frameworks.

Fast-forward to today, and the landscape appears more mature— but only on the surface. Swan described the current moment as a “tale of two trends.” Regulatory frameworks around the world may be using similar language and sharing common goals, but the similarities often dissolve under closer scrutiny.

“There’s still differentiation between legal frameworks and legal definitions,” he explained. “So while we’re seeing convergence in headline regulation, once you get into the details, fragmentation remains.”

Henk J. Hoogendoorn, Chief Financial Sector Officer at Qatar Financial Centre

There is reason for cautious optimism, however. Global institutions such as the Financial Action Task Force (FATF) and the Bank for International Settlements (BIS) are actively working to establish guiding principles. Yet, as Swan observed, these efforts have limits:

“Standards are being published, but they’re often pitched at a high level. And once you start getting into the weeds of legislation—how to implement those standards—you still see fragmentation.”

Pragmatism Over Perfection

Rather than waiting for idealised regulatory blueprints, the report advocates for a pragmatic and phased approach to implementation. Core priorities include infrastructure readiness, interoperability standards, and coordinated sandbox environments to test and iterate safely.

Liechtenstein was cited as an exemplary case, where a civil law definition of tokens has created a robust legal foundation. Qatar’s own

regulatory sandbox also received praise as a model of progressive, well-supervised innovation.

Henk J. Hoogendoorn, Chief Financial Sector Officer at QFC, highlighted the role of tokenisation in value creation:

“Tokenisation must serve a purpose. It should democratise access and create real-world value. Qatar is committed to making tokenisation of real-world assets a success.”

Interoperability and Inclusion: The Policy Mandate

With a growing number of jurisdictions piloting digital asset frameworks, the need for global interoperability has become urgent. The report calls for coordination among central banks, securities regulators, and international standard-setting bodies to prevent regulatory silos and establish reciprocal recognition mechanisms.

Moreover, the economic imperative extends beyond efficiency to inclusion. Tokenised finance— especially when aligned with public

interest goals—can unlock capital for underserved markets, support SME financing, and facilitate climate and impact-linked instruments.

Maha Al-Saadi, Head of Regulatory Affairs at QFC and moderator of the roundtable, stressed:

“Regulatory clarity is not a luxury— it’s a prerequisite for scalable tokenisation. Our goal is to bridge global standards with local implementation to ensure digital assets can operate within a trusted and secure environment.”

This emphasis on clarity amid complexity resonates across emerging markets, where robust policy scaffolding is often the critical difference between experimentation and mainstream adoption.

Roundtable in Doha: Global Expertise, Local Leadership

The roundtable convened a highlevel delegation of thought leaders across finance, technology, and regulation. Participants included executives from the Global Coalition to Fight Financial Crime, Taurus, XDC Network, ChainArgos, Zodia Custody, and representatives from financial authorities such as the Qatar Financial Centre Regulatory Authority (QFCRA) and the Central Bank of Liechtenstein.

The event marked the beginning of an ongoing series of closed-door regulatory dialogues spearheaded by Global Stratalogues across Europe, the Gulf, and Asia. These aim to tackle shared priorities such as cross-border legal recognition, AI-blockchain convergence, and the governance of decentralised financial systems

Patrick Tan, General Counsel of ChainArgos

Banking Reinvente Rethink. Reimagine Reinvent.

Ready to challenge the status quo? Get insights from the pioneers driving change in AI, digital transformation, and customer-first innovation, one episode at a time.

Listen on:

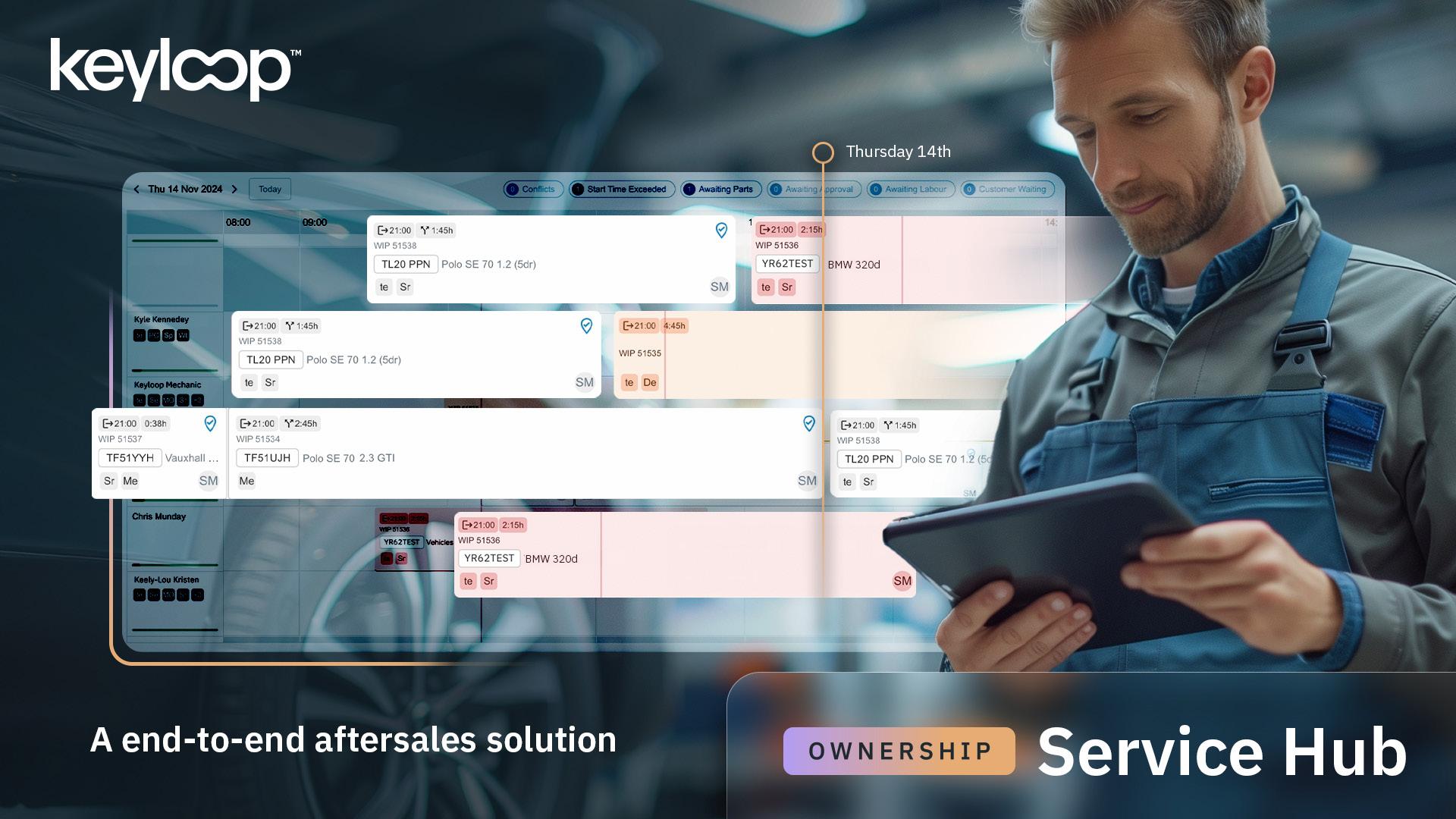

Reimagining the Road Ahead: How Keyloop’s Fusion is Redefining the Automotive Customer Journey

Tim Smith, Chief Strategy Officer at Keyloop, shares how the company’s groundbreaking Automotive Retail Platform is transforming car buying and ownership—bridging digital and in-person experiences, unlocking data-driven insights, and giving dealers the agility to thrive in a fast-changing industry.

What does today’s customer journey look like to you, and how might it change in the years ahead?

With only 1% of consumers describing the car buying journey as “ideal”, according to McKinsey’s Automotive Retail Consumer Survey, it’s time for automotive retailers to adapt or risk being left behind as changing consumer preferences require the industry to evolve.

Customers are becoming more comfortable with online transactions, wanting to avoid the hassle of negotiations and price debates. However, this reduces potential leads with those customers who have poor online experiences.

What’s more, many automotive retailers and OEMs struggle to truly understand their consumers and their ever-changing preferences. This is further hindered by outdated processes, fragmented solutions, and isolated technology resulting in trapped data.

The net effect of this is slow innovation and eroding loyalty. Today’s customers expect a seamless and personalised experience – whether they interact entirely digitally or entirely face to face, or as is most often the case, a blend of the two.

That’s why at Keyloop, we’ve developed Fusion, the Automotive Retail Platform to keep the customer journey relevant in an automotive retailer’s dynamic world and give dealerships game-

changing agility to delight consumers and support them to grow margins.

Is there a danger that the customer journey becomes too convoluted and harder to map – making it more difficult for retailers to retain control or exert influence?

According to research from OC&C, the main pain points affecting retailers’ efficiency include disjointed and lengthy customer journeys, data re-entry and inconsistencies across systems and processes. So, this isn’t just a possibility, it’s already a reality

Tim Smith, Chief Strategy Officer at Keyloop

One of the most important components of a successful automotive omnichannel experience is ensuring that it supports how customers want to purchase their vehicle

for many.

However, the key to successfully navigating the customer journey – no matter how straightforward or complex – is learning to embrace and harness technology to unlock rich data insights. Embracing a connected and empowered ecosystem is the only way to build trust and deliver the very best customer experience.

How does Fusion differ from your established DMS – isn’t it just the same thing with a new name?

Traditional Dealer Management Systems (DMS) had promised to solve many of the industry’s challenges and inefficiencies. Yet, they have proved similarly ineffective, and data remains siloed, inhibiting the ability to connect consumer touch points and personalise their experience.

Harnessing the strength of Keyloop’s best-in-class people, products, and processes, Fusion is the industry’s first

true Automotive Retail Platform (ARP). More than just a technological solution, it’s a transformative approach to reshaping our industry and delivering meaningful value to all stakeholders.

While we all like the convenience provided in the digital world, many consumers still favour an in-person car-buying experience. How does Fusion support an omnichannel customer journey?

One of the most important components of a successful automotive omnichannel experience is ensuring that it supports how customers want to purchase their vehicle. While there is no one size fits all approach, one thing is certain: there should be a consistent and seamless experience across every touchpoint as customers move through their buying journey and beyond.

Technology enables connectivity across these touchpoints. When all the tools are linked together, we can minimise the number of times customers need to provide the same information – reducing frustration and improving the buying experience.

Covering four key domains: Supply, Demand, Ownership and Operate –Fusion optimises the entire vehicle sales process from consumer enquiry through to ownership and retention, centralising every aspect of the automotive retail ecosystem into a single, powerful solution.

What tangible benefits might sales and aftersales staff experience using Fusion and how can it make their lives easier?

As part of Fusion, Service Hub is a groundbreaking aftersales solution, enhancing workshop productivity and customer advocacy through a seamless, end-to-end experience. Service Hub addresses these issues by automating repetitive tasks, reducing manual inefficiencies, and streamlining workflows. It empowers

service advisors to focus on customer engagement and technicians to maximise their expertise. Key benefits include:

• 45% uplift in service appointments booked online, out of hours, with 24/7 self-service bookings

• Technicians save up to 45 minutes daily with streamlined workflows

• Customer queries are resolved 4x faster

• 30% of online check-ins result in upsell opportunities.

What impact can Fusion have on the typical customer’s lifetime value?

Customers are willing to pay more when they receive good service. However, they are also more likely to find an alternative service provider if left unsatisfied. Many retailers’ systems are outmoded, fragmented and siloed. They don’t have the flexibility needed to deliver a frictionless, connected experience.

Yet the growth and margin winners will be those who capture the ultimate consumer experience. Fusion is the

solution - providing a robust framework to amplify customer and vehicle lifetime value and reduce operational costs, making businesses more agile in a rapidly evolving sector.

How is Keyloop helping dealerships to leverage data to build stronger, omnichannel customer relationships?

In many industries, businesses know their customers inside out. From past purchases to browsing habits, they use data to ensure that every transaction is tailored to the individual. The key is not just collecting data but using it in meaningful ways to improve every interaction with every customer.

With Fusion, retailers can leverage deeper insights to enable a hyperpersonalised experience, driving loyalty and increasing lifetime value. Built with Experience-First at its heart, Fusion enables retailers to move away from managing transactions, and towards fostering relationships. It prioritises both experience and operational efficiency, delivering exceptional outcomes for customers and retailers alike.

What role does AI have in the future of automotive retail solutions and how does Fusion deliver this in the retail experience?

Artificial intelligence (AI) has the power to revolutionise the industry by further supporting the development of personalised and seamless customer experiences. What’s more, it can also be deployed to improve efficiencies such as analysing vast amounts of data or predicting maintenance needs.

Mindful of new market entrants, the faltering shift towards electrification and increasing economic headwinds, are there any specific areas that retailers should be focusing on to increase revenue and maximise operational efficiency over the next 12 months?

To boost revenue and efficiency, automotive retailers should focus on several key areas. First and foremost, is developing a personalised, seamless and omnichannel customer experience. Equally critical is the need to achieve operational efficiency –breaking down siloes to avoid data duplication. Investments in talent and technology cannot be understated. Outdated sales tactics and systems will no longer make the cut, as the competition moves rapidly to integrate new tools and upskill its workforce.

How does it align with the broader trends shaping the future of the automotive industry?

In today’s new automotive retail landscape, those who win will be those who capture, not own the customer experience. What modern consumers are increasingly demanding is relevancy – personalised and hasslefree buying journeys. By connecting and creating value, rather than merely conducting a transaction, retailers can cater to the real needs and concerns of the consumers and enhance their overall experience

Keyloop onstage at the MEA Business Awards 2025, receiving the Technology – Innovation in Automotive Retail award.

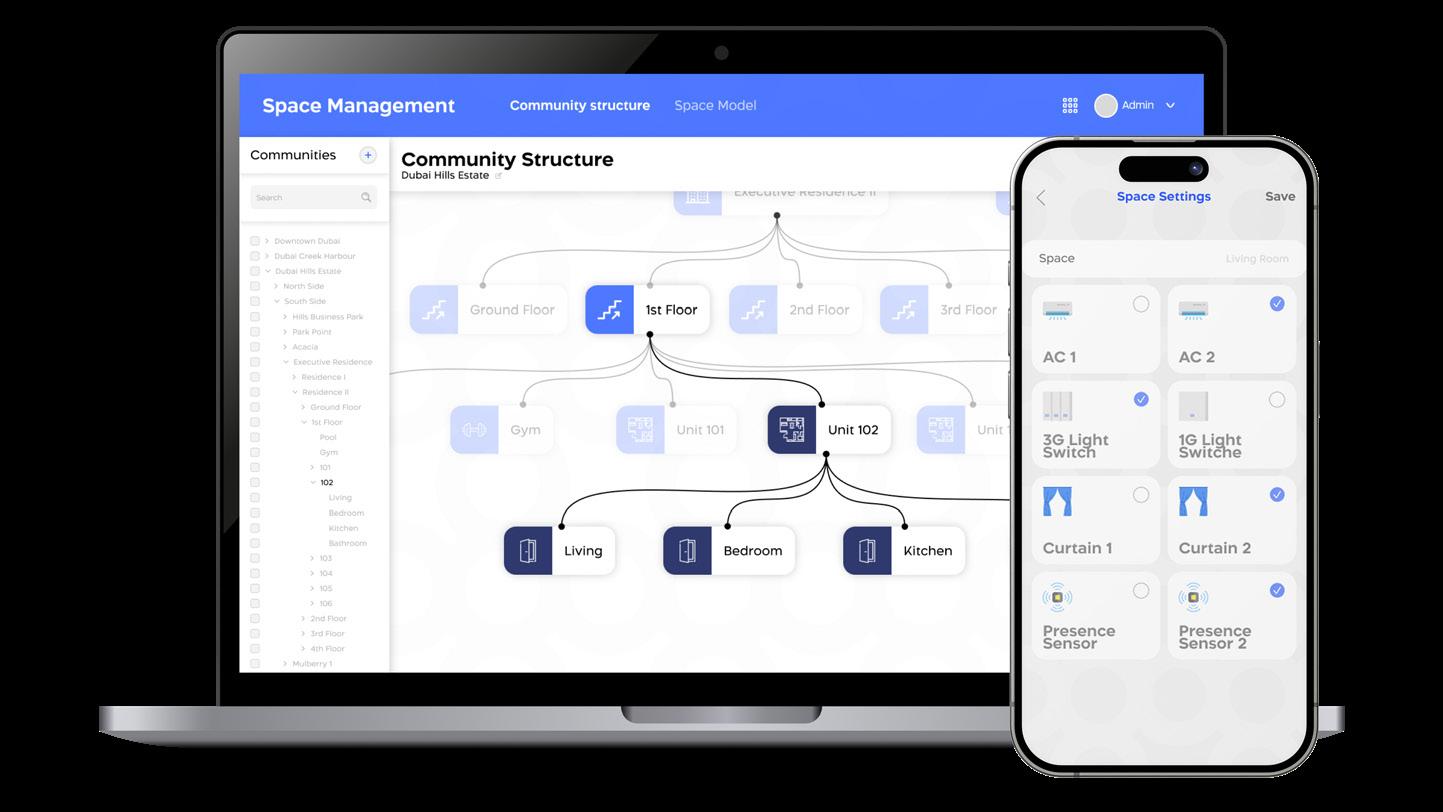

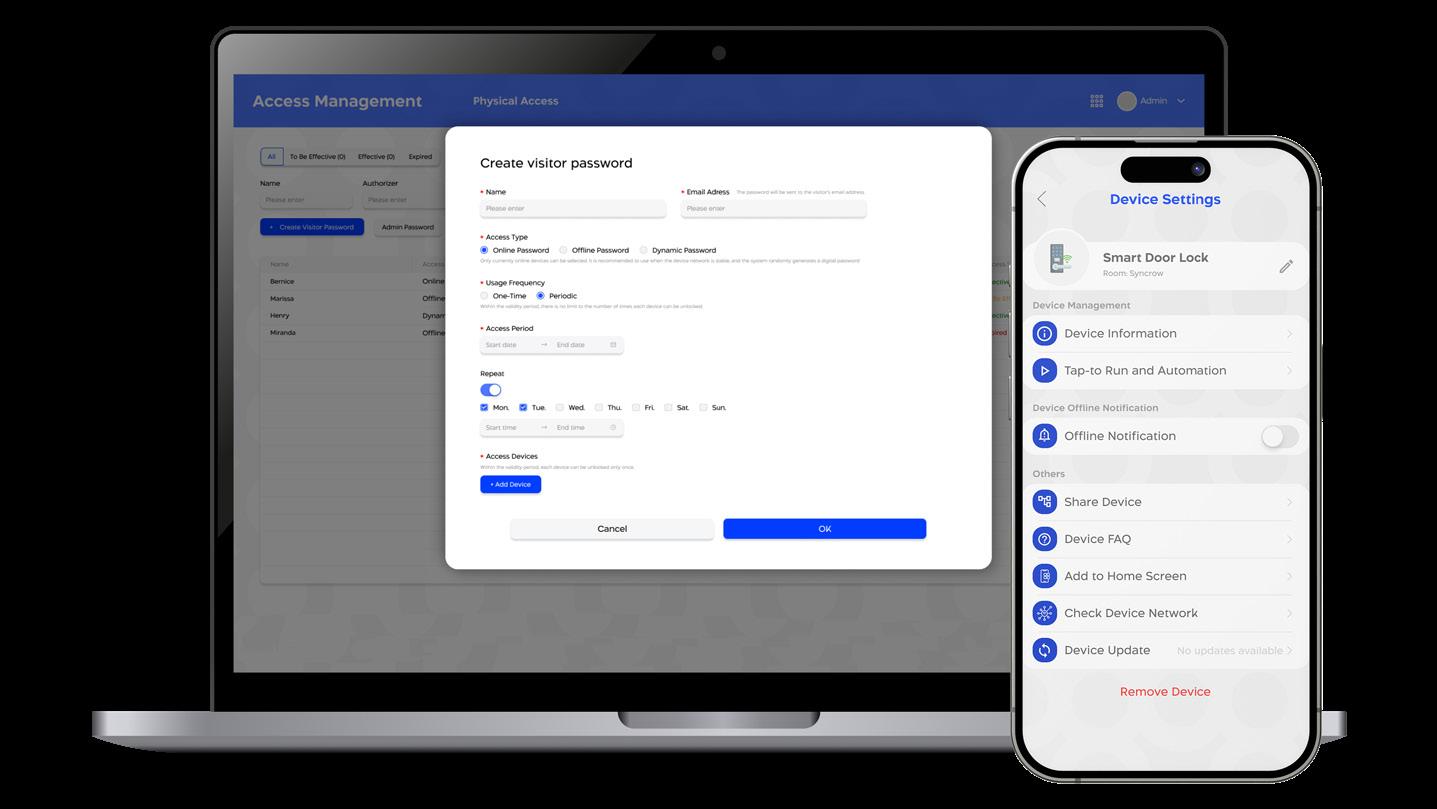

Building the Future: How Syncrow’s IoT Innovations Are Powering the UAE’s Smart City Vision

Talal Debs, Co-Founder and CEO of Syncrow, reveals how the company’s cloudbased SyncOS platform is transforming buildings into intelligent, sustainable, and wellness-focused environments—driving efficiency, compliance, and comfort across the UAE and beyond.

IoT-based building management solutions are key to the UAE’s smart future, says Syncrow CEO Talal Debs

The UAE’s rapidly growing construction industry is projected to expand by 6.2% annually to reach AED 189.59 billion ($51.6 billion) in 2025 and AED 242.33 billion ($65.98 billion) by 2029. This is driven by population growth, ambitious infrastructure projects and smart city initiatives.

Alongside the construction boom is a surge in demand for Internet of Things (IoT) solutions in construction, which is transforming how buildings are designed, operated, and experienced. From $112 million in 2024, the UAE’s IoT in construction market is expected to be worth $309.8 million by 2030.

Talal Debs, Co-Founder and CEO of automation solutions provider Syncrow, highlights how IoT technology is central to the UAE’s and the rest of the GCC region’s smart future.

The UAE is experiencing a major construction boom. How does IoT fit into this evolving landscape?

As the UAE’s urban landscape continues to rapidly develop, the demand for smarter homes and offices with automation features that address wellness and sustainability preferences from increasingly sophisticated end-users is also growing. This is where the Internet

Talal Debs, Co-Founder and CEO of Syncrow

of Things (IoT) plays a pivotal role by enabling real-time monitoring, automation, and data-driven decision-making, which helps improve efficiency, reduce operational costs, and enhance occupant experience.

Syncrow’s IoT solutions, like SyncOS, are designed to meet the demand for smarter infrastructure by offering scalable, cloud-based tools that transform traditional buildings into intelligent ecosystems.

Syncrow stands out for our ability to retrofit existing buildings with smart IoT technology, with no major structural changes required. This is crucial in a region where both new developments and legacy buildings coexist.

What makes Syncrow’s approach to IoT unique in the region?

Syncrow stands out for our ability to retrofit existing buildings with smart IoT technology, with no major structural changes required. This is crucial in a region where both new developments and legacy buildings coexist. Many operate with outdated infrastructure, systems, and technologies. These often don’t communicate with each other, creating siloed data that limits insight and control and reduces efficiency.

For many building owners and operators, the idea of replacing entire systems can seem overwhelming. We enable them to enhance their operations and bring their building management up to date without costly overhauls.

Our solutions are also designed with occupants in mind, prioritising air quality, thermal comfort, and overall environmental wellness to create healthier, more responsive spaces for the people who live and work in them.

Can you tell us more about SyncOS and how it supports smart construction?

SyncOS is our flagship cloudbased IoT platform that we officially launched in early July. It allows centralised control of multiple buildings, floors, or rooms via web or mobile. It replaces traditional Building Management Systems with a modern, scalable alternative that includes real-time insights and smart controls. It’s ideal for developers and property managers alike because it’s OEM-ready, allowing businesses to seamlessly integrate their existing apps and ecosystems using open APIs.

In which sectors are Syncrow’s solutions being adopted?

We serve a wide range of sectors

– from hospitality and healthcare to education, government, and residential real estate. The flexibility of our platform makes it suitable for virtually any kind of indoor environment, such as hotels, co-working spaces, mosques, shopping malls, and shortterm rentals. Our presence in both Dubai and Riyadh reflects the growing regional demand.

How does SyncOS make buildings more sustainable?

At its core, SyncOS is designed to optimise building performance through real-time monitoring and intelligent automation. It integrates with systems like HVAC, lighting, and energy meters to ensure that resources are used efficiently. For example, SyncOS can automatically dim lights or adjust cooling based on occupancy patterns, time of day, or external weather conditions, thus reducing unnecessary energy consumption without compromising comfort.

How are you contributing to sustainability initiatives in the region?

By enabling more efficient building management and energy consumption, we are valuable contributors to various government

initiatives, such as the UAE’s Green Agenda – 2030 and Saudi Arabia’s Vision 2030. These programmes emphasise the use of advanced technologies to promote energy efficiency and sustainable development.

His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, Deputy Prime Minister, Minister of Defence, and Chairman of The Executive Council of Dubai, recently approved a new smart building policy that aims to reduce energy and water consumption, lower operational costs, and enhance the quality of life for residents. Syncrow’s solutions are valuable in ensuring buildings comply with this directive, which sends a message that sustainability is no longer optional. Rather, it should now be central in how buildings are designed, managed, and evaluated.

How does SyncOS provide wellness benefits to end-users?

In a post-pandemic scenario, wellness has become an essential preference of both home and office end-users. As a result, features that address wellness benefits have become increasingly recognised as a critical component of building design and

operation, and SyncOS is engineered to support this priority at scale.

As a cloud-based IoT platform, SyncOS enables centralised, intelligent control over environmental systems that directly impact occupant health and comfort, such as HVAC, lighting, and air quality.

Through real-time data insights, SyncOS continuously monitors indoor conditions and provides actionable feedback. For example, it can detect poor air quality or temperature imbalances and automatically adjust systems to restore optimal conditions. This proactive approach helps maintain thermal comfort, reduce exposure to pollutants, and ensure consistent lighting – all of which contribute to better sleep, productivity, and overall wellbeing.

What are Syncrow’s plans for the future for the UAE smart city journey?

As the UAE pushes forward with smart city initiatives, Syncrow is committed to being a key enabler, delivering solutions that are both technologically advanced and human-centric. We aim to scale SyncOS across diverse property portfolios, from residential towers and commercial hubs to healthcare facilities and government buildings. Its cloud-based architecture and open API ecosystem make this feasible for both new and existing buildings.

We envision a future where every residential and commercial space is seamlessly connected and datadriven, giving rise to more sustainable and resilient communities

Aviation Annual Gala Evening & Innovation Awards Return During Dubai Airshow Week 2025

As anticipation builds for Dubai Airshow Week 2025, the Aviation Annual Gala Evening (AAGE) is confirmed to return on 19th November 2025, offering an evening of distinction aboard a luxurious 155ft mega yacht in Dubai Marina.

Now celebrating its 10th year, AAGE has become a cornerstone of the aviation calendar, providing a rare and refined networking environment for senior aviation leaders. With an invitation-only guest list, the event consistently attracts both regional and international dignitaries, solidifying its position as a premier industry gathering.

An exclusive luxury mega yacht event recognizing outstanding achievements and leadership in aviation, held alongside Dubai’s premier aerospace gathering excellence.

The evening’s program promises an unforgettable experience, beginning with an exclusive drinks reception and gala dinner, followed by an immersive night cruise showcasing the stunning Dubai Marina skyline, Palm Jumeirah, and Burj Al Arab. Live entertainment rounds out the evening, blending business and pleasure in a unique setting designed to foster meaningful connections.

A highlight of the event is the Aviation Innovation Awards, which recognize outstanding achievements across aviation technology, sustainability, operations, engineering, and leadership. Categories such as “Exceptional Product/Services Innovation” and “Sustainability Innovation” celebrate the trailblazers who are shaping the future of the industry and setting new standards for

The Aviation Annual Gala Evening is proudly organised by MEA Business in partnership with Creative Middle East Media, two leading media and events companies specialising in the aviation, business, and technology sectors. With extensive experience delivering high-profile industry events and awards, MEA Business and Creative Middle East Media bring unparalleled expertise in creating exclusive networking platforms that connect senior professionals, innovators, and decision-makers across the Middle East and beyond. Their combined commitment ensures that AAGE continues to be the go-to event for aviation’s most influential leaders.

More than just a gala, AAGE offers an exclusive platform where aviation leaders can showcase innovations, pursue strategic partnerships, and

celebrate collective successes. The event’s unique setting aboard a luxury mega yacht provides an inspiring backdrop for the connections and conversations that will shape the future of aviation.

For aviation professionals looking to be part of this prestigious evening, registration for attendance, table bookings, awards nominations, and sponsorship opportunities is now open. Join the region’s aviation elite for a night that promises to elevate your network and celebrate the industry’s finest

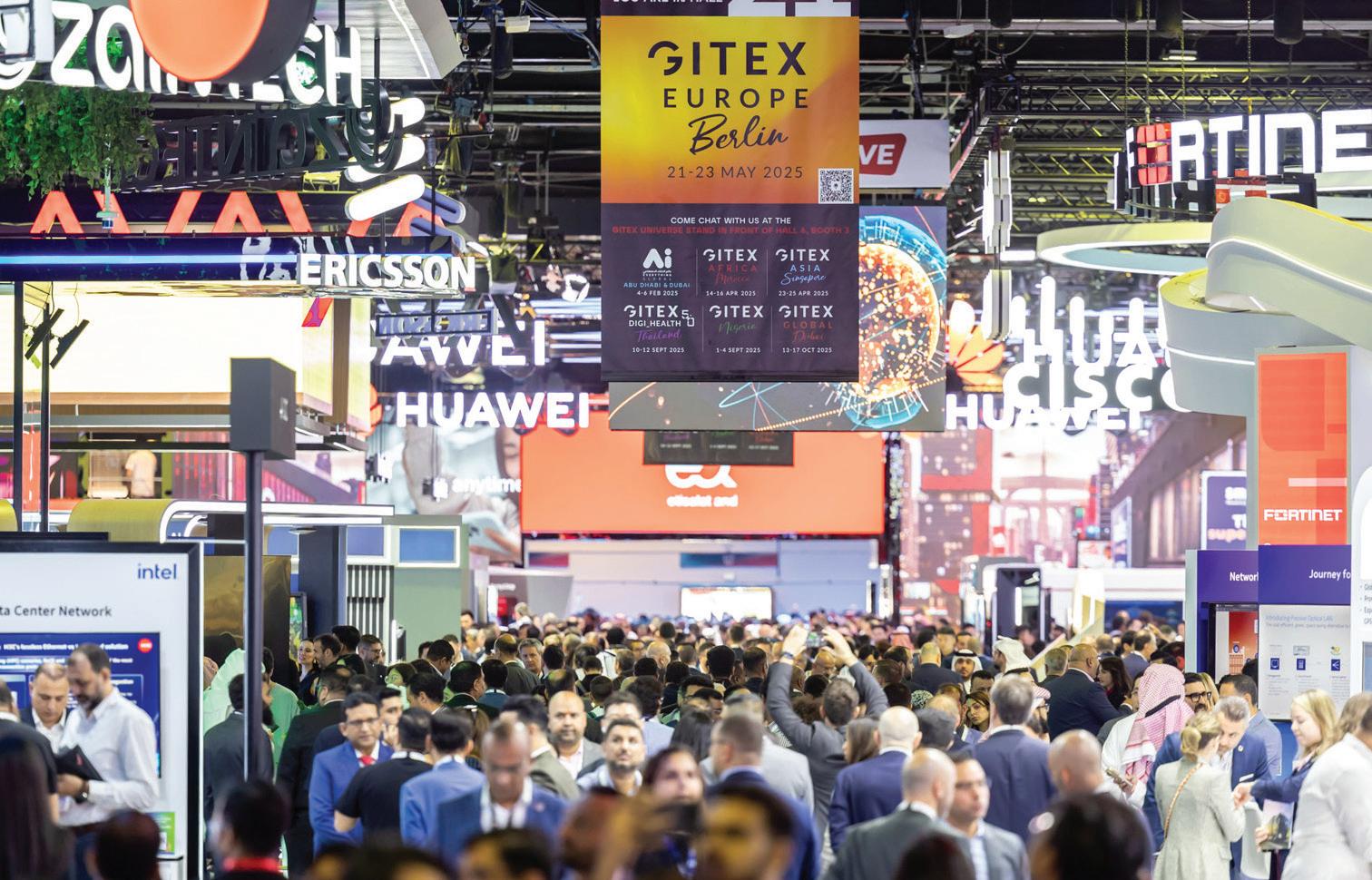

MEA Business Technology Achievement Awards 2025: Celebrating Innovation at GITEX

As the pace of technological change accelerates, groundbreaking innovations like artificial intelligence, cloud computing, and blockchain are reshaping the way businesses operate across the Middle East and Africa. The MEA Business Technology Achievement Awards, held during GITEX Technology Week, shine a spotlight on the visionary leaders and game-changing solutions

In today’s fast-moving digital era, technology is no longer just a support function — it has become the heartbeat of business innovation and growth. Across the Middle East and Africa (MEA), industries are being transformed by revolutionary technologies such as artificial intelligence (AI), cloud computing, blockchain, Internet of Things (IoT), and data analytics. These advancements are unlocking unprecedented opportunities, enabling companies to streamline operations, enhance customer experiences, and create new business models.

The MEA Business Technology Achievement Awards have emerged as a vital platform to recognise the trailblazers who are harnessing these cutting-edge technologies to redefine what’s possible. Scheduled to take place alongside the prestigious GITEX Technology Week in Dubai, these awards celebrate the innovation, leadership, and vision that are powering the digital transformation of the region.

For businesses in the MEA region, the rapid adoption of technologies like AI and cloud platforms is not just about staying competitive — it’s about survival and thriving in a landscape where agility and foresight are paramount. The Awards provide an opportunity to highlight the success stories of organisations and individuals who are making significant impacts, whether through pioneering new solutions, driving sustainable growth, or enabling seamless digital experiences.

Beyond the prestige of receiving an award, winners gain invaluable exposure to a global audience of technology buyers, investors, and industry peers. The Awards also amplify the winners’ voice through extensive media coverage, interviews, and digital promotions by MEA Business Magazine, helping them to build stronger brand recognition and open doors to new business opportunities.

As GITEX Technology Week continues to be a focal point for technology innovation and industry dialogue, the MEA Business Technology Achievement Awards serve as a powerful complement — celebrating the very people and projects that define the future of business in the region.

With nominations now open, technology companies, startups, consultancies, and government entities are encouraged to step forward and share their stories of transformation and innovation. The Awards not only recognise achievement but also inspire others to push boundaries and embrace the technological revolution sweeping through the MEA region.

In a world where technology changes at lightning speed, the MEA Business Technology Achievement Awards stand as a beacon of excellence, spotlighting those who dare to innovate and lead. As the region looks toward a future shaped by digital ingenuity, this event remains an essential part of the technology calendar

How Shariah Investing is Shaping the Next Generation of Wealth

Christophe Lalandre Senior Executive Officer at Lombard Odier Abu Dhabi Global Market Branch makes an emphatic case for the importance of awakening to the fact that Sharia Investment and Wealth Management is not a niche or specialist zone within the world of finance, but one that now demands day-to-day attention from investment managers

There is a quiet revolution reshaping the investment world. It is not driven by hype, speculation or the latest digital trend, but is being led by values –specifically, those embedded in Shariahcompliant finance.

While it still represents a modest share of global assets under management, Islamic finance is growing fast, and with intention. It is not just expanding across Sukuks, equities and ETFs. It is also finding alignment with something much bigger: a global movement toward sustainability, ethical investing, and long-term impact.

In this convergence, we see a glimpse of the future of wealth management.

Islamic finance is not playing catch-up, it is leading the way

Forecasts from S&P Global estimate Sukuk issuance could reach USD 200 billion in 20251, up sharply from USD 140 billion in 2025 2 . This is not a marginal uptick, but signals deep structural growth, driven by the GCC countries, Malaysia, Indonesia, and increasingly by investors who want their capital to serve more than short-term gain.

Major infrastructure developments in these countries, along with new industrial investments, are increasing financing requirements. The Sukuk market is well positioned to benefit and grow in response. New opportunities are also emerging in the Islamic finance market through sustainable investments and renewable energy projects. In 2021, ReNIKOLA Solar issued a USD 83 million green Sukuk to fund solar power in Malaysia1. This year, UAE-based Tabreed raised USD 700 million via a green Sukuk to finance sustainable cooling3

These are not just examples. They are proof that Islamic finance is already solving some of the biggest challenges facing economies today. It is capital in service of purpose. And the market is responding with appetite, not hesitation.

The next generation is not waiting If you want to know where the future of wealth is headed, ask the people inheriting it.

In a recent Lombard Odier survey of high-net-worth individuals across the Middle East, 67 percent said it was important for their investments to comply with Shariah principles4. Among investors

similarity. It represents a natural alignment of philosophies that view capital as a force for both prosperity and positive impact.

At Lombard Odier, we have been building on this alignment for over a decade. In 2012, we launched our first Shariah-compliant managed portfolios. Since then, we have developed a full suite of Islamic investment solutions, including discretionary mandates, a Shariah Global Equity Fund with ESG filters launched in partnership with SEDCO Capital, and a multi-asset Shariah Certificate.

1 S&P Global - Sukuk Market: Strong Performance Set

To Continue In 2025

2 S&P Global Sukuk Issuance

3 https://www.thebanker.com/content/219c2790-6a245dd8-ba65-02f9f4f2d723

4 Tabreed Successfully Issues USD 700 Million, Inaugural Green Sukuk

5 Middle East investor views| Lombard Odier

aged 18 to 40, that figure remains just as high. In fact, more than half of next-gen wealth in the region is already allocated to Shariah-compliant assets.

This is not a symbolic gesture. It is a redefinition of what wealth means and

In June 2025, we introduced the Lombard Odier Multi-Asset Balanced Fund, officially certified by Amanie Advisors. This actively managed strategy reflects our long-held conviction that performance and principle can and should go hand in hand. The fund seeks to balance growth with capital preservation, investing in a blend of Sukuks and Shariah-approved equities.

IF YOU WANT TO KNOW WHERE THE FUTURE OF WEALTH IS HEADED, ASK THE PEOPLE INHERITING IT

how it should be managed. Younger investors are not simply choosing faithaligned investing because it is expected of them. They are choosing it because it reflects who they are, what they believe and how they see the future.

This is a generation that will not separate profit from purpose. And the market must take note.

When values and value align

There is often a false divide in finance: purpose vs performance, ethics vs economics. But Shariah-compliant investing is rewriting that script. The principles that govern Islamic finance, such as stewardship, fairness, risk sharing and long-term thinking, mirror the values underpinning sustainable investing. This is not merely a point of

The opportunity ahead

Islamic finance is no longer a niche, and it is certainly not a compromise. It is a sophisticated, principle-driven framework for investing that aligns deeply with the moral and environmental concerns of a global investor base.

If wealth managers want to stay relevant, let alone lead, they must build more inclusive, value-aligned strategies. They must stop viewing Islamic finance as a specialised request and start recognising it as a blueprint for the broader shift we are seeing in finance. Because Shariah investing does not sit outside the mainstream. Increasingly, it is the mainstream, especially among the generation that will define the future of capital.

Christophe Lalandre, Senior Executive Officer, Lombard Odier Abu Dhabi Global Market Branch

Building Growth

C h ristiane El H ab re Regional Managing

Di rector – Mi ddle E ast, Ap ex Group L td., talking w ith MEABusiness about t he r egional reale s tate in vestment market, o u t li n e s t h e factors fuelling t hi s a sset class and highlight s t h e s e ctor s t h at are curr ently sho wing the most pr omising results

What are the leading two real estate sectors attracting the most investor attention today?

The current frontrunners are logistics/ industrial real estate and high-end residential properties. This trend is evident through both fund structuring and investor capital deployment.

Apex serves around US$280 Billion dollars in real estate structures globally, offering fully integrated services through accredited business processes. Over the last five years, real estate structures have represented a substantial portion

Christiane El Habre, Regional Managing Director – Middle East, Apex Group Ltd.

of Apex’s new funds launched in the GCC. We have seen a sharp uptick in development-focused vehicles tied to Vision 2030 mega projects in Saudi Arabia. In fact, over 40% of the new offshore property Special Purpose Vehicles (SPVs) set up through the Apex platform in the last couple of years have been tied to luxury and branded residences in Dubai.

Prime residential real estate in Dubai continues to attract international High Net Worth Individuals (HNWIs). In 2023, over 40% of offshore property investment vehicles focused on high-end Dubai assets, supported by a 28% rise in luxury home prices.

Additionally, fund managers have launched logistics-focused vehicles targeting last-mile warehousing near Riyadh, Jeddah and Dubai South, driven by the region’s e-commerce and ThirdParty Logistics (3PL) boom. The GCC logistics sector is forecast to reach USD 66 billion by 2026.

It is worth mentioning that Apex supports this demand by helping fund managers and real estate developers structure and administer cross-border vehicles tailored to logistics and

residential strategies—from SPVs and REITs to fully regulated real estate funds.

What real estate sector has the most promising long-term investment potential?

It is no secret that logistics, data centres /AI and industrial real estate’s stand out as a particularly durable opportunity. Recent trends indicate a significant influx of capital into logistics parks in NEOM and the Red Sea corridor. These developments are closely aligned with Saudi Arabia’s Vision 2030, which anticipates a 50% increase in warehousing demand by 2030. This growth is expected to be driven by trade, consumption and supply chain upgrades.

The logistics, Data Centres /AI and industrial sector offers a unique combination of yield stability, strong tenant demand and strategic alignment with national goals, making it an attractive option for long-term institutional capital. At Apex, we enable access to this sector by structuring REITs, Sharia-compliant platforms and regulated funds. These structures align with government-linked

IT IS NO SECRET THAT LOGISTICS, DATA CENTRES /AI AND INDUSTRIAL REAL ESTATE’S STAND OUT AS A PARTICULARLY DURABLE OPPORTUNITY

institutional and family office investor channels, we cannot help but notice several dynamics accelerating the momentum in GCC real estate.

Firstly, urban expansion is a significant driver. Dubai is projected to reach 5.8 million residents by 2040, and Saudi Arabia has already surpassed 36 million. This growth is driving sustained real estate demand in these regions.

Secondly, cross-border inflows are playing a crucial role. Investors from Europe, Asia and Africa continue to enter the market, with AED 634 billion (USD 172 billion dollars) in Dubai transactions just in 2023 alone. This influx of international capital is bolstering the market’s strength and potential.

THE NEXT WAVE OF INNOVATION IS SET TO INCLUDE ESG-LINKED REITS AND TOKENISED REAL ESTATE PLATFORMS, WHICH WILL FURTHER ENHANCE THE MARKET’S APPEAL AND SUSTAINABILITY

infrastructure and foreign investor mandates, providing a secure and strategic investment pathway.

What factors are adding heat to the regional real estate market?

As we continue to support the entire ecosystem, from international inflow structuring to fund administration, while ensuring regulatory compliance, risk controls and scalability across both

Mega-projects are also becoming increasingly attractive to funds. There is a noticeable shift toward developmentled investment, with projects, and Mega projects drawing significant interest and capital.

Lifestyle trends are yet another factor contributing to the market’s ongoing momentum. Family-friendly, highquality living formats, such as gated communities and branded residences,

are drawing significant capital and attention from investors.

Lastly, we must be aware of the speculation risks. In submarkets such as off-plan coastal properties, short-term speculation is on the rise, highlighting the need for robust oversight to mitigate potential risks.

What is the outlook for the regional REITs market?

The GCC REIT market, is entering a new phase of maturity and diversification, and we are witnessing growing participation from both retail and institutional investors, which is truly a clear testament to the market and its potential.

In Saudi Arabia and the UAE, new REITs are emerging in various sectors such as logistics, healthcare and community retail. The region’s REIT capitalisation has now exceeded an impressive multibillions USD value, with average yields ranging from 5% to 7%, continuing to attract income-seeking investors.

Saudi Arabia is leading this evolution, boasting 17 listed REITs and expanded access for foreign investors. The next wave of innovation is set to include ESGlinked REITs and tokenised real estate platforms, which will further enhance the market’s appeal and sustainability.

At Apex, we are well-positioned to support this growth. Servicing already the majority of the listed REITS, we also offer end-to-end services, including fund formation, digital custody, ESG reporting, investor onboarding and cross-border administration. Our comprehensive solutions help REIT sponsors scale efficiently while also staying ahead of regulatory developments.

Putting the AI in Sustainability

AI can provide banks with new opportunities to work through the challenges of transitioning to sustainable, low carbon economies, and help them make more measurably beneficial lending decisions

From Wall Street to Tokyo, global banks have been quitting what had been one of the most popular clubs inside the global finance en masse.

The Net-Zero Banking Alliance (NZBA), a group dedicated to helping lenders reduce their carbon footprints, has in quick succession been abandoned by Goldman Sachs, Citigroup, Bank of Montreal, Royal Bank of Canada, Mitsubishi UFJ Financial Group, Mizuho and Macquarie Bank.

Banks that sign up to NZBA are still committed to transitioning their financed emissions to align with “pathways to net zero by 2050” at the latest. The alliance counts the UAE’s First Abu Dhabi Bank

(FAB), Egypt’s Commercial International Bank, Oman’s Bank Nizwa and Bahrain’s Gulf International Bank among its members from the Middle East.

Financial institutions hold a pivotal position, not only by channelling funds towards developing nations but also by serving as a significant driving force behind climate and clean energy initiatives in the Global South.

Trillions of dollars in financing are needed to mitigate global warming and adapt to climate risks. However, a 2023 Corporate Sustainability Assessment by S&P Global found that only one-fifth of financial institutions in the survey have pinpointed concrete business opportunities tied to climate change.

Navigating transition risks presents a heightened challenge for banks. Financial institutions could see their earnings decline, businesses disrupted and funding costs increase due to policy action, technological changes, as well as consumer and investor demands for alignment with sustainability policies.

“When it comes to transition risks, banks have an even more challenging job on their hands,” EY said, adding that banks’ Chief Risk Officers need to assess multiple industries that they finance and consider how their financing needs will evolve as they transition to a zerocarbon economy.

Meanwhile, the United Nations Climate Change Conference (COP29), held in Baku, Azerbaijan, concluded with a historic deal on climate finance. Nearly 200 countries agreed to triple the amount of money available to help developing countries confront rapidly warming temperatures.

The Middle East faces significant climate challenges, including desertification, biodiversity loss, drought and water scarcity. However, GCC states are undergoing massive economic transformation programs to put their

economies on a more diversified and sustainable footing.

Unlocking the potential

Climate finance has emerged as one of the most promising frontiers for the global banking sector as economies transition toward a greener and more sustainable future. With growing regulatory pressure, rising investor awareness and increasing demand for sustainable solutions, climate finance is fast becoming a mainstream growth engine.

The funding required for the energy transition, climate adaptation and disaster relief presents a formidable challenge. However, GCC states are proactively undertaking initiatives across several industries, including the financial services sector and the sustainable finance space, to establish mechanisms to channel private capital towards essential infrastructure investments and the achievement of net-zero emissions goals.

The $1.2 trillion in private sector capital that is required for nature investment reflects the amount needed for 14 different levers.

“Banks have two primary mechanisms through which they can play a role in the deployment of these nature-positive levers: investment management (including venture capital, private equity and asset management) and capital markets and lending,” according to a BCG report.

Green finance presents a substantial and largely untapped opportunity for Middle Eastern nations, particularly the Gulf states, which possess wellestablished capital markets. Strategy& analysts forecast that green investments will unlock as much as $2 trillion in cumulative GDP contribution in the GCC.

Sustainable financing has seen considerable evolution in the GCC region, driven by both governmental initiatives and private sector involvement. Over the years, GCC states, including Oman and Saudi Arabia, have introduced green financing frameworks. The frameworks facilitate the issuance of

financial instruments like green, social and sustainability bonds, as well as loans and sukuk to fund environmentally friendly projects.

“Sustainable finance can provide crucial leverage and support for the growth of these thematic areas, as they directly contribute to economic diversification across GCC countries,” said KPMG.

Similarly, many of the region’s core corporate entities continue to pivot toward sustainability. The Public Investment Fund, Alinma Bank, Emirates Global Aluminium, Dubai Islamic Bank, Bank Dhofar and Nama Electricity Distribution Company have laid out plans for raising green debt to fund environmentally friendly initiatives.

For banks operating in the GCC, there’s a growing expectation to actively support sustainable development by offering green debt and sustainable finance solutions. The UAE’s financial sector pledged to mobilise $270 billion (AED 1 trillion) in sustainable finance by 2030.

The Bahrain Association of Banks also established a permanent sustainable development committee back in 2018 to “strengthen the role of banks and their contribution to sustainable development and economic growth.

“GCC banks are trying to advance their relatively nascent sustainability programs by increasing their sustainable finance offerings to customers and contributing to government efforts to decarbonise local economies,” said S&P Global.

GCC banks are playing a crucial role in the region’s decarbonisation efforts by funding both public and private sector investments aimed at achieving net-zero emissions. While the transition of carbon-intensive industries presents significant opportunities for high-impact ESG investments across the region, advancing the global effort to combat climate change remains its primary rationale.

Transitioning risks

The financial services sector finds itself at a critical crossroads as the global economy pivots toward sustainability. Banks, often

perceived as insulated intermediaries, are increasingly exposed to climate transition risks – those arising from the global shift to a low-carbon economy.

EY said that risk managers at banks are unequivocal – climate change is the biggest emerging risk they face and boards of directors concur. With extreme weather events persisting globally and governments worldwide transitioning towards lower-carbon economies, the banking industry is actively pursuing two interconnected goals.

Concurrently, banks are not only analysing how climate change will reshape their own strategies and operations but are also striving to guide customers and communities through the complex and rapidly evolving market landscape.

The UAE central bank said climate risks can affect banks in several ways, including through their loan books (credit risk channel), their financial asset portfolios (market risk channel) and their liquidity positions and funding costs (liquidity risk channel).

Navigating transition risks presents an even greater challenge for banks. Policy actions, technological shifts, and increasing demands from consumers and investors for alignment with sustainability policies could lead to decreased earnings, business disruptions and higher funding costs for financial institutions.

“Climate transition risks can increase banks’ credit risk and losses. This is especially the case if banks are exposed to high-emitting industries and borrowers that are most vulnerable to the climate transition,” said S&P Global.

“Exposure to these high-emitting industries could also damage banks’ reputation, deprive them of access to some funding sources and increase funding costs.”

Meanwhile, the transition from fossil fuels as a primary source of energy is projected to pose significant challenges to the business models of some companies. The speed and smoothness of this transition will determine if and how

investors adjust their expectations for these firms’ future profitability – which could trigger a sudden and significant repricing of certain financial assets.

Financial institutions such as banks that are currently involved in financing these firms could be significantly impacted by such sudden reassessments. Bank of Canada said that the financial distress in one entity can spread to others, given the interconnectedness in the financial system.

However, within this risk lies an opportunity. Forward-looking banks in the GCC region are repositioning themselves by reallocating capital towards green technologies, renewable energy and sustainable infrastructure. The development of sustainable finance products – green bonds, transition loans and ESG-linked derivatives – is opening new revenue streams.

“The continued growth of environmental, social and governance (ESG) investing offers critical opportunities for banks to accelerate the decarbonisation of economic activity in the GCC,” said McKinsey.

For the Gulf region, climate transition is not a distant storm – it’s already at the door. How financial institutions respond today will define the industry’s viability tomorrow. Banks that adapt swiftly will not only shield themselves from systemic shocks but also lead the financing of a more sustainable, resilient economy.

AI in sustainable finance

Sustainable finance is no longer a niche concept but a mainstream imperative and artificial intelligence (AI) is emerging as a crucial catalyst in accelerating its adoption and impact.

For years, sustainable finance has been hampered by a lack of reliable, standardised data. ESG reporting has been inconsistent, making it difficult for investors to assess the sustainability performance of companies accurately, and this is where AI steps in.

“Developments in AI and machine learning are accelerating the creation

of a new type of ESG data providers that analyse and collect large amounts of unstructured data from different internet sources, using AI and without necessarily relying on information provided by companies,” according to Amundi.

AI tools can scrape, sort and synthesise data from sustainability reports, news articles, regulatory filings and even social media, allowing asset managers and institutions to generate real-time ESG insights with greater accuracy and depth than ever before.

KPMG said AI algorithms use vast amounts of data to identify trends, optimise portfolios, make investment decisions and assess risk more accurately, empowering investors to make well-informed decisions.

generate measurable environmental or social benefits in addition to financial returns.

On the susta inable lendi ng front, AI models help banks evaluate green project proposals by analysing their carbon footprint, energy efficiency and compliance with environmental standards. The datadriven insights not only speed up the due diligence process but ensure that financing f l ows to truly sustainab l e initiatives, minimising the risk of greenwashing. AI based analytics provide banks with the chance to weigh-up their portfolios environmental impact and so make sustainable lending decisions.

From empowering investors with actionable ESG insights to ensuring capital flows to projects that demonstrate

GCC BANKS ARE TRYING TO ADVANCE THEIR RELATIVELY NASCENT SUSTAINABILITY PROGRAMS BY INCREASING THEIR SUSTAINABLE FINANCE OFFERINGS TO CUSTOMERS AND CONTRIBUTING TO GOVERNMENT EFFORTS TO DECARBONISE LOCAL ECONOMIES

– S&P Global

AI enhances risk assessment by identifying hidden ESG-related risks that might otherwise be overlooked. The transformative technology empowers investors to reallocate capital more responsibly, avoiding companies with weak sustainability profiles and supporting those driving positive change.

“By analysing vast amounts of data from diverse sources, including satellite imagery, social media, and financial reports, AI algorithms can assess companies’ sustainability performance and anticipate potential risks associated with environmental and social factors,” said KPMG.

AI facilitates impact investing by identifying investment opportunities that

compliance with the transition to a lowcarbon and climate-resilient economy, AI is fast becoming the backbone of a more intelligent, impactful financial ecosystem. With the right safeguards, the transformative technology could be the key to bridging the gap between ambition and action in the global sustainability agenda.

GCC countries are capitalising on the growing demand for sustainable finance as a key driver of economic diversification and their transition toward net-zero goals. The region’s focus on green investments is projected to contribute up to $2 trillion to regional GDP by 2030, primarily through sectors such as renewable energy and sustainable infrastructure and create over one million jobs.

We provide the reach, resiliency, security and innovation you need to compete in the world of digital payments

Connectivity

Scale globally and accept payments across channels and devices with over 200 acquirer connections

Flexibility

Exceed customer needs with a dynamic suite of services, partners and solutions

Security

Protect all players from fraud and risk with advanced technology and built-in compliance

With the right connections, anything is possible

mastercard.com/gateway

Innovation

Futureproof your business and lead the competition in an always evolving market

Partner in Progress

As part of the MEA Finance Leadership Video Series, Hazem Mulhim Founder and CEO of Eastnets highlights increased threats of financial crime, the expanding regulatory environment and the role that Eastnets has and continues to play in partnering with banks to keep them safe and compliant

From your perspective, how do you see the current trade tariffs disruption impacting your sector?

From a technology perspective, it will impact everything related to data centres, cloud computing and AI. If we look at the materials that are used in data centres and for AI, all are imported from China, whether rare earth metals, chips or even servers themselves. Even with the waiver for technology, you can imagine the uncertainty, confusion and disruption going to happen in the industry, whether there are tariffs or no tariffs.

If we look at industry in general, supply chains will be disrupted. This is going be an opportunity for illicit money to flow because they’re going to use all these

Hazem Mulhim, Founder and CEO, Eastnets

loopholes in this mayhem for underinvoicing and over-invoicing. They’re even going to be evading taxes or changing their sources.

We’re going to see huge impact, not only from the industry point of view but also with the illicit money that’s going to be flowing thanks to the mayhem taking place in trade.

How do you see trade-based risk and financial crime evolving in the GCC over the next three to five years?

The GCC is part of the global financial industry and is trying to meet all regulatory requirements, be them the FATF requirements, or to be whitelisted as meeting all the requirements for combating financial terrorism.

This part of the world, as others, depends on two pillars that are very important for the economy. One of them is trade and the other, remittances. In the UAE we are witnessing a huge inflow of the investments now taking place in addition to the outflow.

All banks in this part of the world are working very hard to be part of the global financial industry, either in meeting the regulatory requirements or upgrading with the technological necessities to meet all the necessary requirements, not only regionally, but also globally. For example, if they are dealing with European banks, they have to be DORA-compliant since there are many fintechs here dealing with banks that are outside or with third parties. So, this is one part of it.

The UAE and Saudi Arabia have been ahead in this. They are continuously implementing digital transformations and are on par with global entities in meeting the regulations and combating financial

terrorism, whether FATF requirements or being compliant in combating money laundering.

Traditional compliance tools are no longer enough in today’s environment. So how is Eastnets helping banks evolve their approach to financial crime detection?

Looking at financial crime globally, there is nearly two trillion dollars of illicit money going around the world, representing 2% of the global GDP according to the United Nations. This illicit money comes from organised crime, and is growing. At Eastnets, our purpose as a company is to help banks and communities enjoy a better, secure and safer world. And of course, in order to be part of this safe and secure world, we have to work in our core competencies which is offering financial tools to the banks to combat financial terrorism, combat money laundering and fraudulent activities.

Eastnets has been developing bestin-industry products and been ranked by analysts as leaders in the industry, with the products we develop not only for meeting the latest technological requirements, but also for our continuous enhancements. As a result we can reduce false positives, we have better tools in predictive analytics and better tools in machine learning. We can help bankers to trace any anomalies taking place in their operations and become highly compliant, so they can help their communities be vigilant against illicit money, either locally or as part of the global combating of financial terrorism.

Nowadays Eastnets has been developing products with AI, and of course with the AI tools that we have,

AT

EASTNETS, OUR PURPOSE AS A COMPANY IS TO HELP BANKS AND COMMUNITIES ENJOY A BETTER, SECURE AND SAFER WORLD

we are working very hard to reduce false positives so bankers can focus on other offerings of their banks, to their customers and the communities that they work in.

AI and Machine Learning are becoming essential. Can you share how Eastnets is using these technologies to stay ahead of increasingly sophisticated financial crime?

Traditional rules based ways of combating financial terrorism are no longer sufficient, as criminals use more sophisticated tools. Bankers must meet all these challenges they are facing from the criminal organisations, but remain compliant too.

The requirements are huge and Eastnets can help banks meet these requirements. For example, when we talk about instant payments taking place between this part of the world and Europe, they require that banks should be able to transfer money between parties within 10 seconds. Of course, in order to send this money, the bank has to have tools to combat any fraudulent activity. Recently there have been huge fraudulent activities taking place on instant payments in Europe, many in the UK. So, this is where we have developed tools to help the banks use machine learning so we can immediately combat any fraudulent activity that happens either online or through phishing emails, etc.

This is one part of how we can combat fraudulent activity and use the latest tools in machine learning. On the other hand, in AI, whatever the requirement, whether in sanctions training, to help reduce false positives and/or in money laundering, we can help the banks in predictive analytics so they can tell if a transaction is normal or abnormal. With this the bank can continually look at whatever is taking place in real time.

Additionally, the tools that we have recently developed and are now using, help banks know who the ultimate beneficiary owners are, so you know