Sewerage District of Buncombe

AnnualComprehensiveFinancialReport FiscalYearEndedJune30,2022

Metropolitan

County, North Carolina

PRINCIPAL OFFICIALS

BoardMember

M.JerryVeHaun,Chairman

E.GlennKelly,Vice-Chairman

Representativeof

TownofWoodfin

TownofBiltmoreForest

JackieW.Bryson,Secretary/Treasurer WoodfinSanitaryWater&SewerDistrict

MattAshley.Jr. TownofMontreat

SheilaFranklin

HendersonCounty

WilliamG.Lapsley HendersonCounty

EstherManheimer CityofAsheville

ChrisPelly CityofAsheville

NathanPennington BuncombeCounty

RobertPressley BuncombeCounty

EarlValois TownofWeaverville

RobertC.Watts TownofBlackMountain

AlWhitesides BuncombeCounty

GwenWisler CityofAsheville

PreparedBy:FinancialServicesDepartment

W.ScottPowell,CLGFO,DirectorofFinance CherylS.Rice,Accounting Manager

JodyGermaine,BudgetAnalyst

Annual Comprehensive Financial Report for the Fiscal Year Ended June 30, 2022

Legal Counsel Engineer of Record Roberts&Stevens,P.A. McGillAssociates,P.A. General Manager Director of Finance ThomasE.Hartye,P.E. W.ScottPowell,CLGFO

ReportofIndependentAuditor Management’sDiscussionandAnalysis BasicFinancialStatements StatementofNetPosition StatementofRevenues,Expenses,andChangesinNetPosition StatementofCashFlows NotestoBasicFinancialStatements RequiredSupplementalInformation LocalGovernmentEmployees’RetirementSystem–Scheduleofthe District’sProportionateShareoftheNetPensionLiability(Asset) LocalGovernmentEmployees’RetirementSystem–Scheduleof DistrictContributions ScheduleofChangesintheTotalOPEBLiabilityandRelatedRatios SupplementalFinancialData ComparativeStatementofNetPosition ComparativeStatementofRevenues,Expenses,andChangesin NetPosition ScheduleofRevenuesandExpenditures–BudgettoActual(Non-GAAP) CombiningScheduleofNetPosition,AllFunds(Non-GAAP) CombiningScheduleofRevenues,Expenses,andChangesin NetPosition,AllFunds–(Non-GAAP) LetterofTransmittal CertificateofAchievementfor ExcellenceinFinancingReporting(GFOA) MapofDistrictBoundary PrincipalOfficials OrganizationalChart Table of Contents 1-12 13 14 15 16 17-19 21-30 31 32 33 35-70 71 72 73 75 76 77-78 79-82 83-84 Financial Section

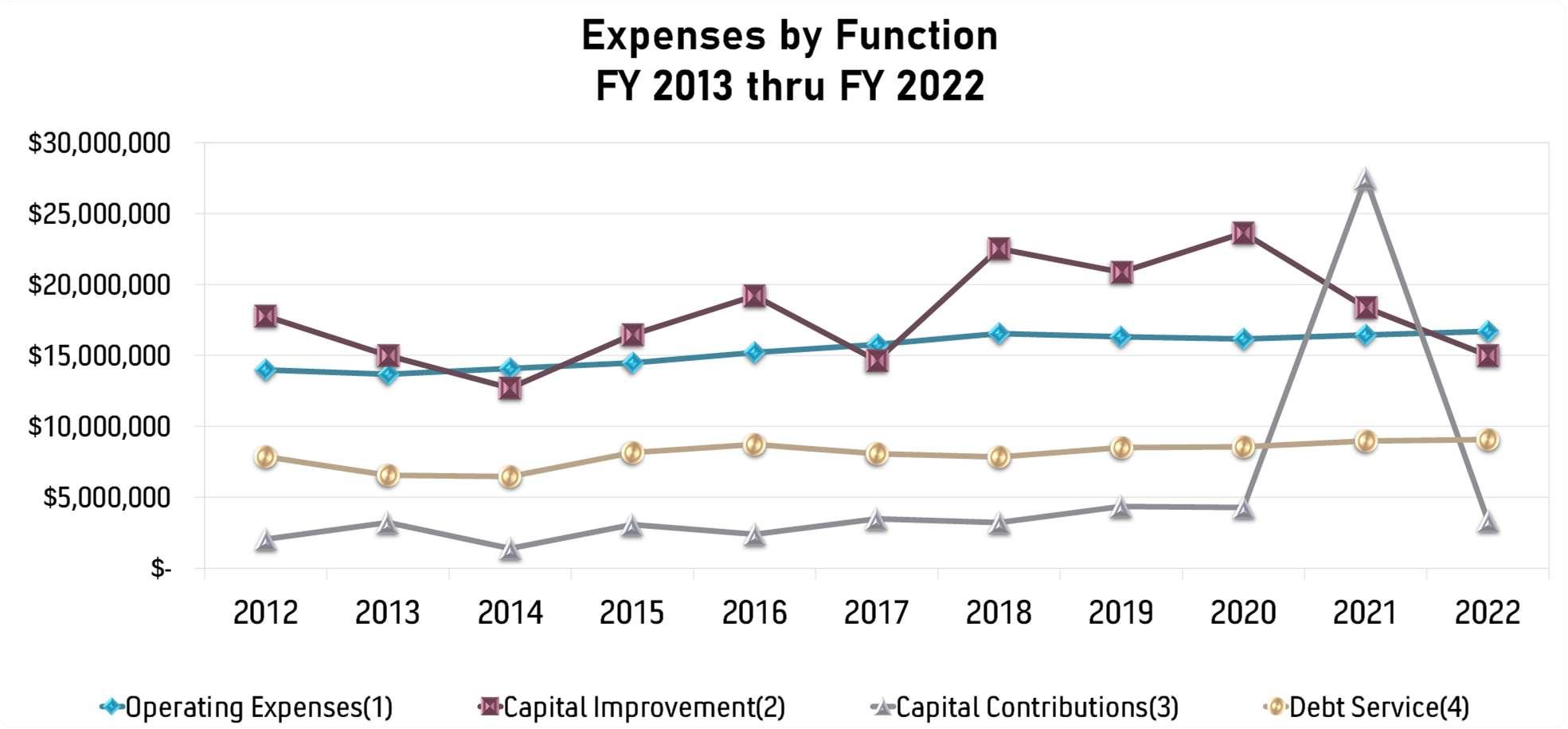

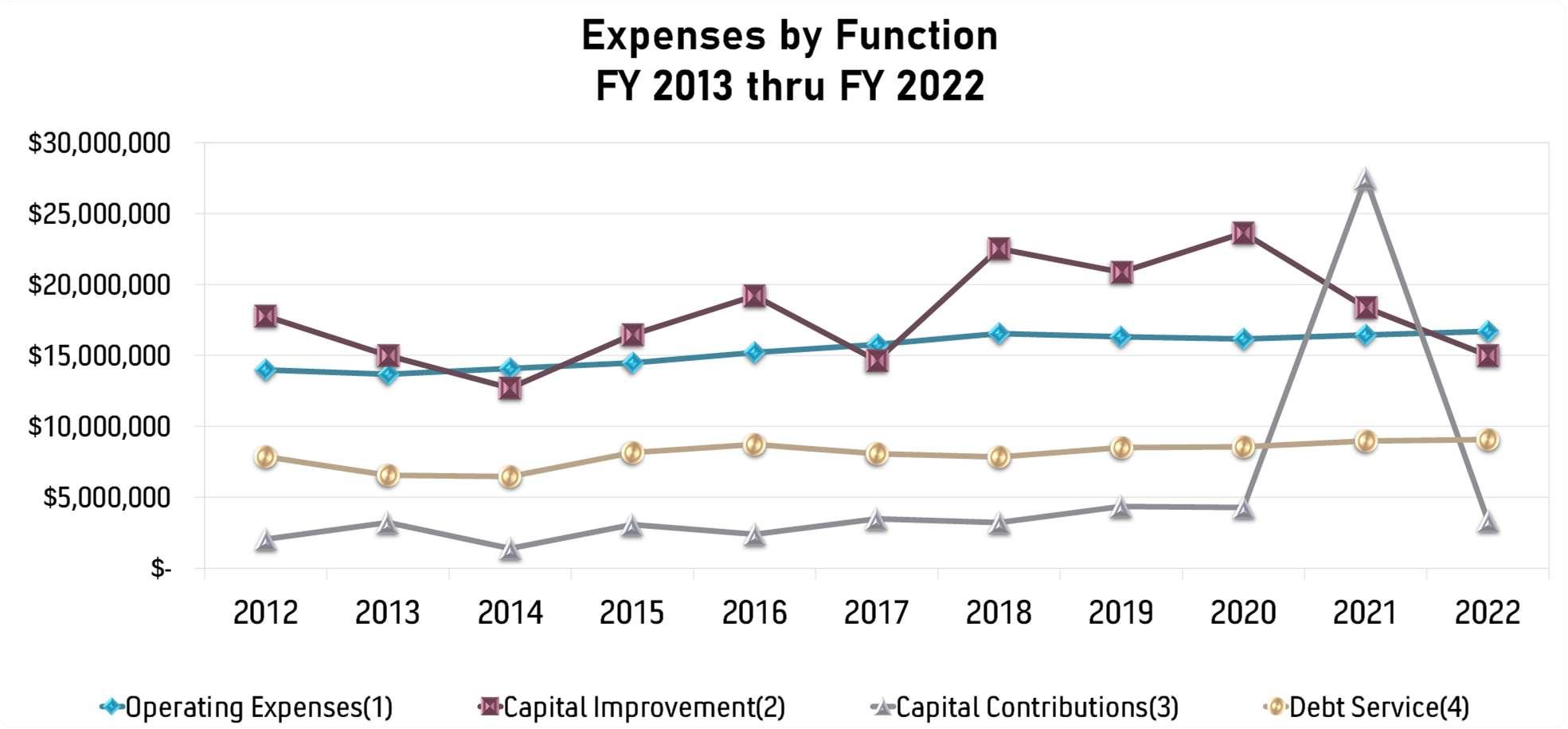

ReportofIndependentAuditoronInternalControloverFinancial ReportingandonComplianceandotherMattersBased onanAuditofFinancialStatementsPerformedin AccordancewithGovernmentAuditingStandards Introduction NetPositionbyComponent ChangesinNetPosition(AccrualBasisofAccounting) GeneralRevenuesbySource ExpensesbyFunction(Non-GAAP) SewerChargeRevenuebyCustomerType CustomerAccountsbyMemberAgency ResidentialSewerRates PrincipalCommercialUsers RatioofOutstandingDebt RevenueBondCoverage Demographic&EconomicStatistics PersonalIncomebyIndustry PrincipalEmployers StaffingHistory(FTE’s) OperatingIndicatorsbyDivision Table of Contents 86-87 88 89 90 91 92 93 94 95 96 97-98 99 100 101 102 103 104-105 Compliance Section Statistical Section

Thispageintentionallyleftblank.

Introduction

MetropolitanSewerageDistrict OFBUNCOMBE

COUNTY,NORTHCAROLINA

October27, 2022

To the Metropolitan Sewerage District of Buncombe County, North Carolina Board of Directors, Bondholders, and Customers

We are pleased to present the Annual Comprehensive Financial Report of the Metropolitan Sewerage District of Buncombe County, North Carolina (MSD or District) for the Fiscal Year ended June 30, 2022. State law requires local governments to publish within five months of the close of each fiscal year a complete set of financial statements presented in conformity with accounting principles generally accepted in the United States of America (GAAP) and audited in accordance with auditing standards generally accepted in the United States of America by a firm of licensed certified public accountants. MSD’s Bond Order requires release of such audited financial statements within seven months of the close of the fiscal year. This Annual Report presents MSD’s financial statements and adds this transmittal letter and statistical data to assist the reader in analyzing ourfinancialstatements.

The report consists of management’s representations concerning the finances of the District. Consequently, management assumes full responsibility for the completeness and reliability of all the information presented in this report. To provide a reasonable basis for making these representations, MSD’s management established an internal control framework designed both to protect the District’s assets from loss, theft, or misuse and to compile sufficient reliable information for the preparation of financialstatementsinconformitywithGAAP.Becausethecostofinternalcontrolsshouldnotoutweigh their benefits, MSD’s framework of internal controls has been designed to provide reasonable rather than absolute assurance that the financial statements will be free from material misstatement. As management, we assert that, to the best of our knowledge and belief, this financial report is complete and reliable in all material respects.

CherryBekaertLLP,afirmoflicensedcertifiedpublicaccountants,hasauditedthefinancialstatements. The goal of the independent audit was to provide reasonable but not absolute assurance that MSD’s financial statements forthe Fiscal YearendedJune 30, 2022, are free of material misstatement.

1

The independent audit involved examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements; assessing the accounting principles used and significant estimates madeby management; and evaluating the overall financial statement presentation.

The independent auditor concluded, based upon the audit, that there was a reasonable basis for rendering an unmodified opinion that MSD’s financial statements for the Fiscal Year ended June 30, 2022, are fairly presented in conformity with GAAP. The report of the independent auditor is presented as the first component ofthefinancial section of this report.

Accounting standard (GASB No. 34) requires that management provide a narrative introduction, overview, and analysis to accompany the basic financial statements in the form of Management’s DiscussionandAnalysis(MD&A). Thisletterof transmittalisdesignedtocomplementthe MD&A, which is placed immediately following the report of the independent auditors and should be read in conjunctionwithit.

Accounting standard (GASB No. 44) calls for revised statistical reports designed to increase assistance to the reader in assessing the financial situation and condition of the District. Readers may note some changesinreportformatsfromprioryears.Inaddition,newschedulesforwhichthereisnoinformation prior to implementation of GASB No. 34 may have less than the otherwise required ten years of comparativedata.

Financial trend information is presented to assist readers in understanding and assessing how a government’s financial position has changed over time. Revenue capacity information is intended to assist users in understanding and assessing the factors affecting a government’s ability to generate revenues.

Debt capacity information is designed to assist users in understanding and assessing a government’s debtburdenanditsabilitytoissueadditionaldebt.Demographicandeconomicinformationisintended to assist users in understanding the socioeconomic environment within which a government operates and provide information that facilitates comparisons of financial statement information over time and among governments.

Operating information should provide contextual information about a government’s operations and resources to assist readers in using financial statement information to understand and assess a government’s economic condition.

2

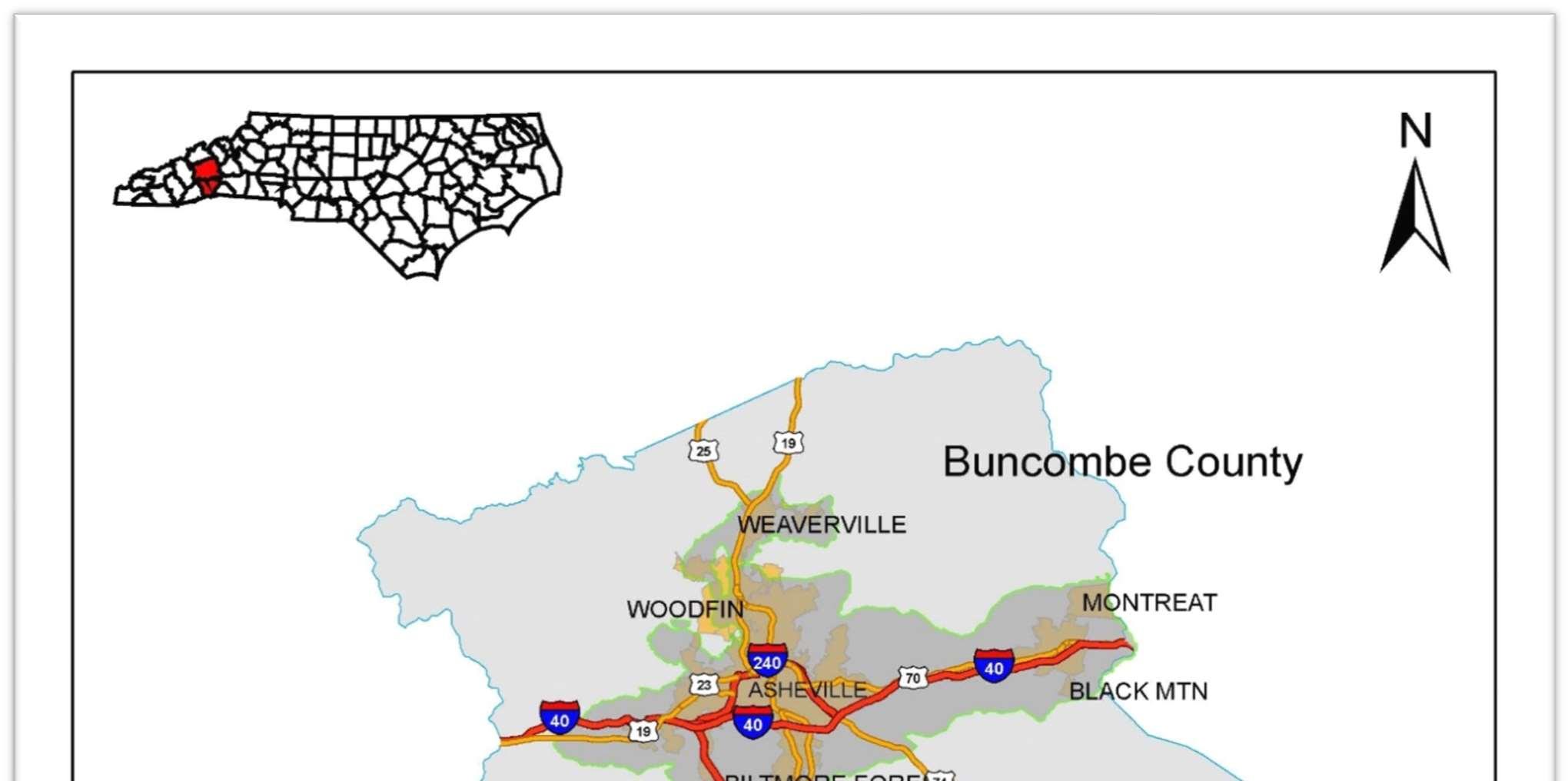

Profile of the District A. Overview

The District was createdby thestate of NorthCarolinain 1962 to provide awastewater treatment plant serving the City of Asheville and surrounding communities, including Biltmore Forest, Weaverville, Black Mountain, Montreat, Woodfin, the Woodfin Sanitary Water & Sewer District, and certain other unincorporated areas of Buncombe County. Through separate contractual arrangements, the District also serves customers in the Cane Creek Water and Sewer District in northern HendersonCountyandin theAveryCreek SanitarySewerDistrictinsouthernBuncombe County. The collection system has been extended over the years as a result of expansion and development,andnowcollectswastewaterthroughapproximately1,140milesofsewerlinewith 33,890 manholes and serves approximately 58,900 residential and commercial customers and over 20 significant industries.

The wastewater treated by the District is gathered in the collector sewer systems located primarily within the boundaries of the municipalities and other political subdivisions comprising the District and conveyed to the wastewater treatment plant through large sewer lines called interceptors that generally run parallel to the French Broad River, the Swannanoa River or one of their primaryandsecondarytributaries.Included inthesystemareremotepumpingstationsthat pumpwastewater throughforce mains where gravity flow is not feasible.

With theSewerConsolidation,which wassignedin1990,theDistrict agreedtotakepossessionof andtooperate,maintain,andrepairorreplace,asnecessary,thevariouscollectorsewersystems, which were simultaneously deeded to MSD by these same political subdivisions. Many of the collector sewer systems were undersized, deteriorated, and inadequately maintained. Since taking over the sewer systems, the District has developed and implemented, with input from its member political subdivisions, an ongoing Capital Improvement Program (the “CIP”). Approximately1,353,000linearfeetofexistingsewerlinehavebeenreplacedsinceconsolidation, representingover25.8%of the entire collection system.

In addition,theDistrict expects toreplace approximately194,000feetof existingsewerlinesover the next five years. The District also has an aggressive program in effect for systematic preventative maintenance of collector sewers. The lines are first cleaned using water under high pressure and then are videotaped. The cleaning reduces line blockages and overflows, and the videotapes enable the District to locate and repair problems in the lines. The District cleans and inspects by videotapingbetween 15% and 20% of its system eachyear.

3

The District also owns, operates, and maintains a 40 million gallon per day (MGD) wastewater treatment plant to treat raw sewage and industrial wastewater as well as a hydroelectric facility, which is used to generate power for the wastewater treatment plant, which helps defray utility costs for theoperation.

Memberagencies providing water service include the sewerfees on their water bills and provide customer service and collection services tothe District for a negotiated fee.However, the District direct bills about 500 customers, predominantly local industries, and private residences served by wells, yetconnectedto the sewer system.

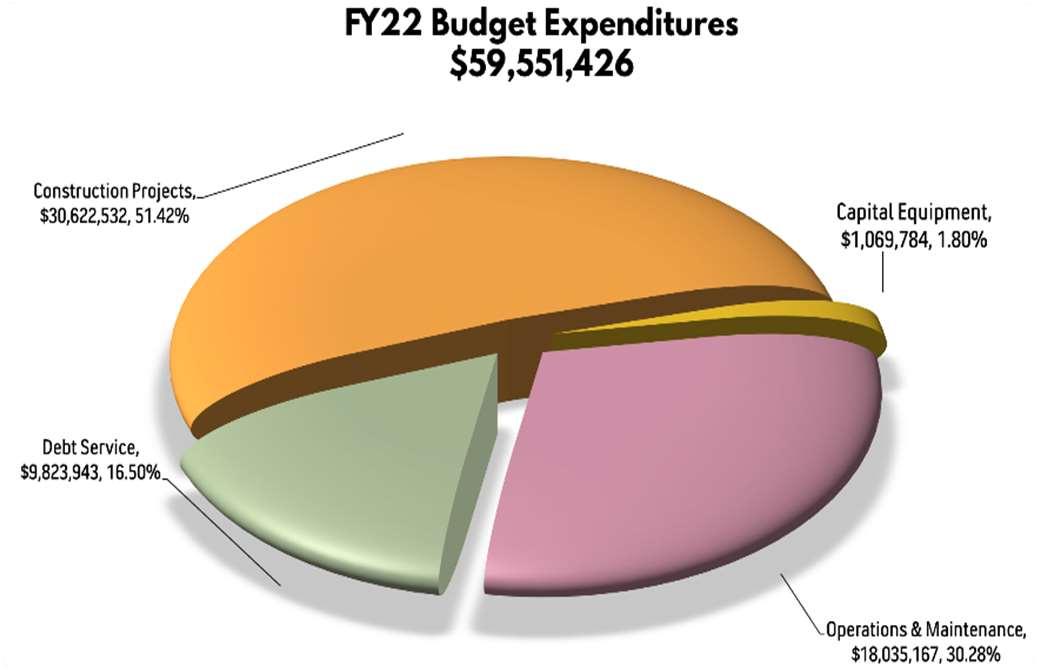

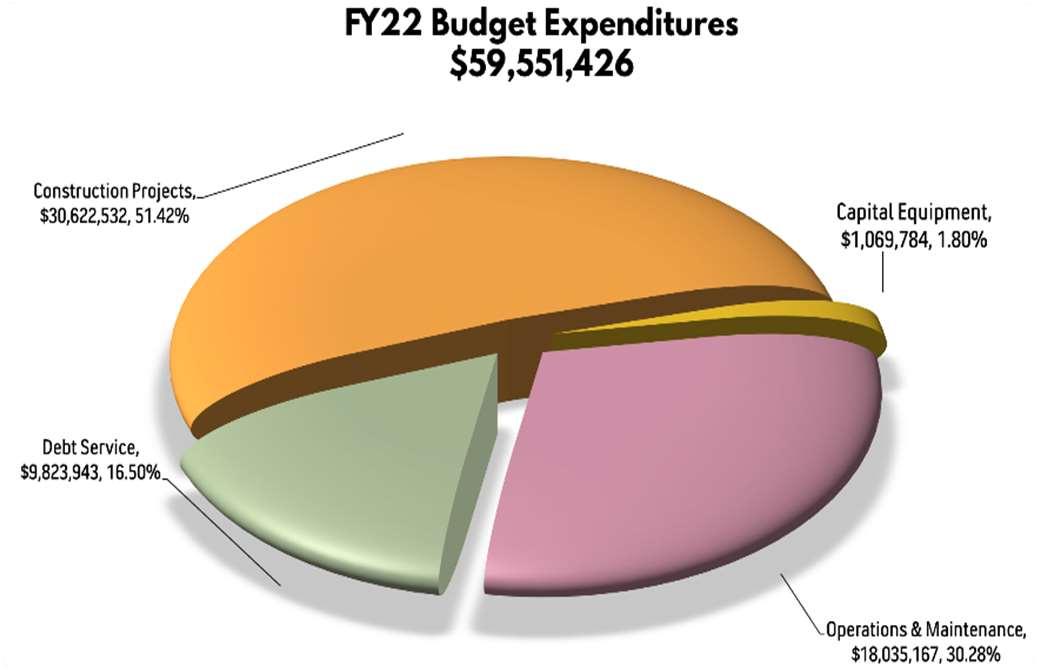

B. Budget

The annual budget serves as the foundation for the District’s financial planning and control. The Bond Orderrequiresthat theDistrict adoptitsfinalbudgeton or beforeJune 15of each year after a preliminary budget hearing no more than 30 days prior to adoption. North Carolina General Statutescallforanannualbalancedbudgetordinancebaseduponexpectedrevenues,alongwith abudgetmessage,tobepresentedtothegoverningboardnolaterthanJune1.Duringthespring, District departmental staff work with the Board’s Finance and Personnel Committees to develop an operational budget by function (administration, system services, plant operation, etc.), and District engineers work with the Board’s Planning and Capital Improvement Plan Committees on a capital budget.

After the Board approves the budget, it is administered by Department heads who may make transfers of appropriations within a department and by the General Manager who may make transfersbetweendepartments.BudgettoactualcomparisonsoffinancialdatafortheFiscalYear ended June 30, 2022 are in the supplemental information following the notes to the financial statements.

4

Factors Affecting Financial Condition

Theinformationpresentedinthefinancialstatementsisperhapsbestunderstoodwhenitisconsidered fromthebroader perspective of the specific environment within which the District operates.

A. Local Economy

The Asheville-Buncombe County area in which the District is located possesses a combination of characteristics thathelp protect itin thecurrenteconomicclimate.They consist ofa re-emerging more technologically advanced industrial base, a strong tourism position, concentrated healthcare employment, manufacturing diversity, and positive population in-migration. These factors are discussed in further detail in the Management’s Discussion andAnalysis (MD&A).

Local economic development initiatives and various private/public programs have arisen in response to these recent developments designed to strengthen the local economy. Industrial recruitment, workforce development, urbanrevitalization, broadband access, and improvements to interstate highways are examples of active and pending projects. Area leaders realize the importance of cooperation and action to maintaina healthy, diverse, and sustainable economy.

Whileindustrialusageisuniform,residential,andcommercialexpansionhasresultedina higher demand for MSD services, as evidenced by growth in overall revenue, and especially by facility andtapfeesdirectlyresultingfromnewdevelopment.ThemajorityofnewresidentsbeingDistrict customers result from emphasis on in-fill development by local communities and large new subdivisions with developer-donated sewer infrastructure.

B. Long-Term Financial Planning

In November2008, the District’s Collection SystemMasterPlanwas completed.Thisplan focuses on the orderly growth of the collection system into future service areas. As the sewer system grows over time, this plan will ensure that extensions of the system are made in an orderly fashion, in accordance with the planningpoliciesof the District’s member agencies.

In 2015, the District updated the Facility Plan for the WRF. It focused on future regulatory requirements, the viability of existing processes, long-term costs, and needed performance. This comprehensive plan recommends various options for the future of the treatment plant and will help the District continue to protect our local environment by implementing the latest technologies in a phased, cost-efficient manner. The short-term and mid-term projects are scheduledwithin the 10-year CIP.

5

Using these plans as guides, District engineers developed a ten-year Capital Improvement Program (CIP), which is updated annually. The capital budgeting process beginswith considering projects identified in theseplans, as well as those recommendedby various departments to deal with recurring wastewater collection and treatment problems. Engineering staff prioritize such projects, preparing cost estimates and asuggested timetable for construction.

The CIP Committee, consisting of representatives from the District’s member agencies, meets to reviewtheprogramandtomakerecommendationstotheBoardconcerningtheCIP’sadoptionas part of the annual budget.

TheCIPcontinuestohavethelargestimpactontheDistrict’scurrentandfuturefinancialposition.

In connection with the long-term CIP, the District prepares a ten-year cash flow projection, which integrates revenue and expenditure projections with planned capital expenditures to anticipate rate increasesand timing of debt issuance.

Major Initiatives and Accomplishments

A. Collection System & Plant Rehabilitation

TheDistrictmaintainsanaggressive,proactiverehabilitationprogramforboththeregional1,140mile collection system and the treatment plant facility. MSD assumed ownership and maintenanceofthelocalpubliccollectionsystemsin1991andsincethattimeover$475.8million hasbeen re-invested back intothesystem.

Plant High-Rate Primary Treatment Project

This is thesecond criticalproject recommendedby thePlant Facilities Plan. This $17.1 million project will provide chemically enhanced primarytreatmentaftertheheadworksand prior to the plant’s biological process. This new process is expected to improve the plant’sbiologicalprocessandinturn,plant effluent quality. Construction is complete and the process is currently in the startup phase.

6

Carrier Bridge Pump Station Replacement

This $42.5 million project is for the replacement of the Carrier Bridge Pump Station. Carrier Bridge is the District’s largest pump station and serves significant areas of Buncombe and northern Henderson Counties. Its current capacity is 22 MGD andwillbeexpandedto36MGDwiththe ability to be further expanded in the future. Design is currently underway, with construction expected to begin by Spring 2024.

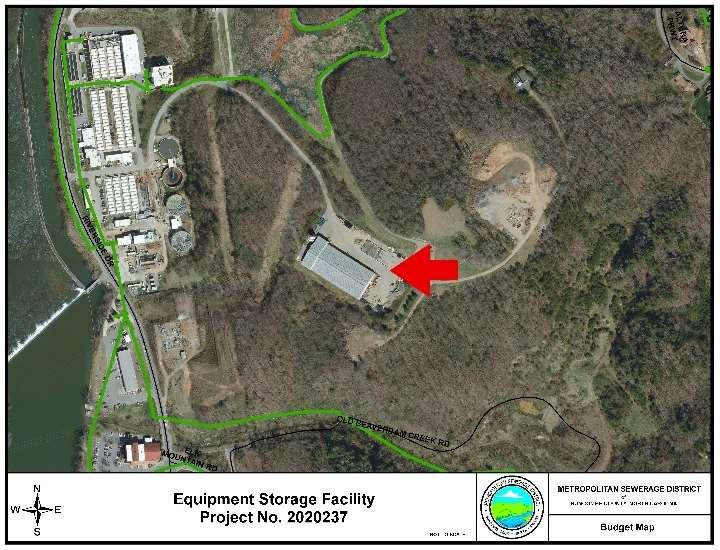

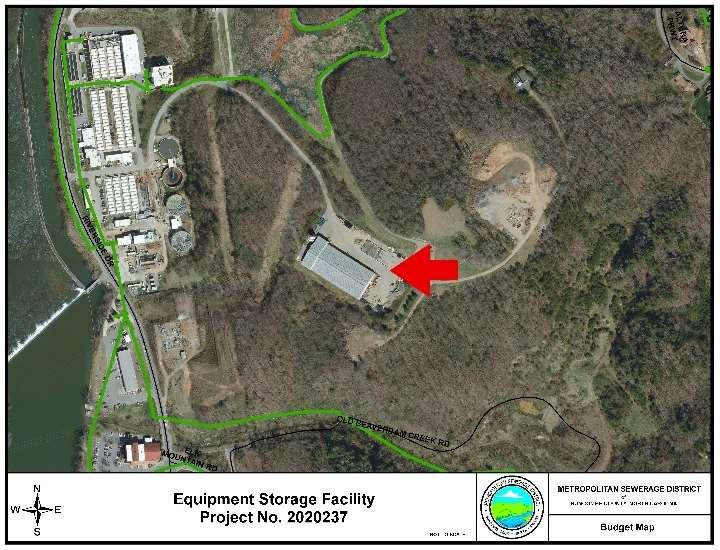

Equipment Storage Building

On November 10, 2020 a fire destroyed MSD’s Alkaline Stabilization Building, also known as the “Nutri-Lime Building”, which is located on the main plant property. The Nutri-Lime process was decommissioned in the early 1990s and the facility had been utilized for equipment storage ever since. This project is to design and construct a new storage facility at the same location. The new building is scheduled for completion in Spring 2023.

7

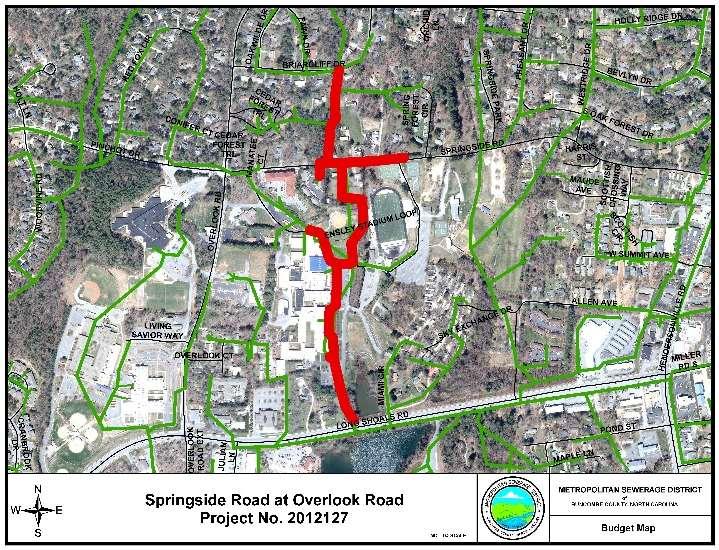

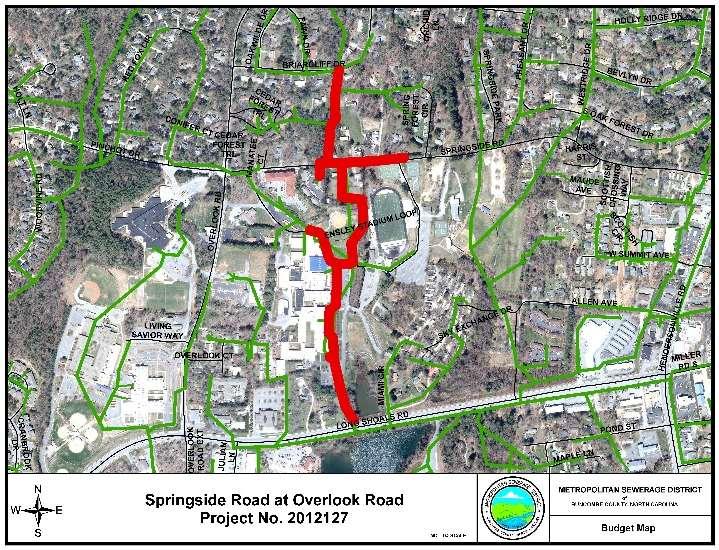

Springside Road @ Overlook Road Sewer Rehabilitation Project

TheSpringsideRoad@ OverlookRoadrehabilitationprojectwaslocatedinSouthAshevilleon the campus of T.C. Roberson High School. Theexisting6-inchclaylines were in poor condition and had a history of SSOs. Approximately 3,922LF of new 8-inch DIP was installed. Buncombe County Schools partnered with MSD and utilized the same contractor to installsanitarysewerlines(forMSD) and new stormwater infrastructure on T.C. Roberson’s campus.

Mountainbrook Road @ Chunns Cover Sewer Rehabilitation Project

Another rehabilitation project completed this past year was the “Mountainbrook Road @ ChunnsCoveRoad”sewerrehabilitationinEastAsheville.Thisprojectrelocatedexistingsewer lines from the rear of the parcels (where access and maintenance was extremelydifficult)to thepublic street rights of way. This project also eliminated one high aerial creek crossing where existing support piers were failing due to erosion. The subjectlineshadahistory ofSSOs and the project replaced approximately 3,204LF of sewer lines.

8

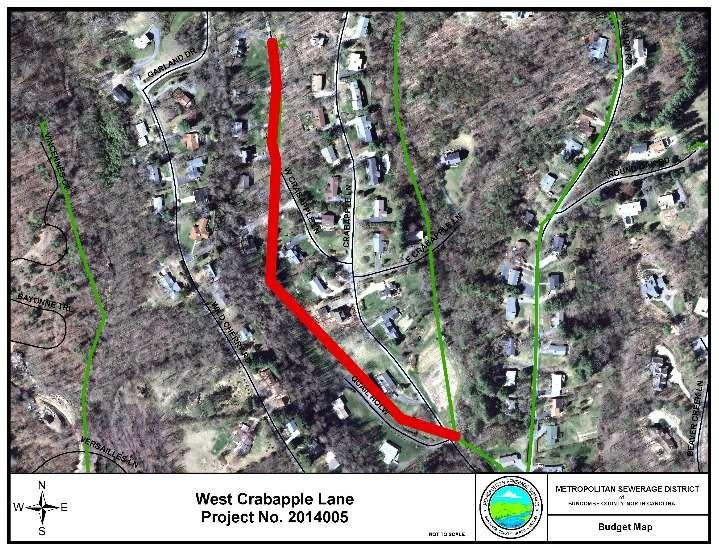

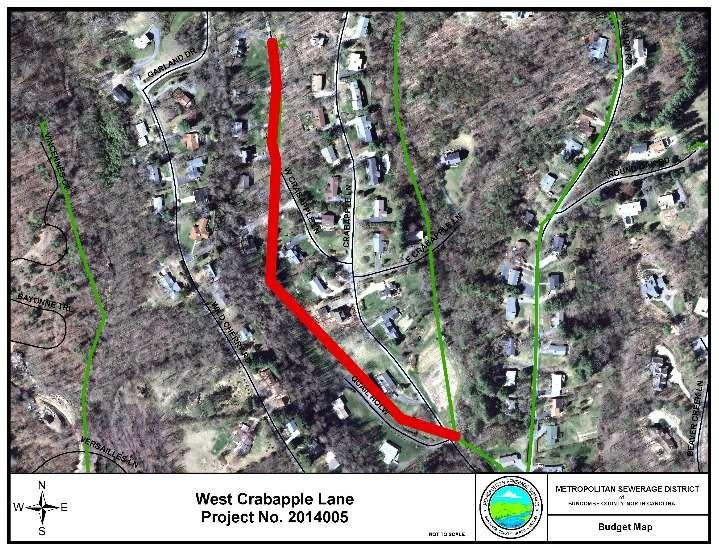

West Crabapple Lane Sewer Rehabilitation Project

This project was located in West Asheville on a private road, West Crabapple Lane. The existing 8-inch clay pipe was in poor condition and approximately 1,774LF of new 8-inch DIP wasinstalledtoreplacetheaging infrastructure. MSD’s System Services crews had reported multiple structural defects in the pipe which resulted in major infiltration and inflow.

Significant Reduction of Sanitary Sewer Overflows

Reduction of Sanitary Sewer Overflows (SSO’s) is one of the District’s primary goals related to the collection system. This has been accomplished by aggressive rehabilitation and preventative maintenance(linecleaning)programs.Overthepasttwelveyears,theDistricthasrealizedasignificant reduction of SSO’s –from289 in FY2000 to 26 in FY2022.

National Environmental Achievement Award

In February 2017, MSD received a National Environmental Achievement Award from NACWA for its Incinerator System Emissions Upgrades Project. This award recognizes individuals and NACWA member agencies that have outstanding contributions to environmental protection and the cleanwatercommunity.This$7.4millionprojectreducedemissions from the incinerator, and utilized a new mercury removal technology, which saved MSD ratepayers $5 million over traditionaltechnology.

9

Peak Performance Award Recognition

The District was recognized once again for outstanding wastewater treatment efforts by the National Association of Clean Water Agencies (NACWA) and received the prestigious NACWA Gold Award signifying consistent NPDES permit compliance during the 2019 calendar year. This marks the nineteenth year the District has been honored with a “Peak Performance Award”representing continuedexcellence in environmental protection.

Excellence in Management Recognition Award

NationalAssociationofCleanWaterAgencies(NACWA)establishedtheExcellenceinManagement(EIM) Recognition Program to recognize public clean water utilities that implement progressive management initiatives and thereby advance the goals of the Clean Water Act. NACWA is committed to clean water and a healthy environment and strives to help ensure that member agencies have the tools they need to meet these objectives. In 2015, the District received gold recognition.

Improved Customer Service Response

The Systems Services Department reclassified a management position to that of a first responder to handle emergency calls between 2:00 p.m. and 10:30 p.m. as well as holidays, which reduced average response time from90 minutes in FY2006to 34 minutes in FY2022.

Environmental Regulations Compliance

TheDistrictreceivedfavorableregulatoryreportsfromtheNorthCarolinaDepartmentofEnvironmental Quality(NCDEQ)forwastewaterdischarge,pretreatment,collectionssystem,and air quality permits.In addition, the District maintained ISO 14001Environmental compliancecertification.

Another requirement of the annual Collection Systems permit is to perform preventative maintenance onatleast 600,000linearfeetofsewerline.Duringthecurrentyear,theDistrictcleanedapproximately 845,000 linearfeet.

10

Continuing Disclosure Obligation

The District issued revenue bonds most recently in May 2018. In accordance with the requirements of the Securities Exchange Commission Rule 15C-12, as amended, and the North Carolina Local Government Commission, the District will provide continuing disclosure information to recognized municipal security information repositories. This will include the audited financial statements, historical net revenues and debt coverage, future rate increases and listing of the District’s largest commercial and industrial customers.

Financial Awards

The Government Finance Officers Association of the United States and Canada (GFOA) awarded a Certificate of Achievement for Excellence in Financial Reporting to Metropolitan Sewerage District of Buncombe County, North Carolina for its Comprehensive Annual Financial Report for the Fiscal Year ended June 30, 2021. This was the twenty-seventh consecutive year that the District has achieved this prestigious award. In order to receive a Certificate of Achievement award, a government must publish an easily readable and efficiently organized comprehensive annual financial report. This report must satisfy both generally accepted accounting principles and applicable legal requirements.

A Certificate of Achievement is valid for a period of one year only. We believe that our current Comprehensive Annual Financial Report continues to meet the Certificate of Achievement Program’s requirements and we are submitting itto the GFOA to determine its eligibilityfor another certificate.

Inaddition,theDistrictalsoreceivedtheGFOA’sDistinguishedBudgetPresentationAwardforitsannual FY2022 budget document. In order to qualify for the Distinguished Budget Presentation Award, the District’sbudgetdocumentwasjudgedproficientinseveralcategories,includingasapolicydocument, a financial plan, an operations guide, and a communications device. This is the twenty-fourth consecutive year that theDistrict has achievedthis prestigious award.

11

Acknowledgments

Thepreparationofthisreportcouldnothavebeenaccomplishedwithoutthededicatedservicesofstaff throughout the District and the District’s independent auditor, Cherry Bekaert LLP. We would like to acknowledge the hard work and dedication of Cheryl Rice, the District’s Accounting Manager. In addition,aspecialthankstoJodyGermainewhoassembledtheAnnualReportdocumentsandprepared the graphs, and to Asheville Chamber of Commerce for the current economic data and insightful identification of business trends.

We also would like to thank the members of the Finance Committee and Board for their support of maintaininghigh standards of fiscal accountabilityand responsibility forthe District.

Submitted, ThomasE. Hartye, P.E. W. Scott Powell, CLGFO General Manager Director of Finance

12

Respectfully

Certificate of Achievement

13

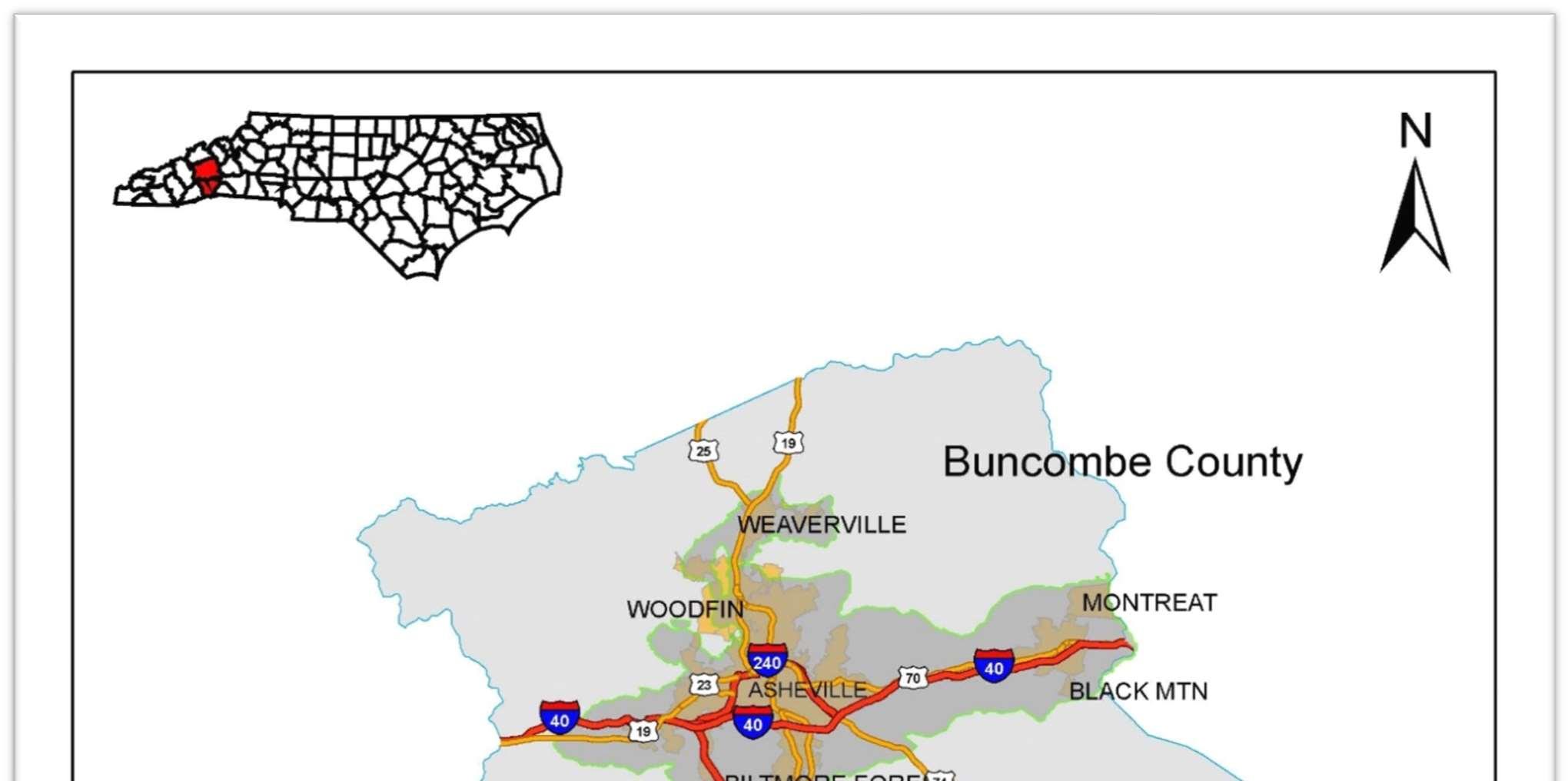

Map of District Boundary

14

Principal Officials

BoardMembersRepresentativeof

MattAshley,Jr.TownofMontreat

JackieW.Bryson,Secretary/TreasurerWoodfinSanitaryWater&SewerDistrict

DouglasDearthTownofWeaverville

SheilaFranklinHendersonCounty

E.GlennKellyTownofBiltmoreForest

WilliamG.LapsleyHendersonCounty

EstherManheimerCityofAsheville

ChrisPellyCityofAsheville

NathanPenningtonBuncombeCounty

RobertPressleyBuncombeCounty

M.JerryVeHaun,ChairmanTownofWoodfin

RobertC.WattsTownofBlackMountain

AlWhitesidesBuncombeCounty

GwenWislerCityofAsheville

15

LegalCounsel Roberts&Stevens,P.A. EngineerofRecord McGillAssociates,P.A. GeneralManager ThomasE.Hartye,P.E. DirectorofFinance W.ScottPowell,CLGFO

16 Organizational Chart Number of Employees: 152 Engineering Financial Services Human Resources Information Technology System Services Construction System Services Maintenance Waste Treatment Director Hunter Carson, P.E. Director W. Scott Powell, CLGFO Director Pam Thomas Director Matthew Walter Director Mike Stamey, P.E. Director Ken Stines Director Roger Edwards Project Management Design/Drafting Capital Projects Right-of-Way Allocations Taps Sewer Expansion Accounting Budget Cash Flow Mgmt. Facilities Maintenance Finance Financial Forecasting Fleet Maintenance Investments Purchasing Warehouse Employee Relations Payroll Employee Benefits Environmental Health & Safety Information Technology Management Information Systems Geographical Information Systems Construction Administration Construction (in-house) Emergency Maintenance Electrical Mechanical Preventative Maintenance Technical Services Pump Station Maintenance Operations Industrial Waste Reclamation Services # of employees = 15 # of employees = 17 # of employees = 7 # of employees = 10 # of employees = 34 # of employees = 49 # of employees = 19 ExecutiveSecretary PamNolan GeneralManager ThomasE.Hartye,P.E. Engineerof Record Legal Counsel Committees CIP Finance Personnel Planning RightofWay MSDBoard

Financial Section

17

18

19

This page intentionally left blank.

20

Management’s Discussion and Analysis

As management of the Metropolitan Sewerage District of BuncombeCounty(District), we offer readers of the District’s financial statements this narrative overview and analysis of the District’s financial activitiesfor theFiscal Year endedJune 30, 2022.

Financial Highlights

A. Net Position

Net Position is defined as the value of all assets, plus deferred outflows of resources, less all liabilities and deferred inflows of resources. Restricted net position is restricted by law, bond covenant, or other contractual arrangement, less debt incurred. The financial well-being of a government is reflected to alarge degree by the growth of net position.

The District’s net position totals $494.1 million and reflects a $20.4 million or 4.3% increase from the prior year. The income and expense items affecting this improvement will be discussed in greater detail in the section, “Financial Analysis of the District” on page3.

The $20.4 million increase is attributable to the District’s normal operations and includes contributedcapital assets fromdevelopers of $3.3 million

Net investment in capital assets increased by $13.3 million or 3.3%, evidencing the District’s continuedrehabilitationof infrastructure aswell as anincrease in donatedcapital.

B. Outstanding Debt

After principal repayments of $6.1 million, the District has approximately $88.4 million of outstanding debt exclusive of related unamortized discounts and premiums.

Overview of the Financial Statements

This Discussion and Analysis is intended to serve as an introduction to the District’s basic financial statements.TheDistrict’sbasic financialstatementsarecomprisedoftwocomponents: thefinancial statements and notestothefinancialstatementsthatexplain inmoredetailsomeoftheinformation in the financial statements.

21

Afterthenotes,supplementalinformationisprovidedtoshowdetailsabouttheDistrict’sfundstructure as set forth in the Bond Order. Budgetary information required by the North Carolina General Statutes also can be found in thispart of the statements.

A. Basic Financial Statements

The financial statements of the District report information about the District using accounting methodssimilarto those usedby private-sectorcompanies.There are three requiredstatements, which provide both long-term and short-term information about the District’s overall financial status.

The Statement of Net Position presents information on all the District’s assets, plus deferred outflows of resources, less liabilities, and deferred inflows of resources with the difference reported as net position. This Statement provides information about the types and amountsofresources(assets),deferredoutflowsofresources,theobligationstotheDistrict’s employees andcreditors(liabilities),anddeferredinflowsofresources,whichmaybeusedto measure the financial health of the District by providing the basis for evaluating the capital structure of the District and assessing liquidity and financialflexibility.

The Statement of Revenues, Expenses, and Changes in Net Position presents the current year’s results of operations and can be usedto determine how successful the District hasbeenincollectingrevenues,controllingexpenses,andrecoveringcoststhroughuserfees and charges.

The final required financial statement is the Statement of Cash Flows. This Statement reports cash receipts, cash payments, and net changes in cash resulting from operating, investing,andcapitalandrelatedfinancingactivities,andmaybeusedtodeterminehowcash originated, what that cash was used for, and how these activities resulted in the change to cash balance during the year.

These financial statements should be evaluated with other external factors such as economic conditions, regional employment statistics, and population growth for a more complete analysis of the District’s current and future financial condition.

22

Financial Analysis of the District

A. Net Position

As previously noted, net position may serve over time as one useful indicator of an entity’s financial condition. The District’s assets plus deferred outflows of resources exceeded liabilities and deferred inflows by $494.1million at June 30,2022.

ThelargestproportionoftheDistrict’snetposition,approximately83.6%,reflectstheDistrict’snet investmentincapitalassets(e.g.,land,buildings,interceptorandcollectorsewerlines,treatment facilities, equipment, etc.), less any related debt outstanding that was issued to acquire these items. As these assets are required to provide wastewater collection and treatment services, these resources are not available for future spending. Although the District’s investment in its capital assets is reported net of the outstanding relateddebt, the resources needed to repay that debt must be provided by other sources as the capital assets cannot be used to liquidate these liabilities.

An additional $7.3 million or 1.5% of the District’s net position are funds restricted by the Bond Order to be held in reserve for either debt service or for emergency capital equipment repair or replacement.Theremainingbalanceof$73.8millionisunrestrictedandmay beusedtofund payas-you-go capital projects, medical or workers’ compensation claims, replacement reserves, or any other legal purpose.

The District’s overall financial position improved during the Fiscal Year ended June 30, 2022 as overallnetpositiongrewby4.3%.TheDistrict’sfinancialstrategyistosetratesatalevelsufficient to cover operating and debt service expenses as well as to provide about half of the funding for pay-as-you-go infrastructure rehabilitation. The success of this approach is visible in the continuinggrowthoftheDistrict’snetposition.Currentassetswilldecreasegraduallyascashand investmentsareusedtorehabilitateinfrastructure,untilthenextplannedrevenuebondissuance.

23

CurrentandOtherAssets $ 93,230,537 $ 85,322,943 9.27% CapitalAssets,net 503,311,630 496,582,900 1.36% TotalAssets 596,542,167 581,905,843 2.52% DeferredOutflowsofResources 5,805,300 7,674,781 (24.36%)

Long-TermLiabilitiesOutstanding 92,696,512 103,934,604 (10.81%) OtherLiabilities 12,849,524 11,636,880 10.42% TotalLiabilities 105,546,036 115,571,484 (8.67%) DeferredInflowsofResources 2,735,434 262,801 940.88% NetPosition: NetInvestmentinCapitalAssets 412,955,363 399,621,901 3.33% Restrictedfor: DebtService 6,259,891 5,990,231 4.50% BondCovenant 1,028,381 1,026,733 17.69% Unrestricted 73,822,362 67,107,474 10.01% TotalNetPosition $ 494,065,997 $ 473,746,339 4.29%

The Condensed Statement of Revenues, Expenses, and Changes in Net Position shown in Table 2 below provides information concerning whatcontributed to the net changesreported in Table 1.

24

Table 1—Condensed Statement of Net Position FY2022 FY2021 % Increase (Decrease) 2022 Vs. 2021

5,966,012 5,092,060 17.16%

1,798,794 1,810,481 (0.65%)

1,446,493 1,105,110 30.89%

1,026,018 998,183 2.79%

1,325,837 1,623,222 (18.32%)

2,332,926 2,351,485 (0.79%)

25

2—Condensed Statement of Revenues, Expenses, and Changes in Net Position

% Increase

SewerCharges

FacilityandTapFees

Miscellaneous

SalariesandEmployeeBenefits

ContractualServices

Utilities

RepairsandMaintenance

OtherSuppliesandExpenses

InsuranceClaimsandExpenses

Depreciation

OperatingIncome

InvestmentIncome

InterestExpense

Gain(Loss)onSaleofSurplusProperty

TotalNon-operatingRevenues(Expenses)

Incomebeforeothertransactions

CapitalContribution

SpecialItem-CaneCreekWaterandSewerDistrict assetcontributionfromHendersonCounty -

(100.00%) ChangeinNetPosition 20,319,658 41,267,622 (50.76%) TotalNetPosition,beginningofyear 473,746,339 432,478,717 9.54% TotalNetPosition,endofyear $494,065,997 $473,746,339 4.29%

Table

FY2022 FY2021

(Decrease) 2021 Vs. 2020 OperatingRevenues:

$41,484,740 $38,591,901 7.50%

660,754 1,770,022 (62.67%) TotalOperatingRevenues 48,111,506 45,453,983 5.85% OperatingExpenses:

8,427,033 8,640,936 (2.48%)

12,339,044 12,394,875 (0.45%) TotalOperatingExpenses 28,696,145 28,924,292 (0.79%)

19,415,361 16,529,691 17.46% Non-operatingRevenues(Expenses):

87,001 30,582 184.48%

(2,949,509) (3,110,487) (5.18%)

418,696 322,770 29.72%

(2,443,812) (2,757,135) (11.36%)

16,971,549 13,772,656 23.23%

3,348,109 7,558,647 (55.70%)

19,936,419

ThissectiondiscussessignificantfactorscontributingtotheDistrict’s4.3%increaseinnetpositionfrom $473.7 millionto $494.1 million.

A. Operating Revenues

Sewer revenues increased 7.5%. The District raised domestic sewer rates by 2.75% at the beginning of the Fiscal Year 2022. The additional increase was due to better than anticipated revenue as aresult to increasedusage over the previous year.

Facility and Tap Fees increased 17.2% over the previous year reflecting a rebound in development in the area.

B. Operating Expenses were kept fairly flat with the exception

of:

Salaries and Employee Benefits—The District experienced a 2.48% decrease in current year expense due to general retirements inthe current year.

Utilities Expense—A decrease in internally generated hydroelectric power as well as increasing cost of fuel and natural gas attributed to the 30.9% increase in current year expenses.

C. Investment Income—Increasing short-term interest rates resulted in a 184.5% increase in the District’s interest income.

D. Interest Expense—Interest expense decreaseddueto the reductionof outstanding debt.

E. Capital Contribution—The amounts reported as capital contributions represent the estimatedfairmarketvalueofdonatedsewercollectorlinesbydevelopersandmemberagencies.

The District has no direct control over the amount of contributions received. These amounts are reflectedas equal incomeand capital expendituresin the financial statement.

26

Capital

A.

27

Debt

Asset and

Administration

capital assettransactions

Rehabilitation

Mountain

West

Jarnaul Avenues Christian

Interceptor Plant

Treatment

Table 3—Capital Assets FY2022 FY2021 Land $ 2,773,980 $ 2,773,980 Easements 11,435,322 11,117,028 ImprovementsOtherthanBuildings 8,520,054 7,431,575 Buildings 49,064,646 49,092,193 MachineryandEquipment 85,131,956 85,439,600 InterceptorSewerLines 126,480,246 126,477,532 CollectorSewerLines 414,625,022 404,428,663 ConstructioninProgress 27,149.553 20,770,543 Subtotal 725,180,779 707,531,114 Less:AccumulatedDepreciation (221,869,149) (210,948,214) NetProperty,PlantandEquipment $ 503,311,630 $ 496,582,900

Capital Assets TheDistrictownscapitalassetswithahistoricalcostof$725,180,779.Theseassetsconsistofland (including easements), improvements including a hydroelectric dam, buildings, collector sewer lines, interceptor lines (large pipelines into which collector sewer lines feed), construction equipment and machinery, service vehicles, officemachines, computer hardware and software. The District has begun several projects expected to cost $176.4 million to complete and at June 30, 2022 was committed to contracts expectedto cost $10.7 million. Major

during theyear include:

of over 27,183 feet of sewer line including:

Brook Road @Chunns Cove Road

Crabapple Lane

Creek

High-Rate Primary

Bryson Street

More detailed information on the District’s capital assets is presented in Note 5 to the financial statements.

B. Debt Administration

At June 30, 2022, the District had $88,373,590 in par value of outstanding debt. Unlike cities and counties, the District does not have a debt limit. However, the District’s Bond Order requires that user rates be set to achieve a minimum debt service coverage ratio of 1.2 annually. This means thatinanyyear,aftertheDistrictpaysallcurrentoperatingexpenses,thenetrevenuesremaining must beat least 120% of that year’sprincipal and interestpayments.

The District holds an AA+ rating from Standard & Poor’s, an Aaa rating from Moody’s Investor Service, and an AAA rating from Fitch. These high ratings allow the District to pay a lower rate of interest thanother entitieswith less favorable ratings.

Further details on long-termdebt are provided in Note 3 to the financial statements.

Economic Factors and Next Year’s Budget and Rates

The District, located in Buncombe County within the Asheville metropolitan area, has been in a better economic position than many other communities in the state and the nation dueto several key factors.

A. Unemployment—From 2003 through 2021, Asheville’s unemployment rate has been among the lowest compared to the other ten metropolitan areas in North Carolina. As of June 2022, Asheville’s unemployment rate was 3.4%. This is below the state and national averages of 4.1% and 3.8%, respectively. Over the past year, about 8,000 jobs have been added to the economy, increasing current employment to 200,100.

B. Balanced Economic Growth

—TheAshevillemetropolitanareahasdevelopedaunique and balanced economy based on several key drivers. Actions of each driver can overlap and support other drivers in the local economy. History has also shown that a period of weakness for one driver can lead to theexpansion of another.

Key drivers include:

Specializedhealthcare industry

Restructuredmanufacturing sector

28

Baby-boom generation fueledpopulation growth

Growing professional services sector

Stable tourismactivity

Resilient housingmarket

LocalHealthcareEmployment—Atover36,700workers,healthservicesisnowthelargest industry sectorin the Asheville metropolitan area.Ambulatory health services is the chief source of the new jobs. Strong gains in well-paying health services have softened the earlier losses in the traditional manufacturing sector. Historically, stable growth in local healthcare services has had an average annual rate of 2% to 4%. Healthcare has had a 2.8% increasein employment over the previous year.

Manufacturing Employment—With 22,600 workers, manufacturing continues to be transformed into a high-skilled sector restructured around an advanced group of machinery, plastics, and electronics manufacturers. Recent economic indicators suggest job gain in manufacturing despite the impact by the COVID-19 Pandemic. Manufacturing did experiencea 3.2% increase overthe previousyear.

Continued Moderate Population Growth—Population growth remains a consistent and stablecontributortothelocaleconomy.Estimatesindicatemoderategrowthpatternswill continue between 1.5% and 2.0% per year. More than 95% of local population growth is fromin-migration, with the remaining from births overdeaths.

Professional and Business Sector—The confluence of retiring baby-boomers, local quality of life, and economic growth has resulted in the emergence of a growing professionalandbusinessservicessector.Thissectorincludesmany highlytechnicaland well-paid services such as engineering, computer design, and temporary employment services. Recent economic indicators suggest job gain in the professional and business sectordespitetheimpactbytheCOVID-19Pandemic.Theprofessionalandbusinesssector did experiencea 12.9% increase overthe previous year

ThemajoreconomicchallengefacingtheDistrictisthecontinuedimpactofCOVID-19Pandemic on employment and tourism. However, the impacts should be temporary and tempered by the District’s more than adequate cash position.

29

Based on the District’s projections for residential, commercial, and industrial sewer use, sewer rates will increase by 3.0% for the Fiscal Year ended June 30, 2023. Current projections indicate adequatefundingforoperations,debtservice,andtheDistrict’slong-termCapitalImprovement Program.

Requests for Additional Information

Thisreportis designedtoprovideanoverview oftheDistrict’sfinancesforthosewith aninterestinthis area. Questions concerning any of the information found in this report or requests for additional information should be directed to W. Scott Powell, Director of Finance, Metropolitan Sewerage District ofBuncombeCounty,2028RiversideDrive,Asheville,NC28804,(828)225-8211, or spowell@msdbc.org.

30

Statement of Net Position June 30, 2022

MSD StatementofNetPosition June30,2022

Assets:

Currentassets:

Cashandcashequivalents $43,942,852 Investments 32,666,087

Restrictedcashandcashequivalents 7,657,635

Receivables(net): Accounts 6,967,419 Sales 431,438 Employee 9,210 Interest 29,279 Inventories 495,586 Prepaidexpenses 2,650

Totalcurrentassets 92,202,156

Noncurrentassets:

Restrictedcashandcashequivalents 1,028,381

Capitalassets: Land 2,773,980 Easements 11,435,322

Plantandequipment 683,821,924 Constructioninprogress 27,149,553 Less:accumulateddepreciation (221,869,149)

Totalpropertyandequipment 503,311,630

Totalnoncurrentassets 504,340,011

Totalassets 596,542,167

Deferredoutflowsofresources: 5,805,300

Liabilities:

Currentliabilities:

Paymentsfromcurrentassets: Accountspayableandaccruedexpenses 5,030,955

Currentportionofcompensatedabsencespayable 60,000

Paymentsfromrestrictedcashandcashequivalents: Bondinterestpayable 1,397,744

Currentportionoflongtermobligations 6,360,825

Totalcurrentliabilities 12,849,524

Noncurrentliabilities:

Compensatedabsences,netofcurrentportion 823,174

Totalotherpost-employmentbenefits 4,049,000

Totalpensionliability 1,803,202

Derivativeliability 809,389

Long-termobligations,netofcurrentmaturities 85,211,747

Totalnoncurrentliabilities 92,696,512

Totalliabilities 105,546,036

Deferredinflowsofresources: 2,735,434

Netposition:

Netinvestmentincapitalassets 412,955,363

Restrictedfor: Debtservice 6,259,891 Bondcovenant 1,028,381 Unrestricted 73,822,362

Totalnetposition $494,065,997

The accompanying notes are an integral part of the financial statements.

31

Statement of Revenues, Expenses, and Changes in Net Position

Operatingrevenues: Sewercharges $41,484,740 Facilityandtapfees 5,966,012 Miscellaneous 660,754 Totaloperatingrevenues 48,111,506

32

For the Year Ended June 30, 2022 The accompanying notes are an integral part of the financial statements.

Operatingexpenses: Salariesandemployeebenefits 8,427,033 Contractualservices 1,798,794 Utilities 1,446,493 Repairsandmaintenance 1,026,018 Othersuppliesandexpenses 1,325,837 Insuranceclaimsandexpenses 2,332,926 Depreciation 12,339,044 Totaloperatingexpenses 28,696,145 Operatingincome 19,415,361

Changeinnetposition

Totalnetposition,beginningofyear

Totalnetposition,endofyear $494,065,997

Nonoperatingrevenues(expenses): Investmentincome 87,001 Interestexpense (2,949,509) Gainondisposalofsurplusproperty 418,696 Totalnonoperatingrevenues(expenses) (2,443,812) Incomebeforecontributions 16,971,549 Capitalcontribution 3,348,109

20,319,658

473,746,339

Statement of Cash Flows

For the Year Ended June 30, 2022

Cashflowsfromoperatingactivities:

Cashreceivedfromcustomers

$47,318,435

Salestaxpaid 36,374

Cashpaidtoemployeesforservices (6,529,427)

Cashpaidforgoodsandservices (10,247,654) Otheroperatingrevenue 671,024

Netcashprovidedbyoperatingactivities 31,248,752

Cashflowsfromcapitalandrelatedfinancingactivities

Acquisitionandconstructionof capitalassets (14,343,274)

Proceedsfromsaleofsurplusproperty 439,435

Principalpaidonbondmaturities (6,120,825)

Interestpaidonbondmaturities (3,527,874)

Netcashusedincapitalandrelatedfinancingactivities (23,552,538)

Cashflowsfrominvestingactivities:

Proceedsfromsaleofinvestments 178,306,530

Purchasesofinvestments (197,018,837)

Incomeoninvestments 100,571

Netcashusedininvestingactivities (18,611,736)

Netdecreaseincashandcashequivalents (10,915,522)

Cashandcashequivalents,July1 63,544,390 Cashandcashequivalents,June30 $52,628,868

Reconciliationofoperatingincometonetcash providedbyoperatingactivities:

Operatingincome $19,415,361

Adjustmentstoreconcileoperating incometonetcashprovidedby operatingactivities:

Depreciation 12,339,044

Changesinassetsandliabilities:

(Increase)inreceivables (85,672)

(Increase)ininventory (38,558)

(Increase)inprepaiditems (150)

(Decrease)inaccountspayableandaccruedexpenses (330,026)

Increaseinotherpost-employmentbenefits 375,000

(Decrease)inaccruedcompensatedabsences (4,118)

(Increase)indeferredoutflowsofresources-pensions (411,920)

(Increase)indeferredoutflowsofresources-otherpost-employment benefits (112,640)

(Decrease)innetpensionliability (2,370,202)

(Decrease)indeferredinflowsofresources-otherpost-employment benefits (98,000)

Increaseindeferredinflowsofresources-pensions 2,570,633

Totaladjustments 11,833,391

The accompanying notes are an integral part of the financial statements.

33

Netcashprovidedbyoperatingactivities $31,248,752 Noncashinvesting,capital,andfinancingactivities:

1.AtvarioustimesduringtheyearendedJune30,2022theDistrictreceivedcontributionofsewerlinesconstructed bydeveloperswithareportedestimatedfairvalueof$3,348,109. 2.DuringtheyearendedJune30,2022,atotalof$42,849ofunrealizedlossdecreasedthefairvalue ofinvestmentsnotconsideredtobecashequivalents.

This pageintentionallyleft blank.

34

Notes to Basic Financial Statements June 30, 2022

Note 1—Summary of Significant Accounting Policies

The accounting policies of the Metropolitan Sewerage District of Buncombe County, North Carolina (District) conform to generally accepted accounting principles as applicable to enterprise-type governments. The following is a summary of the more significant accountingpolicies:

A. Reporting Entity

The District is a public body and body politic and corporate of the State of North Carolina, created pursuant to the North Carolina Metropolitan Sewerage DistrictsAct (Article 5, Chapter 162Aof the GeneralStatutesofNorthCarolina,asamended).TheDistrictwasestablishedin1962bytheNorth Carolina State Stream Sanitation Committee for the purpose of constructing and operating facilities for sewage treatment within the political subdivisions serviced by the District as listed below.

City ofAsheville Town of Montreat

Beaverdam Water and Sewer District Enka-Candler Water and Sewer District Town of Biltmore Forest Fairview Sanitary SewerDistrict Town of Black Mountain Skyland Sanitary Sewer District BusbeeSanitary Sewer District Swannanoa Water and Sewer District Caney Valley Sanitary Sewer District Town of Weaverville CrescentHill Sanitary Sewer District Venable Sanitary District Woodfin Sanitary Water and Sewer District

On July 1, 2020, the District, pursuant toN.C. General Statute,§162A-68.5, acquiredtheCane Creek Water and Sewer District in northern Henderson County. As required by G.S. 162A-68.5, two new members representing Henderson County were added to the Board.

Under the North Carolina Metropolitan Sewerage Districts Act, the District is authorized, among other things, to: (a) acquire, construct, improve, extend, maintain, and operate any sewerage system or part thereof (including facilities for the generation and transmission of electric power andenergy)withinorwithouttheDistrict; (b) toissuerevenuebondstopaythecostsofanyofthe foregoing;and (c) tosetandcollectrents,rates,fees,andotherchargesforprovisionofsewerage services and theuse of any District facilities.

35

The District Board consists of fourteen members appointed as follows: three from the County of Buncombe,threefromtheCity ofAsheville,twofromtheCountyofHendersonandoneeachfrom Woodfin Sanitary Water & Sewer District, and the Towns of Biltmore Forest, Black Mountain, Montreat, Woodfin, and Weaverville.

The District owns, operates, and maintains a Wastewater Treatment Plant as well as the related network of collector and interceptor sewers. The Treatment Plant has a capacity to treat up to 40 million gallons per day, but currently receives an average of 22.2 million gallons per day from approximately 58,000 residential and commercial customer accounts transported through approximately 1,032 miles of collector sewers.

The District’s basic financial statements include all transactions of the District for which the Districtisfinanciallyaccountable.Financialaccountabilityisdefinedasappointmentofamajority ofacomponentunit’sboardandeithertheabilitytoimposethewilloftheDistrictorthepossibility that the component unit will provide a financial benefit to or impose a financial burden on the District. Based on these criteria, the District has determined that there are no component units, which come under the criteria for inclusion. The District is not a component unit of any other governmental entity.

B. Basis of Presentation—Fund Accounting

The accounts of the District are organized and operated on the basis of funds in accordance with the District’s Bond Order. A Fund is an independent fiscal and accounting entity with a selfbalancingsetofaccountscomprisedofassets,deferredoutflows,liabilities,deferredinflows,net position, revenues, and expenditures or expenses as appropriate. Fund accounting segregates funds according to their intended purpose and is used to aid management in demonstrating compliancewithfinance-relatedlegalandcontractualprovisions.Theminimumnumberoffunds is maintained consistentwith legal and managerial requirements.

TheDistrictpresentsthebasicfinancialstatementsasaproprietaryfundbasis.Aproprietaryfund accounts for those operations (a) that are financed and operated in a manner similar to private business enterprises where the intent of the governing body is that costs (expenses, including depreciation) of providing goodsor services to thegeneralpublic on a continuing basis be financed or recovered primarily through user charges; or (b) where the governing body has decided that the periodic determination of revenues earned, expenses incurred, and/or net incomeisappropriateforcapitalmaintenance,publicpolicy,managementcontrol,accountability, and other purposes.

36

C. Measurement Focus and Basis of Accounting

Theproprietaryfundisaccountedforontheflowofeconomicresourcesmeasurementfocus.With this measurement focus, all assets and deferred outflows of resources, and all liabilities and deferred inflows of resources associated with the operation of these funds are included on the balance sheet. Proprietary Funds are presented in the financial statements on the accrual basis of accounting. Under this basis, revenues are recognized in the accounting period when earned and expenses are recognized in the periodthey are incurred.

D. Budgetary Data

Budgets are adopted as required by state statute and in compliance with the Bond Order. All annualappropriationslapseatfiscalyear-end.Thebudgetispreparedusingthemodifiedaccrual basis of accounting, which is consistent with the accounting system used to record transactions during thefiscal year. Expenditures may not legallyexceed appropriations at the functional level. Managementisauthorizedtotransferappropriationswithinadepartment;however,anyrevisions thataltertotalexpendituresofanyfunctionmustbeapprovedbythegoverningboard.Therewere no budgetamendments.

As required by North Carolina State law [G.S. 159-26(d)], the District maintains encumbrance accounts, which are considered to be “budgetary accounts”. Encumbrances outstanding at yearend represent the estimated amounts of the expenditures ultimately to result if unperformed contracts in progress at year-end are completed. Encumbrances outstanding at year-end do not constitute expenditures or liabilities.

E. Deposits and Investments

All deposits of the District are made in board-designated official depositories and are secured as required by State law [G.S. 159-31]. The District may designate as an official depository any bank orsavingsandloanassociationwhoseprincipalofficeislocatedinNorthCarolina.Inaddition,the BoardmayestablishtimedepositaccountssuchasNOWandSuperNOWaccounts,moneymarket accounts, and certificates of deposit.

State law [G.S. 159-30(c)] authorizes the District to invest in obligations of the United States or obligations fully guaranteed both as to principal and interest by the United States; obligations of theStateof NorthCarolina,(the “State”); bonds andnotesofanyNorthCarolina localgovernment or public authority; obligations of certain non-guaranteed federal agencies, and certain high

37

quality issues of commercial paper and bankers’ acceptances and the North Carolina Capital Management Trust (NCCMT).

The District’s Bond Order limits investments to:

a. government obligations;

b. obligations of the following agencies: Federal Financing Bank, Federal Home Loan Banks, Federal Home Loan Mortgage Corporation (exceptfor stripped mortgage securitieswhich are purchased at prices exceeding their principal amounts), The Federal National Mortgage Association(exceptforstrippedmortgagesecuritieswhicharepurchasedatpricesexceeding theirprincipalamounts),theGovernmentNationalMortgageAssociation,theFederalHousing Administration, and the Farmers HomeAdministration;

c. direct general obligations of the State secured by the full faith and credit and taxingpower of the State rated in one of the two highest rating categoriesby Moody’s and S&P;

d. bonds and notes of any North Carolina local government or public authority (other than the District), subject to such restrictions as the Secretary of the Local Government Commission may impose, provided such bonds or notes are rated in one of the two highest rating categories by Moody’sand S&P;

e. savings certificates or certificates of deposit issued by any commercial bank or savings and loan association organized under the laws of the State or in any federal bank or savings and loan association having its principal office in the State; provided, however, that any principal amount ofsuchcertificatesin excessoftheamount insuredbythefederalgovernment orany agency thereof; or by a mutual deposit guaranty association authorized by the Administrator of the Savings Institutions Division of the Department of Commerce of the State, be fully collateralizedby obligations reservedby financialinstitution;

f. primequalitycommercialpaper(havingoriginalmaturitiesofnotmorethan270days)bearing the highest rating of Moody’s and S&P and not bearing a rating below the highest by any nationally recognizedrating service whichrates the particular obligation;

g. participatingsharesinthegovernmentportfolioof North CarolinaCapitalManagement Trust, provided that the investments of such fund are limited to those qualifying for investment under this definition andthatsaid fund is certifiedby theLocal GovernmentCommission;

38

h. acommingledinvestmentpoolestablishedandadministeredbytheStateTreasurerpursuant to G. S. 147-69.3;

i. repurchase agreements with respect to Government Obligations if entered into with certain restrictions;

j. anyotherinvestmentnoworhereafterpermittedforinvestmentoffundsbytheDistrictbythe GeneralStatutesofNorthCarolina,including,withoutlimitation,Section159-30oftheGeneral Statutes of North Carolina.

TheDistrict’sinvestmentswithamaturityofmorethanoneyearatacquisitionandnon-money market investments are reported at fair value as determined by quoted market prices. The NCCMT Government Portfolio invest in treasuries and government agencies, is a money market fund (2a7), and maintains an AAAm rating from S&P and AAA-mf by Moody’s Investor Service. It isreported atfair value.

F. Restricted Assets and Liabilities

Any unexpended bond proceeds from the revenue bonds issued by the District are classified as restricted assets because their use is completely restricted to the purpose for which the bonds were originally issued. Cash and investments included in the District’s bond service and debt servicereserveaccountsareclassifiedasrestrictedbecausetheiruseiscompletelyrestrictedfor reserves and debtservice of the outstanding bonds. TheDistrict firstapplies restrictedresources when an expense is incurred for purposes for which both restricted and unrestricted net position is available.

Anyamountspayablefromrestrictedassetsare consideredrestrictedliabilities.AtJune30,2022, the bond interest payable of $1,397,444 and the current portion of long-term debt of $6,360,825 representtotal restrictedliabilities of the District.

G. Allowance for Doubtful Accounts

All receivables that historically experience uncollectible accounts are shown net of an allowance fordoubtfulaccounts.Thisamountisestimatedbasedonthepercentageofreceivablesthatwere written off in prior years.The allowance was$2,668,111 as of June 30, 2022.

39

H. Inventories

Inventories consist of materials and supplies held for consumption and expensed as used. Inventories are valuedat cost (first-in, first-out) whichapproximates market.

I. Capital Assets

Capital assets, primarily property and equipment, are recorded at original cost at acquisition or construction. Donated capital assets are recorded at acquisition value. Assets costing at least $15,000 and with a useful life of over one year are capitalized. The cost of normal maintenance and repairs that do not add to the value of the asset or materially extend asset lives are not capitalized.

Depreciation is computed on the straight-line basis. Assets are depreciated based on useful life estimated byDistrict engineers as follows. See Note 5 for further details.

J. Deferred Outflows of Resources/Inflows of Resources

In addition to assets, the Statement of Net Position reports a separate section for deferred outflowsofresources.Thisseparatefinancialstatementelement,DeferredOutflowsofResources, represents a consumption of net assets that applies to a future period and therefore will not be recognizedasanexpenseuntilthatperiod.TheDistricthassixitemsthatmeetthiscriterion-bond refundingcharges,accumulateddecreaseinfairvalueofhedgingderivativeinstruments,pension and OPEBdeferrals, contributions made to the pension plan, and contributionsmade to the OPEB plan in the 2022 Fiscal Year.

In addition to liabilities, the Statement of Net Position will sometimes report a separate section for deferred inflows of resources. This separate financial statement element, Deferred Inflows of Resources, represents an acquisition of net assets that applies to a future period and so will not be recognized as revenue until then. The District has two items that meets the criterion for this category -deferrals of pension and OPEB expense.

40

ImprovementsotherthanBuildings

WasteTreatment/PumpingStationsMachinery

InterceptorSewerLines

CollectorSewerLines

Buildings/WasteTreatmentPlants 50years LabEquipment 5-10years

10-50years MaintenanceEquipment 5-10years

10-15years Automobiles/Trucks 5-10years

50-100 years CommunicationEquipment 5-10years

50-100 years ComputerEquipment/Software 3-5years OfficeFurniture/Fixtures 10years

K. Compensated Absences

The vacation policy of the District provides for the accumulation of up to forty (40) days earned vacation leave with such leave being fully vested when earned. Accordingly, an expense and a liability for compensated absences and any salary-related payments such as retirement contributions and payroll taxes are recorded. Accumulated earned vacation at June 30, 2022 is $883,174. See Note 3D forfurther details.

The District's sick leave policy provides for an unlimited accumulation of earned sick leave. Accumulated sick leave at June 30, 2022 amounts to approximately $2.78 million. Sick leave does not vest but any unused sick leave accumulated at the time of retirement may be used in the determination of length of service for retirement benefit purposes. Since the District has no obligation for the accumulated sick leave until it is actually taken, no accrual for sick leave has been made.

L. Cash Equivalents

ForthepurposesoftheStatementofCashFlow,theDistrictconsidersallhighlyliquidinvestments (including restricted assets) with an original maturity of three months or less when purchased to be cash equivalents.

M.Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and disclosures of contingent assetsandliabilitiesatthedateofthefinancialstatementsandthereportedamountsofrevenues and expenses during the reporting period. Actual results could differ fromthose estimates.

N. Operating and Non-operating Revenues and Expenses

The District defines operating revenues and expenses as those directly received and incurred in the process of providing wastewater collection and treatment. Nonoperating revenues and expenses are those resulting from incidental functions such as investment income, interest expense on long-term debt, and sale of surplus equipment.

41

O. Pensions and OPEB

For purposes of measuring the net pension liability, deferred outflows of resources, deferred inflows of resources related to pensions, pension expense, information about the fiduciary net position of the Local Governmental Employees’ Retirement System (LGERS), and additions to/deductionsfromLGERS’fiduciarynetpositionhavebeendeterminedonthesamebasisasthey are reported by LGERS. For this purpose, plan member contributions are recognized in the period inwhichthecontributionsaredue.TheDistrict’semployercontributionsarerecognizedwhendue and the District has a legal requirement to provide the contributions. Benefits and refunds are recognized when due and payable in accordance with the terms of LGERS. Investments are reported at fair value.

The District participates in one other postemployment benefit plan (OPEB), for health insurance (The Plan). The District currently finances the Planfollowing a pay-as-you-go approach, paying an amounteachyearequaltopremiumsrelatedtothecoverage.Forpurposesofmeasuringthetotal OPEB liability, deferred outflows and inflows of resources related to OPEB, and the OPEB expense have been determined on the same basis as they are reported by the Plan. For this purpose, the Plan recognizes benefit payments when dueand payable in accordancewith the benefit terms.

42

Investments A reconciliation of the District’s deposits and investments for disclosure purposes and cash,cash equivalents, and investments for financial statement presentation as of June 30, 2022 is included below: Cashonhand $ 350 Deposits 1,804,337 Investments 83,490,268 Total $ 85,294,955 PresentationonStatementofNetPosition CurrentAssets Cashandcashequivalents $ 43,942,852 Investments 32,666,087 Restrictedcashandcashequivalents 7,657,635 NoncurrentAssets Restrictedcashandcashequivalents 1,028,381 Total $ 85,294,955

Note 2—Deposits and

A. Deposits

AlloftheDistrict’sdepositsareeitherinsuredorcollateralizedbyusingthePoolingMethod.Under the Pooling Method, which is a collateral pool, all uninsured deposits are collateralized with securities held by the State Treasurer’s agent in the name of the State Treasurer. Since the State Treasurerisacting inafiduciarycapacityfor theDistrict,thesedepositsareconsideredtobeheld by the District’s agent in theDistrict’s name.

Theamount of thepledgedcollateralis basedon anapprovedaveraging methodfornon-interestbearing depositsand the actual current balance for interest-bearing deposits.Depositories using the Pooling Method report to the State Treasurer theadequacy of their pooled collateral covering uninsured deposits. The State Treasurer does not confirm this information with the District or the escrow agent.

Because of the inability to measure the exact amount of collateral pledged for the District under the Pooling Method, the potential exists for under collateralization, and this risk may increase in periods of high cash flows.

However, the State Treasurer enforces strict standards of financial stability for each depository that collateralizes public deposits under the Pooling Method and the District relies on the State Treasurertomonitorthosefinancialinstitutions.TheDistrict’sformallyadoptedinvestmentpolicy attempts to mitigate custodial credit risk for deposits by pre-qualifying the financial institutions receiving funds. The District also complies with the provisions of G.S. 159-31 when designating official depositories andverifying thatdepositsareproperly secured.

At June 30, 2022, the District’s deposits had a carrying amount of $1,804,337 and a bank balance of $2,025,321 Of the bank balance, $296,697 was covered by federal depository insurance and $1,728,624in interest-bearingdeposits was covered bycollateral held under thePooling Method.

At June 30, 2022, the District had $350 cash on hand.

43

All investments are measured using the market approach: using prices and other relevant information generated by market transactions involving identical or comparable assets or a group of assets.

Level of fair value hierarchy: Level 1: Debt securities valued using directly observable, quoted prices (unadjusted) in activemarkets foridenticalassets.Level2:Debtsecuritiesare valued using a matrix pricingtechnique.Matrix pricing is used to value securities based on the securities’ relationship to benchmark quoted prices.

Interest Rate Risk—As a means of limiting its exposure to changes in fair value arising from risinginterest rates,theDistrict’s formally adoptedinvestment policycallsforstructuring the investment portfolio so that securities mature to meet cash requirements for ongoing operations and/or scheduled debt service, thereby avoiding the need to sell securities on the open market prior to maturity. In addition, the District invests operating funds primarily in shorter-term securities.

Credit Risk—Credit risk is the risk of loss due to the failure of the security issuer or backer. TheDistrict’sformallyadoptedinvestmentpolicymitigatescreditriskbylimitinginvestments tothesafesttypesofsecuritiesandrestrictsthepurchaseofsecuritiestothehighestpossible ratings whenever particular types of securities are rated. As of June 30, 2022, the District’s investments in commercial paper were at least P-1 by Standard & Poor’s, F-1 by Fitch Ratings, andA-1byMoody’sInvestorsService.TheDistrict’sinvestmentsintheNCCapitalManagement TrustGovernmentPortfoliocarriedacreditrating ofAAAmbyStandard&Poor’s asofJune30, 2022. The District’s investments in US Agencies(Federal Home Loan Bank) are rated AAA by Standard & Poor’s and Aaa by Moody'sInvestors Service.

44

InvestmentType Valuation Measurement Method FairValue LessThan 6Months 6to12 Months 1to3 Years 3to5 Years

FairValue –Level1 $27,877,555 $27,877,555 N/A N/A N/A USGovernment

FairValue –Level2 17,410,099 17,410,099 N/A N/A N/A

FairValue –Level1 500,000 500,000 N/A N/A N/A

FairValue

15,275,590 9,379,081 5,896,509 N/A

22,427,024 22,427,024 N/A N/A N/A Total $83,490,268 $77,593,759 $5,896,509 N/A

B. Investments As of June 30, 2022, theDistrict hadthe following investments and maturities.

USTreasuries

Agencies

MunicipalBond

CommercialPaper

–Level2

N/A NCCapital ManagementTrust–Government FairValue –Level1

N/A

Custodial Credit Risk—For an investment, custodial credit risk is the risk that in the event of the failure of the counterparty, the District will not be able to recover the value of its investments or collateral securities that are in the possession of an outside party. The District’s formally adopted investment policy requires all transactions to be conducted on a delivery-versus-payment (DVP) basis and to be held by acontracted third-party custodian and evidencedbysafekeepingreceipts.AtJune30,2022,theDistrictdidnothaveanyinvestments exposedto custodial credit risk.

Concentration of Credit Risk—The District’s investment policy mitigates concentration of credit risk, that is, the risk from the failure of any one entity or industry, by limiting the maximumamountoftheDistrict’sportfoliothatmaybeinvestedinBankers’Acceptancesand Commercial Paper to 20% each.

Inaddition,theDistrict’sformallyadoptedpolicylimitsinvestmentinanysingleissueofanongovernmental entity to thegreater of $5,000,000 or1% of the entire portfolio.

C. Hedging Derivative Instrument

At June 30, 2022, the District had the followinghedging derivativeinstrument:

The fair value of the interest rate swap is determined using Level 2 inputs of the fair value hierarchy. Inputs used in determining the fair value of the interest rate swap include both observable and unobservable inputs. Observable inputs include the notional amount as shown above and the variable and fixed rates within the swap agreement as disclosed in Note 3c. Unobservable inputs include quoted market prices for similar instruments, discounted cash flow methodologies, or similar techniques.

The mark-to-market valuation was established by market quotations from the counterparty representingestimatesoftheamountsthatwouldbepaidforreplacementtransactions.Because

45

Changes

Fair Value Fair Value - June

2022 Type Objective Valuation Measurement Method Notional Amount Classification Amount Effective Date Maturity Date Classification Amount Cash Flow Hedge: Pay-Fixed Interest Rate Swap Hedge

cash flows

Revenue

Fair Value Level

$22,860,000 Deferred

Resources $2,209,435 1/6/2005 7/1/2031 Debt $ (809,389)

in

30,

of changes in

on the 2005/2008A Series

Refunding Bonds

2

Outflow of

the coupons on the District’s variable-rate bonds adjust to changing interest rates, the bonds do not have acorrespondingfair value increase.

Objective—Asameanstolowerits borrowingcosts,whencomparedagainst fixed-rate bonds at the time of issuance in January 2005, the District issued variable interest rate debt and entered into an interest rate exchange agreement (swap) in connection with its variable rate Series2005RevenueRefundingBondsintheamountof$33,915,000.Theintentionoftheswap was to effectively changethe District’s variable interest rate on thebonds to a synthetic fixed rate of 3.4175%.

In April 2008, the District issued $33,635,000 in Series 2008A Revenue Refunding Bonds to currently refund the Series 2005 Revenue Refunding Bonds. The swap described above now applies to the Series 2008A Revenue Refunding Bonds. In April of 2020, the District amended the swap to eliminate the London Interbank Offered Rate(LIBOR) rate it receives as a variable payment. As a result the new synthetic fixed rate is 3.2910%.

Terms—Undertheinitialtermsoftheswap,theDistrictpaysthecounterpartyafixedpayment of 3.4175% and receives a variable payment computed as 59% of the one-month LIBOR plus 35 basis points. In April of 2020, the District amended the term of the swap, the District pays the counterparty a fixed payment of 3.2910% and receives a variable payment computed as 100% of theSecuritiesIndustry and Financial Markets Association (SIFMA).

TheswaphadaninitialnotionalamountequaltotheassociatedSeries2005variableratebond principal amount of $33,915,000. Theswapwas entered into at the sametimethe Series 2005 Bonds were issuedin January of 2005.

Starting in Fiscal Year 2006, the notional value of the swap and the principal amount of the associated debt declined in equal amounts. As the swap now applies to the Series 2008A Bonds, the remaining notional value of the swap is correlated to the variable rate bond principal amount of $33,635,000. Starting in Fiscal Year 2010, the notional value of the swap and the principal amount associated debt decline in similar amounts until the debt is completelyretired.The notional amount outstanding is $22,860,000 as of June 30, 2022.

The bonds’ variable rate coupons are determined by the remarketing agent based on prevailing market conditions. This usually approximates SIFMA. The bonds and the related swap agreement both mature on July 1, 2031.

46

CreditRisk—Asof June 30,2022, theDistrictwasnotexposedto credit riskbecausetheswap hadanegativefairvalue.However,shouldinterestrateschangeandthefairvalueoftheswap becomespositive,theDistrict wouldbeexposed to credit risk intheamountof theswap’sfair value. The swap counterparty was rated Aa2 by Moody’s and A+ by Standard & Poor’s, and AA by Fitch Ratings as of June 30, 2022. To mitigate the potential credit risk, if the counterparty’s credit quality falls below Baa3 (Moody’s) and BBB-(S&P), the value of the swap may be fully collateralized by the counterparty or by several other means specified in the International Swap Dealers Association (ISDA) Master Agreement and Counterparty Schedule.

Interest Rate/Basis Risk—As noted above, the swap exposes the District to basis risk should the relationship between SIFMA and the bonds’ variable rate coupns determined by the remarketing agent, changing thesyntheticrate onthe bonds.

The effect of this difference in basis is indicated by the difference between the intended synthetic rate of 3.2910% and the actual synthetic rate for the period ending June 30, 2022 of 3.2110%. As of June 30, 2022, the rate on the District’s bonds was 0.90% whereas 100% of SIFMAwas0.98%.Ifachangeoccursthatresultsintherates movinginadirectionunfavorable to the District, the expectedcost savings may not be realized.

Termination Risk—The interest rate exchange contract uses the ISDA Master Agreement, which includes standard termination events, such as failure to pay and bankruptcy. The ISDA Schedule to the Master Agreement includes an “additional termination event.” That is, the swap may be terminated by the District if the counterparty’s credit quality rating falls below Baa3 (Moody’s) and BBB-(S&P). The District or the counterparty may terminate the swap if the other party fails to perform under the terms of the contract. If the swap was terminated, the variable-rate bonds would no longer carry a synthetic interest rate. In addition, if at the time of termination the swap has a negative fair value, the District would be liable to the counterparty for apayment equal to the swap’s fair value.

Market Access Risk/Rollover Risk—The District’s interest rate exchange contract is for the term (maturity) of the bonds and, therefore, thereis no market-access risk or rollover risk.

47

Note 3—Long-Term Obligations

A. Long-Term Debt

The District issues debt to help finance the cost of rehabilitation of wastewater interceptor and collection infrastructure, and treatment plant facilities. All debt is secured by a pledge of and payable from net receipts and certain other moneys. In the event of a default, the District agrees topaytothepurchaser,ondemand,interestonanyandallamountsdueandowingbytheDistrict under the related agreements. Unlike cities and counties, the District has no legal debt limit. However, the District must comply with the legal requirements contained in its Bond Order as describedin Note 11.

TheDistrict’sborrowingsaresubjecttofederalarbitrageregulations;however,managementdoes not anticipate any material liabilityfor arbitrage from any of these debt issues.

The District currently hasthefollowingissuesoutstanding:

OriginalIssue Amount

Revenue Bonds: Enka-CandlerWater&SewerDistrictBonds $ 1,451,000 Series2008A,RevenueRefundingBonds 33,635,000 Series2013,RevenueRefundingBonds 30,230,000 Series2014,RevenueBonds 26,195,000 Series2017,RevenueandRefundingBonds 37,485,000 Direct Borrowings -StateRevolvingFund: 2009NorthCarolinaWaterPollutionControlRevolvingFund $ 672,980

48

The following is a summary of changes in the Districts’ long-term debt for the Fiscal Year ended June 30, 2022:

BALANCE JULY 1,2021 ADDITIONS RETIREMENTS

BALANCE JUNE 30,2022