By Tiffany Kjos

Competing with some of the biggest players in the finance industry, Vantage West Credit Union has thrived for 70 years by being deeply committed to the community, making banking more accessible, particularly for low- and middle-income members, and by providing proactive, innovative technological solutions.

With more than 200,000 members, Vantage West is the largest credit union based in Southern Arizona and has more than doubled its assets in just the last 10 years.

“Our continued growth is a strong reflection of the trust and support we’ve earned from the communities we serve,” said Mark Papoccia, chief commercial and impact officer at Vantage West Credit Union. “Many people turn to credit unions because they’re seeking a more personalized, member-first experience − something that can be hard to find at larger financial institutions. At Vantage West, our focus has always been, and will continue to be, on serving our members and putting their needs at the center of everything we do.”

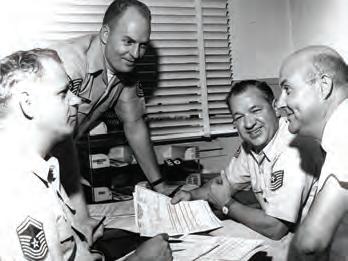

Started in a one-room barracks at DavisMonthan Air Force Base with the mission to help Tucson’s airmen and their families. Served a little under 600 members and had less than $60,000 in assets.

1960s

By the end of the 1960s, grew to nearly 14,000 members sowing the seeds for the rapid growth in the decades to come.

1975 - 1989

Merged with five different credit unions.

Merged with Saguaro Credit Union and nearly doubled in size.

Introduced Investment Service through a CUSO (Credit Union Service Organization).

2003 Launched Business Banking.

The fundamental difference between banks and credit unions is that stockholders own banks, and profits go to them. In contrast, credit unions are owned by their members, and profits are reinvested into the community through loans and other services, said Sandra Sagehorn-Elliott, president and CEO of Vantage West.

Remaining competitive means continuously evolving Vantage West’s portfolio of loan and deposit solutions to meet changing member needs, Sagehorn-Elliott said. “The world is changing so quickly, we have to keep up and give people what they’re looking for.”

Changed the name to Vantage West and converted from a federal to a state charter. The new name was to better represent the diversity of the membership that spanned beyond DMAFB and paved the way for continued expansion across the state of Arizona.

Vantage West expanded by merging with First Edition Community Credit Union and the former Tombstone Federal Credit Union.

2011

Expanded its presence in Pinal County and cut the ribbon on the Casa Grande branch.

The credit union has come a long way since its founding in 1955, with 600 members and an office in a one-room barracks. Originally known as DMAFB Federal Credit Union, the organization was established on Davis-Monthan Air Force Base to help airmen who were often targeted with high-interest loan offers, Sagehorn-Elliott said. Today, Vantage West still serves many military personnel and retirees but has expanded its membership to include a larger geographic footprint in Pima, Pinal, Cochise and Maricopa counties.

2015

Recognized as the first Arizona credit union to earn the Juntos Avanzamos designation for commitment to serving the Hispanic market.

2017

Earned 17 Arizona Daily Star Reader’s Choice Awards.

Since its 60th anniversary, Vantage West’s assets have surged from $1.5 billion to $3.2 billion. And while it expanded through mergers in the past, the last decade saw it grow organically.

“We had a couple of mergers, but the most recent was well over 10 years ago,” Sagehorn-Elliott said. “Word of mouth is huge – families referring their children and their neighbors − and we work hard to offer products and services that are relevant.”

That growth also reflects an increase in home loans, and auto, personal, credit card and business loans, Papoccia said.

“We can only make those loans through the depositors – those individuals who have faith in us, members who place their deposits with us,” he said. “In return, we pass along the benefits associated with that by making loans with low rates and flexible terms right here in our community.”

The credit union has trained 90 bankers as financial coaches who work with members and, in some cases, nonmembers in branches and through Vantage West’s call center. It also deploys credit union representatives into the community.

continued on page 102 >>>

2018

Earned the special designation from the U.S. Treasury as a Community Development Financial Institution or CDFI.

2019

Expanded into the Phoenix East Valley and opened the Cooper Square branch in Gilbert.

2023

Refreshed the company brand to reflect a modern approach to banking, setting the stage for future growth and innovation.

Launched Interactive Teller Machines at 43rd & Peoria branch to provide additional one-on-one touchpoints for members in Glendale.

Opened the Interstate 19 and Irvington branch and expanded into South Tucson.

2024

Began remodeling branches to reflect new brand and suppor t member needs.

2025

Introducing a new branch in Oro Valley later this year: 11165 N. La Cañada Drive, Suite 155.

continued from page 101

For example, it recently joined with the Sahuarita Food Bank and Community Resource Center to offer regular office hours every week at the food bank, where it provides financial coaching and the opportunity to open accounts and help members apply for loans.

“We continuously get feedback that organizations are amazed that we not only come out and talk about what we want to do, but then we show up the next day and we actually do it,” Papoccia said.

The credit union’s community-mindedness is also reflected in its loan-making decisions, which all happen locally. Often, members who apply for a loan via the credit union’s app are approved immediately, but, “if there’s any question, then a real, live person gets involved and will contact you and take the time to understand you and your needs and clarify any questions. That’s all happening right here in Tucson,” Sagehorn-Elliott said.

As a result of helping people in lowerincome brackets, Vantage West was certified as a Community Development Financial Institution in 2018, which gives it access to federal grants through the CDFI fund.

teller machines, Vantage West continues to expand its physical footprint. Its newest location opened in 2024 in the Golder Ranch Plaza on Oracle Road, and the next new branch will open soon at West Naranja Drive and North La Cañada Drive.

Vantage West is on a mission to make members feel at home at its branches by hosting events such as Member Appreciation Week and a celebration of its 70th anniversary. The credit union also allows nonprofits to use many of its branches for meeting space.

sages, but genuine check-ins to ensure our needs are being met and our mission is being supported,” Bond said.

The credit union supports its employees with a robust benefits package that includes generous parental leave, paid time off, and free education through the University of Arizona Global Campus, which offers classes online.

“We always had an education benefit, but this program with the University of Arizona makes it so easy for people with full-time jobs to further their education – it’s very flexible,” Sagehorn-Elliott said. “When the program launched, we went from about 10 or 12 employees taking advantage of our education ben-

“We pass those grants on to other community organizations and nonprofits and we give them back to our membership through lower fees and interest rates on loans,” Papoccia said.

In 2006 the credit union converted from a federal to a state charter, which enabled it to open membership to more Arizona residents, and it changed its name from DMAFB Federal Credit Union to Vantage West to reflect its new stature.

“So now we have ways of accepting people into the membership that we did not have when we were a federally chartered credit union,” Sagehorn-Elliott explained. “There’s not a big barrier to membership as there had been in past years.”

The credit union still has a branch at Davis-Monthan, along with 12 others in Tucson and five in the Phoenix area, Casa Grande, and Tombstone. While emphasizing technology such as its robust online banking and interactive

– Sandra Sagehorn-Elliott President & CEO Vantage West Credit Union

Employees at each branch also get to choose a community nonprofit to support and hold donation drives to support it.

Esperanza, a nonprofit that helps homeless veterans, has benefited from Vantage West’s philanthropy. Last year it received an unexpected $5,000 donation from Vantage West and ultimately moved its banking operations to the credit union.

“We didn’t realize what we were missing until we discovered what genuine community banking looks like,” said Esperanza CEO Suzanne Bond. “Where our previous banking relationship was transactional, Vantage West has proven to be transformational.”

“Since officially making the switch, I receive personal emails from bank employees regularly – not automated mes-

antage West also offers wellness incentives and in-person sessions with investment and retirement advisors. Those kinds of benefits, and its authentic community culture, keep employees Kelly Mobley happy and engaged.

Mobley started as a teller 22 years ago, progressed through the branches into management, and is now VP of digital and payments.

“Each individual’s journey is unique, and what truly sets Vantage West apart is our commitment to not only professional development but also educational opportunities. This investment significantly impacts our growth,” she said. “Ultimately, our focus is on helping people. When we thrive as an organization, we can reinvest in our communities, fostering their growth and success.”

Vantage West believes that its people are the key to the organization’s success, and nowhere is this more evident than in a platform called Idea Exchange.

Any employee, brand new or tenured, can point out opportunities to improve products, processes or guidelines all for the benefit of the credit union’s members. A cross-functional team evaluates every suggestion and for each one that is adopted, the employee receives time off with pay or a bonus.

“I am a firm believer that our team members who are closest to the work are the ones with the best grasp of how to eliminate unneeded steps, improve products, and enhance our members’ experience with the credit union,” said Sagehorn-Elliott.

Sandra Sagehorn-Elliott President & CEO

West Credit Union

By Tiffany Kjos

Sandra Sagehorn-Elliott made the bold decision to move to Tucson without ever setting foot in the city. She was captivated by its unique charm from the moment she arrived.

With more than two decades of experience in the financial services industry, Sagehorn-Elliott was recruited to take on the role of president and CEO at Vantage West Credit Union, coming from her position at a Massachusetts credit union during the peak of the COVID pandemic.

She interviewed with the Vantage West board via Zoom, and never had the chance to visit Tucson. But she saw a growing organization in a place that was appealing to her.

“When we did come out, my whole family and I just fell in love with Tucson – with the mountain views that surround the city, which is so full of culture and art and great restaurants,” Sagehorn-Elliott said. “And it’s just amazing how warm people are. We are really lucky.”

October marks five years for Sagehorn-Elliott at the credit union, and she is eager to lead the 70-year-old institution into the future with innova-

tive tools that make banking easier and more convenient for members.

“We, of course, know that the technology and offering all those convenience features for our members, is incredibly important to them,” she said. “They’ve told us that in their actions and their comments. So that’s going to continue to be a focus. But we really think the people side of our business is the most important element of what we do.”

Sagehorn-Elliott, from the tiny town of Polk, Neb., population 400, infuses her work with her personal philosophy of being helpful and kind, which she attributes to the lessons learned from living in such a close-knit community.

“It was an amazing way to grow up,” Sagehorn-Elliott said. “There was a really strong sense of community, so I think that taught me a lot about the value of creating community. I think that’s why I was so drawn to credit unions.”

Sagehorn-Elliott’s career in the credit union sector began at a call center while she was attending Nebraska Wes-

continued on page 106 >>>

“We really think the people side of our business is the most important element of what we do.”

continued from page 105

– Sandra Sagehorn-Elliott, President & CEO, Vantage West Credit Union

leyan University. Most recently, she was an executive for five years at Workers Credit Union in Massachusetts. Before that, she worked for 14 years at Bellco Credit Union in Colorado.

What drives her, she said, is the ability to change people’s lives – she has “umpteen” stories of how the credit union has helped people through good times and bad. One member, who co-signed for an auto title loan with an annual interest rate of a whopping 119% and $500 monthly payments, wept when he found out the credit union had approved his loan application and dropped his payment to $139 a month. Another member, who worked for a nonprofit while

supporting her daughter on her own, is now a proud homeowner.

Sagehorn-Elliott is committed to uplifting credit union members, particularly when they are facing hardships.

“It’s humbling that people trust us so much,” she said. “We train our representatives to be super sensitive to the fact that some people have shame connected to their financial missteps. And what we try to tell them is everybody has made a bad financial choice or two in their life. We’re not here to judge –we’re here to help.”

Named among the Most Influential Women in Arizona by AZ Business Magazine in 2021, Sagehorn-Elliott is deeply involved in the community. The

credit union is a member of The Chamber of Southern Arizona along with the Marana, Oro Valley, Southern Arizona Hispanic, Vail and Tombstone chambers of commerce.

Sagehorn-Elliott also is a member of the Southern Arizona Leadership Council.

“We are big believers in the value of local organizations, and I’ve been really impressed in Tucson, and Phoenix, too, at the number of organizations that exist (to help the community),” she said. “We really believe that you dance with the one that brought you to the party. Our members have been really good to us, so it’s important for us to give back and to be involved.”

“We have reimagined the teller position.”

– Jimena Valdés-Walls Senior VP, Member Experience Vantage West Credit Union

By Tiffany Kjos

Vantage West Credit Union is flipping the script on banking tech with interactive teller machines that offer more personal interaction with bankers, not less, and allow employees to spend more time focusing on what really matters –meeting members’ needs.

The ITMs enable users to conduct transactions via a video connection with a live banker “like an ATM 2.0,” said Jimena Valdés-Walls, Vantage West’s senior VP of member experience. “Think about the ATM today – you can make deposits, withdrawals, payments, transfers. You can do all that at an ITM, but now you have the option to talk to a live banker if you have additional questions or have a more complex transaction and you need assistance.”

Vantage West deployed ITMs in Phoenix in 2023, and they are now in lobbies, and outside or at drive-thrus at 17 of its 18 branches, including Southern Arizona.

“One of the biggest differences that I’m excited about is we’re able to offer extended hours for our members,” Valdés-Walls said. “Usually, our hours are 9 to 5 Monday through Friday, 9 to 1 on Saturday. But with the ITMs, we now offer assistance with a live banker an hour before we open and an hour after we close.”

The credit union introduced the machines in response to a decline in teller transactions as members increasingly opted for online and other services.

“Our members were starting to adopt our digital services and ATM services, so we were starting to see a downturn

in transactions (in branches) and we thought, let’s be proactive and reimagine the teller role and see how we can keep these team members engaged so we have less turnover in our branches and have more satisfied members overall,” Valdés-Walls said.

Initially, members worried that the ITMs would eliminate jobs. But the technology still employs local bankers, and the credit union trained its team members as “ITM ambassadors” to help members navigate the technology.

“We have reimagined the teller position so they’re able to do what they actually love doing, which is to help members achieve their short-term and long-term financial goals,” Valdés-Walls said.

Even credit union members who were initially hesitant to try the new technology have now welcomed it, often with assistance from the ITM ambassadors.

“Jimena and her team understand that the one-on-one, direct approach when members walk into the branch is the best way to explain the new features and to gain adoption, as well as to highlight that the virtual bankers are all local,” said Keysha Webb, the credit union’s senior VP of market development.

At their core, the ITMs have allowed the credit union to strengthen its commitment to a consultative banking approach rather than a purely transactional one, Valdés-Walls said.

“Before, when you walked into a branch and made your withdrawal or deposit or transfer, we didn’t have the

opportunity to talk to you about your financial goals because we had a long line of members waiting behind you who also needed help,” she said.

“We wanted to shift that approach to being more consultative, where you can self-serve for your transactions by using the ITMs, and then you can sit down with a banker who has the time and the ability to really help you achieve your goals. That’s really where we feel that we can offer more benefit to our members rather than just processing transactions all day long.”

And benefiting members and the community is at the heart of everything the credit union does. That includes reenvisioning branches as community centers that Vantage West uses for celebrations and nonprofits use for meetings, while creating welcoming spaces for members.

“I think of it as when you walk into one of our branches you are greeted by a friendly face, someone who knows you by name, an individual who makes you feel comfortable and will provide solutions for you that make sense,” Webb said. “We never push products. We offer tailored solutions.

“That, to me, is much more community-focused – it’s not about making the most profit and distributing it to shareholders. It’s about making our membership stronger, because if they’re more financially stable, that makes a community stronger overall.”

By Jay Gonzales

In the broadest terms, “community” means the people around you, generally within a certain geographic location.

Vantage West Credit Union sees community as much more.

As a member-owned and locally headquartered credit union, Vantage West views its role as a community partner as an integral part of its business strategy.

It’s why, for the first time in its 70-year history, Vantage West created an executive-level position for its community efforts.

In 2018, Vantage West’s longtime impact as a community partner earned the credit union a special designation from the U.S. Treasury as a Community Development Financial Institution – or CDFI – which opened the door to government resources that would allow it to provide more loans to its membership base, particularly in low-income communities.

“Becoming a CDFI introduced a renewed outlook on growth opportunities and provided a valuable framework for aligning our efforts with the evolving needs of the community,” said Jon Bruflat, who was named VP of community impact for Vantage West in 2023. “We started looking at all of what we had been doing and said we should narrow our focus to what truly drives economic growth in our community.

“The culmination of those two factors highlighted that we should probably have someone dedicated to this. Not only did we have resources that we didn’t have before, we had a new sense of strategy and purpose,” he said. “At the same time, organizations we wanted

to partner with were reaching out to us, and we had to find a way to bring all of that together and make it work.”

With Bruflat as VP and a narrowed focus on its community work, Vantage West began taking a look at specifically where and how it was placing its resources in the community, said Rosanna Ramirez, who was named PR and market development manager in 2024.

“We were already doing the work,” Ramirez said of the donations, sponsorships and volunteerism Vantage West was putting into the community. “We just wanted to refine it, and it was looking at how we could be more intentional with the resources that we were going to be serving our community with.”

“For us, it really is building relationships and connections between the people in our community, with nonprofit organizations and local businesses, along with other credit unions in the area.”

One of those ways Vantage West is building relationships is to pay its employees 16 hours annually to do work in the community. Ramirez said it can be used for anything from an employee reading to a child’s class to doing work for a local charity. In 2024, it led to over 4,200 hours of service.

“When we say community, we say we’re serving our neighbors,” Ramirez said. “We’re serving people who we know, our peers and even our own team members within Vantage West.”

Jaime Hinojos leads a program that combines community impact with good business by promoting financial wellness for credit union members and the community at large. The program started in January 2024.

Hinojos said the organization’s leadership saw a need to provide members with financial coaching from a live person at a credit union branch instead of visiting a big-bank website and hoping for the best.

“We decided to do something different where you can meet with someone one-on-one at a branch or remotely by appointment,” Hinojos said. “Then, once you meet with that person one-onone, we’ll create that road map for you to be able to achieve whatever financial goal that might be.”

With branches in Tucson and surrounding communities including Marana, Vail, Oro Valley, Tombstone, Casa Grande, Davis-Monthan, as well as three branches in the Phoenix area, Vantage West is taking its financial wellness services to members where they’re needed.

“Our coaches are trained to know the resources in their own communities so they can refer our members to those resources,” Hinojos said. “That’s another way we differentiate our approach.”

In the end, Bruflat said, it’s about caring. He calls the Vantage West strategy a “layered approach.”

“We are in the community and we care about the community,” he said. “That’s a genuine feeling that all of our staff have. We really do care.”

“We want to be more than just a donation or sponsorship. We want to be a community partner. A lot of times that means just starting a conversation and seeing where it takes us. We want to meet our communities where they are, and we want to be there for a long-term partnership.”

David Denos VP, Commercial Sales

Vantage West Credit Union

By Jay Gonzales

With nearly three decades as a businessman in Tucson, Edmund Marquez has been around the proverbial block a time or two with various banks, credit unions and other financial institutions.

He’s owned an insurance agency since he was 22. He owned an auto dealership, operated some gas stations, and dabbled in automobile warranties, repairs and financing.

More recently, as a real estate investor, he’s experiencing the value of working with a credit union – specifically Vantage West Credit Union – in an area that hasn’t been a common offering by those financial institutions – a commercial real estate loan.

“I have banks that I do business with, and when you look at what’s happening in the economy, with all the different regulations, you have to survey the environment,” Marquez said. “Traditionally, an individual doesn’t think about credit unions when it comes to commercial lending.

“But in the last 10 years or so, credit unions have started to really get into the commercial game, and they’ve been smart about it. They stick to the breadand-butter deals of commercial real estate. They’ve ended up being the most competitive.”

Credit unions are generally known for offering more personalized, often locally focused service to businesses, whereas large banks tend to cater to bigger commercial clients, particularly for high-value needs like commercial real estate financing.

That’s changing, said David Denos, VP of commercial sales for Vantage West. Denos was referred to Marquez for his insurance needs when he moved to Tucson. It was from that relationship that Marquez went to Vantage West for a loan on a commercial property he’s acquiring.

Denos said the company has fully staffed, specialized teams supporting both commercial lending and a comprehensive suite of business banking services, including tools to handle payments, deposits and expenses, equipment financing, and lines of credit.

What sets a local credit union apart is the kind of relationships it can build with its members − something big banks often struggle with unless you’re one of their high-value clients, said Mark Papoccia, Vantage West’s chief commercial and impact officer.

“As with any meaningful relationship, trust and respect must be earned over time,” Papoccia said. “It rarely happens in the first meeting − it often takes multiple touchpoints to build genuine rapport and lasting connections.”

“In the last 10 years or so, credit unions have started to really get into the commercial game, and they’ve been smart about it.”

– Edmund Marquez, Agency Principal, Edmund Marquez Allstate Agencies

Denos added: “We really encourage our team to go on-site and meet our business members, to see their operations first-hand, build stronger relationships, and gain a deeper understanding of how their businesses work.

“If we all understand where we’re trying to go and exactly what we’re trying to do, it helps if there’s no miscommunication − or what I call the 11th-hour fire that potentially pops up every now and then and ends up creating confusion in a transaction. We really try hard to avoid those.”

As it does with its financial wellness program for individual members, Vantage West wants to be a resource for its commercial customers to help them manage their businesses and succeed.

“We’re committed to offering thoughtful advice and guidance at every stage,” Papoccia said. “Just like individuals, businesses go through life cycles whether it’s securing startup capital, funding for expansion, or implementing advanced cash management solutions as their operations evolve.

“No matter the size − whether you’re a large enterprise or a first-time entrepreneur − we’re here to support that jour ney with the right tools and insights at each step.”

A necessary aspect of building those relationships and that trust with its members, Denos said, is hiring the right people to do that. He said it’s what separates credit unions − at least Vantage West Credit Union – from banks and competitors.

“When it comes to financial institutions, our products or offerings are largely similar,” Denos said. “Our competitive advantage is the people we hire. We go to great lengths to make sure we are hiring top talent that truly cares about helping businesses.”