COMMERCIAL | EMPLOYEE BENEFITS | PERSONAL | LIFE

MICA_MCMSwrapad9-15.qxp_Layout 1 9/9/15 4:23 PM Page 1

your side. From day one. We’ll be at your side. And on your family and your business. build peace of mind – for you, to help you reduce risks and has the expertise and resources obstacle. Johnson Insurance partners, you can overcome any With solid planning and strong

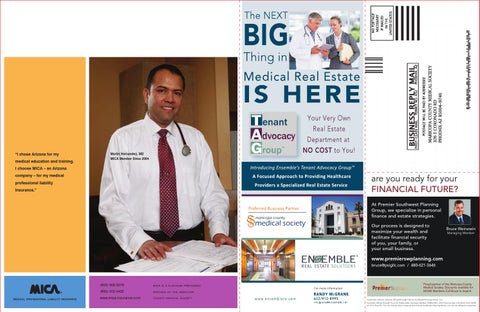

“I chose Arizona for my medical education and training.

always be 100% for you. can be against you, we’ll In a world where statistics

Martin Hernandez, MD MICA Member Since 2004

I choose MICA – an Arizona

Persevere. Protect. Prepare.

company – for my medical professional liability insurance.”

are you ready for your FINANCIAL FUTURE? At Premier Southwest Planning Group, we specialize in personal finance and estate strategies. Our process is designed to maximize your wealth and facilitate financial security of you, your family, or your small business.

Bruce Weinstein Managing Member

www.premierswplanning.com bruce@psigllc.com / 480-621-3646

MEDICAL PROFESSIONAL LIABILITY INSURANCE

(602) 956-5276

MICA IS A PLATINUM PREFERRED

(800) 352-0402

PARTNER OF THE MARICOPA

www.mica-insurance.com

COUNTY MEDICAL SOCIETY

Proud partner of the Maricopa County Medical Society. Discounts available for MCMS Members.Call Bruce to inquire. Investment Advisory Services offered through Premier Southwest Planning Group, LLC. Securities offered through The O.N. Equity Sales Company Member FINRA/SIPC, One Financial Way, Cincinnati, Ohio 45232 Ph: 513-794-6794. The O.N. Equity Sales Company and Premier Southwest Planning Group, LLC are not affiliated companies.