Understanding Your Ownership Statement

Ownership Name

This should be the registered Ownership as noted on the Certificate of Title.

Owner contact information

The address block contains your information contained in our system.

Statement information

Statement numbers are sequential starting at 1.

Statement Period = Dates covered by this statement.

Opening Balance = The $ amount in your account at start of this statement.

Closing Balance = The $ amount in your account at end of this statement. Ownership Payment = $ amount paid to you on this statement.

Tax Invoice

Owner Statements are Tax Invoices.

Rental Income Summary

Rental Income will be displayed as a total per property. GST Paid will display on Ownerships with Commercial Properties who are registered for GST. It will be broken down by rent/budgeted outgoings

What does Paid To, Effective Paid To and Part Payment mean?

Paid To: The date tenant is Paid To for a fully paid rental period ie Weekly/Fortnightly/Monthly. This date does not factor any Part Payments.

Part Payment: Funds that have been allocated to rent that do not amount to a fully paid period. This is recorded as a credit towards the rent and is carried over until the full period is paid.

Effective Paid To: The Effective Paid To Date will differ from the Paid To Date when there is a Part Payment. The Part Payment is divided by the daily rent to produce the Effective Paid To Date.

Property income, expenses and Ownership contributions

Income and Expenses from Invoices or Ownership contributions will be broken down by transaction.

Total property expenses and Owner contributions

Income and Expenses from Invoices or Ownership contributions will show the total in the bottom pane.

Total fees paid / credited

Fees will be totalled by Fee type not Property.

Ownership Payment Breakdown

Where there are multiple Owners, this section will show the breakdown of funds received by each individual.

Total Ownership Payments

The total ownership payment will display as a negative on the account balance, representing funds debited from our account and credited to yours.

GST Summary

GST Summary will only appear for commercial Owners registered for GST.

Outstanding Amounts

Details of any outstanding invoices or transactions will appear here. (This section will not print if there are no transactions to show)

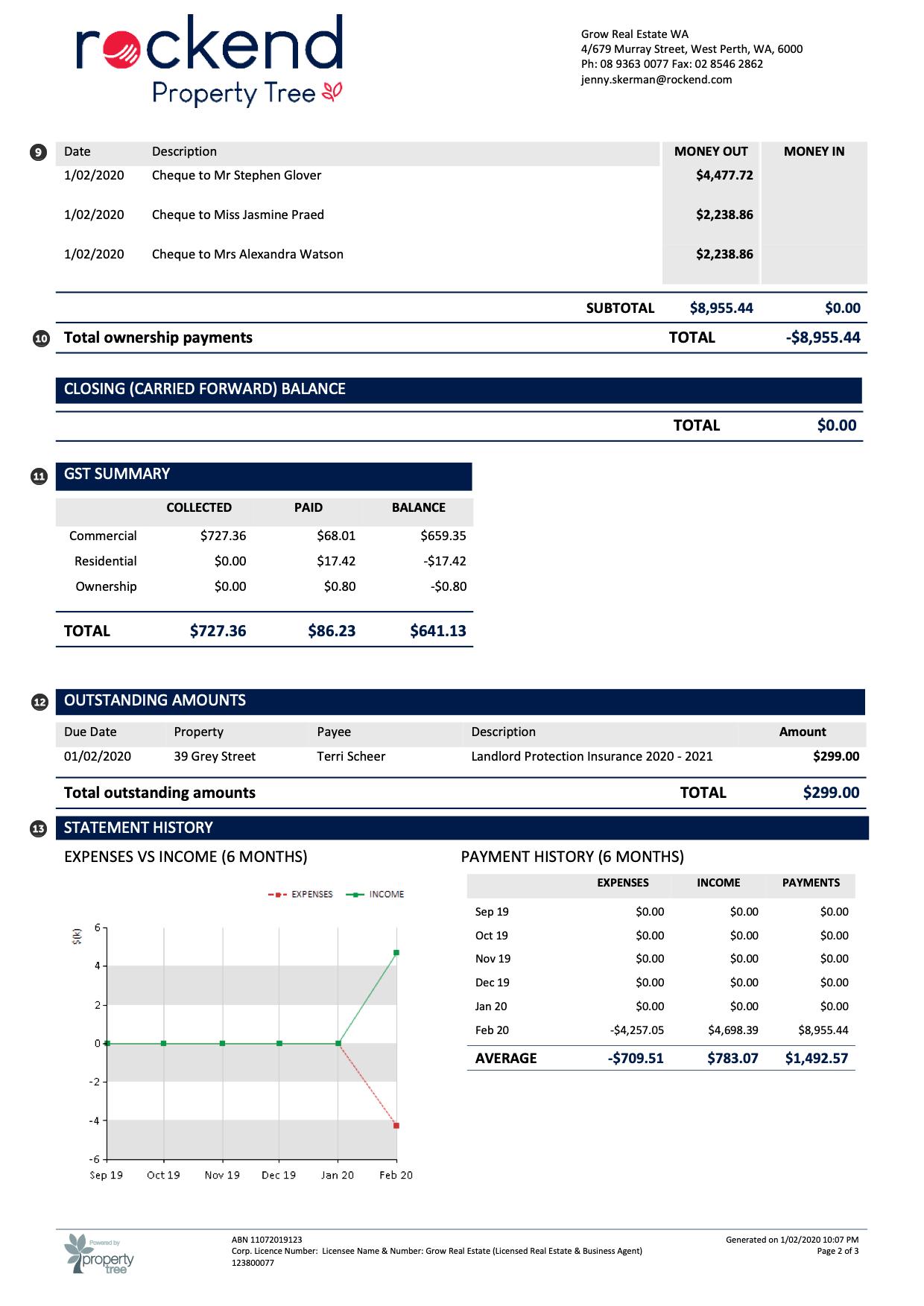

Statement History

Gives a snapshot of the totals for the past 6 months and provides the information in a line graph and payment history format. N.B. This is based on totals in the calendar month period so may differ to Ownership Statement totals.

Expenses Vs Income (6 months)

The line graph represents the income and expenses for the past 6 months which collates to the information contained on the Payment History beside it. This graph reflects the income with a green line and the expenses with a red line. The vertical axis reflects the dollar value in $500 increments and the horizontal axis reflects the breakdown for each calendar month in the 6 month period.

Payment History

Income: Income reflects the income received including rent and water usage in the calendar month.

Payments: Payments reflects the amount paid out to the Owner in the calendar month.