by McLachlan Partners

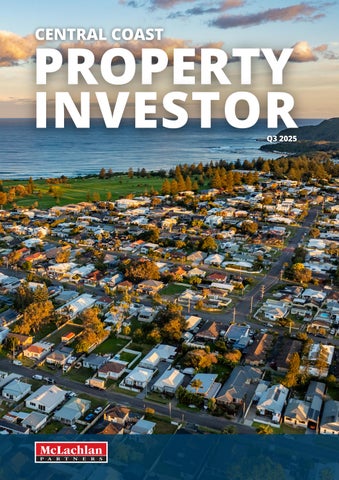

Welcome to the Q3 edition of our Central Coast Property Investor magazine – your trusted guide to smart property ownership and investment on the Central Coast.

In this quarter’s issue, we explore some of the most pressing topics and timely strategies that affect your investment journey. From understanding what tenants want in today’s market to choosing between furnished and unfurnished properties, we've covered the fundamentals of maximising your rental yield without overcapitalising.

We also take a practical look at the end of financial year with a complete financial health check guide for your portfolio, helping you uncover hidden costs, boost cash flow, and leverage your equity for future growth

Thinking of making a move? Whether it’s time to reduce vacancies, upgrade your property’s appeal, or explore if now is the right time to sell, we offer expert guidance to help you make informed decisions.

We know that every property investor’s situation is unique That’s why we’re here to provide clarity, confidence, and personalised service that helps your investment thrive in any market.

If you’re leasing, growing, or considering a sale, contact us for a free, no-obligation appraisal. Let’s talk about how we can help you get the most from your property.

McLachlan Partners

Considering a sale? Scan the QR code to contact our sales team for an up-to-date market appraisal.

Looking to lease your property or change property manager? Scan the QR code, fill in your details and our team will be in touch.

WELCOME

MAXIMISING RENTAL YIELDS

LANDLORD INSURANCE IS ESSENTIAL

FURNISHED OR UNFURNISHED? REDUCING VACANCIES

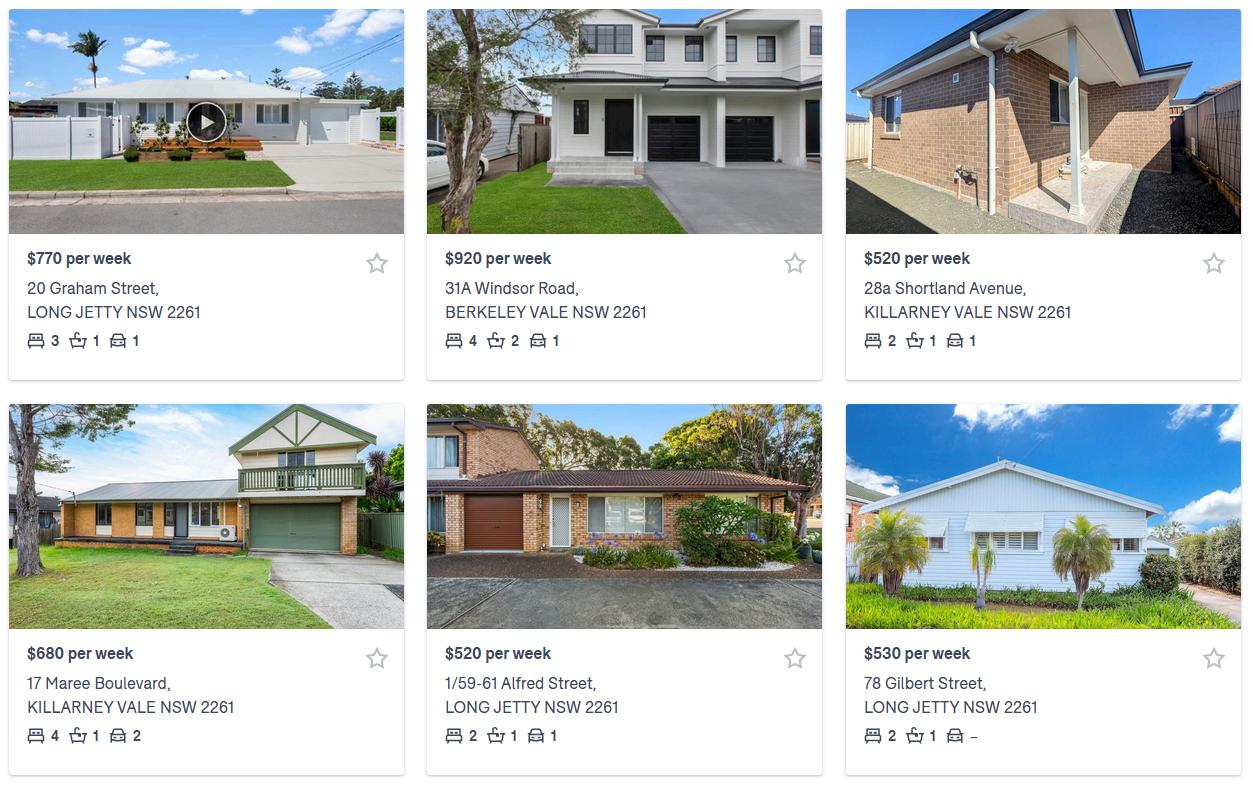

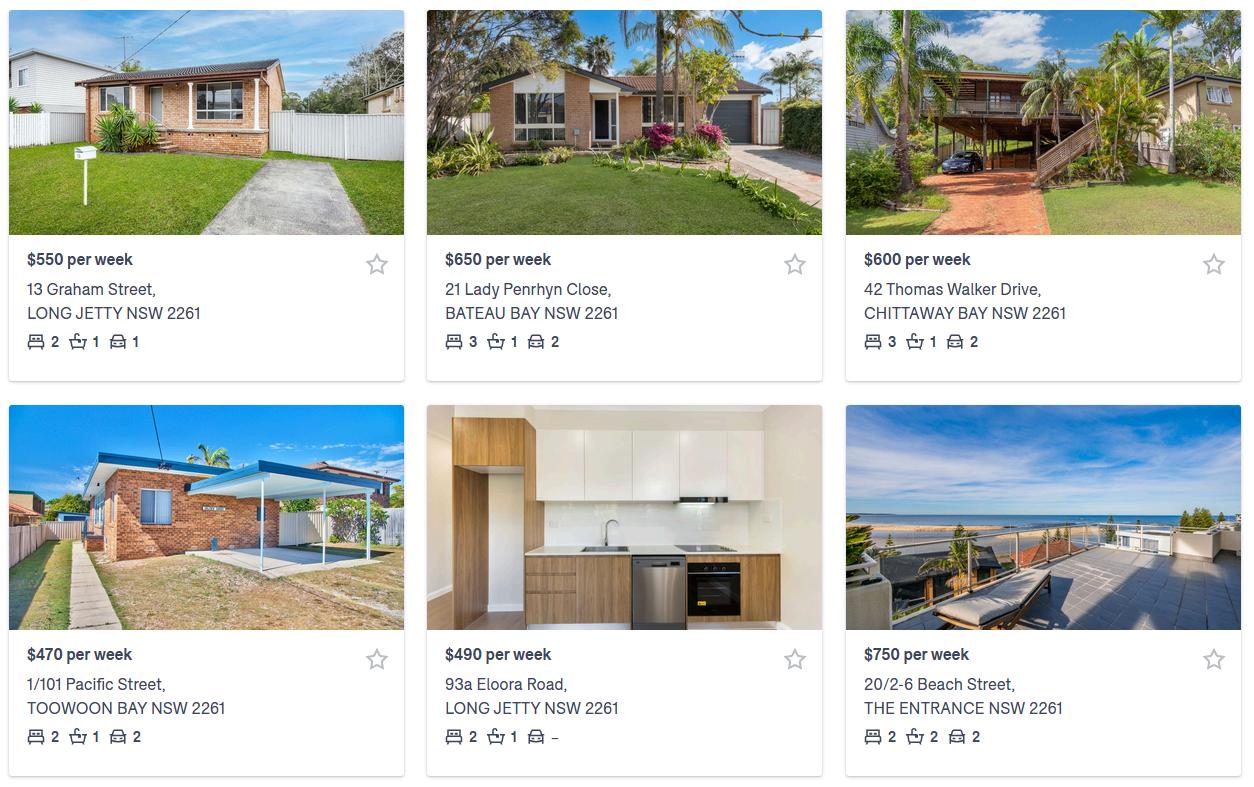

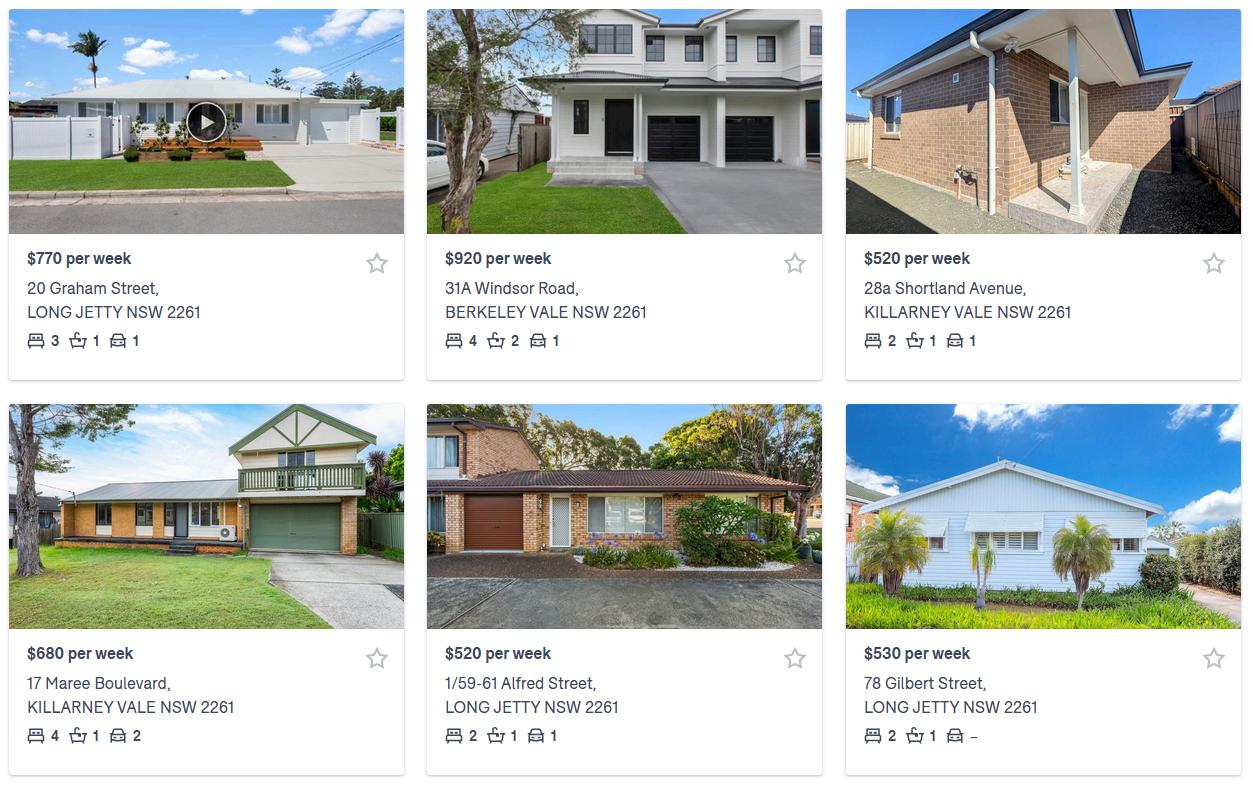

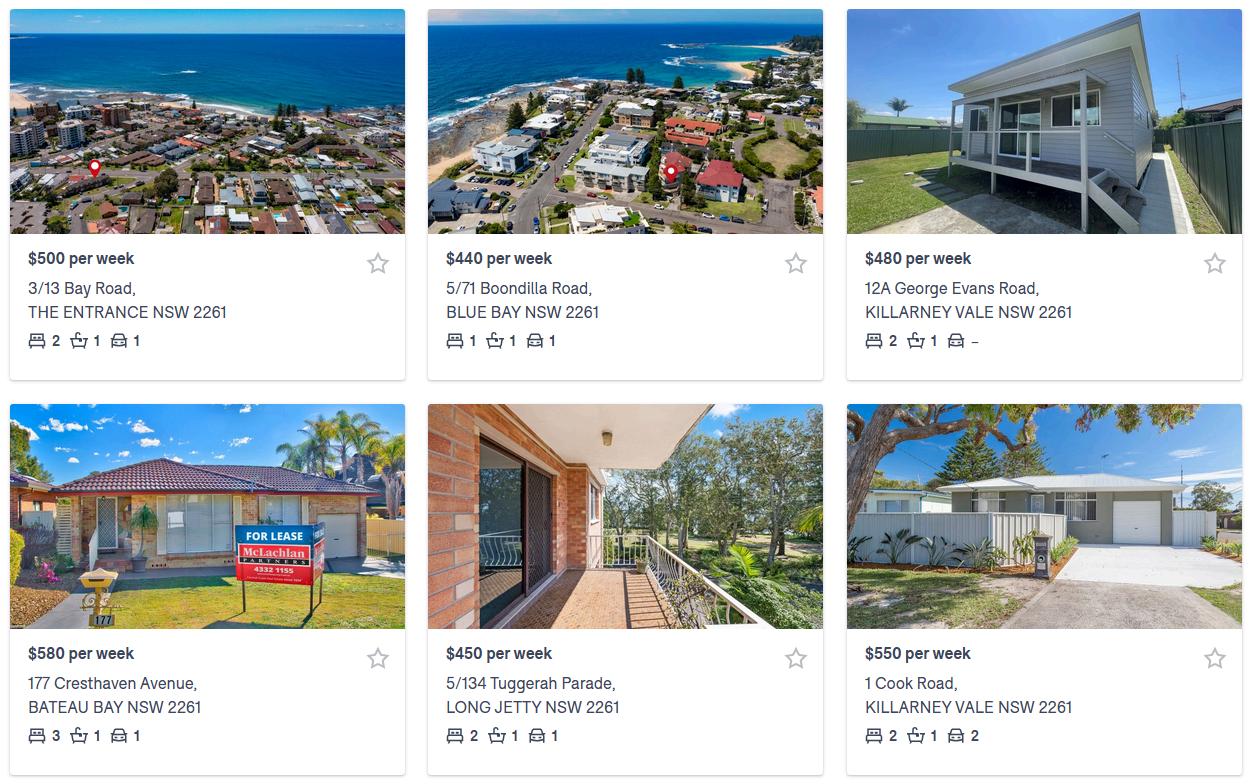

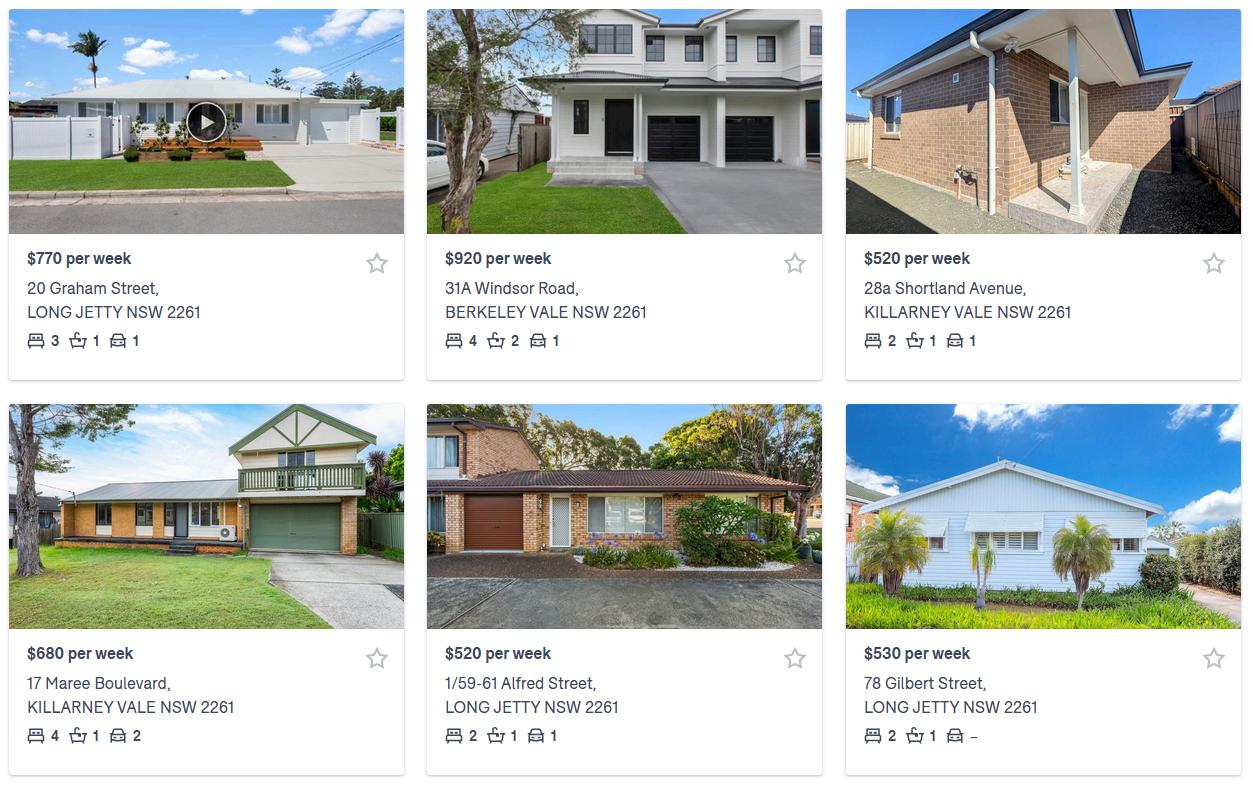

RECENTLY LEASED

INVESTMENT

SMART TIPS TO BUY A PROPERTY WITH GREAT RESALE VALUE

09 07

ROUTINE INSPECTIONS

EOFY FINANCIAL HEALTH CHECK

7 Bed | 5 Bath | 4 Car | Rental Return: ~$1640 per week FOR SALE | Guide $1,950,000

Iconic Federation home opposite lakefront with stunning views and high exposure location.

Triple-income setup: house, villa and studio with $1,640pw combined rental return.

Main home offers 4 bedrooms, 2 bathrooms, modern kitchen and multiple living areas

Villa features 2 bedrooms, ducted air, timber kitchen and internal access garage.

Detached studio above double garage with kitchen, bathroom and private gated access

632m² fully fenced corner block with 2 driveways and landscaped gardens.

Ideal for investors, extended families, Airbnb or a flexible coastal holiday home.

Brent Speechley 0412 467 796

brent@mclachlanpartners com au

All they need to do is mention to us that you referred them, and after the first month of rental, we’ll send you an e-gift card.

Terms & Conditions:

This offer is redeemable by existing landlord clients of McLachlan Partners only. The gift card will be delivered via email after the first month of occupied rental. The person you refer must confirm that you referred them to McLachlan Partners for our property management services. The person you refer will receive the first month of management fee for free. This means that no commission percentage will be charged on rent collected for that month. Normal charges will resume following the first month of services. This offer is subject to change at any time.

For property investors, rental yield is more than just a percentage. It is a key performance indicator. Yet maximising your return does not always require costly renovations or significant rent increases. In our experience at McLachlan Partners, the most effective improvements are often simple, strategic, and consistent

It starts with understanding tenant demand in your specific market Knowing what local renters value, such as updated kitchens, splitsystem air conditioning, or low-maintenance gardens, allows you to make targeted improvements that boost appeal without overcapitalising

Regular maintenance plays a major role A proactive approach keeps costs down over time and shows tenants the property is cared for, encouraging them to treat it with respect. Wellmaintained properties are also easier to re-let and often command higher rent.

Tenant relationships also impact returns. Tenants who feel supported and respected are more likely to stay longer, reducing advertising and vacancy costs. Clear, responsive communication makes a big difference.

Financially, it is worth reviewing your mortgage structure, depreciation schedule, and insurance policy annually A proactive property manager will assist in guiding those conversations with your accountant or mortgage broker

Maximising yield is not about cutting corners It is about making smart decisions, backed by experience and expertise

Owning an investment property should provide financial security But when things go wrong, that security can be quickly tested This is where landlord insurance becomes essential.

Unlike standard home insurance, landlord insurance covers tenant-related risks such as loss of rent, malicious damage, and legal liability. For instance, if your tenant defaults, breaks their lease early, or your property becomes uninhabitable due to storm or fire damage, this type of cover can help protect your income.

Many policies also include protection against accidental or intentional damage caused by tenants This provides peace of mind and safeguards your financial position. Public liability cover is another major inclusion, protecting you in the event of injury on the premises.

Not all policies are the same, however. Some may exclude short-term rentals, pet damage, or specific tenant behaviours. It is important to select a policy that suits your property and your rental strategy. A good property manager can recommend providers and ensure your lease terms align with the policy. Having the right insurance in place means you are not only protected, but prepared.

Buying an investment property is a significant financial move, and choosing the right property from the start can increase your resale value in the future.

At McLachlan Partners, we suggest considering the following tips:

Location – Properties close to schools, shops, and transport consistently perform well

Street appeal – Well-maintained streets and gardens make a lasting impression.

Size and layout – Aim for homes with three bedrooms and two bathrooms, and avoid properties with awkward or windowless rooms.

Keep renovations practical – Focus on clean, modern updates Overcapitalising often leads to disappointment at sale time.

Low-maintenance is better – Homes with updated roofing, plumbing, and wiring reduce headaches and attract tenants.

Energy efficiency – Solar panels, insulation, and smart systems are increasingly in demand

Future area development – Research upcoming infrastructure projects in the area.

Gut feeling – A property that feels right to you is likely to feel right to future buyers and renters

Making informed decisions upfront can help you grow your portfolio with fewer setbacks

Deciding whether to rent your property furnished or unfurnished can significantly affect your returns and your tenancy outcomes.

Furnished properties appeal to short-term tenants such as corporate travellers, students, and people relocating. They can attract higher weekly rent and may lease more quickly in certain markets. However, they also come with responsibilities, including managing wear and tear, replacing furniture, and maintaining inventories.

Unfurnished rentals usually attract long-term tenants who bring their own furniture and are more likely to renew leases. This reduces vacancy periods and turnover costs and often results in lower insurance premiums and maintenance concerns

Consider the location of your property. Innercity units or properties near hospitals and universities may perform better furnished. Family homes in suburban areas, however, tend to attract tenants looking for unfurnished, longer-term accommodation.

Ultimately, the choice depends on your investment goals. If you value stable income and low maintenance, an unfurnished approach may be best. If your property is in a transient location with high demand, furnishing it could offer higher returns.

A professional property manager can help assess the best approach for your specific property.

Every week your property sits vacant is money lost. At McLachlan Partners, we take a proactive approach to minimising vacancy and securing reliable tenants fast.

Here are some of the key steps we take:

Early advertising – We promote properties as soon as the current tenant gives notice.

Standout marketing – Professional photos, compelling descriptions, and video walkthroughs improve engagement.

Appropriate pricing – We research local data to ensure your rent is competitive

Presentation matters – A clean, well-maintained property with good street appeal attracts better tenants.

Flexibility – Offering extras like garden maintenance, solar, or included appliances can increase interest

Tenant feedback – We listen to inspection feedback and adjust our approach if necessary.

With the right marketing and experienced management, vacancies can be minimised, protecting your cash flow and preserving your return.

Routine inspections are an essential part of professional property management. They help safeguard your asset, yourtenants’safety,andyourlong-terminvestmentreturn.

AtMcLachlanPartners,wetreatinspectionsasagenuineopportunitytomaintainandimproveyourproperty.We:

Identifymaintenanceissuesearly,beforetheybecomeexpensive. Ensurethetenantiscomplyingwithleaseobligations.

Maintainpositiverelationshipswithtenantsthroughrespectfulcommunication. Offerdetailedinspectionreportsforyourrecords.

Providerecommendationstoenhancerentalperformanceorprotectassetvalue.

Proactiveinspectionsleadtobetterupkeep,happiertenants,andstrongeroverallperformance.

With the end of the financial year approaching, it is the perfect time to review your investment property's performanceandmakesureyourfinancesareintopshape

Hereiswhatwerecommendchecking:

Income vs expenses – Ensure your rental income is keeping up with outgoings like interest, maintenance, and stratafees

Cashflow–Trackyourmonthlyandannualreturnsandmakesureyouhaveabufferforunexpectedcosts Capitalgrowthandequity–Getafreshappraisalandcalculateyourequity Thisishelpfulifyouplantorefinance orpurchaseanotherinvestment

Loanstructure–Reviewyourmortgageterms,interestrate,andlenderfees.Youmaybenefitfromrefinancing. Markettrends–Stayinformedaboutrentsandvacancyratesinyoursuburb.Adjustpricingasneeded. Maintenancebudget–Planforrepairsorupgradestoimproveappealandreduceurgentcosts.

Tax planning – Work with your accountant to ensure you are claiming all allowable deductions, including depreciationandborrowingcosts.

Takingtimenowtoreviewyourportfoliocouldmakeabigdifferencetoyourbottomline.

Early Access & Sneak Previews, Articles & Advice from our Expert Team, Community Announcements, Property News, Local Market Analysis and more...

“ You made a very stressful time for us into a worry free experience. I would highly recommend McLachlan Partners”

“Brent and his team did such a great job for us always polite and helpful he certainly knows his real estate we bought from him and sold with him . Would highly recommend him for the sale of your property getting you the best price..”

“ First choice Agent. When it comes to buying or selling property Brent Speechley is the first person we want to speak to. He has an extensive knowledge of property sales in the area & is very experienced in his field”

We have qualified buyers actively looking in your area - Now is the time to act while buyer demand is high! Let us show you how our proven strategy can help you achieve the best result for you!

Our family agency is the longes Coast. Originally founded in 192 after returning from the trenc quickly gained a reputation for h reputation has been carried on hallmark foundations on what w the last 100 years.

The key difference of McLachlan the most experienced, trustwort and Property Managers on the C

We would be more than happ property needs.

Bruce McLachlan Principal