M:

The Big Picture

Recent reductions to the official interest rate have seen banks follow through to mortgage lending rates which has encouraged homebuyer activity to return, with many anticipating future rate cuts

Regional NSW residential property is experiencing an upward trajectory in sales despite less new listings, though the time on market is now taking longer.

Winter/25

Regional New South Wales Residential

Property prices continue to climb, supported by limited housing supply and the likelihood of further price growth which is improving buyer sentiment.

Until more homes are built or made available in Regional NSW, rents are likely to stay elevated while vacancy remains low, adding pressure to many household budgets.

Interest Rate

3.85%

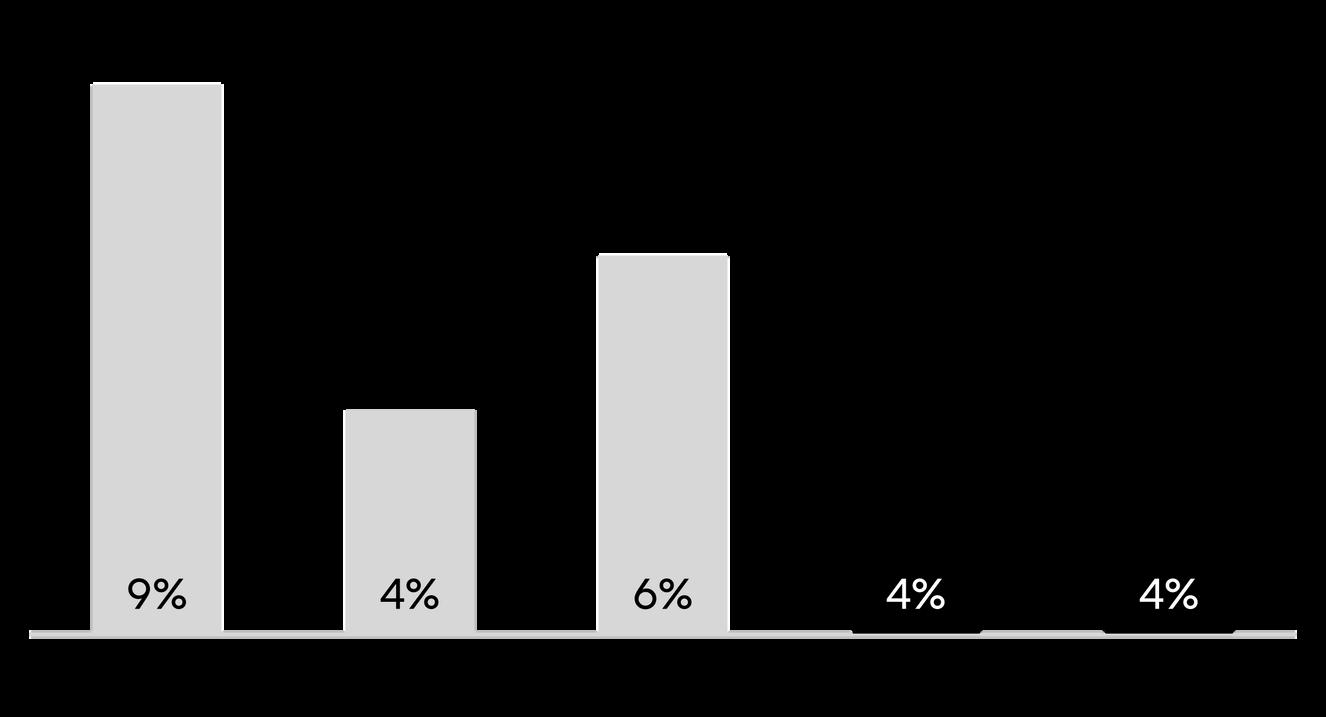

The Reserve Bank of Australia (RBA) lowered the interest rate target 25 bps to 3 85% in May 2025 Many banks followed this direction and adjusted their mortgage lending rates accordingly. Interest rates significantly influence the cost of borrowing money, which in turn affects the willingness and ability to apply for a home loan. The RBA forecasts the target could be 3 40% by the end of 2025, and 3 20% in 2026 When interest rates are lowered, borrowing becomes cheaper, which can stimulate demand for residential property and drive economic growth

Unemployment Rate

4.3%

Employment levels influence people’s ability to initially purchase a home and then the ongoing mortgage repayments servicing the loan The unemployment rate in Australia was 4 3% in March 2025, which is considered a healthy, balanced labour market given the rate falls within the ideal range of 4% to 5% The RBA forecasts the unemployment rate to rise by the end of 2025 to 4.3%, then remain relatively steady in 2026

Economic Growth 1.3%

Economic growth remains a key driver because it fuels job creation, boosts incomes, and increases demand across property markets Australia recorded economic growth at 1.3% in 2024, following stronger performance of 3.1% in 2022 and 1 5% in 2023 Looking forward, the RBA forecasts economic growth to lift to 2.1% in 2025 and 2.2% in 2026. Ideally, sustainable economic growth is considered to be around 2% to 3%

Population Growth

1.1%

Population growth increases housing demand as more people require places to live, encouraging more housing and infrastructure to be built in regional areas. As more people moved to Regional New South Wales (NSW) following the pandemic, the population grew by 1 0% in 2022, 1 0% in 2023, then 1 1% in 2024 The ABS have projected the long term population growth for Regional NSW at 0 2% in 2025 and 0.2% in 2026.

Source: McGrath Research, RBA, ABS

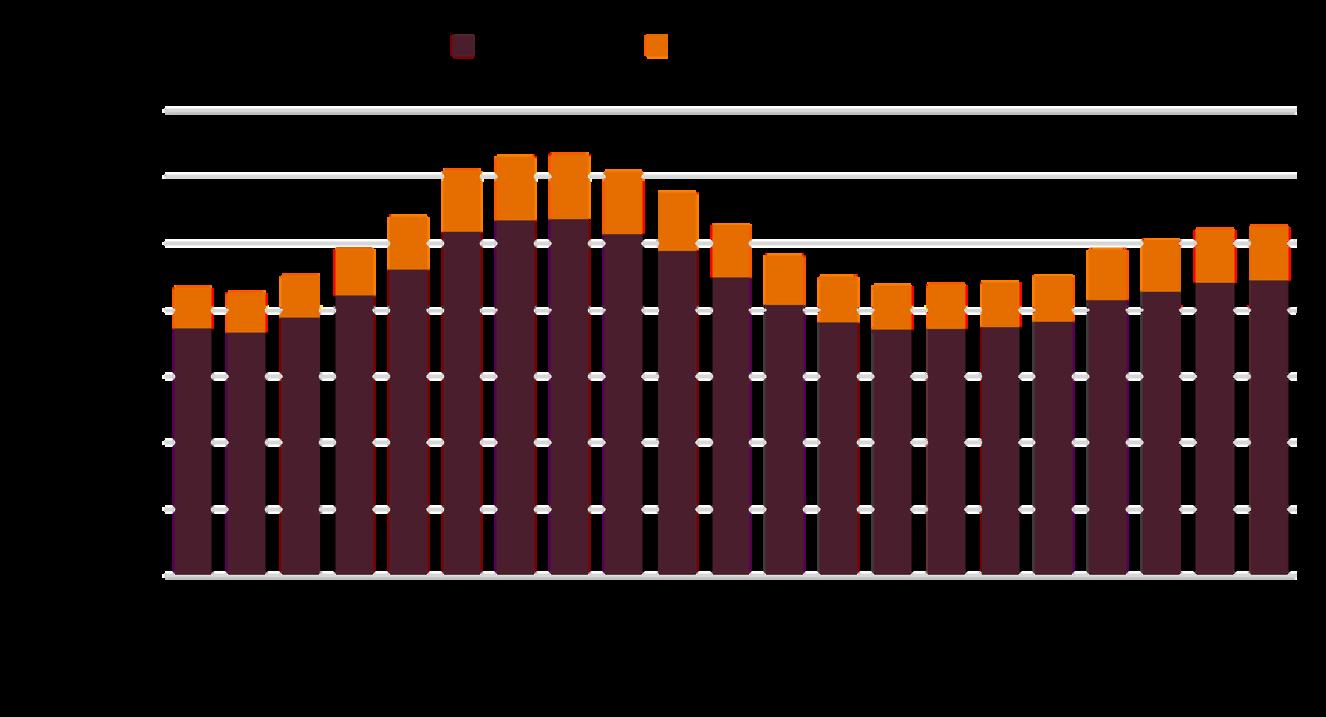

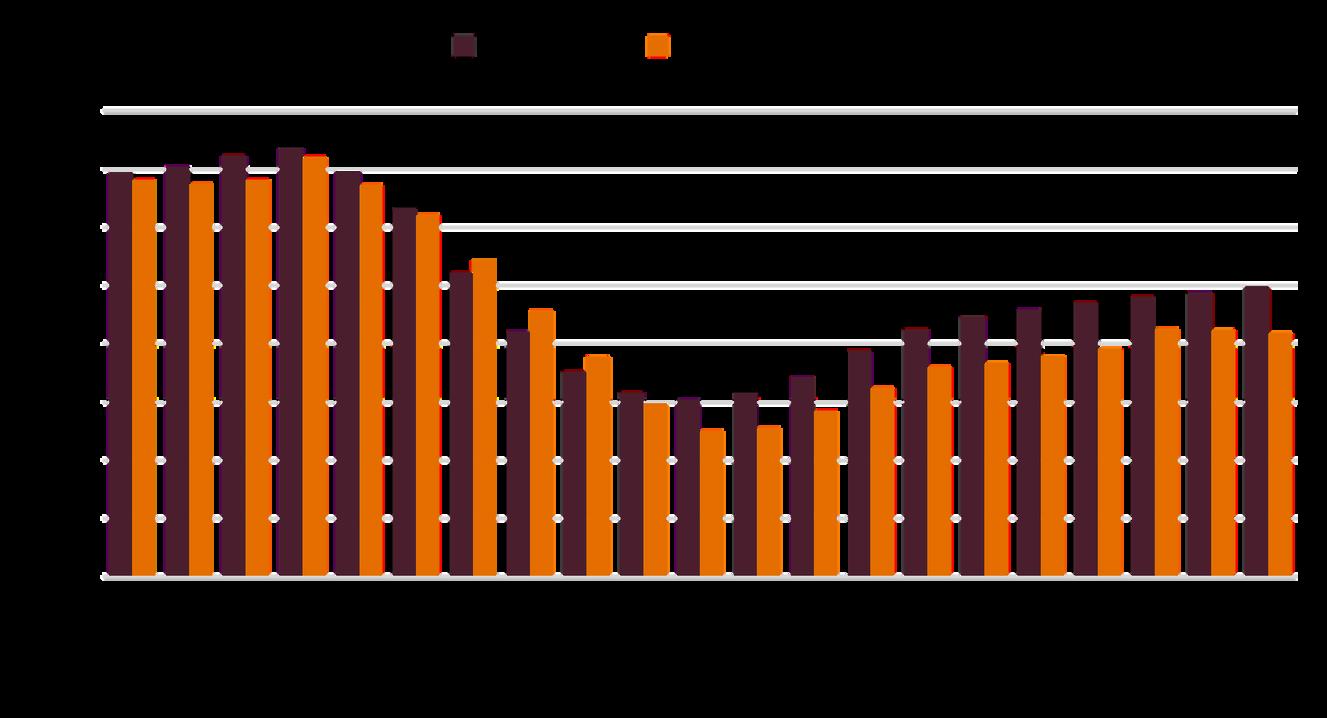

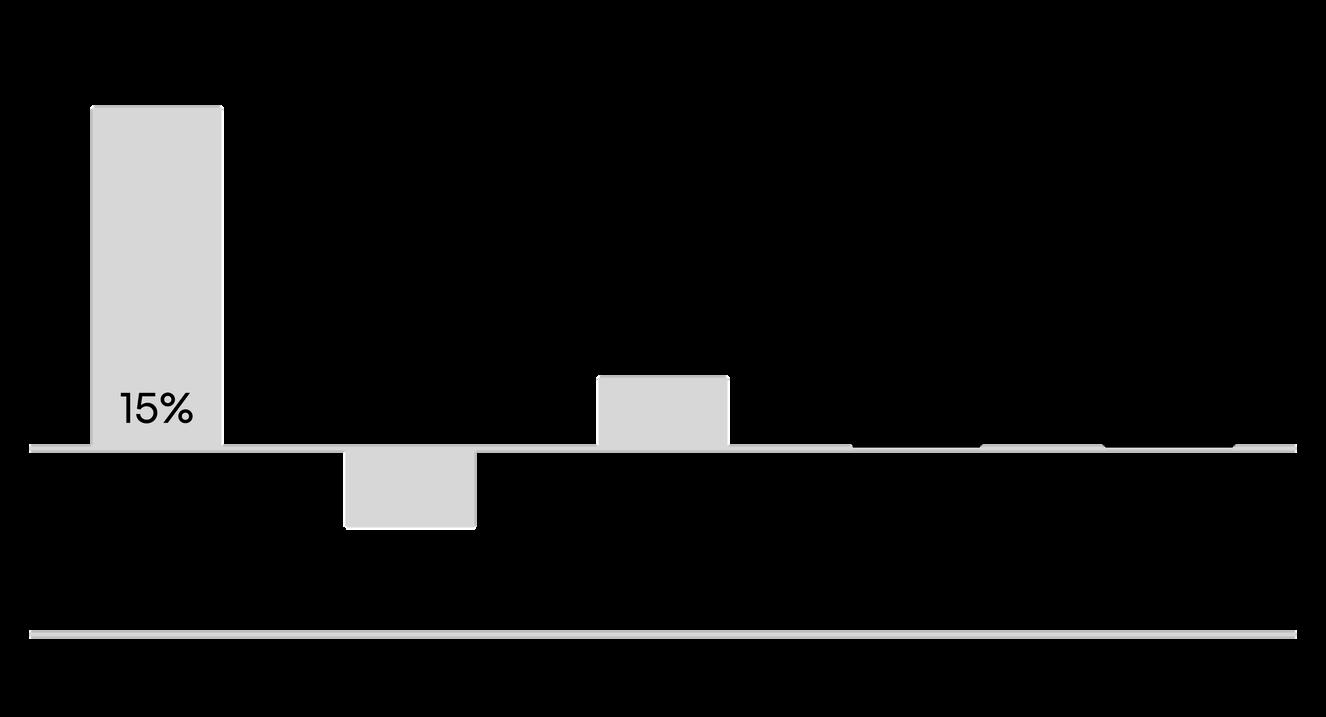

Sales

Regional NSW residential annual sale transactions tallied to 52,372 in the first quarter of 2025, an upward movement of 1% from the previous quarter Although over the past year, the total number was 16% higher. This was influenced by the total number of listings being 2 3% more in the four weeks ending March 2025 when compared to the equivalent period last year. Other factors include the improving lending environment with the market anticipating a further reduction in interest rates by the end of the year

Total Number of Annual Sales Regional NSW

Share of NSW Annual Sales

The share of total number of NSW annual residential sales recorded by Regional NSW was 33% at the end of Q1 2025 This was higher than one year ago when the proportion was 29%, and remains above the 31% share recorded five years ago Over the past year, Regional NSW (16%) far outpaced the annual growth of sales activity in Greater Sydney (-3%).

Share of NSW Annual Sales, by Number Regional NSW

Source: McGrath Research, APM

Source: McGrath Research, APM

Source: McGrath Research APM

Residential Sales Update

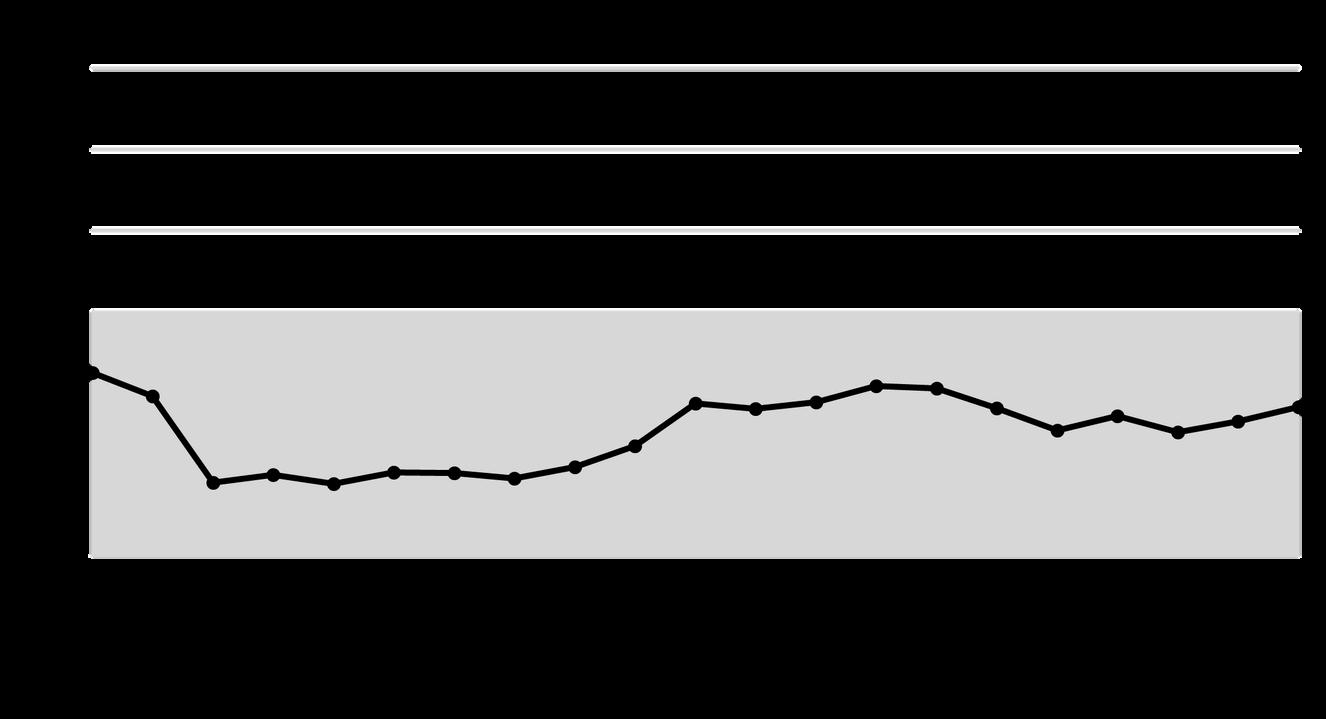

Duration

97 days

In the March 2025 quarter, Regional NSW homes averaged 97 days on market - from the time they were listed to the day they went under contract This duration was 95 days the quarter before and 89 days one year ago Historically, houses have typically taken longer to sell than apartments and this was no different in the past quarter Houses averaged 100 days to sell in Q1 2025, which was 3 days longer than in Q4 2024 and 8 days more than in Q1 2024 Apartments took an average 83 days to sell, being 1 day less than the previous quarter but 8 days more than a year ago A low number of days on market mean homes are selling fast with more desirable or undersupplied properties, while a high number of days suggests a slower market

Average Days on the Market Regional NSW

Source: McGrath Research

Newly advertised property listings in Regional NSW were 3 6% lower in the month of March 2025 than the equivalent period last year. This trended slightly above the -4.8% average for the combined regional areas of Australia

Regional NSW’s total number of listings in the month of March 2025 were 2 3% above the equivalent period last year. By comparison, total listings were an average 0.7% higher across the combined regional areas of Australia

Source: McGrath Research, CoreLogic

Source: McGrath Research

Residential Prices Update

Median Price

$800,000

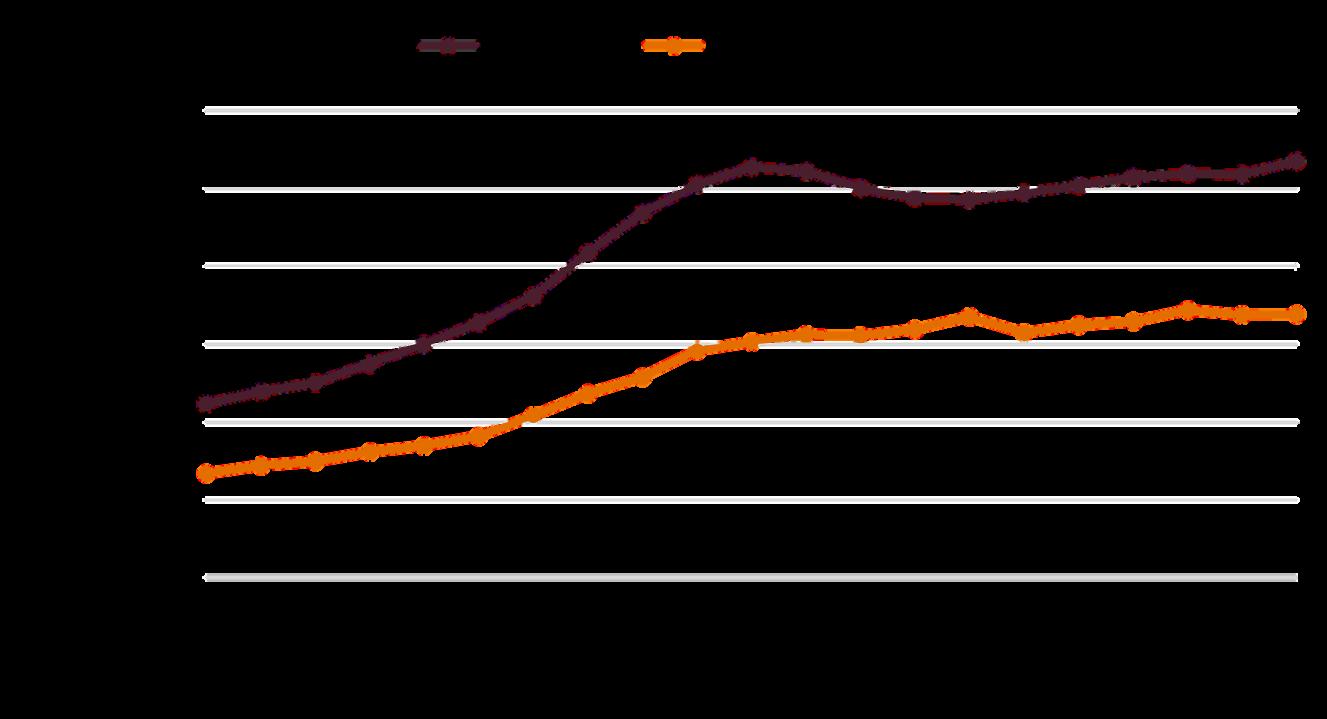

Median property prices provide a benchmark for homebuyers when assessing market performance and can help identify emerging trends Regional NSW residential property prices rose by 3.7% in the year to March 2025, with a 1 8% increase recorded in the most recent quarter This brought the median value to $800,000, reflecting stronger housing demand. Median house prices were $835,500, while the value of apartments was at $639,000 in Q1 2025 House prices grew 2 1% from a quarter ago but were overall 3 9% higher over the year Over the same quarter, apartments rose by 0.2% and by 2.2% in the past year.

Change in Median Prices Regional NSW

Source: McGrath Research

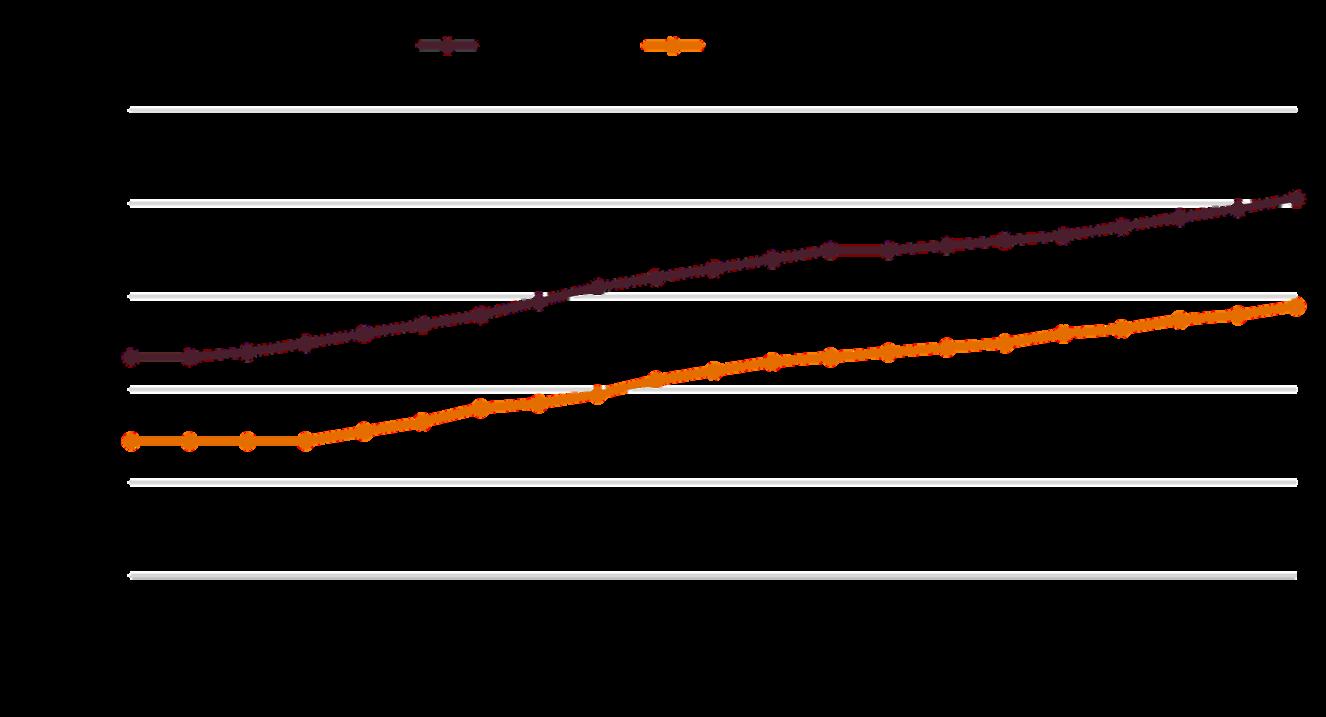

Price Outlook +1%

Forecast for Median Prices Regional NSW

Looking ahead, McGrath Research anticipates Regional NSW residential property prices to increase by 1% by the end of 2025, followed by a stronger 2% rise in 2026 This more sustainable price growth projection factors in lowered interest rates in a slower moving sales environment.

Source: McGrath Research

Source: McGrath Research

Residential Rents Update

Regional NSW residential rental vacancy was recorded at 1 8% in Q1 2025, rising 18 bps in the quarter and in total, 29 bps over the past year. Generally, 3% vacancy is considered a balanced market between rental supply and demand Below this benchmark is considered to be an undersupplied pool of rental homes. Changes in rental vacancy can have a significant impact on the residential property market, influencing both rental prices and property values

Change in Residential Rental Vacancy

Source: McGrath Research

Yield

+2 bps

Regional NSW residential gross rental yields rose 2 bps in the Q1 2025 quarter to be 4 32%, while this was 7 bps higher than a year ago Apartment yields (4 73%) consistently outperform house yields (4 23%) in most markets House yields rose 3 bps in Q1 2025 and increased by 5 bps over the past year, while apartment yields were 2 bps higher in this past quarter and 18 higher from a year ago Gross rental yields are a good initial measure of comparing the return of a property investment before expenses are deducted A range of 4 00% to 5 00% is considered good for many properties located in a capital city, while below this, may indicate high property prices relative to rent, or low rental demand

Change in Gross Rental Yield

Regional NSW

Source: McGrath Research

Source: McGrath Research

Residential Rents Update

Median Weekly Rent

An undersupplied rental market is keeping residential rents elevated across Regional NSW. Residential rents rose 1.7% in Q1 2025, while rents increased by 7 3% over the past year, to stand at $585 per week Median weekly house rents were $115 higher than apartments in Q1 2025, rising 1.7% to $605 per week, with 7 1% growth over the past year Apartment weekly rents, at $490, rose 2 1% in Q1 2025 and by 6 5% in the past year

Change in Median Weekly Rents

Regional NSW

Rental Outlook

While Regional NSW continues to experience population growth ahead of the long term forecast and a delay in new housing completions, McGrath Research forecast sustained upward pressure on rents of 4% at the end of 2025, with a further 4% rental growth likely in 2026

Forecast for Median Rents

Regional NSW

Source: McGrath Research

Source: McGrath Research

Source: McGrath Research

Regional NSW

Regional New South Wales (NSW) refers to the area outside of ‘Greater Sydney’ or ‘Rest of State’ for NSW as defined by the Australian Bureau of Statistics

Guiding you home

Michelle Ciesielski

Head of Residential Research, McGrath Research

michelleciesielski@mcgrath com au +61 414 694 220

www.mcgrath.com.au