OAKLAND MARKET UPDATE

CELEBRATING 50 YEARS OF

CHALLENGING OURSELVES TO EXCELLENCE AND BEING THE LEADER IN THE MECHANICAL CONSTRUCTION INDUSTRY

Photo of Mill 19 courtesy of RIDC.

PUBLISHER

Master Builders’ Association of Western PA www.mbawpa.org

EDITOR

Jeff Burd

412-366-1857

jburd@talltimbergroup.com

PRODUCTION

Carson Publishing, Inc.

Kevin J. Gordon

kgordon@carsonpublishing.com

GRAPHIC DESIGN Blink

CONTRIBUTING PHOTOGRAPHY

CREW Pittsburgh

Roy Engelbrecht Photography

Chad Isaiah Photography

NAIOP Pittsburgh

Tall Timber Group

CONTRIBUTING EDITORS

Karen Kukish

ADVERTISING SALES

Karen Kukish 412-837-6971

kkukish@talltimbergroup.com

MORE INFORMATION:

DevelopingPittsburghTM is published by Tall Timber Group for NAIOP Pittsburgh 412-928-8303 www.naioppittsburgh.com

No part of this magazine may be reproduced without written permission by the Publisher. All rights reserved.

This information is carefully gathered and compiled in such a manner as to ensure maximum accuracy. We cannot, and do not, guarantee either the correctness of all information furnished nor the complete absence of errors and omissions. Hence, responsibility for same neither can be, nor is, assumed.

It’s been said that in policy making, if you’re not at the table, you’re on the menu.

I joined NAIOP about 13 years ago as a Developing Leader and knew the organization as the preeminent real estate networking organization in Pittsburgh with great events and lots of happy hours. Since then, NAIOP Pittsburgh has done yeoman’s work on the advocacy front, inching our way off the proverbial menu and towards the dinner chair, earning policy wins along the way. While we won’t stop our educational and social initiatives (we all look forward to sharing a few beverages on May 22nd at the Awards Banquet), know that the NAIOP Pittsburgh Board and I remain focused on promoting the interests of Pittsburgh’s real estate developers, our principal members.

Advocacy is front and center in our agenda, and we have got lots of policy threats and opportunities for wins on the horizon. But the reality is that we are an organization of volunteers, and while committed to the success of our region, we need more input from our Principal Members to get things done. Our NAIOP chapter is healthy financially and is 500 members strong. We have a wealth of resources available to implement positive changes, and we have opportunities in both City Hall and Harrisburg. What we are missing, though, is your voice.

To those Principal Members (or developers that aren’t yet members) that are frustrated with the status quo, I urge you to add your voice to our advocacy efforts. Sitting on the sidelines has gotten us a city that generally discourages development, and makes developers negotiate individually on their projects instead of building an ecosystem where projects can proceed quickly and with certainty. It’s allowed our regional Department of Environmental Protection to become the most restrictive in the

state and kept Pittsburgh from being the counterweight to Ohio’s success. Wondering why your site can’t get electric power? Well, we’re working on that too, and we need your experience in the mix.

Our chapter is as strong as ever, and we have an incredible opportunity to make the Pittsburgh region a model for strong economic growth, led by the development community. Reach out, get involved, and let’s get to work.

Nate Phillips NAIOP Pittsburgh President

Roy Engelbrecht Photography

# W e A r e V o l p a t t ustrial institutional

Last year passed quickly, and I am deeply appreciative of our former president, Brandon Snyder, for his guidance as I transitioned into this role. During his tenure, we expanded our advocacy initiatives, hosted several successful events, and achieved a strong financial performance, enabling us to reinvest in our chapter’s growth. Now, under the leadership of our new chapter president, Nate Phillips, we are further strengthening our advocacy efforts. We are focused on promoting responsible development, influencing affordable housing policies in the city, and eliminating obstacles to new projects. Our advocacy now extends to both state and local levels, and we are collaborating with organizations such as the Allegheny Conference, BAMP, the AIA, other NAIOP chapters, and our members. Together, we are addressing critical priorities, including the DEP’s redefinition of coal, advancing energy solutions for Pennsylvania, and securing increased funding for building conversion projects. Our chapter also participated in the Legislative Retreat in Washington, D.C., hosted by NAIOP

Corporate, advocating for federal policies such as a development-friendly tax code, funding for building conversions, and national energy solutions. Additionally, our NAIOP Pittsburgh PAC has been actively raising funds—thanks to the generous support of our members—and has successfully hosted its first two PAC events. To keep our membership informed and engaged, we will begin hosting quarterly chapter-wide advocacy meetings to provide detailed updates on state and regional developments while welcoming your valuable input.

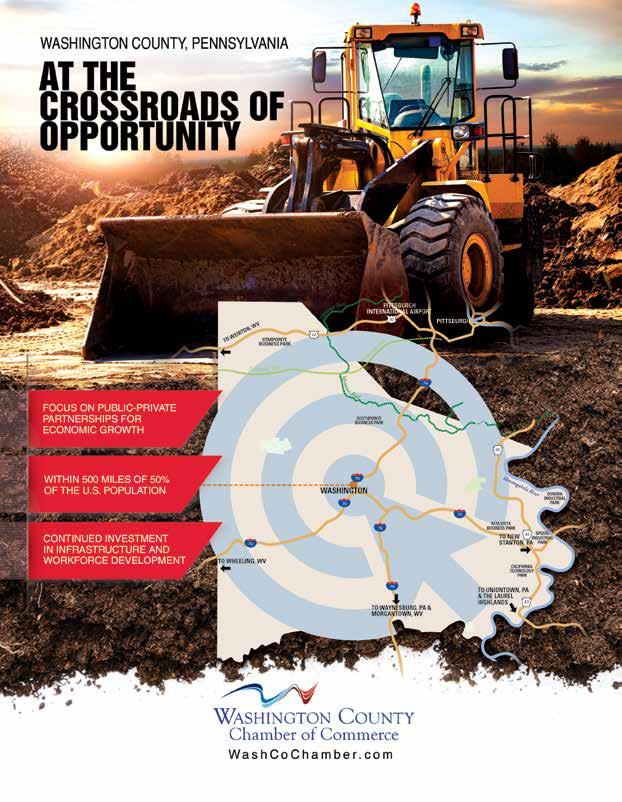

Looking ahead, we have an exciting lineup of events. I invite you to join us at our Annual Awards Banquet on May 22nd, where we anticipate a significant turnout, potentially surpassing last year’s impressive attendance. In June, our chapter breakfast will focus on the industrial market. Over the summer, our Bus Tour, in collaboration with the Washington County Chamber of Commerce, will target new industrial sites, a tour of a distillery, and other locations showcasing the region. We have also scheduled an engaging project tour at

Collaborative Real Estate’s 700 Technology Drive. In June, we will host our annual golf outing at Fox Chapel Golf Club, a highlight of our event calendar.

These initiatives and events require dedication and effort. I extend my heartfelt gratitude to all our members who volunteer their time to NAIOP—your contributions significantly benefit our region. Our events would not be possible without your attendance and sponsorship, which have been instrumental in establishing this chapter as one of the strongest in the nation. Finally, I wish to express my appreciation to Erica Loftus, David Caliguiri, Nate Phillips, and our board of directors for their support and for positioning our chapter for continued success. Thank you.

Tom Frank Executive Director NAIOP Pittsburgh

BANQUET

Annual Awards

Ambridge Regional Center Bohler

Buccini Pollin Group

Buchanan Ingersoll & Rooney PC

Buncher Company & Buncher

Realty Services

Civil & Environmental Consultants, Inc.

Cohen & Company

Crossgates, Inc.

Desmone

Eastern Atlantic States Regional Council of Carpenters

The Elmhurst Group

Franjo Construction

Gateway Engineers

Kimley-Horn

Associates

M&T Bank

Mascaro Construction

Master Builders’ Association of Western PA

McCaffery

Merus

Piatt Companies

S&T Bank

Sebring & Associates

Sentinel Construction

Turner

NAIOP PITTSBURGH AWARDS

HALL OF FAME

Leo Castagnari, Retired Executive Director, NAIOP Pittsburgh

Leo Castagnari was executive director of NAIOP Pittsburgh for 20 years until his retirement in Spring 2018. During his tenure NAIOP Pittsburgh experienced substantial growth in size and reputation, with its membership more than doubling. Castagnari, a former staffer for Senator John Heinz, led NAIOP Pittsburgh to be a strong legislative advocate. Among the initiatives that led to impactful wins for the region during his leadership were the interstate highway designation of the Parkway West, the completion of the I-79/I-376 interchange in Robinson Township, and the revision of PA’s mechanics lien law. Also, during this time, the NAIOP Pittsburgh chapter has won multiple national industry awards for its Developing Pittsburgh magazine, educational programming, and advocacy efforts. Castagnari can be credited with growing the NAIOP Pittsburgh Annual Banquet to be the largest commercial real estate event in Western PA, both in attendance and sponsorship.

Outside of his work with NAIOP Pittsburgh, Castagnari was a partner in King Communications, a management and marketing consultancy that specialized in helping non-profit organizations. Castagnari served on the boards of Leadership Pittsburgh and Contemporary Craft. Since establishing the Castagnari Family Charitable Fund at The Pittsburgh Foundation in October 2002, Leo has continued to give time, as well as financial support to The Greater Pittsburgh Community Food Bank, Planned Parenthood of Western Pennsylvania, The Pittsburgh Symphony Orchestra and Quantum Theater.

BUILDING ABOVE AND BEYOND

Go beyond. Repeat.

BEST NEW DEVELOPMENT

FNB Financial Center

Developer: Buccini Pollin Group in partnership with F.N.B. Corporation

Construction Manager: PJ Dick/ Mascaro/Massaro Jt. Venture

Architect: Gensler

Located on the site of the former Pittsburgh Civic Arena, F.N.B. Corporation’s (FNB) headquarters, FNB Financial Center, serves as the cornerstone of the 28-acre, $1 billion Lower Hill District redevelopment.

Commissioned by FNB to accommodate its significant growth, the $250 million LEED Gold-certified, mixed-use tower was delivered in Fall 2024. This achievement — made even more significant by the site’s complex history and unique construction challenges faced during COVID-19 — was made possible through FNB’s substantial equity commitment, as well as the determination of its leadership and supporting organizations that included Buccini Pollin Group, the Pittsburgh Penguins and Clay Cove Capital.

PROFESSIONAL.

These are the hallmarks the region’s union construction trades and contractors bring to the jobsite everyday. Our professional tradespeople and contractors bring the dreams and visions of our fast-growing region to life with a dedication that only those who live here, work here, and raise their families here can commit to. It is, after all, our home, our legacy.

We are also committed to providing opportunity for all who share these values and want to pursue a lifelong, lucrative and satisfying career. For more information on building with our union trades and contractors, or to explore career opportunities, please visit www.buildersguild.org where you will find direct links to our Trade Unions, Joint Apprenticeship Training Centers and Contractor Associations.

NAIOP PITTSBURGH AWARDS

BEST NEW BUSINESS PARK

Northfield Industrial Park

Findlay Township, Allegheny County

Developer: Allegheny County Airport Authority

The Allegheny County Airport Authority is a key economic driver for the region – from air service to real estate development. Northfield Industrial Park is a premier 90-acre Class A development situated on the campus of Pittsburgh International Airport. Developed by the Airport Authority, the park is designed to support industries such as technology, life sciences, and specialized manufacturing, with infrastructure including roadways, utilities, regional stormwater facilities, and pre-graded pads for development. Since 2020, Merus (formerly Al. Neyer) has built three buildings, totaling 400,000 square feet of prime industrial space. These facilities are now fully leased to industry leaders such as Krystal Biotech, PepsiCo, and Legrande, making Northfield a hub for life sciences and specialized manufacturing/distribution. The development has already generated a direct and indirect economic impact of over $60 million and created more than 400 jobs, driving economic impact for the region.

NAIOP PITTSBURGH AWARDS

BEST INDUSTRIAL RENOVATION BUILDING

Re:Build Manufacturing at NKAMP by RIDC and WCIDC

New Kensington, Westmoreland County

Developer: RIDC of Southwestern PA

Co-Developer: Westmoreland County Industrial Development Corporation (WCIDC)

Contractor: Mascaro Construction, LP

Architect: Renaissance 3 Architects

The 175,000 square foot Re:Build Manufacturing project, a partnership between RIDC and WCIDC, is revitalizing New Kensington and bringing manufacturing jobs back to the Pittsburgh region. Instead of building new, Re:Build chose to renovate five century-old buildings, preserving the site’s industrial legacy while modernizing its infrastructure. As a contract manufacturer, Re:Build needed flexibility. The site was in severe disrepair, requiring $30 million in renovations, including structural upgrades, electrical system overhauls, and energy-efficient improvements like spray foam insulation and Extech polycarbonate windows. Funding from the Commonwealth of PA, Westmoreland County, and the Richard King Mellon Foundation was crucial, alongside equity investments from RIDC and WCIDC. Re:Build’s New Kensington facility is its first ground-up U.S. manufacturing site, focusing on high-tech industries like energy, life sciences, robotics, and aerospace. The company invested $50 million in the project, set to create 300 full-time jobs in three years, plus 100 construction jobs.

“From revitalizing abandoned steel mills and industrial sites into thriving business and technology parks to transforming underutilized land into locations built for job-creating companies, RIDC has created a unique blend of economic development advocacy, community and regional revitalization, and high-quality job creation that could be a model for other regions that were once powerhouses of America’s industrial economy.”

Pre-order from Amazon, Barnes & Noble and booksellers around the region.

BEST NEW TECH FLEX BUILDING

Allegheny County Health Department’s Public Health Laboratory

Commonwealth Manor, Marshall Township, Allegheny County

Developer: The Elmhurst Group

Contractor: Mascaro

Construction, LP

Architect: Stantec

Lender: First Commonwealth Bank

In 2019, Elmhurst Group acquired Commonwealth Manor, a two-building flex property in Marshall Township.

Building One, comprised of 45,900 square feet of vacant pharmaceutical space, was proposed to the Allegheny County Public Health Department as a candidate to be their next new Public Health Laboratory. After extensive collaboration with Marshall Township’s Planning Commission, the project was approved to move forward in September 2023 and was completed in March 2025. The project includes nearly 25,000 square feet of biosafety laboratory (BSL) space of which 12,000 square feet is classified as BSL 3. The remaining space is utilized as office, teaching and staff areas. The new Public Health Laboratory will serve Allegheny County and Western Pennsylvania and will accommodate growth of the County’s staff for this purpose.

Building the future.

Congratulations to our friends at Elmhurst Group on your 2025 NAIOP award. It’s a privilege to provide financing for the companies that are relentlessly focused on responsible development in our region. Thank you for considering us to be the best bank for your business for nearly 20 years.

BEST BUILD-TO-SUIT INDUSTRIAL BUILDING

Samuel Son & Company, Ridge Road Industrial Park

Robinson Township, Washington County

Developer/Contractor:

Chapman Properties

Architect: NEXT Architecture

Lender: S&T Bank

The first of five buildings at Chapman’s Ridge Road Industrial Park, the 85,000 square foot steel and aluminum warehouse represents a major reinvestment in Pittsburgh by Samuel Son & Company. The building features heavy structural concrete floors, four 10-ton overhead cranes, and two truck drive-through lanes. The design allows for rapid loading and unloading of products for up to four trucks at a time, a massive improvement over their previous facility in Carnegie. The building’s 30-foot clear height accommodates custom cantilevered racking to maximize density and variety of their customers’ proprietary aluminum extrusions. The building is a 40 percent increase in floor area over their previous facility, but the height and configuration can accommodate double Samuel’s inventory. A 20,000 square foot machining area, with CNC cut-to-length, drilling, and finishing processes, allows Samuel to capture greater revenue through value-add services. The building is on a 9.5-acre site overlooking I-576 near the Westport Interchange. Growth of Samuel’s business was considered at every level, and as a result the tenant signed a 10-year lease with multiple five-year options.

TRUSTED EXPERTS SINCE

1956

Our history and expertise as commercial real estate investors allow us to understand and actively participate in all phases of the deal cycle as no other general contractor can. Our team efficiently manages all aspects of construction contracts, ensuring quality workmanship, adherence to timelines, and cost-effectiveness for our clients’ development projects.

Development & Construction Services

Owner’s Representation

Ground-Up

Office

Retail/Restaurant

Light Industrial/Flex

Life Science/Healthcare

Large Mixed-Use

Land/Residential Lot Development

Hospitality

Multifamily

INTERESTED IN SEEING MORE OF OUR PORTFOLIO?

HYDE PARK AT THE CASCADE North Shore

DIAMOND RIDGE Moon Township

NAIOP PITTSBURGH AWARDS

BEST NEW SPECULATIVE OFFICE BUILDING

Diamond Ridge I

Moon Township, Allegheny County

Developer/Contractor: NAI

Burns Scalo

Architect: NEXT Architecture

Lender: First National Bank

Diamond Ridge I is a 165,200 square-foot, Class A office building, the first phase of a 500,000 square foot, three-building campus developed by NAI Burns Scalo. Strategically located in Moon Township’s Parkway West corridor, the development sits within a 780-acre specially planned district near Pittsburgh International Airport, offering seamless access to shopping, dining, and growing residential options. Designed to meet the needs of modern tenants, Diamond Ridge I features a striking lobby, public art, premium fitness center, pickleball courts, a conference facility with hospitality kitchen, outdoor collaboration spaces, and a wellness-focused design. This speculative development has been well received by the marketplace and was roughly 50 percent leased prior to obtaining a certificate of occupancy. Tenants include Edgeworth Security, Coterra Energy, and Assured Partners. Supported by private and public funding, including a $1.5 million Redevelopment Assistance Capital Program grant, the project also contributed to key infrastructure improvements.

The real estate development life cycle.

CEC congratulates our partners on two award-winning projects:

Burns Scalo: Diamond Ridge is the Best New Speculative Office Building

Somera Road: The Park at South Side Works Apartments is the Best New Multi-Family Residential Building

At CEC, we thrive on dynamic collaboration, celebrate bold creativity, and champion unstoppable growth. Here, your contributions and collaboration aren’t just recognized — they’re celebrated. As employee-owners of the firm, we are all personally accountable for building lasting relationships and delivering outstanding results.

Learn more about our Real Estate

412.429.2324

NAIOP PITTSBURGH AWARDS

BEST NEW MULTIFAMILY BUILDING

The Park at SouthSide Works Apartments

Pittsburgh, Allegheny County

Developer: SomeraRoad

Architect: Desmone Architects

Contractor: Rycon Construction Inc.

Lenders: Related Fund Management, Bank OZK

The Park at SouthSide Works is a vibrant waterfront community nestled along the Three Rivers Heritage Trail and within Pittsburgh’s premier live, work, play, stay destination – SouthSide Works. Located on the site of a former steel mill, The Park brings new life into the iconic neighborhood and redefines the area’s relationship with the river. The 247-unit new development residential project from SomeraRoad offers one- and two-bedroom apartments and two-story townhomes boasting an array of upscale amenities. The community’s sleek design draws inspiration from its riverside location, as spaces indoors and out reflect nature’s palette, energy and warm welcome. Amenities include high-end finishes, waterfront and downtown views, building lounge with shuffleboard, billiards, kitchen, and hosting venues, pool with river views, courtyard with grilling areas, fitness center with yoga space, a remote workspace and podcast room, bike and resident storage, an on-site dog wash, and much more. The project has seen great leasing traction, attracting residents looking for urban, walkable living within a peaceful and natural location.

THRIVE DESIGNED TO

At Desmone, we design buildings and spaces that allow people to thrive – physically, emotionally, and spiritually. Our unique service journey is rooted in effective delivery strategies and informed by principles of health and wellness. We believe that healthy spaces lead to healthy people, and healthy people lead to a healthy world.

Oakland Market Update

Pittsburgh’s “Innovation Corridor” was articulated by former CMU president Subra Suresh a decade ago. It envisioned a connected economic engine linking CMU (foreground), Pitt, and Downtown (upper

left).

Photo by Roy Engelbrecht Photography.

Oakland is the economic heartbeat of the Pittsburgh region. It would not be a stretch to call it the economic heartbeat of Pennsylvania. Oakland is acknowledged to be the third largest business district in the commonwealth. So, it is reasonable to look at the current conditions in Oakland with concern.

Expansion at Carnegie Mellon University’s campus only went beyond the original Carnegie Tech boundaries within the last decade, although its economic impact has driven development throughout the region.

Arbitrary cuts in federal research grants are sending a chill through the research universities and the University of Pittsburgh Medical Center (UPMC) at a time when these economic drivers were already pulling back from expansion due to other cyclical concerns. Local government has survived on the fruits of the growth of jobs in technology, education, and healthcare that can be traced to Oakland’s institutions, but has been less than helpful in fostering more opportunities. Instead, the Gainey administration has been targeting not-forprofit institutions, like those in Oakland, to drain more revenue at a difficult time.

To look at the economic fundamentals of Oakland – its employment and real estate data – it is hard to see problems, let alone a crisis. While it is true that the supply and demand fundamentals of the neighborhood are enviable, the trends point to more difficult conditions. The good news is that many of the problems facing Oakland are not insurmountable. The institutions that rely on federal funding will adjust to new realities

if necessary, and that will dull the economic impact for a time; however, the fruits of the work done in Oakland will continue to be in higher demand across the globe. That bodes well for the 2030s and beyond.

In the meantime, the ingredients for Oakland’s continued thriving are mostly in place. The vision of an innovation corridor stretching from Carnegie Mellon University through the University of Pittsburgh to the heart of the region’s business center is as valid as it was a decade ago.

Oakland’s Economics

As go education and healthcare, so go Oakland (and Pittsburgh). Through the end of February, the Bureau of Labor Statistics reported that education and healthcare jobs made up 22 percent of Pittsburgh’s total employment, totaling 271,600 jobs. While not all education and healthcare jobs are in Oakland, most jobs in that neighborhood are in those two sectors. Education and healthcare employment grew by 3.2 percent in 2024

and employed 8,000 more workers in February 2025 than a year earlier.

The improvement in employment is a welcome shift from what has generally been bad news about education and healthcare industry trends. Both industries face challenges that linger from the pandemic, as well as long-term structural challenges that can be traced to demographics. Now, each faces additional challenges stemming from changes in federal policies.

Higher education has been barreling towards a demographic cliff for more than a decade. Lower birth rates have led to fewer college students. Social pressures that favor college attendance have waned, at least somewhat, suggesting that fewer graduating high school students will choose to attend college. Moreover, after decades of riding aggressive tuition hikes, universities are now faced with much larger staff and overhead costs than 20 or 30 years ago.

In Oakland, the negative structural trends have been less pronounced. One of the

Photo by

Roy Engelbrecht Photography.

emerging counter trends of this era of declining enrollment is that universities among the top 50 or 100 in the U.S. have struggled less or even thrived. Oakland is home to two of those universities – Pitt and CMU – perceived to be among the nation’s best.

At Pitt, enrollment in 2023 exceeded the previous year by 1.7 percent at the Oakland campus. In June 2024, Chancellor Joan Gable announced that the university’s strategic plan calls for increasing enrollment by more than 11 percent, or 3,200 students, by 2028. That news preceded an increase in applications for 2025 to more than 60,000. With an acceptance rate just under 50 percent, the increased enrollment is achievable without a significant change in standards.

Carnegie Mellon bucks most of the trends that are driving higher education today. At roughly 16,000 students, CMU’s enrollment in Oakland is roughly half that of Pitt’s. With an acceptance rate of less than 15 percent, CMU’s enrollment ebbs and flows slightly depending upon the makeup of that year’s applicants. Between

2021 and 2022, for example, applications rose by 4.15 percent while admissions fell by 13 percent because the acceptance rate tightened to 11.3 percent. CMU has been able to maintain price increases, with the 2024-2025 published tuition, room and board costs topping $80,000. Almost 94 percent of CMU’s students are full-time students.

Oakland’s third university, Carlow University, does not have the advantages of its neighbors, but has worked hard to reverse its long-term enrollment decline with some success. After losing 17 percent of its enrollment from 2011 to 2021, Carlow saw enrollment grow by 5.7 percent in 2022 and nine percent in 2023.

The other dominant force in Oakland’s economic impact is healthcare.

Oakland is home to most of UPMC’s major hospital facilities, including its billion-dollar new Heart and Transplant Hospital at UPMC Presbyterian. Within a few blocks of Presbyterian Hospital are UPMC Montefiore, Western Psychiatric Hospital, Eye and Ear Hospital, and UPMC Magee Women’s Hospital. University of

Pittsburgh’s Medical School is located in the midst of these institutions as well.

A mix of related and unrelated issues have plagued healthcare operations since the late 2010s. Like most industries, healthcare has a demographic problem. An aging patient population requires more healthcare services while an aging physician and nursing provider population shrinks with retirements that are growing faster than new providers are joining the ranks. This imbalance is driving salaries for doctors and nurses higher at a faster rate than the overall wage growth rate. It has also pushed recruitment costs much higher, as turnover in larger healthcare systems is virtually continuous.

Higher salaries are one of many areas that have become more expensive for hospitals. The pandemic-era supply chain disruptions led to shortages and price spikes. The inflation cycle of 2021-2023 affected healthcare products more severely than goods inflation overall. Construction and maintenance costs for healthcare facilities also rose sharply during that period, likely ending 40

Dickie, McCamey & Chilcote | Pittsburgh, PA

percent higher than the costs in 2019. Hospitals also require more frequent investments in new technologies and upgrades of existing technology.

This rising tide of operating and capital costs is occurring at the same time that revenue streams for hospitals are becoming less reliable. Reimbursements from Medicare, Medicaid, and private insurance have declined from pandemic highs. Federal and state policies are threatening to reduce those reimbursements further. Insurance premiums and deductibles have also increased at higher rates during the past two years, which pushes more patients into uninsured status and more hospitals delivering uncompensated care.

Taken together, the trends of higher costs and lower, less reliable revenues

have dampened healthcare capital spending since 2022, including spending on additional commercial space for rent. In Oakland, however, neither of the business cycle problems will be as impactful as the decline or loss of federal funding for research.

The federal government’s backlash against diversity, equity, and inclusion programs looms as a threat to funding for numerous student-focused programs at universities. Pitt, CMU, and Carlow each have programs that give opportunities to segments of the population that have been underserved or historically victims of discrimination. Those programs, and the federal funding that helped support them, are under attack for being discriminatory. While none of Oakland’s universities seem to be under the Trump administration’s microscope for their response to

anti-Israel demonstrations, Pitt and CMU are vulnerable to policies that are targeting foreign-born students.

The biggest economic threat associated with the new administration’s change in focus for higher education is its radical cutback on research funding.

For Pitt, the threatened cuts in NIH grants would amount to $185 million annually. The NIH cuts would eliminate $8.5 million from CMU; however, CMU received $214 million from the Department of Defense, $61 million from the National Science Foundation, and $40 million from the Department of Health and Human Services in the current fiscal year.

At a minimum, the loss of funding has effectively frozen capital spending plans for the universities and UPMC. In some

Oakland’s office vacancy is among the region’s lowest and its rents are among the region’s highest. Source: CoStar, Cushman & Wakefield.

ways, the timing of the administration’s cuts could have been worse. Both Pitt and CMU were at a point of pausing after years of major construction projects. UPMC’s capital spending has become more diffused as it expands beyond Western PA, and its attention has been primarily on the completion of its billion-dollar Heart and Transplant Hospital, which will replace the Presbyterian University Hospital bed tower. There was going to be a slowdown in construction in Oakland for the next couple of years; however, the funding cuts, especially those that are affecting some of the most innovative research being conducted, bring paralyzing uncertainty.

The three major institutions anchoring Oakland’s economy have typically been transparent neighbors when discussing their plans. Today, the best that any of them can articulate is that all capital spending is being evaluated.

Market Fundamentals

Oakland’s real estate is primarily an owner-occupied, institutional building market. To the extent that there is commercial space for rent, Oakland is an office and multifamily market. The ground floor spaces of most commercial streets in Oakland are filled with retail and hospitality tenants, but upper floors make up 3.5 million square feet of office space.

The fundamentals of the office market in Oakland are among the strongest in the region. At the end of the first quarter, office vacancy was lower than most submarkets, ranging from 6.8 per cent to 8.5 percent, depending on which data you were reading. The strong occupancy level comes following a year in which Oakland office buildings saw negative absorption of roughly 16,000 square feet.

Demand for purely office space is solid in Oakland, but not spectacular. Despite its low vacancy rate, which has been relatively consistent for many years, there has been little addition to supply in recent decades. The most recent was the 95,000 square foot Murdoch Building at 3420 Forbes developed by Murland Associates. Elmhurst Group’s Schenley Place added 105,000 square feet in 2014. Elmhurst also developed a 106,000 square foot office at Fifth and Craig, home to Rand Corporation, in 2006. Prior to Fifth and Craig, Sterling Land Company built its 90,000 square foot Sterling Plaza in 1991. Sterling Land Company has proposed the companion Two Sterling Plaza several times, including as recently as 2017, without starting construction.

Oakland has not been immune to the dynamics that are challenging the office market everywhere. Even before the grant funding cuts were made, the Oakland institutions were reducing their real estate footprint.

“We have had some vacancy in the past year, although not much,” says Blake Stanton, co-president of Sterling Land Company. “If we’re talking about traditional commercial office space, there has been a flight to Class A. There has also been a general rightsizing among tenants.”

“Tenants are not changing their staffing, but workers are parttime in the office and they’re able to share offices, hoteling,

depending upon the day of the week” agrees Sterling Land’s co-president, Amy Adams.

Brad Totten, principal and managing director for the Pittsburgh office of Avison Young, says that he has observed that several blocks of available space have been from the Oakland institutions choosing to vacate.

“It was in the news recently that UPMC decided not to renew a 21,000 square foot lease at 450 Melwood. The lease expired in January, and it was clearly on the chopping block. That’s one lease of many,” he says. “The funding cutback is a hot subject relative to future budgets and future rent commitments. I wouldn’t say any requirements have been pulled but there is a wariness. The playing field has shifted and, if it continues, there will be some longer-term adjustments from a lease commitment standpoint.”

“Where there is a neighborhood with a finite amount of space, properties are generally going to perform well, especially when you have institutions so heavily invested and committed to long-term plans of expansion,” says Michael Connor, vice president and market leader for Hanna Commercial Real Estate. “But without that funding they’re used to getting, I think it’s pencils down until there’s a sense of what the funding will be.”

The other major commercial real estate property type in Oakland is multi-family, driven primarily by demand from students. According to the 2024 Comprehensive Housing Analysis for Pittsburgh done by the U.S. Department of Housing and Urban Development, 70 percent of the student population in Oakland lives in housing that is not owned by the universities.

Pitt has added four new residence halls over the past 20 years but still cannot provide sufficient housing for its undergraduate population. During the same period, private developers have added even more beds to the inventory in Oakland. Pitt’s 2019 master plan called for the addition of 2,400 beds on campus, but that is not expected to provide adequate housing for its graduate student and upper-class undergraduate students who wish to live off campus. Currently, the most viable private developments in the pipeline are student residences.

It is the size of the student rental market that is the root of the unusual characteristics of the Oakland housing market. Demand so far outstripped supply for so long that the opportunity for single-family homeowners to convert properties into rental units was too good

to pass up. The result is a neighborhood that has pockets that are undesirable for single-family living, even as the value of the homes there soars. In South and Central Oakland in particular, the conditions are a kind of reverse gentrification.

“Our goal is to upgrade the housing inventory in Oakland to free up the redevelopment of homes that had been converted for student housing. Those can be renovated and made more appropriate for people that are living and working in Oakland,” says Todd Reidbord, president of Walnut Capital, which is developing The Caroline, a 160-unit student apartment on McKee Street.

“We want to reduce some of the rental pressure on the lower density areas of Oakland. By advocating for and supporting appropriate high density student rental development in the places that the Oakland plan, for instance, prioritizes, we’ll be making space in Oakland for everyone,” says Andrea Boykowycz, executive director of Oakland Planning and Development Corporation (OPDC). “That works very well in the context of the inclusionary zoning overlay that Oakland is in.”

The Oakland Plan is a 10-year plan for the neighborhood that is adopted by the Pittsburgh Planning Commission. It

is intended to be a guiding document to which all stakeholders in Oakland contribute. Boykowycz explains that creating housing options across all income depends upon solving the student housing dilemma.

“A lot of the problems the permanent residents of Oakland face are because there are not enough legal beds for the student demand,” she says.

“You can create neighborhoods that are appropriate for people that are working, whether it’s in the hospitals or elsewhere in Oakland. Right now, if you live there, you have students surrounding you,” continues Reidbord. “There’s nothing wrong with students, but those may not be the kind of neighborhoods that we think of as appropriate for people that are working in the hospitals and universities and want to raise a family. I think we want those family neighborhoods in Oakland.”

Developers also believe there is unmet demand for market rate apartments in Oakland. Since the zoning changes were made in 2022 to accommodate the Oakland Crossings development, numerous sites below Forbes Avenue have been reported to be under consideration for new multi-family projects.

Radnor Property Group has been rumored to be interested in developing the Quality Inn site at 3401 Forbes Avenue. Radnor completed McGinley Hall, a student residence building serving Duquesne University at 1045 Forbes Avenue, in summer 2024. Asked about what is appealing about Oakland as a location for a new investment, Tim Gigliotti, managing director/partner, pointed to the shortage of housing of all types.

“It’s a dynamic market with the strong education and healthcare base that is there. Not only is the undergraduate population strong, the graduate student market, as well as the young professional market, which includes researchers and resident doctors, is a very deep base of young people that seems to be underserved in the neighborhood,” Gigliotti says. “It is traditionally known as an undergraduate housing neighborhood. Once you move up to the professional class, you have to move out of the neighborhood to have your housing needs met.”

For the coming 24 to 36 months, development in Oakland will be mostly focused on the opportunities to close the gap on student housing and the goal of returning the neighborhoods south of Forbes Avenue to single-family ownership

The Murdoch Building, developed by Murland Associates before the pandemic and occupied by Pitt, was the last new speculative office building in Oakland. Photo courtesy Mascaro Construction LP.

and appropriate multi-family housing.

The Development Environment

While the issue of adequate affordable housing is top of mind among Oakland’s stakeholders, there seems to be less concern about the inclusionary zoning than in other neighborhoods. That is most likely because the tight supply allows for rents that make it economically feasible to set aside 10 percent of the units for affordable housing. Those dynamics will be tested if a burst of supply enters the market over the balance of the decade.

The first neighborhood to potentially feel the impact of the new supply will be North Oakland. This year the 148-unit Julian Apartments at 419 Melwood Avenue will hit the market. Julian’s owner/developer, the

Hudson Companies, has plans to develop 166 units in a 12-story apartment called The Parker at 435 Melwood and convert an office building at 450 Melwood to 48 apartments. The 352 new apartments will be the first in North Oakland since the Metropolitan was built in 2006. North Oakland is home to many of the older multi-family buildings that have served as housing for permanent residents, and for students. Blake Stanton feels the new supply will offer variety without diminishing the prospects for the older buildings that Sterling Land and others operate.

“When I look at the newer product being built, the price point is going to attract different tenants than we have in ours. Ours are a little more price conscious,” Stanton says. “We certainly reacted to the realities of the market by upgrading our

common spaces, but our price point and value per square foot is stronger. We’ll see what the appetite for a brand-new product is like in North Oakland. We’re in the thick of it right now so we’ll see how the new product shakes out through year end.”

Stanton is describing a market reaction commonly called filtering. In a market with tight supply, new apartments attract tenants who can afford higher rents, allowing those who cannot to find lower-priced apartments as renters “filter” up to newer product. Filtering is an approach to affordable housing that is supported by opponents of inclusionary zoning, who argue that more inventory ultimately frees up more units at the lower end of the market, forcing landlords to be more competitive. The theory is supported by data from markets where

A key element in Pitt’s 2019 master plan, to be updated over the next year, is the private development of mid-rise commercial buildings at the western end of Fifth and Forbes. Rendering from University of Pittsburgh, Envisioning the Future.

new construction has boomed since the pandemic. According to the Zumper National Rent Report, the cities that saw the biggest declines in rent over the past 24 months were the Sun Belt cities that delivered the most new units. For example, San Antonio saw rents drop three percent as 10,000 units delivered in 2024. Rents for one-bedroom units in Austin were 10 percent lower in February 2024 than a year earlier. Raleigh-Durham rents fell 7.6 percent for a one-bedroom apartment. Not coincidentally, deliveries of new apartments in Pittsburgh slowed in 2024 following a steep decline in construction in 2022-2023, while multifamily construction boomed nationwide.

Proponents of inclusionary zoning, like Boykowycz, prefer to see new construction include units that are affordable, rather than trusting the market to filter renters to their individual levels of affordability.

“The new development here is primarily Class A rental. That doesn’t leave room for the kind of affordability that Oakland needs. We’d like to see new development benefit a larger swath of the population,” Boykowycz notes.

The 2022 zoning changes that were adopted to allow higher density in the traditional low-density neighborhoods south of Forbes Avenue should facilitate more high-quality multi-family, both for students and permanent residents. Developers have responded to the opportunity with new projects in the pipeline. In addition to The Caroline and the former Quality Inn site, for which Pitt is expected to approve a new development agreement this spring, Trinitas Ventures has proposed a 326-unit apartment on Halket Street. There are reports of early-stage activity by developers of multi-family projects on Meyran Avenue and Fifth Avenue, west of Carlow University. And Elmhurst’s Bill Hunt reports that plans are being developed to expand Webster Hall.

The hope is that the higher density allowed, along with the opportunity to achieve more density through energy conservation or environmental measures, will create enough vacancy in South and Central Oakland to incentivize the conversion of rentals to single-family homes. The economics of this aspiration are not simple, however, as the rental income of the homes has pushed prices well beyond the value per square foot for a single-family home.

“It’s a complex issue that does not lend itself to simplification. It has been a while since Oakland has had both the zoning and development interests to support the construction of high-density rental housing that’s geared towards student needs,” Boykowycz says. “The universities have increased their undergraduate enrollment, but without a corresponding increase in the supply of student beds, either on campus or off, the pressure from student rentals has driven displacement and a strange kind of gentrification in Oakland.”

Under its past leadership, OPDC was skeptical of higher density development south of Forbes. To the development community, OPDC’s Oakland Plan and the Pittsburgh Planning Commission

were at odds with many of the specifics of the innovation corridor vision. The well-organized opposition to projects often included the property owners of the singlefamily-turned rentals that benefitted from the status quo. It remains to be seen whether new leadership and direction will be more accommodating to new development.

New commercial development, which would support more university-related research and, ideally, the growing companies that result from technology transfer, is likely at a standstill until there is clarity about funding. But, even without that recent uncertainty, technology-driven commercial development has been slowed.

Pitt’s Fifth and Halket project, which the university developed after purchasing the fully-prepared project from Walnut Capital, is a 306,000 square foot office and lab that was to be home to several Pitt departments. The construction is being done on the fit-out for those spaces but occupancy is uncertain since the funding cuts. Should Pitt not occupy the building, the market would have a difficult time absorbing the space. Such a turn of events would also make it more difficult for Wexford Science + Technology’s to build its 10-story office/research tower at 3440 Forbes Avenue, which has battled through entitlement and neighborhood challenges since 2019. That project is awaiting a lead tenant.

“Our technology growth is not where it could be. We’re not seeing a lot of high-end demand for 20,000 square feet of office or dry lab space near the universities. I’d love to see three or four new buildings going up along Forbes or Fifth Avenue, but we don’t have that yet,” says Hunt. “To grow as a region, we need a tech corridor, and I think it needs to be in Oakland. You want to have adjunct professors who work in technology or graduate students being able to walk across the street from business to university, like in Cambridge or Atlanta. That requires an ecosystem that I don’t quite see yet in Oakland.”

Sean Luther is president and CEO of InnovatePGH, a public-private partnership aimed at accelerating Pittsburgh’s status as a technology center. He sees the most robust economic growth coming from artificial intelligence and the life science/ healthcare collaborations between Pitt

and CMU. Luther says that there are some practical reasons why the region’s best innovations are not yet driving real estate demand.

“Anything that Pitt and CMU are working on together is a unique value proposition for Pittsburgh and will become important for the development strategy for growth in Oakland,” Luther says. “I think we’re starting to see things getting to scale already, but it is quiet. A lot of the technologies Pittsburgh is really good at are really hard. With digital health you’re talking about considerable government oversight, patient safety, and data safety. When you talk about medical devices, you’re talking about significant FDA approval and other layers of federal regulation.”

Collaboration between the two universities is also on Hunt’s mind. Elmhurst’s Fifth and Craig location is home to Rand Corporation, which cited its location directly between Pitt and CMU as an attraction to the Oakland building. During the administrations of Jared Cohon at CMU and Mark Nordenberg at Pitt, the two institutions collaborated to form several key technology-focused initiatives, including the Pittsburgh Digital Greenhouse and the Pittsburgh Life Science Greenhouse. Collaboration continues between the schools but the current challenges facing

universities would seem to be a strong incentive for more.

“Chancellor Gabel at Pitt is pushing for a strategic plan between the universities but that’s going to be another two years. I hope the two universities begin to work together more and maybe the physical space should be part of that,” Hunt suggests.

For now, collaboration might mean less real estate leased in the aggregate, which would exaggerate the recent trend. Luther notes that the shift in the absorption strategies of the universities and UPMC offers more opportunities for private companies to locate in Oakland at rents that are competitive to the neighborhoods, like the Strip District, where tech companies have leased after growing. Up until now, Oakland has been home to the startups, which demand less space.

“The companies in Oakland are almost exclusively smaller than a 10-person head count. They are in the early stages of commercialization and just getting ramped up,” says Luther. “That reinforces that Oakland’s core job as an economic driver for the region is to be the engine. It’s difficult also for it to be the drivetrain and wheels and other parts of the vehicle. Most of the companies that need proximity back to the university are younger and therefore smaller.”

The kind of growth that will spark the kind of innovation corridor that former CMU President Subra Suresh called for in 2015 will take more than collaboration and commercialization. There are barriers to growth that go beyond those that might be inherent to Oakland or the City of Pittsburgh. The corner of Fifth and Craig is located in Pennsylvania, which has room to improve its competitiveness for technology companies, according to Stefani Pashman, CEO of the Allegheny Conference on Community Development.

“Significant elements of our plan are built around fostering a better business environment. A lot of that is centered around the innovation economy, which is anchored in Oakland,” Pashman explains. “A couple of specific policies that we think will help Oakland are streamlining permitting and regulatory processes to reduce hurdles for startups and life sciences companies. How do we make sure high growth sectors can support talent attraction and investment with reduced regulation? The PA SITES program is critical for life sciences. That program is live, and we’ll see the first round of applications soon.

“There are other things that we are advocating for in Governor Shapiro’s budget. One is establishing a Statewide

Photo by University of Pittsburgh.

Innovation Fund, which would directly benefit Oakland. This fund would directly invest in early-stage companies to help foster an ecosystem for the research institutions and startups. We are also advocating for having the state match federal Small Business Innovation Research and Small Business Technology Transfer grants. All other states in the country provide matches for these and Pennsylvania does not. This is a loud cry we hear from the universities and companies coming out of Oakland. It’s the kind of investment that helps drive advancements and growth.”

Oakland, and the region overall, would also greatly benefit from state investment in infrastructure to improve important connections to and within the neighborhood. Improvements are needed on Craig Street and the Forbes Avenue bridge to make it safer for pedestrians moving from CMU to the Craig Street shopping district. Oakland is getting a major investment with the Bus Rapid Transit System (BRT), but that improvement only highlights the poor connection that exists between the universities and the other

locations, Strip District or Hazelwood Green, where technology transfer investments have been made.

Elmhurst’s Hunt suggests that a single Oakland advocacy entity that represented all the neighborhood’s stakeholders, including the city, could better coordinate for development. He also advocates for development of commercial area like Midtown Atlanta, which markets corporations to locate in proximity to Georgia Tech and promotes opportunities for students, like internships, that serve to anchor the companies in Atlanta.

“The one main difference between Midtown and Oakland is Oakland is an authentic and real neighborhood. That asset is nearly impossible to replicate,” Hunt says.

The next few years are likely to see less commercial development in Oakland, as the major economic drivers respond to uncertainty. Even without the challenges that Pitt, CMU, and UPMC face, the development environment faces its own challenges of higher interest rates and construction costs. These could be ideal years for state and local governments

to invest in future growth and to set the agenda for private development to more easily respond to that growth. Assuming that life science and information technology return as economic drivers in Pennsylvania, developers would be prepared to invest in Oakland and remake its residential and commercial corridors. The City of Pittsburgh would do well to prepare to meet that kind of investment potential with certain and rapid processes for entitlement and permitting.

“The idea that Oakland is built out is far from reality,” says Luther. “We still have single-story bank branches directly across the street from $900 million hospital expansions. We have single-level fast food restaurants staring down major investments that CMU and Pitt are making. We recognize that it is a greater challenge to put these projects together because of site assembly and costs, but we are committed to the idea that the return on that is the highest that you can achieve in the region. We’re excited to be working with developers who can see that vision and are aware of where the economic center of Western Pennsylvania has moved.” DP

The Caroline at University Commons

time – plus some local politics and a global

create 1,000 new student and workforce housing units to spark the revitalization of the South Oakland single-family housing stock. Along with new retail, grocery, and miscellaneous commercial users, Oakland Crossings was intended to fill 18 acres with the kind of development that has transformed neighborhoods surrounding thriving universities in other cities across the U.S. City of Pittsburgh and neighborhood politics slowed the development, and the effects of a global pandemic altered the execution.

Todd Reidbord, president and co-founder of Walnut Capital, says that the larger purpose for the new development has not changed, even if the scope of Oakland Crossings has been revised.

“We had spent a fair amount of time, even pre-COVID, thinking about transforming Oakland and how Oakland Crossing could impact the ecosystem around the University of Pittsburgh and Carnegie Mellon,” he says. “There are a lot of other cities with great universities that have even more of a mixed demographic living around those universities, cities like Philadelphia, Boston, St. Louis, or wherever there are great universities in urban settings. You see living and shopping and working not 100 percent geared toward students but towards working people that want to live in an urban environment. Those places attract people from all over the world that are comfortable in that environment. We thought that was something that could benefit Oakland.”

Rendering by Strada Architecture LLC.

“We’re of the opinion that Oakland has evolved the way it has because of the lack of appropriate housing for students. Most of that was due to zoning and other restrictions. There were people that had generational homes that were converted to student apartments because that was the best way to make money. People moved out to the suburbs but kept the family house as an apartment for students. That wasn’t the best for the neighborhood, but it evolved that way because of a lack of planning,” Reidbord continues. “We tried to spearhead changing the zoning in Oakland. It took two years. It wasn’t supported by everybody, but we were able to convince City Council and others that the appropriate way to move Oakland forward was to change the zoning.”

After the pandemic eased in 2021, Walnut Capital began the process of neighborhood meetings, design, and entitlement for what it proposed. Getting The Caroline to the point of

construction required overcoming two major challenges: reaching an agreement with the City of Pittsburgh and Oakland neighbors; and making the project economically feasible at a time when construction costs were rising rapidly and borrowing costs were two points higher.

Walnut Capital proposed changes to Pittsburgh’s zoning for Central and South Oakland to create higher density and commercial uses. At the city, the proposed changes were submitted as a bill by then-mayor Bill Peduto in September 2021, Councilman Bobby Wilson then introduced the bill (20211096) to City Council four days later. The new bill did not go through Pittsburgh’s Department of City Planning. It was also not a product of the Oakland Plan, a longterm evolving master plan coordinated by Oakland Planning and Development Corporation (OPDC), the neighborhood’s advocate organization.

Opposition to the zoning changes formed quickly. OPDC objected to some of the

substance of the bill and to the lack of due process. Mayor Peduto perhaps hoped to leave the revised zoning as part of his administration’s legacy in its final days, but the political realities would not allow that. Initial council hearings attracted significant opposition. Oakland Councilman Bruce Kraus worked with Walnut Capital to revise the proposed zoning, which were referred to Planning Commission just before the mayoral election. More public hearings were scheduled for January 2022, but incoming Mayor Ed Gainey requested two extensions, which pushed the hearing to early March.

Over the next few months, Council Bill 2021-1096 was reviewed by committees and publicly debated. On June 28, 2022, City Council passed the bill, which expanded the uses, increased the density and building sizes permitted in the Oakland Subdistrict.

“We’re not happy about everything in the zoning envelope - I think it should include

Rendering by Strada Architecture LLC.

more incentives for new constructionbut we can work with it,” says Reidbord. “Since we owned this property for many years, we were able to make this project work. Then, of course, the other challenge was the higher cost of construction. We were fortunate to have good partners in PJ Dick, Strada, and others to make it work, but it has taken a fair amount of time to get the subcontractors on board and within budget.”

Getting the project under budget required an unusually high level of collaboration between the general contractor, architect, developer, and specialty contractors. Virtually every design decision was scrutinized in a way that many architects might find intolerable. Strada and PJ Dick have worked together on numerous Walnut Capital projects and have developed a mutual professional respect that allows for a high level of communication.

“We worked hard as a team early on to identify the most efficient, effective

way to build the building. We turned over every stone to figure out a way to help with the budget,” recalls Tom Price, principal at Strada Architecture. “That’s what we would do on every job but here we really worked hand in hand with the engineering team and PJ Dick’s construction team. It’s also a high quality 11-story building that’s going to be here for a long time. We made sure not to sacrifice material durability.”

“Early in the design process, we budgeted the job several times, and it was always over the owner’s budget. Through the pre-construction process we did an analysis by trade, by system, of what was over budget,” explains Frank Babik, vice president for PJ Dick. “We reviewed three or four structural options, working with Strada and Atlantic Engineering to come up with the most cost-efficient system that had the least variation in this crazy market. We looked at several foundation systems and landed on a design-assist ground improvement plan rather than

more conventional foundations. When that package bid, it came in under budget. We also exhaustively looked at the exterior wall details with our quality control department, in collaboration with Strada, to make sure every detail was accurate before it went out to bid.”

The team settled on a girder slab system that saves significantly on structural steel and is erected more quickly. Babik notes that the structural packages were bid early, while design on the interiors was being completed. That acceleration locked pricing in early and trimmed several months from the schedule.

“We also worked hard as a team to get the layout efficient. Apartment kitchens and bathrooms are back-to-back so that we can combine plumbing stacks and the electrical feed, for example. Before the project was even designed, PJ Dick and Walnut Capital went out to the mechanical and electrical suppliers and negotiated commodity pricing for the fixtures so that when the project went out

Rendering by Strada Architecture LLC.

to bid, the subcontractors knew those prices,” continues Babik. “When we hit the market, the pricing came in under budget. We think that’s the benefit of a well-planned, well-thought-out design.”

“The other big thing was being able to use performance points built into the city’s zoning for this district to maximize the building height. We needed that volume that many apartments to make the pro forma work,” says Price. “We’re doing zero energy and rainwater performance points. That’s great for the environment, but it also works for the application. Sometimes those things can be a hurdle but, in this case, they were helpful. If we hadn’t had that volume, we might not have been able to make the project happen.”

Price credits Allen & Shariff Engineering and Hampton Technical Associates for their work in doing the mechanical/electrical design and site engineering respectively. Reidbord notes that, even with the hard work that brought the project under budget, the project might have stalled without the $6 million Redevelopment Assistance Capital Program grant.

“It took the design and construction team, Dollar Bank, PenTrust, and the ERECT Funds to bring The Caroline to fruition. Everybody put their heads down and made it work,” Reidbord says.

As of spring 2025, the demolition of properties on the site has been completed and construction is getting underway. Occupancy is scheduled for August 2027.

Walnut Capital is confident that The Caroline will be the first of numerous multifamily projects that will up the ante on student housing and change the character of the Oakland residential market.

“It has lots of amenities. It’s ADA accessible and is safe. It’s fully sprinklered, which you don’t see throughout South Oakland or even Central Oakland,” Reidbord says. “It will provide a place for students to live so that they’re not scattered in random homes or older apartment buildings throughout South Oakland. It’s a first step to make Oakland a community that’s appropriate for all demographics and income levels.”

Reidbord points to other neighborhoods in Pittsburgh that had much weaker

fundamentals than Oakland but are experiencing a residential resurgence because of the infusion of new high-quality multi-family housing nearby. He points to Friendship, Morningside, and Garfield as neighborhoods where homes have been converted back to single-family use.

“I think that’s great and what you could see in Oakland. There is an opportunity to build more apartment buildings that cater not just to students now that the zoning allows greater density. It’s a snowball effect,” he says. “We believe that there are opportunities to create additional development in Oakland without relying on the universities or UPMC to attract people. We believe in the strength of the Oakland market. It’s a long-term plan but we’re long-term holders.” DP

Avison Young creates real economic, social and environmental value as a global real estate advisor, powered by people. Our integrated talent realizes the full potential of real estate by using global intelligence platforms that provide clients with insights and advantage. Together, we can create healthy, productive workplaces for employees, cities that are centers for prosperity for their citizens, and built spaces and places that create a net benefit to the economy, the environment and the community.

The Caroline at University Commons - Developed by Walnut Capital

Rendering by Strada Architecture LLC

Rendering by Strada Architecture LLC.

In late 2024, Amazon, Dell, and Starbucks all announced an enforced return to office (RTO) policy in the new year. Jamie Dimon, CEO of JP Morgan, added fuel to the fire when a leaked tirade against remote workers went viral. Then, shortly after assuming power, the Trump administration quickly implemented a full time return policy for federal employees.

This led many to suspect that 2025 would be the year Pittsburgh businesses put their pandemic policies permanently behind them. However, those yearning for an immediate return to 2019 will likely be disappointed with what the year brings. That is because while there is ample evidence showing an uptick in office use, none of it yet suggests that employers are beginning to seriously enforce a full return.

In fact, the opposite may be the case. A 2025 report from Flex Index, a research firm centered around office attendance, shows that only 32 percent of U.S. companies required full time in person office for corporate employees, a 17 percent decline since 2023.

This is due in large part to serious resistance from employees who, in the current tight labor market, retain a good bit of leverage. And the data is quite clear what this cohort wants: flexibility.

A 2024 survey by Owl Labs asked employees how they would react if their employer enforced RTO policy. Over 40 percent of respondents said they would immediately begin searching for a new job. This is in line with a 2024 Bamboo HR survey which indicated that 50 percent of employees would look for a new job if they were forced to return for three days or more.

These are not idle threats. A 2024 academic study by researchers at the University of Chicago, University of Michigan, and the International Institute for Management Development found companies which implemented a strict RTO plan (particularly with more than three days back in office) could quickly expect 10 to 20 percent turnover. The study indicates that a disproportionate number of those who leave are high performers and critical thinkers, not

Ben Atwood

Are Corporate Back-to-Office Initiatives Driving Occupancy Higher? by

front-line workers. Replacing them can be difficult and time consuming, leading to losses in productivity and innovation.

That helps explain why many firms remain committed to the hybrid model, however, there is data and plentiful anecdotes showing a real drift away from full time remote. Flex Index also shows a notable uptick in the number of firms that moved to a “structured hybrid” schedule since 2023.

“It’s interesting to look at technology sector,” says Sam McGill, managing director at Cushman Wakefield. “It was the largest absorber of office space pre-2019 and arguably the most important industry to the office market. It was also once thought to be the industry that would work from home forever. That dynamic has shifted, with 43 percent of surveyed firms adopting flexible office policies.”

McGill believes the remote pendulum has finally begun to swing in the other direction, citing conversations with his own clients as well as an uptick in leasing activity. This spike can clearly be seen in CoStar data. The commercial real estate research firm, which closely monitors the office market at both a local and national level, reports that the fourth quarter of 2024 saw positive office absorption of 3.3 million square feet, the highest level since 2022.

CoStar’s local data indicates that Pittsburgh’s office recovery may have begun in 2024. Net absorption was close to 500,000 square feet in 2024, the first year with positive net absorption since the pandemic and one of the strongest years for that measurement in the past decade. Additionally, the total number of square feet leased jumped by over one million square feet and the market has seen four straight years of increasing lease counts.

While there are still 4.6 million more square feet of available office space on the market now than there was in 2019, and total leasing volume is about 20 percent

lower than pre-pandemic averages, McGill says the strong absorption figures are not possible if firms planned on being fullremote into the future.

“A good rule of thumb is if you are in the office three days a week, firms need to allocate a seat for you, or you will have seating overlap. Businesses aren’t reducing their headcount; they are consolidating their space. Smaller offices, more utilitarian approaches to foster

collaboration,” McGill says. “These savings are translating into a 20-30 percent reduction in new space, which matches up with 2024 leasing data. If most firms were still doing remote or two days, the leasing data would still be falling off.”

McGill says the consolidation is coming from smaller offices and workstations with more focus on collaboration, and this is occurring now because many tenants who had to make decisions in the

chaotic years of 2020-22 are coming up on renewals.

That sentiment is shared by the tenant rep team at Colliers. Cody Sharik, a senior associate at the firm, noted that in the immediate aftermath of the pandemic, “Businesses who had leasing decisions to make during the pandemic signed shortterm deals kicking the can down the road a few years. These leases are now coming up and more businesses have committed game plans for making use of their office.”

A big part of that game plan is adapting the office for hybrid use while fostering an environment where employees want to return.

Architects who design office space also see evidence of increased daily occupancy and the durability of the three- or four-day hybrid model. Dan Delisio, principal at NEXT Architecture, says the feedback from clients who have invested in upgraded space and amenities when moving or renewing leases in place was that more employees were returning to the office, whether that was on a full-time or hybrid basis. Jeff Young, managing principal of Perkins Eastman’s Pittsburgh studio, concurs, adding that many clients were beginning to realize that the pressure to downsize was going to lead to offices that were too small to meet future needs.

“No one wants to return to the space they left in 2019,” says Kate Herrara, a senior vice president at Franklin, a Pittsburghbased design firm that specializes in workspace furniture and layout.

Herrara says there have been numerous changes in what businesses are looking to get from their office space.

“One major change we’ve seen is a much stronger focus on spaces purpose-built for digital collaboration. With the rise of hybrid meetings, companies are rethinking how conference rooms, huddle spaces, and even individual enclaves function. It’s no longer just about putting a screen on the wall, it’s about creating rooms where people can truly see and be seen, hear and be heard. Some of the most valued office features today are hybrid collaboration spaces and singleperson enclaves for video meetings.”

Architects and workplace designers mentioned the increased focus on digital collaboration, noting an uptick in interest about once niche topics like acoustics.

“Working from home, you get accustomed to silence but, in the office, you get a lot more background noise. In recent years, there has definitely been an increase in attention to good acoustic design,” says Kate LaForest, a principal at Moss Architects.

More private rooms are being added for employees to make and receive Zoom calls for virtual meetings, and there is an increased emphasis on making the interior more hospitable.

“Prior to the pandemic, companies didn’t care as much”, says Catherine Montague, founder of Montague Design. “The old office was bland walls and old furniture. Companies must be more appealing now. The office must be an extension of home.”

All of this is being done to bring employees back, but is it working? There are indications that it is.

The Pittsburgh Downtown Partnership (PDP) tracks daytime and off hours traffic in and out of the city. Its data on daily employee visits are built on observations by Placer:ai, a location intelligence firm that uses cell phones to analyze office traffic.

In its tracking of daily employee visits at the end of February, there were an average of 41,260 employees in Downtown offices. That is just 58.8 percent of the 70,099 employees who occupied offices Downtown in January of 2020, a powerful indication that local employers are not pushing employees’ back full time.

Foot traffic levels have definitely picked up since the pandemic, but last year appeared to flatline. The monthly average was 57 percent in 2024, whereas it was 56 percent in 2023 and 42 percent in 2022. But it is important to note that Placer. ai is likely under-counting the number of employees regularly commuting downtown, and thus where Pittsburgh’s office recovery stands.

“Placer.ai classifies individuals as employees if they are observed in the Central Business District (CBD) four or more days per week, and as visitors if they are present three days or fewer. This methodology helps avoid misclassifying long-weekend travelers or frequent short-term visitors as employees,” explains Cate Irvin, senior director of development at PDP.

But Flex Index’s survey shows the average number of days in office is 2.78, with the

most frequent in office days are Tuesday through Thursday.

Brad Totten, principal and managing director for the Pittsburgh office of Avison Young says that the parking garage at PPG Place tells the story of the recovery graphically, with a display that gives a real-time count of available spaces.

“Things have clearly improved from where they were,” he says. “That said,

Union Craftsmen

Mondays and Fridays are still in the mid-to-low 20 percent range of people in the office. In the middle of the week, it’s probably 65 percent.”

Additional city data also lends credence to the three-day work week. The PDP also tracks garage and lot activity from the Public Parking Authority of Pittsburgh (PPAP). Its data indicates that parking garage activity across downtown has returned to about 75 percent of prepandemic levels, far higher than the foot traffic would suggest.

The PPAP also tracks and posts daily usage of downtown’s meters. While not a complete glimpse into return to work, it does provide real insight into parking activity in the heart of downtown during the work week. Its data corroborates Flex Index’s report, showing that the heaviest days of use are Tuesday to Thursday.

Additional insight can be gleaned from The Port Authority’s database, which collects and publishes monthly average use for its bus routes and the light rail. Though down about 40 percent when compared to the three-year average leading up to the pandemic, public transportation use has picked up on both the bus and light rail.

The number of companies with structured hybrid policies continues to rise, while those enforcing a full return decline. Source: Flex Index.

Monthly minutes from PPAP meetings also reveal that January 2025 parking garage revenues were $2.1 million, up 1.2 percent from January of 2024. The January 2025 meeting breaks down the revenue generated from 2024, showing that year’s garage revenue was at $2.3 million, up from $2 million in 2023, but down from the base year of 2019, which was $2.9 million.

Aggregated parking meter transactions by workday shows highest levels of vehicle activity in middle of the work week. Source: Western Pennsylvania Regional Data Center.

parking court revenues, as more tickets are likely to correspond with additional vehicles. Revenue generated in 2024 for parking tickets was $9.9 million, compared to $11 million in 2019.

Another measurement of activity downtown can be seen in the form of

These data all indicate that while flexible schedules remain entrenched, employees

are in fact returning to the office and likely doing so at a higher rate than in 2023. Though it seems unlikely this dynamic will accelerate rapidly while employees retain the level of leverage they currently enjoy, should economic winds shift, employers RTO mandates may be more effective. DP

DESIGN-BUILD SERVICES

Safety | Efficiency | Quality

WHO WE ARE

Bridges & Company, Inc. provides construction expertise for commercial, institutional, and light industrial clients in and around Pittsburgh. For nearly 40 years, we’ve delivered hands-on construction services that guarantee customer satisfaction. Our design-build capabilities have evolved to offer clients a streamlined construction experience that guarantees high-quality results.

DESIGN-BUILD BENEFITS

EXPEDITED SCHEDULING: Our ownership manages projects for greater schedule control and faster decision-making.

Through Bridges’ early involvement in the construction process, we were not only able to arrive at a guaranteed maximum price that enabled us to secure funding, but we were able to value-engineer many of the building systems and develop an aggressive schedule.

Park Rankin | University of Pittsburgh

IN-HOUSE TRADESPEOPLE: We employ over 30 skilled builders to handle concrete, carpentry, excavation, drywall, and more.