Rare Collectibles | Build a Collection

Anthony is a relationship manager who genuinely cares about his clients’ best interests. His strongest skill is in finding the best value acquisitions for clients, based on their areas of interest.

Rare collectibles are an interesting and at times, complex field, with certain attributes in varying categories making a huge difference to the potential opportunities for profit they offer.

Anthony will ensure that our service aligns with your objectives and requirements. He will guide you through our categories and discuss your interests and ambitions.

In the first instance, please arrange a consultation with Anthony. He will be delighted to meet face to face, by phone or via video call.

Call +44(0)1534 639998 Email info@paulfrasercollectibles.com

The Paul Fraser Collectibles Build a Collection Service strives to enable clients to acquire top-quality pieces at below market prices. Offering an easy and enjoyable way to build a valuable portfolio of rare collectibles.

As a client, you receive the very best of what we have to offer, with relationships at the forefront of this personal service, providing you with the peace of mind that we always have your best interests at heart.

Many of our clients use this service to diversify their pension fund. Others use it to save for future events, such as school or university fees. Those with a longer-term perspective view it as a legacy plan for their children or grandchildren. We will provide annual valuations, allowing you to track the growth of your collection’s value over time.

• A sensible diversification to long-term financial planning

• Low entry point, enabling you to build a valuable collection with small monthly contributions

• Potential for steady capital growth based on the historic performance of rare collectibles

• Rare collectibles are tangible, uncorrelated, low-volatility assets

• Six months’ interest-free credit in advance

• Storage in secure, humidity and temperature controlled vault

• Free specialised insurance while items are held

• Free worldwide delivery

• Dedicated client services Manager

• Annual valuations on your pieces

• 0% management or valuation fees

• Lifetime authenticity guarantee on all purchases

• Complete flexibility to change or stop payments, and sell your collection when the time is right (on loyalty tie-in periods)

We only acquire rare collectibles we want to hold as long-term investments on our balance sheet. This approach ensures our interests are, inherently, always aligned with our clients’.

Our team of experts has a proven track record, spanning over 40 years, of successfully buying and selling rare collectibles for profit.

In a similar fashion to a fund manager picking stocks, our team constantly studies the market and carefully selects short lists of rare collectibles that are becoming available.

Our stringent due diligence process focuses only on the rarest, highest-quality items with impeccable authenticity. We acquire only those pieces we believe, based on our deep understanding of market dynamics, have the potential to appreciate in value over time.

Importantly, we only purchase when we can secure an item at below our internal valuation of its “market value”. This built-in margin of safety enables us to pass on that advantage to our clients, giving them a head-start on the value of the item versus the price paid.

Most of our clients build collections. They either blend different categories, or focus on a specific passion. They enjoy the thrill of discovering exciting new pieces and the pride, prestige, and pleasure of ownership.

Building such a collection allows value to mature over time. Clients can decide either to sell the collection as a whole or retain it as a store of wealth and pass it down as a family heirloom.

We employ several key strategies to acquire the finest rare collectibles at below market value:

• Global Network of Experts

Our team works with an extensive, worldwide network of specialist experts in each collectible category.

• Auction Tracking

We diligently monitor auctions worldwide, targeting key rarities that appear in less optimal markets. For example, a Lord Nelson-signed document would achieve less in the US than in the UK.

• Smaller Auctions

We follow and attend smaller provincial auctions where exceptional items occasionally surface. These often lack the marketing reach of larger sales, allowing us to acquire key pieces at a significant discount to market value.

• Forced Sales

Opportunities occasionally arise through unfortunate circumstances - debt, divorce, or death - enabling us to buy items or collections at artificially lower prices.

• Hidden Value

We excel at spotting items others have overlooked. A cheque signed by Marilyn Monroe on August 3, 1963 gains significant value when you know she died the

Every collectible we acquire must meet the following criteria:

1. Rarity

We focus exclusively on rare collectibles where only a few examples exist, and we always seek out unique pieces where possible.

2. Quality

We aim for the finest-known examples of collectibles or, at the very least, items in excellent condition. Discerning collectors consistently pay more for the bestpreserved pieces.

3. Authenticity/Provenance

Our in-house specialists rigorously authenticate each piece. In cases of doubt, we rely on independent specialist authorities. We prioritise items with traceable, cast-iron provenance.

4. Liquidity

We only acquire rare collectibles in markets with a strong base of passionate collectors, avoiding niche areas with limited buyer interest.

5. Price

We acquire items either as a value investment - where we secure them below market value - or as a momentum investment in markets where prices are rising, enabling us to turn a quick profit for our clients.

When it’s time to liquidate and bring a portfolio to market, selling rare collectibles through Paul Fraser Collectibles offers you the best possible return on your initial outlay.

We achieve this for you through:

• Global Network

Our global network of high-net-worth clients helps ensure you find a buyer willing to pay full market value for your rare collectibles.

• Item Descriptions

The way an item is described matters. Our knowledge base enables us to craft detailed, compelling descriptions that increase engagement and value.

• Matching Sellers with Buyers

Our client relationship managers know their clients’ assets, aspirations, and interests intimately, enabling us to match sellers with the right buyers.

• Public relations and media coverage

We excel at securing media coverage. Our clients regularly enjoy the pleasure of seeing their items featured in national and international outlets.

• Commission Rates

Most auction houses charge 25% to 50% when you factor in seller’s fees and the buyer’s premium. Our commission rates will vary depending on the sales route chosen, however we will always strive to minimise your ‘trading spread’. This we achieve through a combination of buying at discount to market value, and a very competitive commission rate on exit.

As a rule of thumb, we work towards ensuring a trading spread of no more than 10% At all times our commission rate will be transparent.

When the time comes to sell, your dedicated collectibles portfolio manager, with whom you will have developed a close relationship, will guide you through the process. Your exit strategy is underpinned by our careful acquisition process, ensuring you’ve bought below market value.

Our commission will always be lower than mainstream auction houses.

We provide several exit options:

• Private Treaty Sale

We promote your item to our international database of buyers at an agreed price, led by our expert market valuation. We have a long history of achieving results for our clients that match those of major auction houses. However, our commission is lower, so you keep more from the sale. Our skilled marketing team promotes your items across multiple channels, including newsletters and blogs, social media, digital brochures, and our quarterly magazine. We produce high quality, in-depth sales material accompanied by professional photography and video production.

• Periodic Auctions

We hold periodic auctions, agreeing on a reserve price with you beforehand. We promote the auction to attract the highest possible price.

• Third-Party Auctions

Sometimes we recommend selling through a major auction house to achieve the best possible price. Thanks to our preferential terms with these auction houses, our clients pay no seller’s fees, which can be as high as 15%.

We provide expert valuations, offering insights into current market trends and recommendations on the ideal time to sell. Clients receive comprehensive annual valuations for their entire collectibles portfolio, with detailed assessments of each individual item. A dedicated account manager will offer commentary on a portfolio’s progress and provide strategic advice tailored to your time frame.

We follow a four stage onboarding process:

1 Arrange an initial consultation on +44 (0) 1534 639 998 or info@paulfrasercollectibles.com

2 Decide on a monthly payment figure

3 Complete our short client onboarding form

4 Choose your first item

Your personal portfolio manager will meet you face to face, by phone or via video call to ensure our service aligns with your objectives, requirements and ambitions. This will provide a guide as to what level your monthly contributions should be set at.

They will arrange to receive clear copies of your passport and/or driving licence, accompanied by a recent utility bill, full address and contact information for onboarding you as a new client.

In advance you will receive 6 months’ interest free credit, based on your agreed monthly contribution.

The six month credit springboard provides you with a perpetual six-month interest-free credit period to purchase from any of our listed categories.

For example, if you commit £1,000 a month in your plan, you can select and purchase collectibles valued at £6,000 upfront. This could be one item or several. Once the six month payments are complete and your account balance is cleared, we repeat the process, targeting items which show the best potential for profit.

There is a general rule of thumb within the rare collectibles market: select the best item you can afford, whether it’s stamps, coins, luxury watches or memorabilia. The best items always offer the optimum potential for profit (and pleasure).

We offer two straightforward options, both equally flexible. A client can simply pay by lump sum throughout the year or we put in place a regular monthly payment.

A lump sum payment can either buy items outright as you build your portfolio, or be built up against higher value items over a period. Once payment is complete, your item(s) will be released to you and delivered by secure courier.

You decide the amount you wish to contribute per month. This amount can be amended should you wish at a later time. The minimum amount is £100 (c. $130). We have a number of clients entering the collectibles market at this level. Some of our clients contribute far more, in the region of £5k-£10k per month.

This flexible service operates like a regular savings plan with no fixed maturity date, which you decide upon.

We ensure your purchases are only high-quality, rare, and authentic collectibles with a proven track record of long-term, healthy price appreciation. Yet you retain full control, with the freedom to choose what to add to your collection.

There’s no long-term commitment, and you can freeze or cancel your monthly payments at any time. Whether you’re a passionate collector or see rare collectibles as a valuable, tangible asset, we are completely flexible, ensuring that the service works for you.

Selecting Option 2, Monthly Contributions, you will automatically benefit from The Paul Fraser Credit Springboard, where in advance you will receive 6 months’ interest free credit, based on your agreed monthly contribution - expanded upon on the following page.

Terms and Conditions are available online at paulfrasercollectibles.com

1 Specialist Collector

Specialist collectors focus on a specific area, using the service mainly to benefit from the six-month interest-free credit. They often rely on us to source unique items through our international network.

2 General Collector

General collectors have broader interests, often spanning stamps, coins, art, and autographs. They use the service to establish a clear budget for their hobby, purchasing from our newsletters or website.

3 Passion & Profit

Individuals use the service to build a valuable collection over time, benefiting from our expertise in selecting items with strong long-term profit potential. We offer recommendations, and they choose the items to add to their collection. These clients benefit from allocating capital to tangible assets and, in some cases, seeing capital appreciation before making full payment.

Browse our ready-made portfolios online for inspiration. Each piece has been hand-picked for its long-term profit potential.

You can select one or more objects from a portfolio, and even select from different portfolios to give your collection true diversity. If you are looking for a specific item, much of our stock is not shown on the website, so please ask - and if we do not have the item we will source it for you.

• The Rare Autographs Portfolio

• The Rare Stamps Portfolio

• The Rare Coins Portfolio

• The Luxury Watches Portfolio

• The Historical Objects Portfolio

• The Historical Documents Portfolio

Whatever your plan, your dedicated portfolio manager will be with you every step of the way.

Our experience and quality of our stockholding has earned us global credibility, enabling us to operate at the highest levels in the industry.

We have secured historic artefacts for the Smithsonian, sold major rarities for the British Postal Museum, and acquired unique items for Ripley’s. Our experts have also advised the Discovery Channel, the BBC, the Wall Street Journal and many more international publications on the rare collectibles market.

Museums are expanding at an unprecedented rate, with 4 new museums opening every day, and 1,450 new institutions opening each year worldwide. From the Louvre Abu Dhabi to M+ in Hong Kong, major museums continue to launch - and they all require artefacts to fill their halls.

This global museum boom is creating a scarcity of pieces available for private sale, which in turn is driving up prices across sectors - from fine art to postage stamps and film memorabilia.

For savvy collectors, this presents a unique opportunity. Buying the right piece now could position you to sell at a premium in the next decade. By then, many similar works may be housed permanently in museums, leaving the private market with limited supply.

The British Museum only displays 1% of its collection at any given time - that’s 80,000 objects out of around 8 million. The Metropolitan Museum of Art in New York fares slightly better, showcasing just 5% of its holdings.

• The British Museum alone spent £109 million on new acquisitions

• New York’s Museum of Modern Art (MoMA) spends $50 million in a typical year

• The Getty in LA has to spend $100 million each year to retain its charitable status

High-value collectors are known to build and enjoy their collection for a number of years, then receive substantial tax deductions, through donating their collection to museums.

That’s exactly what collectors like Bill Gross, the US “bond king,” have done. Gross has donated $700 million in stamps and other collectibles to institutions like the Smithsonian.

In many countries, donations to museums are 100% tax deductible. Similar benefits apply to gifts to charities, universities, and libraries, ensuring your collection inspires future generations while offering you financial advantages.

1. Acceptance in Lieu (AIL) Scheme

Allows taxpayers to transfer significant heritage objects to public ownership in place of paying Inheritance Tax, often resulting in a tax reduction that exceeds market value.

2. Cultural Gifts Scheme

Individuals and companies can donate valuable objects to public collections, receiving a tax reduction spread over five years: 30% for individuals and 20% for companies.

There are two principal methods of enjoying your collection. Take your collection out of a vault occasionally and spend time with the items. Or, whether you live in a mansion or humble abode, enjoy them on a daily basis, allowing family, friends, work colleagues and your clients to experience them too - giving them insight into your personality and aspirations. Here are some display suggestions:

• The Hallway – a glimpse of your personality

Make your hallway a captivating introduction to your home. It’s the perfect space to showcase items that reflect your taste, spark curiosity, and open up conversations. Greet your guests with rare Picasso prints, autographs from US presidents, or even handwritten documents by Tudor kings.

• Office or Home Office – a source of inspiration

Turn your workspace into a sanctuary of inspiration, filled with items tied to those you admire. A letter penned by Charles Dickens could fuel your creativity, while a book signed by Martin Luther King might serve as a reminder of resilience and vision. Or perhaps a signed cigar once held by Winston Churchill will be the perfect accompaniment to a day of strategic thinking.

• Games Room – celebrate sporting legends

Deck your games room with the memorabilia of sporting greats, and let their achievements inspire you to aim higher. How about a Brazil jersey worn by Pele during a match, or a signed photograph of Muhammad Ali? You could even display an Olympic torch to evoke the spirit of competition.

• Cinema Room – a homage to film icons

Transform your cinema room into a shrine for the silver screen’s most iconic figures. An original Star Wars poster might set the scene, while Marilyn Monroe’s lipstick mirror or James Dean’s high school yearbook could add a personal touch to your cinematic tribute. Create an immersive experience where each piece tells a story of Hollywood glamour.

• The Garage – A tribute to the power and speed

For the car enthusiast, the garage can be a space where history and horsepower unite. Picture a signed photograph of Ayrton Senna watching over you as you tune your car, or Steve McQueen on his iconic motorbike as a constant reminder of cool, classic style. You might even display a pair of raceworn overalls from Michael Schumacher for that extra dash of racing pedigree.

All items mentioned above are pieces we’ve handled in recent years.

Rare collectibles offer unmatched portability, privacy, and protection from currency fluctuations. They can be traded seamlessly in major cities around the world, acting as a medium of exchange across currencies and offering a safeguard against any one currency’s instability.

In times of hyper-inflation in the past, collectibles were used extensively as an alternative currency. For example, in the last period of high inflation in the UK between 1975-1980, British rare stamps on average, increased in value by over 600%. Many of our clients see the added benefits of owning rare collectibles as a proven hedge against inflationary risks.

Unlike bank accounts or stocks, collectibles resist government seizure, providing you with greater control over your wealth. Their compact nature also allows for discreet transport - valuable assets stored in hand luggage have been used by those fleeing conflict or political upheaval throughout history.

Historically collectibles resist government seizure, and hedge against inflationary risks.

Discover further details and current example values below - just match the number to the corresponding image.

1 Buzz Aldrin Apollo 11

Excellent quality 8 x 6” print clearly signed by Buzz Aldrin

2 Buzz Aldrin Apollo 11 NASA Flight Training Suit

Buzz Aldrin’s personally owned and worn NASA flight training suit from the Gemini 12 and Apollo 11 missions

3 Queen Elizabeth I

Museum quality Royal manuscript signed by Queen Elizabeth I in 1591

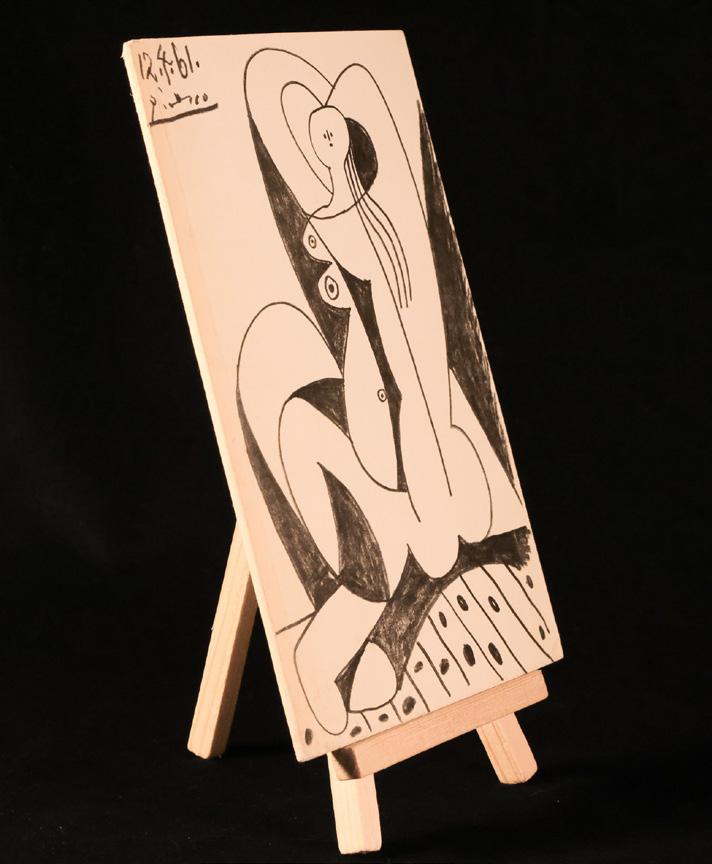

4 Pablo Picasso Signed Drawing

An original signed drawing by Pablo Picasso, dated February 3, 1962, drawn inside an exhibition catalogue from a Picasso show in Switzerland

5 Great Britain 1864 1d Rose Red Plate 77, SG43

£9,500

£150,000

£50,000

£35,000

£650,000 Britain’s rarest stamp. Of the three examples of the legendary Plate 77 Penny Red remaining in private hands, this is considered the finest example

6 England Elizabeth I Coin 1558 - 1603

Very good example. Gold Hammered 1st to 4th, Half pound

7 Great Britain 1840 1d Penny Black Plate 1b, SG2

The magnificent unused, with original gum, left-hand marginal inscriptional block of 18, lettered ‘MA-OF’ (MF Double letter, OA-OB Re-entry) wonderfully well margined all round, vibrant colour and with practically full original gum

8 China 1980 Year of the Monkey 8f vermilion, black and gold, SG2968

£8,000

£1,000,000

A very fine unmounted mint example with full original gum and good perforations

9 Muhammad Ali oversized Signed Photograph

Measuring 16 by 15 inches, in very good condition, a stunning oversized Muhammad Ali signed colour photograph

10 Winston Churchill

Winston Churchill typed signed letter

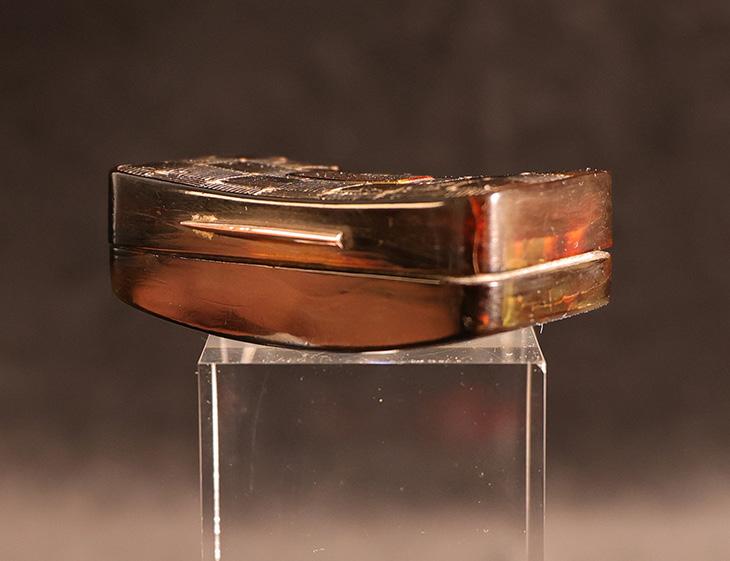

11 Admiral Horatio Nelson Snuff Box

The snuff box, which has a watercolour miniature of the Amalfi coast fitted into the lid, is accompanied by a note of provenance

12 King Henry VII Autographed Historical Document

Clearly signed “HR” by King Henry VII - the first monarch of the House of Tudor. Dated 1499 and addressed to Sir Robert Lytton, Keeper of the Great Wardrobe. Very good condition for age - document is over 500 years old

13 Charles Dickens 1847 handwritten and Signed Letter

£1,750

£2,995

£4,995

£45,000

£29,995

£1,995 Dickens writes the letter to the prominent Reading bookseller George Lovejoy (1808-1883), declining an invitation

14 Oliver Cromwell-era Document, Signed by Beale

A large and ornate Oliver-Cromwell era (1640-1649) document. Concerning the employment of an Edward Osbaldston

15 Patek Philippe Rose Gold Nautilus

An immaculate unworn and fully boxed and documented watch

16 Rolex Submariner Date

£2,500

£90,000

£18,500 ‘Kermit’ 16610LV Engraved Rehaut + Box

17 Napoleon Bonaparte owned Snuffbox

Owned during his exile on St Helena, circa 1815-1821. Offered with an unbroken 203-year chain of provenance

£45,000

“I would be delighted to have a face to face, phone or video meeting and discuss what your ambitions are and how we can support you.

Please complete this form, and either:

> Hand it to me

> Take a pic and email it or simply give me a call.

I look forward to hearing from you.”

Best, Anthony.