British Virgin Islands Financial Action Task Force ("FATF") Report

Podcast

June 2024

Podcast

June 2024

Chris Capewell Partner

+1 345 814 5666

chris.capewell@maples.com

Nikki Wood Associate

+1 345 814 5463

nikki.wood@maples.com

Chris Newton Managing Partner

+1 284 852 3043

chris.newton@maples.com

Daniel Moore Associate

+852 3690 7443

daniel.moore@maples.com

Matthew Gilbert Partner

+44 20 7466 1608

matthew.gilbert@maples.com

Alice Reid

Senior Vice President

+1 345 814 6150

alice.reid@maples.com

• Money laundering: processing criminal proceeds to disguise illegal origin

• Terrorist financing: financing of terrorist acts, terrorists and terrorist organisations

• Proliferation financing: financing transfer and export of nuclear, chemical or biological weapons, their means of delivery and related materials

• Targeted financial sanctions: asset freezing and prohibitions to prevent funds or other assets from being made available, directly or indirectly, for the benefit of designated persons and entities

• Who are they? The Financial Action Task Force ("FATF") is the global money laundering, terrorist and proliferation financing watchdog

• What do they do? FATF researches how money is laundered and terrorism is funded, promotes global standards to mitigate the risks and assesses whether countries are taking effective action

• Why is this important? FATF is a primary source for assessing the quality of a country's legal and institutional Anti-Money Laundering ("AML") / Counter Terrorist Financing ("CTF") / Counter Proliferation Financing ("CPF") framework and its application in practice; governments, regulatory bodies and financial institutions use FATF's findings in their own assessments of country risk for AML / CTF / CPF

• FATF conducts mutual evaluations of its members' levels of implementation of FATF Recommendations on an ongoing basis. These are peer reviews, where members from different countries assess another country. FATF Methodology for assessing compliance with FATF Recommendations and the effectiveness of AML / CFT systems sets out the evaluation process

• Assessments focus on two areas, effectiveness and technical compliance

• The emphasis of any assessment is on effectiveness. A country must demonstrate that, in the context of the risks it is exposed to, it has an effective framework to protect the financial system from abuse. The assessment team will look at 11 key areas, or immediate outcomes, to determine the level of effectiveness of a country's efforts

• The assessment also looks at whether a country has met all of the technical requirements of each of the 40 FATF Recommendations in its laws, regulations and other legal instruments to combat money laundering, and the financing of terrorism and proliferation

• A mutual evaluation report provides an in-depth description and analysis of a country's system for preventing criminal abuse of the financial system as well as focused recommendations to the country to further strengthen its system

• The Methodology will be used by FATF, FATF-Style Regional Bodies and other assessment bodies such as the International Monetary Fund and the World Bank. The Methodology was adopted on 22 February 2013, and regularly updated*

*https://www.fatf-gafi.org/en/publications/Mutualevaluations/Fatf-methodology.html

• On 15 – 30 March 2023, assessors from the International Monetary Fund and the Caribbean Financial Action Task Force ("CFATF") conducted a fourth round of mutual evaluation in the BVI

• On 26 February 2024 the Mutual Evaluation Report ("MER") for the BVI was published following the FATF Plenary

• MER assesses a country's legal framework and its implementation of AML / CTF / CPF measures.

• MER for the BVI recognises that:

• The BVI's resources and capabilities have been severely impacted over the last five years due to Hurricanes Irma and Maria and the impact of COVID-19

• "to undergo a mutual evaluation is challenging for any country, but especially so for small jurisdictions with relatively limited resources and which have been impacted by multiple catastrophes, such as the Virgin Islands"

Outcomes:

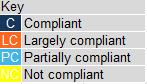

• Technical Compliance: compliance with the 40 FATF Recommendations, i.e. global AML / CTF /CPF standards

• The BVI is compliant with 11 of the 40 recommendations, largely compliant with 25, partially compliant with three and non-compliant with one recommendation

• Effectiveness: 11 key effectiveness goals or Immediate Outcomes ("IOs")

• The BVI received four moderate ratings and seven low ratings (with no substantial or high effectiveness ratings for effectiveness)

• The MER also provides recommendations on how the AML / CTF / CPF system could be strengthened

• Recommendation 24 Transparency and Beneficial Ownership of Legal

Persons – identifying gaps with foreign companies, collection of director information, updating of beneficial ownership information, nominee arrangements and information on co-operative and friendly societies

• Recommendation 26 Regulation and Supervision of Financial Institutions

– noting that trading in foreign exchange is not covered under sectoral legislation, there are deficiencies in the prevention of criminals and their associates from entering the financial sector and the Financial Services Commission ("FSC") is not held to review the assessment of a financial institution's risk profile where there are major events or developments in the management of the entity or group

• Recommendation 28 Regulation and Supervision of Designated nonfinancial businesses and professionals ("DNFBPs") noting that the Financial Investigation Agency ("FIA") lacks sufficient powers of enforcement where it cannot revoke, withdraw or suspend a license, authorisation or registration and the FIA is not required to conduct supervision on a risk-sensitive basis, nor is such approach systematically applied

• The 1 Non-Compliant rating is for Recommendation 8 on Non-Profit Organisations ("NPOs"): due to major shortcomings in BVI's approach to and regulation and supervision of NPOs

• The government has confirmed that it is committed to, "…rigorously implementing the CFATF's recommendations" as laid out in the National Action Plan (the "NAP")

• The implementation process will be observed by the CFATF through its follow up process

• The NAP includes:

• revising the national AML / CTF policy

• updating and implementing risk assessment frameworks and inspection processes of the FIA and Financial Services Commission ("FSC")

• implementing the virtual assets service provider ("VASP") regulatory framework by the FSC

• drafting of legislation to address minor technical gaps identified in the MER

• Ensuring that maintenance of beneficial ownership information is directly with a public authority

• Commencing the terrorist financing risk assessment of non-profit organisations by the FIA

• Establishing a specific Sanctions Unit within the Attorney General's Chambers to ensure greater efficiency in dealing with all sanctions-related matters

• Training for law enforcement agencies and other relevant authorities on money laundering investigative techniques and sanctions compliance

• Enhancing coordination and cooperation among law enforcement agencies and other competent authorities

• Updating the terrorist financing risk assessment and assessing the specific risk posed to the jurisdiction by legal persons and legal arrangements

• Introducing a Compliance and Governance Master Course to provide industry professionals with essential knowledge and skills

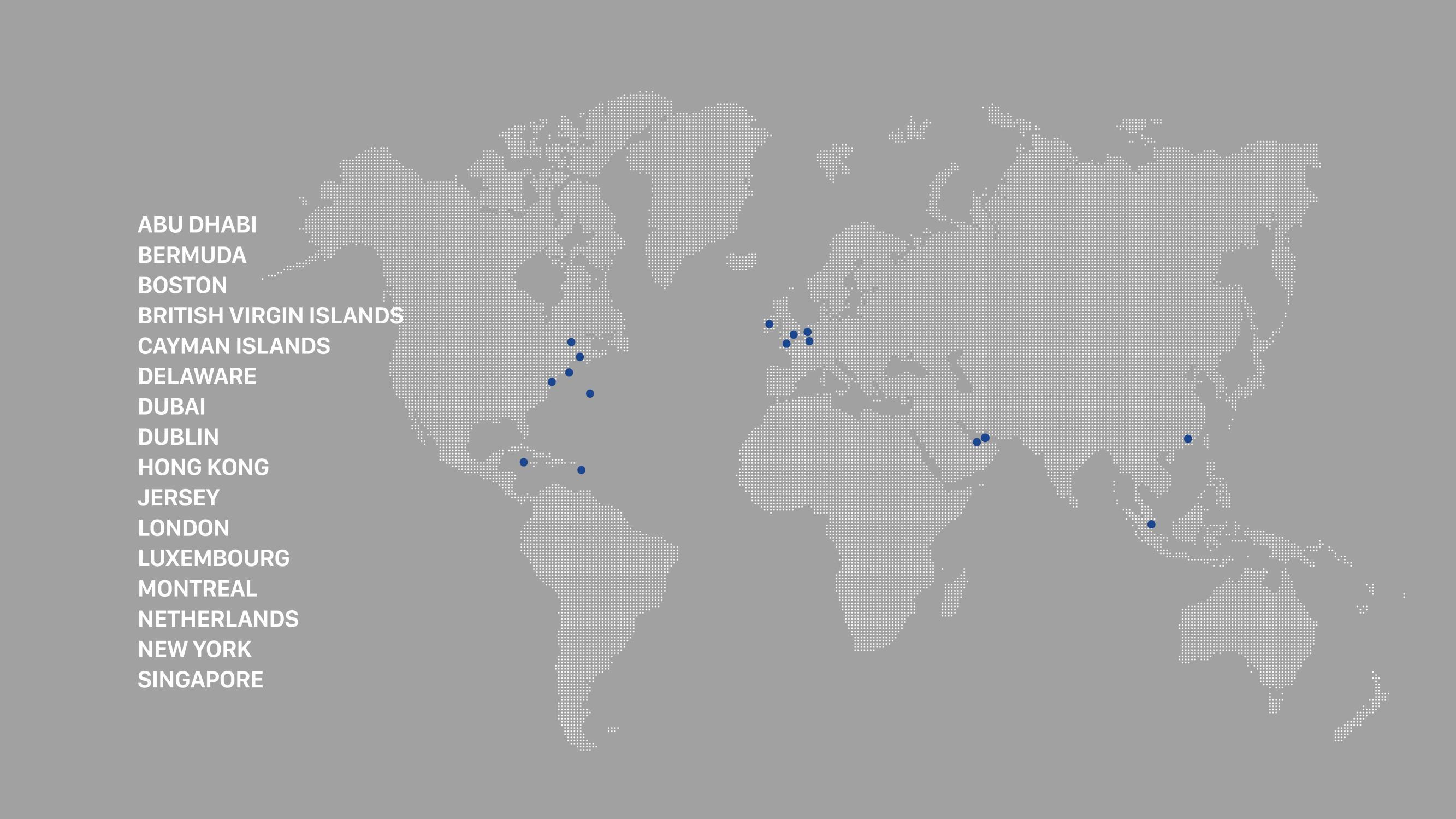

• Maples Compliance Services Limited ("MCSL") is one of the largest providers of AML compliance services

• Teams in Hong Kong, Montreal, Dublin and Cayman Islands

• Provide Money laundering Reporting Officers for

• Investment Funds

• Investment Manager

• This includes the MLRO preparing board reports whether quarterly or annually as the client preferred

• Presenting at the board meetings

• Providing guidance to the Funds as it relates to the BVI regulations

• The International Tax Authority ("ITA") responsible for:

• Dealing with practical aspects of tax information exchange

• Negotiating tax information exchange agreements

• Ensuring that the BVI is fully compliant with international standards of transparency and exchange of information for tax purposes

• Expectation that the ITA will now be more active in its oversight role

• The ITA has recently been reconciling the publicly available Internal Revenue Service GIIN list with entities registered as FIs in the BVI

• ITA has the power to impose penalties

This presentation was presented on, and is only accurate to 27 June 2024. The information within this presentation is provided for general guidance only, is not intended to be comprehensive and does not constitute legal advice or give rise to an attorney / client relationship.

Specialist legal advice should be taken in relation to specific circumstances. If you require legal advice, please reach out to your usual Maples and Calder contact.

Published by Maples and Calder (Cayman) LLP.