February/March 2023

An Eli Lilly medication is reportedly poised to shatter the record for pharmaceutical annual sales volume.

Blockbuster Humira

It’s among the prohibitively expensive biologic pharmaceuticals being replaced by cheaper “biosimilar” copycats.

17

Mark Cuban Cost Plus Drug Company is selling prescription medications at dramatically lower prices than the competition.

18

The nation’s newest retail drug impresario joins our expert panel to weigh in on the state of American pharma.

A shortage started with Adderall and spread to Ritalin. A government crackdown made it worse.

Big pharma profits when doctors prescribe a drug for a disorder other than the one that earned FDA approval.

There’s not necessarily anything scientific or magical about the dates printed on medications.

Active investors can navigate the boom or bust biotech sector with the help of strategies like C-suite buying, cash to value and cash flow.

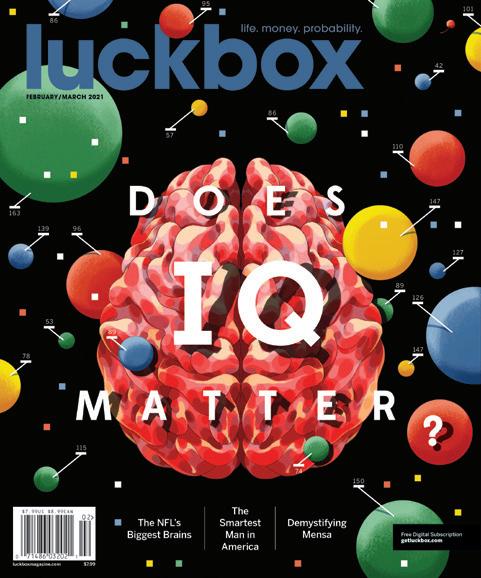

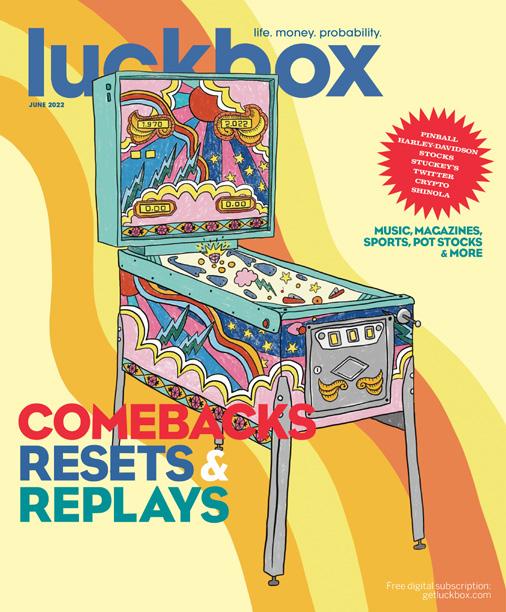

On the cover:

Illustration by Ian Murray mrmurray.co.uk

editor-in-chief ed mckinley

managing editors

yesenia duran, james melton associate editors

kendall polidori, navpreet dhillon editor at large garrett baldwin

technical editor

james blakeway

contributing editors

vonetta logan, tom preston, mike rechenthin

editorial assistant

anam vaziri

creative directors

tim hussey + gail snable contributing photographer

garrett roodbergen

editorial director

jeff joseph

comments, tips & story ideas feedback@luckboxmagazine.com

contributor’s guidelines, press releases & editorial inquiries editor@luckboxmagazine.com

subscriptions & service support@luckboxmagazine.com

media & business inquiries

associate publisher james melton jm@luckboxmagazine.com

publisher jeff joseph

jj@luckboxmagazine.com

Luckbox magazine, a tastylive publication, is published at 19 N. Sangamon, Chicago, IL 60607

Editorial offices: 312.761.4218

ISSN: 2689-5692

Printed at Lane Press in Vermont luckboxmagazine.com

Luckbox magazine @luckboxmag

2019 & 2020 Best New Magazine Folio Award for Custom Content

Luckbox Magazine content is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities and futures can involve high risk and the loss of any funds invested. Luckbox Magazine, a product provided by tastytrade, Inc. (which uses the brand name tastylive) does not provide investment or financial advice or make investment recommendations through its content, financial programming or otherwise. The information provided in Luckbox Magazine may not be appropriate for all individuals, and is provided without respect to any individual’s financial sophistication, financial situation, investing time horizon or risk tolerance. Luckbox Magazine and tastytrade, Inc. are not in the business of executing securities or futures transactions, nor do they direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Luckbox Magazine and tastytrade, Inc. are not licensed financial advisers, registered investment advisers, or registered broker-dealers. Options, futures and futures options are not suitable for all investors. Transaction costs (commissions and other fees) are important factors and should be considered when evaluating any securities or futures transaction or trade. For simplicity, the examples and illustrations in these articles may not include transaction costs. Nothing contained in this magazine constitutes a solicitation, recommendation, endorsement, promotion or offer by tastytrade, Inc., or any of its subsidiaries, affiliates or assigns. While Luckbox Magazine and tastytrade, Inc. believe that the information contained in Luckbox Magazine is reliable and make efforts to assure its accuracy, the publisher disclaims responsibility for opinions and representation of facts contained herein. Active investing is not easy, so be careful out there!

The law of karma tells us our bad deeds catch up with us, and that certainly seems to apply to the pharmaceutical industry. It’s earned the public’s disdain by charging what many view as untenably high prices for prescription drugs.

The average cost of a year’s supply of the new medications the FDA approved last year would set a patient back $222,003, according to a report from the Reuters news wire. Tell that to the average American worker who makes $54,132 a year.

But those new drugs seem like a bargain compared to Zolgensma, a pharmaceutical that’s been around for a few years. Novartis (NVS) makes it to treat progressive spinal muscular atrophy, which is caused by a defective gene. It’s usually diagnosed in infants and toddlers and often proves fatal.

It’s perhaps a miracle that a single injection of Zolgensma can replace the functions of that bad gene and give a child a new start on life. But it might also take a miracle to raise the $2.1 million required to pay for that single shot.

Even insurance companies can have a hard time covering some pharmaceutical bills and sometimes resort to paying for a drug in annual installments spread over five years.

But you might argue that a lot of the cash flooding the coffers of pharmaceutical compa-

Luckbox

1

2

nies flows right back out to pay for seemingly endless and financially risky research and testing. That’s true, yet Big Pharma also keeps a lot of the money.

During the years when drug manufacturers have the exclusive right to produce a new product, companies rake in an average of $18.6 billion, a figure that amounts to 10 times the typical development cost of $1.8 billion, according to AHIP, a health insurance trade group formerly called America’s Health Insurance Plans.

Those whopping margins help explain why Americans pay three times as much for prescription medicine as residents of other countries, says Protect Our Care, a group that lobbies the federal government for lower drug prices and wider access to healthcare.

Still, the differential can be even more dramatic. Sen. Bernie Sanders, D-VT., wrote in a Fox News opinion piece last month that he accompanied a busload of Americans to Canada, where they bought prescription drugs for a tenth of the U.S. price.

America’s Big Pharma apparently likes it that way because drug makers collectively spent a little more than $100 million last year to lobby government officials who wield the power to counteract high drug prices, according to Protect Our Care.

So given the high prices for prescriptions

and the big spending to protect those prices, it’s little wonder pharmaceutical companies aren’t wildly popular. In fact, Big Pharma ranked dead last in popularity among 25 industries in a Gallup poll from a couple of years ago. More recently, the federal government and gas companies have pushed Big Pharma out of the bottom position.

But things change. Downward pressure on drug prices is coming from two sources: government and the markets.

The Inflation Reduction Act of 2022 requires that Medicare negotiate the price it pays for some pharmaceuticals. It also caps insulin copays at $35.

Meanwhile, billionaire Mark Cuban is promising his fairly new online Mark Cuban Cost Plus Drugs Company will “eliminate the middleman” and spare customers the tribulation of what he calls “price games.” (Turn to p. 16 for more on CPD, including some hard-tobelieve prices.)

Cuban faces competition from Amazon’s (AMZN) new RXPass, which enables customers to add $5 a month to their Amazon Prime bill and in return receive supposedly unlimited access to 80 eligible generic prescription medications.

At any rate, it appears somebody can do something about an average annual price of $222,003 for new prescription drugs.

Ed McKinley Editor in Chief Jeff Joseph Editorial Director3

4

Your thoughts on this issue?

Please take the next reader poll at luckboxmagazine.com/survey

is dedicated to helping active investors achieve skill-derived, outlier results.

Probability is the key to improving outcomes in the markets and in life.

Greater market volatility brings greater opportunity for astute active investors.

Options are the best vehicle to manage risk and exploit market volatility.

Don’t rely on chance. Know your options because luck smiles upon the prepared.

We asked Luckbox readers ... Did you or do you plan to have a flu shot this year?

Have you ever skipped a prescribed medication because of the cost?

Yes

Would you consider purchasing prescription medicine from an online source not sanctioned by the FDA if it decreased your cost?

Thank you for the story on Tony (The Master) Battista. On the tastylive network, Tony does a great job of explaining the strategy behind all of his Option Trades Today ideas. Even when I don’t put on these trades (usually because the price has moved against me), I still learn a lot from Tony’s discussions.

—James S., Lafayette, LouisianaI appreciated the stories about the three traders at different skill levels. Thanks for your great work.

—Harald W., Wiesbaden, GermanyFirst off, I love this magazine. Keep up the good work. This is a great piece of work that I look forward to each month.

Based on last month’s (Trading Faces) issue, I was greatly anticipating reading about the guy (Son Dao, The Journeyman) who had the 150,000% gain. I have two questions.

First, this guy is gambling, correct? As a follower of tastylive mechanics, it seems that he is completely ignoring the “stay small” component. It was still a really fun read and hearing stories like this is entertaining to someone like me who has his emotional game under control. But, I feel like there should be a counter article talking about how this is an extreme outlier and most people could not tolerate these kinds of swings—both emotionally and without blowing up their account on a bad day.

How many doses of the COVID-19 vaccines have you received?

Second, it specifically mentions he sold Carvana (CVNA) puts. How did he not lose his shirt during this period using this strategy on this stock? Did you guys fact-check that? It seems nearly impossible this one would have been a successful strategy for him. But, the overall theme of the three personal stories (The Master, The Journeyman and The Apprentice) was an interesting and creative idea for this issue.

—Tony L., Aliso Viejo, CaliforniaShould companies rehire employees who were fired for failing to get a COVID-19 vaccination?

James Blakeway, Luckbox technical editor, replies: When Son Dao started with $1,600, he was taking large trades disproportionate to his account size—often risking more in percentage terms than many traders would be willing to hazard.

As his account grew, he pared back the size of trades relative to the account. The article detailed his current ideas on trade size as risk.

We also recounted his rollercoaster journey, highlighting several large losses and an extensive drawdown in his account. But, given that he risked no more than 3% of his account (via 2SD loss potentials), he was “trading small” in his own way.

Two

We vetted his trading history, reviewing each of his statements for the period documented in the article. Sure, Carvana has been obliterated, but it exhibited short periods of upswings. Dao accurately rode one of those uptrends around earnings.

The January 2023 Trading Faces issue, along with every previous edition of Luckbox, is available for free in digital format at getluckbox.com.

$5.5 BILLION

Pharma ad-spending for the first six months of 2022

Videos tagged #ozempic have garnered 311 million views on TikTok, while #ozempicweightloss is at 125 million views and rising.

—Celebrity magazine The Kit

41.4 million

—Moderna CEO Stephan Bancel on why the company may charge $110 to $130 per dose for the COVID-19 vaccine in the U.S. when it shifts from government contracting to commercial distribution. The original vaccine cost $15 to $16 per dose in earlier supply contracts.

The number of Adderall prescriptions dispensed in the U.S. in 2021

“OBESITY IS A CHRONIC DISEASE THAT IMPACTS THE HEALTH OF NEARLY 100 MILLION AMERICANS AND IS A SIGNIFICANT DRIVER OF HEALTHCARE COSTS … MOST PATIENTS DON’T ACHIEVE THEIR DESIRED TREATMENT GOALS WITH ONLY DIET AND EXERCISE.”

—Mike Mason, president of Lilly Diabetes, a division of Eli Lilly & Co.

“Kardashian has never commented on it, but TikTok in particular is convinced that she’s been using a drug called Ozempic to induce rapid, extreme weight loss.”

“The whole pharma industry is intentionally distorted. And now it’s my turn to fuck them up.”

“I would think this type of pricing is consistent with the value.”

The number of people Pfizer plans to offer vaccines and medicine at not-for-cost

—Pfizer CEO Albert Bourla via a press release on Jan. 18, 2023 SEE PAGE 58

Global Bond Sales Off to Record Start of Nearly $600 Billion

—Bloomberg, January 2023 SEE PAGE 60

Bristol-Myers Squibb stock saw an 18% rise last year, far better than the broader S&P 500 Index, which was down 20%.

Forbes

“TICKETMASTER HAD THE TEMERITY TO IMPLY THAT THE DEBACLE INVOLVED IN PRE-TICKET SALES WAS TAYLOR SWIFT’S FAULT BECAUSE SHE WAS FAILING TO DO TOO MANY CONCERTS. MAY I SUGGEST RESPECTFULLY THAT TICKETMASTER OUGHT TO LOOK IN THE MIRROR AND SAY, ‘I’M THE PROBLEM, IT’S ME.’”

Sen. Richard Blumenthal, D-Conn., during a Jan. 24 hearing on the ticketing industry

12,807 feet

Granite Peak, the highest point in Bozeman, Montana

“It’s truly amazing that 2.4 million people got tickets, but it really pisses me off that a lot of them feel like they went through several bear attacks to get them.”

—Taylor Swift, Nov. 18, 2022

Cleaning my apartment with the TV on in the background, I’m caught up in a catchy bop sonically streaming into my living room. My hips shimmy as I move my Swiffer in time with the music. I casually sing along, “A1C…down with ReeBell-Susssssss.”

As I shower and get ready for work, I can’t get it out of my head: “A1Ceeeeeeee down with Ree-Bell-Suss.” As I make coffee at the office, a subtle vocal run of “Get down with Reybelsus!” reverberates in my cranium. Later, I make a request before I go to bed: “Alexa…play Down with Rybelsus.”

At least I’m not alone in my addiction to this YouTube video ad for a diabetes drug manufactured by Novo Nordisk (NVO). Look at the comments on the website. “Why is this such a catchy song?” one listener asked. “Just hearing this song kept my A1C down,” another testifies.

But don’t expect much company from overseas. Advertising drugs this way is legal only in The United States and New Zealand.

In 2022, society reached the 25-year milestone of subjugation to non-stop pop anthems from drug manufacturers. Drugs literally are big business, and it all starts with the name.

So, for this special issue dedicated to all things pharma, Luckbox set out to discover why pharmaceutical names got so wonky and how the companies have crafted the names to get you to ask your doctor if one’s right for you.

To that end, we interviewed a man who deals names to drugs. He’s Jeremy Vannatta, former president of a company called Brand Institute, which is responsible for naming 75% of the drugs that make it to market.

Unlike pop icons like Cher, Madonna and Beyoncé, drugs have two names: a generic

These were the Top 5 best-selling drugs in 2021. Match the drug brand name and company to its generic name. Bonus points if you know which disorders the drug can counteract. (Answers on p. 39)

(non-proprietary) one and a proprietary (brand name) one.

“There are a lot of rules about the non-proprietary name based on the chemical structure and the mechanism of action,” Vannatta says. “It will have an ending that’s predetermined by USAN (the U.S. Adopted Names Council, which selects names for generic drugs).”

The generic, or non-proprietary drug name, is what you might search for if you’re trying to find lower-cost options on a site like billionaire entrepreneur Mark Cuban’s Cost Plus Drugs. (See p. 17.)

For example, a “prazole” suffix indicates anti-ulcer agents or the presence of Italian comfort food. Vannatta and his team worked to come up with prefixes to add to these suffixes that would differentiate the drug’s name from others in that class. The Brand Institute then “workshops” the non-proprietary names with physicians.

“We would ask them, ‘Do you know any drugs that sound like this?’” Vannatta says. “We would ask them to write it, then show those handwriting samples to other doctors and we’d have them spell it out for us.”

Can you imagine the Dr. vs. Dr. handwriting challenge? “I need you to write out idarucizumab, ixabepilone and eszopiclone.” (Everyone dies.)

“You can launch a drug without a brand name, but you cannot launch a drug without a non-proprietary name because there’s no way to prescribe it,” Vannatta notes.

So, firms pay big bucks to get good names. The cost can range from $75,000 to $250,000 for a single drug name, according to Scott Piergrossi, vice president of creative development for the Brand Institute.

Once the non-proprietary name is approved, companies like the Brand Institute can start working on the brand names. Last year, Big Pharma spent $7 billion dollars on advertising

those precious names.

Pharmaceutical companies want innovative names that stand out so consumers can ask for them by name. They convene “nomenclature workshops” to figure out if the brand name should sound strong with lots of Xs and Ks and Zs, or if it should have soft, soothing Rs and Ss.

When contemplating names, Vannatta asks his team to think of mountain ranges, Greek mythology or art. Inspiration is everywhere, he maintains.

He also shares some of his favorite naming insights with me to see if I could guess what the drug name meant. “You know the drug Latisse?” he asks. I excitedly respond that I had heard of the eyelash lengthening drug when it went viral a few years ago. “The ‘La’ in Latisse

pimp” in Portuguese.

Drug namers also must walk a fine line between empowering patients (Do more with Dupixent!) and being flat-out promotional. You can’t name your drug for male impotence bonerriffic.

Ceftaroline, bum, bum, bum

“Nobody gave a rat’s ass what drugs were called before everyday consumers became their target,” Sandy Hingston writes in City Life, a column in Philadelphia Magazine which covers Philadelphia news. “No one was matching them up with 1970s pop songs, like Sonny and Cher’s The Beat Goes On (Novartis (NVS) heart drug Entresto) or the Jackson Five’s ABC (GlaxoSmithKline (GSK) allergy med Trelegy).”

Catchy brand names work, according to Steve Woloshin of the Center for Medicine and Media at Dartmouth Institute.

“They increase patient requests and prescriptions for advertised drugs, even when there are lower-cost alternatives,” Woloshin says.

Companies recognized this and started

is for lash, and the ‘tisse’ for the artist Henri Matisse,” he replies.

Vannatta then offers another anecdote, saying, “You know Premarin?” I laugh and respond, “Of course! Anyone with a menopausal mom knows!” Vannatta breaks down the name, saying the “P” is for pregnant (best after school special ever), “mare” is for horse and “in” is for horse urine. Yup. They make Premarin out of pregnant mare urine. How are we a global superpower? Our drugs are named after horse wee.

After the naming workshops, Brand Institute takes the names global. Remember, drug names must be universal worldwide. So, they ask physicians across the world to pronounce the brand name and to write it. The team also has to make sure their pretty new name doesn’t mean something terrible like “candy

dropping off wheelbarrows full of cash to their marketing departments. Compared to other types of healthcare companies, pharmaceutical manufacturers had the largest marketing budgets.

So, that leaves an American public that’s sick of pharmaceutical ads. But hey, they have a catchy beat and that part where they mention “anal leakage” gets drowned out by the montage of the lady running through the forest with her newly healthy lungs, or eyes or restless legs.

Don’t fall for a slick ad. Do your own research and see if there are lower-cost options. And if your erection lasts more than four hours … call me.

They make Premarin out of pregnant mare urine— just as the name implies.

Catchy names prompt patients to request advertised prescription drugs instead of lower-cost alternatives.

prescription drug that combats obesity is expected to become the biggest-grossing pharmaceutical in history, ringing up five times the sales volume of its nearest competitor, an industry authority predicts.

“With modest patient penetration, we could see tirzepatide generating more than $100 billion in sales annually” for drug manufacturer Eli Lilly & Co. (LLY), says Bank of America analyst Geoffery Meacham.

That would dwarf the one-year record of $21 billion in sales that the anti-inflammatory drug Humira posted in 2021 for its maker, AbbVie (ABBV). But a tirzepatide juggernaut seems likely, partly because the medication could prove effective in the treatment of a number of maladies.

Lately, tirzepatide has been generating buzz and capturing headlines for its ability to address obesity. It’s expected to earn U.S. Food and Drug Administration (FDA) fast-track approval this summer for treating that condition.

Yet the drug’s not as new as its pending certification might make it seem. Lilly received a patent for it in 2016, and it won FDA approval a year ago as a treatment for Type 2 diabetes.

Plus, a string of additional FDA approvals may extend far into the future and contribute to its projected record-breaking sales volume. Someday soon, the drug may earn certification for liver problems, sleep apnea, kidney disease and heart failure.

Let’s look first at tirzepatide for weight loss, the application of the drug that was lighting up the internet as Luckbox went to press.

Tests show tirzepatide affects two parts of the brain where hunger resides. Other weight-loss drugs that have recently won FDA approval can influence just one part of the brain, multiple sources say.

Tirzepatide works by curbing appetite, according to Lilly, the Indianapolis-based industry giant that developed the medication. The drug makes recipients feel full

sooner, encouraging them to eat less and thus lose weight. It also improves control of blood sugar, a Lilly report says.

In a clinical trial of the drug, participants lost up to 22.5% of their body weight or 52 pounds, the maker says. Viewed another way, 63% of the test subjects shed at least 20% of their weight. Average weight loss was 16% or 35 pounds in a 72-week trial that included 2,539 participants, and 89% lost at least 5%.

An overweight nation may welcome those results. The United States ranks near the top in obesity among developed countries. About 42% of American adults suffer from the disease, up from 10% in the 1950s, according to the Centers for Disease Control and Prevention.

Obesity becomes more prevalent as higher income enables the population to consume high-calorie foods and lead more sedentary lives. At the same time, doctors consider the condition a disease that results from the brain’s survival instinct.

Together, health problems related to obesity and less severe but still significant weight problems claim the lives of about 325,000 Americans annually, says the National Institutes of Health (NIH). That makes being overweight the No. 2 cause of preventable death in the United States, second only to using tobacco, the NIH says.

Although tirzepatide could forestall some of those deaths and ease much of the associated suffering, the drug still doesn’t qualify as a panacea.

Like so many pharmaceuticals, tirzepatide can produce unwanted or even dangerous physical reactions.

Common side effects—the ones patients most often experience—include indigestion, constipation, decreased appetite, nausea, vomiting, diarrhea and intense abdominal pain, according to WebMD, a site for the healthcare profession.

Infrequent side effects listed on the website—which tend to be more severe but more unusual than common side effects—are gas, burping, abdominal bloating, skin reactions at the site of the injection and gastroesophageal reflux disease.

Rare yet severe side effects include gallstones, hypersensitivity and decreased kidney function.

is reportedly

to

The drawbacks don’t end with undesirable physical issues. Tirzepatide can also come with what some would consider a prohibitively high price tag.

Four weekly doses of tirzepatide cost $974.33, which adds up to around $12,666 annually, the Medscape website says.

Help with those bills may or may not be forthcoming.

Some insurance companies have declared weight loss a matter of vanity and may not cover drugs that address the disease, Pharmacy Times reports.

Medicare covers some approaches to dealing with obesity, like behavioral therapy, but doesn’t pick up the bill for anti-obesity drugs, according to the National Council on Aging.

A 5-foot-10-inch male should weigh between 133 and 168 pounds with a body mass index of 18.5 to 24.9, according to the Centers for Disease Control. We asked our readers to use the CDC’s Body Mass Index calculator to determine their BMI and then we compared the results with a CDC study. Here’s what we found:

Pharmaceutical companies are inundating the market with drugs meant to slow the progress of memory-robbing Alzheimer’s disease, but skeptics insist they’re taking the wrong approach.

Most researchers study the effects of prescription drugs on brain-clogging amyloid plaque, says Joanne Silberner, a National Public Radio correspondent and veteran of the medical beat. She claims they’re squandering time and resources.

The problem is some of the nation’s 6.5 million Alzheimer’s victims don’t have a buildup of that plaque, and some people who have the plaque aren’t subject to Alzheimer’s symptoms, Silberner says in an article on The Free Press website.

Medicaid pays for pharmaceuticals that target obesity under the programs in some states, but not others, says the Journal of the American Medical Association.

Some patients might need to take the medicine as long as they live, so for them the cost would never cease.

And even after raising the funds to finance tirzepatide, some patients may find it daunting to inject the drug themselves at home.

Some experience such intense anxiety at the prospect that they forego their medication, Amber Specialty Pharmacy notes on its website.

What’s more, taking a weight-loss medication for an indefinite period could distract patients from the need to control their weight by exercising and eating properly, some doctors say.

Meanwhile, some consumers have already embarked upon a tirzepatide regimen for weight loss, even though the FDA hasn’t approved it for that.

That’s because many doctors are already prescribing it off-label for shedding pounds, The Washington Post reports. The term “off-label” refers to the fairly common practice of ordering a medication that’s FDA-approved for some other ailment. (See p. 28.)

Yet anyone who raises doubts about focusing on plaque is quickly shut down and marginalized, she says in the story. They’re repudiated despite what they view as decades of painfully slow progress against Alzheimer’s.

One of the Alzheimer drugs generating publicity these days goes by the generic name lecanemab and is marketed as Leqembi by two companies, Tokyobased Eisai (ESALY) and Biogen (BIIB), which has headquarters in Cambridge, Massachusetts.

Prescribing tirzepatide for losing weight seems certain to be a factor in a shortage of the drug for diabetes patients. It’s marketed to fight diabetes under the brand name Mounjaro, and the FDA has added it to the lists of pharmaceuticals in short supply.

Moreover, the demand for tirzepatide could become even greater if it wins the FDA’s blessing for treating a laundry list of series conditions—something Bank of America analyst Geoff Meacham says he fully expects.

So, it becomes a matter of ramping up production to fill all the orders along the way to becoming the first $100 billion pharmaceutical.

In an 18-month test of 1,795 people in the early stages of Alzheimers, interviews and brain scans showed Leqembi slowed cognitive decline by 27%, the manufacturers say. That’s not enough for the skeptics, but it satisfied the U.S. Food and Drug Administration, which granted the drug accelerated approval in January.

Leqembi could post $6.5 billion in sales by 2030, according to a Bank of America report. The cost of a dose every two weeks comes to $26,500 a year, Eisai officials say.

IN A 72-WEEK CLINICAL TRIAL OF TIRZEPATIDE, 63% OF THE 2,539 TEST SUBJECTS SHED AT LEAST 20% OF THEIR WEIGHT. AVERAGE WEIGHT LOSS WAS 16% OR 35 POUNDS.

orldwide sales of Humira have totaled $200 billion in the last 20 years— just about the biggest haul in the history of prescription drugs. The bonanza was predicated on charging as much as $84,000 for a year’s supply.

But price relief is on the way for patients who need Humira, a product made by AbbVie (ABBV) to combat conditions ranging from arthritis and psoriasis to Crohn’s disease and ulcerative colitis.

They won’t be paying as much for their medication because Humira belongs to a class of high-priced pharmaceuticals known as biologics, which drug companies are replacing with cheaper substitutes.

The stand-ins, called biosimilars, cost an average of 27% less than the originals they mimic, according to the National Institutes of Health, a government research agency. The savings mount up because of the sky-high cost of biologics. Unlike most pharmaceuticals, which are synthetic, biologic drugs are produced or extracted from humans, animals, plants or bacteria. Biosimilar drugs resemble their reference drug (i.e., the brand-name biologic) in structure and function, but they’re not exact copies.

The relationship between biologics and biosimilars approximates the connection between brand-name synthetic drugs and their generic substitutes.

Three factors are converging to cause the switch from biologics to biosimilars: Biologic patents are expiring, biosimilar makers are suing biologic companies and the government has taken action to lower drug prices.

Adalimumab, the biologic often sold under the brand name Humira, provides a classic example of biosimilars’ downward pressure on prices, and shows how it came about.

The patent on Humira doesn’t expire until 2034, but competition’s about to heat up because of litigation brought by biosimilar makers and because the Affordable Care Act of 2010 provides an easier path for biosimilars to win U.S. Food and Drug Administration (FDA) approval.

A biosimilar version of Humira was scheduled to begin reaching the market in January, the GoodRX Health website says. As many as seven other substitutes could become available in the second half of this year. But what’s up with these copycats?

Because they’re biological, biologics vary more than synthesized pharmaceuticals in form, function or efficacy. As biological entities, biologics are also more sensitive than synthetic drugs to environmental conditions during production, storage and use.

It’s among the prohibitively expensive biologic pharmaceuticals being replaced by cheaper “biosimilar”

To accommodate those differences, regulators subject biologics and biosimilars to stricter standards than synthesized pharmaceuticals.

Approved substitutes for traditional synthetic pharmaceuticals go by the name “generics.” While biosimilars can pinch hit for biologics, they’re not the same as generics, notes Brandon Shank, a clinical pharmacy specialist at the University of Texas MD Anderson Cancer Center.

“Generic products are simple molecules, while biosimilars are large proteins or macromolecules, so they are different in their structure and how they are produced,” Shank told ASH Clinical News.

To earn the biosimilar designation, a drug must be safe, effective and work in much the same way as the brand-name reference drug. And, like generics, biosimilars are more affordable than the drugs they replace.

However, generic medications typically cost up to 85% less than their brand-name equivalents, quite a bit less than the average 27% difference between biologics and their biosimilar replacements.

Yet because biologics qualify for the specialty drug class of medications that cost more than $1,000 a month, any reduction in price becomes meaningful. Increased market penetration of biosimilars can help rein in the expense.

The jaw-dropping $7,000 monthly cost of Humira, for example, shows why specialty drugs account for only 2% of prescriptions in the United States but nearly 50% of total drug revenue.

Biosimilars have been available in Europe for nearly 15 years but have been used on a limited basis in the U.S. for about seven years. The FDA has approved 621 biologics, and 40 of them have associated biosimilars on the market.

Besides adalimumab (aka Humira), biosimilars that are available include the nearly unpronounceable lineup of bevacizumab, epoetin alfa, etanercept, filgrastim, infliximab, insulin glargine, pegfilgrastim, ranibizumab, rituximab and trastuzumab.

In addition to AbbVie, the world’s top manufacturers of biologics in terms of annual sales include Amgen (AMGN), Bristol-Myers Squibb (BMY), GSK (GSK), Johnson & Johnson (JNJ), Merck (MRK), Novartis

Biosimilars, less-expensive copies of biologic drugs, must match the originals in safety and effectiveness to earn U.S. Food and Drug Administration approval.

Biosimilars are safe and effective biologic medications for treating many conditions, including

CANCER

KIDNEY DISEASE

DIABETES

PSORIAIS

CROHN’S DISEASE

The seven drug makers expected to begin offering biosimilar versions of Humira in the coming months will be selling copies of adalimumab, the active ingredient. The companies are Amgen (AMGN), Organon (OGN), Coherus (CHRS), the Sandoz Division of Novartis (NVS), Pfizer (PFE), Viatris (VTRS) and privately held Boehringer Ingelheim.

Three more manufacturers may join them next year—Alvotech (ALVO), Fresenius (FMS) and privately held Celltrion.

ARTHRITIS

MACULAR DEGENERATION

MACULAR EDEMA

COLITIS

(NVS), Novo Nordisk (NVO), Ono Pharmaceutical (OPHLY), Pfizer (PFE), Regeneron (REGN), Roche (RHHBY), Sanofi (SNY) and Teva (TEVA).

So-called middlemen that negotiate prices and distribute biosimilars— including healthcare and insurance provider Cigna (CI) and CVS Health (CVS), the drugstore chain and insurer—also stand to benefit financially from the proliferation of the substitute pharmaceuticals, The Wall Street Journal says.

Consumers win, too. Lower prices inevitably make cutting-edge treatments more widely available, observes Steven Newmark, chief legal officer for the Global Healthy Living Foundation.

“With so many biosimilars coming on to the market, we hope it signals a sea change that biosimilars will finally live up to their intended purpose of providing effective, safe treatment at a more affordable cost in the coming years,” Newmark told Healio Rheumatology, a healthcare publication.

Andrew Prochnow, a longtime options trader, has contributed articles to Luckbox, Bleacher Report, Yahoo! Sports and other publications.

COSTLY “SPECIALTY DRUGS” ACCOUNT FOR ONLY 2% OF PRESCRIPTIONS IN THE UNITED STATES BUT NEARLY 50% OF TOTAL DRUG REVENUE.

THE BILL FOR A YEAR’S SUPPLY OF THE PRESCRIPTION DRUG HUMIRA CAN COME TO $84,000.

hat would happen if drug pricing made sense to consumers?

Mark Cuban Cost Plus Drug Company, which launched its online pharmacy about a year ago, is trying to answer that question. Its approach is easy to understand—even if it’s difficult to implement.

First, CPD negotiates directly with manufacturers to get the best possible price. It adds a 15% markup based on the per-pill price that CPD pays to buy the medicines. Then, CPD adds a flat $3 pharmacy labor fee and $5 standard shipping to get to the total retail price.

Cuban believes strongly in CPD’s mission and business model. Among his many ventures, this is the first company to bear his name.

“I wanted everyone to know I was fully committed to taking on the incumbents in the pharmaceutical industry,” Cuban told Luckbox.

Under its model, the company says, prices to consumers can fall dramatically. For example, a 30-count supply of 400mg imatinib, a cancer drug sold under the brand names Gleevec and Glivec, costs $39 through CPD. That compares to as much as $9,657.30 else-

where, the company says.

Besides transparency, CPD offers a social mission. The operation is a public benefit corporation set up to generate social and public good while also making a profit.

CPD has more than 1,000 SKUs in its inventory and adds new ones constantly. On Dec. 20, the company announced on social media the addition of 10 new drugs. And on Jan. 6, it announced six more.

“We hopefully will grow to more than 5 million accounts and save people hundreds of millions of dollars—if not more,” Cuban said.

He maintained that CPD will have “a huge impact on not just generics, but also brand drugs pricing” in 2023.

1983

Cuban forms MicroSolutions with Martin Woodall.

1990 CompuServe buys MicroSolutions for $6 million.

1995

Cuban and Todd Wagner found Broadcast.com.

1998 Broadcast.com goes public.

1999 Yahoo! purchases Broadcast.com for $5.6 billion.

2000

Cuban buys the Dallas Mavericks pro basketball team for $285 million.

2011

The Mavericks become NBA World Champions.

2011

Cuban begins appearing on ABC’s Shark Tank

2022

Cuban and Alex Oshmyansky launch Cost Plus Drugs online pharmacy, Capital Blue Cross becomes the first health plan in the nation to collaborate with CPD, and CPD partners with pharmacy benefits manager EmsanaRx.

–Sources: Bloomberg Billionaires Index, MarkCubanCompanies.com, MCCPDC press releases

Of all your investments on ABC’s Shark Tank show, you lost the most money on the Breathometer—a device that used a smartphone to measure blood alcohol. What was your biggest success on the show?

I have a bunch. I was just visiting with BeatBox Beverages [which sells ready-to-drink cocktails in single-serve boxes]. I invested $1 million dollars at a $3 million valuation They just raised it to a $199 million valuation and are crushing it! [BeatBox Beverages had only $350,000 in sales before appearing on Shark Tank in October 2014. Since then, the company has surpassed $57 million in revenue.]

Are you open to running for public office? No chance!

Here’s an example from the Cost Plus Drugs (CPD) website: CPD’s’ cost per-pill is 2.4568 cents. The company multiplies that number times 0.15 to determine a mark-up of 0.036852 cents per pill—and rounds up to the nearest cent.

In this example, the total per-pill price would be 2¢, plus 1¢, equaling 3¢.

The company multiplies the per-pill total by the number of pills in your prescription. It then applies the pharmacy and shipping fees, which adds another $8

In this case, a 90-pill prescription would cost: (3¢ x 90) + $3 + $5 = $10.70.

BY JAMES MELTON & JEFF JOSEPH

CHIEF OF THE DIVISION OF HEMATOLOGY, SYLVESTER COMPREHENSIVE CANCER CENTER AT THE UNIVERSITY OF MIAMI MILLER SCHOOL OF MEDICINE. AUTHOR OF DRUGS AND THE FDA: SAFETY, EFFICACY, AND THE PUBLIC’S TRUST.

ENTREPRENEUR, VENTURE CAPITALIST, TELEVISION PERSONALITY, OWNER OF THE DALLAS MAVERICKS AND INVESTOR IN MARK CUBAN COST PLUS DRUG COMPANY.

//LUCKBOX: Only 25% of Americans view of the pharmaceutical industry favorably. What’s the biggest problem?

PROFESSOR OF EPIDEMIOLOGY AND MEDICINE AT JOHNS HOPKINS BLOOMBERG SCHOOL OF PUBLIC HEALTH WHERE HE SERVES AS CODIRECTOR OF THE CENTER FOR DRUG SAFETY AND EFFECTIVENESS.

POSNER: It’s remarkable that positive ratings for pharma are declining after it came to the rescue on COVID-19 by developing lifesaving vaccines and therapeutics in record time. There’s no question the pharma industry stepped up to the plate when it was most necessary during the pandemic. Pharma has gotten a lot of bad press over the last few years over the opioid crisis and deserved it in many cases. If you ask the average person what they think about drug pricing, most will have heard about insulin prices. They’ve read an article saying insulin is too expensive and somebody is not eating the right food because of the cost.

INVESTIGATIVE JOURNALIST AND AUTHOR OF 13 BOOKS, INCLUDING PHARMA: GREED, LIES, AND THE POISONING OF AMERICA.

CUBAN: Lack of transparency and trust. No one understands how prices are set and why prices always go up. That’s going to upset everyone and is why we made cost plus drugs transparent.

SEKERES: During the pandemic we saw science, drug development and regulatory science unfold in real time. But a lot of people in this country also saw

Mark Cuban, the nation’s newest retail drug impresario, joins our expert panel to weigh in on the state of American pharma. Here’s what our panelists say lies ahead. (Luckbox lightly edited the responses for brevity and clarity.)

science is not always a linear process. And we saw information that was wrong communicated about COVID. I remember how much time we spent washing our hands when COVID was just breaking, not realizing the importance of masking. And then you had frequent vaccines rolled out, and they were free. More recently, you’ve heard that the government isn’t going to subsidize this anymore. People are going to have to pay for it.

ALEXANDER: On the one hand, we continue to see enormous innovation within the industry and remarkable scientific breakthroughs brought to market. On the other hand, millions of Americans are burdened and, in some cases, devastated by the cost of prescription drugs. The modern pharmaceutical industry is a mixed bag. We have remarkable breakthroughs and scientific innovations. But for every blockbuster, plenty of other products are marginal innovations at best.

Government officials and executives at Twitter may have suppressed the Great Barrington Declaration (GBD), an open letter signed by scientists harboring “grave concerns” about COVID-19 lockdowns. Assuming that happened, was it harmful?

the public airing of those disagreements is fine. Even during the pandemic, you’re going to get the experts at the government level at the FDA and others saying, ‘this is what we’ve decided, and this is what we’re going to do. And that’s what really matters.’ But it’s unfortunate that the Twitter files show the public had a right to have that information out there.

ALEXANDER: Unfortunately, we’ve learned the hard way that we were not as well prepared for COVID-19 as we should have been—as a country and as a society. There are a lot of lessons to learn from the pandemic, not the least of which is the threat misinformation poses to public health. Information and misinformation have been weaponized and used for political purposes or other purposes contrary to public health. If there’s one thing that we can learn from the pandemic, it’s the importance of investing in our public health system to ensure a more rapid, coordinated, and robust response to the next pandemic.

SEKERES: The basis for our understanding of science and the development of new therapies is transparency,

Luckbox asked readers for their view of each of the following sectors ...

CUBAN: If information were suppressed, no one would have known about GBD. Everyone who supports GBD has a Substack account and a YouTube channel. All of them appeared on Fox and every other supportive platform—all of which reach more people than Twitter. What Twitter did by taking requests from the Trump administration and then Biden was a non-event.

POSNER: Censoring any group because you think that’s not the ‘truth’ at the moment when you’re not doctors—which they weren’t at Twitter —boy, that’s fraught with problems. If you want to make some idea go viral as a conspiracy theory—I’m telling you as someone who studied conspiracy theories—then tell one group they can’t have something. And that will be the one everyone thinks was the truth. So, it was problematic on so many levels. It’s unfortunate because

communication and vetting ideas. If I submit an article to a scientific journal, it will undergo external review, where people will comment on it. Increasingly, scientists put their findings online and open them up to public comment before sending something to a journal. So, the basis of science is transparency, feedback from colleagues and eventually arriving at a source of truth. So, any censorship of that is ultimately going to hurt science.

What did we learn from

Warp Speed that might apply to the development of other vaccines?

“NO ONE UNDERSTANDS HOW PRICES ARE SET AND WHY PRICES ALWAYS GO UP. THAT’S GOING TO UPSET EVERYONE AND IS WHY WE MADE COST PLUS DRUGS TRANSPARENT.”

– Mark Cuban

ALEXANDER: When there is the right political will, and the forces are properly aligned, we can bring tremendous innovations to market and do so much more quickly than historically has been the case. There were many efforts by many individuals and organizations—and parts of the federal government—that allowed vaccine development to progress at the speed that it did. The speed with which the COVID vaccines were developed—and their remarkable safety and effectiveness—reflects what’s possible when there is the right momentum and alignment across many, many parties. So, that’s the main take-home for me. The whole drug development framework should take a close look at the achievements that were possible.

SEKERES: We learned the FDA could move quickly if adequately resourced. The FDA needs the resources to bring every drug for life-threatening diseases to market within a year. Similarly, we provided enormous government resources to some of the manufacturers of these vaccines to get the trials up and running. You had motivated medical centers and a motivated public enroll in these trials very quickly to get an answer.

POSNER: I would hope some lessons were learned and could be implemented into the future operating procedures. But I am a pessimist about that. The system responds best and fastest to a crisis. There’s nothing that could have made the FDA operate better than it did. Like everyone in Washington, the FDA responds to public pressure. And the pharma companies know that very well. That’s why they have mastered the art of creating patient advocacy groups for specific diseases. They find the most vulnerable of those patients to go to Capitol Hill and testify before Congress. Then Congress asks the FDA why aren’t [they] approving these drugs, and two months later something comes out.

President Biden has announced a “Cancer Moonshot” aimed at rebooting an Obama-era initiative to slice the cancer death rate in half within 25 years while improving the lives of cancer victims.

There have been some wildly effective drugs that have been approved under FDA’s accelerated mechanism [launched in 1992]. In the 1980s and 1990s people diagnosed with chronic myeloid leukemia—a cancer caused by a specific genetic mutation known as the “Philadelphia chromosome”—could expect to live, on average, for about three years after their diagnosis. Then the drug imatinib (brand name Gleevec) … was discovered and tested in 532 CML [Chronic myelogenous leukemia] patients … Almost all patients enrolled in the trial had a complete remission from their leukemia, and in almost one-third the Philadelphia chromosome—the root of all evil in CML—was eradicated.

—Excerpted from Drugs and the FDA: Safety, Efficacy, and the Public’s Trust by Dr. Mikkael Sekeres. Reprinted with permission from The MIT Press. ©2023.

“FDA CAN MOVE QUICKLY, IF ADEQUATELY RESOURCED. BUT THE FDA ISN’T ADEQUATELY RESOURCED TO BRING EVERY DRUG FOR LIFE-THREATENING DISEASE TO MARKET WITHIN A YEAR.”

– Mikkael Sekeres

25%

Of Americans had a favorable view of the pharmaceutical industry in 2022, down from 31% a year earlier.

–Gallup

SEKERES: Increasingly, we’re recognizing that cancer represents thousands of diagnoses. Leukemia, for example, isn’t just one thing. It’s dozens or hundreds of diagnoses of leukemia. So, within those narrower and narrower subtypes, yes, we are going to cure some people. But are we going to eliminate cancer as we know it in 25 years? No. One big reason is that is, during the pandemic, a third of the workforce for conducting clinical trials left as part of the great resignation. It will be hard to cure cancer with a third of resources to support clinical trials gone.

POSNER: Biden’s goal is admirable. The problem is that the idea of curing cancer or slashing rates by half is an over-promise made by every president since Richard Nixon declared a ‘war on cancer’ in 1971. The moonshot metaphor, which Biden has relied upon for six years, is simply the latest in fifty years of presidents talking tough about cancer. Nixon was the first to use that moonshot symbolism. The problem is that the moonshot metaphor is too simplistic and creates unrealistic expectations for many patients. As Mikkael points out, medical researchers realized over time that cancer was a far more complex disease with many variations. There would be no single cure but the battle against it would be more nuanced and take much longer, with some victories and plenty of setbacks.

The fees pharmaceutical companies pay to expedite FDA approval of their new drugs are said to provide 50% to 75% of the agency’s drug review budget. Does that threaten the FDA’s independence?

CUBAN: I don’t think the FDA inherently plays favor ites. They know they are responsible for saving lives and no one at the FDA gains financially from their decisions. The challenge is the optics of it. There will always be people who criticize the economics of the pharma business. But that’s the reality of how we do things in the U.S. We don’t want to pay more in taxes, so we find other sources of revenue for our agencies.

POSNER: There’s no quid pro quo because of these expedited fees. Does that constrain FDA’s enforcement ability? It is possible to be an aggressive regulator and enforce the rules, notwithstanding where the funding comes from. As an investigative reporter, I’d prefer in a perfect world that half of the budget didn’t come from the industry you’re regulating. But if you take away that funding, someone must give more money to the FDA, and no one wants to do that.

ALEXANDER: The FDA typically does remarkably good work. It has many different mechanisms to keep industry at arm’s length. But there are also many cases where regulators failed to do so. It creates concern about the perception of conflicts of interest. It’s a complex issue. It’s not a plain vanilla matter. The federal government has yet to step up and say, ‘We want to provide this money so you don’t have to rely upon user fees.’

SEKERES: In the history of the FDA, some people were fired because they had conflicts of interest. However, in my interactions with the FDA, I met a dedicated team who wanted to do the right thing and thought about the public’s safety all the time. The only way to resolve this potential conflict of interest is adequate funding from Congress to the FDA.

Does the drug approval process need improvement? If so, how?

POSNER: The FDA is underfunded and overmatched. I’ve spoken to people working in different divisions in the FDA over the last few years—and this is pre-COVID—and they were drowning. They were trying their best to keep their heads above water. And they’re earning a government salary. They say somebody in the private sector often tempts them with two to three times the salary to jump out. And so, some of the best people are leaving while others stay. Do they need a larger budget? Absolutely. Yes.

“THERE ARE A LOT OF LESSONS TO LEARN FROM THE PANDEMIC, NOT THE LEAST OF WHICH IS THE THREAT THAT MISINFORMATION POSES TO PUBLIC HEALTH.”

– Caleb Alexander

ALEXANDER: On the one hand, the United States is at the front of the pack in innovation in the pharmaceutical marketplace. But enormous inefficiencies, costly delays and, in some cases, inadequate safeguards exist. There are reasons to look at what was done during the pandemic, learn from that, and further improve and refine our drug development system.

SEKERES: People who are in clinical trials can trust that they are receiving—at the very least—the standard of care for their condition. And researchers conduct trials safely and with a lot of oversight. There’s not any other country that does that better than we do. However, to get that sort of oversight, pharmaceutical companies often contract out the supervision of clinical trials to groups called contract research organizations, or CROs. There’s a perverse incentive in that the CROs’ bill is based on how much work they do. We have essentially incentivized them to put more regulatory infrastructure into trials. So, how we conduct clinical trials here in the U.S. is safe, but oversight has gotten out of control to the point where the clinical trials have become very costly, laborious and take a long time to complete.

What should the U.S. do to make drugs more accessible and affordable?

SEKERES: One thing that’s done differently in Europe is regulatory agencies consider costs at the same time they’re considering approval. And if they’re not getting enough bang for their buck—if a drug isn’t prolonging survival in a meaningful way—they’re going to say, ‘Nope, we’re not going to pay a lot for that drug.’

What are your thoughts on Mark Cuban’s new Cost Plus Drugs platform?

ALEXANDER: We need innovation in pharmaceutical pricing. A lot of good ideas have been put on the table about how to lower drug prices. But unfortunately, there has yet to be the political will to adopt policies that get this done. [Cuban’s initiative] is a very important step. And I think the transparency of his model has broad appeal.

42%

Of Americans bought medications online in 2021, up from 35% the previous year.

POSNER: To use a very hackneyed expression, critics of the industry say what is needed is out-of-the-box thinking. And Cuban has done that. There’s no question he’s taken a model that he thinks will keep prices competitively low for patients and, at the same time, be profitable enough to run as a business. Now, it sounds simple when you think of its essence, but it’s not. If it were simple, everybody would be doing it. But I think that if anybody can do this, it’s a person like Cuban.

CUBAN: More transparency. Less dependence on insurance companies. I don’t think the interests of insurance companies and patients align.

SEKERES: It’s great to make medications affordable to patients. I know of at least one patient who is taking advantage of that. An important aspect of it is to make sure that the drug supply that’s going through that initiative is shored up. Part of the [Food and Drug Administration’s] job is to determine the relative balance of safety and efficacy of drugs—to get them to the U.S. population and to approve a drug for marketing purposes. The FDA also must ensure the consistency of drug manufacturing. And that can become harder when drug supply chains are outside this country. One thing I do know about the Cuban initiative is the drug pricing is awesome. That’s particularly true for the sorts of drugs that I prescribe—some of which might cost $120,000 a year.

HOW WE CONDUCT CLINICAL TRIALS HERE IN THE U.S. IS SAFE. BUT RESEARCHERS WHO WORK ON CONTRACT CAN PROFIT FINANCIALLY BY PROLONGING STUDIES.

– Mikkael Sekeres

–ASOP Global Foundation

No one knows where [the next pandemic] will come from,” says Karen Bush, a biology professor who had worked for nearly forty years in antibacterial development at a succession of large pharma companies. “Only when it arrives can we look back and identify what sparked it.” Cross-species transmissions have been the cause of every major epidemic from the bubonic plague (rats and fleas) to the 1918 influenza (birds), malaria (mosquitoes), and HIV/ AIDS (primates). Scientists have identified eighty-four diseases that pass from animals to humans. The one about which they are most concerned is the one that has not yet jumped species. “We won’t know until it happens,” says Bush.

The prediction of a coming pandemic, unstoppable because the pharmaceutical industry has put profits over its duty to develop drugs for the public good, is no wildeyed conspiracy theory heavy on drama and light on evidence. “It is not a question of if,” warns Professor Bush, “it is a question of when.”

— Excerpted from Pharma: Greed, Lies and the Poisoning of America by Gerald Posner. Reprinted with permission from Avid Reader Press, an imprint of Simon & Schuster. ©2020.

“I WOULD HOPE THAT SOME LESSONS WERE LEARNED [FROM OPERATION WARP SPEED] AND COULD BE IMPLEMENTED INTO THE FUTURE OPERATING PROCEDURES. BUT I AM A PESSIMIST ABOUT THAT.”

– Gerald PosnerBY JAMES MELTON

s 2023 began, the national Adderall shortage had spread to other drugs used to treat attention-deficit/hyperactivity disorder (ADHD). Experts expect the mess to continue for much of the year.

The shortages started with Adderall—known generically as amphetamine mixed salts—which became harder to get because of a surge in demand during the pandemic, coupled with manufacturing bottlenecks.

The U.S. Food and Drug Administration (FDA) acknowledged the drug shortage last October, saying Teva Pharmaceutical Industries Ltd. (TEVA), the largest Adderall manufacturer, was “experiencing ongoing intermittent manufacturing delays.” Other manufacturers were unable to fill the void, the FDA said.

Teva, one of nine companies supplying generic Adderall in the U.S., controls about 30% of the market here, making it—by a long shot—the largest manufacturer.

In October, generic Adderall makers Camber Pharmaceuticals (a division of Hetero Drugs) and Sun Pharmaceutical Industries (SUNPHARMA) also reported supply chain problems related to Adderall.

At the same time, Fierce Pharma, a news website covering the pharmaceutical business, reported the Adderall suppliers serving the U.S. had supply chain problems affecting their ability to produce the drug.

Teva does not break out sales for individual generic drugs and did not respond to requests for more information about the status of its Adderall production.

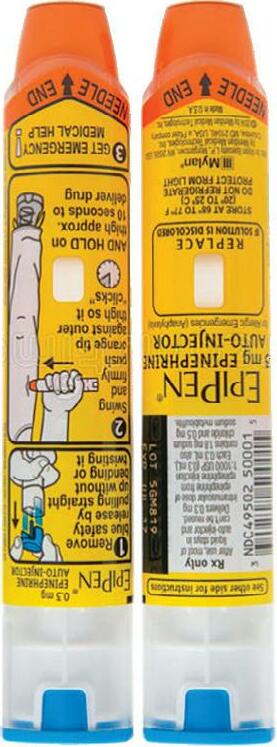

The seemingly obvious solution to the shortage of ADHD drugs would be to boost the supply. But the pharmaceutical market works differently from markets for consumer products like cars, washing machines or ginger ale. Big Pharma cannot just make more ADHD drugs—at least not without clearance from the Drug Enforcement

The active ingredient in Adderall—an amphetamine—is a Schedule II controlled substance. That’s a classification of prescription drugs with medically acceptable uses that also have a high potential for abuse and/or addiction.

By law, the DEA regulates the production of all legal controlled substances in the U.S., says Erin Fox, senior pharmacy director at University of Utah Health.

“The DEA allows drug companies a certain amount of raw material each year ... And so, they say, OK, you could have ‘X’ amount, and that’s what the drug companies have to work with,” Fox says.

As supplies of Adderall run low, she notes, doctors and patients have turned to alternatives like the brand-name and generic versions of the popular ADHD drugs Ritalin and Concerta.

But Ritalin and Concerta rely on a stimulant called methylphenidate. Like amphetamines, methylphenidate is a Schedule II substance regulated by the DEA. As with Adderall, drug makers can’t quickly boost the supply of methylphenidate-based drugs. The result has been a shortage of all three medications.

The DEA could loosen the screws and allow manufacturers to boost the production of ADHD drugs, right? Yes, it could. But first, the agency wants to reduce illicit use, which regulators believe accounts for much of the increased demand.

In April 2022, the FDA and DEA issued joint warning letters to operators of two websites the agencies said were illegally selling Schedule II stimulants. The agencies said Kubapharm.com and premiumlightssupplier.com sold Adderall without prescriptions. Also, the feds said, some of the products might have been “counterfeit, contaminated, expired or otherwise harmful.”

The crackdown continues. The Wall Street Journal reported on Dec. 31, 2022, that the DEA sent a letter to the makers of ADHD drugs saying it feared that “aggressive marketing practices” had driven prescriptions to excessive levels. The DEA’s concerns included how telehealth medical providers promote ADHD drugs, the Journal reported, based on its analysis of the DEA letter.

In December, the DEA said it was considering whether to revoke mail-order pharmacy Truepill’s ability to handle controlled substances because of allegedly

A shortage began with Adderall and spread to Ritalin. A government crackdown made it worse.

TEVA, THE LARGEST MAKER OF ADDERALL, HAS FACED MANUFACTURING DELAYS, AND OTHER PHARMACEUTICAL COMPANIES COULDN’T FILL THE VOID.

Attention-deficit/hyperactivity disorder—better known as ADHD—is among the most common neurodevelopmental disorders in children, the Centers for Disease Control (CDC) says.

Kids with ADHD may have trouble paying attention, controlling impulsive behavior or refraining from overactivity.

The CDC estimates 9.8% of children aged 3–17 have been diagnosed with ADHD at some point, according to a 2016-2019 annual national survey of parents.

ADHD-related hyperactivity can decrease in adulthood, but patients may continue to struggle with impulsiveness, restlessness and difficulty paying attention.

ADHD costs the United States $156 billion annually, the National Library of Medicine website says. That includes the price of healthcare and the cost of absences from work for ADHD patients and their families.

unlawful prescriptions.

Other sources buttress the DEA’s concerns. A June 2022 report from healthcare data analytics firm Trilliant Health concluded that “there are more adults receiving prescription Adderall than there are with a formal ADHD diagnosis. This discrepancy likely speaks to the number of individuals using a direct-to-consumer, self-pay service in this clinical scenario.”

A study by the University of North Carolina at Chapel Hill found 62 online pharmacies sold Adderall online in late 2019 and early 2020. Researchers classified 61 of those sites as “rogue or unclassified” sellers.

It’s not just ADHD drugs that are in short supply. As of year-end 2022, the U.S. had 295 active drug shortages—the most since 2014, according to the University of Utah Drug Information Service and the American Society of Health-System Pharmacists.

stocks, as measured by the S&P 500 Pharmaceuticals Industry Index, handily beat the S&P 500 over the past year. For the 12 months that ended Jan. 19, the pharma index grew 7.48%. For the same period, SPX dropped 14.14%.

In 2021, U.S. prescription drug spending reached $576.87 billion, according to the American Society of Health-System Pharmacists. To put it another way, American spending on prescription drugs is nearly as big as the entire Belgian economy.

Fox says transparency will be a large part of avoiding, mitigating and responding to drug shortages in the future. In many cases, Fox says, it’s unclear why any drug is in short supply because drug companies do not have to report why shortfalls happen. That lack of information, she says, makes it hard for the public to estimate how long a shortage might last.

As part of a committee of the National Academies of Sciences, Engineering and Medicine, Fox was among the authors of a 2022 report that made seven detailed recommendations for making the drug supply chain more resilient.

Among the suggestions: “Make sourcing, quality, volume and capacity information publicly available for all medical products approved or cleared for sale in the United States.”

Doing that alone, the committee said, would give government agencies a firmer grasp of medical product supply chain vulnerabilities. Among other things, that could create better risk assessments and make it easier to predict future drug shortages.

The need for more transparency is a problem. But the performance of pharma

Unsurprisingly, traditional, walk-in retail pharmacies represented the largest share (42.2%) of those 2021 sales. But the fastest-growing sectors were online, mail-order pharmacies—some of which are operated by health-insurance companies or brick-and-mortar retailers. Online channels experienced sales growth of 10.4% in 2021. Sales growth of home health care providers was in second place, up 10.1% year over year. If trends continue, the future of online pharmacy services looks bright. In a June 2022 survey of 1,482 U.S. adults by the research company Software Advice, 58% of respondents cited “I don’t have to leave my home” as an important benefit of using a web pharmacy, and 51% said the online prices were lower than at traditional pharmacies. Also, half said online pharmacies could fill prescriptions faster than other retailers.

Software Advice, part of the consulting firm Gartner (IT), provides advisory services, research and user reviews on software applications for businesses.

Across all distribution channels, experts expect prescription drug sales to continue at a respectable, but not stunning, rate. Fortune Business Insights, a market data and analysis firm, projects U.S. prescription drug sales to see a compound annual growth rate of 6.3% through 2028, reaching $861.67 billion.

According to the Drug Channels Institute, the top

The desire not to leave the house is manifested in relatively strong growth for mail-order pharmacies and home healthcare

From December 2019 to February 2020, researchers at the Eshelman School of Pharmacy, University of North Carolina at Chapel Hill, searched the web by typing the phrase “buy Adderall online” into the Google, Bing, Yahoo and DuckDuckGo search engines.

The findings were eye-opening:

• Of the 62 online pharmacies they found selling Adderall, the researchers believed 61 were “rogue or unclassified” sellers.

• None of the rogue or unclassified online pharmacies required prescriptions, offered pharmacist services or placed limits on Adderall purchases.

• Among the rogue and unclassified online pharmacies, most offered price discounts (61%), bulk discounts (67%) and coupon codes (70%).

• Contrary to the claims made on those sites, lower prices were available for all formulations and dosages of Adderall from GoodRx—an online platform that offers free coupons for discounts on medications.

• 74% of the rogue and unclassified online pharmacies accepted cryptocurrencies for purchases.

–Source: Journal of the American Pharmacists Association

seven players accounted for more than 70% of U.S. prescription dispensing revenues in 2021. The top dispensing pharmacies in the U.S., in order, are:

CVS Health (CVS)

Walgreens Boots Alliance (WBA)

Cigna (parent of Express Scripts, an online pharmacy and a pharmacy benefit manager) (CI)

UnitedHealth Group (parent of OptumRX, a pharmacy services manager and mail-order pharmacy) (UNH)

Walmart (WMT)

Kroger (KR)

Rite Aid (RAD)

Schedule I: Schedule I drugs, substances or chemicals have no accepted medical use and high potential for abuse. Examples include heroin, lysergic acid diethylamide (LSD), marijuana (cannabis) and peyote.

Schedule II: Schedule II drugs, substances or chemicals have high potential for abuse and could lead to severe psychological or physical dependence. Examples include combination products with less than 15 milligrams of hydrocodone per dose (Vicodin), cocaine, fentanyl, Dexedrine, Adderall and Ritalin.

Schedule III: Schedule III drugs, substances or chemicals have low potential for physical or psychological dependence. They have less potential for abuse than Schedule I and Schedule II drugs but more than Schedule IV. Examples are Tylenol and codeine products containing less than 90 milligrams of codeine and ketamine, anabolic steroids and testosterone.

Schedule IV: Schedule IV drugs, substances or chemicals have low potential for abuse and low risk of dependence. Examples are Xanax, Soma, Darvon, Darvocet, Valium, Ativan, Talwin, Ambien and Tramadol.

Schedule V: Schedule V drugs, substances or chemicals have lower potential for abuse than Schedule IV and contain limited quantities of certain narcotics. They’re used for antidiarrheal, antitussive and analgesic purposes, and examples include cough preparations with less than 200 milligrams of codeine or per 100 milliliters (Robitussin AC), Lomotil, Motofen, Lyrica and Parepectolin.

–Source: Drug Enforcement Administration

ne in five prescriptions written in the United States is for a drug that hasn’t been approved for what’s ailing the patient.

That factoid from the Agency for Healthcare Research and Quality website casts a shadow of doubt over many of the prescriptions known as “off-label.”

It’s when doctors prescribe a drug for a disorder other than the one that earned Food and Drug Administration (FDA) approval. They might, for example, order a diabetes drug for a patient who’s not diabetic but wants to lose weight.

Off-label prescribing is often appropriate, and it’s become an everyday occurrence. The most common off-label prescriptions are cardiac medications, anticonvulsants and antiasthmatics. They’re most often used to treat depression, bipolar disorder and insomnia.

But up to 73% of off-label prescriptions aren’t backed by scientific research that would establish whether they’re effective for uses other than those the FDA certified, says Dr. Randall Stafford, a Stanford School of Medicine professor and director of the university’s Program on Prevention Outcomes and Practices.

Instead, medical providers prescribe drugs off-label because of anecdotal evidence, under-the-counter marketing and lax FDA supervision, Stafford notes.

They don’t always work, according to Dr. Caleb Alexander, a pharmacoepidemiologist and co-founding director of Johns Hopkins’ Center for Drug Safety and Effectiveness.

“Off-label use runs the gamut from highly evidence-based to grossly egregious use—and everything in between,” Alexander says. “But the concern is that many off-label uses are not well supported by clinical evidence.”

Stafford conducted a study revealing the limitations of the FDA. Take gabapentin (Neurontin), for example, an anticonvulsant off-label prescribed for bipolar disorder and nerve pain.

As many as 83% of gabapentin prescriptions were off-label, the highest percentage of any drug Stafford studied. What’s more, 80% of those off-label prescriptions were not backed by

Big pharma profits when doctors prescribe a drug for a disorder other than the one that earned FDA approval. The practice ranges from evidence-based to highly egregious.

UP TO 73% OF OFF-LABEL PRESCRIPTIONS ARE FOR DRUGS THAT HAVEN’T BEEN PROVEN EFFECTIVE FOR TREATING THE PATIENT’S ILLNESS.

The great unknown Doctors often prescribe drugs even when there’s little or no proof they’ll combat the patient’s condition.

scientific support.

Gabapentin’s manufacturer, the Warner-Lambert division of Pfizer (PFE), paid more than $430 million in damages in 2004 for marketing the drug for bipolar disorder and nerve pain even when supplemental studies found a placebo performed better.

The settlement amounted to a slap on the wrist for Pfizer compared to the billions of dollars gabapentin made the company, as Jeanne Lenzer wrote in a study published in the National Library of Medicine. Plus, gabapentin is still prescribed off-label for severe cases of bipolar disorder, depression and nerve pain.

“Old habits die hard,” Alexander observes. “Some of these prescribing patterns are heavily entrenched and have been learned and taught among a generation or two of providers and patients.”

While medical practitioners attempt to make the best decisions for patients, clinical trials should form the backbone of prescriptions, Stafford says.

Yet legislation mandates that the FDA keep its hands off of active clinical practice decisions, allowing providers to base prescriptions on their own knowledge.

“While it might look at post-market use—about how drugs are being used,” Stafford says of the FDA, “it doesn’t have the ability to say, ‘Well, that’s wrong, you should stop doing that.’”

When manufacturers do find compelling evidence for additional uses for a medication, they can submit a supplemental new drug application (sNDA) to the FDA. An sNDA provides clinical studies for new uses and enables the manufacturer to market the drug for additional approval.

In a prime example of an sNDA, the FDA in 1990 approved the drug lamotrigine (Lamictal) to combat epileptic seizures. Then it approved the drug with an sNDA again in 2003 to treat bipolar disorder.

The blockbuster drug semaglutide, known as Ozempic and Wegovy, won FDA approval as a Type 2 diabetes management drug and retained an sNDA approval for reducing cardiovascular risk from Type 2 diabetes and weight management.

This drug, manufactured by Novo Nordisk (NVO), gained traction for its ability to help users drop around 15% of their weight, a number that caught social media’s attention.

It’s no secret that weight loss tips dominate social media conversations—but Ozempic and Wegovy took that to a new level. The Wegovy website labels it as a weight loss drug for obesity while the Ozempic website specifies it’s for lowering blood sugar and isn’t meant for weight loss.

The same compound but in different doses, semaglutide, quickly took off as celebrities credited their weight loss to both Wegovy and Ozempic, resulting in a shortage that has left Type 2 diabetes patients without the necessary drug.

Dr. Disha Narang, a diabetes expert and endocrinologist at Northwestern Medical Group in Lake Forest, Illinois, maintains that while off-label prescribing for semaglutide led to its approval for weight loss, the shortage reveals healthcare

providers have misinterpreted the indication.

“Obesity and weight management is chronic,” Narang says. “These drugs are meant to be used longer-term for this disease, so they’re not for short term use nor have they been indicated as such. But because of the social media surrounding it, people, unfortunately, are using it for that purpose.”

It remains unclear how patients react to semaglutide if taken short-term. Discontinued use likely leads to a weight rebound, but the long-term effects remain unknown for people without blood sugar problems, obesity or diabetes who have taken semaglutide for a period of months.

Because of a lack of funding, the FDA tends not to monitor drug use post-market. That means it can’t follow up on long-term effects of an approved drug.

Semaglutide, for example, underwent a two-year study, but for a disease that requires lifelong management, researchers like Stafford raise concerns about the consequences over time.

“It’s not completely clear that the FDA looked closely enough at long-term potential adverse effects of using this injectable drug,” Stafford says. “But it is certainly all the rage.”

Even in the development process, manufacturers compare the drug against a placebo, not against competing drugs. The lack of comparison prevents both the FDA and consumers from understanding whether the drug is an innovation and adds value to the system as a whole, or if it’s another drug released to saturate the market and liable to cause greater risk for unstudied off-label use.

Then, too, the FDA relies on funding from pharmaceutical manufacturers and thus isn’t entirely independent, observers say. As the dictator of what enters the market, the FDA needs better federal funding to serve the public and its needs, they conclude.

“Do we want an FDA that is dependent on corporate fees for its work?” Stafford asks. “Or do we want an FDA that is more oriented towards a societal or a public health viewpoint?”

DRUG

FOR 21% OF ALL PRESCRIPTIONS.

THE FDA TENDS TO STOP MONITORING PRESCRIPTION DRUGS ONCE THEY’RE ON THE MARKET.BY NAVPREET DHILLON

hose expiration dates stamped on everything from a gallon of milk to a bottle of acetaminophen don’t mean what you probably think. Food doesn’t suddenly become unsafe and medicine doesn’t magically lose its potency at noon on a certain preordained day.

But that doesn’t stop hospitals, nursing homes, businesses and households—just about every institution— from wasting billions of dollars every year by throwing out food and drugs that might still be good.

See, it’s more subtle than being OK one day and not OK the next. Expiration dates represent the latest date when the manufacturer guarantees a drug’s safety and full potency. While the law requires drug makers to provide expiration dates, setting them is more or less on the honor system.

The U.S. Food and Drug Administration (FDA) isn’t responsible for verifying expiration dates when approving a drug. That lack of oversight leads critics to charge pharma companies with setting the dates with an eye toward enticing buyers to throw out and replace medicine that might still be perfectly good.

Whether the motivation is corporate profit or just an abundance of caution, it’s clear that at least some classes of drugs can last much longer than the expiration dates suggest.