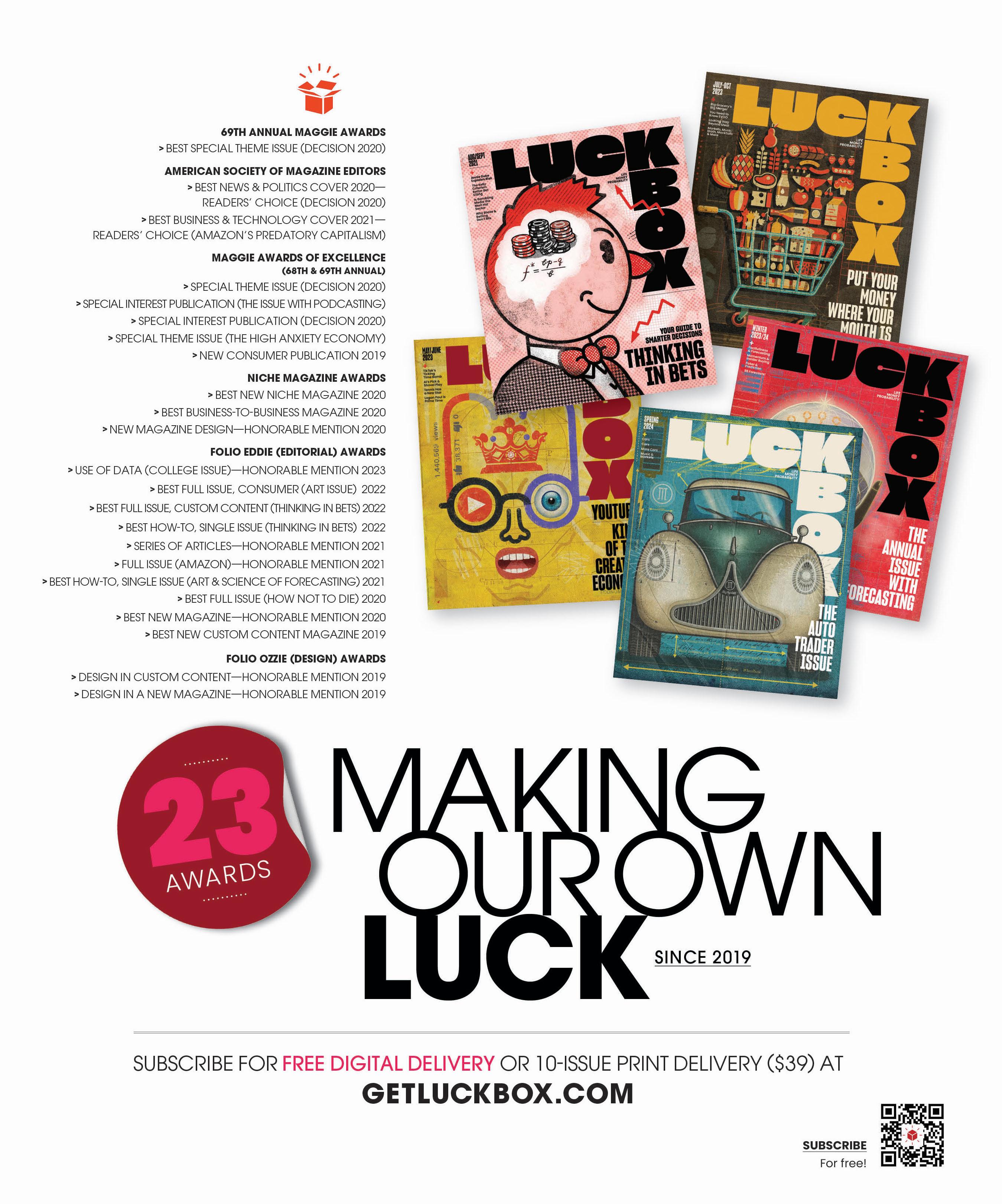

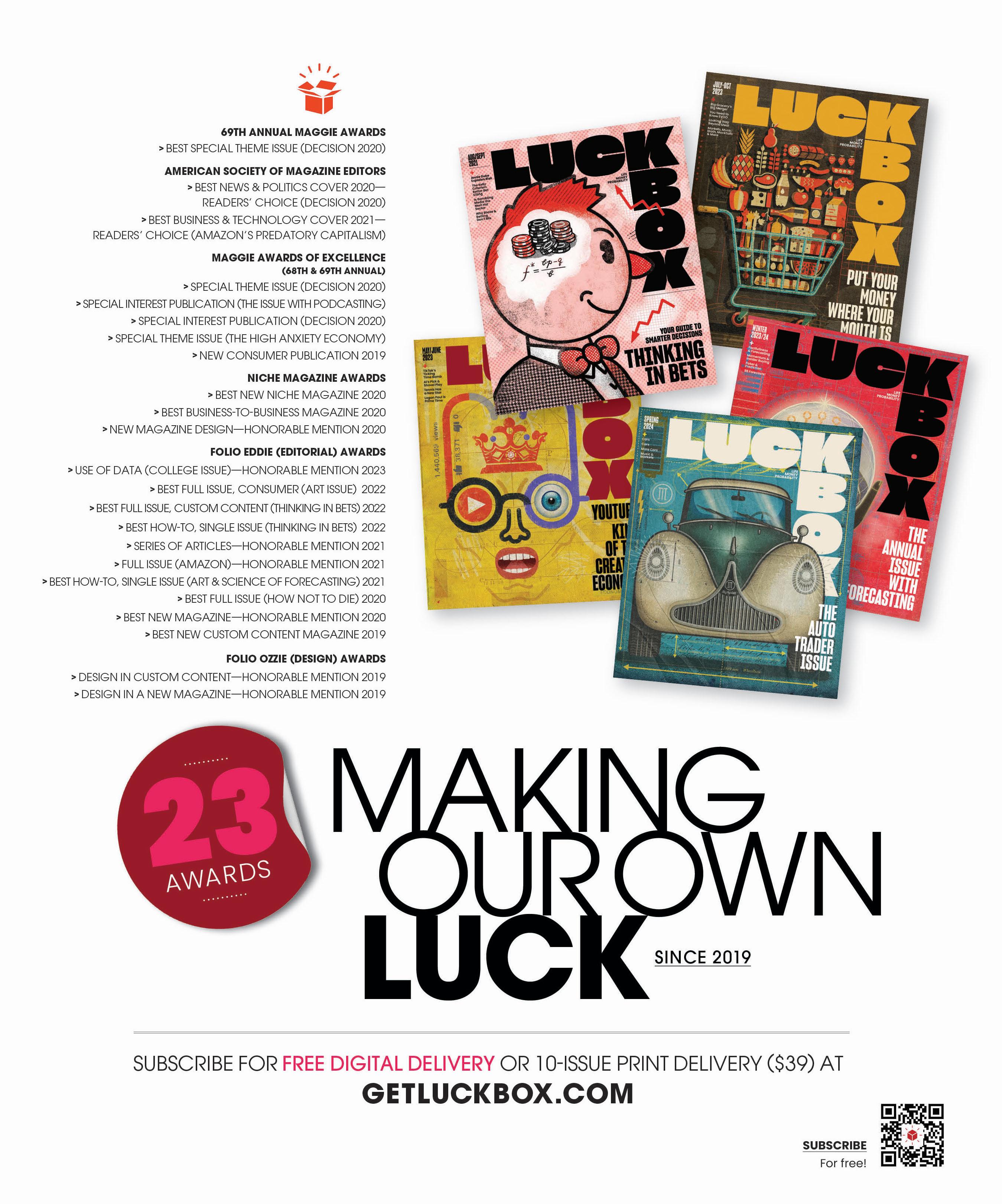

SPRING 2024 Cars Cars More Cars Music & Markets

LIFE MONEY PROBABILITY

THE AUTO TRADER ISSUE

the control freak's guide to life, money & probability

There are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here. Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers/. These products and digital assets are complex and are suitable only for sophisticated market participants. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can a ord to lose without a ecting their lifestyle. ©2024 Cboe Exchange, Inc. All Rights Reserved Experience the ultimate trading flexibility with Cboe’s suite of index options Gain broad market exposure and respond to market moving events. Any time. Any day. S&P 500 INDEX OPTIONS SPX® | XSP®

“The last six months of last year ... will rapidly sort out winners and losers in our industry.”

—FORD

LESS THAN ELECTRIFYING

Range worries and sticker shock are slowing the growth of EV sales.

EV ANXIETIES

An automotive journalist addresses the electric-vehicle market.

FAST-CHARGING TOYOTA

The Japanese auto giant plans to jumpstart battery technology.

FORD VS. GENERAL MOTORS

Two venerable automakers face political and economic hassles.

THE TWELVE HOTTEST NEW CARS OF 2024

60% of Luckbox readers are not confident the U.S. will build the necessary EV infrastructure.

LUCKBOX

From the practical to the aspirational, these autos made our shortlist.

TESLA’S WORST NIGHTMARE

It’s a Chinese EV maker called “Build Your Dream.”

ADOPTION ISSUES

Auto industry experts assess EV appeal, environmental impact, jobs and prices.

IT’S NOT EASY BEING GREEN

Regulatory capture impedes America’s transition to electric vehicles.

RETRO COOL

An upstart EV sports a Bond-like style and a voice-activated cockpit.

THE AUTO TRADER ISSUE

On the Cover Illustration

by Ian Murray

READER SURVEY

1

CEO JIM FARLEY

11

Book Value THE

These four books captured our attention this issue.

12

Diversions WILL EVS KILL THE RADIO STAR?

Some automakers want to banish AM radio.

17

18

20

Rockhound WHERE’S FRIKO BEEN?

The Chicago indie rock band releases its debut album.

Diversions A CAR-WORLD DIVIDE Enthusiasts love combustion, but EVs attract a new crowd.

Diversions

22

Fettle & Fitness HIGH-OCTANE BODY FUEL

Your body deserves a fill-up with premium.

The Ford F-Series pickup family was America’s bestselling vehicle for the 42nd year in a row.

“Nobody’s going to intercept our code. We put it on AM radio.”

09 Fake Financial News OFF THE ROAD AGAIN

out of town in the auto show’s newest

vehicles.

Get

adventure

MOTOR TREND , 2024

IRON MAN HAS A STEEL FETISH

Robert Downey Jr.’s eco-modified dream cars.

LUCKBOX BOOKSHELF

3 ILLUSTRATIONS: SHUTTERSTOCK

55 Breakout TESLA LOSING CHARGE?

The EV-maker’s shareholders are experiencing price range anxiety.

56 Technician FROM MUSK TO DAWN

An early experience with Elon and the many phases of Tesla.

59 Trader MEET W. JOHN SABIN

He started learning how to trade at the age of 11.

60 Macro CRUDE OIL AND A REVOLUTION IN RETREAT

How to pick a winner among GM, Ford, Toyota and Tesla.

62 Macro CHALLENGES MOUNT FOR AUTOMAKERS

Rising delinquencies and China’s supply are squeezing margins.

63 Watchlist A LITHIUM TRADE

Heavy expectations for the world’s lightest metal.

“It runs on fossil fuel.”

06

“We are fighting back to get every piece of the [Lithium] supply chain back in the United States or with our allies.”

—ENERGY SECRETARY JENNIFER GRANHOLM

the

05 From

Editors

Open Outcry

Calendar

Mathbox

The Last Picture

22

53

64

4

From the Editors

Who’s gonna hold you down when you shake?

Who’s gonna come around when you break?

You can’t go on, thinking nothing’s wrong, but now Who’s gonna drive you home tonight? DRIVE

Ed McKinley EDITOR IN CHIEF

Ed McKinley EDITOR IN CHIEF

Jeff Joseph EDITORIAL DIRECTOR

Jeff Joseph EDITORIAL DIRECTOR

IN EV ITABLE EVOLUTION

THE ELECTRIC VEHICLE debate teeters between praise for groundbreaking innovation and wariness about perceived impracticality.

But Elon Musk’s audacious claim that the second-generation Tesla Roadster will streak from zero to 60 in less than a second shows the EV industry continues to push the boundaries of what’s technologically possible.

And if that’s not enough, Musk also promises a range of more than 620 miles on a single charge for the forthcoming Roadster. That would negate the “range anxiety” complaint— the most-frequent consumer objection to buying an EV.

Meanwhile, everyone from legacy carmakers like Ford to upstarts like Olympian are sharpening their strategies amid shifting consumer sentiment and volatile market dynamics.

Yet beneath the surface of all this drama,

attitudes toward EVs are undergoing a nuanced metamorphosis. For many, it no longer seems certain that battery-powered vehicles will someday dominate the world’s streets and roads. Confidence is wavering.

It didn’t help when the consulting company J.D. Power found 21% of public chargers are malfunctioning. Hearing that, you could almost feel the gap widen between EVs and

Two ways to send comments, criticism and suggestions to Luckbox.

Email: feedback@luckboxmagazine.com

Visit: luckboxmagazine.com/survey A new survey every issue

mainstream acceptance.

Plus, Consumer Reports found repair problems occur more often with EVs than with hybrids or internal-combustion cars. That didn’t do much to spur confidence in the electric transformation.

Now we find Hertz is rethinking its commitment to an all-EV fleet of rental cars. States already grappling with fiscal deficits are having second thoughts about subsidizing EV purchases.

Ford is throttling back on EV investment in favor of hybrids, reflecting the realization that hybrids are gaining traction over pure EVs. The public apparently values practicality over innovation for innovation’s sake.

So, it seems EV euphoria is subsiding.

But despite the challenges, companies like BYD are cranking out multitudes of EVs. The China-based manufacturer even outsold Tesla to become the world’s biggest maker of EVs for the first time ever in the fourth quarter of last year. We have to mention, however, that Tesla still led for the year after falling behind in the final quarter.

So, it’s complicated. The industry’s false starts and stutters are well-documented in this issue of Luckbox, but so are the advances, particularly in battery technology. Toyota, for example, says it’s developing a battery that charges quickly and has unheard of range.

The competitive push—both from established automotive players and new entrants— ensures a vibrant marketplace, teeming with options for consumers. Competition will inevitably drive down costs, bringing EVs within the grasp of a broader audience.

Plus, the environmental imperatives driving the shift toward cleaner transportation will continue to bolster governmental and consumer support for electric vehicles.

Despite the challenges shadowing the electric vehicle market, the technology will not only improve but also become more affordable. It will help shape a sustainable new automotive landscape.

As traders, investors and financial market forecasters, our experiences remind us that the convergence of innovation, government subsidies, lower costs and consumer satisfaction invariably creates an unstoppable force and a predictable outcome.

Luckbox expects the march toward wider EV adoption—albeit peppered with lessons from its formative years, as well as future missteps—will continue nearly unabated, eventually transforming our very notion of mobility and rewarding savvy investors.

1984 5 Illustrations by Tyson Cole SPRING 2024

, THE CARS,

Threats Aside, AI Will Be

Health. I learned how AI is already helping the University of Oxford and other institutions predict cardiac episodes. I am excited to see what the future holds for humanity having AI in our corner— or should I say coronary?

Imagine we live in a world where all vehicles are electric. Then along comes a new invention: the internal combustion engine. With this new technology we can build vehicles at half the weight and half the price. They can be refueled in one-tenth the time and have up to four times the range of electric vehicles in all weather conditions. They perform well in sub-zero temperatures, where battery-powered vehicles struggle. They don’t rely on destructive mining of rare earth elements for power, instead using fuel more easily and cleanly obtained by drilling. They would help reduce home energy costs by greatly decreasing the loads on our electrical grid. Do you suppose car buyers would be interested?

Mike T. | Winston Salem, North Carolina

I have a Tesla and love it. Living in Oklahoma I have no issues with charging. I am sure moving forward this will get even better. I will never go back to an internal combustion engine.

Tony Provenzano | Edmond, Oklahoma

I absolutely love my Tesla Y. It has tons of room, drives like a dream and the dog mode is brilliant. The only con, which will be eliminated over time, is the lack of superchargers. My biggest issue is having to listen to the media slam Tesla repeatedly and the amount of fake news swirling around this company! They keep talking about recalls over and over again, leading most people to believe Tesla owners are in the dealership all the time. Any recall usually involves an over-air software update performed in my driveway. We get updates and improvements ALL the time. It is like I get a new car every month or so.

K. Rouse | Ontario

I wouldn’t buy a pure EV. I’ve owned a hybrid Honda Civic since 2007. It’s been a great car, and I never worried about running out of battery power. I saved $2,000 in gas in the first six years. Then, I had to spend $2,500 to get new batteries.

Alex Lussos | Atlanta

Pros of EV ownership are you save on fuel and help the environment. If you plug it in when you get home, it’s always full in the morning. Before leaving, you can warm or cool the car while it’s in the garage. They have awesome acceleration, and there’s no more standing outside a gas station in the cold, rain or heat. Say goodbye to oil, transmission fluid, coolant, differential fluid, and belts and hoses. Get ready for peace and quiet while driving. My next car will definitely be electric.

Brad Beilfuss | Dyer, Indiana

6 LUCKBOX Great issue! My favorite article was Existential

Your

—OZ

Open Outcry Your thoughts on this issue? Take the reader poll at luckboxmagazine.com/survey FACEBOOK • LINKEDIN: Luckbox magazine X (TWITTER) • INSTAGRAM: @luckboxmag WEBSITE: luckboxmagazine.com

Good for

PENA | ALEXANDRIA, VIRGINIA

TRUTH TK

Much of what you believe is wrong.

Now that we have your attention, we’ll walk that back a bit—but not completely. All of us carry around plenty of misconceptions.

Most of our errors, illusions and flawed perceptions result from outdated “facts.” We harbor beliefs that have been disproved decades ago. Truth evolves.

With that in mind, Luckbox is setting out to dispel myths, present new data and combat disinformation.

“TK” is journalism lingo for “to come.” The answers to the questions posed here are found in the stories that follow.

1. An electric vehicle typically uses 30 kilowatt-hours of electricity to travel 100 miles. That’s about the same as the average home uses in ...

One hour

One week

One day

One month

2. In the fourth quarter of 2023, Sirius XM Radio had nearly 34 million subscribers. How many Americans listen specifically to AM radio each month?

42.3 million

62.3 million

82.3 million

102.3 million

3. The Biden Administration appears likely to reconsider Environment Protection Agency electric vehicle mandates for new light-duty vehicle sales by 2032, according to The New York Times. What was the EPA’s original target for EV sales for 2032?

Reader Survey

Do you support phasing out the production of gasoline cars and trucks by 2025?

See answers on pp. 26, 15 and 45.

Luckbox Magazine is a product and service offered by tastylive, Inc. (“tastylive”). Luckbox Magazine content is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involves risk and may result in a loss greater than the original amount invested. The information provided in Luckbox Magazine may not be appropriate for all individuals, and is provided without respect to any individual’s financial sophistication, financial situation, investing time horizon or risk tolerance. Transaction costs (commissions and other fees) are important factors and should be considered when evaluating any securities, futures, or digital asset transaction or trade. For simplicity, the examples and illustrations in these articles may not include transaction costs. Nothing contained in this magazine constitutes a solicitation, recommendation, endorsement, promotion or offer by Luckbox Magazine or tastylive, Inc., or any of its subsidiaries, affiliates or assigns. While Luckbox Magazine and tastylive believe that the information contained in Luckbox Magazine is reliable and make efforts to assure its accuracy, the publisher disclaims responsibility for opinions and representation of facts contained therein. Active investing is not easy, so be careful!

17% 37% 47% 67%

EDITOR-IN-CHIEF Ed McKinley MANAGING EDITORS Yesenia Duran James Melton Kendall Polidori EDITOR-AT-LARGE Garrett Baldwin TECHNICAL EDITOR Kai Keng CONTRIBUTING EDITORS Vonetta Logan, Tom Preston, Mike Rechenthin CREATIVE DIRECTORS AptCDesign + Gail Snable CONTRIBUTING PHOTOGRAPHER Garrett Roodbergen EDITORIAL DIRECTOR Jeff Joseph COMMENTS, TIPS & STORY IDEAS Feedback@Luckboxmagazine.com CONTRIBUTORS GUIDELINES PRESS RELEASES & EDITORIAL INQUIRIES Editor@Luckboxmagazine.com ADVERTISING INQUIRIES Advertise@Luckboxmagazine.com SUBSCRIPTIONS & SERVICE Support@Luckboxmagazine.com MEDIA & BUSINESS INQUIRIES PUBLISHER: JEFF JOSEPH jj@Luckboxmagazine.com Luckbox magazine, a tastylive publication, is published at 1330 W. Fulton St., Chicago, IL, 60607 Editorial Offices: 312.761.4218 Issn: 2689-5692 Printed at Lane Press in Vermont Luckboxmagazine.com LUCKBOX 7 SPRING 2024 SCAN THIS There’s more to Luckbox than meets the page. Look for this QR code icon for videos, websites, extended stories and other additional digital content. QR codes work with most cell phones and tablets with cameras. 1 Open your camera 2 Hover over the QR code 3 Click on the link that pops up 4 Enjoy the additional content

Favor 10% Oppose 78% Not sure 8%

INSPIRED

FEW HAS THE SPICE . HAND-MADE IN SMALL BATCHES, USING A MASH-BILL

INSPIRED BY WHISKEY’S PRE-PROHIBITION GOLDEN ERA. FEW COMBINES

YEAST TO MAKE A UNIQUELY

A HIGH RYE CONTENT & PEPPERY

SPICY BOURBON.

BY

1893

By Vonetta Logan

By Vonetta Logan

Fake Financial News

Off the Road Again

Illustration by Tyson Cole

A look at the auto show’s newest adventure vehicles

WHEN I WAS a kid, my dad and I would make the pilgrimage from our small town in Indiana to the big city of Chicago every February to visit the country’s largest auto show.

My dad is such a Car Guy™ that after I was born, he rigged a precarious baby seat in the trunk of a Datsun 240Z for my ride home from the hospital. Pretty good parenting!

I grew up loving cars, so it was quite a treat to cover the 2024 Chicago Auto Show for Luckbox. What I wasn’t expecting was the fake trees, ersatz boulders and artfully applied mud on a multitude of conveyances marketed as “adventure vehi-

cles.” What’s with all this nature cosplay? I thought we were at the show for the cars, trucks, vans and SUVs themselves.

Ready for adventure?

Tim Huber defined the “adventure” category of motoring in an article for HiConsumption, a digital lifestyle magazine for men. “‘Adventure vehicle’ is a big term to be throwing around, and we’re sure a lot of different definitions fit,” Huber

LIFE, LUXURY & THE PURSUIT OF HAPPINESS

9

wrote. “For us, however, it’s a fairly specific genre of vehicle, boasting equal parts versatility, durability, dependability and go-anywhere capability.”

Whether you want to conquer rugged terrain or just need something to take you to an off-the-grid location, adventure vehicles are the Swiss Army knives of the auto world. And more automakers are focusing on off-road or adventure-type cars. “Auto manufacturers are

The Hummer EV Omega packs a staggering 11,500 pound-feet of torque.

simply selling the image of the millennial lifestyle,” Huber wrote.

But there’s more to it, as Humphrey Bwayo maintained in Autoevolution: “People don’t buy vehicles for who they are, but rather, who they want to be. Millennials are shaping the current consumer markets because they’re adventure-seekers, spontaneous, curious about the unknown and highly emphasize being unique.”

Even though the most harrowing trip many of these vehicles will face is the drive-thru at ChickFil-A, consumers want the potential to escape the 9-5 grind and live out their lives in a National Forest. Or maybe I’m just reading from my diary.

Subaru: an outdoor OG

Japanese automakers definitely understand the assignment when it comes to marketing cars for adventure. In a rugged display at the auto show, Subaru (FUJHY) simulated several woodland scenarios for their vehicles

to subjugate. Coniferous trees (hey, look at me using ninth-grade science class) dotted the booth, and the bland carpet of Chicago’s McCormick Place was replaced with a mockup of the dewy moss and pine needle floor of a forest in the Pacific Northwest.

Subaru’s latest lineup was not showroom pristine. Instead, the vehicles on display were covered in mud and grime and looked frozen in time as they climbed a steep incline. The display included a treehouse, log benches, a tent pitched on the ground and a tent mounted on a roof rack. The company even had puppies you could adopt.

Of all the Subaru display vehicles, I enjoyed the new 2024 Ascent the most. The eight-passenger SUV had a functional yet appealing interior layout with a huge touchscreen display. It comes with symmetrical all-wheel drive and 8.7 inches of ground clearance. Subaru describes its 75.6 cubic feet of cargo space as class-leading.

The Base Ascent starts at $34,395 but goes up to $48,695 for the seven-passenger Touring model. I give it three and a half Patagonia vests out of five. It’s definitely one of the more affordable models I saw.

Ride a Bronco

If Subaru was trying to set a scene and engage your mind, Ford (F) was trying to jack up your adrenaline and elevate your heart rate with its “Bronco Experience.” That’s what they called the massive indoor test track and a revolving coterie of the latest Bronco models, each performing off-camber maneuvers. It demonstrated Bronco’s class-leading electronic-locking front and rear axles and had a 40° hill climb with a squeal-inducing rapid descent.

The auto-show setting for the Broncos drew inspiration from rugged terrain ranging from the desert outside Moab, Utah, to the White Mountains of New Hampshire. There wasn’t

just a “Sasquatch Crossing” sign. There was a Sasquatch posing for selfies with attendees.

The Raptor iteration of the Bronco was my favorite with its glossy green exterior and menacing 37-inch tires. It’s a dead sexy car from the outside, but reading that sticker price is another way to elevate your heart rate.

Coming in at a starting price of $90,035, I was shocked that the interior had bungee nets instead of side door compartments. Some parts of the interior just felt cheap. But there are tons of off-road modes, and you can even remove the doors and roof. Look, for $90K imma need it to come with someone to remove the roof for me.

It does have G.O.A.T mode, though, which is just a *chef’s kiss* by the Ford marketing team. It stands for Goes Over Any Terrain. I was impressed with the camera systems in the Broncos to help drivers navigate off-road obstacles using wheel view and a cool drone mode, but 90K is a bonkers price. Four Patagonia vests out of five.

If money is no object …

GM (GM) showcased its lineup of electric Hummers (that sounds kinkier than it is), but the true main attraction was the integrated EarthCruiser. The base model, two-motor Hummer EV 2 has an astounding 570 horsepower and 7,400 pound-feet of torque with

a reported 300-mile range. The price starts at $96,550.

The top-tier Hummer EV Omega has 830 horsepower. (Where are you going? The moon?) It’s rated at a staggering 11,500 pound-feet of torque. (Nope, not overcom -

Hummer EV 2 with an integrated EarthCruiser.

10 LUCKBOX

Ford Bronco

pensating for anything at all). The Omega trim starts at $138K.

In a partnership with EarthCruiser, GM showcased a GMC Hummer EV with an integrated carbon-fiber overlanding module. Think of it as REI meets Jiffy Pop. It’s a zero-emission pop-up compartment where you can live, sleep and work as you and your billionaire friends wait for them to rebuild that Titanic submarine thingy.

There’s a full-size RV bed, full solar power and a 12-gallon capacity water tank. The tri-layered pop-up roof is insulated, and there’s enough juice to power a fridge/freezer combo for almost a full week.

GM Hummers are actual production vehicles, but the EarthCruiser is a concept and a representative told me they were at the show to gauge consumer interest. I was super interested. A zero-emission overlanding beast? Yes, please.

However, cost is definitely an issue. See above for the base costs across the Hummer line. Now, I’m told the EarthCruiser module will debut with a retail price of around $90,000 to $100,000. So, $100-$138K for the Hummer and then another $90K for the module. That’s a legit, nice-ass three-bedroom house in Kansas somewhere. Five Patagonia vests out of five.

Roads? Who needs ’em?

The pandemic focused us on exploring the outdoors and getting away from urban areas. Just try getting a camping reservation. Manufacturers are leaning into the moment, and this year’s auto show and its displays prove the adventure segment isn’t just growing. It’s here to stay.

“What this market has brought to us is new manufacturers and better-quality products,” said Andrew Funk, president of Cap-it International in an interview for the Specialty Equipment Market Association (SEMA).

“There are new ‘glamping’ and creature comforts that are nice while you’re out in the bush off-roading, but it’s becoming so mainstream now that your average consumer is seriously looking into it as an option.”

So, wherever you’re headed, perhaps an “adventure vehicle” is in your future. I’m of the mindset that any vehicle can be an adventure vehicle if you try hard enough.

Vonetta Logan, a writer and comedian, appears daily on the tastylive network. @vonettalogan

The Luckbox Bookshelf The books that captured our attention this issue

The Electric Vehicle Revolution: The Past, Present, and Future of EVs (2023)

By Kevin A. Wilson

The Future of Automotive Retail (2022)

By Steve Greenfield

Automotive journalist Kevin Wilson offers a thorough evaluation of the state of electric-vehicle technology, explains how it got there and predicts where it’s going. His timeline includes early attempts at modern EVs, like GM’s wonky EV1, and the first Tesla, a tiny roadster targeting an even tinier segment of the motoring public. From post-WW II experiments to today’s rush to electrify, here’s your guide to the EV revolution.

Automotive retailing is changing with lightning speed, and author Steve Greenfield explains how the transformation is reshaping the century-old industry. It’s an account of how technology is altering vehicle production, redefining the ownership experience and altering consumer expectations. His book helps readers understand advances in power sources, connectivity and vehicle servicing. Best of all, he shares his thoughts on how to navigate a future that’s already here.

The Cloud Revolution: How the Convergence of New Technologies Will Unleash the Next Economic Boom and A Roaring 2020s (2021)

By Mark P. Mills

Carmageddon: How Cars Make Life Worse and What to Do About It (2023)

Daniel Knowles

Conventional wisdom is simply wrong about how technology can change the future, according to author Mark Mills. Instead of succumbing to the usual dread, he’s developed a stunningly optimistic vision of what he says lies ahead. He expects a convergence of new microprocessors, materials and machines to drive an economic boom in the “Roaring 2020s.” Read more about his thoughts in an interview on p. 44.

Hot take: Cars are ruining the world and making us unhappy and unhealthy.

Journalist Daniel Knowles acknowledges the automobile as one of the greatest inventions of the 20th century but reminds us that relying on them has fueled climate change. Weaving together history and economics, he outlines the rise of the automobile and documents the costs we all bear as a result.

Far too often, book reviews drive readers away. They’re written from the viewpoint of just one stranger and taking them to heart leaves great books undiscovered. That’s why Book Value offers profiles instead of reviews. Don’t look to this page for opinions. Think of it as a place to find writing that educates, entertains and challenges entrenched beliefs

Book Value

11 SPRING 2024

PHOTOGRAPHS: VONETTA LOGAN

by Kendall Polidori

Will EVs Kill the Radio Star? Some automakers want to banish AM

TRENDS

UUPON READING HIS own premature obituary, Mark Twain supposedly observed that “reports of my death are greatly exaggerated.” The same goes for AM radio.

Some 82 million Americans listen to AM radio monthly, according to Nielsen Audio Today 2023. It reaches 91% of all Americans 18 years or older monthly—more than TV, PCs, tablets, smartphones or TV-connected devices, the report says.

Interest in radio parallels the resurgence of vinyl records, notes Robert Quicke, author of Finding Your Voice in Radio, Audio and Podcast Production and founder of College Radio Day. They’re old media, but old is good, he says.

“In general, people have taken radio for granted,” Quicke says, adding that they’re missing out on a great medium. “Radio is still this vital, brilliant thing that when it’s at its best, it’s creating compelling content.”

Radio reaches 87% of Americans ages 1834, a Nielsen study reported last year. Spotify lands at 41%, Pandora at 21%, Apple Music at 18%, Amazon Music at 14% and satellite radio at 7%, the data measurement firm says.

Yet despite what some view as the glories and mass appeal of radio, skeptics abound.

Diversions

12 LUCKBOX PHOTOGRAPH: GETTY IMAGES

In the form we recognize today, AM radio began in 1906. From Bryant Rock, Massachusetts, Canadian radio pioneer Reginald A. Fessenden transmitted the first broadcast containing speech and music.

Who’s listening?

Critics accuse commercial radio of irrelevance for younger generations.

Most if not all of instructor Tom Moran’s students in his Columbia College Chicago course on writing for radio and broadcasting don’t listen to the radio.

“The fact is that younger people are not listening,” Moran says. “The main issue is that there is just too much media out there. I don’t know how any [medium] is supposed to be profitable—there’s too much competition.”

Measuring the audience can get complicated, too, notes Paul McLane, editor-in-chief of the trade journal Radio World. Some analysts combine radio and streaming when collecting data. People are counted as radio consumers if they listen to a radio station on a streaming app, he says.

It’s part of the uncertainty clouding our understanding of the present and future of radio.

“A lot of younger people still use radio as part of their lifestyle,” McLane says. “But that said, there’s no question that it’s probably a more challenging area for the business, and the long-term stability of our business is to make sure those listeners are locked in [and] to figure out more about how they’re listening. I think it’s an open question.”

cial radio could have the upper hand—it’s an accessible medium that does the work for you. But it’s all about having compelling content.

The most important trend over the past 10 to 15 years, McLane says, is that audio remains important in the lives of consumers. Radio execs have had to figure out how to adjust their businesses and use their presence in cars to maximum advantage.

“There are a lot of exciting things going on,” Quicke says, “and we’re putting a lot of exciting things into our vehicles. But let’s not forget that with a radio, this could be a potentially lifesaving tool when all else fails. We’re so connected to the cloud, there needs to be a device that isn’t.”

Threats to AM radio

In April 2023, Ford Motor Co. (F) announced plans to stop putting AM radio in new gas-powered and electric vehicles beginning in 2024.

About the same time, the National Association of Broadcasters (NAB) launched a “Depend on AM Radio Campaign” in response to some automakers stripping AM radio from certain vehicles. The campaign is meant to share the “dire implications of this decision and will amplify the voices of the more than 82 million Americans that AM reaches each month.”

A month after its announcement, Ford backpedaled and said it would keep AM radio in its cars. Ford CEO Jim Farley made this statement on LinkedIn:

Radio Waves

Can radio still kickstart a musician’s career? In today’s recording industry, songs first have to get past the new gatekeepers— Tik Tok and streaming. Then radio can help build the critical mass needed for a true hit.

That’s the view of Sean Ross, writer and editor for the Ross on Radio website and vice president of music and programming at Edison Research.

“Only songs that have Tik Tok, then enough streams, then a label commitment to radio, then perform well in radio research—have a chance,” Ross says. “Meanwhile, there are far fewer consensus hits than ever, and some artists can have a No. 1 record but never get promoted on radio again.”

But even in radio’s diminished state, it can do a lot for the career of a mainstream artist who wants to make mass-appeal music, Ross says. Most musicians aren’t interested in doing what radio has asked for in previous years—releasing clean versions and playing radio station concerts, he notes.

“I think labels and artists would be smart to fill the void by making radio records if their counterparts don’t want to,” Ross says.

Radio reaches more Americans than TV, PCs, tablets, smartphones or TV-connected devices.

Quicke, the radio book author, says the radio industry has had to adapt quickly and use different channels. Shock Jock Howard Stern, he notes, was a pioneer because he brought video cameras into the radio studio.

“Radio is becoming an increasingly visual medium,” Quicke says. “Radio has to be clever to compete ... utilizing everything, all the different social media channels and outlets.”

That muddles the overcrowded field, leaving the public with the task of deciding what to watch or listen to. This is where commer-

“After speaking with policy leaders about the importance of AM broadcast radio as a part of the emergency alert system, we’ve decided to include it on all 2024 Ford and Lincoln vehicles. For any owners of Ford EVs without AM broadcast capability, we’ll offer a software update. Customers can currently listen to AM radio content in a variety of ways in our vehicles—including via streaming—and we will continue to innovate to deliver even better in-vehicle entertainment and emergency notification options in the future.”

But Ford isn’t the only company that’s threatened AM radio. In December 2022, Sen. Ed Markey (D-Mass.) sent a letter to automakers urging them to maintain free broadcast radio in EVs. He asked the manufacturers to answer questions about their plans to discontinue free access to AM/FM radio. Of 20 companies, eight—Ford, BMW, Mazda, Polestar, Rivian, Tesla, Volkswagen and Volvo—had removed AM radio from some vehicles, primarily EVs.

In May 2023, Markey introduced the AM for Every Vehicle Act with the support of Sens. Ted Cruz (R-Tex.), Tammy Baldwin (D-Wis.), Deb Fischer (R-Neb.), Ben Ray Luján (D-N.M.) and J.D. Vance (R-Ohio) and Reps. Josh Gottheimer (D-N.J.), Tom Kean Jr. (R-N.J.), Rob Menendez (D-N.J.), Bruce Westerman (R-Ark.) and Marie Gluesenkamp Perez (D-Wash.). The proposed legislation

13 SPRING 2024

More Americans listen to the radio than use Facebook each week.

— Musical Pursuits

was endorsed by Jessica Rosenworcel, chair of the Federal Communications Commission (FCC).

If passed into law, the bill would require the Department of Transportation (DOT) to issue a rule requiring all new motor vehicles to have devices that can access AM broadcast stations as standard equipment. The bill applies to vehicles manufactured in the U.S., imported to the U.S. or shipped in interstate commerce.

So, why are some automakers not including AM radio in EV models?

The electric motors can interfere with AM reception in cars, says David Layer, vice president of advanced engineering for the National Association of Broadcasters (NAB).

AM and FM frequencies are on very different parts of the RF spectrum, Layer notes. The AM frequency band is from 550 kilohertz to 1,750 kilohertz and is known as the medium wave band of RF frequencies. FM is in the VHF band, from 88 megahertz to 108 megahertz. The reception characteristics and propagation characteristics of signals in those two bands differ significantly.

AM is at a much lower frequency, and it happens that interference generated by the electric motors is stronger at the lower frequencies, plus the nature of AM is more susceptible to that interference, Layer notes.

“These are not insurmountable problems, though, because a lot of EVs have AM radio in them,” he says. “It’s doable. It’s just a matter of priorities.”

EVs aside, McLane says the broadcasting industry has invested time and resources addressing this question: “How can we keep stations at the forefront of the car dashboard?”

“We don’t know where it’s going,” he says, “but the fact that broadcast interests have seen it necessary to push for legislation is an indication that it’s very important.”

Despite the worries, Moran, the college instructor, doesn’t think electric vehicles are sounding the death knell for commercial AM radio. About 2 million EVs are registered in the U.S. as of November 2023, according to

Serious Radio

If you’ve been listening to Sirius XM (SIRI), you’re not alone. The largest audio entertainment company in North America had a reported 34 million paid subscribers by July 2022.

But the numbers fluctuate. It lost 225,000 subscribers in the fourth quarter of 2023, even though sales were booming for cars—the place where listeners most often hear Sirius XM. Still, the company had picked up 2,000 in the quarter before that.

The service isn’t cheap but offers a vast assortment of audio. Its car + app platinum plan costs $23.99 per month and provides more than 425 channels of ad-free music, news, talk, comedy, podcasts and sports.

Sirius XM reported Q4 2023 revenue of $2.29 billion on Feb. 1, 2024, and announced it earned 9 cents per share. The company expects full-year revenue to clock in around $8.75 billion, compared to $8.95 billion in 2023.

Night Radio

The Federal Communications Commission (FCC) requires some AM stations to reduce their power at night or even stop operating until daylight to avoid interference with other AM stations. This is a consequence of the laws of psychics.

Because of the way the relatively long wavelengths of AM radio signals interact with the ionized layers of the ionosphere miles above the earth’s surface, the propagation of AM radio waves greatly changes from day to night, the FCC says.

The change in AM radio propagation occurs at sunset because of “radical shifts in the ionospheric layers, which persist throughout the night. During daytime hours, when ionospheric reflection does not occur to any great degree, AM signals travel principally by conduction over the surface of the earth,” according to the FCC.

Daytime AM is typically limited to a radius of 100 miles or less, while at night, AM signals can travel over hundreds of miles by reflection from the ionosphere, which is called skywave propagation.

The motors in EVs can interfere with the reception of emergency alerts on AM radio.

the Exploding Topics website, meaning the market isn’t necessarily booming. Moran says it will take a long time to see a major change in AM radio—that is, if the AM for Every Vehicle Act doesn’t succeed.

Sean Ross, writer and editor for Ross on Radio, says the biggest issue with deleting AM is that it’s a likely stalking horse of the future of FM, as well.

“I’m surprised the broadcasters who are

TRENDS

14 LUCKBOX PHOTOGRAPH: PRNEWSWIRE

Radio holds the highest share of collective trust across all advertising channels.

— Musical Pursuits

lobbying for this to be addressed through legislation aren’t pushing for a guaranteed place for AM and FM, particularly given the number of news and talk outlets now found on FM,” Ross says.

For Quicke, the AM in EVs controversy brings to mind the recent Netflix movie Leave The World Behind, where two families fight for survival during a blackout that precedes a war. News of the conflict was scarce when the electrical grid went down.

“Having an AM radio is a tested method of communicating information out over long distances for large populations,” Quicke says. “I know very few people who get up and listen to AM radio, but as a potentially lifesaving device, it has value.”

Primary Entry Point (PEP) stations provide the public with information and alerts during emergencies. The stations are privately owned commercial and non-commercial radio broadcast stations that participate with the Federal Emergency Management Agency (FEMA).

Moran notes that AM radio also provides Americans with unbiased and direct news. As opposed to selecting content that caters directly to your personal views, Moran says you can turn on an AM radio station for objective newscasts.

But will keeping radio in cars matter if no one’s listening?

Rethinking audio

Stations should zero in on compelling content to gain and retain listeners, Quicke suggests. Commercial radio could do that by taking a page from the college radio book, he says.

“There is this perception that college radio is not professional—that it’s poorly produced, that it’s scruffy. I would say, ‘Yeah, that’s probably true,’” he says. “But college radio has an authenticity...rather than being this highly polished, technical product. That kind of roughness gives it value.”

Listeners are seeking local connections, and the human contact radio can deliver, Quicke

says. “Radio is the most intimate form of communication. I really believe that radio is still that companion in the darkness.”

“McLane cites other factors. “In their public presentation of the benefits of broadcasting, they will always talk about the importance of being local,” he says. “You can question how sincere some of them are. But at the end of the day, it’s true—these are local signals.”

How do radio fans listen to their favorite stations? More than half of consumption is on AM/FM radios.

19%

82.3

— Nielsen Report TRUTH

He notes the issue of geotargeting, a form of advertising that uses location data to reach customers. The Federal Communications Commission is considering authorization of geotargeted content via FM boosters. It’s not currently allowed, but McLane says the FCC may change the rule this year.

Meanwhile, trends in the industry include increasing content related to gambling because rules governing sports wagering have changed. People on the radio used to avoid even mentioning the word “gambling,” and now it’s becoming an accepted format, McLane says.

As for what to look for in the industry this year, Layer says hybrid radio will level the playing field for AM. He expects more automakers to announce its use in the coming years. It essentially combines information from the internet with information that arrives over the air.

“Now with these hybrid radio systems, AM stations can look just as good as any other station,” Layer says.

Ross says the radio’s strength is in the easeof-use AM/FM. If broadcasters are sincere about the public safety value of radio, there’s no reason not to have a hybrid approach, and they need to be more competitive in streaming, he says.

The goal, he says, is to bring more people to broadcast commercial radio, which includes more robust offerings on AM.

“Every time a major talk radio station moves to FM, it’s one less reason to go to AM,” Ross says.

18%

58%

38%

39%

Which song is your favorite for road trips from Billboard’s Top 5 Car Songs of All Time? Luckbox readers 1. Bruce Springsteen, Born to Run 2. Golden Earring, Radar Love 3. The Beach Boys, I Get Around 4. The Beatles, Drive My Car 5. Tracy Chapman, Fast Car

Bruce Springsteen, Born to Run 2. Tracy Chapman, Fast Car 3. The Beach Boys, I Get Around 4. Eazy-E, Boyz-N-The-Hood 5. Prince, Little Red Corvette

Billboard staff 1.

— Percentage of time spent with their P1 station via each platform in a typical week

PODCASTS

SMART SPEAKER

MOBILE APPS

OTHER

AM/FM RADIO AT HOME, WORK

4%

7%

9%

4%

OR SCHOOL

COMPUTER STREAM

TRADITIONAL:

VEHICLE

DIGITAL:

AM/FM RADIO IN

listen to AM radio monthly,

the AM listeners

million Americans

and 57% of

tune into news/talk stations.

15 SPRING 2024

THE ROCKHOUND

Where’s Friko Been?

Chicago rock band releases debut album

C

CHICAGO INDIE BAND Friko’s debut album, Where We’ve Been, Where We Go From Here, opens with a song (Where We’ve Been) so strong it sounds like a record closer.

“When we play shows, [Where We’ve Been] is always one of the last ones,” says guitarist and

vocalist Niko Kapetan. “Moving it to the front has a lot to do with it being our debut record. For me, that song is like everything encapsulated in one song. If people are going to hear us for the first time and turn on this record, they’re going to get everything at first.”

That’s because the song relates the band’s four-year history and embodies the friendship among its members, Kapetan says.

It has a strong and steady buildup to an arc that opens the floodgates for booming guitar rhythms, improvised collective harmonies and the rapping of drumheads—all to end abruptly, isolating Kapetan’s vocals and guitar once again.

Friko didn’t just write and record their debut album. Instead, they found themselves as a band, decided how they wanted to record and discovered what music they wanted to write.

The band debuted the album March 1 with a headline set at Metro, one of Chicago’s larger independent venues.

The sold-out show featured a Chicago-centric lineup with Neptune’s Core, a female rock group, and Smut, a punk alternative band. I felt part of the older crowd at the all-ages show because many in the audience were in their teens. It was refreshing to see the next generation of Chicago music come out and support the young bands. The joy and community on stage was infectious.

When we chatted with Friko, it was still

by Kendall Polidori

more than three weeks before the release of Where We’ve Been, Where We Go From Here. It’s been a long wait for a piece of work that fills the band members with pride.

Many of the songs on the release stem from demos written in 2021, a time when Kapetan says he was in a much darker place. “I just didn’t know what I was doing, which a lot of people don’t in their 20s.

“By the time we finished it, for me it felt like I reached the top of some mountain,” he says. “Not the final point I want to get to, but recognizing we made a whole thing that represents our friendship. It’s something we’re really proud of, which I have not had my whole life.”

Where We’ve Been, Where We Go From Here is triumphantly hopeful, with an overarching theme of wanting to be better for oneself and the people around you—but the world presents challenges along the way.

Many of the album tracks started as live tapes—there are still plenty of overdubs—but the band wanted to spotlight the energy of live performances. You can hear the passion in Kapetan’s voice as it shakes and quivers, conveying real-time emotion and heart.

The band also made space for improvisation, sitting down at pianos and just seeing what came out—or having everyone sing on the recording for more body in the melodies.

“It felt good, and I honestly think we could try more of it going forward,” drummer Bailey Minzenberger says. “It can be easy to get caught inside of structure.”

The album maintains a versatile dynamic with energetic guitar anthems like Where We’ve Been and Chemical. But there are also some soft emotional ballads like For Ella and Until I’m With You Again. It’s a one-stop shop, catering to whatever mood listeners might crave. A post-punk romanticism melds with their love of classical music and art-rock.

Read The Rockhound’s full review at luckboxmagazine.com.

TRENDS

Kendall Polidori is The Rockhound, Luckbox’s resident rock critic. Follow her reviews on IG and X @rockhoundlb, TikTok @rockhoundkp

More Friko

17

Concert review on TikTok

SPRING 2024

PHOTOGRAPH: POONEH GHANA

by Ed McKinley

A Car-World Divide Enthusiasts love combustion, but EVs attract a new crowd

IIN 1963 , legendary stock car builders Holman & Moody proudly painted “410 HP” on the hood of the fearsome Ford Galaxy they campaigned on the NASCAR circuit. It took a folk hero like Glenn “Fireball” Roberts to drive it.

But these days, any reasonably well-off suburban family can wrangle a 1,020-horsepower electric Tesla Model S Plaid through stop-andgo traffic on the way to their kid’s soccer game.

It’s a vehicular revolution that’s pulling the car culture in two directions.

On the one hand, old-school enthusiasts and collectors vow they’ll never forsake their beloved gasoline-powered cars. They’ll cling

to big-block Detroit iron, seductive European exotics, precision-engineered Asian tuners or historic century-old Brass Era relics.

Meanwhile, a new breed of electric car aficionados seems to be emerging. They’re not defecting from the ranks of traditional gear heads. Most were never really enamored of internal combustion engines, but they’re bewitched by EVs’ style, quiet, smoothness, handling and mind-blowingly instantaneous acceleration.

Let’s start with what attracts enthusiasts to internal combustion engines, which car watchers now call ICE for short.

Smelly, roaring beasts

Automotive journalists who spoke with Luckbox waxed poetic over the rustic charm of ICE vehicles.

“Firing to life when you turn the key or push the start button, the rumble of an idle, the smell of octane, putting that manual shifter into gear, opening up the hood and sensing the mechanical workings—a lot of that stirs the soul of the driving enthusiast,” said Matt Avery a writer and video producer for Mecum Auctions, a company known for selling collector cars.

Automotive writer and broadcaster John McElroy couldn’t agree more. “People love that rumble and jumble of a V8 engine,” he noted. “They relish that visceral noise, vibration, harshness. It’s hard to beat the roar of an engine going to full throttle.”

Car enthusiasts become obsessed with the feedback they get from internal combustion cars, according to Daniel Pund, editor-in-chief of Road & Track magazine. He explained how serious drivers relate to what the car’s telling them.

“What has a better exhaust sound and a bet-

ter intake sound?” Pund said of the qualities enthusiasts seek. “Whose transmission shifts quicker or more firmly or is slow to react—all those things that went into building their hierarchy of performance cars.”

Enthusiasts love the controlled chaos of explosions driving pistons, and it just isn’t there with electric motors. But that’s not the only thing old-school enthusiasts find lacking in today’s electric vehicles.

A certain sameness

“What you find is the Mercedes, BMW, Porsche and Audi EVs drive more alike than their gasoline counterparts did,” Pund said. “They sound almost the same, the power delivery is almost the same and the center of gravity is almost the same because they all put batteries in the floor between the wheels.”

EVs can be so quiet you don’t even know the car’s turned on, Avery noted, comparing the driving experience to operating a kitchen appliance. “A microwave will do an admirable job,” he said, “but it’s certainly not the same experience as cooking over an open fire.”

Still, the peace, comfort, smoothness and strong acceleration that comes with an EV captures that feeling of luxury that companies like Mercedes, Rolls Royce and Bentley have sought for years to create with ICE vehicles, Pund maintained.

“Tesla has created Tesla enthusiasts,” he said, noting the company’s first CEO, Martin Eberhard, might deserve some of the credit.

But the trend doesn’t end there. “Certain very good EVs, such as Porsche Taycan or the Hyundai-Kia stuff that’s coming out now, have a way of converting people,” Pund maintained.

TRENDS DIVERSIONS

The visceral thrills of the Ford-powered Shelby Cobra can stir the soul. Of the 998 made between 1961 and 1968, 890 have survived, and they sell for an average of more than $2 million at auction. Fiberglas-bodied replicas abound.

18 LUCKBOX PHOTOGRAPH: SHUTTERSTOCK

Besides, EVs can perform admirably on the track, a trait McElroy can attest to from personal experience. He races in autocross, an event where cars are timed as they individually run a gauntlet of curves.

“Fastest cars out on the track??’ he asks rhetorically. “Tesla Model 3 dual motors with competition tires. You can’t beat them. I mean, man, are they quick.”

In autocross, you can’t beat a Tesla Model 3 with dual motors and competition tires.

He scoffs at skeptics who assume a Tesla can’t be competent in the curves because it’s a true heavyweight at more than two tons. “Let me tell you, these cars handle like they’re on rails because all that weight is very low and brings the center of gravity down,” he insists.

Acceleration? “I’ve done both Tesla’s Plaid

43 million Collector cars in the United States

16% The

$1

mode and Ludicrous mode,” McElroy said. “It’s the fastest I have ever accelerated in my life, and I’ve been in dragsters. So, there are a lot of electric enthusiasts because the power response is absolutely unmatched by an internal combustion car. The ranks of EV performance enthusiasts will grow.”

Off the track, commuters are taking to the comfort of EVs—including drivers who consider themselves ICE weekend warriors, Pund said.

“A lot of people are saying, ‘I have a Porsche Taycan EV or Mustang Mach E for my daily driver and then for my weekend car I’ll have an old, smelly, noisy, traditional enthusiast car,’” he said. “Increasingly, that’s what we’re going to see because commuting in an EV just makes a world of sense.”

So, EVs are filling niches, but does that mean they’ll become collectable?

EVs as future classics

Age isn’t the only variable in the collector car world. Rarity also factors into the equation, according to Avery, who’s seen the newest, most desirable but still difficult-to-obtain EVs sell for more than their sticker price at Mecum auctions.

But age also counts among collectors— many chase the machines they coveted but couldn’t afford when they were young. It’s an opportunity to rewrite their personal histories, Pund said.

“It has everything to do with that vehicle being tied to whatever stage of life they were in—when they first saw there was a beautiful woman in it, or the cool guy on the street had it,” he maintained. “I don’t see any reason that wouldn’t be the case with EVs.”

share of America’s 275 million cars considered collectable

Total sales at American collector car auctions in 2021

$2.2 billion

The combined value of the nation’s 43 million collector cars —HAGERTY CLASSIC CAR INSURANCE

trillion

19 SPRING 2024

These two hypercars combine internal combustion and electricity to reach speeds well over 200 mph. A Porsche 918 Spyder Weissach (top) sold for $1.6 million a few years ago at a Mecum auction, and a Ferrari S90 Stradale (bottom) earned a high bid of $800,000.

PHOTOGRAPHS: MECUM AUCTIONS

by James Melton

Iron Man Has a Steel Fetish Robert Downey Jr.’s eco-modified dream cars

TRENDS H

HOW DO YOU MAKE a dream car?

When Chris Mazzilli and his team of experts took on the challenge of transforming six vintage classics for movie star Robert Downey Jr., restoration wasn’t enough.

Mazzilli, founder of Dream Car Restorations/CMC Motors, worked with his team to make each vehicle—which included a 1969 Mercedes Benz once owned by Downey’s mother—into a cleaner-greener version of itself. The project was the basis for Downey’s Max TV series Downey’s Dream Cars.

The Downey cars are similar to projects the shop has taken on for other clients, Mazzilli said.

“We’ve done similar things—not so much for celebrities—but a lot of people these days want what they call ‘restomods.’ They have modern engines in them that run a lot more efficiently,” he noted.

But Downey took things a step farther, Mazzilli told Luckbox

“He wanted to modify not just the motors, but other things in the cars,” he said. “One of the cars has a vegan mushroom leather interior that has carpets made from recycled plastic bottles.”

Now, Downey is giving the cars away in a

Diversions

Top: 1965 Chevrolet Corvette convertible, Bottom: 1985 Chevrolet El Camino.

20 LUCKBOX

One of Downey’s cars has a vegan mushroom leather interior and carpets made from recycled plastic bottles.

sweepstakes to raise money for the FootPrint Coalition, a nonprofit organization he and his partners launched to focus on adoption of clean technologies.

DOWNEY’S

DREAM CARS

• 1969 MERCEDES BENZ 280 SE: Modifications included installing a new diesel engine, converting the fuel system to biodiesel and replacing the interior’s suede with recycled plastics.

• 1972 VW BUS: This classic became an EV. The team replaced the 1100cc aircooled engine with an EV West electric motor conversion and custom battery rack. They also added a solar-powered electric barbecue that slides out of the back of the bus.

• 1966 BUICK RIVIERA: Changes included replacing the stock 425-cubic-inch V8 engine with a modern hybrid engine and adding an air-quality sensor.

• 1972 K-10 PICKUP: Now an EV, this pickup has a custom electric motor and battery pack.

• 1965 CHEVROLET CORVETTE

CONVERTIBLE: The team replaced its 327 small-block engine with a modern electric motor and installed a mushroom-leather interior.

• 1985 CHEVROLET EL CAMINO: A new four-cylinder Chevy turbo truck engine replaced the stock engine. A solar-powered bike rack was also added.

I still love these cars. I feel like they represent something uniquely beautiful about the past. So I want to bring them into the present. Maybe even the future.

—ROBERT DOWNEY JR.

Robert Downey Jr. loves his cars. For the movie Iron Man 3, Acura built a special NSX concept car. Marvel let Downey keep the $9 million supercar.

Clockwise: 1972 VW bus, 1972 K-10 pickup, 1966 Buick Riviera and 1969 Mercedes Benz 280 SE.

More Downey

Dream Car Sweepstakes

Robert Downey Jr. loves his cars. For the movie Iron Man 3, Acura built a special NSX concept car. Marvel let Downey keep the $9 million supercar.

Clockwise: 1972 VW bus, 1972 K-10 pickup, 1966 Buick Riviera and 1969 Mercedes Benz 280 SE.

More Downey

Dream Car Sweepstakes

21 SPRING 2024

PHOTOGRAPHS: RDJ DREAM CARS AND SHUTTERSTOCK

High-Octane Body Fuel Power up on lean meat, apples, broccoli, sweet potatoes & brown rice

A CORVETTE NEEDS premium fuel and so does your body.

Sure, you can keep yourself running for a while on Pop-Tarts, Hot Pockets and Jelly Belly treats, but you’re going to feel like garbage. You’re trading the short-term sugar rush of Skittles for the long-term consequences of lethargy and sluggishness.

Your personal engines—like muscles, joints, heart, brain and lungs—will wear out more

by Jim Schultz

quickly from low-quality fuel choices. Garbage in—garbage out.

But if you fuel up with lean meats, apples, broccoli, sweet potatoes and brown rice, your body will efficiently transform those inputs into usable outputs. You’ll be healthier, perform better and just feel lighter.

It’s all in the math

A mathematical equation largely determines how much body fat you carry and how much you weigh. Many of us do everything we can to avoid this truth. But calories in and calories out governs the way your love handles spill over your jeans or how many notches you have to uncinch your belt. If you’re in a caloric surplus, you gain weight. If you’re in a caloric deficit, you lose weight. When you’re at your maintenance calories, your weight stays the same.

In theory, you could lose weight eating just Ho Hos, Cookie Crisp and Twinkies. But no one over the age of 10 thinks that’s a recipe for health, longevity and sustainability. And if

Today’s sugar rush causes tomorrow’s sluggishness

Total eclipse of the Sun

A total solar eclipse will cross North America on April 8, passing over Mexico, the United States and Canada. The phenomenon occurs when the Moon passes between the Sun and Earth, blocking the Sun’s face.

Astronomers predict half a billion people will witness the “Great North American Eclipse.” They’ll also feel the temperature dive about 10 degrees Fahrenheit, depending upon humidity and cloud cover.

Major U.S. cities with the best view along the path of the eclipse include Dallas; Little Rock, Arkansas; Indianapolis; Cleveland; Buffalo, New York; and Burlington, Vermont.

FITNESS

FETTLE &

Calendar

New York International Auto Show

Texas Solar Eclipse Festival BURNET, TEXAS 4.13 tastylive on Tour NEW YORK CITY

National Tax Day

Barrett-Jackson Collector Car Auction PALM BEACH, FLORIDA

April-June 4.1-7

4.8

4.15

4.18-20

GETTY IMAGES

PHOTOGRAPH:

22 LUCKBOX

you have any athletic aspirations whatsoever, consistently cleaner choices of fuel will boost your performance in the gym, on the track or at the pool.

Like a Mustang Mach-E

While the barriers to entry for owning an electric vehicle might seem too high because of the price or range, everybody can make better nutritional choices. The short-term sugar-high payoff from a Payday bar may seem attractive, but the long-term effect is to move you farther from your fitness goals.

Make the cleaner choice. Your future self will thank you.

Jim Schultz, Ph.D., a derivatives trader, fitness expert, owner of livefcubed.com and the daily host of From Theory to Practice on the tastylive network, was named North American Natural Bodybuilding Federation’s 2017 Novice Bodybuilding Champion. @jschultzf3

STAYING HEALTHY

• 85% Of your calories should come from nutrient-dense foods

• Below 2,300 Your daily intake of sodium in milligrams

SOURCE: U.S. Department of Health and Human Services at dietaryguidelines.gov.

Eat This, Not That

Stick to high-quality foods in appropriately sized portions and pay attention to the carbohydrates you consume. That’s the advice of nutritionists at the Harvard School of Public Health.

AVOID

2024 tastytour

The tastylive crew plans to visit cities across the U.S. and make one stop in London on the latest tastytour. Highlights will include tastylive shows like Where’s Bat? and eight free shows co-sponsored with Cboe/CME Group and scheduled to feature traders Tom Sosnoff, Pete Mulmat, Jermal Chandler, Nick Battista, Mike Butler and Katie McGarrigle. See tastylive.com/events for information.

Vehicular autonomy

Since 2017, Americans have been celebrating self-driving cars and aircraft on National Autonomous Vehicle Day. Aficionados praise the sector’s advanced engineering and welcome its business opportunities. Although the technology isn’t 100% foolproof, it continues to improve rapidly. Just think of the Waymo driverless cars used as taxis in San Francisco.

SHUTTERSTOCK EAT

TRENDS PHOTOGRAPHS:

Options Industry Conference ASHEVILLE, NORTH CAROLINA 5.10-18 The Mecum Collector Car Auction INDIANAPOLIS 5.17 NASCAR Day 5.26 Indy 500 INDIANAPOLIS 5.31 National Autonomous Vehicle Day 6.2 International Volkswagen Bus Day 6.14 National Bourbon Day

5.1

SHUTTERSTOCK

PHOTOGRAPH:

23 SPRING 2024

44

IN THIS SECTION

26 Is the EV Boom Cooling?

28 Range Worry & EV Anxiety

31 Toyota’s Bold Battery Claim

32 Ford vs. GM (Once Again)

36 The 12 Hottest New Cars

40 BYD’s Bid for Dominance

EVs: For or Against?

48 A Rare Earth Mineral Play 51 Retro Design’s Comeback

24 LUCKBOX

ILLUSTRATION

BY IAN MURRAY

THE AUTO TRADE

BY ED MCKINLEY

RANGE WORRIES AND STICKER SHOCK ARE SLOWING THE GROWTH OF EV SALES

Filled with optimism, American and European automakers were plunging headlong into electric vehicle production just a year ago. So, why are they pulling back?

“There was one component missing in the forecasts of the EV transition and that was demand,” said Steve LeVine, an automotive journalist at The Information, a digital news outlet.

Shoppers “very likely” to consider buying an EV fell to 25.6% in January, a percentage point lower than in December, according to J.D. Power, a firm known for car reliability ratings.

EV sales in North America are expected to grow this year by 25% to 30%, but that’s down from 46% last year, multiple sources agreed. It’s a big enough slowdown to pit Tesla (TSLA) against General Motors (GM) in a price war and force Ford (F) to cut back production of its F-150 Lightning EV.

Meanwhile, reports from the front lines of auto retailing shed light on why growth has slowed.

EVs GATHERING DUST

“As people come into the store to look to buy transportation, they are identifying the EVs as more expensive and less useful,” said Mickey Anderson, CEO of Baxter Auto Group, an Omaha, Nebraska-based network of 21 dealerships selling nine car brands in four states. “Far more often than not, they’re not the right choice for customers today.”

Many of his potential buyers drive long distances across the Great Plains and in the Midwest, making them skeptical of owning a vehicle that might travel only 150 miles on a charge. What’s more, the region’s bitterly cold winters challenge the capacity of car batteries.

Motorists often fear they’ll find themselves far from a charger when they need to power up. Some also object to waiting 20 minutes or so for a car to charge on a public device at the end of a dark and lonely Walmart parking lot.

Then there’s price. The average EV sticker price of $60,000 is about $10,000 more than the typical car with an internal combustion engine, or ICE, according to automotive writer and broadcaster John McElroy.

Price wasn’t a big enough factor to discourage the tech fans and status seekers who

100 MILES ONE DAY

on the amount of electricity it takes to power a home for An EV travels TRUTH —PERCH ENERGY ON EVS, AND ECOFLOW ON HOUSES LUCKBOX 26

became the early adopters of EVs, but it compels average consumers to stick with less-expensive ICE vehicles.

These days, however, the price differential is continuing to narrow and may disappear in two to three years, LeVine said. That’s when the true demand for electric vehicles will come into focus.

“If they still aren’t buying EVs, that means there’s something wrong,” he said of the near future when EVs and ICE vehicles reach price parity.

But whether they like EVs or not, consumers should choose their means of locomotion for themselves without the federal government deciding for them, Anderson maintained. In his view, free markets should prevail, not policy makers.

FREEDOM TO CHOOSE

“If carbon were cancer, we would never dream to let the federal government mandate one therapy to fight it,” he said. “This is the one drug, and 75% of that drug is made by the Chinese.”

Without intervention, the public would choose a mix of vehicles powered by a wide range of sources, including batteries, gasoline, diesel, hydrogen and biofuels, Anderson said.

Instead, the Environmental Protection Agency is easing but not abandoning emissions standards and mileage requirements that would push automakers to phase out ICE vehicles.

To comply with the regulations, manufacturers would need to ensure that by 2032 about two-thirds of the cars they produce are electric, said Nick Nigro, founder of Atlas Public Policy, a company that helps businesses and state and federal agencies track issues.

The declining cost of building EVs could

COMPETITORS.

encourage car makers to exceed the EPA standards because it would be in the best interest of their businesses, Nigro suggested.

But those standards still amount to a de facto EV mandate, and that prompted Anderson to become part of an informal alliance representing 4,000 dealerships. The ad hoc group has dispatched two letters to the Biden administration asking it to “tap the brakes” on promoting EVs.

UNREALISTIC EV GOALS?

Growing EVs’ market share from 7.6% in 2023 to 67% in nine years simply won’t work, the dealers maintained in the letters. Reaching the government’s goal of having 2.8 million public chargers by 2032, up from 170,000 today, would require building 800 every single day and in their opinion strains the imagination.

Besides, EV production can be anything but green, Anderson noted. “I’m a car dealer in Omaha, Nebraska, and even I’m aware of what’s going on in the strip mining of Malaysian rainforests to get nickel and the really irresponsible way that they’re chasing down rare earth minerals in the Congo,” he said.

Lately, attention has focused on the slow rollout of a federally funded network of EV chargers 50 miles apart along the nation’s major highways. The Bipartisan Infrastructure Law that President Biden signed in 2021 provides $7.5 billion to subsidize placing 500,000 of the chargers by 2030.

When LeVine began tracking research on EV batteries in 2010, researchers “cherished” grants in the hundreds of thousands of dollars. “If you were a researcher or a company and got a three-year grant for $2 million or $3 million, you’d take your wife out to dinner— that was an incredible amount of money,” he said of conditions 14 years ago. “And now they routinely give $100 million to one company to do something.”

The Obama administration committed $2.4 billion to building the EV battery supply

1.2 MILLION

THE NUMBER OF NEW EV s SOLD OR LEASED IN 2023

7.6% EVs’ U.S. MARKETSHARE IN 2023

— STATISTA

chain, he noted, and the government loaned Tesla $465 million to fund development of the Model S.

But green or not, EVs have been receiving government largesse for years in the form of loans, tax credits, research grants and funding for charging stations. Some might conclude it’s already too late to stand aside and allow the markets to reign.

EV buyers can qualify for a tax credit of up to $7,500 on new or used EVs, depending upon the purchaser’s income, the price of the vehicle, and where the car, battery, minerals, and other components were sourced or manufactured.

No one knows how much cash the government may eventually spend promoting EVs because it depends upon how much the public avails itself of the incentives and how businesses react to charger subsidies, LeVine said. But some observers expect a $500 billion price tag, and others warn it could easily reach $1 trillion, he notes.

Still, some consider it money well-spent.

SEIZING THE EV FUTURE

“The U.S. has to try to win the future here,” said Nigro. “We’re playing catch up, unfortunately, because we were asleep at the wheel for about four years, between 2016 and 2021. And in that time period, Europe and China passed us in terms of leadership on this issue.”

But the future need not resemble the past. The ingenuity that put America on wheels could keep it on wheels in a new era of electrification.

POTENTIAL CUSTOMERS FIND EVS MORE EXPENSIVE AND LESS USEFUL THAN GASOLINE-POWERED

27 SPRING 2024

THE AUTO TRADE

BY ED MCKINLEY

BY ED MCKINLEY

AN AUTOMOTIVE JOURNALIST ADDRESSES THE ELECTRIC-VEHICLE MARKET

JOHN MCELROY,

a print, radio, television and online journalist, serves as president of Blue Sky Productions, producer of the Autoline Daily webcast.

McElroy is a former editor at Road & Track magazine, writes monthly for Ward’s Auto World and has contributed the annual automotive entry for the Encyclopedia Britannica Yearbook.

He was gracious enough to sit down with Luckbox for a wide-ranging Q&A about the state of the electric vehicle industry and automotive world in general.

LUCKBOX 28

PHOTOGRAPH: BLUE SKY PRODUCTIONS

LUCKBOX: WHY DO EVs COST SO MUCH?

—

JOHN MCELROY: The price of EVs is too high but so far that’s been a deliberate strategy by the automakers. Batteries are still very expensive, and the market for EVs is somewhat limited. They can’t make money on EVs, but they lose a whole lot less on their expensive ones.

Besides, it’s wealthier people who have the disposable income to add an EV to their two-car or three-car garage and keep a couple of ICE (internal combustion engine) vehicles handy for when they want to travel long distances.

But in China, which is a much more mature EV market, it’s quite a different situation. In fact, just last week I drove the BYD Seagull electric car that sells for $11,000 in China. It doesn’t meet U.S. crash standards, and it has limited range. But it’s a very nice car, and it’s very comfortable. It doesn’t feel cheap. There are other Chinese electric cars under $30,000 that are also very nice. So, it can be done.

WHEN WILL WE SEE MORE MODESTLY PRICED EVs IN THE U.S.?

—

We’re not going to see inexpensive electric cars in the U.S. without any government subsidies anytime soon, and by that, I mean $25,000 or less. That’s still at least three years away in the U.S. market. And as automakers start to come out with EVs that are more reasonably priced for the mass market, you’ll see far more adoption.

In the U.S., the average EV sells for something like $60,000. The average ICE vehicle sells for about $50,000. So EVs are, rule of thumb, about 10 grand more expensive. That limits who can afford to buy them. Until we see mid-priced or lower-priced EVs, the market cannot be a whole lot bigger than it is.

MORE

CARBON IS RELEASED INTO THE ATMOSPHERE IN MAKING EVs THAN IN MAKING ICE VEHICLES. PLUS, A LOT OF THE ELECTRICITY POWERING EVs IS GENERATED BY BURNING COAL, OIL OR NATURAL GAS. ARE EVs ACTUALLY GREENER?

—

The reality is EVs are far cleaner, but they don’t come off the assembly line that way. EVs start with a much bigger carbon footprint than ICE vehicles do because the battery is very energy-intensive to manufacture.

But for every gallon of gasoline you burn, you release 19 pounds of greenhouse gases. Once an EV travels 20,000 miles, it matches the carbon footprint of an ICE vehicle to that point. After that, the EV is cleaner, and since

most cars are scrapped with 200,000 miles on them, EVs come out much, much cleaner than any ICE vehicle.

Last year, the U.S. generated more electricity with renewables than it did with coal. Coal is down to like 20% of all electric generation in the United States. But EVs are so efficient that even if you run them on electricity generated fully by coal, they’re about the same or slightly cleaner than ICE vehicles.

SO, EVs ARE GREEN. BUT ARE THERE OTHER REASONS TO BUY THEM?

—

Look, EVs offer a better driving experience for a regular everyday driver. Smoother, quieter, faster. What’s not to like about that? Acceleration? Look where you want to go, bang you’re there. It just responds so much better. There’s so little vibration compared to an ICE car.

If you drive for less than 200 miles a day,

the hassle of taking a lot longer to charge on their trip than it takes to fill up a gas tank. So, yeah, you bet range anxiety is still an issue.

LET’S SHIFT GEARS EVEN THOUGH MOST EVs HAVE SINGLE-SPEED TRANSMISSIONS. WHAT EFFECT ARE FEDERAL INCENTIVES, GRANTS, REGULATIONS AND MANDATES HAVING ON EVs?

There’s no EV mandate per se in the United States. There are emission and fuel economy standards that get to be pretty tough for an automaker to meet unless they’ve got EVs in their fleet. So, it’s sort of a de facto EV mandate.

Incentives play a big role in getting people to buy EVs, but they’re not the only determining factor. The first go-around of EV incentives capped an automaker at 200,000 unit sales. As soon as they hit that number, the $7,500 tax credit individual car buyers could claim on their taxes started to phase out. It

“[ELECTRIC VEHICLES] ARE THE KIND OF THING THAT EVENTUALLY MORE AND MORE PEOPLE WILL ADOPT, AND IT DOESN’T NEED TO BE FORCED ON PEOPLE. THE GRID’S NOT READY YET. THE GOALS THAT BIDEN HAS SET ARE UNREALISTIC.”

—REP. THOMAS MASSIE (R-KY.), WHO OWNS A TESLA

you can plug in at home and you’re going to love it. You’ll never go back. Every morning when you leave your garage, you’re leaving with a full tank. And gasoline is far more expensive than electricity, so the average person would save about $1,000 a year running on electricity instead of running on gasoline.

IS RANGE ANXIETY STILL A PROBLEM?

—

The average American drives under 40 miles a day. So, just about any electric car would easily serve their needs. But people don’t look at it that way. They dream of going over the river and through the woods to grandmother’s house on Thanksgiving, and she might live a state or two over. Here in Michigan, people talk about going up north and trailering their snowmobiles or their WaveRunners.

Americans buy cars with a dream. And it’s not just driving back and forth to work. It involves cross-country trips and vacations. They recognize an EV will not fulfill those needs, or they’re going to have to put up with

dropped to half in six months, and then in another six months it was gone altogether.

That didn’t seem to affect Tesla sales very much. Even though the incentives went away, people kept on buying them. I don’t think that was going to be the case with other manufacturers. If you yank the subsidies on GM and Ford and any of the other legacy car makers, you’d see a big hit on sales.

But look at Porsche with the Taycan. The buyers certainly don’t qualify for the $7,500 tax rebate. Still, they went out and bought those things. They bought more of them than they bought 911s [iconic Porsche sportscars]. It shows if you have the right product, you don’t need incentives.

HOW HAS THE INFLATION REDUCTION ACT AFFECTED EVs?

—

There’s a lot of talk about EVs increasing our dependence on China because China controls the supply chain for this. But because of all the money going into the U.S. EV industry, be-

29 SPRING 2024

—

cause of the Inflation Reduction Act [IRA], spectacular progress is being made in sourcing the raw materials right here in the United States or among our allies.

VEHICLE EFFICIENCY (DISTANCE COVERED FOR THE AMOUNT OF ENERGY CONSUMED)

30% : GAS-POWERED CARS

40% : HYBRIDS

50% : FORMULA 1 CARS

government’s trying to shove them down their throat. So, there’s quite a bit of opposition to EVs.

In fact, we just reported day before yesterday that the biggest rare earth mineral found in the world was in Nevada. Same with lithium. Now that there’s demand, they’re starting to find this stuff all over the place. While we will not be China-free by the end of the decade, we are going to be very early in the 2030s.

88% : ELECTRIC VEHICLES

—JOURNALIST JOHN

MCELROY

—

The IRA kicked off an investment frenzy that I call the California Gold Rush or the Oklahoma Land Rush—pick your choice. For every dollar the federal government is investing, three dollars is coming in from private investors. So, there’s a real multiplier effect. Europe is deeply worried because so much is happening here. We’re seeing progress coming far faster than most people are aware of.

THE FEDERAL GOVERNMENT IS SPENDING BILLIONS TO SUBSIDIZE

500,000 PUBLICLY AVAILABLE CHARGERS BY 2030. BUT ONLY THREE WERE OPERATING BY THE BEGINNING OF THIS YEAR. THOUGHTS?

—