LJ Hooker Newsletter and Blogs

• Letter from Principal (Brent Worthington) – Update

o Appraisal Numbers Remain Strong as Property Market Stabilises

o Sell with Confidence: Essential Steps for Selling Property

o SH1 Papakura to Drury project works & Drury Interchange update

o Community Connections – The Role of Facilities in Shaping Property Values

• Property Management (Rent Exchange)

• REINZ Property Report – 14 May 24 – (April Data)withlink

o Press Release - A subdued market amid economic challenges (Jen Baird, CEO)

o Market Snap Shote

o Annual Median Price Changes

• REINZ House Price Index Report (HPI) May 24 (April Data) withlink

• CoreLogic

o House Prices Flatten in April (withInteractiveLink)

• RealEstate.CoNZ

Our People

• Venita Attrill

• Paul Cox

• KJ Klavens

• Lina Roban

• Brent Worthington

• Debbie Harrison

•

•

•

16 May 2024

Hi

DatafromtheRealEstateInstituteofNewZealand(REINZ)indicatesamixedpictureinthe propertymarket.Whiletherehasbeenariseinsalesactivityacrossmostregions comparedtothepreviousyear,thetotalnumberofpropertiessoldinNewZealand decreasedby17.3%comparedtoMarch2024,thoughyear-on-yearsalesincreasedby 25.3%.Thissuggestsafluctuatingmarketwithseasonalvariations.

Listingshavesurgednationally,withsubstantialyear-on-yearincreasesinmostregions, notablyinWellingtonandAuckland.Thisincreaseinlistingssuggestsamorecompetitive market,givingbuyersmoreoptionstochoosefrom.However,italsoindicatesthatsellers mayfaceincreasedcompetition,potentiallyleadingtosofterpricetrends.

Expertssuggestthatthecurrentmarketfavorsbuyersduetosofterpricetrendsand increasedhousingstock.However,theycautionthateconomicfactorslikeinterestrates andjobmarketstabilitycontinuetoinfluencebuyercaution.Uncertaintiessuchas potentialchangestodebt-to-incomeratioscouldimpactthemarketoutlookinthecoming years,makingitdifficulttopredictlong-termtrendsinthehousingmarket.

TheReserveBankwillgiveafurthermonetarypolicyupdateon22Maytosetoutany changestotheOfficialCashRatewhichislikelytoremaina5.5percentuntillaterthisyear.

Additionally,thecoalitiongovernmentwillunveilitsfirstbudgeton30Maywhichcould impactthecostoflivingandthewidereconomyaswelearnwhereitsprioritieswillbe throughoutthenextyearandifitwillimpactthehousingmarket.

As always we hope you enjoy this publication.

Kind regards

Brent Brent Worthington Principal and Licensee AgentLJ Hooker Town & Country & Property Management 1/233 Great South road, Drury 0292 965 362

13May2024

As the property market continues to stabilise, homeowners are wanting to know what their property may achieve when selling in this market.

The property market has come a long way in the past year, as it continues to recover since the market slowed more than a year ago. Fast rising interest rates, increased cost of living and the unknown make the property market slow drastically. However, those concerns seem to be behind us as more activity returns to the market.

The latest figures from LJ Hooker Group reveals a notable surge in property appraisals across the country. While month-on-month activity has been relatively flat, the improvement has been drastic when compared year-onyear, showing a 39 percent increase in April 2024.

LJ Hooker Group Head of Network NZ Campbell Dunoon attributes this surge to a growing interest among property owners, fuelled by increasingly favourable market conditions.

"Homeownersareproactively seekinginsightsintothepotentialvalueof theirproperties, signallingagrowingconfidenceinthemarket'sstability," remarksDunoon.

Thissentimentechoesintheriseofnewlistings, reflectingowners' optimismandbelief inthemarket'spotential.Despitelingering uncertainties, LJHookerGroupreportsa worthy 15percentyear-on-year increaseinsales, underscoringtheresilienceandallureoftheproperty landscape.

Akey driverbehindthisbuoyancy isthesynergy betweensupply and demand.Withpropertiespricedandmarketedstrategically, sellersare witnessingthefruitionoftheirendeavours, attractinga poolofeager buyers.

Thevibrancy isevidentintheheightenedactivity observed atopenhomes andauctionsnationwide.Notably, auctionscontinuetoasserttheir dominance.

“Auctionshavecontinuedtorepresenta strong proportionof sales, with34 percentofourAprilsalesunderthehammer.Withmorebuyersreturningto themarketcompetitionisincreasingintheauctionrooms, whichis delivering resultsfor property sellers,”Dunoonsaid

However, amidstthisoptimism,loomingchangescouldbeholding property ownersback fromlistingsatthistime.

Theimpendingalterationstothebright-lineproperty rules, dueJuly 1, 2024, mark ashiftintax forresidentialpropertiesthatarenotthefamily home. Currently residential propertiesownedbetweenfivetotenyearsmay have topay acapitalgainstax.Thebright-linerulesaresettoundergoa significantreduction, limitingthetaxablewindowtojusttwo yearsof ownership.Thisimminentadjustmentcouldpotentially influencea potentialseller’stiminganddecision-makingprocesses.

"Withthischangecoming,peoplemaybehesitantaboutsellingproperty outsidethemainfamilyhomeexclusions,nowknowingbetterconditions arejustafewmonthsaway,"Dunoonsaid.

Theanticipationoffavourableconditionspost-July underscoresastrategic approachamongresidentialproperty investors.Thisregulatory shift highlightsthecomplex interplay betweenpolicy dynamicsandmarket sentiments, shaping realestatetransactions.

Conditionssurroundingtherealestate marketareexpectedtoremain stableasnotalotisexpectedtochange inthecomingmonths.

Sellingaproperty canfeellikeadauntingtask.Therearesomany variables thatmakeitchallengingtodeterminewhichpathyoushouldtake.Atthe endoftheday, every sellerwantstoselltheirproperty forthebestpricein theshortestamount oftimepossible.

Beforesettlementday arrives, thereareafewstepsyouneedtotakethat willsetyouupfora successfulsale.Althoughthejourney canbestressful, understandingtheprocessandwhatto expectshouldputyourmindat ease.

Here’sastep-by-stepguidetosetyouupforsuccesswithyournext property sale:

Understandingthecurrentmarketvalue ofyourproperty isessentialfor settingrealisticexpectationsandplanningyoursellingstrategy.Aproperty appraisalprovidesvaluableinsightsintoyourhome'sworthbasedon factorslikelocation,size, condition, andrecentsalesinthearea.

Additionally, itcanidentify any areasthatmay needimprovementto maximiseyourproperty'sappealtopotentialbuyers.

YourlocalLJHookerrealestateagentwillbeabletoprovide youwithafree property appraisal, makingitaneasy firststep.

Onceyouhaveaclearunderstandingof yourproperty'svalue, you'llbe betterequippedtomakeinformeddecisionsthroughouttheselling process.Whetheryou'reaimingtosellquicklyormaximiseyourreturnon investment, aproperty appraisallaysthegroundwork forasuccessfulsale.

Selecting the right real estate agent is crucial for a smooth and successful sale. Real estate agents with local expertise and a proven track record can offervaluableinsightsandguidancetailoredtoyourspecificmarket.

Seek recommendationsfromfriends, family, orneighbourswhohave recently soldtheirhomes, andconsiderconductinginterviewswith potentialagentsto assesstheirexperienceandapproach.

Aknowledgeableagentwillnotonly helpyounavigatethecomplexitiesof thesellingprocessbutalsoprovidevaluableadviceonpricing, marketing, andnegotiationstrategies.Consideranagentwhocommunicates effectively, understandsyourneeds, and hasastrongnetworkofpotential buyers.By choosing therightagent, youcanfeelconfidentthatyour property isingoodhands.

Choosingtheright methodofsaleisacrucialdecisionthat can significantly impacttheoutcomeofyour property sale.Popularselling methodsincludeauctions,negotiation, tenders, andexpressionsofinterest. Eachmethodhasitsadvantagesandconsiderations, dependingonfactors likemarketconditions, property type, andsellerpreferences.

Forexample, auctionscancreateasenseofurgency andcompetition amongbuyers, potentially leadingtoahighersaleprice.Ontheotherhand, negotiationsoffermoreflexibility andcontroloverthesellingprocess.Your

chosenagentcanprovideexpertguidanceonthemostsuitablemethod foryourproperty, ensuringyouachievethebestpossibleoutcome.

Settingtherightsellingpriceiscrucialforattractingpotentialbuyersand achievingasuccessfulsale.Inadynamicrealestatemarket, accurately pricingyourproperty requiresathoroughunderstandingoflocalmarket trends, recentsalesdata, andcurrentbuyerdemand.

Work closely withyourrealestateagent toconductacomprehensive marketanalysisandfigureoutacompetitiveyetrealisticsellingprice. Pricingtoohighcan deterpotentialbuyers, whilepricingtoolowmay undervalueyourproperty.By strikingtherightbalance, youcanmaximise interestandultimately securethe best possiblepriceforyourhome.

Signinganagency agreementformalisesyourrelationshipwithyour chosenrealestateagent andoutlinesthetermsofyourpartnership. Agency agreementstypicallylastforaspecifiedperiod, oftenaround90 days, duringwhichyouragentwillactively marketyourproperty and representyourinterests.

Aspartoftheagreement, you'lldiscussimportantdetailssuchas commissionrates, marketingstrategies, andopenhomeschedules.Besure toreviewtheagreementcarefully andask any questionsbeforesigning. Oncesigned, youragentwillwork diligently topromoteyour property and facilitateasuccessfulsale.

Asolidsalesplanisessentialforguiding yourproperty salefromlistingto closing.Workingclosely withyourrealestateagent, you'lldevelopa comprehensivestrategy tailoredtoyour property andmarketconditions.

Thisplanmay includestagingandpresentationtips, marketingstrategies, andnegotiationtacticsaimedatmaximisingyourproperty'sappealand value.

Your agentwilloverseethepreparation ofnecessary documents, suchas salescontractsand disclosures, andcoordinatewithlegalprofessionalsto ensurecompliancewithrelevantlawsandregulations.Havingaclear roadmap, youcanconfidently navigatethesellingprocessandachieve yourdesiredoutcome.

Sellingaproperty involvesvariousexpensesbeyondthesaleprice, soit's essentialtobudget accordingly.Sellerstypicallyincurcostssuchaslegal fees, marketingexpenses, andagentcommissions, aswellaspotential movingcosts.

Work closely withyourrealestateagent toestimatetheseexpensesand planaccordingly.By havingaclearunderstandingofyourfinancial obligationsupfront, youcanavoidany surprisesandensure asmooth transactionfromstarttofinish.

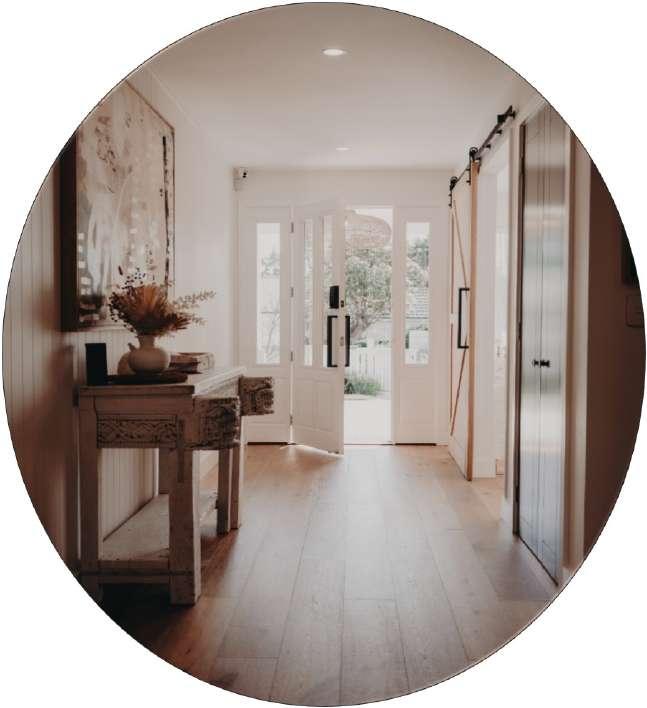

Presentingyourproperty initsbestpossiblelightisessentialforattracting potentialbuyersandmaximisingitsappeal.

Startby decluttering anddepersonalisingyourhometocreateaneutral andinvitingenvironmentthatallowsbuyerstoenvisionthemselvesliving there.

Considermakingminorrepairsandupdatestoenhancecurbappealand addressany maintenanceissues.Yourrealestateagentcanprovide valuable guidance onstagingandpresentationtechniques toshowcase yourproperty'suniquefeaturesandmaximiseitsmarketability.

Professionalstylingcantakeyour property presentationtothenextlevel, potentially increasingitsappealandvalueintheeyesofpotentialbuyers. Professionalstylistsspecialiseincreatinginvitingandaspirationalliving spacesthatresonatewithbuyers.

Whetherit'sarrangingfurniture, addingdecorativetouches, orenhancing naturallight, professionalstylistshavetheexpertisetohighlightyour property'sbestfeaturesandcreate amemorableimpression.Whilethere may beaninitialinvestmentinvolved, thepotentialreturnintermsofa highersalepriceandfastersaletimecanmakeitaworthwhileinvestment.

Effectively marketingyourproperty isessentialforreaching awide audienceofpotentialbuyersand generatinginterestinyour listing.Your realestateagentwilldevelopacomprehensivemarketingstrategy tailored toyourproperty andtargetmarket.

Thismay includeprofessionalphotography, virtualtours, andcompelling property descriptionstoshowcaseyour home'suniquefeaturesand appeal.Additionally, youragentwillleverageonlineandofflinechannels, includingrealestate websites, socialmediaplatforms, andtraditional advertisingmethods, tomaximiseexposureandattractqualifiedbuyers.

Openhomesprovidepotentialbuyerswithanopportunity to viewyour property inpersonandenvisionthemselveslivingthere.Your realestate agentwillcoordinateopenhomes, allowingprospectivebuyerstoexplore yourproperty attheirleisureandask questions.

Whileopenhomescanfeelintrusive, they'reanessentialpartoftheselling processforgauging interestandgatheringfeedback.Your agentwill managethelogisticsofopenhomesandprovideregularupdateson attendeenumbers andbuyerinterest, keepingyouinformedevery stepof theway.

Onceoffersstartcomingin, yourrealestate agentwillnegotiateonyour behalftosecurethe bestpossibleprice andtermsofsale.Whetheryou're sellingvianegotiation, auction, oranothermethod, youragentwilladvise youonthestrength ofeachofferandhelpyoumakeinformeddecisions.

Negotiatingofferscanbeacomplex process, requiringcareful considerationoffactorslikeprice, settlementterms, andcontingencies. Your agent'sexpertiseandnegotiationskillswillbeinvaluableinnavigating thesediscussionsandachievingasuccessfuloutcome.

Uponacceptingan offer, thebuyerwillprovideasecurity depositasasign oftheircommitmenttothepurchase.Thisdepositistypicallyheldina securedtrustaccountby therealestateagency untilsettlementday.

Your agentwillmakesurethatthedepositishandledby legalrequirements andcoordinatewith allpartiesinvolvedtofacilitateasmoothtransaction. By securingthedeposit, youcanproceedwithconfidenceknowingthatthe buyerisseriousaboutcompletingthepurchase.

Assettlementday approaches, you'llneedtoplantoleavethe propertyandprepareitforhandovertothenewowners Thismay involve packingupyourbelongings, arrangingformovingservices, and completingany finalcleaningormaintenancetasks.

Whilemovingcanbeahecticandemotionalprocess, stayingorganised andfocusedonthe excitementofyour nextchaptercanhelpeasethe transition.Yourrealestateagentcanprovidesupport andguidance throughoutthisperiod, ensuringaseamlessmove-outprocess.

Settlementday marksthefinalstepinthesellingprocess, whereownership oftheproperty isofficially transferredfromsellertobuyer.Yoursolicitoror conveyancerwillcoordinatewiththebuyer'srepresentative toensureall conditionsofthesalehavebeenmetandfacilitatethetransferoffunds andlegaldocuments.

Whileyouwon'tneedtobepresentforsettlement, youragentwilloversee thehandoverofkeysandany finalpaperwork, ensuringasmoothand successfultransaction.

Withsettlementcomplete, youcancelebratethesuccessfulsaleofyour property andembark onthenextchapterofyourjourney.

Level 5, AON Centre, 29 Customs StreetWest Private Bag 106602 Auckland1143 www.nzta.govt.nz

Kia ora

Themain SH1 Papakurato DruryprojectworksinandaroundDrury Interchangeareexpected to get underway later thisyear (2024). The design oftheWaihoehoeRoad Upgrade project isalsowellunderway, and construction isexpectedto begin in2025.

Wearevisitinglocal businesses in theDruryareafor the purpose ofbuilding upadatabaseofbusinesseswho wouldliketo bekept informedofany projectworks inthe areathat mayimpact on theirbusiness operations, customers orstaff. Impactsmay includetemporary trafficchanges (e.g. on GreatSouth Road, Waihoehoe Road, Bremner Road, Victoria Street etc) ornoisefrom project construction works duringthe dayornight.

We'dlovetoconnectwith you. Please phoneoremailus your contact detailsifyouwouldlike toreceive updates about oneorboth ofthese projects:

SH1 Papakurato Drury (P2D) project

Forconstruction queries, pleasecontacttheFultonHogan team on 0800 796 796.

Formoreinformation on the SH1 P2Dproject, contact usvia email atp2b@nzta.govt.nz orvisitourwebsite www.nzta.govt.nz/p2b By visiting thewebsite, you canalsosubscribe to receiveregularupdatesviaemail.

Waihoehoe Road Upgrade project

For anyqueries, pleasecontact theproject team on 0800888 947

For more information on the Waihoehoe Upgrade project, contact usviaemailat waihoehoeroad@nzta.govt.nz orvisit ourwebsitewww.nzta.govt.nz/projects/waihoehoe-road-upqrade . Byvisitingthewebsite, you canalso subscribetoreceiveupdates viaemail.

Alternatively, to registerwithusyoucan scanandfollow this QR code.

Detailsofthe upcoming Drury/SouthAucklandcommunity information day on Saturday are includedon the backpage. Come alongand meet the teams and haveyour questionsanswered.

5 May 2024

Finding a place to call home is more than moving into a house that meets your needs, it is about the community and all the facilities you have at your fingertips too. Whether it is being near a park to walk the dog, in the school zone you want your child to attend or near easy transport options, these local features hold a lot of sway when settling on a place to call home

Convenience is a cornerstone of modern living, and nowhere is this more apparent than in the property market. In bustling cities and serene suburbs alike, having essential amenities within easy reach can significantly enhance a property's appeal.

Picture a family searching for their dream home: they're not just looking for a house; they're seeking a lifestyle. This lifestyle includes the ability to pop down the road for groceries, enjoy a leisurely stroll to the nearest park, or catch public transport without hassle.

The proximity and quality of amenities can make or break a property's value. Consider two houses with similar features and prices one nestled in a neighbourhood with parks, schools, and cafes just a stone's throw away,

while the other is isolated from such conveniences. The former is likely to attract more interest and command a higher price because it offers not just a house but a lifestyle enriched by nearby facilities.

Access to quality schools is a prime example. With competition to get children into prestigious school zones, families often prioritise living in areas with reputable schools.

Beyond providing excellent learning opportunities for children, being in a good school zone can significantly impact property values. Parents are willing to pay a premium to secure a spot in these coveted catchment areas, driving up demand and prices for homes nearby.

For families, where to live is intricately linked to their children's education. Access to quality schools is a top priority for many parents. It's not just about academic excellence; it's also about the overall learning environment, extracurricular opportunities, and sense of community within the school.

Homes located in zones with renowned schools often carry a premium due to the demand from families seeking the best education for their children.

Imagine a young couple looking to start a family. As they search for their ideal home, they carefully consider the closeness to schools and the reputation of those institutions. They understand that living in a top school zone not only ensures a quality education for their children but also enhances the resale value of their property. Thus, they're willing to invest in a home that offers this advantage, knowing it will grow in value in the long run.

We’ve all heard the saying "location, location, location," and nowhere is this more evident than in the realm of dining and shopping. Whether you are at home in a vibrant city or quaint town, access to diverse culinary experiences and shops is highly prized.

Imagine living in a neighbourhood where you can stroll to the local farmers' market on weekends, savour a flat white at the corner cafe, or indulge in a gourmet meal at a nearby restaurant.

For property buyers, proximity to supermarkets, cafes, restaurants, and retail hubs is a major drawcard. It's not just about convenience; it's about lifestyle. People want to live in areas where they can easily access the essentials of daily life and indulge in leisure activities without having to travel far. As a result, properties located in bustling precincts with a mix of dining and shopping options often reach a higher price and attract a range of buyers.

Efficient public transportation is the lifeblood of any modern city or town, connecting residents to work, school, and hobbies. Urban centres are growing rapidly, meaning access to reliable public transport is increasingly important for property buyers.

Imagine commuting to work without the stress of traffic congestion, or exploring the city on weekends without worrying about parking. For many people, living near public transport hubs offers both convenience and freedom.

Properties located within walking distance of train stations, bus stops, or ferry terminals are highly sought after, particularly by commuters and urban residents. Not only does proximity to public transport make daily life easier, but it also enhances the value of a property.

Buyers recognise the benefits of being connected to the broader transport network and are willing to pay a premium for the privilege.

Kiwis love getting amongst nature, and outdoor activities are a way of life, which is why access to recreational facilities is highly valued by property buyers. Whether it's a local park with walking trails and playgrounds, a community centre with sports facilities, or a swimming pool for hot summer days, these facilities enhance the quality of life for residents and contribute to the appeal of a neighbourhood.

Imagine living in a community where you can easily access green spaces for picnics and barbecues, join a local sports team for friendly competition, or take your children to a nearby playground for outdoor fun.

These recreational opportunities not only promote physical health and wellbeing but also adopt social connections and a sense of belonging within the community. As a result, the value of properties located near such facilities can fetch a high price and attract buyers seeking an active lifestyle.

Alongside these amenities, here are some additional tips for navigating the real estate market:

Consider local dynamics: Factors like crime rates and community engagement can impact property values over time.

Research the local economy: A thriving local economy often means higher property values.

Stay informed about market trends: Keep track of median house prices, market conditions, and demand-supply dynamics.

Think about resale value: Choose locations with strong resale potential.

Get expert advice: A local real estate expert can provide valuable insights and help you make informed decisions.

Local facilities can significantly influence property sales. Whether you’re buying or selling, having access to schools, shops, and transport options can make your property more appealing and valuable. From vibrant cafes to nearby parks, these perks not only enhance your lifestyle but also attract potential buyers.

Pleasedon'thesitatetocontact ourteamwhocanablyassist youwithanyproperty managementmattersyoumay haveorifyouhaveany questionsaboutanythinginthe newsletterorproperty managementingeneral.

Whenyouknow,youknow.™ MAY 2024

Investing in real estate can be a rewarding journey, offering numerous avenues for wealth creation. Yet, managing multiple properties demands efficient strategies to navigate challenges effectively.

From tenant screening to property maintenance, successfulproperty management requires a blend of organisation and expertise. Here are some real estate investment strategies to optimise the management of your property portfolio.

Investing in real estate requires a clear understanding of your objectives. These goals may vary from maximising cash flow to enhancing property appreciation or diversifying your portfolio.

For instance, if you're aiming to maximise cash flow, setting competitive rental rates aligned with the local market is crucial. Regularly assessing and adjusting rental rates ensures your properties remain attractive to tenants and financially viable.

In today's digital age, property management software can streamline administrative tasks and enhance tenant experiences.

Investing in reliable software tailored to the New Zealand market facilitates rent collection, expense tracking, and maintenance scheduling. Automation features such as rent reminders and maintenance request management improve efficiency and tenant satisfaction.

Accurate financial management is essential for the success of your investment properties.

Implement robust accounting systems to monitor cash flow, analyse profitability, and identify areas for improvement. Regularly reviewing financial reports helps optimise financial performance and inform strategic decisions. Staying on top of income and expenses ensures compliance with tax requirements and maximises returns.

Maintaining open channels of communication with tenants is vital for fostering positive landlord-tenant relationships. Promptly addressing tenant concerns and providing updates on maintenance issues cultivates trust and satisfaction.

Offering multiple communication channels, such as phone, email, and online portals, accommodates tenant preferences and facilitates smooth interactions.

Building a network of trusted professionals in the real estate industry is invaluable. Collaborating with property managers, contractors, and financial advisors provides access to specialised expertise and support. Leveraging their knowledge streamlines operations, mitigates risks, and enhances overall property management.

Proactive maintenance is essential for preserving property value and ensuring tenant satisfaction.

Scheduling routine inspections allows you to identify maintenance issues early and address them promptly. Documenting inspection findings and

implementing necessary repairs minimises risks and enhances the longevity of your investment properties.

The real estate market is dynamic and subject to change. Staying informed about market trends, regulatory developments, and economic factors enables you to adapt your investment strategies accordingly.

Flexibility and agility in your approach to property management allow you to capitalise on opportunities and mitigate risks effectively.

Managing multipleproperties can be challenging, especially in a competitive market. Professional assistance, such as property management services, can alleviate the burden of day-to-day management tasks. Evaluating the costbenefit of outsourcing property management helps determine the most suitable approach for your portfolio.

Partnering with reputable property managers can enhanceefficiency, tenant satisfaction, and overall portfolio performance.

By implementing these strategies and practices you can navigate the complexities of managing multiple properties. Actioning all these points will allow you to optimise the performance of your investment portfolio.

The Real Estate Institute of New Zealand (REINZ) released its April 2024 data today. The data shows sales activity lifting in almost all regions compared to stormaffected April 2023, and year-on-year pricing edging up, continuing a trend seen in recent months.

REINZ Chief Executive Jen Baird says that the market is subdued, despite nationally seeing higher sales counts, properties selling more quickly, increased stock levels, and more listings, compared to a year ago. These increases are a contrast with the much lower measures seen in April 2023, following the impacts of weather events like cyclones Hale and Gabrielle, but are below the average for this time of year longer-term.

The total number of properties sold in New Zealand decreased by 17.3% compared to March 2024, from 6,721 to 5,559, and increased by 25.3% year-on-year, from 4,438 to 5,559. All but one region saw increased year-on-year sales activity, the exception being West Coast, where sales decreased by 5.3% compared with April 2023.

“ Sales activity lifted in 15 of 16 regions, compared with April 2023. Ten of those regions recorded increases of over 20%, with Marlborough (45.8%) recording the highest year-on-year lift in sales. The April 2024 sales figures reflect greater demand, after the impacts of weather events in early 2023. However, sales figures are still below long-term averages in many regions. ” says Baird.

Nationally, median Days to Sell decreased by 3 days, from 46 to 43 days, compared to a year ago. For NZ, excluding Auckland, median Days to Sell decreased by 7 days year-on-year, from 48 to 41 days. In 13 of 16 regions, median Days to Sell were lower compared with April 2023. The biggest decreases were in Tasman (down 29 days), Marlborough (down 18 days), Northland (down 17 days), and Wellington (down 11 days). In contrast, some regions recorded the highest median days to sell for several years: Auckland had the highest days to sell in the month of April since 2001, Manawatu-Whanganui since 2015, and West Coast since 2019.

The national median sale price increased by 1.3% year-onyear, from $780,000 to $790,000, and decreased by 1.3% compared with March 2024, from $800,000 to $790,000. For NZ excluding Auckland, the median price of $700,000 was the same as for April 2023; month-on-month, it decreased by 1.7%, from $712,000 to $700,000.

“The median national sale price has now increased year-onyear for the third consecutive month, and sales are picking up as well. There are vendors who will need to sell and don’t want to wait any more, and these vendors will need to set realistic

Jen Baird CEO, REINZ

expectations, both for price and the time needed to sell their property. The median price for NZ excluding Auckland hasn’t changed compared with April 2023. This may suggest that, with more properties to choose from, some buyers have less competition from other buyers, and some are more comfortable taking a stronger approach to their negotiation.”

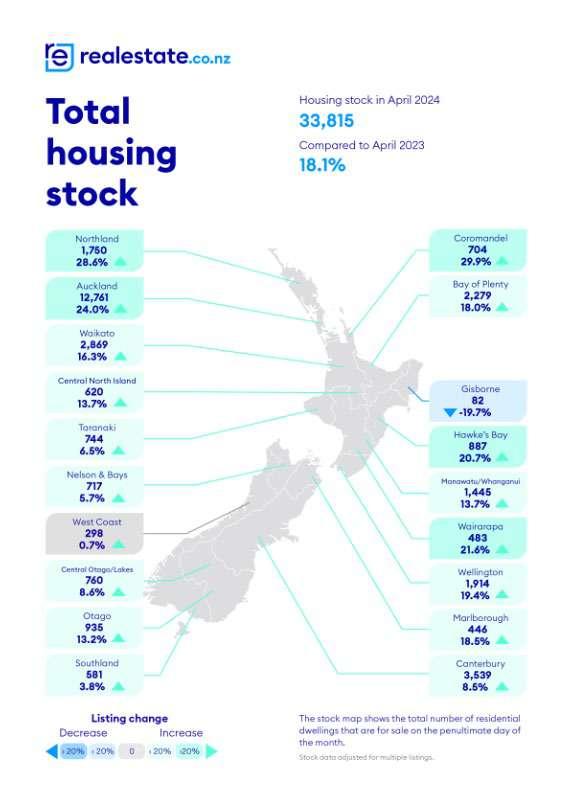

Listings nationally increased by 34.9% year-on-year from 7,142 to 9,636, continuing a trend since the start of 2024. Thirteen of 15 regions saw year-on-year increases in listings, with nine recording increases of over 25%. Wellington had the biggest increase, up by 318 listings year-on-year (69.0%), followed by Otago, up 107 (55.2%); Marlborough, up 35 (46.1%); and Auckland, up 1,034 (41.1%). National stock levels also increased year-onyear, with 18.1% more available properties for sale in April 2024.

The HPI for New Zealand stood at 3,629 in April 2024, down by 0.8% compared to the previous month and up by 2.8% for the same period last year. The average annual growth in the New Zealand HPI over the past five years has been 5.8% per annum, and it is currently 15.1% below the peak of the market reached in 2021.

While the April data shows more activity in the housing market, with year-on-year increases in sales, listings, stock levels, and median prices, it’s clear that economic factors are creating headwinds.

“Activity is picking up for the housing market as we move into autumn, with sales lifting and more choices for buyers. However, the likelihood of interest rates staying at these elevated levels for a while, and more talk of job losses, continues to lead to caution among some buyers.

“There seems to be plenty of buyer interest, with many seeing the current price levels as attractive, but some are taking their time before making a decision. Similarly, some vendors are selling now and are open to meeting the market with their pricing, while others prefer to wait. Nationally, prices are still below their peaks from a few years ago and sales are still lower than long-term averages. Although the cooler months traditionally lead to activity slowing down, demand for properties may increase as investors return to the market in response to upcoming changes to the bright line test and the reintroduction of interest deductibility on investment properties. With this in mind, buyers may want to act now,” adds Baird.

The Real Estate Institute of New Zealand (REINZ) has the latest and most accurate real estate data in New Zealand.

For more information and data on national and regional activity visit the REINZ’s website

Media contact: Laura

WilmotHead of Communications and Engagement, REINZ Mobile: 021 953 308

communications@reinz.co.nz

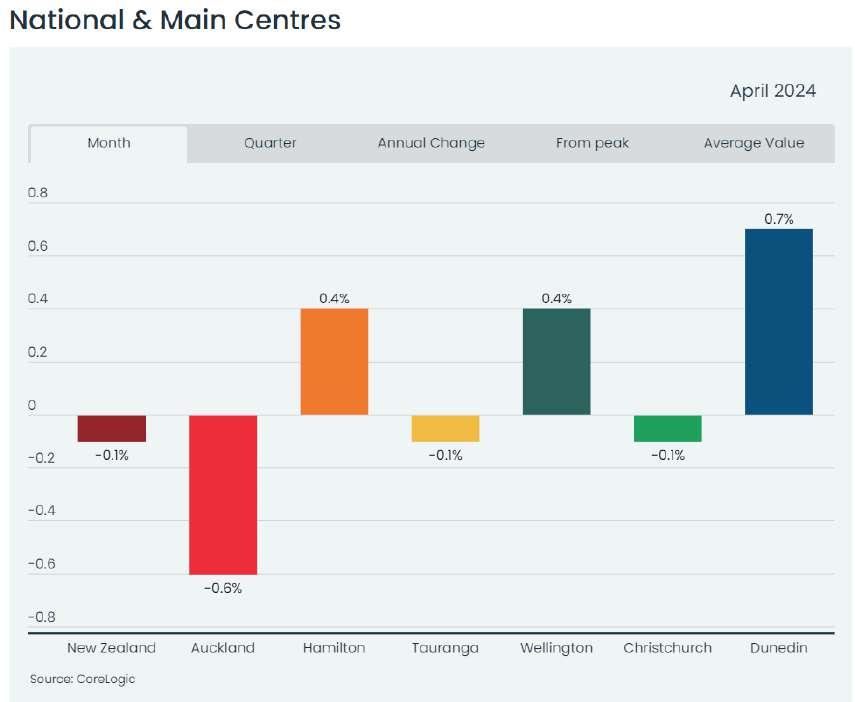

Home value growth in Aotearoa New Zealand stalled in April, with the 0.1% dip indicative of the indecisive nature of the property market at present.

CoreLogic's House Price Index edged down 0.1% in April, with the average NZ property value now $933,633, up around 3% from September's trough, but still almost 11% less than the peak.

Below the 'flat' national result, the main centres continue to show some variability. Dunedin values rose 0.7% in April, with Wellington and Hamilton seeing 0.4% growth. But Christchurch and Tauranga flattened (-0.1% apiece) and Auckland values dipped 0.6%

House Price Index

Click here for interact ive link

CoreLogic NZ Chief Property Economist, Kelvin Davidson, said the continuation of soft house price trends in April reaffirms the sense of a 'buyer's market', giving sellers reduced bargaining power.

"House prices are certainly lacking any strong momentum at present. Given the rise in total listings available on the market, as new properties come forward for sale but actual transactions remain subdued, it’s no surprise price growth has flattened off," Mr Davidson said.

"To be fair, buyers don't have it all their own way. For a start, they've got to have their finance in place first, and that's not easy with mortgage rates still hovering at around 7%. In addition, with new jobs still being filled and the unemployment rate relatively low for now, there aren't many 'forced sellers' out there at the moment either."

"Even so, elevated stock levels mean that finance-approved buyers are in the ascendency. In this environment, I'd expect house price movements to remain a bit variable from month to month, and across regions too," Mr Davidson added.

"We're also now very close to finding out what a system of capping debt to income ratios might look like in NZ, and although deposit requirements will probably ease at the same time, DTI limits are also a reason to be cautious about the housing market's outlook into 2025 as well."

Market performance was variable across Auckland in April, with Rodney the only area to see a small rise. Auckland City saw a minor decline, while Waitakere, Manukau, and Franklin recorded falls of 0.6-0.9%, and North Shore and Franklin were more than 1% down.

Over quarterly and annual horizons, the data also remains patchy across Auckland, with Rodney having seen values rise since January (2.1%) and also compared to last April (0.9%), but an area such as Papakura is now 1.9% down since January, and Auckland City for example still 5% lower than last April.

“I'd always be cautious of reading too much into the results for a single month, but the sluggishness and general variability of house prices across Auckland's sub-markets in April is probably a timely reminder of the challenges that buyers face from high mortgage rates and stretched affordability, even though they have more choice amongst the stock of listings on the market," Mr Davidson said.

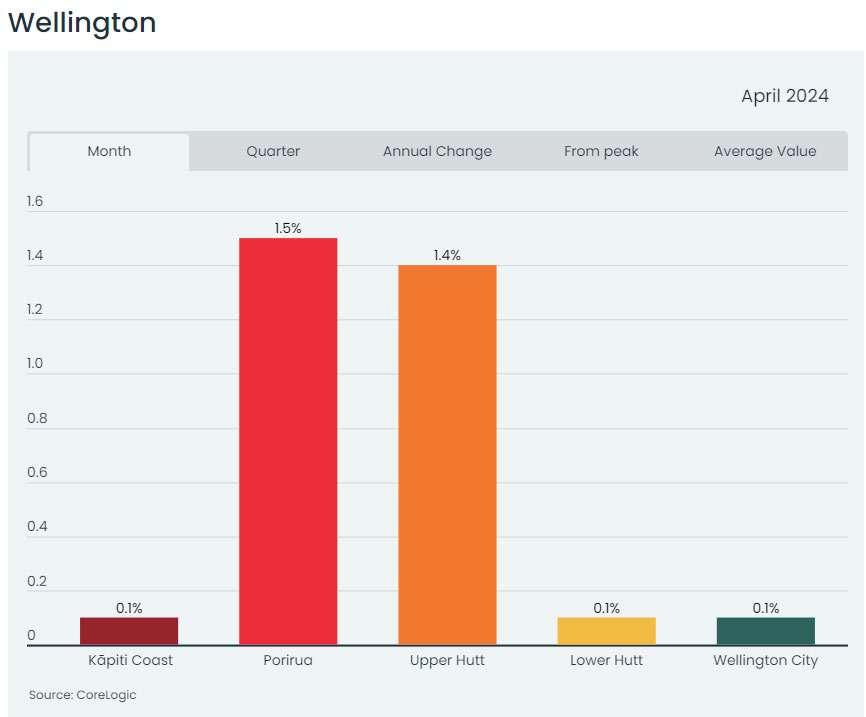

In contrast, Wellington's wider housing market slightly strengthened, although values were still relatively flat in Kapiti Coast, Lower Hutt, and Wellington City. Porirua and Upper Hutt were more buoyant, with 1.5% and 1.4% rises respectively.

Upper Hutt has shown the strongest gains over the past quarter (4.5%) and the past year too, up 5.9% since April 2023. Porirua is up 4.7% in the past 12 months, with Lower Hutt and Wellington City recording 2.1% annual growth.

"Wellington's wider housing market has generally remained on an upwards trend over the past couple of months after recording larger falls through the downturn, but there's a chance this could peter out in the near term, just like we've seen in Auckland. After all, significant public sector job cuts could well be undermining general economic and housing market confidence in Wellington," Mr Davidson said.

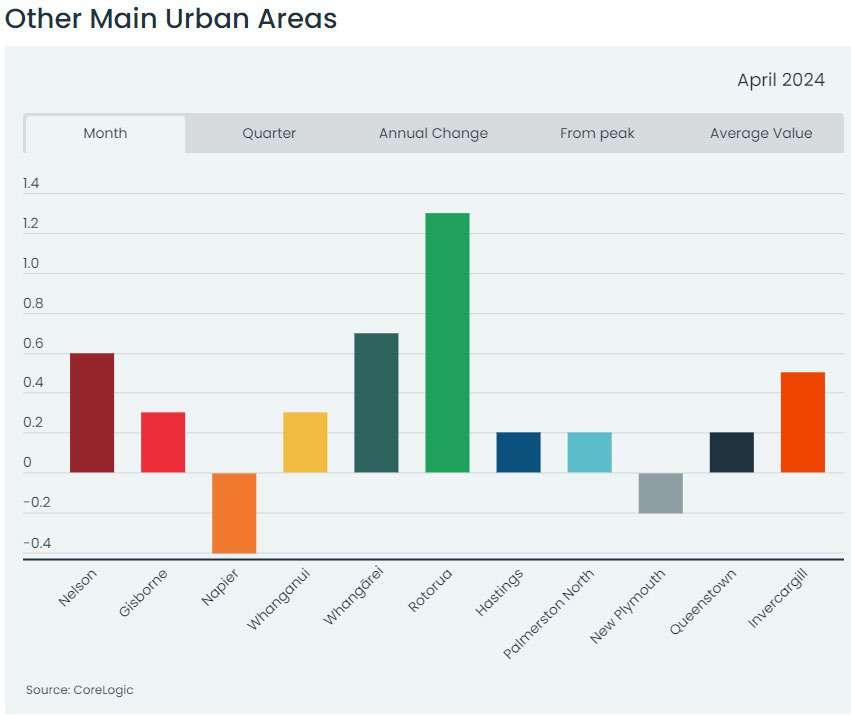

Outside the main centres, the housing market recorded mostly modest gains in April, with the exception of Napier and New Plymouth which both saw mild declines.

Rotorua was perhaps the only area that markedly stood out from the pack in April, with a 1.3% rise in average values, although Whangarei, Nelson, and Invercargill all recorded growth between 0.5-0.7% too.

"The house price results for April across many of the provincial markets just back up the headline result. That is, a market that has gone flat in the past few months, as conditions switch to favour buyers who have secured their finance."

Looking ahead, Mr Davidson said the big-picture theme of an 'underwhelming upturn' for the property market this year and possibly into 2025 remains on track.

"Our expectation is that sales volumes might rise by around 10% this year, which is decent growth in percentage terms, but it's coming off a low base. Indeed, it'd still leave activity about 15-20% below normal. House price growth could be around 5% in 2024, but certainly not uniform across the various regions.

"Clearly, inflation and the Reserve Bank's plans for the official cash rate remain hugely influential for housing market performance in the coming months, with significant mortgage rate falls potentially a story for 2025 not 2024," Mr Davidson added.

"One group that could continue to see good opportunities will be first home buyers. Of course, it's never easy to get that first property. But with other groups, such as mortgaged investors, still just watching and waiting to some degree, the recent strength for FHBs' market share in an environment where prices have flattened might remain a feature for much of the year."

Increasing costs of living, high interest rates, and recessionary pressures all impacted the New Zealand property market in April.

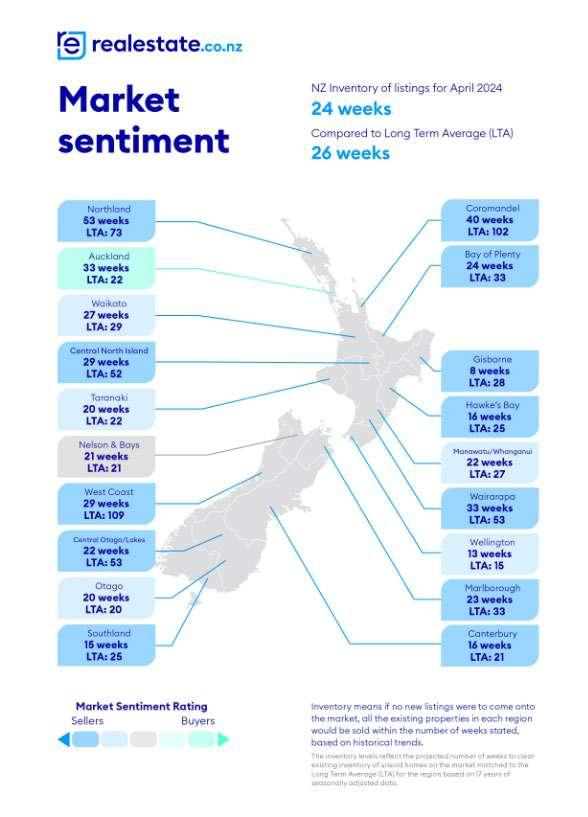

New data from realestate.co.nz indicates a nationwide downturn in property demand, a trend that extends across most regions.

• National average asking price virtually unchanged for over a year

• Central Otago/Lakes District and West Coast defy national trends

• Southland takes the title of the most cost-effective region

Demand in this context is measured by searches and engagements per listing, which are reliable gauges of buyer interest relative to available properties. Nationally, searches per listing were down 10.4%, and engagements per listing decreased by 7.5% year-on-year. On a regional level, searches per listing were down or static in 13 of our 19 regions, and engagements per listing decreased in 11.

SarahWood,CEO ofrealestate.co.nz,notes:

“Thisindicatesacoolingofbuyerinterestamideconomic uncertainty.Itisasignificantshiftas mostregionshave experiencedyear-on-yeardemandgrowthduring2024untilnow.”

Shenotesthateconomicreportsshowthatconsumer confidencewasdownduringAprilandthat decliningdemandfor propertyalsoreflectsthis:

“Inresponsetotherecession,buyersareunderstandablycautious,” addsWood.

Roughly59%ofNewZealand’sexistingmortgages(by value)are up forrenewalwithinthenext12months.“Thosewhofixedtwoyears agomightsoonmovefrominterestratesof around3.0%toaround 7.0%.Thisislikelypullingliquidityfromthemarket anddampening demand,”saysWood.

Contributingtothiswaningdemand,stocklevelswerenotablyhigh lastmonth–echoingfiguresfrom2015.Up18.1%onApril2023,there were33,815totalhomesavailableforsale.

Newlistingswerealsoupnationallyby34.9%year-on-year. However,asthisfollowsanunusuallylowperiodinApril2023dueto weatherevents,thesenewlistinglevelsareareturn tonormalcy ratherthananindicationofaboom.

National average asking price virtually unchanged for over a year

Since January 2023, the national average asking price has remained stable. At $868,877, it is down a marginal 0.6% on April last year and down 1.8% month-on-month.

Wood notes that the national average asking price has remained below $900,000 since December 2022, a significant decrease from the market peak in January 2022 when it exceeded $1 million.

Overall, average asking prices were relatively stable during April, with 12 of 19 regions recording a year-on-year change of less than 5.0% up or down.

“As we move into the winter months, we typically see a cooling market, and in 2024, this is combined with a softening economy. It will be interesting to see how these factors play out for the property market in the coming months,” says Wood.

Bucking the trend in average asking prices was Central Otago/Lakes District and West Coast, which saw year-on-year increases of 17.0% and 21.6%, respectively, albeit at different ends of the price spectrum. Properties in Taranaki also saw a lift in asking price, up 7.2% compared to last year.

Your property market experience, of course, depends on where you are in the country. Wood explains that we often see significant variation between regions depending on their regional ‘microclimate’ and where they are in the property market cycle.

This was particularly true for Central Otago/Lakes District and West Coast, where markets remained buoyant during April. Both regions bucked the national trend with year-on-year growth to average asking prices and decreases in new listings.

"While Central Otago/Lakes District boasts the highest average asking prices in the country, the West Coast remains one of the most cost-effective regions in New Zealand, with more than a $1.1 million difference in average asking prices between these two regions."

"This stark contrast highlights the importance of seeking expert advice from your local agent when buying or selling, as no two regions are the same," explains Wood.

Central Otago/Lakes District saw new listings drop by 7.3% compared to April 2023. The region also reported a month-onmonth increase in demand, with searches per listing up 9.4% and engagements per listing up 3.5%. International views on listings in the region also increased by 18.6% year-on-year in Central Otago/Lakes District, suggesting that this remains a desirable spot for property seekers further afield. 31% of international views for this region are from property seekers based in Australia. Sitting just shy of $1.6 million, Central Otago/Lakes District also saw average asking prices increase by 17.0% year-on-year and 5.4% month-on-month.

WestCoast,asmallmarket,sawjust52newlistingshitthemarket inApril;down7.1%comparedto2023.Atthesametime,searches perlisting(anindicatorofdemand)climbed6.8%comparedto 2023.Theaverageaskingpriceintheregionalsorose to$538,752 duringApril.Thisis thefirsttimesinceJune2018that average askingpricesontheWestCoasthavebeenhigher than Southland's. Southlandnowhasthelowestaverageaskingpricein NewZealandof$534,493.

Despitethecurrenteconomicsqueeze,buyersandsellerscanstill findvaluableopportunities.Central Otago/LakesDistrictandWest Coastshowthatthereisnotonlysomethingforeverypricepoint butthat it’snotall doomandgloomforsellersduringaneconomic downturn.

Inthesechallengingtimes,buyersandsellersmuststayinformed andproactive.Leveragingexpert advicecanunlockpotential opportunities,” emphasisesWood.

Formediaenquiries,pleasecontact:

LizStudholme|liz@realestate.co.nz

Input to your Strategy for Adapting to Challenges

Feel free to pass on to friends and clients wanting independent economic commentary

ISSN: 2703-2825

Sign up for free at www.tonyalexander.nz

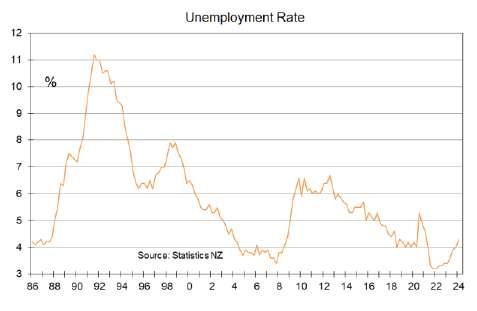

The main data focus this week for those of us examining the state of and prospects for the New Zealand economy was the set of labour market data released by Statistics NZ yesterday. There had been universal expectations of a rise in the unemployment rate from 4.0% in the December quarter and this was the case with a rate of 4.3% recorded for the March quarter.

This takes the rate back to where it was early in 2021 but is still below the 5.3% recorded mid2020. Just before the pandemic the unemployment rate was 4.0% and over the past three decades the rate has averaged 5.3%. So in

2 May 2024

an historical sense 4.3% is not bad. But the trend is up.

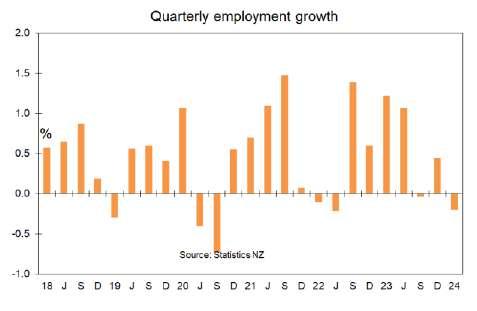

The rise in the unemployment rate to 4.3% came about as the labour force grew 0.1% but the number of people in work fell 0.2%. This 0.2% decline followed 0.4% growth in the December quarter and no growth in the September quarter. It seems okay to say that job growth in the New Zealand economy stopped in the middle of 2023.

Why has the labour market weakened? Because monetary policy was belatedly and aggressively tightened over 2021-23 as the Reserve Bank

fought 7.3% inflation created by the excessively loose financial conditions they created during the pandemic. Their management during that time in hindsight can be considered a failure but unfortunately the price of their poor decisions is borne not by anyone at the RBNZ but by householders with debt and especially those who bought a property late in 2021.

At least exporters this time around have been spared the horror which tended to be inflicted on them in past policy tightening periods. But that is only because interest rates have also been raised sharply in other economies in response to their own pandemic policy failures. This however unfortunately means that more of the burden of fighting inflation this cycle has to fall on the household sector.

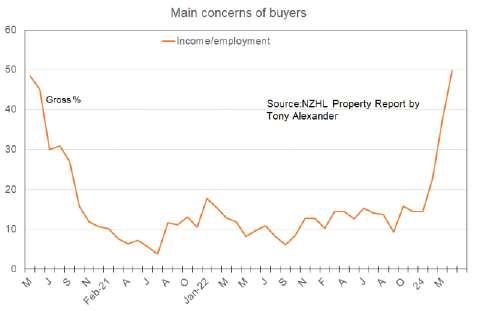

I can tell from my monthly surveys that people are highly and increasingly aware of the weak state of the labour market. For instance, my monthly survey of real estate agents sponsored by NZHL shows that whereas in January only 14% of

agents said buyers were worried about their employment, now a record 50% say that.

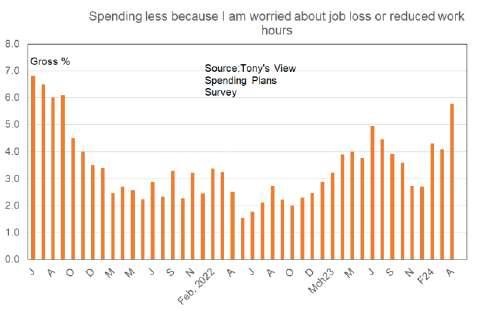

And from my monthly Spending Plans Survey the proportion of people saying they are cutting back spendingbecauseofjobworrieshasrisento5.8% from 2.7% at the start of the year.

We can see that there is labour market weakness underway, and we know this is an important

conduit for tight monetary policy to reduce inflation. It does so by making people scared of spending or unable to spend because they have lost their income, and by suppressing wages growth.

So, is wages growth slowing down at a pace which will please the Reserve Bank? Let’s see.

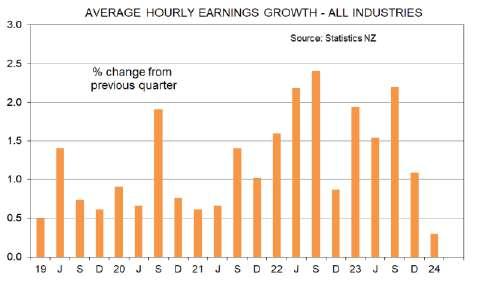

Average hourly ordinary time earnings grew by 0.3% in the March quarter after rising 1.1% in the December quarter, 2.2% in the September quarter, and 1.9% in the March quarter of 2023.

In fact, in March quarter 2022 the rise was 1.6%, 2021 0.6%, 2020 0.9%, 2019 0.5%, and 2018 0.7%.Thelatestquarterlyriseisthe lowestforthis quartersince2015.Thisisapositivedevelopment with implications for inflation and monetary policy.

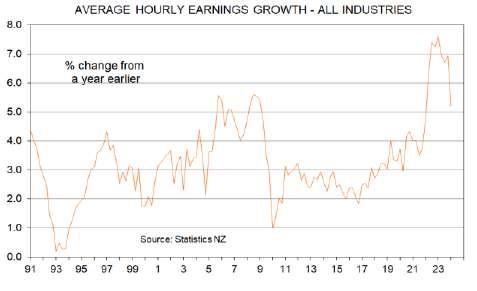

The annual rate of wages growth has fallen to 5.2%from6.9%last quarterand7.6%a year ago. This is still well above the average rate of growth consistent with inflation averaging just above 2% of about 3.3%. But the direction of travel is clear.

There is now no jobs growth in the New Zealand economy and wages growth is slowing. Monetary policy is definitely working and there is just one element needing to fall into place to allow the Reserve Bank to start cutting interest rates. Businesses need to cut back on their price rise plans. Unfortunately that has yet to happen and that means no cut in the official cash rate until late this year at the earliest. In case you missed it

On Monday I released results of my latest monthly survey of residential property investors undertaken with Crockers Property Management. Key points include these.

•The net buying intentions of existing investors remain weak despite easing worries about interest rates and removal of unfavourable tax rule changes.

•Investors’ concerns about prices falling have grown while worries remain highly elevated about council rates, insurance premiums, and maintenance costs.

•For the investors who are thinking about buying there continues to be declining interest in either buying a new property or undertaking a development oneself. Implications for building firms seem reasonably clear.

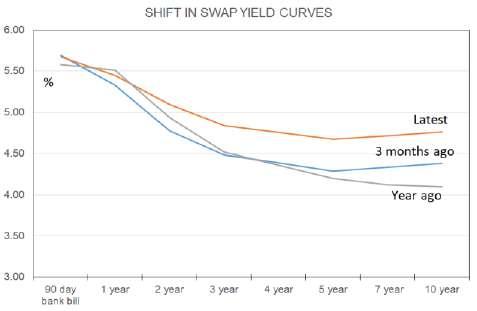

There have been only minor falls in wholesale interest rates this week despite a lot of local data coming out. Business pricing plans remain too high and that wipes out the implications of the slightly weaker than expected labour market data. Offshore the common expectation remains of one easing by the Fed. this year with some happiness overnight that the officials batted back suggestions that they might be thinking about raising rates further.

The world is stuck in a position of downward movements in inflation rates seeming to have stalled too far above 2% inflation targets for monetary policies to be eased.

If I were borrowing at the moment I would take a mix of 6 and 12 month fixed rates and expect to make a similar decision in 6-12 months time.

Nothing I write here or anywhere else in this publication is intended to be personal advice. You should discuss your financing options with a professional.

Winteriscomingandtheeconomicoutlookisgrim.

Kiwis have cut back on spending as job fears mount. This has had an impact on house price growth. Artwork / Beth Walsh

ANALYSIS:Itdoesn’tlooklikethiswinterisgoingtobeaparticularlygoodone formanypeopleandfortheeconomyoverall.MylatestmonthlySpending PlansSurveyhasthisweekrecordedadeteriorationintheproportionofthe555 respondentsexpectingtobuymorestuffinthenext3-6monthstoanet36% negative.

Thatis,36%moreoftherespondentsplantocuttheirspendingthanplanto increaseit.Thisisadeteriorationfrom-30%atthestartofApriland-13%in December.TheaveragereadingforthefouryearsI’vebeenrunningthissurvey is-4%solookingattheselatestnumbersonewouldhavetosayprospectsfor theretailsectorarefairlybad.

Infact,anet16%ofpeopleplanspendinglessonmotorvehicles,anet44% plancuttingspendingoneatingout,andanet27%planbuyingfewer householdappliancesanditemsoffurniture.Theonlytwoareaswhereweplan spendingmorearegroceries–logicallybecausetheycostmore–and internationaltravel.

• Entry-level homes in Auckland $200,000 cheaper - 'sellers want to make deals

• Tony Alexander: Making households suffer is only a means to an end, not the nasty goal itself

• Kiwibank chief economist: Impact of Reserve Bank's 'savage' interest rate rises worse than we thought

A net 4% of us still plan going overseas despite feeling very depressed about the economy and our jobs. Such is what happens after a pandemic when we could not travel offshore for a couple of years. We are still engaging in revenge travel.

Regarding jobs I can get some good insight from the monthly survey of real estate agents which I run with NZHL. I ask agents a variety of questions including what they are seeing buyers express greatest concerns about. On average, since early 2020, 16% of agents have said that buyers are worried about their income.

In January that reading was 14%. Now it is a record 50%. This neatly and clearly shows us the key thing which has changed in our economy since the start of the year – employment confidence and job security. People are fearful of losing their jobs or not securing a new one. It will be interesting to see in the coming year how this affects employee demands to work from home and tolerance of employer requests to get back in the office.

The new high level of concern about job loss helps explain why a net 37% of agents have just reported in the survey that they are seeing reduced numbers of people attending open homes. In January a net 57% said they were seeing more people. The turnaround is quite stark, and it is perhaps no surprise that FOMO – fear of missing out – is now almost completely gone.

Only 3% of agents now say that they can see buyers expressing concern about missing out on a property. This proportion in January was 23% and in September 40%. In contrast the proportion of agents saying buyers are worried about a lack of listings has fallen to a record low of 4% from 25% in January and 55% in September. Buyers have plenty of properties to choose from.

The upturn in New Zealand’s residential real estate market which occurred in the middle of last year plateaued late in the year and now things are going slightly in reverse. When will they improve again? Not until interest rates fall. When might mortgage rates fall by enough (1%) to cause renewed upward movement?

I’d say by the end of the March quarter next year. When that happens focus is likely to turn to the rapid decline in house building despite strong population growth and rules less negatively impacting investors.

But between now and then things are going to look very weak across housing and many other sectors in the economy. As the now common mantra in the business sector goes – “survive to ‘25”.

- Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz

9 GreenhavenAvenue, Opaheke NZ

§3 bl �2

Entry Level Buyingin Opaheke

First home buyers and investors; what an amazing opportunity to purchase and own a property in the s...

16th, May 2024

153 Elliot Street, Pahurehure NZ

§3 bl �1

King OfThe Castle

Built in an era when craftsmanship was valued this elevated 140m2 solid brick and tile family home w...

ForSale $679,000

View Sunday May 19th, 01: 00PM - 0l: 45PM

Steve Reilly021930352 steve.reilly@ljhooker.co.nz

20B ReidyPlace, Pukekohe NZ

§4 b2 �2

Brand new and priced tosell

Introducing a brand-new 4-bedroom haven that seamlessly combines style, functionality, and comfort.

ForSale Price onApplication View By Appointment

Paula Cox 021396 977 paula.cox@ljhooker.co.nz

22 Old Wairoa Road, Papakura NZ

§3 bl �1

YourVery Own Club Med

Enjoy fabulous resort style living at this striking3 double bedroom warm and inviting home. An abun...

ForSale Fixed Price $999,000

View Sunday May 19th, 0l:30PM - 02:30PM VenitaAttrill 021 286 7792 venita.attrill@ljhooker.co.nz

ForSale Price onApplication View By Appointment Paula Cox 021396 977 paula.cox@ljhooker.co.nz

Brandnewandpricedtosell

Introducingabrand-new4-bedroomhaventhat seamlesslycombinesstyle,functionality,andcomfort. Thismodernresidence,adornedwithalowmaintenancebrickandtileexterior,invitesyouto experiencecontemporarylivingatitsfinest.

Agorgeouskitchenfeaturingamplebenchspace, perfectforcreatingculinarydelightsandhosting gatherings.

thispropertyoffersaharmoniousblendofeasycare livingandaccessibilitysodon'tmisstheopportunityto makethisyournewhome.

Please contact Brent directly for more information andfor a copy of the Comprehensive Property Reportor click here to view on website.

•8.4731 ha (more or less)

•8 Bay Milking shed -130sqm (Approx)

•Chicken shed – 200 sqm (Approx)

•Haybarn - Machinery storage

2nd Chicken Shed – 680sqm (Approx)

•Water Bore

Also available is the neighbouring property at 150 Sutton Road.

Zoned Future Urban!

*Increasingly more difficult to find blocks of this size and zoning around in the heart of Papatoetoe

*Site is held in two Records of Title located adjacent to the corner of Coronation and Shirley Roads..

*Under the Auckland Council Auckland Unitary Plan (AUP)statesthat:

"The zone provides for a wide range of activities including commercial, leisure, residential, tourist, cultural, community and civic services, providing a focus for commercial activities and growth."

*Land 3662m² (m.o.)

*The six existing tenants currently return $138,581.00 per annum plus GST and outgoings.

Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land holding of this size and zoning is unlikely.

Currently consented for a 7 Lot residential subdivision, the property is also subject to Auckland Council's Plan Change 78Intensification proposed 18/08/2022. Possibly greater development opportunities!

8/10 Fathom Place, Te Atatu Peninsula NZ

§1 bl �-

SMART TOWNHOUSE - Stunning complex

Located on Fathom Place in TeAtatu Peninsula, this Townhouse is in an area spoilt for choice of Res...

For Sale $635,000 View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

216 Rosebank Road, Avondale South NZ

§1 bl �-

TOWNHOUSES - Modern & Affordable

Located on Rosebank Road, these Townhouses are within walking distance to Eastdale Reserve, Rosebank...

C 26-51/49 Te Kanawa Crescent, Henderson NZ §2 bl �-

ATTRACTIVE ELEGANT TOWNHOUSE

This Townhouse is one of 28 homes in a complex or two or three storey brand new quality, crafted, s...

For Sale $675,000 View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Unit C/23Awaroa Road, Sunnyvale NZ §2 bl �1

Stunning Functional Townhouse

Perfectly positioned for access to trains, buses and motorway connections this Townhouse, at an affo...

For Sale $815,000 View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $740,000 View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Unit 1/200 Carrington Road, Mount Albert NZ §3 b2 �-

ultra Modern Living in MountAlbert

In the Premium suburb of Mount Albert this development features two and three bedroom townhouses.

Unit 7/200 Carrington Road, Mt Albert NZ §2 b2 �1

Welcome to Convenient Living

In the Premium suburb of Mount Albert this development features two and three bedroom townhouses.

For Sale $1,050,000 View ByAppointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $1,290,000 View ByAppointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Town & Country

ASampleofVariousTownHouses&Apartments. FormoreoptionscontactBrenton02922965362

Unit D/200 Carrington Road, Mt Albert NZ

§2 b2 �-

Modern Living in Premium Suburb In the Premium suburb of MountAlbert this development features two and three bedroom townhouses.

For Sale $945,000 View ByAppointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

16th, May 2024

91 Beatty Road, Pukekohe NZ

§8 b7 �

uNuM1TED POTENTIAL

On the market for the first time in 43 years. The 630m2 dwelling is set on a 2,379m2 site (more or I...

35 Briody Terrace, Stonefields NZ §4 bl �4

STAND ALONE IN STONEFIELDS

Set on a 372m2 site (more or less) this 243m2 Fletcher designed and built dwelling will definitely i...

Sold

Brent Worthington brent.worthington@ljhooker.co.nz

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

102 Mountain Road,Mangere Bridge NZ §2 bl �1

LOCATION - LOCATION - LOCATION CONJUNCTIONALS ARE WELCOME.

On the market for the first time ever, this offering is p...

3 Paparata Road, Bombay NZ §4 b2 �8

MOTIVATED VENDOR MOVING SOUTH

*4 Double bedrooms.

* Master with ensuite.

* Impeccably cared for and presented. < ...

151 Barrack Road,Mount Wellington NZ §4 bl �6

UNIQUE INVESTMENT withHUGE POTENTIAL

Located in the geographical centre of metropolitan Auckland, this property is all about potential. D...

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

17 Fairdale Avenue, Red Hill NZ §3 bl �2

Renovate, and Reap the Rewards Lots to do; and lots on offer.

Zoned "residential-mixed housing suburban" this is

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Sold Lina Roban 021 022 88521 lina.rob@ljhooker.co.nz

Sold UNDER THE HAMMER Steve Reilly 021930352 steve.reilly@ljhooker.co.nz

Town&Country

0212867792

venita.attrill@ljhooker.co.nz

MeetVenita-YourTrustedRealEstateExpertSince1996!

With an impressive career spanning over two decades, Venita began her journey in Real Estate sales in 1996 with the esteemed LJ Hooker/Harveys Group. Throughout her tenure, Venita has been recognized with numerous national awards, a testament to her unwavering dedication to her clients. In fact, approximately 90% of Venita's sales are derived from her past clients and client referrals, showcasing the exceptional level of trustandsatisfactionsheconsistentlydelivers.

Selecting the right agent is crucial, and there is no better way to make that decision than by evaluating their success and the manner in which they achieve it. Venita's vast clientele, who repeatedly seek her services, skill, and advice, stand as a true testamenttoherabilitytoexceedexpectations.

While Venita boasts extensive experience and a track record of success, she remains driven and committed to going above and beyond to achieve a premium outcome for every client. Her dedication to continuous improvement ensures that she remainsat theforefrontoftheindustry,offeringyouunparalleledserviceandexpertise.

When you choose Venita as your agent, you can rest assured that you have a trusted partner by your side, who will tirelessly work to secure the best possible results for you. With Venita, your real estate journey is in safe hands, backed by a legacy of excellenceandarelentlesspursuitofsuccess.

Contact Venita today and experience firsthand the difference a seasoned and determinedprofessionalcanmakeinyourrealestateendeavours.

021396977

paula.cox@ljhooker.co.nz

Step into the world of real estate with Paula, an agent who exudes passion and dedication.Withacareerspanningtwodecades,thisseasonedprofessionalhasbeen enamored with every aspect of the industry since 2003. From the moment a property islistedtotheexhilaratingexchangeofkeysonsettlementday,herenthusiasmnever wavers.

WhatsetsPaulaapartisthedeepsenseofprivilegeshefeelswhenentrustedwiththe sale of a property. The responsibility bestowed upon her is not taken lightly, and she approaches each opportunity with humility and gratitude. Over the years, this commitment has not only resulted in successful transactions but has also forged lastingconnectionswithclients,transformingthemintolifelongfriends.

Trustinanagentwhocherisheseverymilestone,wherethesatisfactionofbothbuyers andsellersistheultimatetestamenttoherexceptionalservice.

knut.klavenes@ljhooker.co.nz

Realising he wasn't fixated in winning the game of life based on what college and conventional wisdom taught him, KJ focused less on the security aspect of jobs and focused more on helping people in their success on selling to earn his way.

Not only was he scoped out by the high ends of a Real estate Agent in New Zealand to start out by a mere first sentence upon meeting, he's also been building his empire under the mentorship of the top 10 of New Zealand!

After achieving levels of income, impact and personal freedom he could've only dreamt of as a child, KJ, on top of all his multi 6-8 figure clients, has dedicated his ambitions towards helping people achieve the best prices they can in their own circumstances provided!

Will you be next?

02102288521

lina.roban@ljhooker.co.nz

Prior to entering the world of real estate, driven by her love of meeting and helping people, Lina had an impressive 20 year career in sales and marketing roles in the telecommunications and corporate marketing industries where her expertise in communication and negotiation always resulted in the delivery of superior customer service to her clients.

Originally from Fiji, Lina epitomises energy, passion integrity and hard work in everything she turns her hand to.

When not delivering superior service to her clients, Lina loves spending time with her family and is a passionate cyclist, owning both road and mountain bikes. With her three children all having "flown the coop", Lina and her husband also have plenty of time to enjoy their love of travel and some of their more memorable adventures include extensive journeys throughout South East Asia, the USA and the South Pacific.

BrentWorthington

Brent.worthington@ljhooker.co.nz

There’s not much Brent doesn’t know when it comes to selling real estate. This town and country agent has had a successful career in the property market and is now the proud owner of his own business. Definitely a quality over quantity man, when you bring Brent on board, you’ll find that accumulating listings is far less important to him than making each one as good as it can get. He prides himself on telling it like it isknowing you’ll be able to make better decisions with a person and information you can trust.

Complementing Brent’s practical and credible approach is a background full to the brim of industry knowledge and business expertise from 30 years working within the construction industry. His capabilities have been well proven as a highly successful business owner.

A family man, with a proven track record of success, Brent has earned an excellent reputation and the trust of his local community and business colleagues.

He places huge emphasis on customer satisfaction, attention to detail and conducting his business with a genuine duty of care. Brent has gained many awards as a business leader during his 12-year tenure in Real Estate.

His entrepreneurial style ensures he reaches out and connects people with like minds. He imparts his wisdom in a warm and friendly manner and helps people to make wise and right decisions before investing in the property market, Auckland wide.

If you are considering a lifestyle change, investing for your future or simply wanting to know the worth of your property in this fluctuating market, feel welcome to call or email Brent to receive the latest updates on the trends and statistics in your area.

021302864

debbie.harrison@ljhooker.co.nz

With a passion and a commitment to providing exceptional service, Debbie has a fantastic attitude of getting things done and ensuring that the clients are happy and well cared for. She takes great pride in her work and goes above and beyond to ensure the satisfaction of both property owners and tenants.

Debbie’s attention to detail and organizational abilities are exceptional, enabling her to efficiently handle all aspects of property management, from tenancy agreements, rent collection to property inspections and maintenance coordination.

Debbie understands that property management requires a compassionate and empathetic approach, and she always strives to create a positive and harmonious living environment for tenants while protecting the interests of property owners.

Whether you are a property owner seeking professional management services or a tenant searching for a well-maintained rental property, Debbie is committed to delivering exceptional results and ensuring a smooth and rewarding experience for all parties involved.

With her excellent communication skills, strong work ethic and dedication to excellence, Debbie Harrison is a true asset to LJ Hooker, Drury.

Johnny is proud to be a part of the team at Apollo Auctions NZ. Entering real estate in 2014, he has developed and honed his craft of auctioneering and negotiating skills to a level that now sees him as an industry leader. Johnny has worked and collaborated with some of the most notable agents, business owners and auctioneers across New Zealand.

With the fusion of his knowledge and skill together with his personable approach, Johnny creates the ultimate auction experience . He implements drive and dedication to each and every property that he calls - regardless of value, location or personal circumstances. Johnny’s performance style and welcoming nature allows him to capture the audience and motivate buyers. He will guide you through the process and create a solid platform to achieve the best possible outcome for your auction.

Johnny also has a passion for acting. With a Bachelor of Performing and Screen Arts, he has appeared in several TV commercials and films, his most widely recognized being ‘Falling Inn Love’, an American Netflix production which was filmed in New Zealand. He has also worked with the Auckland Theatre Company on a number of occasions.

He currently resides in Beachlands with his wife and two young children.

WinnerApolloAuction

Invitational2017&2018

FinalistApolloAuction

Invitational2018

FinalistHarcourts

NewZealandAuctioneer oftheYear2011,2018&2019

Runner-upREINZNationalAuction Competition2010&2019

FinalistREINZNationalAuctionCompetition2010,2011,2012, 2013,20162018

WinnerHarcourtsNewZealandAuctioneeroftheYear2010, 2014&2017

WinneroftheAustralasianCompetition2011&2015

FinalistAustralasianCompetition2010

Runner-upREINZNationalAuctionCompetition2020

It’s rare in life that we get something for nothing with no strings attached, especially if it genuinely adds value. Nevertheless, that’s precisely I will give you. Expert home loan advice which has reliably proven to offer significant long-term financial advantage. I keep strict tabs on the country’s largest network of banks plus numerous smaller and second-tier lenders, so you don’t have to. What’s more, this comes at no cost to you because your chosen bank pays for the privilege. You have nothing to lose, yet have a higher chance of securing better terms. Rest assured - if there’s a superior deal out there for you, I’ll find it.

In the typically stoical world of finance, I offer a point of difference. Not only will you receive excellent independent and impartial advice, but you’ll have fun doing it. Even after 15 years in the mortgage arena, my enthusiasm for objectives and commitment to clients shines through at every turn. Endorsement comes from countless glowing testimonials and in my own words: “I’m at my happiest helping people navigate through difficult situations, giving hope and concrete opportunity where they previously had none.”

Prior experience as sales manager in the fields of telecommunications and pharmaceuticals, then later, a small business owner and private property investor, provided me with considerable business acumen across many industries. My customer-focused approach and personable demeanor also reflect a lifetime of experience in client relations. I credit travel to distant locations for creating an enduring interest in different cultures and honing my ability to relate well to the needs of the broader population. In particular, I soundly empathise with people relocating from other countries to make New Zealand their home.

To continue giving my professional best, I maintain balance by travelling and participating in seasonal sports such as paddle boarding and skiing. I enjoy indulging in my creative side; with landscaping, painting watercolours or improving my guitar playing prowess. Additionally, I actively support my community through Christians Against Poverty (CAPNZ), but above all, my wife and our five shared children always take centre stage.

There's little that I haven't seen in my time in the industry, priding myself on an ability to deal with the trickiest of scenarios, never turning anyone away. My philosophy of treating people how I'd like to be treated results in a 360-degree perspective which sets myself apart.

Get in touch if you need any expert guidance. Regards

Keith Jones 021 849 767

keith.jones@loanmarket.co.nz loanmarket.co.nz/keith-jones

Wheretheonlyresultthatmattersisyours!

Town & Country