THE PROPERTY CHRONICLE

Whenyouknow,youknow.

May2023

Town&Country

™

Town & Country Page 3 5 CONTENTS LetterfromPrincipal(BrentWorthington) LJ HookerHomeSmartNewsletter– Whattodoifyoucan’tpayyourmortgage. REINZREPORTS11May2023(AprilData) REINZ MonthlyPropertyReport • Contents Page with link to full report • Press Release (page 3) • Market Snapshot (pages 4) • Annual Median Price Changes (page 7) • Highlights/Sales Count/Inventory Summaries (page 10) 9 10 12 13 14 17 18 REINZ – MonthlyHousePriceIndex(uselinktoviewreport) REINZ &TonyAlexander RealEstateSurvey Realestate.co.nz– TheNewZealandPropertyReport1May2023 • Snail’s pace for Property – Patience is essential 25 FINANCE & LENDING • Mortgages & Tony Alexander – Mortgage Advisors Survey May 2023 • Signs of bottoming out • Mortgage Advisor comments Kainga Ora Shared Ownership Scheme Loan Market – Keith Jones 36 39 43 44 LJ Hooker Town & Country - Properties • Current Listings 49 • Recent Sales 51 Making Your Home Appealing for a Winter Sale 52 Property Management - Rent Exchange • Newsletter – Making your rental property stand out 55 • Putting Your Best Foot Forward When Preparing a Rental Application 57 Our Salespeople • Brent Worthington • Nav Johnson • Lina Roban 60 61 62 Visit us at Fieldays Invitation - (14 – 17 June 2023) Mystery Creek) 63 SuperGold Welcome Here 64

22May2023

Hi,

ThelatestfiguresfromtheRealEstateInstituteofNewZealand(REINZ)revealsthatthe ongoingeconomicclimatecontinuestopresentchallengesforthepropertymarket

JenBaird,REINZchiefexecutive,acknowledgesthatAprilistypicallyaslowermonthdueto publicandschoolholidaysandhighlightsthecombinedimpactofthesefactors alongsideatighteconomyonmarketdynamics.

"Overall,medianpriceshavedecreasedacrossNewZealandbutaremoderating,sales countshaveeasedannuallyandinventorylevelshavestabilised,"Bairdsaid.

Nationally,themedianpriceinApril2023decreasedby10.9percentcomparedtothe previousyear,amountingto$780,000.Theaveragetimetakentosellapropertyincreased to47daysinApril2023,representinganincreaseofninedaysfromApril2022andtwo daysfromMarch2023.

Bairdhighlightspositiveindicatorswithinthemarket,stating,"Salespeopleacrossthe countryarereportingglimpsesofgreenshootsinthemarketthismonthasfirsthome buyersshowmoreinterestaftertheReserveBank’sannouncementontheeasingofLVR restrictions.Ourmembersareseeingfurtheralignmentasvendorscomewithadesireto meetthemarket–thosewhoarepreparedtonegotiateandberealisticaretheones selling,therearebuyersouttherereadytobuy.Twodistrictsreachedrecordmedian pricesinApril."

BytheendofApril,thetotalnumberofpropertiesavailableforsaleacrossNewZealand stoodat28,643,reflectingayear-on-yearincreaseof1,593properties(5.9percent),while experiencingamonth-on-monthdecreaseof2.19percent.

"Inventorylevelshavedecreasedslightlymonth-on-month,buttheyear-on-yearfigures arestillshowinganincreaseasthecurrentpressureonmortgageratessuppressesbuyer activity,"Bairdexplained.

Brent Worthington Principal and Licensee Agent

Brent Worthington Principal and Licensee Agent

continued over...

Town&Country

LJ Hooker Town&Country & Property Management 1/233 Great South road, Drury 0292 965 362

DespitetheReserveBankscontinuedefforttoslowinflationwithcontinuedinterestrate hikes,thejobmarketfiguresfromStatisticsNewZealandinMayshowpositivenewsforthe housingmarket.

Thefiguresshowedbusinessesarestillshortofstaffandjobnumbersgrew0.8percentin theMarchquarter,whichfolloweda0.5percentincreasethepreviousquarter.

IndependenteconomistTonyAlexanderbelievesthisisgoodnewsforthehousingmarket.

“Morepeopleinworkmeansmoredemandforhousestorentandbuy,”Alexandersaid.

“Thebottomofthecycleisbroughtabitcloser.ThebadnewshoweveristhattheReserve Bankhasraisedinterestratesaggressivelysincethelatterpartof2021totryandcrushjob growthandtherebyweakenhouseholdspendingandtheabilityofbusinessestoraisetheir prices.Thejobdestructionisnotoccurring.”

BairdbelievesNewZealandersarewaitingforinflationtopeak,steadyinterestratesand clarityaroundtheoutcomeofthisyear’selection.

“Thisiswhatiskeepingactivitylow.However,forthoselookingtobuy,lowerpricesandgood stocklevelsmeansthereareopportunitiesasweheadintothecoolermonths,”shesaid.

AsalwaysItrustyouenjoythismonth'spublication.

Kindregards

Brent

Brent Worthington Principal and Licensee Agent

Town&Country Continued

Hooker

Country

Great

road, Drury 0292

LJ

Town&

& Property Management 1/233

South

965 362

What to Do if You Can’t Pay Your Mortgage

Owning a home is a significant accomplishment, but sometimes unexpected financial challenges can make it difficult to meet mortgage payments.

If you're struggling to pay your mortgage, it's vital you take proactive steps to address the issue and find a solution. No one wants to be in this situation, but all hope is not lost when you hit a rough patch. Here are some tips to help you if you cannot meet your repayments.

Communicate with your lender

The first and most important step is to communicate openly with your lender.

You want to contact them as soon as you anticipate or experience any financial challenges. Lenders are often willing to work with borrowers to find solutions that work for each other. It's essential to maintain regular communication with your lender and keep them informed about your situation.

Seek financial advice

Reach out to a financial adviser or budgeting service that specialises in mortgage arrears.

These professionals can help you assess your financial situation. Once they have an understanding, they can help you explore your options, and provide guidance on managing your mortgage. The Citizens Advice Bureau, MoneyTalks, or the New Zealand Federation of Family Budgeting Services can offer valuable advice and support.

Apply for government assistance

Consider Government programmes that are available. There could be options to assist homeowners who are struggling to make mortgage payments.

The Kainga Ora Housing New Zealand Corporation provides various support for people in hardship. They have the Mortgage Repayment Assistance (MRA) programme, which is aimed at helping homeowners going through tough financial times. You do have to meet certain criteria to apply, so check their website or contact them directly for further information.

Explore loan modification

Discuss with your lender how you can make changes to you loan to work with your current situation. They may be willing to adjust your mortgage terms temporarily or permanently to make your payments more

manageable. Loan modifications could include extending the loan term, reducing interest rates, or temporarily deferring payments.

Again, communication with your lender is important for exploring these possibilities.

Review your expenses and budget

Your budget might hold all of your answers, so take a close look at what you're spending and where. Then identify where you can potentially make cutbacks.

With a realistic budget that prioritises essentials and minimises unnecessary spending, this could set you on a path to meet your repayments. Utilise online tools and apps to help track and manage your finances effectively. By closely monitoring your spending habits, you may be able to find extra money to put towards your mortgage.

Explore temporary income options

A second job could provide temporary income to top up your current earnings. This could include taking on parttime work, freelancing, or offering services in your community. Additionally, you could qualify for government assistance that could provide temporary relief.

Investigate mortgage refinancing

With interest rates changing, you current mortgage terms might not work for you anymore. Refinancing and finding better terms with different lenders could be a better long term plan to meet your repayments. This could mean you replace your existing mortgage with a new one, often with better interest rates and terms. A

ljhooker.co.nz

mortgage broker or financial adviser would be able to help you consider all your refinancing options and if it's right for you.

Responding to a default notice

Your options get harder once you receive a default notice, so you want to do everything you can to avoid getting this letter. If you do receive a default notice, it means that you are significantly behind on your repayments. You don't want to waste time, you need to take immediate action to address this situation.

Here are some steps to consider:

Read and understand the notice

Carefully review the default notice and make sure you understand what it says. It should outline the amount in arrears and how long you have to repay your debt. It will also outline any actions your lender may take if the default is not remedied.

Contact your lender

Communication is key. You will want to reach out to your lender quickly after receiving the default notice. Be willing to discuss your financial situation and consider potential options for fix the arrears. They may be open to negotiating a repayment plan or other options to help you catch up on your payments.

Seek legal advice

This can be a stressful time, and it is likely you will feel overwhelmed and unsure about what to do next. If that's the case, getting legal advice from a qualified professional experienced in mortgage and property law would be wise. They can provide guidance specific to your situation, help you understand your rights and obligations, and ensure you understand any legal implications.

Provide necessary documentation

Prepare yourself to be open about your current financial situation. Your lender may request specific documents to assess your financial situation. Have pay slips, bank statements and any other documents proving your expenses ready to demonstrates your willingness to resolve the default. Open and transparent communication is essential during this process.

Negotiate a repayment plan

Work with your lender to create a repayment plan that works with your financial situation. This plan may involve spreading the arrears over an extended period, increasing your regular mortgage payments, or making lump sum payments. The lender may also consider extending the loan term or temporarily suspending interest charges.

Comply with the agreement

If you reach an agreement with your lender, make sure you meet those terms in the repayment plan. To avoid further complications, promptly make the agreedupon payments. Continue to regularly communicate with your lender to keep them updated on your progress and address any unforeseen challenges before they come up.

Explore dispute resolution options

If you are working hard to find a solution, but you're finding it challenging to reach a resolution with your lender, then you have the option to use dispute resolution services. The Financial Services Complaints Limited (FSCL) and the Banking Ombudsman are organisations that can assist in resolving disputes between borrowers and lenders.

Get advice

Remember, every situation is unique. It's important to seek personalised advice and support when dealing with a default notice. Act quickly, communicate openly, and being proactive in your approach can help you navigate through this challenging period and find a suitable resolution.

This is going to be a stressful time in your life, however, remember, you are not alone.

There are resources and assistance available to help you navigate this challenging time. By communicating with your lender, seeking professional advice, exploring government programmes, and making necessary adjustments to your finances, you can find solutions. This will help address your mortgage arrears and work towards a more stable financial future.

ljhooker.co.nz

The information contained in this publication is general in nature and is not intended to be personalised real estate advice Before making any decisions, you should consult a legal or professional advisor LJ Hooker New Zealand Ltd believes the information in this publication is correct, and it has reasonable grounds for any opinion or recommendation contained in this publication on the date of this publication Nothing in this publication is, or should be taken as, an offer, invitation or recommendation LJ Hooker New Zealand Ltd accepts no responsibility for any loss caused as a result of any person relying on any information in this publication This publication is for the use of persons in New Zealand only Copyright in this publication is owned by LJ Hooker New Zealand Ltd You must not reproduce or distribute content from this publication or any part of it without prior permission

MONTHLY PROPERTY REPORT. 11 May 2023

2| REINZ Monthly Property Report Northland ........................................................................................................................................................... 10 Auckland .............................................................................................................................................................. 12 Waikato 14 Bay of Plenty 17 Gisborne 20 Hawke’s Bay 22 Taranaki 24 Manawatu/Whanganui 26 Wellington 29 Nelson/Marlborough/Tasman 32 West Coast 34 Canterbury 38 Otago 39 Southland 41 Contents 3 Press Release 4 Market Snapshot 7 Annual Median Price Changes RegionalCommentaries CLICKHERETOVIEWFULLREPORT

REINZPRESSRELEASE11May2023

REINZ April data: Holidays add to market slow-down, but green shoot begin to emerge

11

May 2023

The Real Estate Institute of New Zealand’s (REINZ) April 2023 figures show the continuing challenge of the economic climate has put further pressure on market pace.

REINZ Chief Executive Jen Baird says April tends to be slow due to public and school holidays, and it’s clear those factors combined with a tight economy are still influencing the market.

“Overall, median prices have decreased across New Zealand but are moderating, sales counts have eased annually, and inventory levels have stabilised,” adds Baird.

Nationally, the April 2023 median price decreased 10.9 year-on-year to $780,000. Days to sell have risen to 47 days for April 2023 — up 9 days compared to April 2022 and up 2 days from 45 when compared to March 2023. The West Coast and Otago regions saw an annual increase in median price up 8.6% to $379,000 and 3.2% to $680,000 respectively. Two districts reached record median prices: Grey District ($398,000) and Ashburton District ($615,000).

“Salespeople across the country are reporting glimpses of green shoots in the market this month as first home buyers show more interest after the Reserve Bank’s announced on the easing of LVR restrictions. Our members are seeing further alignment as vendors come with a desire to meet the market – those who are prepared to negotiate and be realistic are the ones selling, there are buyers out there ready to buy. Two districts reached record median prices in April,” states Baird.

At the end of April, the total number of properties for sale across New Zealand was 28,643 up 1,593 properties (+5.9%) year-on-year, and down 2.19% month-on-month. New Zealand excluding Auckland was also up from 17,060 to 18,351 an increase of 1,291 properties annually (+7.6%). Month-on-month, inventory decreased 2.2%.

“Inventory levels have decreased slightly month-on-month, but the year-on-year figures are still showing an increase as the current pressure on mortgage rates supressing buyer activity,” says Baird.

The total number of properties sold across New Zealand in April 2023 was 4,262, down from 5,984 in March 2023 (-28.8%), and down 15.3% year-on-year. New Zealand excluding Auckland sales counts decreased by 11.5% year-on-year and 26.9% monthon-month. While that seems a considerable fall, in seasonally adjusted terms April was 8.1% stronger when compared to the usual seasonal change we would see at the time of year.

Nationally, new listings decreased by 18.9%, from 8,806 listings in April 2022 to 7,142 listings in April 2023. Compared to March 2023, listings decreased by 22.7% from 9,242 to 7,142. New Zealand excluding Auckland listings decreased 20.0% year-on-year from 5,780 to 4,626. Auckland’s listings were down 16.9% from 3,026 to 2,516 year-on-year.

“New Zealanders are waiting for the peak of inflation, a settling in interest rates and some clarity around the outcome of this year’s election. This is what is keeping activity low. However, for those looking to buy, lower prices and good stock levels means there are opportunities as we head into the cooler months.”

“We won’t know if we are at the bottom of the market until we have passed it, so for those who can get their financial ducks in a row, now is a good time to buy,” suggests Baird.

The REINZ House Price Index (HPI) for New Zealand which measures the changing value of residential property nationwide showed an annual decrease of -12.0% for New Zealand and a -10.7% decrease for New Zealand excluding Auckland.

The Real Estate Institute of New Zealand (REINZ) has the latest and most accurate real estate data in New Zealand.

Media contact:

Laura Wilmot

Head of Communications and Engagement, REINZ

Mobile: 021 953 308

lwilmot@reinz.co.nz

Fact sheet

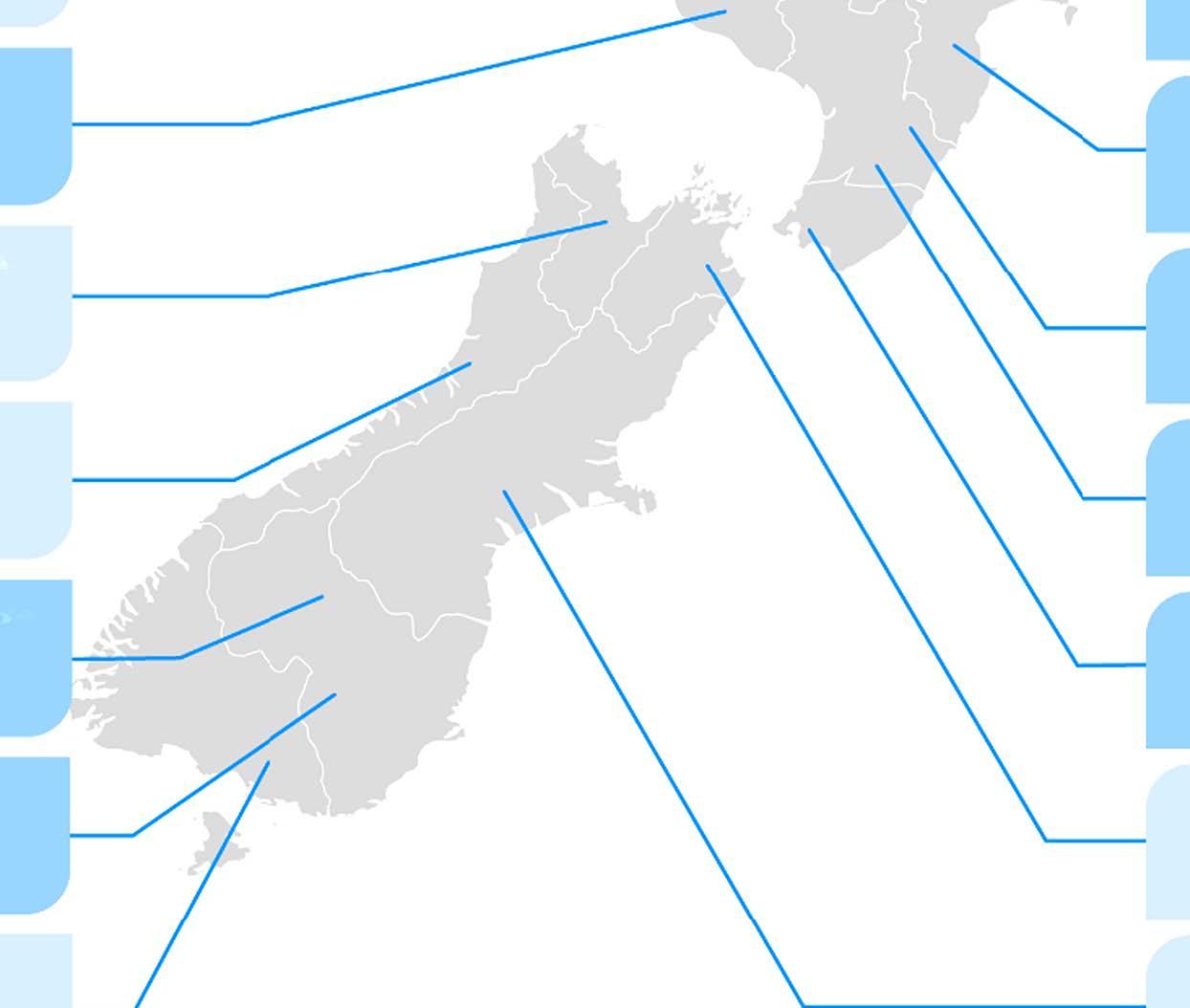

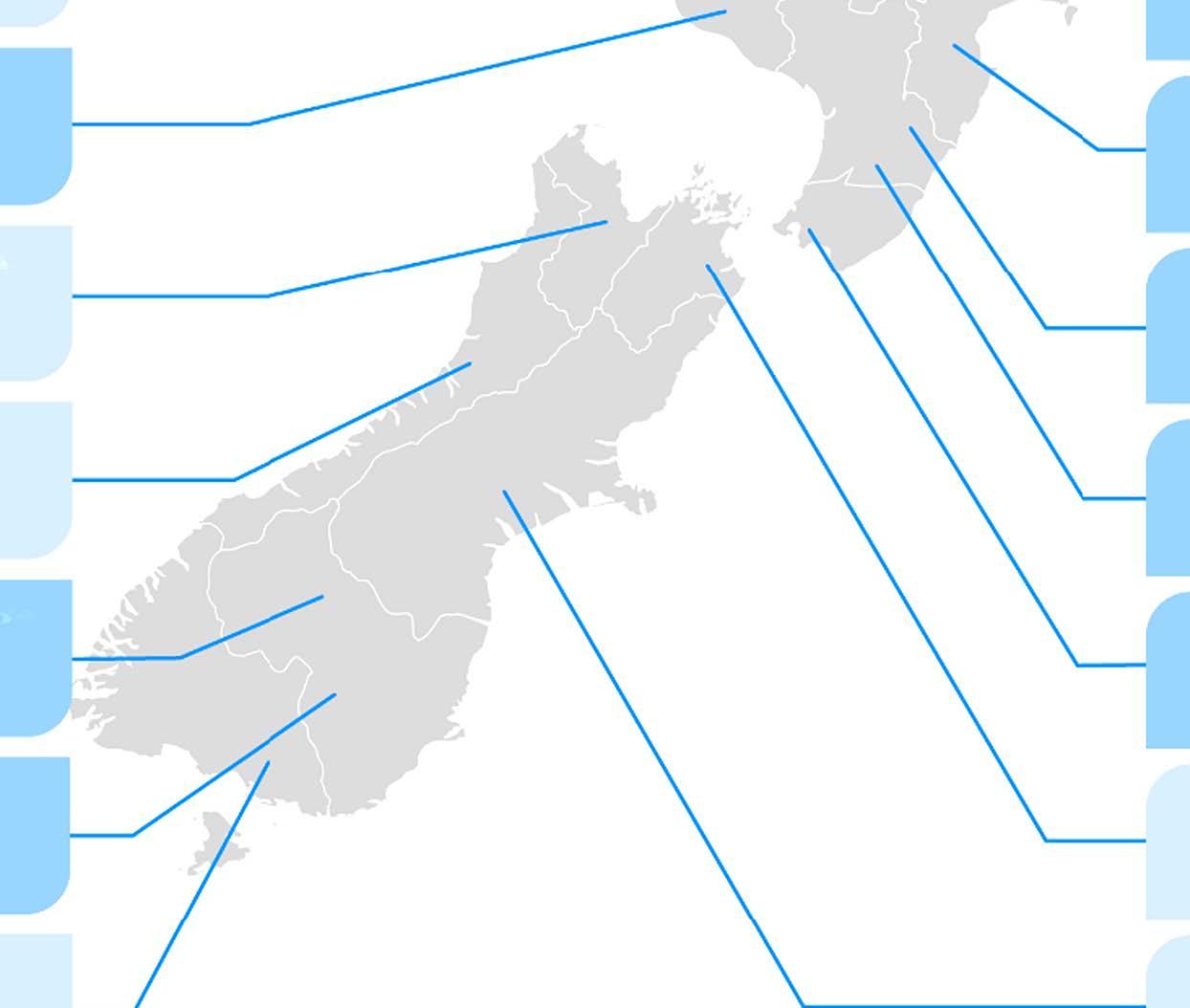

ANNUAL MEDIAN PRICE CHANGES

APRIL2023 Northland RElNZI REAL ESTATE INSTITUTE OF NEW ZEALAND ------$675,000 National Median Price $780,000 Compared to April 2022 -10.9%T Median Days to Sell 47 Auckland $995,000 -15.0%T Waikato $750,000___ -12.8%T Taranaki -9.1% -9.4%T Bayof Plenty $824,500 T Gisborne $650,000 -5.1%T Hawkes Bay $750,000 -2.6%T Manawatu-Whanganui Nelson $693,000 ----$556,000 -41%T -9.4%T__,,, Wellington Tasman $797,000 $780,000 -133%T------/1 West Coast $379,000 � 8.6% _,,,._� Marlborough Canterbury $617,500 -19.2%T $660,000 -2.9%T Otago ,..------$680,000 3.2% Southland o( +' �-- $424,000 ) ,�"l: ) ,.,.-6.4%T ,:,r...r -14.3%T ® Record Median Prices Increase ► Stable T Decrease Residenliill Mediiln Sille Price S379.ooot:'.jjjjjjiiiiism.ooo

National highlights

• The national median price decreased 10.9% year-on-year to $780,000. For New Zealand excluding Auckland, median prices were down 7.3% to $700,000.

• The total number of properties for sale across New Zealand increased 5.9% yearon-year, and down 2.2% month-on-month.

• The total number of properties sold across New Zealand in April 2023 decreased 15.3% year-on-year, decreased 11.5% month-on-month.

• Nationally, new listings decreased by 18.9%, from 8,806 listings in April 2022 to 7,142 listings in April 2023.

• Days to sell have risen to 47 days for April 2023 up 9 days compared to April 2022 and up 2 days from 45 when compared to March 2023.

• The REINZ House Price Index (HPI) for New Zealand showed an annual decrease of 0% in the value of residential property nationwide.

Regional highlights

• Whilst prices continue to ease annually in most regions, West Coast and Otago saw increases in median sale price to $379,000 and $680,000 respectively.

• Auckland had a 15.0% decrease in the median sale price for April year-on-year and dropped under the $1m price point to $995,000.

• Six regions had a decrease in the median days to sell.

• West Coast had the highest increase in median days to sell month-on-month (42 days) and the largest year-on-year increase (46 days).

More information on activity by region can be found in the regional commentaries visit the REINZ website.

Median Prices

Our two biggest cities have seen ongoing year-on-year median price declines for the beginning of 2023. Auckland’s median price again dropped under $1,000,000 for the second month running.

There were no record median prices at the regional level.

Grey District and Ashburton District saw record median prices this month.

Sales Count

New Zealand, New Zealand excluding Auckland, Manawatu/Whanganui, Nelson, Taranaki and Wellington all had the lowest sales this month since record began.

April saw the lowest sales count in:

• Southland since 2000

• Bay of Plenty, Otago, and Waikato since 2008

• Canterbury, Northland, and Tasman since 2011

• West Coast since 2017

*Excluding the month of January and the two lockdown-affected months of April 2020 and May 2020

Days to Sell

Month-on-month

All regions had an increase in median days to sell compared to April 2022. West Coast had the highest median days to sell since August 2020.

In terms of the month of April, April 2023 had the highest median days to sell in thirteen of eighteen regions.

House Price Index (HPI)

The HPI measures the changing value of residential property nationwide.

Wellington has been in the bottom two ranked regions eighteen months in a row for the year-on-year HPI movement.

Manawatu-Whanganui and Nelson/Marlborough/Tasman/West Coast regions had their second largest year-on-year drop in HPI since records began.

Bay of Plenty and Waikato had its third-largest year-on-year drop in HPI since records began.

Otago is the top-ranked HPI year-on-year movement this month; Southland is second and Canterbury is third.

Inventory

Four of fifteen regions (27.0%) had at least a 20.0% year-on-year increase in inventory.

Six regions had less inventory than they had one year ago.

Listings

All regions had had a decrease in listings since April 2022.

Eleven of fifteen regions (73%) of the regions have had listings decrease by more than 15% year on year.

Inventory and listing data come from realestate.co.nz.

Auctions

Nationally, 9.6% (395) of properties were sold at auction in April 2023, compared to 14.6% (736) in April 2022.

New Zealand excluding Auckland saw 6.6% of properties (192) sell by auction compared to 10.6%

(359)the year prior.

More information on activity by region can be found in the regional commentaries visit the REINZ’s website.

© REINZ - Real Estate Institute of New Zealand Inc. MONTHLY HOUSE PRICE INDEX REPORT 11 May 2023

CLICKHERETOVIEWFULLREPORT

REINZ & TONY ALEXANDER REAL ESTATE SURVEY

May 2023

CONTENTS

Page 1

• Are more or fewer people showing up at auctions?

• Are more or fewer people attending open homes?

Page 2 Page 3 Page 4

• How do you feel prices are generally changing at the moment?

• Do you think FOMO is in play for buyers?

• Are you noticing more or fewer first home buyers in the market?

• Are you noticing more or fewer investors in the market?

• Are you receiving more or fewer enquiries from offshore?

• Are property appraisal requests increasing or decreasing?

• What are the main concerns of buyers?

• Are investors bringing more or fewer properties to the market to sell than three months ago?

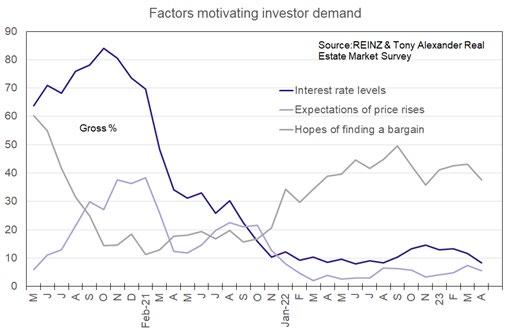

• What factors appear to be motivating investor demand?

Page 5

• Regional results

views of licensed real estate agents all over New Zealand regarding how they are seeing conditions in the residential property market in their areas at the moment. We asked them how activity levels are changing, what the views of first home buyers and investors are, and the factors which are affecting sentiment of those two large groups.

Disclaimer: This report is intended for general information purposes only. This report and the information contained herein is under no circumstances intended to be used or considered as legal, financial or investment advice. The material in this report is obtained from various sources (including third parties) and REINZ does not warrant the accuracy, reliability or completeness of the information provided in this report and does not accept liability for any omissions, inaccuracies or losses incurred, either directly or indirectly, by any person arising from or in connection with the supply, use or misuse of the whole or any part of this report. Any and all third party data or analysis in this report does not necessarily represent the views of REINZ. When referring to this report or any information contained herein, you must cite REINZ as the source of the information. REINZ reserves the right to request that you immediately withdraw from publication any document that fails to cite REINZ as the source. ISSN: 2703-2825 This publication is written by Tony Alexander, independent economist. Subscribe here https://forms.gle/qW9avCbaSiKcTnBQA To enquire about having me in as a speaker or for a webinar contact me at tony@tonyalexander.nz Back issues at www.tonyalexander.nz Tony’sAim To help Kiwis make better decisions for their businesses, investments, home purchases, and people by writing about the economy in an easy to understand manner. This survey gathers together the

FEW CONVINCING SIGNS YET OF BOTTOMING OUT

Welcome to the REINZ & Tony Alexander Real Estate Survey. This survey gathers together the views of licensed real estate agents all over New Zealand regarding how they are seeing conditions in the residential property market in their areas at the moment. We ask them how activity levels are changing, what the views of first home buyers and investors are, and the factors which are affecting sentiment of those two large groups.

The key results from this month’s survey include the following.

No upward trends as yet in auction or open home attendance. Agents still overwhelmingly feel that prices are falling.

• First home buyers are back but investors remain on the side-lines.

• Buyer concerns about access to finance are slowing easing, but worries about interest rates remain elevated.

ARE MORE OR FEWER PEOPLE SHOWING UP AT AUCTIONS?

Auction rooms around the country still remain relatively quiet. A net 18% of the 471 agents responding in this month’s survey have reported that they are seeing fewer people showing up. Conditions are not as bad as during all of 2022 apart from just ahead of the record tightening of monetary policy by the Reserve Bank on 23 November. Interest rate moves and expectations matter when it comes to the level of interest people have in purchasing a dwelling.

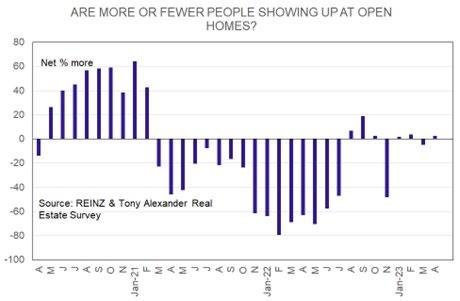

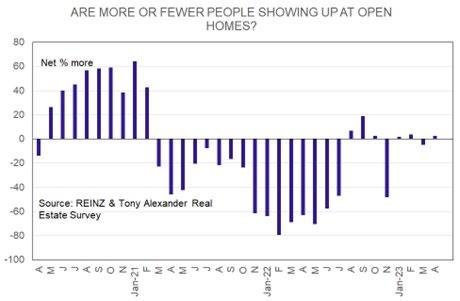

ARE MORE OR FEWER PEOPLE ATTENDING OPEN HOMES?

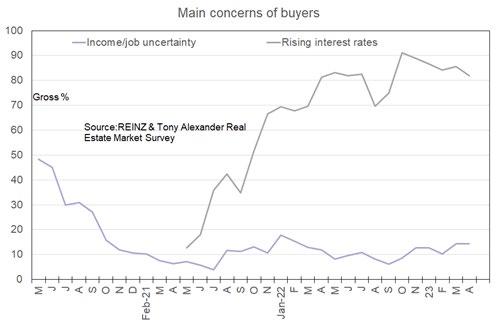

In contrast to the continuing deep weakness in auction attendance, for the first four months of this year things have stabilised with regard to open home attendance. A net 3% of agents have said that more people are attending open homes. This result does not yet allow us to say that an improving trend is underway. As we discuss below, buyers remain firmly concerned about interest rates, access to finance, and the risk of house price falls — but not about their employment.

1

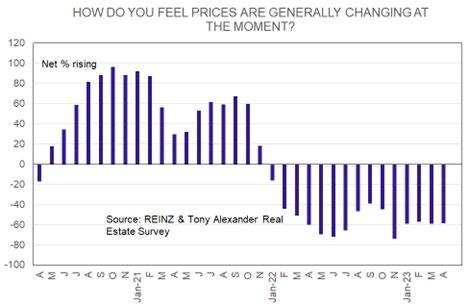

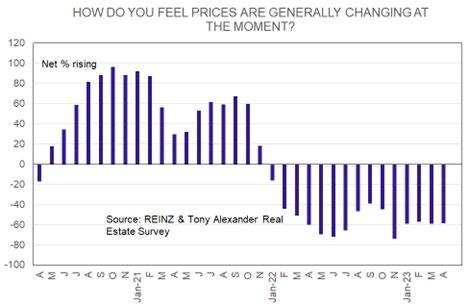

HOW DO YOU FEEL PRICES ARE GENERALLY CHANGING AT THE MOMENT?

A net 58% of agents feel that prices are falling. This is unchanged from the previous three months and tells us that it is very unlikely that when REINZ release their April data the numbers will show that prices are rising. Comments supplied by agents this month show buyers are making lowball offers for properties which vendors continue to refuse.

ARE YOU NOTICING MORE OR FEWER FIRST HOME BUYERS IN THE MARKET?

For the third month in a row a net 22% or thereabouts of agents have said that they are seeing more first home buyers in the market. As previously noted, these generally young buyers are likely to be motivated by the changing equation between renting and buying as rents continue to rise but prices have substantially declined. They are also likely to feel confident in their incomes and in many cases will have built up larger deposits which can help reduce debt needed and dampen the impact therefore of higher interest rates.

DO YOU THINK FOMO IS IN PLAY FOR BUYERS?

FOMO = Fear of missing out

The graph here shows that there is an upward trend underway in the proportion of agents who feel that FOMO is being felt by buyers. However, this is a visual representation only and at 7% the latest reading still bespeaks of minimal concern by buyers that if they wait they will end up missing out on either a low price or a suitable property. Buyers continue to feel that time is on their side.

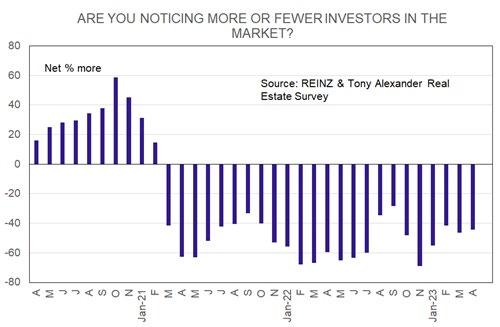

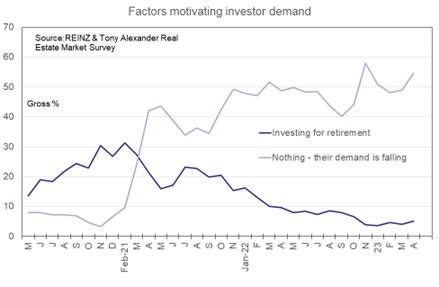

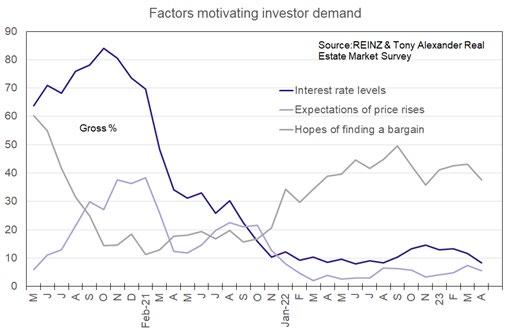

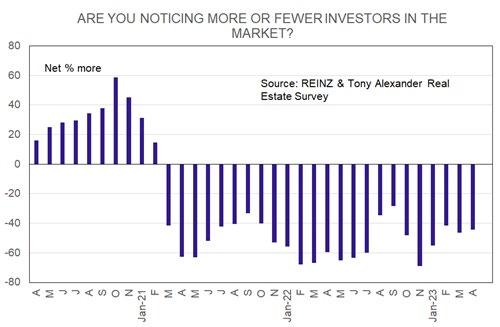

ARE YOU NOTICING MORE OR FEWER INVESTORS IN THE MARKET?

There is still no sign that investors are returning to the market. A net 44% of agents have this month said that they are seeing fewer investors. The result is consistent with others since March 2021 just after tax changes for investors were announced. This clearly shows the effectiveness of this policy in reducing investor demand for property yet also helps explain the results from my separate survey with Crockers

Property Management showing rising rent pressures and growing ease of finding good tenants. The rental pool is not being grown and this can be attributed to at least this government tax policy change. The beneficiaries for now of the tax change are other buyers. But the price will be paid by renters.

2

ARE YOU RECEIVING MORE OR FEWER ENQUIRIES FROM OFFSHORE?

There continues to be very little interest in NZ property from people located offshore. A net 39% of agents this month have reported reduced interest from offshore.

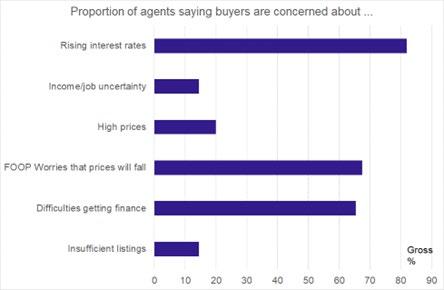

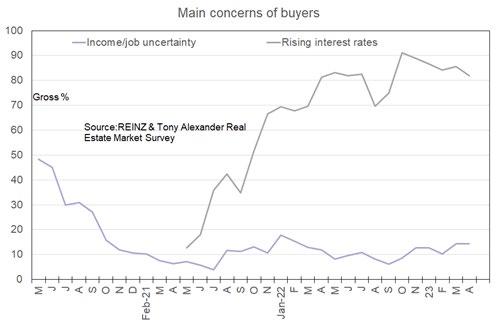

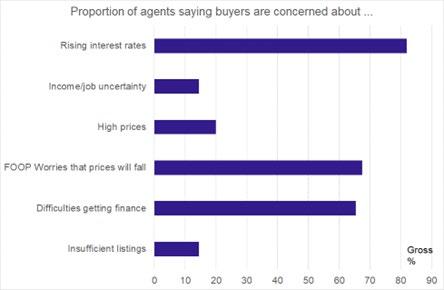

WHAT ARE THE MAIN CONCERNS OF BUYERS?

Buyers remain strongly concerned about interest rate levels, the potential for prices to fall further, and access to finance.

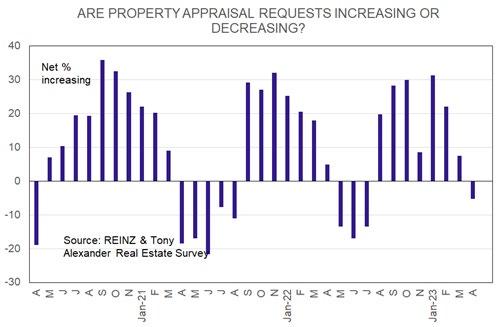

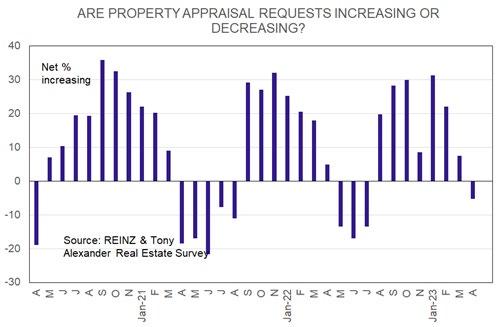

ARE PROPERTY APPRAISAL REQUESTS INCREASING OR DECREASING?

This measure has undergone an interesting change in the past two months. If vendors were feeling pressure to sell, we would expect a rise in the number making enquiries as to the market value of their property. But this month a net 5% of agents have noted that they are receiving fewer appraisal requests. Can we read into this that property listings are about to substantially decline? I do believe they are in the process of trending down; however, the graph tells us that autumn traditionally brings a decline in property appraisal requests as potential vendors prefer waiting until the approach of warm months before putting their property on the market.

The next two graphs examine how these concerns have shifted over time. Note the substantial fall in worries about listings from late in 2021, but the small lift in this measure which is now underway. Worries about getting finance are slowly declining but price decline concerns continue at high levels, as do worries about interest rates shown in the second graph below.

3

ARE INVESTORS BRINGING MORE OR FEWER PROPERTIES TO THE MARKET TO SELL THAN THREE MONTHS AGO?

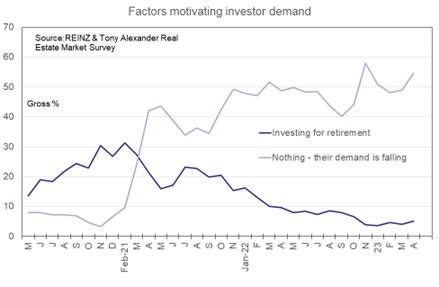

There is no rising trend in agent observations that more investors are looking to bring their properties to the market. In fact, this month a net 6% of agents have reported that fewer investors are stepping forward to sell. There remains no wave of investor selling since March 2021 – just a sharp decline in buying.

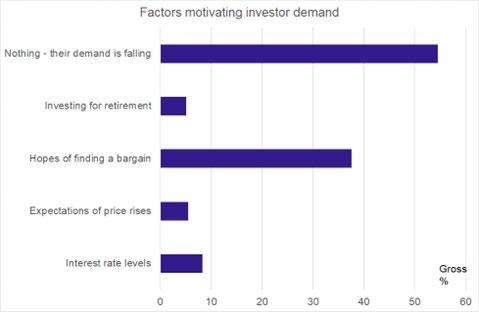

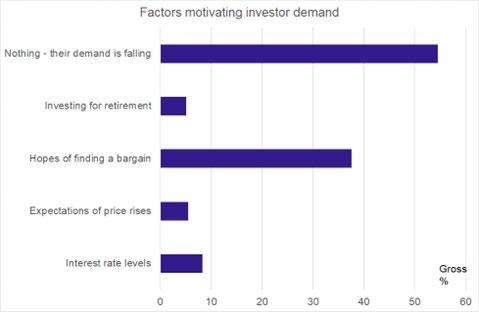

WHAT FACTORS APPEAR TO BE MOTIVATING INVESTOR DEMAND?

For those few investors who are thinking about buying, the biggest motivation is the hope of finding a bargain. Buying for retirement is low as a driving factor.

4

There is little trend in any of these measures of investor motivation, as shown by the following two graphs.

REGIONAL RESULTS

The following table breaks down answers to the numerical questions above by region. No results are presented for regions with fewer than 7 responses as the sample size is too small for good statistical validity of results. The three top of the South Island regions are amalgamated into one and Gisborne is joined with Hawke’s Bay.

Best use of the table is achieved by picking a variable and comparing a region’s outcome with the national result shown in bold in the bottom line. For instance, in Auckland a net 25% of agents note that they are seeing more first home buyers. But in Wellington this is 51%, Queenstown Lakes unsurprisingly is -8%.

The table shows net percentages apart from the FOMO question in column F. The net percent is calculated as the percentage of responses saying a thing will go up less the percentage saying it will go down.

A. # of responses

B. Are property appraisal requests increasing or decreasing?

C. Are more or fewer people showing up at auctions?

D. Are more or fewer people attending open homes?

E. How do you feel prices are generally changing at the moment?

F. Do you think FOMO is in play for buyers?

G. Are you noticing more or fewer first home buyers in the market?

H. Are you noticing more or fewer investors in the market?

I. Are you receiving more or fewer enquiries from offshore?

J. Are investors bringing more or fewer properties to the market to sell than three months ago?

This publication is written by Tony Alexander, independent economist. You can contact me at tony@tonyalexander.nz Subscribe here

This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. We strongly recommend readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. No person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.

5 A #obs B Appraisals C Auctions D Open H. E Prices F FOMO G FHBs H Invest. I O/seas J Inv.selling Northland 24 0-50-29-830-25-38-50-29 Auckland 176-10-910 -57 825-39-36-10 Waikato 47 11-21-2-66434-49-34-2 Bay of Plenty 3123-2623-68616-23-3519 Hawke's Bay 1932-265 -74 1121-58-5316 Taranaki 7-29-290 -57 2914-86 -71 14 Manawatu-Wanganui215-140-625 24-67 -3314 Wellington 41 -37 -1241-495 51 -46-46 -7 Nelson/Tasman 239-17-26 -78 04-48-35-4 Canterbury 51 -14 -24 -14-39622 -51 -43-2 Queenstown Lakes12-33-330017-8-420-17 Otago exc. Q'town100-40-50-8000-60-60-40 Southland 6-33-33-50-501717-500-33 NewZealand471-5-183-58722-44-39-6

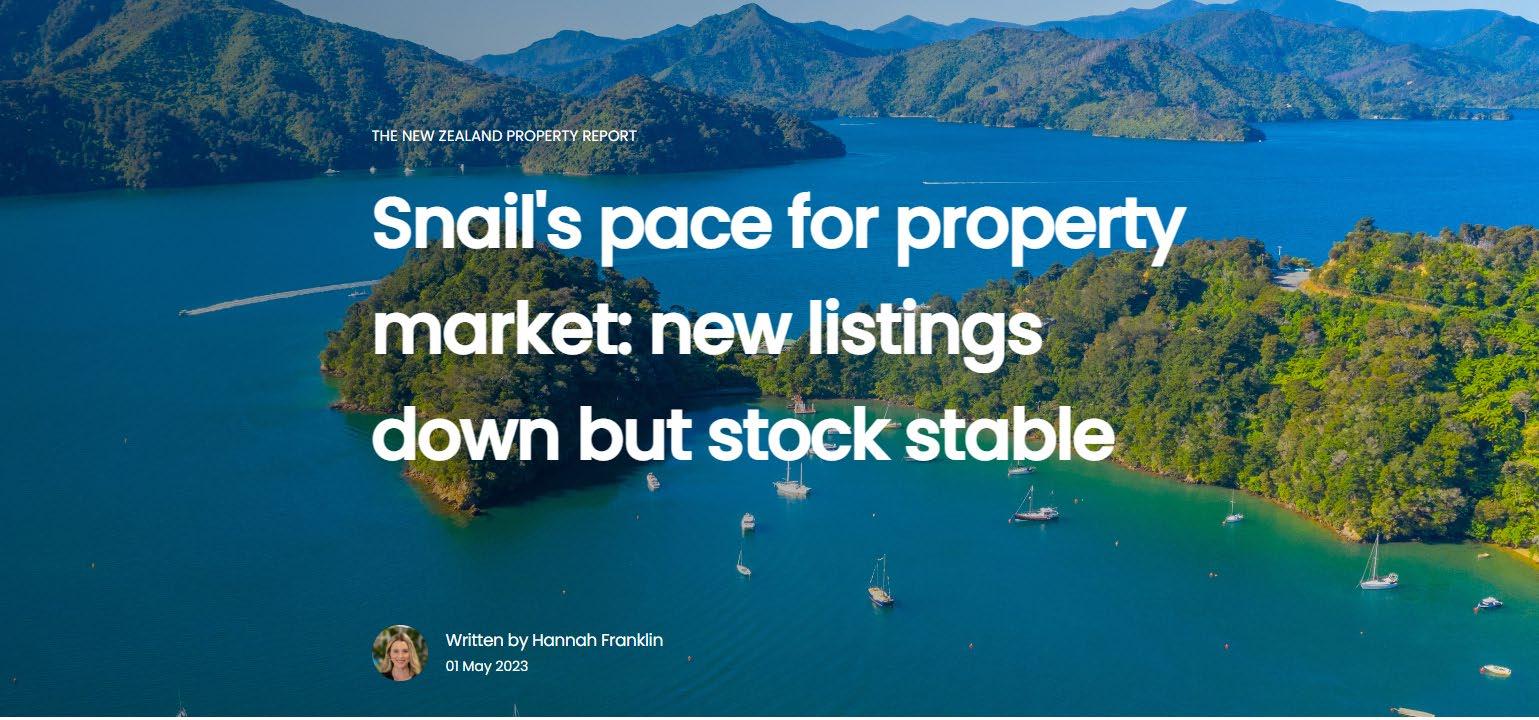

TheNewZealandPropertyReport-01May2023

Patienceisessentialforbothbuyersandsellers,withthelatestdatafrom realestate.co.nzshowingtheextenttowhichthepropertymarkethasslowed.

NewlistingstocomeontothemarketduringAprilweredown18.9%nationally, whilestockremainedupinalmostallregionscomparedtoApril2022. realestate.co.nzspokespersonVanessaWilliamssaysthatwhenweseenew listingsdropbutthedeclineisn'treflectedintotalstocknumbers,ittellsusthat buyersaretakingtheirtime.

"Creditconditionsremaintightforbuyerswhileinterestratesareuncertainfor anyonewithoutacrystalball.Buyersarestillsearchingforproperty,butmany aredelayingtheirpurchasedecisionsgiventhecurrenteconomicclimate." MarchdatafromREINZalsoconfirmsthis,withdaystosellrisingto45daysin March2023– 9dayslongerthaninMarch2022.

Vanessasaysthatwhilewemaynolongerbeinacompetitivemarket,buyers andsellersalikedohavemoretimetonegotiate,whichcanbeagoodthing:

"Ineverencouragepeopletobuybasedonthemarket.Buyingpropertymust comedowntopersonalandfinancialcircumstances."

re) realestate.co.nz

"But plenty of Kiwis have 'I wish I'd bought when' stories, and I believe there will be people who look back and say, 'I wish I'd bought in mid- 2023 when the market was stable, and I had time to make a decision."

She adds that there were still 28,643 homes available for sale last month nationwide and, therefore, many opportunities to find a home and lifestyle to love. Both parties just need to manage their expectations around the pace of the market.

Display price listings overtake auctions as most popular listing type

A further signal of the market's slow pace is how Kiwis are transacting property.

"Last month, only 19.2% of residential dwellings on realestate.co.nz were listed as auctions. However, two years ago in April 2021, when the market was in full flight, auctions made up 34.8% of all listings."

"Display price has overtaken auction as the most popular listing type because, in a slower market, vendors tend to choose a sales method that is less time pressured. However, your real estate professional will be able to advise the best method of sale for your home in this current market."

New listings at lowest levels for any April on record

New listings were down year- on- year in all regions last month except Coromandel, which bucked the trend with a 9.8% increase. Nine regions saw new listing levels down by more than 20% compared to April 2022.

If we look at every April since 2007, new listings were at a record low nationally and in 16 of 19 regions last month1. Only Nelson, Coromandel and Central North Island did not reach this record.

"Agents always have a strong understanding of their local market, so it's good to have the professionals on the job," says Vanessa.

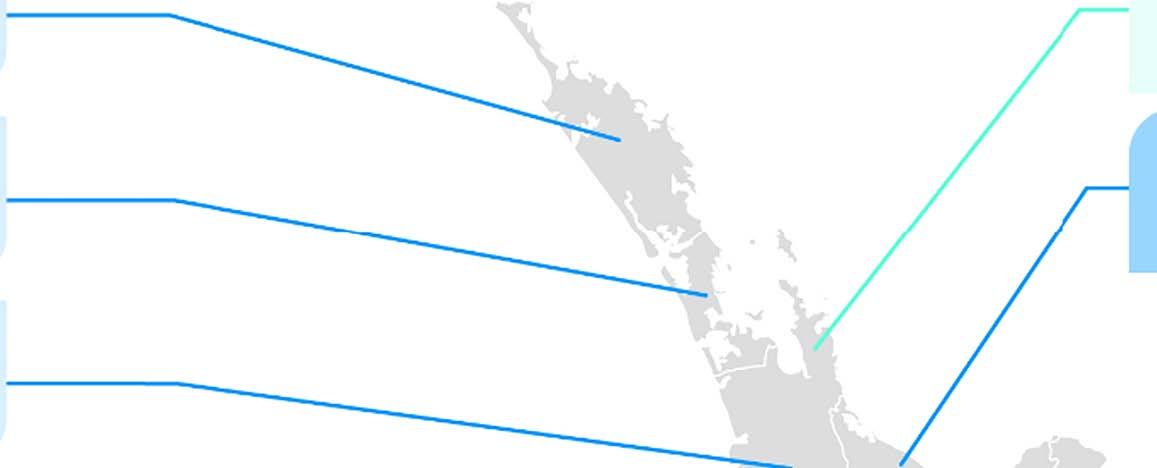

New listings

New property listingsfor April 2023

7,142 Compared to April 2022 -18.9%

Newlistingsarepropertiesthathavebeenadded torealestate.co.nzduringthemonth.This is comparedto thenumber ofnewlistingsinthe same monthinthe previous year.

Actual data of new listings.

re) realestate.co.nz

Northland 296 T-19.3% Auckland 2,516 T-16.9% Waikato 568 T-14.5% Central North Island 102 T-17.1% Taranaki 164 T-21.5% Nelson & Bays 171 T-11.9% WestCoast 56 T-18.8% Central Otego/Lakes 150 T-22.7% Otago 194 T-27.3% Southland 158 T-4.2% Listing change Decrease Increase ◄>20% <20% 0 <20% >20%

Coromandel 101 9.8% Bay ofPlenty 451 T-33.2% Gisborne 30 T-42.3% Hawke's Bay 220 T-21.7% Manawatu/Whanganui 312 T-29.6% Wairarapa 78 T-21.2% Wellington 461 T-35.5% Marlborough 76 T-15.6% Canterbury 1,038

T-4.0%

"We are hearing that many Kiwis are holding off on listing their properties for sale right now – potentially as they wait to see what will happen with interest rates," says Vanessa.

The biggest year-on- year decreases in new listings were in Bay of Plenty (down 33.2%), Gisborne (down 42.3%), Hawke's Bay (down 21.7%), Taranaki (down 21.5%), Wellington (down 35.5%), Otago (down 27.3%), Central Otago/Lakes District (down 22.7%), Wairarapa (down 21.2%), and Manawatu/Whanganui (down 29.6%).

1Excludes April 2020, which was skewed by Covid19 when lockdowns prevented Kiwis from listing their properties for sale.

Average asking prices down in all except two regions

Compared to April 2022, average asking prices were down almost everywhere last month. The only places that didn't see an annual decline were Marlborough (up 6.7%) and West Coast (up 3.6%). In Bay of Plenty and Nelson & Bays, average asking prices remained flat with marginal shifts of just -0.1% and - 0.9%, respectively.

Interestingly, after hitting an all- time high in March, Central Otago/Lakes District fell into line with the national trend, with prices decreasing by 5.6% in the region during April.

Vanessa says: "the national average asking price is now almost $100,000 less than it was a year ago, and in Auckland, Gisborne, Waikato, Wairarapa and Wellington, average asking prices are more than $150,000 below what they were in April 2022."

However, Vanessa urges people to consider this in context:

"We are coming off the back of a competitive market. COVID- 19 saw many Kiwis redirect travel spending into the property market. But with the borders open again, it's as though this is an overcorrection on the way back to something resembling 'normal'.

She adds that the market is also very cyclical, so seeing these peaks and troughs is not unusual.

For media enquiries, please contact:

Hannah Franklin | hannah@realestate.co.nz

About realestate.co.nz

As New Zealand’s longest- standing property website, realestate.co.nz’s mission is to empower New Zealanders with a property search tool they can use to find the life they want to live. With residential, lifestyle, rural and commercial property listings, realestate.co.nz is the place to start for those looking to buy or sell property.

Whatever life you’re searching for, it all starts here.

Want more property insights?

• Market Insights: Search by suburb to see median sale prices, popular property types and trends over time.

• Sold properties: Switch your search to sold to see the last 12 months of sales and prices.

• Valuations: Get a gauge on property prices by browsing comparable property sales.

Glossaryofterms:

Averageaskingprice(AAP) isneitheravaluationnorthesaleprice.Itisan indicationofcurrentmarketsentiment.Statistically,askingpricestendto correlatecloselywiththesalespricesrecordedinfuturemonthswhen thosepropertiesaresold.Asitlooksatdifferentdata,averageasking pricesmaydifferfromrecordedsalesdatareleasedsimultaneously.

Newlistingsarearecordofallthenewresidentialdwellingslistedforsale onrealestate.co.nzfortherelevantcalendarmonth.Thesitereflects97%of allpropertieslistedthroughlicensedrealestateagentsandmajor developersinNewZealand.Thisdescriptiongivesarepresentativeviewof theNewZealandpropertymarket.

Stockisthetotalnumberofresidentialdwellingsthatareforsaleon realestate.co.nzonthepenultimatedayofthemonth.

Inventoryisameasureofhowlongitwouldtake,theoretically,tosellthe currentstockatcurrentaverageratesofsaleifnonewpropertieswereto belistedforsale.Itprovidesameasureoftherateofturnoverinthe market.

Seasonal adjustment is a method realestate.co.nz uses to represent better the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

Truncated mean is the method realestate.co.nz uses to supply statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated to prevent exceptional listings from providing false impressions.

Written by Hannah Franklin

01 May 2023

Town&Country

FINANCE&LENDING

& Tony Alexander MORTGAGE ADVISERS SURVEY May 2023 ISSN: 2744-5194

Signs of a bottoming out

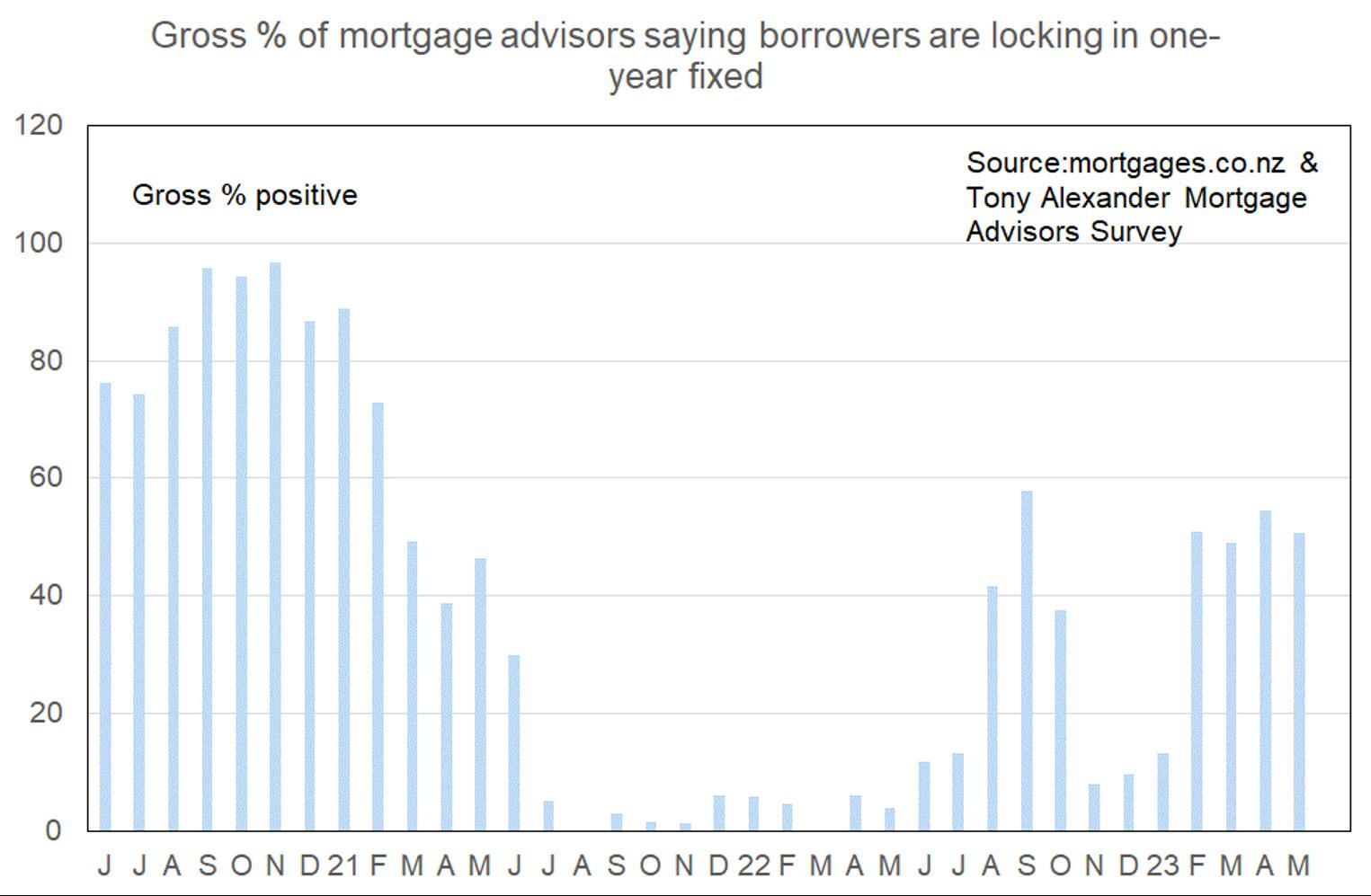

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 74 responses.

The main themes to come through from the statistical and anecdotal responses include these.

• More first home buyers are appearing.

• There are increasing signs that buyers feel we are at or almost at the bottom for prices.

• Some investors are returning but the interest level is still very low.

• Bank willingness to lend has increased further, assisted by CCCFA rule changes – plus anticipation of LVR changes from June 1.

COMPARED WITH A MONTH AGO, ARE YOU SEEING MORE OR FEWER FIRST HOME BUYERS LOOKING FOR MORTGAGE ADVICE?

In this month’s survey a net 49% of responding mortgage advisers have said that they are seeing more first home buyers seeking advice. This is a result broadly consistent with 42% last month and 59% in March and consolidates the shift in first buyer presence seen from early this year.

Young buyers have seen house prices fall a long way. Their incomes have risen, rents are rising, and credit is slowly starting to become more available. High stress test interest rates remain a challenge for many, however.

Comments on bank lending to first home buyers submitted by advisers include the following.

• One bank has opened up lending to people with less than 20% deposit for both existing and new to bank customers. Before, the only option was only if you’re an existing customer with the bank that they can access those funds. Competition is heating back up.

• More willingness to support first home buyers by less stringent review of discretionary spending. CCCFA was amended last week. This will allow borrowers to increase their borrowing capacity as banks are no longer taking a deep dive into bank statements and including discretionary expenditure...about time logic prevailed.

• Banks starting to open up ahead of 1 Jun changes to RBNZ speed limits

• Easing up a bit on LVR. Also, great to see the Kainga Ora LIM is being reduced from 1% to .5 from 01 June.

• Construction loans - cost overruns were previously 15%, now cut back to 10% unless it's not a fixed contract, in which case it'll be 20%.

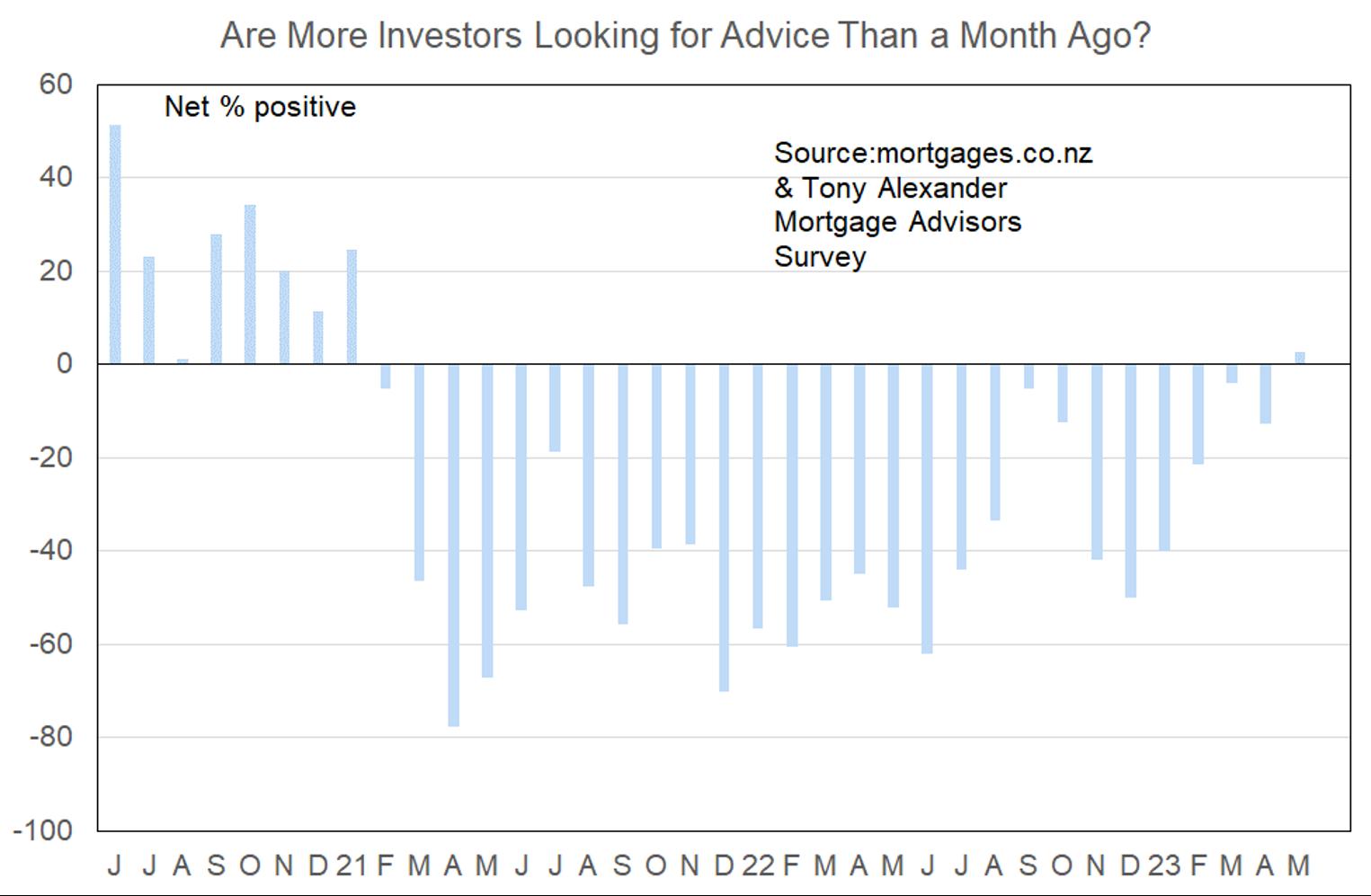

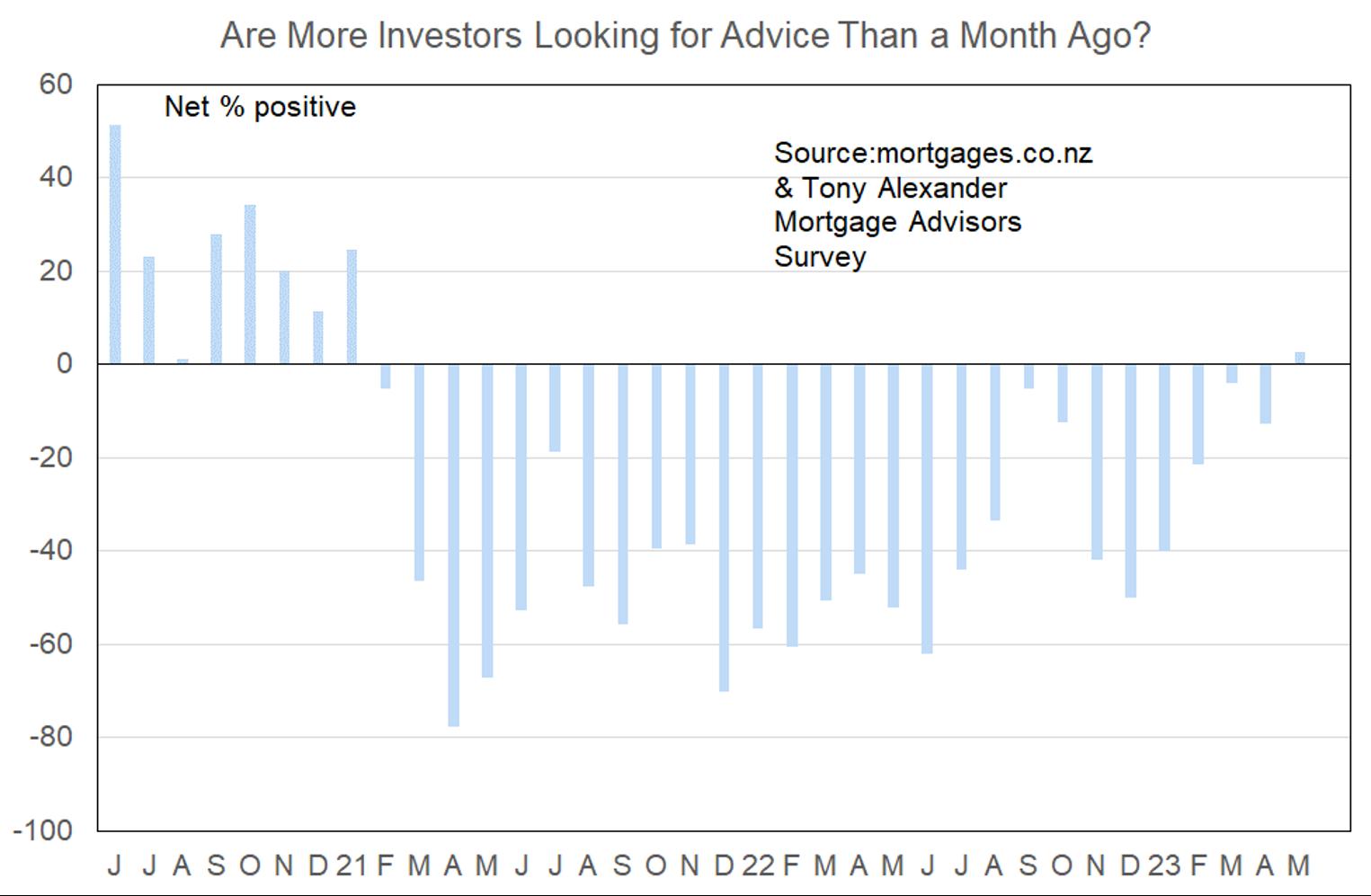

COMPARED WITH A MONTH AGO, ARE YOU SEEING MORE OR FEWER INVESTORS LOOKING FOR MORTGAGE ADVICE?

For the first time in over two years there are more mortgage brokers saying they are seeing more investors seeking advice than the number saying

2

they are seeing fewer. This is the standout result in this month’s survey but not entirely unexpected. The graph here shows that this measure has been getting less dire since the start of this year and was almost in net positive territory in September last year just before the extra high inflation number of 7.2% was revealed.

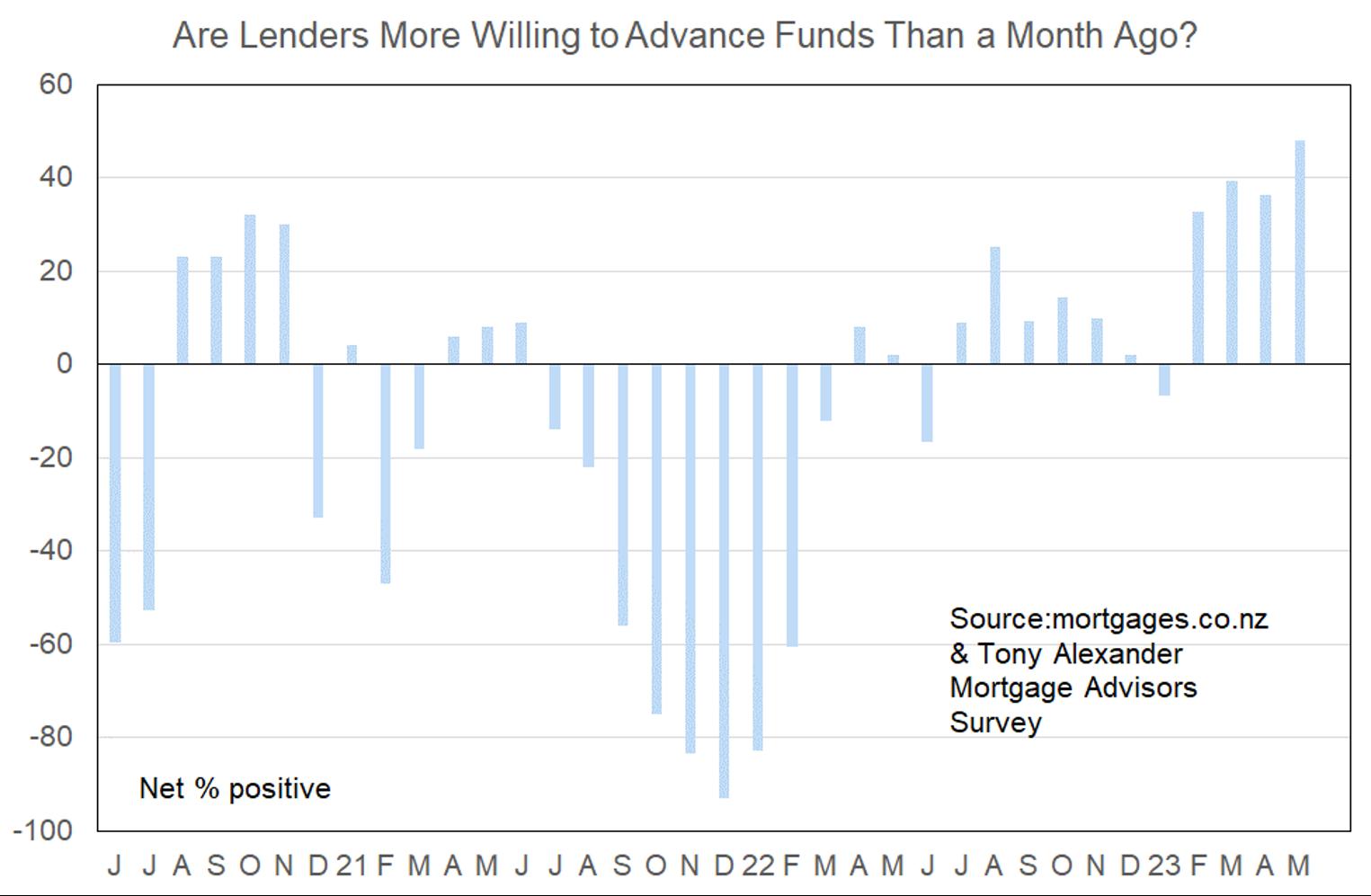

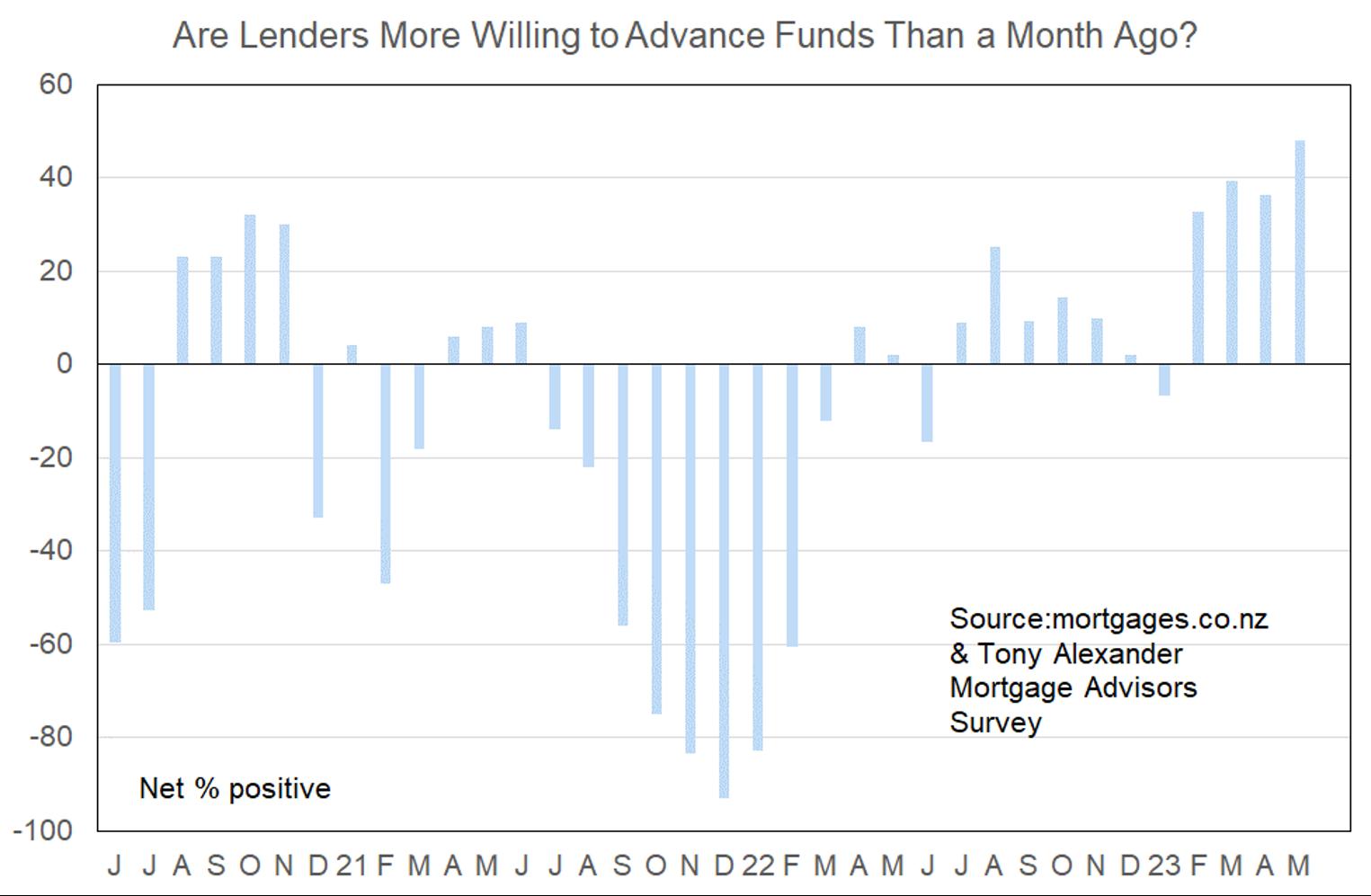

COMPARED WITH A MONTH AGO, ARE YOU FINDING LENDERS MORE OR LESS WILLING TO ADVANCE FUNDS?

This month a record net 48% of brokers have said that they are seeing banks more willing to lend funds to borrowers. This continues a string of positive results since February and a number of factors are likely to be behind this shift.

A net 3% of brokers say they are seeing more investors. This is not a radical shift from a result of -13% in April and -4% in March and the comments about bank lending to investors and investor demand submitted by brokers in this month’s survey show this.

My interpretation of this result is not that investors are back in the market, but rather than the flow out has stopped.

Comments made by advisers regarding bank lending to investors include the following.

• Test rates on existing lending hampering many, especially with rental scaling and full expenses assessment.

• Investor lending still tough but banks seem to be easing policy slightly.

• No change - waiting for 1st June for the LVR changes to come in.

• There is practically no new lending to investors apart from exempt loans to new apartments.

Banks are failing to meet mortgage sales targets and that is leading to greater willingness to act more assertively to acquire business. The tactic of offering extra low special 1-2 year rates about three months ago has not been repeated and that is probably because the Reserve Bank called the bankers up to tell them to not do it.

The response from banks appears to be greater targeting of market share through easing lending criteria rather than making very visible rate reductions.

Changes to application of CCCFA rules are helping willingness to lend and the ability of borrowers to qualify for a loan with further to come from June 1 when LVR rules are set to be eased slightly.

3

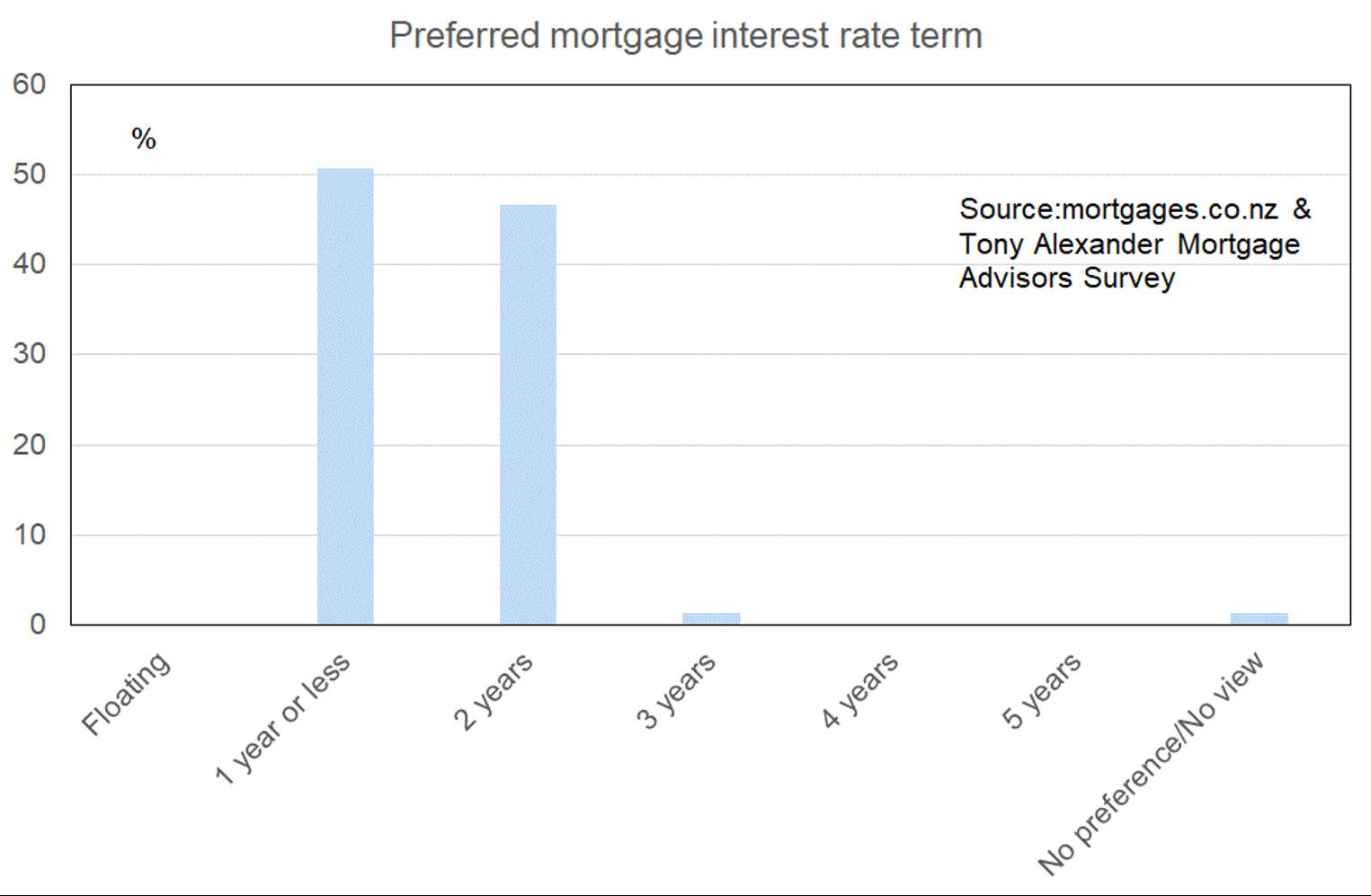

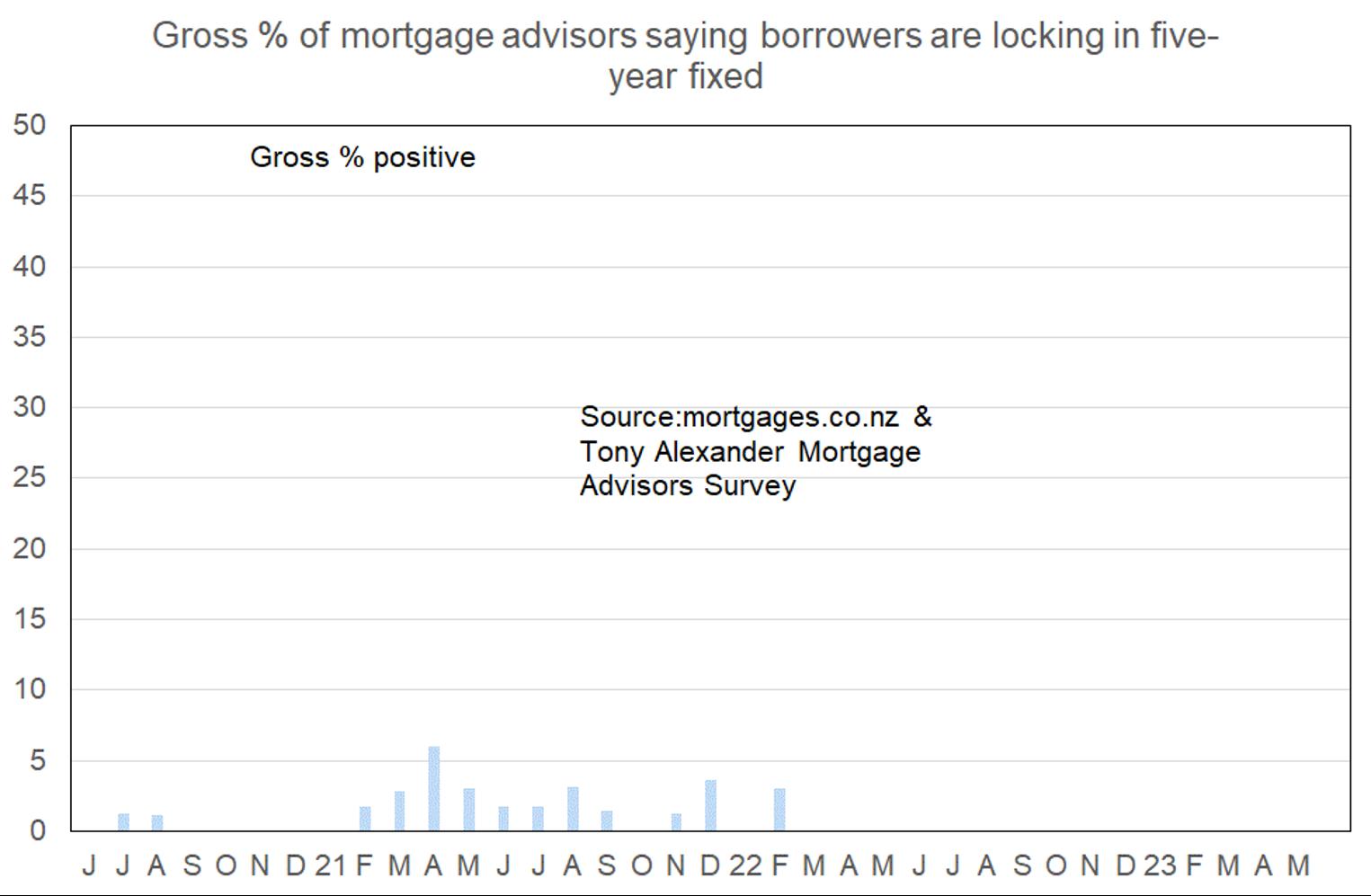

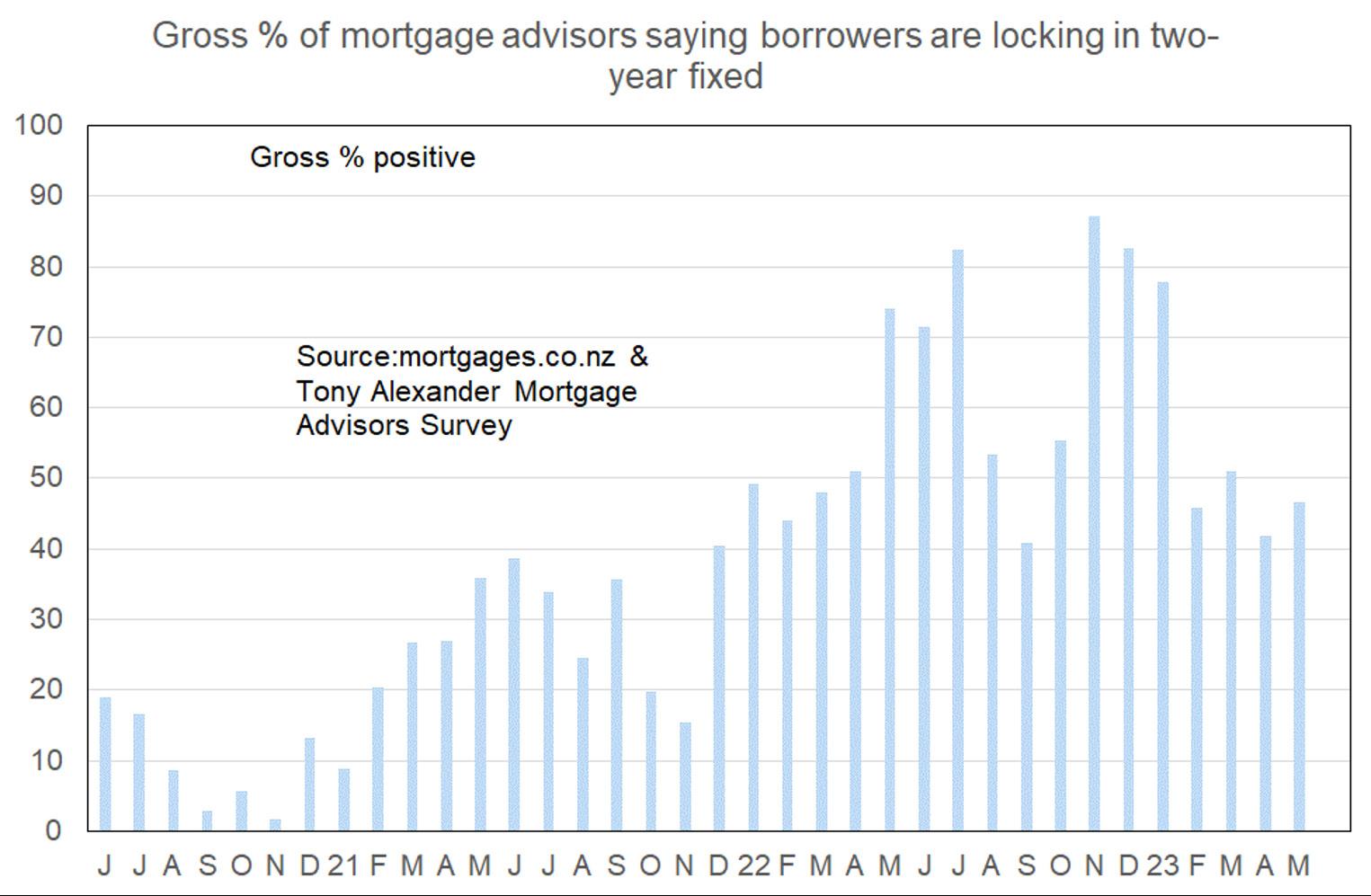

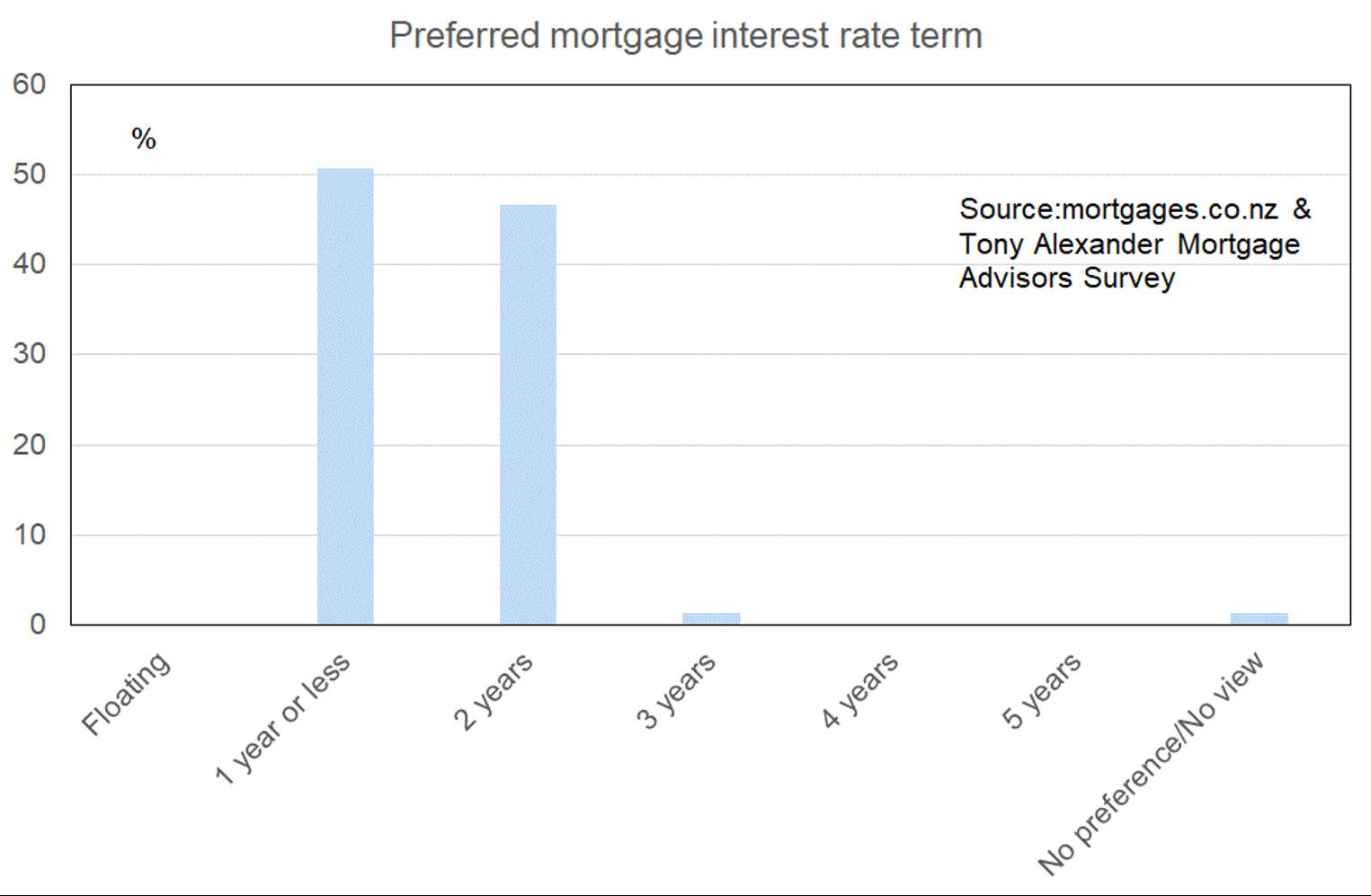

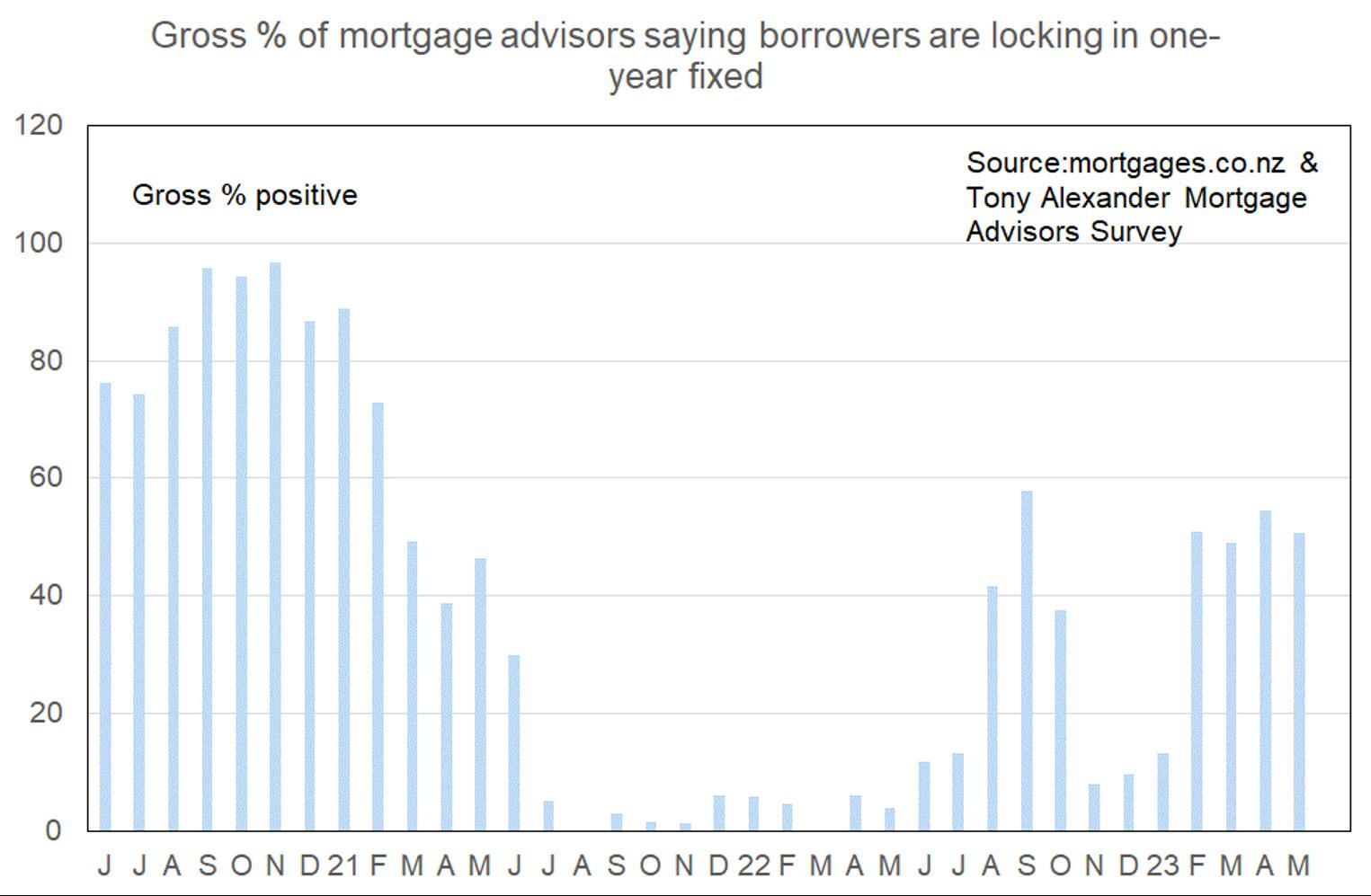

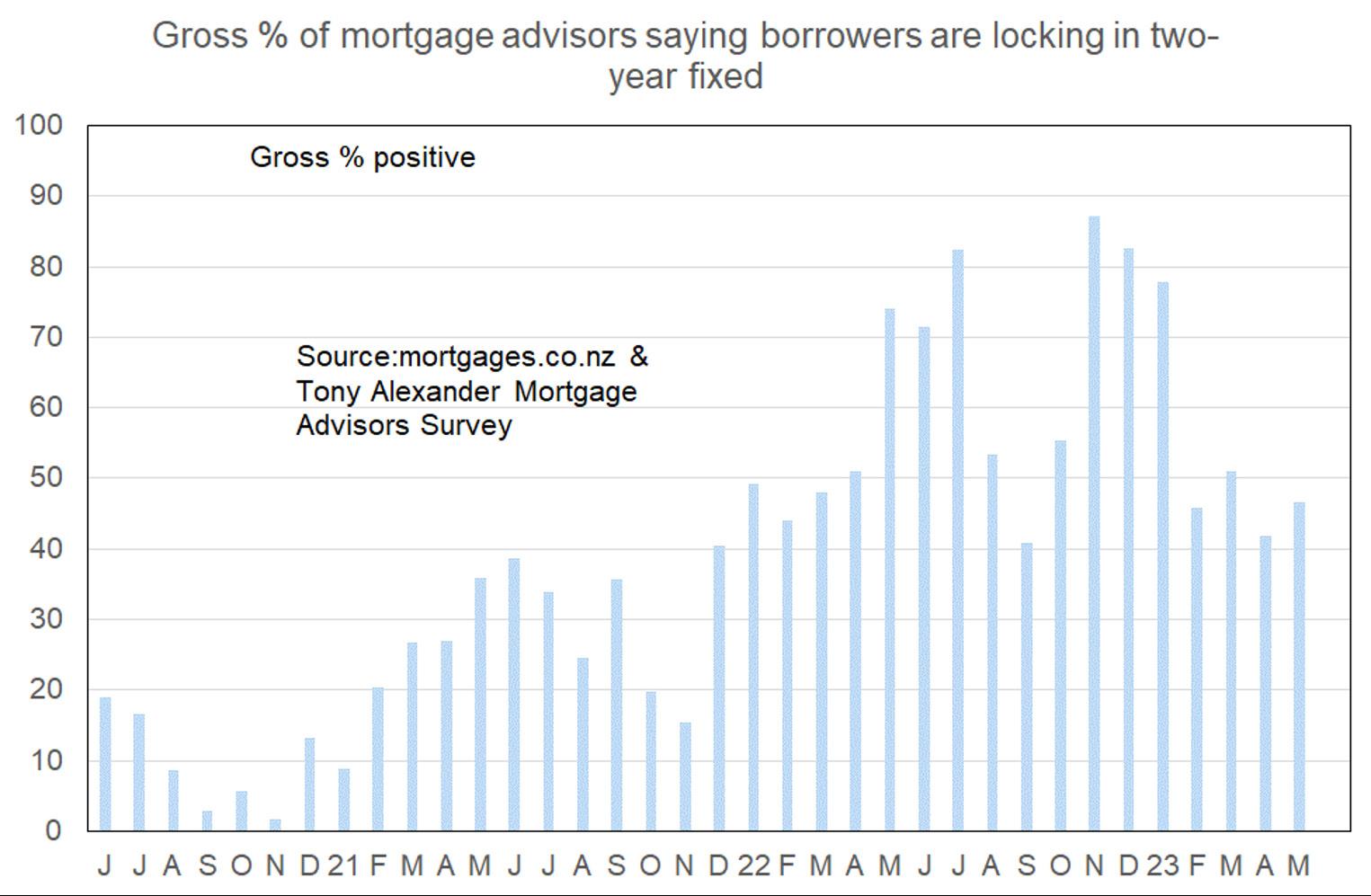

WHAT TIME PERIOD ARE MOST PEOPLE LOOKING AT FIXING THEIR INTEREST RATE?

People overwhelmingly favour fixing one year (51%) or two years (47%) although if the tick box of 18 months were offered quite a few would likely indicate that term as being most attractive to borrowers.

The one year term preference remains strong..

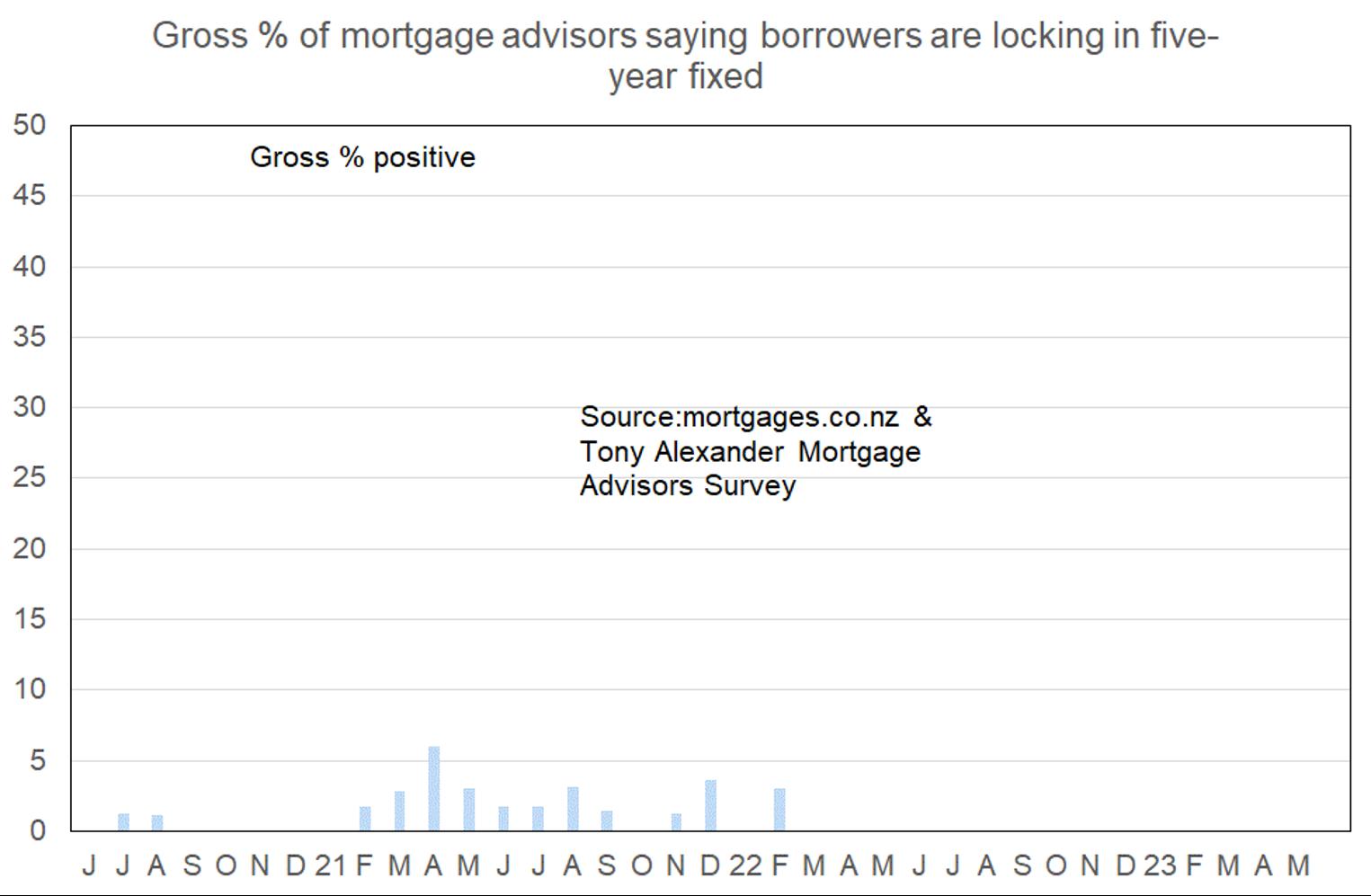

Preference for fixing three years remains almost zero.

The two year preference slipped somewhat in February but has not fallen further out of favour since then.

Even when the five year rate was 2.99% over the second half of 2020 and first half of 2021 hardly anyone touched in.

4

Mortgage Adviser’s Comments

Following are the comments which mortgage advisors volunteered in this month’s survey, grouped by the region in which the advisor primarily works. These insights can be very useful for placing flesh around the bones of the numerical indicators.

NORTHLAND

• General trends are there is more enquiry from first home buyers, investors and existing homeowners shopping for best deals and cashback. Any advantage they can get to reduce their interest costs and get easy cash.

AUCKLAND

• Seeing an uptake of conversations around potential financial hardship and the impact of this. Spending more time on mortgage reviews especially around managing higher repayments in the short term.

• Most activity I've seen since late 2021, first home buyers, owner-occupiers, borrowers looking to refinance and even some investors are coming back into the market. Bit of a mix which is ideal. Cannot speak for other regions but things are definitely turning a corner in Auckland.

• Sensible lending is still some time away, P&I to IO transfers require a financial difficulty case or full loan app

• Buyers - definitely more enquiry from FHB's but still a sense of caution and most don't seem to be in any rush to buy, preferring to take their time and find the right property. We do a lot of work with first time investors in the new build space and there is definite nervousness here.

• A general slow move to optimism based on rates topping out, bottom of the property curve, relaxation in CCCFA and LVR's plus the huge increase in positive population growth.

• Some clients happy with 5.99% FX36

• Still a lot of interest from first home buyers and next home buyers. have not seen Investors

• We have been busier in the last 3 weeks than in the last 3 months, its great, buyer confidence

is increasing but then again, the lending criteria easing has a lot to do with buyer confidence. The announcement of the LVR changes have probably triggered this too.

• The RBNZ increase of Low deposit lending from 10 to 15% of total lending has freed up space to allow banks to look at pre-approvals and new to bank customers buying existing property stock with a low deposit.

• CCCFA amendments means the banks are less worried about the discretionary spending habits of home loan applicants, so this is a positive change.

• Some First Home Buyers are missing out to other FHBs. This is motivating them to put in stronger offers for good housing stock. Most FHBs can't afford to renovate so when something tidy shows up, they all jump on it.

• Banks are willing to lend if an application is strong in all aspects

• Banks no longer looking as hard at discretionary expenditure, willing to accept customer's proposed living expenses rather than actual current expenses in debt servicing calcs. Doesn't mean people can borrow 'more' (rising interest rates have taken care of that) but does mean borrowers aren't be penalised as hard for expenditure that is within their control.

• Buyers don't have high enough incomes to meet servicing criteria due to high test rates

BAY OF PLENTY

• It is very hard out there at present

• New enquiry is starting to ramp up again. I think clients are starting to think rates have peaked and property values are nearing the bottom.

• Most banks have now changed their polices around discretionary spending, strongly in favour of applicants. Most discretionary spending now calculated as the amount clients would be unwilling to forgo should the get into hardship. This results in our ability to create an application that makes sense moving forward and clients dont need to 'prepare' for 3 months of reduced spending prior to application. This is a really positive shift and one that makes total sense.

5

WAIKATO

• A slight easing of criteria but the interest rates and repayments are the biggest hold up for clients.

HAWKE’S BAY

• Definitely seeing an increase in activity. More enquiry and more successful offers.

• Real Estate agents have reported pre-approved clients being declined finance, but this isn't something I have experienced.

• Hawkes Bay is certainly feeling a lot more buoyant than previous months

WELLINGTON

• A lot of turnkey purchases off the plan deals are failing to settle due to the decrease in value and banks reducing the lending approval amounts due to this. Some banks will honour the original purchase price which could be 18 to 24 months old now, but I think this puts the buyer in automatic negative equity and could be risky for lenders.

• Less activity in the market, following the usual winter trend. Election year usually sees a 6 month pre election stagnation in Wellington, and I see no reason why this year will be no different. Banks using cash to entice new business applications. Interest rate spread quite different across lenders with xxx noticeably higher than the others (and less willing to discount).

• One major lender has just released a new debt servicing calculator which has made lending to investors significantly worse. Close to 80% of the lending done with this lender in the last 3 months would now not meet their debt servicing criteria.

• Some lenders have adjusted their debt servicing calculations to take into account the recent CCCFA changes, but it will not make a significant difference.

• Borrowers have no urgency in the market, you can have pre-approvals in place however they are taking their time and possibly hoping for lower prices

• People that have purchased properties off the plans (12-18 months ago) are struggling to get

funding due to the increased costs of living, rising interest rates. factoring in that the value of the properties have generally fallen since they entered into the original contract, they are struggling to get the required deposit.

• Best 3 month period I have had in 18 months with new lending. FHB are re-emerging but they are also missing out on properties, getting the second or third property they try for. Market is changing again back to a normal market. The lack of building will start to hit shortly as buyers enter the market and the unrealistic seller puts their home into the rental pool or stays put.

• Lenders are being more flexible in terms of process, supporting documentation. Buyers feel we see close to bottom of market

• What is becoming more evident is a lot of mum and dad investors have not planned for the double whammy of higher rates and less of a tax deduction. It is common to be told 6.50 % I can't pay that and I owe IRD $ 10,000. This will only get worse as more come up to refix . It is sad that they didn't seek professional advice sooner and prepare for this.

• It is steady with plenty of activity, and enquiries continuing to come in.

• First-home buyers are active.

• Banks seem a little busier taking a bit longer to come back although it may have something to do with the recent three short weeks.

• I am now spending a lot of time with experienced investors who have finally realized the impact of the tax changes on interest deductibility and its impact on their cashflows. Most are caught in a perfect storm of high interest rates, and increasing expenses including their tax commitments. Selling isn't an option as the market for multi flat rentals is dreadful. I can't begin to imagine what’s happening to those investors who believed in buying a property every year and have vast portfolios and vast debt with low yield properties. And yet, there are many who still don't know what’s coming. The best analogy I have come up with is the Frog in the Pot of water on the stove, the water is slowly coming to the boil and they don't take any action because they don't realize what’s happening

6

TOP OF THE SOUTH ISLAND

• Its a wait and see approach by buyers - will prices continue to fall or will a get a better property if I wait. Very few cash buyers or first home buyers have slowed the market.

• Seem to be a lot of clients needing to sell due to relationship break ups and can't move forward until they sell. Splitting their affairs and reducing to one income, then reduces their future spending powers or stop them from being able to purchase and move into rental market.

CANTERBURY

• I was very busy for the first 4 months of this year but it's slowing down a bit now.

• More investors wanting to chat, getting their ducks in a row for any bargains over the next few months. Not necessarily taking action right now but checking their borrowing capacity. Many are sitting on large equity gains over the last 2-3 years and are starting to see some more upside potential in the market with a more positive outlook from here e.g., lower interest rates coming, higher rents, price appreciation. If interest deductibility also gets added to this list with a change in government looking likely over the next few months many will start to take action.

• 1% cashback offers continue to incentivise people to refinance after 3-4 years with their current lender. One bank is specifically targeting refinancers and promising mortgage advisers a turnaround time of 1-2 days for their refinance applications. Lending standards in aggregate seem to be slowly loosening (notwithstanding higher test rates when determining affordability) with banks hungry for new business

• Clients applying under First Home loan are experiencing big delays as some banks are struggling with having staff get over the line with their Level 5's - this has put huge stress on their qualified staff and causing huge backlogs with applications. Other banks are reaching out for applications as their staff are not at full capacity at present.

• Everyone still seems cautious with this higher interest rate and rising living costs

QUEENSTOWN LAKES

• Has been movement from clients who dont want to miss the bottom of the market - and are seeing that its close if not already been.

7

ISSN: 2744-5194

This publication is written by Tony Alexander, independent economist. Subscribe here https://forms.gle/qW9avCbaSiKcTnBQA

To enquire about having me in as a speaker or for a webinar contact me at tony@tonyalexander.nz Back issues at www.tonyalexander.nz

Tony’s Aim

To help Kiwis make better decisions for their businesses, investments, home purchases, and people by writing about the economy in an easy to understand manner.

Feel free to pass on to friends and clients wanting independent economic commentary.

Disclaimer: This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. We strongly recommend readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. No person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication. When referring to this report or any information contained herein, you must cite mortgages.co.nz as the source of the information. mortgages. co.nz reserves the right to request that you immediately withdraw from publication any document or article that fails to cite mortgages.co.nz as the source.

8

KaingaOraSharedPartnershipScheme

FirstHomePartner,iswhenKāingaOramakeafinancialcontribution topurchaseandshareownershipofahome...

Thisschemeappliestoexistingbrand-newhomesbuiltortobebuilt(turn-keydeals)

TheKaingaOraamountistoberepaidtoKaingaOrainterestfreeoverthenext15years. Theincomecapforthelast12monthsearningsforahouseholdis$130,000. Clientsmusthaveeitherofthefollowing.

• NZresidency

• NZpermanent residency

• NZCitizenship Process

• Clients apply to Kainga Ora Shared Partnership Scheme and get preapproval

• Next, Clients are qualified by the bank for the maximum amount of lending that the bank can approve them for.

• Then, clients put in their deposit from Savings, Kiwisavers, Subsidy and Gifts.

• Then, Kainga Ora put in the remaining amount up to $200,000 for the purchase of the property, or up to 25% of the purchase price (whichever is lower)

Clientsmustownandliveinthepropertyforaminimumof3years.

Exampleofa$1,000,000property

A coupleearning$65,000salaryeachwithnodebtsorchildrenapply (notethe$130,000 incomecap).

Basedonanaveragecostofliving(asat03/05/2023) thiscouplecanafford $730,000 inlending.

Theyhave$70,000 fromsavingsandKiwisaver.

KaingaOrawillputin$200,000 equity.

Meaningtheycanbuyahomeofaround$1,000,000.

ForcompletedetailsContact:

KaingaOraorchecktheirwebsite Phone:0508935266

Email:firsthome.enquiries@kaingaora.govt.nz

IIt’srareinlifethatwegetsomethingfornothingwithnostringsattached,especiallyif itgenuinelyaddsvalue.Nevertheless,that’spreciselywhatIwillgiveyou.

Expert home loan advice which has reliably proven to offer significant long-term financial advantage. Keeping strict tabs on the country’s largestnetwork ofbanks and numerous smaller second-tier lenders, soyoudon’thaveto.

What’s more, this comes at no cost to you because your chosen bank pays for the privilege.You have nothing to lose,yet have a higher chance of securingbetter terms.Restassured-ifthere’sasuperiordealoutthereforyou,I’ll findit.

Inthe typicallystoicalworldoffinance,we offera pointofdifference.Not onlywillyou receive excellent independent and impartial advice, but you’llhave fundoing it. Even after 15 years in the mortgage arena, our enthusiasm for objectives and commitment to clients shines through at every turn. Endorsement comes from countless glowing testimonials and Keith's own words: “We are at our happiest helping people navigate through difficultsituations,giving hope and concrete opportunity where they previously hadnone.”

Since 2002, Ihave helped countless clientsachieve their goals and dreams, either purchasing their firsthome, their next or buildinga forever home, or to arrangefinanceto acquire an investment property or asset finance.Annually, I willalso review your existing lending, loan structure or assist with debt consolidation.Being solutionfocused to obtain the ‘best outcomes financially’ and deliveringthe ‘most suitablesolutions’foryour financialsituation,is whatdrives me. No matter what age or stage you are, working alongside my team, we willrepresent you and your situation honestly, with integrity and professionalism. Check out my Google reviews. I look forward to journeyingonthispathwithyou.

KeithJones MortgageAdviser

021849767

keith.jones@loanmarket.co.nz

PROPERTIES

Town&Country

LJHooker

CurrentListings

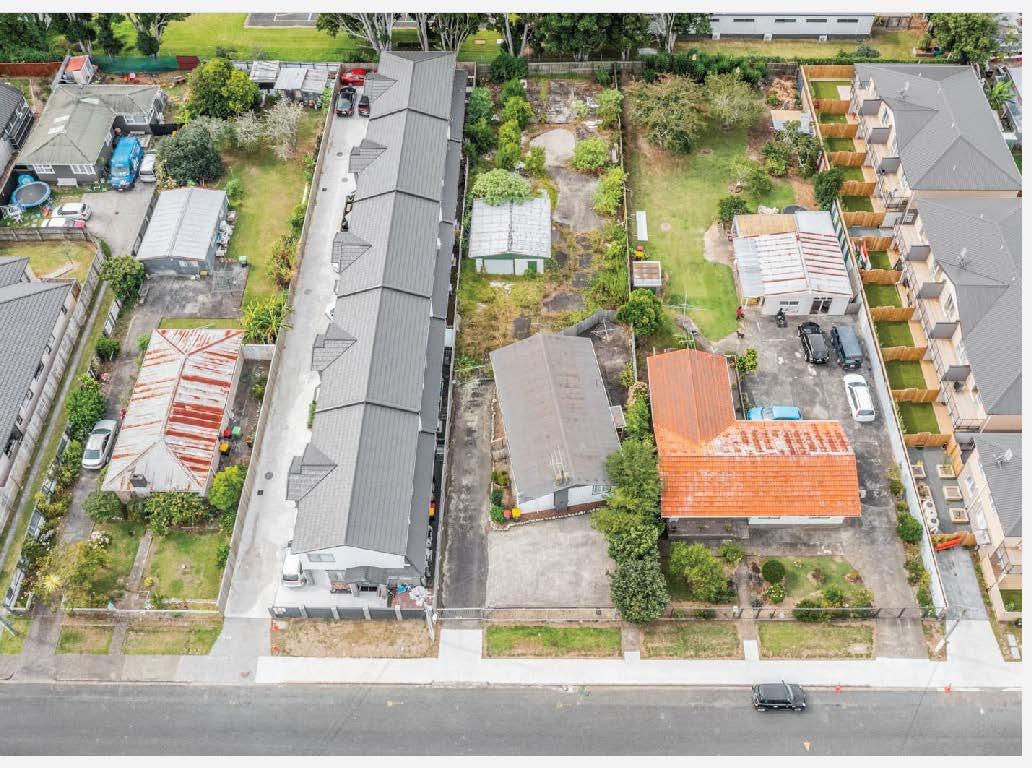

30 FranklyneRoad,OtaraNZ

§3 bl �1

URGENTSALE-MAKE AN OFFER

Currentlytenanted,this985m2site (moreorless)isa developersdream.ZonedResidential (9D),re...

ForSale ByNegotiation

View ByAppointment

BrentWorthington0292965362

brent.worthington@ljhooker.co.nz

https://drury.ljhooker.co.nz/

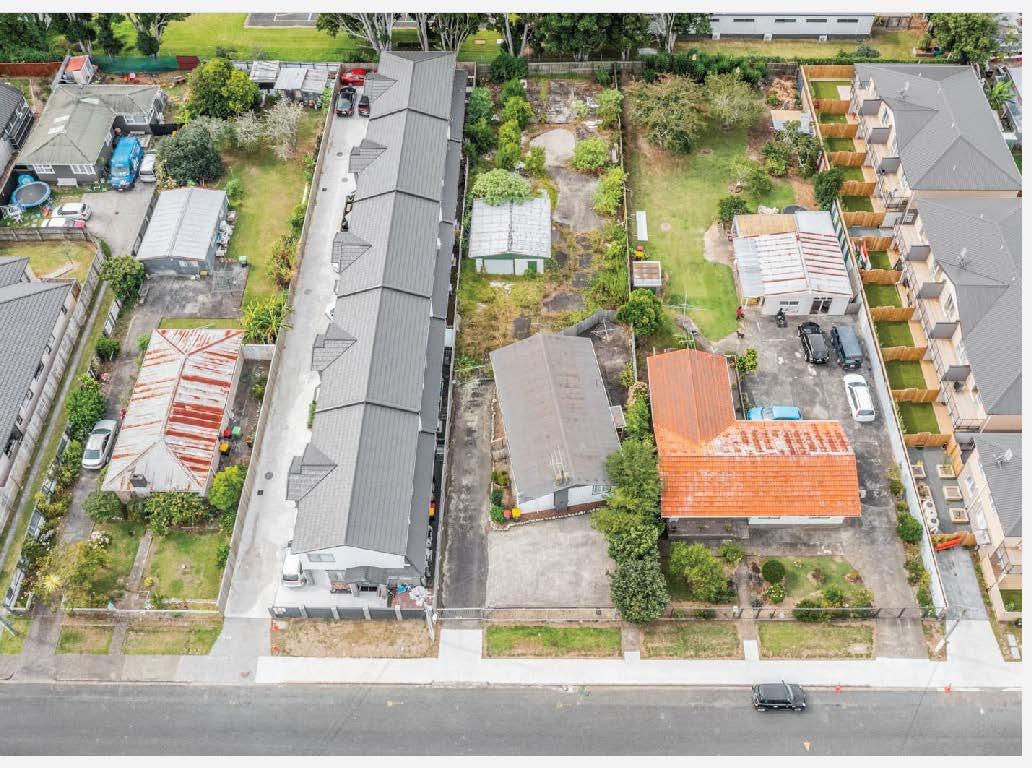

1Luke Place,OtaraNZ

§5 b2 �2

URGENT SALE-MAKE AN OFFER

* Prominentsite

* PrimeLocation

* Hugedevelopmentpotential

114 HarboursideDrive, KarakaNZ §- b-�-

RIPE FORDEVELOPMENT in KARAKA

Locatedinthe"soughtafter" Karaka Harbourside Estate,theopportunitytopurchaseanotherlandho...

ForSale Price ByNegotiation

View ByAppointment

NavJohnson0278272213

nav.johnson@ljhooker.co.nz

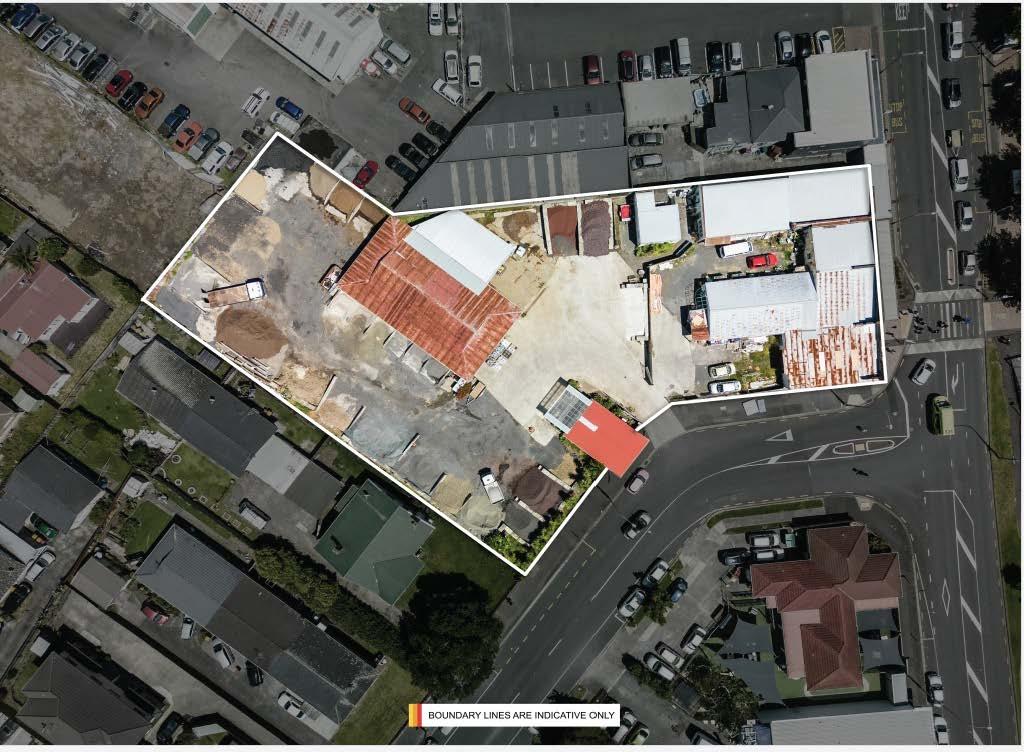

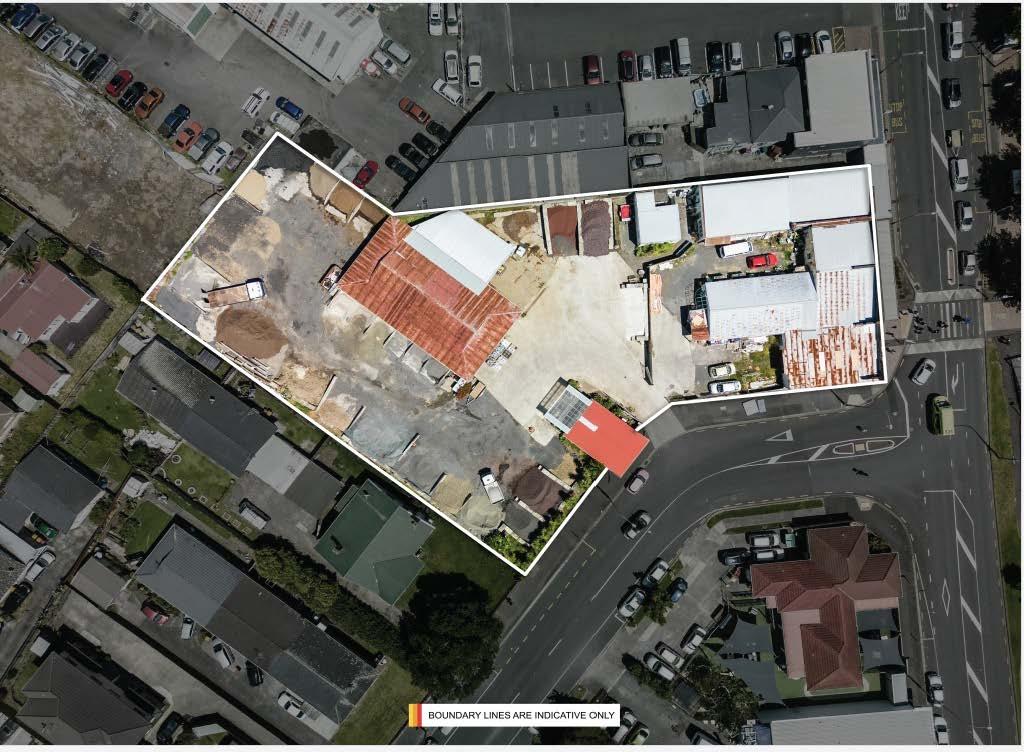

5 CoronationRoad, PapatoetoeNZ

PRIME COMMERCIAL BLOCK.

SetintheheartofOld Papatoetoe'scommercialhub, theopportunitytoacquireblocksofthissize

Under Offer ByNegotiation

BrentWorthington0292965362

brent.worthington@ljhooker.co.nz

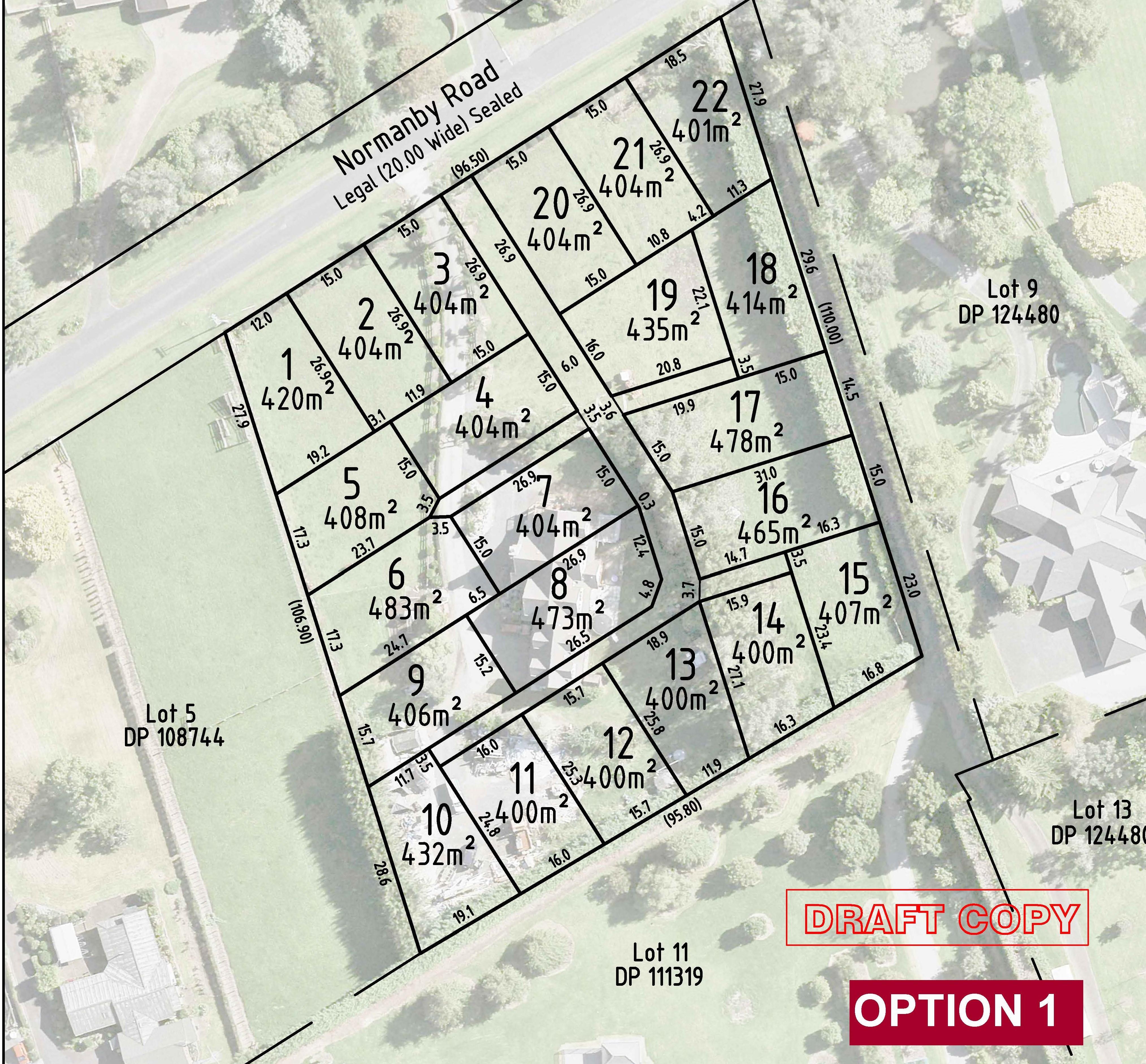

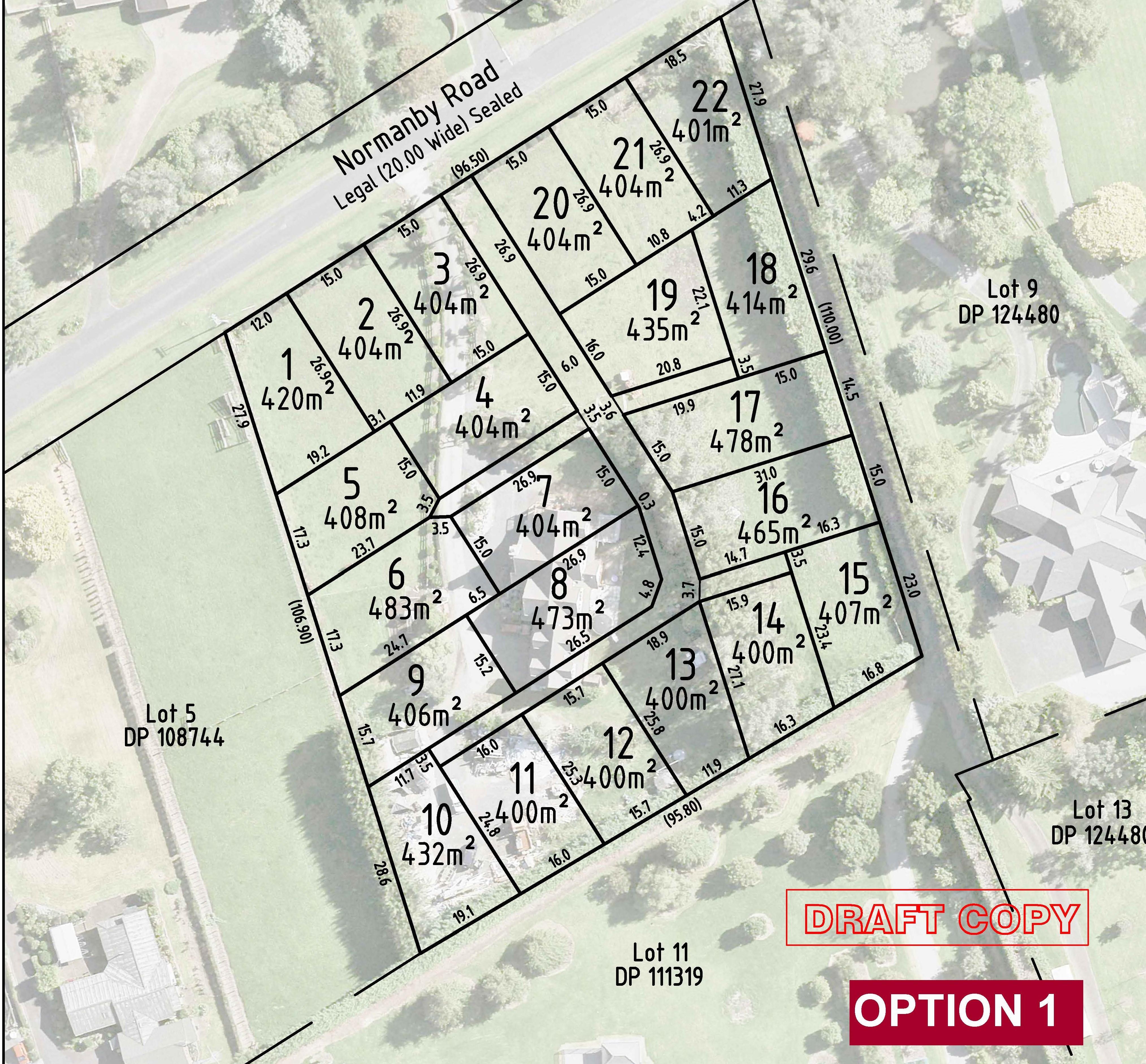

51NormanbyRoad, KarakaNZ

§1 b3 �3

BANKTHELAND- LIVETHELIFESTYLE

Thisofferingispositionperfectanddeliverstheastute buyerauniqueopportunitytoacquirearo...

ForSale ByNegotiation

View ByAppointment

BrentWorthington0292965362

brent.worthington@ljhooker.co.nz

102MountainRoad,Mangere BridgeNZ §2 bl �1

LOCATION-LOCATION-LOCATION. CONJUNCTIONALSAREWELCOME.

Onthemarketforthefirsttimeever,thisofferingisp...

ForSale Price ByNegotiation

View ByAppointment

BrentWorthington0292965362

brent.worthington@ljhooker.co.nz

ForSale Price By Negotiation

View SundayMay28th,11:00AM

-11:45AM,SundayJune4th,11:00AM

-11:45AM,SundayJune11th,11:00AM

-BrentWorthington0292965362

brent.worthington@ljhooker.co.nz

092947500

22MAY2023

1/233 GreatSouthRoadDruryNZ2113 drury@ljhooker.co.nz

LJHooker

3 Paparata Road, Bombay NZ

§3 b2 �s

PRICE REDUCTION! POSITION PERFECT! CONJUNCTIONALS ARE WELCOME.

YOU WON'T FIND BETTER AT THIS PRICE.

98B

§2 bl �2

TOO NEW CallNavformoredetails

ForSale Price By Negotiation View

Sunday May 28th, 01:15PM 02:00PM, Sunday June 4th, 0l:15PM -02:00PM, Sunday June 11th, 01:15PM -Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

ForSale Price By Negotiation View By Appointment Nav Johnson 027 827 2213 navjohnson@ljhooker.co.nz

https://drury.ljhooker.co.nz/

09 294 7500

Kalmar Road, Papatoetoe NZ

Listings

New

17th, May 2023

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

TNBPropertyServicesLtdLicensedREAA (2008) 51NormanbyRoad KARAKA RIPEFORDEVELOPMENTinKARAKA Formoreinformationpleasecontact: BrentWorthington 0292965362 LJHooker Town&Country 092947500 • Expanisve450m2home • 7Bedrooms • 10,109m2(moreorless)

ZonedResidential-Mixed Housing

4xProposedsubdivision consentplansavailablewith optionsupto22LOTS

Sale-ByNegotiation NEW TO THE MARKET

•

•

For

brent.worthington@ljhooker.co.nz (2008) FIRSTTIME valuableland,currently closeproximity FORSALE PricebyNegotiation View ByAppointment Contact 2 1 1 CLICKHERETOVIEWFULLDETAILSONOURWEBSITE

2 (2008) •3-4Bedrooms •2BathroomsinclEnsuite •Walk-inrobe •Largeoffice-fourthbedroom *SeparateLaundry *LargeDoubleGarage ForSalePriceByNegotiation ByAppointment CLICKHERETOVIEWFULLDETAILSONOURWEBSITE

LJHooker

Recent Sales

35 Briody Terrace, Stonefields NZ

4 bed, 3 bath

STAND ALONE IN STONEFIELDS

Set on a 372m2 site (more or less) this 243m2 Fletcher designed and built dwelling will definitely i ...

91 Beatty Road, Pukekohe NZ

§8 b7 �

uNuM1TEo POTENTIAL

On the market for the first time in 43 years. The 630m2 dwelling is set on a 2,379m2 site (more or I...

Sold Brent Worthington 0292 965 362

brent.worthington@ljhooker.co.nz

Sold Brent Worthington 0292 965 362

brent.worthington@ljhooker.co.nz

https://drury.ljhooker.co.nz/

16 Stellata Court, Randwick Park NZ

§3 b2 �2

Brick&Tile Beauty In The Park. If it's the easy care of a brick and tile home you're after, then this one's for you.

Situat

87 Beatty Road, Pukekohe NZ

5 bdrm 4 bathrm 2 vehicles

Perfect Home and Income

The 262m2 (more or less) main dwelling is set on a 949m2 site (more or less) and offers the perfect ...

Sold Nav Johnson 027 827 2213

nav.johnson@ljhooker.co.nz

Sold Brent Worthington 0292 965 362

brent.worthington@ljhooker.co.nz

09 294 7500

LJ Hooker Town&Country

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

Making Your Home Appealing for a Winter Sale

Nobody likes a cold and draughty home, and if you are getting your home ready for a winter sale, you want people to know how warm and toasty their future home will be.Before Jack Frost starts nipping at your toes, and ice crystals blanket your lawn, you want to plug all those gaps that allows cold air to bring down the temperature in your home.

Awarm and dry home is important for your family’s health, so it is critical to make sure you keep the temperature between 18 and 21 degrees.

Up to 20 percent ofheating can be lost through draughts, so your first step should be tracking down and blocking any openings –around doors and windows –to trap that warm air inside and keep the cold out.

Insulation is a smart way to keep a home warm and minimise heating costs.Awell-insulated home provides a healthier living environment as it reduces dampnessand condensation, while maintaining heat.

Underfloor and ceiling insulation is now compulsory in rentals where it is reasonably practicable to install.However, if you need more insulation to trap in the warmth, there are government subsidiesavailable to help homeowners and landlord.

Once you have your home warm and toasty, and you want to sell, now it the time to make your house look warm.

Spinning the colour wheel and adding a lick of warm coloured paint isan easy way to bring warmth to a room.Warm lighting and natural light add to the ambience.Also, warm coloured bulbs throw out softer light and give a cosy feel to a room.

Although outdoor plants are mostly dormant to survive the winter, indoor plants will thrive in your warm home.Not only do indoor plants contribute to a cosy and inviting feel, by grouping different shaped pots you can create a focal feature.

Do not overlook the outside, although we spend most of our time inside this time of the year, street appeal still matters when you are selling your property during winter.

Get out the water blaster and clear away green slime and dirt.Clean out the gutters, remove any stray leaves to make your home look inviting during the coldest and wettest months.

Those finishing touches, like a soft blanket tastefully laid across a chair, or placing inviting cushions on a couch will help create those first impressions that count.

Once you have your home feeling and looking warm and inviting, you know you have ticked all the boxes and you are now ready for a winter open home.

Property Management

Onthefollowingpagesyouwillfindour Property ManagementNewsletter.

on’thesitatetocontactDebbieHarrisonwhocanably assist you with any Property Management issues you may have or if you have any questions about anything in the Newsletterorpropertymanagementingeneral

Email: debbie.harrison@ljhooker.co.nz

Phone:021303864

MakeYourRentalPropertyStandOut

Withnewrentaldevelopmentsbeingcompleted,andarangeofvarietyinthetypesofrental properties,landlordsneedtomaketheirhomesstandoutfromtherest

Itisalwaysgoingtobeimportanttomakesureyour propertyisappealingaboveallelse.Attheendofthe day,therearemanylittlethingsthatadduptocreate themeansforsuccessfultenantstomovein.

Thefollowingwillhelpguideyoubygivingyouoptions tomakeyourrentalpropertystandoutandthethings youcandotoprepareyourpropertyforprospective renters.

Showoffthehome’sbestfeatures Identifywhatmakesyourpropertyunique.Doesit havelargebaywindows?Isitthelandscaped garden?Aretheroomsbright?Ordoesithavean eye-catchingfrontdoor?Whateveritis,makesure youdrawattentiontoitinyourlisting.

Mostprospectivetenantswillsearchonlinelistings first,whichiswherehighqualityphotosarekey. Professionalphotoswillhelpgrabtheirattentionand heightentheirappealinyourrentalproperty By stagingyourproperty,youwillmakeitlookevenmore attractivetorenters

Youwanttomakesureyoucovereveryangleofa room Ifyourbudgetallows,makeyourpropertylook goodforaday,withstagedfurnitureandprops,and snapsomegreatphotosshowcasingthebest features Thiscangiveyouacompetitiveedgeanda wideraudiencereach,especiallyforout-of-town renters

Firstimpressionsalwaysmatter Streetappealisvital,anditcanhavearealimpacton rentaldecisions Rentersaremorewillingtopaytop priceforawell-presentedproperty So,ifyouare hopingtomakeyourrentalstandout,youshould

focusonmakingthebestimpressionwithit.

Therearesomesimplewaysyoucanimprovecurb appeal.Firstofall,doesyourpropertylookinviting? Takeintoaccountthefrontgarden,doorstepand exterior.Isthereanythingyoucandotorefresh theseareastomakeitlookmoreattractivefrom thestreet?Perhapssomebasiclandscapingor replacingbrokenfencepalings?Ifyouownaunit, havealookattheconditionofcommonareas suchasthestairwellandfoyer.It’sagoodideato requestrepairsorupdateswheretheymightbe needed.

Next,setahighstandardforcleanliness Whileyou wantyourpropertytolookgoodfromtheoutside, theinsidemattersevenmore!Considerhaving carpetsprofessionallysteamcleanedandwash anydirtormarksoffthewallsandcabinetry

Qualitytenantsareattractedtorentalproperties thatareclean,safeandclearlywellcared-for

Smallfixesgoalongway

Fixingwhateverisbrokenpriortolistingyour propertywillgiveyouabetterchanceofattracting morepeopletoit

Tendtosmallcosmeticfixessuchasrefreshing paintwhereneeded,fixingleakyfaucets,replacing oldlightfixturesandfillingupminorcracksinwalls Payattentiontotheexterior,too Isthefrontgate squeaky?Doestheporchlightwork?Arethereany overhangingbranchesobscuringthegardenpath thatneedpruningback?

Smallrepairshereandtherecansaveyourtenants anyfrustrationdowntheline Italsopreventsany

ljhooker.co.nz

bigger,morecostlyrepairsforyouinthefuture

Detailedlistings

Whenitcomestothepropertywrite-up,makesure yougiveitanaccuratedescription.Howmany roomsarethere?Whatisthestoragespacelike? Whatisthesizeoftheproperty?Whatistherental cost?Whatamenitiesarenearby?Doyouallow pets?Ifyouhaverecentlyrenovatedorupdated appliances,makeitknown

Getasspecificasyoucan Thiswillhelptopainta clearpictureofyourpropertyandgivepotential rentersabetterideaofwhattoexpect Donotforget tohighlightyourproperty’suniquesellingpoint, either Getcreativewithyourlistingandmakeit easyforpotentialtenantstovisualiselivinginthe property If,forexample,itboastsabalcony,write abouthowtenantscanenjoysummerevenings watchingthesunsetontheirbalcony

Someotherwaystogiveyourrentalpropertylisting anadvantageincludesadvertisingonsocialmedia orenticingtenantswithadd-onssuchasfreewi-fi, securitysystemsoranin-unitwasheranddryer

Hireapropertymanager

Apropertymanagercantakecareofarental propertyonyourbehalf.Theycanassistyouwith alloftheaboveaswellasprovideadviceonhow toincreaseyourproperty’svaluealongwith screeningpotentialtenants.

Oneofthebiggestbenefitsofhiringaproperty manageristhattheysaveyoualotoftimeand effortinthemanagingandstagingofyourrental property Theywillalsogiveyouagreaterchance ofattractingandsecuringhigh-qualitytenants

OurteamatLJHookercanhelpyoutomakeyour rentalpropertystandoutfromtherest

Sugarandspicecolourshavebecomethelatest trendininteriordesign Thesehues,suchassweet pinksandearthybrown-reds,evokeasenseof warmthandcomfort Idealforcoolerroomswithout muchnaturalsunlight,theybringacosyandinviting atmosphere

RebeccaLong,acolourexpert,explainsthatthese colours,withtheircreamy,caramel,andterracotta undertones,createagroundedandsoothing ambiance Incontrasttothecoldgreysofthepast, sugarandspicecolorsembracewarm-basedhues thatexudeoptimismandjoy Theyhavebecomea popularchoicefortransforminghousesintohomes, addingcharacterandcharmtoanyspace

Beforemakinganydecisionsyoushouldconsultalegalor professionaladvisorLJHookerNewZealandLtdbelievestheinformationinthispublicationiscorrectandithasreasonablegroundsforanyopinionorrecommendationcontainedinthis publicationonthedateofthispublication NothinginthispublicationisorshouldbetakenasanofferinvitationorrecommendationLJHookerNewZealandLtdacceptsnoresponsibilityfor anylosscausedasaresultofanypersonrelyingonanyinformationinthispublication ThispublicationisfortheuseofpersonsinNewZealandonlyCopyrightinthispublicationisownedby LJHookerNewZealandLtd

Theinformationcontainedinthispublicationisgeneralinnatureandisnotintendedtobepersonalisedrealestateadvice

Youmustnotreproduceordistributecontentfromthispublicationoranypartofitwithoutpriorpermission

ljhooker.co.nz

Putting Your Best Foot Forward When Preparing a Rental Application

6 October 2021 |Lyall Russell| 5 mins

Finding the perfect rental to call home can be a challenge, especially in a competitive rental market.Property inspection can be frequented by dozens of others who, like you, feel that rush when you have found the perfect home, in the right neighbourhood and within your budget.

As a potential renter, it’s important to stand out from the pack.You need to present yourself as the ideal tenant and it all starts with creating a winning rental application.

Being prepared with a complete (and verified)rental profile can be a huge advantage and one that property managers appreciate so everyone can move quickly.So be certain you have all of these documents completed, copied and organised nicely into a folder that you can leave with the property manager on the day.

Here are some rental application tipsthat will assist in putting your best foot forward to secure your dream rental property.

Rental history

One of the most important considerations for property managers and landlords to get you approved for a property, is a good rental history.

Ensure to include your current and previous rental information such as the address, lease start and end dates, amount of rent and details of the property owner/manager. Other must have documents you should provide are references from previous landlords, proof of employment, pay slips, police background and credit checks.

The stronger picture you can provide ofyour rental history, the more likely you are to be chosen.

Employment and income

Having a reliable income and proof that you can pay rent consistently and on time, isa major factor in the approval process.Adding a few recent payslipsto your application will not only show proof of employment but also ease any fearsa landlord may have over missed payments.

Expect a credit check to be undertaken, as this is a normal part of the application process.

Proof of identity

It may seem like an obvious part of the application, but you will need to provide copies of identification to prove you are who you say you are. Ensure these are current and note, they may need to be notarised:

• Driver licence

• Passport

• Kiwi Access Card

Reference letters

Any evidence or reference letters from past landlords and employers, that show you are trustworthy and respectful can greatly help your case.Pet friendly rentalsare highly competitive so it is worthwhile preparing your pet’s reference from the past property manager.

Keep in mind the property manager or landlord may contact your references, so giving them a heads up is a good idea.

Cover letter