THE PROPERTY CHRONICLE MARCH2024 TOWN&COUNTRY Whenyouknow,youknow.™ TNBPropertyServicesLimited,LicensedREAA(2008)

Town & Country CONTENTS Page LJ Hooker Newsletter and Blogs • Letter from Principal (Brent Worthington) – Update • Managing your Property with LJ Hooker / Rent Exchange o Benefits of Long-Term Rental Investment o Selling Investment Property in Autumn 3 5 6 8 Reports, Surveys & Commentaries • REINZ Property Report – 14 March 24 Link – (February Data) • REINZ House Price Index Report (HPI) 14 March 24 Link (February Data) • REINZ (Real Estate Institute of NZ) o Lifestyle Press Release – A slow yet encouraging start for 2024 o Rural Press Release – Low sales continue as buyers wait for the market to improve • CoreLogic o Slow start to 2024 extends into February (Interactive Link) • RealEstate.CoNZ –o Sun-soaked property market offers opportunities aplenty 11 12 12 13 15 18 22 Finance & Lending • Tony’s View Alexander o What if everyone had fixed five years? o Regional Property Insights 32 38 Properties - LJ Hooker Town & Country • Properties Listed 57 • Properties Recently Sold 58 Our People • Brent Worthington • Venita Attrill • Lina Roban • Debbie Harrison • Johnny Bright (Apollo Auctions) • Keith Jones (Loan Market) 69 70 71 72 73 74 SuperGold - Welcome Here 67

26 March 2024

Hi

As real estate market commentators report a lift in market activity and values, we take this opportunity to remind all buyers and sellers of the importance of doing their homework and obtaining information about the property and understanding the real estate process.

Important steps include researching and understanding the different methods of sale, obtaining accurate and up to date information about the property from the salesperson, an accredited building inspector, the Land Information Memorandum (LIM) and council property file. Seeking financial and legal advice at an early stage will also support a smooth process. The time and cost of these steps are important investments to mitigate the potential for higher costs and complex issues that may arise further downstream if good preparation, advice and information is not obtained at the outset.

We recognise that some may be seeking to sell at the best price they can get and others may be seeking to buy quickly to take advantage of the market conditions. Nevertheless, we urge all consumers to do their homework and ensure they know the property and understand the real estate process to ensure a fair and effective transaction.

For property sellers our recommendations include:

1)Knowing the condition of the land and property in detail and seeking professional advice if uncertain along with discussing these issues with your real estate agent.

2)Fix or disclose any defects to your real estate agent when preparing your home for sale.

3)You have a legal obligation to be transparent about any issues with your property to support a fair transaction.

4)Seek legal advice before signing a real estate agency agreement.

5)Read the real Estate Authority's (REA) Residential Agency Agreement Guide https://www.settled.govt.nz/resources/?category=guides which real estate professionals are required to provide to prospective clients.

6)Do your research on the different methods of sale so you know what to expect.

Brent Worthington Principal and Licensee Agent

LJ Hooker Town & Country & Property Management 1/233 Great South road, Drury 0292 965 362 Town & Country

Town & Country

For property buyers our recommendations include:

1) View the property.

2) Engage an accredited building inspector to provide a professional building inspection report.

3) Obtain and read the property Land Information Memorandum (LIM), Record of Title and council file.

4) Research the area/neighbourhood.

5) Consider the long-term costs of buying, including interest and maintenance.

6) Seek advice from a lawyer before making an offer and before signing a sale and purchase agreement.

7) Read the REA sale and purchase agreement guide.

https://www.rea.govt.nz/real-estate-professionals/the-sales-process-and-general-guidance/saleand-purchase-agreement-guidance/

As always I hope you enjoy this publication.

Kind regards

Brent

Brent Worthington Principal and Licensee Agent

LJ Hooker Town & Country & Property Management

1/233 Great South road, Drury 0292 965 362

PROPERTY MANAGEMENT

Pleasedon'thesitateto contactourteamwhocan ablyassistyouwithany propertymanagement mattersyoumayhaveorif youhaveanyquestions aboutanythinginthe newsletterorproperty managementingeneral.

BENEFITSOFLONGTERMRENTAL INVESTMENT

Sixbenefitsoflong-termrentalinvestment

Itcanbetemptingtosellaninvestmentpropertywhen themarketisperforming,butholdingoutforthelong termmayalsohavebenefits.

Adecisionisbestmadebythoroughresearchand assessinglocalmarketconditionsaswellasyourown financialgoalsandrisktolerance.Itmaybeinfluenced byotherdecisionssuchaswhetheryouarerecently retiredormovedintopart-timework.

Thekeyiswhetheryourinvestmentpropertyis generatinganincomeincomparisontoyouroutgoings. Youalsoneedtofactorinthecostsassociatedwith sellingsuchaslegalfees,agent’scommission, marketing,dischargeofmortgageandanyrepairsthat maybeneeded.

Researchthemarket,andlookatyourproperty’s performancetodateaswellasitslocationand potentialforfuturecapitalgrowth.

Long-termrentalinvestmentsalsohaveadvantagesfor thegeneralpopulation,too.Itprovidesqualityrental propertiestohelpaddresshousingneedsinthe communitywhilecreatingasustainableinvestment. Herearesomeotherfactorstoconsider:

1.StableIncomeStream

Long-termrentalpropertiesprovideastableand consistentincomestreamthroughmonthlyrental payments.Thisreliableincomecancontributeto financialstabilityfortheowners.

2.WealthAccumulation

Propertyvaluesincreaseovertime,sothelongerthe investmentisheld,thegreaterthepotentialforcapital growth.Thisappreciationcanresultinsignificantprofits whenthepropertyissold,contributingtowealth

accumulation.Oncealong-termrentalpropertyisset upandoccupiedbytenants,itcanbecomeasourceof passiveincome.Landlordsmayhireproperty managerstohandleday-to-dayresponsibilities, reducingtheneedforactiveinvolvement.

3.RiskMitigation

Long-termrentalinvestmentsaregenerallyconsidered lessriskythanshort-termorspeculativeinvestments. Thestabilityofrentalincomeandthepotentialfor propertyvalueappreciationprovideabufferagainst marketfluctuations.

4.HedgingAgainstInflation

Realestatehashistoricallybeenconsideredahedge againstinflation.Asthecostoflivingincreases,sodo rentalpricesandpropertyvalues,allowinglandlordsto maintainthepurchasingpoweroftheirrentalincome andassetvalue.

5.TaxAdvantages

Long-termrentalpropertyownersmaybenefitfrom varioustaxadvantages,includingdeductionsfor mortgageinterest,propertytaxes,anddepreciation. Thesetaxbenefitscanenhanceoverallreturnson investment.

6.Diversification

Realestateoffersdiversificationforaninvestment portfolio.Includinglong-termrentalpropertiesina diversifiedportfoliocanhelpspreadriskandreduce theimpactofvolatilityinotherassetclasses.Itcan playaroleinretirementplanning.Thesteadyincome fromrentalpropertiescansupplementretirement savingsandprovidefinancialsecurityinlateryears.

ljhooker.com.au

2024

tolearnmoreabout investinginsights? https://www.ljhooker.com.au/invest

What

YourPropertyInvestmentChecklist

Ifyouownarentalpropertyormany,itisimportantto keepthemingoodcondition.Notonlywillthisallowyou toattractandretaingoodtenants,butitwillalsoensure yourinvestmentislookedafter.

Thatmeansdoingsomespecificmaintenancewhen summerrollsaroundtokeepyourassetsintip-top shape.Herearesomejobstodooverthewarmer months.

1.SecurityCheck

Findoutifyourpropertyisgoingtobevacantandifitis, checkthesecurityofyourinvestment.Makesurethe locksarefunctioningwellonallwindowsanddoors, checkthewindowlatchesandsecuritylights,andif therearesecuritycameras,asthereoftenarein apartments,thattheseareworking?

2.Addenergyefficiencyfeatures

Whileinsulatingyourrentalpropertyisacostforyou, youmightfindthatyoucansecureabetterweeklyrent fromtenants,giventheywon'thavetospendasmuch ontheirelectricitybillsandarelesslikelytoswitchon theairconditioner.

4.Gardentidy

Ifyougettheopportunitytoinsulatetheproperty thoroughly,thiscouldpayoffinthelongrun.Howyoudo thiswilldependonthekindofdwellingyou'veinvested in,buthaveachatwithyourpropertymanagerifyou're notsureoftherightapproach.

3.Cleanthegutters

Ifthere'sabuild-upofleaves,sticks,orotherdebrisin gutters,thiscanbeafirehazard.That'snottomention

Spruceupyourgardenbyrefreshingthemulch, weedingthegardenbeds,andconsideringadding somefloweringplantsforasplashofcolour.Clean theexteriorlightingandwindows,andcheckifthe entertainingdeckneedsanyrepairsandthatthe BBQissetupsafely.

5.Planningforthenextyear

Checkyourend-of-leasedate.Ifyouarehappywith thetenants,itmaybeagoodtimetotalktoyour

https://www.ljhooker.com.au/invest

Whattolearnmoreabout investinginsights?

YourGuidetoSellinganInvestmentProperty inAutumn

Theweatherhasfinallybecomealittlecrisperandthe daysalittleshortermakingautumnapopularseason forbothsellersandbuyers.Oftenpeoplebelievethat thewarmermonthsarethebesttimetosell,butintruth, allseasonshavetheiradvantages.It'sallabout preparingyourhometherightway.

Isautumnagoodtimetosell?

Listingyourinvestmentpropertyonthemarketin autumnisconsideredasmartideaforseveralreasons. ByMarch,theyearisinfullswingwithmostpeopleback atworkandthekidsbackintheirschoolroutine.With fewerdistractions,thosekeentosecureaninvestment propertywillstartlooking.Othersellersarealsonot alwaysawareofthebenefitsoflistinginautumn,so yourpropertyislikelytohavelesscompetitiononthe marketthaninthemorepopularspring.

Creatingautumncurbappeal

Ifyourinvestmentislocatedinaleafysuburb,then sellinginautumncanhaveitsprosandcons.Itcan meanmoreworkthanusualtomakethepropertylook neat,particularlyifhavingdeciduoustreesoutthefront. Whilerakingleavescanseemanever-endingtask, manybuyersmayfindsuchagardenwithitsbeautiful orangeandyellowleavestobecharming.Don’tforget aboutotherwaystomakeyourhomemoreappealing suchashigh-pressurehosingpathwaysandcleaning windows.

Checkguttersanddrainage

Buyersdonotwanttoseearooflineoverflowingwith debrisasitgivestheimpressionthehomeisnotwell maintained.

Hireaprofessionaltohelpyouheretocleanthegutters andmakesuretherearenodrainageissues.

Tidyupthegarden

Replaceanytiredlandscapingwithfreshflowering autumnplants.Trimhedgesandshrubsforacleaner look.

Checkheatingsystems

Noonewantstowalkintoapropertythatfeelscold andicy.Makesureyourhomefeelswarmandinviting. Thisistruealsoforshort-termandholidayrentals.Seal anycracksaroundthedoorsandwindowsasthese canletindrafts.Andutiliseyourheatingwithout makingittoohot.

Lighting

Pullbackblinds,opentheshuttersandensureall curtainsareopen.Turnonlightswhereneededinthe house,includingtablelamps.Ifyouhaveadarkroom consideraddingspotlightsbehindfurniture.

ljhooker.com.au SELLINGINVESTMENTPROPERTY INAUTUMN 2024 Whattolearnmoreabout investinginsights? https://www.ljhooker.com.au/invest

AGuidetoChoosingtheRightLandlordInsurance

Eventhebesttenantcouldaccidentallydamageyour investmentpropertyimpactingitsrentalincome.Or whatabouttheriskofpotentialfloodingorbushfires? Landlordinsurance,whilenotlegallyrequiredin Australia,isconsideredamust.Itnotonlycoversthe buildinganditscontentbutisacrucialsafeguard againstunforeseeneventsincludingdamage,lossof income,theftandnaturaldisasters.Selectingtheright landlordinsuranceisastrategicdecisionthatrequires carefulconsideration.Alwaysreadthefineprintofany policytomakesureyouarefullycoveredandreviewit annually.Let’stakealookatthekeyfactorswhen choosinglandlordinsurance.

1.UnderstandingYourNeeds

Considerthetypeofpropertyyouown,itslocation,and thespecificrisksassociatedwithit.Assessyourfinancial situationanddeterminethelevelofcoveragerequired toprotectyourinvestmentadequately.

2.ComprehensiveCoverage

Optforacomprehensiveinsurancepolicythatcoversa rangeofpotentialrisks.Thismayincludecoveragefor propertydamage,lossofrentalincome,liability protection,andlegalexpenses.Awell-roundedpolicy providesamorerobustsafetynetforunforeseenevents.

3.PropertyTypeConsiderations

Differentpropertytypesmayrequirespecificcoverage. Forexample,ifyouownafurnishedproperty,youmay needcoverageforthecontentswithintherentalunit.If youhaveamulti-unitproperty,ensureyourpolicy accountsfortheuniquerisksassociatedwithmultiple tenants.

4.LossofRentalIncome

premises.Ensureyourpolicyincludesliability coveragewithadequatelimits.

6.LegalExpensesCoverage

Legalexpensecoverageisbeneficialinsituations wherelegalactionistakenagainstyou,suchasan evictionprocessortenantdispute.Thiscoverage cansaveyousignificantlegalcostsandassistin navigatinglegalchallenges.

7.ReviewPolicyExclusions

Besuretocarefullyreviewthefineprintofyourpolicy tobeclearaboutwhatisincludedbyyourinsurance. Commonomissionsmayincludewearandtear, intentionaldamagebythetenant,orcertainnatural disasters.Knowingtheseexclusionshelpsmanage expectationsandallowsyoutoconsideradditional coverageifnecessary.

8.EvaluateDeductibles

Assessthedeductiblesassociatedwithyour insurancepolicy.Ahigherdeductibletypicallyresults inlowerpremiumcosts,butitalsomeansyou'llbe responsibleforalargerout-of-pocketexpenseinthe eventofaclaim.Strikeabalancethatalignswith yourrisktoleranceandfinancialcapacity.

9.CompareInsuranceProviders

Don'tsettleforthefirstinsuranceprovideryoucome across.Shoparound,obtainquotesfrommultiple insurers,andcomparecoverageoptions.Read customerreviews,considertheprovider'sreputation andresponsivenesstoclaims.

10.SeekProfessionalAdvice

Consultwithinsuranceprofessionalsorfinancial

Whattolearnmoreabout investinginsights? https://www.ljhooker.com.au/invest

REPORTS, SURVEYS& COMMENTARIES

NEW ZEALAND PROPERTY REPORT Published 14 March 2024 This report includes REINZ residential property statistics from February 2024. CLICKHERETOVIEWLINK

NEW ZEALAND HOUSE PRICE INDEX REPORT Published 14 March 2024 © REINZ - Real Estate Institute of New Zealand Inc. CLICKHERETOVIEWLINK

LIFESTYLEPRESSRELEASE

A slow yet encouraging start for 2024

The Real Estate Institute of New Zealand (REINZ) released data today showing there were 91 fewer lifestyle property sales (-7.2%) for the three months ended January 2024 than in the three months ended December 2023 Overall, there were 1,166 lifestyle property sales in the three months ended January 2024, an increase from the 1,127 lifestyle property sales for the three months ended January 2023 (+3.5%), and 1,257 lifestyle property sales for the three months ended December 2023

In the year to January 2024, 5,273 lifestyle properties were sold, a decrease of 1,017 (-16.2%) from the year to January 2023 Lifestyle property sales totalled $5.79 billion for the year to January 2024

The median price for all lifestyle properties sold in the three months to January 2024 was $950,000, which was $80,000 lower compared to the three months ended January 2023 (7.8%). The median price for Bare land Lifestyle properties sold in the three months to January 2024 was $420,000, which was $44,000 lower compared to the three months ended January 2023 (-9.5%). The median price for Farmlet Lifestyle properties sold in the three months to January 2024 was $1,060,000, which was $110,800 lower compared to the three months ended January 2023 (-9.5%).

Shane O’Brien, Rural Spokesman, at REINZ says: “The number of sales of Lifestyle properties is back slightly from December 2023 as much of the month was taken up by holidays but was up on the corresponding period in 2023 signalling a continued improvement in the market following trends in rising activity in the residential market across much of New Zealand.”

“A reduction in the sale of bareland properties was not unexpected as buyers weigh up increased building costs and timelines along with a reduction in the number of blocks available as developers work through new government policies on developing productive land.”

“Although the volume of sales was only back slightly on the same time in 2023, it is a marked reduction in the total sales recorded for the same period in 2022, being back close to 50% by volume across New Zealand.”

Nine regions had an increase in sales compared to January 2023, with Manawatu-Wanganui (+19 sales) and Nelson/Marlborough (+19 sales) showing the greatest increases Auckland (-50 sales) and Waikato (-8 sales) saw the greatest decreases in sales in the three months to January 2024 compared to the three months to January 2023. Sales increased in three regions compared to the three months to December 2023

In five regions, the median price of lifestyle blocks increased between the three months ended January 2023 and the three months ended January 2024. The most notable increases were in Wellington (+19.4%) and Southland (+11.3%), with the largest decreases were in Gisborne/Hawkes Bay (-25.8%) and West Coast (-13%).

26

February 2024

The median number of days to sell for lifestyle properties increased by 13 days in the three months to January 2024 compared to the three months to January 2023, reaching 65 days. Manawatu-Wanganui (55 days) had the shortest number of days to sell in January 2024 The West Coast had the longest number of days to sell (84 days)

ENDS

Real Estate Institute of New Zealand

For more real estate information and market trends data, visit www.reinz.co.nz. For New Zealand's most comprehensive range of listings for residential, lifestyle, rural, commercial, investment and rental properties, visit www.realestate.co.nz - REINZ's official property directory website.

Editors Note:

The information provided by REINZ in relation to the lifestyle real estate market covers the most recently completed three-month period; thus, references to January 2024 refer to the period from 1 November 2023 to 31 January 2024.

From April 2021 there has been a change in the methodology for calculating rural statistics. To date, the rural statistics have referred to a Return Period which is the month in which a sale record was submitted to REINZ. Going forward, the rural statistics will refer to an Unconditional Month i.e., the month in which the sale went unconditional. This change in methodology ensures that sales that took place in April, for instance, are recorded against April even if they were submitted to REINZ late. The change also brings Rural statistics calculation into line with the Residential statistics calculation, where the Unconditional Month approach has been used successfully to calculate Residential Statistics for several years now. The Unconditional Month methodology also ensures that the most up-to-date state of the REINZ database is reported at the time the data is released with revision of prior months’ statistics often occurring to reflect the submission of late data or sale amendments that took place after the prior statistics release.

In addition to the calculation period change there are two additional changes to the data worth noting:

1.12 Districts have been replaced by 13 Regions. These are consistent with the parts of the residential press release and it has been done to be consistent with regional definitions outside REINZ e.g., Statistics NZ

2.Dairy Support is a new farm category and we now have the ability to separate Lifestyle Blocks into Bareland and Farmlets.

If you have any questions regarding this change in methodology, please email statistics@reinz.co.nz.

RURALPRESSRELEASE

26February2024

Low sales continue as buyers wait for the market to improve

According to data released today by the Real Estate Institute of New Zealand (REINZ), there were 142 less farm sales (-38.4%) for the three months ended January 2024 than the same period in January 2023. Overall, there were 228 farm sales in the three months ended January 2024, compared to 243 farm sales in the three months ended December 2023 (6.2%), and 370 farm sales for the three months ended January 2023

In the year to January 2024, 919 farms were sold. This was 475 less fewer than in the year to January 2023, with 43.7% fewer Dairy farms, 7.1% fewer Dairy Support, 37.8% fewer Grazing farms, 35.3% fewer Finishing farms and 26.1% fewer Arable farms sold during the same period.

The median price per hectare for all farms sold in the three months to January 2024 was $30,940, down from $32,895 recorded for the three months ended January 2023 (-5.9%). The median price per hectare fell 8.9% from December 2023.

The REINZ All Farm Price Index rose 1.2% in the three months to January 2024 compared to the three months to December 2023. In comparison to the three months ended January 2023, the REINZ All Farm Price Index fell by 10.1%. The REINZ All Farm Price Index takes into account the differences in farm size, location, and farming type, but the median price per hectare, does not adjust for these factors.

One region saw a rise in the number of farm sales for the three months ended January 2024 compared to the three months ended January 2023, with the most notable being Auckland (+1 sales) and Northland ( -2 sales) Manawatu-Wanganui ( -25 sales) and Taranaki ( -20 sales) recorded the largest decreases in sales. Compared to the three months ended December 2023, three regions recorded an increase in sales, the most notable being Northland (+6 sales) and Southland (+4 sales).

Shane O’Brien, Rural Spokesman, at REINZ says: “The market has continued its downward trend as volumes of sales recorded dips again during the first month of 2024. It is particularly noticeable in the dairy sector, when in January 2022 there were 123 recorded dairy farm sales, but this reduced to 86 sales in 2023 and reduced by 50% again to just 43 sales this year. It is interesting to note that half the recorded sales were in the Waikato region with Southland, Canterbury and Taranaki also recording a number of sales. Dairy support farm sales volumes are back slightly also on previous years.

The reduced dairy payout plus rising farm costs and the higher interest rates are causing dairy farm buyers to take a cautious approach with many farmers focused on farm operating costs at this time. Although many farmers are buoyed by the recently announced lift in dairy payout for this season by Fonterra and encouraging results in the recent Global Dairy Trade auctions, this is yet to transpire in an increase in sales activity so far this year.”

Another area to record a sharp decline is horticultural properties with 46 sales recorded in January 2022 which reduced in 2023 to 21 sales and fell sharply this year to just 9 sales across the country in January. Headwinds in the avocado and kiwifruit industries were impacting buying decisions.

The traditional sheep and beef farm markets have also not escaped buyers’ reluctance, with just 124 finishing and grazing property sales recorded for the month of January back from 202 in 2023 and down significantly from the recorded 266 sales in January 2022.

“There remains a number of properties on the market from Spring 2024 plus some new Autumn 2024 listings giving the limited pool of buyers a good selection of properties across New Zealand. With the suggestion of potential interest rate rises and a continuation of poor farm product prices and dry weather conditions setting in, there appears little likelihood of sales volumes picking up dramatically in coming months ”

In January 2024, finishing farms accounted for a 30% share of all sales. Grazing farms accounted for 24% of all sales, dairy farms accounted for 19% of all sales and Dairy Support farms accounted for 9% of all sales. These four property types accounted for 82% of all sales during the three months ended January 2024

Dairy Farms

For the three months ended January 2024, the median sales price per hectare for dairy farms was $41,540 (43 properties), compared to $41,020 (37 properties) in the three months ended December 2023, and $43,930 (86 properties) in the three months ended January 2023. Over the last 12 months, the median price per hectare for dairy farms declined by 5.4%. The median dairy farm size in the three months ended January 2024 was 128 hectares.

In terms of price per kilo of milk solids basis, the median sales price was $38.39 per kg of milk solids for the three months ended January 2024, compared to $43.30 per kg of milk solids for the three months ended December 2023 (-11.3%), and $40.26 per kg of milk solids for the three months ended January 2023 (-4.6%).

The REINZ Dairy Farm Price Index rose 2.9% in the three months to January 2024 compared to the three months to December 2023. Compared to January 2023, the REINZ Dairy Farm Price Index fell 2.7%. The REINZ Dairy Farm Price Index takes into account the differences in farm size and location, unlike the median price per hectare, which does not.

Finishing Farms

The median sales price per hectare for finishing farms for the three months ended January 2024 was $35,060 (69 properties). This was lower than the $35,920 (81 properties) for the three months ended December 2023, and $39,400 (100 properties) for the three months ended January 2023 Over the previous 12 months, the median price per hectare for finishing farms dropped by 11.0% For the three months ended January 2024, the median finishing farm size was 36 hectares.

Grazing Farms

The median sales price per hectare for grazing farms for the three months ended January 2024 was $14,120 (55 properties), compared to $13,465 (48 properties) for the three months ended December 2023 and $13,080 (102 properties) for the three months ended January 2023. Over the previous 12 months, there was an 8.0% increase in the median price per hectare for grazing farms. For the three months ended January 2024, the median grazing farm size was 128 hectares.

Horticulture Farms

The median sales price per hectare for horticulture farms for the three months ended January 2024, was $227,660 (9 properties). This was lower than the $228,970 (15 properties) for the three months ended December 2023 and $375,140 (21 properties) for the three months ended January 2023. Over the previous 12 months, the median price per hectare for horticulture farms went down by 39.3%. For the three months ended January 2024, the median horticulture farm size was 11 hectares.

ENDS

Real

Estate Institute of New Zealand

For more real estate information and market trends data, visit www.reinz.co.nz. For New Zealand's most comprehensive range of listings for residential, lifestyle, rural, commercial, investment and rental properties, visit www.realestate.co.nz - REINZ's official property directory website.

Editor’s Note:

The information provided by REINZ in relation to the rural real estate market covers the most recently completed three-month period; thus, references to January 2024 refer to the period from 1 November 2023 to 31 January 2024

The REINZ Farm Price Indices have been developed in conjunction with the Reserve Bank of New Zealand. It adjusts sale prices for property specific factors such as location, size and farm type which can affect the median $/hectare calculations and provides a more accurate measure of farm price movements. The REINZ Farm Price Indices have been calculated with a base of 1,000 for the three months ended March 1996. The REINZ Farm Price Indices is best utilised in assessing percentage changes over various time periods rather than trying to apply changes in the REINZ Farm Price Index to specific property transactions.

From March 2021 there has been a change in the methodology for calculating rural statistics. To date, the rural statistics have referred to a Return Period which is the month in which a sale record was submitted to REINZ. Going forward, the rural statistics will refer to an Unconditional Month i.e., the month in which the sale went unconditional. This change in methodology ensures that sales that took place in April, for instance, are recorded against April even if they were submitted to REINZ late. The change also brings Rural statistics calculation into line with the Residential statistics calculation, where the Unconditional Month approach has been used successfully to calculate Residential Statistics for several years now. The Unconditional Month methodology also ensures that the most up-to-date state of the REINZ database is reported at the time the data is released with revision of prior months’ statistics often occurring to reflect the submission of late data or sale amendments that took place after the prior statistics release.

In addition to the calculation period change there are two additional changes to the data worth noting:

1.12 Districts have been replaced by 13 Regions. These are consistent with the parts of the residential press release and it has been done to be consistent with regional definitions outside REINZ e.g., Statistics NZ 2.Dairy Support is a new farm category and we now have the ability to separate Lifestyle Blocks into Bareland and Farmlets.

National home values rose 0.3% in February, continuing the decelerating trend seen since December, CoreLogic's House Price

Index shows.

Property values have risen for five consecutive months, however the pace of gains is down from November's 0.4% rise and December's 1.0% increase.

The average property value across NZ now stands at $930,495, up 2.8% from September's trough, but still 10.8% below the recent peak.

Most of the main centres were relatively subdued in February, with Hamilton, Tauranga, and Christchurch seeing marginal 0.1% rises, while Dunedin and Auckland ticked up by 0.2%. Wellington saw a stronger 0.6% rise in February, but that was after a below-average result in January.

CoreLogic NZ Chief Property Economist, Kelvin Davidson, said the recent sets of muted house price figures show that this isn't a straight-line market recovery.

"Given that mortgage rates remain high and property sales volumes through January remained at near record lows, buyers and sellers are still taking their time and this is flowing through to more subdued value growth," Mr Davidson said.

"For new entrants to the housing market, there are still significant challenges in terms of saving the deposit and satisfying loan serviceability criteria. Investors are also facing challenges from high mortgage rates too, while even existing owner-occupiers looking to move up the ladder still need to assess their finances closely.

"While the official cash rate remains on hold for now, the risk of a further rise in the short term hasn't dissipated altogether, and the likelihood of official cash rate cuts aren't on the table for the foreseeable future either. This will mean shorter-term fixed mortgage rates, such as the one and two year loans, could remain elevated for a while yet.

"As a result, we could continue to see mixed results across the housing market, with localised factors affecting each region and stretched affordability continuing to restrict growth in property demand and therefore price growth too," he said.

CoreLogic House Price Index

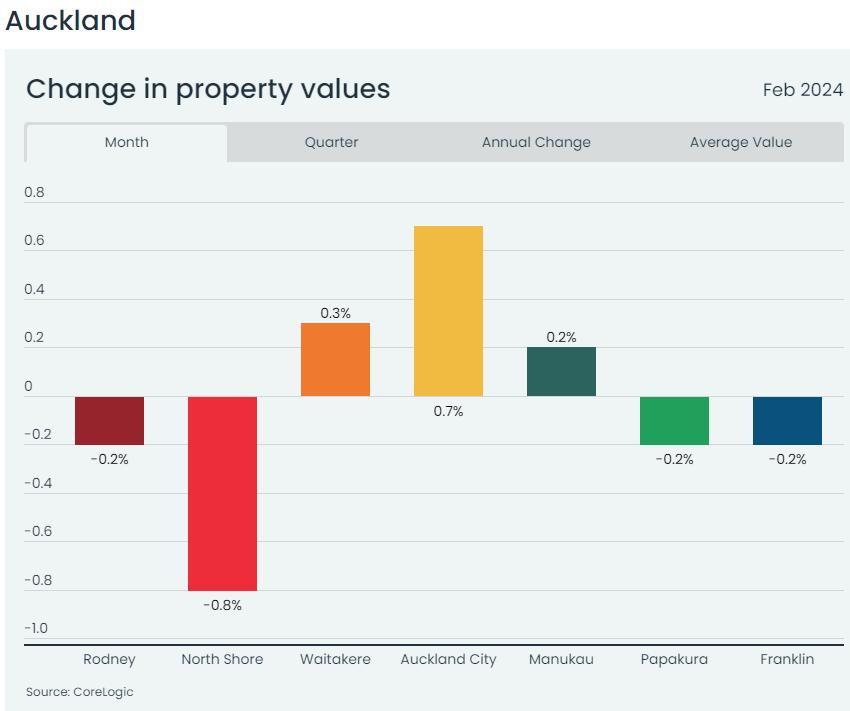

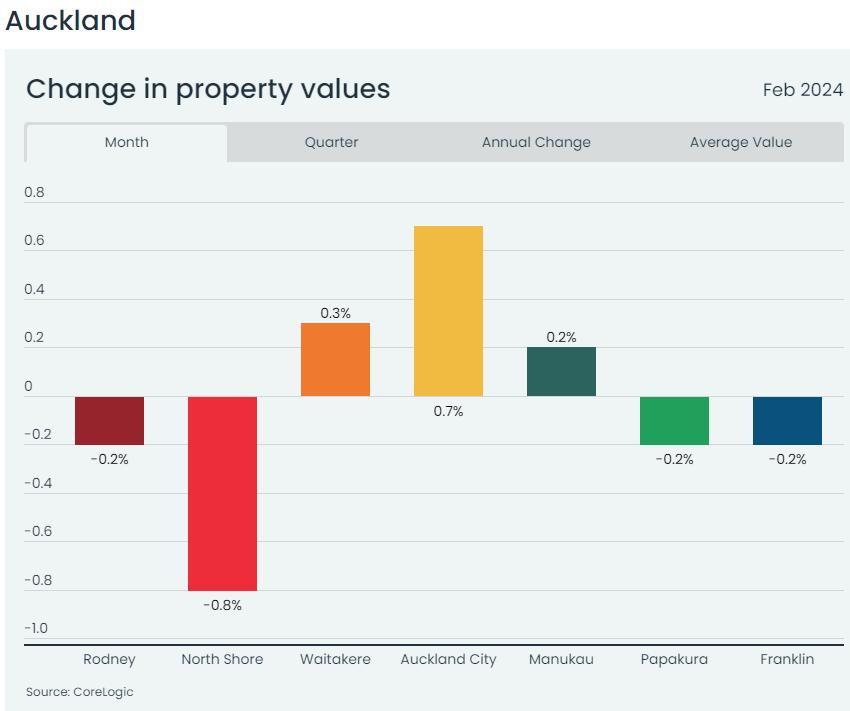

In February Auckland's sub-markets were relatively bunched, with the exception of North Shore (-0.8%) and Auckland City (0.7%). Over the past three months, each market has seen property values rise, with Manukau up at a 3.5% gain, while Franklin has just edged back into positive territory on a 12-month comparison (0.1%).

“Auckland's market has clearly picked up from the lulls seen over 2022 and for much of last year as well, but even though population growth is strong, the challenges from stretched housing affordability and high mortgage rates remain firmly in place. It'll be another fascinating year for our largest housing market," Mr Davidson said.

After a softer month in January, there might have been a bit of 'catch up' growth around Wellington in February. Each of the sub-markets saw values rise at least 0.5%, with Lower Hutt and Kapiti Coast rising by 0.8%. In Porirua and Lower Hutt, values are now about 2% higher than a year ago, although other parts of Wellington are still lower than February 2023.

"Wellington's data over January and February is a good illustration of wider market trends at present – one month softer, one month stronger. This could well be a dominant pattern across most of the country in 2024," Mr Davidson said.

Regional House Price Index results

Outside the main centres, many of the key urban areas also saw muted value change over the month, ranging from a -0.4% dip in Rotorua and Hastings, to a 0.5% rise in Whanganui.

Mr Davidson noted that the clear exception continued to be Queenstown, which recorded a 0.9% rise in February, taking its quarterly gain to 3.8%, and the annual rise to 7.8%.

"At present there's just no stopping the Queenstown property market. Wealth must be playing a key role, with housing much less affordable or accessible for anybody without that accumulated equity and instead relying on their local income," he said.

Other Main Urban Areas (ordered by annual growth)

Property market outlook

"Housing market sentiment has improved a little in recent months, and we're anticipating growth in national sales volumes of about 10% this year, with prices potentially rising by around 5%. But that’s coming from a low base, and the averages could also mask quite a bit of regional variance, with the main centres boosted by stronger population growth, yet some other areas perhaps held back by affordability concerns," Mr Davidson said.

"It will also be worth keeping an eye on each of the various buyer groups. First home buyers are still enjoying market conditions for now, using KiwiSaver for at least part of the deposit, and making full use of the low deposit lending allowances at the banks. By contrast, mortgaged investors remain a bit quieter. However, they're a group to watch closely in the coming months, as tax and lending regulations shift."

Female-only real estate investors significantly lag their male counterparts in fast-tracking wealth creation through property, an analysis of New Zealand’s home ownership reveals.

CoreLogic’s 2024 Women & Property report released ahead of International Women’s Day, found while female-only owner occupier rates were higher than men, they fell behind significantly when it came to investment properties.

The fourth edition of the report, which provides an update to the state of home ownership for men and women across New Zealand as of January 2024, shows the proportion of female-only owner-occupied properties is 22.9% compared to male-only owner-occupied figure of 20.7%.

On the contrary, CoreLogic’s examination of investment stock identified female-only ownership rate fell to 21.6%, while male-only ownership was notably higher at 26.3%.

CoreLogic report author and chief property economist Kelvin Davidson said there were several factors explaining the tendency for more men to own investment properties than women, but as suggested in previous reports pay and financial literacy were two likely contributing factors.

“The gender wage gap means that, in theory at least, males can build financial wealth a bit faster, allowing for earlier and more investment in rental properties,” he said.

“There is some evidence that financial education and literacy is higher among males too, potentially giving them more awareness of different options.”

The report found 22.2% of homes across all dwellings are owned exclusively by one or more females, slightly less than the 22.7% owned by males. The remaining 55.0% of homes have mixed gender ownership.

The 50-basis point gap between female-only and male-only ownership equates to less than 8,000 properties.

A year earlier, the same figures were 22.0%, 22.5%, and 55.5%. Mr Davidson said while these changes since early 2023 are minor, there’s been a small shift towards single gender ownership, for both females and males, with the mixed-gender share dropping by 50 basis points. Previously, 2023’s figure for mixed-gender ownership had been a small rise from 2022.

In terms of the value of property, female-only stock had a median value of $650,532 in the latest results, versus $675,975 for male-owned dwellings.

Gender-owned property trends in the regions

Of the 14 regions nationally, four have a female-only ownership rate higher than the national average. Gisborne has the highest female-only ownership rate, at 24.9%, followed by Auckland at 23.7%, followed by Wellington and Manawatu-Whanganui. The West Coast and Tasman-Nelson-Marlborough are the lowest.

Mr Davidson suspects more affordable apartment living options in cities such as Auckland and Wellington might assist female-only ownership where saving for a deposit and mortgage serviceability is a challenge.

“Other areas of the country, such as the West Coast, are predominantly mining and farming areas, which may attract fewer female-only property owners,” he said.

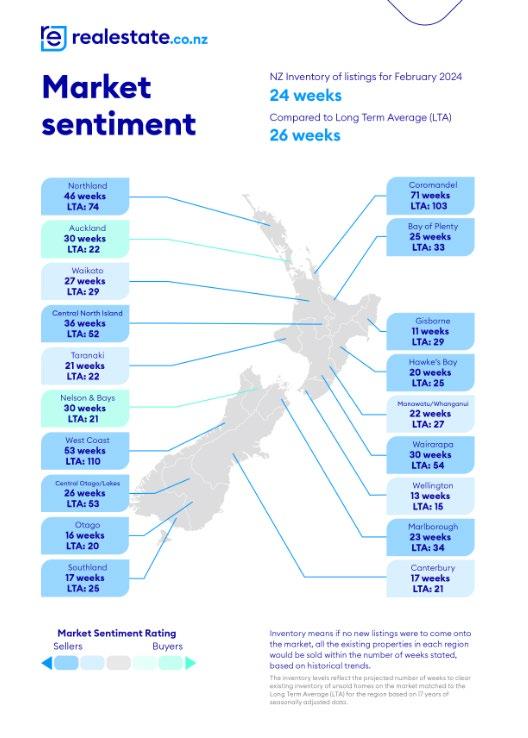

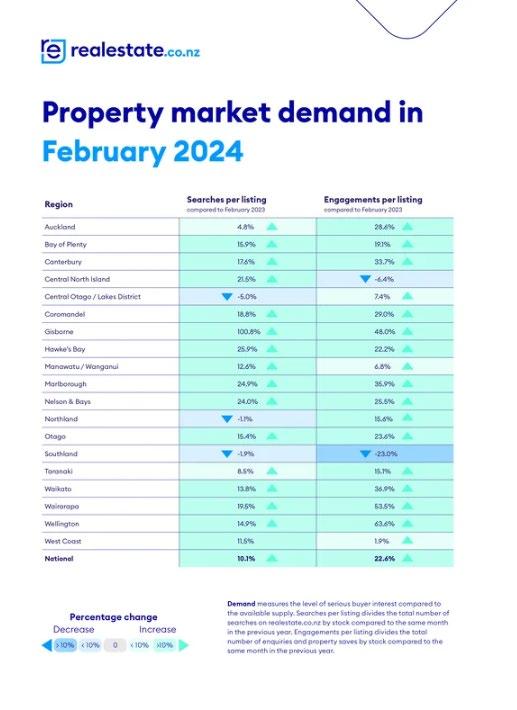

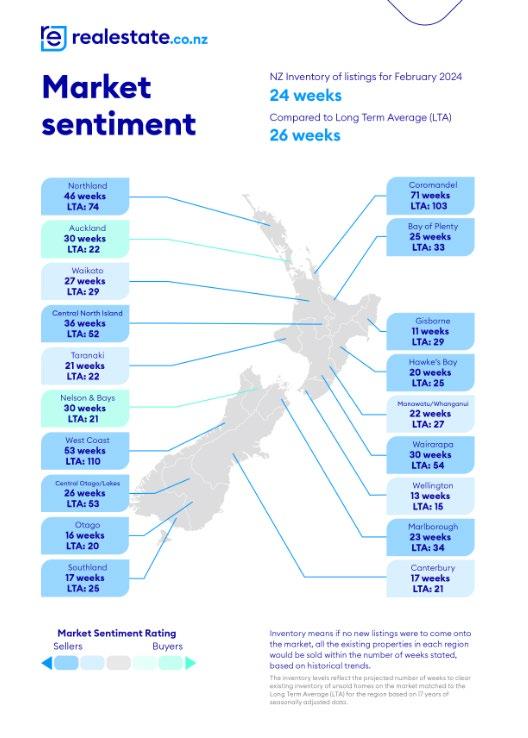

Stock levels hit an 8-year high as new listing levels bounce back to welcome buyers. Prices remained stable while Kiwis awaited the latest OCR announcement.

• New listings bounce back to health

• High stock brings options aplenty for buyers

• Prices rise gently; Central Otago continues to break records

The end of summer has seen the New Zealand property market return to full health as Kiwis started back at school and work. The latest data from realestate.co.nz for February saw high stock levels nationally, thanks to more new listings refilling housing supply levels.

Nationally, prices rose gently in February, suggesting that while the market is starting to warm up, a more sustainable market is in play.

Kiwis have been waiting in the wings for news on the Official Cash Rate (OCR) in February, uncertain about whether the rate would come down, hold or increase. Wednesday’s announcement from the Reserve Bank holding the rate at 5.5% has provided some certainty for vendors and buyers.

Vanessa Williams, spokesperson for realestate.co.nz, remarks that as the country navigates ongoing economic challenges, it is refreshing to see the property market looking more stable:

“With no change to the OCR and gentle easing of interest rates by some of the larger retail banks, it will be interesting to see how these factors play out for the property market in the coming months.”

New listings bounce back to health

In February, 11,788 new listings came onto the market, marking a 44.8% increase nationally compared to last year. This influx is a return to health after new listings in February 2023 hit an all-time low for any February since realestate.co.nz records began in 2007.

New listings were up across all 19 regions, with the most significant increases observed in Northland (up 94.6%), Coromandel (up 85.3%), Wellington (up 76.6%), Hawke’s Bay (up 75.4%) and Auckland (up 64.0%).

Vanessa says that the bounce back in listings reveals a confident market, a much different market to the same time last year:

“Last February saw us dealing with a very different summer as Kiwis grappled with the effects of back-to-back weather events.

“In a typical February month, we would see around 11,000 new listings come onto the market. Seeing numbers back in the ‘normal’ range tells us that Kiwis are becoming more positive about listing their properties for sale. This is great news for buyers, offering them a wider array of options.”

High stock brings options aplenty for buyers

February saw the highest number of total properties on the market in almost a decade. Housing stock rose to 31,424 in February (an increase of 8.1% year on year); the last time supply reached over 30,000 was in November 2015.

Most regions contributed to the revival, with stock levels rising in all except two regions year-on-year, these were Gisborne (down 32.4%) and Otago (down 4.2%). Gisborne saw record-low stock levels for any February since records began 17 years ago.

Coromandel and Northland saw the largest increases in housing stock, with levels rising 41.5% and 27.2%, respectively.

Vanessa explains that the rise in stock levels not only gives buyers more opportunities but also more time to decide:

“We haven’t seen this level of opportunity for buyers in over eight years. The high number of people searching on our site shows that this increase in options is being met with interest.”

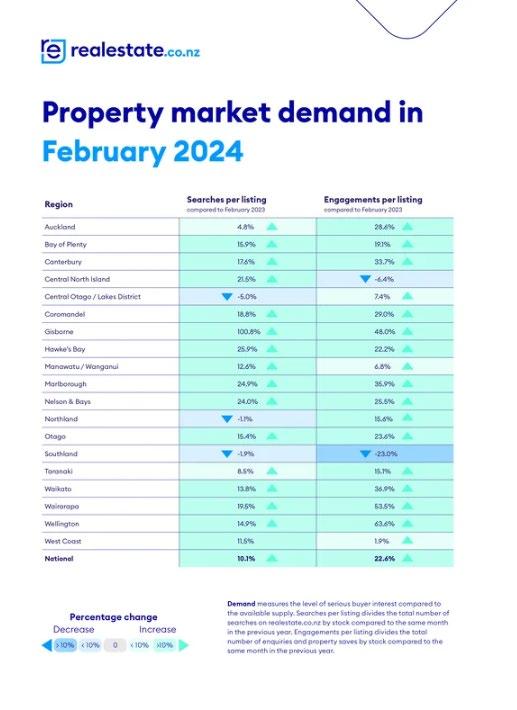

The number of people searching per listing on realestate.co.nz in February was up 10.1% compared to the same time last year. Engagement, which includes property saves and enquiries, was also up 22.6% nationally. Regions that saw the highest increase in engagements were Wellington (up 63.6%) and Wairarapa (up 53.5%).

Prices rise gently; Central Otago continues to break records

The national average asking price rose to $899,756, up 3.0% on the same time last year and 1.2% from January.

Another small lift to the average asking prices in February is an indicator of sustainable market health, says Vanessa:

“This slight increase in asking price, alongside an increase in properties coming to market, suggests buyers are being more considered with purchase time.”

Amid the relative stability across the country, several regions saw new records set.

Marlborough, Wairarapa, Central Otago/ Lakes District, and the West Coast all experienced record-high average asking prices for any February since records began. After a challenging year, Hawke’s Bay saw asking prices return to above $800,000 for the first time since before the weather events in 2023.

The stand-out performer among our regions, Central Otago/ Lakes District, maintained an average asking price above $1.6 million in February after reaching an all-time national high in January.

“After the highs and lows of the past few years, we are now seeing signs across the board that the property market is recovering, which is good news for those looking to buy or sell across the motu,” Vanessa adds.

For media enquiries, please contact:

Hannah Franklin | hannah@realestate.co.nz

WrittenbyHannahFranklin

FINANCE& LENDING

Input to your Strategy for Adapting to Challenges

Feel free to pass on to friends and clients wanting independent economic commentary

ISSN: 2703-2825

Sign up for free at www.tonyalexander.nz

14 March 2024

What if everyone had fixed five years?

Back from the middle of 2020 to about the middle of 2021 you could lock in a five year fixed mortgage rate at 2.99%. I jumped up and down like an idiot saying that I would gladly sacrifice the immediate cash flow benefit and skiting ability of locking in a one or two year rate below 2.5% for the certainty of a low 2.99% for fiveyears.

I did not base my recommendation to myself on any expectation that NZ interest rates would soar. In fact I recall writing that when monetary policy tightened, we might only see the one-year fixed rate rise to just under 6%. I was out by about1.3%.

I did not have a feeling for when interest rates would start rising or the speed with which theywouldgoup.

All that happened is that I looked at the rate in the context of what NZ interest rates have done for the past few decades and concluded that the chances of a 2.99% rate sticking around for very long were not high. At some stage the Reserve Bank would not be fighting a fear of deflation associated with a global pandemic and interest rates would go back up to some new level of

normal – not that even now we know what thenew average willbe for the likesof the officialcashrateandfixedmortgagerates.

I also had the benefit of having been around for a while, paid 18.5% in 1987, and seen the strains which families come under when mortgage rates are pushed up tofightinflation.

In the event hardly anyone did fix five years at 2.99%. But dining out on the 2.99% call is not what this article is about. An emailer this week asked the following question. “Is it our propensity to opt for fixed mortgage rates (typically 2 years) that makes it difficult for the RB to subdueinflationquicklywhenitrises?”

Theanswerisyes.WeKiwistypicallyhave about 80% of our mortgages at fixed rates, usually for three years or less and recently usually for either one year or two years. In Australia most people are on floatingrates.

1

This means that the negative household effects of a rise in interest rates hit far more quickly in Australian than here. Our central bank has to wait longer before it gets to see the true impact of its policy changes. That is why their incentive is to go fast. But they did not do so in the tightening cycle which started in 2004 and for this most recent cycle which started late in 2021 they initially raised the cash rate only by 0.25% for three reviews in a row before getting serious and moving in 0.5% jumps and then a big jumpin November2022of0.75%.

What if the 80% or so of people who usually sit at a fixed mortgage rate did as I said I would do over 2020-21 if I had a mortgage (I did not) and fixed five years at 2.99%. Let’s assume people broke their existing higher rates to lock in the best interest rate available since the 1960s and early1970s.

All of those people would still be sitting at 2.99% now some four or three years down the track. They wouldn’t be feeling any pain until mid-2025 to mid-2026. The only people who would be hit by rising interest rates associated with the inflation fight would be new borrowers and people onfloatingmortgagerates.

In this instance monetary policy as currently defined would be considerably weakened. The Reserve Bank would have torelynotoncrunched

household spending to subdue the economy and inflationary pressures, but a soaring NZ dollar boosted by the cash rate not rising to 5.5% but maybe the 8.25%of2008orhigher.

Our export sector would have been badly affected. So, farmers, you have the short planning horisons of typical Kiwis to thank for the exchange rate this tightening cyclecausingnearnopainatall.

The Reserve Bank would have had to rely on the government helping out by tightening fiscal policy. That would involve cutting spending and raising taxes. One can imagine the Labour government at the time would have found cutting spending an impossible thing to do. So instead they would likely have raised taxes.

However, while they might gleefully have imposed a new extra high marginal income tax rate on upper income earners,tobeeffectivetheinflationfighting tax increases would have to have been applied to low and middle income earners. The 2023 election result would have been even more damaging for Labour than it was.

Page | 2

Hence a lesson for those who say inflation fighting should be done with fiscal policy instead of monetary policy via interest rate changes. No sensible government is ever going to call themselves a turkey and hop in the oven in the name of helping out the Reserve Bank.

So, what else might the Reserve Bank have done to try and exert downward pressure on the economy? To minimise the extent to which they would have to raise the cash rate and cause the NZ dollar to rise, the Reserve Bank might look at extra rules curtailing the availability of new loans for home purchases and even buyingofconsumergoods.

That wouldn’t be hard to do. Just take the minimum deposit from 20% to 50% or more and allow only 5% of bank lending to breach that rule. The resulting decline in house prices would likely have easily exceeded the 18% we saw from the end of 2021 to mid-2023. Sharply reduced household wealth would have helped curtailspending.

The house building sector would also have been crunched because no exemptions could be provided for funding of newbuilds as this would have generated unwelcome employment of people in the construction sector. At this point a

fight with the government would probably have been opened up because of the impact on firsthomebuyers.

It is likely that the net outflow of Kiwis from New Zealand this past year would have comfortably exceeded the 47,000 reported.

It would have been a mess frankly. So, while the tendency of Kiwis to fix their mortgage rates does cause lags in the impact of monetary policy tightening and loosening, at least hardly anyone paid attention to what I was writing over 2020-21 and we avoided a big problem. Well done all you people paying 6.5%+, you’ve helped the export sector, limited the net loss of Kiwis, and delayed the house building downturn by a couple of years.

Page | 3

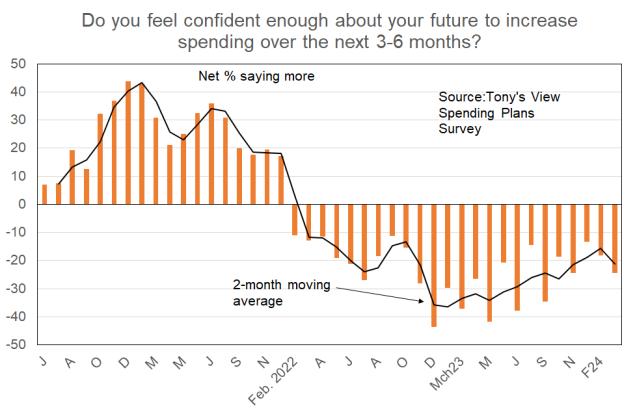

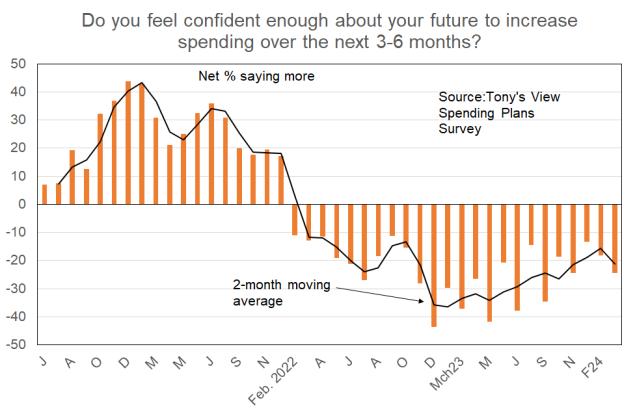

The continuing bad outlook for retailers

This week I ran my monthly Spending Plans Survey. I do this exercise in order to get a feel for whether consumers are planning to spend more or less on stuff generallyinthenext3-6months,whatthey planbuyingmoreandlessof,andwhatthe motivationsarebehindtheirdecisions.

Unfortunately for retailers the news remains bad. Closures which have been happening amongst retailers over the past 18monthslookhighlylikelytocontinue.

In this month’s survey a net 24% of the 343 respondentssaidtheyplancutting their spending. This is a deterioration from the net 18% ofFebruary.

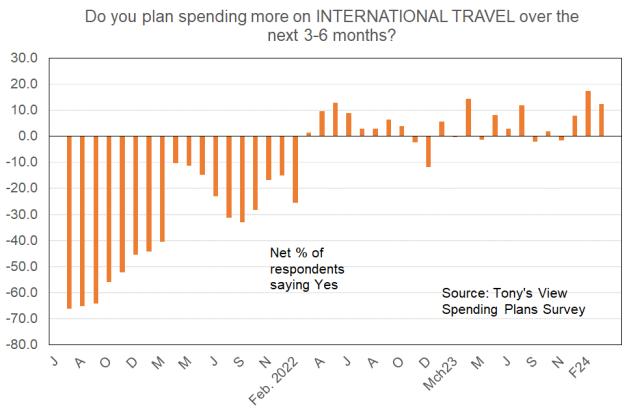

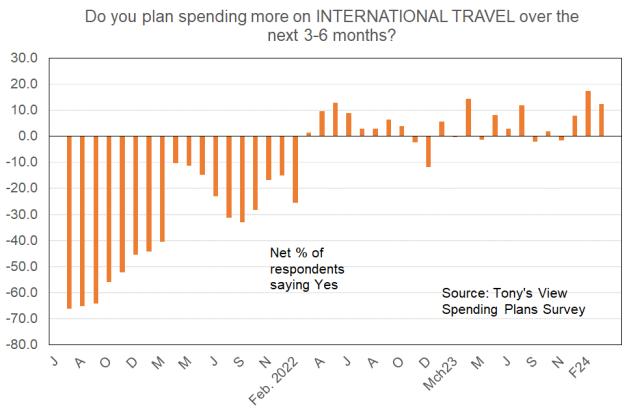

The biggest area in which people plan cutting spending remains eating out followed by furniture and appliances. Increases are planned for general groceries – clearly reflecting higher prices – plusinternationaltravel.

In the following graphs we can see the changes in spending plans through time for a selection of the categories listed in theprecedinggraph.

We may display high pessimism, but we are determined to travel offshore. Anyone who lived through the 1970s and 1980s would probably find this dynamic confusing.

Page | 4

But we don’t want new furniture and appliances.

The home renovation boom induced by the pandemic ended almost two years ago and hasn’t come back in these challengingtimesasyet.

Things have actually just got a tad less bad formotorvehicles.

Sportsequipmentdemandremainsweak.

Plans for spending on eating out collapsed twoyearsagoandremainhighly negative. Sentiment and incomed will be one factor. Soaringcosts offoodanddrink willbeanother.

Page | 5

I will discuss outcomes for the questions about buying a dwelling to live in and an investment property next week, along with motivations behind people’s spending plans.

In case you missed it

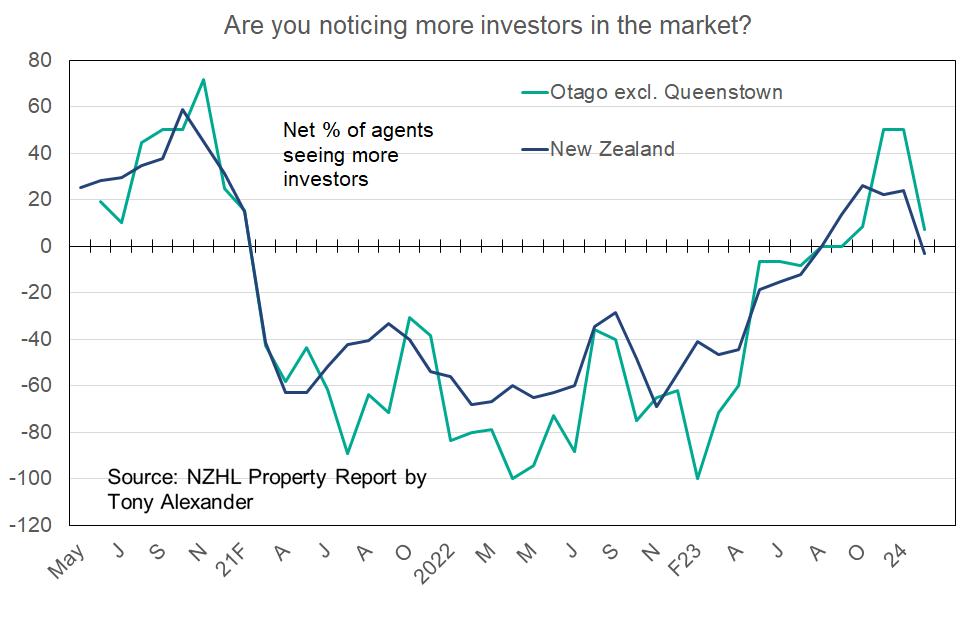

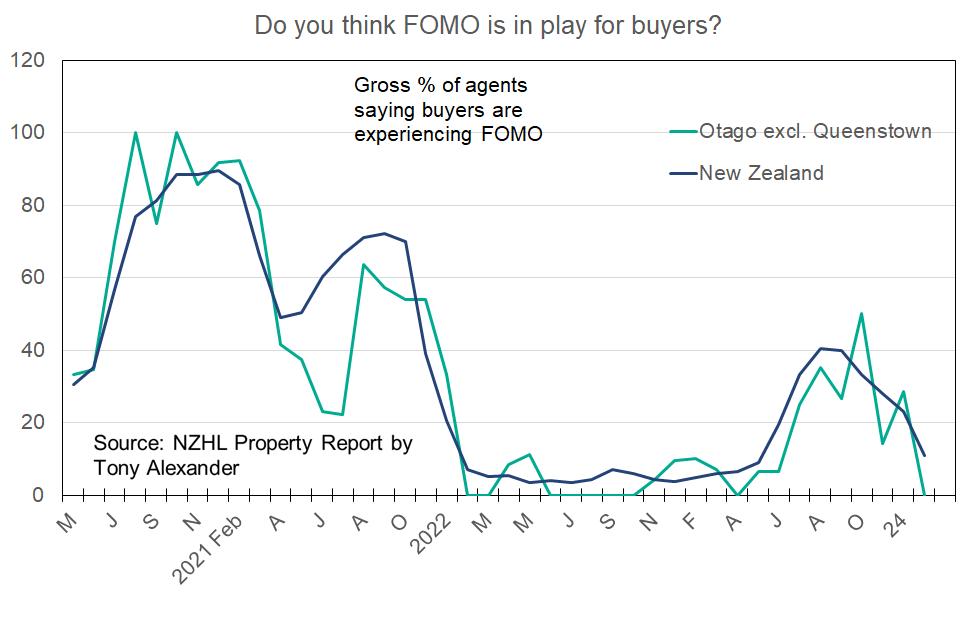

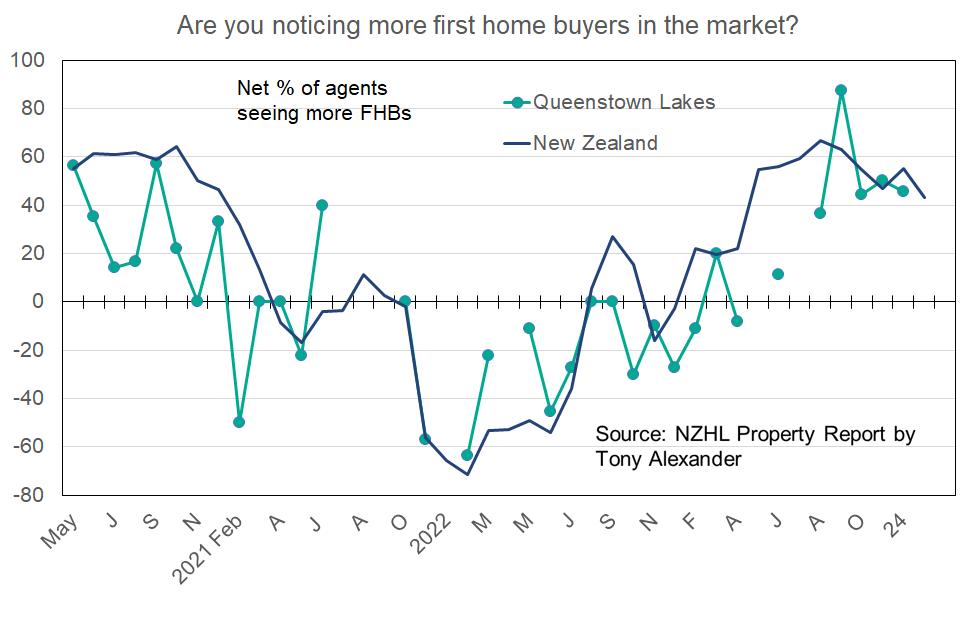

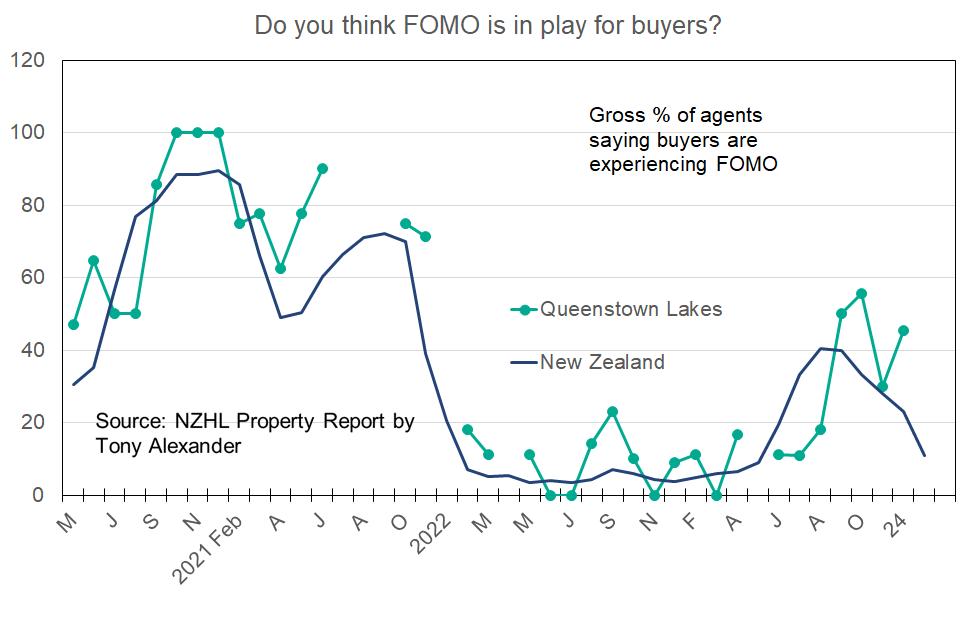

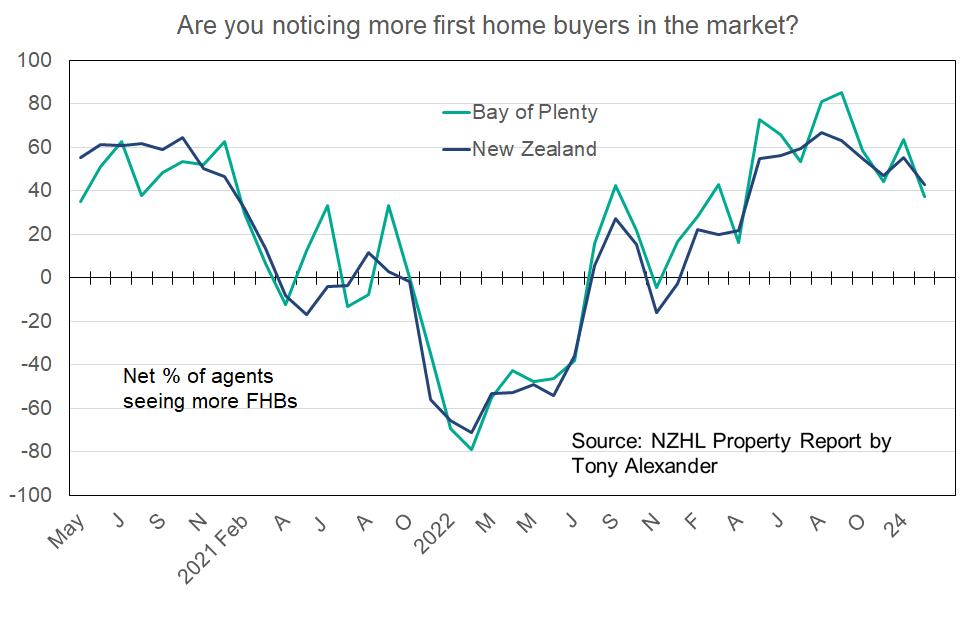

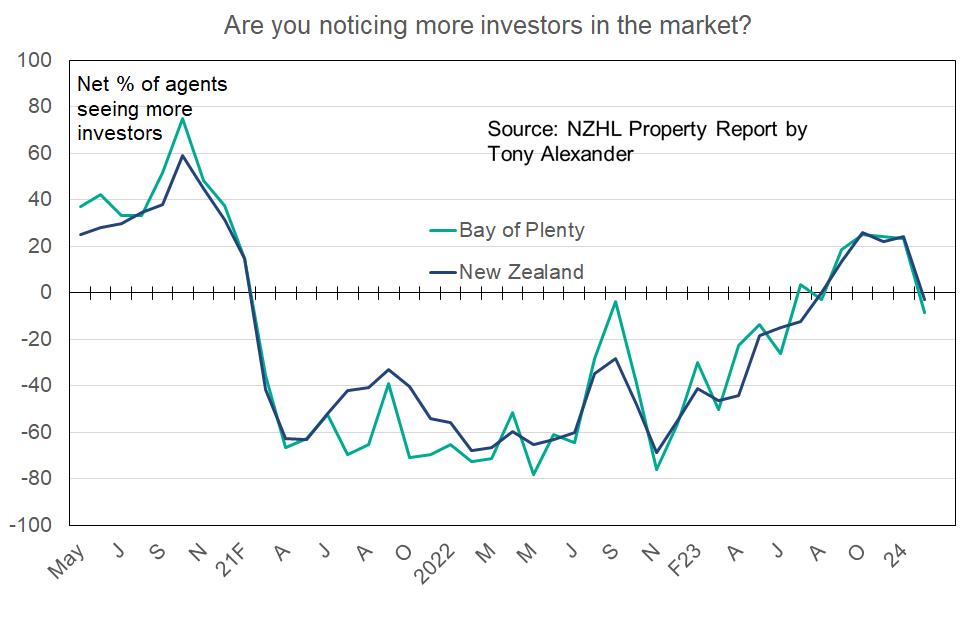

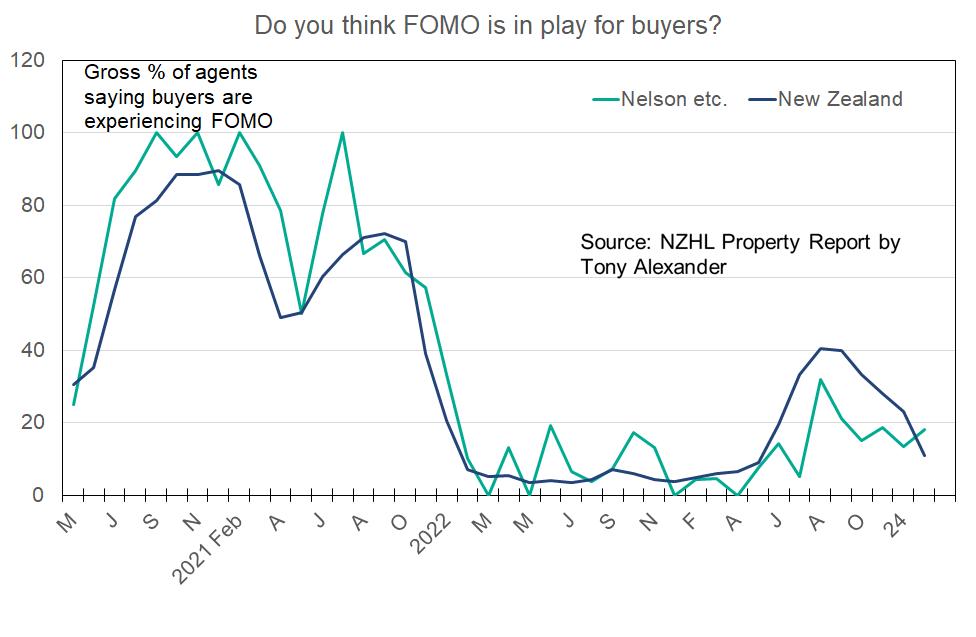

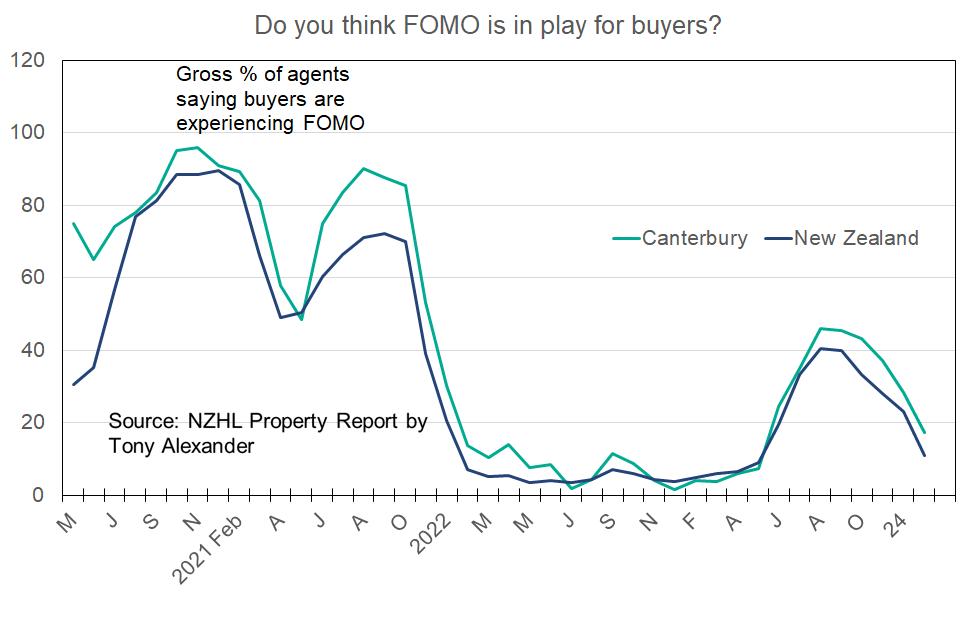

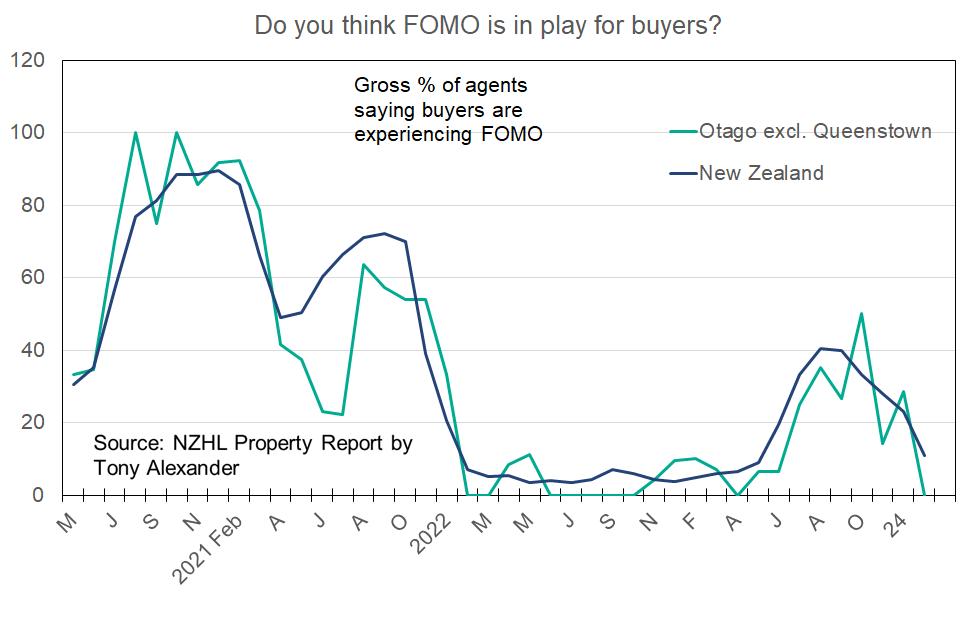

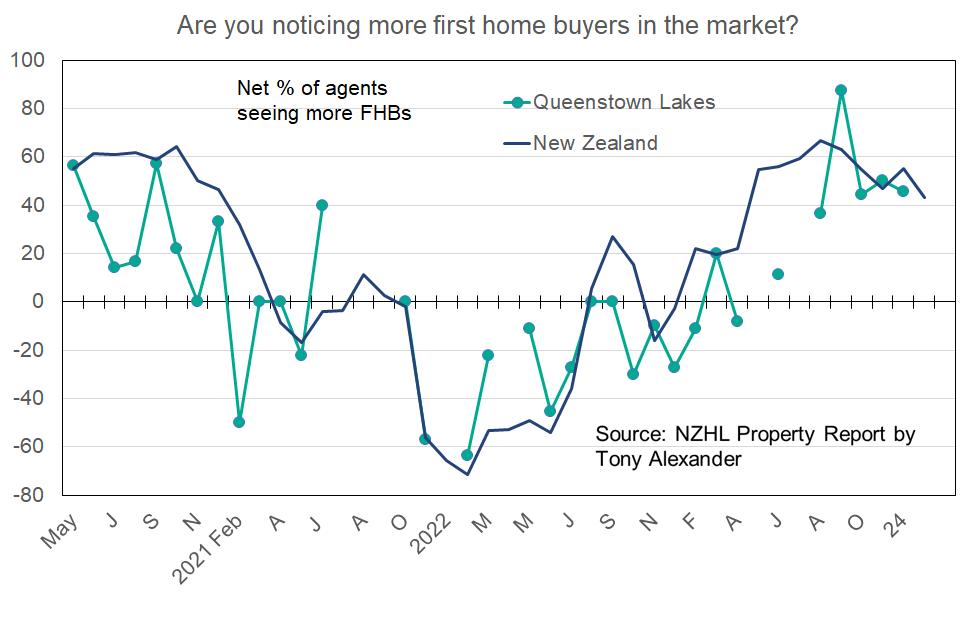

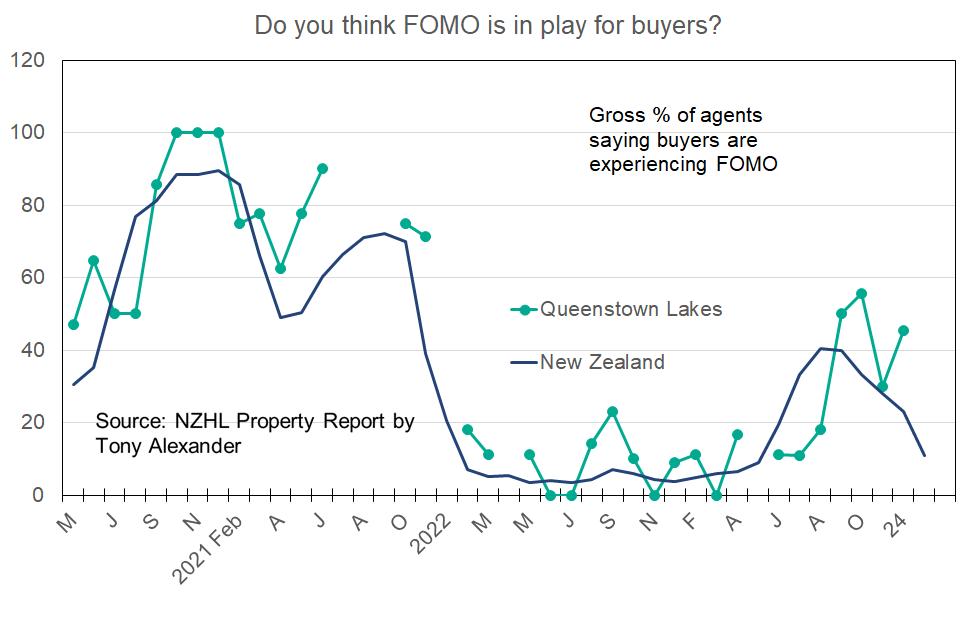

On Monday I released results from my survey of real estate agents sponsored by NZHL. The key outtakes include these.

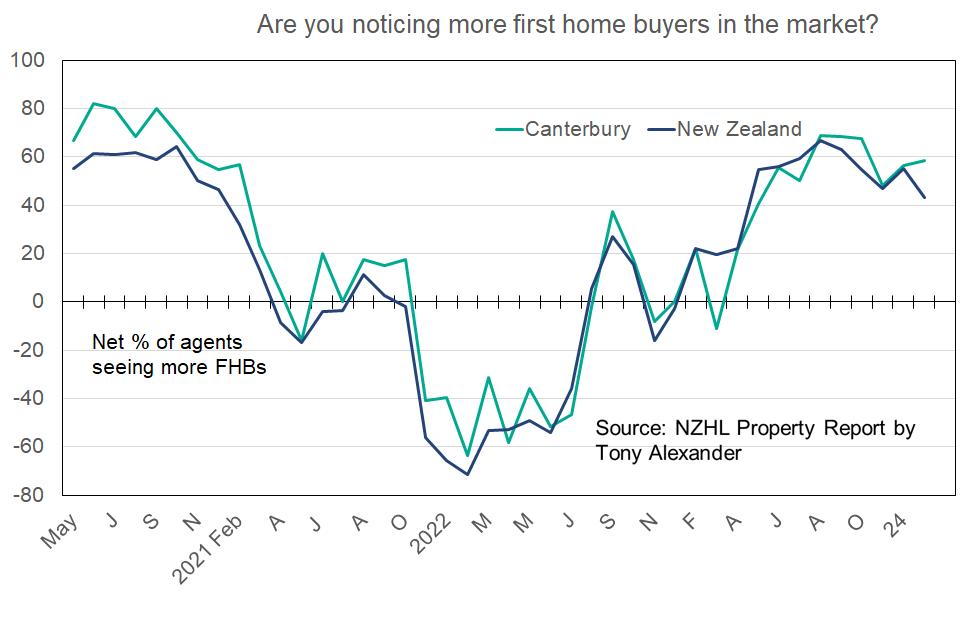

• There has been a noticeable decline in buyer presence in the market although first home buyers remain active.

• Buyer concerns have grown about their employment, and the earlier decline in worries about interest rates has reversed in the face of discussion about monetary policy tightening again.

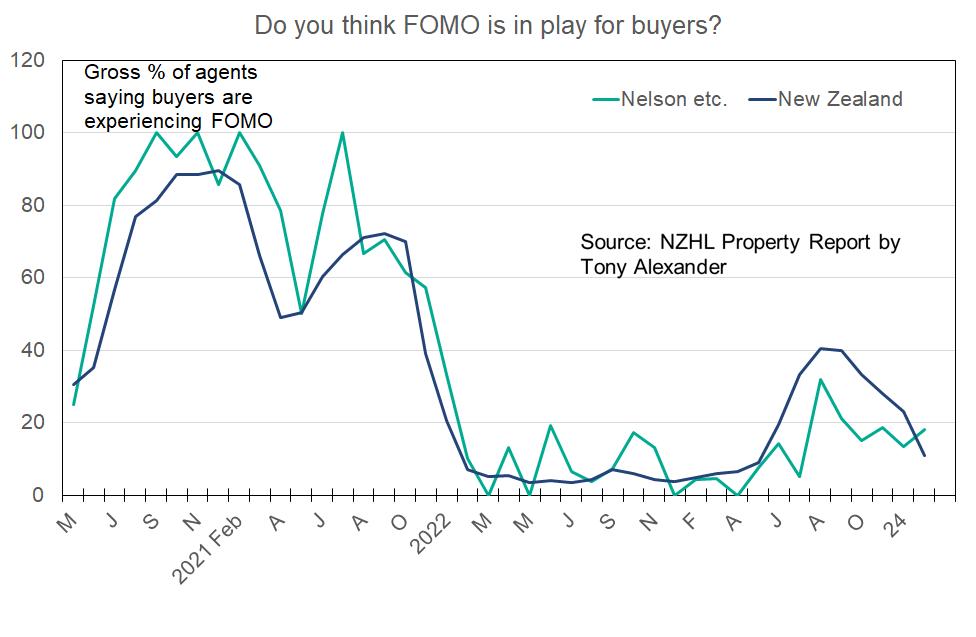

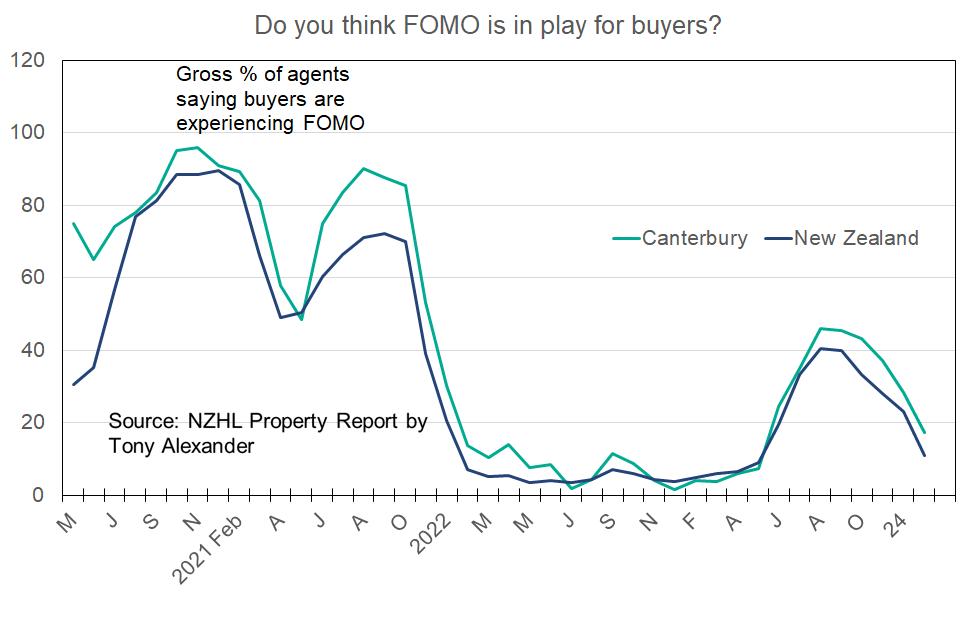

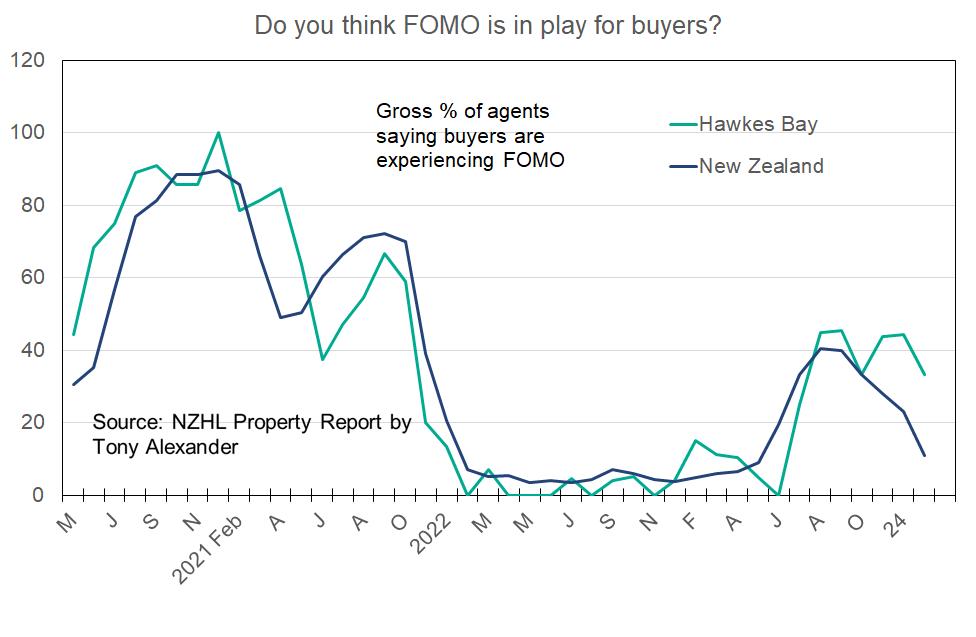

• Appraisal requests to agents are running at very high levels suggesting that for the moment motivated sellers are exceeding motivated buyers. As a result, FOMO levels have fallen away.

The-NZHL-Property-Report-February-2024.pdf

If I were a borrower, what would I do?

This week NZ wholesale interest rates have edged down by small amounts. Extremely high uncertainty remains regarding the speed with which the inflation rate will settle comfortably under 3%. We can expect rates to move up and down as data results come in stronger or weaker than expected. This week the very weak card spending data contributed to the lower rates.

I have a view that the Reserve Bank has overcrunched the economy and will play catch-up policy easing from late this year. So, if I were borrowing at the moment, I would probably take a mix of 6 and 12 month rates.

Nothing I write here or anywhere else in this publication is intended to be personal advice You should discuss your financing options with a professional.

This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. We strongly recommend readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. No person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation, or omission, whether negligent or otherwise, contained in this publication. No material in this publication was produced by AI.

Page | 6

© Tony Alexander and First Mortgage Trust ISSN 2744-3809 SPONSORED BY

ALEXANDER

Property Insights MARCH 2024

TONY

Regional

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 1 Contents Introduction 2 Northland ................................................................... 3 Auckland .................................................................... 4 Bay of Plenty 5 Waikato 6 Gisborne .................................................................... 7 Hawke’s Bay 8 Manawatu-Wanganui 9 Taranaki ................................................................... 10 Wellington ............................................................... 11 Nelson, Tasman, Marlborough 12 Canterbury 13 Dunedin City/Otago ................................................. 14 Queenstown Lakes 15 Southland 16

Sponsored by:

Regional Property Insights

Introduction

Welcome to the third issue of Regional Property Insights for 2024, prepared by Tony Alexander with the support of First Mortgage Trust.

In this month’s Regional Property Insights I look at what the latest results from my monthly survey of real estate agents with NZHL tell us about real estate conditions around the country. For the bigger regions there are usually enough responses to present the results. But for the smallest regions usually there are not, and, in that case, I have substituted in some other data.

As with all the material presented in RPI, my aim is to provide information which can be collected up over time and used as input into one’s property purchase and divestment decisions.

Previous issues of Regional Property Insights are available here. First Mortgage Trust Articles

Further extensive discussion of house price movements and factors affecting prices can be found in the weekly Tony’s View publication available from www.tonyalexander.nz

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 2

Regional Property Insights

Northland

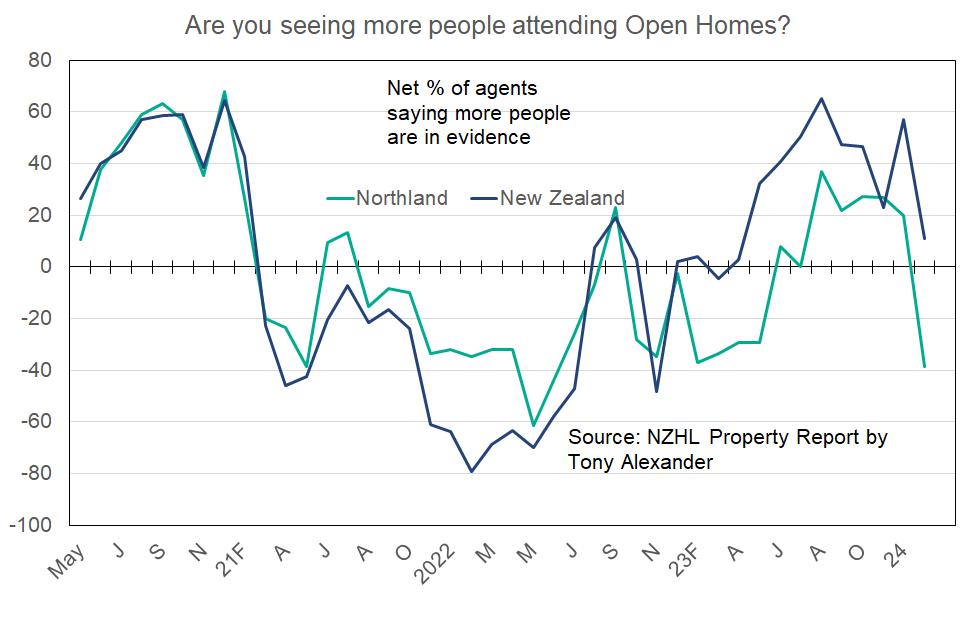

Weaker than average

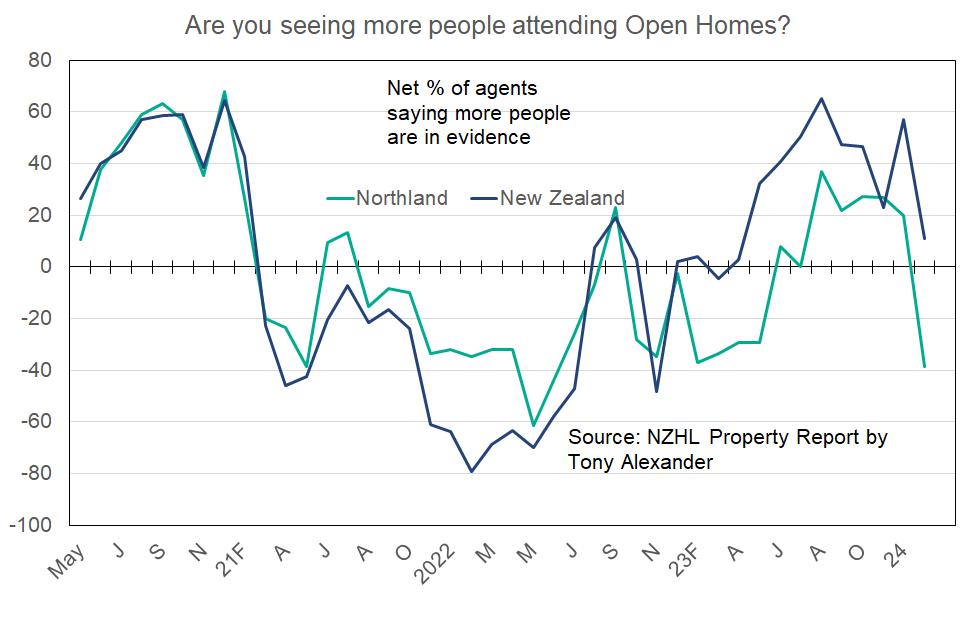

Since the start of 2023 real estate agents in Northland have noted less strong attendance of people at open homes than the country on average. Recently this gap has become unusually large with a net 38% saying fewer people are attending compared with a net 11% nationwide still saying that more people are showing up.

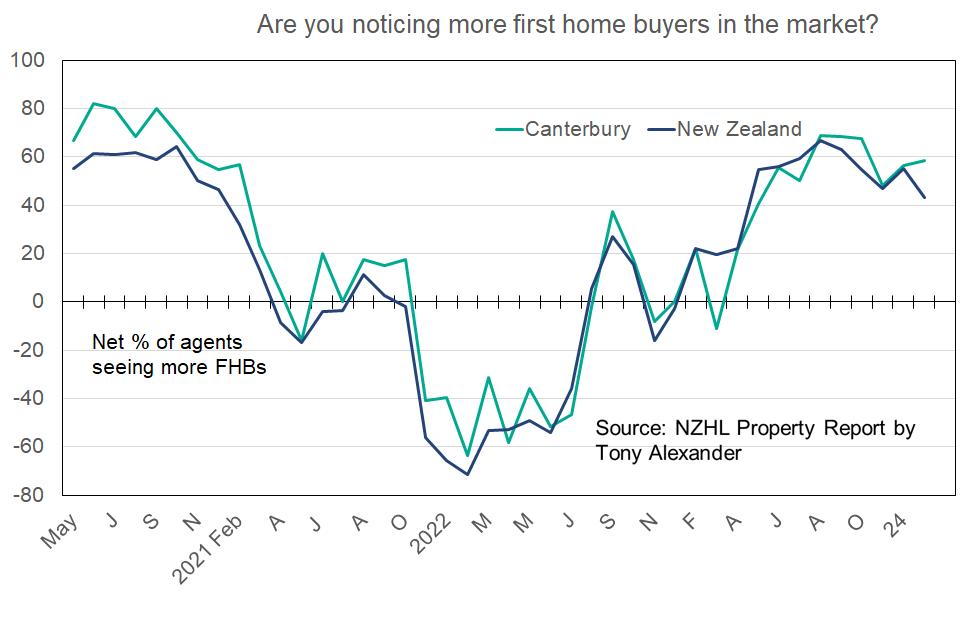

Is this weakness in people window shopping showing up in other measures? Yes. As the next graph shows the net proportion of agents reporting that they are seeing more first home buyers in the market has pulled back to just 12% in Northland compared with 43% nationwide.

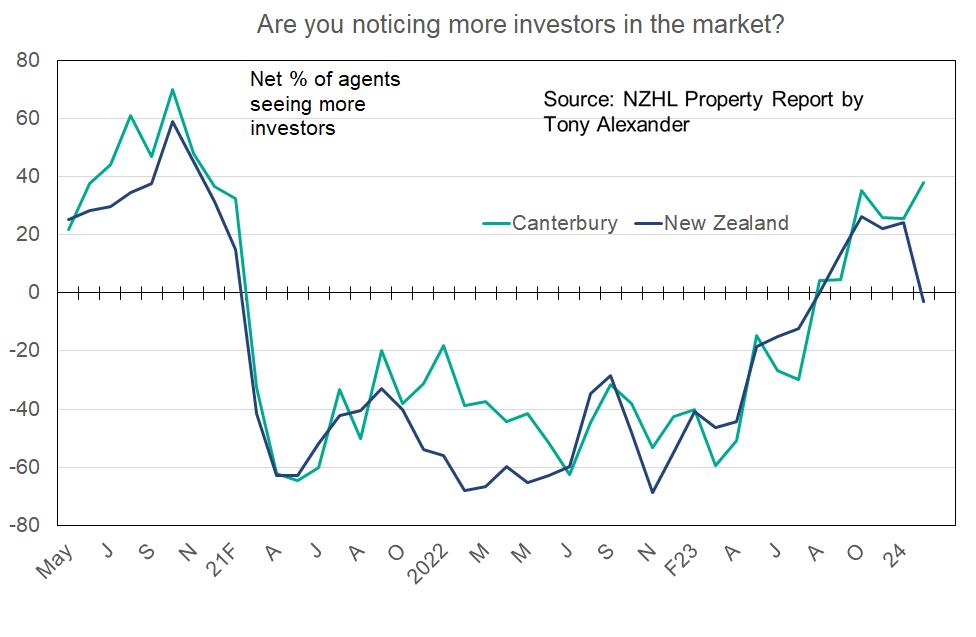

Similarly, the net proportion of real estate agents in Northland noting that they are seeing more investors has fallen to 19% seeing fewer compared with 3% nationwide.

Sponsored by:

With these weak developments underway it is no surprise that the feeling by buyers that they need to hurry and make a purchase – their FOMO – is weaker in Northland than the country on average. A gross 0% of Northland agents say they are seeing FOMO – meaning none are seeing it. In contrast 11% of agents nationwide are seeing it.

On virtually all measures the Northland residential real estate market is tracking in a weaker state than the country overall. This is a market which can be heavily influenced by Auckland and because Auckland is weak compared with the rest of the country now in our survey Northland is suffering in extra fashion.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 3

Regional Property Insights

Auckland

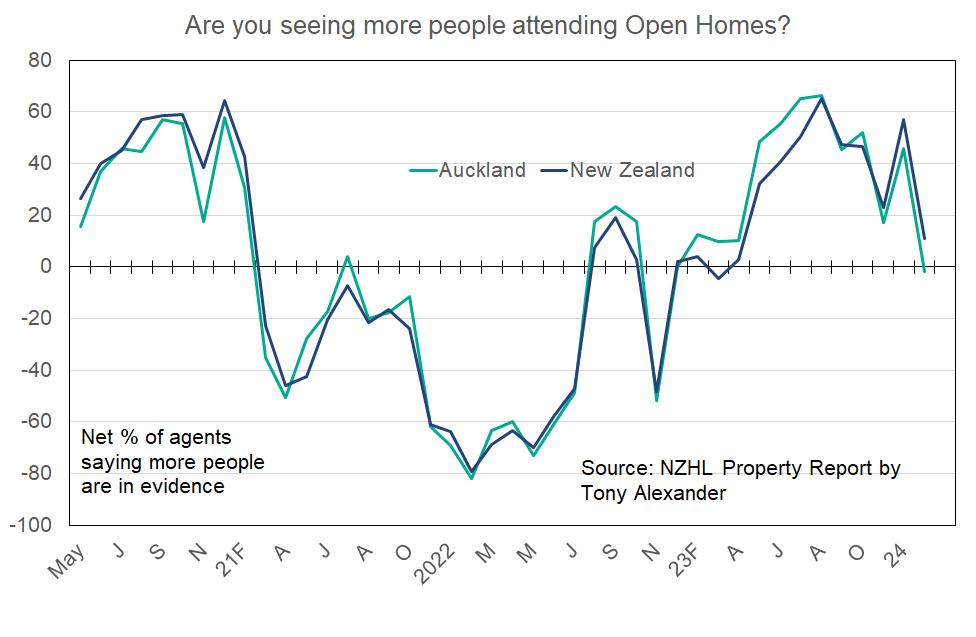

Weak despite the migrant surge

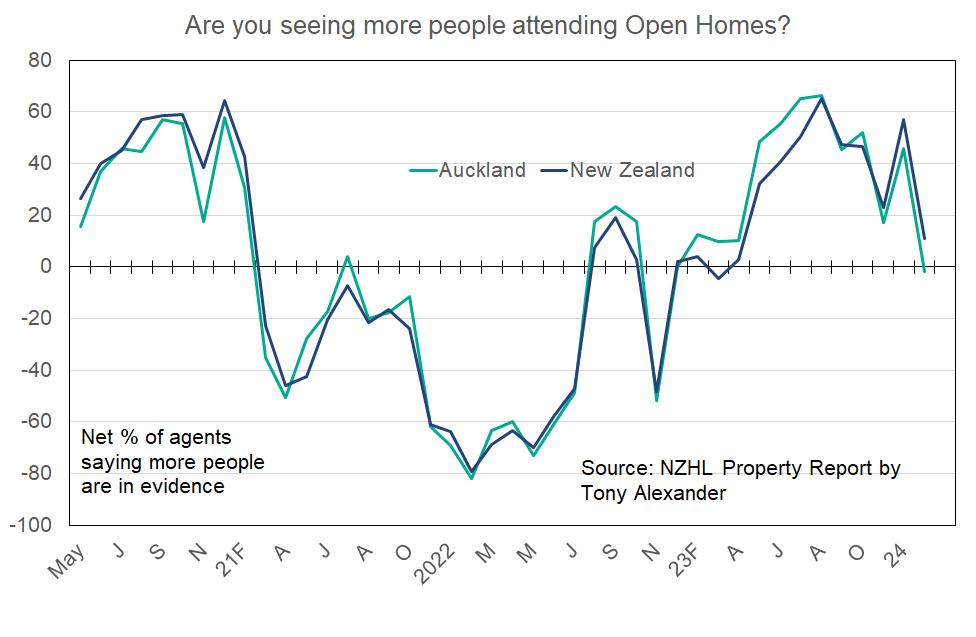

In Auckland the net proportion of agents saying that they are seeing more people attending their open homes has declined from a strong 66% in August to a net 2% now saying that fewer people are in fact showing up.

Nationwide there has been a similar change but a net 11% still say they are seeing more people. Auckland is weak compared with the rest of the country.

We see this relationship also when we look at the net proportion of agents saying that they are seeing more first home buyers. In Auckland a net 36% of agents say they are seeing more first time buyers compared with 43% nationwide.

This measure is remaining at relatively firm levels in most parts of the country at the same time as other measures have substantially declined through summer.

Sponsored by:

Young buyers are continuing to enjoy a period of relatively low competition from other buyers.

As is the case with first home buyers so too do we see weaker observations of investor presence in the market in Auckland than elsewhere. A net 11% of agents in our biggest city note that they are seeing fewer investors whereas in October a net 24% were seeing more. Nationwide a net 3% of agents are seeing fewer investors.

Unsurprisingly, FOMO is weaker in Auckland than elsewhere with 7% of agents seeing buyers display it compared with 11% across all of the country.

Auckland’s residential real estate market is weaker than average and this seems surprising considering the strong population surge associated with the net migration boom of the past year. But it may reflect the visible nature of the plethora of townhouse developments recently. Until they clear, Auckland may continue to lag.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 4

Regional Property Insights

Bay of Plenty

Almost average

In the Bay of Plenty region, a net 4% of agents in our most recent survey have said that they are seeing fewer people attending open homes. Across the regions we track this is the second weakest result and below the net 11% of agents nationwide saying that they are seeing more people attending open homes.

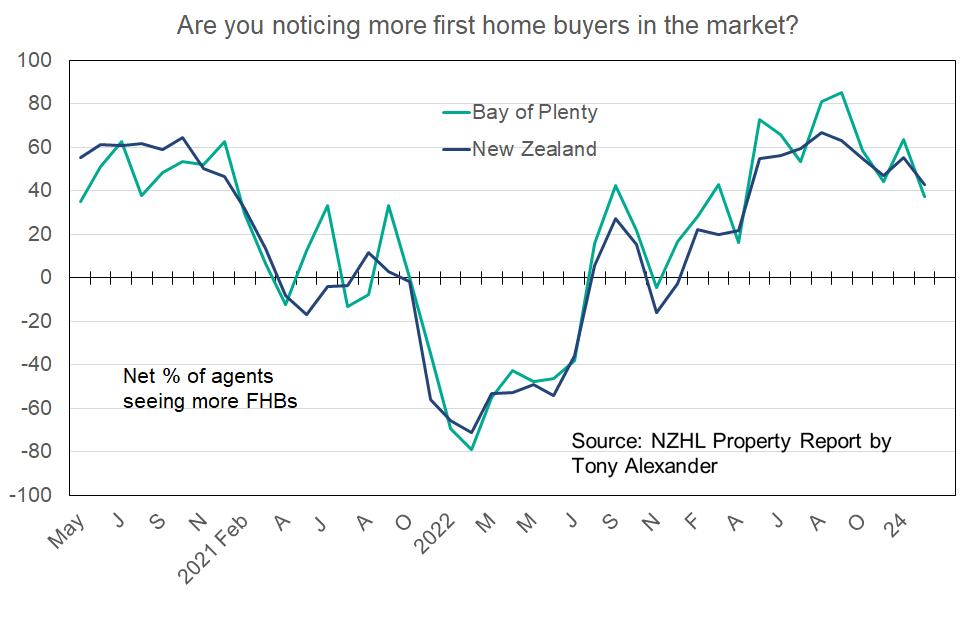

The net proportion of agents saying they are seeing more first home buyers is also weaker than average but only marginally so at 38% versus 43% across all the country. The region usually tracks the country closely for this measure.

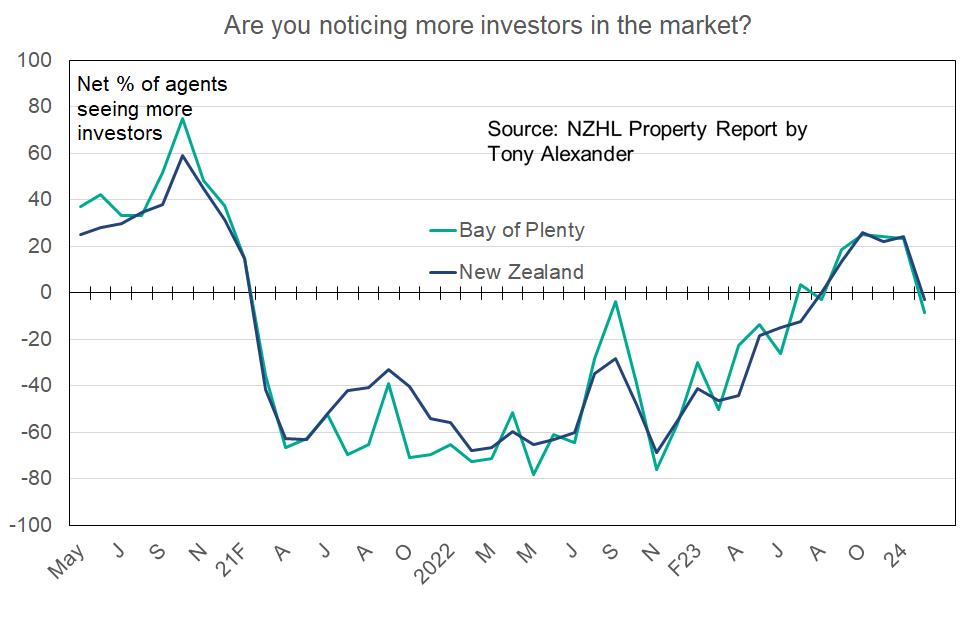

Similarly, a weaker than average net 8% of agents say that they are seeing fewer investors in the market looking to make a property purchase. The national average is a net 3% of agents seeing fewer investors.

Sponsored by:

Unsurprisingly, with the measures covered here all below average for the Bay of Plenty FOMO is also below average. Just 4% of agents in the region say buyers are displaying worries about missing out on making a purchase as compared with 11% nationwide.

The Bay of Plenty region tends to track closely to the NZ average for almost all of the measures in my monthly real estate agent survey. For the moment the region is weaker than average and that likely more reflects the spillover from weakness in Auckland than necessarily some region-specific factors.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 5

Regional Property Insights

Waikato

Slightly stronger than average

In the Waikato region a net 23% of real estate agents recently reported seeing more people attending open homes. This is better than the 11% result nationwide. However, the pattern of new weakness appearing over summer mirrors that seen elsewhere.

The net proportion of agents seeing more first home buyers in the Waikato region exactly matches the NZ average at 43%. As is the case for the Bay of Plenty region discussed above, most measures in this monthly survey for Waikato track reasonably closely to the national outcomes.

This tracking is also seen in our measure of investor strength in the market. A net 14% of agents in Waikato note seeing more investor buyers as compared with a net 3% nationwide seeing fewer. The region is stronger, but as the graph shows, movements generally stay close to the country as a whole.

Sponsored by:

It is no surprise that our reading for FOMO in the Waikato region is almost exactly the same as the national average at 14% versus 11% nationwide.

The Waikato region is displaying slightly greater strength than the national average, Auckland, Northland, and Bay of Plenty. But the pattern of reduced strength through summer is the same as elsewhere.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 6

Regional Property Insights

Gisborne

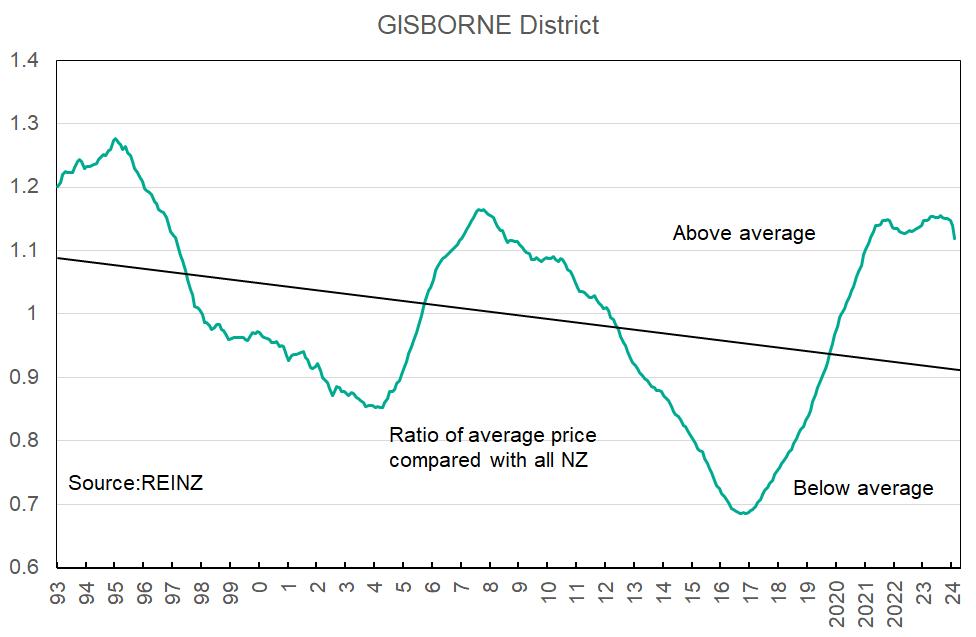

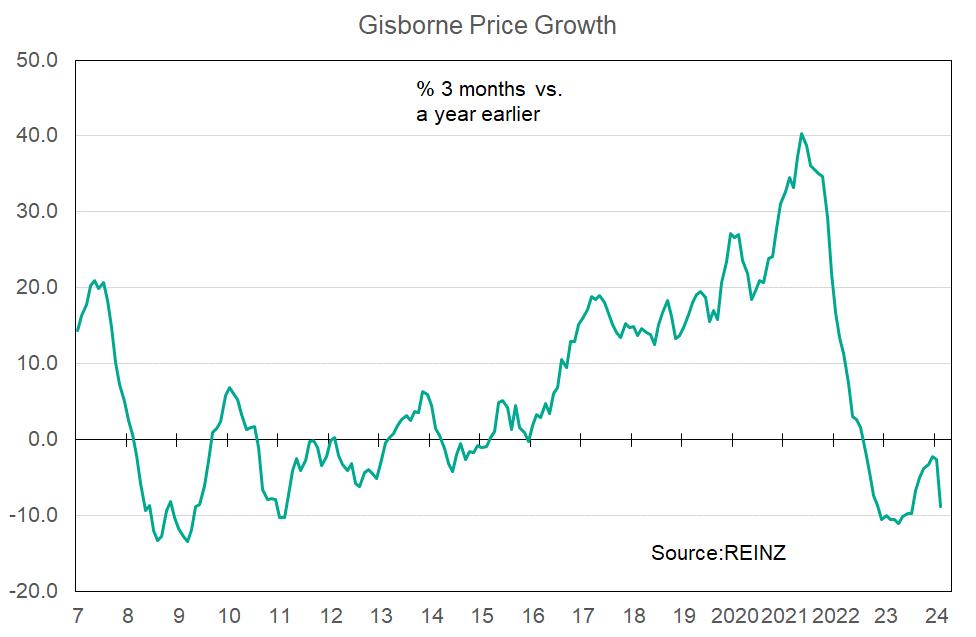

Highly priced for the moment

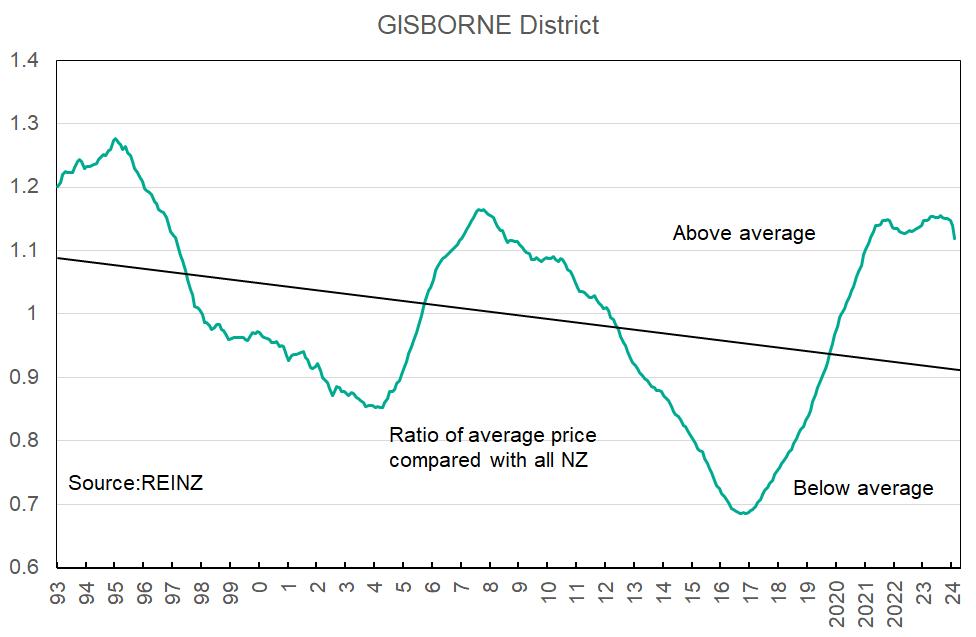

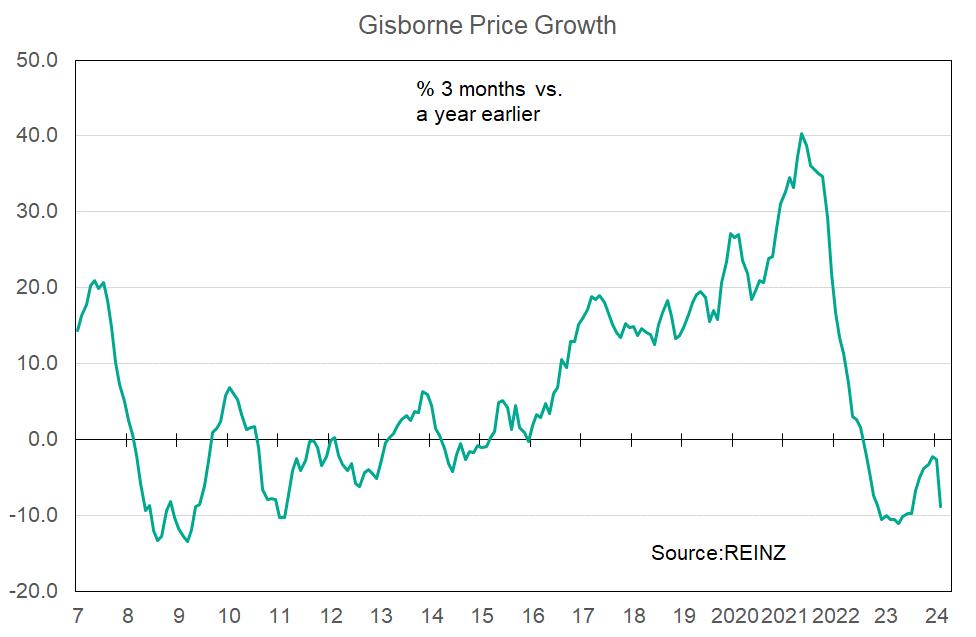

Because the Gisborne region is so small I almost never receive enough results in any of my monthly surveys to allow presentation of results and that is the case for real estate agents. So, let’s have a look at a couple of things here instead of my survey outcomes.

In the Gisborne region average house prices remain well above levels versus the country overall associated with a long-term trend since 1992. This doesn’t mean that they are about to fall. Instead, it simply says that potential for gain relative to the rest of New Zealand is much less now than other regions may display.

The period of superior price performance of Gisborne largely ended in 2022 and under-performance has now set in.

Prices in fact are falling away nowadays.

Sponsored by:

Gisborne has experienced a period of very strong construction growth. This surge in supply may initially have been soaked up by people shifting to the regions during the pandemic. But the pandemic is now over and cost of living pressures alongside a newly weakening labour market mean this flow if anything is likely to now be back the other way.

Housing markets move in cycles and for the near future the various pressures in play suggest underperformance of the Gisborne housing market.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 7

Regional Property Insights

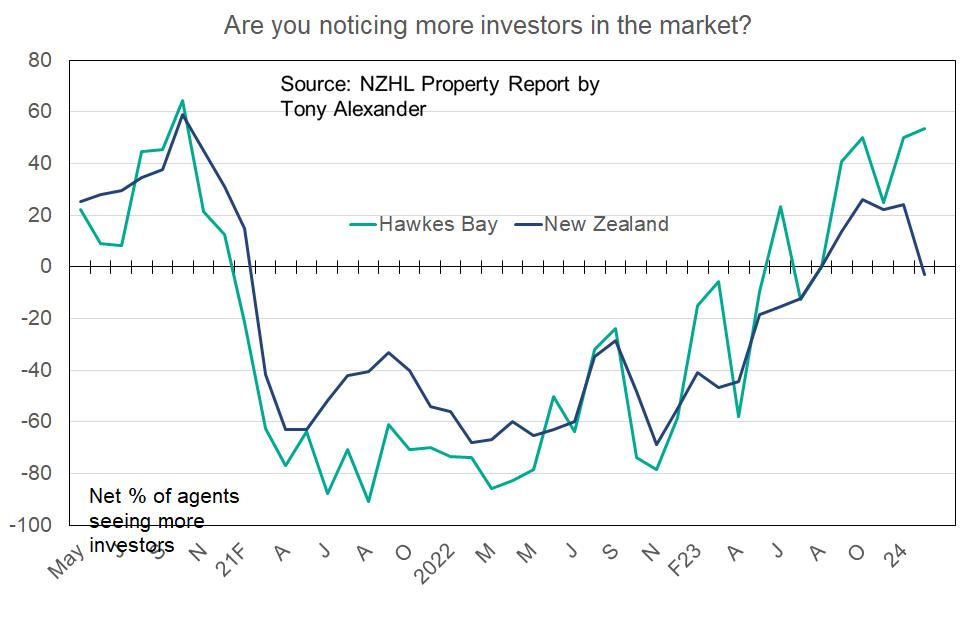

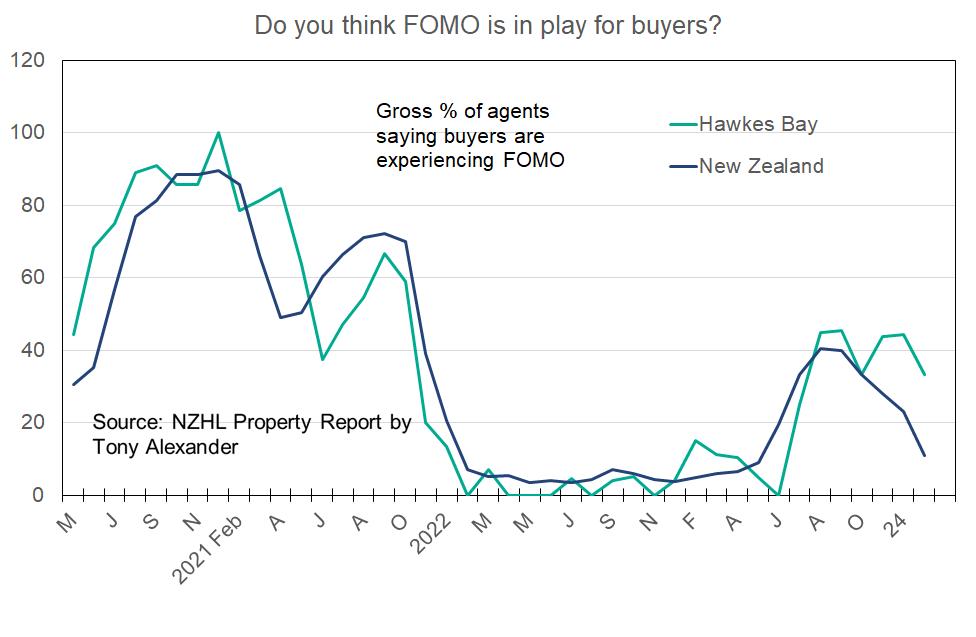

Hawke’s Bay

Extra strength

In contrast to all of the regions covered so far in this month’s RPI, Hawke’s Bay sticks out as being relatively strong. A net 80% of agents have just reported that they are seeing more people attending open homes.

The result is at odds with other parts of the country in that it has improved strongly over summer. Is this apparent in other gauges of residential real estate market strength in the region?

If we look at presence of first home buyers, we find a net 100% of agents reporting that they are seeing more. You can’t get more positive than that.

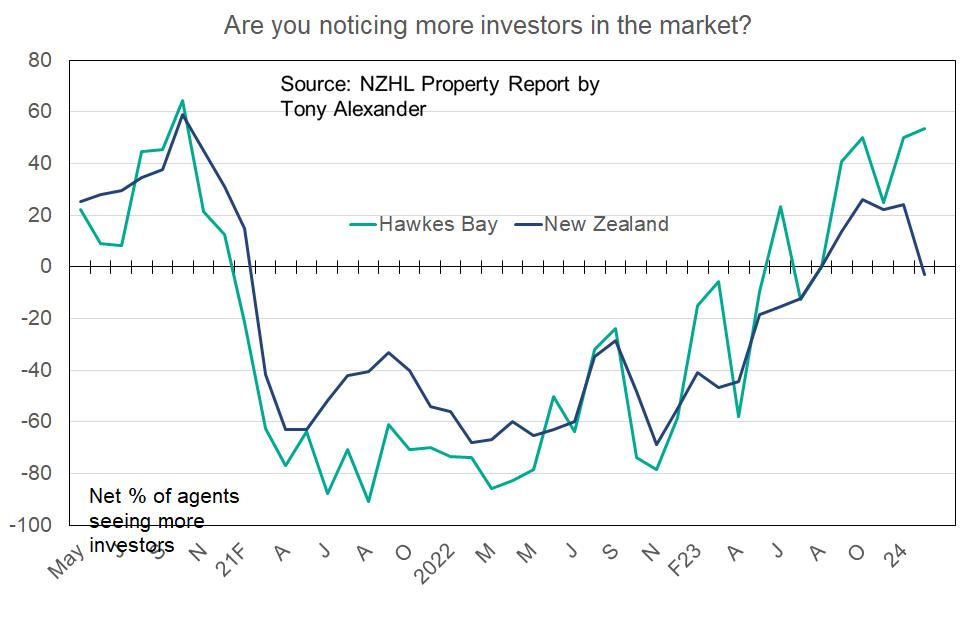

What about investor presence in the Hawke’s Bay market? A net 53% of our survey respondents have said that they are seeing more investor buyers compared with a net 3% nationwide seeing fewer.

Sponsored by:

Despite the extra high strength, one might conclude is in the Hawke’s Bay market currently based on the readings so far, the gross proportion of agents saying they see buyers displaying FOMO sits at 33%. The recent peak was 45% in September and this measure hit 100% at the end of 2020.

All up the Hawke’s Bay market is displaying surprising strength considering the flooding of last year, dry growing conditions for farmers, and the extent to which prices are above trend versus the country as a whole.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 8

Regional Property Insights

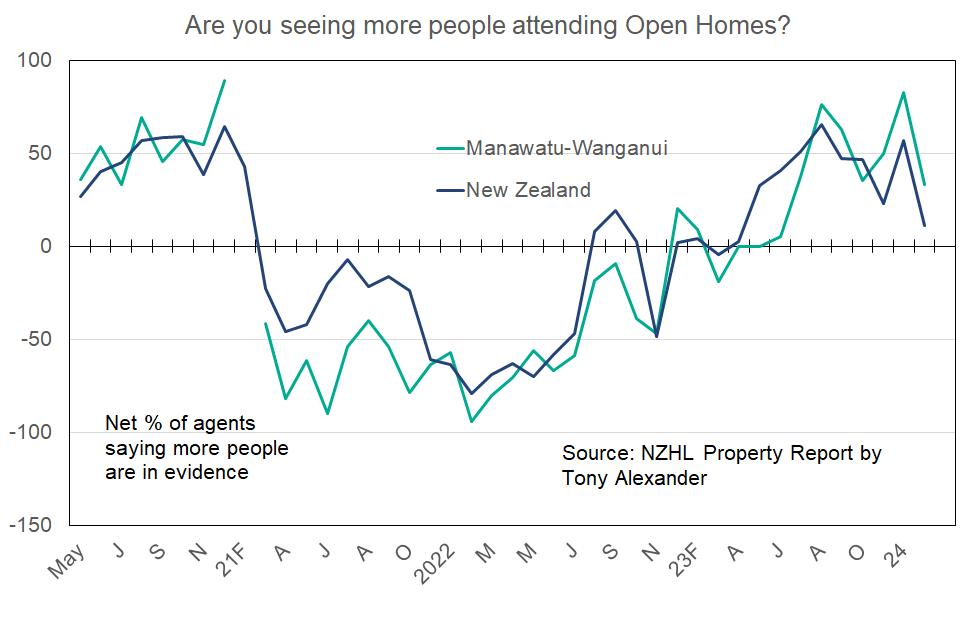

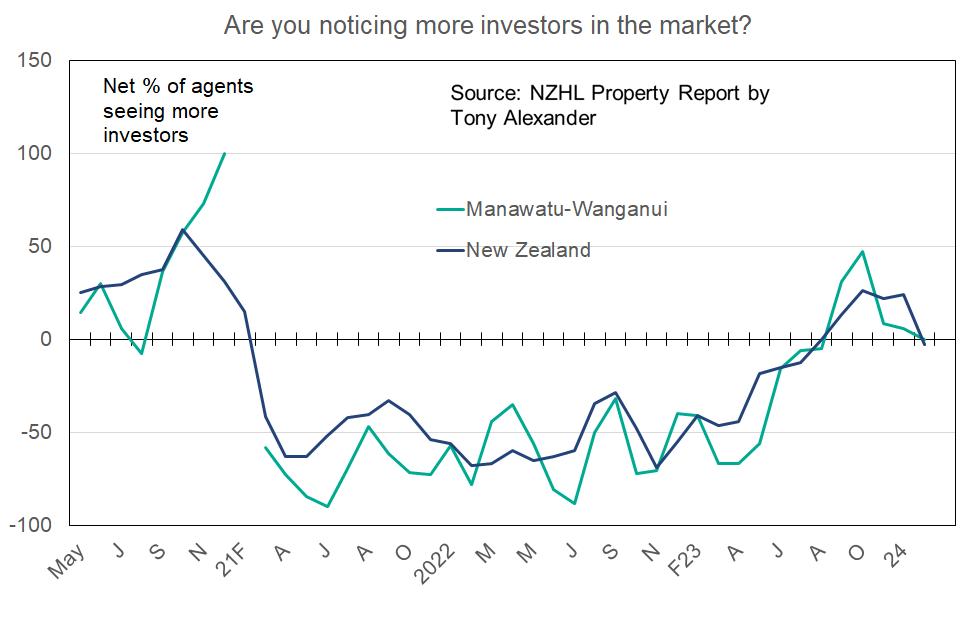

Manawatu-Wanganui

Holding stronger than average

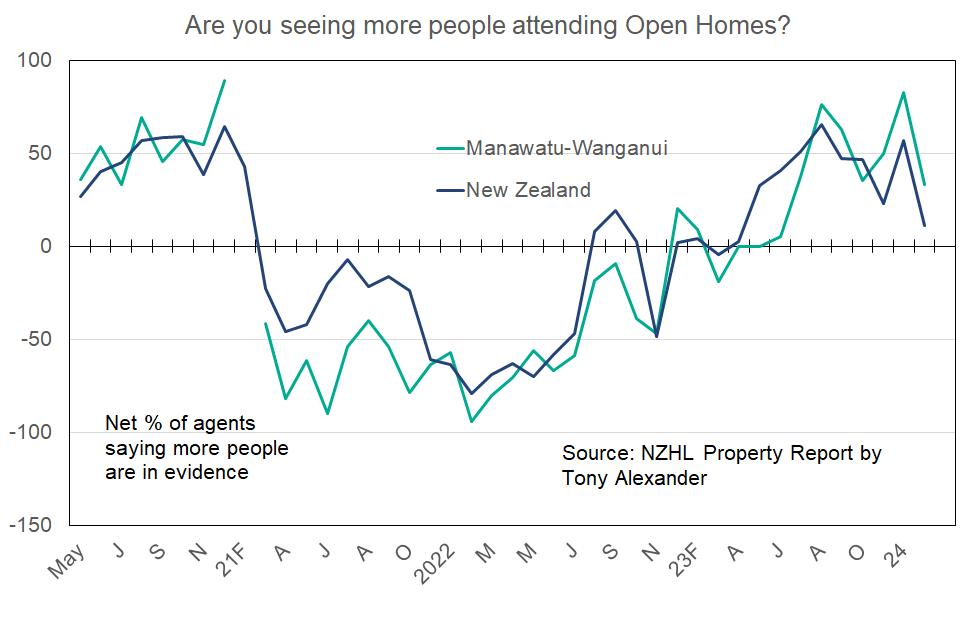

Can the Manawatu-Wanganui region on the west coast match the strength directly on the other side of the North Island? Our first measure looking at the net proportion of local agents seeing more people attending open homes is above the NZ average of 11% at 33%. Hawke’s Bay is 80%.

The net proportion of agents in Manawatu-Wanganui seeing more first home buyers also sits above average at 50% versus 43% nationwide. Hawke’s Bay is 100%.

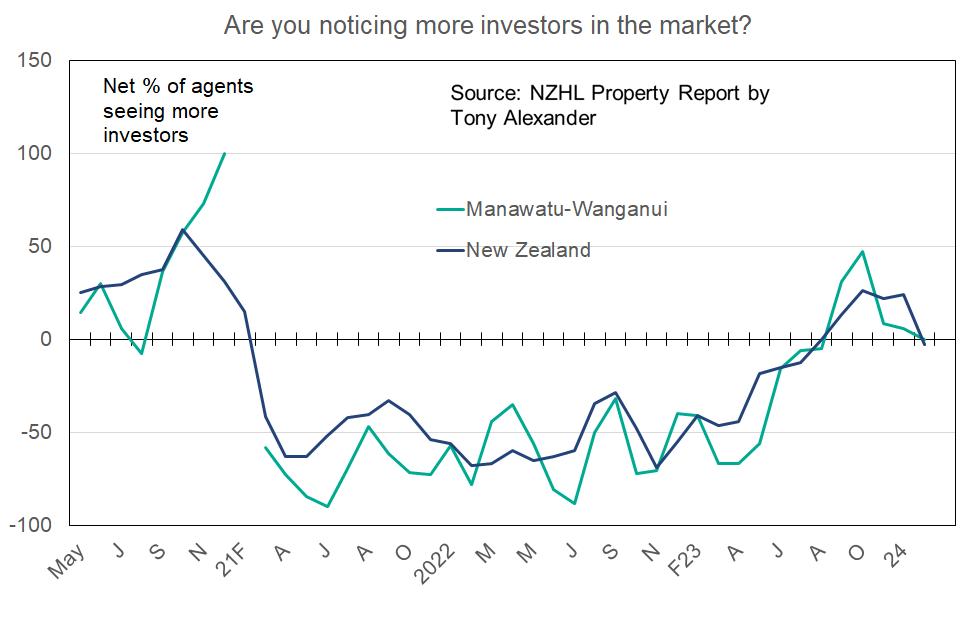

When we look at investors do we see similar above average strength? Not really. A net 0% of agents are seeing more investors versus a net 3% nationwide seeing fewer. The numbers are essentially the same. It looks like it is the young buyers driving strength in this central North Island region.

Sponsored by:

What does all this mean for FOMO in the region? It is slightly below average at 6% versus 11% with the same summer weakening as seen elsewhere around the country on average.

Overall, the Manawatu-Wanganui residential real estate market seems to be holding up slightly better than the country overall – but not as much so as in Hawke’s Bay.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 9

Regional Property Insights

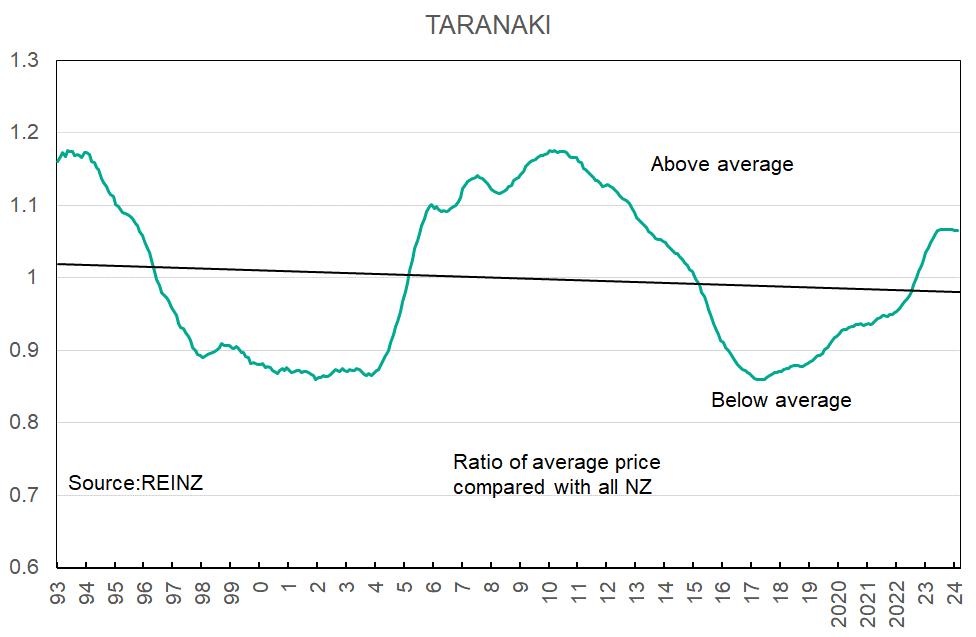

Taranaki

Hard to draw strong conclusions

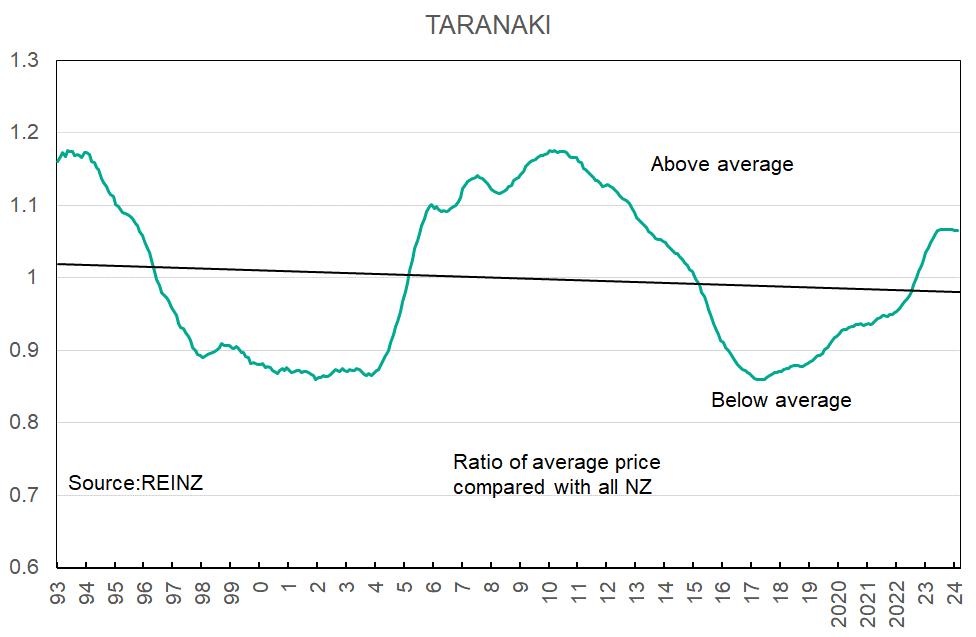

For the Taranaki region we unfortunately do not have enough responses received in most months to allow presentation of the region’s results. So, as done above for Gisborne, here are some other indicators.

Taranaki has prices which are above their average trend level with the rest of the country, but not to a sufficient degree to draw any particularly strong conclusions about how they may relatively perform going forward.

An extended period of price out-performance from 2017 has however come to an end.

Prices were falling through 2022-23 as was the case elsewhere. But now some stability has appeared.

Sponsored by:

The region has shed any over-valuation one might consider exists based on its long-term price trend on a standalone basis.

In contrast note this graph for Manawatu-Wanganui.

While Taranaki may not receive much of a population boost from booming migration, improving dairy incomes and a housing affordability argument come 2025 (not this year), imply strength down the track.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 10

Sponsored by:

Regional Property Insights

Wellington

Less popular with investors for now

In the Wellington region this month a net 13% of agents have reported that they are seeing more people at open homes. This is a substantial decline from 82% a month ago and 50% two month’s back. The region has slipped back to average on this measure.

The region remains slightly above average with respect to the net proportion of agents seeing more first home buyers at 57% versus 43% nationwide.

But when we look at agent observations of investors the situation is much weaker than average.

A net 33% have just reported seeing fewer investors as compared with 3% nationwide. The redundancies occurring in the public sector may be playing a role alongside the negative publicity regarding the city’s infrastructure, nightlife, council finances etc. Add in earthquake risks and costs and the region presents as a hard sell to investors for the moment.

However, even taking investor reticence into account the proportion of real estate agents feeling that buyers are displaying FOMO still sits above average at 17% versus 11% nationwide.

Will the recent increase in parts of the city able to be intensified for housing make a difference. It will take a potentially long time for any effect to be visible.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 11

Regional Property Insights

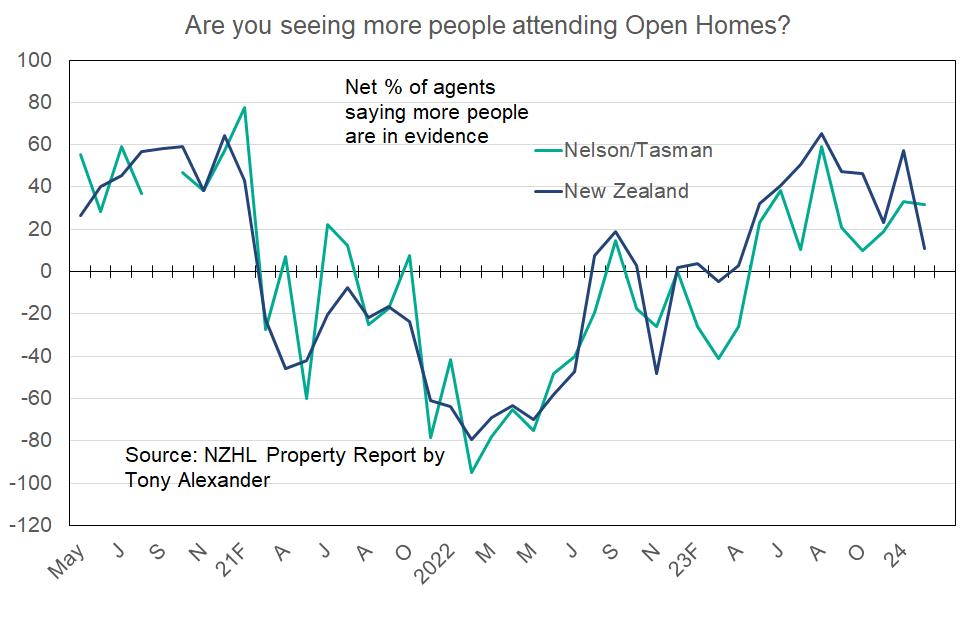

Nelson, Tasman, Marlborough

Tracking near average

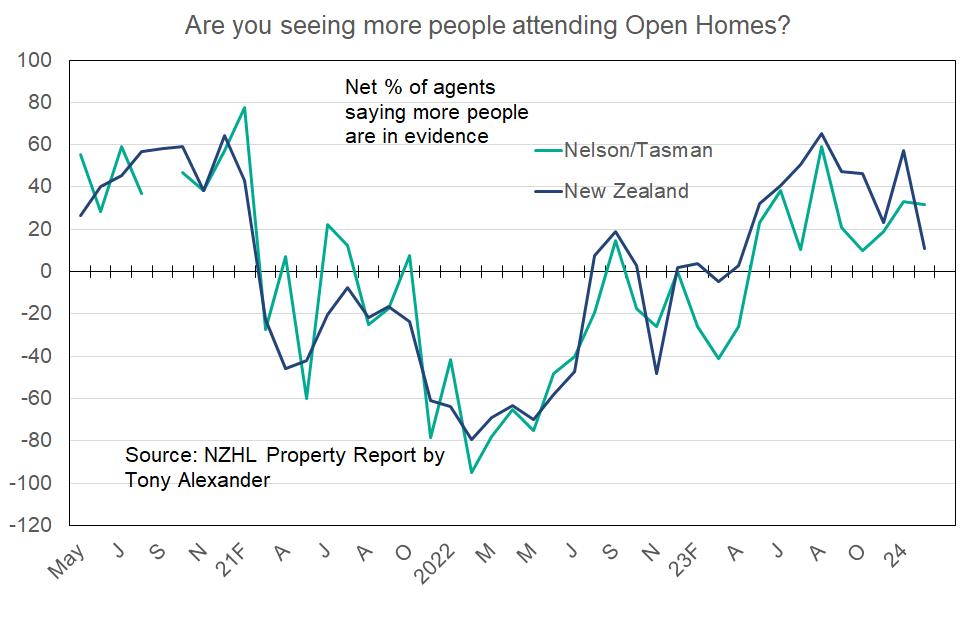

In my survey of real estate agents with NZHL I gather all responses from Tasman, Nelson, and Marlborough into one classification as often not enough replies are received for the regions individually. Doing this we see the following.

The net proportion of agents reporting that they are seeing more people showing up at open homes was 32% at the start of this month as compared with 11% nationwide. The regions show more activity than average by this measure.

The net proportion of agents seeing more first home buyers this month near exactly matched the nationwide reading of a reasonably healthy 43%.

In contrast, a net 14% of agents at the top of the South Island said that they were seeing fewer investors which was weaker than the NZ-wide reading of -3%.

Sponsored by:

But the graph shows reasonably clearly that the regions covered here do tend to display degrees of investor interest which are quite close to average.

Perhaps with the closeness of the results so far it is not surprising that the reading for FOMO is about the same as elsewhere on average. 18% of agents say that buyers at the top of the South Island are displaying FOMO as compared with 11% nationwide.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 12

Regional Property Insights

Canterbury

Stronger than average investor interest

A net 24% of agents located in the Canterbury region have this month reported seeing more people showing up at open homes. This is stronger than the NZ-wide reading of 11% but not consistently enough to allow us to truly say that the region is showing far greater interest from buyers than average.

With regard to first home buyers however a net 59% of Canterbury agents say that they are seeing more in the market as compared with 43% nationwide. But again, this reading has tended to track closely with the NZ average so we cannot truly say that young buyers are in action to a greater degree than average.

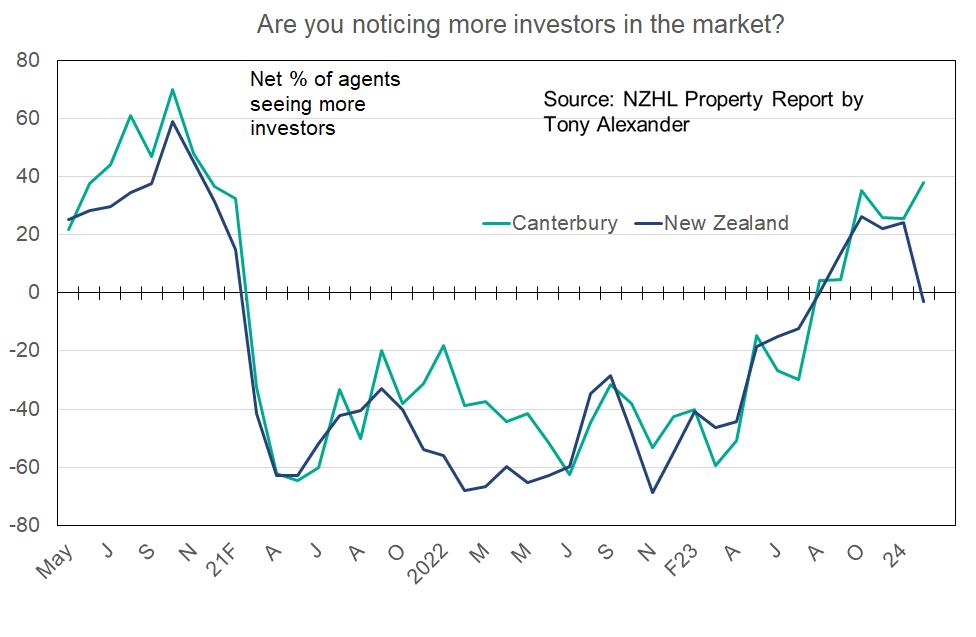

But we can draw this conclusion when we look at investors. A net 38% of agents in Canterbury report that they are seeing more investors. Nationwide a net 3% report that they are seeing fewer investors. This is a strong divergence and as the graph shows the change

Sponsored by:

in the past month is in the opposite direction from the country overall.

A gross 17% of agents report that in Canterbury they can see buyers displaying FOMO. This is not sufficiently different from the 11% situation nationwide to allow anything strong to be said.

Nonetheless, overall the Canterbury region presents as being slightly stronger than the national average.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 13

Regional Property Insights

Dunedin City/Otago

About average

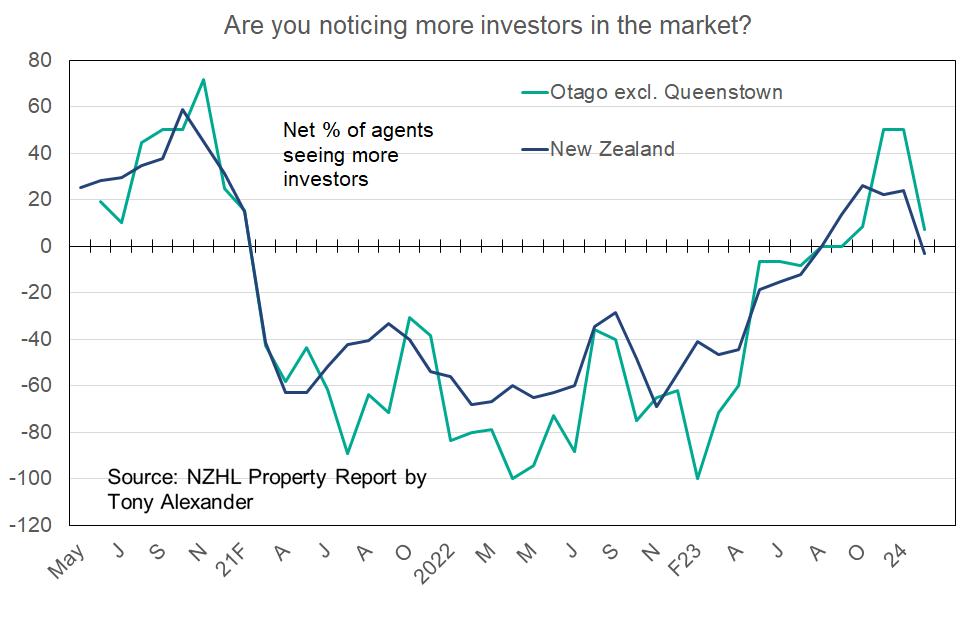

In the Otago region outside of Queenstown Lakes (largely Dunedin but some smaller locations now and then) a net 29% of residential real estate agents have recently reported that they are seeing more people appearing at open homes. This is above the NZ average of 11% and in the most recent months the region has tended towards being stronger than average.

When we look at agent perceptions of market presence by first home buyers however we see that things are about average with a net 50% of agents seeing young folk compared with 43% nationwide.

Switching to agent observations of investors in the market we see that a net 7% of the region’s agents are observing more investors. This is above the nationwide outcome of a net 3% of agents seeing fewer investors. But like the country overall there has most recently been a firm decline in investor presence in the market.

Sponsored by:

Looking at FOMO we find that for the Otago region outside of Queenstown Lakes agents say they are seeing no FOMO. Nationwide 11% of agents say they are seeing FOMO.

Putting it all together it looks like in this region things are not all that distant from the nationwide average.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 14

Regional Property Insights

Queenstown Lakes

Stronger than average

We usually get enough responses from the Queenstown Lakes region to conduct our monthly analysis but unfortunately that has not been the case for this month. Nonetheless, we can get a feel for how things are tracking from the data we do have in hand.

In recent months a higher-than-average net proportion of real estate agents in the Queenstown Lakes region have been observing more people at open homes.

With regard to the presence of first home buyers, in recent months the region has been tracking close to the NZ-wide average level of young buyer presence.

For investors the results of our survey in recent months suggest greater than average interest.

Sponsored by:

With regard to agent observations of buyers’ feelings of angst, FOMO is seen as higher in the Queenstown Lakes region than elsewhere around New Zealand on average.

All up, the Queenstown Lakes region is running stronger than average, and this is seen most clearly in REINZ House Price Index data showing prices since June rising 13% versus 5% for all of the country.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 15

Regional Property Insights

Southland

Good price gains recently

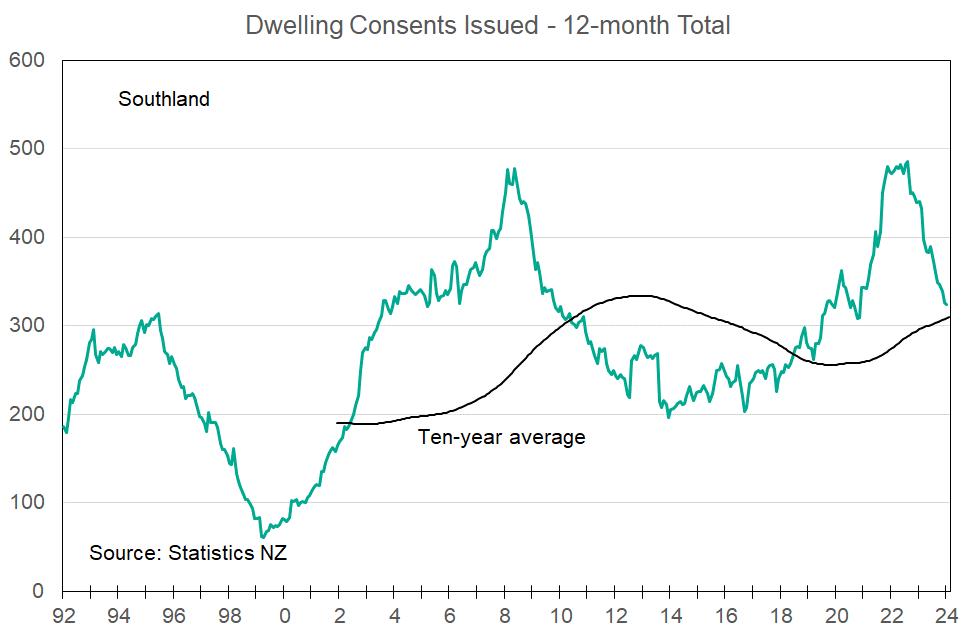

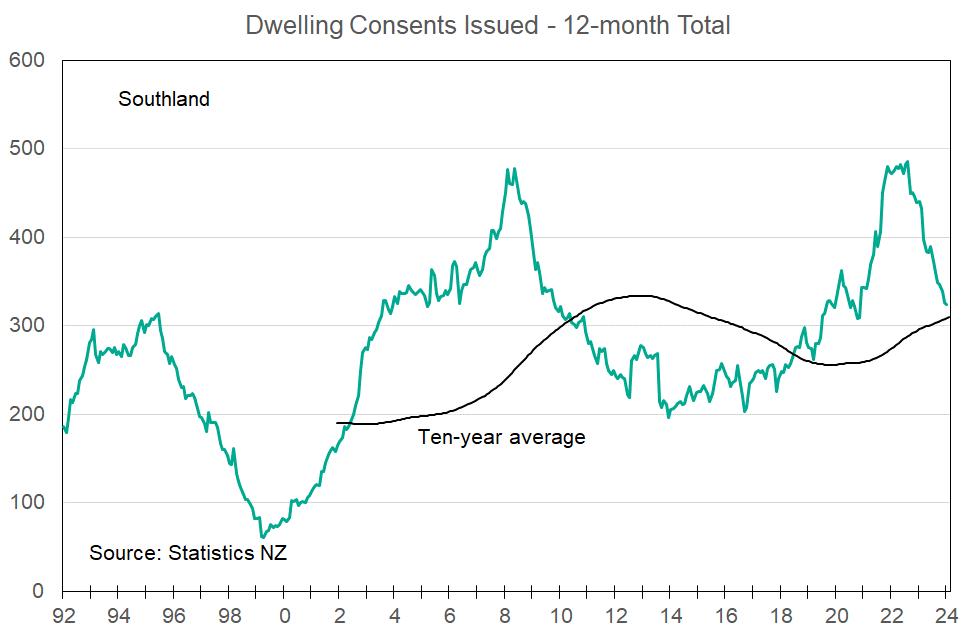

As a rule we never receive sufficient response in my monthly survey of real estate agents to allow presentation of data. Thus, as we have done above for Gisborne and Taranaki here are some other graphs showing how things are tracking.

Prices for dwellings in Southland are sitting at unusually high levels compared with nationwide prices on average.

This reflects the outcome of the period from 2022 until the end of 2023 when prices in Southland rose at a faster than average pace.

Like the rest of the country the Southland region experienced falling prices through 2022 into 2023. But also like almost all other parts of the country prices have recently been rising again.

Sponsored by:

Since the nationwide house price cycle turned upward in June last year prices on average have increased by 5.3%. In Southland the average gain since then has been 7.3%. Therefore, the region is showing stronger than average prices growth.

However, like the rest of the country Southland is seeing a decline in new home construction. But unlike Auckland at least the prevalence of standalone house construction as opposed to townhouse developments suggests that as the chickens come home to roost in this sector this year and next, Southland will be spared.

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 16

Regional Property Insights

This publication is written by Tony Alexander, independent economist. You can contact me via LinkedIn or email tony@tonyalexander.nz

Subscribers to Tony Alexander’s free weekly “Tony’s View” receive additional information on the economy and housing markets to that contained here, through such add-ons as the monthly Spending Plans Survey, mortgages.co.nz & Tony Alexander Mortgage Advisors Survey, Sharesies and Tony Alexander Portfolio Investments survey, and REINZ & Tony Alexander Real Estate Survey. Subscribe for free here. https://forms.gle/qW9avCbaSiKcTnBQA

This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. We strongly recommend readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. No person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.

Sponsored by:

REGIONAL PROPERTY INSIGHTS – Issue March 2024 Page 17

PROPERTIES

LJHooker

Town&Country

216 Rosebank Road

Avondale,Auckland

LISTINGS

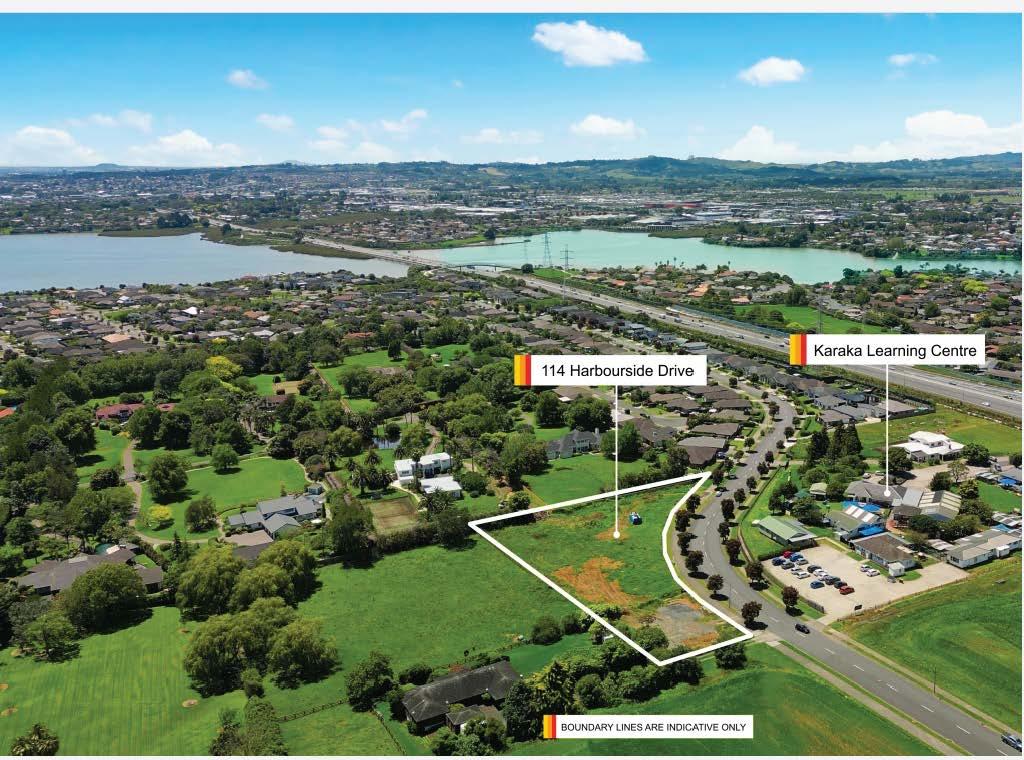

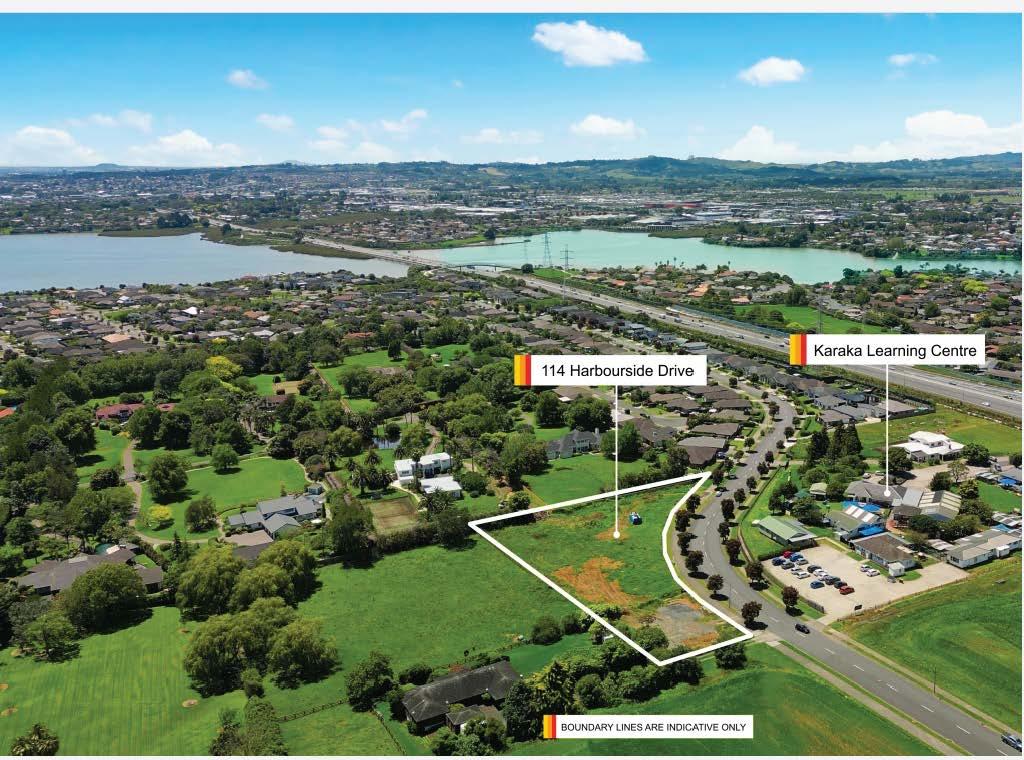

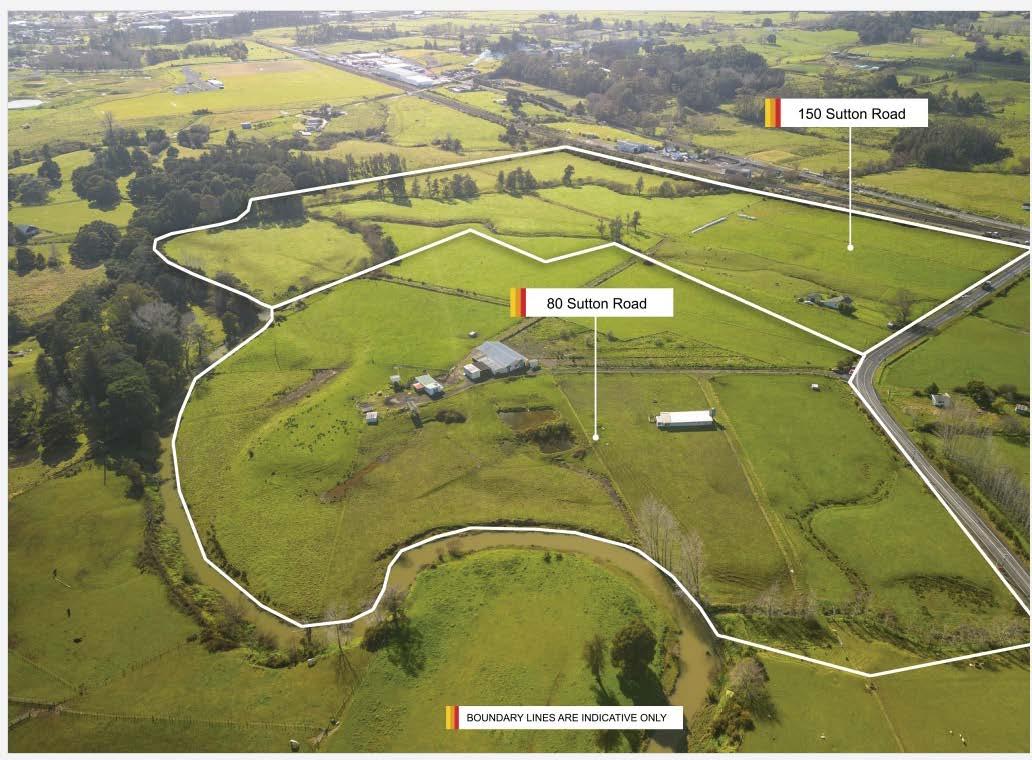

114 Harbourside Drive, Karaka NZ

§- b-�-

RIPE FOR DEVELOPMENT in KARAKA

Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land ho...

24th, Mar2024

For Sale $4,000,000 Plus GST (if any)

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

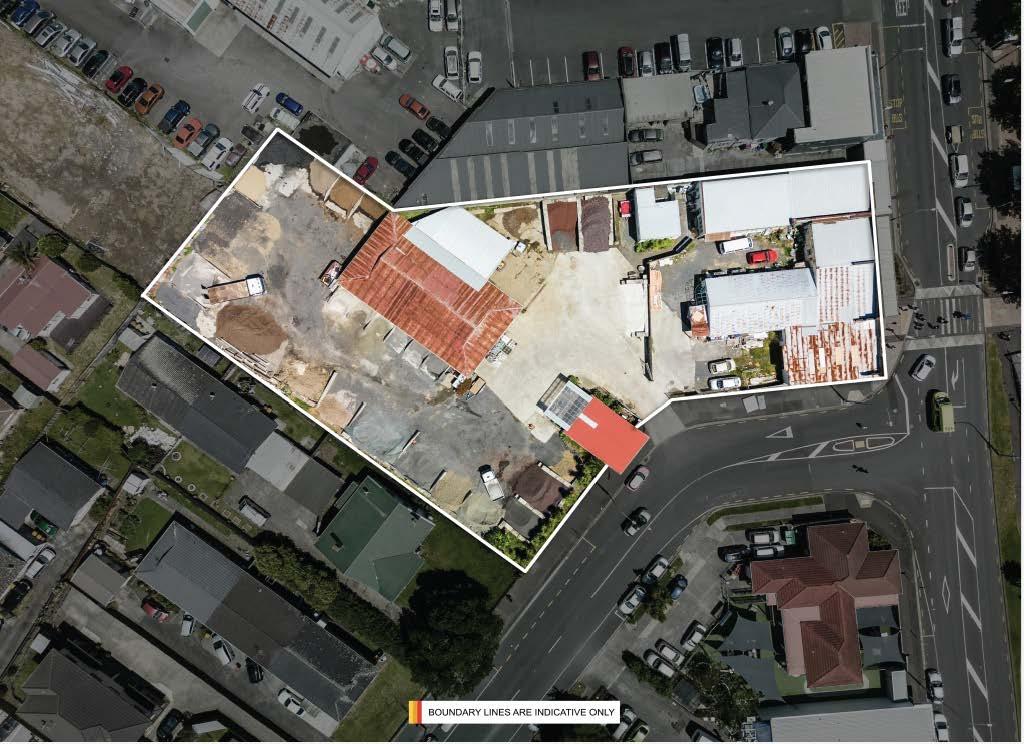

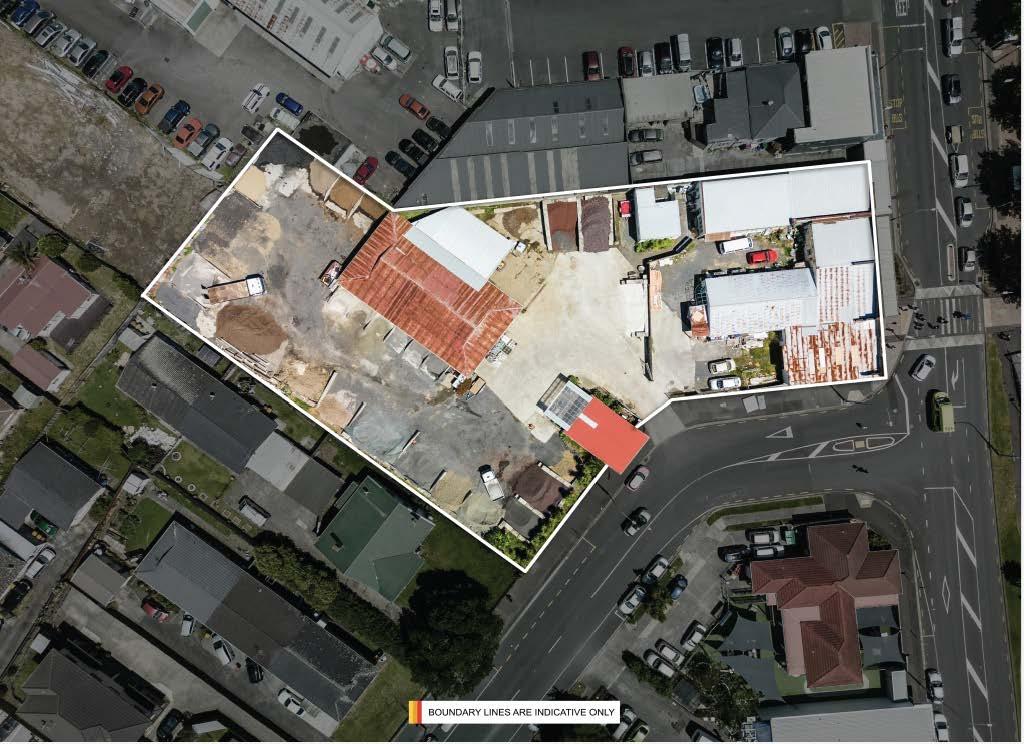

5 Coronation Road, Papatoetoe NZ

PRIME COMMERCIAL BLOCK.

Set in the heart of Old Papatoetoe's commercial hub, the opportunity to acquire blocks of this size

8/10 Fathom Place, Te Atatu Peninsula NZ

§1 bl �-

SMART TOWNHOUSE - Stunning complex

Located on Fathom Place in TeAtatu Peninsula, this Townhouse is in an area spoilt for choice of Res...

For Sale Price onApplication

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $635,000

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

216 Rosebank Road, Avondale South NZ

§1 bl �-

TOWNHOUSES - Modern & Affordable

Located on Rosebank Road, these Townhouses are within walking distance to Eastdale Reserve, Rosebank...

C 26-51/49 Te Kanawa Crescent, Henderson NZ

§2 bl �-

ATTRACTIVE ELEGANT TOWNHOUSE

This Townhouse is one of 28 homes in a complex or two or three storey brand new quality, crafted, s...

For Sale $675,000

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $815,000

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

tihttps://drury.ljhooker.co.nz/

Unit C/23Awaroa Road, Sunnyvale NZ

§2 bl �1

Stunning Functional Townhouse

Perfectly positioned for access to trains, buses and motorway connections this Townhouse, at an affo...

For Sale $740,000

View ByAppointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

294 7500

09

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

LJHooker

Town&Country

LISTINGS

Unit 1/200Carrington Road, MountAlbert NZ

§3 b2 �Ultra Modern Living in Mount Albert Inthe Premiumsuburbof MountAlbertthis developmentfeaturestwoandthreebedroom townhouses.

Unit7/200 Carrington Road, MtAlbert NZ

§2 b2 �1

Welcome to Convenient Living Inthe Premiumsuburbof MountAlbertthis developmentfeaturestwoandthreebedroom townhouses.

Unit D/200 Carrington Road, MtAlbert NZ

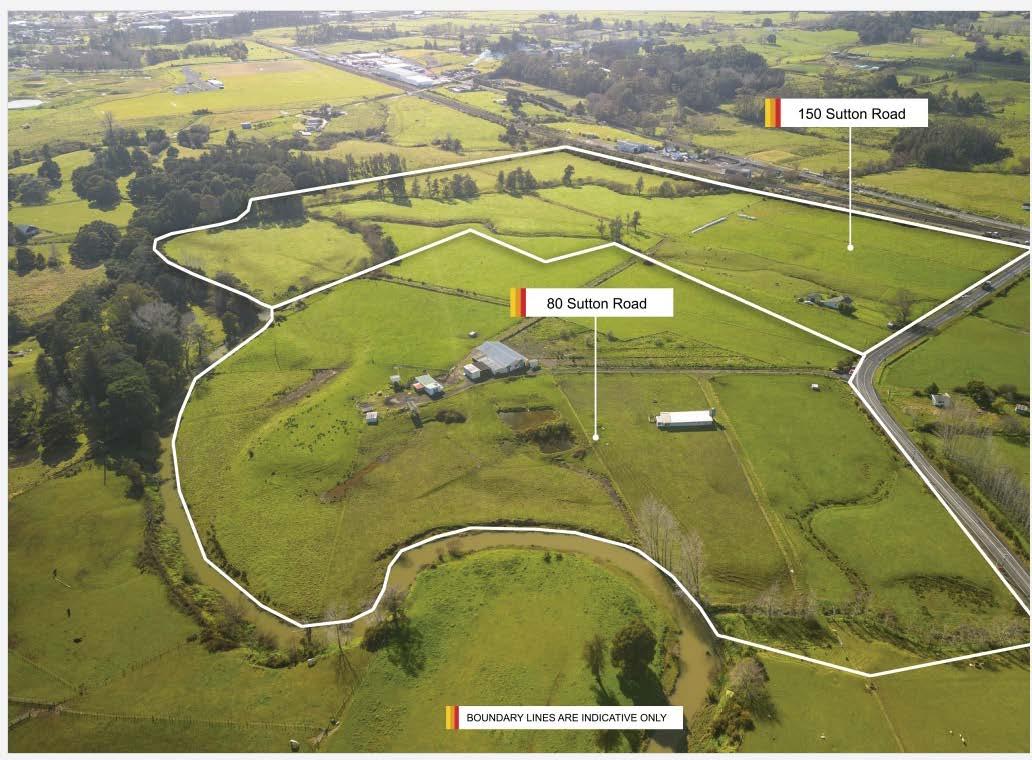

§2 b2 �-