Wheretheonlyresultthatmattersisyours! TNBPropetyServicesLimited(LicencedREAA2008) June2024

The Property Chronicle Town&Country

Hooker Newsletter and Blogs

• Letter from Principal (Brent Worthington) – Update • Rent Exchange

Reports, Surveys & Commentaries

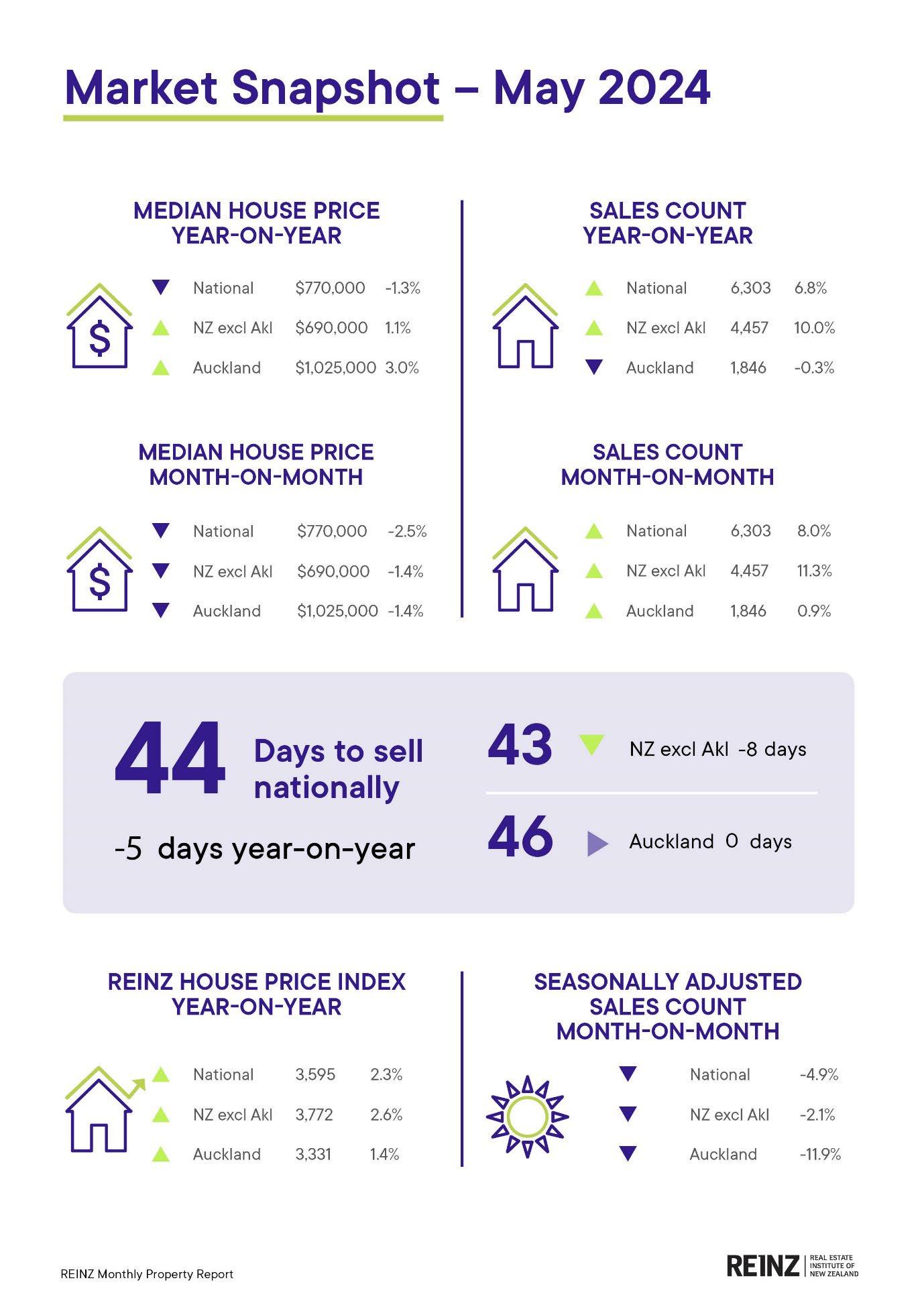

• REINZ PressRelease-Asubdued marketamideconomic challenges

o MarketSnapShot

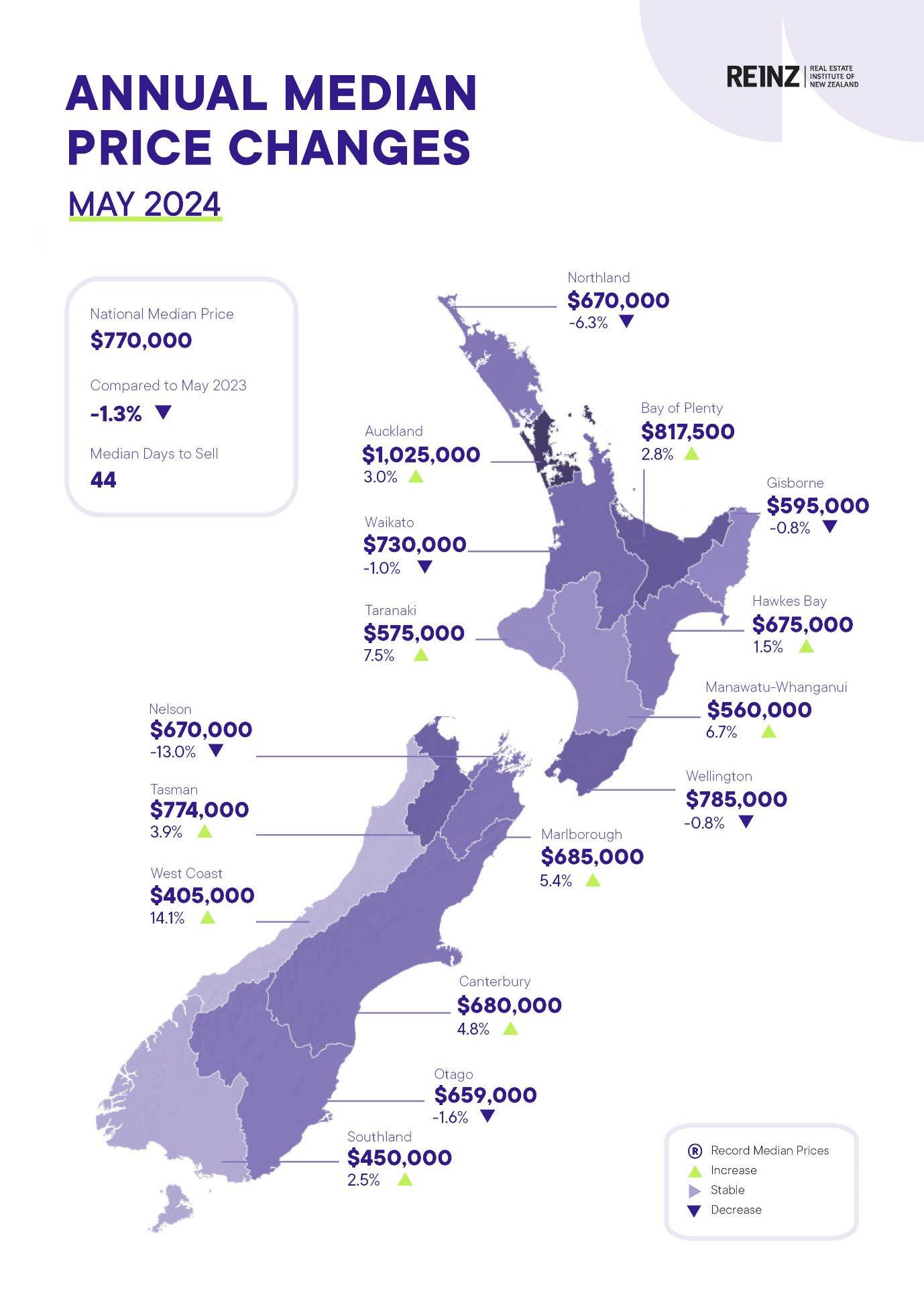

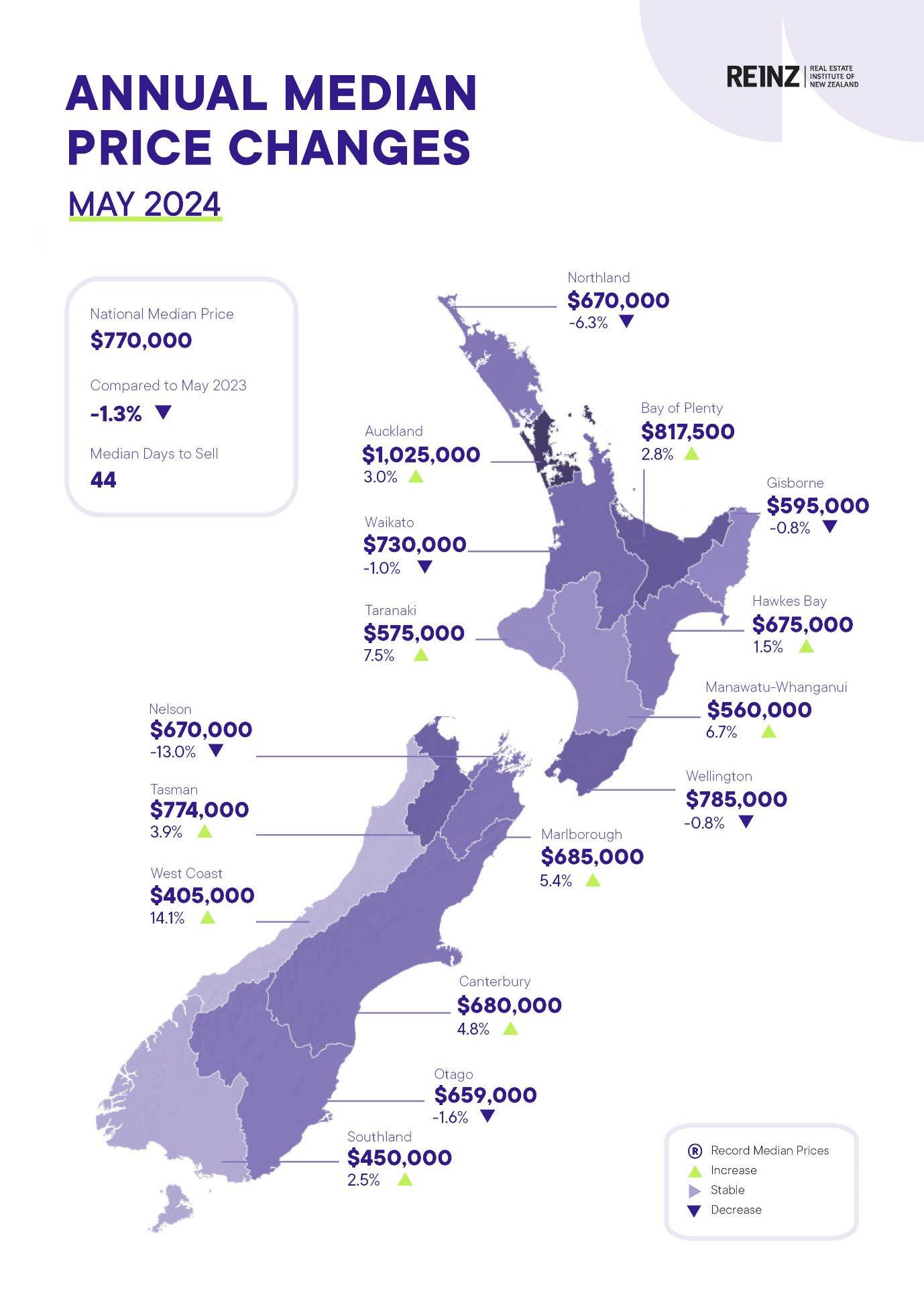

o AnnualMedianPriceChanges

• REINZPropertyReportJune24(MayData)withlink

• REINZHouse PriceIndex Report (HPI)May24(April Data)withlink

• CoreLogic

o Aucklandleadsslowdown,as nationalpricesdipagain(withInteractiveLink)

• RealEstate.CoNZ

headwindsfail

shake New

What’s the secret?

Finance & Lending

• Tony’s View Alexander o Input to your strategy

• Venita Attrill

• Paul Cox

• KJ Klavens

• Steve Reilly

• Anu Jay

• Lina Roban

• Brent Worthington

• Debbie Harrison

• Johnny Bright (Apollo Auctions)

• Robert Tulp (Apollo Auctions)

• Keith

(Loan

Town & Country CONTENTS Page LJ

– Property Management • A comprehensive guide to investing in holiday homes • The Importance of maintaining gutters •

Papakura to Drury project works & Drury Interchange update 3 5 9 10

SH1

–o

to

Zealandpropertyprices:

LizStudholme 12 15 16 17 18 19 25

Economic

to challenges

The return of the housing slump: Who’s to blame? 36 46 Properties - LJ Hooker Town & Country • Properties Listed 52 • Properties Recently Sold 58

for adapting

o

Our People

Jones

Market) 60 61 62 63 64 65 66 67 68 69 70 SuperGold

Here

- Welcome

19 June 2024 Hi

According to recent data, a substantial number of potential buyers, including first-home buyers and investors, are delaying or reconsidering their plans. The proportion of first-home buyers looking to enter the market has dropped sharply from earlier in the year, reflecting concerns over job insecurity amidst forecasts of rising unemployment rates.

Investors, too, have retreated, with a growing number shelving plans to purchase investment properties. Real estate agents report a decrease in investor interest compared to earlier in the year, attributing it to economic uncertainties and stringent monetary policies. The economic backdrop includes heightened living costs, increased council rates, and insurance premiums, alongside a surge in property listings since the New Year. These factors have collectively contributed to a cooling effect on sales and price growth observed last year.

Looking ahead, market analysts suggest that a potential turnaround could occur later in the year if the Reserve Bank eases monetary policy by lowering interest rates. The timing and extent of any recovery hinges on economic indicators and policy adjustments, with ongoing caution expected among buyers and investors until then.

However, the New Zealand real estate market in May 2024 demonstrates resilience amidst these economic challenges, characterised by stable national average asking prices and varied regional performances. Regional variations highlight the diverse market conditions, with some areas experiencing price declines while others see modest gains.

Increased stock levels provide opportunities for buyers, while sellers navigate strategic pricing amidst competitive conditions.

As economic factors and regulatory changes continue to influence buyer behaviour and market sentiment, shaping expectations for future market activity, market participants are advised to stay informed and seek guidance from local real estate experts to navigate current dynamics effectively.

As always we hope you enjoy this publication.

Kind regards

Brent

Brent Worthington Principal and Licensee Agent

LJ Hooker Town & Country & Property Management 1/233 Great South road, Drury 0292 965 362

Town & Country

Town&Country

Please don't hesitate to contact our team who can ably assist you with any property management matters you may have or if you have any questions about anything in the newsletter or property management in general.

TNBPropetyServicesLimited(LicencedREAA2008) June2024 Property Management Specialists

A Comprehensive Guide to Investing in Holiday Homes

Investing in a holiday home can provide a rewarding opportunity, offering both a source of income and a personal getaway.

However, before diving in, it's critical to assess the potential costs and benefits. Whether you're paying in full or considering a second mortgage, understanding the impact on your finances, lifestyle, and long-term objectives is crucial.

Here's an overview of key considerations to help you determine if a holiday home is a suitable investment for you.

Holiday home investment in New Zealand

Purchasing a holiday home is a popular choice for those looking to enjoy time with family, escape daily stresses, or make a profitable investment.

Kiwis love a bach to escape to, whether it’s at the beach, lake or in the mountains. Many of us aspire to have somewhere to escape our daily grind and enjoy life at a different pace.

If it’s a holiday home you are after, there is a chance it sits empty for part of the year. Which is why you could consider making it a holiday rental so others can enjoy it when you cannot.

Holiday homes can offer solid returns, but the investment comes with risks. Many vacation spots are highly seasonal, which can affect both rental income and property values.

13 June 2024

Before making a purchase, investigate property value trends and occupancy rates during both peak and off-peak seasons. Investing in areas with diverse industries beyond tourism can help maintain occupancy year-round.

Key considerations for holiday home investment

Before buying a holiday home as an investment, consider these important factors:

Choosing the ideal location

Location is critical when investing in a holiday home. You need to balance personal enjoyment with investment potential.

Research popular vacation spots in New Zealand that match your interests and lifestyle. Whether you prefer the lively atmosphere of Auckland, the tranquillity of Queenstown, or the coastal allure of the Bay of Islands, select a location that suits you.

Consider proximity to amenities, attractions, and transport links. Properties near beaches, ski fields, or tourist attractions are more likely to attract renters and allow higher rental rates. Don’t overlook lesser-known areas that offer unique experiences and potential for property value growth.

Maximising rental income across seasons

A key advantage of owning a holiday home is the potential for rental income. To maximise earnings, understand the seasonal variations in the rental market.

Peak seasons, such as school holidays and summer months, provide opportunities to charge higher rates due to increased demand.

Enhancing your property with amenities and upgrades can boost its appeal and justify higher rental rates even during off-peak seasons. Features like a heated swimming pool, home bar, entertainment room, home gym, BBQ facilities, or highend furnishings can attract renters year-round.

Understanding tax responsibilities

When investing in a holiday home, it's crucial to understand your tax obligations to avoid any unexpected liabilities.

In New Zealand, the Bright-line test is a key factor in property taxation. This rule requires you to pay income tax on any profit made from selling a residential property if the sale occurs within a certain timeframe after purchase.

As of 1 July 2024, the Bright-line test only applies to investment properties sold within two years of purchase. If you do you will be liable to pay income tax on the profit from the sale.

In addition to potential capital gains tax, you must also declare any rental income from your holiday home. This includes income earned from short-term rentals on platforms like Airbnb or traditional long-term rents.

Fortunately, you can deduct certain expenses related to earning that rental income, which can help reduce your taxable income. These deductible expenses include:

Maintenance Costs: Any repairs or upkeep required to maintain the property.

Rates: Local council rates levied on the property.

Insurance: Costs for insuring the property.

Property Management Fees: Fees paid to property managers or rental agents for managing the property on your behalf.

It's advisable to keep detailed records of all income and expenses associated with your holiday home to ensure you can substantiate your claims.

Given the complexities of tax regulations, consulting a tax professional is highly recommended. They can help you navigate these rules, maximise your allowable deductions, and ensure compliance with New Zealand’s tax laws. This professional guidance is essential to make informed financial decisions and optimize the profitability of your holiday home investment.

Property management

Managing a holiday home involves numerous responsibilities, including maintenance, guest management, and marketing. If you prefer not to handle these tasks, professional property management services can be invaluable.

A reliable property manager can oversee maintenance, handle guest inquiries and bookings, and implement marketing strategies to promote your property on various platforms, from listing sites to social media.

Marketing your holiday home

To ensure a steady flow of bookings, you need to market your holiday home effectively.

Create an appealing listing: Use high-quality photos and detailed descriptions on platforms like Airbnb or Bookabach.

Set competitive prices: Price your rental based on location and amenities, offering discounts for longer stays or off-peak periods.

Target your audience: Advertise to your ideal guests through social media and targeted ads.

Partner locally: Collaborate with local businesses to offer special deals to your guests.

Work with an agent: A local real estate agent can use their expertise and network to attract guests and manage bookings.

Ready to make a decision

Investing in a holiday home can be profitable, but due diligence is essential. Be realistic about rental income and ongoing maintenance costs. Short-term rentals can boost cash flow, but income varies with the seasons. Location is a key factor. Your holiday home will likely be most in demand during times when you may want to use it, like school holidays and summer. Carefully consider these trade-offs before making your investment decision.

THEIMPORTANCEOFMAINTAININGGUTTERS!

As thevibrantcoloursofsummerbegintofadeandbrisk windsofautumnsweepin,itistime toprepareourhomes fortheseasonaltransition.Amidstthetasks thatcomewiththis change,schedulingaguttercleaningsessionmightnotbethemostglamorouschore,butit is undoubtedlyoneofthemostcrucialones.Gutters,oftenoverlooked,theyplayavitalrolein protectingourhomes fromtheelements,especiallyduringrainyseasons.

Neglectingtheirmaintenancecanleadtoissues,fromminorinconveniences tosignificant damages,ultimatelyimpactingourfinances andpeaceofmind.

Gutters serveas theunsungheroesofourhomes,quietlyredirectingrainwaterawayfrom theproperty’s foundationandexterior.Thisseeminglymundanefunctionprevents water pooling,potentialflooding,andstructuraldamage.However,theireffectiveness diminishes whencloggedwithleaves,twigs,anddebris

As autumnprogresses,thesheddingofleaves intensifies,posingagreaterriskofgutter blockages.Whengutters deteriorateandbecomeclogged,theyceasetoprotectproperty effectively,leavingitvulnerabletomanyproblems.Oneofthemostimmediate consequences ofneglectedguttermaintenanceisroofdamage.Cloggedgutterscancause watertoaccumulateontheroof,leadingtoleaksandstructuralweakeningovertime.

Theweightofstandingwatercanalsostraintheroof'ssupportstructure,potentiallyresulting incostlyrepairs.Additionally,wateroverflowfromcloggedgutters canseepintoroofspaces, causingmoisturebuildupandfosteringthegrowthofmould.

Theinsidious natureoftheseissuesmeansextensivedamagemayalreadyhaveoccurred bythetimetheybecomenoticeable.Interiorwaterdamageisanothermajorconcern stemmingfromneglectedguttermaintenance.

Whengutters overfloworleak duetoblockages,watercaninfiltratewalls andceilings of our homes,causingunsightlystains,peelingpaint,andstructuralweakening.Damppatches in thehomeorgardenareoftentell-talesignsofablockedgutter,indicatingwateris notbeing properlydivertedaway.Leftunchecked,thismoisturecanleadtorot,compromisingthe integrityofthebuildingandnecessitatingcostlyrepairs.

Tomitigatetheserisks,propertyownersareadvisedtoarrangeforguttercleaningatleast onceayear,preferablybeforetheonsetofautumnrains.Regularmaintenancenotonly ensures optimalfunctioningofgutters butalsoextendstheirlifespan,savinghomeowners fromtheexpenseofprematurereplacement.While somemayoptforaDIYapproachto guttercleaning,itis essentialtorecognizepotentialhazardsinvolved,especiallyfortaller structures ortwo-storyhomes.

TheSH1PapakuratoBombayprojectispartofalonger-termstrategictransport networkbeinginvestigatedanddeliveredtosupportgrowthinSouthAuckland. Stage1oftheproject,PapakuratoDrury,iscurrentlybeingdeliveredasaRoadof RegionalSignificance

Clickhereforfullinformationonthisprojectand tosubscribetoupdates

NZTA-Projectintroduction:

Reports, Surveys

Wheretheonlyresultthatmattersisyours! TNBPropetyServicesLimited(LicencedREAA2008) June2024

& Commentaries Town&Country

REINZ May data: Sales up, amidst voluminous listing levels

Press Release

Published 17 June 2024

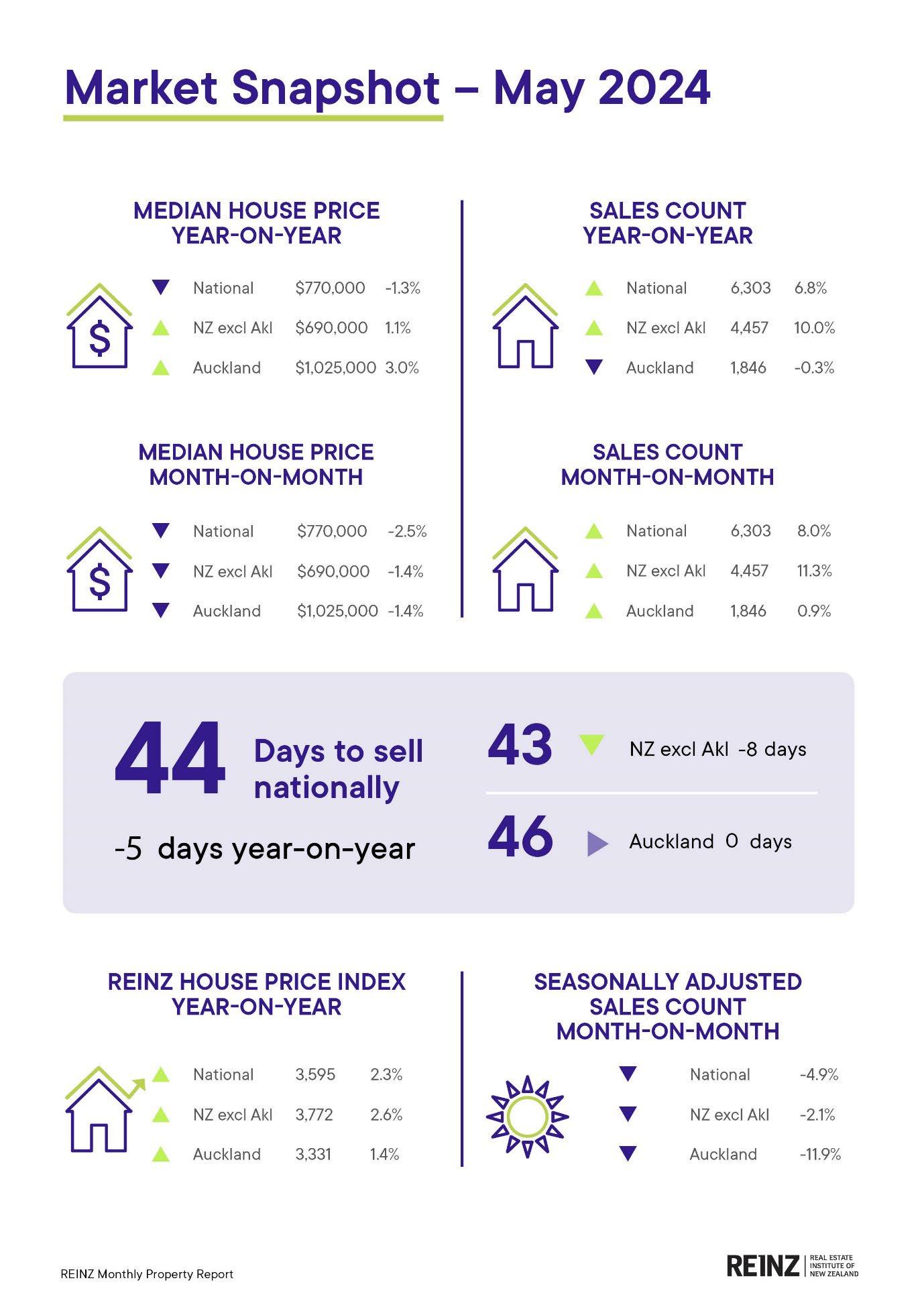

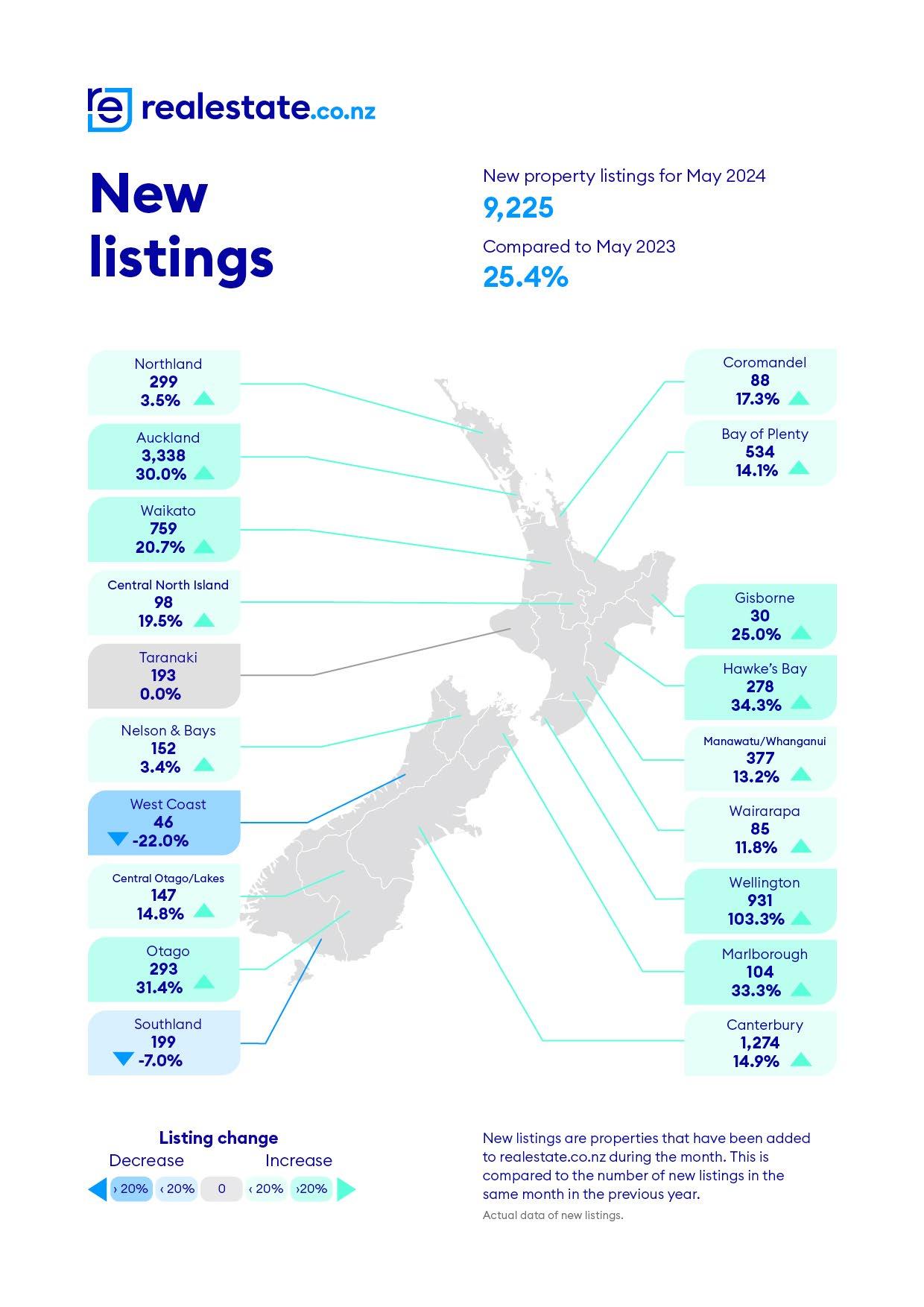

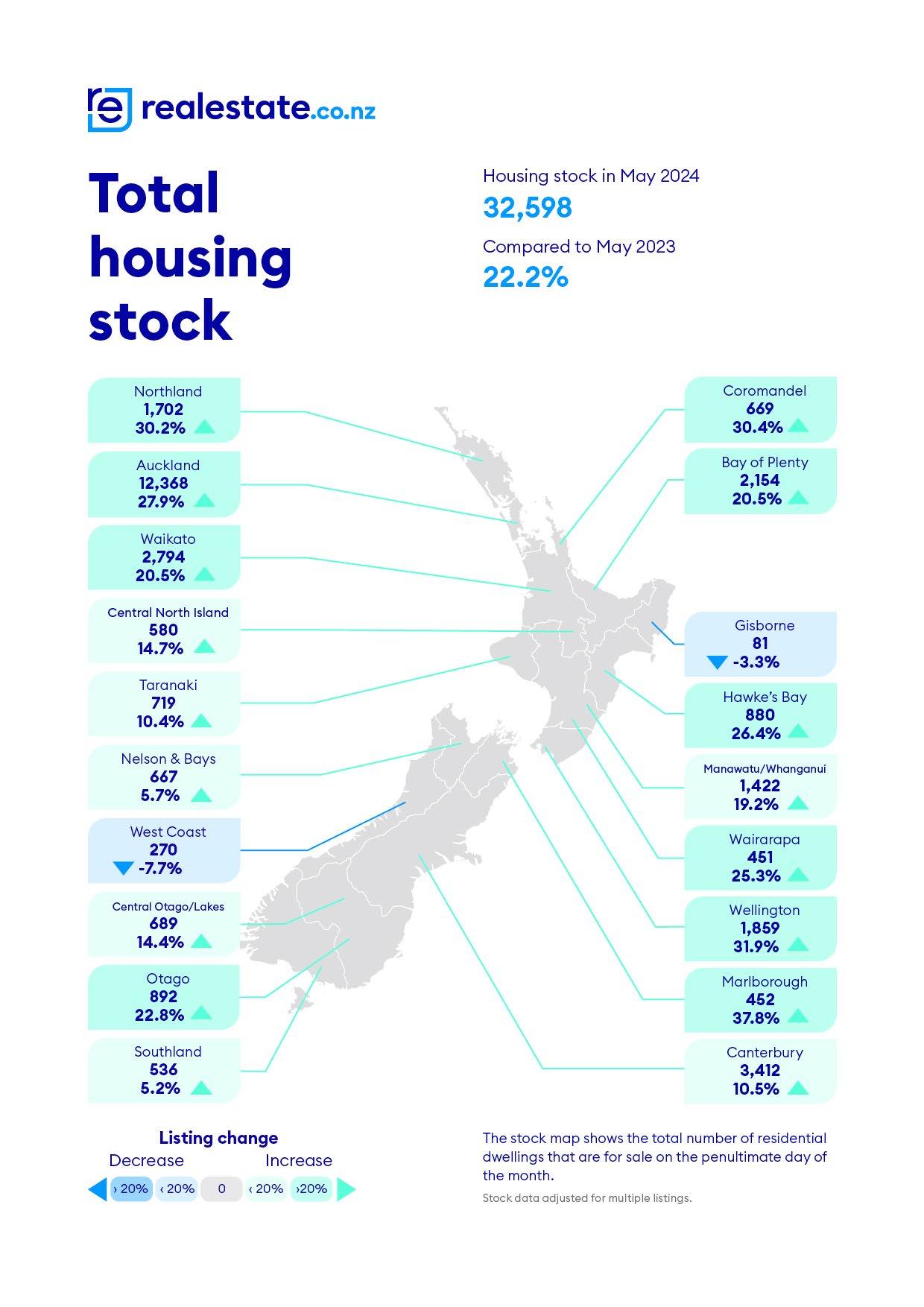

The Real Estate Institute of New Zealand (REINZ) released its May 2024 data today. The data shows a national and regional increase in listings and sales counts while median sales prices stabilise.

REINZ Chief Executive Jen Baird says the market shows a general theme of more this month with higher sales counts, increased stock levels, more listings, and properties selling more quickly than a year ago. These annual increases contrast with current challenges in securing finance, changes in the job market, and the wait on OCR and interest rate changes.

The total number of properties sold in New Zealand increased by 8.0% compared to April 2024, from 5,834 to 6,303, and by 6.8% year-on-year, from 5,903 to 6,303. Gisborne had the highest increase, up by +112% year-on-year, and 11 of the 16 regions had increases in sales count month-on-month and year-on-year.

“The seasonally adjusted figure is an important indicator of the underlying market trends. By seasonally adjusting the data we can see whether the change in sales is part of a normal change we would expect, or something else is happening.”

“Nationally, seasonally adjusted figures show a 5.2% increase, indicating that year-on-year sales counts performed slightly above expectations – an encouraging sign despite the current economic challenges.”

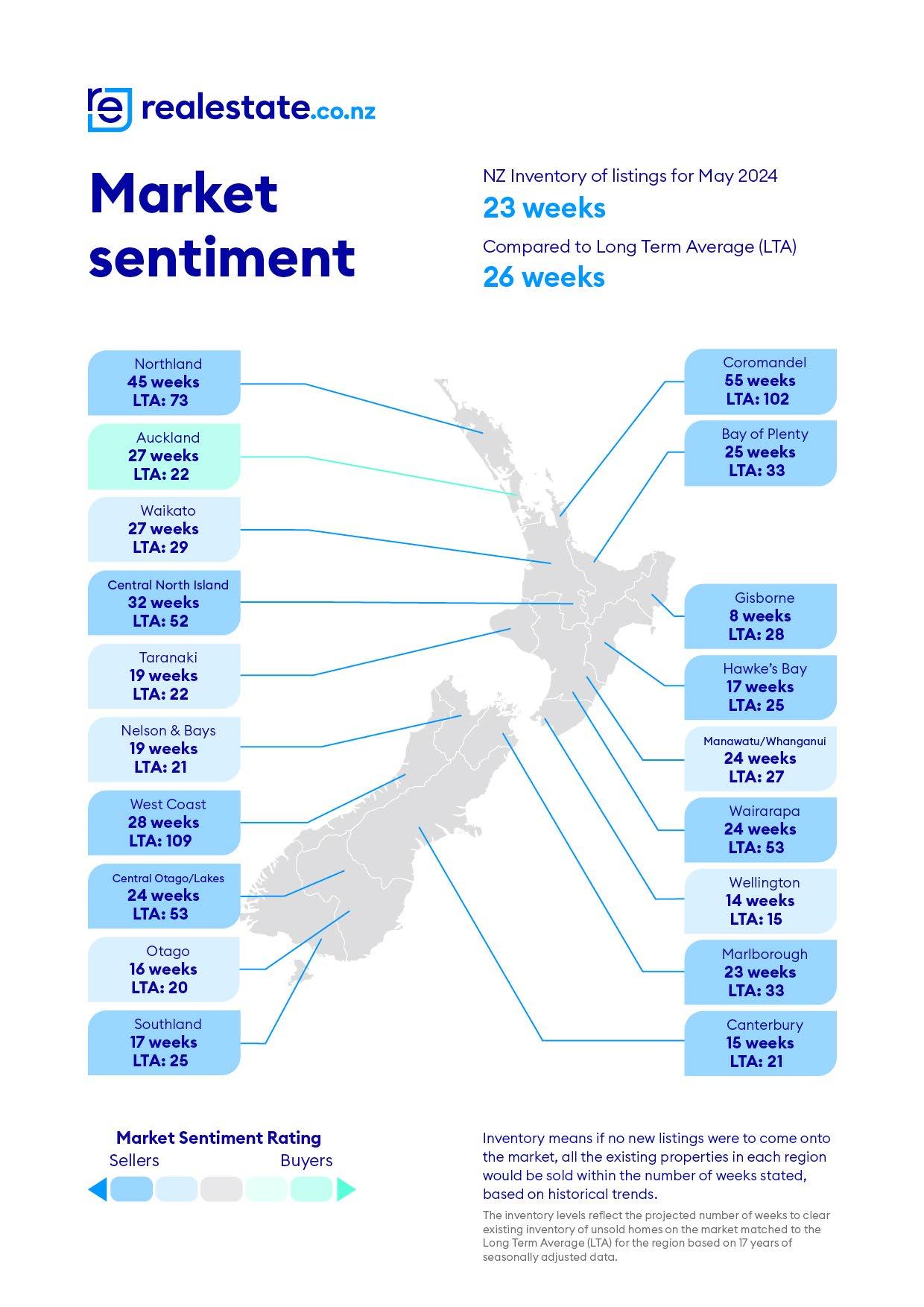

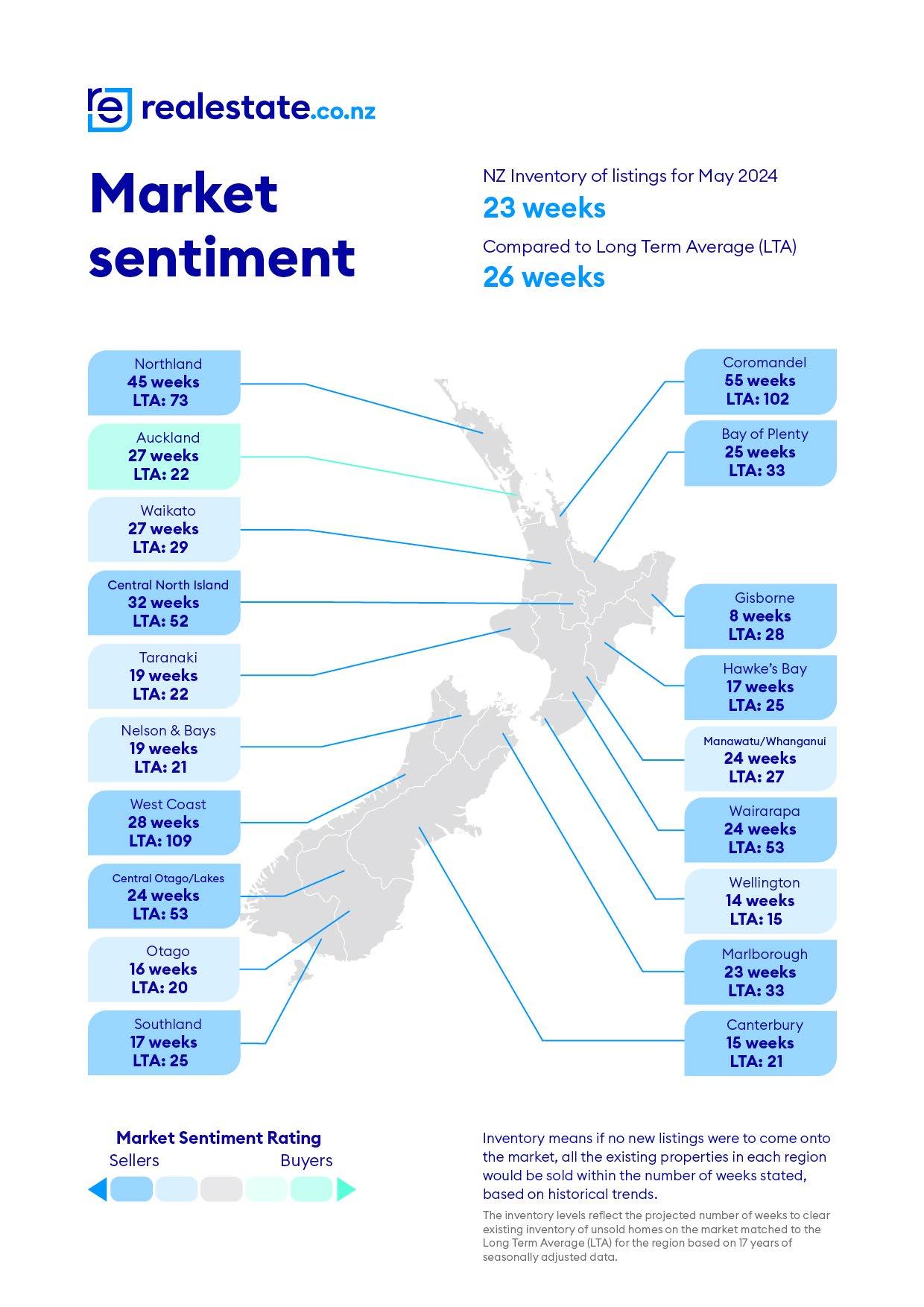

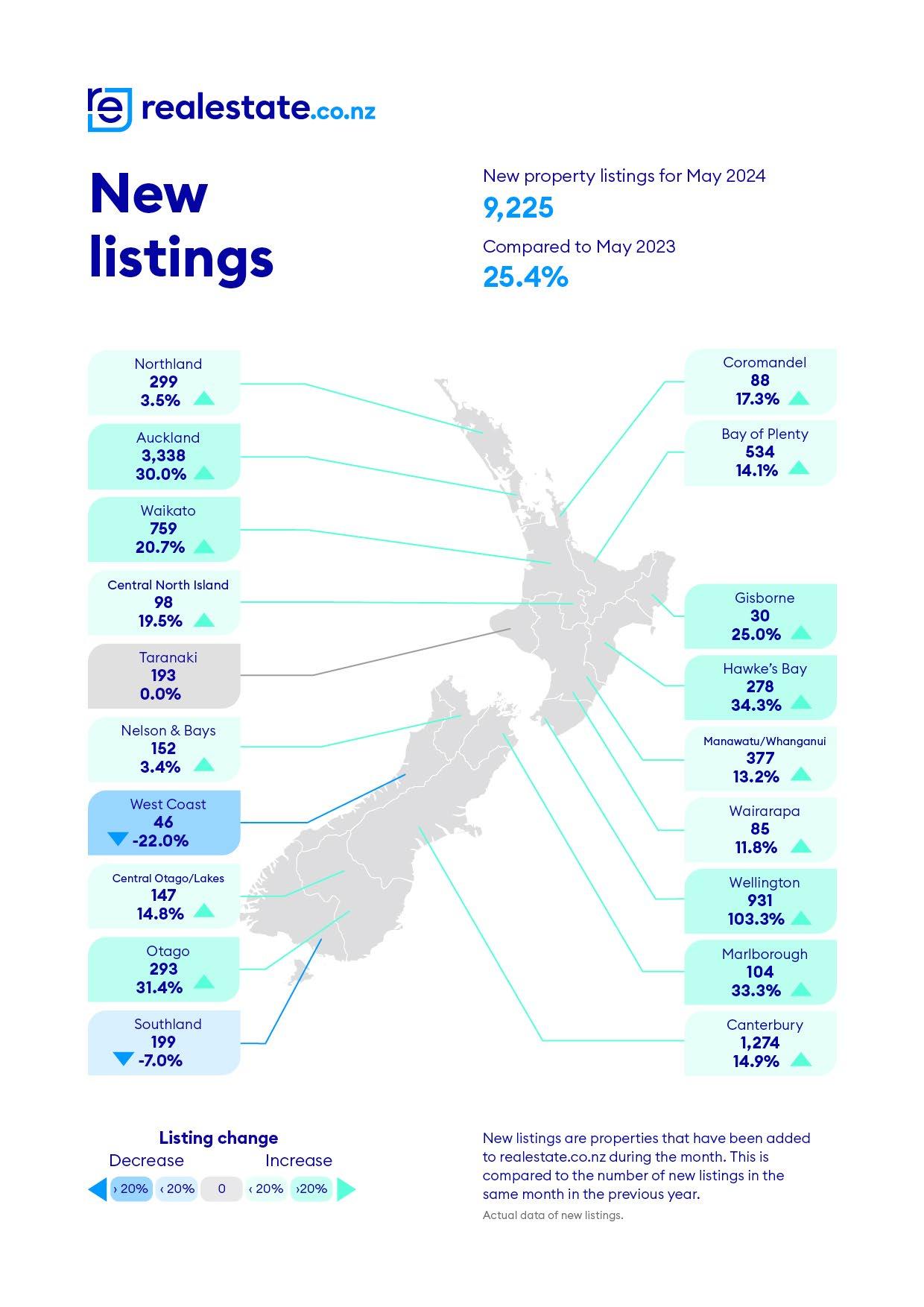

Listings increased nationally by 25.4% year-on-year from 7,359 to 9,225, continuing a trend since the start of 2024. Twelve of the sixteen regions have increased in new listings year-on-year with notable increases in Wellington (+103.3%), Hawke’s Bay (+34.3%), Marlborough (+33.3%), Auckland (+30.0%), Otago (+31.4%) and Waikato (+20.7%).

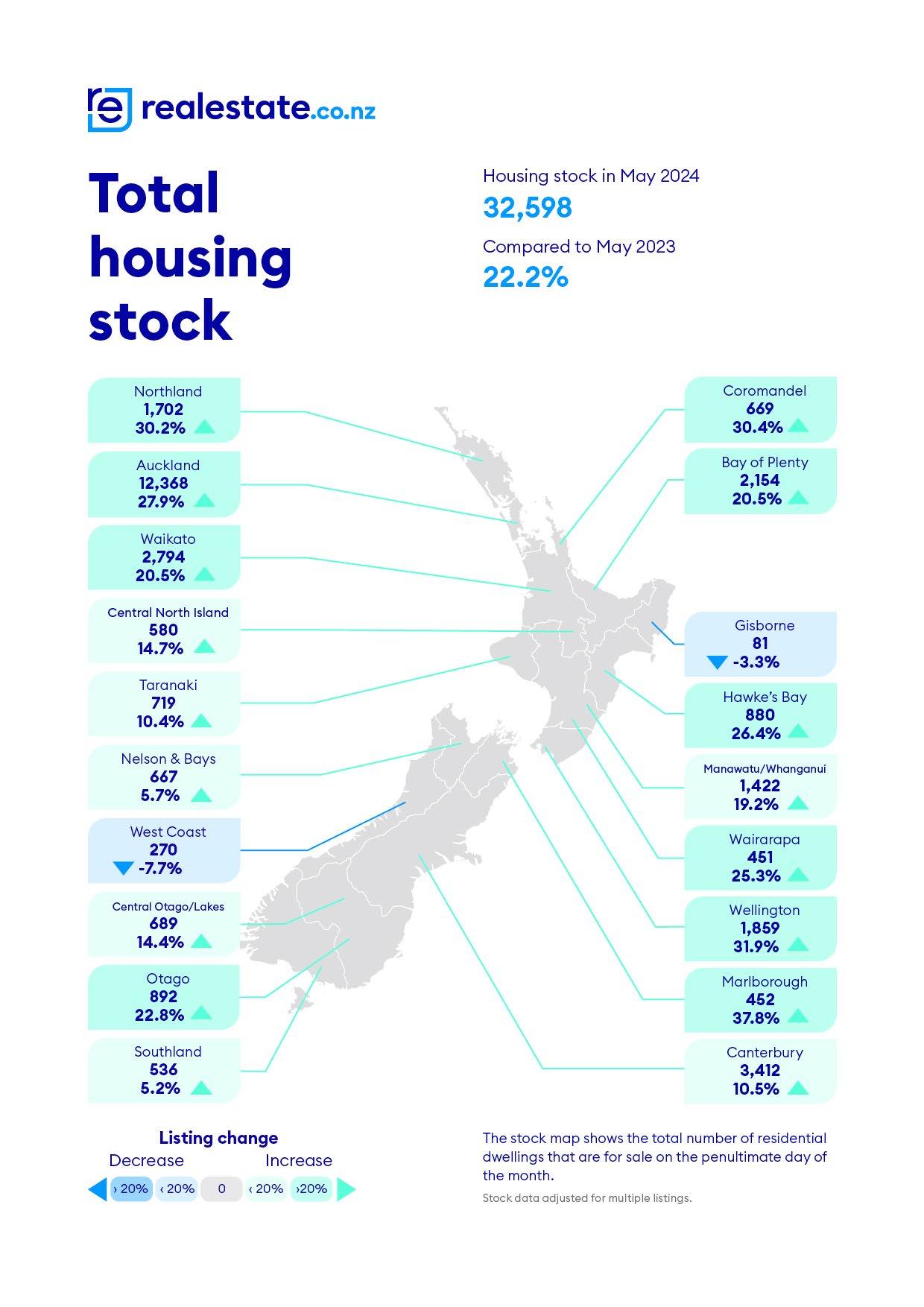

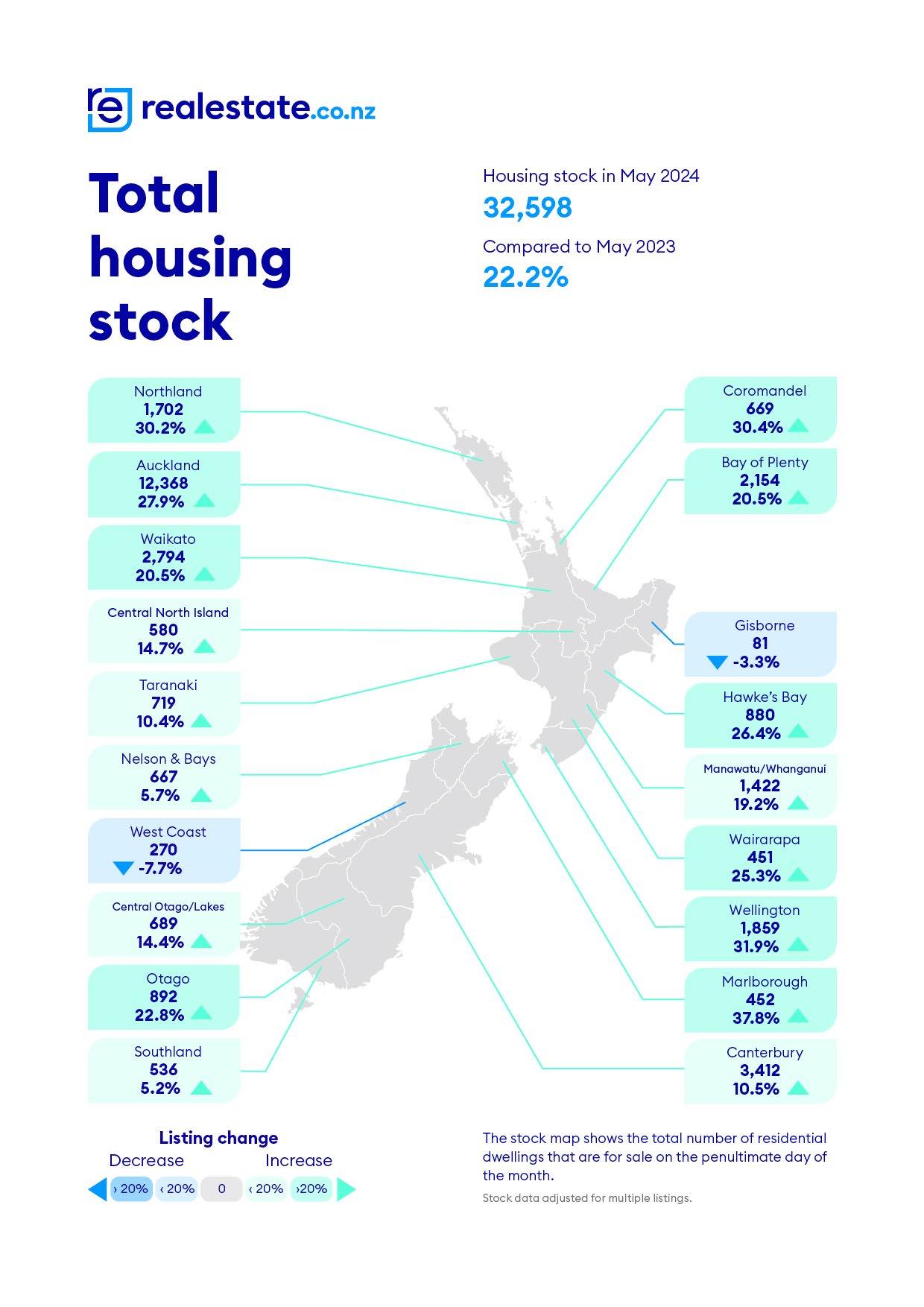

Stock levels for the May 2024 increased 22% (+5,912) from 26,685 to 32,598 year-on-year and decreased 3.6% from 33,815 month-on-month. For New Zealand ex Auckland, stock levels increased 18.9% (+3,215) up from 17,015 to 20,230.

“With a continued flow of new options coming to the market adding to a large level of stock this does provide a lot of choice for buyers and a sense that they can take their time to make decisions.”

The national median sale price decreased slightly by 1.3% year -on-year, from $780,000 to $770,000, and decreased by 2.5% compared with April 2024, from $790,000 to $770,000.

“The seasonally adjusted figures show a 1.2% decrease, showing prices performed slightly below the change usual for May. The volume of listings and choice can affect prices as well as vendor price points adjusting to buyer demands.”

Ten of 16 regions had year-on-year price increases with West Coast leading the way with a 14.1% increase, from $355,000 to $405,000. Compared to April 2024, only three additional regions had median sale price increases (Hawke’s Bay +2.3% to $675,000; Manawatu-Wanganui +0.9% to $560,000; Canterbury +1.5% to $680,000).

Nationally there were 833 auctions in May 2024, 13.2% of all sales compared to 574 auctions or 9.7% of all sales in May 2023. Auckland increased 2.5% from 22.4% (409) to 24.9% (460) in the number of sales by auction compared to last month and increased 7.2% (17.7%) compared to May 2023.

Nationally, median Days to Sell decreased by 5 days, from 49 to 44 days, compared to a year ago. For New Zealand, excluding Auckland, median Days to Sell decreased by 8 days year-on-year, from 51 to 43 days. In 10 of the 16 regions, median Days to Sell were lower compared with May 2023. Northland had the highest days to sell at 71 days compared to 56 last month and 60 compared to May 2023.

The HPI for New Zealand stood at 3,595 in May 2024, down 1.0% from the previous month and up by 2.3% for the same period last year. The average annual growth in the New Zealand HPI over the past five years has been 5.5% per annum, and it is currently 15.9% below the peak of the market reached in 2021.

“There's solid buyer interest and activity, and more listings are coming to a well-stocked market. While some buyers are taking their time, others are snapping up properties at attractive prices before the expected slowing during the winter months and the potential reemergence of investors midyear. It might be a few months yet before the residual impact of readjustments post the government’s 100-day plan and budget are felt. Indeed, there are cool economic breezes being felt but there are signs of more positive activity ahead,” adds Baird.

The Real Estate Institute of New Zealand (REINZ) has the latest and most accurate real estate data in New Zealand.

Media contact:

Communications and Engagement Team communications@reinz.co.nz

Published 17 June 2024 NEW ZEALAND PROPERTY REPORT This report includes REINZ residential property statistics from May 2024. CLICK HERE TO VIEW FULL REPORT

Published 17 June 2024 NEW ZEALAND HOUSE PRICE INDEX REPORT © REINZ - Real Estate Institute of New Zealand Inc. CLICK HERE TO VIEW FULL REPORT

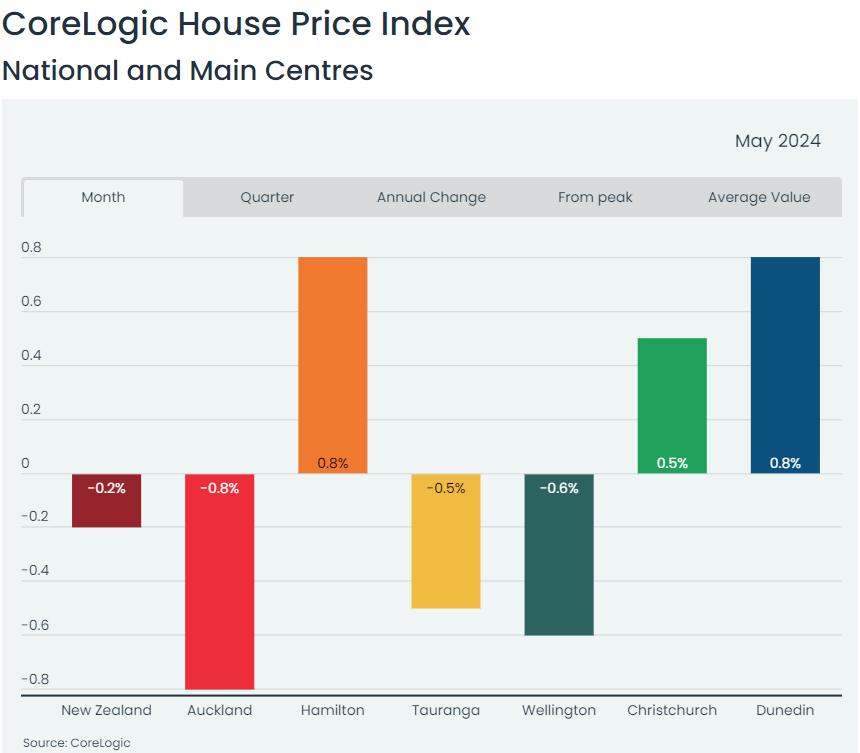

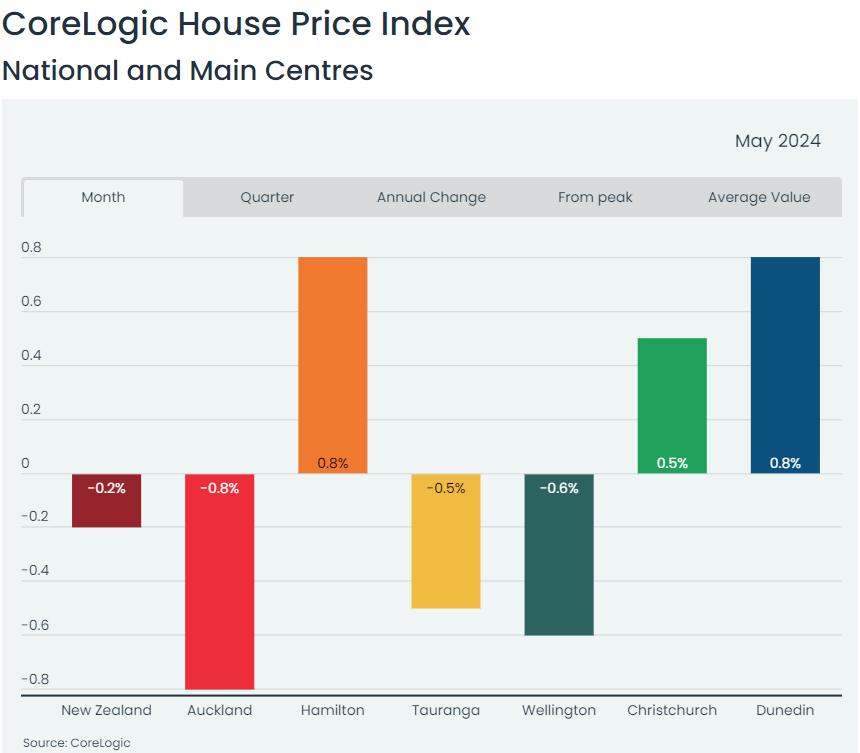

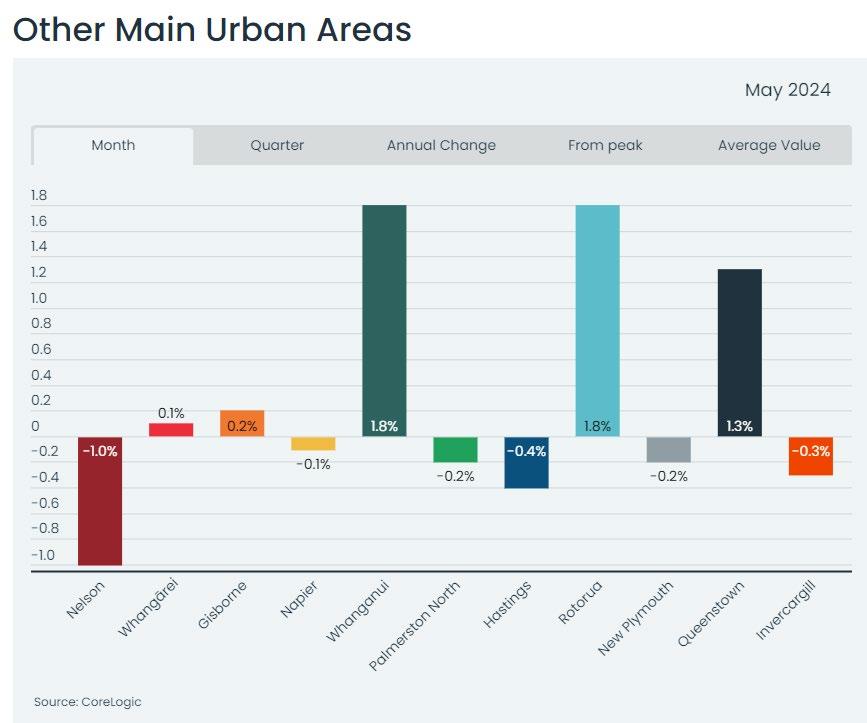

Home value growth in Aotearoa New Zealand has completely petered out in the past two months, with values dipping by 0.2% in May, after a minor 0.1% fall in April.

CoreLogic's House Price Index now shows an average property value across NZ of $931,438, up by 1.0% from a year ago, but still roughly 11% below the peak.

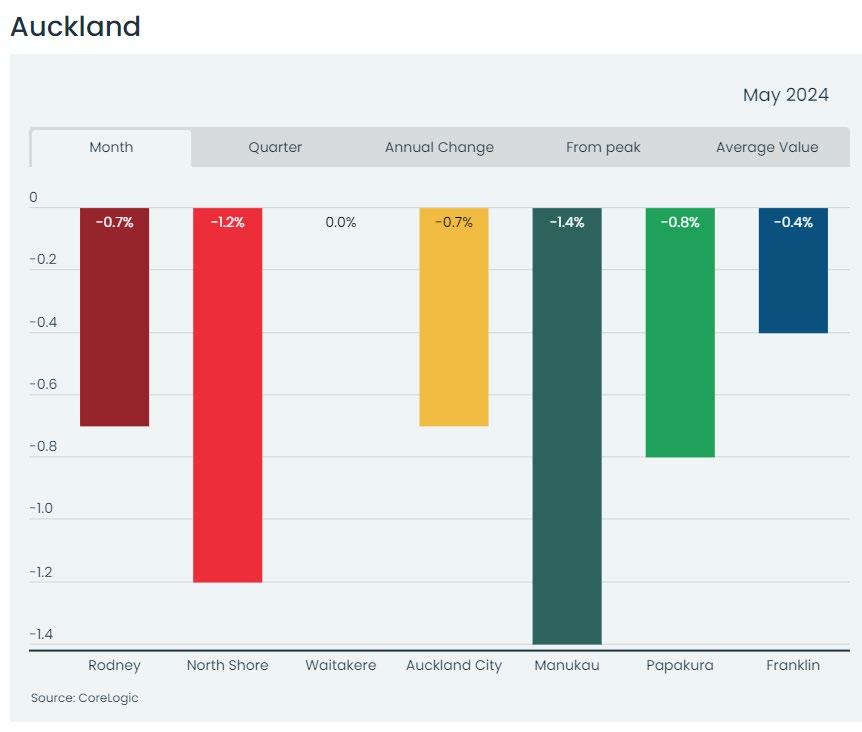

Below the recent stagnation at the national level, the main centres are showing multi-speed conditions. Auckland dropped a notable 0.8% in May (after a 0.6% fall in April), while Wellington saw a 0.6% fall, and Tauranga dipped 0.5%. By contrast, Christchurch rose 0.5%, and Hamilton and Dunedin both saw gains of 0.8% over the month.

CoreLogic NZ Chief Property Economist, Kelvin Davidson, noted that although the national declines over April and May have been very small, the shift in the market is clear to see.

"In the past few weeks we've seen a raft of regulatory changes, including the abrupt scrapping of first home grants, the near-term easing of the LVR rules and the introduction of debt-to-income caps. But with mortgage rates tipped to remain high for a while yet, it's no surprise the market has lost a bit of the momentum we had been seeing through the early part of this year. Forthcoming tax relief for households is unlikely to change that," Mr Davidson said.

"An important factor still in play is the high stock of listings on the market, and the associated shift in bargaining power towards buyers, which is subduing prices. We also estimate that the shortening of the Brightline Test from 1st July could see as many as 50,000 or so properties benefit to some degree from reduced risk of having to pay capital gains tax, which could

see some more listings coming to market. Of course, only a portion of those properties will actually be put up for sale.

"On another note, borrowers who have faced higher interest rates as their previous mortgage deals come to an end have coped pretty well with tight monetary policy thus far, thanks largely to the strong labour market.

Looking ahead, a little less job security could see housing activity and prices remain fairly subdued," he added. Clickhereforinteraciveversion

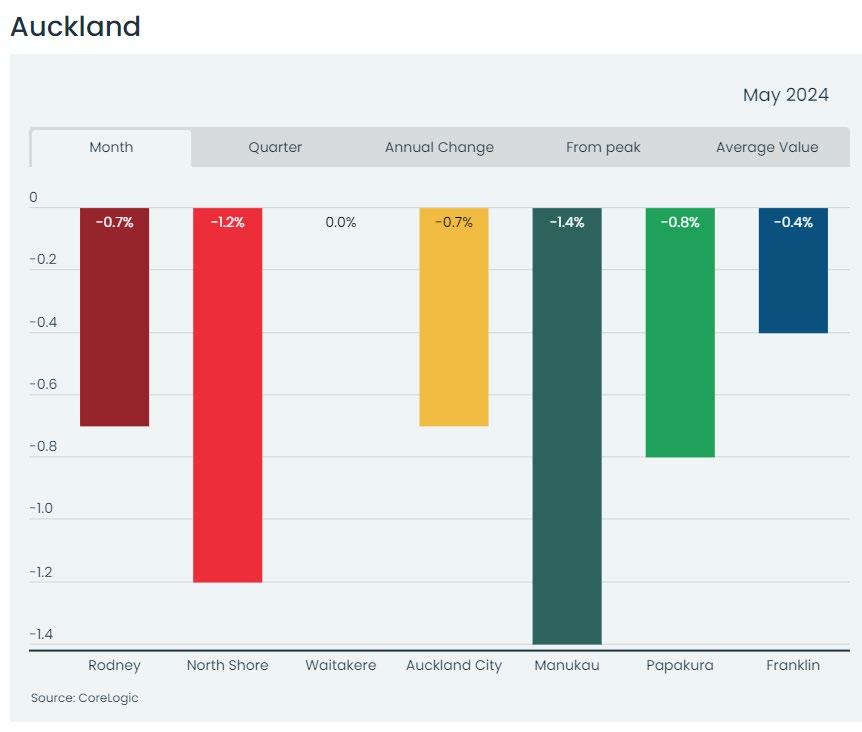

Auckland has been at the forefront of the recent slowdown in property values across the country, and Waitakere was the only sub-market to avoid falls in May. The remaining markets saw declines ranging from 0.4% in Franklin to more than 1% in both North Shore and Manukau.

Over the three months to May, only Rodney saw growth in property values (1.5%), with the rest of Auckland down by at least 0.6%, and as much as 2.6%.

“There's always been a perception that Auckland leads the rest of the country in terms of property market performance, and although the evidence shows that isn't always the case, it's certainly still pretty striking that our largest city is now seeing renewed weakness in prices," Mr Davidson said.

"With listings up, buyers now have the bargaining power, and it'll be interesting to see if this pattern spills over more significantly into other markets in the next few months."

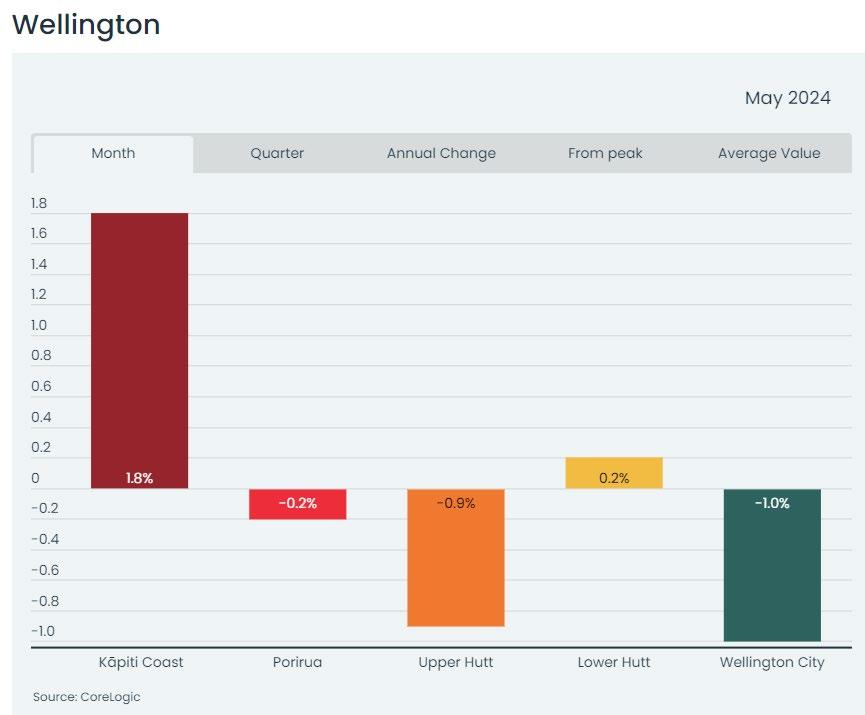

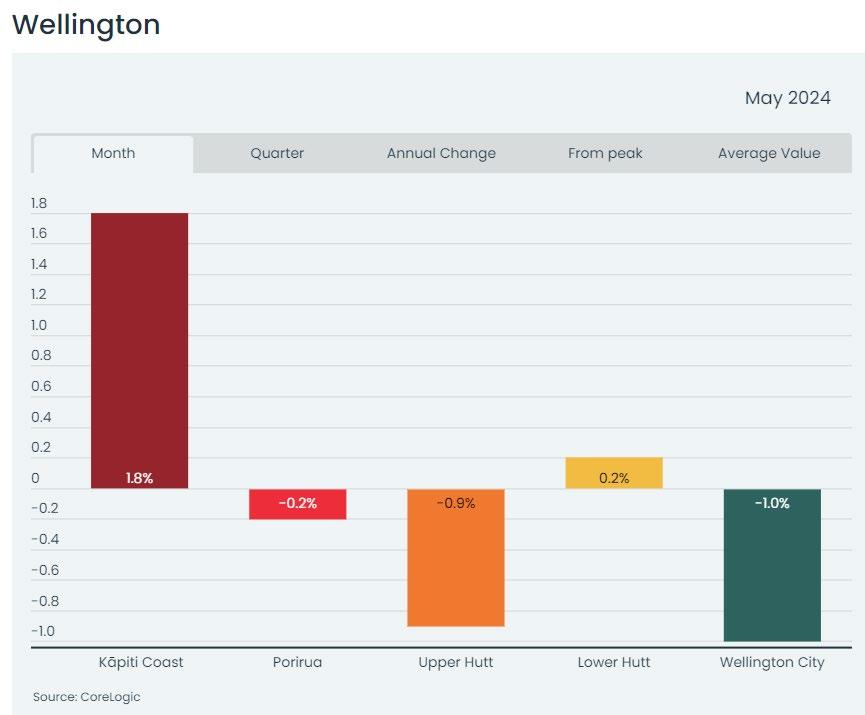

After a slightly more robust result for April, Wellington's property market slid back again in May, with Kapiti Coast the only area to record a meaningful gain (1.8%). Meanwhile, Porirua dipped 0.2%, and both Upper Hutt and Wellington City saw values fall in May by about 1%.

"Values across Wellington's wider housing market remain 15-20% below their peak, but this doesn't mean affordability has magically been restored to normal. With property values still quite high and mortgage rates elevated too, buyers are still facing challenges. That seems to be showing up in the variability of values from month-to-month, and within the various sub-markets," Mr Davidson said.

Regional House Price Index results

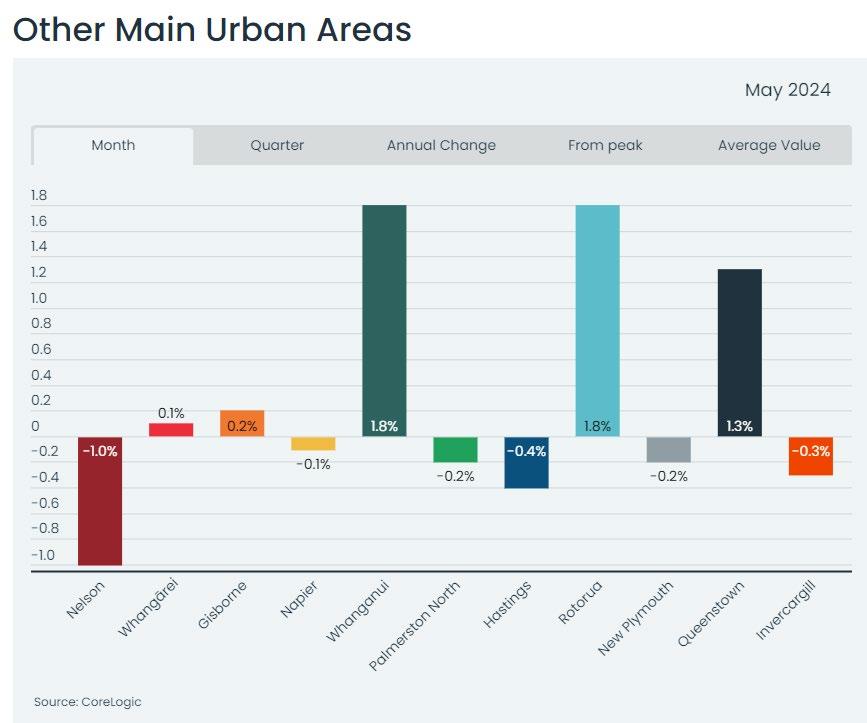

Outside the main centres, the housing market is also a mixed bag. For example, Whanganui, Rotorua, and Queenstown all grew by at least 1% in May, but there were falls in values in areas such as Invercargill and Hastings, while Nelson was down by a more notable 1.0%.

Mr Davidson said high mortgage rates present challenges for all markets, whether they're large or small.

"Many provincial parts of NZ are also dealing with some migration issues, such as younger people heading overseas. That could well be taking a bit of steam out of the property market in these areas."

Property market outlook

Looking ahead, Mr Davidson said the rest of 2024 could remain fairly subdued for the housing market, both in terms of sales volumes and property values.

"Affordability remains stretched and significant falls in mortgage rates probably remain a story for next year not this, especially if there's risk the upcoming tax cuts do prove to be slightly inflationary.

"The removal of first home grants is unlikely to have a lasting or significant impact on new buyer demand, and the caps on debt-to-income ratios won't bite straightaway either.

"But even so, our expectation that 2024 will only really see the housing market ticking along remains firmly on track, with activity and prices set to remain variable from month-to-month and across regions," Mr Davidson concluded.

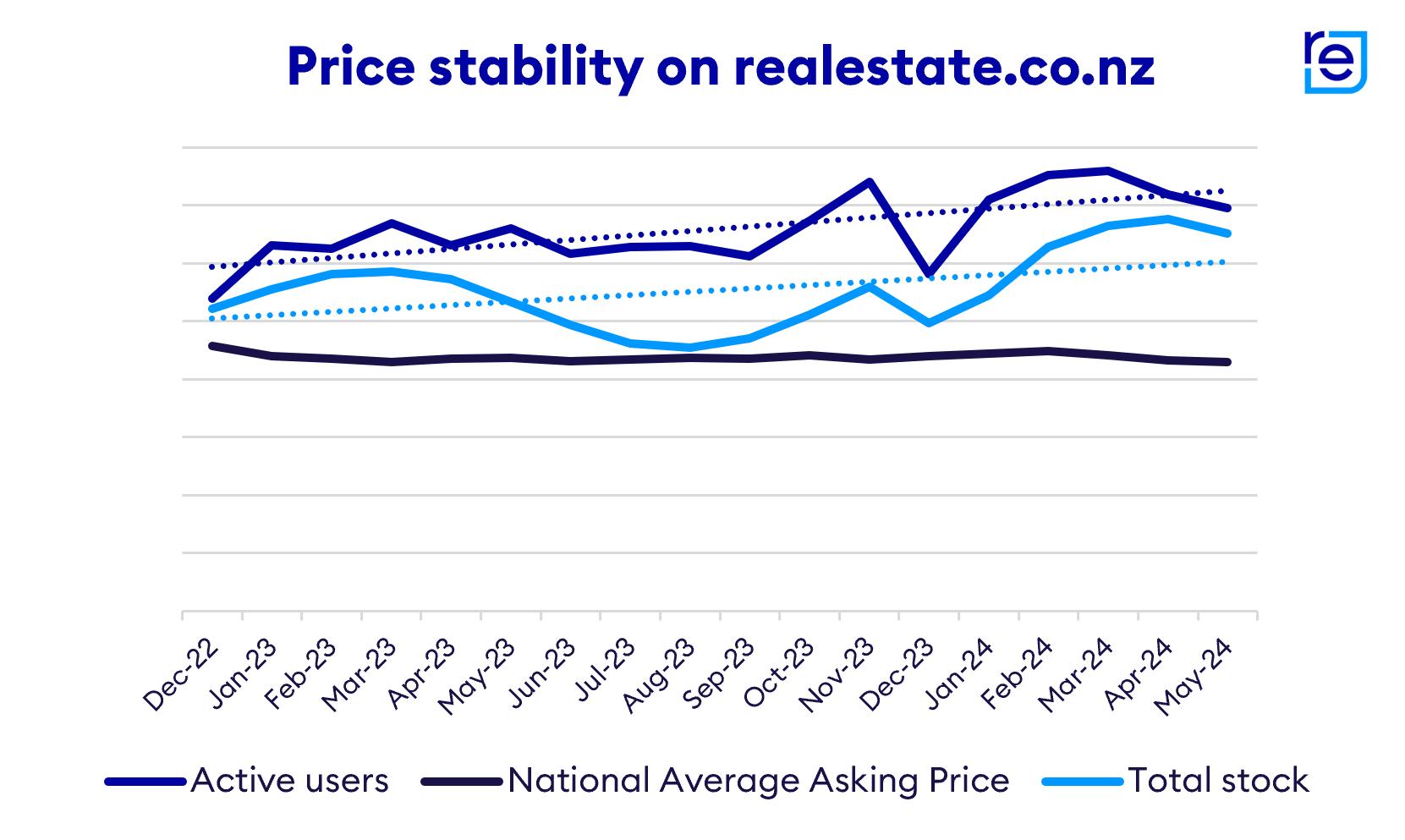

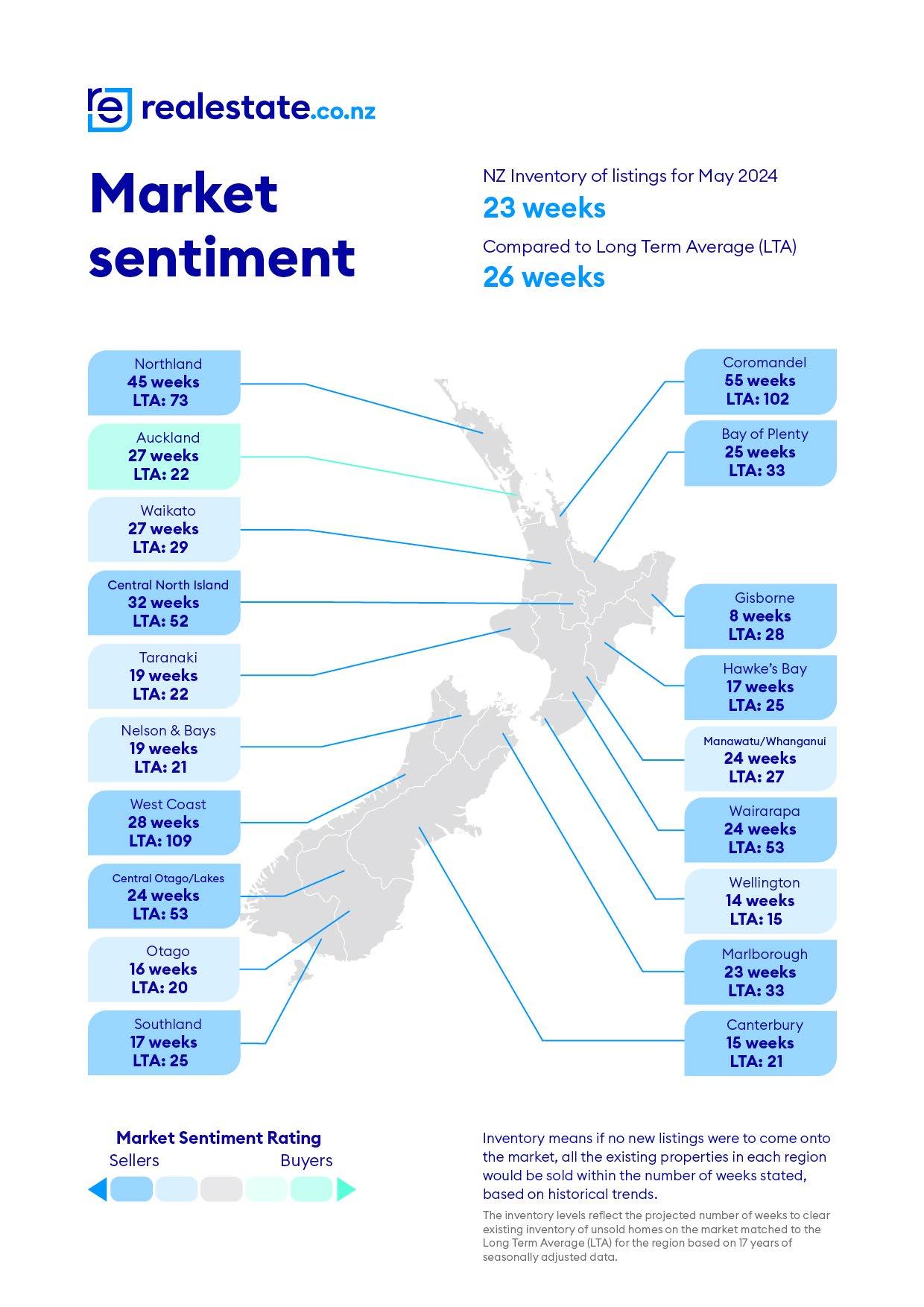

Despitestrongeconomicheadwinds,NewZealand'spropertyprices haveremainedstable.

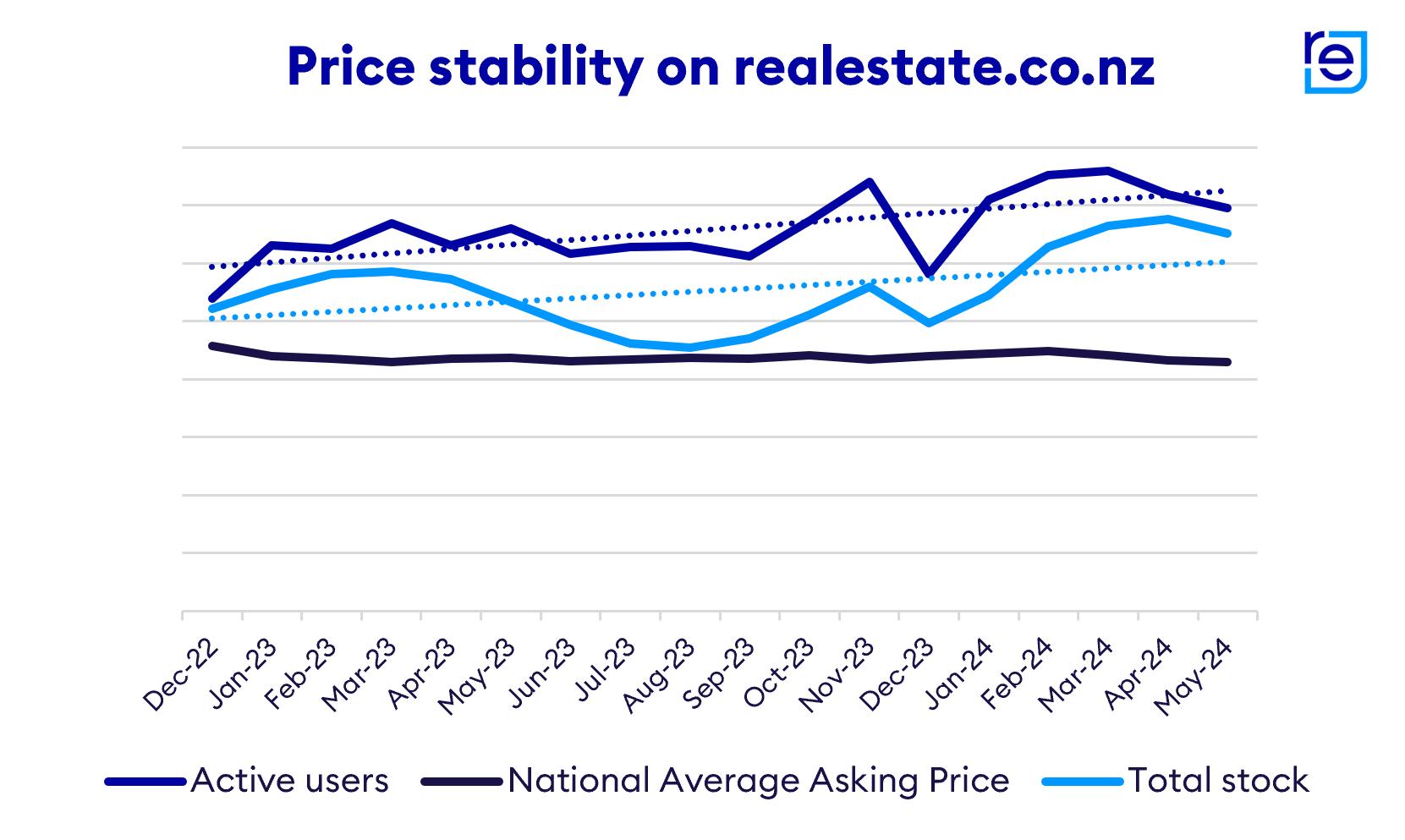

Thelatestreal-timedatafromrealestate.co.nzshowsthatthe nationalaverageaskingpricehasremainedalmostunchangedfor nearlyayearandahalf,fluctuatingbetween$860,000and $890,000sinceNovember2022.

• Property bosssaysitcouldbeanadvantageoustimetotransact–havewehitbottom?

• Wellingtonpricefall–isnervousnessaroundjobsecurity toblame?

• Plenty ofstock available:whatitmeans

SarahWood,CEOofrealestate.co.nz,saysthatwhilethismaybe surprisingtoKiwisfacinghighinflation,risinglivingcosts,and restrictiveinterestrates,theanswerliesinthealignmentofsupply meetingdemand:

"Bothstocklevels(supply)andthenumberofpropertyseekers visitingrealestate.co.nz(demand)hasincreasedyear-on-year.This confirmsthelawsofeconomics,wherepricestabilityisachieved whensupplyanddemandarematched."

“Eighteenmonthsago,wesawashiftfromafearofmissingout (FOMO)toafearofoverpaying(FOOP).Sincethen,thingshave stabilised.Overthepastyearandahalf,we'veexperienceda remarkablyconsistentmarket.”sheadds.

Graph:Activeusersandtotalstockhavealignedwhilethenationalaverageasking priceremainsflat.

Propertybosssuggestsitcouldbeanadvantageoustimeto transact

Reflectingabalancingofsupplyanddemand,mostregionssaw minimalfluctuationsinaverageaskingpriceslastmonth.Ourmost populatedregion,Auckland,sawaverageaskingpricesdipyearon-yearby1.6%to$1,062,110duringMay.Similarly,ournational averageaskingpricedippedby1.6%year-on-yearto$859,301.

AccordingtoWood,whetherweareatthebottomofthemarket remainstobeseen:

“Wecansaythatithasabsolutelybeenaflatmarketforalmosta yearandahalf.Thankstothisstability,it'sanadvantageoustime totransactbecausehomeownershaveabetterchanceat predictingpropertyvalueswhensellingandbuying."

Despitethisrelativestability,someregionsbuckedthetrend.

TheWestCoastwastheonlyregiontohitanall-timeaskingprice highlastmonth.Reaching$554,877,thisisthefirsttimein17yearsof datathattheregion’saskingpricehasbeenabove$550,000.The WestCoastsawthebiggestincreaseofall19regionsduringMay, risingby21.4%year-on-year.Itmaintaineditspositionover Southland,whichhasthelowestaverageaskingpriceinthe countryforthesecondmonthinarow.

Conversely,WellingtonandCentralNorthIslandsawaverageasking pricesfallyear-on-yearduringMay.However,Woodexplainsthat CentralNorthIslandisananomaly,havingseenanunusuallyhigh averageaskingpriceinMay2023.

Wellingtonpricefall–arejobsecurityfearstoblame?

Wellington's average asking price fell by 14.1% year-on-year during May to $739,497. This is the first time since November 2020 that the averageaskingpriceintheregionhasbeenbelow$800,000.

Woodsuggestspublicsectorredundanciesandageneral tighteningofthejobmarketcouldbecreatingasenseof nervousnessandpromptinghomeownerstopricetheirproperties morecompetitivelytogetthesaledone:

“Whenthemarketissofter,pricebecomestheprimaryleverfor sellerswantingtomovetheirpropertiesmorequickly.Unlikeother factorssuchaslocationorpropertysize,pricecanbeadjusted.”

Liketherestofthecountry,averageaskingpricesinWellingtonhave beenflatoverthelast12monthstoApril.“Itwillbeinterestingtosee whetherMaydataisasharpdiporifpriceswillremainlowduring June,”saysWood.

Plentyofstockavailable:whatitmeans.

Year-on-year,stockwasupnationallyandinallexcepttwo regionslastmonth.Thebiggestyear-on-yearincreaseswerein Marlborough(up37.8%),Wellington(up31.9%),Coromandel(up 30.4%),andNorthland(up30.2%).Significantincreaseswerealso seeninAuckland(up27.9%),Hawke’sBay(up26.4%),andWairarapa (up25.3%).Nationally,stocklevelsroseby22.2%.

→ • 1

Stockhasremainedhighthroughout2024,reflectinglevelslastseen in2015,whenstockalsohoveredaround30,000properties.

"Forbuyers,increasedstocklevelsmeanmoreoptionsandpossibly betterbargainingpower.Forsellers,heightenedcompetition requirescarefulpricingstrategies,optimalpropertypresentation andagoodmarketingstrategytostandoutfromthecrowd."

Shenotesthatit’salwaysbesttoseekadvicefromyourlocalreal estateagent.

Buckingthetrend,GisborneandtheWestCoastsawstocklevels decreaseby3.3%and7.7%,respectively.However,SarahWood,CEO ofrealestate.co.nz,explainsthattheGisbornemarketissmalland pronetofluctuations:“Iwouldconsiderthisafairlyminorshift, perhapsevenstableinthecontextofthislocalmarket.”

“TheWestCoast,however,isanothercleardemonstrationofsupply anddemandinaction.Oursearchdatashowsactiveusers searchinginthisregionwereup31.7%year-on-yearwhilestockwas down.Thismismatchlikelycontributestothisregion's17-yearalltimeaskingpricehigh.”

Written by Liz Studholme

04 Jun 2024

Liz Studholme | liz@realestate.co.nz

•

•

2

3

Finance & Lending

Wheretheonlyresultthatmattersisyours! TNBPropetyServicesLimited(LicencedREAA2008) June2024

Town&Country

Latest Tony’s View

Input to your Strategy for Adapting to Challenges

The retail outlook gets worse – again

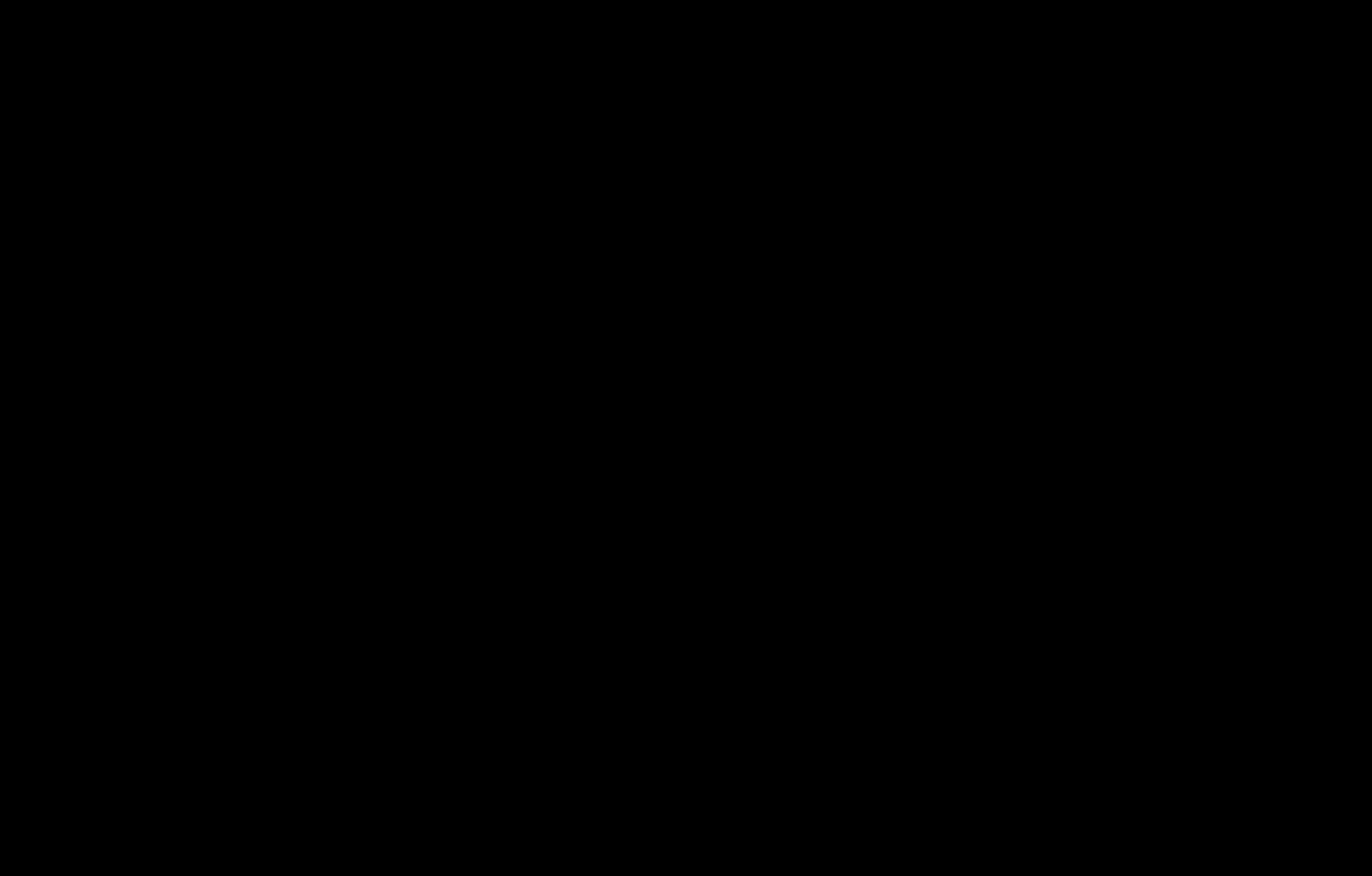

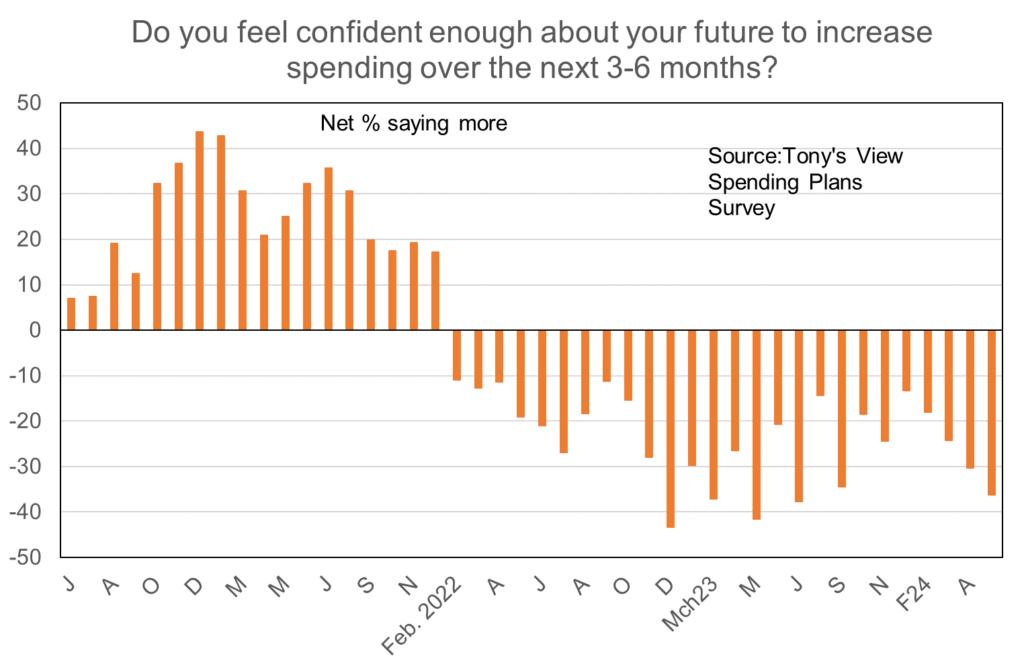

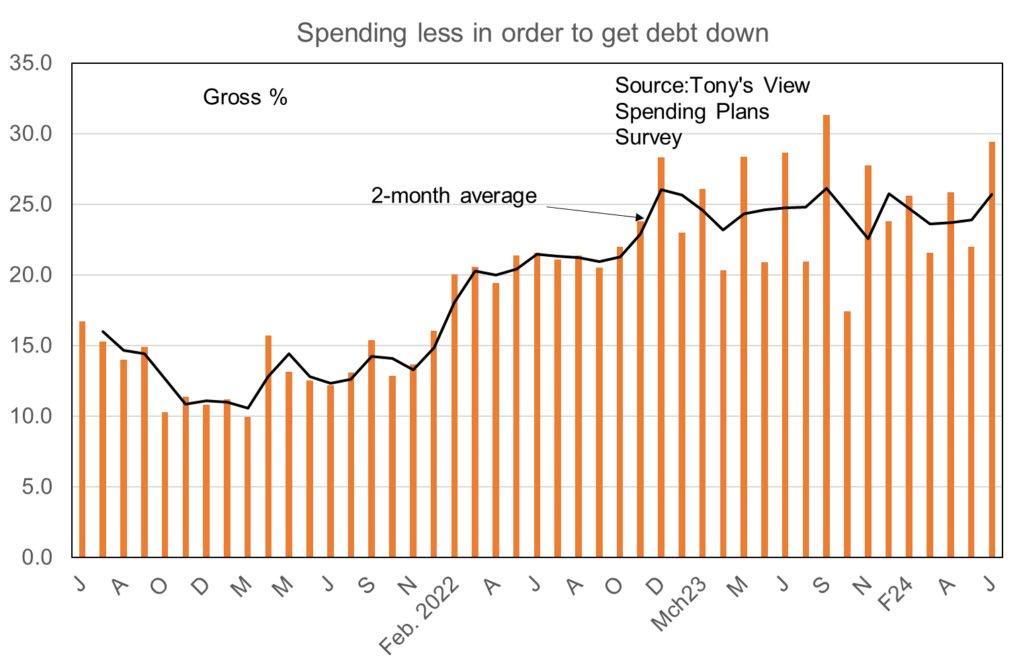

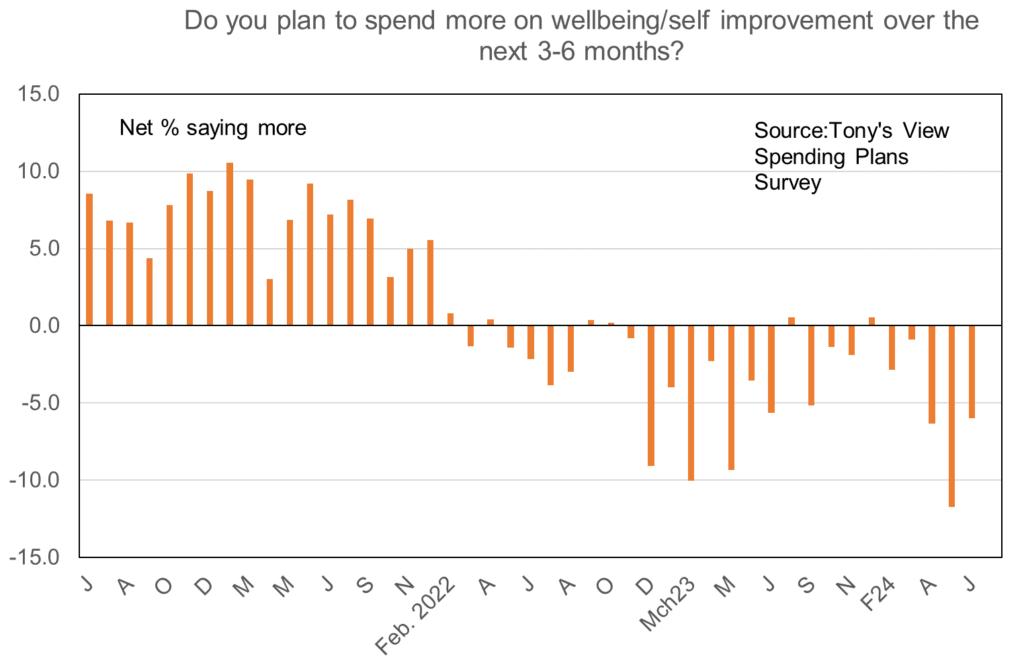

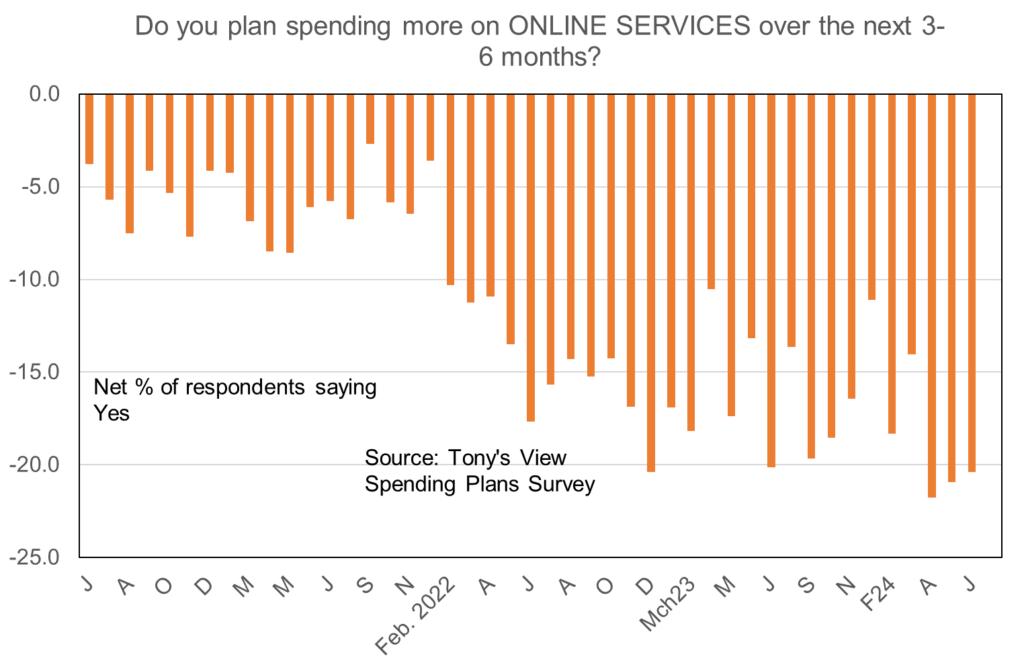

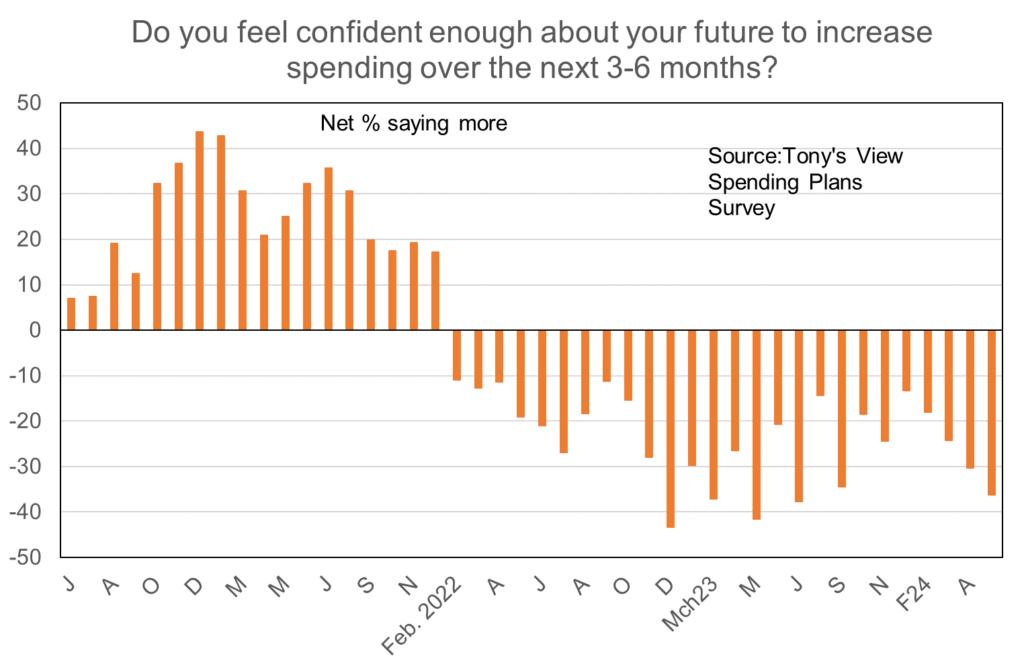

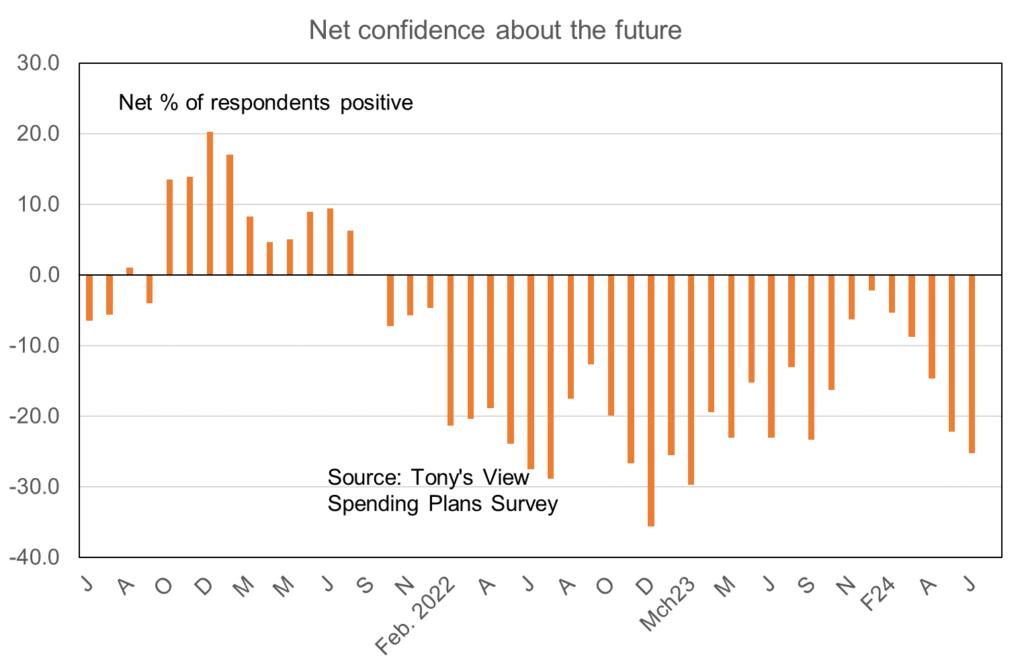

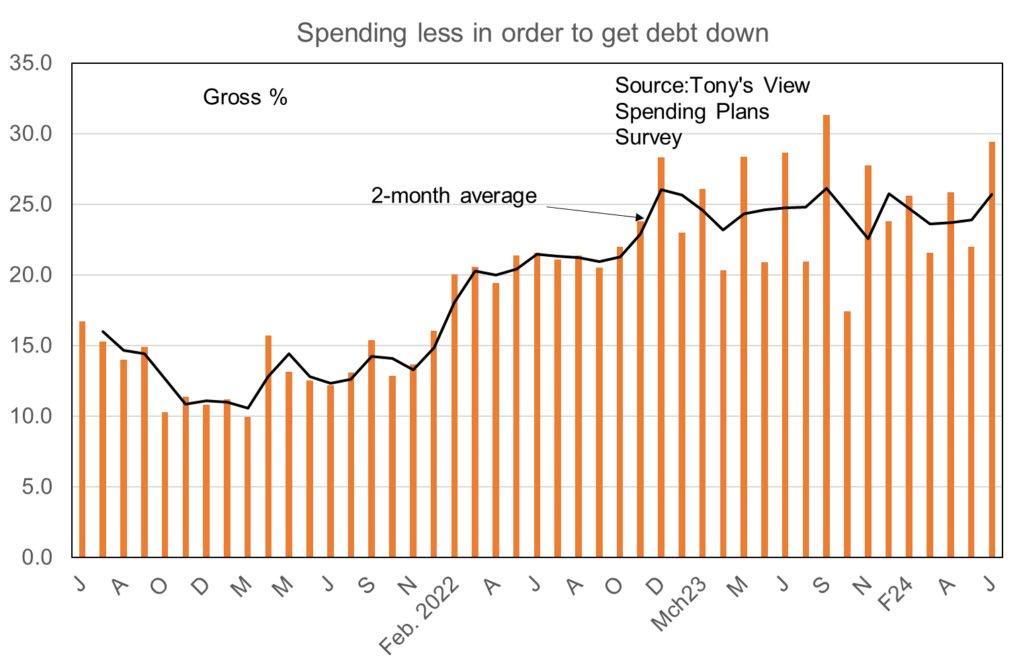

I conducted my monthly Spending Plans Survey earlier this week and the results continue to paint a bad and deteriorating picture for retailers and the housing market as we advance through winter and then spring.

A net 42% of the 649 respondents have said that they plan cutting back on their spending in the next 3-6 months. This is a deterioration from a net 36% last month and just 13% negative in December.

13 June 2024

The result tells us that people are so fearful of a number of things that they do not feel it will be safe for them to spend more in the immediate future, or that they won’t have the money to spend. Confidence about the future has deteriorated anew to a net 25% pessimism from 22% in May and 2% in December.

A net 12% of people with businesses expect their profits to go down compared with 15% last month and 9% in December. Expectations for business returns have been very weak since early in 2022.

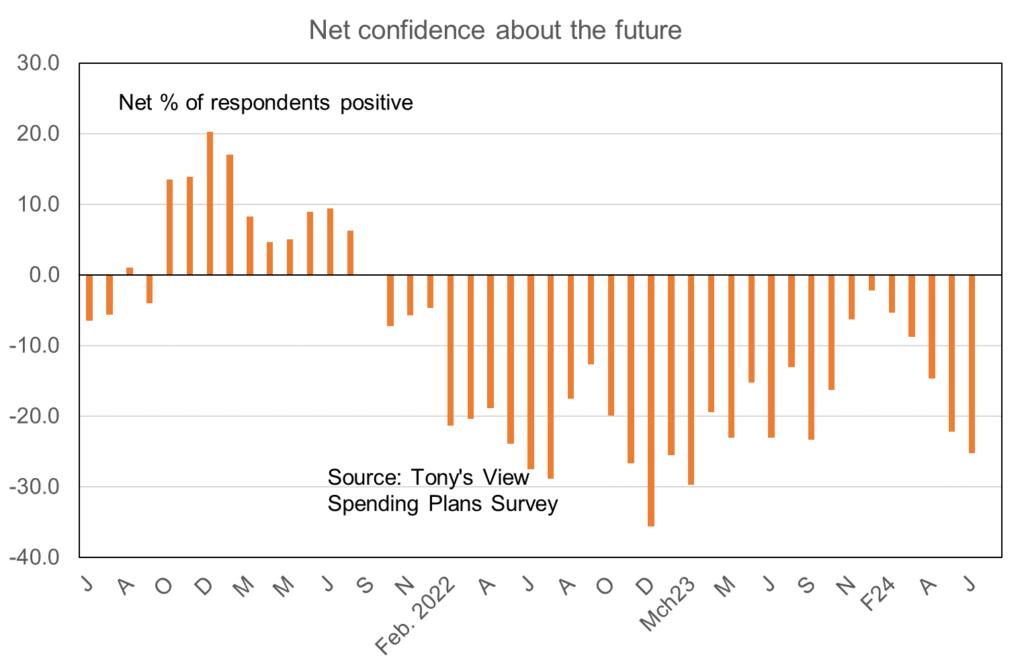

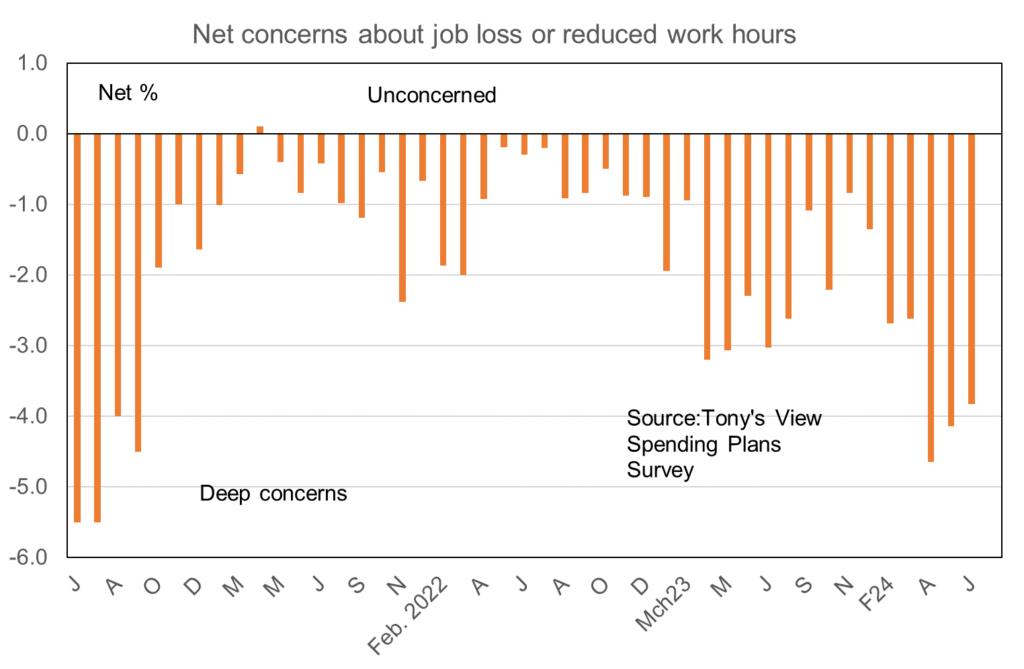

Frankly it is surprising how long this poor profit outlook has taken to manifest itself in a strong change in the labour market. We can tell from the Household Labour Force Survey that jobs growth in the economy roughly stopped in the middle of last year. But people’s feelings about job security have only really fallen sharply away since early this year. The net proportion of people expressing concern about their job and/or work hours grew about a year ago but only really plumbed depths of concern from April this year.

This is one of the new elements in play so far this year which I have written about in recent months as helping to explain the new worsened outlook for the economy and housing market. These things also underpin my view that monetary policy will be eased before the end of the year as the Reserve Bank is likely to be surprised by how weak the economy is this year. There is also underway now the traditional 18-24 month lagged response to the true tightening of monetary policy from November 2022 (0.75% OCR jump, “recession” word).

The proportion of people saying they are cutting spending because they want to get their debt levels down has jumped to the second highest reading on record this month. But this measure has a tendency to go up and down from month to month so pay attention to the two month average rather than the monthly results.

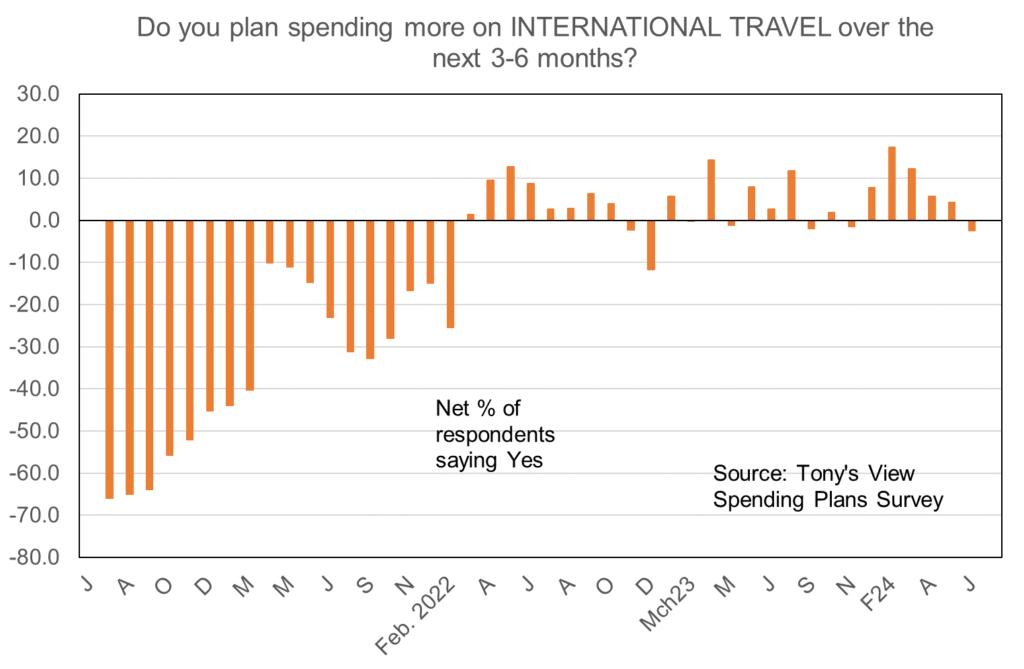

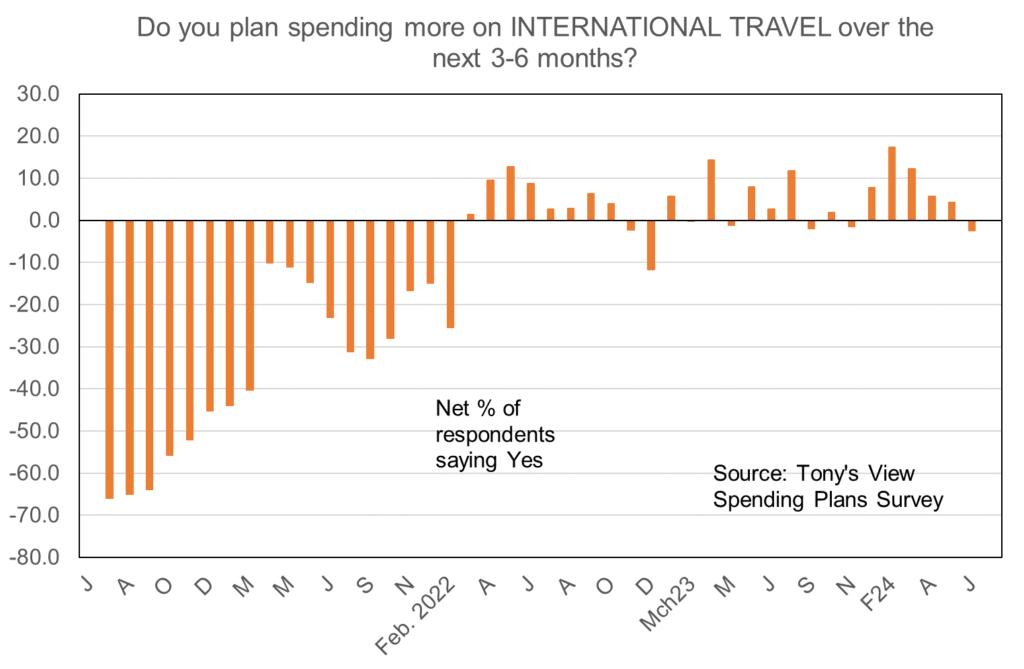

Now, let’s run through individual areas of spending intentions to witness the true horror for some sectors. Let’s start with the weirdest spending area of all during this period when overall retail sales per capita have collapsed – international travel.

A net 3% of people plan cutting their spending on travelling abroad. This is down from net 4% positive travelling intentions last month. We have seen this sort of movement before and as yet there is no solid move back into negative territory. But surely by now the revenge travel drive post-pandemic is all over. Only the next couple of surveys will be able to tell us if this is the case or not. I’m not prepared to call it yet.

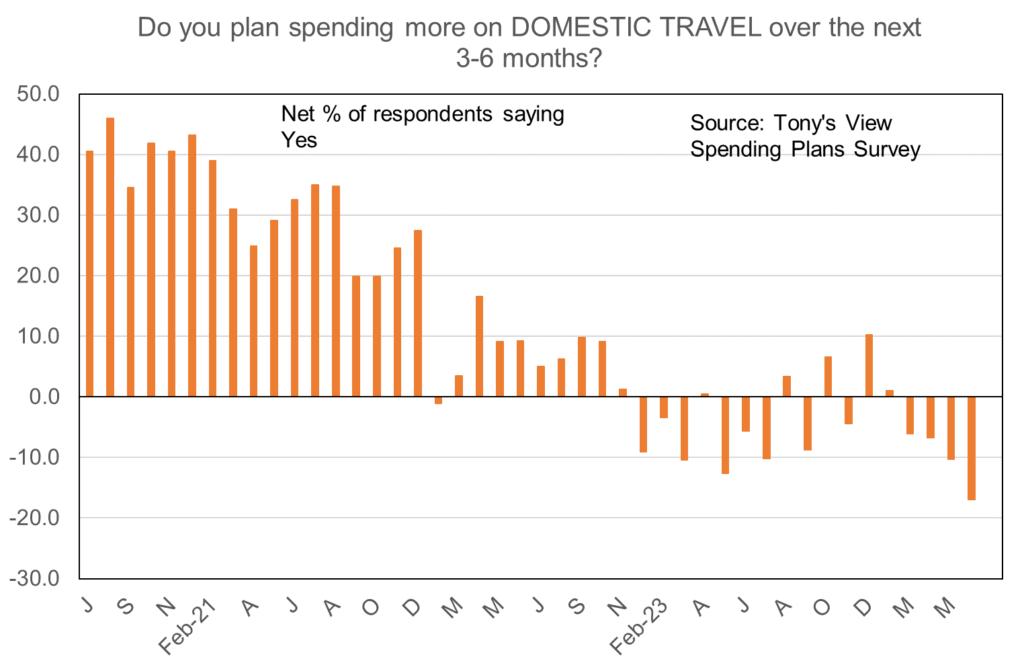

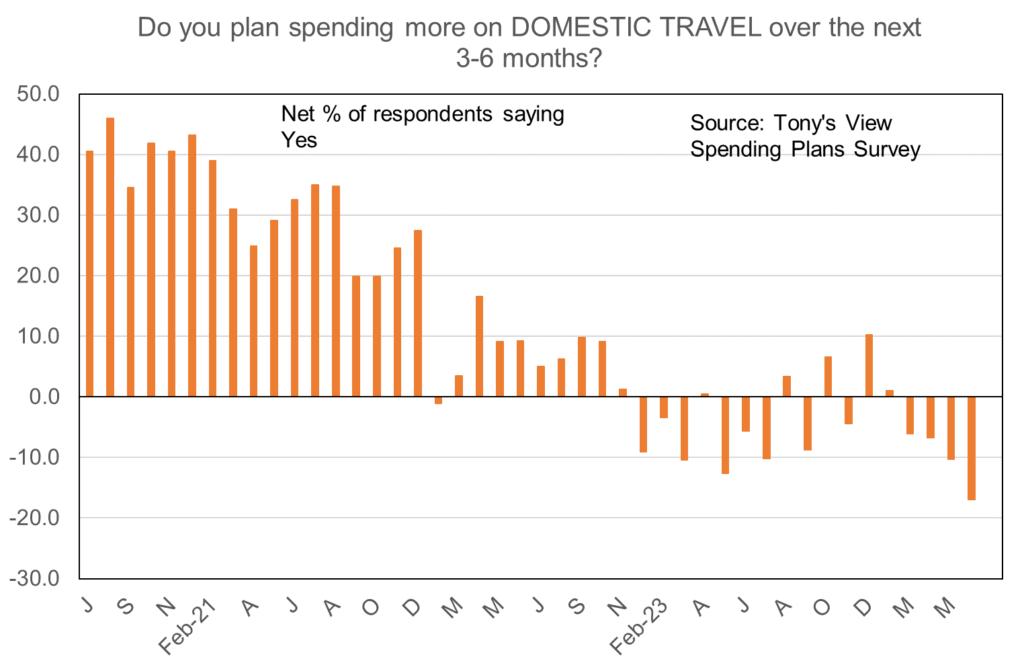

With regard to domestic travelling intentions the outlook is solidly trending downward with a net 17% of people planning less local travel. This is the weakest result on record.

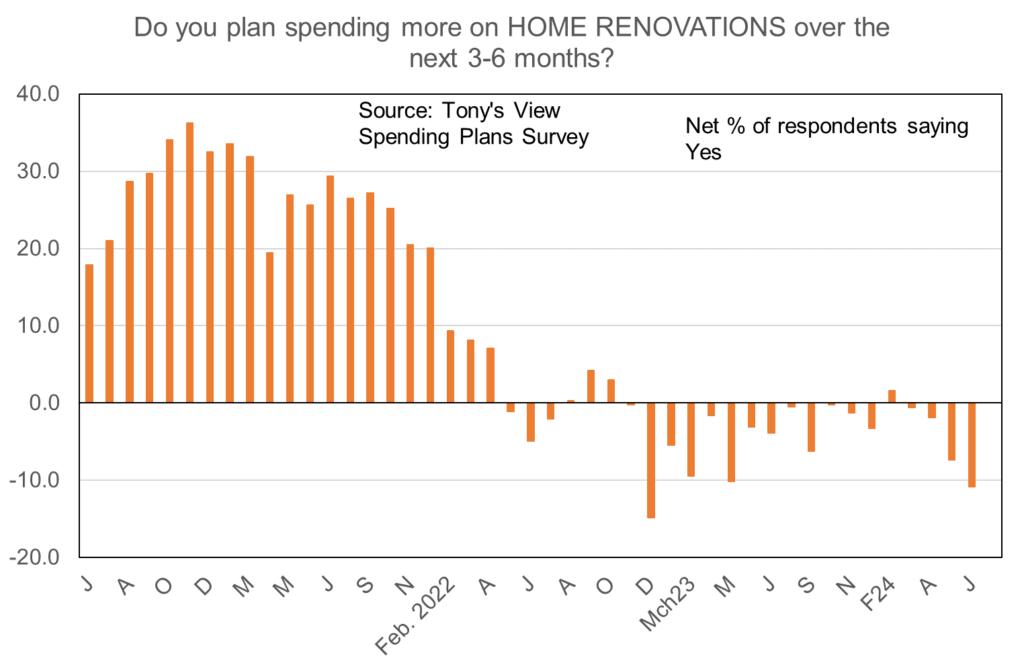

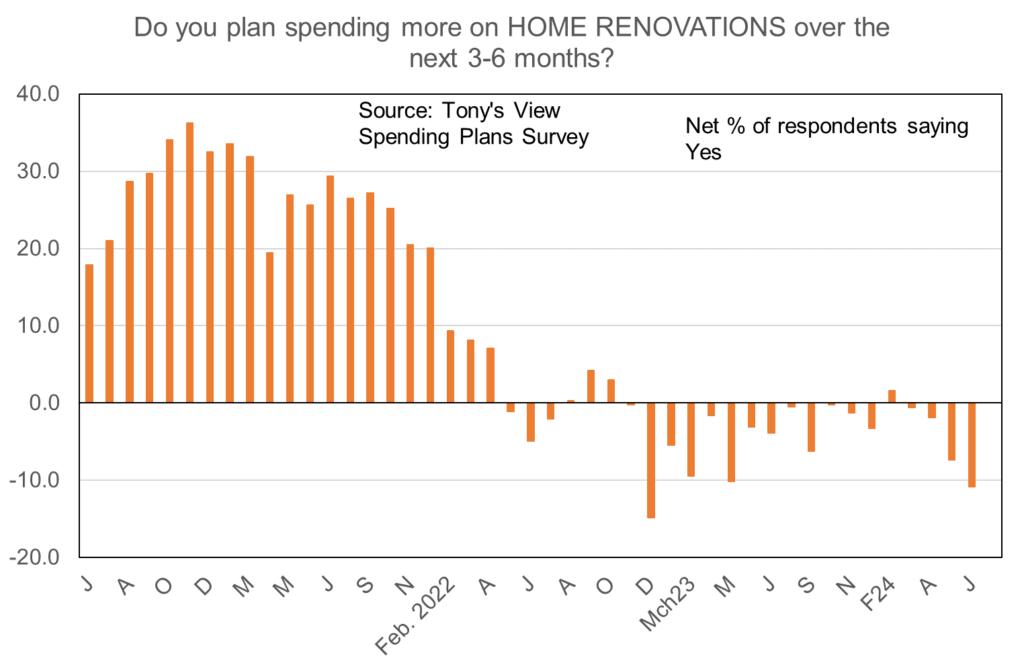

The outlook for businesses involved in home renovations continues to get worse. I recall pointing this out to some people in the sector a year and a half or so ago and they said they were still busy. But as my survey looks ahead in time, I reckon they’ll be struggling for much business now, especially as older people rejig their spending plans to allow for this year’s hikes in rates and insurance costs and councils promising similar rate increases for many years. That’s what you get with monopolies.

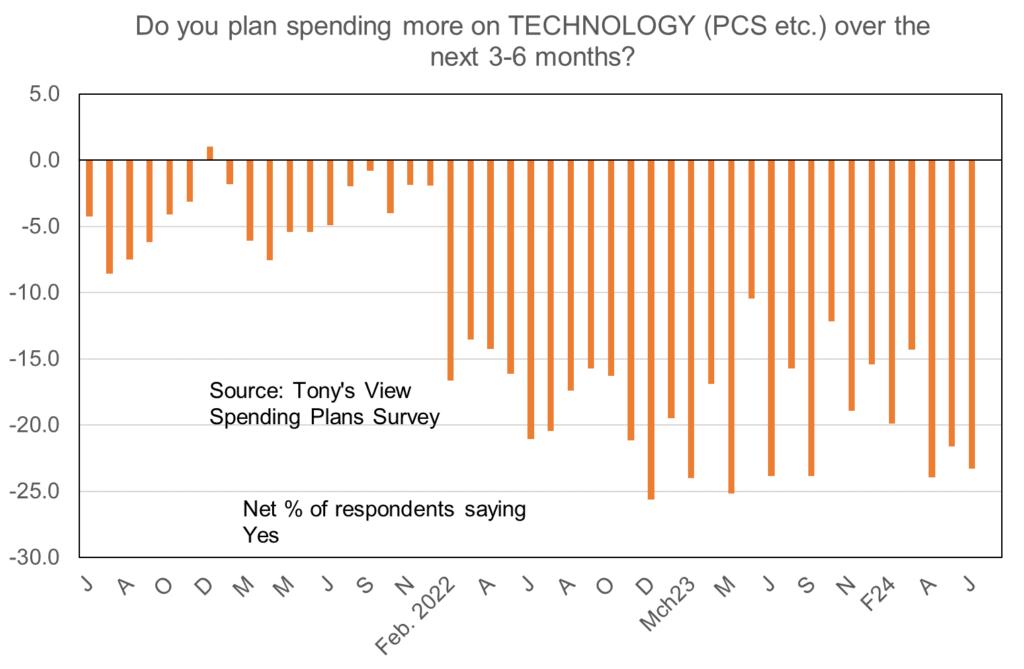

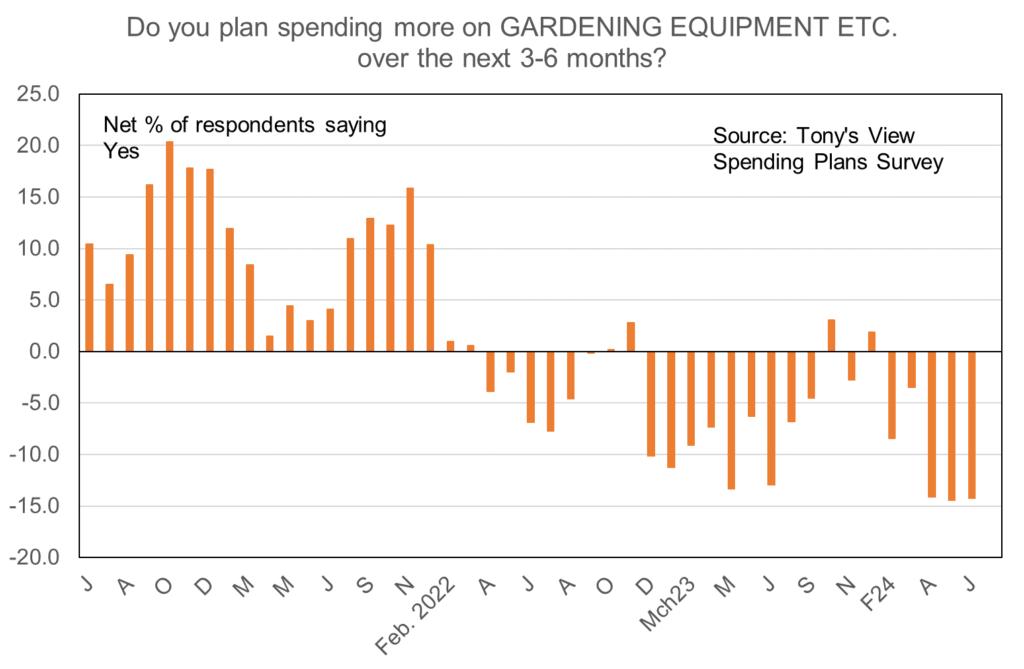

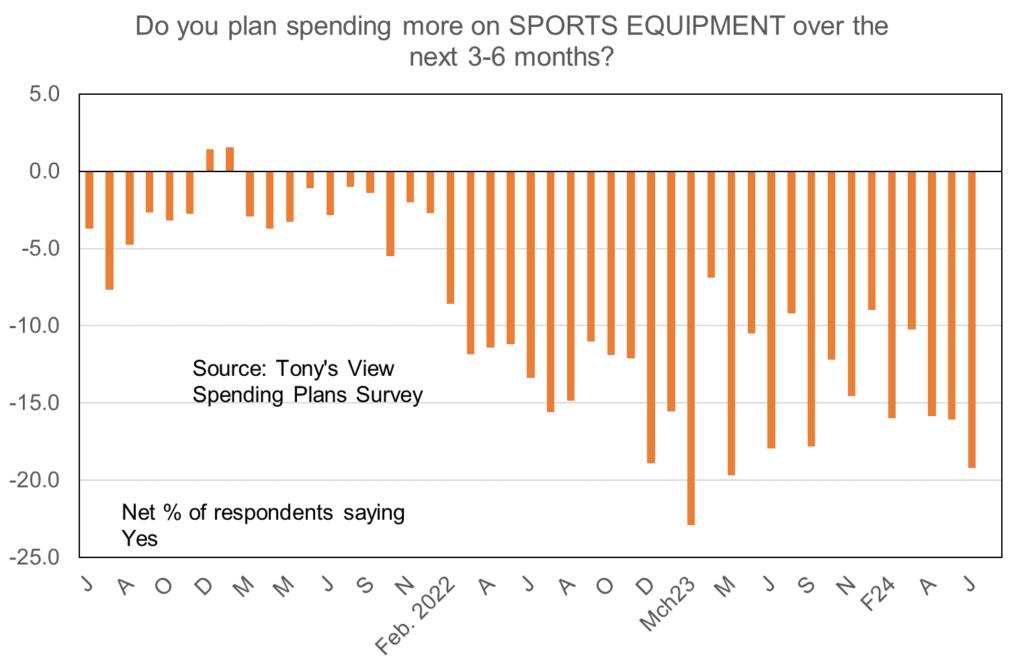

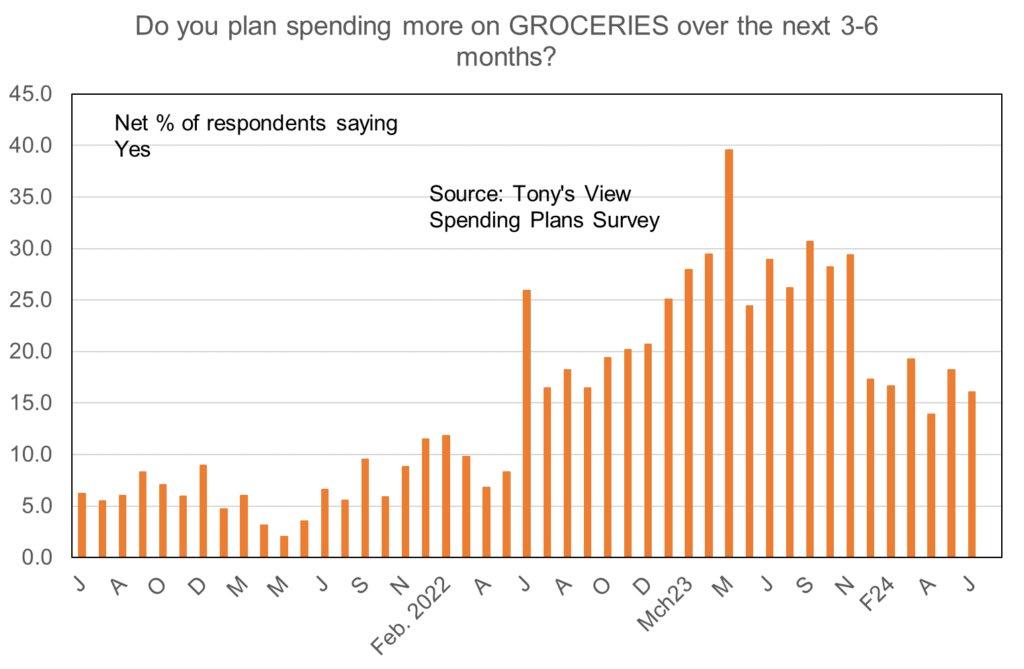

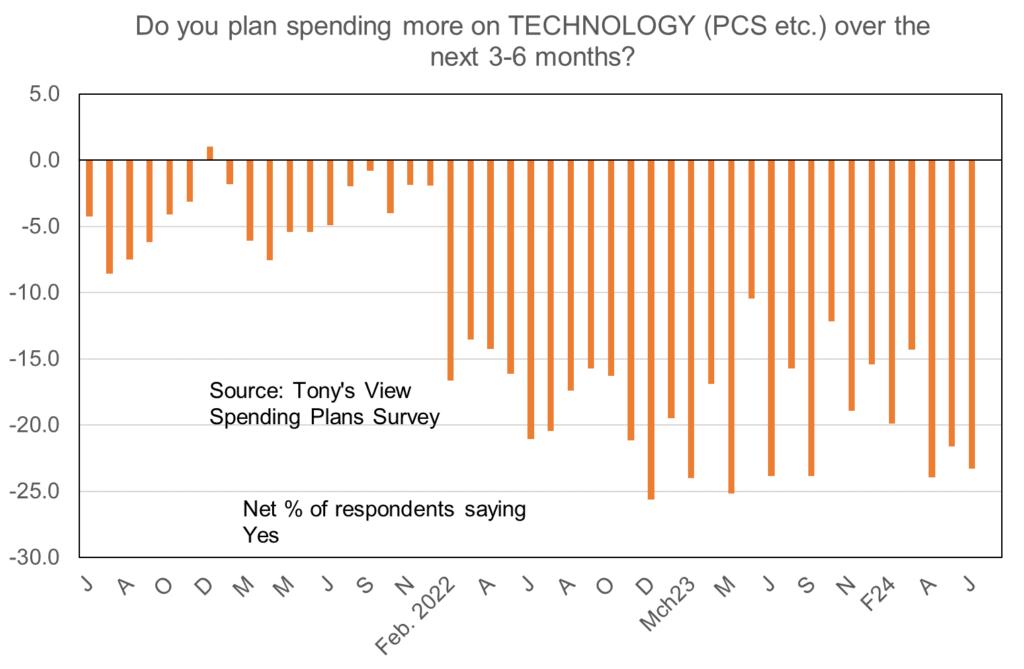

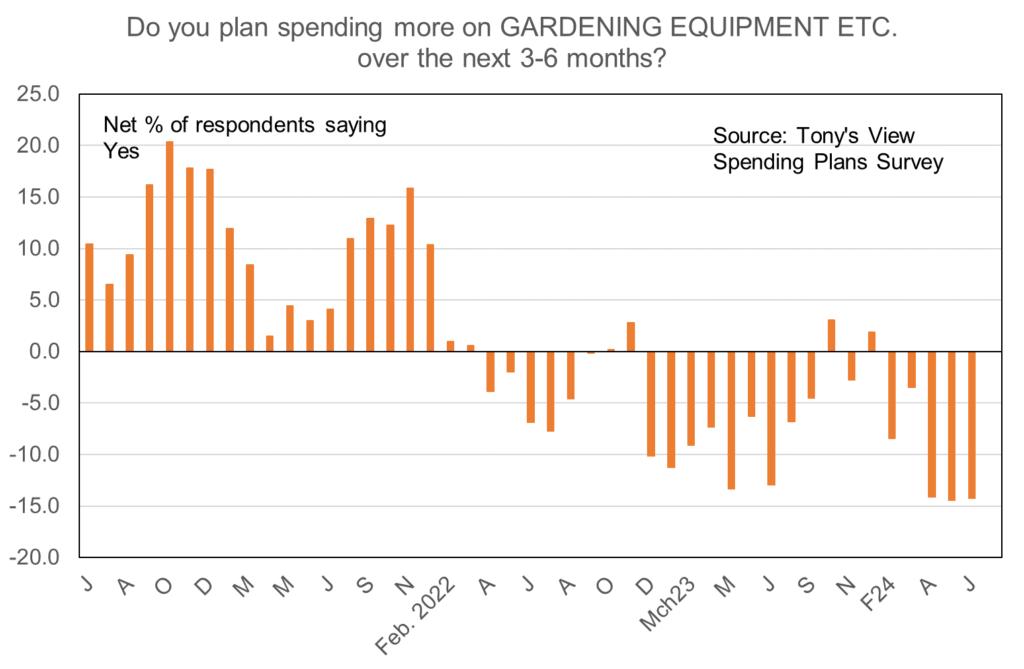

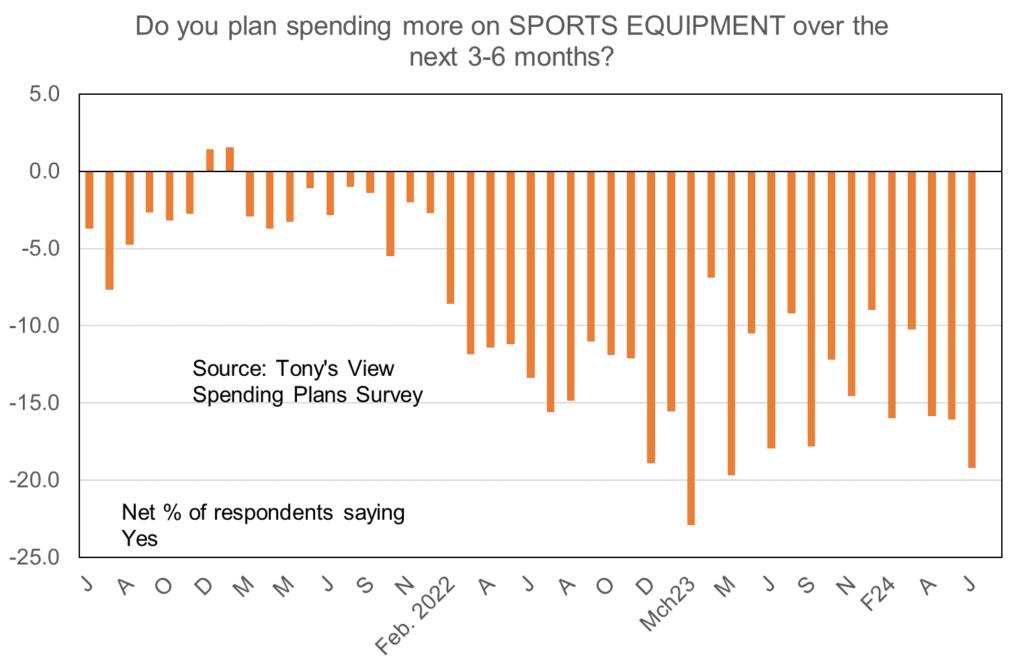

Here are the graphs for durable things showing the extreme spending intentions weakness one would naturally expect to flow from the poor economic outlook people have.

For garden centres prospects for sales continue to look poor. For the third month in a row a net 14% of respondents have said they plan cutting back on their gardening-related expenditure. Note that there is more than just a seasonal factor in play.

Plans for spending on sporting equipment plunged with the end of the pandemic and have remained weak ever since.

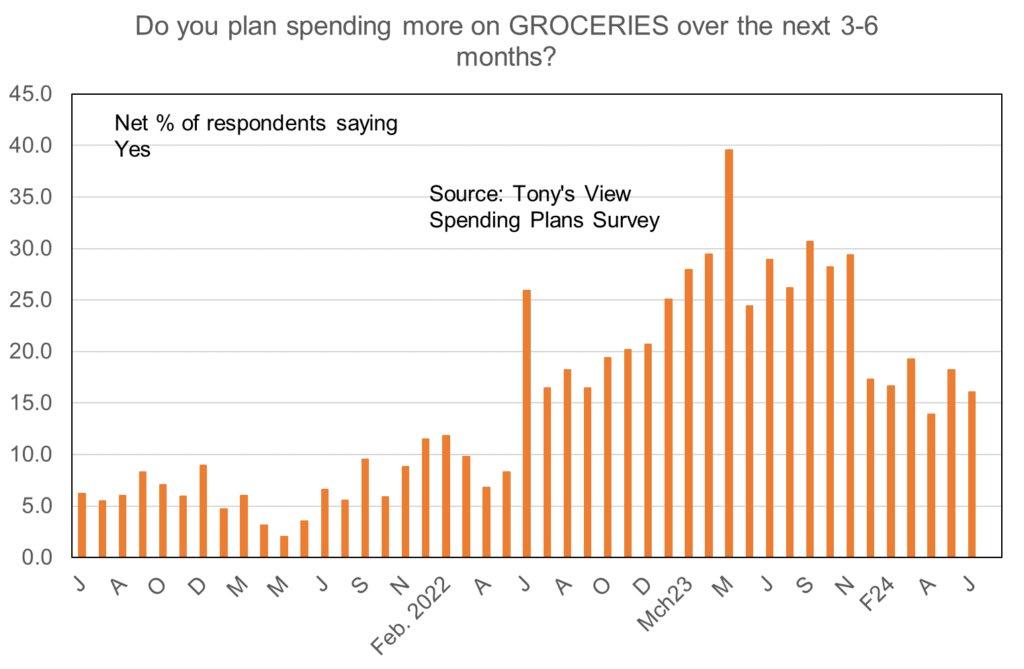

For groceries we still have a high net 16% of people saying they plan to spend more. But note the downward trend which will reflect a combination of worsening household finances outlook and inflation slowing down.

When it comes to eating out intentions our plans are as horrible as ever at a net 42% negative. My view is that the better restaurants frequented by those who to date have been little affected by the recession will now be suffering because of soaring bills for rates and insurance.

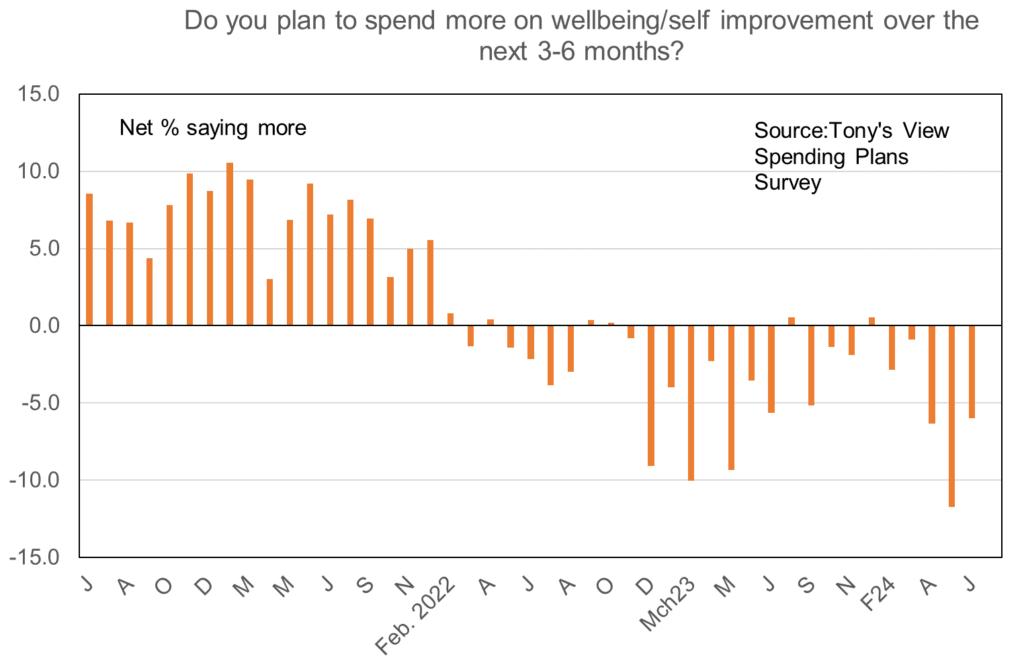

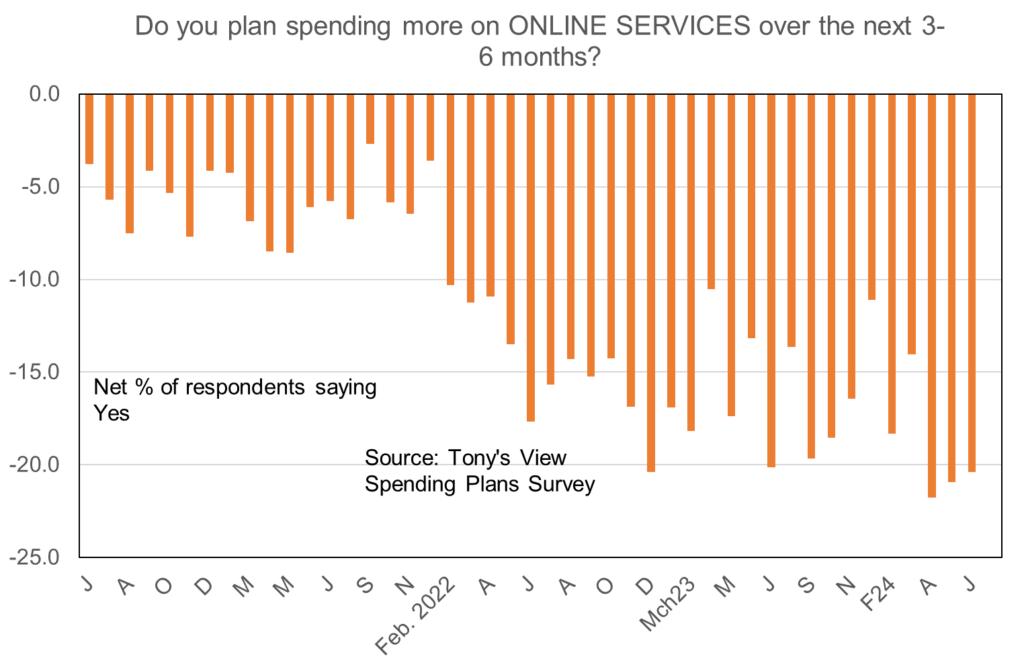

Finally, plans for spending on wellbeing and online services remain poor.

Next week I will look at results for spending on a property to live in and investment property. Don’t hold your breath if you’re looking to sell your house.

In case you missed it

This week I released results of my monthly survey of real estate agents sponsored by NZHL. Key insights included these.

• FOMO has almost completely disappeared.

• There is evidence that the wave of fresh listings may be easing off. But a flow of investor sellers is still apparent.

• Most agents feel that prices are falling in their area.

The-NZHL-Property-REport-May-2024.pdf

If I were a borrower, what would I do?

Wholesale interest rates have fallen from where they were when I last wrote two weeks ago. The key driver has been a decline in United States rates (although for a while they had jumped higher). Their declines reflect a slight fall in the inflation rate to 3.3% reported last night and expectations of monetary policy easing in September this year.

Locally we’ve seen some improvement in price gauges in the ANZ’s monthly Business Outlook Survey, net migration flows falling away relatively quickly, and more weak measures for the housing market.

My expectation remains that weakness in the economy to a greater degree than allowed for currently by the Reserve Bank will bring the first OCR cut in November rather than the common pick of the first half of next year. The one-year swap rate currently sits near 5.37% from 5.51% two weeks ago and 5.24% at the start of the year. The three year swap rate is near 4.69% from 4.89% two weeks back and 4.29% early in January.

Nothing I write here or anywhere else in this publication is intended to be personal advice. You should discuss your financing options with a professional.

Tony Alexander: The return of the housing market slump - who’s to blame?

Tony Alexander

Tony Alexander

12 Jun 2024

Houses in Wellington. The Reserve Bank has stated it is keeping interest rates higher for longer to combat inflation. Photo / Fiona Goodall

ANALYSIS: New Zealand house prices rose on average by 0.9% per month between July and November 2023, according to the Real Estate Institute of New Zealand’s house price index. Since then, prices have fallen on average by 0.3% per month, and all the housingrelated indicators I gather from my monthly surveys point to continuing deterioration in the residential real estate market.

Most recently, my Spending Plans Survey showed a net 10% of respondents were delaying or halting plans to buy a house. This is the second weakest result on record and compares with a net 4% stepping back from the market at the start of the year.

Not surprisingly, real estate agents are noticing a drop in first-home buyer activity. The proportion of agents who have seen more first-home buyers planning to make a purchase has fallen from a net 55% positive at the start of the year to a 16-month low of just 5% at the end of May.

Young buyers are pulling back and I feel this is due to increasing insecurity in the job market, especially among those who have not seen a weak labour market before Or, if they have, the Reserve Bank and government were stepping in to boost things for them. But no one is there to help this time around and forecasts that the unemployment rate will soon rise from 4.3% to above 5% are scaring people away from the biggest financial decision of their lives so far.

But it is not just young buyers who are stepping back. Investors, too, have retreated further into the hills they have been hiding in since the end of March 2021.

A net 19% of respondents to my Spending Plans Survey said they were shelving thoughts of buying an investment property, up from a net 9% at the start of the year.

Independent economist Tony Alexander: "When do I think things will improve? Not until interest rates fall away." Photo / Fiona Goodall

And a net 25% of real estate agents are now saying they are seeing fewer investors looking to make a housing purchase, in contrast to the net 22% of agents at the start of the year who said they were seeing more investor buyers.

The real estate market has cooled since the surge in sales and prices around the middle of last year. Job worries have grown, a new flood of vendors hit the market in the New Year, and the overall outlook for the economy has deteriorated amidst new unavoidable cost of living surges, including higher council rates and insurance premiums.

When do I think things will improve? Not until interest rates fall away. When might that happen? Late this year, when the Reserve Bank acknowledges that its monetary policy settings are now too tight (a reversal of 2021-2022 when they were much too loose). If you’re losing your business or job this year, the chances are it’s because of the central bank’s misreading of the economy in 2021 in particular. Or you’re a public servant affected by the inevitable consequences of the debt blowout from 2017-23.

-Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz

Search

Debt-to-income ratios now a reality: What do they mean for first-home buyers and investors?

The Reserve Bank has also loosened deposit rules.

From July 1, buyer incomes will heavily influence what they are able to borrow and spend in the housing market. Photo / Fiona Goodall

The Reserve Bank of New Zealand has introduced new rules governing how much house buyers can borrow while at the same time loosening deposit restrictions.

The heavily signalled debt-to-income (DTI) ratios will take effect from July 1, 2024 and are aimed at reducing the build-up of unmanageable debt.

Under the new rules, home buyers will, in most cases, be unable to borrow more than six times their pre-tax income, while investors will be restricted to seven times their pre-tax income.

Deputy RBNZ governor Christian Hawkesby said: “DTIs reduce the probability of default by targeting the ability of borrowers to continue to repay debt.”

The RBNZ said banks had been given 12 months to prepare for the introduction of DTIs. There will be exceptions to the rule, with banks allowed to make 20% of their lending outside the restrictions.

The RBNZ also announced it was loosening loan-to-value ratio (LVR) rules, benefiting lowdeposit buyers and investors.

From July 1, the percentage of loans to owner-occupiers with less than 20% deposits will be raised from 15% to 20%. The percentage of loans to low-deposit investors remains the same at 5% but the amount of capital investors need has decreased from 35% to 30%.

CoreLogic chief economist Kelvin Davidson said DTIs and looser LVRs were not a surprise as they had been on the table for some time.

“The settings are no different from what the RBNZ had originally suggested. And banks are currently lending way below that 20% speed limit. High mortgage rates are already stopping people from taking on unmanageable debt so buyers are unlikely to worry about DTIs,” he said.

The Reserve Bank headquarters in Wellington. Under the new RBNZ rules, buyers may not be able to borrow as much as they previously might under the new DTI rules. Photo / Getty Images

“But interest rates won’t be 7% forever, and when they go down DTIs will have an impact. The key thing is that DTIs tie house prices more closely to income and reduce average house price growth from 6% to 4%, which will help with housing affordability.

“DTIs will have more of an impact on investors. From July 1, they will only be able to buy when their income goes up. That will limit the speed at which they expand their portfolio. In the past, they may have bought a house every one or two years. Now it might take five or six or seven years before they can buy again.”

Davidson said first-home buyers were less likely to over-commit on a mortgage right now, having seen what had happened to those who bought at market peak when interest rates were low.

“First-home buyers will probably know of people who did over-stretch. Those stories get around. However, first-home buyers tend to react to what’s in front of them, not behind – and at the moment they face less competition from other buyers and prices are lower.”

Other housing market experts OneRoof spoke to agreed there was more caution in the market right now. Broker Gareth Veale, of EasyStreet Mortgages, said first-home buyers this year were “absolutely” more worried about debt than those who were borrowing in 2020 or 2021.

“Previously, a young couple could have an income of $150,000 to $200,000 and could afford a huge mortgage at a 2.5% to 3% interest rate. People did stretch themselves and mortgages of $750,000 to $800,000 were common.

“I have clients who bought a property in Wellington for $1.9 million, with a 10% deposit at the height of the market. The latest value of that property is $1.5m. They are bureaucrats with a combined income of $400,000 but they’re now struggling because it’s a huge amount of debt and they’re in negative equity.”

He said the proportion of household income servicing mortgage debt now was “so high” buyers were lowering what they were willing to spend. “I’m meeting clients and saying, ‘Hey look, you can afford this’ and they’re like, ‘No, we can’t’. The bank is telling them they can afford $800,000 but they’re saying no.”

Kiwibank chief economist Jarrod Kerr: "I think if we get rate cuts from the Reserve Bank, that'll kick-start the housing market in 2025." Photo / Supplied

Kiwibank chief economist Jarrod Kerr said that while first-home buyers were still active in the market – they accounted for 26% of new mortgage lending this year – higher interest rates had made them gun-shy.

“We have been through a correction since the 2021-2022 madness. That was unsustainable, and it got way too heated. Since then interest rates have tripled so that’s forcing people to think about how much [debt] they’re willing to take on. That caution I think is being forced by higher interest rates,” he said.

“In 2021-22, you could get mortgage rates of around 2.5%, which was extraordinary in itself. People made decisions based on those rates. They thought, ‘Yeah, I can afford that’. Sure, banks tested them. We asked, ‘Hey, can you pay 6%’, and, of course, everyone said yes. And then they woke up a year-and-a-half later and interest rates are at 7%.”

Kerr said it was important for people to realize that house prices can go down as well as up.

“There’s this idea that property prices only ever go up. We’ve been through a correction, and it was painful, but more often than not the housing market is at least stable to rising. That’s what we’re going to see this year, and that’s what we’re going to see next year. We expect house prices to start lifting by the end of the year, to gain momentum over the rest of the year. I think if we get rate cuts from the Reserve Bank, which will be the big story for later this year, that’ll kick-start the housing market in 2025.”

Williamson said DTIs wouldn't have been a big surprise. "They were already built into the back-end of many bank calculations, so for most borrowers, they aren't going to change all that much." She said mortgage affordability was influencing the amount people were prepared to borrow. “Most of the time the conversation is around the deposit and the amount they can borrow based on what they want to pay. So we're not saying, ‘Hey, you can borrow $800,000’ but instead saying, ‘Hey, how much per week would you like to pay and what's comfortable for you?’."

Claire Williamson, of My Mortgage, said that while first-time buyers were a bit more cautious, they weren't facing much competition in the market and had more power to negotiate. “Vendors are more realistic about what prices they can achieve," she said.

Catherine Smith 28 May 2024

Properties

Wheretheonlyresultthatmattersisyours! TNBPropetyServicesLimited(LicencedREAA2008) June2024

Town&Country

48aSinclairRoad

PrivateTranquilHideaway

Nestledinatranquilsettingjustashortdrivefromthemotorwaylies anexceptionalpropertywaitingtobediscovered.Accessedviaa private,treelineddriveway,thisexecutivehomespanning336m2,is atestamenttofinecraftmanshipandthoughtfuldesign.

BuiltbytheawardwinningVanDerPuttenConstructionand designedwithextendedfamilylivinginmind,theresidenceboasts dualkitchens,5bedrooms,anoffice,and3bathrooms,providing ample spaceforeveryonetoenjoytheirprivacywhilestillfostering togetherness.

Vaultedceilingsandhighstudthroughoutaddsatouchofelegance andspaciousnesstoeveryroom,creatingasenseofluxury. Soakin thebreathtakingviewsofthesurroundingbushandcountryside, offeringapicturesquebackdropforeverydayliving.With6.8 Hectaresofusableland,thereisvastpotentialtofurtherenhance thispropertytosuityourlifestyle.

Convenientlylocatedjustminutesfromthemotorway,yetsecluded enoughtoenjoypeaceandtranquility,thispropertyoffersthebestof bothworlds.

ForSale PriceByNegotiation View ByAppointmentor OpenHomeasadvertised 3 1

Ararimu

Allinformationcontainedhereinisgatheredfromsourcesweconsidertobereliable.However,wecannotguaranteeorgiveanywarrantyabouttheinformationprovided.Interestedpartiesmustsolelyrelyontheirownenquiries. TNBPropertyServicesLtdLicencedREAA(2008) VenitaAttrill 0212867792 5 3 3 1 FEATUREDPROPERTYOFTHEMONTH Clickhereforfulldetails-48aSinclairroad,Ararimu

Brandnewandpricedtosell

Introducingabrand-new4-bedroomhaventhat seamlesslycombinesstyle,functionality,and

aharmoniousblendofeasycare

the

ForSale NOWpricedat $969,000 View ByAppointmentor OpenHomeasadvertised 4 2 2 20BReidlyPlace Pukekohe

comfort. Thismodernresidence,

living

adornedwithalowmaintenancebrickandtileexterior,invitesyouto experiencecontemporary

atitsfinest.

perfect

TNBPropertyServicesLtdLicencedREAA(2008)

Agorgeouskitchenfeaturingamplebenchspace,

forcreatingculinarydelightsandhosting gatherings. thispropertyoffers

livingandaccessibilitysodon'tmiss

opportunityto makethisyournewhome.

0212867792 Clickheretoviewfulldetails-2/11ReidyPlace,Pukekohe

VenitaAttrill

LJHooker

Town&Country

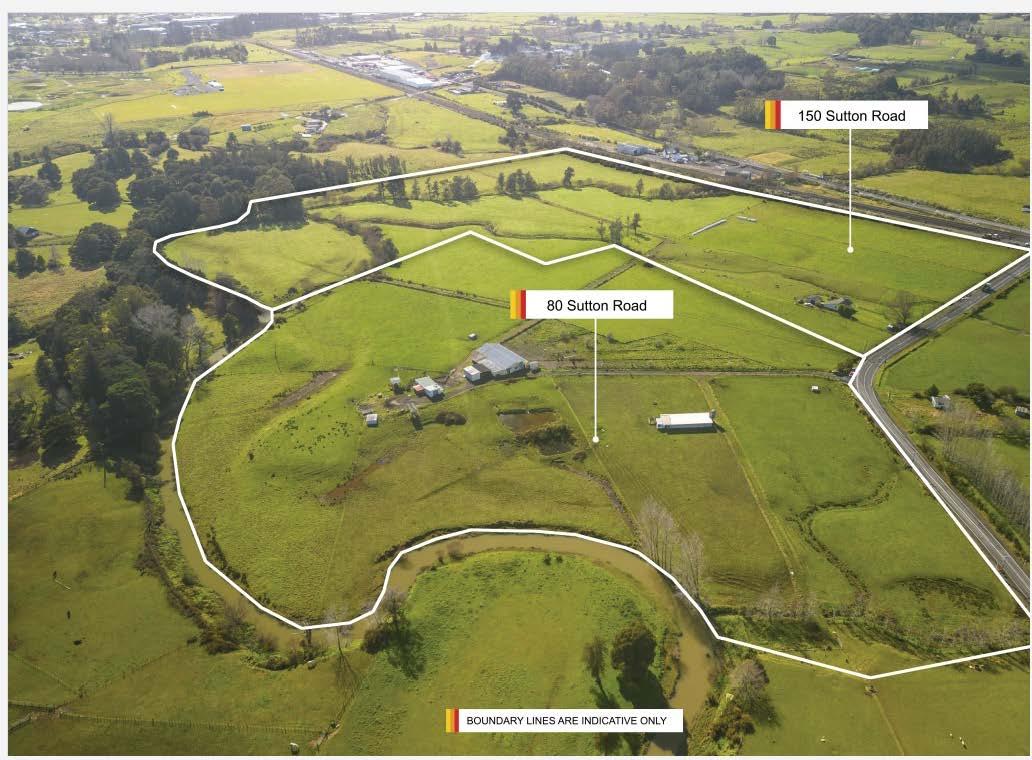

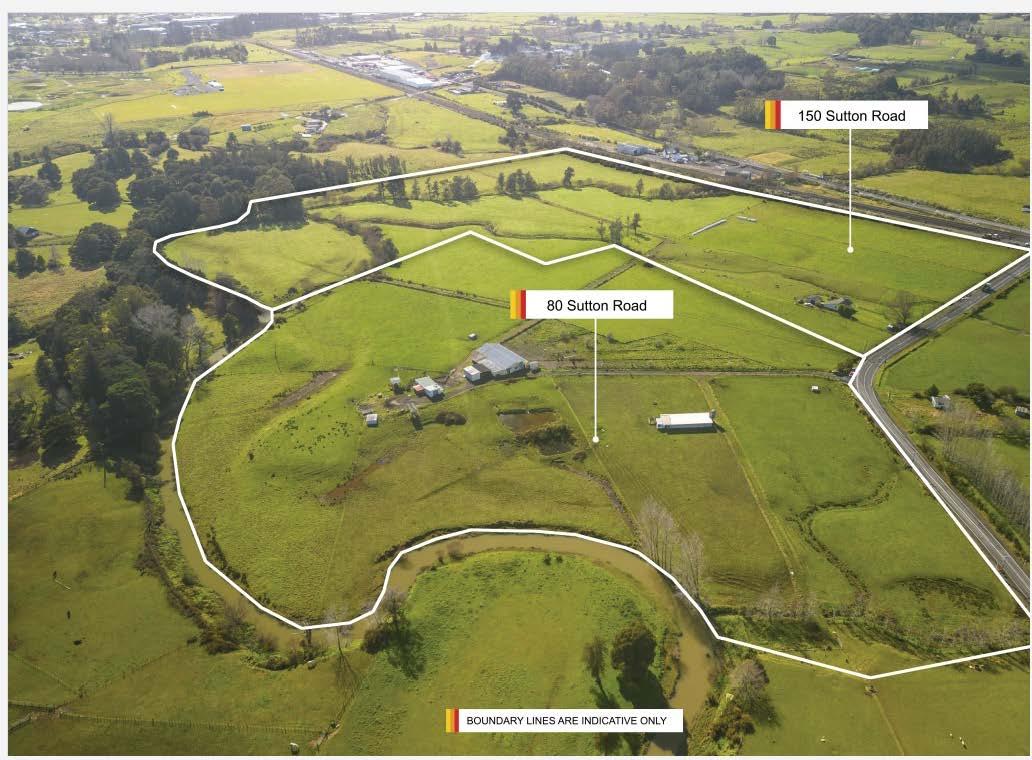

80 Sutton Road, Drury NZ

§2 bl �-

RARE OPPORTUNITY- Zoned Future Urban

80 Sutton Road

* 8.4731 ha (more or less)

*8 Bay Milking Shed -130sqm approx

150 Sutton Road, Drury NZ

§2 bl �-

Arare opportunity- Zoned Future Urban

150 Sutton Road

* 11.9382ha (more or less)

*2 Bedroom Cottage -124sqm approx

2/11 Beach Road, Pahurehure NZ

§3 bl �1

More Than meets the eye

Nestled in the heart ofconvenience,this 193m2 residence is more than just a house, its anembodime...

For Sale $3,400,000 (plus GST if any) View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

9 GreenhavenAvenue, Opaheke NZ

§3 bl �2

RED HOT STARTERIN OPAHEKE

Priced to sell; first home buyers, investors or downsizerswill love thisamazingopportunity. Truly...

For Sale $4,800,000 (plus GST if any) View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale Fixed Price $775,000 View By Appointment

VenitaAttrill 021 286 7792

venita.attrill@ljhooker.co.nz

153 Elliot Street, Pahurehure NZ

§3 bl �1

King OfThe Castle

Built in an era when craftsmanship was valued this elevated 140m2 solid brick and tile family home w...

For Sale $679,000 View By Appointment

Steve Reilly 021930352 steve.reilly@ljhooker.co.nz

22 Old Wairoa Road, Papakura NZ §3 bl �1

YourVery Own Club Med

Enjoy fabulous resort style living at this striking 3 double bedroom warm and inviting home. An abun...

For Sale Price onApplication View ByAppointment

Paula Cox 021 396 977 paula.cox@ljhooker.co.nz

For Sale Price on Application View By Appointment

Paula Cox 021 396 977 paula.cox@ljhooker.co.nz

09 294 7500 https://drury.ljhooker.co.nz/

18th, Jun 2024

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz CURRENT LISTINGS

LJHooker

Town&Country

48ASinclair Road,Ararimu NZ

§S b3 �-

Private Tranquil Hideaway Nestledinatranquilsettingjustashortdrivefromthe motorwayliesanexceptionalpropertywait...

20B ReidyPlace,Pukekohe NZ

§4 b2 �2

Brand new, close to town, available now! Introducingabrand-new4-bedroomhaventhat seamlesslycombinesstyle,functionality,andcomfort.

For Sale Priceon Application View SundayJune23rd,0l:30PM02:30PM

VenitaAttrill0212867792 venita.attrill@ljhooker.co.nz

For Sale FixedPrice $969,000 View SundayJune23rd,12:00PM12:30PM

VenitaAttrill0212867792 venita.attrill@ljhooker.co.nz

092947500

https://drury.ljhooker.co.nz/

18th, Jun 2024

1/233 GreatSouth Road Drury NZ 2113 drury@ljhooker.co.nz

AsampleofvariousTownHouses& Apartmentstochoosefrom Town&Country

LJHooker

18th,

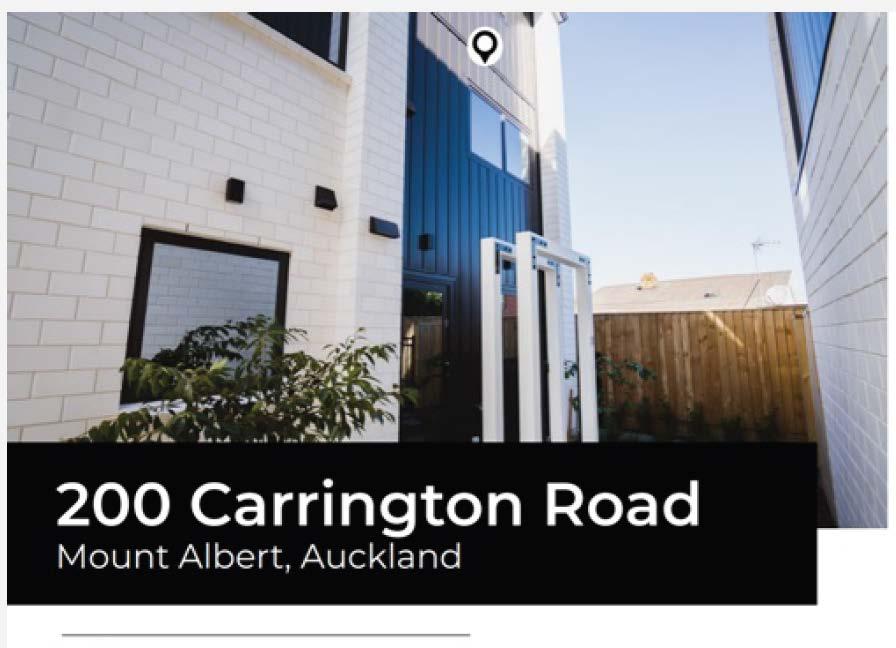

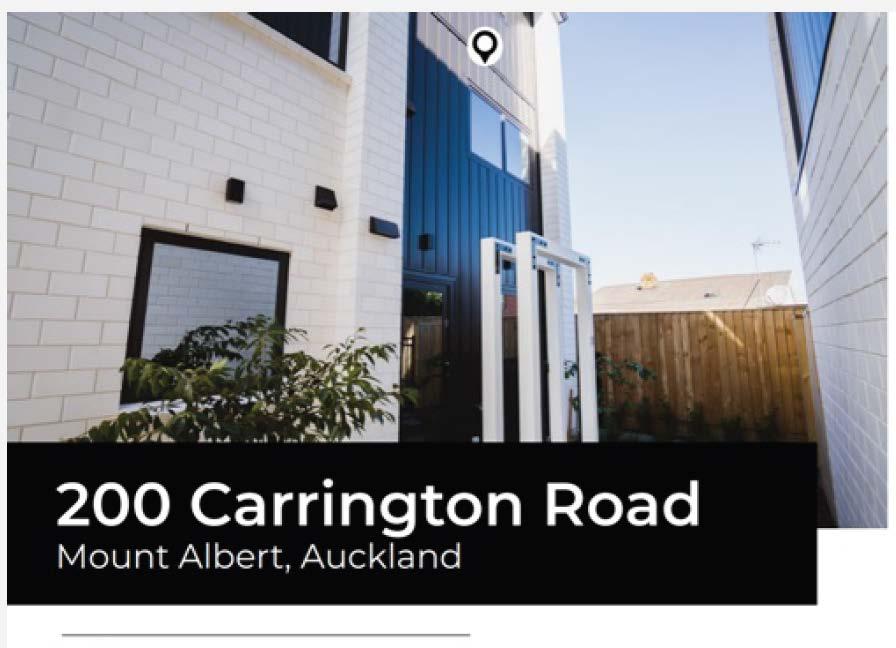

11/200 Carrington Road, Mount Albert NZ §2 b2 �1

Experience Timeless Elegance at Carrington Road

Discover the epitome ofmodern living at Unit X, 11/200 Carrington Road, where a vibrant community ...

19/10 Fathom Place, Te Atatu Peninsula NZ Y §1 bl �1

Discover Modern Luxury at Fathom Place, Auckland Step into the epitome ofmodern living in the vibrant city ofAuckland with a newly built one-bedroo...

For Sale$ 1,150,700 View By Appointment

KJ Klavenes 027 5566 194 knut.klavenes@ljhooker.co.nz

For Sale$ 685,700 View By Appointment

Anu Jay 022 3577 554 anu.jay@ljhooker.co.nz

.mi2

-2..S 6iiiib,

fl.llLl��•-1

loAt;itu "'n nsu ;i /,uckl;ird 09 294 7500 https://drury.ljhooker.co.nz/

19/10 Fathom Place

Jun 2024

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

LJHooker

Town&Country

Some of our SOLD properties

18th, Jun 2024

3 Paparata Road, Bombay NZ

§4 b2 �s

MOTIVATED VENDOR MOVING SOUTH

*4 Double bedrooms.

* Master with ensuite.

* Impeccably cared for and presented. < ...

151 Barrack Road, Mount Wellington NZ

§4 bl �6

UNIQUE INVESTMENT with HUGE POTENTIAL

Located in the geographical centre of metropolitan Auckland, this property is all about potential. D...

Sold $990,000.00

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

60 Harriet Johnston Drive, Pokeno NZ

§4 bl �2

Paradise In Pokeno - Room for Mum & Dad

Enjoy coming home to the very best of executive style living by residing in this sophisticated, 4 ye...

Sold Lina Roban 021 022 88521 lina.rob@ljhooker.co.nz

Sold $969,000 Paula Cox 021 396 977 paula.cox@ljhooker.co.nz

17 Fairdale Avenue, Red Hill NZ

§3 bl �2

Renovate, and Reap the Rewards Lots to do; and lots on offer.

Zoned "residential-mixed housing suburban" this is

1/7 Opaheke Road, Papakura NZ

§4 b2 �1

Beautifully Renovated Bungalow

This emotionally engaging 1910's beautiful character bungalow will stimulate your senses and soothe ...

Sold Steve Reilly 021930352 steve.reilly@ljhooker.co.nz

Sold Price onApplication Paula Cox 021 396 977 paula.cox@ljhooker.co.nz

3/2 Sunnydale Place, Oteha NZ

§4 bl �1

Convenient Lifestyle Awaits

3/2 Sunnydale Place, Oteha, is a residence that seamlessly marries space and comfort. This 4bedroom...

Sold Enquiries over $685,000 Anu Jay 022 3577 554 anu.jay@ljhooker.co.nz

09 294 7500 https://drury.ljhooker.co.nz/

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

&Country Wheretheonlyresultthatmattersisyours! TNBPropetyServicesLimited(LicencedREAA2008) June2024

Our People Town

Town&Country

VENITAATTRILL

VenitaAttrill SalesConsultant

0212867792

venita.attrill@ljhooker.co.nz

MeetVenita-YourTrustedRealEstateExpertSince1996!

With an impressive career spanning over three decades, Venita began her journey in Real Estate sales in 1996 with the esteemed LJ Hooker/Harveys Group. Throughout her tenure, Venita has been recognized with numerous national awards, a testament toher unwavering dedication to her clients. In fact, approximately 90% of Venita's sales are derived from her past clients and client referrals, showcasing the exceptionalleveloftrustandsatisfactionsheconsistentlydelivers.

Selecting the right agent is crucial, and there is no better way to make that decision than by evaluating their success and the manner in which they achieve it. Venita's vast clientele, who repeatedly seek her services, skill, and advice, stand as a true testamenttoherabilitytoexceedexpectations.

While Venita boasts extensive experience and a track record of success, she remains driven and committed to going above and beyond to achieve a premium outcome for every client. Her dedication to continuous improvement ensures that she remainsat theforefrontoftheindustry,offeringyouunparalleledserviceandexpertise.

When you choose Venita as your agent, you can rest assured that you have a trusted partner by your side, who will tirelessly work to secure the best possible results for you. With Venita, your real estate journey is in safe hands, backed by a legacy of excellenceandarelentlesspursuitofsuccess.

Contact Venita today and experience firsthand the difference a seasoned and determinedprofessionalcanmakeinyourrealestateendeavours.

Whenyouknow,youknow. ™ TNBPropertyServicesLimited,LicensedREAA(2008)

PAULACOX

PaulaCox Sales&MarketingConsultant

021396977

paula.cox@ljhooker.co.nz

Step into the world of real estate with Paula, an agent who exudes passion and dedication.Withacareerspanningtwodecades,thisseasonedprofessionalhasbeen enamored with every aspect of the industry since 2003. From the moment a property islistedtotheexhilaratingexchangeofkeysonsettlementday,herenthusiasmnever wavers.

WhatsetsPaulaapartisthedeepsenseofprivilegeshefeelswhenentrustedwiththe sale of a property. The responsibility bestowed upon her is not taken lightly, and she approaches each opportunity with humility and gratitude. Over the years, this commitment has not only resulted in successful transactions but has also forged lastingconnectionswithclients,transformingthemintolifelongfriends.

Trustinanagentwhocherisheseverymilestone,wherethesatisfactionofbothbuyers andsellersistheultimatetestamenttoherexceptionalservice.

Whenyouknow,youknow. ™ TNBPropertyServicesLimited,LicensedREAA(2008)

Town&Country

Klavenes

knut.klavenes@ljhooker.co.nz

Realising he wasn't fixated in winning the game of life based on what college and conventional wisdom taught him, KJ focused less on the security aspect of jobs and focused more on helping people in their success on selling to earn his way.

Not only was he scoped out by the high ends of a Real estate Agent in New Zealand to start out by a mere first sentence upon meeting, he's also been building his empire under the mentorship of the top 10 of New Zealand!

After achieving levels of income, impact and personal freedom he could've only dreamt of as a child, KJ, on top of all his multi 6-8 figure clients, has dedicated his ambitions towards helping people achieve the best prices they can in their own circumstances provided!

Will you be next?

KJ

KJ

5566 194

Licensee Salesperson 027

Whenyouknow,youknow. ™ TNBPropertyServicesLimited,LicensedREAA(2008)

Town&Country

Steve Reilly

Town&Country

Steve Reilly

Licensee

Salesperson

021 930 352

steve.reilly@ljhooker.co.nz

Steve commenced Real Estate in 2001 and since then has continually been in the upper echelon of Real Estate performers. There are many reasons why people approach Steve to work for them.

Not only his experience (and in the Real Estate world we now live in, this is a significant benefit to the client), but more-so his integrity. The fact that Steve's business is built around repeat clients (as well as a significant referral network) is testimony to the fact that Steve really understands and appreciates what Real Estate is all about. That is, building relationships with integrity, expertise and of course hard work to achieve premium results. This no doubt creates clients for life.

Steve's commitment is also demonstrated by his wife Suzie, who has been along side him for some 43 years. A great sporting family, with four children and now doting grandparents.

Being life-long South Auckland residents, Steve enjoys contributing to the local community and sporting associations, further endorsing his strong belief in the families and community.

Steve and the team will work hard obtaining the very best result for you too with 100% confidence.

Whenyouknow,youknow. ™ TNBPropertyServicesLimited,LicensedREAA(2008)

Anu Jay

LicenseeSalesperson

ANU JAY

Introducing Anu Jay, a seasonsed and accomplished sales profession with an impressive track record in the retail sales / financial sales & services industry. With extensive expertise in Sales, Customer Service, Banking, Credit analysis & Business Development, Anu Jay has consistently demonstrated a keen understanding of the industry'snuancesandapassionfordrivingsuccess.

Equipped with a Master of Business Administration (MBA) degree in Business Administration and Management from the prestigious London Metropolitan University, Anu Jay possesses a sold foundation of knowledge and strategic acumen, making him avaluableassettoanyteamororganisation.

Currently, Anu Jay has ventured into the dynamic world of Real Estate as a Sales & Marketing Consultant. Leveraging his robust experience and innovative approach, he excels in finding tailored solutions for clients, ensuring their needs are met and exceeded.

If you are seeking a seasoned professional with a proven track record in the financial and real estate sectors, look no further. Contact Anu Jay today and discover how his expertisecanelevateyourbusinessorrealestateendeavourstonewheights.

7754 anu.jay@ljhooker.co.nz TNB Property Services Limited, Licensed REAA (2008 When you know, you know. ™

&Country

022 357

Town

LINAROBAN

LinaRoban LicenseeSalesperson

02102288521

lina.roban@ljhooker.co.nz

Prior to entering the world of real estate, driven by her love of meeting and helping people, Lina had an impressive 20 year career in sales and marketing roles in the telecommunications and corporate marketing industries where her expertise in communication and negotiation always resulted in the delivery of superior customer service to her clients.

Originally from Fiji, Lina epitomises energy, passion integrity and hard work in everything she turns her hand to.

When not delivering superior service to her clients, Lina loves spending time with her family and is a passionate cyclist, owning both road and mountain bikes. With her three children all having "flown the coop", Lina and her husband also have plenty of time to enjoy their love of travel and some of their more memorable adventures include extensive journeys throughout South East Asia, the USA and the South Pacific.

TNB Property Services Limited, Licensed REAA (2008 When you know, you know. ™

&Country

Town

BRENTWORTHINGTON

BrentWorthington

LicensedAgent&Principal

0292965362

Brent.worthington@ljhooker.co.nz

There’s not much Brent doesn’t know when it comes to selling real estate. This town and country agent has had a successful career in the property market and is now the proud owner of his own business. Definitely a quality over quantity man, when you bring Brent on board, you’ll find that accumulating listings is far less important to him than making each one as good as it can get. He prides himself on telling it like it isknowing you’ll be able to make better decisions with a person and information you can trust.

Complementing Brent’s practical and credible approach is a background full to the brim of industry knowledge and business expertise from 30 years working within the construction industry. His capabilities have been well proven as a highly successful business owner.

A family man, with a proven track record of success, Brent has earned an excellent reputation and the trust of his local community and business colleagues.

He places huge emphasis on customer satisfaction, attention to detail and conducting his business with a genuine duty of care. Brent has gained many awards as a business leader during his 12-year tenure in Real Estate.

His entrepreneurial style ensures he reaches out and connects people with like minds. He imparts his wisdom in a warm and friendly manner and helps people to make wise and right decisions before investing in the property market, Auckland wide.

If you are considering a lifestyle change, investing for your future or simply wanting to know the worth of your property in this fluctuating market, feel welcome to call or email Brent to receive the latest updates on the trends and statistics in your area.

Whenyouknow,youknow. ™ TNB Property Services Limited, Licensed REAA (2008)

DEBBIEHARRISON

Debbie Harrison PropertyManager

021302864

debbie.harrison@ljhooker.co.nz

With a passion and a commitment to providing exceptional service, Debbie has a fantastic attitude of getting things done and ensuring that the clients are happy and well cared for. She takes great pride in her work and goes above and beyond to ensure the satisfaction of both property owners and tenants.

Debbie’s attention to detail and organizational abilities are exceptional, enabling her to efficiently handle all aspects of property management, from tenancy agreements, rent collection to property inspections and maintenance coordination.

Debbie understands that property management requires a compassionate and empathetic approach, and she always strives to create a positive and harmonious living environment for tenants while protecting the interests of property owners.

Whether you are a property owner seeking professional management services or a tenant searching for a well-maintained rental property, Debbie is committed to delivering exceptional results and ensuring a smooth and rewarding experience for all parties involved.

With her excellent communication skills, strong work ethic and dedication to excellence, Debbie Harrison is a true asset to LJ Hooker, Drury.

Whenyouknow,youknow. ™ TNB Property Services Limited, Licensed REAA (2008)

JohnnyBright

AUCTIONEER

Johnny is proud to be a part of the team at Apollo Auctions NZ. Entering real estate in 2014, he has developed and honed his craft of auctioneering and negotiating skills to a level that now sees him as an industry leader. Johnny has worked and collaborated with some of the most notable agents, business owners and auctioneers across New Zealand.

With the fusion of his knowledge and skill together with his personable approach, Johnny creates the ultimate auction experience . He implements drive and dedication to each and every property that he calls - regardless of value, location or personal circumstances. Johnny’s performance style and welcoming nature allows him to capture the audience and motivate buyers. He will guide you through the process and create a solid platform to achieve the best possible outcome for your auction.

Johnny also has a passion for acting. With a Bachelor of Performing and Screen Arts, he has appeared in several TV commercials and films, his most widely recognized being ‘Falling Inn Love’, an American Netflix production which was filmed in New Zealand. He has also worked with the Auckland Theatre Company on a number of occasions.

He currently resides in Beachlands with his wife and two young children.

Interested in working with the best in the business?

M: 022 173 1885 E: johnny@apolloauctions.co.nz

RobertTulp DIRECTOR& AUCTIONEER

WinnerApolloAuction

Invitational2017&2018

FinalistApolloAuction

Invitational2018

FinalistHarcourts

NewZealandAuctioneer oftheYear2011,2018&2019

Runner-upREINZNationalAuction Competition2010&2019

FinalistREINZNationalAuctionCompetition2010,2011,2012, 2013,20162018

WinnerHarcourtsNewZealandAuctioneeroftheYear2010, 2014&2017

WinneroftheAustralasianCompetition2011&2015

FinalistAustralasianCompetition2010

Runner-upREINZNationalAuctionCompetition2020

in working with the best in the business?

Interested

M:021741499 E: robert@apolloauctions.co.nz

It’s rare in life that we get something for nothing with no strings attached, especially if it genuinely adds value. Nevertheless, that’s precisely I will give you. Expert home loan advice which has reliably proven to offer significant long-term financial advantage. I keep strict tabs on the country’s largest network of banks plus numerous smaller and second-tier lenders, so you don’t have to. What’s more, this comes at no cost to you because your chosen bank pays for the privilege. You have nothing to lose, yet have a higher chance of securing better terms. Rest assured - if there’s a superior deal out there for you, I’ll find it.

In the typically stoical world of finance, I offer a point of difference. Not only will you receive excellent independent and impartial advice, but you’ll have fun doing it. Even after 15 years in the mortgage arena, my enthusiasm for objectives and commitment to clients shines through at every turn. Endorsement comes from countless glowing testimonials and in my own words: “I’m at my happiest helping people navigate through difficult situations, giving hope and concrete opportunity where they previously had none.”

Prior experience as sales manager in the fields of telecommunications and pharmaceuticals, then later, a small business owner and private property investor, provided me with considerable business acumen across many industries. My customer-focused approach and personable demeanor also reflect a lifetime of experience in client relations. I credit travel to distant locations for creating an enduring interest in different cultures and honing my ability to relate well to the needs of the broader population. In particular, I soundly empathise with people relocating from other countries to make New Zealand their home.

To continue giving my professional best, I maintain balance by travelling and participating in seasonal sports such as paddle boarding and skiing. I enjoy indulging in my creative side; with landscaping, painting watercolours or improving my guitar playing prowess. Additionally, I actively support my community through Christians Against Poverty (CAPNZ), but above all, my wife and our five shared children always take centre stage.

There's little that I haven't seen in my time in the industry, priding myself on an ability to deal with the trickiest of scenarios, never turning anyone away. My philosophy of treating people how I'd like to be treated results in a 360-degree perspective which sets myself apart.

Get in touch if you need any expert guidance. Regards

Keith Jones 021 849 767

keith.jones@loanmarket.co.nz loanmarket.co.nz/keith-jones

View Website

Wheretheonlyresultthatmattersisyours!

Town & Country

Tony Alexander

Tony Alexander