THE PROPERTY CHRONICLE

Town & Country

When you know, you know.™

JUNE 2023

Town & Country CONTENTS Page Letter from Principal (Brent Worthington) 3 Property Management - Rent Exchange 5 • Newsletter – Maintaining a Weatherproof Rental Property – Essential Tips for Landlords. 6 • Making Your Rental Yours Without Breaking the Rules 8 PROPERTY REPORTS & SURVEYS REINZ Monthly Property Report – June 23 (May data) 13 • Contents Page with link to full report • Press Release (page 3) • Market Snapshot (pages 4) • Annual Median Price Changes (page 7) • Seasonally Adjusted Median Price (page 9) 14 15 17 18 19 REINZ – Monthly House Price Index (May 2023 Results) 22 REINZ & Tony Alexander Real Estate Survey (June 2023) 29 Realestate.co.nz – The New Zealand Property Report 1 June 2023 • Have we hit the bottom of the market and an interest rate peak? 41 Apollo Auctions – April Survey Results 50 FINANCE & LENDING • Mortgages & Tony Alexander – Mortgage Advisors Survey June 2023 • Strengthening signs grow • Mortgage Advisor comments Kainga Ora Shared Ownership Scheme Loan Market – Keith Jones 53 54 57 60 61 LJ Hooker Home Smart Newsletter • Is it time to buy a house? Key Signs to Assess your readiness 63 • Starting Your Journey as a Real Estate Investor 66 Properties - LJ Hooker Town & Country • Current Listings 72 • Featured Properties 74 Our Team • Brent Worthington • Lina Roban • Lorretta Dale 79 80 81 SuperGold Welcome Here 82

Hi HousingMarketShowsSignsofPositivity.

Thehousingmarkethasdisplayedglimpsesofpositivityinrecentmonths,particularlyinthe regions,asindicatedbythelatestdatafromtheRealEstateInstituteofNewZealand(REINZ).

Theeasingloan-to-valuerestrictionsannouncedbytheReserveBankandthestabilisationof interestrateshavecontributedtothisencouragingtrend.Despitethecurrenteconomic challenges,buyersarecautiouslynavigatingthemarket,resultinginaslowerdeclinein medianpricesandamarginaldecreaseinsalescountscomparedtothepreviousyear.

JenBaird,REINZchiefexecutive,emphasisedtheinfluenceofhighinterestratesandatight economyonthemarket.

“It’sclearthatcurrenthighinterestratescombinedwithatighteconomy,arestillinfluencing themarketasbuyerscontinuetoactwithcautionwhileeconomicheadwindsplayout.This monthmedianpriceseasedataslowerrateandsalescountsaremarginallydown comparedtoMay2022.Sevenregionsincreasedinsalescounts,anindicatorofreturning marketconfidence,”Bairdsaid.

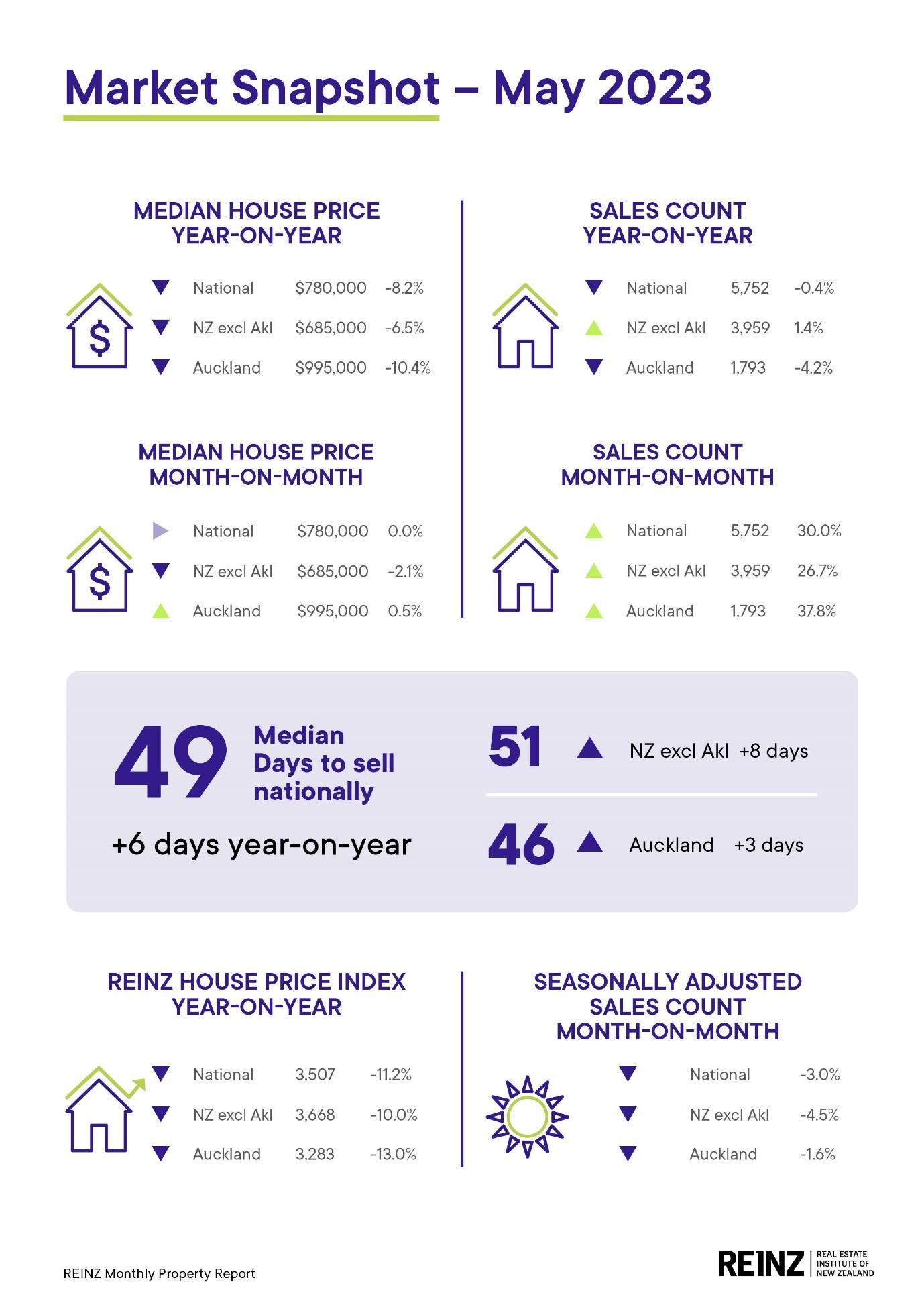

AccordingtotheREINZreportforMay2023,thenationalmedianpricedeclinedby8.2percent year-on-yeartoreach$780,000.However,therewasnochangeinthemedianprice comparedtothepreviousmonth,indicatingapotentiallevellingoff.

Themediandaystosellroseto49days,reflectingaslightincreaseof6dayscomparedto May2022anda3-dayincreasefromApril2023.

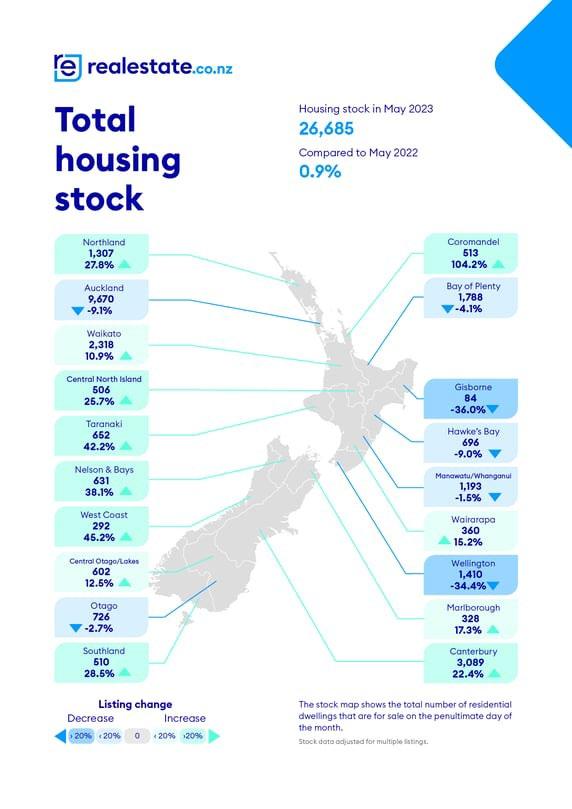

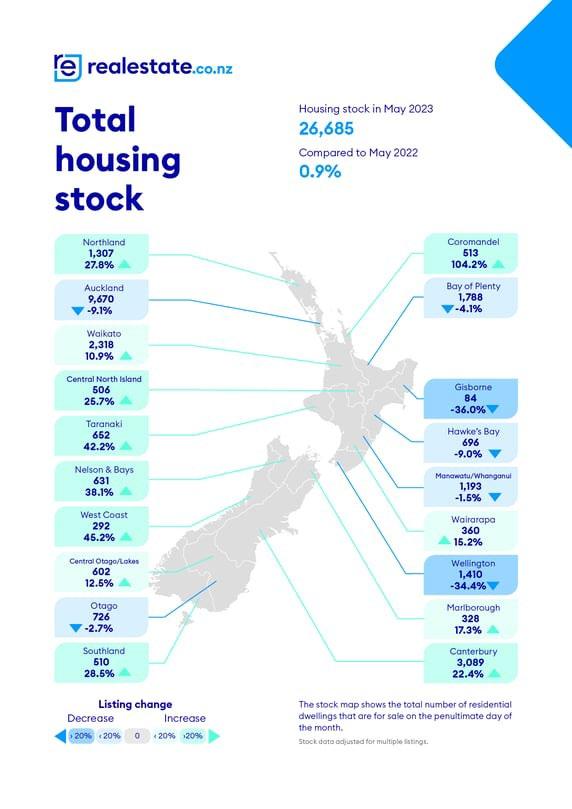

Intermsoflistings,thetotalnumberofpropertiesforsaleacrossNewZealandattheendof Maywas26,685,representinga0.9percentincreaseof250propertiescomparedtothe previousyear.

Brent Worthington Principal and Licensee Agent

LJ

continued over...

Town&Country

1June23

Hooker Town&Country & Property Management 1/233 Great South road, Drury 0292 965 362

2

“Inventorylevelslooktohavestabilisedwithonlyaslightincreaseinstocklevels.We haveseenlowlevelsofpropertycomingtomarketacrossthecountryformuchofthis yearand,assalesvolumesarebackatmorenormallevels,wemaybeseeingthe beginningofashiftinthebalanceofsupplyvsdemand,”saysBaird.

ThelatestASBHousingConfidenceSurveyprovidesfurtherinsightsintothehousing marketsentiment.

Thesurvey,coveringthefirstthreemonthsof2023,revealsthatrespondentscontinueto believehousepricefallsandinterestrateincreasesarelikelytopersist.However,a growingportionofrespondentsnowperceivethatinterestratesmightbereachinga peak,andalargerminoritybelievesthatpricesarestabilisingorevenpoisedto increase.

Thereportdoespointoutthatthissurveydoesn’ttakeintoconsiderationthelatest governmentbudgetandtheReserveBank’sdecisioninMay,whichmaymeaninterest rateshavelikelypeeked.

“Thelargestdivideamongoursurvey’srespondentsisaroundwhetherit’sagoodtime tobuy,withroughlyevennumbersoneitherside,”ASBeconomistNathanielKeallsaidin thereport.

“Twelvemonthsago,respondentswerelargelyinagreementthatitwasa‘bad’time, withfearofoverpayingandrisinginterestratespotentiallybigconcerns.

“Giventhemagnitudeofhousepriceeasingsincethen,itmaybethatmoreKiwisfeel therearebargainstobehad.”

AsalwaysItrustyouenjoythismonth'spublication.

Kindregards Brent

Brent Worthington Principal and Licensee Agent

LJ Hooker

LJ Hooker

Town

&Country & Property Management

1/233 Great South road, Drury

0292 965 362

Town&Country Continued

PROPERTYMANAGEMENT

Onthefollowingpagesyouwillfindourlatest propertymanagementnewsletter.

Pleasedon'thesitatetocontactLorrettawhocanably assistyouwithanypropertymanagementmattersyou mayhaveorifyouhaveanyquestionsaboutanything inthenewsletterorpropertymanagementingeneral.

LorrettaDale SeniorPropertyManager

LorrettaDale SeniorPropertyManager

021549432

MaintainingaWeatherproofRentalProperty: EssentialTipsforLandlords

Asaresponsiblelandlord,it'scrucialtoprioritisetheupkeepofyourrentalproperty Youwant toensureitiscomfortableforyourtenantsandmeetsHealthyHomesstandards.

Bystayingproactiveandtakingnecessary maintenancemeasures,youcanprotectyour investment,provideasafeandcomfortablehomefor tenants,andmitigatepotentialweather-related issues

SafeguardingAgainsttheElements:A ComprehensiveMaintenanceGuide

CleartheGutters

Regularlycleaningtheguttersofyourrentalproperty isnotonlyimportantforfiresafetybutalsotoensure properwaterdrainage

Leavesanddebrisaccumulationcanleadtosagging gutters,waterdamage,andthegrowthofharmful moulds Totacklethistask,eithercarefullycleanthe guttersyourselfusingasturdyladderandabucket,or consultyourpropertymanagerforrecommendations onprofessionalguttercleaners

CombatMould

Inadequateventilationcanresultinmouldissues withinrentalproperties

It'sessentialtoeducatetenantsaboutthesignsof mouldandencouragethemtoopenwindows, especiallyinareaspronetosteamandmoisture,such asbathroomsandlaundries Ifthere'sasignificant mouldbuild-up,considerprofessionalmould treatmentandprovideappropriatenoticetotenants

Installingadequateexhaustfansinproblemareas

canalsocontributetomouldprevention Youdo wanttoensurethefanisstrongenoughforthe room,orelseitwon’tbeeffectiveatall

EnhanceInsulationandWindows

Investingincomprehensiveinsulationforyour rentalpropertyofferslong-termbenefits

YourLJHookerpropertymanagerwillbeableto helpyoudeterminethebestinsulationapproach basedonthepropertytype Qualityinsulationnot onlyimprovesenergyefficiencybutalsoprevents dampness

Upgradingtodouble-glazedwindowsisan effectivewaytoreduceheatloss,with40percent ofheatenergyescapingthroughwindows If budgetconstraintsapply,focusonminimising draftsbyinstallingorreplacingweatherstripping arounddoorsandwindows.

EnsureSafety:PreventSlippingHazards

Withdampandshadyconditions,moss,mildew, andalgaecanaccumulateondriveways,paths, andoutdoorpatios,posingsliphazards.Asa landlord,youareresponsiblefortheupkeepand maintenanceoftheoutsideoftheproperty.To avoidpotentialhazards,proactivecommunication iskey.Educatetenantsaboutpotentialdangers andtheimportanceofregularcleaning.Encourage themtosweeporbrushthesesurfacesperiodically toremoveleavesanddebris.Additionally,thereare productsavailabletopreventmossandmildew growth.

ljhooker.co.nz

Draft-ProofingforComfortandEfficiency

Draftscanleadtoincreasedcondensation, discomfort,andhigherenergyconsumption.Protect yourtenantsandoptimiseenergyefficiencyby addressingdrafts.

Sealobviousgapswithweatherstrippingorwindow treatments,useheavy,linedcurtainstoretain warmth,andinspectwindowsforcracksordamage

Considerweatherstrippingexistingwindowsor investinginenergy-efficientreplacements Installing doorsweepsandsealinggapsaroundskirting boardsandwindow/doorarchitraveswillfurther reducedrafts

RoofandGutterMaintenance

Extremeweathereventscancausesubstantial damageifyourproperty'sroofandguttersarenot well-maintained Regularlyinspecttherooffor crackedormissingtilesorpanelsthatmayresultin leaksandwaterdamage Damagedeavescanalso leadtomouldissues Checkguttersforcracks,rust, orlooseness,andensuretheyremainfreefrom leavesanddebristopreventwater-relatedproperty damage

WindowsandDoors:KeepingtheElementsOut Windowsanddoorsarecommonentrypointsfor theelements

Regularlyassesstheconditionofwindowsand doors,consideringreplacementsorupgradesto enhanceclimatecontrolandenergyefficiency Energy-efficientwindowsanddoorscan significantlylowerenergybillswhileimproving tenantcomfort

Exploreoptionslikedouble-glazingorweather strippingexistingwindowstoreduceheatloss Seal anygapsarounddoorframesandinstalldoor sweepstominimisedrafts

LandscapingandDrainage

Properlandscapinganddrainageareessentialto preventwaterloggingandsubsequentproperty

damageduringrainstorms.Ensurepropergrading aroundtherentalpropertyandcheckthatpaving andgardenbedsfacilitatewaterdrainageaway fromexteriorwalls.

Regularlymaintaintreesandshrubs,removingany branchesortreesthatmaycompromisethe property'sstructureortenantsafety Inspectand protectexteriorstructureslikepatios,sheds, handrails,fences,anddecksfromsevereweather changes

VentilationSystemMaintenance

Maintainingtheventilationsystem,likeanyroof ventilationsystemorheatpump,willallowyour tenanttobecomfortablewhileenjoyingadry property

EnsureyourrentalpropertymeetstheHealthy Homesstandardsbyprovidingafixed,energyefficientheaterinthemainlivingarea Regular ventilationsystemmaintenance,includingfilter replacementandductcleaning,ensuresoptimal systemperformanceandtenantsafety

PlumbingandPipeProtection

Frozenpipescanburstduringcoldwintermonths Winteriseyourplumbingsystembyinsulating exposedpipesinareaslikegarages,crawlspaces, andattics Useheattape,heatcables,orinsulation materialstowrappipes Sealanyleaksnearthe pipesthatallowcoldairinfiltration

ExteriorMaintenance

Regularexteriormaintenancehelpspreventthe escalationofexistingissues Inspectandrepair sidingstoaddresspotentialmouldorwoodrot problems High-qualitywaterproofing,including paintingandsealingexteriorsurfaces,provides additionalprotectionagainstweather-related damage

Theinformationcontainedinthispublicationisgeneralinnatureandisnotintendedtobepersonalisedrealestateadvice

Beforemakinganydecisionsyoushouldconsultalegalor professionaladvisorLJHookerNewZealandLtdbelievestheinformationinthispublicationiscorrectandithasreasonablegroundsforanyopinionorrecommendationcontainedinthis publicationonthedateofthispublication NothinginthispublicationisorshouldbetakenasanofferinvitationorrecommendationLJHookerNewZealandLtdacceptsnoresponsibilityfor anylosscausedasaresultofanypersonrelyingonanyinformationinthispublication ThispublicationisfortheuseofpersonsinNewZealandonlyCopyrightinthispublicationisownedby LJHookerNewZealandLtd

Youmustnotreproduceordistributecontentfromthispublicationoranypartofitwithoutpriorpermission

ljhooker.co.nz

MakingYourRentalYoursWithoutBreakingtheRules

Home renovations programmes are alwaysa source for inspiration, giving you ideasof what your dream home could be.Needless to say, if you are a renter, your ability to renovate your home is limited.

Although you might not be able to make drastic changes to your rental, there are ways you can personalise your home to make it feel like your own.

Update window treatments

If you have outdated plastic blinds, or curtains that just aren’t reflective of you, go out and find something that suitsyou.Remember, don’t throw out those old blinds as you will need to reinstall them when the time comesto leave. And of course, make sure you don’t make any new holes in the wall when installing your new blinds.

Window shutters might be something your heart isset on, so it might be worth approaching your property manager and asking whether the landlord would be prepared to go halves with you to install the shutters.In thisinstance, you get to enjoy them while you are there, and they get to keep them when you leave.This is a great win/win situation.

Introduce plants

New pot plants and flower give an instant lift to any space –so add them to your kitchen and living room to brighten these communal spaces and boost the mood of you, your familyand yourguests.Whileitmayseemclichétosayplantsbringlifetoaroom,thereisalotoftruth toit.Plus,theyhavetheaddedbonusofhelpingtocleantheairandremovetoxins.Cleaning theairandrevitalisingyourrentalwithindoorplantsandflowersisanicefeeling,especially ifloadsofotherpeoplehavelivedtherebeforeyou.

Think beyond the living room when adding plantsto your home.Find a place for a plant in your bathroom too.Many plants, like cactuses, love the climate of a warm room and thrive in bathroom spaces.If you have little outdoor space, indoor plantshelp bring a bit of nature inside.You also introduce new texturesand coloursto your home interior and that can add intrigue to a blank or unusable space like a room corner.

Decorate walls

While you may not be able to change the wallpaper or the colour of the paint on the walls, have you considered peel and stick vinyl stickers?Decals are super popular and can be found at many home improvement stores and online.The range of coloursand designs are vast and they are relatively inexpensive.They can be easily added and removed and are a great way to add details to your wall without damaging the paint underneath.

Another trick is to use removable wallpaper to create a feature wall.Made out of selfadhesive wall sticker fabric, it looksand feels like traditional wallpaper but you can easily DIY it as it requires no glue, no water, and no tradesperson.Then when it is time to move, the removable wallpaper will peel off without leaving any residue or damaging the surface –making it a landlord-friendly option.

Storage

Storage space can be hard to come across, so furniture that can double up as a space to help declutter and reduce any mess is an added bonus.

Some of these storage solutions could include:

• Atelevision cabinet with added storage for electronics, accessories, DVDsand knick-knacks

• Acoffee table with a lid and storage inside to place itemsthat you don’t use a lot

• Afree-standing bookshelf to help balance decoration with storage

• Portable clothes racks or freestanding wardrobes to place your clothesor to even double as pantry storage

• Under-bed storage boxes to store personal items discreetly

Liven up the walls with artwork

Removable, self-adhesive hooks to hang your favourite photos or artwork isa great way to get around putting holesin the walls, and it keepsyour landlord happy.However, make sure you check the weight they can hold, as it does vary.

If you can’t hang anything on the walls, consider decorating from the floor up.A large mirror works well leaning against the wall, as do large canvas prints.Another unique way to display artwork and add intrigue to your rental space is by using an old ladder adorned with colourful scarves, bags and rugs –looks great and provides another handy storage solution!

Personalise the flooring

If your rental’s flooring is not to your tastes and your landlord isn’t keen to replace it, a good way to improve the look is to add a large neutral rug to cover the space and then add some colour and texture with layered rugs on top.Arunner in a hallway can change the whole feel of an entryway and isrelatively inexpensive.Some other temporary floor optionsfor rentersinclude:

• Peel and stick carpet tiles

• Vinyl sheets/rolls (these come in wood-look, stone-look, ceramic-look and decorative sheets so you can have a cost-effective, renter-friendly floor solution in no time at all!)

• Waterproof vinyl planks.These can be laid over carpet regardless of the pile height.Simply snap and lock together.

• Laminate planks

• Foam tiles.These are a great solution for highly-trafficked wooden floors and can also be laid over the carpet or hard surface floors to add extra padding in a workout room/home gym or yoga studio

• Composite decking.You might have an outdoor patio space that hasseen better days.This temporary outdoor flooring option is great for refreshing an outdoor space whether it’s a patio, deck or balcony

Add a vignette

Awhat?!I hear you say.Avignette is a grouping of objects.It is usually made up of homewares such as a vase or bowl, some flowersand other natural elements, mementos and arts& crafts.They help to add personality to a space and bring it to life.So find your favourite things that you have collected over the yearsand group them together to create a little display.These work well in the living room, on a dining table, in a bathroom and in your bedroom.

Some tipsfor creating a vignette:

• Create a theme.If you live in a beachy area, for example, create a little beachy display on your shelf or mantlepiece with objectssuch assea shells, bottles filled with sand and beachy-themed figurines.

• Build your vignette around a light source such ason a windowsill or beneath a lamp.Otherwise, you won’t be able to see your display clearly.

• Use colour and different heights for a temporary art display.For example, a bright orange vase grouped with a stack of old books and a potted plant.

• Place your vignette in a display tray and use it asa table centrepiece.

Upgrade the light fixtures

Rentals often come with some very regular lighting!And while it is probably not practical to change all the light fittings, spending some time and money upgrading those light fixtures in high-traffic rooms can make a big difference.If you have bare bulbs or ugly pendants, an easy way to refresh these is to replace the shades.Don’t throw anything away, asupon leaving, you might be asked to “make good” and restore the property back to the same condition aswhen you moved in.

Table lamps positioned in a hall or on a side table can create a homely feel and add some character and personality to your space.Large floor lamps can also make a statement while adding sufficient lighting to a dark space.You might even opt for a bold lampshade that ties into the colour of artwork in the room.In bedrooms or outdoor patio areas, hanging string lights or fairy lights is another effective lighting solution that beautifiesa room on a budget.

A word or warning

Before you go crazy with home improvements, remember that a standard tenancy agreement usually preventsany renovations, alterations or additions to the premises without the landlord'swritten consent.If you are wanting to do something drastic like paint a wall or change the flooring, make sure to contact your property manager to find out what your options are here before you do anything.

Property Reports& Surveys

June23 (MayData)

June 2023

MONTHLY PROPERTY REPORT. 15

2 | REINZ Monthly Property Report Contents 3 Press Release 4 Market Snapshot 7 Annual Median Price Changes 9 Seasonally Adjusted Median Price Regional Commentaries Northland ........................................................................................................................................................... 10 Auckland .............................................................................................................................................................. 12 Waikato 14 Bay of Plenty 17 Gisborne 20 Hawke’s Bay 22 Taranaki 24 Manawatu/Whanganui 26 Wellington 39 Nelson/Marlborough/Tasman 32 West Coast 34 Canterbury 36 Otago 39 Southland 42 CLICKHERETOVIEWFULLREPORT

REINZ PRESSRELEASE- May data: Early signs of returning confidence assalesvolumesriseintheregions

15 June 2023

TheRealEstateInstituteofNewZealand’s(REINZ)May2023figuresshowanincrease insalescountsinsomepartsofthecountrywhilebuyersandsellersinotherparts continuetowait.

REINZChiefExecutiveJenBairdsaysasweheadintothewintermonths,weare seeingglimpsesofpositivity,especiallyintheregionsfollowingtheReserveBank’s announcementofeasingloan-to-valuerestrictionsandthestabilisingofinterest rates.

“It’sclearthatcurrenthighinterestratescombinedwithatighteconomy,arestill influencingthemarketasbuyerscontinuetoactwithcautionwhileeconomic headwindsplayout.Thismonthmedianpriceseasedataslowerrateandsales countsaremarginallydowncomparedtoMay2022.Sevenregionsincreasedinsales counts,anindicatorofreturningmarketconfidence,”addsBaird.

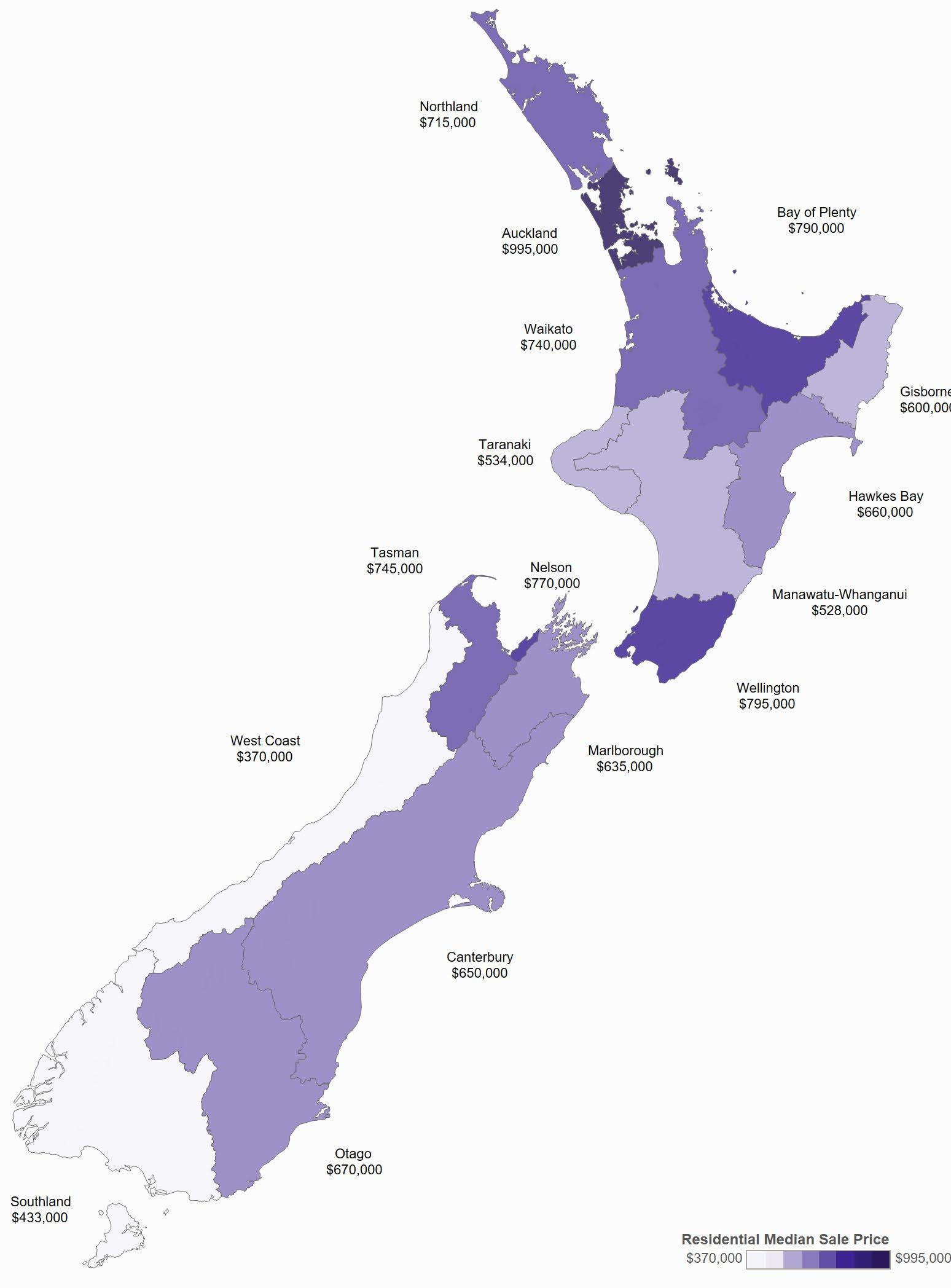

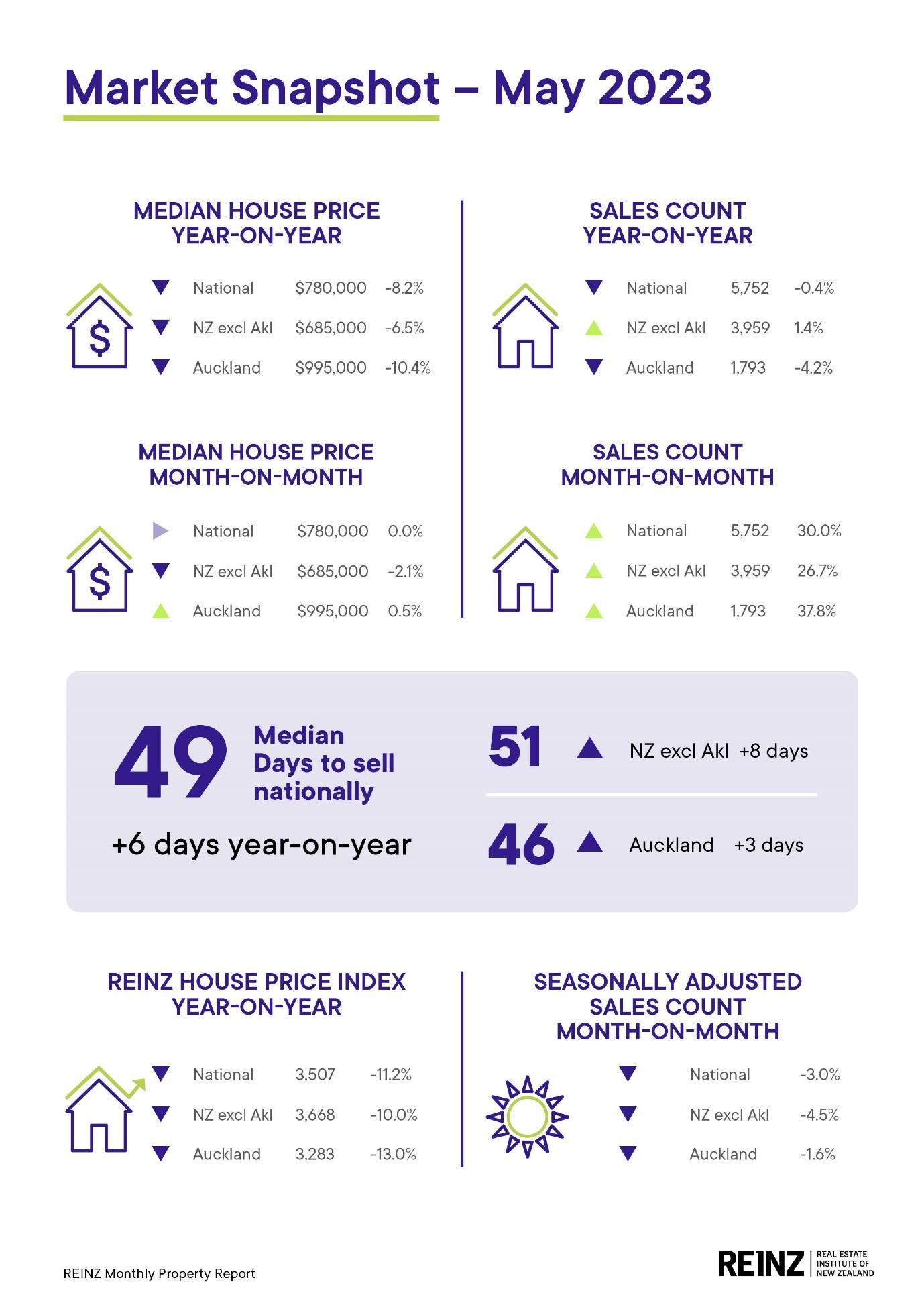

Nationally,theMay2023medianpricedecreased8.2%year-on-yearto$780,000but sawnochangemonth-on-month.Themediandaystosellhasrisento49daysfor May2023—up6dayscomparedtoMay2022,andup3daysfrom46,when comparedtoApril2023.NewZealandexcluding Auckland,sawadecreaseinthe medianpriceof6.5%to$685,000anda2.1%decreasemonth-on-month.

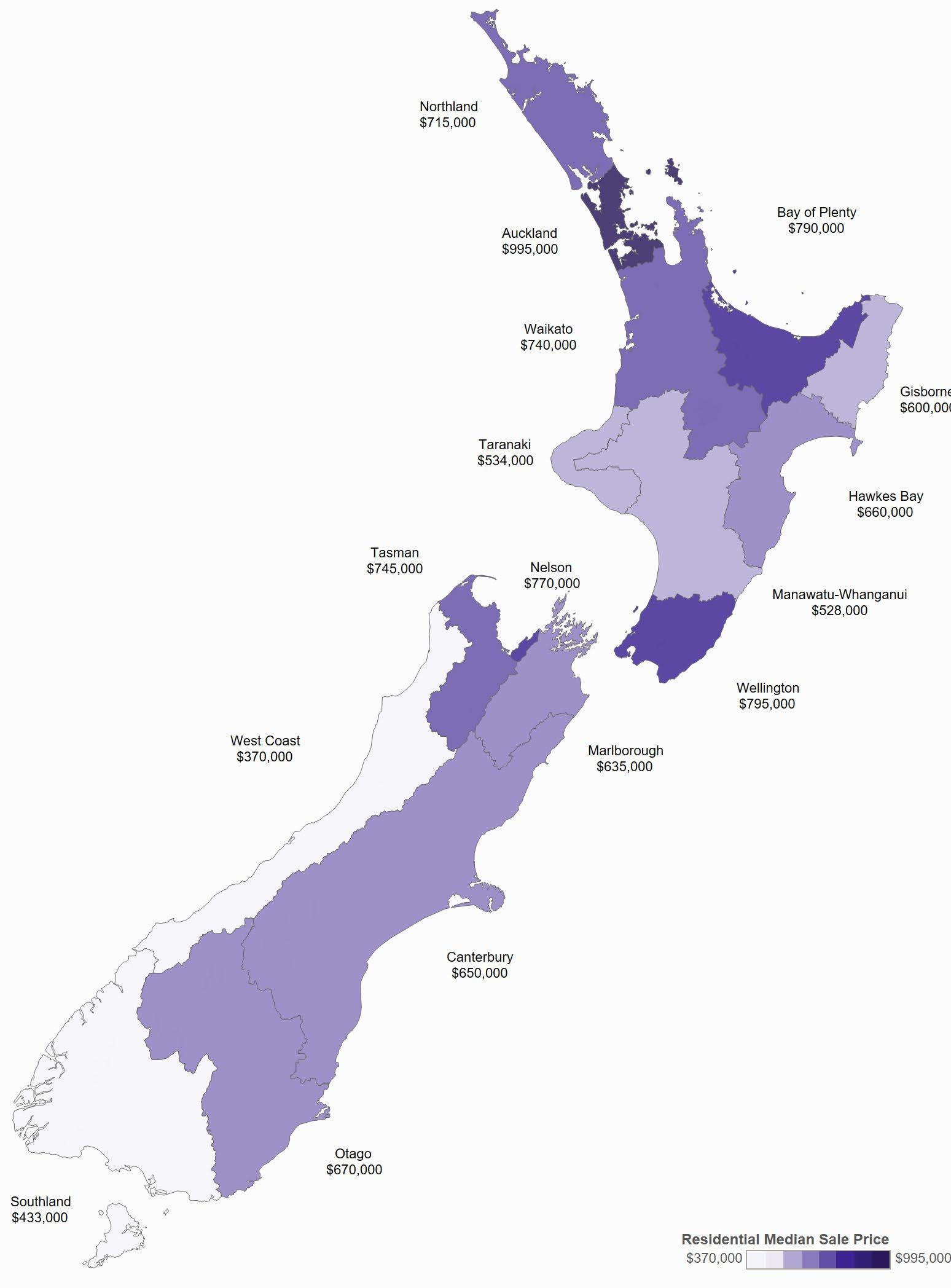

Intheregions,Nelsonhadthebiggestmedianpricerisethismonthat2.7%year-onyearand6.9%month-on-monthto$770,000.TheWestCoastsawanotherincrease withamonth-on-monthriseof3.1%.Twodistrictsreachedrecordmedianprices: GreyDistrictwitha18.7%increaseyearonyear($400,000)andWaitomoDistrict takingtopspotwitha53.4%increaseyearonyear($655,000).

AttheendofMay,thetotalnumberofpropertiesforsaleacrossNewZealandwas 26,685,up250properties(0.9%)year-on-year,anddown6.8%month-on-month. NewZealand,excludingAuckland,wasalsoupfrom15,799to17,015,anincreaseof 1,216propertiesannually(+7.7%).Month-on-month,inventorydecreased7.3%.

“Inventorylevelslooktohavestabilisedwithonlyaslightincreaseinstocklevels. Wehaveseenlowlevelsofpropertycomingtomarketacrossthecountryfor muchofthisyearand,assalesvolumesarebackatmorenormallevels,wemay beseeingthebeginningofashiftinthebalanceofsupplyvsdemand,”says Baird.

ThetotalnumberofpropertiessoldacrossNewZealandinMay2023was5,752, downfrom5,776inMay2022(-0.4%),andup30.0%monthonmonth.New Zealand,excludingAuckland,salescountsincreasedby1.4%year-on-yearand 26.7%month-on-month.

Sevenregions,Northland,Auckland,Waikato,Wellington,Tasman,Marlborough andSouthlandallhada30%increaseormoreinsalesvolumesmonth-onmonth,withMarlboroughtoppingthelistwith66.7%insales.

“WedoneedtoconsiderthetypicalchangesthatoccurfromApriltoMaywhen interpretatingthemonthlysalescount.Ofthosesevenregions,itwasonly Marlborough,TasmanandWellingtonthatwellexceededwhatwouldtypicallybe expectedinMay2023basedontheApril2023salescounts.”

“NorthlandandWaikatohadaslightlylargerincreaseinsalescountfromlast monththanistypicalwhereastheAucklandandSouthlandmonth-on-month movementsinsalescountwerelessthanwhattypicallyhappensinthoseregions whenmovingfromApriltoMay,”commentsBaird.

“We’veheardfromsalespeoplethatmostsellersaremeetingthemarketwhile othersarepotentiallyholdingtightonsellingatahighersaleprice,particularlyif theyhadboughtinthepeakofthemarket.Thesetendtobethepropertiesthat stayonthemarketlonger.Easingofloan-to-valuerestrictions,commentary aroundpeakinflationandarenewedconfidenceisseeingmorefirsthome buyersseekoutopportunities,”statesBaird.

Nationally,newlistingsdecreasedby18.1%,from8,983listingsinMay2022to7,359 listingsinMay2023.ComparedtoApril2023,listingsincreasedby3.0%from7,142. ForNewZealandexcludingAucklandlistingsdecreased17.4%year-on-yearfrom 5,801to4,792.Auckland’slistingsweredown19.3%from3,182to2,567year-onyear,butup2.0%onApril2023.

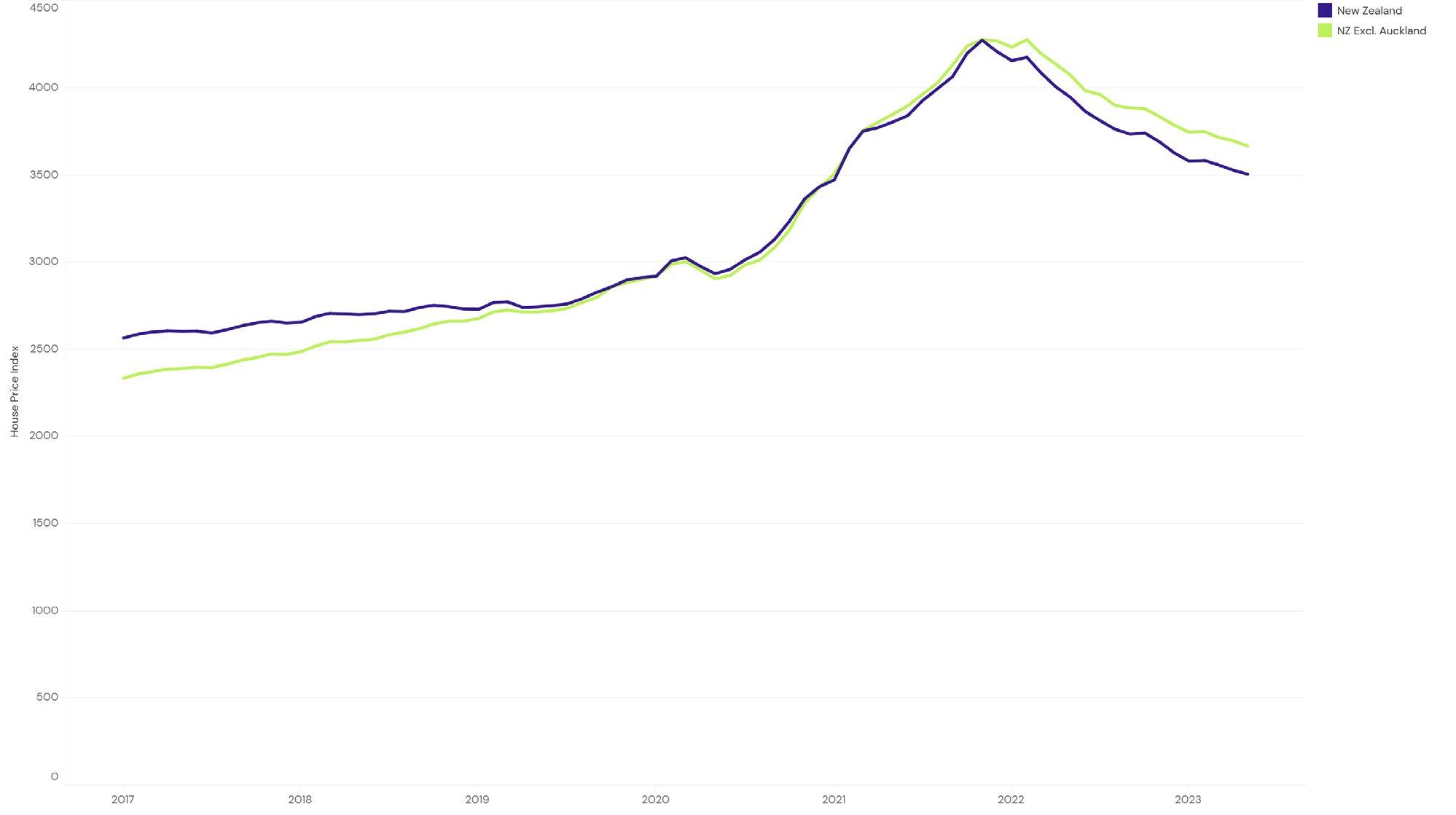

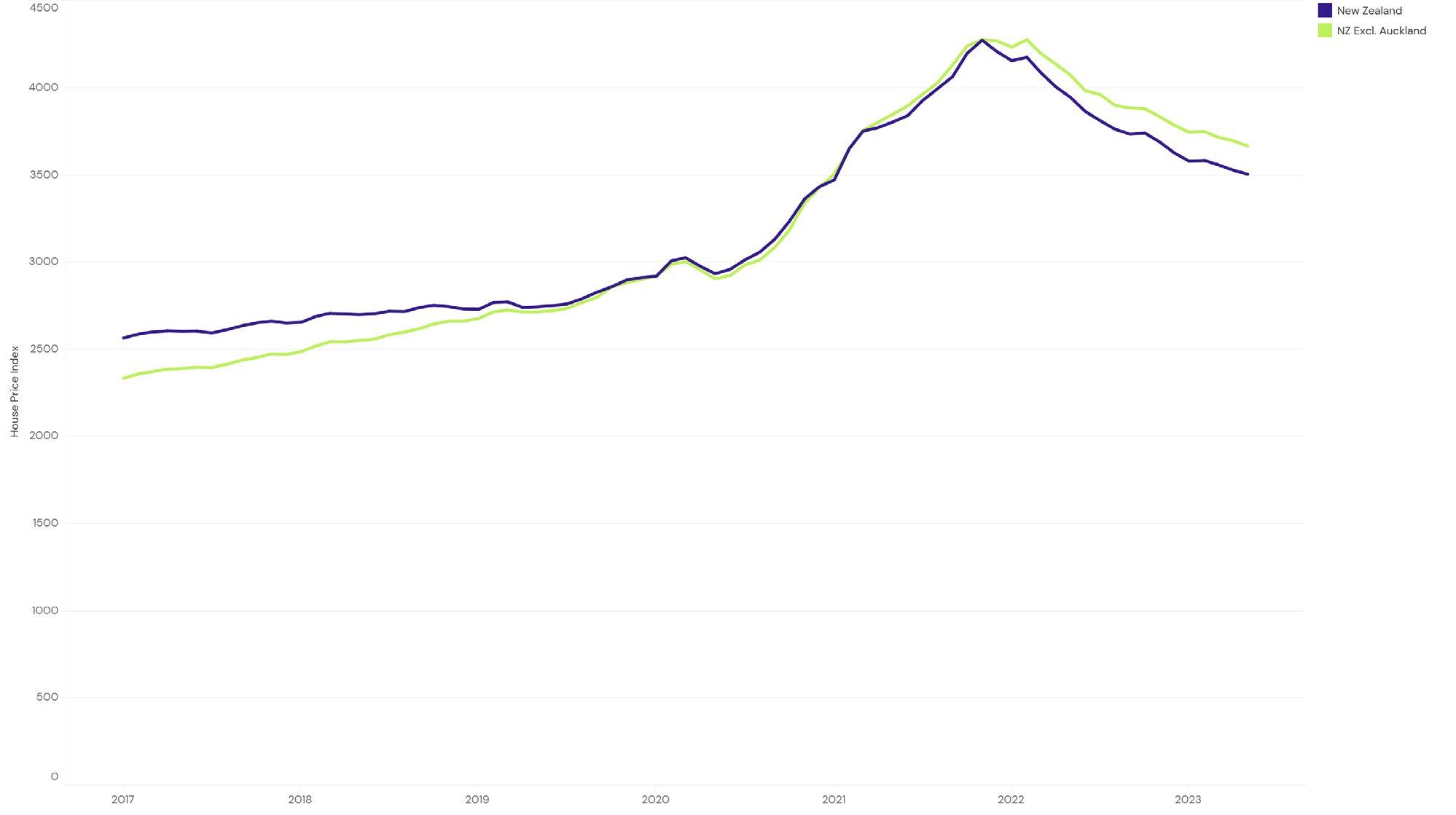

TheREINZHousePriceIndex(HPI)forNewZealandwhichmeasuresthechanging valueofresidentialpropertynationwideshowedanannualdecreaseof-11.2%for NewZealandanda-10.0%decreaseforNewZealandexcludingAuckland.

TheRealEstateInstituteofNewZealand(REINZ)hasthelatestandmostaccurate realestatedatainNewZealand.

Fact sheet National highlights

MAY 2023

5 | REINZ Monthly Property Report

Manawatu-Whanganui Hawkes Bay Gisborne Bay of Plenty $715,000 Northland $780,000 Auckland Wellington Waikato Taranaki Nelson Tasman West Coast Southland Marlborough Canterbury Otago National Median Price Median Days to Sell Compared to May 2022 R Record Median Prices Increase Decrease Stable -2.1% q $995,000 -10.4% q $790,000 -13.2% q $600,000 -9.8% q $660,000 -10.2% q $528,000 -12.4% q $795,000 -11.7% q $740,000 -7.5% q $534,000 -15.9% q $770,000 2.7% p $745,000 -12.9% q $370,000 -6.3% q $635,000 -6.8% q $650,000 -5.4% q $670,000 -6.9% q $433,000 -3.6% q

ANNUAL MEDIAN PRICE CHANGES

49 -8.2%

Sales volumes seasonally adjusted

Compared to April Compared to May 2022

price seasonally adjusted

Compared to April Compared to May 2022

9 | REINZ

Monthly Property Report

Count Change Seasonally Adjusted Change Count Change Seasonally Adjusted Change New Zealand 30.0% -3.0% -0.4% -4.8% NZ ex Akl 26.7% -4.5% 1.4% -3.7% Northland 31.0% 3.9% -11.4% -16.8% Auckland 37.8% -1.6% -4.2% -8.4% Waikato 44.5% 2.6% 6.4% 3.4% Bay of Plenty 16.0% -7.5% 4.3% 1.1% Gisborne -28.6% -46.6% -46.8% -51.9% Hawke’s Bay 24.5% -15.7% -2.6% -9.5% Manawatu/Whanganui 7.2% -13.1% -10.9% -15.7% Taranaki 12.3% -17.0% -21.5% -29.9% Wellington 38.9% 14.2% 24.6% 18.4% Nelson -3.8% -4.4% -31.1% -21.3% Marlborough 66.7% 23.7% 19.4% 15.9% Tasman 54.7% 21.6% 39.0% 42.1% Canterbury 21.6% -7.3% -5.0% -11.8% West Coast -15.8% -39.5% 10.3% 5.5% Otago 28.5% -4.4% 5.9% 1.8% Southland 37.7% -14.8% -2.0% -7.9%

Median

Median Change Seasonally Adjusted Change Median Change Seasonally Adjusted Change New Zealand 0.0% 0.5% -8.2% -8.3% NZ ex Akl -2.1% -0.7% -6.5% -6.5% Northland 2.1% 0.0% -2.1% 5.3% Auckland 0.5% 1.1% -10.4% -10.4% Waikato -0.7% 0.2% -7.5% -7.5% Bay of Plenty -3.7% -3.7% -13.2% -13.2% Gisborne -6.3% -6.3% -9.8% -9.8% Hawke's Bay -12.0% -8.7% -10.2% -9.6% Manawatu/Whanganui -5.0% -1.8% -12.4% -10.5% Taranaki -5.7% -4.9% -15.9% -15.7% Wellington -1.2% 0.8% -11.7% -11.7% Nelson 6.9% 6.9% 2.7% 2.7% Marlborough 2.8% 2.8% -6.8% -6.8% Tasman -4.5% -4.3% -12.9% -12.7% Canterbury -2.3% -1.8% -5.4% -5.4% West Coast 3.1% 3.1% -6.3% -6.3% Otago -1.5% -1.5% -6.9% -6.9% Southland 1.9% 1.9% -3.6% -3.6%

© REINZ - Real Estate Institute of New Zealand Inc.

15 June 2023

MONTHLY HOUSE PRICE INDEX REPORT

REINZ House Price Index (HPI)

As one of the country’s foremost authorities on real estate data, we are proud to bring you the REINZ HPI (House Price Index). It provides a level of detail and understanding of the true movements of housing values over time to a higher standard than before. The REINZ HPI was developed in partnership with the Reserve Bank of New Zealand and provides a more complete picture of the New Zealand housing market.

BENEFITS OF THE REINZ HPI

Data on median and average house prices is open to being skewed by market composition changes. This means observed changes in these values could be almost entirely due to the changed nature in the underlying sample (e.g. an unusually large representation of high end housing sales) rather than changes in the true market value. The REINZ HPI takes many aspects of market composition into account resulting in greater accuracy.

ABOUT REINZ HPI

The REINZ HPI is based on the SPAR methodology and has been proven to be the most comprehensive tool to understand the housing market for four main reasons:

• Timeliness - This is the number one advantage of REINZ HPI. REINZ data is based on sales as they occur (unconditional) so is the most up to date data source in NZ.

• Accuracy - REINZ data is supplied by the actual sales prices supplied by its members so has a high level of accuracy.

• Stability - REINZ has the most data available to it so can provide the most stable and complete one month indices.

• Disaggregation - Indices can be disaggregated to a lower level than before. Disaggregation means you can focus on a smaller data set, allowing comparison of building typology and suburbs, i.e. Three bedroom houses in Manukau.

EXPERT INDUSTRY FEEDBACK

“I have had the opportunity to utilise the REINZ HPI website, and have been involved in advising on the HPI’s preparation. The new index fills a gap in providing reliable up to date information on house price developments across all of New Zealand’s local authorities. It’s wonderful to see REINZ providing this level of detailed data for wider public use. I am already planning to use this data in my own research.”

Dr Arthur Grimes Senior Fellow, Motu Research; and Adjunct Professor, Victoria University of Wellington

“Accuracy and timeliness of information on house price movements is vital for home buyers, sellers, agents, and analysts such as myself. The data from REINZ meets both requirements and gives New Zealand a collection of house price series comparable with the best overseas.”

Tony Alexander Independent Economist and Speaker

“The Real Estate Institute of New Zealand’s Market Intelligence portal opens up to users the ability to interactively compare price trends amongst a wide range of local council regions. Users can pick and choose regions of interest and use the chart tools to instantly compare price performances. For those wanting to look at house prices in more depth there is the capability to download the data in spreadsheet format all the way back to 1992 when the Institute started recording sales price information.”

Nick Tuffley Chief Economist, ASB

The number one advantage between REINZ data and other housing data on the market is that REINZ has access to sales data from the time the price is locked in (unconditional data) as opposed to when the house changes hands (settlement date) which can often be weeks/months later. Therefore, the REINZ HPI is the best and most timely measure of recent housing market activity.

2 | REINZ Monthly House

Index Report

Price

For more information visit: reinz.co.nz/reinz-hpi

MAY 2023 RESULTS REINZ HOUSE PRICE INDEX

Looking at the REINZ HPI for May 2023, the ‘gold standard’ for New Zealand house price analysis, Jen Baird, Chief Executive at REINZ, says:

The REINZ House Price Index was developed in partnership with the Reserve Bank of New Zealand.

Already being used by the Reserve Bank’s forecasting and macro financial teams, plus the major banks, the REINZ HPI provides a level of detail and understanding of the true movements of housing values over time. It does this by analysing how prices in a market are influenced by a range of attributes such as land area, floor area, number of bedrooms etc. to create a single, more accurate measure of housing market activity and trends over time. Using the Reserve Bank’s preferred Sale Price to Appraisal Ratio (SPAR) methodology, the REINZ HPI uses unconditional sales data (when the price is agreed) rather than at settlement, which can often be weeks later. It is therefore more accurate and timely.

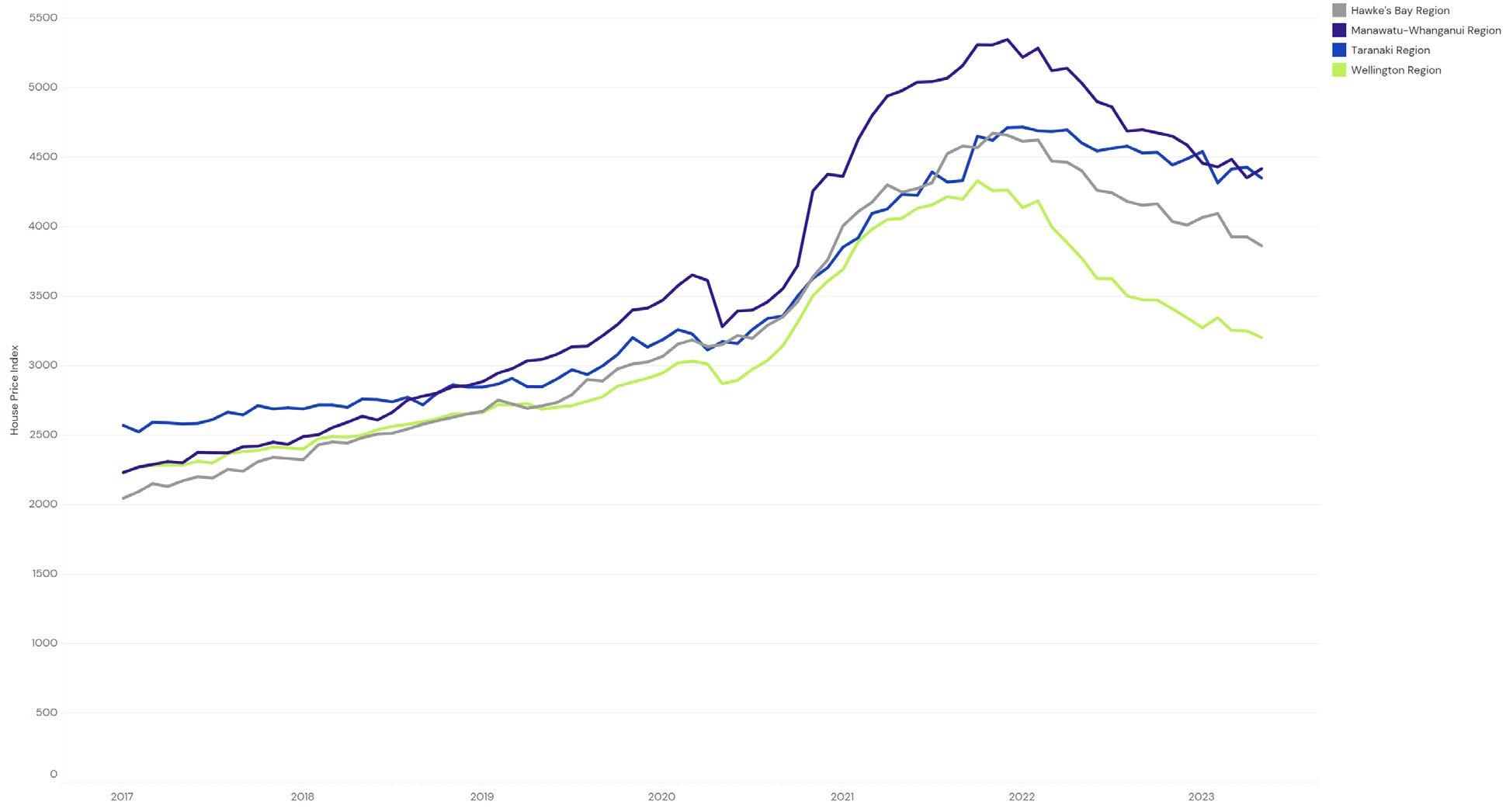

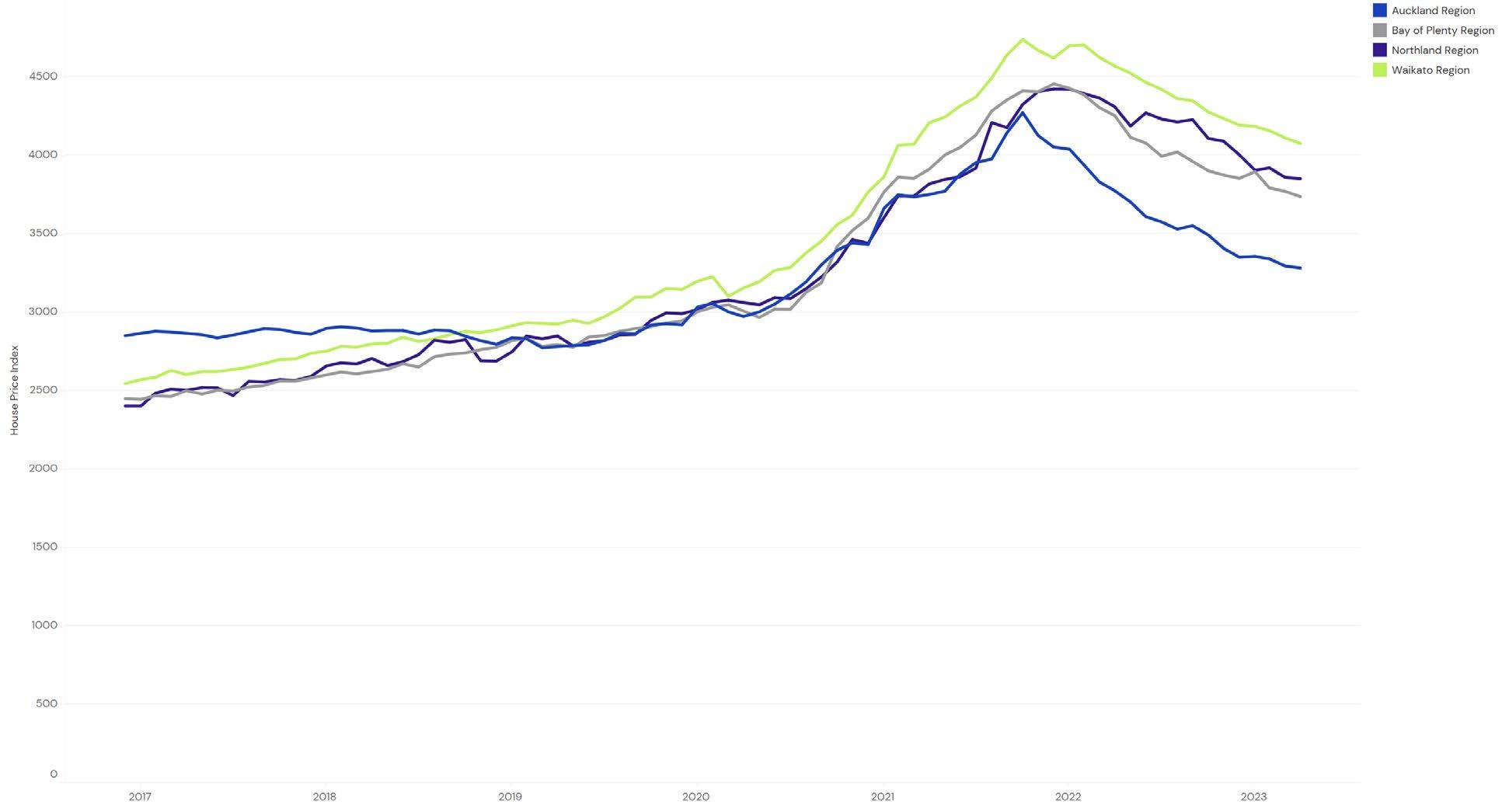

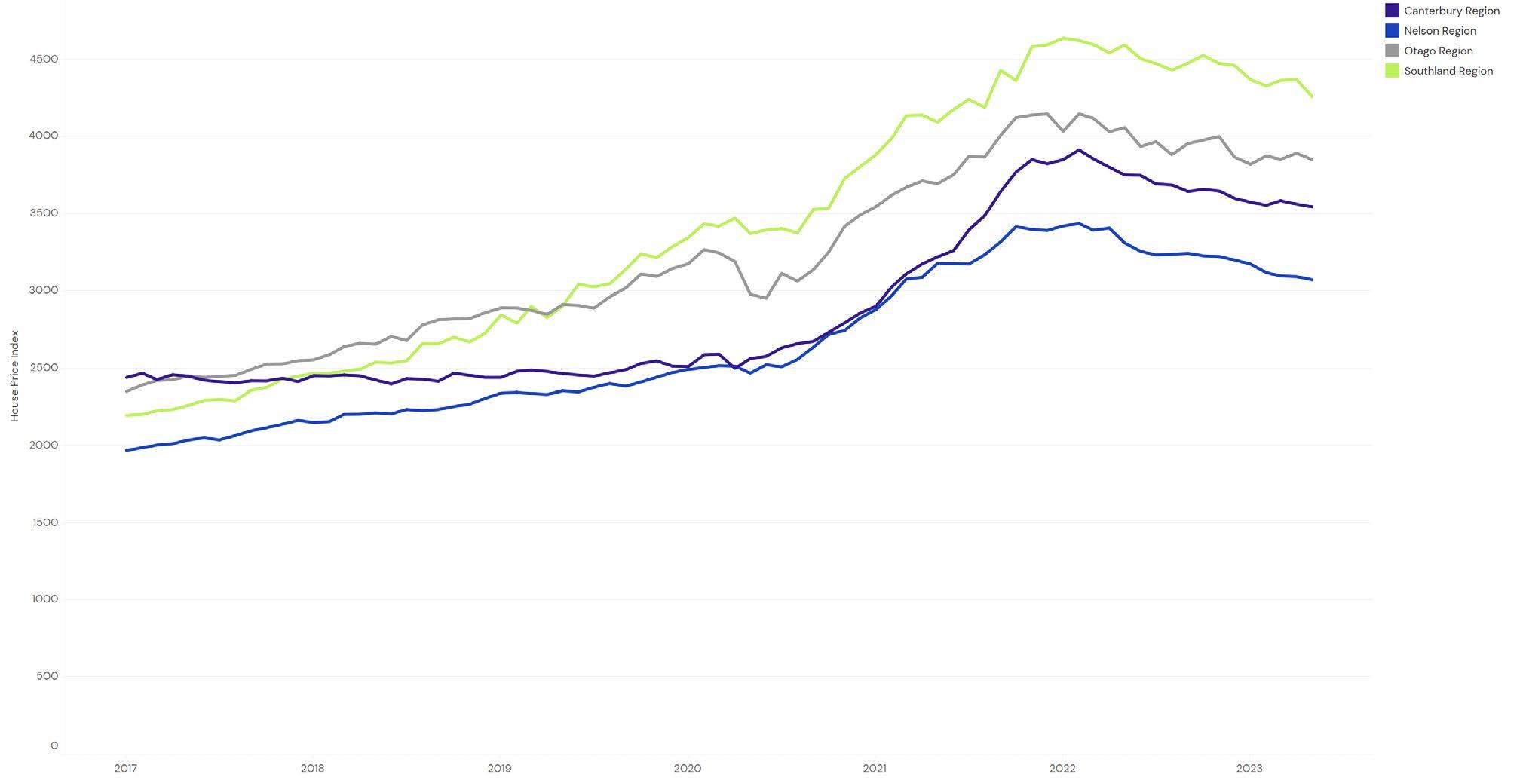

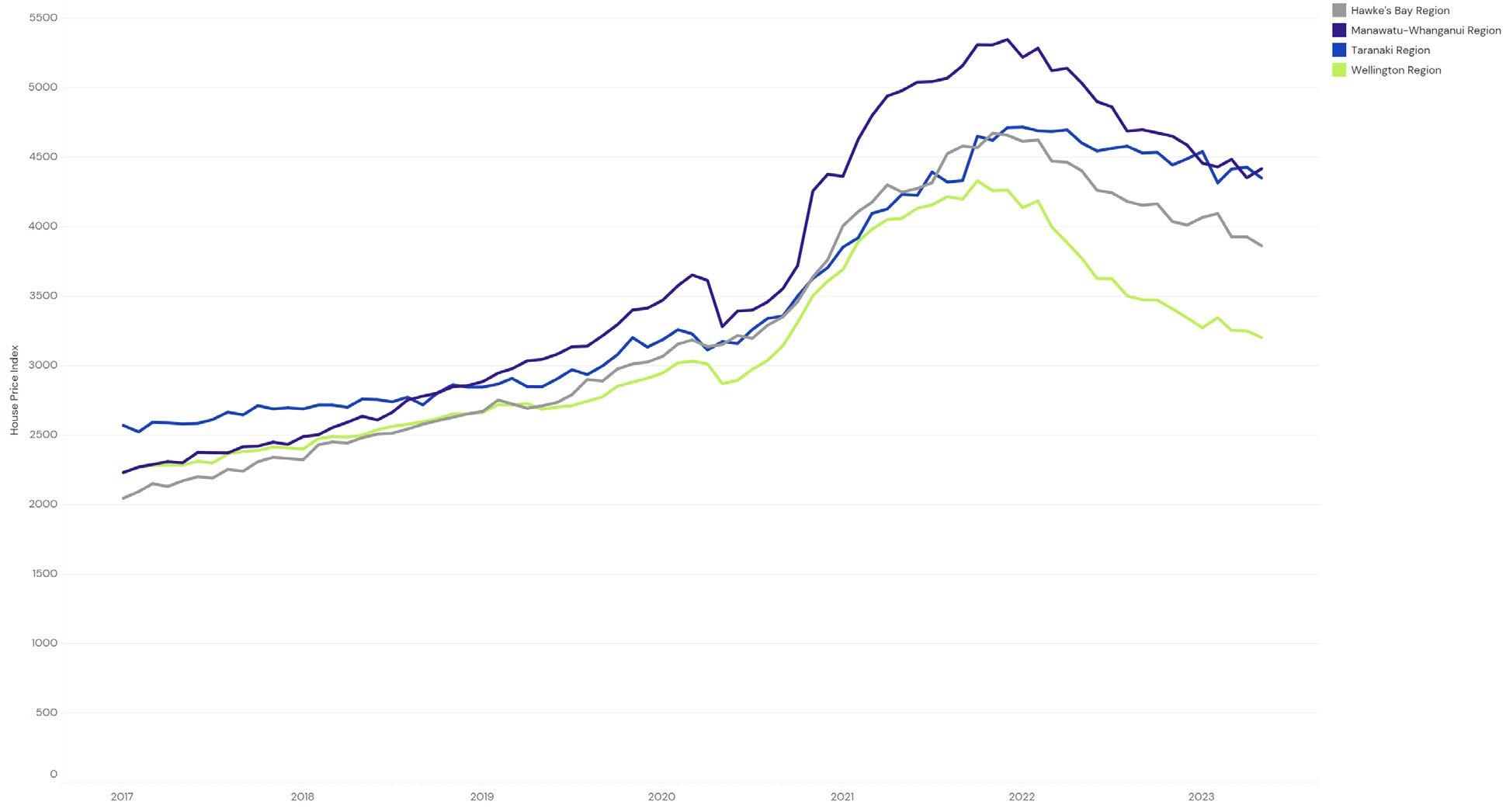

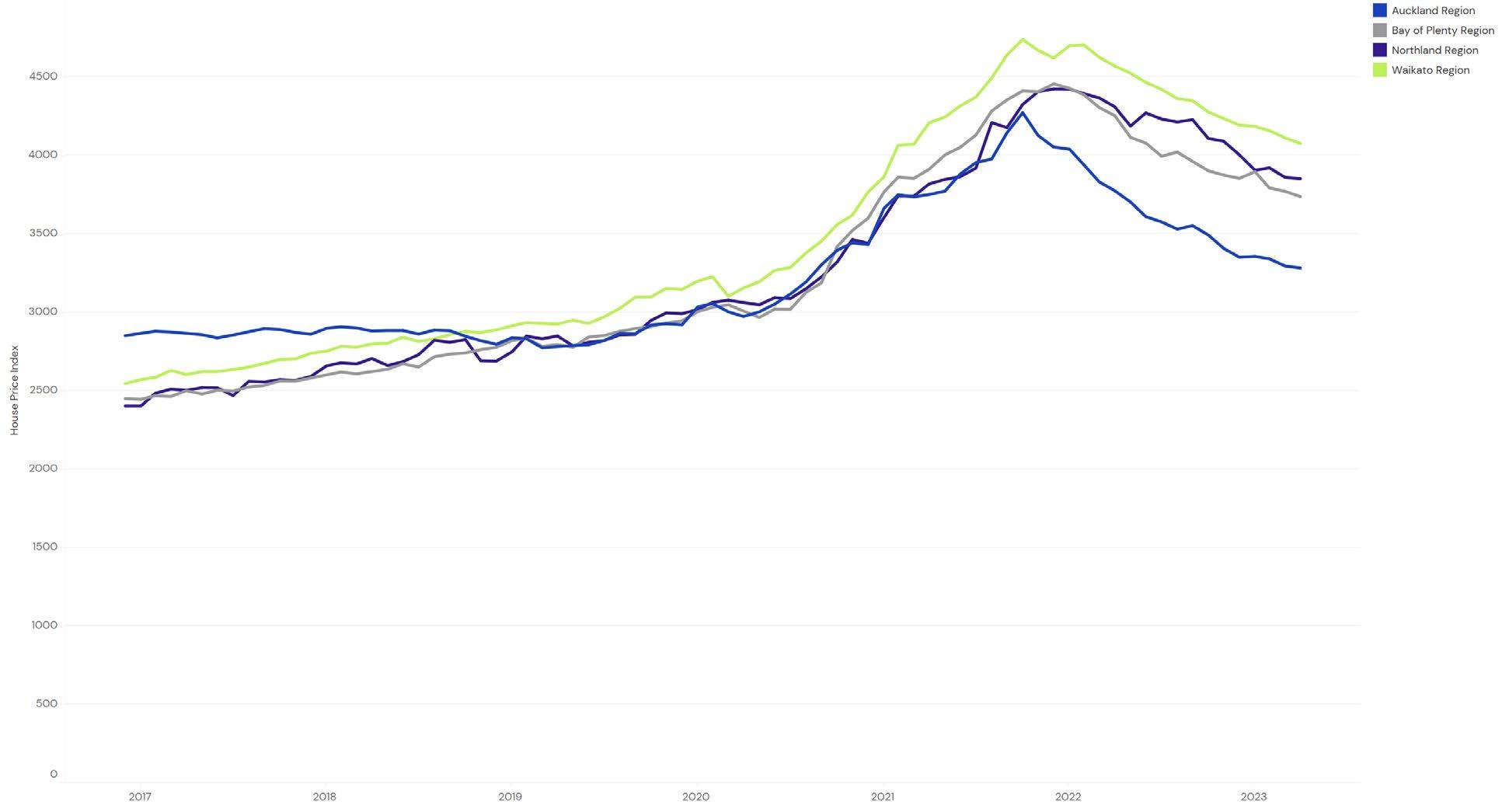

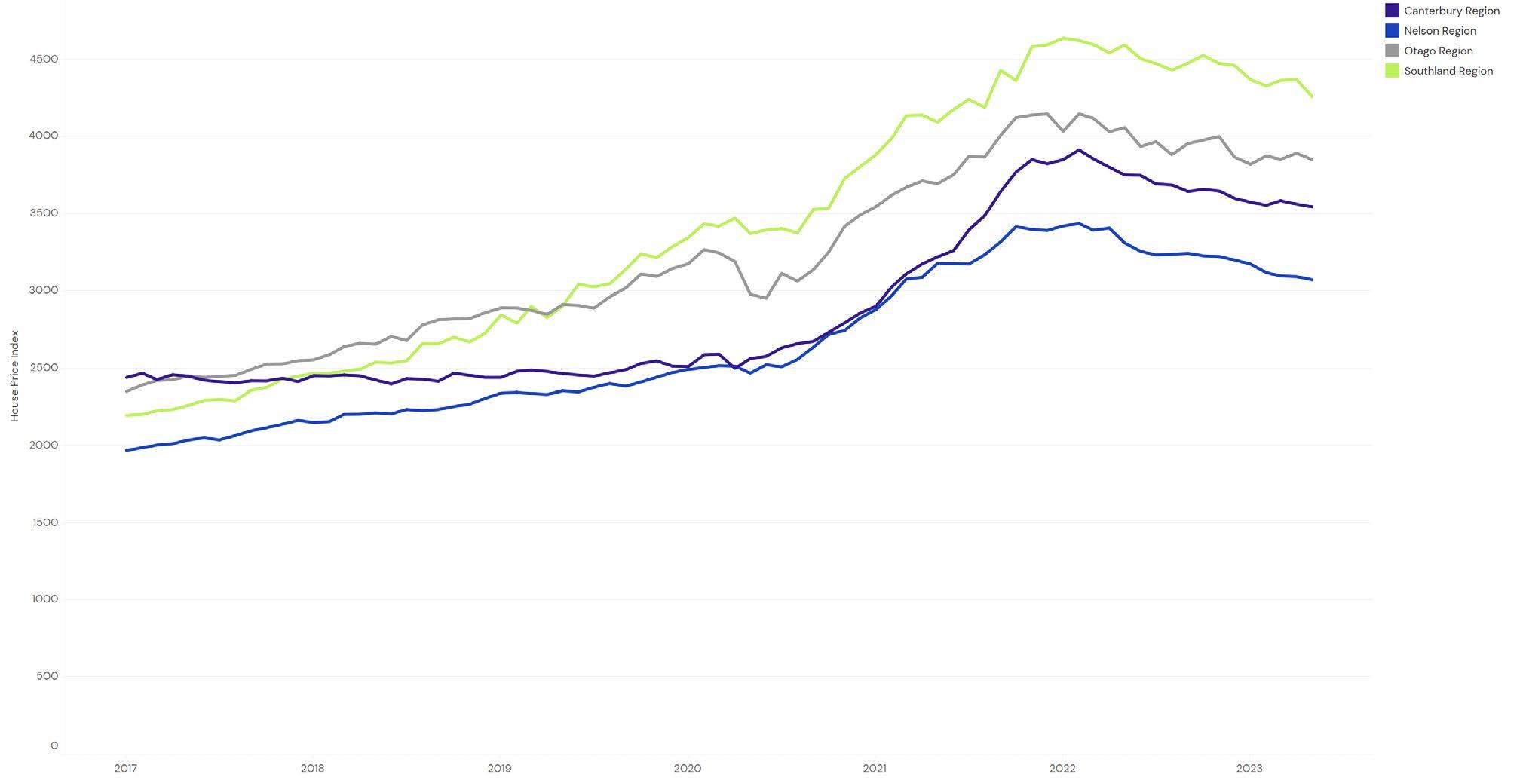

“The REINZ HPI takes many aspects of market composition into account and thus provides more accurate results. When applied to the May data, the HPI indicates that the housing market value nationwide has dropped 11.2% year-on-year. In Auckland, the value decreased by 13.0% and decreased by 10.0% outside of Auckland. Otago retains the top spot in the 12-month ending percentage changes. Canterbury and Taranaki came second and third, respectively, for annual percentage movement.

“The importance of the HPI is evident in the Taranaki region this month, where the median sale price tells a different story to the HPI.

“The median sale price in the region decreased 15.9% over the past year, the weakest return compared to the other regions. This suggests a market where performance is very poor in the long term compared to other regions.

“However, the Taranaki region had the third strongest annual performance of all regions in HPI over the past year with a decrease of 5.5%. Sample composition changes — such as the size of properties or the underlying value of properties sold — can change statistics, such as median, that are purely based on price. However, because the underlying value of each property sold is considered by the HPI, such sample changes have little effect on HPI results. In summary, long-term property value growth in Taranaki is decreasing at a slower rate than most other regions, a fact that would have remained hidden from those monitoring statistics without access to the HPI.”

3 | REINZ Monthly House Price Index Report

Year-on-year, the HPI indicates that housing market value nationwide has fallen 11.2%, down in Auckland by 13.0% and down outside Auckland by 10.0%.

NEW ZEALAND HOUSE PRICE INDICIES

4 | REINZ Monthly House Price Index Report

National House Price Index Figures

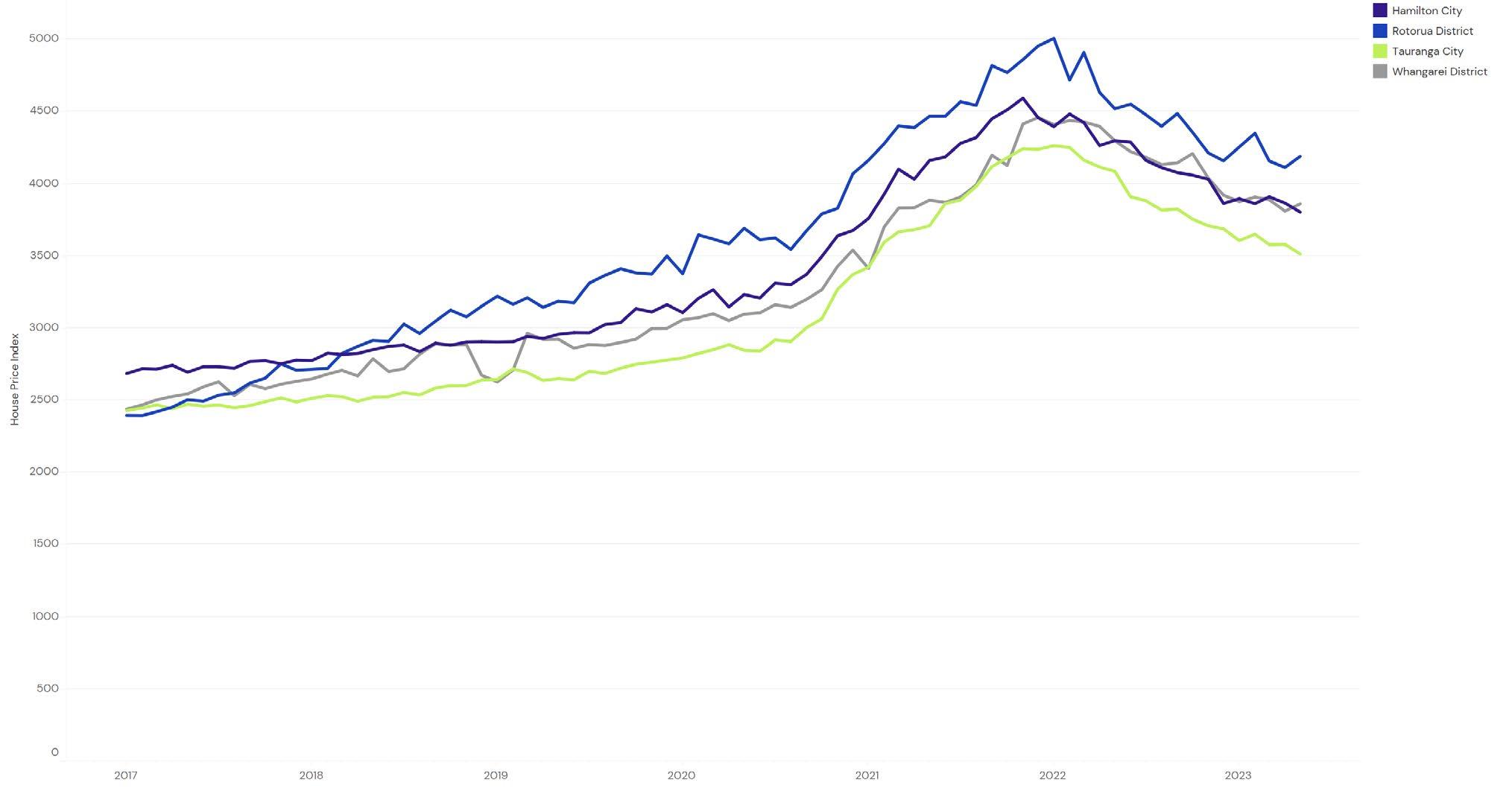

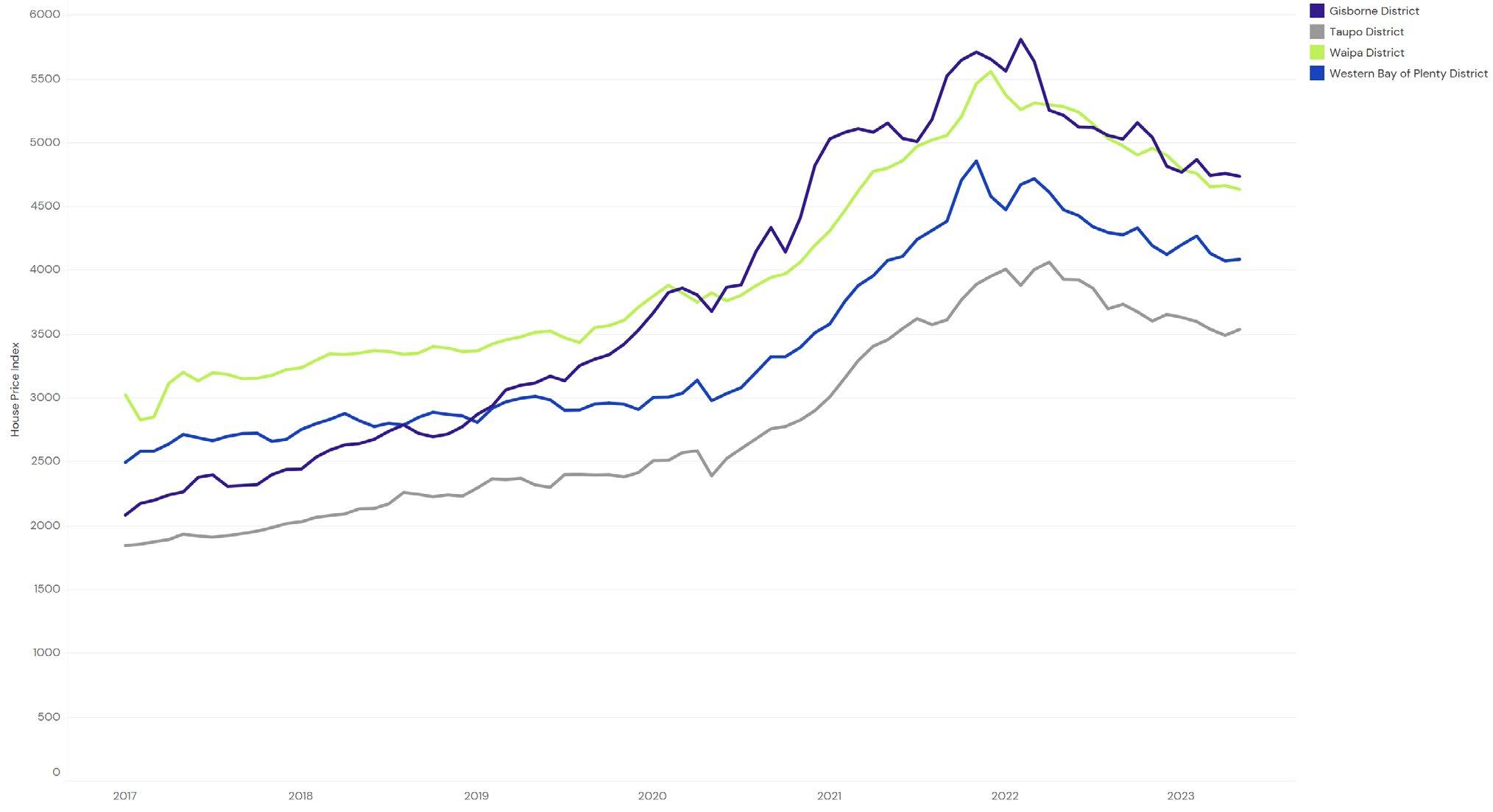

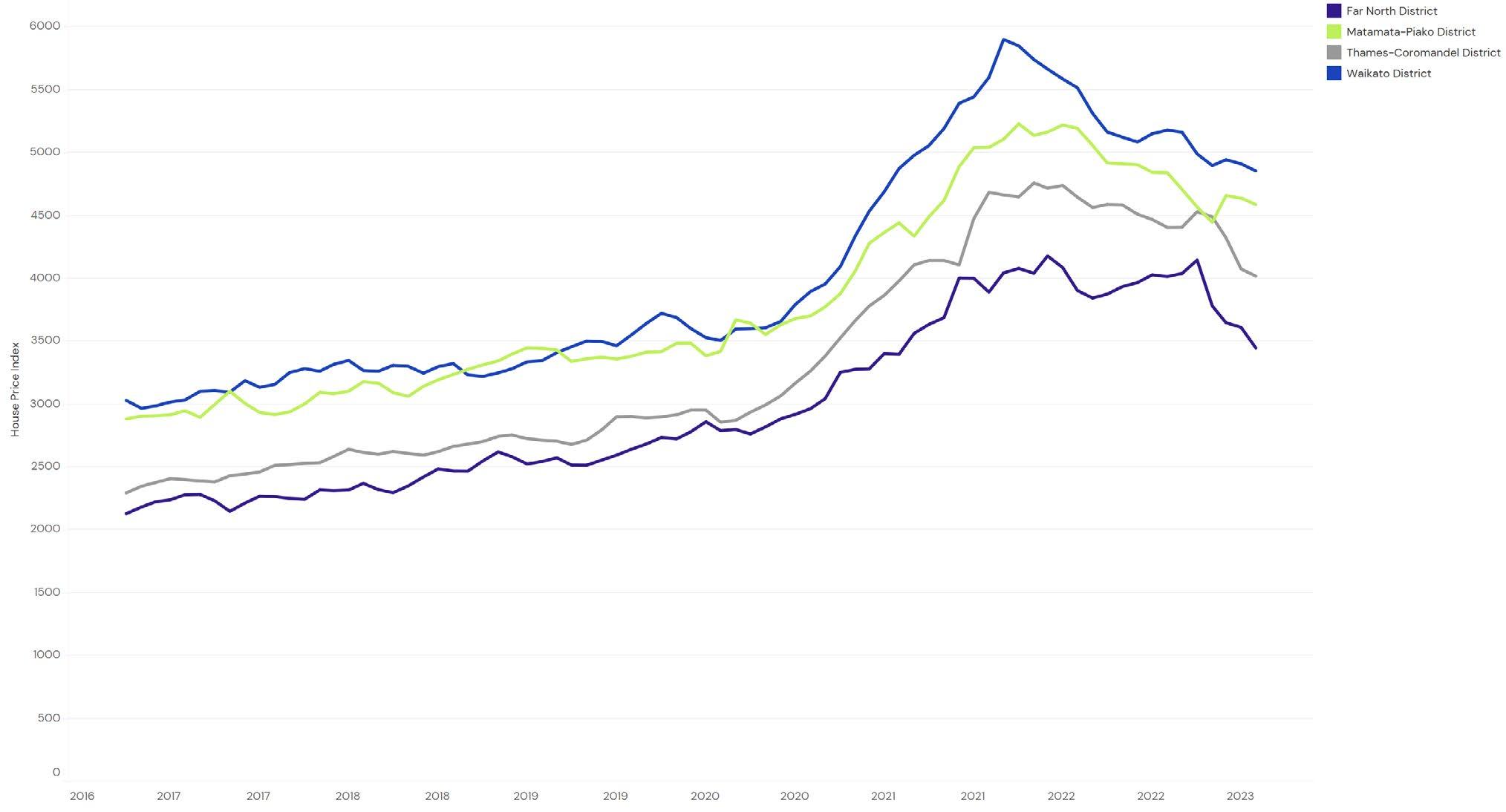

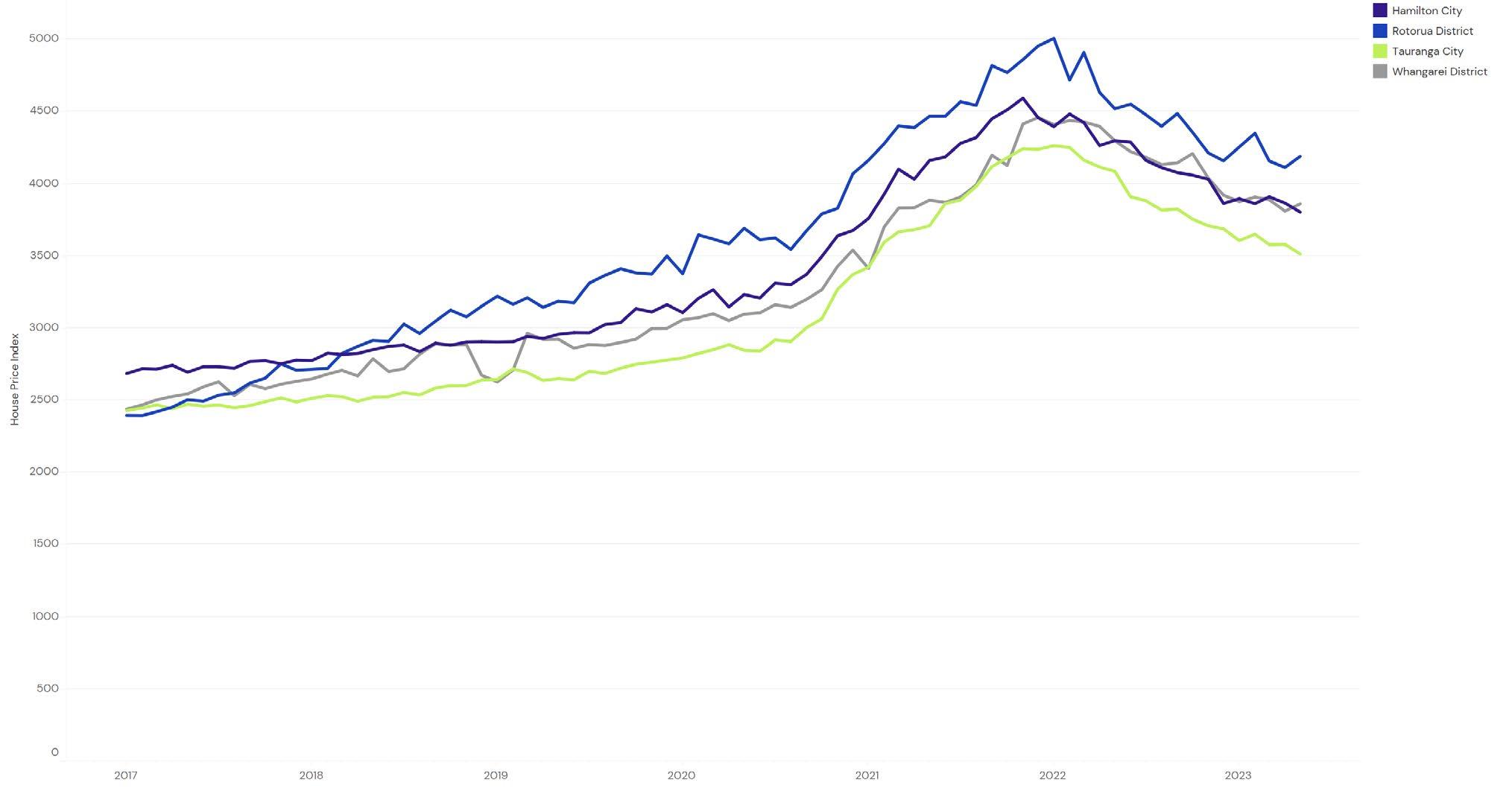

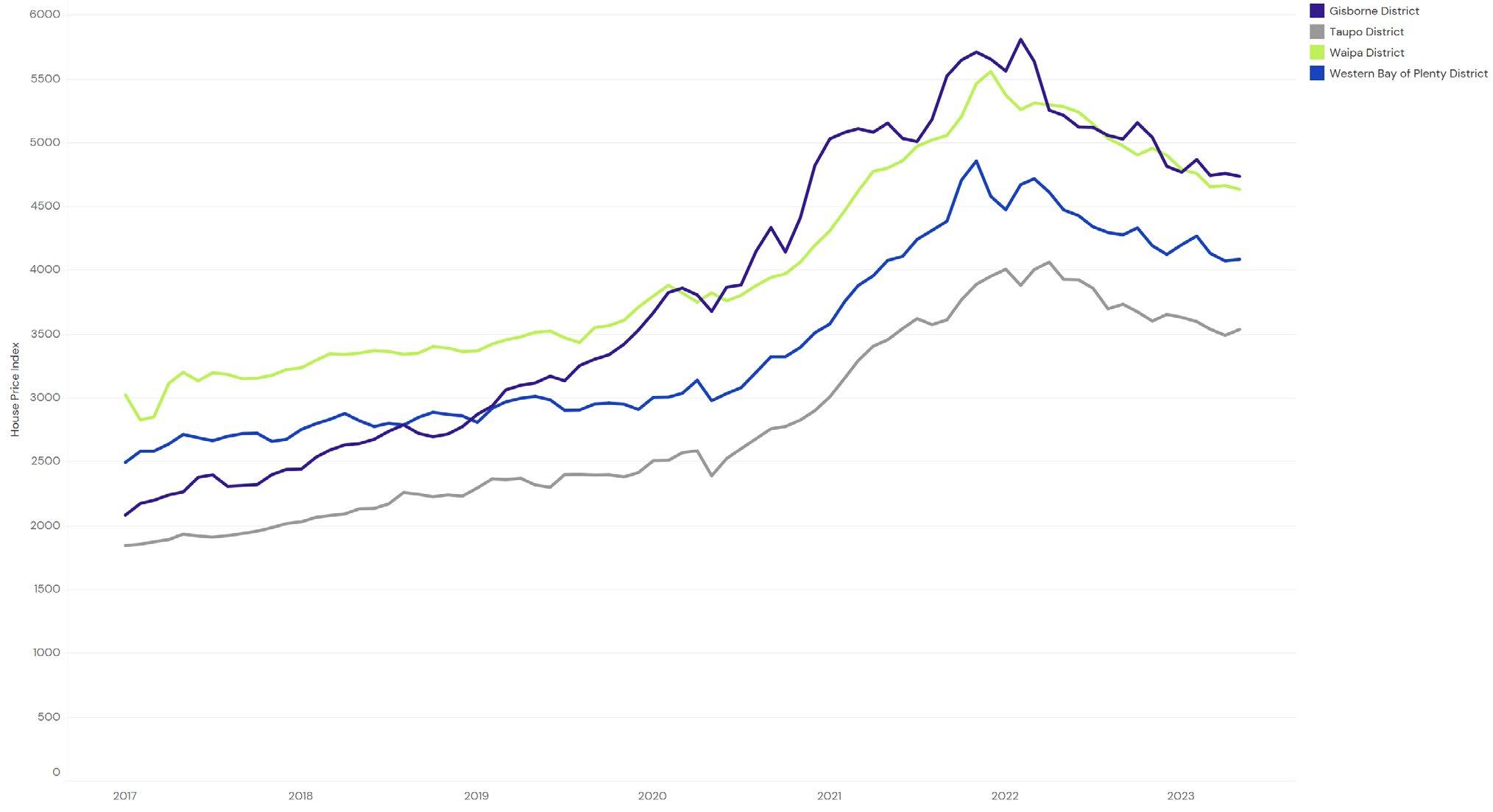

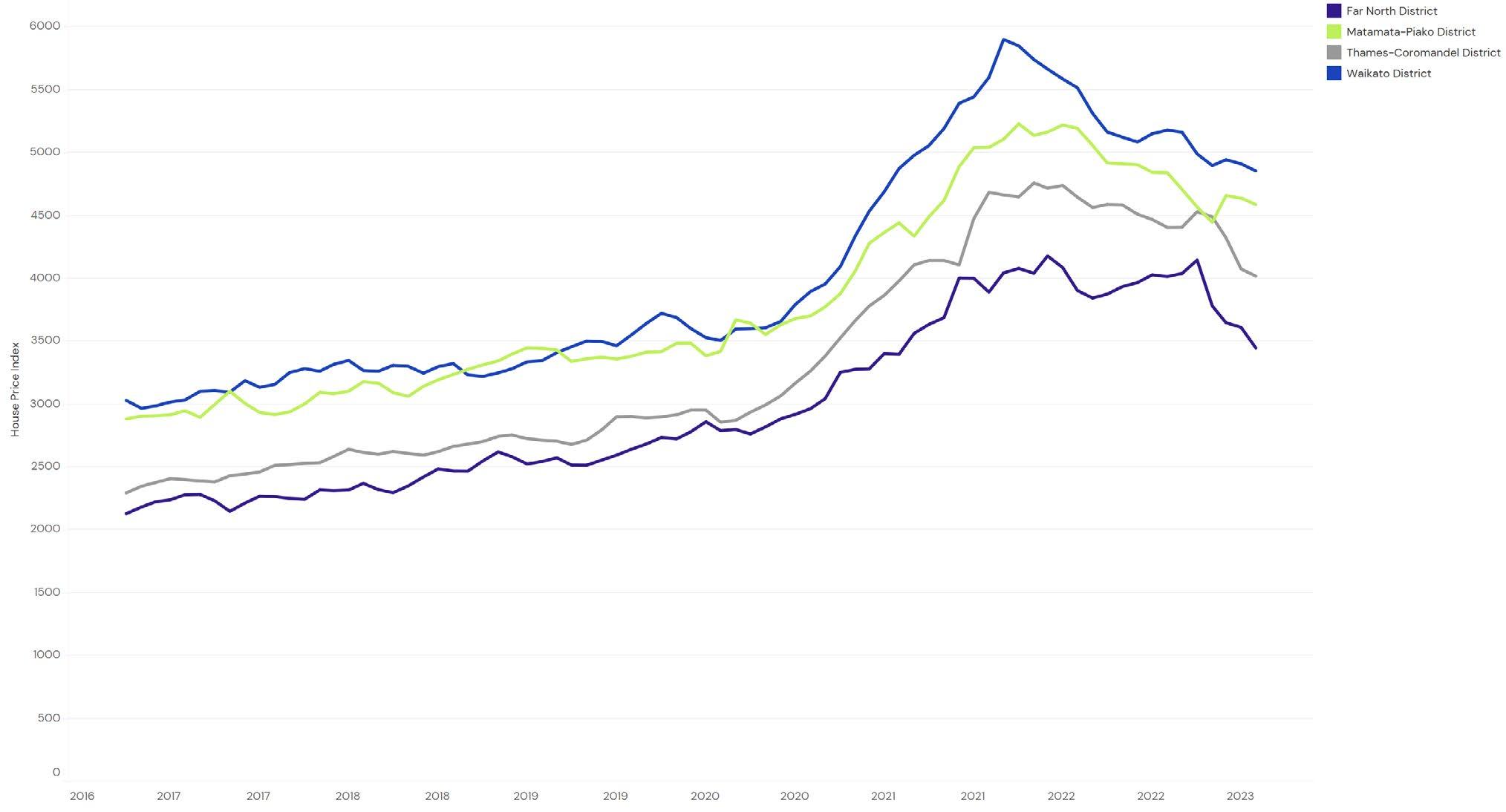

UPPER NORTH ISLAND

REGIONAL HOUSE PRICE INDICIES

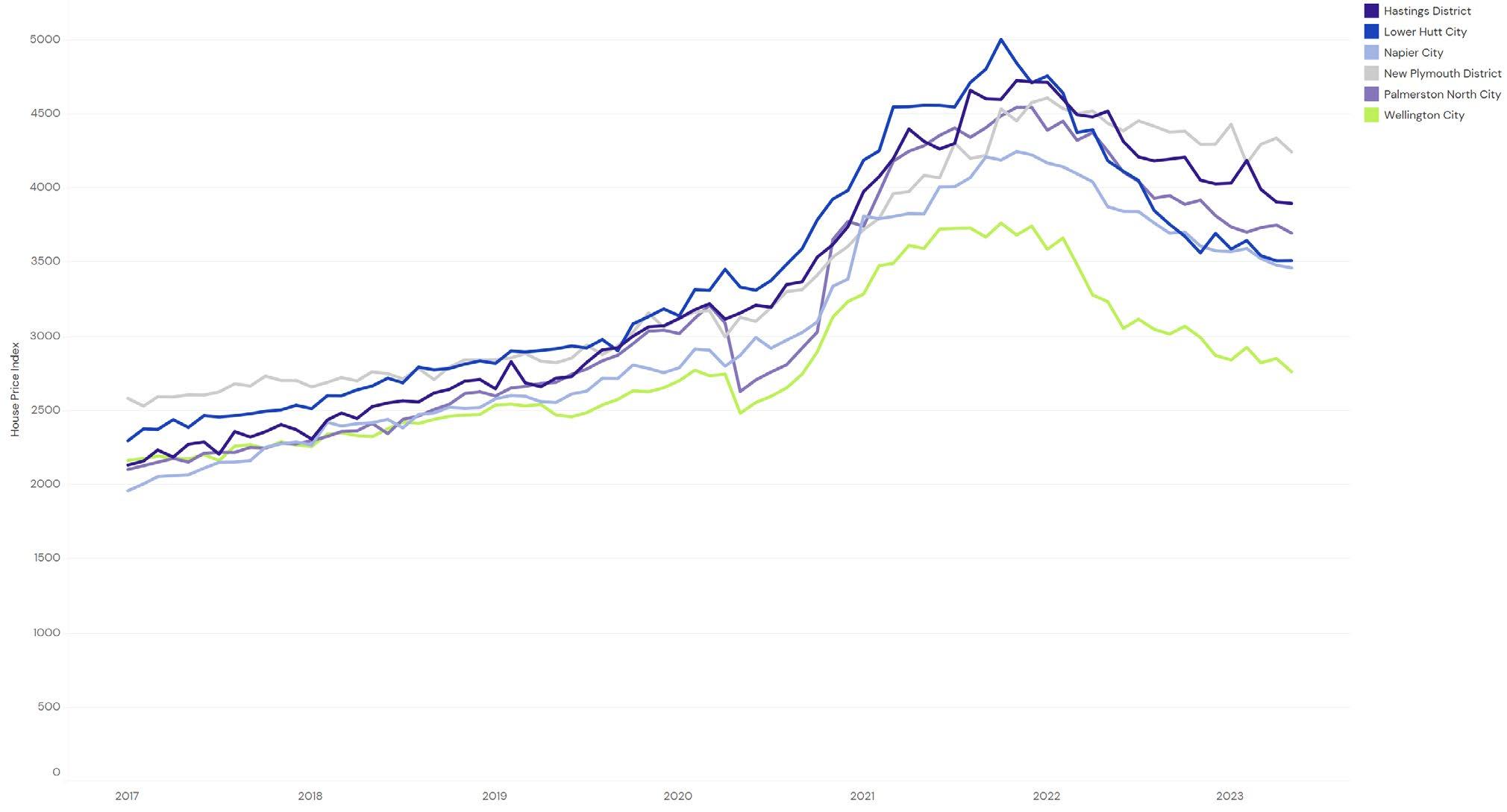

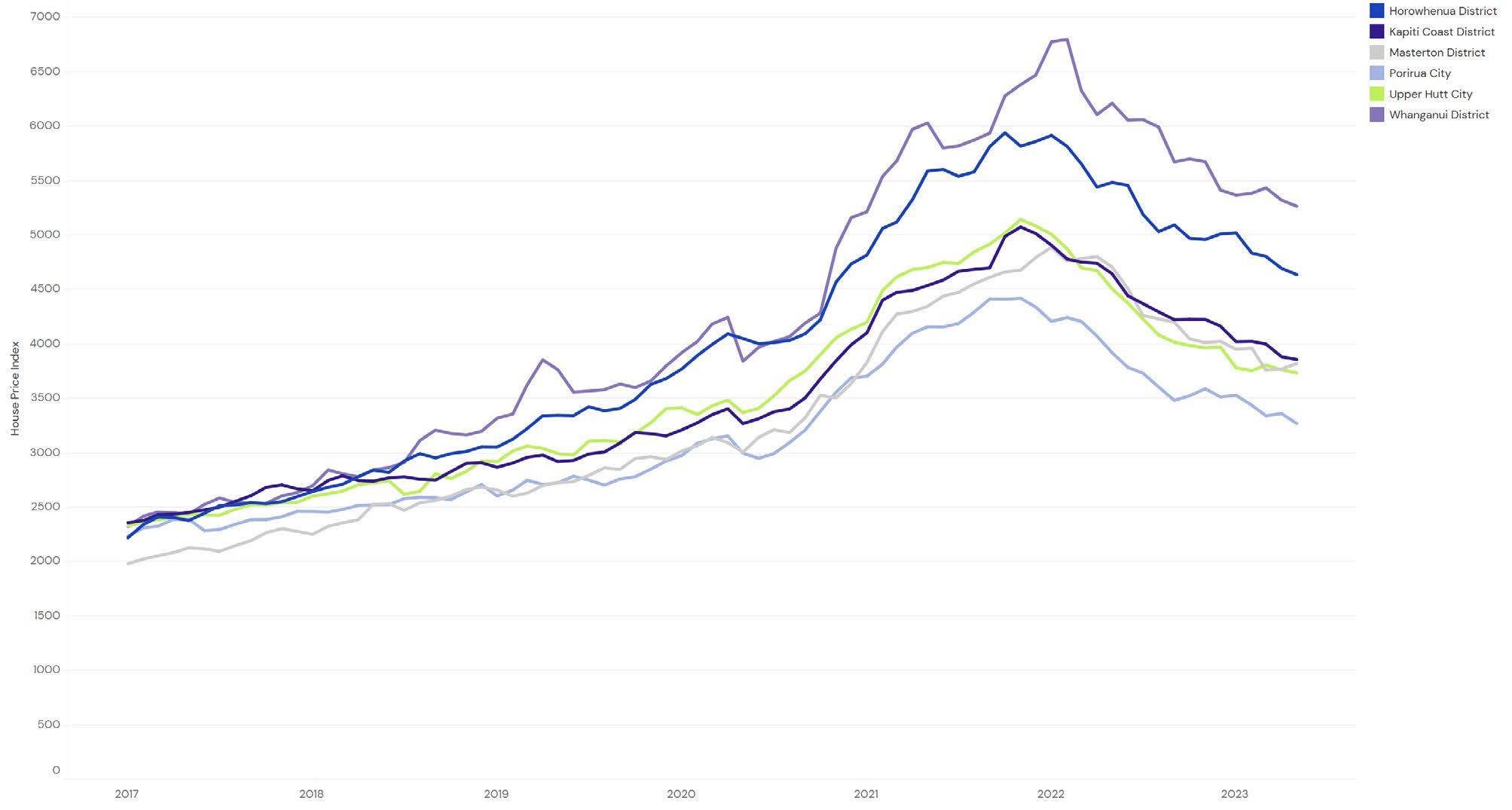

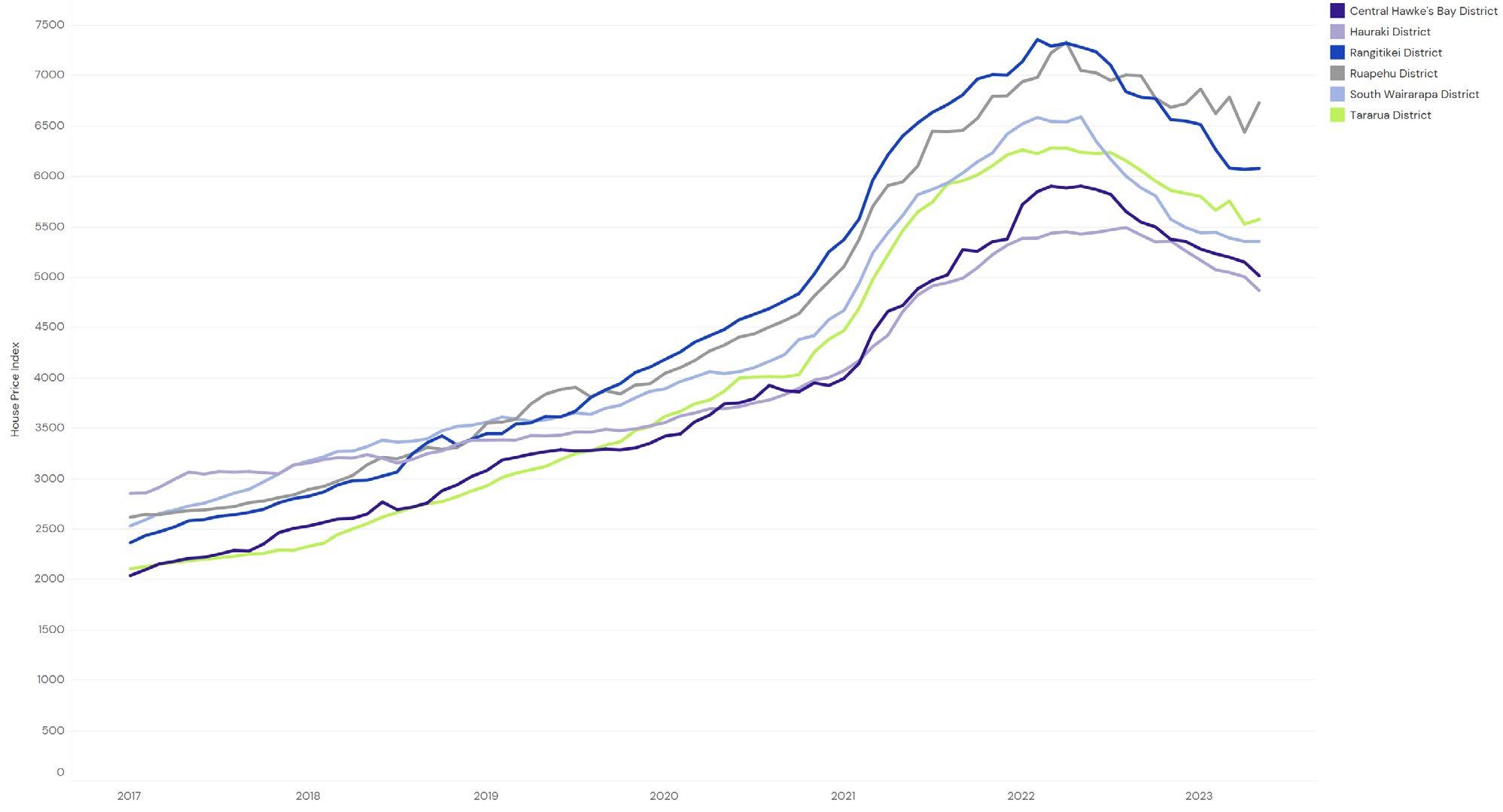

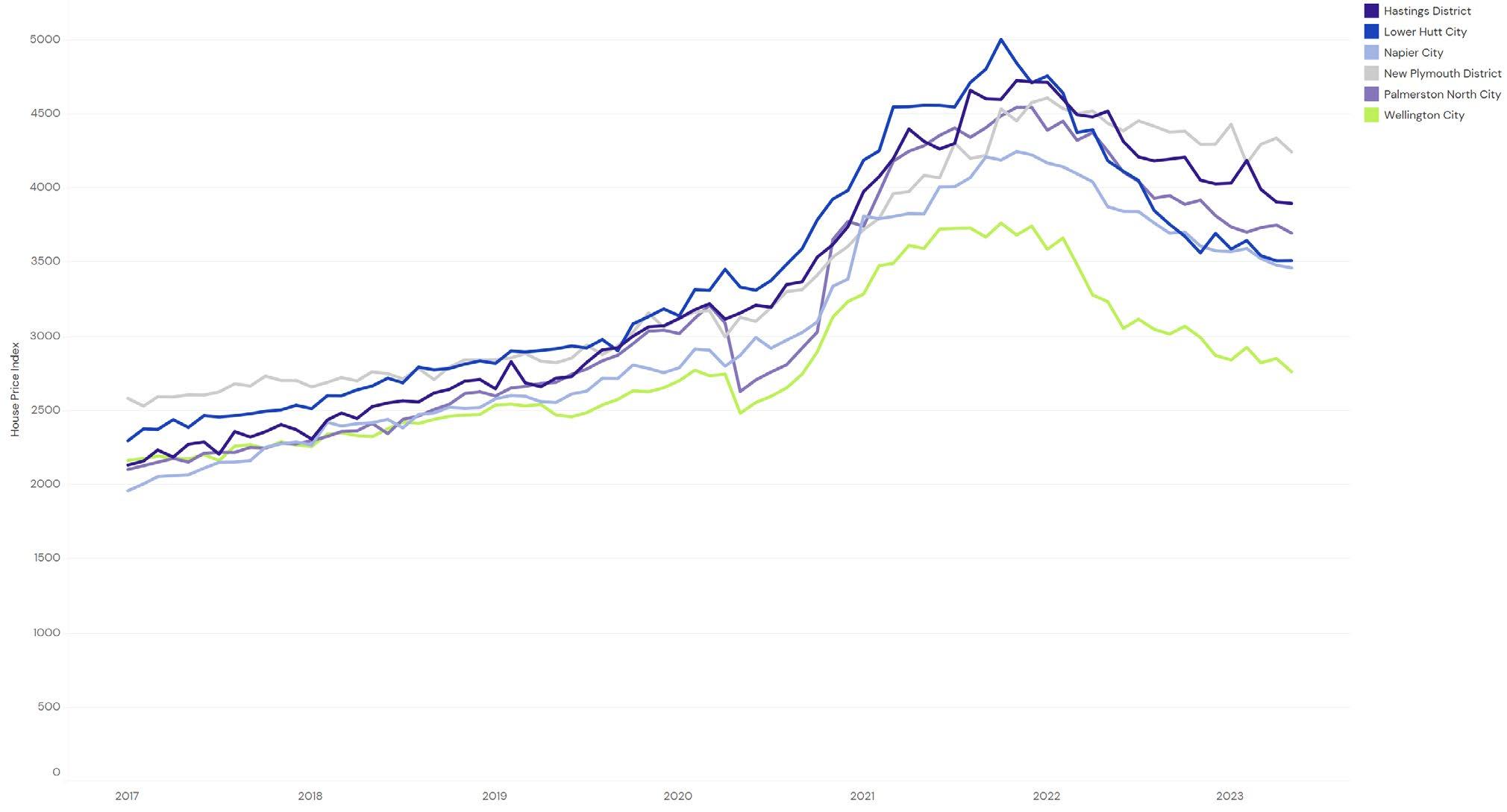

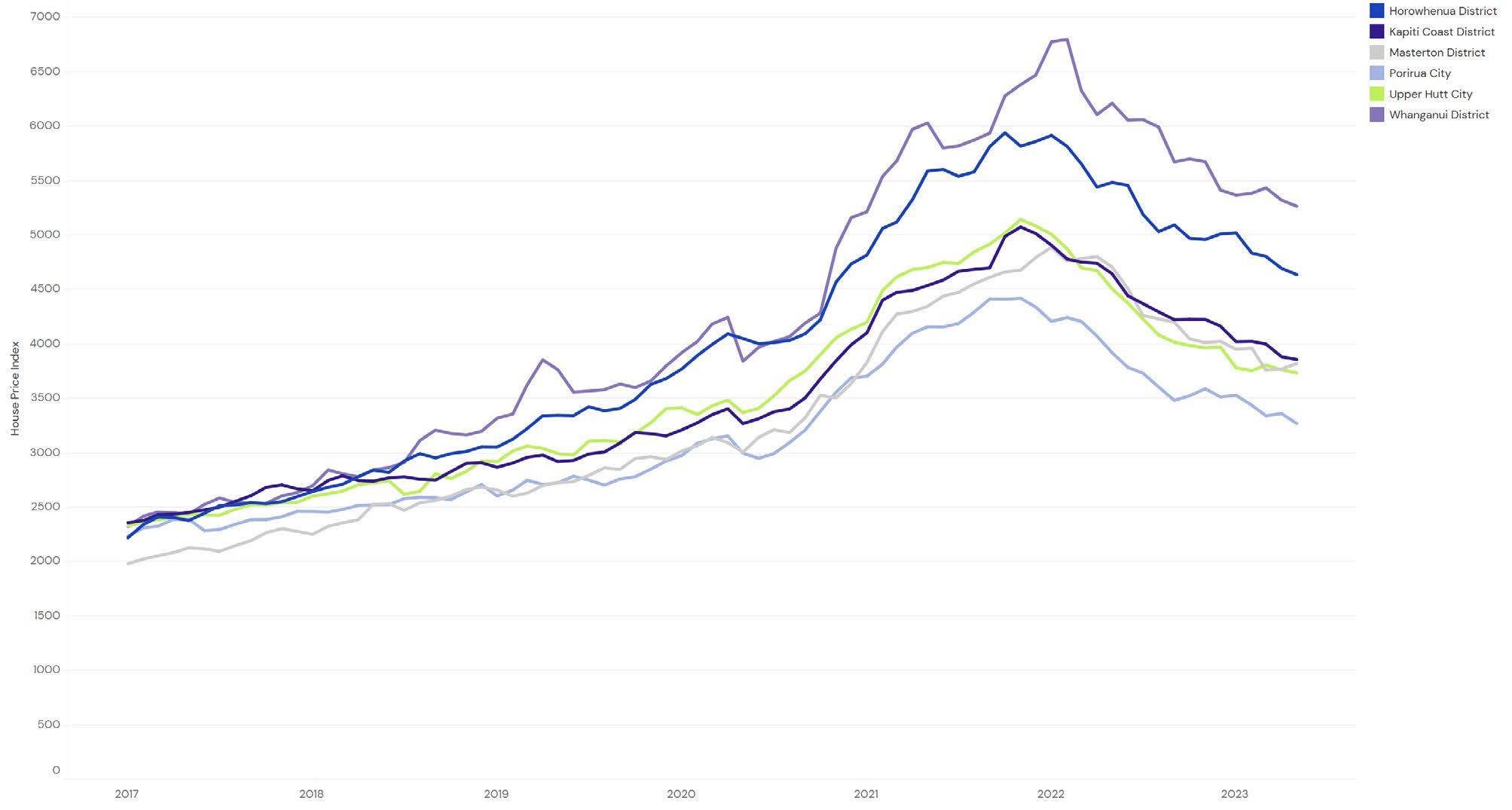

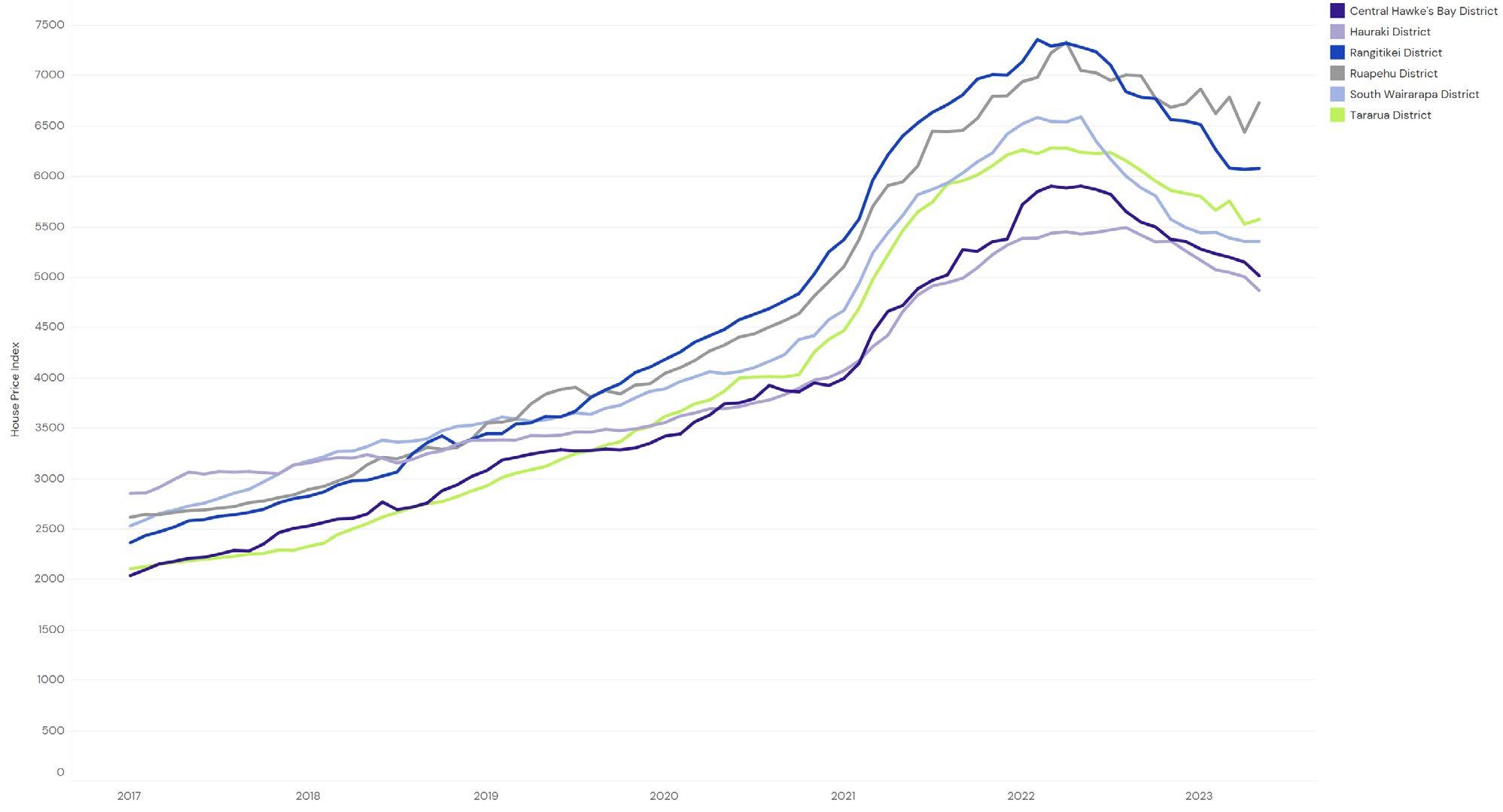

LOWER NORTH ISLAND REGIONAL HOUSE PRICE INDICIES

5 | REINZ Monthly House Price Index Report

Regional House Price Index Figures

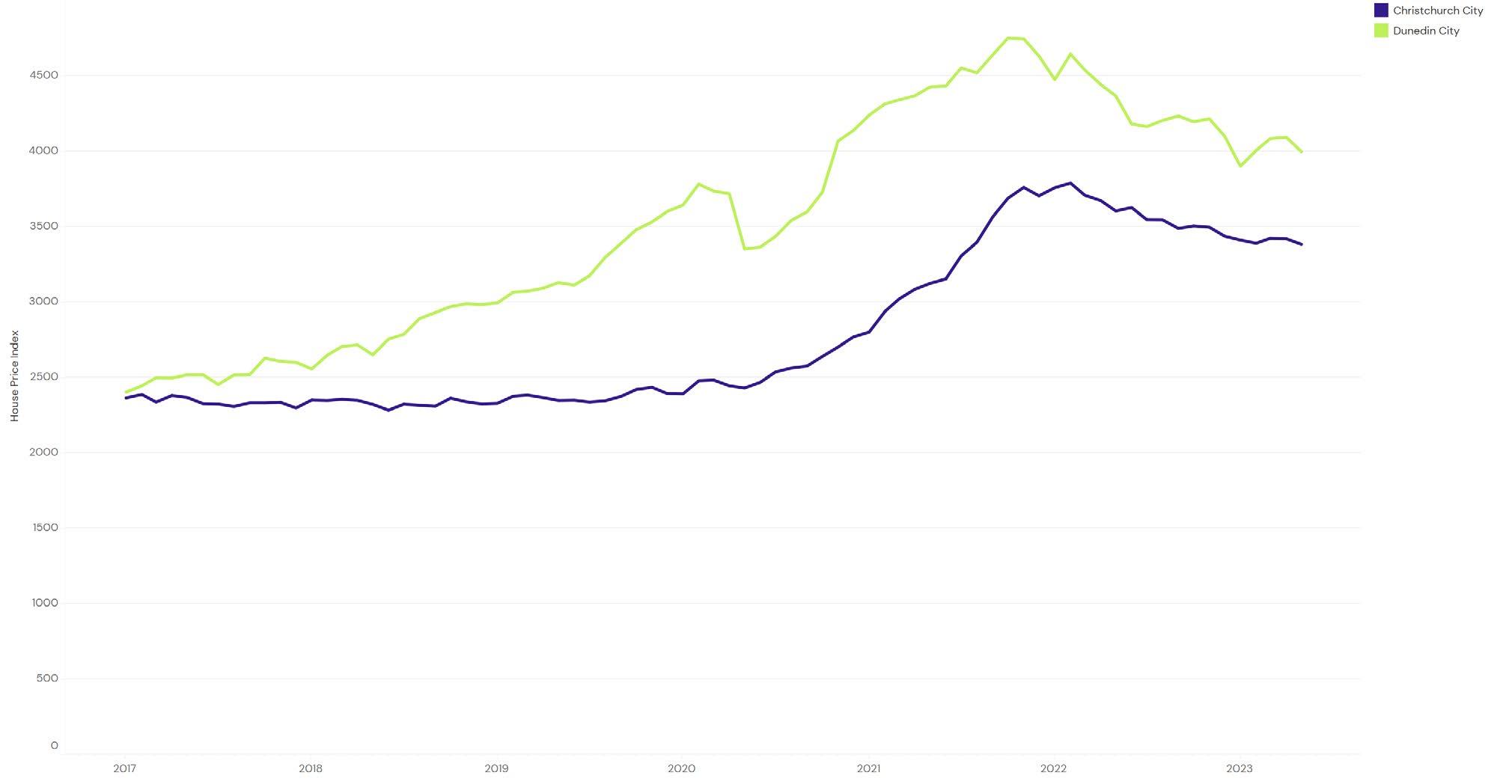

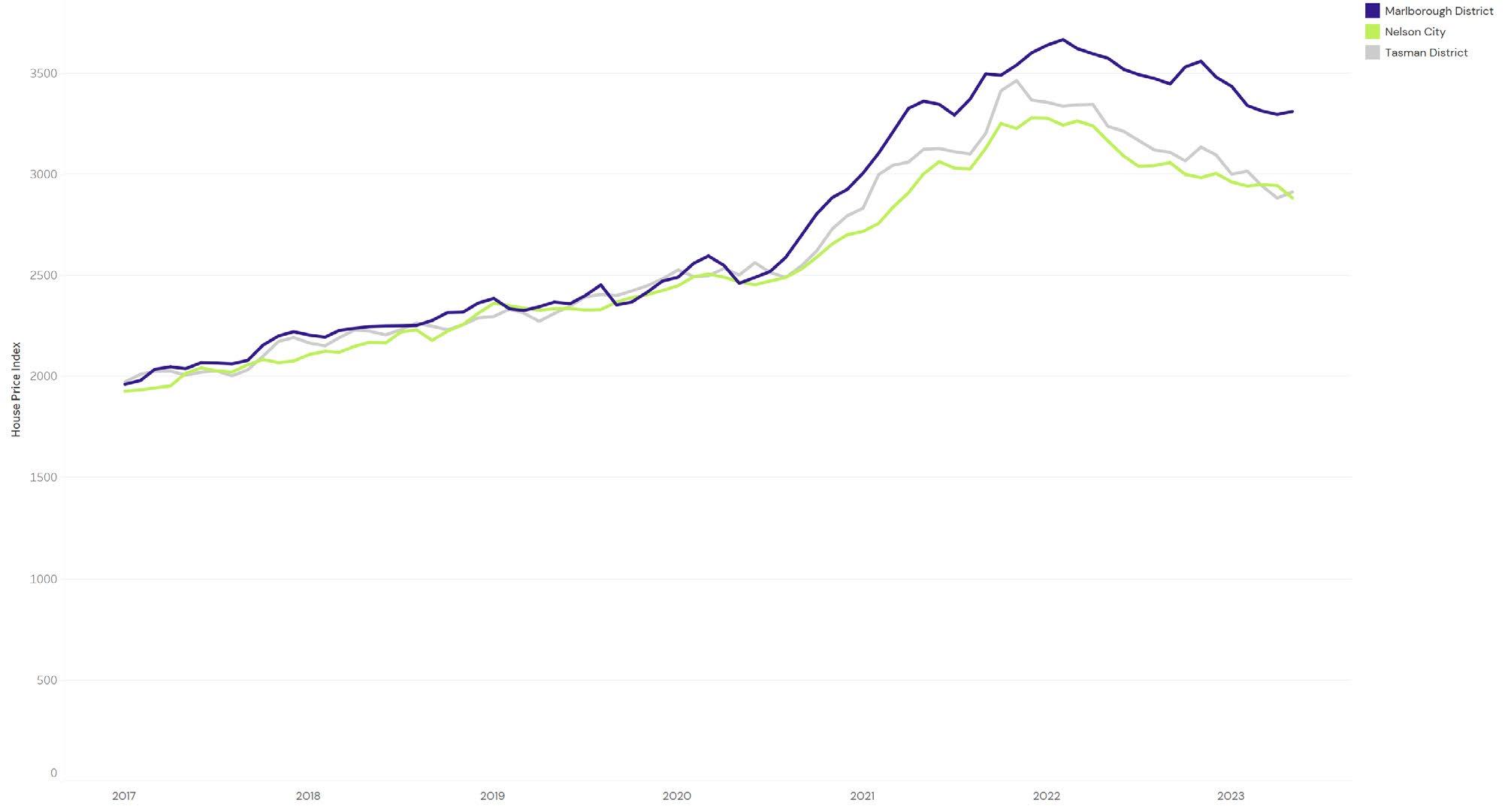

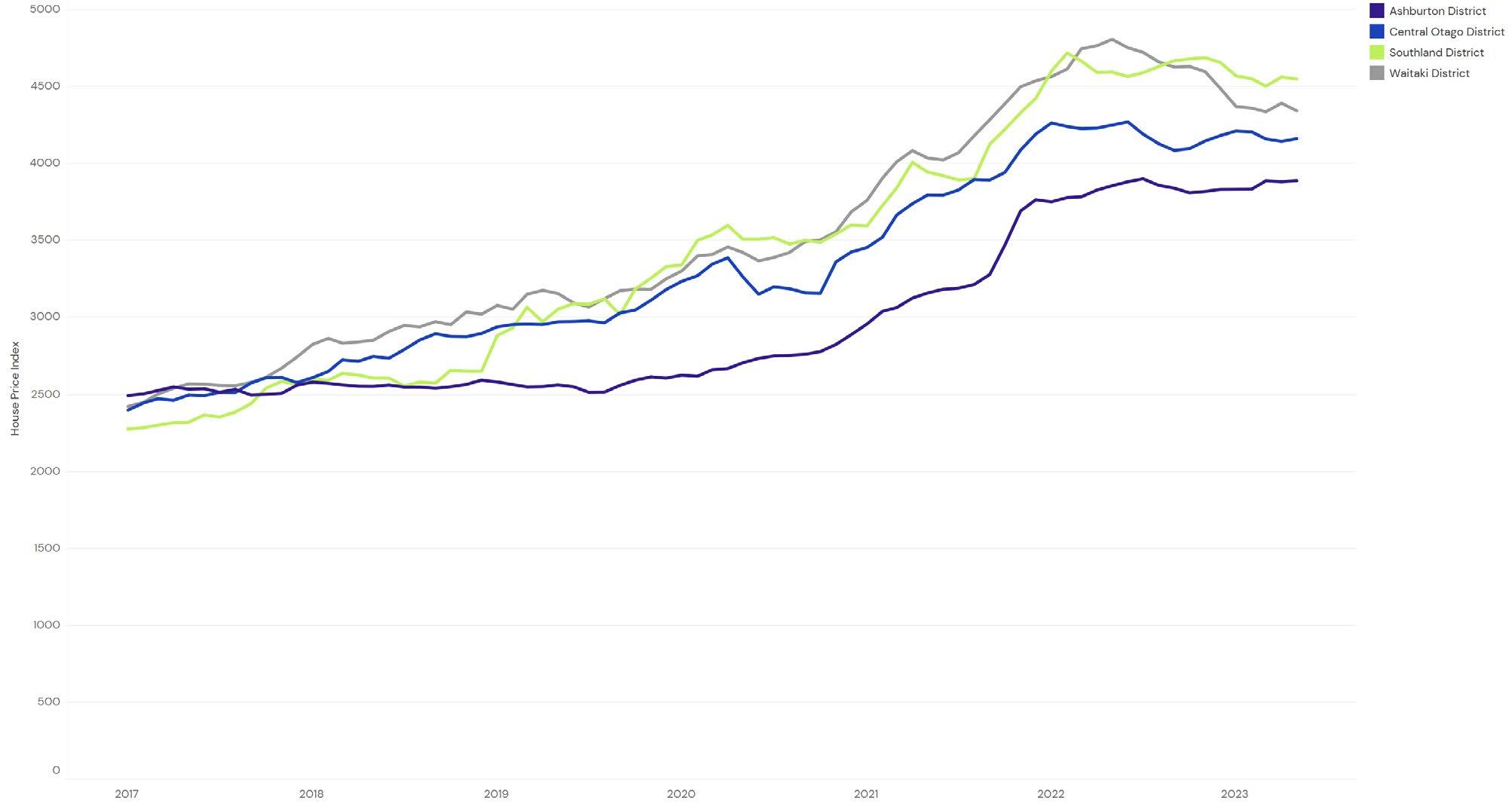

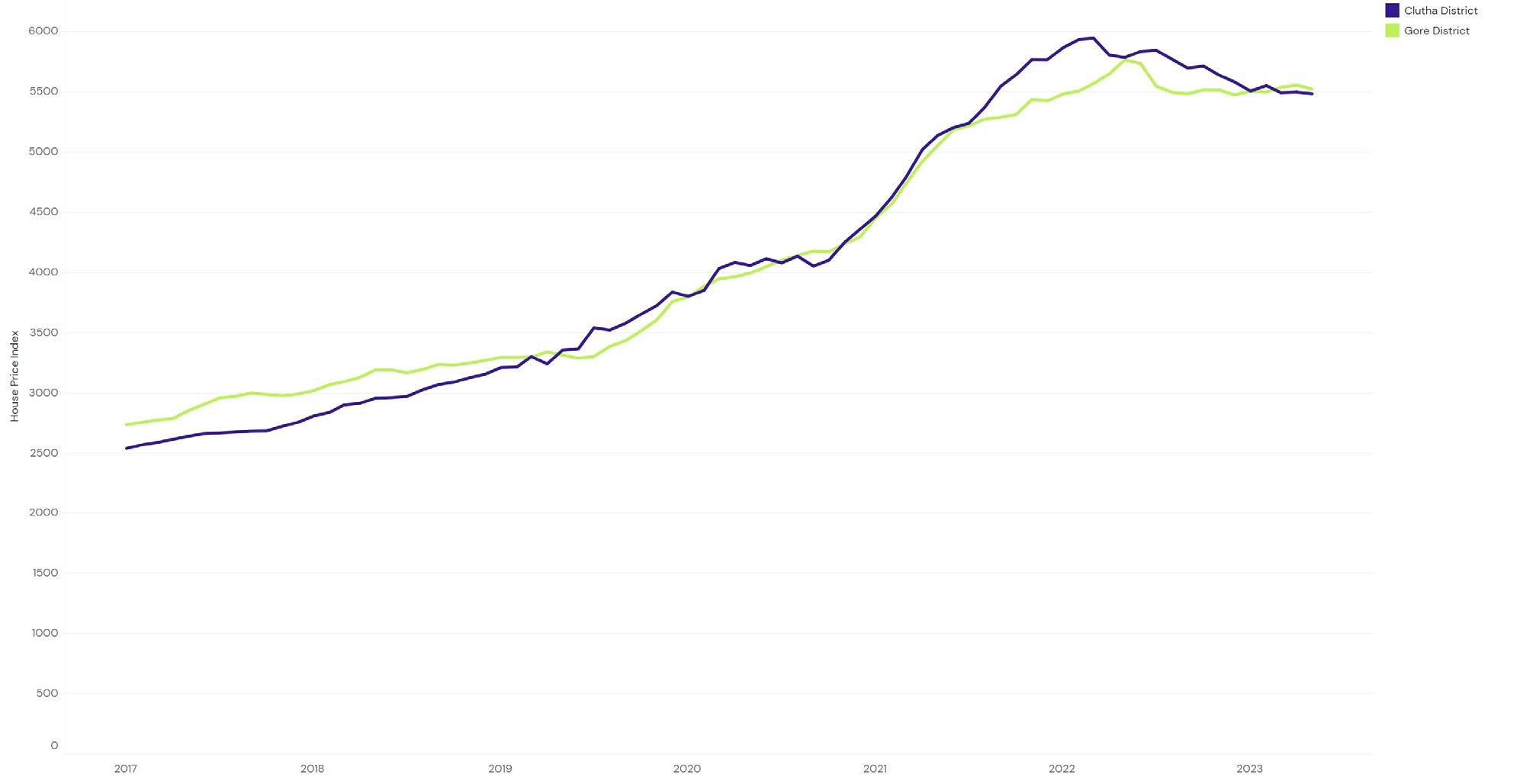

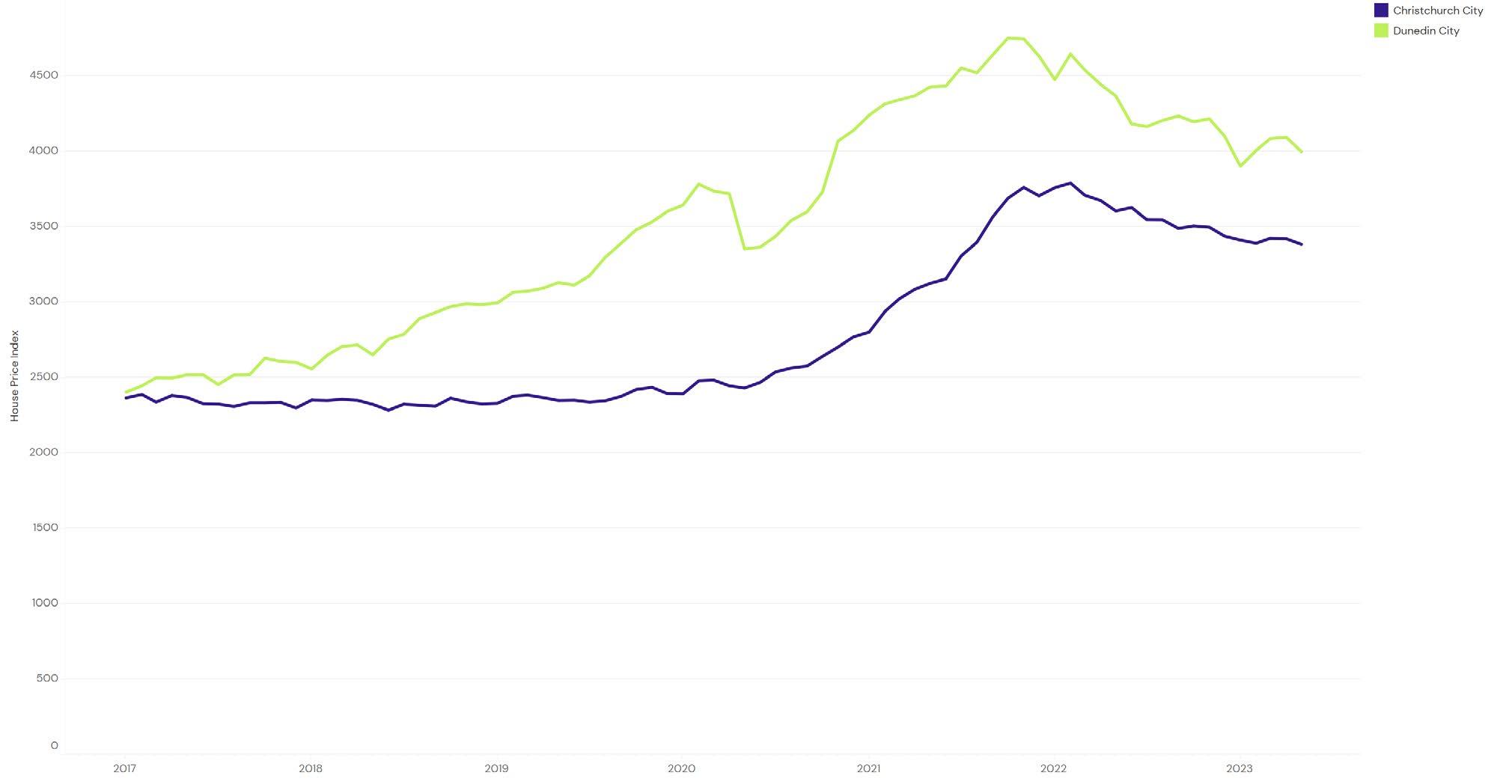

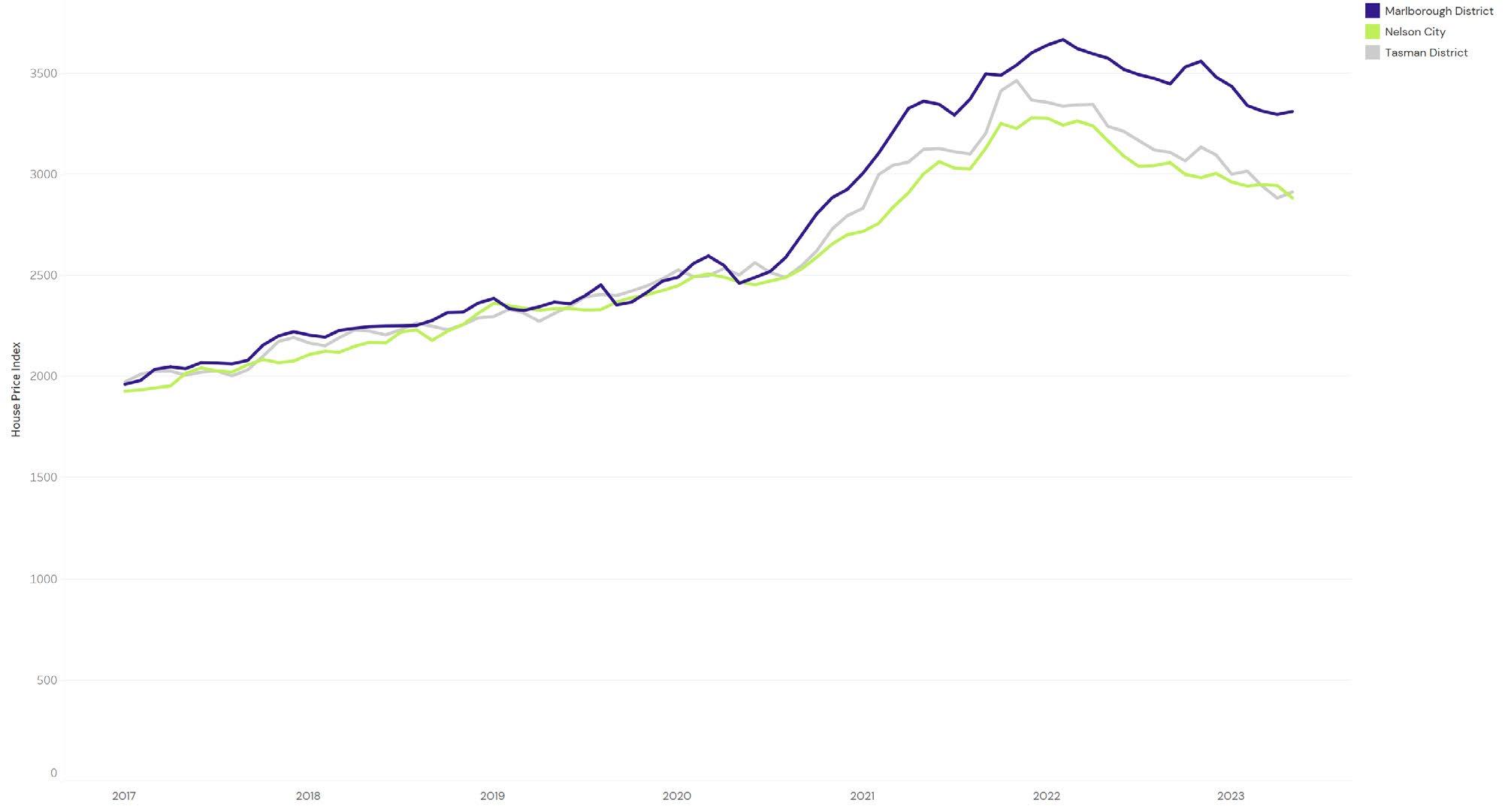

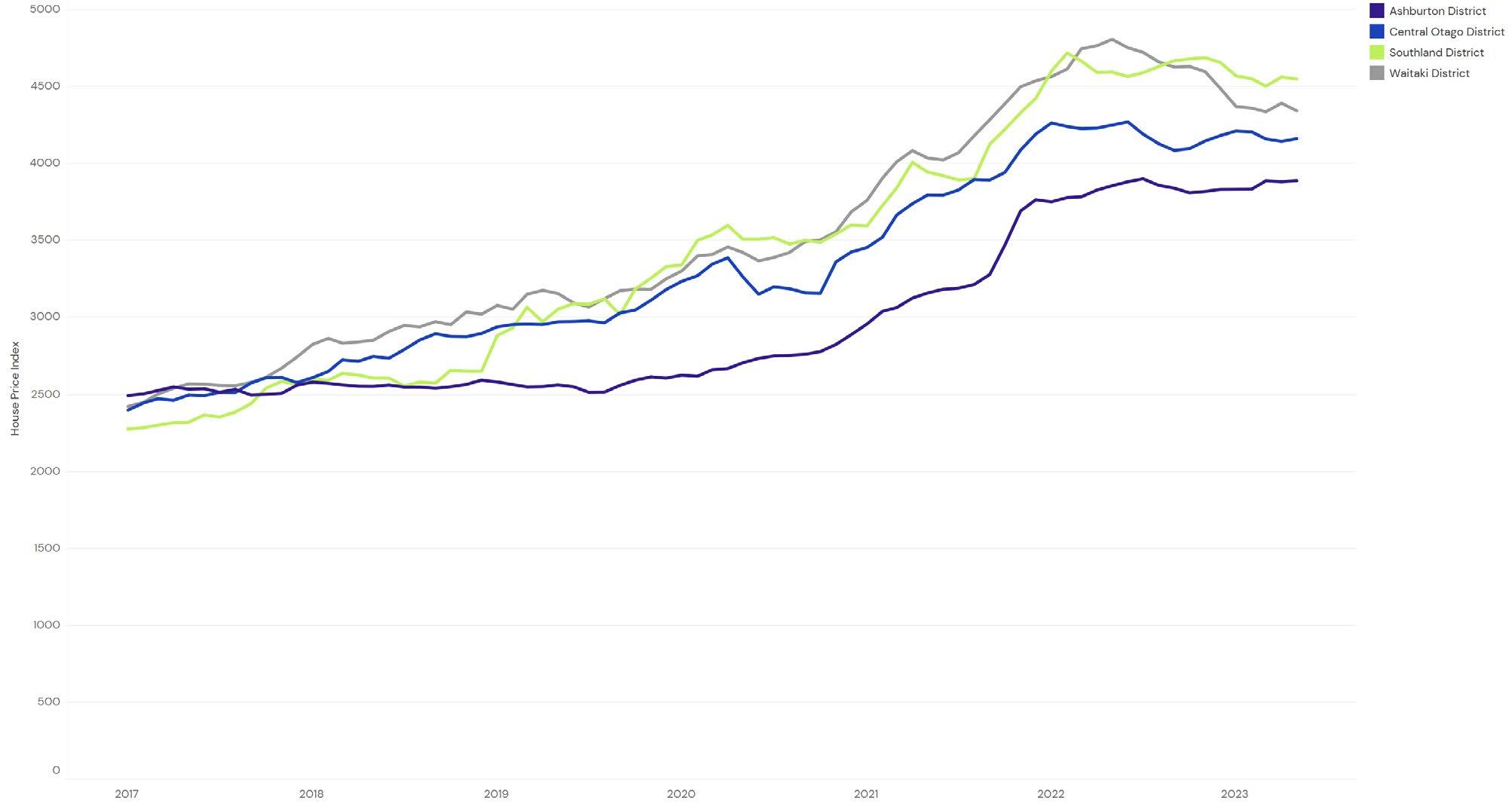

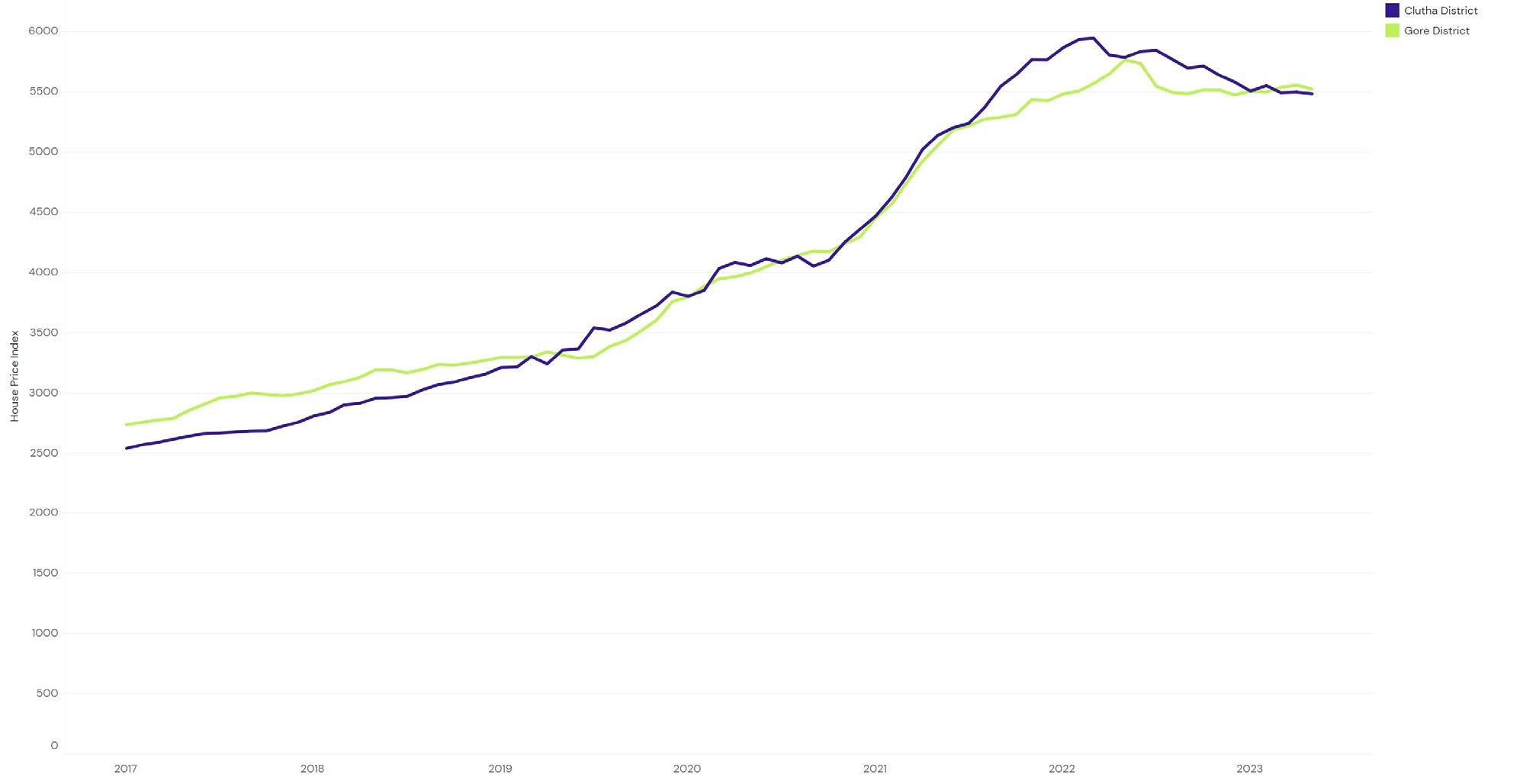

SOUTH ISLAND REGIONAL HOUSE PRICE INDICIES

SUMMARY OF MOVEMENTS

6 | REINZ Monthly House Price Index Report

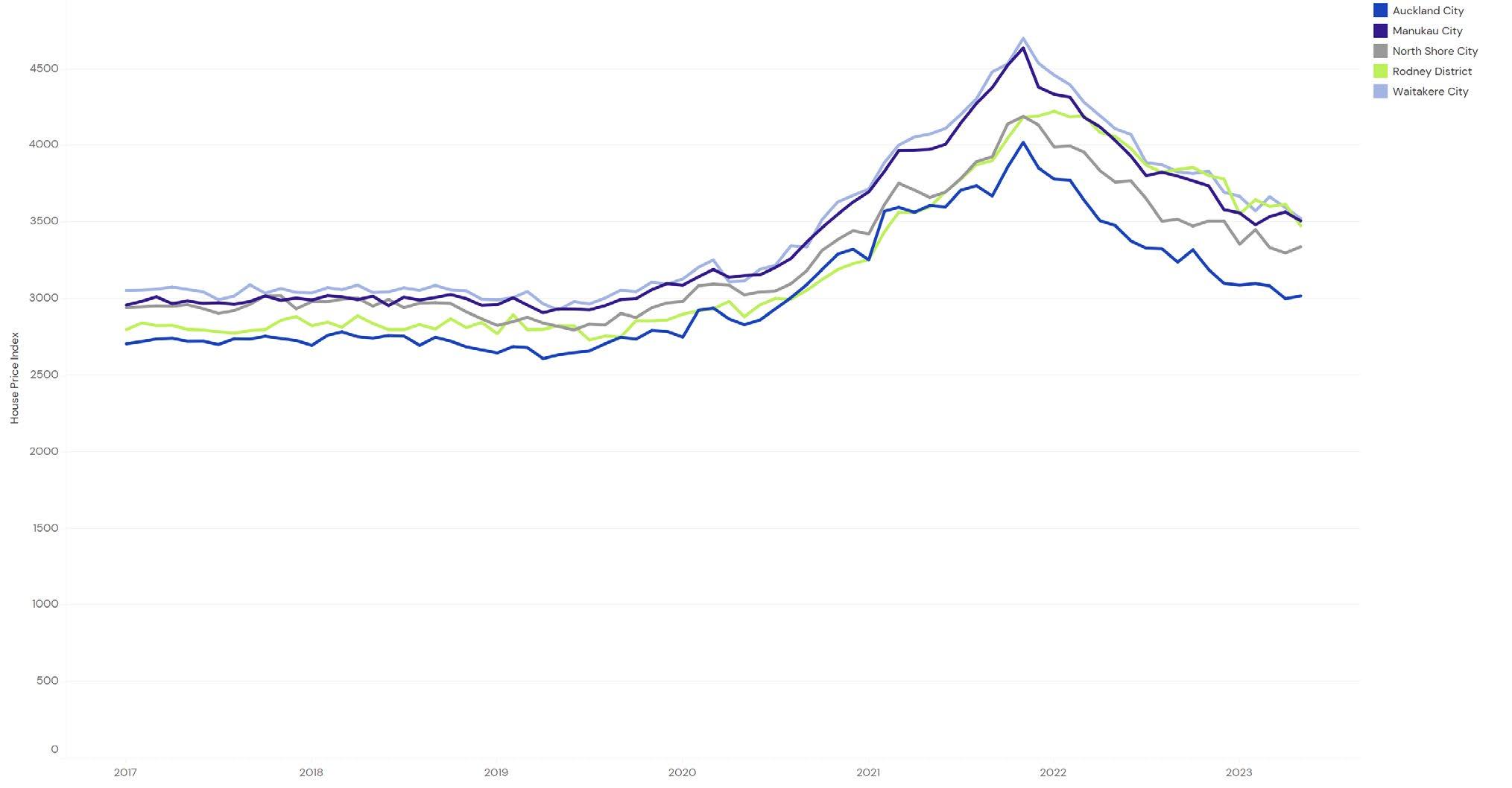

Regional House Price Index Figures House Price Index Index level One Month Three Months One Year Five Years* House Price Index Index level One Month Three Months One Year Five Years* New Zealand 3,507 -0.7% -2.2% -11.2% 5.4% NZ excl. Auckland 3,668 -0.8% -2.2% -10.0% 7.5% Auckland 3,283 -0.4% -2.2% -13.0% 2.6% Rodney District 3,477 -3.9% -4.7% -14.4% 4.1% North Shore City 3,340 1.2% -3.2% -11.2% 2.5% Waitakere City 3,525 -1.9% -1.4% -14.3% 3.0% Auckland City 3,019 0.6% -2.6% -13.2% 1.9% Manukau City 3,509 -1.6% 0.7% -13.0% 3.1% Papakura District 3,756 -0.3% 0.5% -15.2% 4.4% Franklin District 3,939 1.8% -5.8% -13.5% 4.7% Other North Island Whangarei District 3,861 1.3% -1.2% -10.2% 6.7% Hamilton City 3,804 -1.6% -1.5% -11.5% 5.9% Tauranga City 3,514 -1.9% -3.8% -14.0% 6.9% Rotorua District 4,190 1.9% -3.7% -7.3% 7.5% Hastings District 3,898 -0.3% -6.9% -13.8% 9.0% Napier City 3,464 -0.5% -3.6% -10.6% 7.4% New Plymouth District 4,246 -2.1% 1.9% -4.3% 9.0% Palmerston North City 3,698 -1.5% -0.2% -13.0% 8.9% Wellington 3,205 -1.4% -4.3% -15.1% 5.1% Porirua City 3,277 -1.9% -0.5% -15.1% 5.6% Upper Hutt City 3,817 3.9% -0.9% -13.8% 6.7% Lower Hutt City 3,512 0.0% -3.7% -16.1% 5.7% Wellington City 2,763 -3.2% -5.6% -14.6% 3.5% South Island Nelson City 2,814 -2.5% -3.0% -8.9% 5.7% Christchurch City 3,382 -1.1% -0.2% -6.1% 7.8% Queenstown-Lakes District 3,599 0.3% -1.0% -1.4% 6.5% Dunedin City 3,997 -2.3% -0.2% -8.5% 8.6% Invercargill City 4,105 -0.3% -1.4% -7.8% 10.8%

Source: REINZ *=Compound Growth Rate

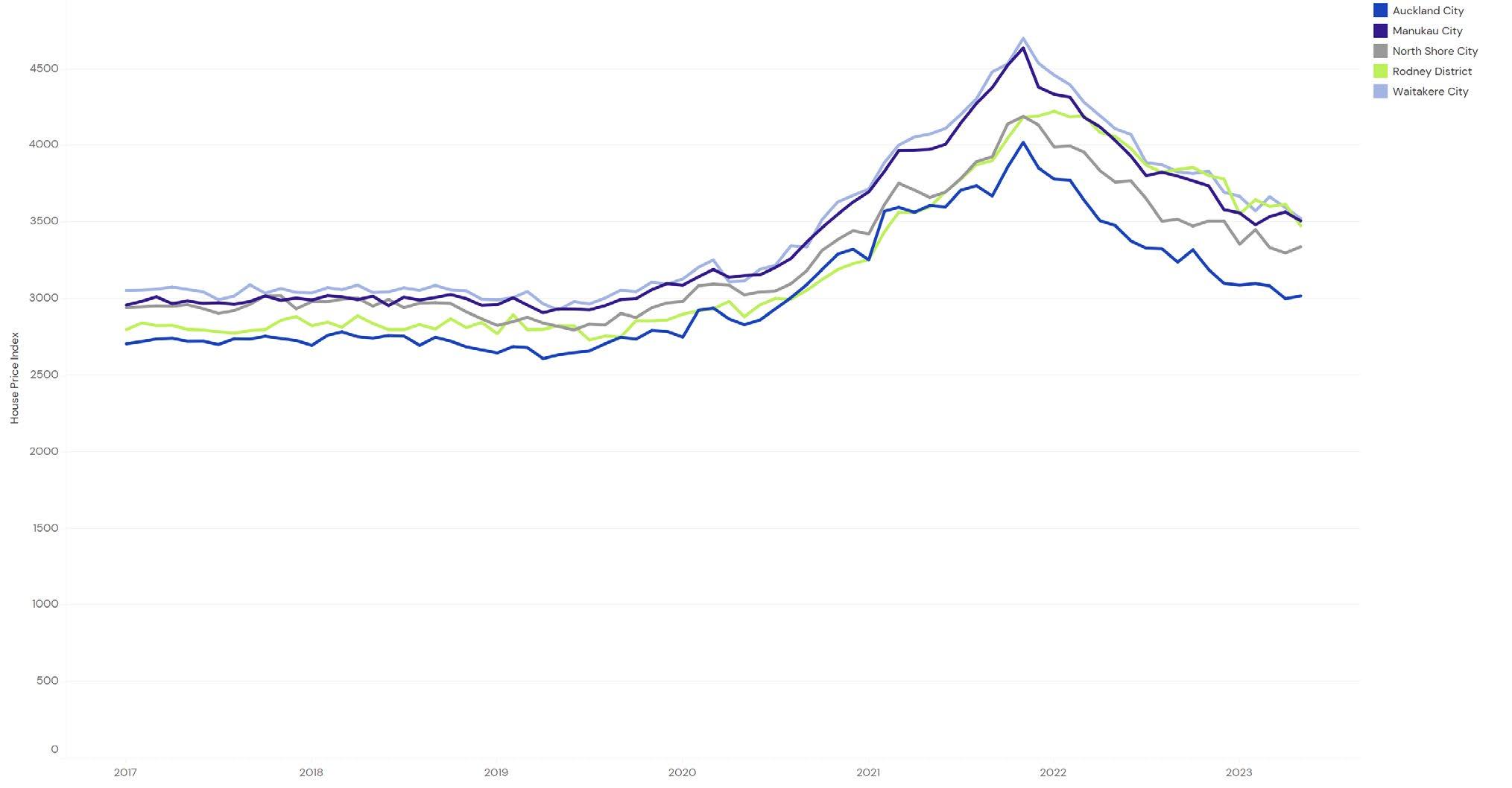

AUCKLAND COUNCILS HOUSE PRICE INDICIES

UPPER NORTH ISLAND (EX-AUCKLAND)

COUNCIL HOUSE PRICE INDICIES

7 | REINZ Monthly House Price Index Report

Monthly Calculated House Price Index Figures For Councils

LOWER NORTH ISLAND COUNCILS HOUSE PRICE INDICIES

SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES

8 | REINZ Monthly House Price Index Report

Monthly Calculated House Price Index Figures For Councils

UPPER NORTH ISLAND

(EX-AUCKLAND) COUNCILS HOUSE PRICE INDICIES

MID NORTH ISLAND COUNCIL HOUSE PRICE INDICIES

9 | REINZ Monthly House Price Index Report Two Month Rolling Calculated House Price Index Figures For Councils

LOWER NORTH ISLAND COUNCILS HOUSE PRICE INDICIES

UPPER SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES

10 | REINZ Monthly House Price Index Report Two Month Rolling Calculated House Price Index Figures For Councils

LOWER SOUTH ISLAND

COUNCIL HOUSE PRICE INDICIES

11 | REINZ Monthly House Price Index Report Two Month Rolling Calculated House Price Index Figures For Councils

NORTH ISLAND COUNCILS HOUSE PRICE INDICIES

SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES

12 | REINZ Monthly House Price Index Report Three Month Rolling Calculated House Price Index Figures For Councils

NORTH ISLAND COUNCILS HOUSE PRICE INDICIES

SOUTH ISLAND COUNCIL HOUSE PRICE INDICIES

13 | REINZ Monthly House Price Index Report Six Month Rolling Calculated House Price Index Figures For Councils

TERRITORIAL AUTHORITY HPI VALUES

DISCLAIMER

This report is intended for general information purposes only. This report and the information contained herein is under no circumstances intended to be used or considered as legal, financial or investment advice. The material in this report is obtained from various sources (including third parties) and REINZ does not warrant the accuracy, reliability or completeness of the information provided in this report and does not accept liability for any omissions, inaccuracies or losses incurred, either directly or indirectly, by any person arising from or in connection with the supply, use or misuse of the whole or any part of this report. Any and all third party data or analysis in this report does not necessarily represent the views of REINZ. When referring to this report or any information contained herein, you must cite REINZ as the source of the information. REINZ reserves the right to request that you immediately withdraw from publication any document that fails to cite REINZ as the source.

14 | REINZ Monthly House Price Index Report

Council Calculated HPI Ashburton District 3 month rolling 3,892 Auckland City Actual Month 3,019 Buller District 6 month rolling 4,221 Carterton District 6 month rolling 4,433 Central Hawke’s Bay District 6 month rolling 5,019 Central Otago District 3 month rolling 4,165 Christchurch City Actual Month 3,382 Clutha District 6 month rolling 5,489 Dunedin City Actual Month 3,997 Far North District 2 month rolling 3,449 Franklin District 2 month rolling 3,773 Gisborne District 2 month rolling 4,740 Gore District 6 month rolling 5,528 Grey District 6 month rolling 3,880 Hamilton City Actual Month 3,804 Hastings District Actual Month 3,898 Hauraki District 6 month rolling 4,873 Horowhenua District 2 month rolling 4,640 Hurunui District 6 month rolling 4,561 Invercargill City Actual Month 4,105 Kaikoura District 3 month rolling 3,204 Kaipara District 2 month rolling 4,628 Kapiti Coast District Actual Month 3,922 Kawerau District 3 month rolling 6,216 Lower Hutt City Actual Month 3,512 Mackenzie District 6 month rolling 7,275 Manawatu District 3 month rolling 4,731 Manukau City Actual Month 3,509 Marlborough District 2 month rolling 3,311 Masterton District 2 month rolling 3,823 Matamata-Piako District 2 month rolling 4,590 Napier City Actual Month 3,464 Nelson City 2 month rolling 2,884 New Plymouth District Actual Month 4,246 North Shore City Actual Month 3,340 Opotiki District 6 month rolling 4,485 Council Calculated HPI Otorohanga District 6 month rolling 5,058 Palmerston North City Actual Month 3,698 Papakura District 2 month rolling 3,745 Porirua City 2 month rolling 3,272 Queenstown-Lakes District 2 month rolling 3,762 Rangitikei District 6 month rolling 6,085 Rodney District Actual Month 3,477 Rotorua District Actual Month 4,190 Ruapehu District 6 month rolling 6,737 Selwyn District 2 month rolling 3,849 South Taranaki District 3 month rolling 4,737 South Waikato District 3 month rolling 6,887 South Wairarapa District 6 month rolling 5,362 Southland District 3 month rolling 4,552 Stratford District 6 month rolling 5,856 Tararua District 6 month rolling 5,579 Tasman District 2 month rolling 2,913 Taupo District 2 month rolling 3,541 Tauranga City Actual Month 3,514 Thames-Coromandel District 2 month rolling 4,021 Timaru District 2 month rolling 4,475 Upper Hutt City 2 month rolling 3,735 Waikato District 2 month rolling 4,857 Waimakariri District 2 month rolling 3,683 Waimate District 6 month rolling 6,319 Waipa District 2 month rolling 4,639 Wairoa District 6 month rolling 4,946 Waitakere City Actual Month 3,525 Waitaki District 3 month rolling 4,346 Waitomo District 6 month rolling 5,280 Wellington City Actual Month 2,763 Western Bay of Plenty District 2 month rolling 4,091 Westland District 6 month rolling 4,934 Whakatane District 3 month rolling 4,117 Whanganui District 2 month rolling 5,268 Whangarei District Actual Month 3,861

REINZ & TONY ALEXANDER REAL ESTATE SURVEY

June 2023

MORE TURNAROUND SIGNS EVIDENT

Welcome to the REINZ & Tony Alexander Real Estate Survey. This survey gathers together the views of licensed real estate agents all over New Zealand regarding how they are seeing conditions in the residential property market in their areas at the moment. We ask them how activity levels are changing, what the views of first home buyers and investors are, and the factors which are affecting sentiment of those two large groups.

The key results from this month’s survey include the following.

The net proportions of agents seeing more people attending auctions and open homes are at their highest levels in over two years.

• FOOP – the fear of overpaying – has fallen to its lowest level since January 22.

• FOMO is trending up but remains low with only 9% of agents noting buyers displaying this worry.

Buyers are becoming less relaxed about listings being plentiful.

ARE MORE OR FEWER PEOPLE SHOWING UP AT AUCTIONS?

For the first time in over two years our survey has shown more agents are seeing increased numbers attending auctions than are seeing decreased numbers. The net percentage of respondents at 2% is some distance from the high results during the second half of 2020. But back then trading was in a pandemic frenzy. This time around, the result is one of many indicators telling us that the market is bottoming out and may already have done so.

ARE MORE OR FEWER PEOPLE ATTENDING OPEN HOMES?

A net 32% of our 374 respondents have this month reported that they are seeing more people attending open homes. This is the strongest result since February 2021 just before LVR rules returned and tax changes were imposed on investors. The willingness of people to more actively canvas potential purchasing options is clear from this result.

1

HOW DO YOU FEEL PRICES ARE GENERALLY CHANGING AT THE MOMENT?

A net 30% of agents feel that house prices are falling in their location. Based on this result we have to be cautious when speaking in terms of the house price cycle hitting a bottom. But the signs are clear. Last month a net 58% of agents were seeing prices still falling and the latest result is the best since early 2022. Note how agents still observed prices as rising through 2021 even as fewer people were attending auctions and open homes. Physical presence of buyers is not the overarching determinant of house price changes.

ARE YOU NOTICING MORE OR FEWER FIRST HOME BUYERS IN THE MARKET?

A net 55% of agents this month have reported that they are seeing more first home buyers in the market. This is the strongest result since October 2020 and the jump from a net 22% last month is very noticeable. There may be little FOMO as yet, but young buyers are deciding the time is right to advance their home purchase plans. We can only expect this feeling to intensify now that the media have picked up on the firming signs evident in our survey from much earlier this year.

DO YOU THINK FOMO IS IN PLAY FOR BUYERS?

FOMO = Fear of missing out

There is a small upward trend underway in our FOMO reading — the only one available in New Zealand. But at a gross 9% of agents the level is still very low. This tells us that while more buyers are out kicking the tyres (hopefully not the walls) they do not display impatience about buying to any great degree. Buyers still feel that time is on their side.

ARE YOU NOTICING MORE OR FEWER INVESTORS IN THE MARKET?

Above we noted a sharp improvement in agent observations of more first home buyers in the market of a net 33% (22% rising to 55%). The change upward for observations of investors has been almost as strong at 26%. However, this gain from a net 44% negative last month still means that a net 18% of real estate agents say that they are seeing fewer investors in the market — not more. Tax changes are keeping many investors out of the market, and this has been the case since the end of March 2021 when tax rules were altered.

2

ARE YOU RECEIVING MORE OR FEWER ENQUIRIES FROM OFFSHORE?

A net 29% of agents have reported this month that they are receiving fewer enquiries from offshore. Foreign interest in the NZ housing market is limited, which is unsurprising considering the rules preventing offshore buying for all bar Australians and Singaporeans, and the flow of Kiwis leaving NZ as opposed to shifting back here.

WHAT ARE THE MAIN CONCERNS OF BUYERS?

There remain three key things which buyers are concerned about. 76% of agents cite rising interest rates, 62% cite access to finance, and 49% report worries about prices falling after buying.

ARE PROPERTY APPRAISAL REQUESTS INCREASING OR DECREASING?

This month there has been a firm lift in the net proportion of agents saying that they are seeing more requests for property appraisals coming through. A net 15% have reported this compared with a net 5% reporting fewer appraisals last month. Note that there is no clear trend in this measure as compared with the improving trends evident in almost all of our other gauges.

But while buyers are only slowly getting less concerned about access to finance, this month has produced a notable drop in the proportion of agents saying price falls are of concern. This reading has fallen to 49% from 68% last month and a range of 63% to 73% since March last year. FOOP (fear of over-paying ) is ebbing away. Note however that concerns about the supply of listings are drifting up, reaching 25% of agents noting it this month from a low of 7% in November.

3

ARE INVESTORS BRINGING MORE OR FEWER PROPERTIES TO THE MARKET TO SELL THAN THREE MONTHS AGO?

There is still no rising trend in the proportion of agents seeing investors bringing more properties to the market to sell.

However, the following graph shows that there is no trend up or down in the proportion of investors hoping for a bargain.

WHAT FACTORS APPEAR TO BE MOTIVATING INVESTOR DEMAND?

44% of agents feel that the hopes of finding a bargain are motivating investors to make a purchase.

4

REGIONAL RESULTS

The following table breaks down answers to the numerical questions above by region. No results are presented for regions with fewer than 7 responses as the sample size is too small for good statistical validity of results. The three top of the South Island regions are amalgamated into one and Gisborne is joined with Hawke’s Bay.

Best use of the table is achieved by picking a variable and comparing a region’s outcome with the national result shown in bold in the bottom line. For instance, nationwide 9% of agents say they are seeing buyers display FOMO. But in Wellington this is 18%.

The table shows net percentages apart from the FOMO question in column F. The net percent is calculated as the percentage of responses saying a thing will go up less the percentage saying it will go down.

A. # of responses

B. Are property appraisal requests increasing or decreasing?

C. Are more or fewer people showing up at auctions?

D. Are more or fewer people attending open homes?

E. How do you feel prices are generally changing at the moment?

F. Do you think FOMO is in play for buyers?

G. Are you noticing more or fewer first home buyers in the market?

H. Are you noticing more or fewer investors in the market?

I. Are you receiving more or fewer enquiries from offshore?

J. Are investors bringing more or fewer properties to the market to sell than three months ago?

This publication is written by Tony Alexander, independent economist. You can contact me at tony@tonyalexander.nz Subscribe here

This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. We strongly recommend readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. No person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.

5 A #obs B Appraisals C Auctions D Open H. E Prices F FOMO G FHBs H Invest. I O/seas J Inv.selling Northland 17 24 -53 -29 -59 0 6 -53 -47 -35 Auckland 148 30 31 49 -26 11 57 -19 -16 -4 Waikato 42 5 -24 17 -48 2 62 -14 -48 0 Bay of Plenty 22 -5 5 36 -41 14 73 -14 0 9 Hawke's Bay 21 -5 0 38 -14 5 81 -10 -52 -5 Taranaki 4 0 0 0 0 0 0 0 0 0 Manawatu-Wanganui 16 6 -25 0 -44 0 44 -56 -38 0 Wellington 39 3 3 44 -15 18 67 -23 -44 -8 Nelson/Tasman 13 -15 -23 23 -46 8 46 0 -23 -15 Canterbury 27 26 -22 30 -33 7 41 -15 -37 0 Queenstown Lakes 5 0 0 0 0 0 0 0 0 0 Otago exc. Q'town 15 13 -40 13 -27 7 53 -7 -33 -20 Southland 4 0 0 0 0 0 0 0 0 0 New Zealand 374 15 2 32 -30 9 55 -18 -29 -6

Interestingly,thisflatteningmightcoincidewithpeakinginterestrates followinglastweek's11thconsecutiveOCRhike.NathanMiglani,Managing DirectorandHeadofLendingforNZMortgages,suggeststhatifwe'renot alreadyatthepeakofinterestrates,thenwe'reveryclosetoit:

"Weanticipateratesbeginningagradualdescentfromlate2023,soour generaladviceistofixforashorttermwherepossible,sayoneyearor18 months.Withinterestrateslikelytofall,fixingforalongtermcouldmean aheftybreakagecostifcircumstanceschangeandyouneedto restructureearly."

TherelationshipbetweenaverageaskingpricesandtheOCRprovides valuableinsights.Vanessasuggests,forexample,thathighinterestrates areoneofthefactorsimpactingtheslowpacewe'veseeninthemarket recently.

"Whenthecashrateishigh,financebecomestighter,meaningsome buyershavetoreconsidertheirlendingoptions.However,whenthe cashrateislow,financeismorereadilyavailable,andbuyerconfidence tendstocreateabitofactivityinthemarket."

Nathanaddsthattheyarealreadyseeingthismomentumstartingto increaseinthemarket:

"Somebuyersbelievethatrateshavealreadypeaked,andthey're makingdecisionsbasedontheideathatrateswillbegoingdown."

Wemightbeatthebottom,butaverageaskingpricesarestillup22.5% onpre-COVID-19levels

DespitethedoomsdaypropertymarketstoriesmanyKiwisarehearing, averageaskingpricesarestillabovewhattheywerepre-COVID-19,and thisshouldbeviewedasgoodnewsforpropertyownersconcerned aboutshrinkingequity.

"GoingintoourfirstlockdowninMarch2020,thenationalaverage askingpricewas$707,233.Lastmonth,itwas$866,696–asolid $159,463or22.5%increaseinjustoverthreeyears,"saysVanessa.

Year-on-year,averageaskingpricesweredowninalmostallregions comparedtoMay2022,butVanessaurgespropertyownersnotto getdiscouragedbyshort-termdips.

"Typically,propertyisn'tashort-terminvestment.Lookingbackover thelast16yearsofourdata,nomatterwhat'shappened economically,averageaskingpriceshavealwaysincreasedinthe longterm,"explainsVanessa.

Lowestautumnonrecordfornewlistings–nearlockdownlevels

ThenumberofnewlistingscomingontothemarketinMaywereata 16-yearlow,withautumnlistingsdippingalmosttothesamelevel wesawduringthe2020lockdown.

Thecombinedtotalofnewlistingscomingontothemarket nationallyduringMarch,April,andMay(autumn)thisyearwasjust 23,743.

"Thisisonlyjustabovethe21,391newlistingsthatcameontothe marketduringthesameperiodin2020whenrestrictions,attimes, meantvendorscouldn'tlisttheirhomeseveniftheywantedto,"says Vanessa.

Comparatively,therewere18.2%morelistingsduringautumnin2022 thanin2023.

"Wetypicallyseearound30,000newlistingsaddedtothesite betweenMarchandMayandhavedonesoforthelast16years,so thisisasignificantdrop,"saysVanessa.

Sheexplainsthatthelowlistingnumbersarelikelyasymptomof uncertaintyinthemarket:

"Kiwisareknownfordelayingbuyingandsellingdecisionsduring timesofuncertainty.Andfrominterestratestowhowillbein governmentnextterm–thingsaredifficulttopredictrightnow."

indicating that the ballooning stock levels we've seen over the last 12 months could be easing.

The total homes available for sale were down by 36.0% in Gisborne, 34.4% in Wellington, 9.1% in Auckland, 9.0% in Hawke's Bay, 4.1% in Bay of Plenty, 2.7% in Otago, and 1.5% in Manawatu/Whanganui. Nationally, stock levels were flat year-on-year, with a marginal increase of just 0.9%.

Vanessa says it wasn't uncommon to see stock levels double yearon-year during 2022 and early 2023, as the slow market allowed buyers to take their time and forced sellers to be patient:

"While we aren't quite back to 2020 levels where stock was low across the board and the market highly competitive, this looks to be the beginning of a market shift."

The levelling of stock could eventually impact average asking prices as supply inches closer to demand.

Coromandel did buck the trend with a year-on-year increase of 104.2%, but Vanessa explains that this small market tends to see numbers fluctuate. All other regional stock increases were below 50.0%.

Formediaenquiries,pleasecontact: HannahFranklin|hannah@realestate.co.nz

reflects 97% of all properties listed through licensed real estate agents and major developers in New Zealand. This description gives a representative view of the New Zealand property market.

Stock is the total number of residential dwellings that are for sale on realestate.co.nz on the penultimate day of the month.

Inventory is a measure of how long it would take, theoretically, to sell the current stock at current average rates of sale if no new properties were to be listed for sale. It provides a measure of the rate of turnover in the market.

Seasonal adjustment is a method realestate.co.nz uses to represent better the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

Truncated mean is the method realestate.co.nz uses to supply statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated to prevent exceptional listings from providing false impressions.

Written by Hannah Franklin

01 Jun 2023

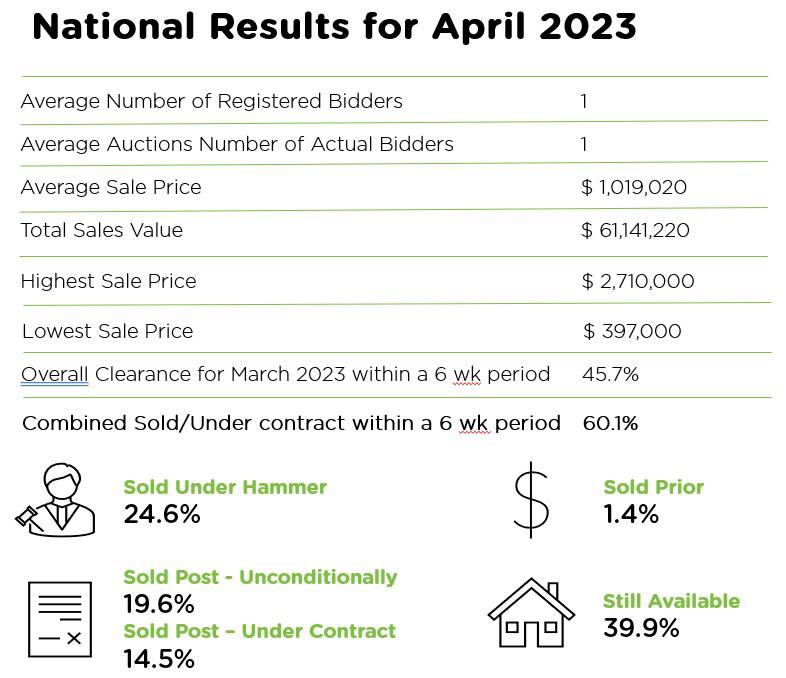

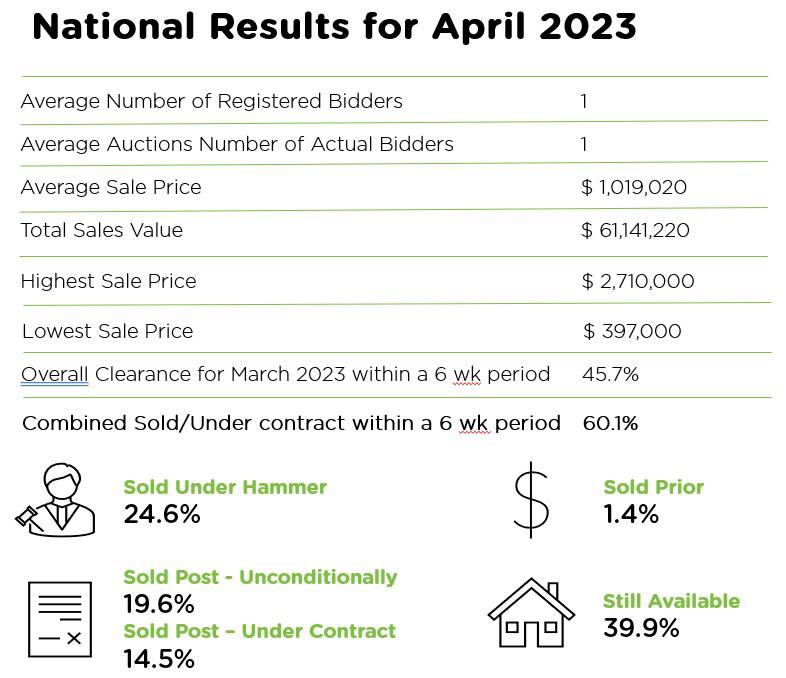

Auckland surges as regions feel the pinch!

It is great to bring you the latest update on New Zealand's national auction statistics, after some interesting movements over the last couple of months.

We look back on results from April below, but are happy to report that the month of May has continued to yield positive results.

Aprils' results across the national spread showed that the brakes on the market had spread into the regions, however Auckland appeared to have the green light, bouncing back with some strong results.

Generally speaking the Auckland market creates a ripple effect and flows onto the regions. The regions over the April period seemed to be experiencing the tightening of the buying market and the effects of the raise in both OCR and interest rates that Auckland had experienced some months prior.

In some of our Apollo core areas, Northland and Canterbury REINZ stats showed sharper declines in value, owners in those locations were having to catch up to the market after experiencing a reasonable start to the year with values holding better than other areas. Days on market dramatically pushed out and 42 day clearance dropped away. It is now more important than ever in these locations that a method of sale is used that promotes keeping days on market down.

A focus on procuring auctions has been key focus for our top performing businesses. Auckland on the other hand appeared to have flattened the curve with overall clearance at 67.9% with 57% of those being unconditional results.

More buyers were entering the market with brokers reporting high volumes of applications, and multiple bidders were back trying to secure properties at auction to beat the conditional onslaught. If the Auckland ripple effect takes place in the next couple of months, it could represent an opportune time for buyers and sellers in the regions to take advantage of an increase in activity.

At Apollo we are proud of the ability to report to our clients with a national overview of the market with insights into multiple areas, agencies and trends.

If you would like to know more about running successful auction campaigns for your business, or would like some further insights into your local market, don't hesitate to get in touch with one of our world class auctioneers.

Rob & Tim

APOLLO AUCTIONS NZ LIMITED | LICENSED REAA 2008

Finance

& Tony Alexander

2023 ISSN: 2744-5194

MORTGAGE ADVISERS SURVEY June

Strengthening signs grow

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 53 responses.

The main themes to come through from the statistical and anecdotal responses include these.

• First home buyers are solidly in the market, assisted by some easing in credit rules.

• Investors are still rare but starting to express some mild interest.

• The one year, 18-month, and two year terms are most favoured for fixing one’s mortgage interest rate.

COMPARED WITH A MONTH AGO, ARE YOU SEEING MORE OR FEWER FIRST HOME BUYERS LOOKING FOR MORTGAGE ADVICE?

For the fifth month in a row a strongly positive net proportion of mortgage advisers have reported that they are seeing more first home buyers in the market looking for advice. Last month the reading was a net 49%, this month it is 51%.

There is increasing discussion about house prices bottoming out and many buyers have been waiting up to two years for market conditions to be more favourable to buyers. Initially they may in 2021 have held off buying because of a lack of choice, lack of ability to attach conditions to offers, and high cost of repeatedly undertaking work required to make a bid then failing to secure a property.

Comments on bank lending to first home buyers submitted by advisers include the following.

• A little more low deposit lending opened up 1st June. CCCFA relaxed at same time making things a little easier.

• More relaxed with expenses, provided bank statements are in order.

• slight softening in acceptance of over 80% lending. Kainga Ora loans still the main way to purchase with a small deposit, needing a live deal elsewhere. Further softening in the cccfa is positive.

• Loosened LVR requirements with RBNZ changes. Reduced UMI surpluses required for debt servicing.

COMPARED WITH A MONTH AGO, ARE YOU SEEING MORE OR FEWER INVESTORS LOOKING FOR MORTGAGE ADVICE?

For the second month in a row our survey has shown more brokers as seeing extra investors in the market seeking advice rather than fewer. The latest result of a net 13% positive is the strongest since January 2021 and up from 3% in May and -13% in April.

2

Comments submitted by mortgage brokers indicate that the overall level of interest from investors is still very low. But the discussion of the market bottoming out and interest rates peaking appears to be eliciting some selected interest.

Comments made by advisers regarding bank lending to investors include the following.

• Haven't noticed much difference yet with LVR increasing from 60-65%.

• Deposit requirements have reduced to 35% but again test rates have gone up, with interest rates so high, investors are not keen to take on debt at the moment. Interest deductibility is what everyone is waiting for - waiting for election results to see if there is a change of government.

• Less of a deposit required now.

COMPARED WITH A MONTH AGO, ARE YOU FINDING LENDERS MORE OR LESS WILLING TO ADVANCE FUNDS?

A net 42% of mortgage advisers this month have reported that they are noticing banks as being more willing to lend funds for a home purchase. This is slightly down from a net 48% last month but makes for five months in a row of strongly positive results for this measure.

In an environment of low sales and with the Reserve Bank perhaps still sensitive to any signs that mortgage rates are being discounted, banks are relying on easier lending rules in order to at least protect market share.

The easing of lending toughness has been assisted by the June 1 change in Loan to Value Ratio rules allowing banks to undertake extra lending at less than 20% deposit, and cutting the minimum investor deposit from 40% to 35% of property valuation.

WHAT TIME PERIOD ARE MOST PEOPLE LOOKING AT FIXING THEIR INTEREST RATE?

The one and two year terms continue to be most favoured by borrowers. There is no interest in floating of fixing longer than three years. Not captured in our survey is the strong preference which many people have for the 18-month term.

3

The one year term preference has been very strong since February.

Preference for fixing three years has increased this month, perhaps assisted by some recent cuts to that term in contrast with recent increases for one and two years.

The two year preference slipped has settled at levels near 45% of borrowers as compared with 75% for a few months late last year when worries about interest rates ising were very high.

No-one wants to touch five year rates with a bargepole.

4

Mortgage Adviser’s Comments

Following are the comments which mortgage advisors volunteered in this month’s survey, grouped by the region in which the advisor primarily works. These insights can be very useful for placing flesh around the bones of the numerical indicators.

AUCKLAND

• Seeing a change in sales and auction rooms with a few surprises on the upside recently. Improving credit criteria will help support. One headwind is still off the plans purchasers 2 years ago coming up for settlement who may have fallen out of criteria / suffered drop in value

• There are more buyers in the market now than say 3 months ago. There is a lot more activity with contracts being written, even some of the properties are being sold in auctions as well. There are properties that are getting multi offers -something that wasn't there around 2 months ago. So definitely a lot more activity, property prices are still lower than the peaks of 2021, but I would say higher than pre-COVID. For first home buyers, it is still a good opportunity to purchase while the prices are relatively low. Interest rates are high, but we might be at the peak of the rates as well, that's why most people are choosing to fix for 1 year.

• Lenders not applying microscopic scrutiny of household expenses for the last few weeks has been good for all classes of borrower. Combine that with relaxed LVR restrictions and the world has become a quite a bit rosier for high LVR customers (i.e. first home buyers). They better be quick though; I see property inventory running short by Autumn 2024.

• Buyers more relaxed that the market has bottomed out. Most are competing with other buyers when bidding or putting offers of properties, especially first home buyers. Very few good properties on offer.

• Banks are asking what business they are losing to the competition. i.e. conscious of losing market share.

• Rates and cashback offers not quite as good as

they were with some banks not competing.

• 1% cashback still available but ceilings like $12K or $20K being applied. Also the threat that these offers could be withdrawn without notice.

• First home buyers are galvanised to seek advice, but slow to implement action - they struggle to make a move when they cannot see others doing the same. One thing I have not seen anywhere (I may have missed it) are the literally thousands of new home owners (RBNZ exempt), that have used the discounted floating rates for their purchases - especially the turnkey buys - these folk are sitting on rates circa 5.88 for xxx bank today (yyy bank a fraction more) that are not facing the high refix rates for, in many cases another couple of years - some will be coming to the end-of the discount but most are doing ok - comparatively.

BAY OF PLENTY

• Crazy busy at the moment

• Its still pretty tough to get FHB approved, due to bank servicing/test rates being 8.59%. But banks have eased up on the CCCFA requirements, making it easier for change in spending habits prospectively.

WAIKATO

• Market starting to warm up again.

WELLINGTON

• Seems like a normal winter with good demand but nothing drastic yet, spring and a government change would see the market take off. Banks’ affordability criteria will be the issue then with high test rates getting close to 9%.

• Property values and sales are still decreasing in Wellington with major issues around turnkey settlements not settling due to drop in value, some developers not willing to compromise and are keeping deposits instead.

• Market has started to turn, with customers now competing with other offers on the table (multi offers). The price delta between new builds and existing homes is increasing, resulting in the new build market significantly slowing down

• 18 month rate very popular.

• Good clean offers coming back quickly from the

5

banks.

• Buyers are still a little hesitant, thinking it might go lower.

• Enquiry has picked up further in the last month again. Banks are busier

TOP OF THE SOUTH ISLAND

• Rising frustration from borrowers with the poor government led policy that has been restricting access to funds in the finance industry.

CANTERBURY

• For the first time ever (in 16 years) got an approval as exception to LVR rule for investor refinancing from a 2nd tier lender. Fell off my chair.

• More investors making plans to purchase in the next 6 months.

• Non-bank lenders priced out of the game at the moment with rates around 10%.

• Although lender appetite seems to have increased, stress test rates have increased which negate most of the positive impact.

• More activity in FHB area with some clients having better success in finding a property that suits budget. They do need to be resilient about the purchase process though, as it can take a few disappointments before they are successful with their offer.

• Seem to be a few newer assessors in some of the larger banks who are not as confident around making a decision. They're reluctant to pick up the phone and discuss further or obtain clarity. More long term assessors happy to call and go over a deal to elicit further detail or your feeling about the client - this made for a smoother process and a better outcome.

QUEENSTOWN LAKES

• Banks are more open to assessing applications, however their higher test rates are restricting the deals meeting criteria

6

KaingaOraSharedPartnershipScheme

FirstHomePartner,iswhenKāingaOramakeafinancialcontribution topurchaseandshareownershipofahome...

Thisschemeappliestoexistingbrand-newhomesbuiltortobebuilt(turn-keydeals)

TheKaingaOraamountistoberepaidtoKaingaOrainterestfreeoverthenext15years. Theincomecapforthelast12monthsearningsforahouseholdis$130,000. Clientsmusthaveeitherofthefollowing.

• NZresidency

• NZpermanent residency

• NZCitizenship Process

• Clients apply to Kainga Ora Shared Partnership Scheme and get preapproval

• Next, Clients are qualified by the bank for the maximum amount of lending that the bank can approve them for.

• Then, clients put in their deposit from Savings, Kiwisavers, Subsidy and Gifts.

• Then, Kainga Ora put in the remaining amount up to $200,000 for the purchase of the property, or up to 25% of the purchase price (whichever is lower)

Clientsmustownandliveinthepropertyforaminimumof3years.

Exampleofa$1,000,000property

A coupleearning$65,000salaryeachwithnodebtsorchildrenapply (notethe$130,000 incomecap).

Basedonanaveragecostofliving(asat03/05/2023) thiscouplecanafford $730,000 inlending.

Theyhave$70,000 fromsavingsandKiwisaver.

KaingaOrawillputin$200,000 equity.

Meaningtheycanbuyahomeofaround$1,000,000.

ForcompletedetailsContact:

KaingaOraorchecktheirwebsite Phone:0508935266

Email:firsthome.enquiries@kaingaora.govt.nz

IIt’srareinlifethatwegetsomethingfornothingwithnostringsattached,especiallyif itgenuinelyaddsvalue.Nevertheless,that’spreciselywhatIwillgiveyou.

Expert home loan advice which has reliably proven to offer significant long-term financial advantage. Keeping strict tabs on the country’s largest network of banks and numerous smaller second-tier lenders, so you don’thaveto.

What’s more, this comes at no cost to you because your chosen bank pays for the privilege.You have nothing to lose,yet have a higher chance of securing better terms. Rest assured - if there’s a superior deal out there for you, I’ll findit.

Inthe typicallystoicalworld offinance,we offera point ofdifference.Not onlywillyou receive excellent independent and impartial advice, but you’llhave fun doing it. Even after 15 years in the mortgage arena, our enthusiasm for objectives and commitment to clients shines through at every turn. Endorsement comes from countless glowing testimonials and Keith's own words: “We are at our happiest helping people navigate through difficultsituations,giving hope and concrete opportunity where they previously hadnone.”

Since 2002, I have helped countless clients achieve their goals and dreams, either purchasing their firsthome, their next or buildinga forever home, or to arrangefinanceto acquire an investment property or asset finance.Annually, I will also review your existing lending, loan structure or assist with debt consolidation.Being solutionfocused to obtain the ‘best outcomes financially’ and deliveringthe ‘most suitable solutions’foryour financialsituation,is whatdrives me. No matter what age or stage you are, working alongside my team, we willrepresent you and your situation honestly, with integrity and professionalism. Check out my Google reviews. I look forward to journeyingonthispathwithyou.

KeithJones MortgageAdviser

021849767

keith.jones@loanmarket.co.nz

LJHooker Newsletter &Blog

Starting Your Journey as a Real Estate Investor

Investing in real estate can be a lucrative way to build wealth over time.

However, many people believe that it takes a lot of money to get started in this field.The truth is, you don't necessarily need a large sum of money to invest in real estate.You will need a strategy to reach your financial goals.

As a property owner, you may have the option to kickstart your investment portfolio by leveraging the equity in your current home.Alternatively, if you're new to the market, you could consider partnering with a family member or friend.

It's essential to be strategic with your spending and have a clear plan for your investment property.Consider your investment horizon and exit strategy in case of unforeseen circumstances that may require you to sell.

Keep in mind that rental income is not a guarantee, so it'scrucial to choose a property that hasa high potential to attract reliable tenants.

Prioritise your savings -make saving for your investment property a priority and allocate a portion of your income towards it each month.

Consider ways to increase your income -look for ways to increase your income, such as taking on a second job, selling items you no longer need, or asking for a raise at work.

Reduce your expenses -look for ways to reduce your expenses, such as cutting back on non-essential items, subscription services, negotiating bills, or downsizing your home.

Another option is to use the equity you have built up from your home as a deposit.

Equity is the difference between the current value of your house and how much you owe on it.As you pay down your mortgage or asproperty value increases, so does your equity.

While you won’t be able to use all your equity, your bank will usually want you to leave at least 20percent of the value of your property.

When deciding how much you can draw, your bank will also take into consideration things like your income and potential rental income.

How to start investing?

Here are some steps you can take to start investing in real estate:

Set your investment goals -determine what you want to achieve from your investment, whether it's capital gains or rental income.

Educate yourself -read books, attend seminars, and talk to experts in the field to gain knowledge and insights.Understand any tax implications, such as the bright-line test.

Start small -consider purchasing a small property as your first investment to learn the ropes.

Get pre-approved for a home loan -speak to your bank or a mortgage broker to get an idea of how much you can borrow.

Research the market -look for properties that fit your investment goals and budget.

When investing in real estate, there are many factors to consider.Here are some important things to keep in mind:

Location -the location of the property will play a significant role in its potential value and rental income.

Rental yield -the amount of rent you can charge relative to the property's value will determine your rental yield.

Capital growth potential -look for properties in areas with good potential for capital growth over time.

Maintenance costs -factor in the ongoing maintenance costs when calculating your return on investment.

Property management -consider whether you will manage the property yourself or hire a property manager.

What makes a good investment property?

Agood investment property will meet the following criteria:

Positive cash flow -the rental income should be greater than the expenses, including the mortgage repayments, rates, insurance, and maintenance costs.

Good location -the property should be in an area with potential for capital growth and rental demand.

Low purchase price -a property that isundervalued or hasthe potential to add value through renovations can be a good investment.

Low maintenance costs -a property that is low maintenance can help maximise your return on investment.

Diverse tenant pool -a property that appeals to a diverse range of tenants can help minimise the risk of vacancies.

Before you go out and buy an investment property, make sure you do all your research.Know what you are getting into and understand your responsibilities.

Start by setting your investment goals, educating yourself, and researching the market.Look for properties that meet the criteria of a good investment, such as positive cash flow, good location, and low maintenance costs.

Remember to negotiate the purchase price and get pre-approved for a home loan.With careful planning and research, you can build wealth through real estate investing.

Properties

LJHooker

Town&Country

30 FranklyneRoad, Otara NZ

§3 bl �1

URGENTSALE-MAKE AN OFFER

CurrentListings

ForSale By Negotiation

View By Appointment

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

https://drury.ljhooker.co.nz/

Currently tenanted, this 985m2 site (more or less) is a developers dream. Zoned Residential (9D), re...

1 Luke Place, Otara NZ

§5 b2 �2

URGENTSALE-MAKE AN OFFER

* Prominent site

* PrimeLocation

* Hugedevelopmentpotential

114 HarboursideDrive, Karaka NZ

§- b-�-

RIPE FORDEVELOPMENT in KARAKA

Located in the "sought after" Karaka Harbourside Estate, the opportunity topurchase another land ho...

ForSale Price ByNegotiation

View ByAppointment

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

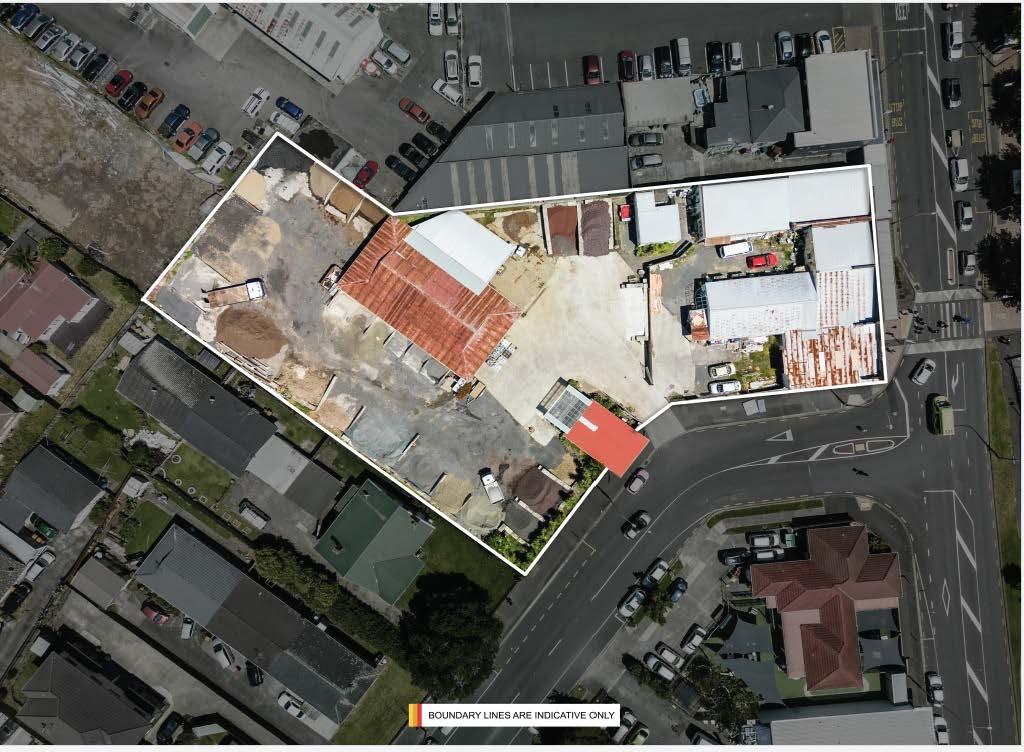

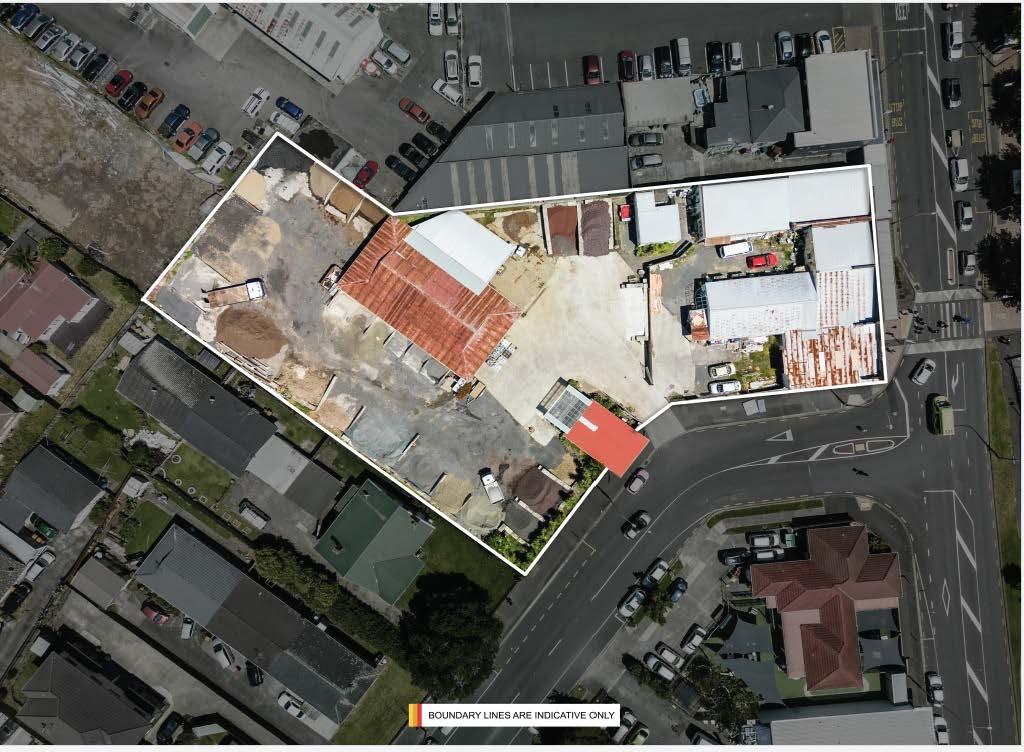

5 Coronation Road, Papatoetoe NZ

PRIME COMMERCIAL BLOCK.

Set in the heart of Old Papatoetoe's commercial hub, the opportunity to acquire blocks of this size

ForSale ByNegotiation

View ByAppointment

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

51 Normanby Road, Karaka NZ

§1 b3 �3

BANKTHELAND-LIVETHELIFESTYLE

This offering is position perfect and delivers the astute buyer a unique opportunity to acquire a ro...

ForSale ByNegotiation

View ByAppointment

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

102 MountainRoad, Mangere Bridge NZ

§2 bl �1

LOCATION -LOCATION -LOCATION CONJUNCTIONALS ARE WELCOME.

On the market for the first time ever, this offering is p...

ForSale Price ByNegotiation

View ByAppointment

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

Under Offer Price ByNegotiation

View Sunday June 25th, 11:00AM11:45AM, Sunday July 2nd, 11:00AM -

11:45AM, Sunday July 9th, 11:00AM11:45AM

Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

09 294 7500

20th, Jun 2023

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

LJHooker

Town&Country

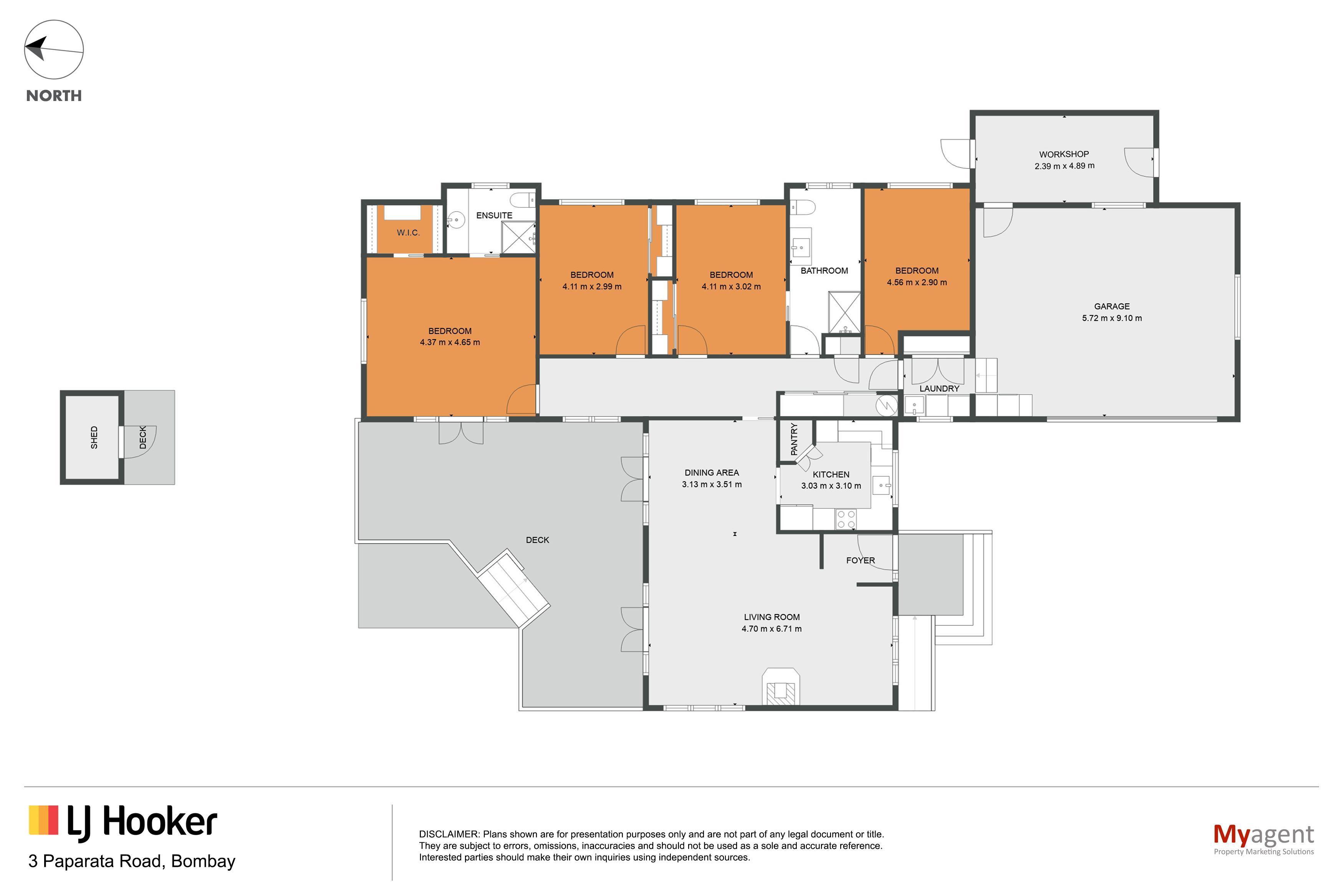

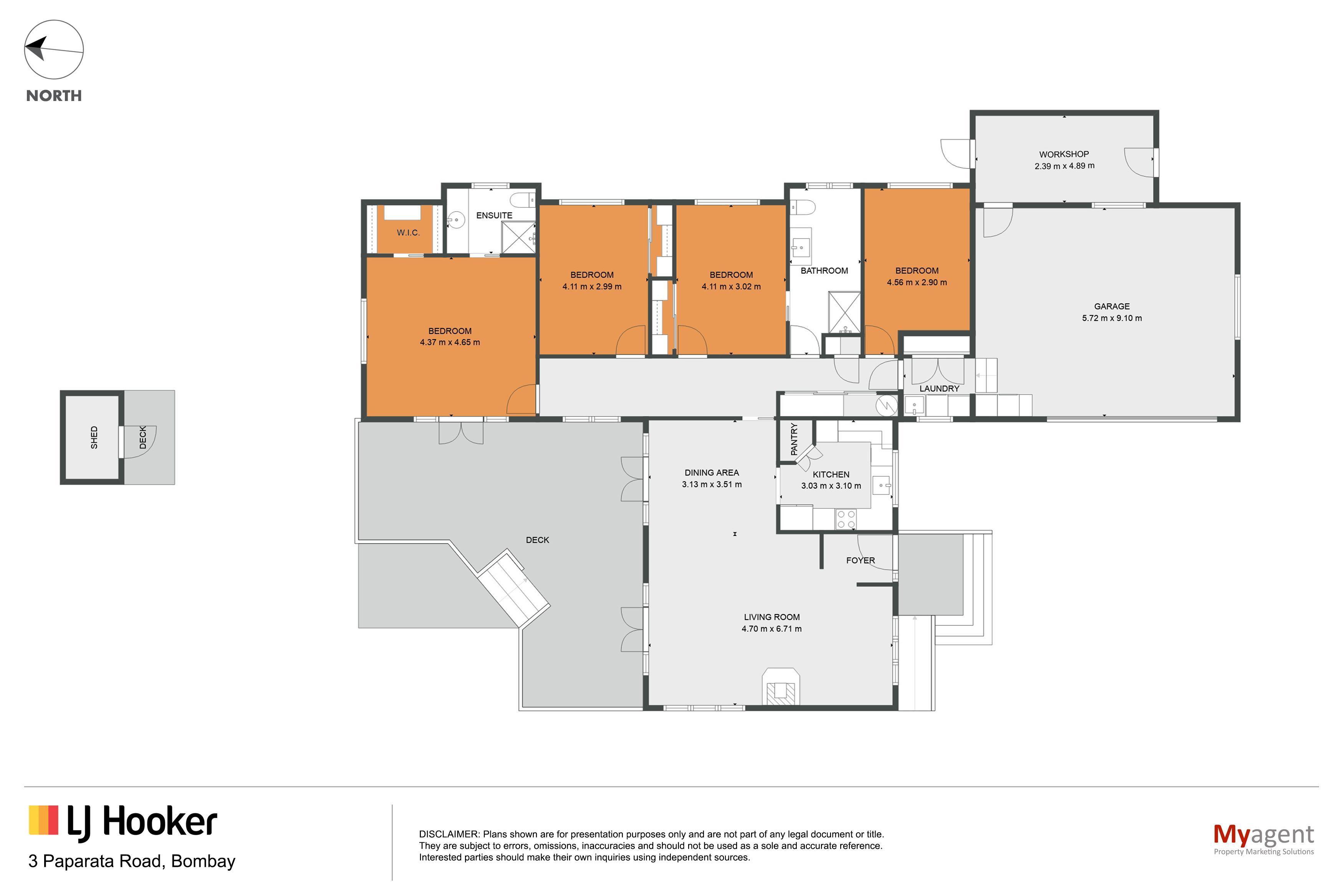

3 Paparata Road, Bombay NZ

§4 b2 �s

BOMBAYBEAUTY - BOXES TICKED!

•4 Double bedrooms.

• Master with ensuite.

• Impeccably cared fo...

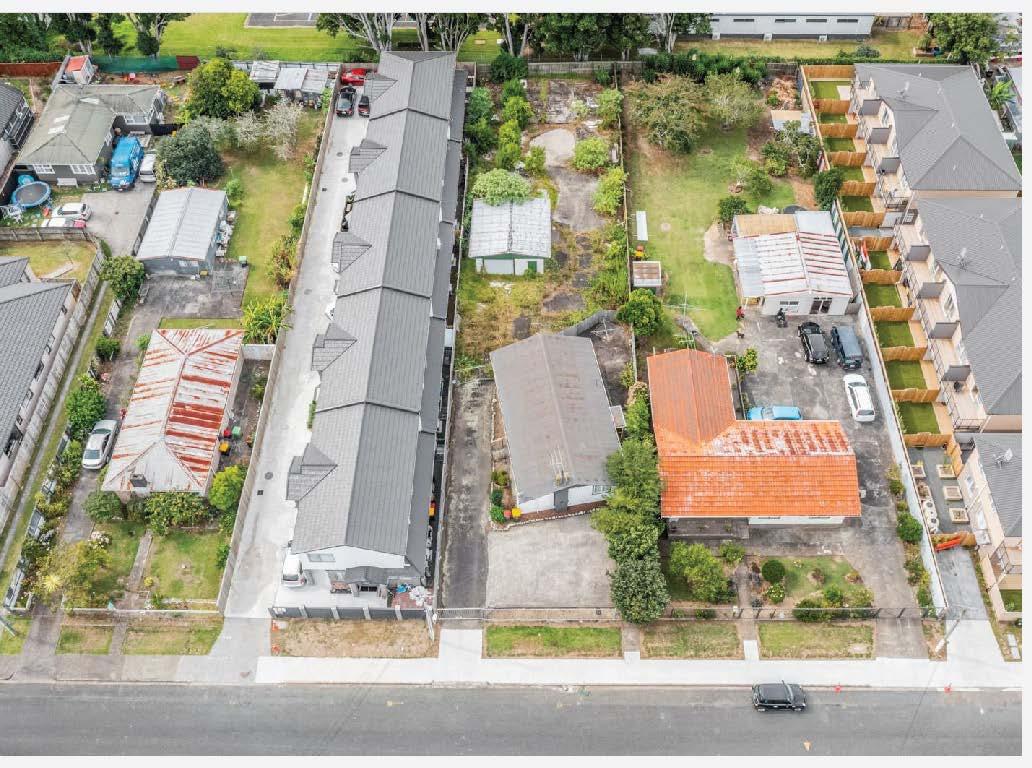

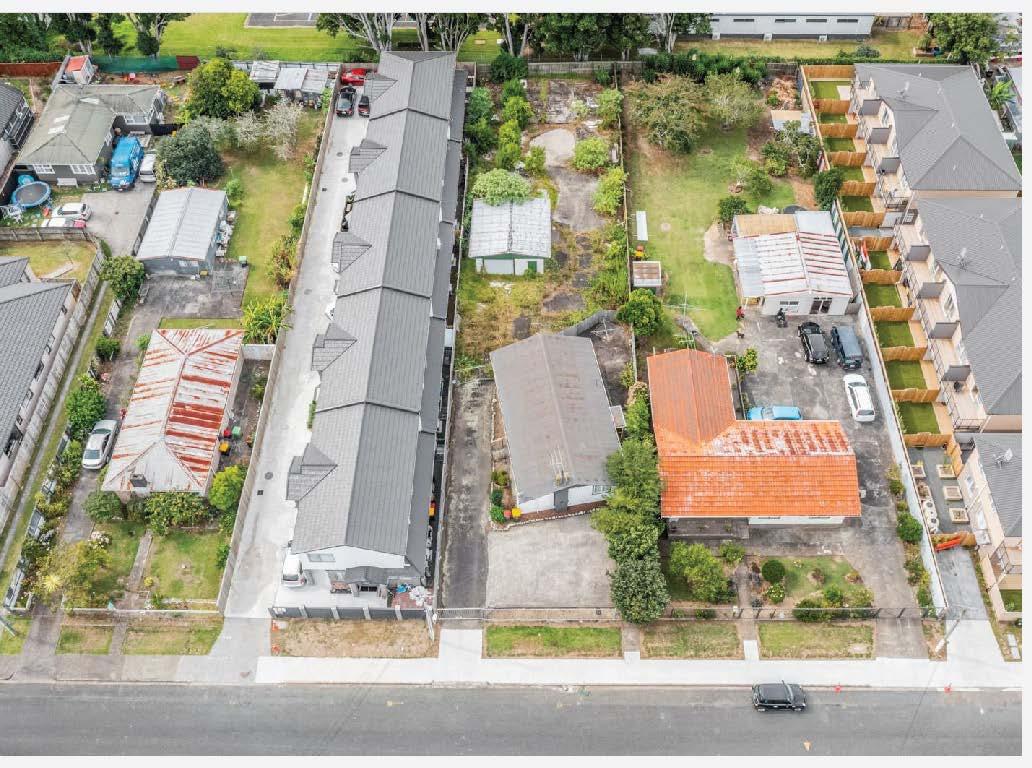

151 Barrack Road, Mount Wellington NZ

§4 bl �6

UNIQUE INVESTMENTwith HUGE POTENTIAL

Located in the geographical centre of metropolitan Auckland, this property is all about potential. D...

ForSale Price By Negotiation

View Sunday June 25th, 01:lSPM -

02:00PM, Sunday July 2nd, 01:lSPM -

02:00PM, Sunday July 9th, 01:lSPM02:00PM

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

ForAuction Price onApplication

Auction Sunday July 9th, 03:00PM

View Saturday June 24th, 02:00PM -

02:45PM, Sunday June 25th, 02:00PM -

02:45PM, Saturday July 1st, 02:00PMLina Roban 021 022 88521 lina.rob@ljhooker.co.nz

https://drury.ljhooker.co.nz/

09 294 7500

20th, Jun 2023

CurrentListings

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

3PaparataRoad BOMBAY

BOMBAYBEAUTY-BOXESTICKED!

Sitedforalldaysunandsituatedclosetoso manyamenitiesandlocations!

1006sqm

4Bedrooms

2BathroomsinclEnsuite Walk-inrobe

*SeparateLaundry

*LargeDoubleGaragewithInternalEntry Minimalcaregroundswithsafeandsecure rearforchildrenandpets.

ByNegotiation

ByAppointment orOpenHomeasadvertised _____________________________________________________________

(2008)

2

ONOURWEBSITE

CLICKHERETOVIEWFULLDETAILS