THE PROPERTY CHRONICLE

Town&Country

Whenyouknow,youknow. February2024

Town & Country CONTENTS Page LJ Hooker Newsletter and Blogs • Letter from Principal (Brent Worthington) – Update o Managing your Property with LJ Hooker / Rent Exchange o Property Management – Invest with Confidence- Checklist 3 4 5 Reports, Surveys & Commentaries • REINZ (Real Estate Institute of NZ) o Press Release 14 February 24 – (January Data) o Market Snapshot o Annual Median Price Changes • REINZ Property Report – 18 Jan 24 (Link) • REINZ House Price Index Report (HPI) – 18 Jan 24 (Link) • RealEstate.CoNZ –o Propety Prices Double in a Decade (Hannah Franklin 13Feb24) o Remarkable – Central Otago Lakes average asking price $1.6million (Hannah Franklin 4Feb24) • CoreLogic – Property Values Rise 0.4% to kick off 2024 (interactive link) • Tony Alexander – More Cash Rate Rises Not Likely 9 11 12 13 14 15 18 25 31 Finance & Lending • Mortgage Advisers Survey – Tony Alexander • KiwiBank – Todd Dixon - A new Government and new changes to come 38 45 Properties - LJ Hooker Town & Country • Properties Listed 47 • Properties Recently Sold 58 Our People • Brent Worthington • Venita Attrill • Lina Roban • Christine Connolly • Debbie Harrison • Johnny Bright (Apollo Auctions) • Keith Jones (Loan Market) 60 61 62 63 64 65 66 SuperGold - Welcome Here 67

26 February 2024

Hi

Here's a brief update of how we view the current state of the residential housing market. Overall, New Zealand’s housing sales and price cycles hit their lows in the middle of last year.

Construction will probably reach its low next year albeit that a significant number of housing and building companies continue to close or go into liquidation.

Buyers for the moment feel little need to hurry, especially with plenty of listings to choose from and interest rates at high levels.

One's ability to pick exactly when the market will hit its straps again is nigh on impossible. If you wish to buy or sell or are thinking about it, just do it.

A "heads up" when you're talking to your mortgage broker. We're hearing that banks are discounting fixed rates below their advertised rates to a greater extent than has been the case for a while.

As always, we trust you enjoy this month's publication.

Kind regards

Brent

Brent Worthington Principal and Licensee Agent

LJ Hooker Town & Country & Property Management 1/233 Great South road, Drury 0292 965 362 Town & Country

PROPERTY MANAGMENT

Pleasedon'thesitatetocontact ourteamwhocanablyassist youwithanyproperty managementmattersyoumay haveorifyouhaveany questionsaboutanythinginthe newsletterorproperty managementingeneral.

Invest with Confidence: A Checklist for Your Property Success

No matter the time of year, as a responsibly rental property owner it is important to keep them in good order. Not only will you attract and retain good tenants, you are also future-proofing your investment.

With warmer and drier conditions in summer, this is a great time of the year to keep your assets in tip-top shape. Here are some jobs to consider during the warmer months:

Security check

With great weather and many holidays, summer is a time when a lot of people travel. The house gets locked up and many of us head away to spend time with friends and family, which means your property could be empty for a couple of weeks. When a home is empty, it can become a potential target for thieves.

Ensure the functionality of all locks on windows and doors, inspect window latches and security lights, and verify the operational status of any security cameras, particularly in apartment buildings. This proactive approach helps safeguard your investment and provides peace of mind during periods of vacancy.

Organise repairs and maintenance

Summer offers an opportune time to organise necessary repairs, maintenance, and refurbishments on your rental property.

Coordinate with your tenants, especially if they plan to be away, to address any pending tasks. This may include painting, re-sanding floors, and fixing issues in bathrooms or kitchens. Engaging in these activities not only enhances the property's condition but also requires proactive communication with tenants to secure necessary permissions for access.

Get onto this early and lock in your tradies ahead of time as they could be on holiday too.

Clean out the gutters

It's essential to clean out the gutters of your rental property before severe weather arrives. The accumulation of leaves, sticks, or debris in gutters poses not only a fire hazard but also the risk of structural blockages that hinder proper drainage.

Neglecting this task may result in more significant problems, including sagging gutters and water damage, requiring costly repairs. Weatherproofing your property through proper gutter maintenance ensures resilience against adverse weather conditions.

Planning for the next year

Given the fluctuations in students' and fixed-term tenancy agreements due to end during the summer, it's prudent to plan for the future.

Evaluate your current tenants' satisfaction and consider renewing agreements where appropriate. Initiate a conversation with your property manager to discuss potential incentives for rental renewals, address any existing issues, and optimise rental terms for both parties.

Summer garden maintenance

Post-winter, your property's garden may require attention. Use the summer months to revitalise the outdoor space by refreshing mulch, weeding garden beds, and adding vibrant flowering plants for a touch of colour.

Additionally, adjust watering system timers, clean exterior lighting and windows, and inspect outdoor structures like decks and barbecues to ensure safety and functionality throughout the summer season.

Insulation

While investing in insulation incurs initial costs, it can potentially lead to higher weekly rents from tenants. Lower electricity bills and increased comfort can make your property more attractive. Consult with your property manager to explore insulation options that align with your property's specifications, maximising long-term benefits.

Check for sub-rent:

With many rental properties rented to students who may head home for the summer, it's essential to confirm whether sub-renting is occurring. Ensure compliance with rental agreements, and if sub-renting is sought, require written approval from the property owner. Understanding and regulating who occupies your investment property is crucial for maintaining control and ensuring compliance to your rental agreements.

Find out your borrowing power

For property owners considering additional investments, understanding your borrowing capacity is paramount. Evaluate factors influencing your borrowing power, such as the strength of your loan application and existing property equity. Utilising equity from current properties can serve as a deposit for future investments.

Get pre-approval

Securing pre-loan approval is a proactive step to streamline the process of acquiring a new investment property. By doing so before property hunting, you gain clarity on your borrowing limits and present yourself as a serious and prepared buyer in the real estate market.

Hire a property manager

While not all property investors opt for property managers, their services can significantly ease the landlord's responsibilities.

Hiring a property manager assists in managing the property, organising repairs, marketing to potential tenants, tenant screening, and rent collection. Although this comes with a fee, the time and cost savings for owners with multiple properties often outweigh the expense.

Select the right mortgage

The mortgage you choose plays a pivotal role in your investment strategy. Many investors consider interest-only loans due to smaller repayments and potential tax deductions. However, it's essential to remember that the principal will eventually need to be paid. Selecting the right mortgage aligns with your financial goals and property investment strategy.

Find the right tenants

Securing the right tenants is fundamental to the long-term success of your property investment. It goes beyond filling vacancies quickly; it involves cultivating a mutually beneficial, long-term relationship.

Thorough tenant screening during the application process helps prevent potential issues and ensures a harmonious landlord-tenant dynamic.

Cash-flow strategy

Regularly conducting a cash-flow analysis is crucial for landlords to maintain financial stability.

A positive cash flow, where property income exceeds ownership costs, ensures financial health. In contrast, a negative cash flow strategy involves anticipating future property value growth to offset annual losses against taxes. A thoughtful cash-flow strategy contributes to the overall success and sustainability of your property investment.

REPORTS, SURVEYS& COMMENTARIES

REINZ January data: Golden weather sees confidence lift

Published 14 February 2024

According to the Real Estate Institute of New Zealand (REINZ), January 2024 has seen slower sales and a significant increase in the number of property listings available. This shows confidence from sellers while warming up buyers with a greater choice of property to choose from.

“January is usually a slower month for the completion of sales in New Zealand and this year is no exception with 2,995 properties being sold. While this is 4.9% more than January 2023, the increase in listings is a stronger indicator that the market continues to pick up. Listings increased by 10.4% nationally and 5.4% for New Zealand, excluding Auckland, year-on-year. The biggest increases in listings compared with the previous month were seen in Wellington at 148%, followed by Gisborne at 84%, Canterbury at 81%, and Auckland at 76.8%,” says Baird.

The total number of properties sold increased in January, rising by 16.0% year-on-year for New Zealand, excluding Auckland. Ten regions, including the bigger markets of Bay of Plenty, Waikato, and Northland, had higher sales counts this January compared to January 2023.

The national median sale price has slightly decreased from December 2023, down 2.5% from $779,830 to $760,000. Year-on-year, there is a slight decrease in the national median price by 0.7% from $765,000 to $760,000, while New Zealand, excluding Auckland, is down by 2.1% month-on-month (from $700,000 to $685,000) and up year-on-year by 0.8% (from $680,000 to $685,000).

The data shows regional variation in median sale prices, with Northland topping the scale with a 21% increase month-on-month from $630,000 to $762,000, and a 10.8% increase year-on-year from $687,500 to $762,000. Meanwhile, Auckland's median sale price has fallen under the $1 million mark again this month, for the fifth time in a year, to $975,000 – however this is still 3.4% more than a year ago.

“Despite the wave of listings favouring buyers, the challenges of last year, including the cost of living, inflation, interest rate changes, and government reforms, mean some buyers remain cautious. However, most regions are reporting more buyer activity across the board, with some seeing a particular surge in first-home buyer interest. Vendors are also being confident but realistic with prices as activity increases over the summer months. This is likely to resolve in inventory moving over the coming more active months in the year, “adds Baird.

“With changes to the debt-to-income ratios coming, REINZ data will be helpful indicators for buyers to see when to buy in a developing market.”

One area of significant change that has widespread support across the property sector is the Residential Property Managers Bill. This regulation provides much-needed structure to a sector that collects rent from 670,000 tenants and manages billions of dollars in assets for everyday New Zealanders. As disincentives are removed, this is important regulation to monitor as it may change market activity, inviting investors back or to refresh their portfolios, making more housing available for those who are not in the market,” comments Baird.”

“2024 is shaping up to deliver a series of changes and shifts in dynamics for the market. The property sector is expecting the new government to make good on its promises to reduce the bright line back to two years and reintroduce interest deductibility on investment properties, changing the dynamics of the property market again.”

The HPI for New Zealand, which stood at 3,660 in January 2024, showed a 0.4% increase compared to the previous month and a 2.2% increase for the same period last year. The average annual growth in the New Zealand HPI over the past five years has been 6.0% per annum, and it is currently 14.4% below the peak of the market in 2021.

The Real Estate Institute of New Zealand (REINZ) has the latest and most accurate real estate data in New Zealand.

Media contact:

Laura Wilmot

Head of Communications and Engagement, REINZ

Mobile: 021 953 308

communications@reinz.co.nz

ClickHeretoViewReport Published 14 February 2024 NEW ZEALAND PROPERTY REPORT This report includes REINZ residential property statistics from January 2024.

Published 14 February 2024 NEW ZEALAND HOUSE PRICE INDEX REPORT © REINZ - Real Estate Institute of New Zealand Inc. ClickHeretoViewReport

Kawerau in the Bay of Plenty was top of the table for five consecutive years, and Auckland’s Hauraki Gulf Islands almost tripled in price.

Despite the fall in property prices last year, the latest data from realestate.co.nz proves that prices inevitably go up in the long run.

In the ten years to 2023, the average asking price in every New Zealand region has increased, with 12 of 19 regions at least doubling and the remaining six increasing by at least 50%. Of our 76 districts, 36 have increased by at least two-fold*, while a further six were up by more than 90%.

Nationally, the average asking price was up by 77.5%, increasing from $504,388 in 2014 to $895,289 in 2023.

Sarah Wood, CEO of realestate.co.nz, says the data underscores a resilient real estate market:

"We saw the market go through a correction in 2023 after rapid growth during the previous few years. Despite prices dropping back last year, they are still up substantially in most places when we compare them to the years before COVID-19 ignited the market.

“It’s welcome news for the vast majority of Kiwis whose biggest asset is their home that although we will see peaks and troughs, prices are continuing to trend upward over the long term”

Findoutifpriceshavedoubledinyourarea.

*Districts are considered to have doubled in ten years if the asking price has increased by 99.5% and above when comparing the average asking price in 2014 vs. 2023.

COVID-19 years bring unprecedented price growth

The standout years for significant price growth were 2019 to 2022, with the national average asking price increasing by almost 40% over this four-year period.

In the decade leading up to and including 2019, only one district doubled, and some even saw prices go backwards – Whakatane (down by 33%), Waitomo (down by 20%), and Grey (down by 11%).

A new decade in 2020 brought new levels of growth, with prices in almost all districts increasing over ten years and three doubling –Kawerau (up by 132%), Central Hawke’s Bay (up by 108%), and Hamilton City (up by 102%).

But it was 2021 and 2022 that brought the biggest changes to prices, with a substantial number of places doubling in ten years. In 2021, 34 of our 76 districts had doubled in the past ten years; in 2022, more than half had doubled (43 out of 76).

“This unprecedented growth can be attributed to several factors, including low interest rates, population growth, and limited housing supply, which have combined to create a competitive market environment,” explains Sarah.

One of the areas to benefit the most from price hikes over the growth years is Wanaka. In the decade up to 2019, Wanaka was the slowestgrowing district in the Central Otago/Lakes region, up 23% from 2010. Prices in the district didn’t double in ten years until 2022, when prices went from $906,387 in 2013 to $1,966,673. This trajectory continued into 2023, which saw Wanaka achieve the largest ten-year growth in the region, hitting an average asking price of $2,012,974.

Kawerau tops charts for five years running

The Bay of Plenty township of Kawerau has seen the most significant growth, increasing by 261.2% during the past decade.

While it remains New Zealand’s lowest-priced district, with an average asking price of $443,093 in 2023, this has almost quadrupled from $122,665 in 2014.

Wood says it’s the fifth consecutive year Kawerau has seen the biggest decade growth.

“In 2019, the first year we analysed this data, Kawerau was the only district that had doubled in 10 years, up by 112% on 2010.

“Since then, it has achieved the biggest growth in average asking prices every year compared to the ten years prior.”

Tania Humberstone, a spokesperson for Kawerau District Council, says enabling new housing options in the area has been a council priority over the past seven-plus years, spurring demand.

“Our housing strategy is committed to its vision of creating vibrant, sustainable communities that cater to diverse needs.

“Kawerau remains a valuable market, offering an incentive for people to return home to purchase homes, or to embrace more flexible working arrangements and move away from more populated nearby areas such as Tauranga.”

Following Kawerau, the Hauraki Gulf Islands saw the next biggest increase in prices in the ten years to 2023.

Made up of Great Barrier, Kawau, and Rakino, these islands within the Auckland region increased by 171.8% from an average asking price of $713,123 in 2014 to $1,938,342 in 2023.

The Hauraki Gulf Islands were the only Auckland district to double in ten years in the past decade.

At the other end of the scale, the districts to see the smallest ten-year growth are all within the Canterbury region: Selwyn (up by 39.2%), Ashburton (up by 40.5%), and Waimate (up by 40.9%).

For media enquiries, please contact:

Hannah Franklin | hannah@realestate.co.nz

A bright start to 2024: new listings significantly lift, and demand rebounds in New Zealand's property market

• Average asking prices warm up. South Island breaks records.

• Lifestyle preferences in property: Auckland vs Central Otago Lakes District over five years

• Sellers say signs up: new listings rise 10.5% nationally, signalling renewed market activity

• Back under the hammer: Auctions edge out display as preferred price type

• Buyers are back: new year sees renewed demand for property

As 2024 dawned, the New Zealand property market showed signs of vigour and vitality. January data from realestate.co.nz saw sellers eager to list, buyers actively searching, and prices rising.

Vanessa Williams, spokesperson for realestate.co.nz, says the positive start to the year offers opportunity for buyers and sellers alike:

"The mood of the market is warming. 2023 was the year of market correction, with low listings and fluctuating prices. At the start of 2024, we are seeing new energy, including record price growth in the South Island.”

Average asking prices warm up. South Island breaks records

Prices started to warm up during January as more than half of New Zealand’s regions saw year-on-year average asking price increases. In locations where prices dipped, the decreases were modest.

“None of the regions that experienced a drop in average asking prices year-on-year saw declines greater than 10%, indicating stability in the market,” says Vanessa.

The average asking price upswings were driven mainly by regional centres in January. Notably, Central Otago Lakes District, Coromandel, Marlborough, Northland, Otago, Southland, and Wairarapa all saw both year-on-year and month-on-month increases.

In a first for New Zealand, Central Otago Lakes District's average asking price soared past $1.6 million, setting a national record. Homes in this renowned Pinot Noir region are now averaging $1,621,899, marking a significant 19.3% increase from January 2023.

Its neighbour, Southland, the second most affordable region in New Zealand, also achieved a 17-year record average asking price high. At $555,173, Southland’s average asking price is around a third of the price sought in Central Otago Lakes District.

“The extraordinary rise in Central Otago Lakes District, crossing the $1.6 million mark, alongside Southland's peak, highlights the diverse and dynamic nature of New Zealand's property market.”

“It's fascinating to see such contrasting price points within geographical proximity, offering buyers a wide spectrum of opportunities. This highlights the uniqueness of each market and illustrates the broad appeal of New Zealand's regions, catering to different lifestyles and buyer demographics.”

Lifestyle preferences in property: Auckland vs Central Otago Lakes District over five years

Despite being New Zealand’s economic powerhouse, Auckland is not currently the nation’s most expensive location to purchase property. Instead, Central Otago Lakes District has been fetching the highest prices fairly consistently over the past five years, with brief stints from Auckland in June 2021 and January 2022.

Vanessa says interest in Central Otago LakesDistrict is also surging. In January, property seekers on realestate.co.nz searching for properties in the area were up 39.6% compared to December and up 43.2% on January 2023. Interestingly, the most searched suburb was Cromwell, followed by Wanaka. Searches came from people in Auckland, Christchurch and Sydney, Australia*. She says the activity highlights how important lifestyle factors are for property seekers:

"It's fascinating to see how, not long ago, in mid-2021, Auckland and Central Otago Lakes were at a similar price point of around 1.2 million. Since then, Auckland's prices have dipped, while Central Otago Lakes’ have climbed.”

“The price gap between the regions illustrates the unique appeal of lifestyle areas like Central Otago Lakes and Coromandel over major urban centres like Auckland. The data tells us that when Kiwis look to buy property, lifestyle is a major consideration.”

Sellers say signs up: new listings rise 10.5% nationally, signalling renewed market activity

After a year of low listing numbers, the new year has seen a change in seller activity, with a 10.5% increase in new listings nationally year-on-year. January 2024 also saw significant growth in new listings across 11 of 19 regions. Wairarapa (42.9%), Coromandel (26.4%), Auckland (22.4%), Marlborough (19.0%), Hawkes Bay (18.4%), Manawatu/Whanganui (17.8%), Northland (16.6%), and Central North Island (13.8%) all experienced a substantial year-on-year boost to new listings, surpassing the national average.

Conversely, Gisborne, West Coast, and Otago faced their lowest January listings since realestate.co.nz records began 17 years ago, with decreases of 20.5%, 27.1%, and 7.6%, respectively.

Looking month-on-month, the start of the new year brought a dramatic shift in market activity. Following a quiet December, realestate.co.nz data highlighted a 52.2% surge in new listings nationally, far exceeding the average 23.7% increase typically observed over the past five years between December and January.

“This upswing in new listings nationally, along with heightened activity in regions like Wairarapa and Auckland, is a clear signal of renewed seller confidence and market vitality,” says Vanessa.

Back under the hammer: Auctions edge out display as preferred price type

In January, the way vendors chose to list their property for sale indicates market confidence.

Auctions are returning to their pre-December prominence after a hiatus over the festive break, rising 38.1% year-on-year to reclaim their status as the preferred pricing strategy for vendors.

Vanessa explains that increased auctions reflect vendors’ preference for the transparency and competitive advantage that this sale method offers:

“It's a sign of sellers’ optimism and a belief in the strength of the current market, as they lean towards a method that can often bring about quicker sales."

Buyers are back: new year sees renewed demand for property

The start of the year saw a resurgence in demand for properties. Nationally, searches per listing were up by 21.0% on December and 14.2% compared to January last year.

This positive trend was mirrored in engagements (number of properties saved and email enquiries sent to agents), with a 25.3% increase from December and a 21.9% rise on the same period the previous year.

The significant increase in demand as we kick off the year, Vanessa comments, is a clear sign that buyers have returned to the market with renewed interest:

“Seeing such enthusiasm from buyers nationwide is encouraging, suggesting a strong start to the year and a positive outlook for the property market ahead."

*Source: Internal metrics (January 2024 vs. January 2023 and December 2023)

For media enquiries, please contact:

Hannah Franklin | hannah@realestate.co.nz

Want more property insights?

• Market Insights: Search by suburb to see median sale prices, popular property types and trends over time.

• Sold properties: Switch your search to sold to see the last 12 months of sales and prices.

• Valuations: Get a gauge on property prices by browsing sold residential properties, with latest sale prices and an estimated value in the current market.

Find a glossary of terms here.

Written by Hannah Franklin

04 Feb 2024

The CoreLogic House Price Index rose for the fourth month in a row in January, although the 0.4% increase was a deceleration in the pace of gains on both November (0.7%) and December (1.0%). Since September's trough, property values have now risen 2.5%, bringing the national average to $928,184, or 11% below the recent peak.

Wellington and Hamilton recorded mild growth of 0.1% and 0.2% respectively in January, while Tauranga and Dunedin saw gains of at least 0.6%.

CoreLogic NZ Chief Property Economist, Kelvin Davidson, said the slowdown in the pace of monthly gains is a timely reminder the emerging recovery trend remains tentative and shows some variability from region to region.

"The mood in the housing market has certainly turned since the middle of last year, given a fillip by the change of government, and its property policies that are friendlier to investors. This mindset shift is reinforcing the effects of the underlying fundamental drivers, such as continued employment growth, and high migration," he said.

"The Reserve Bank's proposals around loan to value and debt to income ratio rules, if enacted, will operate in tandem, however the DTIs may not bind straightway so the net effect on the market in the near term could be positive."

"Certainly, some buyers will already be starting to anticipate a likely easing in the LVR rules from the middle of the year, which will allow more owner-occupiers to purchase with less than a 20% deposit, and reduce the required deposit for investors from 35% to 30%."

"Even though most indicators are pointing up, there's still the challenge of high mortgage rates to contend with, both for new borrowers and those who are repricing existing loans. Granted, there's now a whiff of official cash rate cuts on the horizon, which will help mortgage rates to drift lower on the popular, shorter fixed terms, but that's probably a story for the second half of 2024, not the first."

CoreLogic House Price Index Clickherefor thefullyinterativeversion

Within Auckland, Franklin recorded the strongest rise in average property values in January, with a lift of 2.1%.

"A bit of lingering weakness in that market over the prior months was always likely to be 'caught up' at some stage," Mr Davidson said.

Manukau also saw values rise by more than 1%, but the rest of the Auckland sub-markets were a little softer in January, including no change in Waitakere. Over the past three months as a whole, Papakura has been a bit sluggish (-0.1%), but most other parts of Auckland have seen gains of 1.6% or more.

“Auckland's property market has certainly started to turn around, and although significant net migration inflows are probably boosting rents more than house prices at this stage, the effects of strong population growth will still be accumulating across the various segments," Mr Davidson said

आ

Wellington's sub-markets generally saw further growth in January, with Lower Hutt and Kapiti Coast both up by at least 0.5%. But Wellington City itself was a little more subdued (0.2% rise), and Porirua dropped by 1% to start the year.

Mr Davidson said when taken over a slightly longer three-month horizon, Porirua has still shown an increase of 1.5%, with Lower Hutt up by nearly 5%, and gains of 2-3% over the same period in Kapiti Coast and Upper Hutt.

"The wider Wellington property market is certainly playing a part in the emerging national upturn, especially in the two Hutt Valley areas. That said, these parts of the country, and especially Wellington City itself, could become very interesting markets to watch should the Government decide to pare back the size of public sector workforces more significantly in the coming years," Mr Davidson said.

Regional House Price Index results

The expectation that 2024's property market upturn could be mercurial is reinforced by the provincial value results for January.

For example, after falls in December, both Gisborne and Napier bounced back in January, rising by 3.0% and 1.4% respectively. By contrast, after a sizeable rise in December, Rotorua fell back in January, while Hastings also saw property values dip a little on the latest data.

Mr Davidson noted that Queenstown, once again, stands out in terms of house price performance. Values there were up by 0.7% in January, and are 6% higher than a year ago, standing at nearly $1.8m.

"Clearly, Queenstown is a still a magnet for wealthy buyers, whether local or from out of town. And strong demand to live and work in the area as tourism snaps back is seemingly contributing to price pressures as well," he said.

Property market outlook

"We continue to expect sales volumes and house prices to track higher in 2024, but with variability from month to month, and across regions. The main centres are no doubt being boosted at the moment by extra demand from large migration inflows. But with typically higher ratios of house prices to incomes than the provinces, the proposed DTI rules may become more binding in the cities over the medium term after they come into effect," Mr Davidson said.

"A key theme for this year will also be the relative shifts in activity for first home buyers and mortgaged investors. In 2023, first home buyers had a blinder, dominating in terms of market share. However, higher rents, greater interest deductibility, lower deposit requirements, and a possible drop in mortgage rates could pull some investors back in to the market in 2024," Mr Davidson concluded.

15 February 2024

More cash rate rises not likely

Last week in response to marginally better than expected labour market data for the December quarter the financial markets shifted from pricing in the next cash rate move as a cut to pricing in a rise by the end of May. One forecasting group shifted their call to predicting two more rate rises.

First, why predict more rises? It pays to realise that if you’re an economist working in a dealing room the thing you need to sell is not a record of rate forecasting success – no-one has that – but of convincing rate change views. Your dealers and client advisers need something to go to their clients with even if it is only an explanation of divergence from the views of others.

Divergence is good but a calculated gamble as deviating from the pack can risk reputational damage if you are wrong. That contact opportunity can lead to trading business which is the reason for the existence of many people in the room.

Less cynically, the Reserve Bank last November predicated its view of no more rate rises on data falling in line with their expectations outlined in the forecasts section of their Monetary Policy Statement. However, the stronger than expected data means the risk of wages growth slowing as they hope has been diminished.

The problem for the rate rise pundits however is that some of the RB’s forecasts have also proved too high and the outcomes imply less inflation than they have pencilled in.

For instance, they estimated that the NZ economy grew by 0.3% in the September quarter. In fact it shrank 0.3%. They also estimated that the CPI rose by 0.8% in the December quarter. In fact it rose by 0.5%.

These data divergences are one reason why not everyone is jumping on the excited rate rise wagon and why the risk is that the markets have pushed swap rates unsustainably high at the moment.

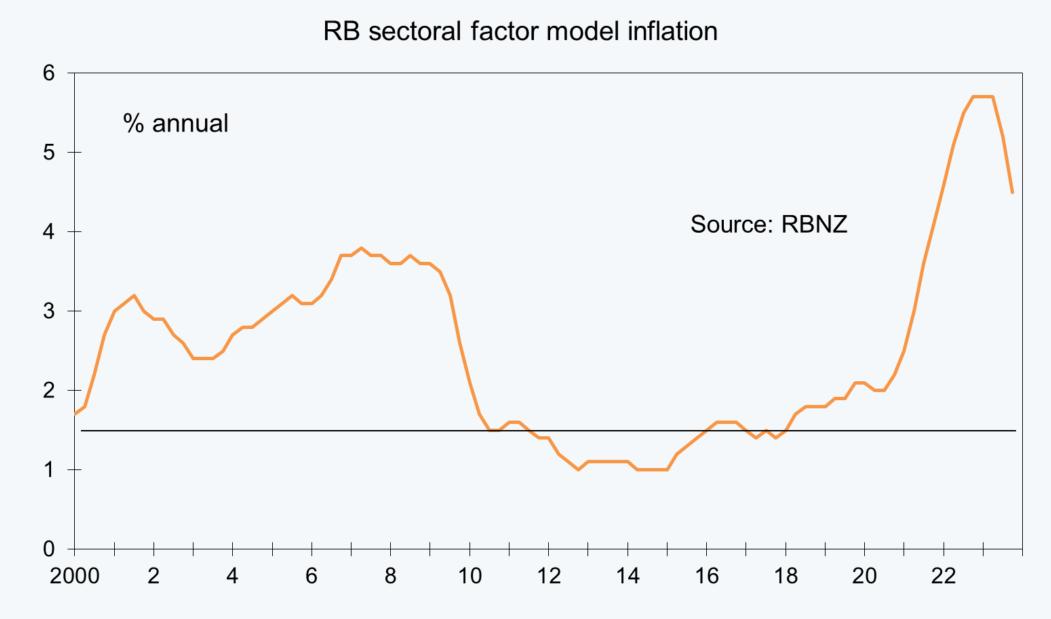

It also pays to note that the Reserve Bank have emphasised that it is core inflation measures which they focus on and as one other forecasting group pointed out this week, some are falling faster than they shot up.

Consider for instance one of the measures which attracts a lot of attention in the United States – the CPI excluding food and energy. Four quarters before the peak in this rate of 6.7% in the December

quarter of 2022 the rate was 5.4%. Now, four quarters after that 2022 peak rate of core inflation the change is 4.1%.

The measure of inflation excluding the top 10% of risers and fallers however peaked at 7% in the September quarter of 2022 and five quarters before then was 3.2% whereas now five quarters after the rate is 5.0%.

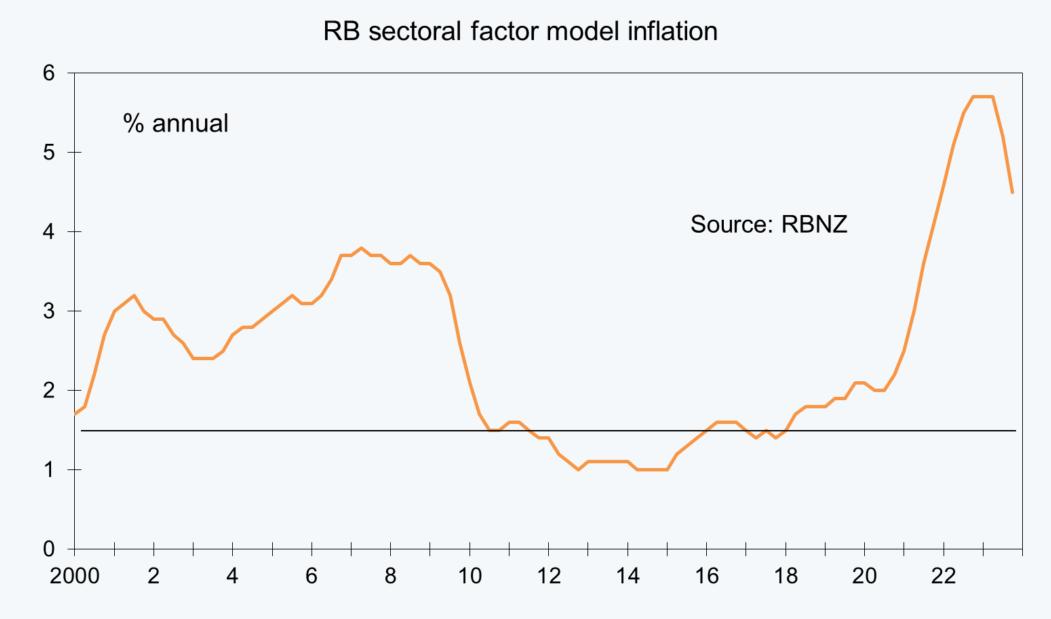

The sectoral factor model inflation measure calculated by the Reserve Bank and published in their M1 table after each CPI release peaked at 5.7% in the three quarters from December 2022 to June 2023. Two quarters before the start of this 5.7% run the measure was up 5.1%. Two quarters after at the end of last year it was up 4.5%.

Despite the legitimate worry one can have about inflation from business pricing expectations getting stuck at twice their long-term average, core measures seemingly favoured by the Reserve Bank are tending to fall faster than the shock speed at which they shot up.

If I were running the show on The Terrace, I would definitely not feel inclined to do borrowers a favour at the moment and either signal to banks that they can cut their fixed lending rates or signal generally that I was happy with the inflation outlook. But I also would not feel inclined to raise the cash rate again because of the risk that this would be an over-tightening for which the eventual response would have to be very rapidly cutting rates from late this year.

There is another thing to consider regarding the change in monetary policy view in response to last week’s employment data. The Household Labour Force Survey has an established record of throwing up occasional rogue results and there is a strong risk that has happened for the December quarter.

The NZIER’s Quarterly Survey of Opinion for the quarter has shown businesses feel the availability of labour is the best it has been in 14 years.

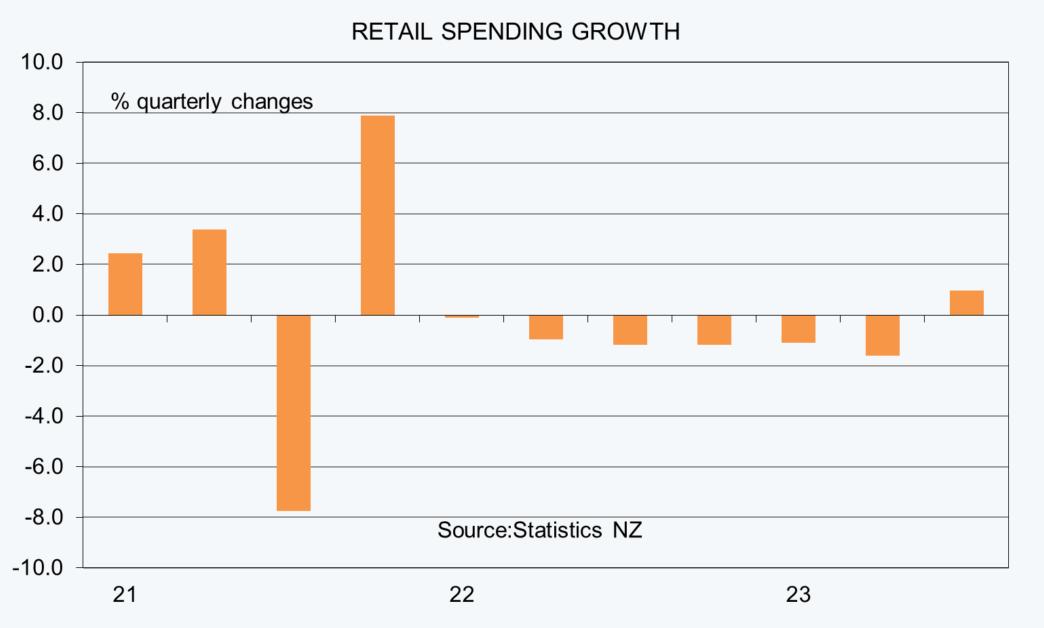

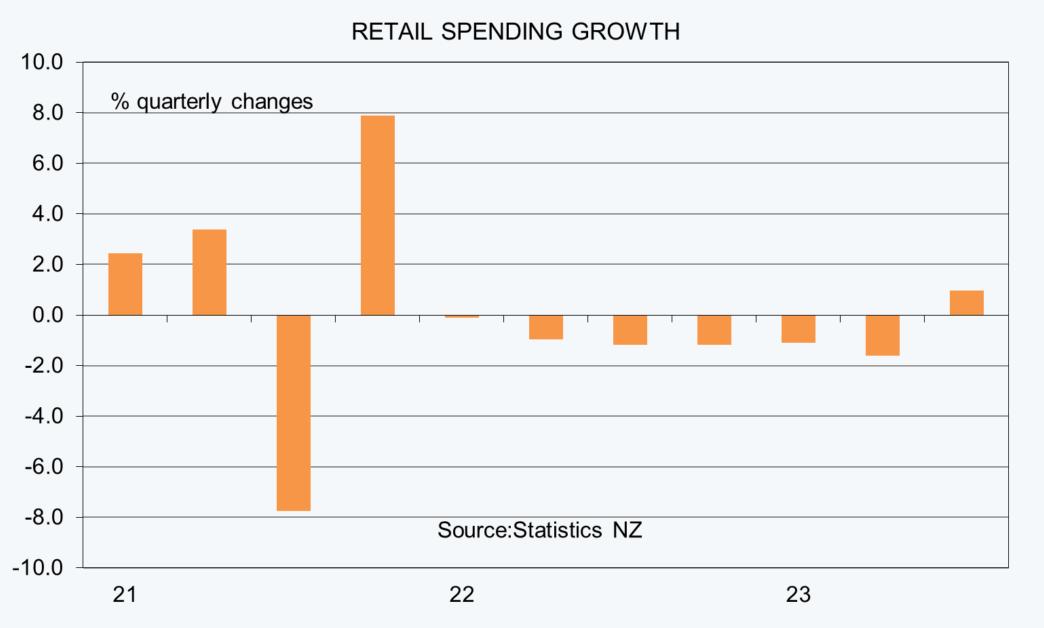

Of significance also is the fact that the labour market lags changes in the economy’s growth rate. The key route by which the Reserve Bank wants higher interest rates to work – crunched consumer spending – is functioning perfectly. Retail spending volumes have declined in six of the last seven quarters and consumer sentiment remains well below average levels

It pays also to note that there is extra restraint on the economy yet to be felt as people keep rolling onto higher fixed mortgage rates. It takes a while for monetary policy changes to affect inflation in New Zealand because of our high use of fixed interest rates. That accentuates the risk that a central bank eases too much on the way down as they grow frustrated waiting for inflation to lift, and tightens too much on the way up as they grow frustrated waiting for inflation to fall.

Having said that none of us should expect monetary policy changes over any cycle to be optimal. There will be tightening that is too slow or too fast, loosening that is too slow or too fast, steadiness in rates that is too extended. Borrowers need to recognise that the Reserve Bank is engaging in as much guesswork about where the economy and inflation are headed as the rest of us and factor this into their interest rate risk hedging decisions.

I’m of the view that there will be some catch-up rate easing down the track which will get borrowers quite excited and spark new life into the rising housing market. But we’re not there yet. The first signal from the Reserve Bank that they are feeling more relaxed may be behind the doors indications to banks that the RB would not get upset if they were to pass lower wholesale borrowing costs into lower fixed mortgage rates. Maybe that will come in the June quarter. But who knows what we will learn about NZ and global inflation pressures by then, let alone by the end of 2025?

If I were a borrower, what would I do?

I have already discussed monetary policy in depth in this week’s main article, so this is just a summary. Wholesale interest rates have risen firmly this past week in response to a shift in market expectations for monetary policy in New Zealand towards one more rate rise and away from expecting cuts before the middle of the year

This shift has been assisted by a sell-off in the United States debt markets in response recently to stronger than expected jobs data, comments from Fed. officials, and data on Tuesday night showing inflation 0.2% higher than expected at 3.1%.

The outcome has been a lift in the one year wholesale fixed interest rate facing banks to near 5.65% from 5.47% last week and a low of 5.24% at the turn of the year.

The three year swap rate has climbed to near 4.86% from 4.65% last week and a low near 4.3% at the start of January.

From here we await the Reserve Bank’s updated set of economic forecasts and monetary policy indications on February 28. A rate rise is unlikely but warning that inflation risks remain is expected.

If I were borrowing at the moment I would probably take a mix of 6 and 12 month rates. Nothing I write here or anywhere else in this publication is intended to be personal advice. You should discuss your financing options with a professional.

FINANCE& LENDING

& Tony Alexander

MORTGAGE ADVISERS SURVEY

February 2024

ISSN: 2744-5194

First home buyers back

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 53 responses.

The main themes to come through from the statistical and anecdotal responses include these.

• While first home buyers are active others and particularly investors remain cautious.

• Banks are slowly easing their lending criteria still but not overly competing for business in general.

• Some buyers are awaiting much greater clarity on how the debt to income (DTI) regime will work and where interest rates are headed. New confusion has appeared in this space.

COMPARED WITH A MONTH AGO, ARE YOU SEEING MORE OR FEWER FIRST HOME BUYERS LOOKING FOR MORTGAGE ADVICE?

First home buyers continue to have a strong presence in the housing market as we start to advance through 2024 in an uncertain interest rates environment. A net 46% of our survey respondents have reported that they are seeing more first home buyers looking for advice.

This is up from a net 38% in January but consistent with almost all other results since this time a year ago.

Comments on bank lending to first home buyers submitted by advisers include the following.

• More supportive in assisting first home buyers however we are still limited in obtaining pre approvals for clients with less than 20% deposit.

• General market has taken a wait and see approach.

• No changes here. Some banks have started offering more cash back and sharp rates for first home buyers even if high LVR.

• Kainga Ora tightening up their criteria so a little more difficult to get First Home Loans approved through the banks that do them.

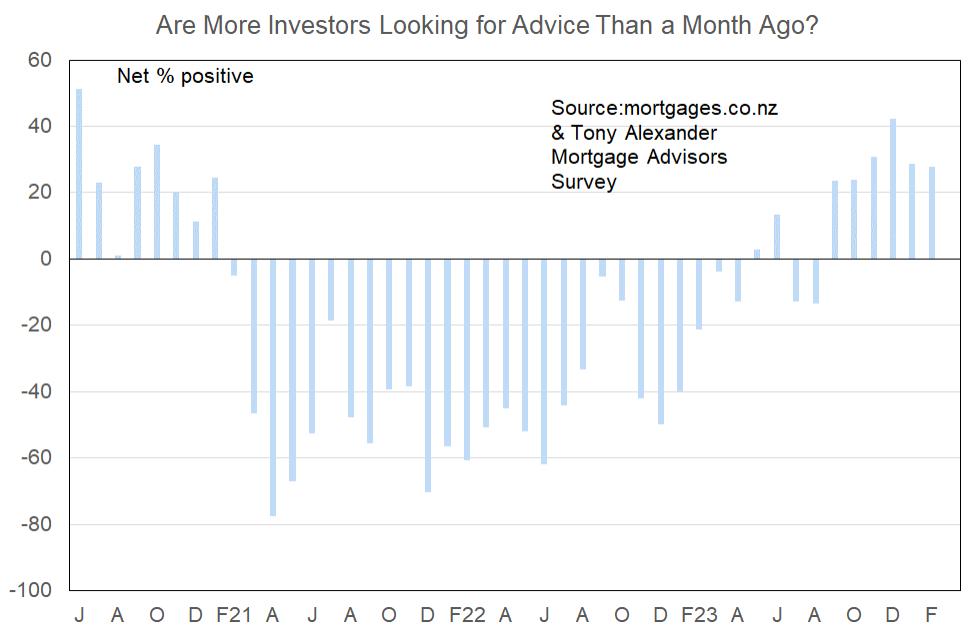

COMPARED WITH A MONTH AGO, ARE YOU SEEING MORE OR FEWER INVESTORS LOOKING FOR MORTGAGE ADVICE?

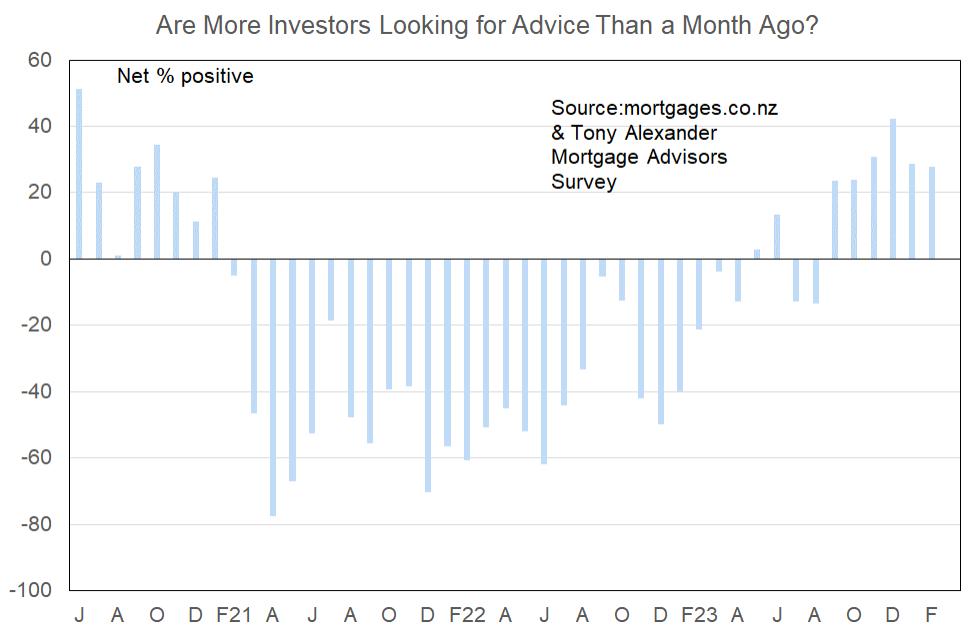

Our survey shows that investors began moving into the housing market in the latter part of 2023, perhaps encouraged by what the polls were suggesting would be the outcome for the general election.

A net 28% of survey respondents this month have said that they are seeing more investors, virtually the same as January’s net 29% and consistent with other months since September.

2

Comments made by advisers regarding bank lending to investors include the following.

• LVR rules are tough for preexisting property, Some banks are shading rental income plus adding second dwelling expenses i.e. rates insurance etc.

• Investors slowly coming back but its very slow and they are weary.

• I'd say banks are cautious and wanting evidence of ongoing costs like rates and insurance to be verified.

• Waiting for the government to change the rules for LVR.

COMPARED WITH A MONTH AGO, ARE YOU FINDING LENDERS MORE OR LESS WILLING TO ADVANCE FUNDS?

One factor which mortgage brokers have been reporting as assisting the market this past year has been an improvement in the willingness of banks to advance funds to home buyers. A net 43% this month have said that banks are becoming more willing to lend. This is the strongest result since May last year.

WHAT TIME PERIOD ARE MOST PEOPLE LOOKING AT FIXING THEIR INTEREST RATE?

For the second month in a row brokers have overwhelmingly reported that their clients wish to fix for a period of one year or less. Six months apparently is especially popular.

This month 90% of brokers reported a one year or less preference from 79% last month and just 10% in December. No-one has interest in fixing long and this reflects the widespread expectation amongst borrowers that the next change in interest rates will be a decrease – though when that will happen is impossible to accurately predict.

This graph shows the extreme jump in preference for fixing one year or less recently.

3

Preference for fixing two years has collapsed after being at high levels.

Fixing three years was only popular through 2021 into early-2022.

Kiwis hardly ever fix longer than three years, even when the five year rate was 2.99% from mid-2020 to mid-2021.

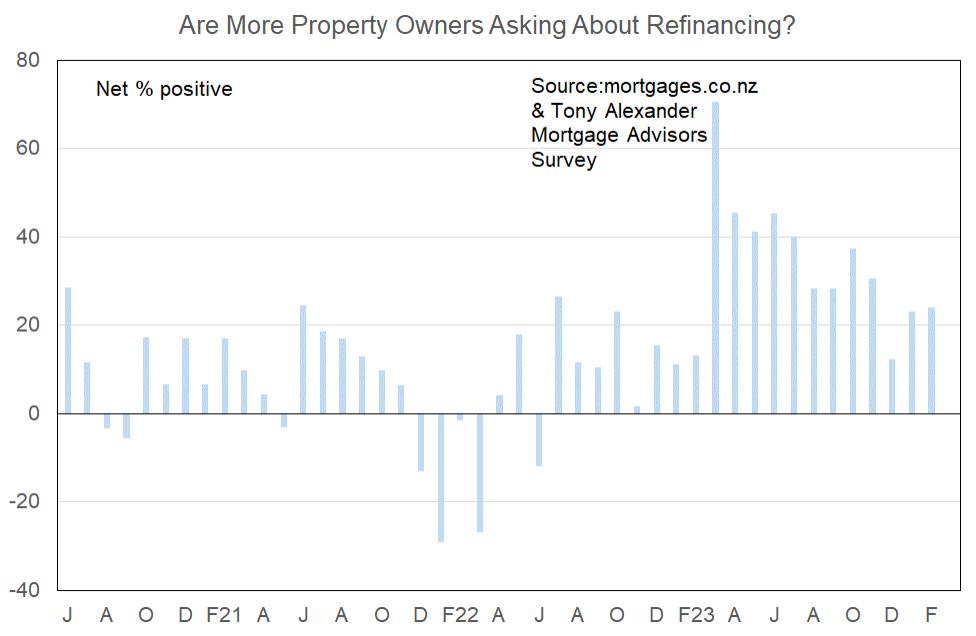

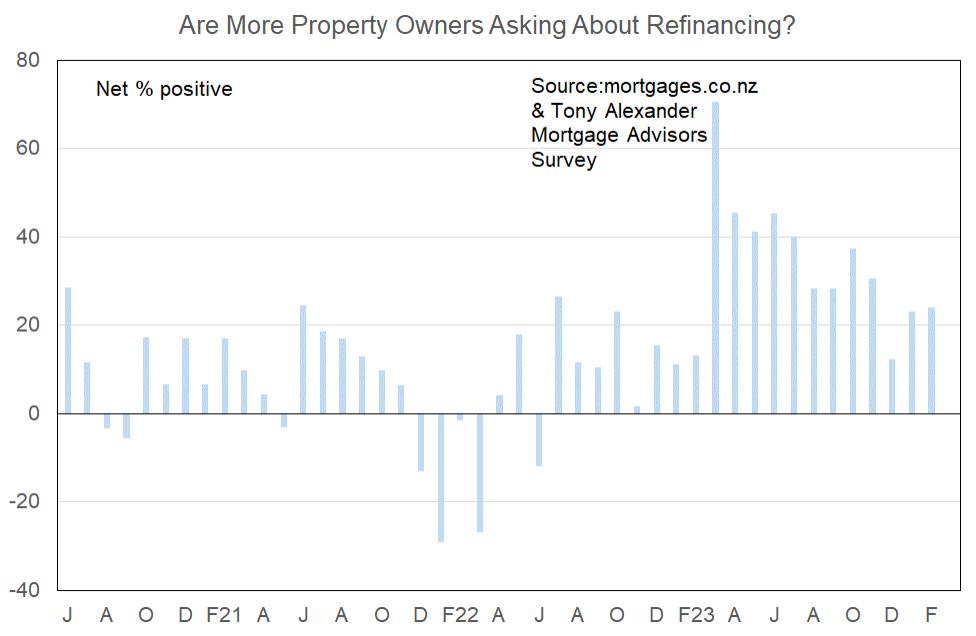

ARE MORE PROPERTY OWNERS ASKING ABOUT REFINANCING?

There is a mild downward trend underway in the proportion of mortgage brokers saying that people are asking about refinancing their existing mortgage.

Mortgage Adviser’s Comments

Following are the general comments which mortgage advisors volunteered in this month’s survey, grouped by the region in which the advisor primarily works. These insights can be very useful for placing flesh around the bones of the numerical indicators.

4

AUCKLAND

• Finding the market quiet. Most queries are from existing clients concerned about interest rate increases.

• Big increase in enquiry, especially from those looking to update/upgrade existing property and move up the ladder, or to see what investment opportunities could be open to them.

• Lenders have started getting late on approvals. Only during holidays they were up to date since most of the advisers are away on holidays. frustration have started to build up.

• We are being prepared for new DTI restrictions with lots of verbal reassurances and zero detail. The issue seems to be how to set standards in the higher cost of living cities.

• The banks are playing lip service to clients who ask for Interest Only facilities. On one hand, they encourage clients to talk to them if they face difficulties in keeping up with the mortgage payments, but on the other the process cannot be any harder. They make you go through all hoops possible and still say no.

• Seems to be mixed messages in media about the year ahead, the market needs some clarity from the Government, which will calm it further or increase the activity level upwards.

• Enquiry has defiantly picked up, I'm finding most enquiry coming from movers at the moment. First Home Buyers have also picked up momentum.

• A strong sense that interest rates have peaked means owner-occupiers who have held back are now looking to get on with buying. The media have successfully conditioned readers to the idea the interest rates are poised to fall but wise heads will counsel against going 'all in' on that possibility because the world still remains an uncertain place.

• Lenders are not budging on pricing.

• More activity, banks slow to react to swap rates, RBNZ probably in their ear.

• Some banks now tinkering around the edges of the policies with some loosening which is welcome news for some clients e.g. residency, bonus income, overseas income

• There seems to be a number of well organised first home buyers, with enough deposit and income to qualify, who are entering the market.

• Still lender's response are quicker as less applications.

• Lenders pretty reasonable on applications. Plenty of demand for mortgage borrowing.

WAIKATO

• First home buyers are incredibly active in the market. Most are ending up in multi offer situations, with some clients missing out on several at the time before securing a property. Clients are offering above asking because they don't want to miss out. There is urgency and client's are no longer sitting on pre-approvals for extended periods of time. The market absolutely feels like it is changing.

• General market has taken a wait and see approach. Buyers are very cagey.

BAY OF PLENTY

• More buyers in the market. Mini boom. There seems to be more confidence and maybe trying to get in ahead of the introduction of DTI. Xxx bank has reduced int rates and yyy bank will match any main bank advertised rate.

MANAWATU-WANGANUI

• Lots more enquires coming through in the last couple of weeks. But had my slowest couple of months for last 3.5 years

HAWKE’S BAY

• More multi offers on properties especially in the first home buyer price range. A little more FOMO creeping back into the market.

• Investors are still holding back due to high interest rates & a bit of uncertainty ahead of changes to DTIs and LVRs mid year.

WELLINGTON

• A lot of confusion re interest rates.

• 6 Month Rate appears to be very popular.

• Good properties in Wellington are selling at high prices now with multi offers, however, other properties are not getting any offers.

• Xxx bank today announced that they will match the best fixed rates publicly advertised by any

5

major bank.

• Interestingly banks are not competing on price i.e. price matching special offers (xxx bank matching advertised rates - but that’s just an advertising gimmick). Yyy bank continue their flip flop between branch and unit post approval (pre settlement) applications. Just a mess.

• Bank turnaround times are excellent. There is a willingness to lend. Activity has picked up as expected for this time of year.

• We have had quite a bit of enquiry about what the implications of the new DTI's will mean.

• The media seem to have got on the band wagon of the DTI's as we are getting a lot of calls relating to this with worried FHB's and Investors. Other than this not much really has changed for us which at this time of the year is normal given all the public holidays that happen straight after the Christmas period. We have clients who are waiting to see what the Reserve Bank are going to do with the OCR before they decide on refixing their home loans.

NELSON/TASMAN/MARLBOROUGH

• Buyers market still present with little buyer motivation to move on transactions. First home buyers with KiwiSaver as 10% deposit is common..

CANTERBURY

• It's an odd market - I can see the market lifting but clients are still very cautious and many struggling with rates expiring and going onto a higher rate. I've had 2 investors selling up as they feel all they're doing is making the banks richer.

• Prospective clients are optimistic about the year ahead, and keen to get underway, despite the current high rates and household expenses rise. I am seeing an increase in Refinance clients who are looking more at their financial situation and options, even if they are not due to come off low rates for a number of months yet.

• • Cash incentives have increased for FHB over 80% - xxx bank $3,000; yyy bank 1% up to $20,000

• Had a couple of clients get declined through me then approved by going to the same bank

directly. Seems they can bend the policies a bit more if clients go directly to bank.

6

ISSN: 2744-5194

This publication is written by Tony Alexander, independent economist.

Subscribe here https://forms.gle/qW9avCbaSiKcTnBQA

To enquire about having me in as a speaker or for a webinar contact me at tony@tonyalexander.nz Back issues at www.tonyalexander.nz

Tony’s Aim

To help Kiwis make better decisions for their businesses, investments, home purchases, and people by writing about the economy in an easy to understand manner.

Feel free to pass on to friends and clients wanting independent economic commentary.

Disclaimer: This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. We strongly recommend readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. No person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication. When referring to this report or any information contained herein, you must cite mortgages.co.nz as the source of the information. mortgages. co.nz reserves the right to request that you immediately withdraw from publication any document or article that fails to cite mortgages.co.nz as the source.

7

A new Government and new changes to come.

With the change of government there are a number of changes proposed that if they come through should have an effect on the property market. However, until known the market is in a holding position awaiting decisions to be put in place.

1. DTIs debt to income ratio lending are coming next year and “may” completely replace the CCFA and “could be” noted at 6 to 7 x income levels (unknown at this stage) but they are coming.

2. Interest deductibility on rentals are proposed to gradually come back in as

- 60% interest deductibility for 2023 yr

- 80% interest deductibility on 2024 yr

- 100% interest deductibility on 2025 yr

3. Easier for landlords to evict bad tenants which will take a risk away for investors

4. Bright line test removal

- proposed to change to 2 yrs for investment properties

5. More building consents to be issued with a noted proposal to enable granny flats of 60m2 or less to be built with only an engineers report which will turn many properties into home and income assets with smaller capital outlay.

6. A continued push to open up boarders and get more immigrants into NZ which will push up property demand in some areas for renting and home ownership.

The average predictions for house price increases are upward of 5% However the direction of interest rates is not certain but most expect a drop towards the end of next year.

These are my thoughts based on current policy proposals (NOT CONCRETE DATA) and although not certain if implemented will mean a better year for 2024.

Todd Dixon Mobile

M.

27 2355941 Free Ph 0800 452037

Mortgage Manager

+64

Kiwibank is a licenced Financial Advice Provider and our Kiwibank representatives can provide regulated financial advice on our products and services. Please visit Kiwibank’s Financial Advice Provider Statement for more information. Kiwibank representatives only advise on the products and services offered by Kiwibank and cannot compare with others. We can discuss a suitable and affordable home loan option with you. Kiwibank Limited, Auckland Kiwibank.co.nz

PROPERTIES

CURRENTLISTINGS

20th, Feb 2024

Town&Country

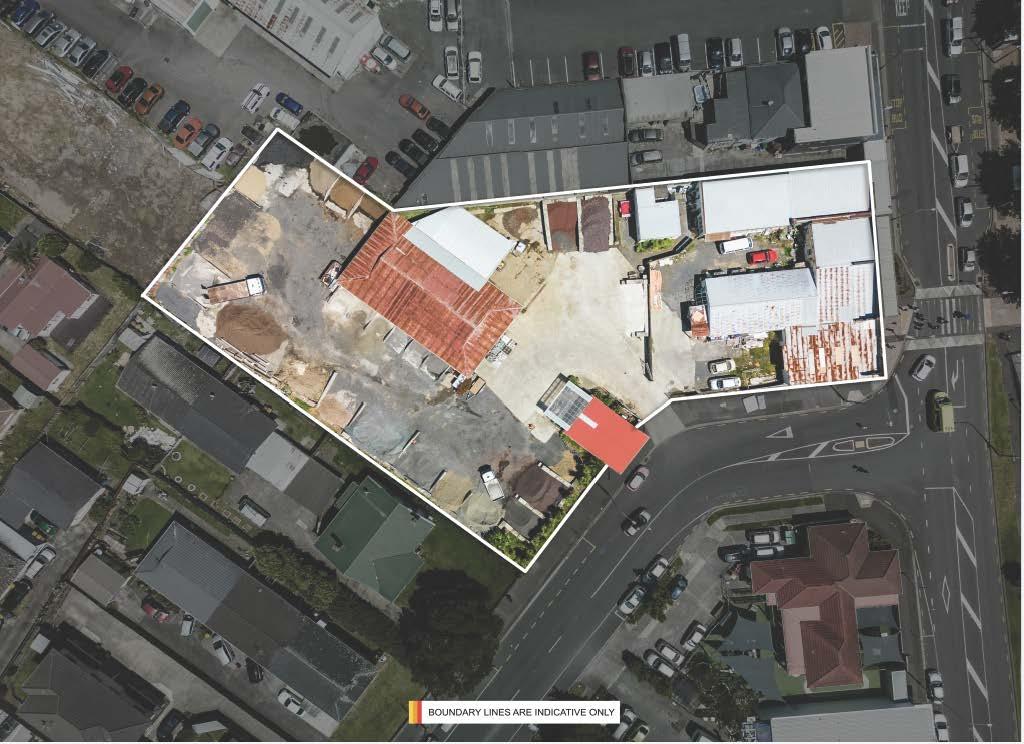

216 Rosebank Road

Avondale,Auckland

114 Harbourside Drive, Karaka NZ

§- b-�-

RIPE FOR DEVELOPMENT in KARAKA

Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land ho...

5 Coronation Road, Papatoetoe NZ

PRIME COMMERCIAL BLOCK.

Set in the heart of Old Papatoetoe's commercial hub, the opportunity to acquire blocks of this size

For Sale $4,000,000 Plus GST (if any)

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

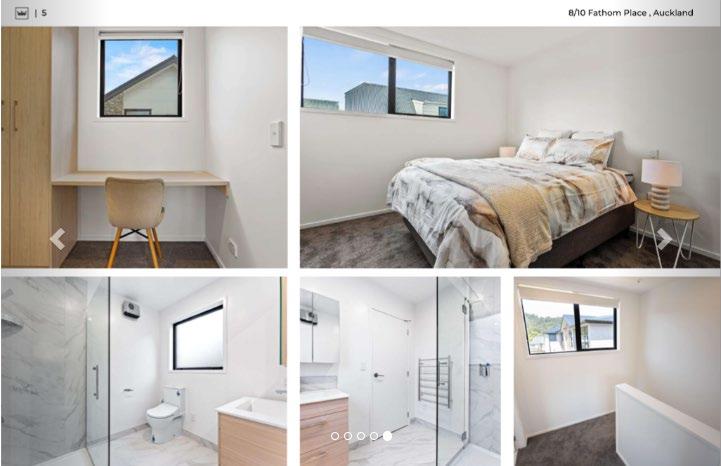

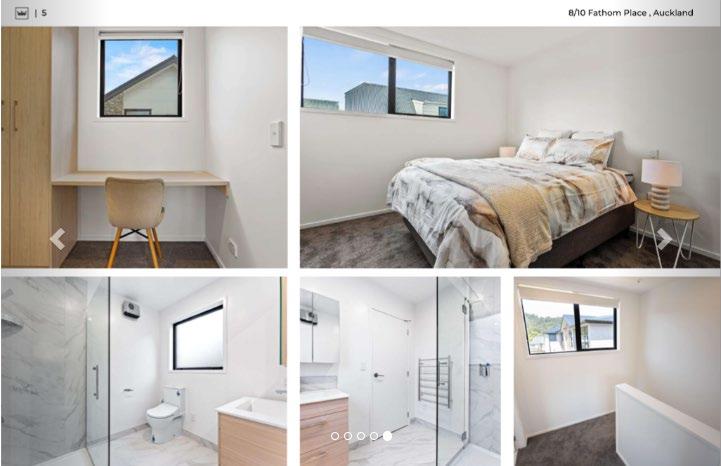

8/10 Fathom Place, Te Atatu Peninsula NZ

§1 bl �-

SMART TOWNHOUSE - Stunning complex

Located on Fathom Place in TeAtatu Peninsula, this Townhouse is in an area spoilt for choice of Res...

For Sale By Negotiation

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $635,000

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

216 Rosebank Road, Avondale South NZ

§1 bl �-

TOWNHOUSES - Modern & Affordable

Located on Rosebank Road, these Townhouses are within walking distance to Eastdale Reserve, Rosebank...

C 26-51/49 Te Kanawa Crescent, Henderson NZ

§2 bl �-

ATTRACTIVE ELEGANT TOWNHOUSE

This Townhouse is one of 28 homes in a complex or two or three storey brand new quality, crafted, s...

For Sale $675,000

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Unit C/23Awaroa Road, Sunnyvale NZ

§2 bl �1

Stunning Functional Townhouse

Perfectly positioned for access to trains, buses and motorway connections this Townhouse, at an affo...

For Sale $815,000

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

For Sale $740,000

View By Appointment

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

LJHooker

I ·-�l • LIi'\.. • f . Ii I •1• ' I l • ' "" ,, J.,,-�-- ' .•,. �-09 294 7500 . https://drury.ljhooker.co.nz/

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

SMART

TOWNHOUSE - Stunning complex

Located on Fathom Place in Te Atatu Peninsula, this Townhouse is in an area spoit for choice of Reservces, Walkways and Beached. Public Transport is also covered, with a Bus Stop around the corner or it's a 3 minutre drive to access the North Western Motorway.

• The ground floor is open plan consisting of the kitchen, dining and living areas. For added convenience, a washer/dryer combination is located in the kitchen space. There is also storage space beneath the stairs

• On the first floor, you will find a generously sized bedroom, featuring a built-in wardrobe. There is also a full-size bathroom on this level

• Step outside to a private, low-maintenance courtyard with a clothesline, storage/ bike shed, and a power supply

This stunning property amongst others, offers the perfect combination of convenience and luxury and value that you simply cannot miss

It is with no doubt that finding new homes at an affordable price point is only going to get increasingly harder as the City's population grows .

For full details on this Townhouse or others available in the complex please contact Brent Worthington

Brent Worthington

Mob: 0292 965 362

E: brent.worthington@ljhooker.co.nz

1 1 -

LJHookerTown&Country TNBPropertyServicesLtdLicencedREAA2008

TOWNHOUSES - Modern & Affordable 1 1

Located on Rosebank Road, these Townhouses are within walking distance to Eastdale Reserve, Rosebank School, Avondale College, and the famous Avondale Sunday Market.

In terms of transport, there is a bus stop just outside or it is a short drive to access the Motorway

•On the Ground Floor, the kitchen, dining, and living areas are open plan.

•There is a Washer/Dryer Combination conveniently located within the kitchen.

•Upstairs on the first floor is a full size bedroom, which includes a wardrobe and high storage space

•Also on this floor is a full size bathroom

•Outside is a low maintenance private courtyard, which includes a power supply. For units A, D-M, a clothesline is included

These move-in-ready homes feature top-of-the-line appliances, catering to both first-time homebuyers and savvy investors looking for a hassle-free experience. Imagine the convenience of having all your appliances seamlessly integrated, allowing you to focus on what truly matters

Constructed with superior materials, these homes are built to last and impress. The commitment to quality extends beyond aesthetics, as these residences are designed to be low-maintenance, giving you more time to live, work, and play in this dynamic city.

For full details please contact Brent Worthington on 0292 965 362

Brent Worthington Mob: 0292 965 362 E: brent.worthington@ljhooker.co.nz LJ Hooker Town & Country TNB Property Services Ltd Licenced REAA 2008

Please contact Brent directly for more information andfor a copy of the Comprehensive Property Reportor click here to view on website.

Drury

•8.4731 ha (more or less)

•8 Bay Milking shed -130sqm (Approx)

•Chicken shed – 200 sqm (Approx)

•Haybarn - Machinery storage

2nd Chicken Shed – 680sqm (Approx)

•Water Bore

Also available is the neighbouring property at 150 Sutton Road.

NOWPRICED!!

View

By Appointment only

Contact

Town & Country

(2008)

brent.worthington@ljhooker.co.nz

Please contact Brent directly for more information andfor a copy of the Comprehensive Property Reportor click here to go to website.

Zoned Future Urban!

•11.9382 ha (more or less)

•2 Bedroom Cottage- 124sqm (Approx)

•Single Garage & Shed - 36sqm (Approx)

Also available is the neighbouring property at 80 Sutton Road.

3 1 1

NOWPRICED!1

View By Appointment only

Contact

brent.worthington@ljhooker.co.nz (2008)

PRIME

150SuttonRoad Drury

DEVELOPMENT

Town & Country

KARAKA

IPE FOR DEVELOPMENT in KARAKA

Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land holding of this size and zoning is unlikely.

Currently consented for a 7 Lot residential subdivision, the property is also subject to Auckland Council's Plan Change 78Intensification proposed 18/08/2022. Possibly greater development opportunities!

TNB Property Services Ltd Licensed REAA(2008)

114HarboursideDrive

NNOW PRICED AT $4,000,000 + GST (if any) Contact Brent Worthington 0292 965 362 Click here to view on website

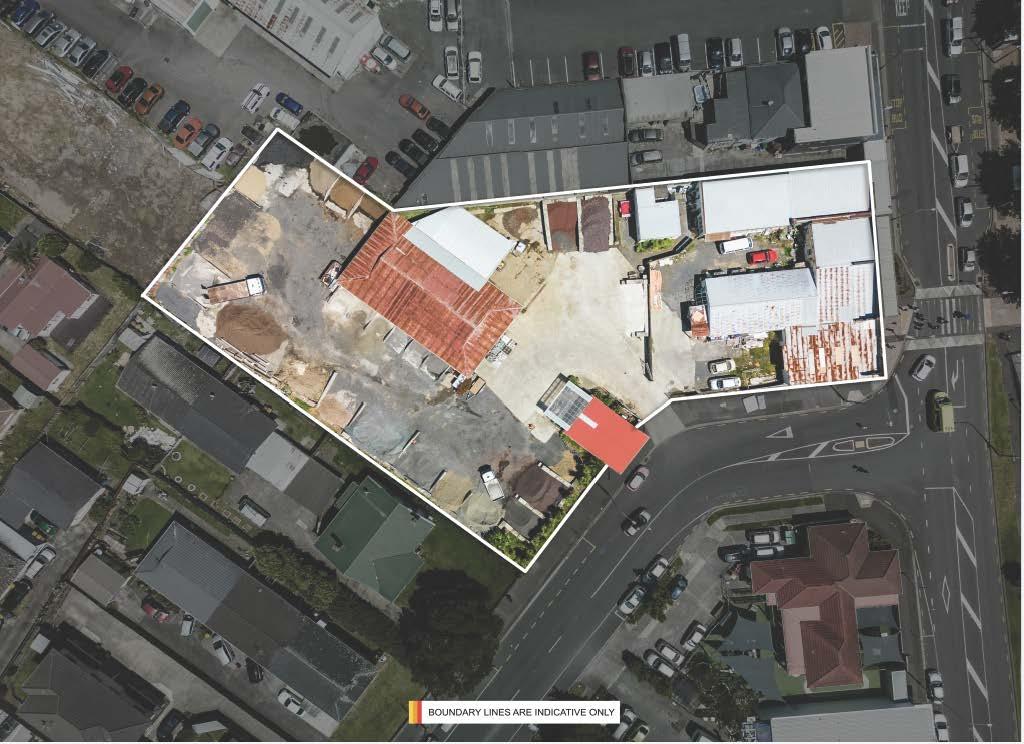

*Increasingly more difficult to find blocks of this size and zoning around in the heart of Papatoetoe

*Site is held in two Records of Title located adjacent to the corner of Coronation and Shirley Roads..

*Under the Auckland Council Auckland Unitary Plan (AUP)statesthat:

"The zone provides for a wide range of activities including commercial, leisure, residential, tourist, cultural, community and civic services, providing a focus for commercial activities and growth."

*Land 3662m² (m.o.)

*The six existing tenants currently return $138,581.00 per annum plus GST and outgoings.

(2008)

COMMERCIALBLOCK. View Contact Please contact Brent directly for more information and for a copy of the Comprehensive Property Report or click here to view on website.

5CoronationRoad PAPATOETOE PRIME

Town & Country

91 Beatty Road, Pukekohe NZ

§8 b7 �

uNuM1TED POTENTIAL

On the market for the first time in 43 years. The 630m2 dwelling is set on a 2,379m2 site (more or I...

SOLD PROPERTIES

https://drury.ljhooker.co.nz/

35 Briody Terrace, Stonefields NZ

§4 bl �4

STAND ALONE IN STONEFIELDS

Set on a 372m2 site (more or less) this 243m2 Fletcher designed and built dwelling will definitely i...

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

102Mountain Road,Mangere Bridge NZ

§2 bl �1

LOCATION - LOCATION - LOCATION CONJUNCTIONALS ARE WELCOME.

On the market for the first time ever, this offering is p...

3 Paparata Road, Bombay NZ

§4 b2 �8

MOTIVATED VENDOR MOVING SOUTH

*4 Double bedrooms.

* Master with ensuite.

* Impeccably cared for and presented. < ...

151 Barrack Road,Mount Wellington NZ

§4 bl �6

UNIQUE INVESTMENT with HUGE POTENTIAL

Located in the geographical centre of metropolitan Auckland, this property is all about potential. D...

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Sold

Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Sold Price onApplication

Lina Roban 021 022 88521 lina.rob@ljhooker.co.nz

LJHooker 09 294 7500

1/233 Great South Road Drury NZ 2113 drury@ljhooker.co.nz

OUR PEOPLE

BRENTWORTHINGTON

0292965362

Brent.worthington@ljhooker.co.nz

There’s not much Brent doesn’t know when it comes to selling real estate. This town and country agent has had a successful career in the property market and is now the proud owner of his own business. Definitely a quality over quantity man, when you bring Brent on board, you’ll find that accumulating listings is far less important to him than making each one as good as it can get. He prides himself on telling it like it isknowing you’ll be able to make better decisions with a person and information you can trust.

Complementing Brent’s practical and credible approach is a background full to the brim of industry knowledge and business expertise from 30 years working within the construction industry. His capabilities have been well proven as a highly successful business owner.

A family man, with a proven track record of success, Brent has earned an excellent reputation and the trust of his local community and business colleagues.

He places huge emphasis on customer satisfaction, attention to detail and conducting his business with a genuine duty of care. Brent has gained many awards as a business leader during his 12-year tenure in Real Estate.

His entrepreneurial style ensures he reaches out and connects people with like minds. He imparts his wisdom in a warm and friendly manner and helps people to make wise and right decisions before investing in the property market, Auckland wide.

If you are considering a lifestyle change, investing for your future or simply wanting to know the worth of your property in this fluctuating market, feel welcome to call or email Brent to receive the latest updates on the trends and statistics in your area.

BrentWorthington LicensedAgent&Principal

Whenyouknow,youknow. ™ TNB Property Services Limited, Licensed REAA (2008)

VENITAATTRILL

VenitaAttrill SalesConsultant

0212867792

venita.attrill@ljhooker.co.nz

MeetVenita-YourTrustedRealEstateExpertSince1996!

With an impressive career spanning over two decades, Venita began her journey in Real Estate sales in 1996 with the esteemed LJ Hooker/Harveys Group. Throughout her tenure, Venita has been recognized with numerous national awards, a testament to her unwavering dedication to her clients. In fact, approximately 90% of Venita's sales are derived from her past clients and client referrals, showcasing the exceptional level of trustandsatisfactionsheconsistentlydelivers.

Selecting the right agent is crucial, and there is no better way to make that decision than by evaluating their success and the manner in which they achieve it. Venita's vast clientele, who repeatedly seek her services, skill, and advice, stand as a true testamenttoherabilitytoexceedexpectations.

While Venita boasts extensive experience and a track record of success, she remains driven and committed to going above and beyond to achieve a premium outcome for every client. Her dedication to continuous improvement ensures that she remainsat theforefrontoftheindustry,offeringyouunparalleledserviceandexpertise.

When you choose Venita as your agent, you can rest assured that you have a trusted partner by your side, who will tirelessly work to secure the best possible results for you. With Venita, your real estate journey is in safe hands, backed by a legacy of excellenceandarelentlesspursuitofsuccess.

Contact Venita today and experience firsthand the difference a seasoned and determinedprofessionalcanmakeinyourrealestateendeavours.

Whenyouknow,youknow. ™ TNBPropertyServicesLimited,LicensedREAA(2008)

Town&Country

LINAROBAN

LinaRoban LicenseeSalesperson

02102288521

lina.roban@ljhooker.co.nz

Prior to entering the world of real estate, driven by her love of meeting and helping people, Lina had an impressive 20 year career in sales and marketing roles in the telecommunications and corporate marketing industries where her expertise in communication and negotiation always resulted in the delivery of superior customer service to her clients.

Originally from Fiji, Lina epitomises energy, passion integrity and hard work in everything she turns her hand to.

When not delivering superior service to her clients, Lina loves spending time with her family and is a passionate cyclist, owning both road and mountain bikes. With her three children all having "flown the coop", Lina and her husband also have plenty of time to enjoy their love of travel and some of their more memorable adventures include extensive journeys throughout South East Asia, the USA and the South Pacific.

TNB Property Services Limited, Licensed REAA (2008 drury@ljhooker.co.nz https: //drury.ljhooker.co.nz) When you know, you know. ™

With Christine's many years of success in Real Estate, Christine isnow contributing to the success of the team at Drury Town & Country along with sharing her vast experience, expertise and cheerful disposition with our clients.

CHRISTINECONNOLLY

Connolly SalesAssociate

Christine

Whenyouknow,youknow. ™ TNB Property Services Limited, Licensed REAA (2008)

0278405248 christine.c@ljhooker.co.nz

DEBBIEHARRISON

Debbie Harrison PropertyManager

021302864

debbie.harrison@ljhooker.co.nz

With a passion and a commitment to providing exceptional service, Debbie has a fantastic attitude of getting things done and ensuring that the clients are happy and well cared for. She takes great pride in her work and goes above and beyond to ensure the satisfaction of both property owners and tenants.

Debbie’s attention to detail and organizational abilities are exceptional, enabling her to efficiently handle all aspects of property management, from tenancy agreements, rent collection to property inspections and maintenance coordination.

Debbie understands that property management requires a compassionate and empathetic approach, and she always strives to create a positive and harmonious living environment for tenants while protecting the interests of property owners.

Whether you are a property owner seeking professional management services or a tenant searching for a well-maintained rental property, Debbie is committed to delivering exceptional results and ensuring a smooth and rewarding experience for all parties involved.

With her excellent communication skills, strong work ethic and dedication to excellence, Debbie Harrison is a true asset to LJ Hooker, Drury.

Whenyouknow,youknow. ™ TNB Property Services Limited, Licensed REAA (2008)

JohnnyBright AUCTIONEER

Johnny is proud to be a part of the team at Apollo Auctions NZ. Entering real estate in 2014, he has developed and honed his craft of auctioneering and negotiating skills to a level that now sees him as an industry leader. Johnny has worked and collaborated with some of the most notable agents, business owners and auctioneers across New Zealand.

With the fusion of his knowledge and skill together with his personable approach, Johnny creates the ultimate auction experience . He implements drive and dedication to each and every property that he calls - regardless of value, location or personal circumstances. Johnny’s performance style and welcoming nature allows him to capture the audience and motivate buyers. He will guide you through the process and create a solid platform to achieve the best possible outcome for your auction.

Johnny also has a passion for acting. With a Bachelor of Performing and Screen Arts, he has appeared in several TV commercials and films, his most widely recognized being ‘Falling Inn Love’, an American Netflix production which was filmed in New Zealand. He has also worked with the Auckland Theatre Company on a number of occasions.

He currently resides in Beachlands with his wife and two young children.

Interested in working with the best in the business?

M: 022 173 1885 E: johnny@apolloauctions.co.nz

It’s rare in life that we get something for nothing with no strings attached, especially if it genuinely adds value. Nevertheless, that’s precisely I will give you. Expert home loan advice which has reliably proven to offer significant long-term financial advantage. I keep strict tabs on the country’s largest network of banks plus numerous smaller and second-tier lenders, so you don’t have to. What’s more, this comes at no cost to you because your chosen bank pays for the privilege. You have nothing to lose, yet have a higher chance of securing better terms. Rest assured - if there’s a superior deal out there for you, I’ll find it.

In the typically stoical world of finance, I offer a point of difference. Not only will you receive excellent independent and impartial advice, but you’ll have fun doing it. Even after 15 years in the mortgage arena, my enthusiasm for objectives and commitment to clients shines through at every turn. Endorsement comes from countless glowing testimonials and in my own words: “I’m at my happiest helping people navigate through difficult situations, giving hope and concrete opportunity where they previously had none.”

Prior experience as sales manager in the fields of telecommunications and pharmaceuticals, then later, a small business owner and private property investor, provided me with considerable business acumen across many industries. My customer-focused approach and personable demeanor also reflect a lifetime of experience in client relations. I credit travel to distant locations for creating an enduring interest in different cultures and honing my ability to relate well to the needs of the broader population. In particular, I soundly empathise with people relocating from other countries to make New Zealand their home.

To continue giving my professional best, I maintain balance by travelling and participating in seasonal sports such as paddle boarding and skiing. I enjoy indulging in my creative side; with landscaping, painting watercolours or improving my guitar playing prowess. Additionally, I actively support my community through Christians Against Poverty (CAPNZ), but above all, my wife and our five shared children always take centre stage.

There's little that I haven't seen in my time in the industry, priding myself on an ability to deal with the trickiest of scenarios, never turning anyone away. My philosophy of treating people how I'd like to be treated results in a 360-degree perspective which sets myself apart.

Get in touch if you need any expert guidance.

Regards

Keith Jones 021 849 767

keith.jones@loanmarket.co.nz

loanmarket.co.nz/keith-jones

View Website

When you know, you know.™

Town & Country