The Property Chronicle

September 2023

Town & Country

When you know. you know.

September 2023

Town & Country

When you know. you know.

25 September 2023

Real Estate Market Flourishes Amidst Changing Demographics and Optimism.REINZ's figures reflect a market that is showing signs of growth. Despite light listing numbers, there has been an uptick in sales, signaling a late-winter surge of confidence. Jen Baird, Chief Executive of REINZ, explained that August typically marks an uptick in activity as spring approaches, and this year is no exception.

“We saw steady activity this month with increased sales counts both compared to August 2022 and last month. This lift in market activity has also seen the median days to sell decrease this month,” Baird said.

Comparing to the same time in 2022, New Zealand saw a significant increase in the total number of properties sold, up 9.2 percent to 5,509. This trend was mirrored outside Auckland, where sales counts increased by 5.2 percent year-on-year.

“Local agents are reporting that, as new listing numbers continue to decrease, the demand for entry-level property is holding and fairly strong, and properties are starting to move quicker,” Baird said.

At the end of August, the total number of properties for sale across New Zealand decreased by 10.6 percent year-on-year, suggesting a tightening market.

“Month-on-month we have seen a 20.9% increase of stock coming to market, suggesting seller confidence is returning and we can expect a more normal spring ahead for the property market,” she said.

Brent Worthington Principal and Licensee Agent

Brent Worthington Principal and Licensee Agent

The real estate market's resilience is further underscored by population dynamics outlined by economist Tony Alexander. Statistics New Zealand reported a net gain of over 96,000 people, driven largely by immigration from countries like India, the Philippines, China, and South Africa. This influx has led to increased demand in the rental market and encouraged young people to consider home purchases

The strong demand for housing has translated into rising sales, Alexander said.

“In seasonally adjusted terms over the past three months to August house sales have grown by about 8 percent after rising nearly 20 percent in the three months to May.

“Prices are also rising and now sit 2.1 percent above their lows nationwide.”

Alexander predicts that house prices are poised for further growth in the coming years, especially as falling interest rates make homeownership more attainable.

“The strong population pressure is an important development for the home building sector … Costs have soared but ability to recoup these rises from buyers has been difficult,” he said.

“As house prices climb further, the stock of listings goes down, and worries about finding a property increase, people will turn their attention back towards getting something new built.”

As always I trust you enjoy this month's publication.

Kind Regards

Brent

Brent Worthington Principal and Licensee Agent

AglimpseofSpringwasseenintherealestatemarketinAugust,asthelatestdatafromtheReal EstateInstituteofNewZealand(REINZ)paintsapictureofresilienceandoptimism.

REINZ'sfiguresreflectamarketthatisshowingsignsof growth.Despitelightlistingnumbers,therehasbeenan uptickinsales,signallingalate-wintersurgeof confidence.JenBaird,ChiefExecutiveofREINZ,explained thatAugusttypicallymarksanuptickinactivityas springapproaches,andthisyearisnoexception.

“Wesawsteadyactivitythismonthwithincreasedsales countsbothcomparedtoAugust2022andlastmonth. Thisliftinmarketactivityhasalsoseenthemediandays toselldecreasethismonth,”Bairdsaid.

Comparingtothesametimein2022,NewZealandsaw asignificantincreaseinthetotalnumberofproperties sold,up9.2percentto5,509.Thistrendwasmirrored outsideAuckland,wheresalescountsincreasedby5.2 percentyear-on-year.

“Localagentsarereportingthat,asnewlistingnumbers continuetodecrease,thedemandforentry-level propertyisholdingandfairlystrong,andpropertiesare startingtomovequicker,”Bairdsaid.

AttheendofAugust,thetotalnumberofpropertiesfor saleacrossNewZealanddecreasedby10.6percent year-on-year,suggestingatighteningmarket.

“Month-on-monthwehaveseena20.9%increaseof stockcomingtomarket,suggestingsellerconfidenceis returningandwecanexpectamorenormalspring aheadforthepropertymarket,”shesaid.

Therealestatemarket'sresilienceisfurtherunderscored

bypopulationdynamicsoutlinedbyeconomistTony Alexander.StatisticsNewZealandreportedanetgainof over96,000people,drivenlargelybyimmigrationfrom countrieslikeIndia,thePhilippines,China,andSouth Africa.Thisinfluxhasledtoincreaseddemandinthe rentalmarketandencouragedyoungpeopleto considerhomepurchases.

Thestrongdemandforhousinghastranslatedinto risingsales,Alexandersaid.

“Inseasonallyadjustedtermsoverthepastthree monthstoAugusthousesaleshavegrownbyabout8 percentafterrisingnearly20percentinthethree monthstoMay.

Alexanderpredictsthathousepricesarepoisedfor furthergrowthinthecomingyears,especiallyasfalling interestratesmakehomeownershipmoreattainable.

“Thestrongpopulationpressureisanimportant developmentforthehomebuildingsector…Costshave soaredbutabilitytorecouptheserisesfrombuyershas beendifficult,”hesaid.

“Ashousepricesclimbfurther,thestockoflistingsgoes down,andworriesaboutfindingapropertyincrease, peoplewillturntheirattentionbacktowardsgetting somethingnewbuilt.”

“Pricesarealsorisingandnowsit2.1 percentabovetheirlowsnationwide.”

Whenitcomestosellingyourhome,firstimpressionsareeverything.

Takingalittletimeandefforttoensureyourpropertyis presentedinthebestpossiblelightcansignificantly impactyourchancesofattractingmorepotential buyers,achievingahighersalesprice,andsellingyour homequickly.

Butwhereshouldyoudirectyourefforts?Preparing yourhomeforthemarketcanfeellikeanendlesslistof tasks,butsomekeyareasaremorelikelytocaptivate prospectivebuyers.Here'sastraightforwardchecklist toguideyouonhowtoprepareyourpropertyfor inspection.

Elevateyourcurbappeal

Manypotentialbuyersdrivebyapropertybefore decidingtoattendanopenhome.Theirfirstimpression isoftenformedatthecurb.Toenticetheminside,pay attentiontoyourhome'sexterior:

* Ensure your property number is visible from the street

* Check that outdoor light bulbs are functional

* Waterblast pavements to remove dirt and grime

* Consider painting your fence or adding a bright accent colour to catch the eye without overwhelming the view

* Tidy up the front garden: trim, weed, remove dead plants, and mow the lawn, including the strip in front of your home

* Give your front garden a simple makeover with defined flower beds, small shrubs, timber borders, and some focal point plants in proportion to the garden's size

* Keep garbage bins out of sight

Clean and shine

Preparing your property for inspection requires a thorough cleaning effort to make it irresistible. If you're short on time, consider hiring a professional cleaner to kickstart the process:

Cleanallwindowsandwindowframes

Eliminatecobwebs,includingthosehighonthe ceiling

Dustandwipedowneveryreachablesurface

Don'tforgettocleantheinsideofcupboardsand removeanyunwantedgrime,animalhair,mould,or dust

Ifyouhavethetimebeforethefirstopenforinspection, havealookaroundforanysmallproblemsthatcanbe fixedeasily.Somejobsthatmightneedyourquick attentioninclude:

* Replace broken tiles

* Re-grout around tiles

* Fix leaky taps

* Patch holes in the walls

* Repair doors that don't swing easily

* Resurface or paint over chipped or stained surfaces Replace cracked glass or mirrors

* Ensure the front gate opens smoothly

* Replace burnt-out light bulbs

Your LJ Hooker agent can connect you with local professionals if you need assistance and offer advice on prioritising these tasks.

Depersonaliseanddeclutter

Youwantbuyerstofallinlovewithyourhouse,tobe abletopicturethemselvescookinginyourkitchen, entertainingfriendsatthetable,relaxinginthe bedroomandsoon,youneedtomakesureyour propertyisnotoverflowingwithyourpersonalitems.

Packawayfamilyphotographsandpersonal items

Keepjustenoughornamentstocreatealived-in, welcomingfeel

Displayornamentsneatlyinsmallgroupson shelves,bedsidetables,andinthebathroom

Arrangefurnitureforastylishlookandeasy movement

Perfectlymakethebeds,thinkhospitalcorners!

Considerhiringahomestylistwhocanworkwithyour existingfurnitureandaddsoftfurnishingsand artwork.YourLJHookeragentcanhelpyoufinda professionalstylisttofityourbudget.

Maximiselightandair

Youknowyourselfhowniceitistowalkintoanairy andlightfilledspace.Yourgoalhereistoensureyour propertyhasasmuchlightaspossibleandhasa feelingoffreshness.

Removeheavydrapesorblindsthatblocklight

Openallblinds,curtains,andshutters

Airoutyourhomeforatleastanhourbefore inspections

Addpottedplantsandfresh-cutflowersfora freshtouch

Highlightkeyareas

Makesureyourpropertyappealstoabroadrangeof buyers.Focusonkeyareasthatcreateanemotional connection.

Livingroom

Createaspaciousfeelbyreducingclutter

Repositionfurnituretoimproveflow

Addacoffeeorsidetableforstyle

Getcarpetsprofessionallycleaned

Kitchen

Thekitchenisoneroomthatcanmakeorbreaka sale.Itisusuallythemostexpensiveroominany property,soprospectivebuyersdonotwanttoseea kitchenthatneedsatotalupgrade.

Herearesomequickfixestohelpmakeyourkitchen shine:

Clearkitchencounterstoshowcasespace

Updateeverydayappliances

Ensureoven,cooktop,anddishwasherareworking

Considerreplacingbenchtopsorcupboarddoors ifneeded

Buyerstodaylikebeautifulbathrooms–theywanta roomtheycanrelaxandpamperthemselvesin,no matterwhatsizeorconditionyourbathroomisin.Itis importanttospendsometimeandmoneymakingthe mostofwhatyouhave.

Cleantiles,grouting,windows,mirrors,andshower screens

Opt.forliquidpumpsoap

Fixanydamagedfittings

Clearvanitytops,leavingonlyessentialitems

Fresh,qualitytowelscanmakeadifference

Bedroomsneedtobepresentedasneat,tidyandas spaciousaspossible.

Investinnewlinensandmatchingbedsidelamps

Declutterwardrobestohighlightstorage

Emptylinenbasketsandbins

Youdonotnecessarilyneedtodoabiglandscaping jobonyourgarden,andyouprobablydonothave timeanyway,butbeforethefirstopenhome,spenda fewhoursoftheweekendsprucingthegardenup.It canpaydividendsinthelongrunwithbuyers.

Spruceupthegardenwithoutmajorlandscaping

Weedgardenbeds

Mowandmaintainthelawn

Pruneshrubsandtrees

Waternewlyplantedshrubs

Tidyupgardentoolsandchildren'splay equipment

Hidepetfoodbowlsandtoys

Bookingafreeexpertpropertyappraisalwithyour localLJHookerrealestateagentisagreatstartto understandingyourhome'svalueandgetting professionalassistance.YourLJHookeragentcanalso provideinvaluabletipsforhomeinspection preparation,ensuringyourpropertyisintopcondition whenyoulistitonthemarket.Withnearly100yearsof industryexperience,theyareyourtrustedpartnersin achievingasuccessfulsale.

Theinformationcontainedinthispublicationisgeneralinnatureandisnotintendedtobepersonalisedrealestateadvice. Beforemakinganydecisions,youshouldconsultalegalor professionaladvisor.LJHookerNewZealandLtdbelievestheinformationinthispublicationiscorrect,andithasreasonablegroundsforanyopinionorrecommendationcontainedinthis publicationonthedateofthispublication. Nothinginthispublicationis,orshouldbetakenas,anoffer,invitationorrecommendation.LJHookerNewZealandLtdacceptsnoresponsibilityfor anylosscausedasaresultofanypersonrelyingonanyinformationinthispublication. ThispublicationisfortheuseofpersonsinNewZealandonly.Copyrightinthispublicationisownedby LJHookerNewZealandLtd. Youmustnotreproduceordistributecontentfromthispublicationoranypartofitwithoutpriorpermission. LicensedREA2008.

No longer constrained by the dull and mundane, home offices now serve as spaces where functionality harmonises with creativity and inspiration. Whether your home workspace occupies a modest corner or an entire room, it's high time to liberate yourself from the traditional office setup and embrace a more dynamic approach that can enhance productivity and unleash creativity.

For those working from home, the concept of "freedom" plays a pivotal role in home office design. The beauty of working remotely lies in the liberty to adorn your workspace with colours that resonate with you, setting the tone for motivation and mood.

Before you embark on your creative journey, take a moment to consider some key factors. Begin by reflecting on the primary purpose of the space. Is it exclusively a workspace, or does it serve multiple functions?

Next, ponder the amount of natural light that graces the room—a factor that can significantly influence the ambiance.

Finally, contemplate the size of the room and the atmosphere you intend to cultivate. Do you desire a cosy and warm environment, or is a light and airy space more in line with your vision?

For those keen on maximising natural light, opt for neutral wall colours to create an open and welcoming atmosphere. Alternatively, experiment with patterns such as checkerboards on the floor to inject visual interest without overwhelming the space.

Contrary to the common belief that smaller spaces demand lighter colour palettes, don't shy away from mid to dark shades. They can bestow depth and character upon your workspace. Blues and greens, particularly, prove to be excellent choices for a home office. The blue spectrum's invigorating effect on the mind makes it a perfect candidate for a workspace.

You can envelop all surfaces in shades of green or blue, allowing vibrant elements to take centre stage. Alternatively, maintain neutral walls and introduce blues and greens through furnishings and accessories.

Vibrant colours can be a powerful source of creativity, transforming your home office into a place where you genuinely want to spend your time. When selecting a colour for a smaller space like a home office, consider your personal preferences as each individual has their own comfort zone when it comes to colours.

However, if you prefer subtlety over boldness, you can still infuse vibrancy into your workspace by incorporating a strong feature colour. Rather than painting entire walls with striking feature colours, consider applying them to bookshelves or using them to create geometric shapes.

For a subtle yet striking transformation, consider rejuvenating a wooden chair with a bold coat of paint. These features can create a captivating contrast against a monochromatic or neutral backdrop.

In today's digital age, your home office can serve as a canvas for expressing your personality and creativity during video calls. These visually appealing backdrops not only reflect your individuality but also serve as conversation starters in virtual meetings.

Consider designing a tidy storage cubicle or shelving display to feature behind you during video calls. Experiment with interesting and eye-catching colours or adorn it with colourful and captivating objects, a painted canvas, or framed travel photos. However, exercise caution as excessively bright colours on expansive areas, like walls, can prove distracting. The primary objective remains to maintain focus.

If you prefer a simpler approach, wallpaper provides a convenient and effortless way to add visual interest to your backdrop. Larger-format patterns, such as mid-century geometric designs or bold florals, work exceptionally well for video calls. These patterns offer visual engagement without inducing visual clutter.

For those looking to elevate their home office design, experimenting with paint effects can introduce creativity and visual intrigue into the workspace. Cubicles, storage units, and desks can be adorned with stencils or geometric shapes to create unique and personalised elements in your home office. The possibilities are limited only by your imagination.

Another practical design choice involves the incorporation of chalkboard or blackboard paint. These paints can provide you with a functional memo space while adding a touch of playfulness to your home office. They are versatile, suitable for both indoor and outdoor use, and available in a range of colours.

To expand your working space to the walls or other flat surfaces, consider utilising a clear coat system that transforms your wall into a functional whiteboard for jotting down ideas, tasks, and reminders.

For those seeking an easily removable memo board without damaging surfaces with pins or tape, explore magnetic paint options. Once applied and dried, these surfaces can securely hold magnets, making them ideal for displaying notes and reminders.

In the realm of home office design, the ultimate objective is to create a space that transcends mere functionality. It should be a place that inspires and motivates, fostering productivity and creativity alike. Through a thoughtful combination of colours, creative design choices, and functional elements, your home office can evolve into a space where you and your family members can work and learn with enthusiasm and efficiency.

As we navigate the dynamic landscape of remote work and education, remember that your home office is more than just a workspace—it's an extension of your personality, interests, and aspirations. Embrace the opportunity to infuse vibrant colours, unleash your creativity, and optimise functionality.

Your home office can become a canvas for productivity, innovation, and inspiration.

On the following pages you will find our latest property management newsletter.

Please don't hesitate to contact our team who can ably assist you with any property management matters you may have or if you have any questions about anything in the newsletter or property management in general..

Investinginpropertycanbealucrativeventure,butitcomeswithitsshareofresponsibilities andchallenges

Oneofthecrucialdecisionsyou'llfaceasaproperty owneriswhethertomanageyourinvestmentproperty yourselforenlisttheservicesofaprofessional propertymanager

Let’sexplorekeybenefitsofusingapropertymanager thatcanmakeasignificantdifferenceinyourreal estateinvestmentjourney

Experiencedpropertymanagersexcelatscreening tenants,conductingreferencechecks,andreviewing rentalhistories Thisexpertisehelpsensurethatyou havehigh-qualitytenantsoccupyingyourproperty

Propertymanagersactasintermediaries,handling tenantissueslikelatepaymentsandproperty damageonyourbehalf,reducingpotentialconflicts betweenyouandthetenant

ImmediateTenantSupport

Propertymanagersareaccessiblearoundtheclock toaddressproperty-relatedissuespromptly Their strongnetworkwithtradespeopleensurescompetitive pricingformaintenanceandrepairs

Skilledpropertymanagersknowhowtokeeptenants satisfied,increasingthelikelihoodofrentalrenewals andreducingvacancies

Workingdiligentlytoensuretimelyrentcollection, propertymanagersalsoenforcerentalpolicieswhen necessary,ensuringaconsistentincomestream

Entrustingyourpropertyandtenantmanagement toaprofessionalmeanslessworry,astheyhandle themajorityoftheworkforyou

Propertymanagersstayup-to-datewitheverchanginglegalrequirements Ensuringyouremain compliantinyourdealingswithtenants,savingyou timeandpotentiallegaltroubles

Propertymanagershelpminimisetheriskof vacantpropertiesandpotentialdamagethrough regularinspectionsanddetailedreports, maintainingtheproperty'scondition

Whilepropertymanagementfeesmayrangefrom 5-10percentofyourrentalincome,theyareoften tax-deductible,makingthemacost-effective choice

Propertymanagerskeepyouinformedabout marketrentalsandrentalincreases,optimising yourreturns

Propertymanagersexcelatfindingsuitable tenantsquickly,reducingthetimebetweenold tenantsleavingandnewonesmovingin

Theypossesslocalknowledgeandaccessto resourcesforeffectivepropertymarketing,

ensuringyourrentalispromotedtotheright audienceatacompetitiveprice.

MaintainingProfessionalBoundaries

Propertymanagersmaintainastrictlyprofessional relationshipwithtenants,preventingtheblurred boundariesthatcanarisewhenlandlordsdevelop personalfriendshipswithtenants

IndustryExperience

Propertymanagersbringyearsofexperience managinginvestmentproperties They'reexpertsat tenantsourcing,disputeresolution,andmarket knowledge,reducingstressforpropertyowners

Withtherightpropertymanageratyourside,itcan transformyourinvestmentpropertyexperience You willreducestress,increaseefficiency,andoptimise yourreturns

Ifthethoughtofmanagingyourpropertykeepsyou upatnight,considerenlistingtheservicesofan experiencedpropertymanagementteam Their expertiseanddedicationwillhelpyounavigatethe complexitiesofpropertyownershipwhileensuring yourinvestmentthrives.

Contactourexperiencedprofessionalstodayfora freeexpertrentalappraisal Discoverhowwecan takethestressoutofmanagingyourpropertywhile maximisingyourreturns

Intheevolvinglandscapeofhomeoffices,the focusisshiftingfrommerefunctionalitytoinfusing creativityandinspirationintothesespaces As remoteworkandhome-basedlearninggain prominence,ourhomeworkspacesdemand attention Whetheryourofficeoccupiesacorner oradedicatedroom,it'stimetobreakfreefrom thedrabcorporatecubiclesandembraceamore vibrantapproach

Workingfromhomeoffersthelibertytopaintyour workspacewithcoloursthatigniteactionand happiness Considerthepurpose,naturallight,and sizeofthespacewhenchoosingcolours Optfor neutralwallstoenhancenaturallightorexperiment withcheckerboardpatternsonthefloorforvisual interest

Don'tshyawayfrommidtodarkcoloursinsmaller spaces;theycanbeimpactful Bluesandgreens, knownforawakeningthemind,areidealforhome offices

Ifboldcoloursaren'tyourstyle,incorporatethem sparinglyonbookshelvesorasgeometricshapes

Forvideocallbackdrops,createeye-catching displayswithvibrantcoloursorwallpapers. Wallpaperwithlargerpatternsworkswell.Toadd funandcreativity,trypainteffects,stencils,or chalkboardpaint.

Indesigningyourhomeoffice,thegoalistocreate aninspiringandmotivatingspace,wherepaint coloursplayasignificantrole,makingitaninviting placeforallfamilymemberstoworkandlearn

Beforemakinganydecisionsyoushouldconsultalegalor professionaladvisorLJHookerNewZealandLtdbelievestheinformationinthispublicationiscorrectandithasreasonablegroundsforanyopinionorrecommendationcontainedinthis publicationonthedateofthispublication Nothinginthispublicationisorshouldbetakenasanofferinvitationorrecommendation

Theinformationcontainedinthispublicationisgeneralinnatureandisnotintendedtobepersonalisedrealestateadvice

LJHookerNewZealandLtdacceptsnoresponsibilityfor anylosscausedasaresultofanypersonrelyingonanyinformationinthispublication ThispublicationisfortheuseofpersonsinNewZealandonlyCopyrightinthispublicationisownedby LJHookerNewZealandLtd

LicensedREA2008

Youmustnotreproduceordistributecontentfromthispublicationoranypartofitwithoutpriorpermission

13 September 2023

The Real Estate Institute of New Zealand’s (REINZ) August 2023 figures show continued optimism and further activity in the property market. While listing numbers remain light, they are up on July and sales counts have increased, showing some late winter confidence.

REINZ Chief Executive Jen Baird says August often shows a resurgence of activity as Spring approaches.

“We saw steady activity this month with increased sales counts both compared to August 2022 and last month. This lift in market activity has also seen the median days to sell decrease this month,” Baird says.

Compared to August 2022, August 2023 saw an increase in the total number of properties sold across New Zealand, up 9.2% to 5,509, from 5,047, and up 9.2% month-on-month. For New Zealand excluding Auckland, sales counts also increased by 5.2% year-on-year from 3,508 to 3,690.

Across the regions, Northland (4.5%), Auckland (18.2%), Waikato (16.2%), ManawatuWanganui (8.6%), Tasman (8.0%), Nelson (12.3%), Marlborough (38.1%), Canterbury (24.9%) and Southland (4.2%) all saw increases in sales counts year-on-year.

“Local agents are reporting that, as new listing numbers continue to decrease, the demand for entry-level property is holding and fairly strong, and properties are starting to move quicker,” says Baird.

REINZ PressReleaseThe national median days to sell reduced by 6 days year-on-year and 5 days month-onmonth, a change from the trend for many months of increased days to sell. Eleven regions saw a decrease in the median days to sell compared to July 2023, with the biggest decrease occurring in Nelson, which dropped 18 days from 60 days to 42 days.

At the end of August, the total number of properties for sale across New Zealand was 22,750, down 10.6% (2,691 properties) from 25,441 year-on-year, and down 1.5% month-on-month. New Zealand excluding Auckland inventory was down year-on-year from 15,196 to 14,099, a decrease of 1,097 properties or 7.5% annually.

Nationally, new listings decreased by 0.6% from 7,492 listings to 7,444 year-on-year and increased 20.9% compared to July 2023. For New Zealand excluding Auckland, listings decreased 4.2% year-on-year from 4,749 to 4,550 and increased 18.3% month-on-month.

“The number of properties available for sale over the last three months continues to fall. Listings are still at lower levels compared to August 2022, but only slightly. Month-onmonth we have seen a 20.9% increase of stock coming to market, suggesting seller confidence is returning and we can expect a more normal spring ahead for the property market,” comments Baird.

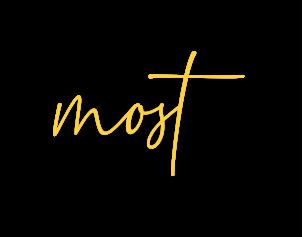

Nationally, the August 2023 median sale price decreased 4.1% year-on-year to $767,000 from $800,000.

Regionally, median sale prices remained down year-on-year except for five regions: Nelson +0.7%; Canterbury +0.8%; Southland +2.0%; Northland +3.6% and Gisborne up 14.8% year-on-year and up 13.0% month-on-month. Auckland, the country's largest property market, saw its median sale price move back up over the $1 million mark to $1,010,000 increasing 2.0% month-on-month, but decreasing 8.2% year-on-year.

Wellington saw month-on-month increases with the median sale price up 2.3% from $733,000 to $750,000, and a 16.9% increase in the number of properties sold from 438 to 512 month-on-month. Days to sell month-on-month decreased from 52 to 38, a 14-day decrease.

“Higher interest rates and ongoing cost of living pressures continue to impact the market ahead of the looming election. There is a sense across the country that the market has seen the bottom both in terms of prices and sales volumes, but we are all waiting to see how long it will take to see growth reemerge,” comments Baird.

The HPI for New Zealand stood at 3,588 in August 2023, showing a 0.9% increase compared to the previous month. However, when compared to the same period last year, the HPI reflects a 4.7% decline. The average annual growth in the New Zealand HPI over the past five years has been 5.7% per annum. It remains 16.1% below the peak.

Media contact: Laura Wilmot Mobile: 021 953 308

Head of Communications and Engagement, REINZ

lwilmot@reinz.co.nz

• Nelson (0.7%), Canterbury (0.8%), Southland (2.0%), Northland (3.6%) and Gisborne (14.8%) saw an increase in median sale price year-on-year with Gisborne also up 13.0% month-on-month.

• Southland had the biggest month-on-month increase in sales count with a 25.5% rise and a 4.2% increase year-on-year, followed by Manawatu-Wanganui with a 20.5% increase month-on-month and an 8.6% increase year-on-year.

• Wellington saw increases in median sale price up 2.3% from $733,000 to $750,000, a 26.9% increase in the number of properties sold from 438 to 512 and a decrease in the days to sell from 52 to 38, a 14-day decrease.

Five of sixteen regions had positive year-on-year median price movements, the largest being Gisborne with +14.8%.

Eight regions (50%) had positive month-on-month movements, Gisborne again leading the way with a 13.0% increase.

With Wellington, six of eight Territorial Authorities had negative year-on-year median price movements with South Wairarapa District worst hit at -28.8%, but Porirua City and Wellington City seeing a 30.8% and 3.5% increase respectively, compared to August 2022. This was the first time since April 2022 (16 months ago) that Wellington City showed a yearon-year increase in median price and the second month in a row that Porirua showed a yearon-year increase.

Hastings District and Kaipara District have both had three consecutive months of year-onyear increases, the most of all Territorial Authorities.

In terms of the month of August, this August saw the lowest sales count in:

• Wellington since 2010

• Otago and West Coast since 2014

• In terms of the month of August, this August saw the highest sales count in:

• New Zealand excluding Auckland, Canterbury, Manawatu-Whanganui, Nelson and Southland since August 2020

Tasman had its highest median days to sell since September 2008.

Wellington had its lowest median days to sell since December 2021.

New Zealand, New Zealand excluding Auckland, Auckland and Canterbury had their lowest median days to sell since December 2022.

In terms of the month of August, August 2023 had the highest median days to sell in:

• Tasman since 1999

• Taranaki since 2013

• Gisborne and Marlborough since 2014

• Northland since 2019

No regional HPI records this month.

Both Otago and Southland had year-on-year HPI increases this month. This is the first time since October 2022 that any region has had a year-on-year increase in HPI.

Wellington’s run of being in the bottom two ranked regions for year-on-year HPI movement has ended after 21 consecutive months between November 2021 and July 2023. Wellington ranked fifth overall this month.

Otago is the top-ranked HPI year-on-year movement this month. Southland is second and Canterbury is third.

In terms of the three months ending HPI movement, Southland ranks first, Otago second and Wellington third.

Seven of fifteen regions have had a decrease in inventory in August 2023 compared to one year prior.

Seven of the fifteen regions had a year-on-year increase in listings. This is the highest number of regions with a year-on-year increase in listings since October 2022.

Inventory and listing data come from realestate.co.nz.

Nationally, 14.3% (786) of properties were sold at auction in August 2023, compared to 9.3% (467) in August 2022.

New Zealand excluding Auckland saw 8.3% of properties (306) sell by auction compared to 7.2% (254) the year prior.

Inventory and listing data is courtesy of realestate.co.nz . More information on activity by region can be found in the regional commentaries visit the REINZ’s website.

August 2023

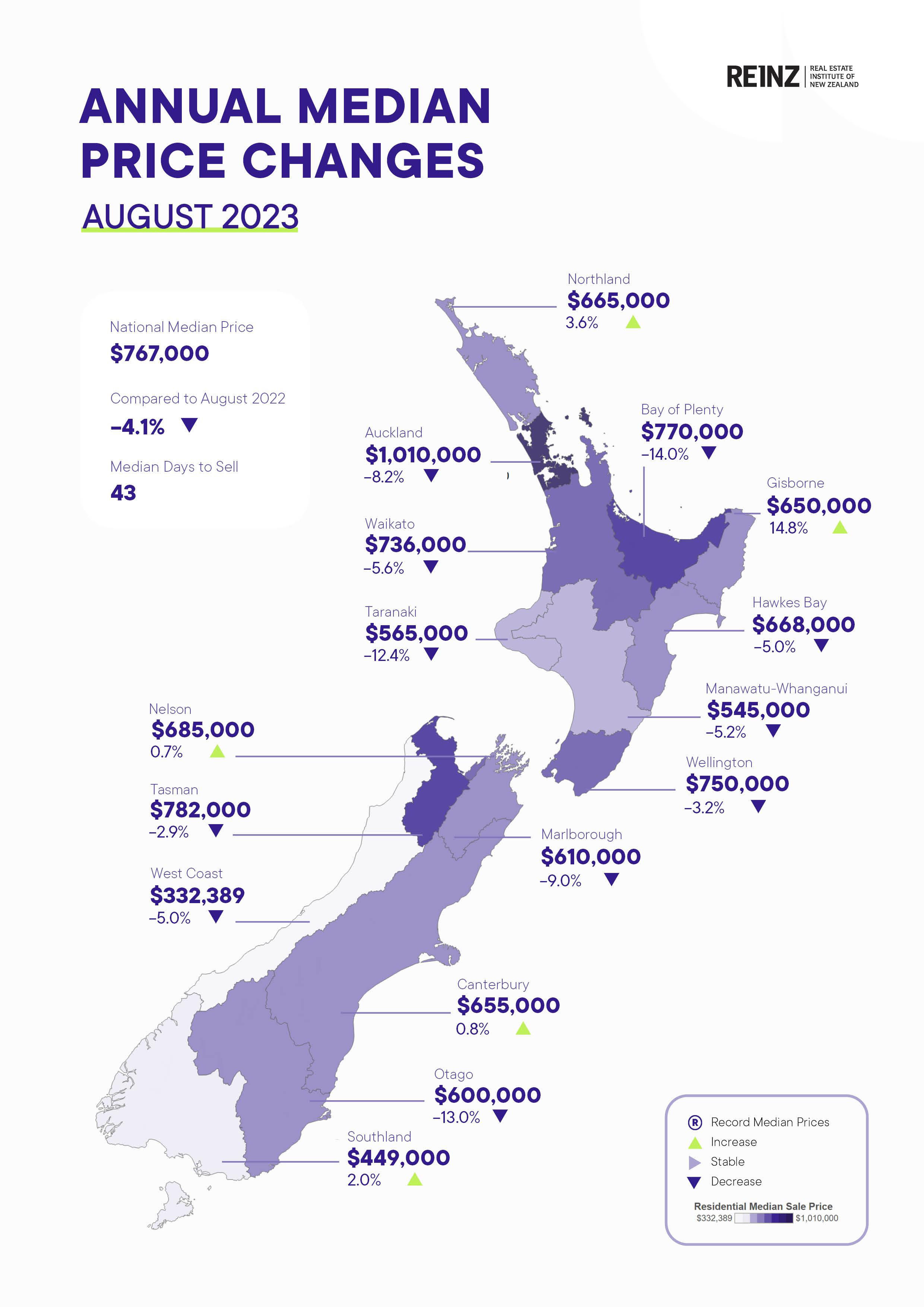

• Are more or fewer people showing up at auctions?

• Are more or fewer people attending open homes?

Page 2 Page 3

• How do you feel prices are generally changing at the moment?

• Do you think FOMO is in play for buyers?

• Are you noticing more or fewer first home buyers in the market?

• Are you noticing more or fewer investors in the market?

• Are you receiving more or fewer enquiries from offshore?

• Are property appraisal requests increasing or decreasing?

• What are the main concerns of buyers?

4 Page 5

• Are investors bringing more or fewer properties to the market to sell than three months ago?

• What factors appear to be motivating investor demand?

• Regional results

views of licensed real estate agents all over New Zealand regarding how they are seeing conditions in the residential property market in their areas at the moment. We asked them how activity levels are changing, what the views of first home buyers and investors are, and the factors which are affecting sentiment of those two large groups.

Welcome to the REINZ & Tony Alexander Real Estate Survey. This survey gathers together the views of licensed real estate agents all over New Zealand regarding how they are seeing conditions in the residential property market in their areas at the moment. We ask them how activity levels are changing, what the views of first home buyers and investors are, and the factors which are affecting the sentiment of those two large groups.

The key results from this month’s survey include the following.

• For the first time since November 2021

FOMO (fear of missing out) exceeds FOOP (fear of over-paying), that is, more agents say buyers are worried about missing out than say they are worried about making a purchase and then watching prices fall away.

• There has been a rise in requests recently for property appraisals, suggesting more stock coming forward soon for buyers to peruse.

• Attendance numbers at auctions and open homes continue to rise.

• First home buyers remain the key driving force in the market while investors have only a small market presence.

A net 30% of the 447 agents responding to this month’s nationwide survey have reported that they are seeing more people showing up at auctions. This is the strongest result since February 2021 and continues a string of improvements in this gauge of buyer interest in the market which has been underway since the start of this year.

Note how like many of our other gauges of buyer interest the graph of auction attendance shows a sharp deterioration in our November survey, undertaken at the very end of October. This reflects the higher than expected inflation number released on October 18 causing an eventual extra 1% to be added to fixed mortgage rates as monetary policy got tightened more than had been previously expected – or at least hoped.

A net 51% of our survey respondents have said that they are seeing more people at open homes. This is the fifth highest reading for this measure in the three years our survey has been running and a long way from the net 48% who in November last year said they were seeing fewer open home attendees. Perusing houses is a precursor to buying them.

For the first time since November 2021, when the credit crunch hit, there are more agents saying that prices are rising in their area than say they are falling – a net 9%. Prices change in lagged response to changes in sales and other measures we track, and it seems probable that this measure will move to higher readings in the near future. This may be especially so when we consider that the housing market is picking up despite not just the absence of any declines in mortgage interest rates but some fresh increases recently despite no extra monetary policy tightening.

For three months now just below a net 58% of agents have reported that they are seeing more first home buyers in the market. This measure moved into sustained positive territory in February this year and experienced a big jump up in our May survey undertaken at the end of April. Note that this jump then from 22% to 55% occurred before the Reserve Bank stopped raising interest rates.

FOMO is making a firm return but has yet to scale the heights seen in 2020 and 2021. A gross 34% of agents this month have said that they see buyers displaying signs of worry about missing out. That can mean either missing out on a particular type of purchase or range of choice or failing to buy before prices go higher.

One of the distinct characteristics of the turnaround in the residential real estate market which is currently underway is the absence of investor buyers. Individuals buying in order to provide accommodation for the one-third of New Zealanders needing rental space have stood back from the market ever since the tax change of March 2021. To date, the effect on the rental supply of this lack of buying and slightly greater than average selling has had its impact obscured by the record surge in house construction over the past decade. But as that boom now fades away and we see the exit of some long-term accommodation to serve holidaymakers and foreign students, conditions are likely to tighten considerably in rental markets. This is especially likely in the main cities.

This month a net 13% of agents still report that they are seeing fewer investors in the market. This is the least weak reading since March 2021 – but it is still negative and well removed from the net 59% positive reading for first home buyers.

We track this measure just in case one day it becomes again a matter of moment. The degree of negativity in this measure has lessened slightly over the past three months. But at -22% it is still telling us that agents are not experiencing much enquiry from offshore. Note that such enquiries can include Kiwis and foreigners – the latter group not being able to make a purchase however, unless Australian or Singaporean.

We ask agents to identify from a list the main things which buyers seem to be concerned about. Their main concern currently is rising interest rates followed by difficulties getting finance and then insufficient listings.

This month a net 33% of agents have said that they are receiving more requests for property appraisals. This is a firm rise from a net 13% in last month’s survey and tells us that there should be some new listings coming forward in the near future. Note however that history tells us when the housing market picks up the arrival of buyers tends to exceed the number of new vendors and the end-month stock of listings trends down as has already been happening since the start of this year.

We have two graphs showing the changes over time in areas of buyer concern and they warrant extra study by readers this month. In this first graph note the grey line. It shows the proportion of agents noting that buyers are worried about prices falling after they make a purchase. This is our FOOP measure – fear of overpaying. Only 28% of buyers now say FOOP is a concern. This is the lowest reading for this concern since October 2021. Note how it has fallen as FOMO has risen and for the first time since November 2021, FOMO exceeds FOOP.

Second, note the dark purple line. It records the proportion of agents saying buyers are worried that there are not enough listings. It has risen to 46% from only 14% just three months ago. The window of opportunity for buyers to casually peruse a good number of properties on offer is closing quickly.

This second graph shows the proportion of agents noticing that buyers are concerned about their incomes and rising interest rates. Worries about employment remain low, while worries about finance costs are still high though easing off slowly.

We ask what factors appear to be motivating investors to buy. 37% of agents have replied nothing is, meaning investors are not buying. As the graph below this one shows, this measure of disinterest is becoming slowly less large.

For the first time since October last year, our survey has revealed more agents observing investors bringing their properties to the market to sell than holding them back. We can take this rather complicated measure as an indication of the general change in the willingness of investors to sell. Under pressure from high interest rates and another year bringing additional reduction in the proportion of interest payments which can be offset against rental income, thoughts of selling are growing.

There has been a slight rise recently in the proportion of agents saying investors are looking to buy because they anticipate price rises – to 15% from 7% two months ago and 17% last month. The rise is not a straight-line increase.

The following table breaks down answers to the numerical questions above by region. No results are presented for regions with fewer than 7 responses as the sample size is too small for good statistical validity of results. The three top of the South Island regions are amalgamated into one and Gisborne is joined with Hawke’s Bay.

The best use of the table is achieved by picking a variable and comparing a region’s outcome with the national result shown in bold in the bottom line. For instance, nationwide 34% of agents are seeing buyers display FOMO. In Auckland the proportion is higher at 43% but not as high as in Wellington at 47%.

The table shows net percentages apart from the FOMO question in column F. The net percent is calculated as the percentage of responses saying a thing will go up less the percentage saying it will go down.

A. # of responses

B. Are property appraisal requests increasing or decreasing?

C. Are more or fewer people showing up at auctions?

D. Are more or fewer people attending open homes?

E. How do you feel prices are generally changing at the moment?

F. Do you think FOMO is in play for buyers?

G. Are you noticing more or fewer first home buyers in the market?

H. Are you noticing more or fewer investors in the market?

I. Are you receiving more or fewer enquiries from offshore?

J. Are investors bringing more or fewer properties to the market to sell than three months ago?

This publication is written by Tony Alexander, independent economist. You can contact me at tony@tonyalexander.nz Subscribe here

This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. We strongly recommend readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. No person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.

CoreLogic Chief Property Economist Kelvin Davidson has forecast that it's only a matter of time until the national average property price stops falling or even starts rising again.

It comes after a noticeable slowdown in price declines over the past three months:

• June = down 1.2% monthly, 2.4% quarterly, 10.6% annually.

• July = down 0.4% monthly, 2.3% quarterly, 10.1% annually.

• August = down 0.2% monthly, 1.8% quarterly, 8.7% annually.

Mr Davidson said the price floor is likely to be near, with many of the key fundamental drivers now turning around.

“It’s notable that mortgage rates are likely to now be close to their peak, although further small changes can’t be ruled out as global markets, and hence wholesale financing costs, remain a little jittery,” he said.

“On top of that, migration has significantly boosted property demand, and labour markets remain robust. We’re also now starting to see the impact of the loosening in the loan to value ratio rules from June 1st flow through to more low-deposit lending for both owner-occupiers and investors with a 35-40% deposit, who were previously locked out.”

KeithJones-LoanMarketIn Auckland, the city’s average property price fell to $1.255 million in August, which was 0.3% lower than the previous month, 3.8% lower than the previous quarter and 10.7% lower than the previous year.

Christchurch’s average price at the end of August was $732,000 – which was up 0.2% over both the month and quarter, but down 3.8% over the year.

Wellington’s average price fell to $891,000, down 0.3% over the month, 0.6% over the quarter and 11.8% over the year.

Hamilton’s average price at the end of August was $800,000, after falling 0.2% over the month, 0.7% over the quarter and 7.4% over the year.

In Tauranga, the average price fell to $1.019 million, after a monthly decline of 0.2%, quarterly decline of 0.4% and annual decline of 10.6%.

Dunedin’s average price at the end of August was $610,000 – down 1.1% monthly, 1.7% quarterly and 7.1% annually.

The national average property price has fallen 13.2% during this downturn but is still 24.3% higher than in March 2020, when the pandemic began. If Mr Davidson is right, prices are more likely to rise than fall from this point. So if you want to buy, it might be best to take action sooner rather than later, so you don’t have to pay a higher price. If you’re thinking about making a purchase, contact me and I’ll arrange a home loan pre-approval for you.

Published: 22/9/2023

30 Franklyne Road, Otara NZ

§3bl�l

URGENT SALE-MAKE AN OFFER

Currently tenanted, this 985m2 site (more or less) is a developers dream. Zoned Residential (9D), re...

Listings

https://drury.ljhooker.co.nz/

1 Luke Place, Otara NZ

§5 b2 �2

URGENT SALE-MAKE AN OFFER

* Prominent site

* Prime Location

* Huge development potential

114 Harbourside Drive, Karaka NZ

§- b- �-

RIPE FOR DEVELOPMENT in KARAKA Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land ho...

ForSale By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

ForSale Price By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

ForSale By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

5 Coronation Road, Papatoetoe NZ

§- b- �6

PRIME COMMERCIAL BLOCK. Set in the heart of Old Papatoetoe's commercialhub, theopportunityto acquire blocks of this size ...

ForSale By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

3 Paparata Road, Bombay NZ

§4 b2 �s

BOMBAYBEAUTY- BOXES TICKED!

*4 Double bedrooms.

* Master with ensuite.

* Impeccably cared for and presented. < ...

26 Dawson Road, Otara NZ

§3 b 1 � 10

UNIQUE INVESTMENTwith HUGE POTENTIAL

Located on the Flat Bush-Otara boundary, this property is all about potential. DEVELOP, DEVE...

ForSale Price By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

ForSale By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

BOMBAY BEAUTY - BOXES TICKED!

1006 sqm

4 Bedrooms

2 Bathrooms incl Ensuite Walk-in robe

Separate Laundry

Large Double Garage with Internal Entry Minimal care grounds with safe and secure rear for children and pets.

ByNegotiation

ByAppointment

ByNegotiation

ByAppointment

Sited for all day sun and situated close to so many amenities and locations! CLICK

(2008)

Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land holding of this size and zoning is unlikely.

Currently consented for a 7 Lot residential subdivision, the property is also subject to Auckland Council's Plan Change 78Intensification proposed 18/08/2022. Possibly greater development opportunities!

ByBy Negotiation91 Beatty Road, Pukekohe NZ §8 b7 �

uNuM1TED POTENTIAL

On the market for the first time in 43years. The 630m2 dwelling is set on a 2,379m2 site (more or I...

22September

Sold Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

35 Briody Terrace, Stonefields NZ §4 bl �4

STAND ALONE IN STONEFIELDS

Set on a 372m2 site (more or less) this 243m2 Fletcher designed and built dwelling will definitely i...

Sold Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

102 Mountain Road,Mangere Bridge NZ §2 bl �1

LOCATION - LOCATION - LOCATION CONJUNCTIONALS ARE WELCOME.

On the market for the first time ever, this offering is p...

151 Barrack Road,Mount Wellington NZ §4 bl �6

"' UNIQUE INVESTMENT with HUGE POTENTIAL

Located in the geographical centre of metropolitan Auckland, this property is all about potential. D...

Sold Brent Worthington 029 296 5362

brent.worthington@ljhooker.co.nz

Sold ina Roban 021 022 88521

lina.rob@ljhooker.co.nz

Consumers will have up to $100,000 of their deposits protected in the unlikely event of a bank failure, after parliament passed legislation designed to strengthen the financial system.

Under the Deposit Takers Bill, which has been approved by parliament, the Reserve Bank of New Zealand (RBNZ) will ensure consumers are “promptly compensated” for up to $100,000 if they’ve deposited their money with an authorised deposit-taking institution that fails.

This government guarantee is expected to begin in late 2024, as the RBNZ first has a lot of preparatory work to do.

Currently, only two of the 38 countries in the OECD (an organisation that primarily consists of developed countries) lack a deposit insurance scheme – New Zealand and Israel.

“The passing of this bill will allow for the introduction of depositor protection and close a long-standing gap in New Zealand’s financial safety net, bringing New Zealand in line with international best practices,” Finance Minister Grant Robertson said.

“This means eligible New Zealanders will be provided economic security if their bank or other deposit-taking institution fails, while helping protect the country’s financial system and wider economy. The $100,000 limit will fully protect around 93% of depositors.”

To access the government guarantee, New Zealanders will have to deposit their money in authorised deposit-taking institutions. That includes banks, credit unions, building societies and certain retail deposit-taking finance companies.

The RBNZ will be responsible for managing the scheme and ensuring depositors are compensated if an eligible institution fails.

“Coverage for the scheme applies on a per depositor, per institution basis. In a compensation payout scenario, amounts held in joint accounts at a single institution will be split equally across account holders and count towards eligible deposits, up to the coverage limit for each depositor at that institution,” according to the RBNZ.

First Home Partner, is when Kāinga Ora make a financial contribution to purchase and share ownership of a home...

This scheme applies to existing brand-new homes built or to be built (turn-key deals) The Kainga Ora amount is to be repaid to Kainga Ora interest free over the next 15 years.

The income cap for the last 12 months earnings for a household is $130,000.

Clients must have either of the following.

• NZ residency

• NZ permanent residency

• NZ Citizenship

• Clients apply to Kainga Ora Shared Partnership Scheme and get preapproval.

• Next, Clients are qualified by the bank for the maximum amount of lending that the bank can approve them for.

• Then, clients put in their deposit from Savings, Kiwisavers, Subsidy and Gifts.

• Then, Kainga Ora put in the remaining amount up to $200,000 for the purchase of the property, or up to 25% of the purchase price (whichever is lower)

Clients must own and live in the property for a minimum of 3 years.

A couple earning $65,000 salary each with no debts or children apply (note the $130,000 income cap).

Based on an average cost of living (as at 03/05/2023) this couple can afford $730,000 in lending. They have $70,000 from savings and Kiwisaver. Kainga Ora will put in $200,000 equity. Meaning they can buy a home of around $1,000,000.

For complete details Contact: Kainga Ora or check their website

Phone: 0508 935 266

Email: firsthome.enquiries@kaingaora.govt.nz

When you know, you know. ™

0292965362

Brent.worthington@ljhooker.co.nz

There’s not much Brent doesn’t know when it comes to selling real estate. This town andcountryagenthashadasuccessfulcareerinthepropertymarketandisnowthe proud owner of his own business. Definitely a quality over quantity man, when you bring Brent on board, you’ll find that accumulating listings is far less important to him than making each one as good as it can get. He prides himself on telling it like it isknowing you’ll be able to make better decisions with a person and information you cantrust.

Complementing Brent’s practical

and credible approach is a background full to the brim of industry knowledge and business expertise from 30 years working within the construction industry. His capabilities have been well proven as a highly successful businessowner.

A family man, with a proven track record of success, Brent has earned an excellent reputationandthetrustofhislocalcommunityandbusinesscolleagues.

He places huge emphasis on customer satisfaction, attention to detail and conducting his business with a genuine duty of care. Brent has gained many awards asabusinessleaderduringhis12-yeartenureinRealEstate.

Hisentrepreneurialstyleensureshereachesoutandconnectspeoplewithlikeminds. Heimpartshiswisdominawarmandfriendlymannerandhelpspeopletomakewise andrightdecisionsbeforeinvestinginthepropertymarket,Aucklandwide.

Ifyouareconsideringalifestylechange,investingforyourfutureorsimplywantingto know the worth of your property in this fluctuating market, feel welcome to call or emailBrenttoreceivethelatestupdatesonthetrendsandstatisticsinyourarea.

0210

2288521lina.roban@ljhooker.co.nz

Prior to entering the world of real estate, driven by her love of meeting and helping people, Lina had an impressive 20 year career in sales and marketing roles in the telecommunications and corporate marketing industries where her expertise in communication and negotiation always resulted in the delivery of superior customer servicetoherclients.

Originally from Fiji, Lina epitomises energy, passion integrity and hard work in everythingsheturnsherhandto.

When not delivering superior service to her clients, Lina loves spending time with her family and is a passionate cyclist, owning both road and mountain bikes. With her three children all having "flown the coop", Lina and her husband also have plenty of time to enjoy their love of travel and some of their more memorable adventures includeextensivejourneysthroughoutSouthEastAsia,theUSAandtheSouthPacific.

0278405248

christine.c@ljhooker.co.nz

WithChristine'smanyyearsofsuccessinReal Estate,Christineisnowcontributingtothesuccess oftheteamatDruryTown&Countryalongwith sharinghervastexperience,expertiseandcheerful dispositionwithourclients.

Whenyouknow,youknow. ™

021302864

debbie.harrison@ljhooker.co.nz

With a passion and a commitment to providing exceptional service, Debbie has a fantastic attitude of getting things done and ensuring that the clients are happy and well cared for. She takes great pride in her work and goes above and beyond to ensure the satisfaction of both property owners and tenants.

Debbie’s attention to detail and organizational abilities are exceptional, enabling her to efficiently handle all aspects of property management, from tenancy agreements, rent collection to property inspections and maintenance coordination.

Debbie understands that property management requires a compassionate and empathetic approach, and she always strives to create a positive and harmonious living environment for tenants while protecting the interests of property owners.

Whether you are a property owner seeking professional management services or a tenant searching for a well-maintained rental property, Debbie is committed to delivering exceptional results and ensuring a smooth and rewarding experience for all parties involved.

With her excellent communication skills, strong work ethic and dedication to excellence, Debbie Harrison is a true asset to LJ Hooker, Drury.

Johnny is proud to be a part of the team at Apollo Auctions NZ. Entering real estate in 2014, he has developed and honed his craft of auctioneering and negotiating skills to a level that now sees him as an industry leader. Johnny has worked and collaborated with some of the most notable agents, business owners and auctioneers across New Zealand.

With the fusion of his knowledge and skill together with his personable approach, Johnny creates the ultimate auction experience . He implements drive and dedication to each and every property that he calls - regardless of value, location or personal circumstances. Johnny’s performance style and welcoming nature allows him to capture the audience and motivate buyers. He will guide you through the process and create a solid platform to achieve the best possible outcome for your auction.

Johnny also has a passion for acting. With a Bachelor of Performing and Screen Arts, he has appeared in several TV commercials and films, his most widely recognized being ‘Falling Inn Love’, an American Netflix production which was filmed in New Zealand. He has also worked with the Auckland Theatre Company on a number of occasions.

He currently resides in Beachlands with his wife and two young children.

It’srareinlifethatwegetsomethingfornothingwithnostringsattached,especially if it genuinely adds value. Nevertheless, that’s precisely I will give you. Expert home loan advice which has reliably proven to offer significant long-term financial advantage. I keep strict tabs on the country’s largest network of banks plus numerous smaller and second-tier lenders, so you don’t have to. What’s more, this comesatnocosttoyoubecauseyourchosenbankpaysfortheprivilege.Youhave nothingtolose,yethaveahigherchanceofsecuringbetterterms.Restassured-if there’sasuperiordealoutthereforyou,I’llfindit.

In the typically stoical world of finance, I offer a point of difference. Not only will you receive excellent independent and impartial advice, but you’ll have fun doing it. Even after 15 years in the mortgage arena, my enthusiasm for objectives and commitment to clients shines through at every turn. Endorsement comes from countless glowing testimonials and in my own words: “I’m at my happiest helping people navigate through difficult situations, giving hope and concrete opportunity wheretheypreviouslyhadnone.”

Prior experience as sales manager in the fields of telecommunications and pharmaceuticals, then later, a small business owner and private property investor, provided me with considerable business acumen across many industries. My customer-focused approach and personable demeanor also reflect a lifetime of experience in client relations. I credit travel to distant locations for creating an enduring interest in different cultures and honing my ability to relate well to the needs of the broader population. In particular, I soundly empathise with people relocatingfromothercountriestomakeNewZealandtheirhome.

To continue giving my professional best, I maintain balance by travelling and participating in seasonal sports such as paddle boarding and skiing. I enjoy indulging in my creative side; with landscaping, painting watercolours or improving my guitar playing prowess. Additionally, I actively support my community through Christians Against Poverty (CAPNZ), but above all, my wife and our five shared childrenalwaystakecentrestage.

There's little that I haven't seen in my time in the industry, priding myself on an ability to deal with the trickiest of scenarios, never turning anyone away. My philosophy of treating people how I'd like to be treated results in a 360-degree perspectivewhichsetsmyselfapart.

Getintouchifyouneedanyexpertguidance.

Regards

KeithJones021849767

keith.jones@loanmarket.co.nz

loanmarket.co.nz/keith-jones

When you know, you know.™

Town&Country