The Property Chronicle

TOWN & COUNTRY

Whenyou know,youknow.™ August2023

TOWN & COUNTRY

Whenyou know,youknow.™ August2023

21 August 2023

The housing market continues to evolve, showcasing a robust demeanour despite historical seasonal slumps.

As the Real Estate Institute of New Zealand (REINZ) releases its July 2023 report, housing analysts and economists are pointing out the positive aspects of the shifting landscape and hinting at a brighter future.

Amidst the ebb and flow of property market trends, economists are providing insightful analysis that sheds light on the underlying dynamics of the market. This comes at a time when the latest property market trends across the regions show resilience and growth.

Despite July typically being a slower month for property sales, REINZ CEO Jen Baird noted there has been a return of buyers to the market.

"This month’s figures show a lift in market activity with sales counts slightly increasing in many parts of the country on July last year, and the year-on-year decrease in median prices continuing to ease, suggesting some confidence is returning."

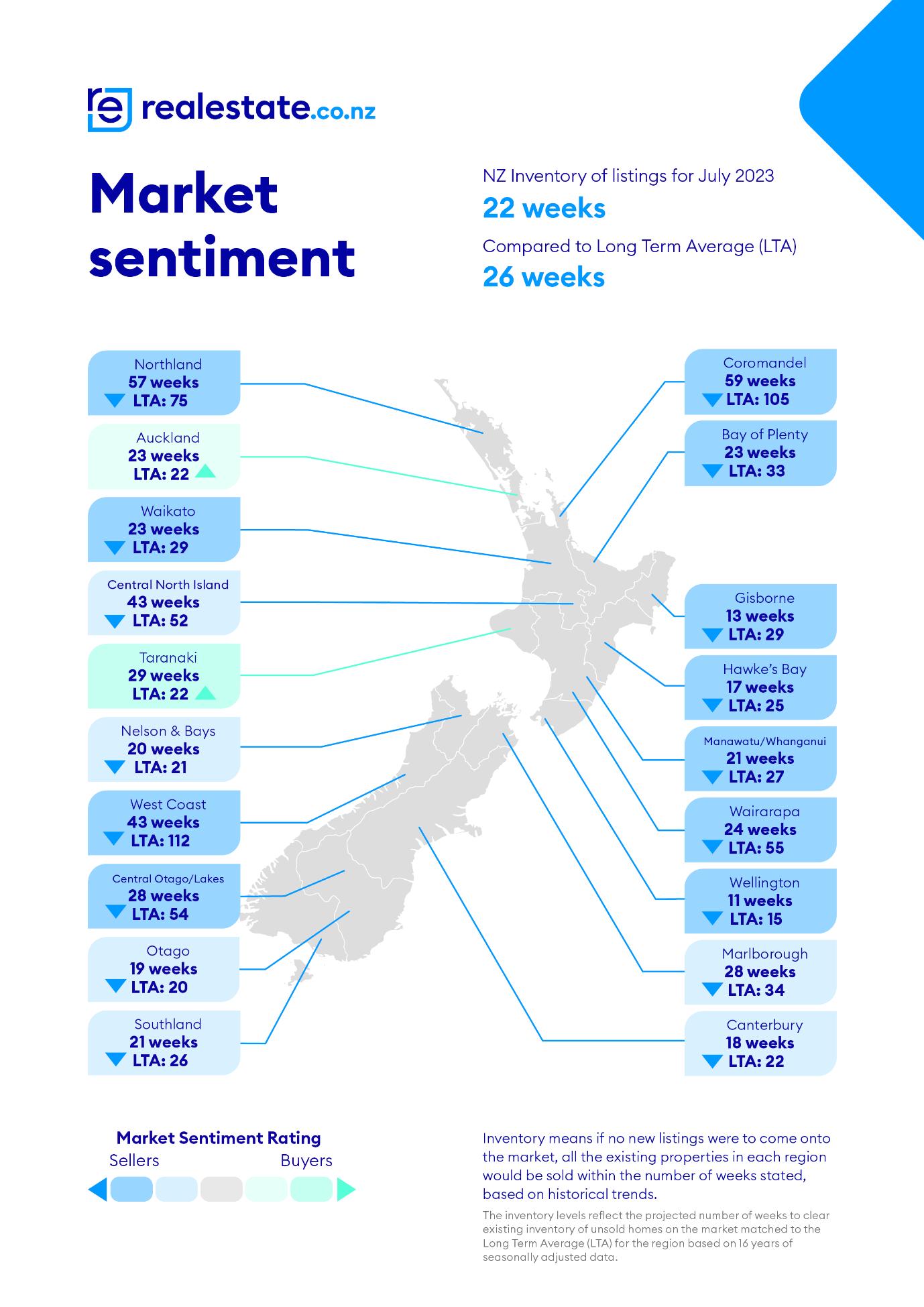

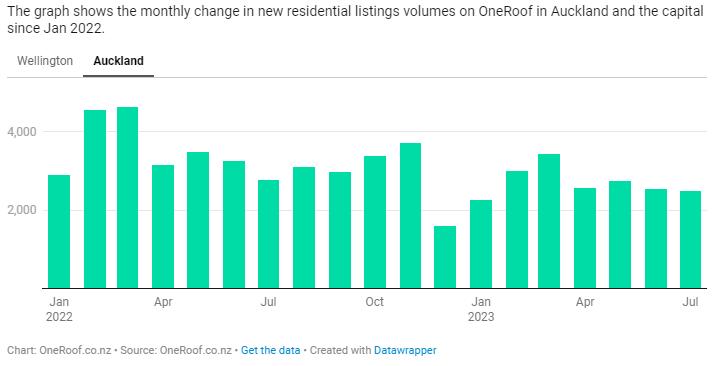

All regions, except for Marlborough, saw a decrease in listings numbers compared to a year ago, and six of the 15 regions have seen listings drop by more than 20 percent year-on year.

"These falls don’t mean that buyers are struggling to find something to purchase as the average nationwide level of stock for the past five years has been almost 22,000 – below the end of July 2023 number of around 24,000," Independent economist Tony Alexander said.

Brent Worthington Principal and Licensee AgentLJ

Alexander noted the changing tides of buyer and seller sentiments. Recent data from his monthly survey of real estate agents reveals a positive shift – the net proportion of agents reporting more requests from potential vendors for property appraisals has surged to 33 percent from a mere 13 percent in late June. This uptick suggests a growing willingness among potential sellers to explore the market and potentially list their properties.

Baird acknowledges the unique economic backdrop, stating, "With sales counts up this month, the national inventory level is falling. More competitive prices and a 'get in now' attitude is bringing more buyers out ahead of this year’s election."

The current economic landscape plays a pivotal role in shaping the property market's trajectory. With robust job growth and a minimal rise in unemployment rates, the market reflects a sense of stability that may deter immediate downsizing or renting decisions among property owners.

History, as Alexander points out, offers valuable insights into the market's behaviour. It's often seen that during market upswings, the number of buyers surpasses that of sellers.

"Maybe not so much this year but instead through 2024, stocks of listings around the country are likely to fall at a rate which may surprise many people. This will become one of the factors causing an acceleration in the pace of price gains next year."

As always I trust you enjoy this month's publication.

Kind Regards

Brent

Brent Worthington Principal and Licensee Agent

Spring is an excellent time to sell your property for a variety of reasons. As the seller, you will want to prepare your home in the right way, as this gives you the best chance of attracting great buyers, achieving a higher sales price, and, ultimately, locking in a successful sale.

Inthisguideweexplainwhyspringisagreattimeto putyourpropertyonthemarket,andweexplore specificstrategiesforgettingyourhouseready.

Whyspringisanidealtimetosell

PropertysellersinNewZealandoftenholdoffuntil springtolisttheirproperty.Oneofthereasonsisthe sunnierweatherandblossominggardensmaking propertieslookmoreappealing.Additionally,buyers aremotivatedtogetoutandaboutafterthecold,rainy months.Unsurprisingly,buyerstendtobemoreinclined toattendopenhomeswhentheweatherissunnyand mild,ratherthanovercastandrainy.

Spring’slongerdaylighthours,alongwithpeople wantingtomoveinbeforetheChristmasholiday period(andnewschoolyear)arealsodrivingfactors. Hencethemarkettendstoseeanupliftinspring.In turn,sellersrecognisemorebuyersleadtoincreased competition,higherprices,andpossiblyaquickersale fortheirproperty.

Eventhoughsalesoutcomestendtobestrongerin spring,moresellersandalargernumberofproperties meanmorecompetitionforyourproperty.Thismeans youwillstillneedtohaveafocusedstrategytoboost yourchancesofagreatsaleoutcome.Ideallythis strategywillincludepropertystagingandpresentation. Followthesetipstomaximiseyourproperty’sappealto buyers.

Startwithacompletespringcleantogetyourhouse readyforthesale.Cleanglassdoorsandwindows fromtheoutsideandinside.Removecobwebsand giveeverythingagooddustingandvacuum.Wash curtainsanddustblinds,lighting,andotherfixtures. Cleanandpolishdoorknobs,mirrors,switches,taps, andfittings.

Haveyourcarpetsprofessionallysteamcleaned.Wipe downcupboardsandallexteriorandinteriorsurfaces likeclosetdoorsaswellasshelvesanddrawers.Pay particularattentiontokitchensandbathrooms,and haveyourtilesandgroutingcleanedbyexpertsif necessary.

Firstimpressionscountwhenitcomestobuyers’ opinions,somakeyourexteriorsstandout.Tidyupyour frontandbackgardenbyclearingawayanyclutter fromyourfrontsection.Useawaterblastertohose downdrivewaysandgardenpathwaysandmakesure youremoveanyoilstains.Rakeawaydeadleaves, prunedeadwintergrowth,anddoathoroughweeding. Haveyourroofandgutterscleanedbyprofessionals. Removeanylargebushesandtrimawaytreebranches tocleartheexteriorviewforprospectivebuyers.

Trimyourlawnedgesforacleanandorderlylook.Fix dead,bald,oryellowinglawnpatchesbyseedingand fertilisingthesespots.Addingsmallimprovementslike mulchcanmakeabigdifferencewhilereducingthe needforongoingweeding.Getridofanyshabbylookingoutdooritemslikerustingdeckchairsand creakingswingsets.

Considerrepaintingfences,exteriorwalls,andtheletter box.Forapopofcolour,addflowersandgreen shrubberytoyourfrontgarden.Donotforgettofertilise yourlawnandgardenbedsforvibrantspringtime growth.Makeanimpactbyintroducingstatementpots andplantstoyourentrance.Remembertokeepupwith wateringtokeepyourlawn,flowersandtreeslooking theirbest.

4.Accessorisetheinterior

Stagingyourpropertyallowsyoutotargetspecific demographicsandpossiblyachieveabetterprice. Anexperiencedrealestateagentisyourbestadviser whenitcomestostaging.He/shecanpinpointthe specialfeaturesandguideyouonhowtohighlight thesewithstaging.

So,whatexactlydoesstaginginvolve?Youcouldrent furniture,artwork,andadditionalaccessoriesto accentuateyourproperty’stopfeatures.Thesecan beusedtorepurposerooms-suchasturningan extrabedroomintoanurseryorahomeofficedependingonyourtargetdemographic.

Youcanaddbasictouchesyourself,suchas updatingoldtowels,rugs,andlinenwithnewones. Drawbacktheblindstoletinnaturallightandadd freshbouquetsofflowers.Duringinspections,the agentmightrecommendaddedelementslike relaxingmusicandpleasingaromaswithbaking cookiesandfreshlybrewedcoffee.

5.Doanynecessaryrepairsandmaintenance

Takeanobjectivelookatyourinteriorsandnoteany flaws,defects,ordamage.Repairleakytaps,loose doorknobs,andfaultylightswitches.Givedamaged

wallsafreshcoatofpaintandconsiderhavingcarpet stainsremovedbyprofessionals.Ifyouhavetimber flooring,thinkabouthavingthemrestrained.

6.Workwithanexpert

Arealestateagentworkscloselywithyouatevery stepofyoursale,ensuringyouarestagingand preparingyourpropertycorrectly.Theycancheckyou areworkingoffanaccuratevalueforyourhomeand assistwithyourcontractsandpaperwork.

Springisabusytimeforbothbuyersandsellers,and youragentcanhelpmakeyourpropertystandout andsuccessfullymarketittoyourtarget demographic.Inaddition,youcouldhavethefull confidencethatitistrulytherighttimetosellifyou havethehelpofarealestateexpertwhoknowsyour localmarket,likeLJHooker’shighlyexperienced agents.

Achievingasuccessfulsaleinspring Springisapreferredtimetosellandbuy,andasa seller,youcouldenhanceyourchancesofgettinga greatpriceandachievingafastersalebypreparing yourpropertyintherightway.Decluttering,cleaning, anddepersonalisationareessentialstrategiesto apply,alongwithworkingwithanexperiencedreal estateagent.

Theinformationcontainedinthispublicationisgeneralinnatureandisnotintendedtobepersonalisedrealestateadvice. Beforemakinganydecisions,youshouldconsultalegalor professionaladvisor.LJHookerNewZealandLtdbelievestheinformationinthispublicationiscorrect,andithasreasonablegroundsforanyopinionorrecommendationcontainedinthis publicationonthedateofthispublication. Nothinginthispublicationis,orshouldbetakenas,anoffer,invitationorrecommendation.LJHookerNewZealandLtdacceptsnoresponsibilityfor anylosscausedasaresultofanypersonrelyingonanyinformationinthispublication. ThispublicationisfortheuseofpersonsinNewZealandonly.Copyrightinthispublicationisownedby LJHookerNewZealandLtd. Youmustnotreproduceordistributecontentfromthispublicationoranypartofitwithoutpriorpermission. LicensedREA2008.

It's taken almost four years, but Isaac and Sue Walker have finally got on to the property ladder in their hometown of Dunedin.

And five months after moving in, they couldn't be happier.

"It still feels new to us, we love it, we really love Dunedin, and we feel so lucky to be homeowners."

While home ownership is an exciting prospect, with so many factors to take into consideration it's not something to rush.

As real estate agent Amelia Hermens says, first home buyers must consider their financial position, how much of a deposit they have available and affordability.

"They must also have realistic expectations of the properties in their price range and work out what features they can compromise on."

Not being organised or having finances in place is a common mistake, while buyers with all their ducks in a row find themselves in a stronger, more competitive position, says Amelia. Isaac and Sue are a perfect example of that.

After living in Melbourne for 11 years – and owning a home there – they began saving for a house as soon as they returned home in 2017.

"We knuckled down and really got into saving mode, making plenty of sacrifices along the way."

Armed with a 20 per cent deposit from savings, KiwiSaver funds and a loan from Sue's Dad, the pair enlisted the help of a mortgage broker and finally started searching seriously for a home last December.

"We were in a good spot to enter the market so we started the open home circuit - at some open homes there would be 30-plus people at one time, and it was very intimidating listening to others and their comments."

After nearly four years of saving and six months of intensive open homing later, they successfully bid on their current home.

They've got five top tips to help other first home buyers realise their dreams:

Keep your eye on the prize - when saving, believe that the end goal is going to be worth it and all the sacrifices you make are worthwhile

Use a mortgage broker - a mortgage broker is critical to providing in-depth knowledge about the housing market, the loan options available and/or how to reach your deposit goals. They also have access to multiple lenders and can provide offers that may not be available to direct customers

Create a checklist of "must-haves", "nice-to-haves" and "bonus points" – the Walkers then attached a score of 3, 2 and 1 respectively to each category and marked each house like this. That way you can be realistic about every house, and they are all on an even playfield to score. Things like the weather, the agent's personality and how you feel on the day won't affect your actual score of the house

Be open - in today's market we all know how difficult it is to get your foot in the door of a home, especially your first home. Your first home doesn't have to be absolutely perfect. Chances are it will not be your "forever home", so be flexible and perhaps sacrifice that large bathroom you wanted, or the distance to the local school may not be as close as you would like

Due diligence - do your homework. The simple stuff everyone should do before buying a home. Before putting in an offer make sure you look at the home's history, such as the sales history and property inspection report (using a qualified property inspector), including a LIM and building report. Talk to the agent and find out as much as possible about the property. Research the suburb. Be nosey and check out the neighbours. Invite a friend or family member to the open home or to a private inspection for another opinion.

From a real estate agent's point of view, Amelia's top five tips are:

• To meet with the bank and mortgage broker early, before starting the property hunt

• Engage the services of a lawyer/solicitor

• Undertake market research – look at what is for available for sale, what is an affordable location, research recent sale prices in the preferred area

• Try and get to the properties you like, preferably before the first open home

• Minimise conditions – your bank/broker and lawyer will be able to help guide you on this as everyone's situation is different.

It's also good to think about current circumstances and long-term goals to decipher whether the time is right before embarking on the home buying journey. Research finances, consider mortgage repayments, the costs involved with buying a house like legal fees and moving costs, as well as living expenses and costs of owning a home too. It's also worth looking into eligibility for financial help being a first home buyer.

For agents like Amelia, helping first home buyers into their first home is both exciting and satisfying.

And as Isaac and Sue have shown, finding a home doesn't happen overnight but by doing their homework and being patient, it has made the property buying process that much easier.

On the following pages you will find our latest property management newsletter.

Please don't hesitate to contact our team.

Propertyinvestmentstandsasacompellingroutetoshapefinancialprosperityandsecurea brighterfuture.

Remarkably,onedoesn'trequireboundlesswealthto embarkonthisjourney;rather,awell-craftedstrategy isthekeytoachievingyourfiscalaspirations.

Forthosealreadypossessingproperty,tappinginto yourexistinghome'sequitymightjustbethestarting pointforyourinvestmentportfolio.Meanwhile, newcomerstotherealestaterealmcouldexplore collaborationwithfamilyorfriendstokickstarttheir venture.

Wiselymanagingyourfundsisparamount.Carefully considerthedurationyou'rewillingtoholdontothe propertyandformulateacontingencyplanfor potentialshiftsincircumstancesthatmight necessitateasale.

Whilerentalincomeisn'tacertainty,selectinga propertywithstrongtenantappealbecomes essential.Don'tforgettoembraceaninvestor's mindsetoverthatofahomeowner–emotions mustn'tswayyourdecisions.Prudentresearchand riskassessmentshouldprecedeanycommitment. Transitioningintoapropertyinvestorisn'tahasty choice;itdemandsmeticulousplanning,financial counsel,andafirmgraspoftherealestate landscape.

Priortomakinganystrides,examinetherentalrates andvacancytrendsinyourchosenneighbourhood. Considerproximitytoforthcominginfrastructurelike hospitalsortransporthubs,asthesecouldspur growth.Couldsimpleupdateselevateyourreturns evenfurther?

TheMeritsofRealEstateInvestment Propertyinvestmenthascontinuallycharmed investorsduetoitstangiblenature–it'ssomething

youcantouchandsee.Itsstabilitysurpassesother formsofinvestment,offeringpassiveincomeand roomforcapitalappreciation.Thisavenueproves especiallyrelevantforfirsthomebuyersstrivingto buildcapitaldespiteincreasingpropertyprices. Furthermore,withadequateresearchandplanning, realestateinvestmentisrelativelyaccessible.

Remarkably,substantialcapitalisn'tanabsolute prerequisiteforsteppingontotheinvestment propertyladder.However,consistentincomeis crucial.

Unlikebuyingahometolivein,youdoneedto havealargerdeposittosecureaninvestment property.Inthisinstance,youwillneedatleast35 percentoftheproperty’svaluetogotowardsthe deposit.Youcansourcethisfromeitherliquid assetsorequityinacurrentproperty.

Considerexploringaguarantorloantohelpraise theneededcapitalforadeposit.Aguarantorloan iswhenaparentcontributesequityfromtheirown hometosecuretheloan.However,thiscouldstrain relationshipsifnotmanagedcautiously.

Beforeventuringintoopenhomes,arationalplanis amust.Draftgoalsandatimeline,determining whetheryou'reaimingforswiftyieldsorwillingto bidetimeforlong-termgains.

Engagewithalocalrealestateagentwhocan offerinsightsintotherentalmarket'snuancesand optimalpropertytypesforreturns.

Assessyoureligibilityforamortgage–ensureyour creditratingstandsstrongandcurtailexistingdebts tobolsterborrowingcapacity.Thebankwill scrutinisefactorslikeincome,expensesand dependents

Pre-approvalwillprovetobeinvaluable. Empoweringyoutoactswiftlywhentheright propertyemerges.

Additionally,liaisewithyouraccountanttotailoryour strategy–anewpropertymightchangeyourtax requirements Anoff-the-planpurchasemightsuit thoserequiringextratimeforfinancialreadiness.

Feasibleforaysintoaffordablehomeinvestment beckon,contingentonyouroptionsawareness

Considertheseavenuesforpropertyinvestment withlimitedfunds:

Owner-OccupierStrategy:Beginasanowneroccupier,resideinthepropertyforaperiodbefore transitioningtoarental Asafirsthomebuyer,you couldpotentiallygetaccesstotheFirstHomeGrant Ifyouintendtolivethereforatleastsixmonths,you willalsobeabletouseyourKiwiSavertohelp towardsyourdeposit

Rentvesting:Astrategicapproachwhereyourent whileowninganinvestmentpropertytailoredtoyour budget Investmentpropertyincomecanaid mortgageorrentalcosts

JointVentures:Joinforceswithafriend,family member,orgrouptoco-investinproperty, mitigatingindividualdepositchallenges

RealEstateInvestmentTrust(REIT):Exploreproperty investmentwithoutasubstantialdepositviaREITs Entry-levelinvestmentscanstartataround$500

Withaplaninplace,it'stimetoexecute.Set attainablegoalsandprogressivelybuildadeposit fund.

Analyseyourexpensestouncoverareasofpotential savings Optingforhomemadelunches,curtailing

barista-brewedcoffees,entertainingathome,and pruningunusedsubscriptionscanallcontribute.

Engageutilityandinsuranceproviderstoexplore additionaldiscounts Utilisewebsiteslike PowerswitchorBroadbandComparetoseeifyou ’ re gettingthebestdeal.Collaboratewithalending specialisttodiscoverunconventionaldeposit avenues.Refinancingorswitchingtointerest-only paymentsmightaugmentfunds.

Whileinvestmentpropertyholdslong-termrewards, itshouldn'tcurbyourlifestyle.Alongsidemortgage repayments,factorinrepairandinterestexpenses. Bepreparedwithreservesshouldtheproperty encountervacancies

Thereisachanceyourrepaymentcommitment couldsurpassrentalincome,necessitating additionalcontributions.Otherbudgetelements couldincludelegalfees,conveyancingcosts, insurance,councilrates,andBodyCorporatefees.

Engagingapropertymanagermitigateslandlord responsibilities,includingmaintenanceandrepairs, albeitatanaddedcost.

TheAnatomyofaStellarInvestmentProperty

The'location,location,location'sayingresonatesin investmentpropertyasmuchasresidentialreal estate

Optforasuburbwithbroadappeal–accessibility toshops,publictransport,childcare,schools,and universitiesisparamount

Dwellingtypehingesonbudget Surveylocal vacancyratestoensuredemandmatchessupply

Prioritisefeaturestenantsseek,suchasamaster ensuite,internallaundry,amplegaragestorage, andclimatecontrol Energy-efficientsystems,such asdoubleglazedwindows,bolstersattractiveness Accommodatingpetscanelevaterentalpotential

Morethan500,000NewZealandersowninvestment property,mostlywithoneproperty Remember,this isn'tanovernightfeat;returnsunfoldovertime, evenacrosspropertycycles

Theinformationcontainedinthispublicationisgeneralinnatureandisnotintendedtobepersonalisedrealestateadvice Beforemakinganydecisionsyoushouldconsultalegalor professionaladvisorLJHookerNewZealandLtdbelievestheinformationinthispublicationiscorrectandithasreasonablegroundsforanyopinionorrecommendationcontainedinthis publicationonthedateofthispublication NothinginthispublicationisorshouldbetakenasanofferinvitationorrecommendationLJHookerNewZealandLtdacceptsnoresponsibilityfor anylosscausedasaresultofanypersonrelyingonanyinformationinthispublication ThispublicationisfortheuseofpersonsinNewZealandonlyCopyrightinthispublicationisownedby LJHookerNewZealandLtd Youmustnotreproduceordistributecontentfromthispublicationoranypartofitwithoutpriorpermission

LicensedREA2008

As a legal document make sure you spend time reading and understanding what you are signing.

A tenancy agreement is a written agreement between a tenant or resident and a property manager/owner. As it is a legally binding contract, spending time reviewing the agreement before you sign it is critical.

All tenancy agreements must include the following:

• The name and address of the tenant, and the property manager/owner or provider

• The dates when the agreement starts and ends (or state that the agreement is periodic)

• Details about how the tenant should pay the rent and how much rent is to be paid

• Any special terms (these should be agreed in advance, e.g. that dogs are allowed but must be kept outside, no smoking etc)

• The period of tenancy agreement

• Fixed term agreement - where a tenant/resident agrees to rent a property for a fixed amount of time (for example, 6, 9 or 12 months)

• Periodic agreement - when a tenant/resident lives there for an indefinite period

Other points to consider

A written agreement must always be used when renting, even if the person renting is family or a friend.

The tenant should be given the agreement before paying any money or being committed to the tenancy and should read it and ask questions if they do not understand anything in it.

If a tenant does not have a written agreement, they still have protection under the law. After thoroughly inspecting the property, if you identify any maintenance issues that need to be rectified, ensure they are added into the tenancy agreement with a time frame to be fixed

The landlord/property manager is responsible for:

• Meeting all the costs of preparing the tenancy agreement

• Ensuring the correct form is used and completed

• Providing a copy of the proposed agreement along with any relevant body corporate rules, if applicable, to the tenant before they sign it. The landlord/property manager must provide a copy of the tenancy agreement to the tenant prior to them moving into the property.

• Ensuring that, when an agreement is signed, there are no legal problems that would prevent the tenant from living in the premises for the length of the tenancy

• Ensuring the premises are in a good state of repair, meet Healthy Homes Standards by the stated compliance date on the tenancy agreement and ready for the tenant to move into on the agreed date.

A year can be a long time, and it's easy to lose documents or throw out old paperwork. Don't let this happen with your tenancy agreement. It's a vital document that you will need when the lease ends and is effectively the rules you must live by in the house.

Keep this, any bond lodgement forms and copies of emails in a specific folder, upload it to the Cloud and email it to yourself for safe keeping. Nine times out of 10 they won't be needed to resolve a dispute, but better safe than sorry! Taking photos of the residency before you move in is also an excellent idea, to prove the condition of the dwelling both before and after your tenancy

For a thorough understanding of current rental regulations, visit Tenancy Services.

It was a relief to see the Reserve Bank of New Zealand (RBNZ) leave the official cash rate on hold earlier this month, after a continuous series of rises over almost two years.

It's possible we've come to the end of this ‘tightening cycle’. That said, the RBNZ has made it clear it’s not planning to cut rates anytime soon, so it’s a good idea to continue budgeting accordingly.

Here are four big property and finance stories that have made news recently:

• Kiwi deposits now protected

• RBNZ pauses rate hikes

• Property market update

• Building costs normalising

Consumers will have up to $100,000 of their deposits protected in the unlikely event of a bank failure, after parliament passed legislation designed to strengthen the financial system.

Consumers will have up to $100,000 of their deposits protected in the unlikely event of a bank failure, after parliament passed legislation designed to strengthen the financial system.

Under the Deposit Takers Bill, which has been approved by parliament, the Reserve Bank of New Zealand (RBNZ) will ensure consumers are “promptly compensated” for up to $100,000 if they’ve deposited their money with an authorised deposit-taking institution that fails.

This government guarantee is expected to begin in late 2024, as the RBNZ first has a lot of preparatory work to do.

Currently, only two of the 38 countries in the OECD (an organisation that primarily consists of developed countries) lack a deposit insurance scheme – New Zealand and Israel.

“The passing of this bill will allow for the introduction of depositor protection and close a long-standing gap in New Zealand’s financial safety net, bringing New Zealand in line with international best practices,” Finance Minister Grant Robertson said.

“This means eligible New Zealanders will be provided economic security if their bank or other deposit-taking institution fails, while helping protect the country’s financial system and wider economy. The $100,000 limit will fully protect around 93% of depositors.”

To access the government guarantee, New Zealanders will have to deposit their money in authorised deposit-taking institutions. That includes banks, credit unions, building societies and certain retail deposit-taking finance companies.

The RBNZ will be responsible for managing the scheme and ensuring depositors are compensated if an eligible institution fails.

“Coverage for the scheme applies on a per depositor, per institution basis. In a compensation payout scenario, amounts held in joint accounts at a single institution will be split equally across account holders and count towards eligible deposits, up to the coverage limit for each depositor at that institution,” according to the RBNZ.

First Home Partner, is when Kāinga Ora make a financial contribution to purchase and share ownership of a home...

This scheme applies to existing brand-new homes built or to be built (turn-key deals) The Kainga Ora amount is to be repaid to Kainga Ora interest free over the next 15 years.

The income cap for the last 12 months earnings for a household is $130,000.

Clients must have either of the following.

• NZ residency

• NZ permanent residency

• NZ Citizenship

• Clients apply to Kainga Ora Shared Partnership Scheme and get preapproval.

• Next, Clients are qualified by the bank for the maximum amount of lending that the bank can approve them for.

• Then, clients put in their deposit from Savings, Kiwisavers, Subsidy and Gifts.

• Then, Kainga Ora put in the remaining amount up to $200,000 for the purchase of the property, or up to 25% of the purchase price (whichever is lower)

Clients must own and live in the property for a minimum of 3 years.

A couple earning $65,000 salary each with no debts or children apply (note the $130,000 income cap).

Based on an average cost of living (as at 03/05/2023) this couple can afford $730,000 in lending. They have $70,000 from savings and Kiwisaver. Kainga Ora will put in $200,000 equity. Meaning they can buy a home of around $1,000,000.

For complete details Contact: Kainga Ora or check their website

Phone: 0508 935 266

Email: firsthome.enquiries@kaingaora.govt.nz

When you know, you know. ™

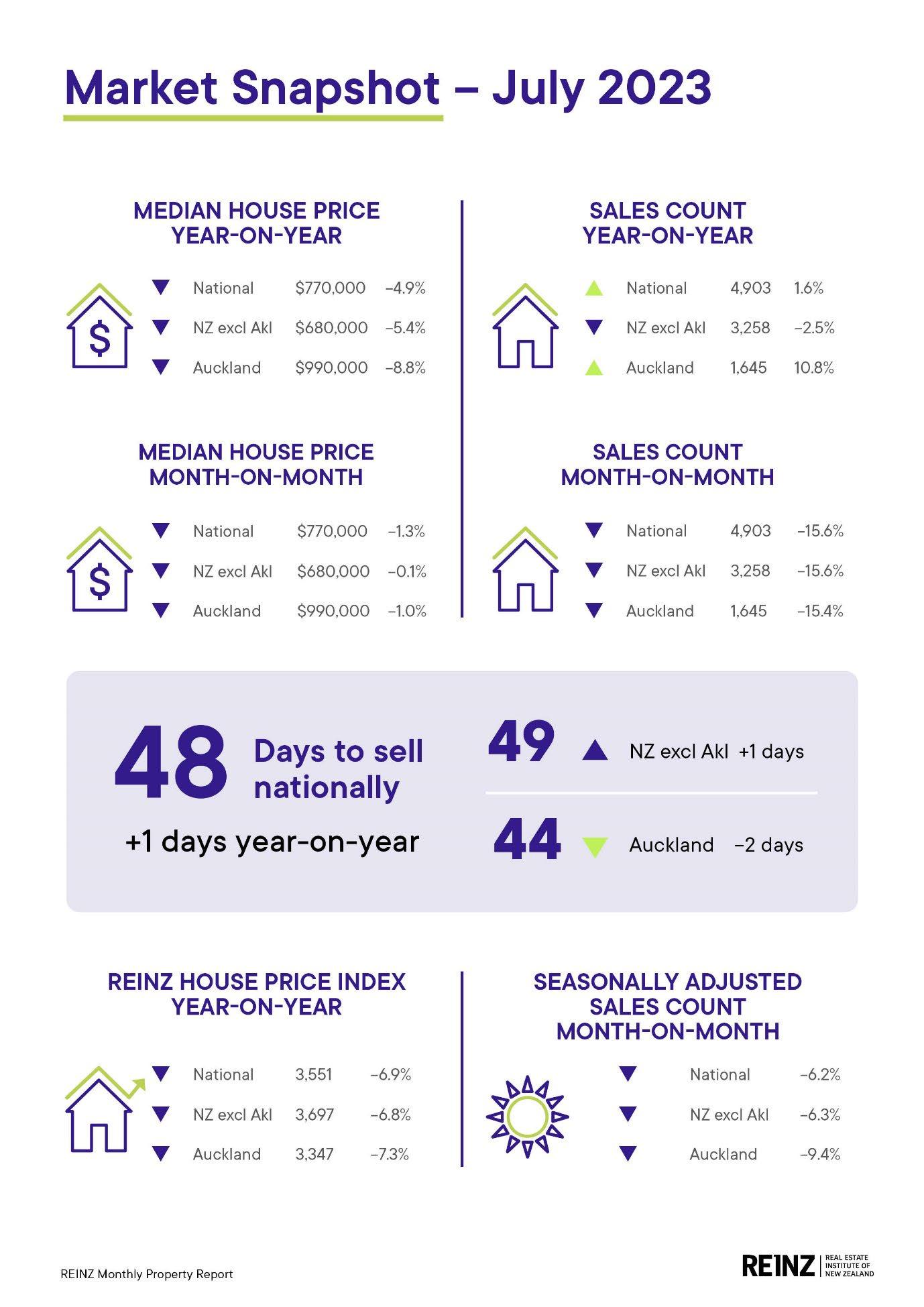

REINZ July data: More activity as new listings remain low

15 August 2023

The Real Estate Institute of New Zealand’s (REINZ) July 2023 figures show more activity emerging while listing numbers remain low seeing total stock numbers fall and some regions have seen little movement in median prices.

REINZ Chief Executive Jen Baird says July tends to be a slower month for the property market, however we are seeing buyers returning alongside varying results across Aotearoa.

“This month’s figures show a lift in market activity with sales counts slightly increasing in many parts of the country on July last year, and the year-on-year decrease in median prices continuing to ease, suggesting some confidence is returning,” Baird suggests.

Compared to July 2022, July 2023 has shown a slight increase in the total number of properties sold across New Zealand, up 1.6% to 4,903, but down 15.6% month-on-month. New Zealand excluding Auckland sales counts decreased by 2.5% year-on-year from 3,343 to 3,258.

Across the regions, Auckland (10.8%), Waikato (9.4%), Bay of Plenty (13.7%), Nelson (3.9%), West Coast (31.0%) and Canterbury (10.1%) all saw increases in sales counts yearon-year. Bay of Plenty was also up 7.8% month-on-month.

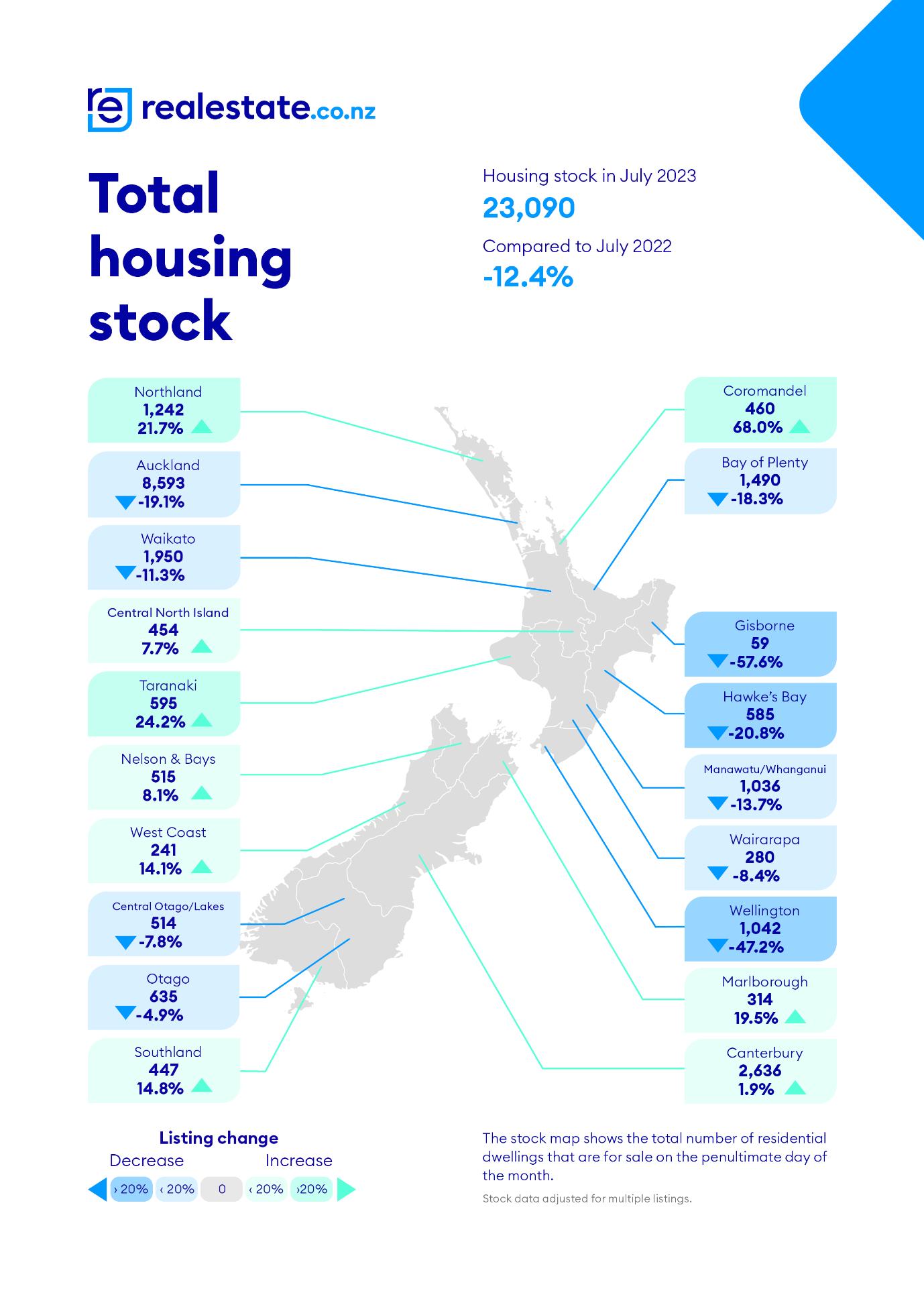

At the end of July, the total number of properties for sale across New Zealand was 23,090, down 12.4% (3,268 properties) from 26,358 year-on-year, and down 6.4% month-on-month. New Zealand excluding Auckland was down year-on-year from 15,732 to 14,497, a decrease of 1,235 properties or 7.8% annually.

“With sales counts up this month, the national inventory level is falling. More competitive prices and a ‘get in now’ attitude is bringing more buyers out ahead of this year’s election,” says Baird.

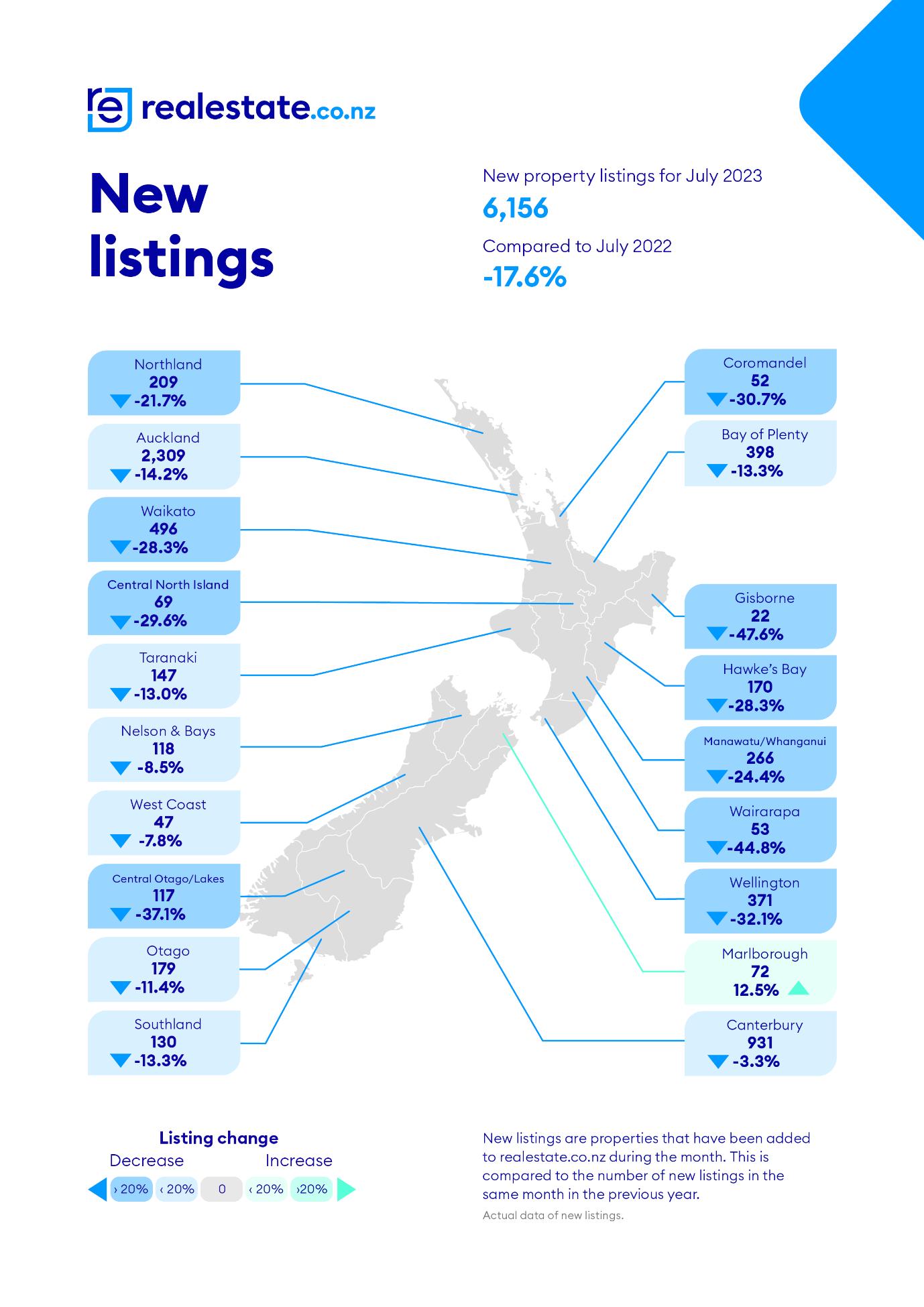

Nationally, new listings decreased by 17.6% year-on-year, from 7,470 listings in July 2022 to 6,156 in July 2023, and a 1.0% decrease compared to June 2023 from 6,218. New Zealand excluding Auckland listings decreased 19.5% year-on-year from 4,778 to 3,847.

“These listing decreases are similar to last month’s so although our salespeople are reporting further increases in activity across the country the looming election and ongoing tighter economic conditions are seeing sellers holding back,” comments Baird.

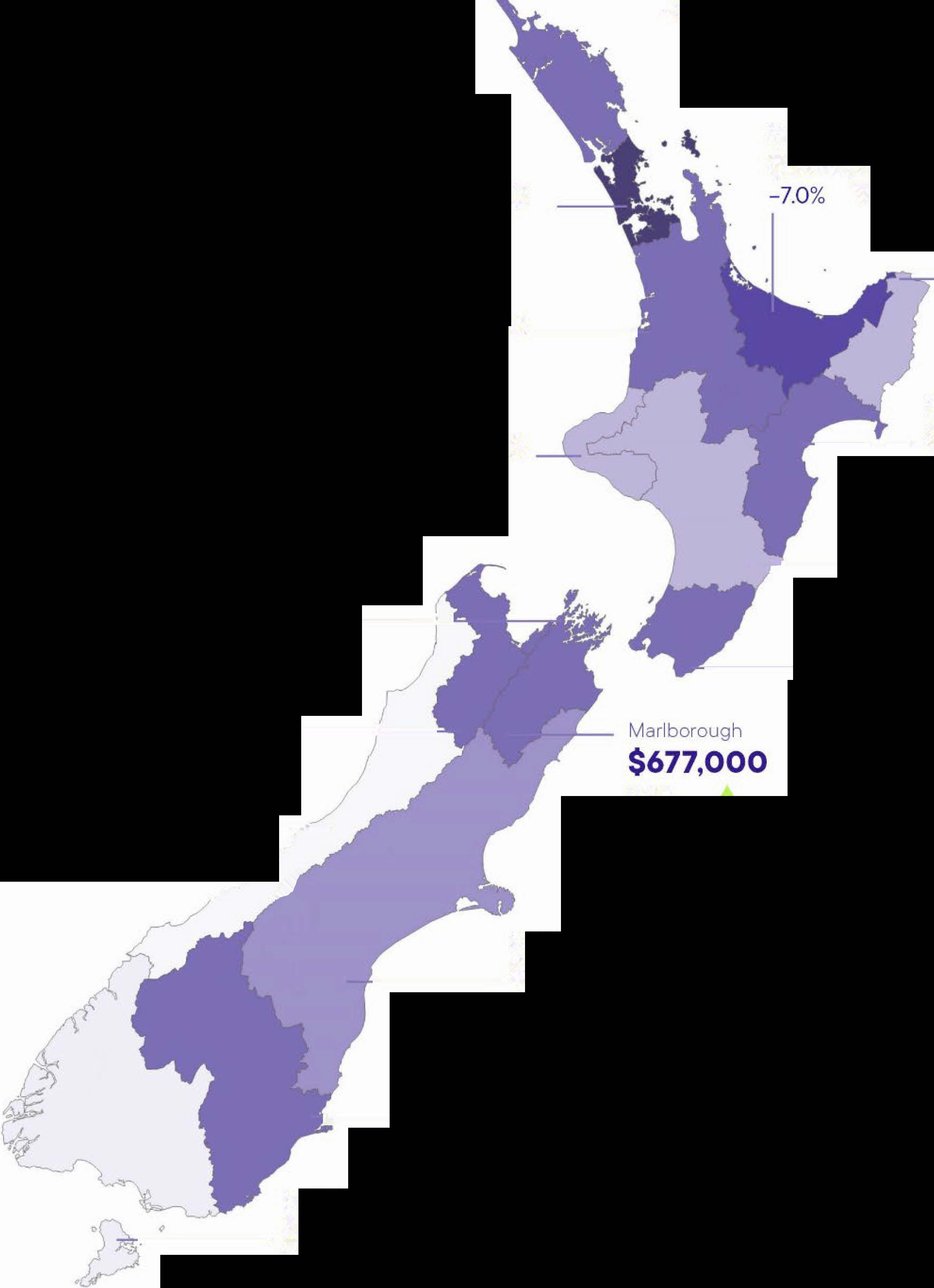

Nationally, the July 2023 median sale price decreased 4.9% year-on-year to $770,000 from $810,000. There was significant regional variation in this month’s median sale prices. Auckland, the country's largest property market, saw its median sale price fall 8.8% from July 2022 to fall back under the one million dollar mark and decrease 1.0% compared to June 2023, down from $1,000,000 to $990,000.

Other regions such as Waikato (down 8.9% year-on-year), Bay of Plenty (down 7.0% yearon-year), and Wellington (down 8.9% year-on-year) also saw declines. Three regions have seen a year-on-year price increase – Marlborough (0.3%) and both Southland (1.2%) and Central Otago (4.6%) have seen more resilient markets for much of this year.

The national median days to sell remained relatively stable at 48 days. The median days to sell varied across regions. West Coast had the shortest median days to sell at 28, while Tasman had the longest at 80.

“The ongoing impact of government policies, economic conditions, and global factors will continue to shape the New Zealand housing market. We also tend to see a slowing in activity in the lead-up to a general election, but with buyer activity rising and lower levels of supply coming to market, we may see stronger demand appear in the coming months,” comments Baird.

While there was a slight increase in the House Price Index (HPI) compared to the previous month, the market continues to face challenges with a decline in value over the past year.

The HPI for New Zealand stood at 3,551 in July 2023, showing a 0.7% increase compared to the previous month. However, when compared to the same period last year, the HPI reflects a 6.9% decline.

The Real Estate Institute of New Zealand (REINZ) has the latest and most accurate real estate data in New Zealand.

Media contact:

Laura Wilmot

Head of Communications and Engagement, REINZ

Mobile: 021 953 308

lwilmot@reinz.co.nz

National highlights

• The national median price has decreased 1.3% month-on-month and decreased 4.9% year-on-year from $810,000 to $770,000. For New Zealand excluding Auckland, median prices decreased 5.4% from $719,000 to $680,000 year-on-year but remained stable at $680,000 with a $400 difference month-on-month.

• The total number of properties for sale across New Zealand decreased 12.4% yearon-year, and down 6.4% month-on-month.

• The total number of properties sold across New Zealand in July 2023 increased 1.6% year-on-year to 4,903, decreasing 15.6% month-on-month.

• Nationally, new listings decreased by 17.6%, from 7,470 listings in July 2022 to 6,156 listings in July 2023.

• Days to sell have remained at 48 days for July 2023 — no change from June 2023 and up 1 day from July 2022.

• The REINZ House Price Index (HPI) for New Zealand showed an annual decrease of 6.9% in the value of residential property nationwide.

Regional highlights

• Marlborough (0.3%), Otago (4.6%) and Southland (1.2%) saw an increase in median sale price with Otago increasing 4.6% both month-on-month and year-on-year from $650,000 to $680,000 in both instances.

• Nelson had the biggest month-on-month increase with a 13.7% rise in median sale price from $650,000 to $739,000.

• Bay of Plenty had both a yearly and monthly increase in sales count with a 7.8% increase month on month (347 to 374) and a 13.7% increase year on year (329 to 374).

• The West Coast again had the highest sales count with a 31% increase year on year from 29 to 38 properties sold

Median Prices

There were no record median prices at the regional level this month.

One Territorial Authority, Central Otago District recorded a record median price this month of $680,000.

Three-quarters (75%) of all Territorial Authorities have had no median record price in any of the past 12 months.

Sales counts

Compared to July 2022:

• Auckland was up 10.8% year-on-year

• Waikato was up 9.4% year-on-year

• Bay of Plenty was up 13.7% year-on-year

• Nelson was up 3.9% year-on-year

• West Coast is still performing up 31.0% year-on-year

• Canterbury was up 10.1% year-on-year

For the three months ending July 2023, New Zealand sales count was up 6.8% year-onyear.

In terms of the month of July, this July saw the lowest sales count in:

• Manawatu-Whanganui, Otago, Southland, and Wellington since records began.

• Tasman since 2008

• Marlborough since 2010

• NZ Excl. Auckland and Gisborne since 2011

• Northland since 2012

• Hawke’s Bay and Taranaki since 2014

Tasman had its highest median days to sell since January 2005 when it was the same as this month. July 2001 was the last time there was a high median days to sell in Tasman.

Manawatu-Whanganui had its highest median days to sell since February 2015

Marlborough had its lowest median days to sell since May 2022

In terms of the month of July, July 2023 had the highest median days to sell in:

• Nelson since 2000

• Tasman since 2001

• NZ since 2008

• Otago since 2009

• NZ Excl. Auckland since 2011

• Taranaki since 2012

• Manawatu-Whanganui and Northland since 2014

• Southland since 2015

In terms of the month of July, July 2023 had the lowest median days to sell in

• West Coast since 1994

House Price Index (HPI)

No regional HPI records this month.

Otago has spent the past 7 months in the top 3 ranked regions for HPI year-on-year increases and is the top-ranked HPI year-on-year movement this month. Canterbury is second and Southland is third.

In terms of the 3 months ending HPI movement, this month saw the first increases in New Zealand, Auckland, Manawatu-Whanganui, and Wellington since December 2021 and the first increase in Canterbury since March 2022.

Five of fifteen regions had at least a 14% year-on-year increase in inventory.

Four of fifteen regions had at least 18% less inventory than they had one year ago.

All regions had a decrease in listings since July 2023 except for Marlborough, a notable exception with a 12.5% increase in listings.

Six of fifteen regions have had listings decrease by more than 20% year-on-year.

Inventory and listing data come from realestate.co.nz

Nationally, 8.2% (517) of properties were sold at auction in July 2023, compared to 4.9% (461) in July 2022. Month-on-month there were 34 less auctions than June 2023.

New Zealand excluding Auckland saw 7.4% of properties (197) sell by auction, compared to 7.2% (217) the year prior.

Inventory and listing data is courtesy of realestate.co.nz More information on activity by region can be found in the regional commentaries visit the REINZ’s website

CLICKHERETOVIEWFULLREPORT

August 2023

More Kiwis slipping off their shoes and stepping into open homes signals a lift in confidence in the New Zealand property market. New listings hit a record low for July while stock was also down 12.4% year-on-year.

• Lowest July on record for new listings

• Stock down in July

• National average asking price stable

• Central Otago/Lakes District first NZ region to hit $1.5m average asking price

Vanessa Williams, spokesperson for realestate.co.nz, says this suggests vendors remain hesitant to sell despite stock starting to move.

“We are hearing from real estate agents that stabilising prices have increased buyer interest, and our data supports this.”

Just 6,156 new listings came onto the market nationally last month – around half the number seen in 2007 when realestate.co.nz records began. Stock was also down in 10 of 19 regions year-on-year, with just 23,090 total homes for sale nationally in July.

Nationally, prices have been stable since the beginning of 2023, sitting around $870,000. Vanessa says increased certainty around price can appeal to buyers and sellers alike.

“The OCR remaining flat last month, for the first time since August 2021, may have also given Kiwis some comfort given the current climate. Although I will add that, since this announcement, banks have increased retail lending rates to around 7.0%.” Properties selling under the hammer are reported to be up, and data shows that vendors are returning to auction rooms around the country too. Last month, 22.1% of all listings were listed for sale by auction, up from just 15.3% in July 2022.

New listings were at an all-time low for any July on record last month in all regions except Marlborough and West Coast. Down 17.6% nationally, 10 of 19 regions saw new listings drop by more than 20.0% year-on-year. Excluding April 2020, when the country was in lockdown, this is one of the lowest months of new listings since records began 16 years ago.

“Only 6,156 properties went up for sale last month, which means new supply is limited for buyers around the country.”

Only Marlborough saw a lift last month, with an increase in new listings of 12.5% year-on-year. However, Vanessa explains that the small regional market is prone to fluctuations, with just 72 new listings hitting the market in July. She adds that listings appeared to have been unusually low in July 2022.

Last month 23,090 homes were on the market, 12.4% less than in July 2022. Vanessa says stock levels have been trending downwards since April:

“I think we perhaps have a perfect storm with some vendors waiting until after the election to list. At the same time, we are seeing this increase in confidence thanks to stable prices and a so-called end in sight to interest rate increases.”

She adds that the number of people searching for property on the realestate.co.nz site was up 7.7% last month and the app by 35.5% compared to the same time in 2022*.

“If you are thinking about selling, now might be a good time, as there is interest around the country,” says Vanessa. Northland, Taranaki, Nelson & Bays, West Coast, Canterbury, Southland, Coromandel, Marlborough and Central North Island all bucked the national trend with a year-on-year increase in stock levels.

Sitting just below $870,000, the national average asking price has remained stable since the beginning of the year. Although down more than $100,000 from the property market peak in January 2022, the minimal changes to the national average asking price throughout 2023 may encourage buyers and sellers.

“We have seen prices starting to level out in several regions this year after a turbulent 2022 of price drops around the country,” says Vanessa. Month-on-month, only three regions saw their average asking price change by more than 5.0%. These regions were Coromandel (up 5.9%), Gisborne (up 8.3%), and Southland (up 9.2%). The rest remained static or changed by less than 5.0%.

Vanessa says this is good news for property owners looking to buy and sell in the same market:

“Stable prices mean people transacting property will likely buy at the same price level, which might not have been the case in 2022 when average asking prices were decreasing considerably month-on-month in some regions.”

Central Otago/Lakes District first NZ region to hit $1.5m average asking price

Once again bucking the national trend, Central Otago/Lakes District hit an alltime average asking price high last month. At $1,541,788, the region is the first in New Zealand to reach an average asking price of more than $1.5 million.

Unlike the rest of the country, average asking prices in Central Otago/Lakes have been trending upward since the beginning of 2022. Vanessa says the tourism mecca appears to exist within an economic microclimate.

“Demand remains high in this region, and it would seem that buyers, many of whom are based overseas, are not as impacted by rising interest rates and household inflation.”

“And might I say, what a fabulous part of New Zealand to buy property in.”

*Source: Internal metrics (July 2022 v July 2023).

For media enquiries, please contact:

Hannah Franklin | hannah@realestate.co.nz

Notes to editors:

realestate.co.nz prides itself on providing accurate data and useful market insights to New Zealanders with its extensive 16-year dataset. Unfortunately, this month we made a mistake in our original release by reporting stock figures inaccurately. This was down to a human error, and we have now strengthened our processes to ensure something like this doesn’t happen again.

Want more property insights?

• Market Insights: Search by suburb to see median sale prices, popular property types and trends over time.

• Sold properties: Switch your search to sold to see the last 12 months of sales and prices.

• Valuations: Get a gauge on property prices by browsing sold residential properties, with latest sale prices and an estimated value in the current market.

Written by Hannah Franklin 01 Aug 2023Falls in national property values continued to moderate in July, and with the latest data showing increases in some parts of the country, it all but confirms that the downturn is in its final stages.

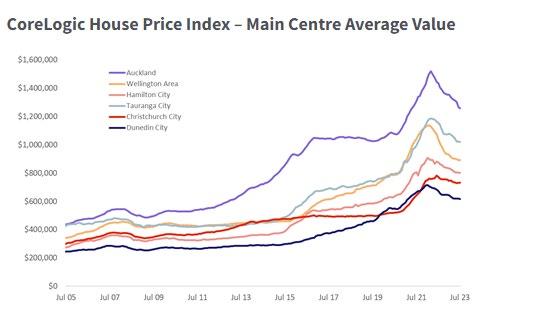

CoreLogic’s House Price Index (HPI) dropped by 0.4% in July, with the three-month change at -2.3%, taking the annual decline to 10.1%. The 0.4% national fall in July was the smallest decline since the 0.3% fall in January, and a significant deceleration from June’s 1.2% fall.

CoreLogic NZ Chief Property Economist, Kelvin Davidson said there were signs in key regions of prices stabilising or in some cases even growing. Indeed, values in five of the seven main sub-markets in Auckland were either flat or higher in July, with most of the other main centres down a marginal 0.2% or 0.3% in the month.

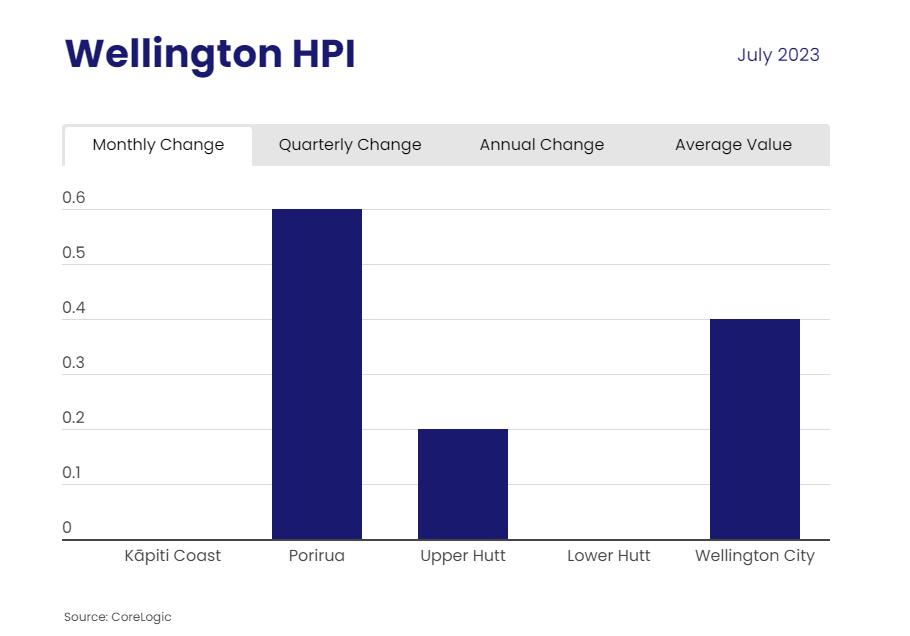

Meanwhile, Mr Davidson said values for the wider Wellington market increased by 0.3%, registering the city’s first rise since February 2022.

“July’s drop in prices at the national level may seem surprising, given the recent commentary about an emerging turnaround for the housing market. But it’s important to note that the latest decline is the smallest in six months, and also that some regional markets saw values rise, most notably Wellington,” he said.

“Market indicators started looking stronger in June and that positive momentum has continued in July. There are several key factors pointing to the trough for house prices, including a broad peak for mortgage rates, albeit some further tweaks by the banks can’t be ruled out, an easing in the CCCFA and LVR rules, still-high employment, and solid net migration flows. The easing in LVR policy has already helped more low deposit investors into the market, such as those with 35-40% deposits who were previously locked out.

“We’ve also seen a pick-up in the volume of sales, stock on the market is dropping, and this is likely starting to result in the re-emergence of competitive price pressures.”

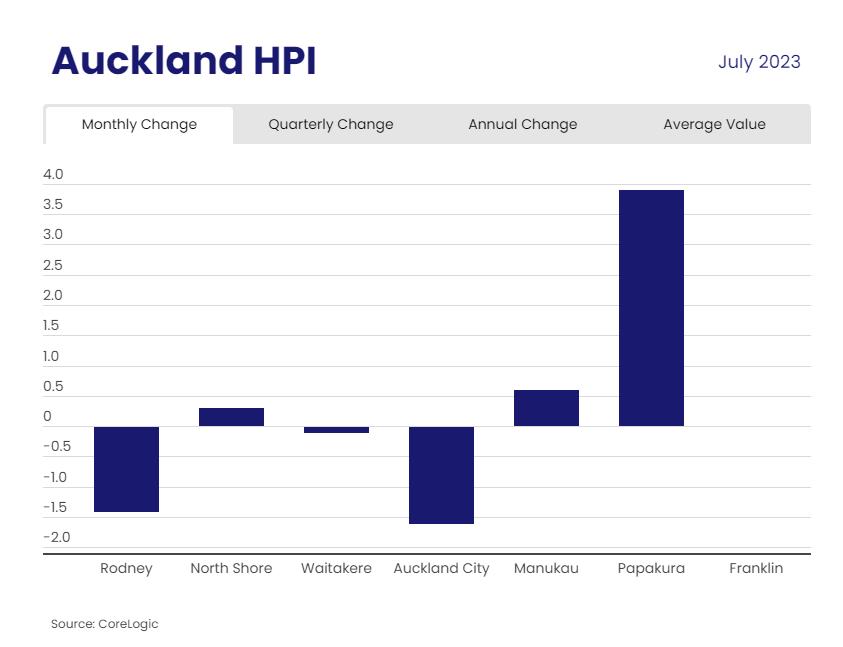

Mr Davidson said the shifting national fundamentals appeared to be mirrored across most of the main centres, with Hamilton, Tauranga, Christchurch and Dunedin each recording a fairly modest drop in average property values in July, of either 0.3% or 0.2%. Auckland’s drop was more significant at 0.6%, but that weakness was not universal for the super-city as a whole, instead occurring in only one or two of its sub-markets

Clickheretoviewinteractivegraphsdata

The July result was notable in Wellington for being the first increase in average property values (0.3%) in 17 months. Amongst the sub-markets, Kapiti Coast was flat in July, as was Lower Hutt. But Upper Hutt rose by 0.2%, Wellington City by 0.4%, and Porirua by 0.6%

“It’s early days for the Wellington market, but the fact that values previously dropped so significantly suggested that it could be among the first areas to bounce back and lead any recovery too. That dynamic might have just started to play out in July’s result,” Mr Davidson said.

Auckland has been another key part of the country to have seen significant falls in property values during this downturn. But July’s data also showed hints of a turnaround despite Auckland City recording a decline of 1.6% in July and Rodney values dropping 1.4%.

Waitakere was more or less flat with a minor 0.1% drop, Franklin stabilised, while North Shore, Manukau, and Papakura rose more significantly.

“There are still appreciable affordability challenges for buyers across Auckland, whether that be first home buyers, investors, or relocating owner-occupiers. But July’s data nevertheless did start to hint that demand has returned in many areas,” Mr Davidson acknowledged.

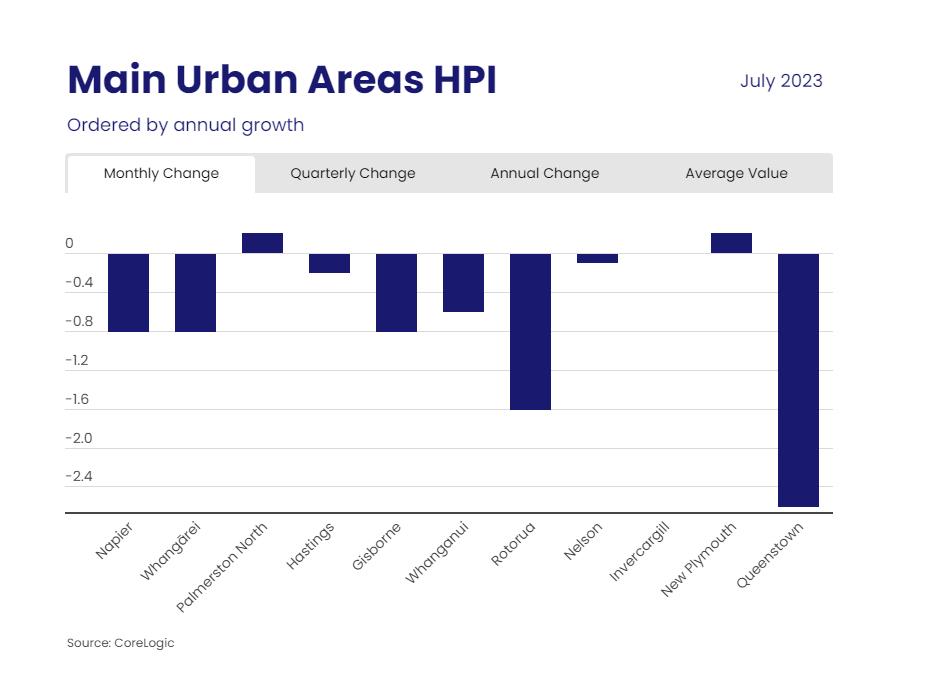

Outside the main centres, property value trends remained a bit patchy in July, as was typically the case at a wider turning point for the market, Mr Davidson said.

Queenstown, Rotorua, Napier, Whangarei, Gisborne, and Whanganui all recorded sizeable drops in value in July, although Queenstown remains higher than the levels recorded at the same time in 2022. By contrast, Invercargill values were stable, with Palmerston North and New Plymouth recording increases. Those three areas have also seen values hold steady or increase over the broader three-month period since April too.

“New Zealand is not just a single housing market and the disparity in the regional results should reaffirm expectations that in many parts of the country the end of the downturn is going to be anything but smooth,” Mr Davidson said.

Mr Davidson said a range of metrics and indicators made it increasingly clear that the trough for New Zealand’s house prices has essentially arrived, with further evidence across all index measures likely to emerge in the next couple of months.

“There will be mixed views about this point we’re at in the cycle. Existing property owners will no doubt be pleased but there are always two sides to the coin in the housing market, and aspiring buyers would clearly prefer to see further declines,” he said.

“Reaching a trough in the downturn does not mean there’s likely to be a sudden snapback to widespread and strong gains in house prices and it will be unsurprising if some areas record further falls in the coming months, while others stabilise or see mild increases. Generally speaking, the ‘next phase’ of the cycle could still be relatively muted, given that affordability remains stretched, mortgage rates aren’t set to drop anytime soon, and also in light of the prospect of caps on debt-to-income ratios for mortgages early in 2024.”

CHIEF ECONOMIST Kelvin joined CoreLogic in March 2018 as Senior Research Analyst, before moving into his current role of Chief Economist. He brings with him a wealth of experience, having spent 15 years working largely in private sector economic consultancies in both New Zealand and the UK.

Meet Kelvin DavidsonA plunge in new listings in the capital has bought pressure on buyers.

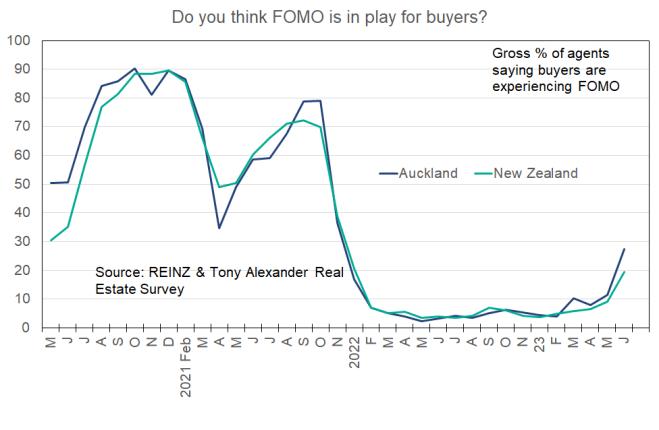

ANALYSIS: This past week I have conducted my monthly survey of real estate agents located all around the country and here are some of the main results at the national and Auckland levels. First, let’s look at FOMO – the fear of missing out. I produce the only measure of this often much talked about gauge for New Zealand and the latest result is 34% of agents saying buyers are displaying FOMO. For Auckland the reading is 44%. Three months ago these readings respectively were 7% and 8%. The jump has been swift.

Photo/GettyImages

Photo/GettyImages

The top reading is Wellington at 47%, assisted no doubt by the over 40% drop in the number of properties on the market for sale over the past 11 months. Auckland stocks are about 11% down from their peak.

When FOMO rises this tells us buyers are feeling more motivated to make a purchase. First home buyers certainly are with a net 58% of agents nationwide and 53% in Auckland saying they are seeing more young buyers. This section of the market has been quite active since February.

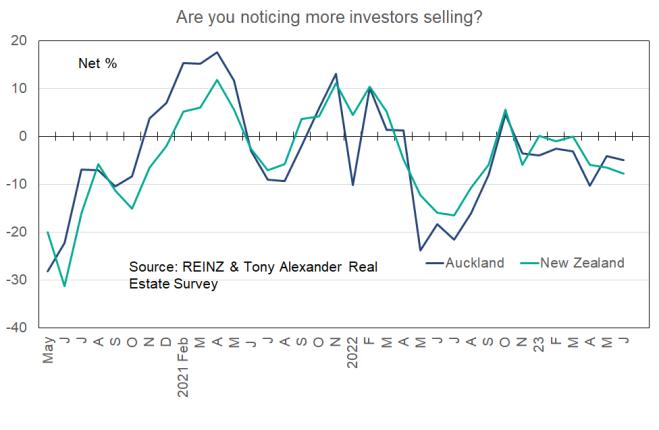

In contrast, nationwide a net 13% of agents still say they are seeing fewer investors. But interestingly, in Auckland this reading is only 1%.

Read more:

- Wellington in a jam: Buyers having to fight harder in the capital as listings plunge

-

- Pre-auction offer blown out of the water in five-minute scrap for 'beaut' villa

-

- House prices climbing in a fifth of NZ suburbs

The opposite of FOMO is FOOP – fear of over-paying. Fewer and fewer agents say that potential buyers are worried about making a purchase then watching prices go lower. Three months ago 68% of agents nationwide said buyers were displaying FOOP. Auckland was also 68%. Now, the NZwide reading is 29% and Auckland sits at only 20%.

For the first time since November 2021 FOMO is greater than FOOP. There is a near one for one correlation between changes in the FOMO less FOOP gap and agent observations of prices rising in their location. Therefore this turnaround in FOMO and FOOP tells us what is happening, or perhaps more accurately about to happen, with prices.

In fact nationwide a net 9% of agents now say prices are rising in their area. Three months ago a net 58% said they were falling. Auckland has shifted to a net 17% seeing prices going up versus a net 57% seeing prices fall three months ago.

That is probably enough numbers for this week. Suffice to say what they show is a housing market turning around. However, we cannot reasonably tell from the results how fast prices are going to rise in the next three to four years, when they will peak, and how much higher they will be when that next cyclical peak comes along.

All we can reasonably say is the potential benefit to a buyer of holding back and waiting to see what happens is not particularly strong. That doesn’t mean all potential buyers should rush into the market right away. Many can’t because with bank stress test mortgage rates around 9% they cannot meet maximum debt servicing to income ratios to qualify for a mortgage.

There is also the matter of finding something suitable to buy. The trend in listings is downward although history shows us that these things never move in straight lines. For instance, between the end of June and the end of July the nationwide stock of properties listed for sale rose by an unusually strong 13%. Given that the number of fresh listings received during the month actually fell 2% from numbers received in June, it is hard to figure out how this rare 13% jump occurred. There might be a slight data collection issue involved somewhere I suspect.

- Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz

ISSN: 2703-2825

Sign up for free at www.tonyalexander.nz

Ahead of delivering six presentations this week in Christchurch and Auckland (see comment about ChCh at the end) I took a look at the Reserve Bank’s Monetary Policy Statement released late in May. In it they were discussing the economic outlook as they always do and noted the surprising strength in China’s economy following it coming out of covid-19 lockdowns late in 2022.

But what has happened in the past two months since they (and most of us) wrote such optimistic comments is illustrative of the unique uncertainties which afflict our business and economic operating environments at the moment.

The outlook for China has gone from good to bad with a growing number of articles not just noting unexpected weakness in consumer spending, employment, business investment, regional government revenues, construction, exports etc., but questioning of China’s ability to ever become more than a middle income country at best.

There is a new focus on the over 20% unemployment rate for young people up to age 24 (30% in France, about 10% in NZ), the shrinking workforce and shrinking population, the aging population, the burden of regional

27 July 2023

government debts and their over-reliance on revenue from property developers, the 40% or so decline in residential construction which used to account for about 25% of economic activity in China over a long period of time, etc.

There is also the shifting by foreign businesses of production facilities out of China and switching of ordering goods also to other countries where possible. The inbound tourism sector has fallen sharply, and consumer confidence levels are very low.

The relevance for New Zealand is that one-third of our export receipts from sending goods offshore come from China including Hong Kong. Weakness in China can translate through to some weakness in our economy. But it pays to keep in mind that a lot of this weakness shows up in lower prices for the largely commodity items which we ship, not always reduced volumes though that is the case for the likes of wood going into the construction sector.

It also pays to keep in mind that China is a huge country of over 1.2 billion people and there are plenty of markets essentially untouched by NZ goods. So, while there are new downside risks for our export receipts, the situation is not the

same as in the pre-1970s when weakness in the UK meant outright recession for us.

Nonetheless, when I look at where the economy is headed, I usually draw up a list of things likely to support and/or boost growth and a list of things which will cause shrinkage or will work to slow the pace of growth. I have shifted China’s economy from the first list to the second. But that is not the only item I have shifted.

Fiscal policy is another. As a result of Labour’s pre-election Budget doing what they always do in such a Budget in an election year when they see a risk of losing – opening the spigots to some degree – there is a stimulus to the economy this year from fiscal policy. But tax receipts are failing to meet Treasury expectations - which is actually unusual as most of the time in NZ for the past 23 decades fiscal surprises have tended to be on the good side.

With a change in government looking increasingly likely later this year, National will have to deal with what Labour traditionally leave them upon exiting office – a fiscal mess. Tidying it up will involve some fiscal restraint. Therefore, passage of time, deterioration in the tax numbers, and increased probability of a change in government towards those with some real world experience outside of the public service, means fiscal policy now shifts from the stimulus side of my outlook ledger to the restraint side.

A third factor which I have partially shifted but only for the very short-term is mortgage interest rates. It looks like banks are getting in as many rate rises as they can get away with before the Reserve Bank gets any chance to signal happiness with inflation and good chances of monetary policy easing. Mortgage interest rates over the past two and a bit months have risen by 0.2% to 0.3% or so for the only time periods which people are really showing some interest in now, 1-2 years including 18 months.

This means a bit more restraint on household budgets for the next year at least than was looking to be the case 2-3 months ago – but its not a biggie.

It is not all a one way street, however. One item on my debit list has moved across to the credit side. The story for 2021 in New Zealand is of a developing credit crunch which reached its zenith right at the end of the year. Early in the year LVRs returned after being scrapped at the start of the pandemic. The rules for investors were tightened in May 2021.

Then in November the LVR rules were tightened again to limit the volume of bank low deposit lending as a proportion of all lending. And finally from December 1 the changes to the CCCFA came into play. Banks sharply curtailed credit availability to consumers and we saw the housing market fall away sharply.

Now, credit is becoming more readily available. Bank worries about the economy have perhaps pulled back a bit amidst signs that tight monetary policy is exercising some good restraint on inflation. But significantly, the rules for LVR and CCCFA-compliant lending have been eased in recent months.

My surveys show people perceiving that credit is becoming more readily available and although there are no signs of banks pro-actively trying to get funds out the door, the route from here is going to be even better availability.

So, what are the factors which sit in my two lists? First, here are the restraining factors. There are others but it is best to try and keep focussed in this business else one can disappear into a pit of despair, or soar too high in a spirit of unrealistic optimism.

This has risen by 18% for the average Kiwi family over the past three and a bit years. That near 6% annual rate is almost triple the average rise for the three decades ahead of the pandemic of just over 2%. People are having to pull back on buying many things in order to pay for things they can’t avoid like buying food, paying rates etc.

Fixed mortgage rates have risen at a pace and to a % degree we have never seen before in New Zealand since these products appeared at the start of the 1990s. For those low rate-chasers who ignored my jumping up and down over 2020/21 suggesting fixing five years at 2.99% seemed a complete gimmee, this has come as a surprise – like, who’d have thunk it? Borrowing costs go up sharply after the mother of all fiscal and monetary stimuluses have been applied to one’s capacity-stretched economy! The rate rises have however far exceeded anything any of us expected.

During the pandemic we brought forward consumption we might have otherwise been likely to do over 2023-25 on lumpy consumer goods and services such as spas, home renovations, landscaping, new furniture and appliances, curtains and flooring. Such a binge can never continue and for the past year and a bit we have pulled back from the splurge and now we are in a period when spending we were going to do is not being done. So, for manufacturers and retailers of such things times are now tough and set to stay that way through into probably late next year.

During the pandemic our “leaders” told us what to do. How to shop, where to travel, when to leave the house and so on. Most of us don’t really like being told what to do so with the borders open we have embraced with a vengeance the ability to go overseas whenever we want to. In fact we have allocated extra funds for doing so it seems at the expense of other things.

House prices have fallen, some people spend on the basis of their paper wealth, so such people will be spending less. Personally I feel this effect tends to be overrated.

Many businesses cannot find the labour they need so they are logically curtailing production to focus on what they do best.

Having given the business sector a lot of latitude for tax filings during the pandemic the IRD are now catching up. At a time of compressed margins this is likely to lead some firms to close down or cut back on spending in order to provide cashflow for delayed tax payments.

Then there is my second list which looks at growth stimulating things, again not including everything.

Numbers have jumped pleasingly though with some sign globally of things calming down a bit now that immediate travel appetites have been sated and the cost of living surge is biting.

There has been a good recovery with more numbers likely next year.

This is booming with a net gain of 78,000 over the year to May. More people means more household spending, alleviation of business hiring difficulties, but extra upward pressure first on rents and then on property prices.

Maybe this time I’ll be right. Our central bank says no further rise in the official cash rate from 5.5% is needed and measures of inflation expectations etc. have been easing. High uncertainty exists in this unique post-pandemic environment which none of us has experienced before. But there is a good chance the first OCR cut comes before the middle of next year. That implies fixed mortgage rates may be falling before the end of this year.

My monthly Business Survey undertaken with Mint Design has revealed an extremely high level of discontent with the policies and disorganisation of the current government. Polls are suggesting a good chance of a change and with that bringing a focus on raising incomes

rather than expensive centralising of services, redistributing income, and imposing new regulations and restraints, better growth will eventuate.

There is a multi-decade period of infrastructure investment needed in New Zealand. This is to catch up on what this and previous governments have let slide over many years plus improve resilience as climate change has more noticeable impacts.

Extra spending is underway and coming in response to the effects of the floods earlier this year.

Much as the unemployment rate is set to eventually rise because of the weakening in the economy, the jobs market is surprisingly strong. People are likely to feel that retention of employment is likely and if layoff occurs then securing a replacement position may not be all that difficult.

This will tend to reduce the extent to which people would otherwise be cutting back spending in response to the cost of living surge and tight monetary policy

Turnover of real estate has gone up 20% seasonally adjusted in recent months and prices look to have stopped falling. Improvement in this services sector as the two and a half year queue of delayed buyers gets activated will directly contribute to GDP growth.

Because monetary policies offshore have been tightened at the same time as ours the Kiwi dollar this cycle has not gone through the roof as has tended to be the case in past cycles. This is good for exports.

I am almost making more presentations now in Christchurch than in Auckland. Wellington is a rarity and always has been. Maybe it is because businesses having me speak at their gatherings of people from around the country want to run the function in a CBD which does not have the clear image issues afflicting Wellington (set to get worse with Lambton Quay & Willis Street redevelopment for the next few years), and Auckland which is still looking empty.

Christchurch CBD is new, the place looks rejuvenated, and the recovery is being led by the hospitality sector but generally (not always) without the vomit afflicting Courteney Place in Wellington. Auckland CBD hospitality beyond the Viaduct which had its heyday some years back, is not so flash. I’d prefer taking a visitor to Ponsonby than the CBD.

Christchurch’s Te Pae convention centre is brilliant. Wellington has a smaller one open now as well but be careful. If you are using it of a weekend, make sure that someone from the council will be there to change air conditioning settings if needed. Apparently, they don’t work at weekends I’m told. Auckland’s second attempt at having a convention centre up and running is still not due to deliver until 2025.

Welcome to the July issue of Regional Property Insights for 2023, prepared by Tony Alexander with the support of First Mortgage Trust.

In this month’s Regional Property Insights I update material last presented in February looking at regional insights able to be gleaned from some of the monthly surveys I run. I look at some key results from my regular survey of real estate agents and where possible add in material also from my Spending Plans Survey.

As with all the material presented in RPI, my aim is to provide information which can be collected up over time and used as input into one’s property purchase and divestment decisions.

In Auckland and outside of Auckland FOMO readings tend to move closely together. We can glean this from the following graph. The dark blue line shows the proportion of real estate agents in Auckland saying that they are seeing fear of missing out on the part of buyers. The green line covers all of the country.

From my monthly Spending Plans Survey we can see that as a rule, since early in 2021 the interest of people in investing in residential property in Auckland has been less than for the rest of the country. The cost of purchasing in Auckland may be one factor in play, along with the tendency for Auckland’s housing market to perform less strongly than the rest of the country since 2017. Hence why Auckland may now be set up for a period of recovery versus the other parts of New Zealand on average.

Recently, the FOMO reading in Auckland has risen above the NZ average, to 27 versus 19, or quite a bit less than that if we were to exclude Auckland (which I will do one day when I get time to reanalyse all the data from May 2020).

There are a number of measures in my collection which suggest Auckland will out-perform the national average through the upward leg of the house price cycle this time around. Perhaps this is one of them.

When I ask agents about whether investors are selling, the graph below suggests that there is no great difference between Auckland and the rest of the country. Investors overall are not displaying rising propensity to sell according to real estate agents.

30 Franklyne Road, Otara NZ

§3 bl �1

URGENT SALE-MAKE AN OFFER

Currently tenanted, this 985m2 site (more or less) is a developers dream. Zoned Residential (9D), re...

21st, Aug2023

https://drury.ljhooker.co.nz/

1 Luke Place, Otara NZ

§5 b2 �2

URGENT SALE-MAKE AN OFFER

* Prominent site

* PrimeLocation

* Huge development potential

114 Harbourside Drive, Karaka NZ §- b-�-

RIPE FOR DEVELOPMENT in KARAKA Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land ho...

ForSale By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

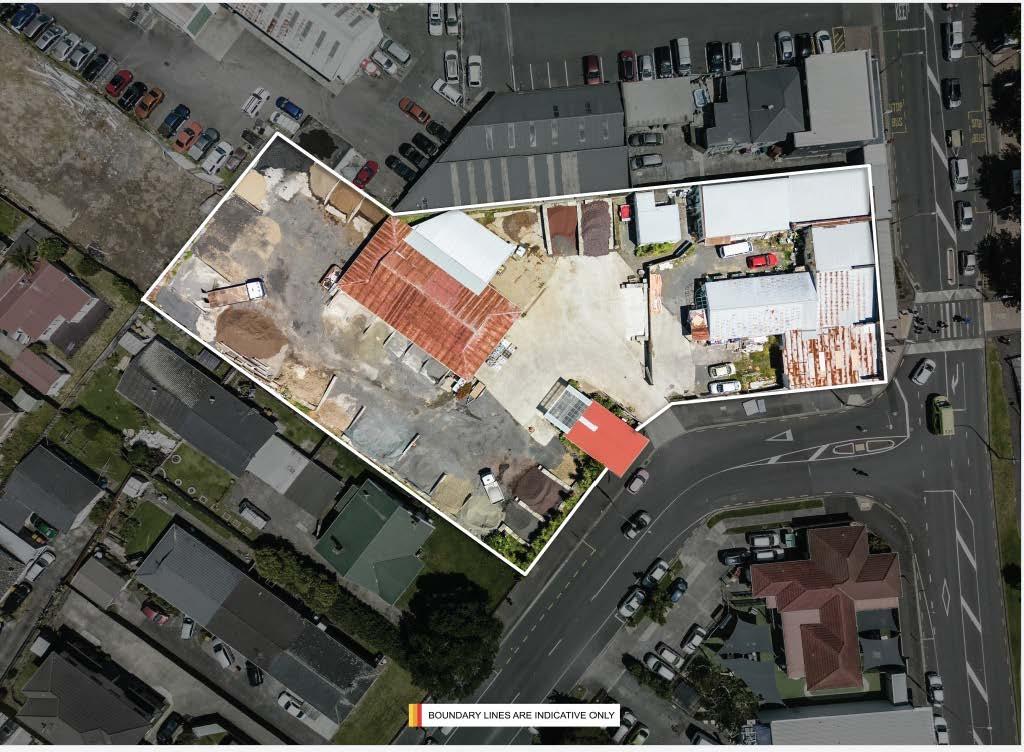

5 Coronation Road, Papatoetoe NZ

PRIME COMMERCIAL BLOCK.

Set in the heart of Old Papatoetoe's commercialhub, the opportunity to acquire blocks of this size

ForSale Price By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

ForSale By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

ForSale By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

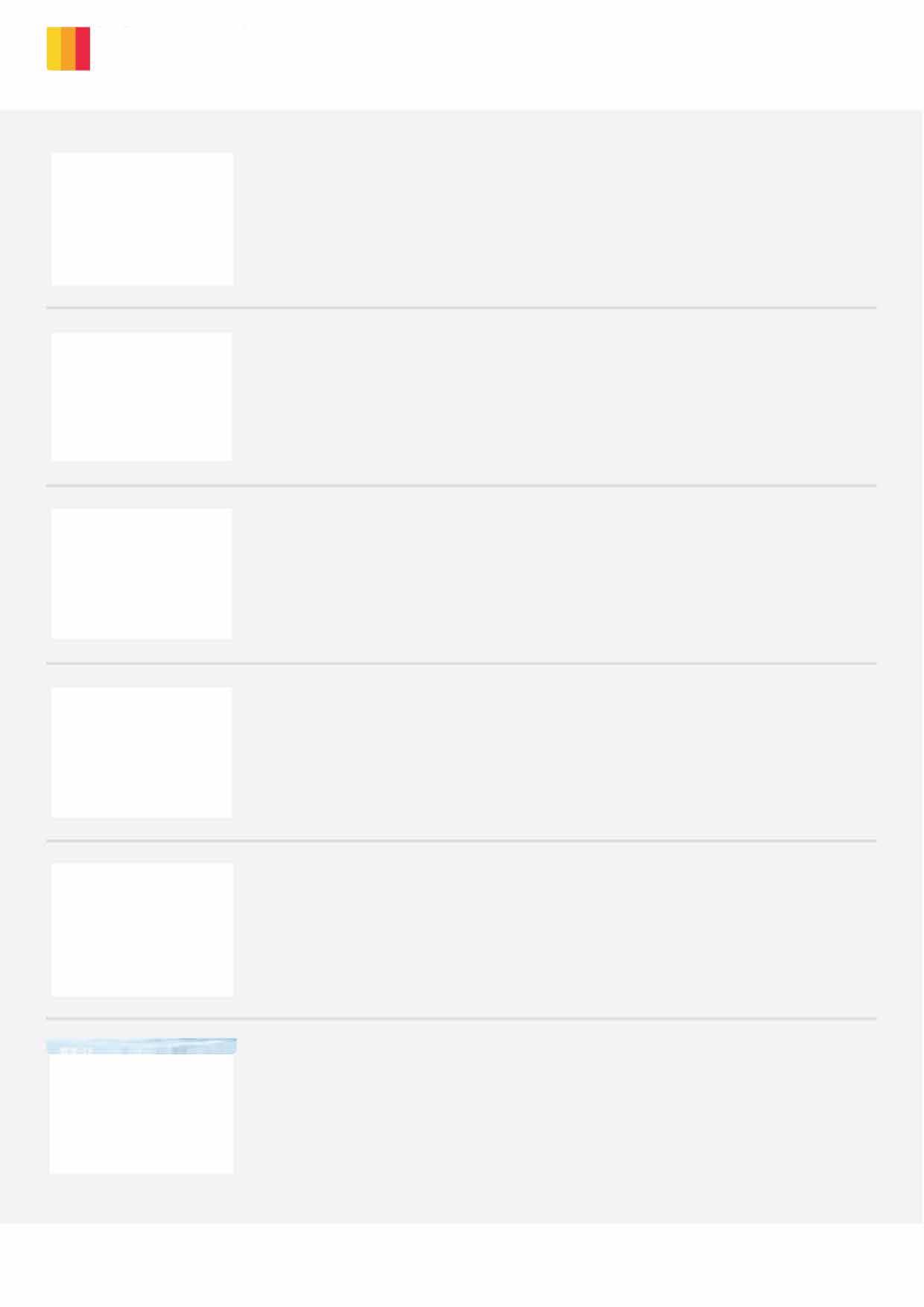

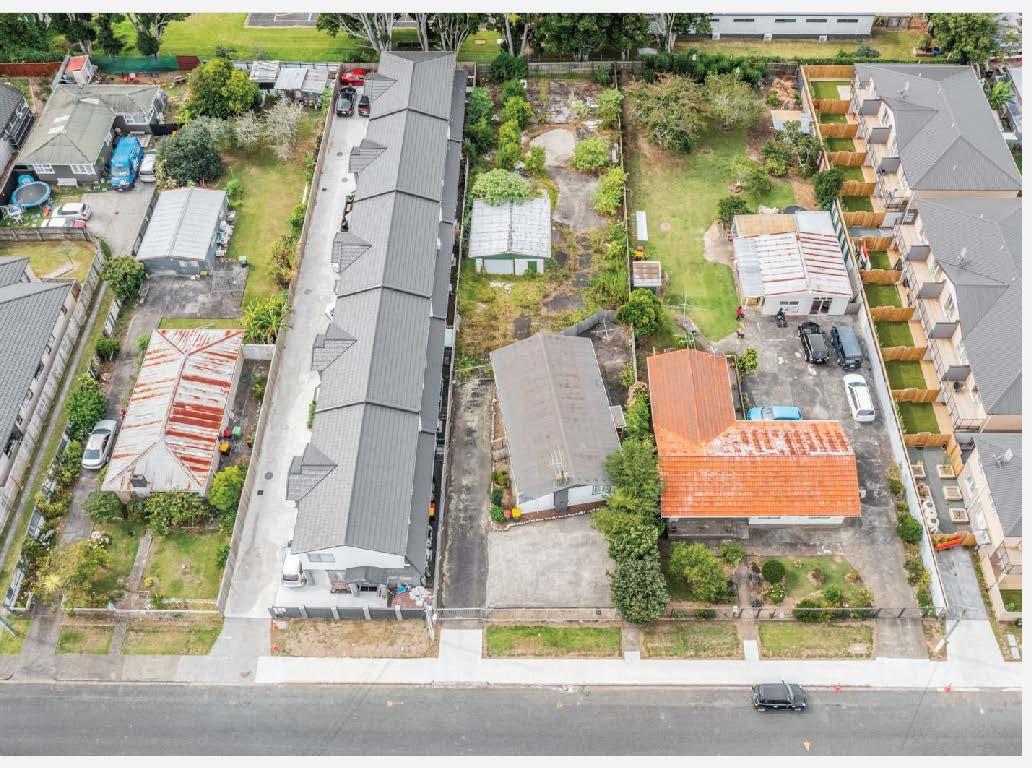

3 Paparata Road, Bombay NZ

§4 b2 �s

BOMBAYBEAUTY- BOXES TICKED!

*4 Double bedrooms.

* Master with ensuite.

* Impeccably cared for and presented. < ...

26 Dawson Road, Otara NZ

§3 bl �10

UNIQUEINVESTMENT with HUGE POTENTIAL

Located on the Flat Bush-Otara boundary, this property is all about potential. DEVELOP, DEVE...

ForSale Price By Negotiation

View ByAppointment

Brent Worthington 029 2965362

brent.worthington@ljhooker.co.nz

For Sale By Negotiation Brent Worthington 029 2965362 b rent.worthington@ljhooker.co.nz

BOMBAY BEAUTY - BOXES TICKED!

Sited for all day sun and situated close to so many amenities and locations!

1006 sqm

4 Bedrooms

2 Bathrooms incl Ensuite Walk-in robe

Separate Laundry

Large Double Garage with Internal Entry Minimal care grounds with safe and secure rear for children and pets.

ByNegotiationByAppointment orOpenHomeasadvertised

_____________________________________________________________

(2008)

Located in the "sought after" Karaka Harbourside Estate, the opportunity to purchase another land holding of this size and zoning is unlikely.

Currently consented for a 7 Lot residential subdivision, the property is also subject to Auckland Council's Plan Change 78Intensification proposed 18/08/2022. Possibly greater development opportunities!

ByBy Negotiation91 Beatty Road, Pukekohe NZ §8 b7 �

uNuM1TED POTENTIAL

On the market for the first time in 43years. The 630m2 dwelling is set on a 2,379m2 site (more or I...

Sold Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

https://drury.ljhooker.co.nz/

35 Briody Terrace, Stonefields NZ §4 bl �4

STAND ALONE IN STONEFIELDS

Set on a 372m2 site (more or less) this 243m2 Fletcher designed and built dwelling will definitely i...

Sold Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

102 Mountain Road,Mangere Bridge NZ §2 bl �1

LOCATION - LOCATION - LOCATION CONJUNCTIONALS ARE WELCOME.

On the market for the first time ever, this offering is p...

151 Barrack Road,Mount Wellington NZ §4 bl �6

"' UNIQUE INVESTMENT with HUGE POTENTIAL

Located in the geographical centre of metropolitan Auckland, this property is all about potential. D...

Sold Brent Worthington 029 296 5362 brent.worthington@ljhooker.co.nz

Sold ina Roban 021 022 88521 lina.rob@ljhooker.co.nz

0292965362

Brent.worthington@ljhooker.co.nz

There’s not much Brent doesn’t know when it comes to selling real estate. This town andcountryagenthashadasuccessfulcareerinthepropertymarketandisnowthe proud owner of his own business. Definitely a quality over quantity man, when you bring Brent on board, you’ll find that accumulating listings is far less important to him than making each one as good as it can get. He prides himself on telling it like it isknowing you’ll be able to make better decisions with a person and information you cantrust.

Complementing Brent’s practical

and credible approach is a background full to the brim of industry knowledge and business expertise from 30 years working within the construction industry. His capabilities have been well proven as a highly successful businessowner.

A family man, with a proven track record of success, Brent has earned an excellent reputationandthetrustofhislocalcommunityandbusinesscolleagues.

He places huge emphasis on customer satisfaction, attention to detail and conducting his business with a genuine duty of care. Brent has gained many awards asabusinessleaderduringhis12-yeartenureinRealEstate.

Hisentrepreneurialstyleensureshereachesoutandconnectspeoplewithlikeminds. Heimpartshiswisdominawarmandfriendlymannerandhelpspeopletomakewise andrightdecisionsbeforeinvestinginthepropertymarket,Aucklandwide.

Ifyouareconsideringalifestylechange,investingforyourfutureorsimplywantingto know the worth of your property in this fluctuating market, feel welcome to call or emailBrenttoreceivethelatestupdatesonthetrendsandstatisticsinyourarea.

0210

2288521lina.roban@ljhooker.co.nz

Prior to entering the world of real estate, driven by her love of meeting and helping people, Lina had an impressive 20 year career in sales and marketing roles in the telecommunications and corporate marketing industries where her expertise in communication and negotiation always resulted in the delivery of superior customer servicetoherclients.

Originally from Fiji, Lina epitomises energy, passion integrity and hard work in everythingsheturnsherhandto.

When not delivering superior service to her clients, Lina loves spending time with her family and is a passionate cyclist, owning both road and mountain bikes. With her three children all having "flown the coop", Lina and her husband also have plenty of time to enjoy their love of travel and some of their more memorable adventures includeextensivejourneysthroughoutSouthEastAsia,theUSAandtheSouthPacific.

0278405248

christine.c@ljhooker.co.nz

WithChristine'smanyyearsofsuccessinReal Estate,Christineisnowcontributingtothesuccess oftheteamatDruryTown&Countryalongwith sharinghervastexperience,expertiseandcheerful dispositionwithourclients.

Whenyouknow,youknow. ™

021302864

debbie.harrison@ljhooker.co.nz

With a passion and a commitment to providing exceptional service, Debbie has a fantastic attitude of getting things done and ensuring that the clients are happy and well cared for. She takes great pride in her work and goes above and beyond to ensure the satisfaction of both property owners and tenants.

Debbie’s attention to detail and organizational abilities are exceptional, enabling her to efficiently handle all aspects of property management, from tenancy agreements, rent collection to property inspections and maintenance coordination.

Debbie understands that property management requires a compassionate and empathetic approach, and she always strives to create a positive and harmonious living environment for tenants while protecting the interests of property owners.

Whether you are a property owner seeking professional management services or a tenant searching for a well-maintained rental property, Debbie is committed to delivering exceptional results and ensuring a smooth and rewarding experience for all parties involved.

With her excellent communication skills, strong work ethic and dedication to excellence, Debbie Harrison is a true asset to LJ Hooker, Drury.

It could be said that our current market is one of the most unpredictable markets in some time. Generally, a market is predictable when we have lower stock levels and low interest rates - the competition lifts and prices increase.

Our current market, however, is a bit less straight forward. We have higher interest rates, lower stock levels, an election looming, $150 billion worth of New Zealand mortgages still to move out of low fixed rates, and a number of investors about to come to the end of their 5-year Brightline periods, allowing them to sell their investments with no tax implications. At the same time, buyers are perceiving that this could be the bottom of the market, so are acting now to secure property before a take-off.

Taking all of this into consideration, one thing we do know for vendors - now is good! Demand is currently outstripping supply leading to some positive outcomes in the marketplace.

Apollo clients across Auckland saw a 76.1% unconditional clearance rate over a 42 day period, with over $72 million worth of property sold. Other regions also followed with strong combined clearance, Canterbury 87.5%, Northland 68.8%, and Central North with 100% of auction properties sold or under contract.

Average bidding numbers also increased across the country, in particular in the first home buyer market.

Whilst there were some standout results achieved at auctions in June, it wouldn't appear we will have any large price hikes in the near future as interest rates control borrowing capacity. The good news for all is that with more of a stable market it makes transacting from one property to the next a little easier.

The dominance of auction focused agencies in all our core areas is increasingly clear. If you or your team would like to know more about creating an auction culture within your business, feel free to reach out to one of our award-winning team.

Rob & Tim

When you know, you know.™

Town&Country