LISSA GRAY ANDERSON

Gottesman Residential Real Estate is passionate about providing the highest level of expertise to our clients. We strive to maintain an unparalleled standard of credibility, knowledge, confidentiality, integrity and professionalism. Our goal is to exceed the expectations of every Buyer and Seller so that his or her experience with our company is exceptional in every way.

Gottesman Residential uses the latest technology, cutting edge marketing and creative networking. Most importantly, we are a collaborative group sharing ideas, market trends and resources. All agents are familiar with the company’s listings and serve as emissaries throughout our individual networks and circles. There is always a sounding board close by and we believe there is energy and strength from locking arms and supporting each other. The cohesive nature, knowledge and deep rooted integrity of our brokerage is enviable throughout the brokerage community.

“WHEN YOU GET ONE OF US, YOU GET ALL OF US”

knowledgeable experienced connected confidential creative client-focused

Over the past five years alone, Gottesman

Residential has sold more than 1,000 properties listed over $1,000,000.

NATIVE AUSTINITE

GRADUATE OF AUSTIN HIGH SCHOOL AND TCU NEELEY SCHOOL OF BUSINESS

MEMBER OF AUSTIN BOARD OF REALTORS AND NATIONAL ASSOCIATION OF REALTORS

MEMBER OF AUSTIN LUXURY NETWORK AND TOP AGENT NETWORK

SETON DEVELOPMENT BOARD MEMBER

HELPING HAND SOCIETY MEMBER SUPPORTING HELPING HOME FOR CHILDREN

O. HENRY MIDDLE SCHOOL PTA BOARD - VP FUNDRAISING

AUSTIN HIGH SCHOOL PTSA BOARD - VP COMMUNICATIONS

ACTIVE VOLUNTEER WITH MOBILE LOAVES & FISHES, COMMUNITY FIRST! VILLAGE AND WESTOVER HELPS FOOD PANTRY

NATIONAL CHARITY LEAGUE GRADE LEVEL ADVISOR

MEET LISSA. Lissa has been helping clients buy and sell their homes for over ten years. Before embarking on her real estate career, she owned a gift and monogramming boutique in Central Austin, where her love for her community and their needs sprouted her passion for real estate.

Helping families buy and sell their homes is a career she values and treasures. Lissa found a home at Gottesman Residential Real Estate because of their shared commitment to nurturing client relationships, innovative marketing, and exceptional customer service.

Born and raised in Austin, Lissa’s extensive knowledge of the city’s rich culture, diverse architecture, and charming character of each of the unique neighborhoods throughout the city truly sets her apart. Lissa’s strong work ethic, positive attitude, and creative thinking have earned her a reputation as a trusted adviser amongst her clients and colleagues.

Austin Luxury Network

Lissa’s two children have helped her understand the importance of home and community. Everyone deserves to find their perfect abode within this bustling city, and Lissa takes pride in knowing the ins and outs of each pocket in order to methodically and thoughtfully help clients achieve their real estate goals.

MEET MOLLY Molly was born and raised in Houston, Texas, and graduated in 2022 from TCU with a bachelor’s degree in Communication Studies. Molly grew up visiting family in Austin and staying in Tarrytown (where she currently resides). Austin was an easy choice when picking a place to call home after college. After moving to Austin, she quickly found a home at Gottesman Residential because of their shared sense of loyalty and community amongst colleagues and clients. Molly obtained her real estate license in 2022 and works with Lauren Romano and Lissa Gray Anderson. With her background in Communications studies, love for being social, and strong work ethic, she is able to provide excellent customer service and assistance to her team members. In addition to real estate, Molly loves exploring the dynamic city of Austin and enjoying all its food and activities with her friends and family.

Congratulations on your decision to buy a home in Austin. Every state treats real estate transactions a little differently and Texas is no exception. We have asked our attorney to provide information about a few unique of a Texas home purchase. Of course, this information is not exhaustive and you should consult your own attorney for specific advice on your real estate purchase.

In Texas, marital property is designated as either separate or community property. Property characterization is important in determining how the property is transferred or inherited. Separate property is (1) property acquired before marriage; (2) property obtained by gift under a will or through inheritance; and (3) property obtained with directly traceable separate property funds. Except for property that is the family “homestead,” separate property may be sold and conveyed without the permission of the other spouse. Community property is property owned by either spouse other than separate property. Texas law presumes that all property, acquired during marriage, including earnings, is community property. As long as its identity can be traced, separate property retains its character, but if separate property is commingled with community property, the whole commingled mass is deemed “community property.” Spouses can agree in writing to alter the nature of their property between them but this requires careful legal advice. Typically a home acquired by a married couple who are Texas residents will be community property.

Texas is unique in its application of homestead protection. In Texas state law, the term “homestead” refers to the special protection from the owner’s creditors, the right of occupancy given to a surviving spouse and children and favorable tax treatment accorded to the owner.

A Texas homestead is exempt from seizure and a forced sale for the claims of a creditor except for an encumbrance for purchase money loans,property taxes, written home improvement loans, partition liens, refinancing, home equity loans and, reverse mortgages. A Texas homestead is not secure from seizure for a debt owed to the federal government. And, any encumbrance existing on land prior to its dedication as a homestead is also enforceable.

The urban residential homestead consists of a lot or contiguous lots of 10 acres or less that is located within a city or town. There is no limit on the value.

Designation of a homestead is achieved by actual use and no recorded claim to the right is required. Either separate or community property may constitute a homestead. A homestead owner’s spouse must join in any transfer or encumbrance of a homestead, and neither spouse can abandon a homestead without the consent of the other.

A surviving spouse is entitled to the sole occupancy of a homestead for life, though the owner may have devised ownership rights in the property to someone else.

Unlike other states, Texas does not have a personal state income tax. As a result, real property (“ad valorem”) taxes can be higher than those assessed in many other states. There are exemptions from a portion of the ad valorem taxes if the property is a “homestead.” The exemptions (including additional exemptions for persons over 65 years of age, disabled persons, and qualified veterans) must be claimed by filing a form with the local property tax appraisal authorities (in Travis County, the Travis County Appraisal District, known as “TCAD”) no later than April 1st of the year for which you are first claiming an exemption.

On your closing statement you will often see prorations of annual charges. Taxes for a current year, interest, maintenance fees, regular condominium assessments, dues and rents will be prorated through the Closing Date (the day you sign the final documents buying or selling property). Taxes for a given calendar year are assessed as of January 1st of that year but are not payable until as late as January 31st of the following year. Therefore it is customary for the buyer to receive a pro-rated credit for the portion of taxes that would accrue during the part of the year that the Seller owned the home. The buyer then pays all of the taxes for that year when they come due by January 31st of the following year.

Homeowners associations in various subdivisions or neighborhoods have authority to enforce deed restrictions. These organizations are also frequently authorized to levy mandatory assessments or fees on all owners of property within that particular subdivision and to enforce that obligation by filing (and foreclosing) liens on property if the assessments are not paid (even if the property is a homestead).

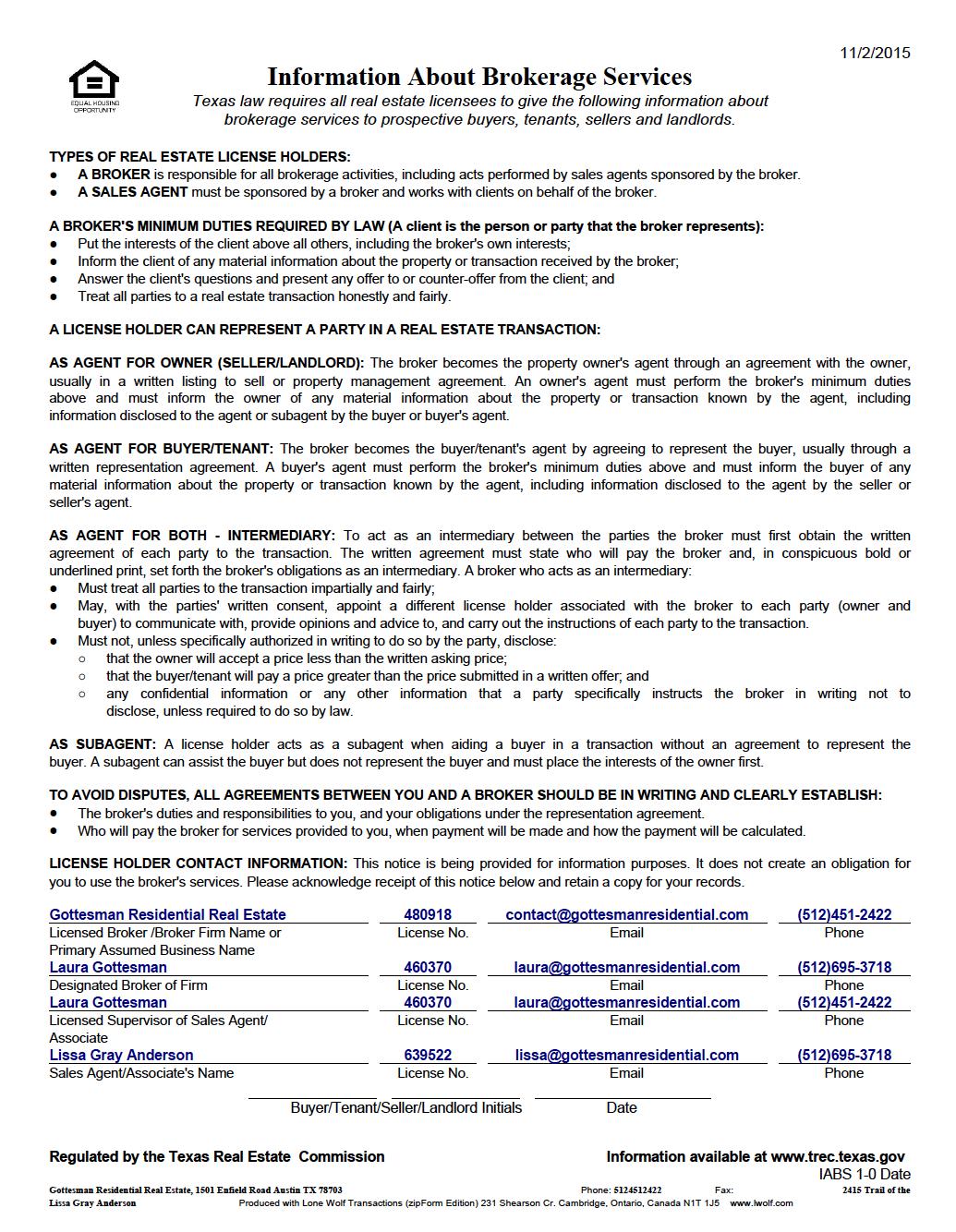

Texas law requires all real estate licensees to provide potential clients with an explanation of brokerage services in the state of texas. a copy of the information is provided here.

Buyers’ agents are typically paid from the proceeds of the sale. The Listing Agreement between the seller and the listing broker contains an agreement for the listing broker to pay the broker representing the buyer. The commissions paid to both the listing agent and the buyers’ agent are therefore included in the sales price of the home. The Information About Brokerage Services form recommends entering into a formal agreement with an agent/broker with a Buyers’ Representation Agreement.

Your signed offer to purchase is the document which presents your price and terms to the seller. It will be prepared on a form promulgated by the Texas Real Estate Commission in conjunction with the Texas Bar Association. This purchase offer contains all the terms and conditions of the sale and if the seller signs it, the document then becomes binding on all parties.

The terms and conditions of each contract are unique. The following are some typical things that buyers and sellers negotiate:

•the sales price

•the amount of your “earnest money”

•the date, time and place of closing and when you will have possession of the home

•the Special Provisions paragraph will contain any terms or conditions which you or the seller will want to include in the purchase agreement.

Lissa will assist you in completing this document before it is submitted to the seller. The Termination Option is of utmost importance to the agreement. This is the paragraph that contains the buyers’ “unrestricted right to terminate” once the contract has been finalized or executed. It is during this “option period” that you will want to have all the inspections completed. This is your “due diligence” time, and you will need to complete you investigation of the home during this time. If, during the inspections, you determine deficiencies in the home that you want the seller to repair or you decide you want to, in any way, amend your offer, you will present an Amendment to the seller stating the amended terms of the contract. This opens the negotiations once again and the seller can agree in part or in whole to your “amended” terms, refuse to agree to your terms, or propose other terms for your consideration. It is important to understand that it is only you as the buyer who has the “unrestricted right to terminate” and therefore the buyer is the one who typically initiates any changes in the terms of the executed contract. At the end of the option period, unless you terminate the contract in writing, you will proceed to closing.

The offer is finalized and becomes a binding contract only after the buyer and seller have initialed all changes and have signed the offer. When all parties have initialed all the changes and signed the contract, the “effective date” of the contract is the date filled in by the broker on the line just above the signatures. This date is the used to determine the timing of stipulations of the contract, such as the buyers credit approval or the option period. At the time the contract is “executed” ie., signed by all parties and dated by the broker, you will write a check for the earnest and option money made payable to the title company. The executed contract and the earnest and option money will be delivered to the title company who will then receipt the contract. The earnest money will be deposited in an escrow account and will be credited toward your closing costs at closing. The title company will also receipt the contract for the option money. If the seller agrees, the amount of that option money check will also be a credit to you at closing.

During the Option Period, you will want to hire a property inspector licensed by the State of Texas to perform a structural and mechanical inspection of the home. At the conclusion of the inspection you will be given a report on a standardize form approved by the Texas Real Estate Commission. It is important to be present for the summary report so that you get the information from the inspector first hand. You will also want to hire an inspector for wood destroying insects. Depending on the property inspection report, you may want to hire a structural engineer to perform a further investigation or possibly a roofer, or another specialist. You’ll want to compete all your investigations, and if you choose to submit an Amendment to the seller requesting repairs or amending the sales price, you’ll want to do that at least two days before the option period expires. The seller will need time to respond to your Amendment before the expiration of the option period. Your unrestricted right to terminate the contract ends when the option period expires.

If you are applying for mortgage financing to purchase the home, the mortgage company will hire an independent fee appraiser to determine the opinion of value for the home for the mortgage company. The tax appraisal value is the assessed value for property taxes but does not establish market value. The mortgage company is agreeing to lend you a percentage of the appraised or market value of the home. So, it is essential that the home appraise for at least the amount of the sales price.

The title company or your lender will order a survey of the property on your behalf. A surveyor determines the exact dimensions of the land and the specific location of the home, garage, patio or deck, fences, pool etc. on the lot and provides a line drawing of the property. Using the title commitment, the surveyor also specifies any easements, encroachments, setback and/or building lines, etc. which are filed with the county. Those are located on the land and described on the survey. The lender and the title company review the survey for potential problems.

Home warranties are offered by several vendors. Lissa can provide individual brochures that will describe the coverage or you can find the companies and the coverage online. The warranties are basically an insurance policy for twelve months during which time the homeowner pays a basic fee for a service call ($60-$75 typically). The warranty company contracts with providers such as HVAC contractors, plumbers, electricians etcetera. When the homeowner needs repair on any of the covered systems, the homeowner calls an 800 number, gives them a specific contract number and the warranty company contacts the service provider who then gets in touch with the homeowner for an appointment for the repair. When the repair person completes the covered repair, the homeowner pays the fee for the service call and the warranty company pays for the repair. As the buyer, you can order and pay for the home warranty or you can negotiate the home warranty as a seller’s concession and expense during the contract negotiations.

You will want to insure your home and its’ contents against loss. Homeowners insurance pays to repair or replace your home or personal property if it is damaged or destroyed. Your policy states the amounts the company will pay and what types of losses it will insure against (such as fires, storms and thefts). You can buy a policy that covers only your house, but most homeowners buy a policy that combines five coverages: dwelling, personal property, liability, medical payments and loss of use. Detailed information about Homeowners Insurance can be found on the Texas Department of Insurance website www. tdi.texas.gov.

Title insurance is significantly different from other forms of insurance in its nature. Other forms of insurance such as casualty and life insurance are “risk assumption” insurance proving protection against losses due to unforeseen future events. Title insurance protects you and your lender if someone challenges your title to your property because of title defects that were unknown when you bought your policy. Most lending institutions will not loan money to purchase a house or other property unless you buy a “mortgagee” title policy. This policy protects the lender’s investment by paying the mortgage (loan amount) if a title defect voids your title. When you buy a house, the title company also issues an owner’s policy, unless you reject it in writing. The owner’s title policy protects you against the covered risks set out in the policy. Title insurance is also regulated by the Texas Department of Insurance. More information can be found on their website www.tdi.texas.

The closing will be held on or before the date specified in the contract.

The closing will take place as specified in the contract at the office of the title company or of an attorney.

Your funds should be wired into the account of the title company the day before closing. The title company will provide you with the appropriate wiring instructions. The amount needed to close will be available from the title company after your lender provides the title company with the closing instructions and documents. If you are using a stock account or an out of town banking institution, please be sure to notify your financial officer that you will need your funds available to be wired the day before the scheduled closing.

To avoid the possibility of an interenet scam, only wire your funds after a phone conversation to confirm the wiring instructions with the title company.

Have your insurance agent deliver your homeowners policy to the title company along with the bill for payment to be included in your closing costs.

Bring a photo ID in the form of either a current driver’s license or passport to closing.

You will be given the keys to your new when your loan “funds” (meaning your mortgage company reviews the signed loan documents and releases their funds along with your funds for the down payment to the seller) which usually takes a few hours.

The title company will record your note and deed of trust at the office of the County Clerk of Travis County. A copy of your deed and title policy will be sent to you by mail within approximately six weeks of closing.

Congratulations! It has been my pleasure and a privilege to represent you in the purchase of your new home.

Austin Luxury Network and Top Agent Network are membership based organizations where real estate agents in Austin can promote and network listings priced over $1MM (ALN) and in all price ranges (TAN), that are not in MLS, with other agents. The website and tours are not open to the general public.

Nurturing a professional network outside of the real estate industry provides a unique avenue for marketing. Lissa’s involvement throughout Austin and in real esate has created connections throughout the business community which have proven invaluable for networking.

Not everyone knows that they are looking for a home. Sometimes, the perfect home just appears for someone. Keeping people updated on fantastic properties, even when they are not active buyers, can often spark an interest that no one knew was there. Lissa’s ongoing relationships with past clients as well as those nurtured through shared interests are a great resource for marketing.

“IF PEOPLE LIKE YOU, THEY’LL LISTEN TO YOU. IF THEY TRUST YOU, THEY’LL DO BUSINESS WITH YOU.”

We are very grateful to Lissa with Gottesman. She knows the Austin market and was able to get us top price for our house. She gave us just the right advice and assistance on what to fix up and what to leave alone so we would get the best net value possible. I am glad we came to her early in the process, long before we were actually planning to move, because she helped us time the market just right and work out an extremely favorable lease-back until we were ready to move out on our timeline. She is very good at negotiation tactics as well. It made the offer, inspection and closing a very smooth process. I highly recommend her! - BRYKER

WOODS SELLERI worked with Lissa over two years to find the perfect property. Over that time, she patiently watched the market, took time to show me properties and offered invaluable inputs about the homes we saw together. It was always clear she was in my corner, focused on finding the right property for my needs, not trying to make a quick sale or push me toward an easy deal. Lissa’s work is her passion and she invests fully in everyone she works with. Lissa is personable, easy to work with and understands the Austin market, having grown up and raising her kids in Central Austin. I cannot recommend her enough!

- CLARKSVILLE BUYER & SELLERLissa represented me in the purchase of a townhouse in central Austin. Although I used to live in Austin and return for both work and play regularly, I still wanted an agent who had deep knowledge of the city, the current market and the area where I was looking. Lissa over-delivered in every possible way. As I was coming in from out-of-state, we had limited time to look at properties. She carefully curated my search and, when we found the right unit, we both knew it was the perfect option. Lissa and her team made the long distance transaction flow seamlessly. She and Molly, her assistant, went above and beyond providing service on every level. My purchase was as stress-free as any real estate transaction could be and our new townhouse is exactly what we were hoping to find. Lissa is professional, knowledgeable, loves Austin and provides gracious service. I am so grateful to her and Gottesman for their work and would recommend them to anyone looking to buy in the area. -

THE GROVE BUYERFrom the moment I met Lissa, I knew I was in excellent hands. Lissa’s expertise and dedication were evident from the start. She went above and beyond to ensure that my home was ready for the market, providing invaluable advice and guidance every step of the way. With her keen eye for detail and deep understanding of the Austin real estate landscape, Lissa knew exactly what needed to be done to showcase my property in the best possible light. What truly sets Lissa apart is her unrivaled knowledge of the Austin market. She knew the Tarrytown neighborhood like the back of her hand, understanding its unique charm and the factors that make it an attractive location for buyers. Lissa’s insights into local market trends and pricing strategies were instrumental in positioning my home competitively, ultimately leading to a successful sale. She was always available to answer my questions and provide updates, ensuring that I felt informed and supported at every stage. Her genuine care for her clients and commitment to their success is truly commendable.

Statistics from:

- TARRYTOWN SELLERhttps://www.nar.realtor/ - profile-of-home-staging

CBS Sunday Morning: Getting Houses Ready for their Close up

REALTOR® 512.695.3718

lissa@gottesmanresidential.com gottesmanresidential.com lissagrayanderson.com

All information is from sources deemed reliable, but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is represented subject to human errors, omissions, changes, or withdrawn without notice. Licensed in the state of Texas.