1.0 Nurturing Talent & Retention

Ireland is at the forefront of global business attraction and job creation. While our employment rates continue to perform well and our educational institutions produce top-tier graduates, we must now prioritise retaining our talent and empowering businesses to establish and grow. The demand for skilled workers is urgent, necessitating targeted solutions that go beyond simple workforce expansion. We must invest in specialised training programs to attract and retain the talent essential for the growth of our industries. Furthermore, the success of these businesses relies heavily on robust infrastructure support. Access to housing and other critical resources is vital for sustained operations. As we approach Budget 2025, it is imperative that we take decisive action to fortify our business ecosystem and ensure enduring prosperity.

1.1 Supporting Enterprise & Industry

• Implement a Trading Interruption Waiver on local authority rates to robustly support businesses facing substantial disruptions due to unforeseen or planned changes affecting customer access, such as extended public realm or roadworks that exceed agreed timelines. It is crucial to establish a fund to compensate local authorities for the waived amounts. This proactive step directly benefits businesses impacted by unexpected delays in capital projects.

• Provide financial assistance to businesses striving to expand their e-commerce operations. This aid must extend beyond solely merchants selling one and should encompass those seeking to amplify their physical store presence, ultimately bolstering both online and in-person trade. This will help to open new markets for local businesses by boosting their online presence.

• We welcome the extension of the waiver for outdoor dining for the remainder of 2024, however, we would like to see this extended to the end of 2025 and continue to include awnings, canopies and heaters used in conjunction with tables and chairs. We see this as critical to supporting the vibrancy of towns, villages and cities.

• We propose eliminating the restriction that limits tax-free status to the first two benefits or vouchers received by employees in a calendar year. This adjustment would offer employers more flexibility to reward employees at various times throughout the year.Wealsoproposed increasingtheSmallBenefits Exemptionto€1,500.

• Defer the €10 million relief limit on business assets that family business owners aged 55 to 69 can transfer to their children free of Capital Gains Tax, set to take effect on 1 January 2025, until a thorough evaluation and proper consideration of its impact are completed.

• Review and simplify existing reliefs, such asRetirement Relief, by integrating them into a more comprehensiveEntrepreneurs’Relief.

• Increase the capital allowances for plant and machinery purchases against Corporation Tax and RentalIncomefrom12.5%perannumto25%.

• Reform the Employment Investment Incentive Scheme (EIIS) by simplifying the qualifying criteriaand enhancing flexibility to encourage broader investorparticipation.

• Reduce the Capital Gains Tax rate of 33% for non-passive investments. Additionally, increase the lifetime limit for qualifying capital gains under EntrepreneursRelieffrom€1million.

• Broaden the range of industries eligible for trade supports to include sectors such as Green and Sustainable products, Skills, Culture, and all SMEs aiming to export to the EU. As well as allocate additionalresources to the Trade and Investment Strategy to actively support small and medium

enterprises (SMEs) in engaging with international trade.

• Budget 2025 must bring forward stronger financial support for indigenous SMEs. Much of the grant / support funding available through Local Enterprise Offices is for companies with up to 10 employees. Meanwhile, Enterprise Ireland funding is largely focused on businesses with an international export function. There needs to be more support for Irish businesses that fall in between both these categories, to ensure that we keep a strong indigenous sector. Furthermore, growing our indigenous sector should diversify the state’s tax revenue, and help to move some of the concentration from MNCs to other sectors. Budget 2025 must allow Local Enterprise Offices to either assist larger companies, or else expand the remit of programmes within Enterprise Ireland.

• Before implementing any gradual increases to the Carbon Tax, the Government must conduct comprehensive impact assessments. These assessments are crucial to evaluating the effects on small and medium-sized enterprises (SMEs), large companies, commuters, and communities. Understanding the potential implications for these groups is essential for informed decision-making and developing targeted strategies to address any challenges that may arise.

• The pandemic and the war in Ukraine have highlighted how quickly supply chain issues can emerge. As an incredibly open economy, Ireland is highly sensitive to global changes. Budget 2025 must commit to reviewing Ireland’s supply chains and determining the necessary actions to mitigate potential disruptions.

• The global landscape has become increasingly volatile, prompting the European Union to bring more key manufacturing items closer to home and into partner countries. This shift presents a significant opportunity for Ireland to enhance its position in critical sectors like semiconductors and

computer chips. Ireland must prioritise capitalising on this opportunity, and the Government must actively support businesses in boosting their capacity to meet this demand.

• Food security has emerged as a significant global threat over the past number of years. Ireland currently enjoys strong food security due to its indigenous production, and this must be protected and enhanced. As other countries seek to secure their food supplies with friendly neighbours, Ireland has a unique opportunity to bolster its agricultural and produce sectors.

• The international trend of skill mismatches and under / over-skilling presents a significant opportunity for Ireland and Mid-West education institutions. By supporting these institutions in offering education and training aligned with the demands of local and international employers, Ireland can enhance its attractiveness to foreign direct investment (FDI) and to individuals seeking education and apprenticeships designed with industry input.

• As countries increasingly turn to modular housing to address their own housing issues, the Mid-West, particularly Foynes, is uniquely positioned for a modular construction factory. With robust road, rail, and maritime transport links, and support from the Government and local educational institutions, Foynes can become a hub for modular housing production.

1.2 Talent & Workforce Cultivation

• We suggest the introduction of an enhanced skills tax credit to incentivise employers to invest in training for employees lacking qualifications or skills in areas of critical skills need. This credit should target areas of critical skills demand. However, it’s imperative to establish a robust system ensuring the delivery of high-quality education from accredited training providers and ensuring tangible returns on investment.

• There needs to be an improved a streamlined process for workers who wish to invest outside property and pension programmes. The red tape and cost burden on items like Exchange-Traded Funds (ETFs) makes the process of investing cumbersome for works who wish to grow their wealth.

• Dedicate resources to retraining initiatives aimed at facilitating the transition from fossil fuel-dependent occupations to low-carbon jobs across multiple sectors. These programs should concentrate on vital areas like energy retrofitting for buildings, sustainable forestry, renewable energy, and peatland restoration. While acknowledging the ongoing efforts in energy retrofitting through local Education and Training Boards (ETB), it’s crucial to sustain support once tangible outcomes are realised.

• As an integral component of Budget 2025, a robust skills demand assessment must be conducted at the regional level. This assessment should thoroughly identify existing and anticipated skills shortages through comprehensive consultations with employers. The insights gleaned should directly inform the enhancement of training and educational offerings tailored to these critical skills gaps. However, the skills demand assessment must take account of each region’s comparative advantages; for example, in the Mid-West, two such items would be renewable energy generation and tourism (Clare).

• Budget 2025 must actively support the establishment of a government apprenticeship scheme, mirroring the successful model of the Central Bank of Ireland’s scholarship program. This scheme would empower individuals to gain invaluable practical experience alongside their higher education pursuits, bolstered by sponsorship from the overseeing entity. It is imperative to scale up this initiative across the civil and public service, especially in regions historically plagued by high unemployment rates and deprivation.

• As people experience longer and healthier lifespans, there’s an expected trend of them continuing to work beyond traditional retirement ages. Census

data underscores the rapid growth of the population aged over 65. It’s imperative for government policy to recognise this increase in older workers and provide necessary support for them to contribute their expertise to society post-retirement, if they so desire. A strategy should be developed to enable the retention of older employees in the workforce for extended periods, should they choose. Offering additional leave benefits and adopting flexible working arrangements will be instrumental in fostering this strategy.

• Budget 2025 should include a strategy to boost participation in critical sectors. For instance, the education and health sectors face shortages, with men representing only c. 26% and c. 20% of the workforce, respectively. The government should encourage more men to enter these fields to increase overall employment. Conversely, women constitute just c. 8% of the construction workforce, indicating a need for increased female participation in this sector. The government must identify and address barriers to participation to enhance the workforce in these vital areas.

• The Australian critical skills list and website should serve as a model for Ireland to enhance its online presence, ease of use and attractiveness. The Australian system offers a user-friendly portal where potential candidates can view regional job opportunities and determine the appropriate visa for each vacant role. It combines skills needed with the relevant visa and process all within one user friendly portal.

• Additionally, Budget 2025 must reduce the tax burden on middle-income earners. This will reward workers based in Ireland for their productivity and maintain Ireland’s appeal to international talent. These workers, often “caught in the middle,” are ineligible for state support yet do not earn enough to live comfortably. Budget 2025 should also implement the indexation of tax bands to ensure real income stability

• It would be prudent to increase the limit for inheritance and capital gains tax to account for the drastic increase in property prices and to help to boost home ownership amongst children of parents without having to settle a large tax bill and possibly take out a large loan to cover it.

1.3 Investing in Society

1.3.1 Local Authority Funding

Accounting for the reduction in funding from sources being phased out in the coming years is essential as urban centres, like Limerick City, transition to a more sustainable lifestyle and counteract the sprawl of the past. Identifying suitable replacement revenue sources during this transition is crucial.

For Instance:

• Limerick City and County Council will likely see a decline in revenue from on-street parking in Limerick City Centre as sustainable and active transportation methods become more prevalent. A comprehensive review of Local Authority funding is imperative to identify and replace potentially declining revenue sources.

• Any revenue-raising measures identified in this review should align with the core goals of the National Planning Framework (NPF), which aim to discourage urban sprawl and promote development within existing urban areas. Currently, local authorities lack incentives to prioritise development in urban areas over suburban ones, as the revenue collection is often comparable. There is a pressing need for greater support and encouragement to foster more compact development. Priority should be given to examining the rate system to incentivise compact and urban-focused development; otherwise, suburban development and sprawl will persist.

1.3.2 Healthcare

• The 2025 budget must prioritise addressing the backlog of individuals awaiting medical procedures

and consultant appointments, while also reducing emergency department waiting times and increasing healthcare capacity. Despite substantial recent funding increases for the health service compared to other sectors, a comprehensive strategic plan is needed that does not solely rely on funding increments without tangible outcomes. The MidWest is clearly experiencing strain due to capacity issues. Budget 2025 should concentrate on expanding healthcare capacity through capital projects throughout the Mid-West and incentivising more individuals to pursue careers in healthcare as well as attracting diaspora back home. This includes offering competitive salaries to trainees and improving working conditions for healthcare providers. Moreover, there is an opportunity to expand national centres of excellence, such as the National Children’s Hospital, beyond Dublin and leverage regional locations like the Mid-West to reduce the necessity for patients to travel to Dublin for certain healthcare services.

• We welcome the review into urgent and emergency care capacity in the Mid-West region to determine whether a new model 3 or 4 hospital. For anybody based in the Mid-West, there is a clear need for such infrastructure, and we ask that this review be expedited as quickly as possible.

• Given that the 65+ age group is one of the fastestgrowing segments according to available census data, it is crucial to allocate sufficient funding to accommodate the increasing average life expectancy of the Irish population. Ireland already has one of the highest healthcare expenditures in Europe, and as life expectancy continues to rise, so will the demand for healthcare services. This demand must be met with adequate support. Conducting a comprehensive population health assessment is essential to inform resource allocation and planning effectively.

1.3.3 Policing

• Our retail-focused businesses within the community

are facing serious issues with anti-social and criminal behaviour. As emphasised in Limerick Chamber’s submission to the divisional policing plan, there is an urgent need to reassign Gardaí from the local courthouse to active-duty policing roles. However, the significant shortage of Gardaí members necessitates a substantial increase in funding for this area resulting in increased Garda numbers.

• Trainee Gardaí must be paid competitive wages, closer to the average salaries in Ireland, to attract candidates. Additionally, recruits should be required to commit to several years of service after training, similar to practices in countries like Australia.

• Notably, Australian regional police forces are currently conducting international recruitment drives, targeting officers from the UK, Ireland, and Canada by offering a higher quality of life and recognising their years of service. Budget 2025 should allocate resources for implementing a comparable system whereby police can carry their years’ service to Ireland if they served abroad. This should help to attract policing diaspora back home.

• Moreover, allowing Gardaí greater flexibility in choosing their work locations could significantly improve retention within the force.

• Equally, given the number of vehicle and road casualties over the past number of years. There should be an increase in roads policing.

• Reporting is of critical importance to police allocation, however, there is also reporting fatigue from our members that are primarily customer facing. While a new system is being trialled in Limerick for thefts up to €1,000, it would be beneficial for a nationwide rollout of an online reporting system whereby petty and non-urgent crimes can be easily reported to ensure that statistics are representative of reality.

1.3.4 Childcare

• Enhance the recent investments in early learning and care (ELC) and school-age childcare (SAC) by raising the universal subsidy above the current €2.14 per hour and increasing the income thresholds beyond €60,000 under the National Childcare Scheme (NCS).

• Budget 2025 should Commit to a 5-year program of sustained investment in Early Years and School Age Childcare. The commitments made over the past two years have been very welcome. However, establishing a long-term investment program for the coming years would be beneficial to ensure the progress achieved so far is sustained and expanded.

• Increase core funding for childcare providers, especially small and medium-sized ones, to ensure an adequate supply of childcare places nationwide.

• High-quality, affordable childcare depends on service providers receiving sufficient support to cover employee pay, overhead costs, and other expenses, especially with fee freezes in place for the past two years for those receiving core funding. Adequate core funding enables providers to expand their businesses, recruit and retain qualified employees, and deliver cost-effective services for both parents and providers.

• Expand mentoring programs such as “Better Start” that focus on improving the quality of childcare and early childhood education. These initiatives provide essential support to childcare providers, fostering continuous improvement and ensuring children receive the best possible care and educational experiences. Investing in mentoring programs enhances the quality and standards of early childhood education, establishing a strong foundation for children’s development.

2.0 Shaping the Built Environment

1.3.5 Judicial System

• Continued investment in the Courts and Judicial System is crucial for enhancing competitiveness. Court delays are hampering Ireland’s competitive edge. Investment in the Courts and Judiciary, along with increased promotion of Alternative Dispute Resolution methods, particularly by the State and Semi-State sectors, is essential. Additionally, the new Environment and Planning Court must be adequately resourced to improve system efficiency and ensure swift adjudication of planning decisions.

• A review needs to be resourced and undertaken to examine Gardaí activity within the courts service to identify how many positions can be undertaken by private security with the view to re-allocating police to front line duties.

• As part of this, a strategic review of prison capacity must be undertaken to account for most recent population projections with the view of building a new prison to deploy extra space within the system.

1.3.6 Local Media Support

• The importance of local media cannot be understated. This was reinforced by coverage of the local elections and indeed the election of Ireland’s first directly elected mayor. Some also play a pivotal role in local investigative journalism. In the face of a changing media landscape, Budget 2025 must examine what potential supports can be deployed to ensure that local media can continue to provide services.

The current housing crisis poses a significant threat to businesses across Ireland, not just in the Mid-West. Affordable housing is crucial for supporting employees and businesses, ensuring stability, and fostering economic growth. However, Ireland faces a severe shortage of affordable housing. Limerick Chamber has emerged as one of the leading housing research organisations over the past number of years and have continually advocated for change within the system. The state must not only allocate funding but also ensure accountability in the departments and agencies responsible for housing delivery. The housing issue goes beyond funding, and Budget 2025 needs to prioritise this accountability. For example, the Land Development Agency (LDA) in October 2019 announced plans for Colbert Station in Limerick, to date a planning application has not been submitted for the site, which is almost 5 years. Equally, the former gas networks site has seen no activity despite reports of LDA undertaking preliminary work on the site.

Our submission focuses on owner-occupiers and renters, who are under immense pressure in the current market. We urge the state to ensure a larger portion of the new home market is allocated to owneroccupiers and to approach the housing crisis with innovative solutions. For instance, just 4 out of every 10 new homes in Limerick are purchased by owneroccupiers, while the state account for the remainder of housing.

2.1 Affordable Homes Initiatives

2.1.1 Funding

• Substantially increase the current capital expenditure for affordable housing, covering both affordable purchase and cost rental options. Mandate Approved Housing Bodies (AHBs) to deliver cost rental housing alongside social housing to ensure a comprehensive mixed-tenure approach. It is crucial that the expanded housing supply includes a diverse range of homes, moving beyond just three and four-bedroom dwellings. Priority must be given to providing more one and two-bedroom residences,

higher-density developments through duplexes etc.

• Increase funding for the Cost Rental Equity Loan Scheme (CREL) and the Affordable Housing Fund (AHF) and establish annual targets for Approved Housing Bodies (AHBs) and Local Authorities to deliver cost rental and affordable homes. This enhanced funding and target-driven strategy will significantly boost the availability of cost rental and affordable housing options across the regions.

• To improve the feasibility and affordability of apartments, consider implementing an expanded Help-to-Buy program specifically for apartments and high-density living, as outlined in Project Ireland 2040. However, it is essential to carefully assess whether this measure could lead to higher prices for the end user.

• Basing new cost rental monthly payments on existing market rents is flawed unless market rents are adjusted for quality. For instance, a new cost rental apartment might not be feasible if it must undercut existing market rents by 25%, even though it would be of higher quality and energy efficiency compared to older, less efficient apartments from the 1980s. This misalignment hinders the development of cost rental housing. While Limerick Chamber supports reducing new rents to below market rates, the calculation must be adjusted to encourage the increased provision of cost rental housing.

• Both the Urban and Rural Regeneration and Development Funds (URDF and RRDF) are essential for achieving key objectives of the National Development Plan. However, recipients of these funds must be required to provide the public with a project timeline and be held accountable for any delays – funding should be contingent on providing the public and other stakeholders with quarterly updates regarding the status of the project. However, it is equally important to ensure transparency of spending to examine if the funds are being allocated to the appropriate projects.

2.1.2 Housing Targets & Demand

•Housing for All targets must be increased in line with the review from the Housing Commission. As part of this, the Land Development Agency must have county level targets for delivery. As it stands, some Local Authorities are the only entities with targets for the delivery of affordable housing at a county / local level which is not appropriate. Furthermore, the targets are too small to make any meaningful impact and must be revised upwards.

2.1.3 Schemes

• Limerick Chamber welcomes past increases in the upper limit for the local authority home loan. However, we recommend raising Limerick’s maximum property value to €330,000, matching that of Cork and Galway. This adjustment would better reflect the actual average price of a new home in Limerick.

• Adjustments made for cost rental income limits have been too modest and do not adequately account for couples earning around the average industrial wage. A further increase in the income limits for cost-rental is necessary to include higher incomes, reflecting the earnings of couples and single people requiring homes. The existing cost-rental model excludes a significant portion of the population, especially middle-income couples, because their net incomes exceed the limits for these schemes.

• To ensure cost rental remains accessible and affordable, income limits must be indexed to account for future inflation.

• The Repair and Leasing Scheme (RLS) is a commendable initiative for revitalising vacant and derelict homes for families. However, to further support cost rental housing, we recommend expanding the scheme to include cost rental homes, not just social housing. This expansion would incentivise increased availability of cost rental properties and help meet the housing needs of individuals and families seeking affordable rental options.

• Establish a pilot fund to support Community Land Trusts and set clear targets for the development, promotion, and regulation of this growing housing market. Partner with public landowners to construct affordable homes that ensure long-term affordability. Collaborate with financial institutions to facilitate this initiative effectively. This housing model is already well-established and successful in Northern European countries.

• Budget 2025 must prioritise Purpose Built Student Accommodation (PBSA), either through direct state construction or by supporting Higher Education Institutions in building and managing more housing. Student housing is often neglected in affordable housing discussions and schemes, but Limerick Chamber insists on developing a plan for new student housing in regions with significant and projected student population growth. There is scope to explore using Public Private Partnerships (PPPs) to build student housing, with the government retaining the right to purchase the properties at a pre-agreed price after a set period.

2.2 Social Housing Programmes

• The primary objective for social housing in Budget 2025 must be to decrease reliance on Part V, leasing, and turnkey approaches and instead prioritise direct construction. Purchasing homes for social housing outside the Part V process creates competition between the state and potential homeowners, which must be avoided. The focus should be on direct building by state organisations and housing-focused social enterprises to meet social housing demand effectively.

• The tenant purchase scheme, while beneficial for promoting home ownership, depletes the available social housing stock. Replacing these homes will likely be considerably more expensive due to future inflation. Addressing this issue is crucial for the state to meet its long-term social housing goals and maintain control over its social housing inventory.

• The state must reduce its reliance on the Housing Assistance Payment (HAP) and similar long-term leasing methods by directly constructing social housing. These leasing approaches are not costeffective and are financially unsustainable. The only viable solution is for state agencies to directly build suitable social housing.

• When the state provides direct, non-repayable funding for social housing delivered by external organisations, it should take an equity stake in these homes.

2.3 Property Reclamation

2.3.1 Residential Vacancy

• We recommended that the Department of Housing, Local Government, and Heritage set specific goals for reducing vacancies at the electoral district level. As new homes are built, overall vacancy rates are expected to decline naturally due to the increased housing stock. Therefore, relying solely on percentage calculations or vacancy rates is insufficient. A more evidence-based approach, such as examining the actual number of homes, is necessary for a comprehensive assessment.

loan can be obtained for carrying out the works from an organisation like Home Building Finance Ireland (HBFI).

2.3.2 Commercial Vacancy

• The government needs to develop a strategy to address vacancy, including regulations for above-theshop living and guidance for owners of commercial spaces on how to reimagine their use for more effective mixed-use properties. However, it is critical that the strategy is for long-term use focusing on either cultural, commercial or mixed-tenure residential opportunities.

• Currently, Local Authorities can provide commercial rate breaks for commercial vacancy, this should no longer be allowed in cities, towns and villages in an effort to discourage hoarding and underutilisation of vacant premises. It also creates an unequal playing field for businesses that are staying open and contributing to society that pay full rates, meanwhile vacant properties can get rate breaks.

• Limerick Chamber supports the grants for refurbishing and renovating vacant and derelict homes. However, providing resources and incentives for local authorities to manage a portal for purchasers to identify vacant homes would enhance the potential uptake of these schemes.

• There is also the concern that the grant is inaccessible due to homeowners needing to have the cash up front to pay for the works, and then claw it back through the grant. Many homeowners will not have the cash reserves to do this, Limerick Chamber encourages Budget 2025 to investigate ways around this whereby the homeowner will not need to have upfront cash and the grant can be paid directly to the company or person carrying out the refurbishing and renovating works and or a bridging

• Budget 2025 should investigate how commercial rate breaks could possibly help to revitalise towns and cities, whereby a business that sets up and operates can avail of a commercial rate break for a few years, if they stop trading within a specified period of time the rates should be clawed back. However, this mechanism must only be used to add value to towns and cities, for example, if an area is saturated with restaurants but no clothing stores, it would make sense to target this scheme towards clothing stores in that area and not restaurants. The scheme could be administered by the local authority, whose revenue remains the same but the monetary value of the rates are covered by central government rather than business owners.

• While there are now programmes on stream to renovate vacant residential properties, this could now be expanded to buildings with other uses in focused areas of towns and cities.

• Limerick Chamber must caution the approach currently undertaken by the Government in repurposing commercial buildings to IPAS accommodation. This creates an environment whereby building owners are not encouraged to invest in buildings for long-term sustainable use and encourages profit and developer led approach to planning towns and cities rather than a planning led approach. As highlighted by the Chamber we encourage a mixed-tenure approach to these buildings, focusing on all cohorts that need housing.

2.4 Strategic Planning

2.4.1 Planning & Systems Improvement

• There must be a stronger policy focus on creating smaller homes for smaller households, such as single individuals, couples, or single parents with one child. While current schemes address the affordability gap of new homes, they predominantly offer 3- or 4-bedroom houses that are too large and costly for smaller households. Consequently, these smaller households are compelled to compete in a highly competitive and constrained existing home market with no affordability support designed for smaller households.

• Budget 2025 presents the opportunity to implement targeted reductions in construction duties and levies for projects that align with the objectives of the National Planning Framework (NPF), especially those focused on providing affordable housing in critical locations. This will both help to boost affordability and achieve the goals of Project Ireland 2040.

• Allocate funding to strengthen the resources and capabilities of planning departments at both local and national levels. This initiative will enable these departments to make more informed and effective planning decisions early on, ensuring their durability under legal scrutiny in court proceedings.

• Allocate resources and investment to bolster the capacity of the courts and judicial system, enabling

them to swiftly and efficiently adjudicate all planning decisions. The current delays within the planning and judicial system are hindering essential housing development projects. By streamlining this process, we will positively impact annual housing commencement data.

• Concerns have arisen about availability of land banks and about the de-zoning of land in Local Development Plans (LDPs) that could have been used for residential or commercial purposes. Although Limerick Chamber recognises that some of this land may have remained unused for a long time, we advocate for promoting development rather than de-zoning and Budget 2025 should seek to tackle this issue.

• As part of Budget 2025 the Land Acquisition Fund should be increased targeting a greater number of homes and regions. As part of this, there should be greater support for the purchase of land for the provision of affordable housing.

2.4.2 Infrastructure

• The development of housing and commercial spaces relies heavily on water infrastructure. Therefore, prioritising investments in water infrastructure is crucial, especially in rural areas, to enable state organisations to fund these projects. Sustained investment in water infrastructure ensures a reliable future water supply and contributes to environmental preservation by preventing untreated water discharge into rivers and seas. Safeguarding water resources must be a top priority for housing, investment, and environmental sustainability.

• As part of the above, it is critical that existing communities with long-term boil water notices are tackled quickly and effectively.

• Budget 2025 must commit to a review of the planned proposal to build a water pipeline from the River

Shannon to Dublin. We need to ensure that there is no ecological damage resulting from the plan. But also, that it will not hamper the future growth of the Mid-West region. There is scope under Project Ireland 2040 to locate new infrastructure close to existing infrastructure, therefore it would make more sense to locate this infrastructure in the MidWest closer to the water source, rather than locating it in Dublin.

• Funds generated through taxation measures under the Housing for All Plan (such as the zoned land tax) should be exclusively allocated for creating essential infrastructure to support efficient residential development.

• The upcoming budget must introduce bold measures to tackle the housing crisis, including the implementation of modular housing and the establishment of a large-scale modular housing facility. Modular housing can drastically reduce construction time and, in some cases, lower costs. Prioritising this approach is essential. These modular homes must be of high quality and designed for longterm accommodation. Additionally, the state must invest in a dedicated modular housing development facility, ideally near a port for material imports, close to a railway line for efficient transportation nationwide, and with excellent road connections. Foynes in County Limerick is an ideal location for such a venture. Funding for this investment can be sourced through the Ireland Strategic Investment Fund (ISIF) or other appropriate channels.

2.4.3 Land Management

• Allocate budgetary funding to establish a National Active Land Management policy and agency to facilitate efficient land banking for housing provision through local authorities, Approved Housing Bodies (AHBs), and other state providers. Many local authorities face dwindling land resources for residential accommodation, and most AHBs lack access to a land bank. Implementing active land

management and investment measures will ensure the timely delivery of homes. Although the Land Development Agency (LDA) initially focused on active land management, it has recently shifted towards development. It is crucial to reinstate and prioritise active land management to address the housing shortage effectively.

• The Department of Housing of the Housing Agency must be fully resourced to conduct an independent review of all state lands, not just relevant lands. This review should detail land holdings at the county level, identify the state entity owning the land, and outline any development plans. Local Authorities, typically the largest landholders in counties, must provide transparency on available land and current plans. If no plans exist, decisive actions must be taken to bring these lands into optimal use.

• The budget must allocate funding to establish a land price register, akin to the property price register. This initiative will enhance transparency in land transactions and offer crucial insights into the total cost of home construction. To effectively address the housing crisis, a comprehensive and publicly accessible database is essential. Implementing a land price register is a vital step forward.

• Temporary housing developments using movable modular housing should be considered a “meanwhileuse” option for state land banks that are unlikely to be developed in the short term. This is particularly relevant to a number of state-owned sites in Limerick that are moving at a glacial pace such as Colbert Quarter, Guiness Lands and the Gas Works site. However, the priority should be longer-term building methods where possible.

2.4.4 Rental

• Despite state measures to discourage bulk purchasing of homes by private entities, these efforts have been insufficient, as companies often absorb the additional stamp duty costs and potentially pass them on to

end users. The 2025 budget must emphasise further discouraging bulk purchases of homes that would otherwise be available to individual buyers.

o Potential disincentives include reducing the tranche size from 10 to 5 and increasing the stamp duty, while carefully evaluating if the increased costs would be passed to end users.

o Another option is to outright prohibit bulk purchases, allowing private entities to buy market land and construct their own homes to boost supply.

o The state must also need to seriously consider its competition with individual buyers, such as purchasing homes before they are listed or through various schemes. The bulk purchase of homes exclusively for social housing should be discouraged to avoid displacing homes from the private market, equally social housing providers should be discouraged from bidding for individual homes on the private market as this increases competition with owner occupiers and thus increases prices.

2.4.5 Density

• Brownfield redevelopment remains a significant challenge due to higher costs compared to greenfield sites, placing these projects at a competitive disadvantage relative to less sustainable sprawling developments. Considering the uncosted externalities associated with greenfield developments, there is a compelling case for increased upfront grant aid and financing for urban developments that already have access to public services. This support is essential to ensure the viability of high-density projects in urban areas.

• With regards to Croí Conaithe Cities, there are some changes which could be made to make it a more viable method of delivery outside Dublin.

o The subsidy could be provided up front to help

with upfront capital costs rather than on the backend.

o In regions with ongoing apartment delivery issues (outside Dublin), reducing the height requirement to three stories could encourage more viable development.

o Apartment delivery could be integrated into larger residential developments, but the current minimum requirement of 40 homes is prohibitive for regional areas. This threshold should be revised downward based on the specific region.

• A significant issue with current density guidelines and apartment building is that most apartments are reported to be not financially viable for owneroccupiers but may work in limited instances for cost rental. However, what we have seen happen on the ground is that density guidelines require apartments to be built, but the only organisations with the financial backing to purchase these apartments (and not require a profit) are local authorities and approved housing bodies. Unless there is a policy change, cost rental will not become commonplace for apartments nor will owner occupying.

2.5 Living Cities Initiative (LCI)

The LCI has the potential to drive significant positive change in Limerick and other Irish cities by revitalising older homes. However, uptake of the scheme has been poor. Despite Limerick Chamber welcoming changes in previous budgets, further improvements are necessary for the scheme to reach its full potential. The scheme should primarily target owner occupiers. It is worth nothing the LCI is mostly a one off measure, once older building stock is renovated and depleted there is no requirement for continual funding. To fully optimise the LCI, Limerick Chamber proposes the following:

• The LCI should be expanded to include “newer” homes.

Currently, it applies to houses built before 1915. If the eligibility threshold were extended to include homes built before 1919, the total number of eligible homes within the existing Special Regeneration Areas in Limerick would be 540 homes, according to the 2016 census. Further extending the eligibility to homes built before 1945, to encompass additional buildings of historic significance, would add another 195 homes to the LCI scheme. This would bring the total potential homes eligible for the LCI in Limerick City to 735.

• While we welcome the increase of the percentage of qualifying costs that an owner occupier can claim (now 15% per annum) – this brings relief an owner occupier can claim in line with the commercial relief an entity could claim. However, Limerick Chamber recommends that this should be increased to 20% per annum to mitigate some of the effects of inflation and to encourage more owner occupiers to avail of the LCI and ultimately make the process more affordable.

• First time buyer owner occupiers should be exempt from VAT and Stamp Duty.

• While Limerick Chamber understands the rationale for delaying relief until a person moves into the house, this approach impacts affordability. Owners should be eligible to claim tax relief in the year renovation work begins, allowing immediate tax relief rather than waiting until occupancy. This would alleviate upfront renovation costs, particularly for homes needing substantial work that may span several years before occupancy is safe. However, such a policy should require the owner to reside in the home for a specified period or include a clawback mechanism. Alternatively, a retrospective tax relief option could be considered, allowing qualifying expenditures to be deducted against prior period tax liabilities once the property is occupied, akin to the “Help to Buy” Scheme.

• Upon the sale of a property, the current policy restricts subsequent owners from accessing available tax relief, potentially rendering it financially unattractive and impractical. This policy should be revised to grant subsequent owners access to the tax credits accrued during the qualifying period. Such a change would facilitate more affordable property transactions and allow individuals to trade up or down in the housing market. However, this access should only be granted after the initial owner occupier has resided in the home as their primary residence for several years.

• Expenditure on a building extension currently qualifies for relief only if it meets building regulations, such as adding a bathroom to an old derelict house or if the house was built pre-1915. The residential relief should be expanded to include new works on non-essential extensions to buildings that qualify under the LCI, albeit at a reduced rate of 7.5% per annum (with a maximum cap of 50% overall). This adjustment would promote the modernisation of buildings and enhance their suitability for contemporary living standards.

• There is a current issue in the system where it is not advantageous to combine an SEAI grant (or other heritage and sustainability grants) with the LCI due to how the grant is treated. This should be revised to allow owner occupiers to access multiple sources of assistance simultaneously.

• Owner occupiers should have the opportunity to access the LCI for a second time for the same building. For instance, someone might purchase an old Georgian home with four floors, but initially only renovate two or three floors before moving in. Currently, once they receive certification from the local authority, they cannot claim further costs under the LCI. Allowing them to access the LCI again for additional refurbishment once they have the necessary funds would provide significant added value. However, this privilege should be subject to a specified cutoff period.

• The LCI should be adjusted to favour owner-occupiers. A new rule should be implemented to ensure a longterm material interest in the building. Organisations should not be allowed to own the building; it must be owner-occupied. However, an exception should be made for properties used exclusively for long-term affordable rentals.

• At the higher end, the average cost of insuring a home in Ireland ranges from €450 to €500. For older, renovated Georgian properties, this could rise to as much as €1,200 per year. Additionally, there are few

• Many owner-occupiers looking to renovate old and Georgian buildings struggle to obtain financing from pillar banks. These projects are often deemed inherently riskier, and the final market value after purchase and renovation may fall short of the total investment. For example, an owner-occupier might buy a Georgian home in Limerick for €300,000 and invest another €300,000 in renovations, only for the bank to value it at €500,000. This discrepancy causes issues with the bank’s security process, as the mortgage amount exceeds the building’s appraised worth. Support is needed to address this problem. Limerick Chamber proposes two potential solutions:

o Home Building Finance Ireland (HBFI) and the Local Authority Home Loan are well-positioned to provide financing for individuals undertaking refurbishment projects on old homes. HBFI or the local authority have the potential to offer full funding for both the purchase and renovation of these properties.

o An adapted version of the “First Home Scheme,” commonly known as “Shared Equity,” could also be utilised. Under this arrangement, the owneroccupier could secure a mortgage from a pillar

essential renovations or to top up the owners existing mortgage.

o Another issue with financing from pillar banks is obtaining a mortgage for mixed-use buildings. Many of these older buildings feature commercial space, such as offices, on the ground floor, with residential areas above or old, disused office space. Securing a mortgage for mixed-use buildings is reportedly challenging. The adapted financing model for the LCI should address this and support the combined use of commercial and residential spaces. This approach aligns with the government’s “above the shop” living policy and promotes more efficient use of space. Owner-occupiers should also be able to claim relief on the commercial portion of the building, provided they live within the building.

• The Special Regeneration Areas (SRAs) should be expanded within the designated cities to include more potential housing stock under the LCI.

2.6 Mobility Solutions

2.6.2

Aviation

• Publish an updated national aviation strategy that establishes a definitive framework for allocating multi-year funding for capital expenditure, operational expenditure, and marketing initiatives. This strategy must provide robust support to airports, particularly those crucial to the regional growth goals outlined in Project Ireland 2040. The policy should prioritise safeguarding existing routes and facilitating the establishment of new business routes to strategic areas, reducing the overreliance on Dublin. These efforts will be pivotal in supporting tourism, economic growth and attractiveness in the regions. The aviation strategy should focus on regional development and align with both Project Ireland 2040 and enterprise policies to foster

• Many owner-occupiers willing to buy and renovate older homes find the process daunting and confusing. We propose that local authorities in LCI-covered areas receive the resources and funding to establish one-stop shops. These should serve as the primary point of contact between owners and the “system,” engagement, sharing experiences, and disseminating information to prospective renovators.

• The temporary inclusion of Shannon Airport in the Regional Airports Programme (RAP) funding was appreciated so too was sustainability funding announced for the remainder of the current plan to 2025. However, it is crucial to permanently integrate Shannon Airport into an expanded RAP that encompasses all state-owned regional airports in Ireland. This alignment with EU frameworks allows for State aid to airports handling fewer than 3 million passengers annually. The RAP focuses on enhancing safety, security, sustainability, and climate action initiatives within airports, crucial for achieving Ireland’s goal of balanced economic growth. There is also an opportunity within the RAP to include Public Service Obligation (PSO) routes for enterprise purposes. Budget 2025 must prioritise direct funding for enterprise routes from Shannon Airport.

• Allocate funds to support the strategic development of enterprise-focused business routes connecting the Mid-West of Ireland via Shannon Airport to key EU hub airports such as Amsterdam, Frankfurt and Copenhagen. This funding should be structured to progressively de-risk route development for airlines over a defined period until these routes achieve self-sustainability. Enterprise-focused routes often experience gradual uptake and require financial support in their early stages to ensure operational viability. By committing financial resources, we can actively promote regional balance in line with the National Planning Framework (NPF), facilitating Shannon Airport and the Mid-West region in establishing and nurturing business ties with other European regions.

2.6.3 Public Service Obligation (PSO) Route Support

• Budget 2025 must prioritise government support for PSOs on enterprise routes. The Mid-West hosts numerous FDI companies operating on both European and international levels, yet it lacks direct connectivity to Northern European destinations, relying instead on connections through Dublin. Connectivity is a

crucial factor for potential investors when selecting investment locations and is a significant barrier to the growth of indigenous businesses aiming to trade within the common European market from a Mid-Western or Western base. The Copenhagen Economics report, commissioned by Limerick Chamber, highlights substantial economic benefits from daily route connectivity to a Northern European hub. However, establishing any EU hub route connection will require initial state funding until it becomes self-sufficient, as demonstrated by the PSO from Kerry Airport.

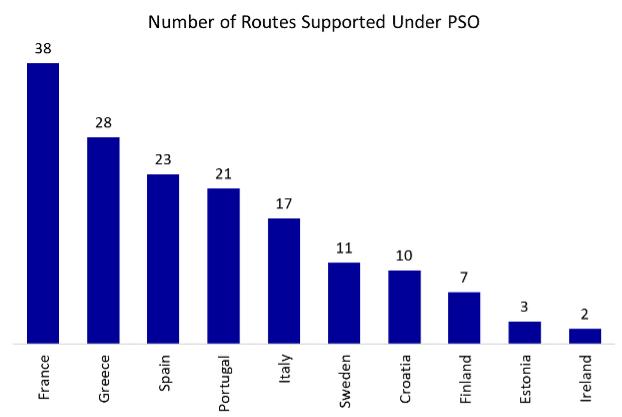

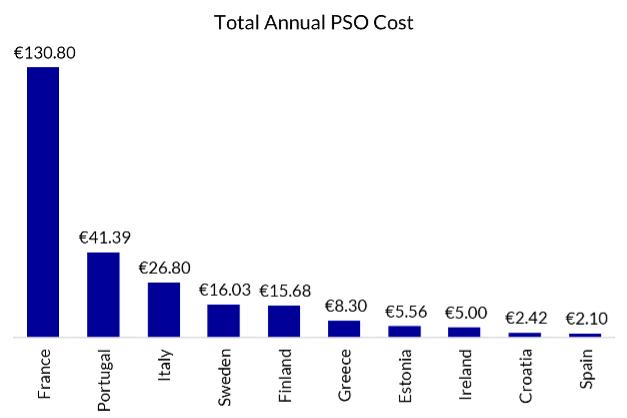

• EU Regulation No 1008/2008 supports countries implementing PSOs due to development needs or lack of existing routes. Figures 2.6.3.1 and 2.6.3.2 demonstrate how other EU nations use PSOs and significant funding to strengthen connections with European neighbours. As an island nation, Ireland cannot benefit from inter-country train travel like much of Europe. However, we can counteract this limitation through aviation routes. The existing Regional Airports Programme can provide the necessary funding, as Shannon Airport has fewer than 3 million annual passengers. Therefore, there is no justification for excluding Shannon from the RAP or withholding support for key economic routes.

2.6.4 Public & Active Transport

• Local Authorities must be adequately resourced to conduct studies on the impact of transport changes in towns and cities. With numerous transport changes underway across Ireland, it is crucial to understand how these will affect existing business and assess the economic impact of these decisions. While the inclusion and the support of the NTA are welcome and beneficial, it should not be required for a Local Authority to adequately undertake impact assessments.

• Invest in expanding passenger train lines to include commercial freight transportation, thereby enhancing connectivity and logistics options for seaports. The Foynes to Limerick route is an example of a rail line with the infrastructure to support both public and freight transport.

• Allocate funds for a pilot scheme on existing rail routes to reduce travel times between major cities, including non-stop services. This is particularly relevant to Limerick and the wider Mid-West, with the need to disembark at Limerick Junction.

• Provide local authorities with the resources needed to establish infrastructure that supports active transportation, connecting residential areas with civic and economic hubs. Ensuring that the principles of Transport-Oriented Development (TOD) are central to all new developments.

• It would be beneficial for a similar type of scheme as “bike to work” to be deployed for students, children, retirees etc so that people not in employment can also avail of support to enable more bicycle use.

• It would be beneficial for Budget 2025 to introduce support for business focused cargo bike schemes.

• The introduction of large, indoor, and supervised bike parks at all major city bus and train stations is required. So too is covered outdoor bike parking at mediumsized transport hubs including greater support for expanded implementation of bicycle bunkers in cities.

2.6.4 Infrastructure

Several key infrastructure projects in Limerick are slated for completion under Project Ireland 2040 and other supplementary initiatives. However, lengthy lead times and the current planning system threaten to delay these projects significantly. It is imperative that these projects remain a top priority. Budget 2025 must unequivocally signal to the industry that these projects have full support and will be delivered promptly. The projects in question are:

• The current TaxSaver Commuter Ticket Scheme in Ireland offers tax relief for commuters purchasing monthly or annual tickets for a five-day commute. However, with many individuals now travelling to work only two or three times a week, it is imperative to introduce a more flexible option, such as a threeday ticket at a reduced price. The existing scheme fails to incentivise the purchase of monthly or annual tickets for these commuters, especially in the era of widespread hybrid working arrangements.

• The N/M20 Limerick to Cork

Fig: 2.6.3.2 - Total Number of PSO Routes Supported by EU Country

• The N21/N69 Limerick to Adare to Foynes

• Foynes to Limerick Railway

• Limerick Regeneration Programme

• Colbert Station Quarter

• University Hospital Limerick Capital Expansion

• BusConnects (with the inclusion of a route to Annacotty

• Business Park)

• Improved public transport options to Shannon Airport

• including intercounty bus services.

Moreover, dedicated funding must be allocated to enhance transparency in the reporting requirements for all major projects and programs. A national portal, similar to Limerick Chamber’s Strategic Development Pipeline (SDP), is essential for real-time progress updates on key projects. Additionally, capital projects should be expedited wherever possible by leveraging current budget surpluses, as these investments will yield significant returns and future-proof the country for continued economic growth, business expansion, and population growth.

2.6.5 Transport Oriented Development (TOD)

Limerick and the Mid-West are at a pivotal point in transforming their transportation infrastructure.

The Limerick Shannon Metropolitan Area Transport Strategy (LSMATS), Limerick BusConnects, N/M20 road improvements and mobility hubs, N69 and Adare bypass, park and ride facilities, the Foynes rail line, and various active travel schemes present Limerick with a unique chance to prioritise Transit-Oriented Development (TOD) through current and future investments.

It is crucial that all state agencies and organisations collaborate to achieve the best outcomes when connecting residential and commercial developments to the transport network. To achieve optimal TOD outcomes, these various state organisations must coordinate efforts in transport, housing, employment, and more, adhering to TOD best practices something which is currently lacking. For instance, the suburb of Raheen in the Limerick Metropolitan area meets several

TOD campus criteria. It is close to major employment opportunities in the business park, has motorway access, proximity to a rail line, and University Hospital Limerick is located there. The new Limerick BusConnects plan will service it well, and it includes a planned park and ride facility, an accompanying mobility hub as part of the N/ M20 project, and available private and public lands for expansion or building residential accommodation. The final necessary amenity is housing for employees, which could be developed in conjunction with a state agency for homebuilding or through a strategic partnership with the private sector. This model can be replicated on a smaller scale throughout Limerick City and its environs, particularly in areas connected by a railway line. This strategy must be a key consideration in the National Development Plan reviews and Budget 2025.

Adopting a TOD approach alongside some Park and Ride facilities optimises land use. Land near transport links is typically more valuable than land isolated from transport. Park and Rides, often underutilised during evenings and weekends, can be paired with housing developments for optimal land use. A critical element in this strategy is leveraging passenger rail options. The Raheen area, in particular, has the potential to accommodate a significant number of employees who can walk or cycle to work and access social services, while also providing transport options for those needing to travel further. This opportunity should not be missed and requires cohesive action among state agencies.

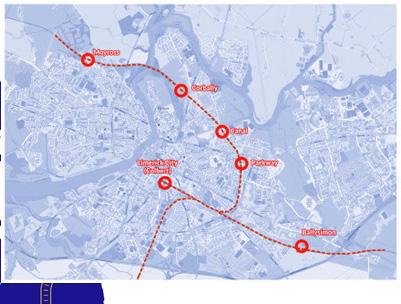

Limerick is perfectly positioned to implement multiple TOD approaches, enhancing existing residential areas and developing new TOD hubs, thanks to the existing orbital rail line encircling the city. The strategy proposed for Raheen can be replicated in Ballysimon, the Parkway area, the Canal Bank, Corbally, and Moyross, with Colbert Station in the city centre serving as the primary hub. This will not only expand housing options by utilising the existing (and in some areas disused) rail line for passenger service but also reduce car usage in the city and suburbs (see fig 2.6.5.2).

Limerick Chamber strongly believes that one of the most

impactful projects for improving transport mobility in the Limerick area is leveraging the existing rail line. Light Rail Transit (LRT) would enable Limerick to efficiently move people between key areas, reducing reliance on the road network and facilitating easier expansion to meet future demand. Reprioritising the road network towards public transport requires substantial investment and as seen in Dublin and Cork, often faces challenges due to the constraints of nearby buildings and green space.

While Limerick Chamber supports the recent BusConnects plan and its core goals, equally prioritising

LRT in Limerick is essential, and Budget 2025 should reflect this. Utilising the Limerick to Foynes line for passenger service (in addition to freight) would be an excellent starting point, as advocated by Limerick Chamber in our submission to LSMATS consultation process.

Although much of the orbital rail line is currently single track and would require investment to convert to dual track and electrification, this represents a significant opportunity. It must be included in the scope of this budget and the National Development Plan review.

Fig: 2.6.5.1 - Rail Map of the Mid-West

3.0 Fuelling the Future

The stark reality for Ireland's energy security presents two clear paths: either continue our International reliance on the United Kingdom via the Moffat gas pipeline in Scotland or acknowledge the urgent need to fully harness the potential of Offshore Renewable Energy (ORE) in Ireland. We urge that Budget 2025 decisively choose the latter, while we understand the positive impact of the Celtic Interconnector project, budget 2025 needs to signal to the industry that Ireland is committed to ORE and other forms of renewable energy generation. Given the long lead times for ORE projects, it is essential to align with European Union energy policy and support LNG in Ireland as a transitional measure. The risk of blackouts, grid capacity issues, and the lack of storage makes the interim use of LNG a prudent decision for security.

While ORE represents Ireland’s greatest opportunity, Budget 2025 must also address broader energy needs such as an improved planning process and support for on land generation. As well as the necessary grid upgrades. Lastly, of critical importance to the West and Shannon Estuary is the advancement of the West Coast Designated Maritime Area Plan (DMAPS).

3.1 Energy Independence & Security

3.1.1 Infrastructure

• Initiate the upgrade of the electricity network in the West of Ireland immediately, in parallel with ongoing developments on the East coast. While East coast projects will generate some offshore energy, achieving long-term, scalable energy security necessitates substantial investment in grid infrastructure for floating offshore energy on the West coast, especially in the Shannon region. Capturing this floating offshore energy opportunity is crucial for ensuring energy security.

• Additionally, secure all exchequer returns from the Carbon Tax and allocate them strategically to green infrastructure, public transportation, and funds that support community transitions to green alternatives for transportation and heating. Ringfencing

these funds is vital for fostering sustainable and environmentally friendly practices.

• Port infrastructure is crucial for developing Ireland’s energy security through offshore renewable energy and other energy forms. Therefore, upgrading and expanding ports must be prioritised in Budget 2025.

• Additionally, futureproof the National Gas Grid by investing in biomethane technologies and systems to ensure a renewable supply of methane and hydrogen. Progress the North-South and Celtic Interconnector projects to enhance energy resilience and connectivity.

• The length of time required to obtain an investigative foreshore licence is not appropriate, and in some cases takes a number of years. This is a risk for attracting private investment and Budget 2025 must allocate resources to streamline the process.

• Budget 2025 needs to ensure plans for grid build out, expansion and investment. This includes enabling cross border infrastructure.

• As it stands, surveying the ocean and its floor is the responsibility of a private developer. This is a significant cost and poses high risk for the site not being suitable for development. It also means the survey data remains in private, rather than public, hands. We believe there is a place for risk sharing which could allow state ownership of data collected.

• Looking towards a more circular economy and longterm use of assets, there needs to be increased policy support for the prioritisation of repowering and life-extension of existing wind assets in local development plans. Article 16 of the EU Renewable Energy Directive, states that Member States Shall facilitate the repowering of existing renewable energy plans by ensuring a simplified and swift permitgranting process.

• Ensure support for low carbon flexibility

infrastructure to guarantee security of supply. This includes conventional generation using technologies like Carbon Capture and Storage, as well as emerging technologies such as Hydrotreated Vegetable Oil (HVO), Hydrogen production, biomethane facilities, batteries, and other electricity services technologies.

3.1.2 Policy & Planning

• Guarantee precise alignment of Local Development Plans (LDPs) and Climate Action Plans (CAPs) with national climate action objectives and renewable energy policy. This includes zoning adequate and appropriate lands to meet renewables targets and capture the associated benefits. It must be a priority of Budget 2025 to ensure sufficient resources are allocated to ensure that Local Development Plans must align with national policy, including the climate action plan and other renewable development policies.

• Mandate forward grid planning and infrastructure projects in LDPs and CAPs to facilitate the connection of new low carbon electricity generation and users.

• Prioritise the repowering and life-extension of existing wind energy assets in Local Development Plans and Climate Action Plans.

• Secure additional resources for specialised planning teams in Local Authorities to effectively manage renewable energy development assessments, ensuring the required expertise to achieve Climate

Action Plan objectives. This is of critical importance as the industry expands and innovates, it will require new planners with completely new skills and mindsets.

3.1.3 Diversifying Source of Supply

• As highlighted in Limerick Chamber’s submission to the Review of the Security of Energy Supply of Ireland’s Electricity and Natural Gas Systems, Ireland must adopt a proactive approach to implementing LNG. Utilising LNG will align Ireland with European policy and secure Ireland’s energy supply while we transition to offshore renewable energy. Budget 2025 should explore the government's role in implementing LNG, including the potential for strategic partnerships to ensure that LNG operations and supply are not solely privately owned.

3.1.4 Skills Development

• The National Training Fund (NTF) must back education and training to meet future demands from the energy sector. Considering Ireland's offshore renewable energy (ORE) potential and its status as a relatively new industry, it is essential to develop and retain the necessary skills.

• Invest in training and education to attract school leavers and individuals re-entering the workforce or seeking career changes to the renewable energy sector. This initiative aims to increase the number of specialists, including ecologists, engineers, health & safety and environmental professionals, technicians, seafarers, and commercial solar panel installers.