MEDIA

ANALYSIS

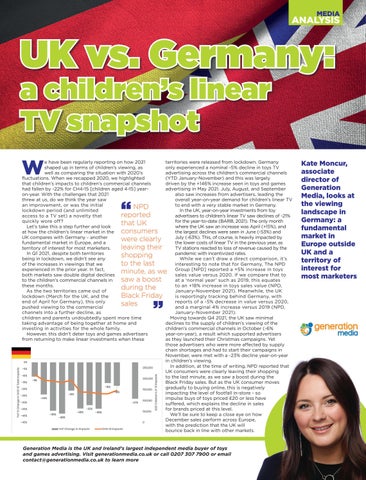

UK vs. Germany: a children’s linear TV snapshot W

e have been regularly reporting on how 2021 territories were released from lockdown. Germany shaped up in terms of children’s viewing, as only experienced a nominal -5% decline in toys TV well as comparing the situation with 2020’s advertising across the children’s commercial channels fluctuations. When we recapped 2020, we highlighted (YTD January-November) and this was largely that children’s impacts to children’s commercial channels driven by the +146% increase seen in toys and games had fallen by -22% for CH4-15 [children aged 4-15] yearadvertising in May 2021. July, August, and September on-year. With the challenges that 2021 also saw increases from advertisers, leading the threw at us, do we think the year saw overall year-on-year demand for children’s linear TV an improvement, or was the initial to end with a very stable market in Germany. NPD lockdown period (and unlimited In the UK, year-on-year investments from toy reported access to a TV set) a novelty that advertisers to children’s linear TV saw declines of -21% quickly wore off? for the year-to-date (BARB, 2021). The only month that UK Let’s take this a step further and look where the UK saw an increase was April (+15%), and consumers at how the children’s linear market in the the largest declines were seen in June (-53%) and UK compares with Germany - another July (-63%). This, of course, is heavily impacted by were clearly fundamental market in Europe, and a the lower costs of linear TV in the previous year, as leaving their territory of interest for most marketers. TV stations reacted to loss of revenue caused by the In Q1 2021, despite both territories pandemic with incentivized rates. shopping being in lockdown, we didn’t see any While we can’t draw a direct comparison, it’s to the last of the increases in viewings that we interesting to note that for Germany, The NPD experienced in the prior year. In fact, [NPD] reported a +5% increase in toys minute, as we Group both markets saw double digital declines sales value versus 2020. If we compare that to saw a boost to the children’s commercial channels in at a ‘normal year’ such as 2019, this equates these months. to an +18% increase in toys sales value (NPD, during the As the two territories came out of January-November 2021). Meanwhile, the UK Black Friday lockdown (March for the UK, and the is reportingly tracking behind Germany, with end of April for Germany), this only reports of a -5% decrease in value versus 2020, sales pushed viewing to the commercial and a marginal 4% increase versus 2019 (NPD, channels into a further decline, as January-November 2021). children and parents undoubtedly spent more time Moving towards Q4 2021, the UK saw minimal taking advantage of being together at home and declines to the supply of children’s viewing of the investing in activities for the whole family. children’s commercial channels in October (-6% However, this didn’t deter toys and games advertisers year-on-year), a result which supported advertisers from returning to make linear investments when these as they launched their Christmas campaigns. Yet those advertisers who were more affected by supply chain shortages and had to start their campaigns in November, were met with a -23% decline year-on-year in children’s viewing. In addition, at the time of writing, NPD reported that UK consumers were clearly leaving their shopping to the last minute, as we saw a boost during the Black Friday sales. But as the UK consumer moves gradually to buying online, this is negatively impacting the level of footfall in-store - so impulse buys of toys priced £20 or less have suffered, which explains the decline in sales for brands priced at this level. We’ll be sure to keep a close eye on how December sales perform across Europe, with the prediction that the UK will bounce back in line with other markets.

“

“

Generation Media is the UK and Ireland’s largest independent media buyer of toys and games advertising. Visit generationmedia.co.uk or call 0207 307 7900 or email contact@generationmedia.co.uk to learn more

Kate Moncur, associate director of Generation Media, looks at the viewing landscape in Germany: a fundamental market in Europe outside UK and a territory of interest for most marketers