Table of Contents

Medicare

Medicare Advantage Enrollment Options

Medicare Connector is Your Best Option

Support for Senate File 2149

Group Benefits

Date Change for Group Benefit Documents

Insurance Marketing

1099 Forms

Individual Benefits

Quick Guide to Short-Term Medical Beneficiary Designations

Events

Welcome to the introductory issue of Boost Monthly!

In this publication, we’re capturing the most important articles from the previous month’s weekly Boost newsletters. The idea is to provide you with critical information that you may have missed during the month or simply remind you of news you can use to help your customers, build your business and help your communities.

Note with the table of contents we’ve tried to attach a product category for each article, but we encourage you to check out all the stories!

Finally, although we’ve included some of the most compelling and informative parts of the weekly Boost Newsletters, the new Monthly version is not allencompassing. If there are previous weekly Boosts you haven’t read, but have deleted the email, you can still access those issues in the agent portal. Simply click on the Education tab and then ‘Boost Newsletter Archives.’

If you have any questions, please do not hesiotate to call us at 651.739.2010!

1

Guiding the needs of health and life insurance agents FEBRUARY 2023

Medicare Advantage Enrollment Options

Now that the Annual Enrollment Period is over, what can you do if a member finds themselves enrolled in a Medicare Advantage plan that isn’t a good fit for them?

Medicare Advantage Open Enrollment Period (OEP)

Starting January 1st and continuing through March 31st, if a member is enrolled in a MA/MAPD plan they have a onetime opportunity during the OEP to disenroll from their current plan and enroll in a different MA plan, MAPD plan, or even go back original Medicare and enroll into a PDP plan. Also, if they can pass underwriting, they could enroll in a Medicare Supplement plan.

The key to this enrollment period is the member must be enrolled in an MA or MAPD plan as of January 1st. And remember, CMS does not allow any advertising of the OEP to members.

Also note that OEP does not apply to members who have a Medicare Savings Account (MSA).

Medicare Advantage 5 Star Enrollment Period

Another enrollment period that may be available to you is the 5-Star Enrollment Period.

If your client lives in the service area of a plan that has a 5-Star rating for that current year, they have a one-time opportunity to dis-enroll from their current MA, MAPD or PDP and enroll in the new MA, MAPD or PDP plan. This is a 12-month enrollment period.

Also, if you have a member that is on original Medicare without a PDP, that member can also enroll in the 5-Star plan. (Late enrollment penalties would still apply if the member has gone 3 or months without a PDP). Minnesota has two 5-Star plans, HealthPartners in the Metro area and Quartz in the Southeastern part of the state.

If you have questions, please contact our Medicare team at 651.739.2010

2

Use Medicare Connector for Enrollments

Starting January 1, 2023, the Medicare Part B delay period will go away and the enrollment effective date will change to the first of the month after enrollment.

This change is only applicable to Medicare Part B. There is no change for those who qualify for Medicare Part A. This coverage begins the month the person turns 65 (for those with a birthday on the first of the month, coverage begins the month before he or she turns 65).

The tables below show when Part B coverage begins:

Current Rules

If you enroll during this month of your initial enrollment period: Your coverage will begin:

enroll

2 months after you turn 65

3 months after you turn 65

Effective January 1, 2023

If you enroll during this month of your initial enrollment period: Your coverage will begin:

As a reminder, your Medicare Part B clients will see a slight decrease in premiums and deductibles in 2023. The Part B premium will be $164.90 in 2023, down from $170.10. This is the first decrease since 2012. Likewise, the annual deductible will drop $7 from the $233 in 2022 to $226 in 2023.

Conversely, the Part A premiums and deductibles are going up a slight amount next year. However, it’s important to note that 99% of Medicare recipients don’t have to pay anything for Part A because they’ve worked 40 calendar quarters (10 full years) while paying Medicare taxes.

For more information, you can reference the October 18, 2022 Boost.

Finally, although Medicare AEP has come to a close, that doesn’t mean an end to Medicare enrollments.

As people reach age 65, they are still applying for Medicare benefits. Medicare Connector is your best option to get material submitted on time. To access the 2023 Medicare Connector site, click here

3

continued on next page

1st of

The month you turn 65

the month after you

2

1 month after you turn 65

months after enrollment

3

months after enrollment

3

months after enrollment

The month

1st of the month after you enroll 1 month

you turn 65 1st of the month after you enroll

months after you turn 65 1st of the month after you enroll 3

you

65 1st of the month after you enroll

you turn 65

after

2

months after

turn

Use Medicare Connector (continued)

Medicare Connector is our online, single sign-in quote and enroll tool for Medicare to help you better serve your clients while staying compliant. If you have questions about Medicare Connector, reach out to your SRM!

You must be appointed with LeClair for each carrier you would like access to for quoting and enrolling on Medicare Connector. If you would like more information regarding appointment consolidation or adding a new appointment, please fill out the Appointment Interest Form

If you have questions, please contact our Medicare team at 651.739.2010.

Support Senate Bill S. 5149

Legislation Introduced to Remove Independent Agents from Call Recording

Although you should have received an email from us about this, we want to make sure we’re reaching everyone regarding a recent bill that was introduced in the U.S. Senate.

On December 1, 2022, Senators Mike Rounds (R-SD) and James Risch (R-ID) introduced S. 5149, which would exclude independent agents and brokers from the recording requirements in the Medicare Marketing Rule.

The intention of the rule is to stop fraudulent or misleading people – such as call centers – from manipulating Medicare beneficiaries. However, the rule has an overly broad scope and applies these requirements to licensed agents and brokers. We fully support the initial purpose of the Medicare Marketing Rule, but we also see it was too encompassing and want to correct it. We know you have the best interests of your customers in mind and to require a recording of your phone calls is needless.

This bill would eliminate you having to record your Medicare phone calls and we urge you to contact your Senators to support this legislation. The National Association of Health Underwriters (NAHU) has an easy method for you to reach out to your Senators and we hope you help to get this adjustment passed.

If you have questions, please reach out to us at 651.739.2010.

4

Group Benefit Document Date Change

As we continue to find solutions that help us better serve you, our agents, we want to remind you of a change we’re making regarding Group Benefit documentation.

When submitting enrollment and supporting documents, please submit materials no later than the 20th day of the month prior to the month in which the benefits are set to start. For example, if benefits are going to begin January 1, documentation should be received by December 20.

This streamlined approach will enable us to process enrollments more efficiently, ensuring everything is in place for a smooth start to benefits.

If you have questions regarding the change or other Group Benefit questions, please contact Nick Forside at Nick.Forside@LeClairGroup.com or 651.735.9824; or Jacob Carroll at Jacob.Carroll@LeClairGroup.com or 651.735.9829.

5

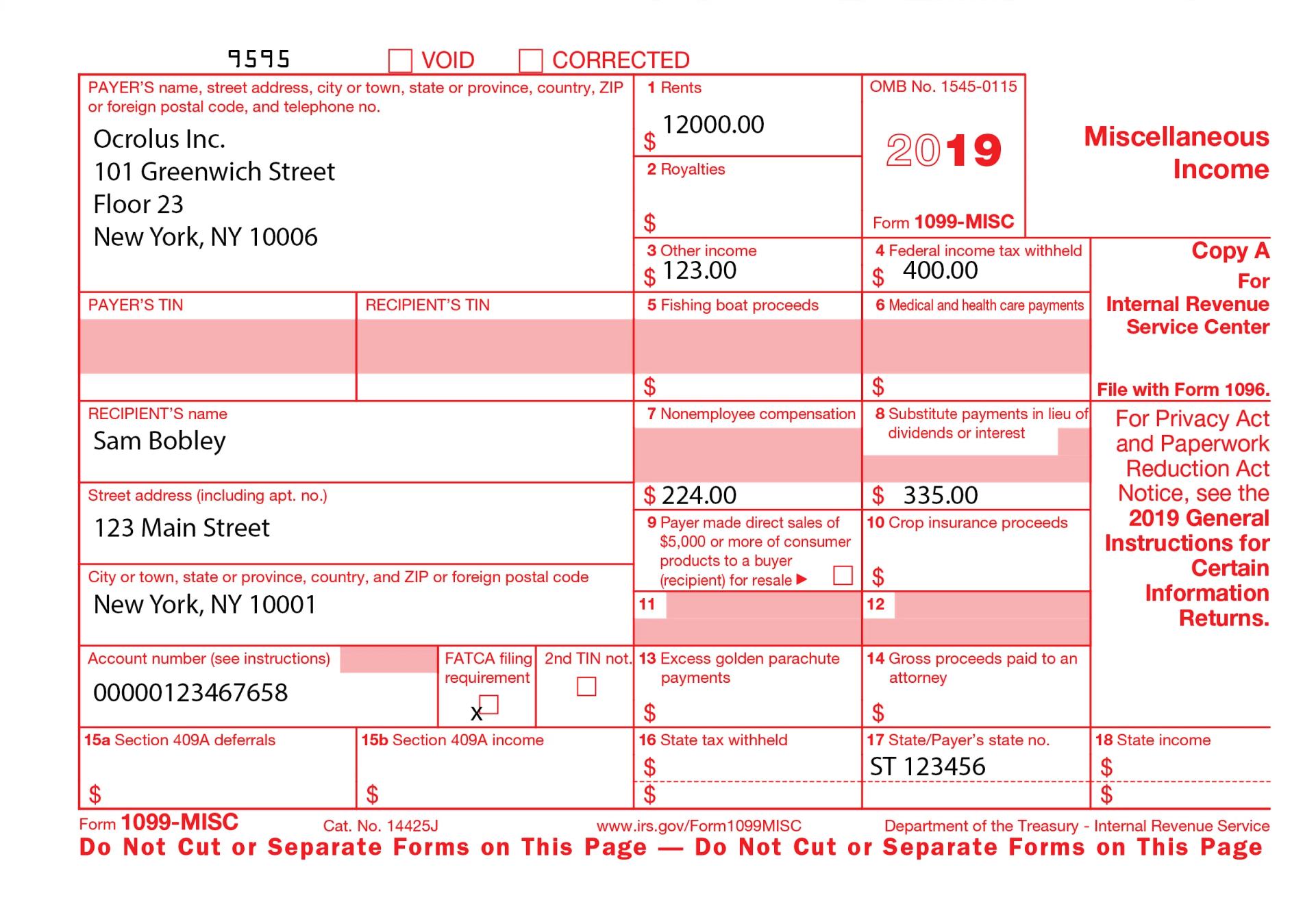

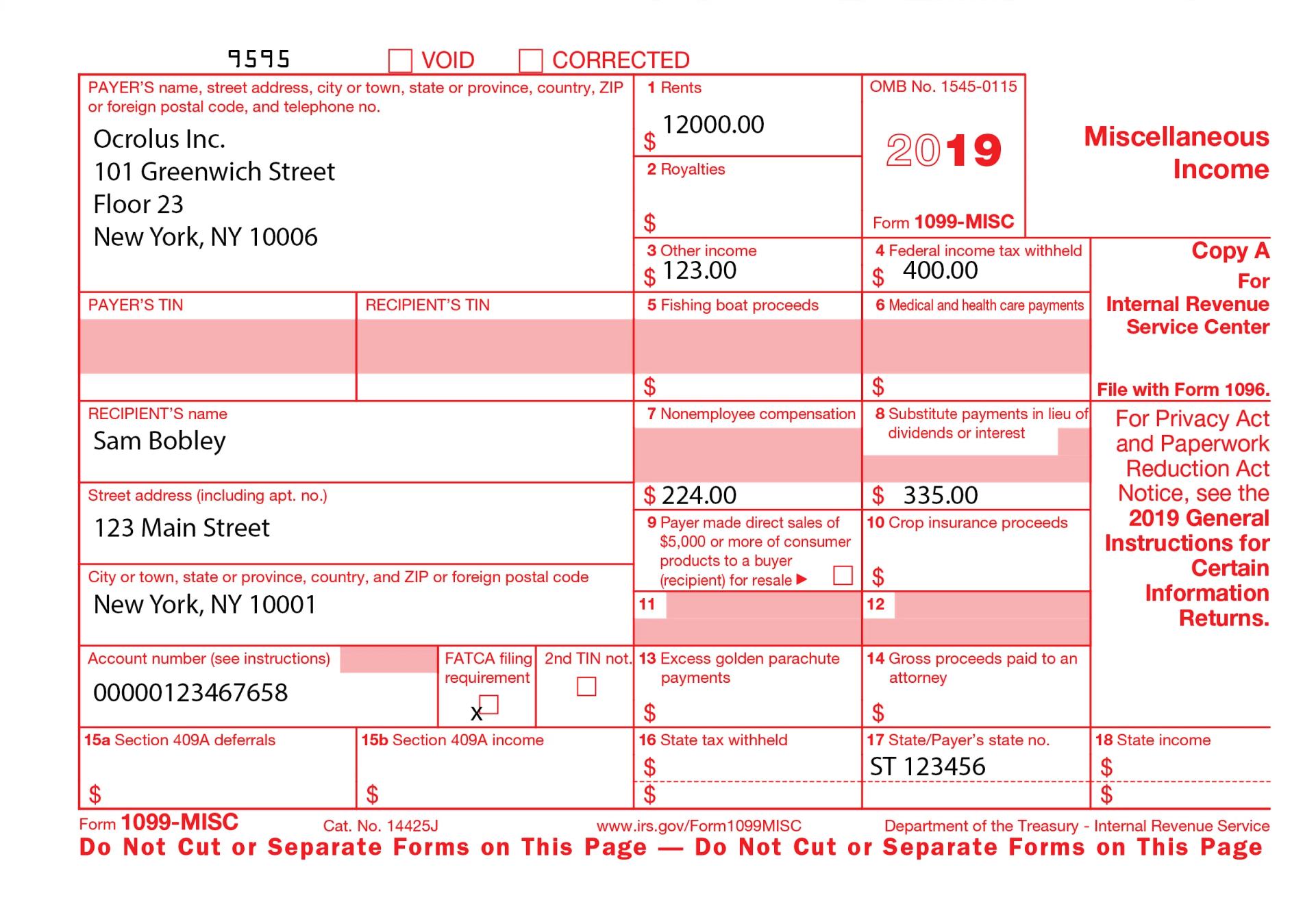

1099 Forms Mailed

If you have $600 or more in commissions from LeClair in 2022, you should soon receive an IRS form 1099 from LeClair.

Forms were mailed the last week of January and will be sent to the address we have on file for you.

If you have questions regarding your 1099, or if you do not receive your form by the end of the first week of February, please contact John LeClair at john.leclair@leclairgroup.com or 651.739.2010.

6

Quick Guide to Short-Term Medical

If you have customers who are between jobs or have started a position in which health benefits don’t kick in on day one, they may need to have some sort of temporary coverage. In a nutshell, Short Term Medical Insurance is designed to bridge the gap between other plans.

What is Short-Term Health Insurance

Generally, Short-Term Medical Insurance (STMi) will run for a few months (or even less) to about a year and is often designed for healthier people who just need coverage to cover certain services. These plans can be used to cover the time between a previous policy and an upcoming one. Among those who could benefit from a Short-Term Medical Policy are people between jobs, recent college graduates, individuals who missed an open enrollment period, retirees who aren’t yet eligible for Medicare and a less expensive alternative to COBRA for those that are healthy and understand the risks.

On the other hand, because STMi is not regulated by the Affordable Care Act (ACA), these plans may not include inpatient or outpatient hospital care, mental health services or even prescription drug coverage. Similarly, these plans are not required to cover pre-existing conditions, including pregnancy.

One benefit of an STMi with UnitedHealthcare is unlike ACA plans, their STMi’s have access to a national network if travel or portability are a benefit.

The important thing to remember is to have conversations with customers and potential customers to understand their scenarios and recognize STMi as a possible solution. You and the customer should pay close attention to the fine print and understand what is and isn’t covered before signing up.

How Much Does It Cost

Under most circumstances, short-term plans are cheaper than major medical plans – usually 50% to 80% less than regular individual market coverage. The cost, though, varies based on the persons age, location and level of coverage. In fact, affordability is one reason these types of plans are so appealing to some people.

How We Can Help

At LeClair, we understand the options available – whether it is a short-term plan, ACA or other option. If you have customers who may qualify for one of these options and have questions, please reach out to us at 651.739.2010.

7

Events

LeClair is sponsoring the following events in the coming weeks. To see the full list of upcoming events and to register, please visit the Agent Portal.

Agent Breakfast Club | February 7, 2023

8:30 am - 11:00 am

LeClair Office

ACA Workshop | February 15, 2023

8:30 am - 12:00 pm

Midland Hills Country Club

Long-Term Care Workshop | February 23, 2023

8:30 am - 12:00 pm

Midland Hills Country Club

LeClair Ladies Luncheon | March 15, 2023

11:30 am - 1:30 pm

Como Park Zoo and Conservatory

Driven Roadshows | Begin March 20

Check the Agent Portal for times, dates, and locations

Healthapalooza | July 24-25, 2023

Registration begins February 15, 2023

8