BRACE FOR CHANGE

The Writing on the Wall: Lower Rates and the Future of Canadian Home Buying Government Response to Inflation

The Canadian Government never ceases to amaze me on all levels! Rather than tackling the reason for inflation (fast population growth vs available product), they felt the need to put immense strain on the economy to help control inflation by way of rate increases. They indirectly continued to show their inability to gauge and predict the true net effect of such a drastic, ultimately negative change. For those in a tough spot, know that the light at the end of the tunnel is nearing… and perhaps MUCH quicker than the government may have anticipated

Timeline of Economic Impact

Generally, the rule of thumb is that it takes 16 to 24 months for the net effect of change to take hold.

HOWEVER, there was little research done on individual resources, such as the amount of credit or savings one had access to

Unfortunately, many people were forced to use these avenues to stay afloat and, in some cases, max out full available credit amounts This only added to the increase in monthly expenses, which essentially speeds up the level of late payments or insufficiencies.

Pressures Leading to Prime Rate Reduction

As the upward pressures and indicators started to become evident, the government was forced to start lowering the prime rate. The rate at which it will start to fall is predicted to decline much quicker than anticipated for a couple of reasons.

They can’t put much more stress on the banking systems. Banks are not in the real estate business. Keeping people in their homes is far less expensive. Without naming institutions, there were a couple of top 5 banks that were unofficially behind on regulated policy requirements. One bank was instructed not to deal with any new clients coming through the front door and to deal only with the top 25% of their portfolios, limiting essential risk Another bank actually had less than the required 10% in cash asset value compared to the loan amounts.

There are approximately 2 million mortgages coming due in 2024-2025. With the effects of rate hikes already felt on many levels, the Canadian government will have no choice but to drastically reduce the prime rate The volume of renewals is far too great, and the ripple effect will be felt across the board on a scale potentially never experienced at today’s dollar values.

Approximately 50% of buyers in the market are first-time buyers. Now imagine if there was no upward movement with first-time buyers, the majority of whom are renters. The pressure on the availability of rental units would become critical. Constant movement is necessary to sustain residential rentals. Traditionally, the cycle for first-time buyers is rent–buy–repeat. Given the backlog in rental development and its inability to keep up with demand, yet with a decent housing stock currently available, the immediate solution is to get those first-time buyers purchasing again

CMHC's New Mortgage Policy

The latest mechanism to control inflation was the CMHC announcement on July 29, 2024: a 30-year amortization for insured mortgages, plus an increase in the maximum loan amount by 33 3% to $1 5 million Those who qualify are first-time buyers and buyers of newly constructed homes. Clearly, the goal was to help move product, with hopes that first-time buyers would comprise a large part of those consumers

Personally, I don't agree with this, as it simply extends and increases the amount of interest paid over the course of the mortgage. I understand the initial appeal of such a mechanism. Stories exist of homes in the GTA receiving 25-50 offers, with the majority of offers at $999,999, as this amount would be accepted by CMHC under the old $1 million threshold.

Doesn’t this seem to speak to how financially strained these buyers are? With the new increase to $1.5 million, there will be movement again, but this will also start to indirectly increase home values To be clear, in financial policy terms, this was a MASSIVE change to get this program going. In hindsight, you would never have seen such a drastic shift if the data now being collected wasn’t pushing immediate changes to this level

“There are approximately 2 million mortgages coming due in 2024-2025. With the effects of rate hikes already felt on many levels, the Canadian government will have no choice but to drastically reduce the prime rate.”

The Need for Continued Rate Reductions

Another mechanism that is clear: rate reductions need to continue Watch for the next rate announcement scheduled for October 23, 2024. If we see a 0.50% reduction, it indicates that the data collected is concerning, and they will be looking to expedite rate cuts quickly. This anticipated announcement will speak volumes about what’s to come. There are strong indicators that we’ll see a 1% reduction by year-end! Because of this, mortgage refinance applications for current investment properties have been on hold,

waiting for better rates a smart move, given that the savings from the refinance would be reinvested. This is a clear example of new investment dollars being held back With this message circulating, buyers are also waiting (and rightfully so) to capitalize on much lower rates. This forces the question: “Will the Canadian government be forced to slash the prime rate as soon as possible to stimulate market movement?” If everyone remains on hold and the new condo development market continues to decline, this may be the only solution

Canada's Debt Obsession and Its Impact on Rate Reductions

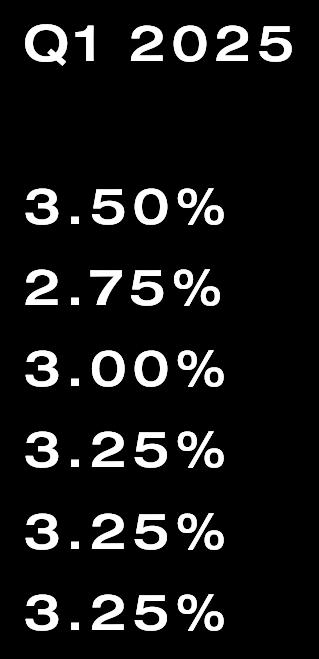

Canada is a debt-obsessed country The mentality is focused on payment amounts rather than value, with little to no consideration of net loss. How many new cars do you see on the road? Very few are bought with cash. As a country, we have the highest debt-to-service ratio in the world. That alone supports the prediction of drastic rate reductions coming quickly Future predictions by the top six banks further support this theory, as shown below:

Preparing for Upcoming Opportunities

The writing is on the wall, and my message is simple: if you’re a buyer, be ready! Put yourself in a position to capitalize on much lower rates that are coming sooner than you think. Nothing is guaranteed, but it’s hard to argue against the risk of not reducing rates, given that the negative effects across all industries could be catastrophic. The Canadian government has shown signs of slowing immigration, which will help, but the damage is already done, and change is coming! Speak to an experienced realtor today to plan the timing of your sale and/or purchase, as we have direct access to high-probability topics and inside information to maximize and protect your best interests!