JACKSON HOLE MARKET REPORT

Keller Williams, the largest brokerage in the world, is a leader in real estate due to its extensive global reach. Our marketing platform engages hundreds of thousands of potential clients every day, ensuring that our listings reach qualified buyers around the globe.

However, successful real estate transactions depend on a thorough understanding of local market conditions, including historical context and current trends. These insights are only available through knowledgeable local experts. Our Keller Williams office in Jackson Hole stands out as the fastest-growing in the region, driven by our local ownership, experienced leadership, and dedicated support staff. Together, our agents are committed to providing clients with the most up-to-date information and advice, empowering them to make informeddecisionsintherealestatemarket

MEET KELLERWILLIAMSJACKSONHOLE EXPLORE THEJACKSONHOLEMARKET

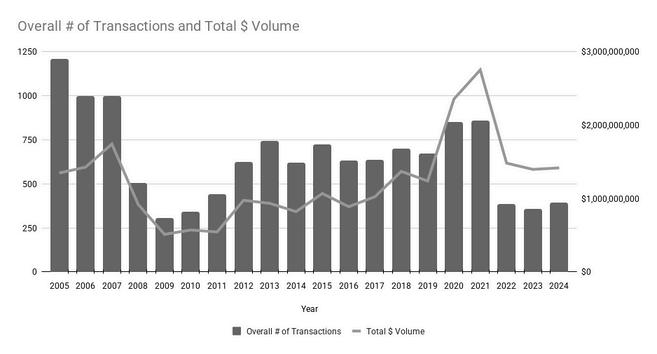

Welcome to our Q1 2025 Jackson Hole Market Report! Our local team has pulled and analyzed the following data, providing insight not only on the past year but historical data that helps identify local trends in the market. For a deeper insight into these numbers, our localteamhereatKellerWilliamsJacksonHoleisalwaysavailabletodiscuss.

MARKET OVERVIEW Q12025

Jackson Hole’s real estate market is off to a strong start in 2025. Compared to the first quarter of last year, the number oftransactionshasincreasedbyapproximately11%,totaling 81 sales. This uptick was somewhat anticipated, as 2024 ended with a significant number of pending listings in the pipeline The most notable surge occurred in the Town of Jackson,wheresalesroseby60%year-over-year

Average and median sale prices saw only modest shifts, down 5% and 2%, respectively. Meanwhile, more sellers appear to be entering the market ahead of the spring selling season likely aiming to capitalize on limited competition At quarter-end, active listings were up 8%, with 165 properties on the market. However, it’s worth noting that even with this increase,inventoryremainshistoricallylowforJackson.

The average days on market dropped by about 15% to 146 days, suggesting homes are selling more quickly than they did at this time last year A 6% rise in pending listings further pointstosteadybuyerdemand.

Withalltherecenteconomic volatility,manyarewondering howit’llaffectJacksonHole realestate.Ithinktheimpact willbenuanced.Somebuyers mayseeitasasmarttimeto invest,whilesomesellers mightfeelpressuretocash out—bringingsomemuchneededinventory Eitherway, itcouldfinallystirupsome movementafteraquiet coupleofyears.

RebekkahKelley, AssociateBroker

While national and global economic factors are expected to remain volatile throughout 2025, Jackson Hole has historically served as a safe haven from broader market fluctuations. Interest rates typically impact lower-priced properties, while the stock market more directly influences the luxury segment Regardless of the direction the US economy takes,JacksonHoleofferscompellinglong-terminvestmentpotential

Connect with one of our local Keller Williams agents to explore the unique advantages ofrealestateownershipinJacksonHole.

Thesingle-familyhomemarketinJacksonHolesawanotablesurgeinactivityduringthefirstquarterof 2025, with 47% more transactions compared to the same period last year. The most significant growth occurred within the city limits of Jackson. The average sale price rose sharply up approximately 33% year-over-year However, this increase does not reflect general home price appreciation but rather the result of a higher concentration of luxury sales In fact, nearly 75% of this year’s single-family home transactionshavebeenabove$5million,comparedtolessthanhalfinthesameperiodlastyear

Buyers currently have a broader selection to choose from, with inventory up more than 30% year-overyear Homesthatdidsellmovedmorequickly,withtheaveragedaysonmarketdroppingnearly20%to around 4.5 months. This suggests that the properties sold are being priced more appropriately for currentmarketconditionsandthatbuyerdemandremainsstrong.

That said, today’s buyers are highly price-sensitive and expect to see clear value. Homes that are mispriced risk lingering on the market evident in the fact that the average days on market for currently active listings is far higher, at over 75 months Strategic pricing remains key in navigating this evolving market S I N G L E F A M I L Y H O M E S

Even with increasing inventory, well positioned homes were selling faster in Q1, pointing to strong demand, especially at the higher end of the market. However, the gap between sold and active listings’ time on the market highlights that active buyers are focused and value-conscious Sellers whounderstandtheimportanceofstrategicpricingwillbetheonesclosingdealsthissummer! KatieBrady,AssociateBroker

Condos and townhomes continue to be a popular segment of the Jackson Hole real estate market Transaction volume saw a healthy 20% increase year-over-year, with approximately 31 sales As is typical, the majority of these occurred within the city limits of Jackson. The average sale price rose significantly upabout22% withthemedianpricereaching$1,200,000.Thisjumpislargelyattributed to a shift in the mix of sales: 2024 saw more activity at the lower end of the market, while 2025 has seenahigherconcentrationofluxurycondoandtownhomesales

As noted in our 2024 Year-End Market Report, this segment had been the only one in Jackson Hole to show price depreciation since the 2021 peak Inventory remained tight at the end of 2024, and that trendhascontinuedinto2025,with36%feweractivelistingscomparedtothesametimelastyear This constrained supply, coupled with an increase in pending activity, suggests that prices in this segment havelikelystabilized

Given that condos and townhomes tend to be more sensitive to interest rate fluctuations, the recent softening in mortgage rates bodes well for continued stability. Rates have remained below 7% for twelve consecutive weeks through early April, and expectations of further reductions suggest this segmentiswell-positionedtoremainstrongastheyearprogresses

C O N D O + T O W N H O M E S

The slight 2024 cool-down has brought some balance back to the Jackson Hole condo/townhome market Buyersarefindingbetternegotiationopportunities,whilesellersseemmorewillingtonegotiate on terms and price The appeal to own in Jackson Hole remains strong, and for those seeking entry into Jackson Hole or looking for a maintenance-light mountain home, condos/townhomes remain one ofthemoststraightforwardpaths.|GillianHeller,AssociateBroker

Landtransactionsinthefirstquarterof2025haveremainednotablysparse,continuingatrendthathas persisted over the past three years. The land market peaked in 2021, with 85% more transactions in the first quarter of that year compared to this year. Due to the low number of sales, both average and medianpricingdataarehighlyvolatileandunreliableindicatorsofbroadermarketconditions

That said, there are still signs of activity With eight pending land sales in the pipeline already surpassing the number of closed sales in Q1 the market shows potential momentum Inventory dipped slightly, with 36 parcels listed for sale at the end of the quarter The average days on market declined by approximately 25%, now just under six months However, it’s worth noting that parcels on the market exhibit a much higher average, currently sitting at over 10 months, highlighting the challengesinthissegment.

Sellers looking to position their property competitively should be aware of how recent updates to the Natural Resource Overlay (NRO) regulations may impact what can and can’t be done with the land These changes can influence a buyer’s vision for development, making it essential to market your propertywithclarityandforesight KellerWilliamsJacksonHoleagentsarewell-versedinthelatestland usepoliciesandcanhelpsellersnavigatehowtopresenttheirpropertyinawaythatalignswithcurrent buyer expectations For buyers, understanding local building considerations such as permitting timelines, design requirements, and environmental factors can unlock the full potential of a land purchase Whetheryou'rebuyingorselling,expertguidancemakesallthedifference L A N D + R A N C H E S

Overthepastthreemonths,thelandandranchmarketinJacksonHolehasremainedhighlydynamic, driven by sustained interest from both lifestyle buyers and investors Despite slight seasonal fluctuations, prices have stayed elevated due to the area's unmatched natural beauty, recreational opportunities, and strong desirability as a safe-haven destination. Buyers are competing for rare opportunities, while sellers benefit from the enduring appeal of Wyoming's tax advantages and the region'sexclusivity.|ScottBlackwood,AssociateBroker

Jackson Hole’s real estate market has become virtually synonymous with luxury. Properties priced above $5 million remain in high demand, and 2025 began with a strong uptick in activity luxury sales rose approximately 67% year-over-year. The average sale price for luxury properties declined by about 34% This drop is not indicative of market weakness but rather a shift in the mix of sales: 2024 saw an unusually high number of ultra-luxury transactions exceeding $20 million, while most of the sales so far in2025havebeeninthe$5–8millionrange

The most notable transaction of the year to date is a property listed for $31,500,000 in Lake Creek Ranch The sale includes 453 acres along Lake Creek, a nearly 10,000-square-foot log home, and privateaccesstotheSnakeRiver.

Asreportedthroughout2024,theluxurysegmentremainssaturated.Attheendofthefirstquarter,over 60 properties priced above $5 million were on the market, marking a 36% increase from a year ago. Pending listings are holding steady compared to last year, and the average days on market dropped about17%to153days,signalingongoingbuyerinterest

The luxury segment in Jackson Hole tends to be influenced by stock market trends Recent volatility has shaken financial markets, and it remains to be seen how this will impact high-end buyer and seller behavior in the coming months One thing is for sure: Jackson Hole continues to attract discerning buyerslookingforlong-termvalue,lifestyle,andlegacy

With the increase in luxury inventory the serious buyers are there, but they have more time, more options and maybe more leverage I expect to see more of the $10m+ inventory to hit the market next quarter as things green up and we head into ‘listing season,’ and how this inventory moves will give us agoodsenseofthestrengthofthismarketsegment.|KelseySpaulding,AssociateBroker

L U X U R Y P R O P E R T I E S