BUSINESS EXPANSION IN THE NORTH

The latest stage of our commitment to deliver outstanding services across the North of England has taken a huge leap forward.

NUTRIENT NEUTRALITY

Simple solutions to a big problem for developers.

RENEWABLE ENERGY SCHEMES

An inheritance tax planning opportunity for farmers and landowners?

ISSUE NO. 6 MAY 2023

WELCOME HOW DO WE SQUARE THAT CIRCLE?

FARMER ASPIRATIONS

“Make money, make more money and live long enough to enjoy it.”

WEATHERING THE STORM

Can planning help farm businesses weather the storm of the Agricultural Transition?

RURAL ENGLAND PROSPERITY FUND

Support for farm diversification given a welcome boost by the new Rural England Prosperity Fund.

GREEN BELT LAND

Is getting planning approval an impossible task in land designated as Green Belt?

NUTRIENT NEUTRALITY

Simple solutions to a big problem for developers.

FARMING

A flexible fund often overlooked by farmers.

RENTERS REFORM BILL

Strengthened section 8 eviction notices announced for landlords.

ARE YOU FULLY COVERED?

Is it time to reassess your property insurance cover?

RENEWABLE ENERGY SCHEMES

An inheritance tax planning opportunity for farmers and landowners?

PROPERTY ROUND-UP

ARE YOU LOOKING TO SELL YOUR FARM?

BUSINESS EXPANSION IN THE NORTH

WELCOME TO THE TEAM

GSC GRAYS

IN PROTECTED LANDSCAPES FUND

CLOSING REMARKS 1 2 21 4 7 10 13 16 18 22 24 26 28 29 30 31 32 ISSUE NO. 6 MAY 2023

TEN CHALLENGES CHAIRMAN’S

CONTENTS

WELCOME

We have also seen the opening of the Rural England Prosperity Fund and the continuation of the Farming in Protected Landscapes programme offering locally targeted funds. You can read about these in further detail later on in the publication.

Many of you will have benefitted from the free Farm Business Advice Service (FBAS), our bespoke scheme funded by Defra’s Future Farming Resilience Fund. We are already beginning to see new and existing clients benefit from taking a hard look at their business and evaluating their plans for the future. With up to two days of one-to-one consultancy covering thirteen service areas, we are proud of our offering to farmers.

The bigger picture is starting to become clearer with the announcement of further SFI ratings and standards, with more to be announced in the summer. Some will benefit more than others as the detail is released, particularly those who have already incorporated more regenerative practices profitably into their business.

Biodiversity Net Gain (BNG) becoming a mandatory requirement later this year will offer further opportunities for landowning clients to deliver BNG projects. We are working with developers to broker such deals and our team are at the forefront of the opportunities available.

Our ambitious expansion plans are designed to deliver our expertise to an ever increasing number of clients. GSC Grays is all about offering a radically different and fresh approach and our new offices continue this commitment.

MAY 2023 1 GUY COGGRAVE MANAGING DIRECTOR 01748 897606 gsc@gscgrays.co.uk

GSC Grays are committed to finding new opportunities and identifying ways our clients can make their businesses more profitable and sustainable.

FINALLY, WE WERE PLEASED TO ANNOUNCE THE OPENING OF THREE NEW OFFICES IN RESPONSE TO CLIENT DEMAND; DRIFFIELD IN THE EAST RIDING OF YORKSHIRE, AND PENRITH AND KIRKBY LONSDALE IN THE NORTH WEST.

HOW DO WE SQUARE THAT CIRCLE?

One option we are discussing with clients is to intelligently use the new environmental schemes to both increase the income generated but also reduce the costs incurred.

In simple terms all businesses have the same options to achieve this:

1. Increase the income generated from the remaining parts of the business, whilst maintaining the existing cost structure.

2. Generate additional income from new enterprises developed by the business (most likely some form of diversification).

3. Reduce the costs incurred in running the business whilst maintaining the existing income.

Having been involved in farm consultancy for over three decades I will always look to points 1. and 3. to achieve the solution. In my experience, most farming businesses do not have the expertise or enthusiasm to successfully diversify away from the core business, let alone the appropriate location. Farmers are in farming to farm – can we find a way to achieve this, fill the void created by the loss of BPS and ensure a financially viable business continues?

This very simple concept, stylised in the picture below, shows the central part of the field remaining in mainstream agriculture (marked in red) being farmed as efficiently as possible. The areas around the edge of each field (marked in yellow) are included in an environmental scheme, which receives a significant payment. By following this concept, the overall profitability rises, which should be sufficient to fill the void from losing the BPS income. This concept could apply to both arable and grassland but for now we will concentrate on an arable situation.

GSC GRAYS 2

With the reduction in BPS payments now really starting to be seen, almost all farming businesses are trying to work out how they can look to fill this void.

REDUCING COST STRUCTURE

Often when reviewing the current performance of arable businesses, an area where many businesses could do better relates to the gross margin generated for every £100 spent on labour and machinery. When this is looked at in detail we do not compare well with other countries across the world.

We are not as efficient in utilising the labour and machinery we have, even though we use modern machinery and have a high-quality workforce. If we can increase our efficiency, then the cost incurred per acre decreases and the gross margin per £100 spent on labour and machinery goes up.

By only farming the central part of the field, we can cover more acres per hour, irrespective of the operation, compared to when we include the headlands, awkward corners etc. Further improvements in efficiencies can occur if the area farmed accurately fits with the working widths of the machines. Increasing the work rates achieved, reduces the cost per acre, and potentially allows a greater area to be farmed by the same labour and machinery pool.

INCREASING INCOME

When looking at yield data it is highly likely that the lowest yielding parts of the fields will be the headlands and awkward corners we are not farming efficiently. These areas will have the same, if not higher, variable costs as the central part of the field, but the yield is lower. As a result, these areas are going to generate the lowest income per acre and be the least profitable areas of the field.

On the other hand, the central parts of the field almost certainly will be achieving the highest yields. As a result, these will generate much higher levels of income per acre, considerably higher than the current field average, resulting in these areas being the most profitable parts of the field.

Those awkward areas and headlands we have chosen not to farm are then entered into an environmental scheme where annual payments of over £600/ha can be achieved. As a result, these areas are also likely to be at least as profitable as the current situation, if not more so.

SQUARING THE CIRCLE

Combining the two elements of higher yields with more efficient use of the labour and machinery pool results in a significant increase in the profitability achieved from the area being actively farmed. Along with the environmental scheme payments for less productive areas, each area has been optimised to achieve the highest margin possible.

There will need to be a change of mindset in terms of managing arable businesses going forward, to ensure the full benefits of this concept are achieved. There will need to be changes in the labour and machinery pool of most businesses, so that these closely match the area being farmed. The area being farmed will also be a totally different area to the area that is occupied and managed by the business.

Overall, this concept could well allow us to square the circle - farmers continue to farm the best land efficiently, whilst benefiting from environmental payments on the remainder.

MAY 2023 3

303 9541 rjs@gscgrays.co.uk

THIS WILL ENABLE THEM TO CONTINUE TO DO WHAT THEY ENJOY DOING, FILL THE VOID CREATED BY THE LOSS OF BPS AND ENSURE A FINANCIALLY VIABLE AND SUSTAINABLE BUSINESS FOR THE FUTURE.

ROBERT SULLIVAN DIRECTOR 0191

FARMER ASPIRATIONS

“Make money, make more money and live long enough to enjoy it.”

At first, I thought this answer was somewhat tongue in cheek. However, when I came to consider it, he was delivering a very honest and deliberate message. Namely that his farming business needed to make more money to be sustainable, but in generating that extra income and profitability, it needed to be achieved in a way that did not impose an unrealistic level of stress and pressure on the family as individuals.

Sustainability is a word which we hear a lot at the moment, almost to the point where I would suggest it is overused.

However, in the context of a farming business, I believe it has two principal meanings. Firstly, it relates to the environmental sustainability of the farming activity. Secondly, it is all about the financial viability of the farming business for the future. I believe these two different meanings are becoming ever more closely linked.

From a financial perspective, to be sustainable a farming business must, in each year, generate sufficient profitability and, most importantly, cash to provide for the following four key areas:

1. The private needs of the family or business owners involved.

2. The servicing and repayment of business funding.

3. The payment of tax.

4. The funding of appropriate reinvestment.

If it is unable to do this, then a fundamental change is needed. We believe the four key stages involved in the process of achieving successful change within a business are:

1. MINDSET – THE ATTITUDE TO CHANGE

The most important first step is to recognise and accept that change is needed in the first place. This recognition is very definitely half the battle, but it is something that some people find much easier to achieve than others. It is all about mindset, but once achieved, it opens the door to the wholly positive and creative process of exploring what that change might look like for the future. Some businesses may need some additional help or encouragement to take this first step.

2. REVIEW AND APPRAISE

Once this positive approach to change has been established, the second crucial step is to review what that change might look like and indeed the scale of the change required, to establish and create a successful farming business for the future.

This may be very different for some businesses than for others, depending on where they start their journey.

For some, relatively minor adjustments to enterprise mix or cropping or stocking policy may be all that is required. To this successful core business, the family may then be able to consider new opportunities or ventures, such as Countryside Stewardship, which obviously links particularly well with environmental sustainability.

Other considerations may be new ventures or enterprises linked to a particular passion or interest that one of the family members can bring to the benefit of the business overall.

However, for some, more fundamental and farreaching change or business restructuring may be required, particularly if the borrowing levels within the business are rather higher than is currently affordable. With interest rates currently heading in only one direction, this is an issue which is uppermost in many people’s minds.

MAY 2023 5

At a recent Farm Business Breakfast, we asked our guests to tell us what the three most pressing concerns were for their farming businesses at present. The first reply we wrote down on our flipchart was, and I quote, “to make money, to make more money and to live long enough to enjoy it.”

Whatever the scale of change required, the process we are advocating here is in many ways exactly the same. It is to undertake a careful, thorough, and realistic review of where the business is at present, and what degree of change would be necessary to meet the family requirements.

3. PLAN

Once a review is complete, the next key step is to plan how you can make those changes or restructure the business as appropriately and effectively as possible.

Essentially, you are creating a business plan for change. It will set out where you are intending to end up and budget the newly configured business once it is fully up and running and established.

Secondly, it will allow you to plan and budget realistically for the journey to get there. It will include a number of fundamental ingredients including enterprise plans, cash flow forecasting, profit and loss budgeting and indeed the careful consideration of any investment that may be required in order to make your plan a reality.

Very importantly, it will also consider the physical aspect of delivering your business plan, the key roles that each individual will take in that delivery and allow the opportunity to make sure the physical demands on everyone are as sustainable as the financial results.

4. POSITIVE AND DECISIVE ACTION

This comes into play once the review and the planning stages are completed and that is you then take very positive and decisive action to implement the changes you have so carefully researched. Almost certainly, many businesses require a team to help them achieve this. This may include an accountant, bank manager, legal advice (depending on what is being considered), and of course, the services of a good farm business consultant.

In concluding my thoughts, I want to recognise that as consultants we appreciate that change - and even contemplating change - can be quite a frightening experience.

Farming, I am sure, can feel a fairly isolated occupation particularly when so many things that are fundamental to our industry, such as the Basic Payment Scheme, are changing so radically.

There is help at hand and we would absolutely encourage anyone to consider reaching out for a second opinion to help them with these fundamental decisions.

To end on a very positive note, we are greatly encouraged by how many farming families are already tackling fundamental change with a really positive and creative attitude and building for a much more ‘sustainable’ future as a result.

I believe our Farm Business Breakfast guest hit the nail on the head when he highlighted the need to make more money. But just as important was his considered wish to be around long enough to enjoy the fruits of his labours.

jrs@gscgrays.co.uk

GSC GRAYS 6

JAMES SEVERN DIRECTOR

01423 740120

THESE CHANGES DO NOT HAVE TO BE CONSIDERED OR RESEARCHED ALONE.

WEATHERING THE STORM

Can planning help farm businesses weather the storm of the Agricultural Transition?

Anyone who has been watching a certain Amazon farming series recently will have heard time and again, ‘we are encouraged by Defra to diversify to maintain farming incomes, but the planning system says no!’ Is this statement an accurate reflection on planning policy and is there anything that can be done to mitigate it?

Historically, yes, planning policy was strict on development within the open countryside and dispensation was only granted where it was deemed to be agricultural development. However, in recent years, planning policy has moved on, albeit with a growing reliability on permitted development rights (PDRs) as a way of fast-tracking certain types of non-agricultural

development. Certain areas, such as National Parks, AONB’s and conservation areas still have some tighter controls to be mindful of. Green Belt land is also a case in point, see page 13 for more details.

SO HOW CAN FARMING BUSINESSES USE PLANNING TO THEIR ADVANTAGE?

Well, it depends on what the family and farming business needs now and in the future.

Is it to increase production of existing enterprises, generate economies of scale, or provide accommodation for a farm worker / family member to live close by to aid employment retention or succession? Or is it to generate a non-farming income through leisure and tourism ventures, commercial letting space or adding value to a farm product and selling direct to the consumer? Or quite simply capital generation to manage borrowing, pay a family member off or as a retirement strategy?

MAY 2023 7

DO PDR S OFFER PLANNING SHORT CUTS?

Permitted development can pave the way for new farm buildings, unencumbered housing or commercial lettings space on farm where there are existing buildings of an age.

In recent cases we have seen, once permitted development has been granted and the principle of the development accepted in said location, it is easier to apply for full planning to ‘tidy up’ the proposed development. This may be a longer route, but an application for full planning at the outset may not be supported under planning policy.

CLASS Q

Class Q is a form of permitted development allowing for the conversion of agricultural buildings to residential use for up to a maximum of 5 dwellings. This is a classic example whereby once the principle of housing has been established, a full application to amend details of the development beyond the parameters of the initial restrictions of Class Q, may be supported if you can demonstrate it would be a better design etc. So, modern or more unusual buildings should not necessarily be discounted.

Class Q can work really well to provide worker accommodation (where you don’t mind your neighbours!), or if appropriate and detached from the farm steading, as a capital raising exercise.

CLASS R

Class R development is an under-used planning policy on farms which allows for the conversion of agricultural buildings to a flexible commercial use including storage and distribution, professional services (e.g. offices), and retail (e.g. shops, cafes etc.). Again, there are parameters to work with initially, but once the foundations are laid there is potential scope to expand.

This is ideal where additional trading income is needed that is not generated from a direct agricultural enterprise, or to support a non-farming family member who wants to diversify with an agricultural product.

CLASS A

Class A is a useful right to put up new farm buildings, allowing up to 1,000 sq. m of building space every two years – and I have yet to meet a farmer who doesn’t like putting up new buildings!

USING PDR S STRATEGICALLY

Permitted development should be used strategically and built into the longer-term plans of the business. For example, Class Q housing prevents further permitted development for 10 years. Therefore, before embarking on a Class Q development, due consideration should be given to whether:

• Any additional development is likely to be required.

• Any further development would best be completed under Class A and Class R permitted development, and the timescales involved.

• Outline or full planning consent should be sought in favour of Class Q development to protect PDRs in the future.

These considerations are typical of the conversations we have had with clients considering on-farm housing for a worker or family member. In recent cases we have recommended clients pursue outline or full planning to protect their PDRs going forward.

GSC GRAYS 8

PREPARATION IS KEY TO PLANNING SUCCESS!

Taking a fresh look at planning opportunities on-farm is never a bad idea, but the reasons and timings behind an application need careful thought and can be the difference between gaining consent or not, or even landing yourself with large borrowing or a big tax bill!

Before venturing off into the world of planning, the key to any successful planning application - whether reported to the planning officer or not - is the financial and business planning that goes before. Having a sound and justified business appraisal will substantially increase your chances of success at planning.

• Will your business need to borrow to complete the development?

• What are your projected returns and how does that stack up against the repayments?

Historical accounts (usually 3 years) are just as important as forward budgets and in certain cases scrutinised to set the trend of the business. For many, there is a temptation to control the bottom line to avoid the tax man, however this can have unintended consequences with planning and the bank later down the line.

A WORD OF CAUTION

Planning can also trigger other issues such as business rates, capital gains or inheritance tax given the scale, change of use or ownership and the possible impacts need to be considered before planning is applied for. Any consent given may affect the valuation of said asset, particularly if the intention is to transfer ownership thereafter.

A further word of caution on planning where a tenant is in situ. The planning process will not support an application for a change of use from agriculture where a tenant is in place and utilising said buildings. Serving notice to quit is not an easy remedy either. Where there is a landlord / tenant relationship, and for matters to run smoothly both in terms of time and costs, it is best to approach any planning application unified.

Some of our recent planning work has seen us obtain planning consent for a lean-to style general purpose building converted into two homes for sale under Class Q, outline consent for a second agricultural worker's dwelling on farm, full planning for a general-purpose building to expand an existing farm enterprise, glamping pods, agricultural roads and accommodation works and in-village redevelopments with farmstead relocation.

PDRs are a useful option and provide a less onerous route than submitting a full planning application. Having said that, nationally, ‘Around 60% of Class Q applications are refused, often due to different interpretations of the rules between planning authority and applicant.’* As such it is prudent to seek professional advice.

An initial assessment of planning potential and a review of your options may be available through the FBAS scheme we are currently offering.

GEORGINA WATSON DIRECTOR 01423 740120 hgw@gscgrays.co.uk

MAY 2023 9

WHILE THERE IS A LOT TO CONSIDER, AND IT CERTAINLY ISN’T EASY, PLANNING POLICY IS NOT AN OUTRIGHT BARRIER TO FARM DIVERSIFICATION PLANS.

*CLA data.

RURAL ENGLAND PROSPERITY FUND

Support for farm diversification given a welcome boost by the new Rural England Prosperity Fund. Funding through the Rural England Prosperity Fund (REPF) is set to unlock millions in additional investment for rural communities over the coming years. How could this new fund support farm businesses considering diversification as a means of improving profitability in the face of diminishing subsidy payments?

WHAT IS THE REPF?

Funded by DEFRA together with the Department for Levelling Up, Housing and Communities, the REPF is effectively a rural top-up to the UK Shared Prosperity Fund (UKSPF) to help address the extra needs and challenges facing rural areas. Replacing the former EU funded Rural Development Programme for England, the REPF, worth up to £110 million, will run for a period of two years from April 2023 until March 2025.

FUNDING OPPORTUNITIES AVAILABLE

The REPF aims to boost the rural economy by providing funding to support new and existing rural businesses to develop ‘new products, facilities and community infrastructure that will be of wider benefit to the local economy’. This includes farm businesses looking to diversify income streams.

Examples of projects that are likely to be supported include:

• Converting farm buildings to other business uses.

• Rural tourism enterprises such as investments in visitor accommodation.

• Develop, restore and refurbish local nature, cultural and heritage assets and sites.

• Creation of public access provisions such as new footpaths and bridleways.

• Boosting rural ‘connectivity’ through broadband projects and grants for provision of digital infrastructure at places such as village halls, pubs and post offices, for community use.

GSC GRAYS 10

FUND DELIVERY

The fund will be delivered by eligible local authorities. While funding must be used on capital projects for business and community purposes, investment decisions will be based on local priorities and will focus on those projects that most improve productivity and create rural job opportunities. As such, each authority is responsible for ensuring applicants have ‘robust business plans which demonstrate the viability and success of the projects’.

SUPPORTING RURAL BUSINESSES

Whilst the REPF is a brand-new scheme, our agents and consultants have experience supporting rural businesses with funding applications and have helped clients successfully secure funding from the former Rural Development Programme for England as follows:

BUSINESS EXPANSION

A small rural business that had reached capacity in their existing space was provided £27,500 from the former LEADER scheme. It funded the purchase

of additional space and equipment to expand their preserve manufacturing business. The project was successful by demonstrating that it provided new employment opportunities and encouraged business growth within the rural economy.

FARM DIVERSIFICATION

A former LEADER farm diversification project received £60,000 for the development of an existing caravan site to create a luxury glamping facility. The aim of the project was to diversify farming activities to develop an alternative income stream. The project was able to demonstrate that it would grow an existing rural business which created jobs and supported local tourism.

CONVERTING FARM BUILDING TO OTHER BUSINESS USES

A former Growth Programme project was awarded £160,000 for the refurbishment of a redundant traditional farm building into new commercial office space. The project created a viable use of redundant buildings and generated income for a small rural business.

MAY 2023 11

THE RIGHT TIME TO ACT!

Diversification is an increasingly important issue for farming businesses looking for additional income streams to lessen reliance on core farming income and subsidy payments.

Our free Farm Business Advice Service, grant funded through Defra's Future Farming Resilience Fund, is seeing an increasing number of farm businesses exploring the diversification opportunities available to them.

THE INTRODUCTION OF THE REPF OFFERS FARMERS A WELCOME OPPORTUNITY TO GAIN ADDITIONAL FINANCIAL SUPPORT TO HELP TURN DIVERSIFICATION PLANS INTO REALITY.

Of course, the fund is not limited to farm businesses considering diversification. We are still in the early stages of the REPF and exactly how each eligible authority will deliver the fund is yet to be finalised.

We expect the fund to be competitive and urge any rural business within eligible authorities considering applying to the fund, to act without delay.

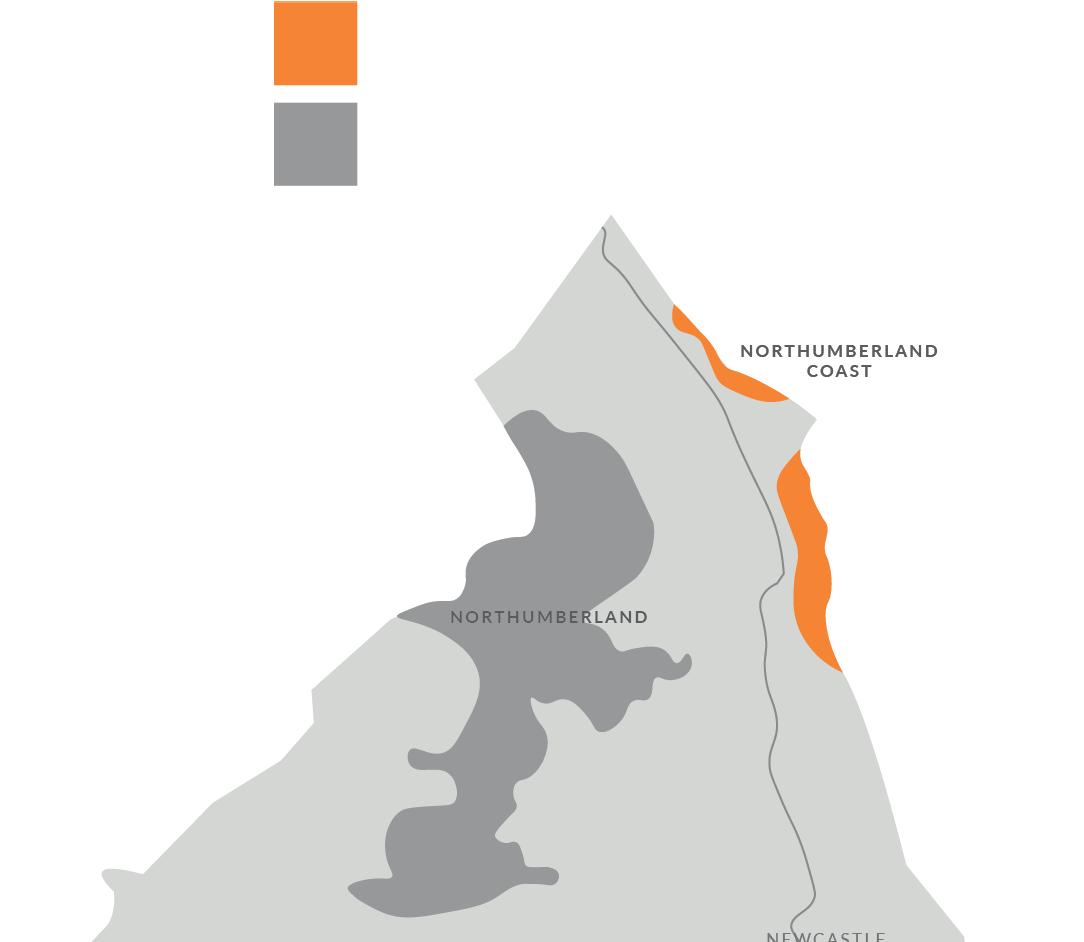

REPF ELIGIBLE AUTHORITIES IN THE NORTH OF ENGLAND

DEFRA has published funding allocations for the eligible authorities which were determined based on rural populations, rural businesses and productivity, and the importance of farming in each authority.

Eligible authorities and their respective funding allocations - combined for the 2 years - are outlined below:

• County Durham - £3,512,301

• Redcar and Cleveland - £624,909

• Eden - £1,051,689

• Ribble Valley - £433,680

• Northumberland - £3,043,546

• South Lakeland - £1,137,962

• North Yorkshire - £5,417,114

(split across districts)

GSC GRAYS 12

SAM COLE ASSOCIATE 01524 880322 sjc@gscgrays.co.uk

GREEN BELT LAND

Is getting planning approval an impossible task in land designated as Green Belt?

MAY 2023

Introduced in the 1950s, it is well-intentioned with its fundamental aim being to prevent urban sprawl by keeping land permanently open. It specifically serves 5 purposes:

1. To check the unrestricted sprawl of large, built-up areas.

2. To prevent neighbouring towns merging into one another.

3. To assist in safeguarding the countryside from encroachment.

4. To preserve the setting and special character of historic towns.

5. To assist in urban regeneration by recycling derelict urban land.

However, there are some significant considerations to be borne in mind by local authorities when designating land as Green Belt. Not least of which is that once established, these policies can only be overcome, or the boundary of the Green Belt changed, through considerable effort demonstrating exceptional circumstances which are fully evidenced and justified.

GREEN BELT DRAWBACKS

Given an essential characteristic of Green Belts is their openness and their permanence in the long term, by its very nature, Green Belt designation prevents most forms of development other than agricultural and forestry enterprises or for outdoor sport and recreation. That development which is permitted remains described as “inappropriate” and thus any development is always described in negative terms, making its promotion more difficult than is often necessary.

It reduces the amount of developable land for housing. The OECD found that the responsiveness of housing supply to demand in the UK was the weakest among developed countries, and largely attributed that to Green Belt policies. Less homes being built leads to higher prices and less sustainable rural communities as people are priced out of an area.

It also reduces the amount of land available for economic development. For those looking at tourism uses that aren’t directly linked to outdoor sport and recreation, energy projects or new small scale commercial ventures, these can be incredibly challenging to bring forward.

CHANGES TO GREEN BELT DESIGNATION IN ENGLAND

Nationally, there has been a noticeable shift towards local authorities releasing Green Belt for both housing and employment development. In the year ending 31st March 2022, fourteen local authorities changed their Green Belt designation. Twelve authorities reduced their designation by releasing a combined total of 2,760ha (6,820 ac), and two increased their area by a combined total of 26,920ha (66,520 ac).

NORTHUMBERLAND BUCKING THE TREND

99.5% of the increased designation was in Northumberland which now has a Green Belt 3 times the size of that protecting London. The very significant increase in the Northumberland Green Belt is centred upon Morpeth, which is arguably not a large built-up area and is at very low risk of merging with another town. The designation of 26,790 hectares (66,200 acres) of additional land as Green Belt is unlikely to do anything to assist with urban regeneration, but places significant restrictions on what those who live and work within it can do.

STRINGENT APPLICATION OF THE RULES

The Green Belt policy places the onus on the developer to demonstrate the very special circumstances that would allow planning permission to be granted, and that burden of evidence is hard to meet.

GSC GRAYS 14

With just over 12%, or 1.6m hectares, of the total land area in England designated as Green Belt, it is an enduring and popular planning policy and is of significant importance to the Government.

One of the most notable cases involving GSC Grays was for a client who was unable to bring forward planning for a modest holiday lodge development just 100m within the Green Belt boundary. Permission was refused because the council deemed it an inappropriate development that would cause unacceptable harm to the Green Belt. This was determined on the basis that not all visitors would participate in the outdoor sport and recreation opportunities which already existed on site and were being expanded as part of the application.

Challenging the decision would be costly and having already spent 4-5 times the cost of a normal planning application due to the Green Belt policy, you have to be confident in your scheme to invest more in the process when a recommendation to refuse consent is highly unlikely to be overturned on appeal.

WHAT NEXT FOR NORTHUMBERLAND?

The adoption of the Local Plan in Northumberland means the Green Belt policies are now set for the next 10-15 years. For a county as rural as Northumberland to put in place policies which effectively prevents economic development for many of its constituents, seems frankly madness. It will be interesting to see how the impact of this decision plays out and is an illustration of why engaging in the plan making consultations run by local authorities is important.

IS GAINING PLANNING APPROVAL THE IMPOSSIBLE TASK?

While gaining planning approval is exceptionally difficult, it isn’t altogether impossible. There is no outright ban on development in the Green Belt. Indeed, we work with clients who have been successful, gaining permission for the construction of agricultural sheds and an Anaerobic Digestion plant. That said, the costs and risks needed to achieve that success were far greater than would have been the case had their land not been designated Green Belt.

A full review of the policies affecting a site and a hardheaded sense check on any proposed development are essential before getting too far down the line with a development within the Green Belt.

MAY 2023 15

WITH FARMERS AND LANDOWNERS INCREASINGLY LOOKING AT ALTERNATIVE WAYS TO GENERATE INCOME AND TO IMPROVE PROFITABILITY, DIVERSIFICATION OPPORTUNITIES FOR FARM BUSINESSES WILL MOST CERTAINLY BE MADE MORE DIFFICULT IF THEIR LAND FALLS WITHIN THE GREEN BELT.

CALUM GILLHESPY DIRECTOR 01833 694931 crg@gscgrays.co.uk

NUTRIENT NEUTRALITY

Simple solutions to a big problem for developers.

It is generally assumed that the guidance only impacts residential developments. However, this is not the case and includes developments relating to all types of overnight accommodation that will be connected to the mains and an off-grid treatment works. Other development applications will be considered on their individual merits, but generally, infrastructure that will increase agricultural intensification will also be impacted by the guidance.

Increased levels of nutrients (especially nitrogen and phosphorous) in water courses create an overabundance of algae leading to algal booms and lowoxygen water that eventually kills essential water habitats. The sources of these nutrients are largely mains and off-grid treatment works and agricultural and industrial processes.

SCALE OF THE PROBLEM

Since 2020, Natural England (NE) have issued guidance to 74 Local Planning Authorities (LPA), advising that they are unable to grant planning permission unless the applicant can demonstrate that the development is ‘nutrient neutral’ i.e. will not increase the current phosphate or nitrate levels within the catchment areas of vulnerable watercourses. This has resulted in a significant number of applications being stalled within the planning system.

NUTRIENT CALCULATIONS

The nutrient neutrality of a development is assessed on the existing and proposed land use changes, which will vary for each proposal. Each catchment area has its own nutrient budget calculator allowing the developer to establish the extent of work required to mitigate the impact of the nutrient effluent from their development.

GSC GRAYS 16

The concept of ‘nutrient neutrality’ is relatively new, but it is having a huge impact on development proposals falling within the catchment areas of vulnerable watercourses.

WHILE IT SOUNDS LIKE A COMPLEX ISSUE, MITIGATION SOLUTIONS CAN BE RELATIVELY SIMPLE IN PRACTICE.

SIMPLE MITIGATION SOLUTIONS

For smaller scale developments, a good place to start is looking at the proposed wastewater treatment works. Connecting to a package treatment system can significantly reduce the nutrient effluent from the development, making it nutrient neutral or reducing the level of mitigation required.

If further mitigation is required, this can often be achieved within the site boundary of the development proposal or within the applicant’s ownership boundary.

Our teams have been able to help clients overcome nutrient neutrality issues on their developments with relatively simple solutions including:

• Small scale woodland planting to create an orchard within a site area.

• Shrub planting to create hedgerows around the perimeter of a site boundary.

• Woodland planting along the access to a site. For larger scale developments, mitigation solutions may need to be found off-site or on land outside the applicant’s ownership.

OFF-SITE MITIGATION

Landowners within nutrient neutrality catchment areas have an opportunity to take land out of agricultural production and convert it to one which has a much lower nutrient leaching rate such as woodland, wetland, conservation grassland and heathland. This can be used to create ‘nutrient credits’ which can then be sold to developers to offset their nutrient load on the waterways - subject to approval by the LPA in conjunction with NE.

Given that the nutrient neutrality guidance covers 74 LPAs across England, and with landowners often looking for alternative income streams, the sale of nutrient credits is likely to become a very competitive marketplace.

Indeed, NE have secured agreements to revert arable land to create nutrient credits for developers within the Tees Valley to purchase.

These were recently auctioned at £1,825 each which will help to establish a market rate. However, the number of credits which each development needs is in doubt.

CURRENT UNCERTAINTY

Whilst applauded by many for this scheme, NE have been criticised for their production of a metric which over-estimates the additional nitrates from a development. At the time of writing some LPAs affected are looking to use substantially lower figures and clarity on the correct figure is needed before developers are likely to commit to mitigation strategies.

PROFESSIONAL HELP AND GUIDANCE

At GSC Grays we seek to ensure that each mitigation strategy is proposed in line with your objectives. Once an appropriate mitigation scheme has been developed, a Habitats Regulations Assessment must be undertaken in consultation with NE who will need to be satisfied that the mitigation measures will achieve nutrient neutrality. The applications with which we have been involved are some of the first to be approved by NE and to be determined within the affected catchment areas.

MAY 2023 17

ALICE BONAS SENIOR SURVEYOR

694933 alb@gscgrays.co.uk

01833

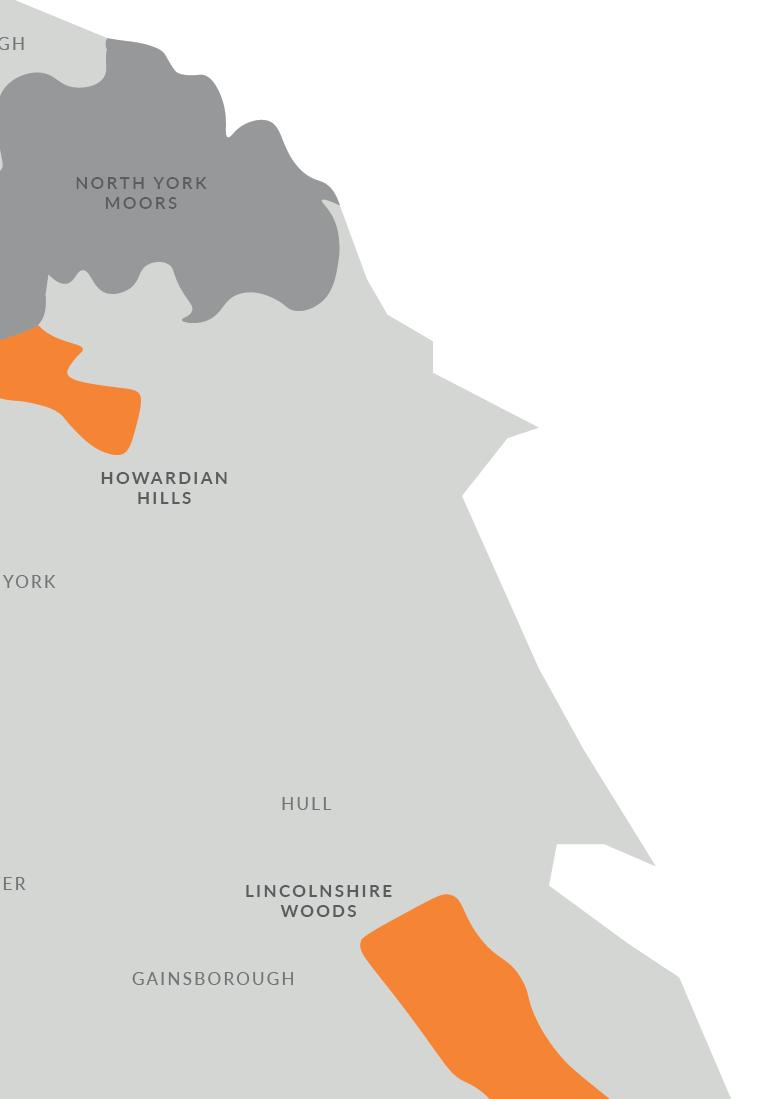

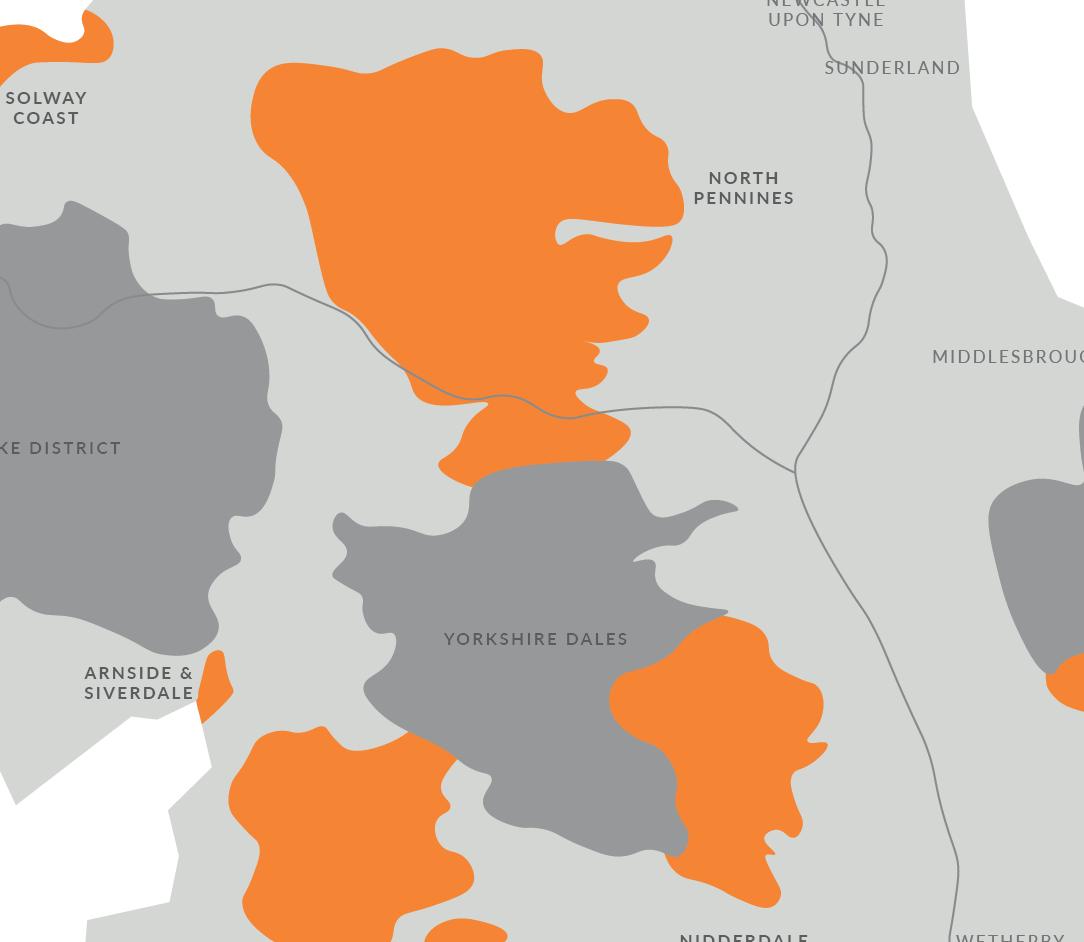

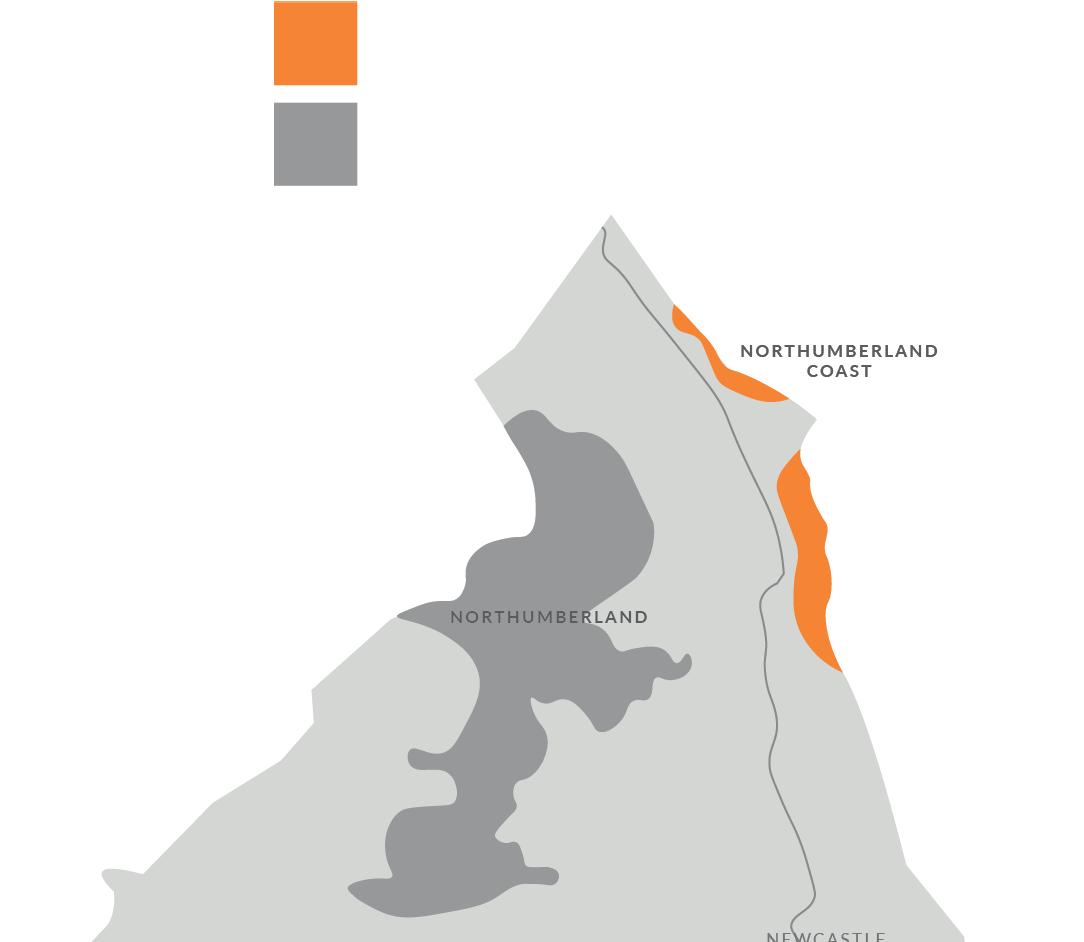

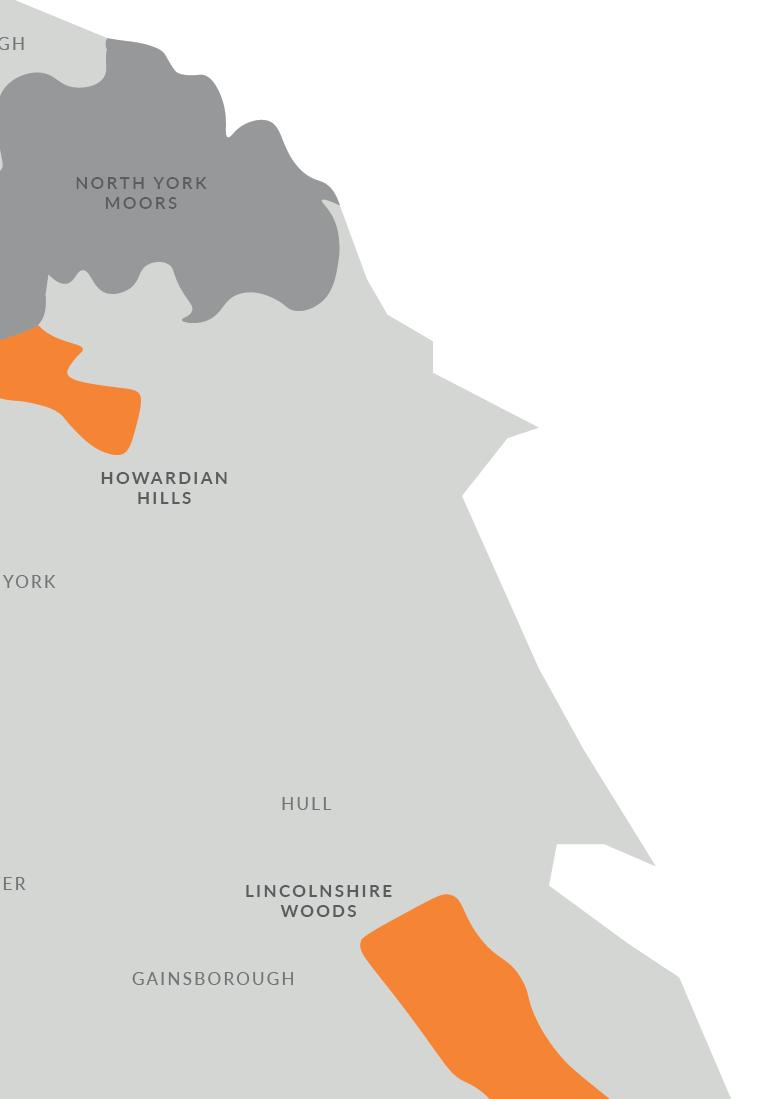

F ARMING IN PROTECTED LANDSCAPES FUND

A flexible fund often overlooked by farmers.

On 2ⁿd February 2023 it was announced that the Farming in Protected Landscapes (FiPL) programme will be extended until March 2025.

With more money available, now is a good time for farmers in these areas to consider making an application.

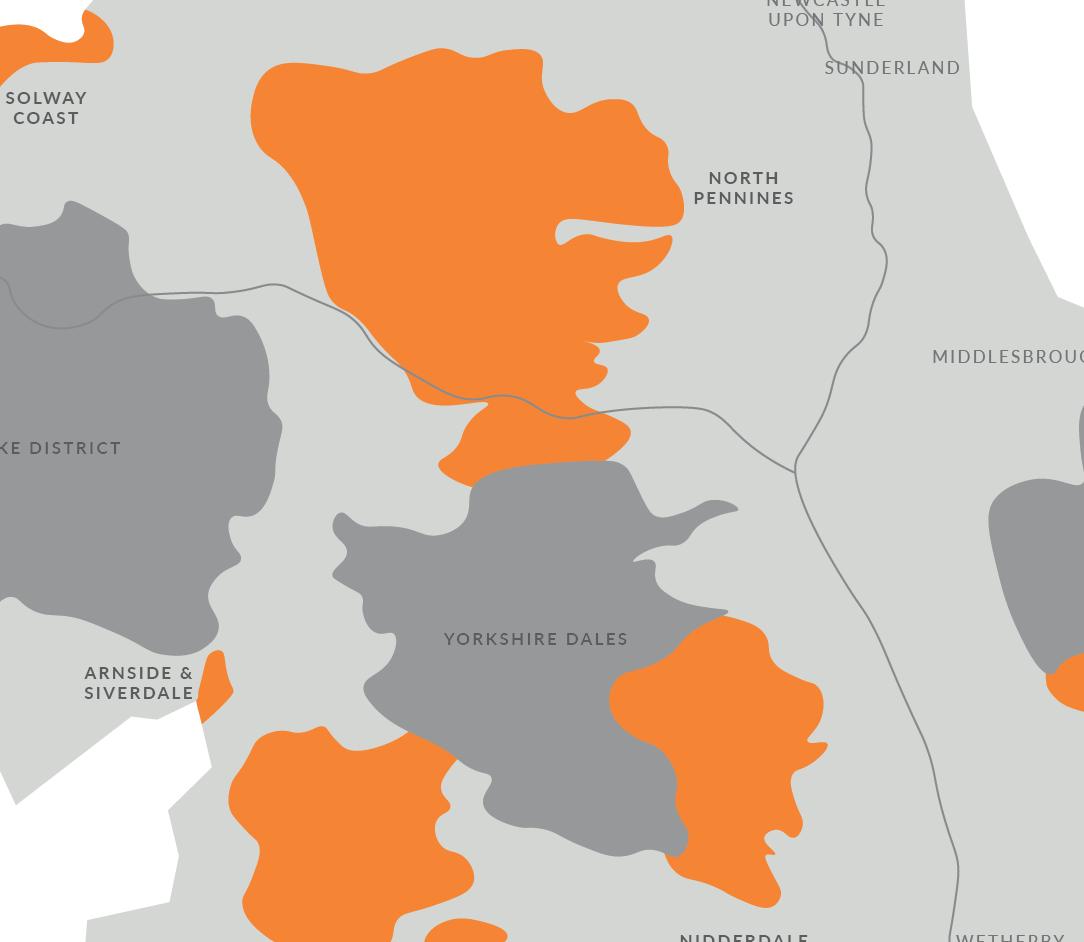

First introduced in 2021, FiPL is a part of Defra’s Agricultural Transition Plan offering funding to farmers and land managers (public, private or charity sector) for projects which help to improve and protect National Parks and Areas of Outstanding Natural Beauty (AONBs) and support local communities.

FiPL works differently to other schemes, avoiding prescribed options or actions in favour of a broader list of outcomes against which supported projects must deliver. The programme will pay for projects that result in at least one ‘climate, nature, people or place’ outcome and which also support the management plan objectives of the relevant protected area. Funding of up to 100% of the cost of the project is available where there is no commercial gain, and reduces depending on how much benefit there is for the business.

GSC GRAYS 18

INBUILT FLEXIBILITY AND CONF USION

While this offers an amount of flexibility, the differing priorities and the broader scope of the scheme has led to confusion by some farmers and land managers as to what to apply for. The amount of funding available in each protected area also varies, creating differing objectives and affecting the type of projects they may be willing to fund.

To offer some clarity, we have shared guidance we have received from the FiPL officers in each of the protected areas in Northern England on their differing priorities and types of projects eligible for funding.

HOWARDIAN HILLS AONB

The focus in this area is on projects which benefit the landscape of the AONB. Examples of the type of projects which have been supported include:

• Traditional hedgerow planting to assist in strengthening the landscape framework.

• Woodland planting provided it does not interrupt the open landscape visually.

• Projects which preserve historic features or restore traditional parklands.

LAKE DISTRICT NATIONAL PARK

The FiPL panel here are happy to provide funding for farm diversifications and nature-based projects including:

• Woodland creation.

• Hedge and wildlife corridor creation.

• Carbon auditing.

• Farm diversification projects including a farmbased traditional bakery and an abattoir.

NIDDERDALE AONB

The FiPL panel here are steering away from projects which can be delivered under other environmental schemes unless part of a wider package, and generally will not fund work which could be delivered under Countryside Stewardship (CS). The panel also advised that capital items for machinery are more likely to be funded where farmers work together to form a machinery ring. This area has supported:

• Projects for farmers to enter regenerative farming, providing advice, soil sampling and equipment to support the transition.

• Children’s development and learning of the landscape and agriculture (where farms are not currently providing access under stewardship).

• Farmers and land managers outside of the AONB where their project delivers for the AONB for example water quality or nature projects.

MAY 2023 19

Area of Outstanding Natural Beauty National Park

NORTH PENNINES AONB

Projects funded in this area have been heavily focused on landscape preservation and nature themes. Any activities with a CS rate equivalent will be paid out at that rate. Projects with capital items, for example equipment to reduce soil compaction, are more likely to be accepted if part of a wider package. Funded projects have included:

• Facilities for education, conservation and wellbeing events.

• Hedgerows and tree planting.

• Soil sampling and meadow surveys.

• Dry stone wall restoration.

NORTH YORK MOORS NATIONAL PARK (NYMNP)

The NYMNP FiPL team fund projects which are in line with their management plan, which focus on climate, nature, health and wellbeing objectives. They have an estimated project spend of £100,000 for this year which they expect to see increase next year. Funded projects have included:

• Fencing of grassland in a SSSI to allow restorative cattle grazing.

• Footpath improvement and bridleway.

• Water wheel feasibility study.

NORTHUMBERLAND NATIONAL PARK

This protected area has a large funding pot, funding £350,000 worth of projects last year. Applications in this area must support FiPL objectives and at least one management plan objective. Projects which have been funded include:

• Wetland creation feasibility study and grip profiling.

• Sitka Spruce regen removal, bracken control and dry-stone walling restoration.

• Restoration of dilapidated historic walls.

• Planting of 40 specific variety fruit trees.

YORKSHIRE DALES NATIONAL PARK (YDNP)

Traditional barn restoration projects have been popular in this area and are therefore very competitive - a strong application is crucial. Other examples of projects funded by the YDNP include:

• Stone wall restoration.

• Peatland restoration.

• Moorland fencing.

• Riparian tree planting.

DON’T DELAY!

Each protected area has a limited fund to allocate and other third sector organisations and land managers are being very proactive in putting forward projects.

Funding is not limited to nature conservation work - farm diversification projects or items aimed at increasing the resilience and sustainability of your business are also eligible.

GSC GRAYS 20

WE ENCOURAGE FARMERS TO MAKE THE MOST OF THIS FUNDING WHILE IT IS AVAILABLE.

OLIVIA FOX SENIOR ENVIRONMENT & SUSTAINABILITY CONSULTANT 01748 897603 ojf@gscgrays.co.uk

RENTERS REFORM BILL

Strengthened section 8 eviction notices announced for landlords.

CHANGES TO NOTICE PERIODS

These proposals should go some way to alleviate landlord concerns around regaining control of their rental properties.

Whilst the abolishment of section 21 no fault notices has grabbed the headlines, the Government has also committed to reform the current section 8 grounds of possession so that ‘they are comprehensive, fair, and efficient, striking a balance between protecting tenants’ security and landlords’ right to manage their property.’

NEW SECTION 8 EVICTION GROUNDS

The Government plans to strengthen existing section 8 eviction notices by proposing new grounds for eviction, including:

• Landlords wishing to sell their property with vacant possession.

• Allowing landlords or a close family member to move into a property.

• Repeated serious rent arrears. Eviction will be mandatory where the tenant has been at least 2 months in arrears 3 times in the previous 3 years (regardless of the remaining balance at hearing).

• Agricultural employment, where the property is needed to house a new employee.

• Agricultural tenant to give vacant possession at the end of the tenancy.

However, to maintain the intended protection of tenants’ rights, the length of notice landlords will be required to give tenants will be increased to a minimum of 2 months where the reason for eviction is outside the tenant’s control – for example where the landlord wishes to sell or move into the property. Less notice will be required for serious tenant fault for example in the case of criminal or antisocial behaviour, and the notice period for rent arrears will be 4 weeks (up from 2 weeks). Furthermore, landlords will not be able to use these grounds in first 6 months of the new tenancy.

NOT LEGISLATION…YET

It is important to note that while this is still a white paper, the Government stands firm on their commitment to push this through to legislation. “The Government have a manifesto commitment to abolish section 21, and we will do so as soon as parliamentary time allows.” Felicity Buchan, Under-Secretary for Levelling Up, Housing and Communities (20th February 2023).

With a general election expected in 2024, that time could be fast approaching.

MAY 2023 21

The Government’s white paper, ‘A Fairer Private Rented Sector’, published in June 2022, set out their intention to abolish section 21 notices which allow landlords the right to impose no-fault evictions.

CAROLINE

RIDLEY-MARRIOTT HEAD OF RESIDENTIAL LETTINGS 01748 829210 crm@gscgrays.co.uk

ARE YOU FULLY COVERED?

With 84% of commercial buildings and an estimated 90% of houses of ‘significant’ value reportedly under-insured, or insured for the wrong amount*, and with the insurance market looking set to redress the most significant losses in over a decade, now would be a good time to reassess your property insurance cover.

The insurance market is facing considerable challenges, experiencing significant losses in 2022 primarily as a result of more commonplace extreme weather events, the implementation of the FCA’s pricing reforms and high inflation. With losses looking set to continue into 2023, Ernst and Young are predicting that insurance premiums could rise by up to 30% in 2023.

Underwriters are also looking at claims more closely and instructing loss adjusters to check whether affected properties are fully valued. Although Storm Otto, mercifully, did far less damage than Storm Arwen, it has served as a timely reminder to make sure that building insurance cover is both up to date and at an appropriate level to mitigate rising premiums and ensure you are fully covered if the worst were to happen.

To do so, I suggest that the following key questions are asked:

1. WHEN WERE THE BUILDING REINSTATEMENT COSTS LAST CHECKED?

Normally, the amount of cover is increased in line with standard approved indices each year. This is fine, but it can provide a false sense of security – particularly if this has not been checked for some years. Ongoing monitoring of construction costs can be key to ensuring your cover is at the appropriate level.

GSC GRAYS 22

Is it time to reassess your property insurance cover?

*Data from RebuildCostASSESSMENT.com which provides the insurance industry with data on the accuracy of building sums insured in the UK each year.

AM I INSURING FOR THE RIGHT USE?

It is also worth considering whether traditional farm buildings, for example, really do have development potential and, if not, it may be better to cap the insurance cover to the cost of a modern replacement building.

3.

I CHANGE TERMS OF COVER?

It may be that there are some assets whose cover could be capped on a first loss basis to help reduce the premium. Or the current policy excess - the amount you pay before cover starts - may be low and could be increased to achieve further premium reductions.

Finally, consideration could also be given to getting tenders from the market to ensure that you are getting the best value.

MAY 2023 23 HUGO MALLABY DIRECTOR 0191 385 1737 achm@gscgrays.co.uk

WE REVIEWED A LARGE ESTATE’S COVER RECENTLY AND RECOMMENDED THAT THE CLIENT INCREASED THEIR COVER BY 75%.

2.

SHOULD

4. SHOULD I CHANGE INSURER?

RENEWABLE ENERGY SCHEMES

Forward-looking farmers and landowners are increasingly integrating energy production into their existing agricultural operations to build businesses that are both environmentally sustainable and economically viable. Landowners considering renewable energy schemes would be well advised to ensure inheritance tax implications are considered from the outset.

GROWING TREND WITH LANDOWNERS

Renewable energy schemes already account for over a quarter of UK electricity production and it is estimated that farmers own or host over half of the UK’s solar power and anaerobic digestion capacity, as well as most of the wind power.

Although national government policy has recently been cutting incentives for low-carbon energy, further growth in agricultural renewables will likely be driven

by reducing costs of some renewable technologies (especially solar PV), and the emergence of new complementary technologies. Renewable energy production has indeed become part of the agricultural growth agenda.

SHORT TERM INCOME VERSUS LONGER-TERM CONSIDERATIONS

With three-quarters of the British land area used in the agricultural sector, farm businesses can choose to become energy producers in their own right or use their existing land / building assets for use as an energy plant developed by others. There is often a tendency for landowners to concentrate on the potential income benefits in the shorter term and reducing the tax on the profits from the energy generation or lease income.

However, it is also vitally important to consider how any changes made now might impact succession proposals for the business, and how the renewable energy business activity will affect the longer-term tax planning position of your land and the various tax reliefs that are linked to it. With many leases extending up to 30 years, the potential changes in fiscal position of the asset for that period, or the driver to allow for an income stream for the younger generations of the family, need to be thought through as early as possible.

GSC GRAYS 24

An inheritance tax planning opportunity for farmers and landowners?

INHERITANCE TAX (IHT) CONSIDERATIONS

There are usually three main phases to renewable energy schemes that, if considered with the right professional advice, offer an opportunity to astutely plan for IHT from the earliest stages.

1. STRUCTURING

Taking the time to structure the business appropriately at the outset, (including who/what is the best entity to own the land/asset on which the proposed scheme will occupy), can be hugely beneficial further down the line. There are a number of potential options for restructuring an existing farm business, often linked to how the business will be financed. The ultimate aim is to structure the business in such a way that will maximise tax reliefs but also provide flexibility for future growth and development.

2. DEVELOPMENT AND INSTALLATION

Most renewable energy businesses will require significant upfront expenditure with returns spread over a longer period of time (usually linked to the life expectancy of the equipment or the lease length). It is essential to consider the treatment of the forthcoming income to ensure you maximise tax reliefs where possible.

3. OPERATION

Once developed, the operation can generate regular returns, often with minimal running costs, plus there is an asset with a tangible value.

As a landowner you need to ensure that the land continues (where possible) to qualify for one of the exemptions from IHT, and you will not want your renewable energy activity to jeopardise that.

A renewable scheme with active involvement from the landowners on the land helps to maximise the use of Business Property Relief as this reinforces that there are the 'badges of trade' to help achieve the Business Property Relief argument.

ALTERNATIVE OPTIONS

A somewhat simpler approach to renewable energy projects is to lease the site to a renewables company and benefit solely from the lease income. This would usually be taxable in the same way as any other rental income and is likely to incur income tax. As this is a commercial lease and not an agricultural use, the Agricultural Property Relief from IHT may be lost. However, Business Property Relief from IHT may still be available, providing this rental income makes up an appropriately proportional part of the total farm business income.

An alternative, and increasingly popular approach, is to enter a joint venture with a renewables company which, from HMRC’s perspective, will require you to demonstrate that you are sharing in both the profits and the losses of the business activities.

Each approach will have different tax treatments and requires specialist accountancy advice.

PROFESSIONAL ADVICE

With so much to consider before embarking on a renewable energy project, it is essential to seek early consultation with your agent and other professional advisors prior to any scheme commencement, to ensure the maximum income is balanced against future tax implications.

MAY 2023 25

THE LONGER-TERM BENEFITS OF HAVING AN INTEREST IN A RENEWABLE ENERGY BUSINESS CAN BE SIGNIFICANT.

DAVID COOPER DIRECTOR 01748 897611 dpc@gscgrays.co.uk

PROPERTY ROUND-UP

Despite many headlines reporting doom and gloom, our agency branches are seeing a more resilient market with an increasing number of buyers and sellers, helped by a growing number of mortgage products. Below is a sample of some of the properties on offer.

MALVERN HOUSE

A spacious Victorian townhouse with ample living space for a growing or multigenerational family, or a B&B business for those looking for an income producing property.

GUIDE PRICE: £450,000

HAMBLETON HOUSE

A superb family home, meticulously updated and enhanced in the sought-after village of Marton cum Grafton. This five-bedroom home has amazing views towards the Hambleton Hills.

GUIDE PRICE: £1,000,000

WOODRIDGE HOUSE

A charming, part Grade II listed country home, designed by architect George Stastny. It is spacious and wellappointed retaining a wealth of period features and offers highly flexible accommodation.

GUIDE PRICE: £625,000

PARK HOUSE AZERLEY

A fantastic equestrian property with Lutyens influenced chalet style house. Positioned in a peaceful setting within private parkland of around 6.5 acres.

GUIDE PRICE: £1,250,000

GSC GRAYS 26

BARNARD CASTLE

ROMALDKIRK

BOROUGHBRIDGE

SOLD

FORSALE UNDEROFFER

UNDEROFFER

Follow us on social media to keep up to date with the latest properties brought to market:

gscgrays_estateagency

GSC Grays Estate Agency

A detached stone-built property with stunning countryside views. Immaculately presented accommodation with an abundance of characterful features.

GUIDE PRICE: £325,000

OLD PARSONAGE INGLEBY

An impressive family home which has been completely modernised while retaining considerable original character. Situated on the edge of the North York Moors, the property benefits from glorious views.

GUIDE PRICE: £800,000

A Grade II listed property occupying a substantial plot within the village of Thornton le Moor. It offers spacious accommodation, full original features and benefits from two separate cottages.

GUIDE PRICE: £1,000,000

BAXTER COTTAGE

GREAT AYTON

Built in 1731 from Yorkshire stone, this charming Grade II listed property offers flexible and spacious accommodation and is situated in a prime position overlooking the River Leven.

GUIDE PRICE: £875,000

MAY 2023 27

A D BARN FREMINGTON

LAUREL DENE NORTHALLERTON

GREENHOW

FORSALE

SOLD

UNDEROFFER

FORSALE

GSC GRAYS 28 SOLD PRESTON LODGE FARM COUNTY DURHAM Former pig unit with productive arable land. 147 acres. GUIDE PRICE: £625,000 SOLD SOUTH MEADOWS FARM NORTHUMBERLAND Free-range egg production unit for 16,000 hens. 64 acres. GUIDE PRICE: £995,000 SOLD OLD PARK HOUSE FARM NORTH YORKSHIRE Well-equipped mixed unit with development potential. 99 acres. GUIDE PRICE: £1,650,000 SOLD LOWTHIAN GILL FARM CUMBRIA First class modern dairy farm with immaculate farmhouse. 498 acres. GUIDE PRICE: £7,000,000 SOLD CINDRA HOW FARM NORTH YORKSHIRE Environmental, wildlife and conservation haven. 95 acres. GUIDE PRICE: £1,100,000 SOLD HORDEN ALLOTMENT COUNTY DURHAM Compact grouse moor in the North Pennines. 300 acres. GUIDE PRICE: £750,000 ARE YOU LOOKING TO SELL YOUR FARM? We had an outstanding 2022 selling a range of farms and country houses across the North of England. SOLD SOLD WEST WOODS FARM WEST YORKSHIRE Investment farm on AHA tenancy. 521 acres. GUIDE PRICE: £995,000 SOLD WEST WOODS PLANTATION WEST YORKSHIRE Commercial, mixed timber woodland. 364 acres. GUIDE PRICE: £995,000 TRUST OUR HIGHLY EXPERIENCED FARM AND COUNTRY HOUSE EXPERT TO HELP YOU! 01423 590500

BUSINESS EXPANSION IN THE NORTH

Simon is a property consultant and Chartered Surveyor with over 25 years of experience in land agency, estate management and residential development. He offers the rare combination of having worked for both developers and the landowning and farming sectors.

James has worked as a farming and sporting estate manager in North Yorkshire for 17 years and his role includes business reviews, enterprise budgeting and monitoring, BPS and grant applications, as well as core farm management advice.

The offices in Kirkby Lonsdale and Penrith have been opened in response to customer demand and will provide innovative business advice across different service sectors including land, farming, property management, planning and development, renewables and environmental management. The team is headed up by Sam Cole, a land agent with an upland specialism that sees him well placed to meet the requirements of our clients in the region.

Joining Sam is Holly Story, our Head of Environment and Sustainability, along with three new recruits in Simon Waller, Director, James Bush, Associate, and Sarah Howe, Graduate Environmental Consultant.

With an increasing demand for advice on eco-system services, Holly’s nationally recognised expertise will help the company advise on the opportunities being presented to all landowners but especially those in the uplands.

David Gray, Chairman at GSC Grays said:

“These are exciting and challenging times. Our ambitious expansion plans are designed to deliver our expertise to an ever-increasing number of clients."

"What sets GSC Grays apart is that our offices are staffed by experts who live and work in the local area which means they really do understand the requirements of the regions they are serving. We now employ over 130 members of staff in 12 offices across the North of England, but we believe it is our local approach which adds real value and long-lasting relationships.”

Further expansion is underway with the development of a new office in the Driffield area as we push further into the south and east of our region.

MAY 2023 29

The latest stage of our commitment to deliver outstanding services across the North of England has taken a huge leap forward with the opening of two new offices in the North West.

WELCOME TO THE TEAM

HANNAH DYKE FARM BUSINESS CONSULTANT

Originally from a farming family, Hannah joined the Farm Business team at Boroughbridge in 2022. Prior to this she gained a BSc (Hons) degree in Agriculture, managed a 1,600-head calfrearing unit and oversaw the completion of a significant grantfunded farm diversification project.

JAMES BUSH ASSOCIATE

James has worked as a farming and sporting estate manager in North Yorkshire for the last 17 years, following several years practising as a farm business consultant in the county. His background also includes agricultural banking and finance, and national-level advisory work.

SIMON WALLER DIRECTOR

Simon is a property consultant and Chartered Surveyor with over 25 years of experience. He offers a broad experience within the Planning and Development team with the rare combination of working for both developers and the landowning and farming sector.

JENN NEILL ASSOCIATE

Jenn is a qualified Chartered Surveyor and has provided advice to clients for over 10 years. Recently her work has primarily focused on utility, infrastructure and renewable energy projects alongside compensation claims, telecom mast leases, easement & wayleave negotiations and access agreements.

SIMON WALTON FARM BUSINESS CONSULTANT

Simon has previously worked with farms across Yorkshire, Lancashire and Cheshire carrying out farm benchmarking on a financial and physical basis. Having gained his degree in Economics from the University of Warwick, Simon has a good knowledge of financial figures.

GSC GRAYS 30

At GSC Grays we bring extraordinary people together to build a brighter future for the rural land and business commnity. As a rapidly growing business we have been delighted to welcome new faces to our teams over the past few months.

TEN CHALLENGES

We wrapped up our 10th anniversary year having supported a number of local, national or industry charities by either volunteering our time, or by baking, cycling, dancing, running and walking our way to raising close to £10,000!

MAY 2023 31

CHAIRMAN'S CLOSING REMARKS

Pressure on land use needs compromise and cooperation.

The pressure on land use in England has never been greater. There is a perfect storm brewing between the wants and needs of the country and the experiences and aspirations of those who live and work in rural England.

We are told by the media that the countryside is in crisis and must be protected at all costs. In addition, the Government has multiple agendas, wanting land for more trees, local nature recovery strategies, biodiversity net gain, nutrient neutrality, renewable energy, recreation and wellbeing, improved infrastructure, more housing, and some way down the list, food production.

The nation may also want the above, but most don’t really want change, particularly if that change is perceived to harm the environment, costs more, or spoils our enjoyment of domestic life. Meanwhile the traditional landowner and farmer looks for opportunity and realises that there just isn’t enough land in England to satisfy everyone. In 2023, compromise appears to be a long-forgotten word.

There is a disconnect between those who want and those who can provide, and I fear that Whitehall and the urban dweller are becoming increasingly removed from the realities of rural life and the necessity to survive economically - not helped by the recent ‘Wild Isles’ series on BBC1.

The Government and the ever-increasing number of NGOs who feel they have the right to impose their own desires upon the rural dweller and landowner, must remember that currently, (and thankfully), it is ultimately up to the property owner what happens to their property.

The pressures on the nation’s limited land resource will only increase over time. Every effort must be made to bring those with different agendas together, to engage in open and frank communication to encourage a mutual understanding of the issues faced in 2023. SIGNIFICANT WORK IS BEING

As ever, a degree of compromise and a willingness to work together will be necessary.

01388 487000

dag@gscgrays.co.uk

GSC GRAYS 32

DAVID GRAY CHAIRMAN

DONE BY SOME ESTATES, FARMERS AND NGO S TO BRIDGE THE KNOWLEDGE GAP, BUT FURTHER WORK IS NEEDED.

OUR OFFICES

We have dedicated consultants across the North of England ready to hear from you.

ALNWICK

alnwick@gscgrays.co.uk 01665 568310

BARNARD CASTLE barnardcastle@gscgrays.co.uk 01833 637000

BOROUGHBRIDGE

boroughbridge@gscgrays.co.uk 01423 590500

COLBURN colburn@gscgrays.co.uk 01748 897630

DRIFFIELD driffield@gscgrays.co.uk 01377 337180

HAMSTERLEY hamsterley@gscgrays.co.uk 01388 487000

Estate Agency

Professional Services

CHESTER-LE-STREET chesterlestreet@gscgrays.co.uk 0191 303 9540

HEXHAM hexham@gscgrays.co.uk 01434 611565

KIRKBY LONSDALE kirkbylonsdale@gscgrays.co.uk 01524 880320

LEYBURN leyburn@gscgrays.co.uk 01969 600120

PENRITH penrith@gscgrays.co.uk 01768 597005

STOKESLEY stokesley@gscgrays.co.uk 01642 710742

MAY 2023 33

NORTH PENNINES AONB

GSCGRAYS . CO . UK