NAVIGATING FARMING SYSTEMS

Intensive vs. extensive approaches.

Key steps for landowners.

BUILDING RESILIENCE

Using

MANAGING VOLATILITY

Strategies

Intensive vs. extensive approaches.

A

A vision for the future.

Key steps for landowners.

Intensive vs. extensive approaches.

Key steps for landowners.

BUILDING RESILIENCE

Using

Strategies

Intensive vs. extensive approaches.

A

A vision for the future.

Key steps for landowners.

Welcome to the eighth edition of the GSC Grays magazine, once again delivering practical advice and strategic insights on a wide range of topics affecting landowners, estate managers, and farming businesses.

Resilience is a recurring theme in this issue. We delve into the financial complexities confronting estates which are increasingly impacted by rising costs and volatility, and discuss how strategic foresight and evolving revenue opportunities are a growing necessity to securing future viability (page 2).

Greg Ricketts addresses the enduring challenge of market volatility and the need to acknowledge its inevitability (page 6). He emphasizes how a comprehensive understanding of market dynamics and proactive planning can lead to lower production costs and improved cash flow which will greatly improve financial resilience. The catastrophic impact of the relentless wet weather on harvests for some farming businesses once again underlines the importance of attaining financial resilience to weather the metaphoric, and literal, storm.

Ali Gray examines how the Sustainable Farming Incentive can help optimise grazing practices for sheep

farmers (page 4). The article highlights the necessity of adjusting management practices to maximise potential benefits and increase resilience. Jake Nixon takes a broader perspective, comparing intensive and extensive farming systems. In his article on page 8 he outlines the benefits and challenges of each approach, providing insights on how farmers can select the best system for their operations.

I am thrilled to share how we have bolstered our own business resilience with the acquisition of the Carter Jonas Kendal office (page 24) and the recruitment of some key individuals across our wider office network, and share our exciting plans for a new office in Driffield (see page 19). This development further strengthens and extends our multi-disciplinary services across the North of England and into the Scottish Borders.

With the General Election on the horizon and the real possibility of a change in government, resilience will be the watchword for rural businesses who must find a way to navigate the uncertainties, challenges and opportunities that this will inevitably bring.

GUY COGGRAVE

MANAGING DIRECTOR

01748 897606

gsc@gscgrays.co.uk

Traditional estates, once emblematic of enduring wealth and stability, are now confronted with a myriad of financial complexities that threaten their sustainability across generations. Historically, these estates served as investments for high net worth individuals, providing both prestige and income.

However, as subsequent generations inherited and managed these estates, fundamental shifts occurred. What was once a diversified investment portfolio has transformed into a primary source of income, subject to volatility, rising costs and evolving revenue streams.

Over time, the financial landscape of traditional estates has undergone profound changes. Costs have escalated significantly, outpacing the growth of investments. Farm rents, once the bedrock of estate revenue, have failed to keep pace with the exponential rise in residential income which has surged by over 20%. Concurrently, commercial rents have plateaued,

and forestry revenues have retreated from their zenith in the 1980s. Despite an uptick in gross income from sporting activities, mounting costs have eroded potential profits. Grant and support income, while exhibiting variability within land types, has shown an overall upward trajectory.

Succession planning poses a formidable challenge to estate longevity. No longer is it commonplace for estates to be unilaterally passed down to the eldest son. Modern sensibilities prioritise equitable distribution among heirs, necessitating nuanced investment strategies to ensure fair wealth allocation, potentially through shares or other independent income-generating assets.

Trusts, long utilised to safeguard generational wealth, present their own set of challenges if not actively managed. As they transition across generations, trusts incur a 6% charge, imposing a financial burden in the absence of liquid assets.

The recent budget announcement proposing a reduction in Capital Gains Tax may offer a tempting opportunity for estate owners to divest underperforming assets, particularly where rental portfolios fail to cover repair costs over prolonged periods. However, such strategic manoeuvres can provoke community resistance and

hinder future development prospects. Illustrative of the times we are in, with the calling of a snap election, the necessary legislation may not make it through the parliamentary process, leaving the decision in the hands of the next government.

Reinvesting proceeds from asset sales into highyielding ventures like strategic land, commercial properties, or shares, presents a viable avenue for augmenting estate income.

Bringing farms back in hand, leveraging favourable grants and subsidy regimes, presents an opportunity for optimising profitability and retaining the tax benefits associated with active farming. However, this option requires astute agricultural management practices and a keen eye for market dynamics.

In this era of unprecedented challenges, the role of land agents must evolve to meet the demands of the modern estate landscape. Proactive and dynamic

engagement, characterised by strategic foresight and adaptability, supplants traditional advisory roles, ensuring the estate's viability across generations.

In conclusion, the financial challenges confronting traditional estates necessitate a multifaceted approach to long-term sustainability. By embracing innovative strategies and facing into challenges head on, estate owners can navigate these turbulent times and safeguard their legacies for generations to come.

DAVID GRAY CHAIRMAN

Using SFI to support a change of grazing

Despite a very wet winter and very challenging conditions, ewes have generally coped well and remained fit, having benefitted from plenty of grass last autumn.

Further wet weather made for a challenging lambing period, but the sun has finally arrived and it is pleasing to see new season lamb markets are strong. Future resilience is not just about here and now, we have learned acutely in recent years, farming can change quickly for the better and the good. So the question is, can your flock sustain big swings in the market, weather extremes, allow some cash to be put aside when its good, and get through unscathed when times are harder?

Input costs have risen sharply just as the reduction in BPS starts to bite. Labour is harder to come by and we know the weather will keep offering unseasonal surprises. However, not wishing to present doom and gloom, future resilience requires an optimist as well as realists’ point of view and presented with all these challenges, there is now a real opportunity for farmers to take stock, plan for the future and change their businesses for the better.

Grazed grass is the undisputed cheapest and best quality form of nutrition for the ewe flock. Optimising grazed grass should be the key focus. Altering management to maximise grass quality will reduce the need for costly feed supplements, and extending the

length of the grazing season can help avoid the need to house stock. Provided there is balanced mineral and forage analysis data to hand, this can go a long way to boosting flock profitability.

Are you getting the best potential out of your grazing platform? In order to get the enhanced grazing quality over a longer grazing season, a change of management may be something to consider. Set stocking regimes have their place and can work fine, while the perception is that this is simpler and less costly to manage. However, rotational grazing techniques, which do not cost the earth in infrastructure and equipment costs, can yield significant benefits despite the often false perception that it’s too complicated and creates a lot of hard work. With a well-designed and thought-out plan, rotational grazing can be implemented and managed relatively easily. Probably the biggest challenge is change in mindset and the will to make it work!

An easy win to help you along is to implement SFI options on grazing land to include legumes on grassland, or better still herbal leys, which can enhance grass quality and lengthen the grazing season if managed accordingly.

GRASSLAND FARMERS NEED A GOOD EXCUSE NOT TO HAVE A SFI GRASSLAND OPTION ON ALL THEIR FIELDS!

Farmers looking at their SFI options are rightly tempted by the payment rates for Herbal Leys (CSAM3). Don’t just chase the SFI payment, there is more potential opportunity in the detail. Herbal leys can’t continue to be grazed as you always have done as they can be easily ruined by set stocking. With too much prolonged grazing pressure, sheep just graze off the herbs and legumes within the ley, resulting in the aim of the SFI option not being met.

Researching the correct seed mix is also an important factor. Most suppliers are now offering herbal ley mixes. Make sure you fine tune the mix to your farm and your planned management regime. Again, the potential opportunity is in the detail.

Incorporating herbal leys into the grazing programme means a change in management practice if their full potential is to be realised, requiring rest periods and a rotational grazing system to be established. The positive news is that those who are prepared to change their grazing management will see improved growth rates of livestock on the leys as a result, along with the decent payment. Look after your herbal ley and it will look after your ewes. There are examples of farmers who have transitioned into rotational grazing systems and found that they have been able to increase the stocking density over the grazing platform, and in time increase numbers, ironically.

Extending the grazing season into the shoulder months does come with its issues in terms of extreme weather. This can be mitigated by installing improved infrastructure and hedge boundary networks through utilising CS Capital Grants. There are also grants available for electric fencing and water infrastructure through the Farm Equipment and Technology Fund.

Transitioning through changes in the grazing platform may need stock number adjustments in the short term, it may unearth other questions such as; do I have the correct ewe genetics to optimise grass in the future, is the marketing strategy right, will I have sufficient future labour supply? In any event, the aspiration should be to achieve better utilisation of higher quality grass which could allow an increase in stock density again in time…but in a system that is more resilient, which might not need as much work.

ALI GRAY DIRECTOR

In recent times, volatility has become an enduring challenge for farm businesses, impacting both input costs and output prices. Whether in the form of fluctuating commodity prices or unpredictable expenses, a strategic approach is required to create a sustainable business and ensure long-term success.

A fundamental aspect of weathering volatility lies in understanding its inevitability. From cereals to livestock, and from feed to fuel, no aspect of farming remains untouched. Acknowledging and addressing these issues is the cornerstone for developing resilient strategies tailored to the unique needs of each farming enterprise.

One crucial tactic for mitigating risk involves keeping costs low to achieve the greatest profit margin. For most farmers, the first and fundamental step is understanding their cost of production, including labour (plus unpaid family input), cost of borrowing, rents, and other expenses. Only once this is achieved

can they begin looking for efficiencies. A recurring theme in our Farm Business Advice Service review has been that less intensive systems, less reliant on inputs, have been lower yielding but far more resilient to external factors and, therefore, more profitable in tougher markets. By striving for the lowest cost of production, farms can not only cope with challenging times but are also better positioned to capitalise on favourable market conditions, maximising profitability when opportunities arise.

Many farmers are bound by overdrafts and finance limits. Those who can manage their cash flow proactively can buy when market conditions are favourable, rather than out of necessity. Purchasing inputs forward at advantageous prices, coupled with strategic selling during market upswings, enables farmers to sell when conditions are right, not when they are forced to.

Achieving stability extends beyond cost of production and cash flow. It requires a comprehensive understanding of market dynamics and a forwardlooking mindset. By staying on top of market trends and proactively planning for future contingencies, farmers can position themselves for success amidst uncertainty. It is all interlinked. Once you understand your cost of production, you know what your profit

margin will be. Selling can often be a gamble, and while it is tempting to hold out for the top of the market, a better strategy is to sell when you can see sufficient profit and the recovery of costs. A popular strategy for selling cereals is the rule of thirds; selling one-third of the predicted yield at planting, one-third in spring, and one-third at the spot price to mitigate any potential yield shortfall.

Central to this approach is the production of a farm budget. A budget is not just a forecast produced at the start of the financial year, it should be a live document that is regularly reviewed and adapted depending on market conditions. A budget informs and supports long-term planning and strategic decision-making. It is also fundamental when assessing borrowing requirements and is helpful when approaching banks for lending or assisting with business restructuring.

It requires a deep understanding of market forces, coupled with proactive planning and a commitment to financial resilience. By embracing these principles, farm businesses can not only withstand volatility, but thrive.

As farm businesses confront the uncertainties of tomorrow, they must recognise volatility not as an insurmountable obstacle but as a catalyst for innovation and resilience. By adopting strategic approaches, market engagement, and financial management, farmers can create a sustainable business and achieve long-term prosperity in an ever-changing agricultural landscape.

Intensive vs. extensive approaches.

In modern agriculture, the choice between intensive and extensive farming systems is crucial for determining a farm's profitability and sustainability. These systems represent different strategies for managing land, labour, and resources, each with its own set of advantages and challenges.

Intensive farming aims to maximise output from a given land area, sometimes as small as 3-4 acres, especially in sectors like broiler or pig production. This approach typically increases the fixed costs of production per unit of output, but the goal is that the increase in output will be significantly higher than the overall increase in costs, thereby boosting profitability.

Extensive farming seeks to reduce input costs and optimise output from the available land. This often results in a lower level of output, but the intention is that the reduction in costs outweighs the decrease in output, thus enhancing profitability.

It is essential to recognise that farming systems exist on a spectrum. While pig, poultry, and dairy production are often associated with intensive farming, and beef and sheep production with extensive systems, the reality is more nuanced. For example, dairy farms using New Zealand-style or organic systems may be more extensive than some intensive beef operations. The same applies to organic poultry and pig producers.

Intensive farming systems offer several advantages. One significant benefit is the potential for higher returns in favourable years. This was exemplified by those who diversified into free-range egg production in the late 2010s experiencing substantial gains. Additionally, intensive systems can provide more employment opportunities for family members on smaller farms than extensive systems. The structured nature of intensive farming typically results in a more regimented daily, weekly, and monthly work routine with less seasonality compared to beef, sheep, and arable production. Furthermore, there are often more opportunities for career progression into management roles for the next generation or employed staff.

However, intensive systems also have notable drawbacks. They are highly dependent on commodity markets for inputs, making them vulnerable to global events. Recent years have shown how market volatility

can lead to shortages and financial pressures, such as the reduction in the national farrowing pig herd. Intensive systems also require rigorous management which can be stressful, especially with labour shortages, increasing the risk of significant mistakes. Additionally, establishing and maintaining the necessary infrastructure requires substantial investment, often leading to high levels of debt and a greater need for profit to service these repayments.

Extensive farming systems offer a different set of advantages. They have less reliance on commodity markets for feed and energy, reducing exposure to volatility and risk. These systems typically require less labour allowing for diversification or off-farm employment opportunities. Investment needs are also generally lower than in intensive systems, though careful investment in labour-saving equipment is still necessary.

On the downside, extensive systems usually result in a reduction in yield and income, particularly in the short term, which requires careful management during the transition. There is also the potential for reduced overall profitability. However, the lower investment requirements can lead to a greater cash surplus. Moreover, the reduced labour needs can limit opportunities for the next generation to become involved in the farm.

Successful intensive enterprises often feature a mix of different operations to spread risk. For example, a feed-intensive enterprise might be paired with an arable enterprise, where gains in one sector can offset losses in another. Attention to detail is crucial in these systems, and managers who can delegate physical tasks and focus on strategic planning tend to thrive.

In contrast, successful extensive enterprises focus on optimising natural resources, such as maximising milk or meat from forage and outwintering stock. Attention to detail remains vital, and effective

extensive farms often integrate multiple enterprises and explore diversification opportunities, like direct sales, marketing, or processing.

When considering a shift between farming systems it is essential to understand your financial starting point. High existing repayment requirements may necessitate careful restructuring to allow for changes. Personal objectives and attitudes towards diversification and new enterprises should also be considered, as well as the aspirations of the next generation. Market analysis is crucial to ensure that you are producing what is in demand, whether locally, nationally, or internationally. Additionally, exploring new income streams, such as Biodiversity Net Gain (BNG), Natural Capital, Carbon Offsetting, and Environmental Land Management Schemes (ELMS), can provide further opportunities.

By carefully evaluating these factors, farmers can make informed decisions about which system—intensive or extensive—best suits their goals and circumstances, paving the way for a sustainable and profitable future.

JAKE NIXON SENIOR FARM

BUSINESS CONSULTANT 07399 136304

jrn@gscgrays.co.uk

A ‘huge advantage’ for future planning.

Last October we received approval from Defra to offer a Sustainable Farming Incentive (SFI) focussed business review as part of our free Farm Business Advice Service (FBAS).

This half day on farm review was created in response to questions we received from farmers relating to the launch of SFI in September 2023. The review is specifically designed to help farmers understand the SFI options available that will be most advantageous for their farm based on their business objectives and current farming practices.

Following on from the launch of this new review, we held a series of SFI Farm Walks, in partnership with NFU North, which demonstrated the practical application of SFI actions at 19 host farms which covered mixed farming as well as arable, beef and sheep, upland and dairy operations. The walks, which were attended by over 500 farmers, were well received, with farmers indicating that they were leaving with a greater understanding of how the post-Brexit system of support could benefit their farm.

James Mills, a sheep and arable farmer near York who had an SFI review and hosted an SFI farm walk, believes the opportunity to get another pair of eyes to look at the business and analyse the options, for free, has been a ‘huge advantage’ to his business.

“Sometimes it sticks in the throat that the Basic Payment Scheme has been divvied up and handed to folks who are not delivering on the ground. But once we looked at it in the context of SFI and understanding the intricate details behind the different standards, that is where the benefit does start to come back."

“It has kicked off conversations at home in terms of what we already do and what we can build on in the future if that is the direction that we choose to go in. We recognise we are not going to get it all back, but if we can get something to supplement the farming income we make, then now is the time to do it.”

While the inaugural series of farm walks has come to an end, the free advice through FBAS continues, with c75% of FBAS sign-ups now requesting the SFI focussed review. The complexity of the recently expanded SFI offer is likely to generate an even greater need for support and advice.

WE ENCOURAGE ANYONE STILL THINKING OF SIGNING UP TO MAKE IT A PRIORITY NOW.

Defra’s FFRF scheme which funds FBAS ends on 1st March 2025 by which time delivery of all our FBAS services need to be completed. In addition, around 70% of the FBAS places that Defra agreed to fund have now been taken.

Registration for FBAS is easy. Call 03333 059 059, email fbas@gscgrays.co.uk or visit www.gscgrays. co.uk/fbas.

JAMES BUSH

ASSOCIATE 01524 880327

jtb@gscgrays.co.uk

The United Kingdom faces a pressing housing crisis, with consensus across the political spectrum that at least 300,000 new homes per annum are required to meet demand.

However, the reality falls woefully short of this target, leading to significant ramifications. Estimates suggest a staggering shortfall of 2 million homes, resulting in soaring rents, local residents being priced out of their communities, and the average age of first-time buyers rising to their late thirties. Policies such as Right to Buy and Right to Acquire have further compounded the issue by reducing the available stock of social housing.

Moreover, planning reforms are hindered by nimbyism and protectionist views, undermining housing delivery targets for Local Planning Authorities.

To tackle this complex challenge effectively, we need thorough reform that is rooted in modern, forwardlooking policies suitable for the demands of the 21st century.

• Town centres should be reimagined as vibrant hubs of activity, fostering local employment opportunities and sustainable high streets. By transforming these spaces into thriving communities, urban areas can be revitalised while simultaneously contributing new stock to reduce our housing needs.

• In addition, there needs to be a framework for approving the extension of existing settlements

and the construction of new ones. These should be designed to be entirely sustainable and capable of development within an approved Design Code to reduce pressure on stretched local authorities. Such an approach would ensure the long-term delivery of housing at the required level, laying the foundation for resilient communities. Achieving this vision requires long-term strategic planning.

• Streamlining the planning process with national standards and local delivery targets is essential for success. A lighter touch planning system would reduce bureaucratic hurdles, expediting housing development without compromising on quality. Implementing financial incentives tied to local delivery targets could further drive results, encouraging timely and efficient development.

• Local Authorities could play a more proactive role in facilitating development while addressing community concerns. Initiatives which forward fund and implement offsetting schemes that mitigate the impact of planned development at a council scale might be one approach. By recovering costs through levies (such as the existing Community Infrastructure Levy), councils could ensure that development benefits local communities, alleviating concerns about strain on infrastructure and services.

• Investment in future-proofed infrastructure is crucial for supporting sustainable development and bridging the rural-urban gap. This includes initiatives such as local renewable energy projects and improved connectivity. Robust infrastructure that can adapt to evolving needs is vital for fostering sustainable growth and development.

• Relaxing prohibitive restrictions in rural areas and places with acute affordability issues, such as national parks and green belts, is necessary. Facilitating economic development in these areas can provide new job opportunities for residents, contributing to a more balanced and equitable distribution of resources and facilities.

The vision outlined above is ambitious but attainable with the right political will and commitment to action.

WHILE ALL POLITICAL PARTIES SHARE RESPONSIBILITY FOR ADDRESSING THE HOUSING CRISIS, THE PATH FORWARD REQUIRES BOLD LEADERSHIP AND INNOVATIVE SOLUTIONS.

Unfortunately, the Conservatives' track record suggests a lack of commitment to bold housing reform. Without decisive action, the housing crisis is likely to persist, with profound consequences for society. Labour have made commitments to planning reform but will they adopt the progressive policies needed to address the housing crisis such as easing green belt restrictions? Clear vision and decisive action is needed to translate potential into tangible results.

In conclusion, confronting the UK housing crisis demands bold leadership and transformative change. By reimagining urban spaces, streamlining planning processes, and investing in sustainable infrastructure, we can build a brighter future for generations to come. It's time for policymakers to rise to the challenge and prioritise the needs of all.

CALUM GILLHESPY DIRECTOR

In anticipation of the winds of government policy shifting favourably towards onshore wind energy, landowners find themselves at the forefront of the renewable energy solution, and a considerable opportunity for those in the right location.

The current policy landscape, dominated by stringent regulations hindering onshore wind development, is expected to undergo a transformation. This article explores recent announcements, anticipated policy changes, and provides insights into what landowners can do to prepare for a potential wind energy boom.

The National Planning Policy Framework (NPPF) set stringent rules demanding local support for onshore wind projects. In 2018, the rules became even more restrictive, allowing a single local objection to derail a project's planning permission. Developers, facing an almost insurmountable challenge, stopped exploring onshore wind developments during this policy era.

At the point of writing, there has already been a significant move by the UK Government as the de facto ban on onshore wind was eased in September 2023 through updates to the NPPF. This was the biggest shift since 2018 but has now been overshadowed by the announcement of the general election on 4th July.

Both the Conservative and Labour manifestos are relying on wind to meet their Net Zero targets. The Conservatives’ pledge is to ensure democratic consent for onshore wind ‘striking the right balance between energy security and the views of local communities', whilst trebling offshore wind capacity. Labour’s manifesto is to double onshore wind and quadruple offshore wind capacity, aided by the launch of ‘Great British Energy’, a publicly-owned developer.

The Conservatives’ shift in position, coupled with the strong possibility of a Labour victory and their pro-wind stance, has sparked a surge in developers betting on a more favourable policy environment. Irrespective of the election result, they are predicting a resurrection of the onshore wind industry, at least to some degree, and are taking a proactive approach to secure prime opportunities and stay ahead of the mass market which could develop.

Like solar and battery developments, onshore wind projects will face challenges with grid connectivity. However, the alternative generation patterns of wind may open up possibilities in areas where solar has failed. Grid connection issues are expected to ease; National Grid’s ‘First Ready, First Connected approach’ takes effect from January 2025, and it is hoped that this will begin to free up the connection queue whilst aligning with potential policy changes and the investment announced in the Spring Budget to finance ongoing reforms and upgrades.

If the expected changes materialise, the re-birth of the subsidy free landscape may lead to larger wind developments, akin to the current trend in solar and battery projects. Whilst the upper limits are not known at present, economics will dictate that the bigger the scheme the better, but with the requirement to balance this against the availability of suitable land and the cumulative impact on the landscape.

GSC Grays can assist landowners in promoting their land to reputable developers. Evaluating wind speeds, grid availability, and various site restrictions is crucial in determining a land's suitability for wind development.

Landowners can engage in developer-led projects by appraising developer interest, choosing a preferred developer, and then allowing the developer to secure the grid connection at their cost. Alternatively, they can take the lead in securing the grid independently by engaging appropriate specialists and then making a grid application. The latter option provides greater negotiation strength but carries the risk of investing substantial capital with less certainty around the planning position.

Lease agreements structured with guaranteed base rents and revenue top-ups provide financial security for landowners. Beyond the economic benefits, onshore wind development allows for continued farming activities beneath turbines and exploration of other opportunities, such as Biodiversity Net Gain.

Multi-landowner schemes present opportunities for collaboration, incorporating landowners with a smaller acreage, whether that be through a turbine on their land or just facilitating access to inaccessible but otherwise suitable locations.

Engaging an experienced land agent is crucial to successfully navigate negotiations and secure favourable agreements, with fee coverage from developers usually limiting the landowner's exposure as part of developer-led schemes.

As the winds of change sweep through the onshore wind energy landscape, landowners stand to benefit. Navigating this shift and securing a lucrative future with a wind energy development requires strategic planning, engagement with experienced professionals and a proactive approach.

SENIOR SURVEYOR 01748 897613

jsl@gscgrays.co.uk

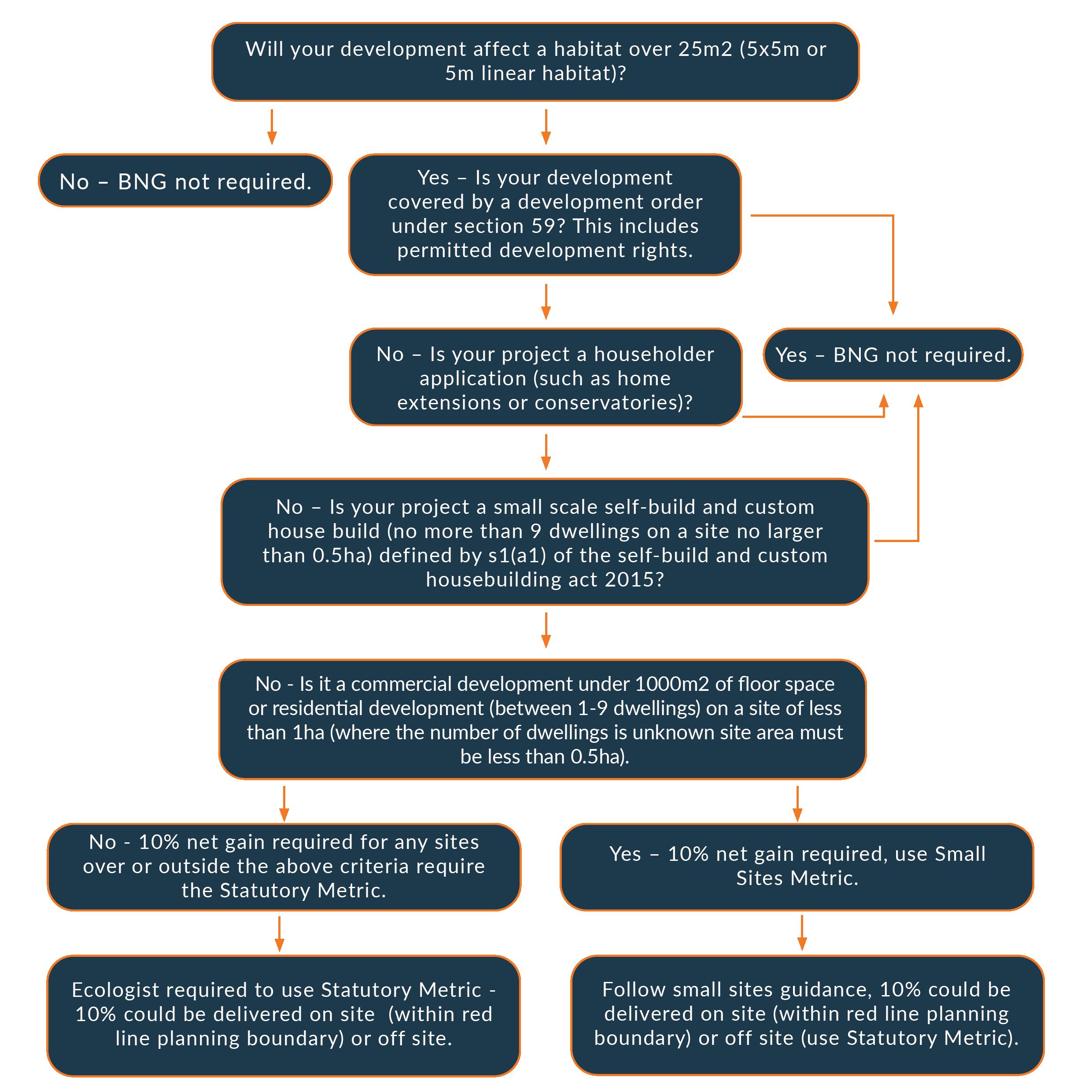

Will your farm be caught out by BNG?

If you are planning an on farm development that will require planning permission, you may need to meet new requirements for the delivery of Biodiversity Net Gain (BNG).

The principle of BNG, as set out in the Environment Act, requires any development to not only offset biodiversity lost as a consequence of development but to deliver a net gain in biodiversity of at least 10%. This became a compulsory requirement for major developments from 12th February 2024. However, some local planning authorities had already implemented it via local policy and have been more stringent than the statutory rules.

BNG for small sites became applicable from April 2024, and implementation for Nationally Significant Infrastructure Projects is planned for 2025.

There are some exemptions to BNG, but they are very specific and some policies may vary locally, so it is important to secure professional advice early on to determine if your site will be affected.

According to national guidance, BNG will be required if the development impacts habitat with an area greater than 25m 2 (5x5m area habitat or 5m of linear habitat), but will not apply to:

• Householder applications (such as home extensions or conservatories).

• Development granted planning permission by a development order under section 59. This includes permitted development rights.

• Biodiversity gain sites.

• Small scale self-build and custom housebuilding (no more than 9 dwellings on a site no larger than 0.5ha) defined by s1(a1) of the self-build and custom housebuilding act 2015.

There are also different rules for small sites, which are defined as:

• Residential development where the number of dwellings is between 1 and 9, or if this is unknown, the site area is less than 0.5 hectares.

• Commercial development where floor space created is less than 1,000 square metres or total site area is less than 1 hectare.

• Development that is not the winning and working of minerals or the use of land for mineral-working deposits.

• Development that is not waste development.

Small sites also have their own metric which is a simplified version of the statutory metric. This metric does not always require an ecologist’s input which will reduce professional costs associated with BNG for small site development.

Whilst BNG may be an opportunity for some farmers who wish to deliver off-site mitigation, it may be more likely to affect them when adding additional infrastructure to the farm or when considering diversification.

The flow chart on page 16 shows where BNG may affect on farm development.

We have already started to see BNG requirements add significant additional cost to on farm development and delay planning applications.

It may be possible to deliver net gain on farm by restoring habitat or creating new habitats. This would help to reduce costs, but there will still be a requirement to create and maintain the habitat for 30 years. There will also be ecology and professional fees and costs associated with monitoring and registration of the project.

1,500m 2 pig shed development within the field boundary affecting an area of grassland over 1,000m 2 and has been requested by the Local Planning Authority to comply with BNG.

The site is expected to impact 0.1ha of poor condition modified grassland (improved grassland defined by UKHab classification). This will result in the destruction of habitat and under the biodiversity metric will result in a loss of 0.5 Biodiversity Units (BDUs). As such under BNG requirements 0.55 BDUs will be required to meet the 10% net gain target.

The client has identified a site on farm in the corner of an arable field (0.5ha) in which the net gain could be delivered. This will be classified as an offsite mitigation as the site does not fall within the red-line boundary of the planning application.

The current baseline of this arable site is 1 BDU. To deliver a 10% ‘net gain’ this value must be increased by at least 0.55 BDUs. This could be achieved by reverting a small area of arable land to grassland, creating a grassy corner at the edge of the field.

This reversion could deliver an additional 1.5 BDUs which would create a small surplus in addition to the requirement for the development. This surplus could be banked for future development or sold to other developers who are in need of BDUs.

There may be opportunities to mitigate damage or incorporate BNG areas into the development. Be aware ecologists can be very busy at certain times of the year and this may affect their availability. Some habitats can only be surveyed at certain times of the year.

Local Planning Authorities will require you to submit your metric calculations for your development baseline with your planning application – not doing so could delay a decision on the application.

Additional units generated could be banked for future development or sold to offset cost.

We are thrilled to announce the intended opening of a new GSC Grays office at Garton-on-theWolds on the outskirts of Driffield in the latest of our ambitious business expansion plans.

Currently existing farm buildings, planning consent has been achieved to create a modern and attractive rural enterprise hub for businesses in the East Riding of Yorkshire, which is home to some of the most successful farming businesses in the North. We have been slowly building our presence in the area, establishing a growing base of farming clients and recruiting key personnel, most recently Alex Green, Associate Farm Business Consultant (see page 24), to work alongside existing talent with roots in the region.

The new Driffield office, anticipated to open in the new year, will be jointly headed by Helen Robinson, Rural Associate and James Thompson, Senior Farm Business Consultant, and will include a small team from our estate management and wider professional service departments who will cover Ryedale, Scarborough, Hull, Selby and Pocklington from this base. Works are expected to start in early summer, during which we will continue to operate from interim office space.

Commenting on the new office, Managing Director, Guy Coggrave said,

“THE OPENING OF AN OFFICE IN DRIFFIELD REPRESENTS THE CULMINATION OF PLANS TO EXTEND OUR DYNAMIC RURAL CONSULTANCY SERVICES INTO THE SOUTHEAST OF OUR REGION. OUR FOCUS IS, AS ALWAYS, TO PROVIDE INCREDIBLE SERVICE AND EXPERT ADVICE THAT ADDS REAL VALUE TO NEW AND EXISTING CLIENTS IN THE AREA.”

Furthermore, in line with our commitment to the communities in which we are based, we will continue our sponsorship of Driffield Rugby Club and will also be main ring sponsors at the Driffield Show this year.

The Driffield team can be contacted on 01377 337180 or by emailing driffield@gscgrays.co.uk.

From single fields to working farms, and from premium town houses to the finest sporting estates in the North of England, our property experts have the local knowledge, technical expertise and broad-based experience to ensure your sale runs smoothly and the best possible price is secured.

ACOMB HOUSE HEXHAM

Beautifully presented, Grade II listed house, offering a unique opportunity to acquire a stunning family home exceeding 10,000ft², in an idyllic setting with about 21 acres of gardens and grounds.

OFFERS OVER: £2,500,000

PROSPECT HOUSE HAMSTERLEY

A stunning Grade II listed, five bedroom family home with outbuildings and approximately 7.36 acres of land, situated in the highly sought after village of Hamsterley.

GUIDE PRICE: £850,000

KIRBY HILL HOUSE BOROUGHBRIDGE

A fine example of a Grade II listed vicarage set amongst grounds with tennis court, grazing paddocks, annexe in converted carriage house and additional outbuildings. In total around 3.32 acres.

GUIDE PRICE: £1,750,000

A superb four bedroom house with extensive south facing gardens and outbuildings backing onto open countryside in the sought after village of Pickhill. Converted in 1999 to create a delightful family home of around 2,500sqft.

GUIDE PRICE: £795,000

Follow us on social media to keep up to date with the latest properties brought to market:

Magnificent Georgian family house in the Tweed Valley with fabulous views to Melrose Abbey and the Eildon Hills.

OFFERS OVER: £1,200,000

LOW BARN RAVENSWORTH

A beautiful property with two substantial reception rooms, four bedrooms, three bathrooms, gym, games room/ bar and additional living space providing ample room for comfortable and adaptable living.

GUIDE PRICE: £725,000

An impeccably presented, Grade II listed house in the heart of a highly regarded village, with three reception rooms, bespoke kitchen, four bedrooms and set in substantial landscaped gardens.

GUIDE PRICE: £1,125,000

A fantastic Grade II listed stone-built home, steeped in history, set in approximately 0.6 acres of grounds with spectacular views over the fells and the Yorkshire Dales National Park.

OFFERS OVER: £675,000

TURSDALE HOUSE FARM

HETT, DURHAM

A desirable and strategically located mixed farm with excellent fixed assets comprising an attractive four-bedroomed farmhouse, a twobedroomed bungalow, a diverse range of farm buildings and productive agricultural land, all within a ring fence. About 288.01 acres (116.55 ha) For sale as a whole.

GUIDE PRICE: £3,250,000

GREENBANK FARM

SNAYGILL, NORTH YORKSHIRE

A fully equipped, modern dairy farm with an attractive four-bedroom farmhouse, detached stone barn with residential planning consent and productive farmland, extending to 110.05 acres (44.52 ha) in total.

GUIDE PRICE: £1,950,000

LAND AT THROSTLE NEST

NORTHALLERTON

An easily accessible block of first-class arable land capable of growing a wide variety of high yielding arable crops as well as potatoes. Offered in two blocks totalling 245.83 acres (99.49 ha).

GUIDE PRICE: £2,600,000

AYSDALE GATE FARM

SALTBURN-BY-THE-SEA, NORTH YORKSHIRE

A well-located livestock farm and livery yard with a substantial farmhouse, an extensive range of farm buildings and stabling facilities, and with significant scope for farm business diversification opportunities. About 301.38 acres (121.96 ha). For sale as a whole.

GUIDE PRICE: £2,600,000

SALTON GRANGE FARM

SINNINGTON, NORTH YORKSHIRE

A desirable, small, amenity farm in a ring-fence situated in a sought-after rural location with an attractive house in need of refurbishment and with significant development potential. For sale as a whole or in three lots.

GUIDE PRICE: £1,145,000

LAND AT NETHER HESLEDEN

SKIPTON, NORTH YORKSHIRE

A substantial ring-fenced block of productive grassland and upland grazing with excellent road frontage to Armistead Barns Road. About 369.44 acres (149.51 ha). For sale as a whole.

OFFERS OVER: £650,000

By the time you read this article, the new government, regardless of its political colour, will have taken office following the general election on 4th July.

The impact of the election may take many months to understand fully. My concern, as always, is that the rural economy will not be prioritised, creating a confusing and uncertain future for landowners, occupiers and farmers alike.

Policies relating to taxation, property compliance, and the environment, along with the ever-changing government schemes such as SFI discussed elsewhere in this magazine, present a dizzying amount of information for rural businesses to digest before they can begin to understand their cumulative impact on business profitability, compliance, and long-term sustainability.

Historically, elections have prompted premature reactions. Amidst this political uncertainty I believe it is prudent for rural businesses to continue their current practices without drastic changes based in anticipation of, or following, election outcomes. Reacting too quickly can lead to poor decisions or unnecessary and costly actions taken. Rather, businesses must foster flexibility and be responsive to change as it occurs – the status quo for most rural

businesses following the unprecedented change and volatility that besets the industry.

Informed decision-making will be crucial as the next government implements its policies. Recent years have seen the introduction of government-backed schemes like Defra’s Future Farming Resilience Fund (FFRF) which provides funding to select organisations, including ours, to provide farmers with expert guidance that will give them the confidence to make important decisions about their business moving forwards.

I encourage any farming business who has yet to take advantage of our scheme, or indeed others, to do so as a priority. A second pair of eyes can be crucial to identifying opportunities which would otherwise remain unseen and take decisions that will help them rise and adapt to the challenges faced. As with the FFRF which ends in February 2025, such funding will not be available forever.

Finally, let’s hope that the government understands the unique needs of those of us who live and work in the rural environment, rather than just the metropolis of London.

DAVID GRAY CHAIRMAN

01388 487000

dag@gscgrays.co.uk

We are delighted to have welcomed more new faces to our team as we deliver on our plans to strengthen our presence and services across the North West and expand our geographical coverage into the East Riding of Yorkshire and the Scottish Borders.

In May we acquired the Carter Jonas Kendal office to strengthen our growing team in Kirkby Lonsdale. The Carter Jonas Kendal team bring extensive experience in estate management, commercial management and valuations that complements our existing farm business, environmental, planning and development, and renewable consultants covering the region.

In advance of the opening of a new office in Driffield (see page 19), we have welcomed Alex Green, Associate Farm Business Consultant, to the team. Alex is a FACTS and BASIS qualified advisor with extensive experience helping farm businesses with a range of services including whole farm appraisals, contract farming agreements, budgeting, agronomy and environmental stewardship advice.

Our Alnwick office has also recruited two key individuals. Victoria Mitchell, Associate Rural Director, is an experienced Chartered Surveyor having worked across the country in both the public and private sector. Victoria works with a number of estates in Northumberland and specialises in all forms of commercial and residential property management.

James Denne joined us as a Property Consultant from Knight Frank, and brings over 30 years of invaluable experience and considerable knowledge of the farm and country house market in the North of England and the Scottish Borders.

Finally, John Pinches has joined our head office as a Business Development Consultant. John, who was formerly the Regional Head of Agriculture at Barclays Bank for Yorkshire and the North East, will focus on mapping the customer journey for the farm and professional services clients.

We now employ over 130 staff who operate from nine offices with a geographical spread from Nottingham to the Scottish Borders. Guy Coggrave, Managing Director, said “This is an exciting and challenging phase of expansion for GSC Grays. What drives us is our commitment to exceptional service delivered by local staff who bring energy, drive and expertise to the areas they live in. Our latest recruits help us to deliver on that commitment.”

We have dedicated consultants across the North of England ready to hear from you.

ALNWICK

alnwick@gscgrays.co.uk 01665 568310

BARNARD CASTLE

barnardcastle@gscgrays.co.uk 01833 637000

BOROUGHBRIDGE

boroughbridge@gscgrays.co.uk 01423 590500

CHESTER-LE-STREET

chesterlestreet@gscgrays.co.uk 0191 303 9540

COLBURN

colburn@gscgrays.co.uk 01748 897630

DRIFFIELD

driffield@gscgrays.co.uk 01377 337180

HEXHAM

hexham@gscgrays.co.uk 01434 611565

KIRKBY LONSDALE

kirkbylonsdale@gscgrays.co.uk 01524 880320

PENRITH

penrith@gscgrays.co.uk 01768 597005