for Fiscal Year 2024 Annual Budget

BOARD OF COMMISSIONERS

Dr. Todd Fowler, Mayor

Aaron T. Murphy, Vice-Mayor

Jenny Brock

John Hunter

Joe Wise

ADMINISTRATION

Cathy D. Ball, City Manager

Randy Trivette, Assistant City Manager

Steve Willis, Assistant City Manager

Joy Baker, Interim Assistant City Manager

Dustin B. Thompson, Budget Director

Samantha Rivera, Budget Analyst

SPECIAL ACKNOWLEDGEMENT

Ann Marie French, Grants Coordinator

Nick Harrison, Digital Multimedia Specialist

J.T. McSpadden, Digital Communications Manager

Sarah Nobles, Public Information Specialist

1

2 TABLE OF CONTENTS Board of Commissioners Message from City Manager City Organizational Chart Strategic Plan City Overview Volunteer Boards and Committees Budget Overview Policies and Procedures Budget Calendar Fund Schedules Capital Debt Service Quasi-Governmental Organizations Departmental Overviews Budget Ordinance Personnel Summary Glossary ..................................................................................... 3 ............................................................................... 4 .................................................................................... 7 .................................................................................................... 10 . .................................................................................................... 14 .................................................................. 19 .............................................................................................. 23 . ................................................................................... 30 ................................................................................................ 38 ................................................................................................. 39 ................................................................................................................73 ...................................................................................................... 81 ................................................................. 91 .................................................................................. 95 ........................................................................................... 175 ........................................................................................ 199 ........................................................................................................... 223

BOARD OF COMMISSIONERS

The City of Johnson City operates as a home rule municipality and is governed by the City ManagerCommission form of government. The Board of Commissioners is the governing body of the City of Johnson City. Commissioners are elected at large for four-year staggered terms. Commissioners select the mayor from among their group following each election. The mayor serves as the ceremonial head of the City, presides over City Commission meetings, and represents the City of Johnson City at a variety of community and public functions. The Board of Commissioners hires a professional city manager to manage and direct day-to-day operations of city

government. City commissioners participate in a variety of boards, commission and committees. Their involvement provides an important link between citizens, businesses, non-profits and municipal government. The City Commission ensures the provision of community services the people of Johnson City need and want. In carrying out its duties, the City Commission must address citizens’ concerns while planning for the community’s long-term growth and development. To this end, it is the responsibility of the City Commission to oversee costs and be as efficient as possible while managing the City’s infrastructure projects and investments.

3

Mayor Todd Fowler

Vice Mayor Aaron T. Murphy

Commissioner Joe Wise Commissioner Jenny Brock

Commissioner John Hunter

City Manager’s Message to Commission

DATE: May 2, 2023

TO: Mayor and Board of Commissioners

FROM: Cathy D. Ball, city manager

SUBJECT: Fiscal Year 2024 Budget

Annually, I present and recommend to you the fiscal year budget in accordance with the Johnson City Charter and applicable governing bodies. The Fiscal Year 2024 budget for the City of Johnson City considers our commitment to financial sustainability and growth while maintaining core services, economic flexibility and a balanced approach. This budget reflects the voice of our citizenry as well as commission’s strategic vision while estimating expenditures and revenue. Moreover, this financial plan recognizes that economic uncertainty coupled with a rise in inflation has an impact on the overall budget. We know that operations will cost more in FY 2024, with significant increases expected in fuel, parts, and construction materials.

The Fiscal Year 2024 budget was built based on a projected estimate of nearly 5 percent growth in local option sales tax collected. Total general fund revenues are expected to come in $5.08 million more than projected for FY 2023, and we anticipate nearly $7.65 million additional next year. The City’s FY 2023 fund balance is projected at $51.26 million, with $23.62 million unassigned.

This budget includes a recommended 25 cent property tax increase to fund the essential services that keep our community thriving. The City’s last property tax adjustment was in FY 2016 and when factoring in future needs and inflation, we believe it is time to again do so. The proposed breakdown of how these additional funds would be allocated is:

1. Schools – 15 cents

2. Infrastructure – 7 cents

3. Partner Agencies (Quasi-governmental) – 3 cents

We recognize that it is our responsibility to provide residents with financial transparency and that we are accountable to them in preparing a sensible budget that ensures the services they rely upon are adequately funded. We know these budget priorities align with our community and respect the Commission’s strategic vision to build on Economic Vitality, Quality of Place, FutureReady Infrastructure, and Excellence in Government.

The $114.45 million general fund budget is prioritized based on the following:

4

City Manager’s Message to Commission

Core Services

A new Towne Acres Elementary School tops the list of capital needs in our community. The 50-year-old, pod-style campus is already over capacity with about 450 students. A new building would be more secure and able to serve 700 students in a highly desirable area of our community. At an estimated cost of $40 million, we recommend that 15 cents of the proposed tax increase be allocated to Schools.

Residents and service providers depend on safe and accessible infrastructure that is maintained and upgraded on schedule. We recommend $5.42 million for these efforts, which include street resurfacing, lane widening and sidewalks.

Another $1.46 million is budgeted for cash-funded projects including Municipal Building third floor design, post steel buildings for Fire Stations 8 and 9, Juvenile Court security glass, Freedom Hall emergency lighting, Carver Recreation Center bleachers, Metro-Kiwanis tennis court resurfacing, design plans for Christian Church Road and Knob Creek Overpass, and downtown cameras.

Other capital projects are covered through ARPA (Washington County water line extension) and other federal funding (Sinking Creek lift station upgrade) as well as bond proceeds (advance meter infrastructure, Boones Creek interceptor replacement I-26 to B Station, C Station wastewater lift station replacement, Knob Creek aeration rehabilitation, regional sewer capacity improvements, Knob Creek Road and CSX utility improvements, and Walnut Street corridor utility improvements).

We are committed to resource stewardship as well as providing employees with the tools and equipment needed for them to perform at the very best of their abilities. We have measures in place for employees to tell us when the equipment they use ages beyond its functionality. Cashfunded capital equipment requests total $4.15 million, most of which is for replacing equipment that has reached its lifespan. These capital funding requests are needed to support the services and projects that enhance livability for citizens.

Community Safety

Our commitment to you includes a safe community. Funding in this budget includes: assistance for our most vulnerable populations; accountability measures for citizens and emergency first responders; and tools to protect visitors and businesses in our downtown community. Investments in additional police training at $100,000, body worn cameras and police radios at $474,976, downtown cameras at $265,000, and $120,000 funded to the Johnson City Development Authority for John Sevier security will make Johnson City a safer place to live, visit and do business.

5

City Manager’s Message to Commission

Employee Recruitment/Retention

A first and significant step in employee retention and recruitment was our Compensation and Classification Study. After an exhaustive, internal evaluation, the team of eight employees who conducted this study recommends a general fund increase of $1.34 million in salaries and benefits and an increase of $514,235 in other funds for a total impact of $1.85 million.

To reaffirm the commitment to employee retention, we recommend a 3 percent pay plan adjustment as well as a merit increase that will range from 2-3 percent. We estimate these adjustments to cost $2.54 million city-wide.

Since 2010, the City has experienced a decline in employee recruitment, most notably in hiring police officers and firefighters. Employees have told us that this can be attributed to a change in retirement plans. By reenrolling in the Tennessee Consolidated Retirement System (TCRS), we look to reverse this decline. The TCRS hybrid plan is an increase of $436,935 in the general fund and $281,010 in other funds for a total impact of $717,945.

Partner Agency Investments

Community partnerships are an important function of our city, as these agencies provide essential services that are not offered directly by municipal government. We rely on these partners to help us serve our citizenry and improve livability. We recommend an additional $400,000 to fund salary increases for our Emergency Medical Services. Also, we endorse $250,000 for 911 Emergency Communications. Finally, we support a new partnership with the Child Advocacy Center with a recommended $50,000.

I thank you for your dedication to our organization, staff and city as a whole. I also want to thank the talented employees who worked diligently in crafting this budget. Their attention to detail and willingness to collaborate demonstrates a commitment to GO. ALL. OUT. to enrich quality of life in Johnson City.

With appreciation,

Cathy D. Ball City Manager

6

ORGANIZATIONAL CHART

7 Administration Economic Development Fire Legal Public Affairs/ Communications &

Police Budget Environmentalist Purchasing Risk Management Special Projects Fleet Management

Human Resources

Facilities Finance Information

Planning/

Marketing

Freedom Hall

Parks & Recreation (all divisions) Transit

Technology MTPO

Development Services Public Works Water and Sewer Services

Cathy D. Ball City Manager

Randy Trivette Assistant City Manager

Steve Willis Assistant City Manager

Joy Baker Int. Assistant City Manager

Director of Risk Management

LEADERSHIP TEAM

8

Aaron Ensor Director of Court Services

Brian Ross Facilities Director

Dustin Thompson Director of Budget and Performance Management

Eldonna Janutalo Transit Director

April Norris Director of Parks & Recreation

Keisha Shoun Director of Public Affairs

Sunny Sandos City Attorney

Stephanie Laos Finance Director

Melanie Rice Director of Human Resources

Mark Stone Civic Center General Manager

Tim Henley Director of Fleet Management

Tom Witherspoon Director of Water/Wastewater

Will Righter Director of Planning & Development Services

David Bell Fire Chief

Glenn Berry MPO Manager

David Eidson Director of Information Technology

Debbie Dillon Director of Purchasing

Alicia Summers Economic Development Director

Andy Best Int. Director of Public Works

Billy Church Police Chief

to enrich the quality of life in Johnson City.

9

STRATEGIC PLANNING

Vision

The City of Johnson City’s 2020-2025 Strategic Plan is goal-oriented and includes the City’s vision, mission, values, strategic goals and directions, as well as anticipated outcomes and results. This plan forms the foundation for all other long-range planning for the City, including the Budget and Capital Investment Plan other targeted plans for more specific goals. The Strategic Plan includes the following components: Johnson City is a highly desirable community where people and businesses thrive.

Mission

We Go. All. Out. to enrich the quality of life in Johnson City.

Organizational Values

Organizational values form the foundation for the City’s decision-making framework and relationships with our stakeholders – employees, residents, and clients. The City of Johnson City strives to be an organization recognized for its excellence in city governance and employee, resident, and client relations.

Our values:

Leadership – We are visionary, strategic, and bold in our decision making.

Stewardship – We are trustees of the resources provided to the City.

Integrity – We are consistent in word and deed, and we are a Commission of character.

Respect – We are accessible and are responsive to the needs of our community.

10

Strategic Goals

The City of Johnson City has identified four strategic goals to support its vision:

Strategic Planning

Strategic Planning Review Process

ECONOMIC VITALITY QUALITY OF PLACE

The Johnson City Board of Commissioners embarked on its strategic planning process in 2020. Commissioners along with city staff consulted numerous surveys, plans and other reports in addition to drawing on input from citizens, businesses and community partners to formulate the initial plan. In 2023, with new city management in place, the Board participated in a professionally led planning retreat that resulted in updated priorities to better reflect the current status of our community. The resulting plan is a combination of the initial research and existing issues facing Johnson City.

FUTURE READY INFRASTRUCTURE EXCELLENCE IN CITY GOVERNANCE

Monitoring Success and Performance

A strong governance model that is based on the principles of openness, fairness and accountability and that ensures informed decision-making throughout the organization and draws on the energies of citizen participation.

11

Strategic Planning

ECONOMIC VITALITY

What we hope to achieve:

• Create an environment that empowers businesses and individuals to pursue their fullest potential

• Recruit and retain businesses and workforce talent

• Cultivate a local entrepreneurial ecosystem and prepare a workforce for 21st Century jobs

• Encourage economic development, with an emphasis on underserved areas

• Ensure a resilient economy

How we plan to achieve it:

• Continue intentional and strategic planning of West Walnut Corridor redevelopment

• Strengthen focus on revitalizing and invigorating South Roan Street in Johnson City

• Secure highest and best use of Ashe Street Courthouse

• Identify developer for reuse of John Sevier hotel

• Identify opportunities where city government can improve support for local business and investment by reviewing local policies, procedures and ordinances

• Strategically promote the benefits of the region and business environment by working with regional partners including the Convention and Visitors Bureau, Chamber of Commerce, etc.

• Pursue all funding and investment resources made available by government and the private sector (opportunity zones, outside investment, etc.)

QUALITY OF PLACE

What we hope to achieve:

• Continue to support and grow “best in class” education systems for k-12, vocational, and higher education

• Protect our natural resources and enhancing outdoor amenities

• Prioritize a safe, vibrant, and family-friendly city;

• Advance a diverse mix of housing

• Make Johnson City the best place to live, work, and play

How we plan to achieve it:

• Develop citywide strategy to reduce drugs and crime

• In conjunction with public and private partners, develop collaborative strategy to address homelessness

• Create an affordable housing strategic plan to include financing options

• Increase downtown footprint and vibrancy, promoting the district as a destination

• Encourage mixed use development along with housing and retail options in traditionally underserved areas

• Engage citizens as we continue making our community safe for all

12

Strategic Planning

FUTURE READY INFRASTRUCTURE

What we hope to achieve:

• Provide safe, secure, sustainable, and technologically advanced water, sewer, waste disposal, and broadband systems

• Proactively complete transportation improvements in anticipation of continued growth

• Position the community to withstand natural disasters

• Maintain and update all City and school facilities and amenities

• Work with partners to ensure critical emergency services are provided to our community

EXCELLENCE IN CITY GOVERNANCE

What we hope to achieve:

• Create an environment that empowers employees to provide excellent and accessible services

• Recruit and develop well-qualified employees

• Stay at the forefront of innovative technology

• Balancing the provision of existing services and infrastructure with planning for future needs to maintain the City’s strong financial position

• Making informed decisions

How we plan to achieve it:

• Complete growth management plan

• Complete parking study

• Continue investment in the maintenance and upgrade of essential infrastructure including water, sewer, stormwater, sidewalks, streets, etc.

• Continue partnership with BrightRidge and other partners to invest in forward-thinking infrastructure

• Explore state and federal funding sources to help offset costs to local taxpayers

• Create citywide sustainability plan

How we plan to achieve it:

• Renovate Commission Chambers at Municipal and Safety Building

• Complete rebuild of senior leadership team

• Establish welcoming and well qualified city staff that resembles the demographic makeup of our community

• Maintain city’s strong financial position

• Encourage “out of the box” thinking and invest in employee training and education

13

CITY OVERVIEW

History

Johnson City, Tennessee is a small city in the northeastern region of the state, located mostly in Washington County, with parts in Carter and Sullivan counties. The city has a rich history dating back to the late 1700s when it was first settled by European immigrants. Known in those early days at Blue Plum or Johnson’s Depot, the farming community only had a population of around 500 people.

Henry Johnson anticipated the hustle and bustle a new mode of transportation – the railroad – would bring and set up shop directly in its path before a single rail car made its way through the area’s mountains. The town of Johnson City was officially incorporated in 1869 with Henry Johnson elected as its first mayor.

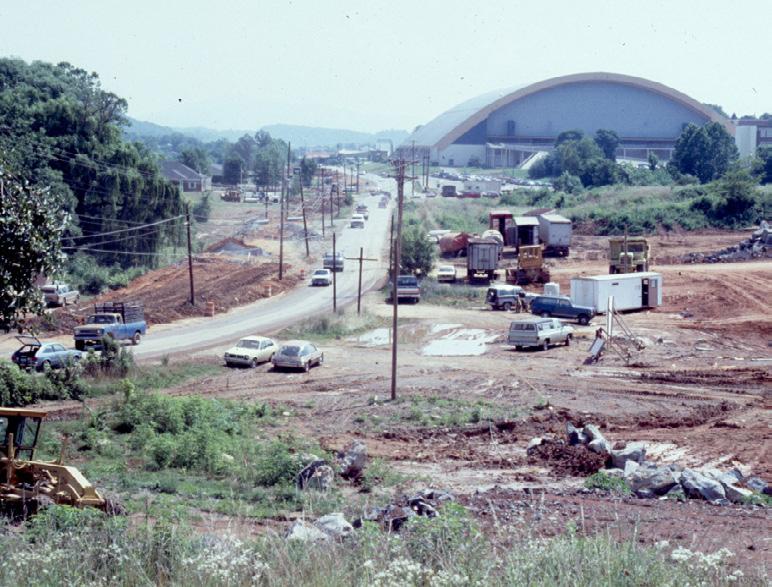

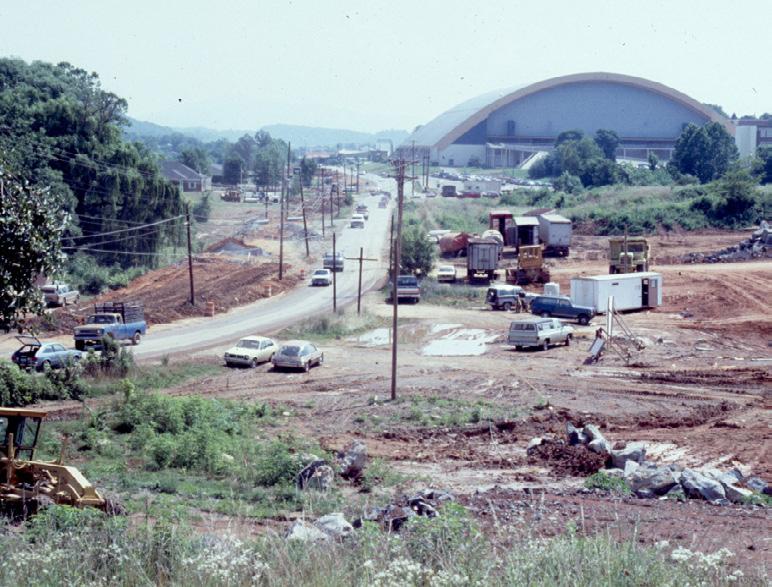

During the early 1900s, Johnson City became a hub for the railroad industry, with several major rail lines passing through the city. Henry Johnson was the first in a line of entrepreneurs who established a variety of businesses and industries that made the railroad central to everyday life in Johnson City.

Johnson City continued to grow and prosper, with the construction of the National Soldiers Home in 1903, a campus for America’s veterans, and the establishment of East Tennessee State Normal School in 1911, the predecessor to East Tennessee State University. Appalachian Hospital also opened during this time. These institutions helped to establish Johnson City as a center for education and healthcare in the region, and the city’s economy continued to thrive. As a

result, the population of Johnson City grew rapidly, reaching over 20,000 by the 1930s.

Throughout the latter half of the 20th century, Johnson City underwent significant changes, with the growth of the retail industry, the expansion of the healthcare sector, and the establishment of several new industries. Today, Johnson City is home to a diverse array of businesses, including manufacturing, healthcare, education, and technology companies.

One of Tennessee’s fastest-growing cities, the City of Johnson City has evolved into a vibrant regional center that strives to honor the physical and cultural characteristics that provide much of its small-town charm and character. The city is home to several historic landmarks and attractions, including the Tipton-Haynes State Historic Site, which was once the home of early settler John Tipton, and the Tweetsie Trail, a popular hiking and biking trail that follows the path of an old railroad.

Johnson City has a rich and diverse history that has helped to shape its identity as a vibrant and thriving community. As the city continues to grow and evolve, local leaders and policymakers are committed to continuing their investment in the city’s infrastructure and resources, ensuring that Johnson City remains a great place to live, work, and visit for years to come.

14

MEDI AN AGE

ETHNIC MAKE UP

HOUS EH OLD I NCOM E

Under $25, 00 0: 23. 9% $25, 000 - $49, 999: 1 9. 3% $50,000 - $74,99 9: 20. 5% $75, 000 - $99,999: 13. 5% $100 ,000 and above: 22 .8 %

Median

White 84 .6%

Black or African American

Hispanic or Latino (any race)

Asian Native American and Alaskan Native

Two or More Races

15

11% Gr owth over last 1 0 years

72,514 POPU LATION

*U.S . Ce nsus B urea u July 2022 Q ui ck fa ct s

35.6

24 8

$5 6,

*U.S . Ce nsus B urea u

7.1% 5. 5% 2. 6% 0. 2% 3. 8% City Overview

33,824 HOUSING UN ITS

Owner-Occupied: 66.1% Renter-O ccupied: 49.5%

33%

2023 marked Johnson City ’s fif th straight appearance on The Wall Street Journal/Realtor.com’s Emerging Housing Markets Index (5th position nation-wide as of winter 2023). The city has attrac ted families across the country with its af fordable quality housing.

RE NT PRICE BY %

32,053 UNEM PLOYME NT R ATE 3. 37%

16

Under $500: 14 .3 % $500 - $999: 53% $1 ,000 - $1 ,499: 23 .2 % $1 ,5 00 - $1 ,999 : 5% Over $2,00 0: 4.5 % *U.S . Ce nsus B urea u $

TOP 5 MO ST COM MO N OCCU PATION S ES TI MATE D WORK FORCE

WORK FORCE

*U.S . Ce nsus B urea u, A CS 5 -Yea r Esti ma te s Heal th C are an d So cial A ssistanc e Retail Trade 20.8 % 12 .4% 10.7 % 10.4% 9. 57% Educ ational Se rv ices Accommod ations & Food Se rv ice Manu fact urin g City Overview 67%

17 Glimcher Mall Johnson City Largest Property Tax Payers Taxable Assessed Value % of Total $22,627,200 1.1% 0.8% 0.7% 0.7% 0.6% 0.5% 0.5% 0.5% 0.4% 0.4% $17,070,340 $14,302,695 $14,032,634 $12,750,963 $11,301,440 $10,334,920 $9,811,320 $8,732,880 $8,200,000 Walmart/Sams Real Estate Mountain States Properties American Water Heater Co. Atmos Energy Corporation Knob Creek Apts. LLC Reserve Johnson City RAF Johnson City LLC (The Crossing) Bristol Highway Partners 1109 University/ETSU 815 LLC 6.1% $129,164,392 Top 10 Total City Overview City of Johnson City Per $100 of A.V. Annual Tax on $100,000 Residence Property Tax Rate One Cent Generates $495 $1.98 212,400 $537 $2.15 $450 $1.80 $450 $1.80 $2,123,998,767 Washington County City (Carter County) City (Sullivan County) Total Assessed Value Actual Taxable Value Assessed % to Actual Value $6,889,626,442 30.83%

City Overview

Sources: First Tennessee Development District, Business Journal, Tennessee Department of Labor & Workforce Development

18 East Tennessee State University Largest Employers (Washington County) Employees % of Total (County) 3,541 6.6% 5.6% 4.1% 3.2% 2.8% 2.2% 2.2% 2.0% 2.0% 1.8% 2,993 2,469 1,700 1,500 1,200 1,170 1,100 1,100 985 Ballad Health Corporation Veteran Health Administration CITI Commerce Solution Advanced Call Center Technologies Washington County Schools A.O. Smith Frontier Health Johnson City Schools City of Johnson City

BOARDS AND COMMITTEES

The City of Johnson City has established a variety of standing and advisory committees and boards intended to provide information, advice, and recommendations for consideration by the Johnson City Board of Commissioners on specific issues of civic concern. These boards and committees are typically made up of citizen representatives, Commission members, other elected officials and City staff. Appointments for the boards and committees take place semi-annually in January and July. Additional information, including agendas, meeting minutes and applications, can be found on the City’s website, https://johnsoncitytn.civicweb.net/Portal/MeetingTypeList.aspx.

ANIMAL CONTROL BOARD

5 members | 3-year terms | Meetings: 2nd Tuesday at 5:00 p.m.

Johnson City/Washington County Animal Shelter, 3411 N. Roan St.

Supervises and governs the policies and activities of the Washington County/Johnson City Animal Control Program and Center, which is responsible for the enforcement of regulations and codes pertaining to animals and prevention of cruelty to animals. City or County residency required.

BOARD OF BUILDING CODES

8 members | 3-year terms | Meetings: As needed on the 1st Tuesday at 4:00 p.m.

Municipal and Safety Building, 601 E. Main St.

Hears and decides appeals to code interpretation made by the chief building official and regulates Johnson City contractor certification. Positions include a professional registered engineer, electrical contractor, plumbing contractor, mechanical/gas contractor, residential building contractor, commercial building contractor, and registered architect. City residency required.

BOARD OF DWELLING STANDARDS AND REVIEW

5 members | 3-year terms | Meetings: Tuesday at 6:00 p.m. (except Nov. and Dec.)

Municipal and Safety Building, 601 E. Main St.

Determines action regarding substandard housing and/or commercial structures within the city limits. City residency required.

BOARD OF ZONING APPEALS

5 members | 3-year terms | Meetings: 1st Tuesday at 6:00 p.m.

Municipal and Safety Building, 601 E. Main St.

Hears and decides appeals to provisions of the zoning code, considers applications for special exceptions and decides questions of interpretation of the code. City residency required.

BRIGHTRIDGE BOARD OF DIRECTORS

10 members | 4-year terms | Meetings: 4th Tuesday at 4:15 p.m.

BrightRidge, 2600 Boones Creek Rd.

Serves as a liaison between BrightRidge’s customers and management. City residency required in order to apply for one of the five at-large positions representing Johnson City.

19

Boards and Committees

CIVIL SERVICE COMMISSION

6 members | 2-year terms | Meetings: As needed

Municipal and Safety Building, 601 E. Main St.

Addresses police and fire employees’ civil service matters and certifies entry level and promotional rosters. Consists of six standing positions, each held for a 2-year term. City residency required.

CONVENTION AND VISITORS BUREAU BOARD OF DIRECTORS

8 members | 3-year terms | Meetings: 3rd Wednesday at 12:00 p.m. Visit Johnson City, 302 Buffalo St.

The CVB showcases the uniqueness of and develops increased civic interest in Johnson City as an attraction to tourists, visitors and individuals; to solicit special events to take place in Johnson City; to promote the distinctive resources of Johnson City; and to increase the economic contribution of tourism in order to grow Johnson City and relieve the burdens of government. City residency or employment with City limits required.

EMERGENCY MEDICAL SERVICE BOARD OF DIRECTORS

10 members | 3-year terms | Meetings: 2nd Tuesday at 6:00 p.m. EMS, 296 Wesley St.

Manages Emergency Medical Services. Two members are appointed by the City Commission with one required to be a healthcare professional and the other a city resident.

GOLF ADVISORY BOARD

8 members | 3-year terms | Meetings: As needed

Memorial Park Community Center, 510 Bert St.

Recommends policies, procedures, rules, and regulations in operation of the golf course. City residency required.

HEALTH AND EDUCATIONAL FACILITIES BOARD

7 members | 2 to 6-year terms | Meetings: As needed

Municipal and Safety Building, 601 E. Main St.

Aids medical and educational facilities in obtaining tax-free loans as allowed by a combination of Federal and State of Tennessee Statutes. City residency required.

HISTORIC ZONING COMMISSION

7 members | 5-year terms | Meetings: 4th Tuesday at 5:30 p.m. (except Nov. and Dec.)

Municipal and Safety Building, 601 E. Main St.

Considers conservation zoning to ensure preservation of historical structures. City residency required.

20

Boards and Committees

HOUSING AND COMMUNITY DEVELOPMENT ADVISORY BOARD

12 members | 3-year terms | Meetings: 4th Thursday at 12:00 p.m. (Jan., April, July & Oct.)

Municipal and Safety Building, 601 E. Main St.

Advises and makes recommendations concerning housing, community, and economic development issues. City residency required.

INDUSTRIAL DEVELOPMENT BOARD

10 members | 6-year terms | Meetings: 3rd Wednesday at 10:00 a.m. (Jan., April, July & Oct.)

Municipal and Safety Building, 601 E. Main St.

A means of financing business/industrial facilities that create employment and economic growth. City residency required.

JOHNSON CITY DEVELOPMENT AUTHORITY

11 members | 3-year terms | Meetings: 4th Friday at 8:00 a.m. Memorial Park Community Center, 510 Bert St.

Promotes and assists with the development and redevelopment of Johnson City, with specific emphasis on the downtown district and support for the local business community. Consists of 11 standing positions, each held for a 3-year term. No residency requirement.

JOHNSON CITY HOUSING AUTHORITY

5 members | 5-year terms | Meetings: 4th Wednesday at 12:00 p.m. Johnson City Housing Authority, 901 Pardee St.

Establishes policy and procedures governing the operation of the housing authority. City residency required.

JOHNSON CITY PUBLIC LIBRARY BOARD

9 members | 3-year terms | Meetings: 3rd Tuesday at 4:30 p.m. Johnson City Public Library, 100 W. Millard St.

Governing body and controlling fiscal authority for the public library. City residency required.

JOHNSON CITY REGIONAL PLANNING COMMISSION

10 members | 3-year terms | Meetings: 2nd Tuesday of the month at 6:00 p.m.

Municipal and Safety Building, 601 E. Main St.

The Planning Commission reviews all rezoning, annexations, and right-of-way abandonments, makes recommendations for approval or denial to the Board of Commissioners, and makes recommendations on land use policy issues through the subdivision regulations, zoning ordinance, and the comprehensive plan. City residency required for nine positions. The remaining position requires residency inside the Regional Planning Jurisdiction but outside the City Limits of Johnson City.

21

Boards and Committees

PARKS AND RECREATION ADVISORY BOARD

10 members | 3-year terms | Meetings: 4th Tuesday at 4:00 p.m. (except June, July, Aug., Nov. & Dec.)

Parks & Recreation Administrative Office, 4137 Bristol Highway

Makes recommendations regarding recreation services and facilities. City residency required.

PUBLIC ART COMMITTEE

15 members | 3-year terms | Meetings: 2nd Wednesday at 5:00 p.m.

Municipal and Safety Building, 601 E. Main St.

Considers matters concerning public art, monuments, murals, or other creative efforts of individuals or groups. No residency requirement.

SENIOR SERVICES ADVISORY COUNCIL

15 members | 3-year terms | Meetings: 3rd Tuesday at 4:00 p.m. (except July, Aug. & Dec.)

Memorial Park Community Center, 510 Bert St.

Makes recommendations on matters affecting planning, support, and programming for the senior center. City residency required.

SENIOR CENTER FOUNDATION BOARD

18 members | 3-year terms | Meetings: 1st Thursday at 5:00 p.m.

Memorial Park Community Center, 510 Bert St.

Responsible for supporting and participating in special events, and assisting in fundraising efforts to benefit senior center operations, services, and/or capital improvements. Residency in Washington, Sullivan, Unicoi or Carter County required.

TRI-CITIES AIRPORT AUTHORITY BOARD

12 members | 3-year terms | Meetings: 4th Tuesday at 10:00 a.m. (Feb., April, June, Aug., Oct. & Dec.)

Tri-Cities Airport, 2525 TN-75, Blountville, TN

Manages and controls the business of the Tri-Cities Regional Airport. Three of the 12 members represent the City of Johnson City. No residency requirement.

WASHINGTON COUNTY BOARD OF EQUALIZATION

6 members | 2-year terms | Meetings: June

Washington County Courthouse, 100 E. Main St., Jonesborough, TN

Reviews the tax assessment rolls, hears complaints and appeals of taxpayers within their jurisdiction. City residency and Washington County residency required.

22

BUDGET OVERVIEW

Budget Message

The budget for Fiscal Year 2024 has been developed in accordance with City Ordinances, State and Federal laws, and the policies and procedures of the City. It has been prepared with the goal of maintaining a high level of service to our community, with as realistic as possible budget requests for expenditures, and with a reasonable level of conservative estimates on revenue.

The Fiscal Year 2024 budget is a balanced budget. Total expenditures for all funds are $334,785,942, which includes the City School budgets.

General Fund

Revenue

Total General Fund revenue is budgeted at $114,451,393, an increase of 12.5%, $12,733,344, on a budget-tobudget basis. When measured against projected revenues for the prior year, FY 2024 revenues are projected to increase by $7,649,724 or 7.2%.

For fiscal year 2024, real and personal property taxes are budgeted to increase by 16.1 percent or $5,892,740 on a budget-to-budget basis. This is due to better the 25 cent property tax increase in FY 24. Overall, property tax collections account for approximately 37% of General Fund revenue.

Local option sales tax, the second largest General Fund revenue source at 29%, is budgeted to increase $5,150,000, or 18.3% on a budget-to-budget basis. This is due to better than expected economic conditions post-pandemic. Collections for FY 2023 are projected at $31.8 million, which is $3,600,000 more than budget and $2,668,481 more than actual

collections from FY 2022. For FY 2024, local option sales tax revenue is budgeted to increase by 4.9% over projected FY 2023 estimates due to steady growth within the city.

Hotel/motel tax collections are budgeted at $3,100,000, an increase of $1,000,000 (47.6%) budget to budget. Projected collections for FY 23 are at $3,100,000 as well, which leave the projected to budget net neutral.

Cable TV Franchise Fee is budgeted to remain the same at $750,000.

23

Actual Budget Projected Budget Budget % FY 2022 FY 2023 FY 2023 FY 2024 24 vs. 23 Change REVENUES Real & Personal Property Taxes 36,673,563 36,700,000 37,268,500 42,592,740 5,892,740 16.1 Local Option Sales Tax 29,081,519 28,150,000 31,750,000 33,300,000 5,150,000 18.3 Other Local Taxes 17,887,802 16,276,000 17,501,000 17,082,000 806,000 5.0 Licenses and Permits 1,102,607 1,071,500 1,207,000 1,238,000 166,500 15.5 Intergovernmental Revenues 13,804,790 13,080,680 12,857,680 13,555,680 475,000 3.6 Charges for Services 3,927,114 4,109,169 4,231,769 4,502,923 393,754 9.6 Fines and Forfeitures 793,102 1,250,000 900,000 1,000,000 (250,000) (20.0) Other Revenues 2,220,643 1,080,700 1,085,720 1,180,050 99,350 9.2 Total Revenues 105,491,140 101,718,049 106,801,669 114,451,393 12,733,344 12.5

Budget Overview

Licenses and permits, which reflect building activity, are budgeted at $1,238,000, an increase of 15.5% or $166,500. This mirrors the steady growth the city has been experiencing.

Intergovernmental revenues, which account for approximately 12% of General Fund revenue, are

budgeted at $13,155,680, an increase of 3.6%, or $475,000, budget to budget. Revenue from the state for the Prison has ceased due to its closure. The City of Johnson City has also entered into an inter-local governmental agreement with Washington County, and will start to see a yearly revenue of $500,000 starting in January 2024.

FY 2024 General Fund Revenue

Property Tax

Local Option Sales Tax

Other Local Taxes Intergovernmental

Charges for Service are budgeted at $4,502,923, an increase of $393,754 or 9.6%. This is mostly due to an increase in administrative fees and computer services to the enterprise funds and projected increases in Pine Oaks Golf Course revenue.

Expenditures & Transfers

There is not a budgeted fund balance drawdown in FY 2024. This leaves a projected fund balance of $51,683,507 at the end of FY 2023, including the Economic Development Reserve. The 20% fund balance reserve target established by the City Commission is $19,051,384.

The General Fund budget totals $114,451,393, an increase of $8,962,254 (8.5%) over the fiscal year 2023 budget. The General Fund budget includes $84,628,218 for personnel and operating expenditures, and $29,823,175 for operating transfers to support other funds.

24

Other

37.2% 29.1% 14.9% 11.8% 6.9%

Actual Budget Budget Budget % FY 2022 FY 2023 FY 2024 24 vs. 23 Change Personnel 43,952,371 48,894,438 52,650,678 3,756,240 7.7 Operating 18,095,260 21,791,416 24,540,787 2,749,371 12.6 Other* 5,974,460 6,690,486 7,436,753 746,267 11.2 Total Operating Expenditures 68,022,091 77,376,340 84,628,218 7,251,878 9.4 * Library and Quasi-Govt'l General Fund Expenditures by Category

Total operating expenditures increased by 9.4% or $7,251,878. Personnel, which accounts for 62% of operating costs, is budgeted at $52,650,678, an increase of $3,756,240 or 7.7%. The FY 2024 budget includes a 3% pay plan adjustment, and a 2% merit

adjustment. It also includes the implementation of the compensation and classification study that went into effect late FY 2023, which was not included in the original FY 2023 budget. In addition, several new and upgraded positions are included.

FY 2024 General Fund

Departmental and other operating expenditures (excluding personnel costs) total $31,977,540, which is an increase of $3,495,638 or 10.9%. The majority of the increase is due to $0.07 of the property tax increase being assigned to roadway improvements, which amount to an additional $1,491,000.

Major transfers from the General Fund include $5,419,267 for capital equipment, facilities, and infrastructure; $11,220,224 for debt service; and $11,626,736 for Johnson City Schools. The City

transfer to assist with funding for the operation of the Johnson City Schools remained the same from FY 23. In the past ten years the City’s appropriation to the Schools has increased five times: FY 2014 – $375,000, FY 2015 - $500,000, FY 2016 - $963,061, FY 2019$500,000, and FY 2022 - $750,000.

Total Operating Transfers increased $1,710,376 or 6.1%. The increase is mostly attributable to increased transfers to the capital funds.

FY 2024 General Fund

25

Operating Other

Budget Overview Personnel

Expenditures by

62% 29% 9%

Debt Service Capital Funds Other

Category

Johnson City Schools

Transfers 39% 38% 18% 5%

Budget Overview

Funding for the Johnson City Public Library is budgeted at $2,210,275 in total, which is an increase of $61,324 or 2.9%. This covers increases in operating costs and revenue reductions. Total funding for the Imagination Library is $39,700. The Imagination Library also receives funding from Washington County. Quasi-Governmental funding is budgeted at

Staffing / Salaries and Benefits

$5,195,778, an increase of $654,243 or 14.4%. $0.03 of the property tax increase will go to 911 and EMS for salaries and recruitment, which is amounted to an additional $654,000. A detailed breakdown of quasigovernmental funding can be found on page 91 of this document.

A total of 997.1 full-time and part-time (FTE) positions are budgeted. The staffing changes for FY 2024, and mid-year adjustments for FY 2023 are as follows:

GENERAL FUND

• Administration: one new Economic Development Analyst

• Administration: one new Staff Attorney

• Communications & Marketing: one new Public Information Officer

• Communications & Marketing: one new Special Events Coordinator

• Development Services: upgrade one Code Enforcement Officer to Supervisor

• Facilities: one new Custodian

• Fire: three FY 23 over hired Firefighters to full-time positions

• Human Resources: one new Human Resources Generalist

• Human Resources: one new Assistant Director of Human Resources

• Parks & Recreation: two new Public Service Workers

• Parks & Recreation: one new Recreation Generalist

• Parks & Recreation: combine two part-time Custodian to one full-time

• Parks & Recreation: combine two temporary Public Service Worker to one full-time

• Police: one new Digital Forensic Officer

• Police: one new Homeless Outreach Coordinator

• Police: elimination of the Detention division: one Jail Superintendent, twelve full-time Correctional Officers, four part-time Correctional Officers, and one Lead Custodian

• Purchasing: upgrade one part-time Administrative Specialist I to full-time

• Public Works: one new Custodian

• Public Works: one new Landscape Technician

• Public Works: upgrade two MEO II to Crew Supervisor

• Risk Management: one new Assistant Director of Risk Management

• Risk Management: upgrade one Risk Management Specialist to Claims Manager

OTHER FUNDS

• Mass Transit: elimination of three vacant positions, one Maintenance Coordinator and two Clerical Specialist II

• Solid Waste – Municipal: upgrade one Crew Supervisor to General Supervisor

• Solid Waste – Regional: upgrade one Crew Supervisor to General Supervisor

• Water/Sewer: two new Custodian

• Water/Sewer: one new Lead Custodian

• Water/Sewer: one new Inventory Specialist

• Water/Sewer: two new Water/Wastewater Service Workers

26

Enterprise Funds

WATER / SEWER FUND

Total revenues are budgeted at $41,904,300, an increase of $1,699,100 or 4.2% from the prior fiscal year budget.

The Water and Sewer Fund expenses total $39,586,846, an increase of $2,046,177 or 5.5% compared to FY 2023 budget. The increase in expenditures is mostly attributed to pay plan adjustment and an increase in depreciation. Total staffing increased by six positions over the prior fiscal year, bringing the total to 188.4 full-time equivalent.

Expenses for capital equipment replacement total $1,067,000, a decrease of $209,000 from the FY 2023 budget.

Budgeted water capital projects total $9,400,000. These include $6,000,000 in improvements funded with debt, $1,200,000 in rate funded (cash) improvements, and $2,200,000 in American Recuse Plan Act (ARPA) funds. Major projects include the advance meter infrastructure ($6,000,000), the Washington County water line extension ($2,200,000), and the small diameter water line replacement ($1,200,000).

Budgeted sewer capital projects total $12,225,000. These include $10,100,000 in improvements funded with debt, $1,125,000 in rate funded (cash) improvements, and $1,000,000 in grant funds. Major projects include the regional sewer capacity improvements – phase III ($4,000,000), Knob Creek aeration rehabilitation ($2,800,000), and the Boones Creek interceptor replacement I-26 to B Station ($2,050,000).

Budgeted combined water and sewer capital projects total $4,181,000 and include $3,100,000 in improvements funded with debt and $1,081,000 in rate funded (cash) improvements. Major projects include Walnut Street corridor utility improvements ($1,600,000), Knob Creek Road &CSX utility improvements ($1,600,000), and local road projects/annexations ($500,000).

SOLID WASTE FUNDS

Solid Waste expenses total $17,854,205, which includes $14,070,517 for the Municipal Solid Waste Fund and $3,783,688 for the Regional Solid Waste Fund.

The Municipal fund is budgeted to increase by $1,577,426 or 12.6% due to operational and personnel increases.

The Regional fund is budgeted to increase by $562,788 or 17.5%, once again to due operational and personnel increases.

Capital equipment is budgeted at $897,900 for Municipal equipment, including two front-load trucks and one pickup truck.

Capital equipment is budgeted at $220,100 for Regional equipment. This is for a rear-load truck.

Revenues for Municipal Solid Waste are projected at $13,591,860, a net increase of $13,591,860 from the prior year. The majority of the increase is due to increased industrial revenue.

27

Budget

Overview

Budget Overview

In the regional system, revenues are projected at $4,095,200, an increase of $166,900 from the prior year. This is due to continued increase in regional residential customers.

MASS TRANSIT FUND

The Mass Transit Fund expenses total $5,575,689, which is an increase of $282,689 (5.3%) from the prior year. This is the fourteenth year of operation for the New Freedom program, which is funded by a Federal Transportation Agency grant. This program allowed the City to establish two new routes that serve the Med Tech corridor and Boones Creek, and it has expanded ADA accessibility for job opportunities and to medical facilities. Federal and state grants account for approximately 80% of the fund’s total revenue. The transfer from the General Fund to support transit operations is budgeted at $1,079,348. This is required to meet federal and state grant matching requirements. Mass Transit capital is budgeted at $204,000.

STORM WATER FUND

The Storm Water Fund expenses total $2,435,141, which is a decrease of $1,060 from the FY 2023 budget. The City Commission approved a rate adjustment of $1.00 in December 2019. This will allow the storm water fund to support the debt service for the West Walnut Street project, as well as provide the cash flow needed to repair and replace bridges in a timely manner.

Capital equipment is budgeted at $250,000 for a tandem axle dump truck. A total of $1,650,000 is budgeted for capital projects, all cash funded. The major project will be the West Oakland Avenue Bridge ($750,000).

The fund is projected to end FY 2024 with approximately $1,399,977 in cash and cash equivalents.

Capital Equipment/Projects & Debt Funds

The capital equipment fund is budgeted at $4,154,267, including a $3,564,267 transfer from the General Fund and $590,000 capital funds re-budget for school buses.

Capital facilities are budgeted at $10,505,440, including $8,500,000 in ARPA funding towards various fire station and training facility improvements.

Capital infrastructure projects are budgeted at $22,115,000, including $15,000,000 (debt funded) for the continuation of the West Walnut Street project. Other debt funded projects include Oakland/Mountainview Road improvements ($2,500,000) and the Grey Station/SR 75 intersection ($1,400,000).

School facility capital projects are budgeted at $2,000,000, which is for the first year of design and construction of a new Towne Acres Elementary School.

The Debt Service Fund is budgeted at $12,260,434, which represents an increase of $529,121 or 4.5% from the prior year. This increase is due to the addition of $40,000,000 in new debt for the Towne Acres Elementary School project. The Debt Service Fund includes the debt service for the City and School System. The City’s debt service is budgeted at $9,637,429. The School System’s debt service is budgeted at $2,623,005.

28

Budget Overview

Other Funds

FREEDOM HALL FUND

The Freedom Hall Fund expenses total $1,875,558, which is an increase of $22,305 or 1.2% from the prior year. The General Fund transfer to support Freedom Hall is budgeted at $417,100, which is $57,100 more than FY 2023.

POLICE DRUG, GRANTS, AND TECHNOLOGY FUNDS

The Police Drug, Grants, and Technology Funds are budgeted at $229,000, $159,500, and $188,074, respectively. The Drug Fund includes $129,000 for three unmarked sedans and a new data analytic system. The Grant Fund includes funds for two secretary positions at the Family Justice Center.

MTPO - TRANSPORTATION PLANNING FUND

The MTPO – Transportation Planning Fund is budgeted at $386,688. MTPO is responsible for regional transportation planning and coordination.

29

POLICIES AND PROCEDURES

General Information

GOVERNMENT

Johnson City adopted the council-manager form of government in 1939, and adopted home-rule in 1955. This form combines the benefits of elected legislative representation with a professionally managed government. Citizens elect, at large, five city commissioners who serve four-year terms. The Board of Commissioners hires a professional city manager to manage and direct the day-to-day operation of the City government, administer the budget, and employ all City employees with the exception of the Juvenile Court Judge, Juvenile Court Clerk, Municipal Court Judge, and City Attorney. The Juvenile Court Judge and Juvenile Court Clerk are elected by the municipal voters. The Municipal Court Judge and City Attorney are appointed by the City Commission.

The City Manager is the chief executive officer for the city. It is the responsibility of the City Manager to enforce the laws and ordinances of the city and attend all meetings of the governing body with the right to take part in the discussion. Having no vote, the City Manager can make a recommendation of measures to the governing body.

The City provides a wide range of services similar to other jurisdictions in the State, including public safety (both Police and Fire), municipal and regional solid waste services, municipal and regional water and sewer services, parks and recreation, a civic center, seniors’ center, one golf course, a mass transit system, public works, a school system, and economic development.

BUDGETARY AND FINANCIAL REPORTING

The City of Johnson City is implementing the recommended practices by the National Advisory Council on State and Local Budgeting (NACSLB). City staff has applied diligent effort into improving the process, decisions, and outcomes with each new budget year.

The budget process is not simply an exercise in balancing revenues and expenditures one year at a time, but is strategic in nature, encompassing a multi-year financial and operational plan that allocates resources on the basis of identified goals and objectives.

The budgetary, accounting, and reporting standards adopted by the City of Johnson City conform to generally accepted accounting principles applicable to government units. The accounts of the City are organized on the basis of funds and account groups, each of which is considered to be a separate entity. The operations of each fund are accounted for with a separate set of self-balancing accounts, recording cash and other financial resources, together with all related liabilities and residual equities or balances, and changes therein, which are segregated for the purposes of carrying on specific activities or obtaining certain objectives in accordance with special regulations, restrictions, or limitations.

The funds included in this budget are as follows:

30

Policies and Procedures

GOVERNMENTAL FUNDS

General Fund

The General fund is the general operating fund of the City. It is used to account for most of the basic government services, such as police, fire, parks and recreation, street maintenance, administration, and planning. General Fund revenues include property taxes, local option sales tax, business license fees, court fines and fees, and state and federal grants. The largest expense within the General Fund is personal services, which includes the cost of employee salaries and benefits.

Capital Projects and Capital Equipment Funds

The Capital Projects and Capital Equipment funds account for capital purchases and improvements, such as land acquisition, fleet equipment replacement, construction of facilities, etc. Most of the items recorded in either of these funds are financed through borrowings or transfers from the General Fund.

Debt Service Fund

Included in a Debt Service Fund are general long-term principal and interest payments on bonds issued, as well as revenue sources to meet the payment obligation on the debt.

Special Revenue Fund

A Special Revenue Fund generates specific revenue sources. Expenses are legally restricted to specified purposes and are directly related to the revenue source. Freedom Hall Civic Center, Transportation Planning, and the Community Development Block Grant Fund are Special Revenue Funds for the city.

PROPRIETARY FUNDS

Enterprise Fund

An Enterprise Fund is intended to be self-supporting in that expenditures are offset by revenues in the form of fees and charges to the external customers for goods and services. Enterprise Funds included in this budget are the Water and Sewer Fund, Solid Waste Funds (Municipal and Regional), Mass Transit Fund, and Stormwater Fund.

31

Policies and Procedures

BASIS FOR BUDGETING

The budgets for all Governmental Funds are prepared on a modified accrual basis. This means that the obligations of the City are budgeted as expenses, but revenues are recognized only when they are actually received.

The Enterprise Funds are budgeted on a full accrual basis. Expenditures are recognized when a commitment is made, and revenues are recognized when they are obligated to the City. Debt interest payments are budgeted as an expense for Enterprise Funds. Not included in the budget are debt principal payments, which are reflected as a reduction in the liability only when payment is made, and capital equipment and improvements, which are funded through the Capital Equipment and Projects Funds or as an operating transfer from the General Fund.

BUDGET AND BUDGETARY CONTROLS

The City’s financial plans are set forth in annual capital and operating budgets which reflect the projection of all receipts from and disbursements to all sources. The Board of Commissioners has the final responsibility for establishing program and fiscal policies, approving the annual operating budget and Capital Improvement Program, amending the annual budget, and setting the property tax rate and fees for services.

Budgetary control is maintained in the individual funds at the department level in order to ensure compliance with legal spending appropriations as approved in the annual operating budget. Activities of the general fund, special revenue funds, enterprise funds, and capital projects and equipment funds are included in the annual appropriated budget.

BASIS OF ACCOUNTING

The modified accrual basis of accounting is used for all governmental funds. The revenues are recognized when they become measurable and available. Those revenues susceptible to accrual are property taxes, special assessments, interest income, and charges for services. Property taxes are levied and due in this fiscal year and also collected within 60 days after year end. Amounts not collected within those 60 days are recorded as deferred revenue. Expenditures are recorded when the related fund liability has been incurred. All proprietary funds use the accrual basis of accounting, where revenues are recognized as soon as they are earned and expenses are realized as soon as a liability is incurred. Proprietary funds also display the assets and liabilities associated with the fund on the balance sheet. In governmental funds, fund balance is segregated into reserved, designated, and undesignated components. Enterprise funds reflect a change in total net assets corresponding to the outcome of revenues and expenditures.

Financial Management Policies

GENERAL FINANCIAL PHILOSOPHY

The financial policy of the City of Johnson City is to provide a sufficient financial base and the resources necessary to sustain a high level of municipal services for the citizens of Johnson City.

32

Policies and Procedures

It is the goal of the City to achieve a strong financial condition with the ability to:

• Withstand local and regional economic impacts;

• Adjust efficiently to the community’s changing service requirements;

• Effectively maintain and improve the City’s infrastructure;

• Prudently plan, coordinate, and implement responsible community development and growth;

• Provide a high level of police, fire, and other protective services to assure public health and safety; and,

• Provide other services necessary to ensure quality of life for the community.

The City of Johnson City’s financial policies shall address the following fiscal goals:

• Keep the City in a fiscally sound position in both the long and short term;

• Maintain sufficient financial liquidity to meet normal operating and contingent obligations;

• Expect that service users pay their fair share of program costs;

• Operate utilities in a responsive and fiscally sound manner;

• Maintain existing infrastructure and capital assets;

• Provide a framework for the prudent use of debt; and,

• Direct the City’s financial resources toward meeting the goals of the City’s strategic plan.

OPERATING BUDGET POLICIES

The annual budget is the central financial planning document that embodies all operating revenue and expenditure decisions. It establishes the level of services to be provided by each department within the confines of anticipated municipal services.

The City Manager shall incorporate the Board of Commissioner’s priorities in the formulation of the preliminary and final budget proposal.

Adequate maintenance and replacement of the City’s capital plant and equipment will be provided for in the annual budget.

The budget shall balance recurring operating expenses with recurring operating revenues.

The City shall adopt a balanced budget annually.

CAPITAL IMPROVEMENT POLICIES

The City will establish and implement a comprehensive five-year Capital Improvement Plan (CIP). This plan will be updated annually.

An annual Capital Improvement Budget will be developed and adopted by the Board of Commissioners as part of the annual budget. The City will make all capital improvements, in accordance with the CIP, for which there is available funding.

Unexpended capital project budgets shall be carried forward to future fiscal years to complete the intent of the original budget.

33

Policies and Procedures

Routine capital needs will be financed from current revenues as opposed to the issuance of long-term debt.

The City will maintain all assets at a level adequate to protect the City’s capital investment and to minimize future maintenance and replacement costs.

REVENUE POLICIES

The City will estimate annual revenues by a conservative, objective, and analytical process.

The City will consider market rates and charges levies by other public and private organizations for similar services in establishing tax rates, fees and charges.

The City will periodically review the cost of activities-supported user fees to determine the impact of inflation and other cost increases. Fees will be adjusted where appropriate to reflect these increases.

The City will set fees and user charges, for the utility funds, at a level that fully supports the total direct and indirect costs of operations, capital requirements, and ensures that adequate reserves are maintained.

The City will continue to identify and pursue grants and appropriations from Federal, State, and other agencies that are consistent with the City’s goals and strategic plan.

The City will follow an aggressive policy of collecting revenues.

INVESTMENT POLICIES

Investments of the City shall be undertaken in a manner that seeks to ensure the preservation of capital in the overall portfolio. The portfolio shall remain sufficiently liquid to enable the City to meet daily cash flow demands and conform to all state and local requirements governing the investment of public funds.

The City will continue the current cash management and investment practices, which are designed to emphasize safety of capital first, sufficient liquidity to meet obligations second, and the highest possible yield, third.

Investments will be made in accordance with the policies set by Tennessee Code Annotated 6-56-106. Authorized investments include, but are not limited to, the following:

• Bonds, notes or treasury bills of the United States Government;

• Bonds, debentures, notes or other evidences of indebtedness issued or guaranteed by United States agencies;

• Certificates of deposit and other evidences of deposit at state and federally chartered banks, savings and loan associations; and,

• The local government investment pool created by title 9, chapter 4, part 7.

The City shall attempt to match its investment with anticipated cash flow requirements. Unless matches to a specific cash flow requirement, the City will not directly invest in securities maturing more than two (2) years from the date of issue. Investments maturing more than two years from date of issue require approval

34

Policies and Procedures

by the state director of local finance.

The City’s financial information system will provide adequate information concerning cash position and investment performance.

DEBT MANAGEMENT POLICIES

The City of Johnson is subject to debt limitations imposed by the City Charter. The total bonded indebtedness of the City shall not exceed 10 percent of the assessed valuation, for the preceding year, of the taxable property of the City. In determining the debt applicable to the legal debt limit, the following types of debt are excluded:

• Bonds payable out of funds derived from special assessments for public improvements;

• Bones primarily secured from revenue of other sources with the secondary backing of general tax revenues; and,

• Tax anticipation bonds and notes.

The City shall issue debt only when necessary to meet a public need and when funding for such projects is not available from current revenues, reserves, or other sources.

Long-term borrowing will be used to finance capital improvements as approved in the City’s Capital Improvement Plan.

Capital projects financed through issuance of debt shall be financed for a period not to exceed the expected useful life of the project.

The City will not incur debt to finance current operations.

The total debt service on tax supported debt of the City shall not exceed 20 percent of total General Fund operating expenditures. It shall be the long-term goal of the City to reduce this percentage to the ideal level of 10 percent.

Lease-purchase obligations, capital outlay notes or other debt instruments may be used as a medium-term method of borrowing for the financing of vehicles, computers, other specialized types of equipment, or other capital improvements.

The City will maintain good communication with bond rating agencies in order to optimize its bond rating status.

UTILITY FUND POLICIES

Enterprise funds will be established for City-operated utility services.

Enterprise fund expenditures will be established at a level sufficient to properly maintain the Fund’s infrastructure and provide for necessary capital development.

35

Policies and Procedures

Each utility fund will maintain an adequate rate structure to cover the costs of all operations, including maintenance, depreciation, capital and debt service requirements, reserves, and any other costs deemed necessary. Ideally, reserves should approximate three (3) months of operating costs.

Utility rate studies will be conducted periodically to update assumptions and make necessary adjustments to reflect inflation, construction needs, maintain bond covenants, and avoid significant periodic rate increases.

Adequate reserve levels are a necessary component of the City’s overall financial management strategy and a key factor in external agencies’ measurement of the City’s financial strength. Reserve funds provide the City with the resources to manage cash flow and deal with unanticipated emergencies and changes in economic conditions. In addition, reserve funds enable the City to take advantage of matching funds and other beneficial (but limited) opportunities.

The City shall place emphasis on increasing unrestricted fund balance in the General Fund to an amount equal to approximately 20 percent of the General Fund operating budget expenditures. This represents approximately two and one half months of operating expenditures.

At the close of each budget year, any excess of revenues over expenditures that will increase the cumulative unrestricted fund balance above the established target amount will be recorded as a restricted reserve account available for appropriation by the Board of Commissioners, for one-time capital expenditures.

Reversion of Bond Proceeds: Bond proceeds remaining (unspent) after the purpose for which the bonds were issued has been completed shall be returned to the respective bond funds for future appropriation. The balance of available bond proceeds will be reported to the Board of Commissioners on a monthly basis. Further use of these monies shall be consistent with provisions contained within the appropriate bond resolutions and inconformity with federal and state regulations.

Budget Procedure

PURPOSE AND SCOPE OF THE BUDGET

The budget is the City’s financial plan, covering a twelve month period that balances projected revenues with anticipated expenditures, related to City services. Upon adoption by the Board of Commissioners, the City of Johnson City’s budget becomes a major policy document of this community for the ensuing fiscal year.

Essentially, the City of Johnson City’s budget strives to achieve the following objectives:

1. Establish a legal basis for the expenditure of city tax dollars;

2. Establish a means of public accountability and control of expenditures;

3. Provide a method for continuous review of city programs through established goals and departmental services;

4. Provide an operating plan of service for city departments;

5. Provide a basis for establishing policies, adopted by the Board of Commissioners, through

36

RESERVE FUND POLICIES

Policies and Procedures

recommendation by the City Manager;

6. Establish more effective communication between the citizens of Johnson City and City Officials.

ANNUAL BUDGET PROCESS OF THE CITY OF JOHNSON CITY

The City’s annual budget process typically begins in September with the preparation of the five-year Capital Improvement Plan (CIP). In January, a budget kick-off meeting is held with department and division directors to distribute budget instructions and to highlight concerns, challenges, and goals that face the City in the upcoming fiscal year. Following this informational meeting, department/division heads prepare their budget requests over the next thirty day period.

From there, the budget calendar is followed through the remainder of the budget process:

• Revenue estimates are prepared for the next fiscal year for all City funds.

• Departmental budgets are reviewed and analyzed and budget hearings are conducted with each department. Following these meetings, a tentative budget is prepared in consideration of the projected revenues and policy guidelines established by the City Manager.

• Budget work sessions are conducted with the Board of Commissioners, City Manager, and staff.

• At the conclusion of these work sessions, the Board of Commissioners’ input is incorporated into the proposed budget. An appropriation ordinance is prepared and is required by the City Charter to be published for public review no later than ten days prior to the first reading of the ordinance.

• By City Charter, the first reading of the budget ordinance and public hearing is required to occur at a regularly scheduled meeting of the Board of Commissioners, followed by two additional readings of the ordinance.

• The adopted budget takes effect July 1, the beginning of the new fiscal year.

BUDGET AMENDMENTS

Amendments which revise the total expenditure of any appropriated fund or department may occur at any time during the fiscal year after advertising and a public hearing before the Board of Commissioners. Three readings of the ordinance amending the budget are required.

37

September 24, 2022

CIP forms distrubted to Department/Division Heads

BUDGET CALENDAR

October 18, 2022

CIP forms due to Budget Office

Nov. 10 - Dec. 1, 2022

CIP work sessions with City Manager, Assistant City Manager, Budget Director, and Analyst

January 31, 2023

Small Department Budgets due to the Budget Office

January 19, 2023

CIP presented to City Commisssioners

January 17, 2023

Budget Kick-Off

Feb. 1 - Feb. 24, 2023

Budget hearings/reviews with the City Manager, Assistant City Mangers, Budget Director, and Analyst

February 7, 2023

Large Department Budgets due to the Budget Office

Feb. 27 - April 25, 2023

Budget analysis and finalize budget

May 2, 2023

Commission receive City Manger’s budget proposal

April 29, 2023

Publish initial advertisment in the Johnson City Press

April 13 - June 1, 2023

Budget work sessions with Commission

May 25, 2023

Budget Ordinance published in the Johnson City Press

June 1, 2023

First reading and public hearing of budget ordinance

June 8, 2023

Second reading of budget ordinance

July 1, 2023

FY 24 Budget is implemented

June 30, 2023

Budget sent to the State

June 15, 2023

Third reading of budget ordinance

38

FUND SCHEDULES

EXPENDITURE CHANGES BY FUND FISCAL YEAR 2024

39

Budget Projected Budget FUND FY 2023 FY 2023 FY 2024 Dollars Percent General Fund (Operating) 77,376,340 78,944,308 84,628,218 5,683,910 7.2 Debt Service Fund 11,731,313 11,731,313 12,260,434 529,121 4.5 Educational Facilities Trust Fund 4,619,297 4,619,297 4,711,950 92,653 2.0 General Purpose School Fund 86,197,617 87,241,551 97,729,610 10,488,059 12.0 School Food Services Fund 4,611,300 3,832,525 3,868,600 36,075 0.9 School Federal Projects Fund 21,704,240 12,338,702 10,415,796 (1,922,906) (15.6) School Special Projects Fund 695,602 1,501,952 3,145,612 1,643,660 109.4 Capital Equipment Fund 2,611,080 4,258,090 4,154,267 (103,823) (2.4) Capital Projects - Facilities/Infrastructure Fund 58,060,203 30,907,682 32,620,440 1,712,758 5.5 Capital Projects - Schools Fund 2,100,000 7,106,339 2,000,000 (5,106,339) (71.9) Community Development Fund 921,250 921,250 720,255 (200,995) (21.8) Drug Fund 224,400 224,400 229,000 4,600 2.0 Freedom Hall Fund 1,853,253 1,897,140 1,875,558 (21,582) (1.1) Mass Transit Fund 5,293,000 5,240,068 5,575,689 335,621 6.4 Police Grant Fund 157,406 169,062 159,500 (9,562) (5.7) Police Technology Fund 212,104 212,104 188,074 (24,030) (11.3) Solid Waste - Municipal Fund 12,632,698 12,507,764 14,218,324 1,710,560 13.7 Solid Waste - Regional Fund 3,473,535 3,473,535 4,060,235 586,700 16.9 Storm Water Fund 2,436,201 2,421,979 2,435,141 13,162 0.5 Transportation Planning Fund 334,434 334,434 386,688 52,254 15.6 Water and Sewer Fund 37,540,669 37,075,905 39,586,846 2,510,941 6.8 TOTAL - ALL FUNDS 334,785,942 306,959,400 324,970,237 18,010,837 5.9 Bdgt. FY 24 vs. Proj. FY 23

Change

40 CITY OF JOHNSON CITY BUDGET SUMMARY FY 2024 ANNUAL BUDGET Fund Beginning Fund Total Available Balance (or Net Position) Revenues Debt Proceeds Transfers In Receipts Funds General Fund 51,683,507 $ 114,451,393114,451,393 166,134,900 Debt Service Fund 454,29212,260,434 12,260,434 12,714,726 Educational Facilities Trust Fund 7,710,132 3,346,0001,900,000 5,246,000 12,956,132 General Purpose School Fund 17,786,713 81,902,31614,536,159 96,438,475 114,225,188 School Food Services Fund 3,936,365 3,868,6003,868,600 7,804,965 School Federal Projects Fund 1,075,350 10,389,79626,000 10,415,796 11,491,146 School Special Projects Fund 8,680 3,126,07319,539 3,145,612 3,154,292 Capital Equipment Fund 1,135,8693,564,267 3,564,267 4,700,136 Capital ProjectsFacilities/Infrastructure 32,610,955 2,800,0001,855,000 4,655,000 37,265,955 Capital ProjectsSchools Fund 396,39340,000,00040,000,000 40,396,393 Community Development Fund 393,718 720,255720,255 1,113,973 Drug Fund 991,699 115,000115,000 1,106,699 Freedom Hall Fund 851,777 1,458,500417,100 1,875,600 2,727,377 Mass Transit Fund 7,099,447 3,668,1891,459,348 5,127,537 12,226,984 Police Grant Fund159,500159,500 159,500 Police Technology Fund 241,082 260,000260,000 501,082 Solid WasteMunicipal Fund 14,401,339 13,591,860199,192 13,791,052 28,192,391 Solid WasteRegional Fund 5,927,360 4,095,2004,095,200 10,022,560 Storm Water Fund 15,651,793 3,289,0003,289,000 18,940,793 Transportation Planning Fund 116,455 326,22260,500 386,722 503,177 Water and Sewer Fund 165,774,575 41,904,300225,162 42,129,462 207,904,037 TotalAll Funds 328,247,500 $ 289,472,204 40,000,000 36,522,701 365,994,905 694,242,405

41 CITY OF JOHNSON CITY BUDGET SUMMARY FY 2024 ANNUAL BUDGET Fund General Fund Debt Service Fund Educational Facilities Trust Fund General Purpose School Fund School Food Services Fund School Federal Projects Fund School Special Projects Fund Capital Equipment Fund Capital ProjectsFacilities/Infrastructure Capital ProjectsSchools Fund Community Development Fund Drug Fund Freedom Hall Fund Mass Transit Fund Police Grant Fund Police Technology Fund Solid WasteMunicipal Fund Solid WasteRegional Fund Storm Water Fund Transportation Planning Fund Water and Sewer Fund TotalAll Funds Total Increase/ Est End Fund Balance Expenses Transfers Out Appropriations Decrease or Net Position 84,628,218 29,823,175 114,451,393 0 51,683,507 12,260,43412,260,434 0 454,292 4,711,9504,711,950 534,050 8,244,182 97,729,61097,729,610 (1,291,135) 16,495,578 3,868,6003,868,600 0 3,936,365 10,415,79610,415,796 0 1,075,350 3,145,6123,145,612 0 8,680 4,154,2674,154,267 (590,000) 545,869 32,620,44032,620,440 (27,965,440) 4,645,515 2,000,0002,000,000 38,000,000 38,396,393 720,255720,255 0 393,718 229,000229,000 (114,000) 877,699 1,875,5581,875,558 42 851,819 5,575,6895,575,689 (448,152) 6,651,295 159,500159,500 0188,074188,074 71,926 313,008 14,070,517 147,807 14,218,324 (427,272) 13,974,067 3,783,688 276,547 4,060,235 34,965 5,962,325 2,435,1412,435,141 853,859 16,505,652 386,688386,688 34 116,489 39,586,84639,586,846 2,542,616 168,317,191 324,545,883 30,247,529 354,793,412 11,201,493 339,448,993

GENERAL FUND SUMMARY