It’s not just a discount It’s our commitment to you

From next year, in line with the changing needs of our audience, there will be a change to the mix of digital and print content from Construction Europe

UNITED KINGDOM (HEAD OFFICE)

KHL Group

Southfields, South View Road, Wadhurst, East Sussex TN5 6TP, UK.

T: +44 (0)1892 784088 | F: +44 (0)1892 784086 ce@khl.com | www.khl.com/ce USA OFFICE

KHL Group Americas

14269 N 87th St., Suite 205, Scottsdale, AZ 85260, USA.

+1 480 535 3862 | americas@khl.com

SOUTH AMERICA OFFICE

KHL Group Américas

Av. Manquehue Sur 520, of. 205, Las Condes, Santiago, Chile.

+56 9 7798 7493 | cristian.peters@khl.com

CHINA OFFICE

KHL Group China

Room 769, Poly Plaza, No.14, South Dong Zhi Men Street, Dong Cheng District, Beijing, PR China 100027

+86 (0)10 65536676 | cathy.yao@khl.com

KHL SALES REPRESENTATIVES

BRAND MANAGER PLUS AUSTRIA/GERMANY/SWITZERLAND

Peter Collinson, UK Head Office

+44 (0)1892 786220 | peter.collinson@khl.com

BENELUX/SPAIN Ollie Hodges, UK Head Office

+44 (0)1892 786253 | ollie.hodges@khl.com

CHINA Cathy Yao

+86 (0)10 65536676 | cathy.yao@khl.com

FRANCE Hamilton Pearman

+33 (0)1 45930858 | hpearman@wanadoo.fr

ITALY Fabio Potestà

+39 010 5704948 | info@mediapointsrl.it

JAPAN Michihiro Kawahara

+81 (0)3 32123671 | kawahara@rayden.jp

SCANDINAVIA Greg Roberts, UK Head Office

+44 (0) 7950 032224 | greg.roberts@khl.com

TURKEY Emre Apa

+90 532 3243616 | emre.apa@apayayincilik.com.tr

UK/IRELAND Eleanor Shefford, UK Head Office

+44 (0)1892 786236 | eleanor.shefford@khl.com

USA/CANADA Thomas Kavooras

+1 847 609 4393 | thomas.kavooras@khl.com

GLOBAL VICE PRESIDENT SALES

Alister Williams

+1 312 860 6775 | alister.williams@khl.com

The digital content for the European construction market will continue to be available through our website, ConstructionBriefing.com

The printed content on the industry in Europe will, from January, be delivered as part of our sister title, International Construction, which will subsequently increase in frequency from six to eight issues a year.

And speaking of issues, those that are shaping European construction – from the race to net zero to next-gen machines and the development of humanoid construction robots (see the tech news page) – will continue to be delivered with regularity, both in print and online.

In fact, the new format gives us a real opportunity to more closely scrutinise the shifts in European construction against the latest developments around the world.

It also aligns perfectly with the opportunities European contractors and equipment manufacturers are increasingly exploring in the global construction market.

In short, it means our European and international editorial teams will be working more closely to deliver a global picture of projects, equipment, technology and trends.

So, look out for the first issue of International Construction in January 2026, incorporating Construction Europe

And, in the meantime, I hope you enjoy a wonderful festive season.

United. Inspired.

Our Midlife services transforms your equipment by replacing key components and adding technical upgrades—so it performs like new at a fraction of the cost of buying a replacement. Renovation over replacement means lower Total Cost of Ownership and a smarter, more sustainable investment for your business.

Pair Midlife services with our CARE service agreements for peace of mind. This powerful combination ensures maximum productivity, proactive maintenance, and predictable costs—keeping your machine running longer and stronger.

Start now at epiroc.com epiroc.com

EDITOR

Mike Hayes

mike.hayes@khl.com

CONSTRUCTION BRIEFING EDITOR

Neil Gerrard

DIRECTOR OF CONTENT

Murray Pollok

EDITORIAL MANAGER

Alex Dahm

GROUP EDITORS

Lindsey Anderson, Andy Brown,

D.Ann Shiffler, Lewis Tyler, Euan Youdale

LAW & CONTRACT CORRESPONDENT

Produced in co-operation with Pinsent Masons

CECE REPORT

Produced in co-operation with the Committee for European Construction Equipment

FIEC REPORT

Produced in co-operation with the European Construction Industry Federation

BRAND MANAGER

Peter Collinson | peter.collinson@khl.com

CLIENT SUCCESS & DELIVERY MANAGER

Charlotte Kemp | charlotte.kemp@khl.com

CLIENT SUCCESS & DELIVERY TEAM

Alex Thomson, Ben Fisher, Olivia Radcliffe

GROUP DESIGNER Jade Hudson

CLIENT SUCCESS & DELIVERY DIRECTOR

Peter Watkinson

DATA MANAGER

Anna Philo | anna.philo@khl.com

DATA EXECUTIVE

Vicki Rummery | vicki.rummery@khl.com

FINANCE MANAGER

Yasmin Youmi | yasmin.youmi@khl.com

HR MANAGER

Sharron Brown

+44 (0)1892 786248 | sharron.brown@khl.com

EVENTS MANAGER Steven Webb

EVENTS DESIGN MANAGER Gary Brinklow

CREATIVE DESIGNER Kate Brown

SUPPORT SERVICES Julie Wolstencroft

CHIEF FINANCIAL OFFICER Paul Baker

CHIEF

10 NEWS REPORT: CECE SUMMIT

Neil Gerrard reports on a Brussels conference with a focus on the simplication of EU regulations

Mitch Keller on how precision demands and lowcarbon power are driving the excavator market

Why global markets are clouded by hesitation

CE asks industry experts for their views on the latest diesel engines and what might follow

26

Andy Brown asks whether it's cultural barriersrather than tech - holding back digital progress

31 INTERVIEW: WACKER NEUSON

Alexander Greschner talks to CE about net zero and his company's expanding equipment portfolio

41 INTERVIEW: WIRTGEN

Benninghoven's Steven Mac

Nelly discusses mult-fuel burner technology in asphalt production

43 PROJECT SPOTLIGHT

How HS2 engineers slid a viaduct deck into place

CONEXPO

Mar 3-7, 2026

Las Vegas, US conexpoconagg.com

SAMOTER

May 6-9, 2026

Verona, Italy

Government aims for planning approval to be given by 2029 and the runway to open in 2035 2026

samoter.it/en

APEX/IRE

Jun 2-4, 2026

Maastricht apexshow.com

The UK government has chosen its preferred plan for a third runway at Heathrow airport, a project with an estimated cost of £33 billion.

The 3.5km-long runway would require a new road tunnel to cross the busy M25 road (a circular

motorway that runs around London) and is scheduled to be operational by 2035.

The transport secretary, Heidi Alexander, said the choice would enable swift progress to full planning permission by 2029, providing the runway met the government’s four tests, including environmental, economic, noise and air quality considerations.

The runway itself is expected to cost £21 billion, with a further £12 billion needed for associated infrastructure, including new satellite terminals.

“Today is another important step to enable a third runway and build on these benefits, setting the direction for the remainder of our work to get the policy framework in place for airport expansion,” said Alexander.

“This will allow a decision on a third runway plan this parliament which meets our key tests including on the environment and economic growth.”

Tunnel boring machines (TMBs) have broken through in the alps the main tunnels of construction section H41 Sill Gorge-Pfons south of Innsbruck as part of the Brenner Base Tunnel (BBT) project in

Austria and Italy.

The Brenner Base Tunnel project is a 55km railway tunnel under construction connecting Innsbruck, Austria, and Fortezza, Italy. Once completed, it will be among the world’s

Reports have emerged, suggesting the Czech Republic is planning to build two nuclear reactors at the Dukovany power plant for a total investment of approximately US$19 billion. Once operational, the two new reactors would double the Czech Republic’s nuclear energy capacity. South Korea’s Korea Hydro and Nuclear Power (KHNP) will construct a new facility featuring two reactors, each exceeding 1,000 megawatts. These reactors are projected to start operations in the late 2030s, alongside the existing four reactors at Dukovany, which have a combined capacity of 2,048 megawatts.

longest railway tunnels and it has an estimated cost of €10.5 billion.

Eight tunnel boring machines manufactured by Herrenknecht have

so far excavated around 83km of tunnel. In midNovember came the breakthrough of two TMBs named ‘Lilia’ and ‘Ida’.

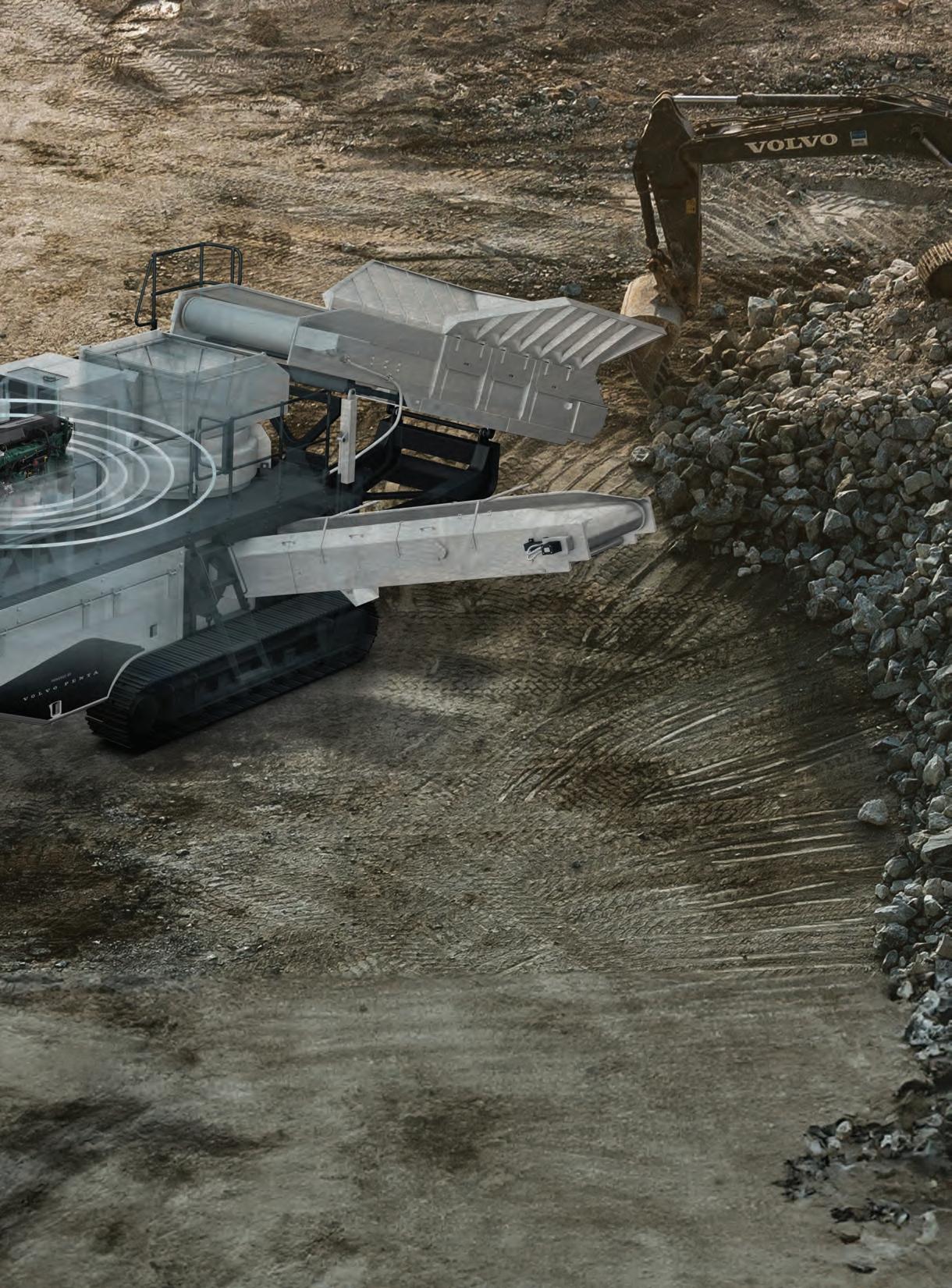

Volvo Construction Equipment (Volvo CE) is set to expand its European industrial footprint with a new crawler excavator assembly factory in Eskilstuna, Sweden. The investment in Sweden is part of Volvo CE’s plan to strengthen its position in the excavator segment. The company said the 30,000m2 facility will meet the growing customer demand by increasing

The two TBMs weigh over 2,400 tons, are around 160m long, have a diameter of 10.25m and a drill head with a drive power of 4,550kW.

With these machines, the construction companies Implenia, Webuild, and CSC (ARGE H41 Silschlucht-Pfons) have excavated over 8km of tunnel since the start of tunnelling in May and June 2023 and lined it with precast concrete segments. ce

Industry's global carbon footprint is expected to more than double by 2050

The global construction industry’s carbon footprint is set to more than double by 2050.

That’s according to a new study published in Nature’s Communications Earth & Environment, which warned that construction’s carbon footprint alone would be enough to exceed the per-annum carbon budget to hold global temperatures below 2˚C over the next two decades. It warned that in 2022, over half of the industry’s carbon emissions came from cementitious materials, bricks, and metals. Glass, plastics, chemicals, and bio-based materials contributed 6%, and the remaining 37% arose from transport, services, machinery, and on-site activities.

It also found that the construction industry’s carbon footprint in global emissions has gradually increased over three decades, from 20% to 33%, fuelled mainly by material-related inputs such as cement, bricks, metals and glass.

A major reason for the increase has been a rapid rise in the number of major construction projects in developing regions.

The study called for a “material revolution” that would involve replacing traditional materials with bio-based, circular, and reused materials. ce

Four crane OEMs have filed a complaint with the European Commission about imports of Chinese mobile cranes into the EU. Liebherr, Manitowoc, Sennebogen and Tadano filed the complaint via the VDMA Materials Handling

and Intralogistics Association, of which they are members. It calls for urgent investigation into “imports of Chinese mobile cranes marketed in the EU at conditions that result in manifestly unfair competition for European producers.”

A Tadano crane operating in Rotterdam

IMAGE: MAMMOET

The four companies represent around 99% of the mobile crane industry in the EU, according to VDMA.

“Chinese mobile cranes [are] marketed

capacity and flexibility, and will enable reduced reliance on long-distance logistics, shorter delivery times, enhancing supply chain resilience and reducing carbon emissions.

“This strategic investment in the future of excavator production in Eskilstuna marks a new era for us and the Swedish industry”, said Melker Jernberg, head of Volvo CE.

CZECH REPUBLIC The European Commission has approved €450 million in Czech state aid to support the construction of a new chip factory in the country. The chips will be used in electric vehicles and fast-charging stations and other industrial applications.

UK UK-based investment firms HICL Infrastructure and The Renewables Infrastructure Group (TRIG) in a £3.98 billion deal that will create the UK’s largest listed infrastructure investment company. The deal will bring together HICL’s portfolio of more than 100 core infrastructure assets across social infrastructure, utilities and transport, with TRIG’s 2.3 GW renewables platform.

GERMANY The number of permits to build apartments in Germany jumped by nearly 60% in September, signalling a continuing if gradual recovery in the country’s residential construction market. Germany’s property sector has been in decline since 2022 but the increase in apartment permits to 24,400 in September was a sign that the market could finally be turning a corner.

SKANSKA Swedish construction giant Skanska has raised its target operating profit margin to ≥4%. The news came ahead of the company’s Capital Markets Day in Seattle, USA, where it provides updates on its strategic priorities and the commercial direction of its businesses. The margin target for the construction business was previously set at 3.5% and is the only one to have been increased.

in the EU at conditions that result in manifestly unfair competition for European producers,” VDMA said, adding that the complaint focuses on “mobile cranes designed for the lifting and moving of materials on land, with a lifting capacity of at least 30 tonnes, mounted on self-propelled vehicles.”

Christoph Kleiner,

MD of sales at Liebherr-Werk, said, “Our European industry welcomes fair competition, but it is patently unfair to compete with products whose selling conditions do not come close to covering the raw materials, energy and production costs of a European mobile crane manufacturer.”

Mace Construct has signed the main construction contract for Vulcan 20-20, a scientific infrastructure project that will deliver the world’s most powerful lasers. Located at the Science and Technology Facilities Council’s UK laboratory, the new facility will house a 20 Petawatt laser system that is capable of delivering, in a single laser pulse, sufficient energy to help scientists recreate and study some of the most extreme conditions found in space, explore new ways to produce clean energy through fusion. Mace Construct will lead the project to build two 7m tall targeting bunkers, with walls and soffits up to 2m thick, formed using a specialised radiation-resistant concrete mix designed to shield beams a billion times hotter than the brightest sunlight.

3DCP Group has completed the printing phase of the project, producing 36 student apartments in Holstebro, with COBOD’s BOD3 3D Construction Printer, on behalf of NordVestBo.

The total printed area is 1,654m² across six buildings and printing time was reduced from several weeks on the first building of six apartments to just five days on the last, equal to more than one apartment per day.

3DCP Group says that it used the COBOD BOD3 printer to achieve millimetre accuracy across all printed walls, operated by a three-person team.

The BOD3’s ground-based track system, specifically designed for residential construction, allowed the printer to extend easily along the Y-axis, enabling uninterrupted printing of long wall sections. ce

The BOD3’s track system allows for large-scale uninterrupted printing

The global management consultancy McKinsey has produced a report called Humanoid robots in the construction industry: A future vision

which argues that these machines could emerge as a solution to construction’s productivity problem.

The report suggests

a logical next step to the bricklaying and drilling robots are general-purpose robots equipped with artificial intelligence

Global engineering firm Aecom has announced it aims to deliver a 20% profit margin by 2028 with the help of AI, as it unveiled its full-year results for 2025.

Troy Rudd, Aecom’s chairman and chief executive officer said that its highmargin advisory business and its proprietary AI would help propel the company towards the increased margin target of 20%. He said, “We exceeded the midpoints of our...financial guidance in fiscal 2025, including delivering a record full year margin and highlighted by a 17.1% margin in the second half of the fiscal year. We made several announcements today that underscore our commitment to extending our competitive advantage and expanding our longterm earnings power. "

Aecom office in Ontario, Canada

IMAGE: RAYSONHO @ OPEN GRID SCHEDULER / GRID ENGINE, CC0, VIA WIKIMEDIA COMMONS

(AI) that can perform diverse, unrelated tasks across multiple settings alongside humans.

And large-scale humanoid usage could only be a “a decade away”, it claims, suggesting this accelerated timeline is possible, due to rapid technological advances.

As things stand, humanoid robots can now handle unstructured tasks like lifting irregularly shaped objects but can’t yet cope with more complex activities such as operating small tools with human-level dexterity. They will also need to advance to the point

where they can operate without “fences”, moving freely across sites safely and in collabouration with humans, rather than being confined to certain areas. ce

Introducing the most advanced excavator ever designed –the Komatsu PC220LCi-12. Built on the all-new powerful 129 kW high torque Komatsu engine and paired with the new high efficiency electronically controlled hydraulic system, this machine achieves 18% reduction in average fuel consumption, compared to the previous model. With the new generation intelligent Machine Control (iMC) 3.0 technology, this cuttingedge machine offers unique-in-the-market features such as auto-swing, swing-to-line and travel-along-line.

CECE

general

If European construction equipment manufacturers want to remain globally competitive, they will need a rapid simplification of the rules, regulations and standards that govern the industry.

That was the key message from the CECE Summit 2025, held at the Residence Palace in Brussels, Belgium.

Around 120 industry leaders, EU policymakers and technical experts attended the event, under the theme “Smarter Rules, Stronger Industry”.

Simplifying European regulations to make them clearer and more efficient while technology is developing rapidly and getting more complex, presents a significant challenge – one that became increasingly clear as a succession of highprofile speakers discussed the topic

Outgoing CECE president José Antonion Niete called for a “simpler, smarter and stronger future” as he opened the Summit, while CECE secretary general Riccardo Viaggi emphasised that simplicity was a necessity for European manufacturers.

The Summit heard from Barbara Bonvissuto, director at the European Commission’s Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs (DG-GROW).

Bonvissuto presented the Commission’s Digital Omnibus Package, which aims to streamline rules on artificial intelligence, cybersecurity and data. Presenting the

Omnibus on 19 November, the European Commission said it could save an estimated €5 billion in administrative costs by 2029.

Meanwhile, CECE experts raised concerns about the Carbon Border Adjustment Mechanism (CBAM) and questioned whether digital compliance tools truly reduce complexity.

And Koert Debeuf, a professor of politics at VUB, highlighted how the current tensions over global tariffs reflect certain moments of “tribalisation” in history.

Also speaking at the Summit, Dr Nicholas Fearnley, head of global construction at Oxford Economics, forecast a rebound in Europe in residential building, nonresidential building, and civil engineering.

“It’s really the civil engineering sector that is driving growth in Europe this year, including transportation and utilities. Building construction activity has remained weak. We do think building construction activity is going to come back stronger next year in Europe,” he told delegates. Ukraine is set to see the fastest growth in construction activity in Europe, ahead of an expected reconstruction programme there, although the level of growth is dependent on a ceasefire and the form it eventually takes.

More generally, Dr. Fearnley noted

that one slightly unexpected feature of today’s construction sector is falling labour productivity, which has gone backwards since 1997, when a construction worker was adding more economic value to the European Union than they are today.

“It is a problem in pretty much all advanced economies. This is a struggle when you have labour shortages and you are getting less out of each worker. We think this is something the construction industry is going to be grappling with over the next five years,” he said.

Phil Layton, group engineering director at UK-based construction equipment manufacturer JCB, was confirmed as the next president of CECE at the conclusion of this year’s Summit.

He was officially welcomed to the role on stage by outgoing president José Antonio Niete. Layton’s presidency will begin in 2026.

Meanwhile, Construction Equipment Association (CEA) chief executive Viki Bell has been appointed to the CECE board, following her interim participation earlier this year.

The CEA also confirmed it will host the CECE Congress 2026 at the IET Savoy Place in London from 27–29 October 2026. ce

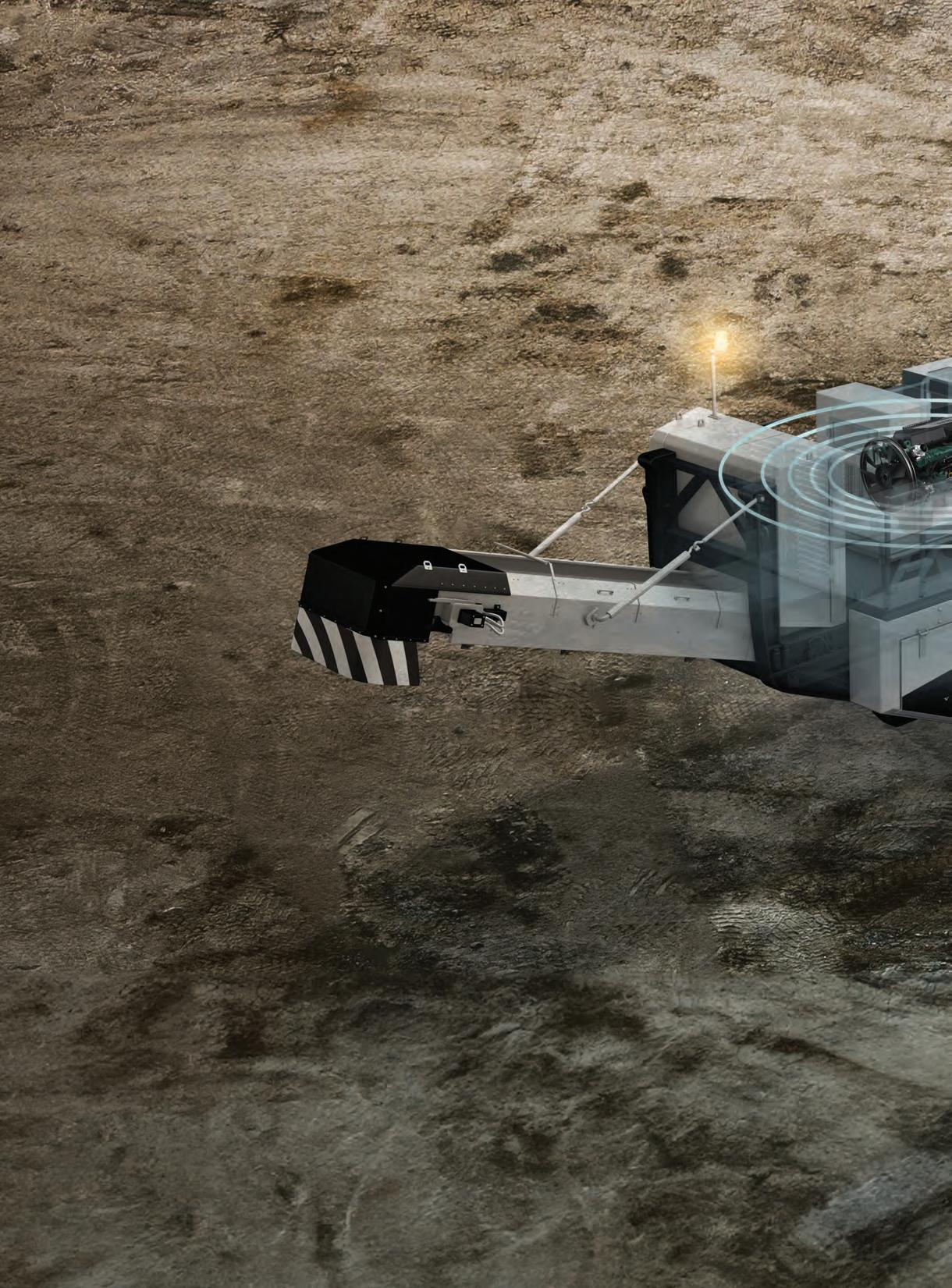

Our user-friendly all-in-one fleet management system gives you instant access to vital performance data on all your equipment. It even collects data from other manufacturers’ machines, giving you a complete overview of your entire fleet. With custom reporting tools focusing on key metrics, and smart geofencing for precise productivity tracking, you’ll have everything you need to boost the efficiency of your machinery and save you valuable time.

For more information, scan the QR code

The UK economic outlook is limited, with real GDP growth expected to grow just 1.0% in 2025 and 0.9% in 2026 and 1.5% in 2027. The economy faces significant global trade uncertainties, damaging business and consumer sentiment.

November’s flash Purchasing Managers’ Index (PMI®) survey by S&P Global suggests that private sector activity continues to struggle. The PMI composite index measuring output from manufacturing and the services sector stood at a negligible 50.5 in November, down from 52.2 in October. A score above 50 indicates expansion, but the latest readings suggest growth has slowed to a trickle. The survey also flagged

that firms expect business conditions to remain tough in the coming months. Also, the latest business survey by the British Chambers of Commerce indicated that confidence is at its lowest level since 2022.

The headline GfK survey reveals that the consumer confidence index fell by 2 points to negative 19 in September, well below its historical average. Lower confidence reflects greater concerns over the general economic situation and personal finances. In addition,

Scott Hazelton is a director with the Global Construction team at the market analyst S&P Global.

Scott has over 30 years experience in construction, heavy equipment, building materials and industrial manufacturing markets.

the GfK survey continued to signal acute job losses in both manufacturing and services.

Real total construction spending in the UK is expected to rise by 2.3% in 2025 as still-high financing costs and ongoing uncertainties weigh on household and business sentiment. Even so, government spending on public-sector projects, as well as major infrastructure projects and investment programs, will sustain construction activity and drive stronger growth of 4.3% in 2026. Lower borrowing costs and receding uncertainties should also drive activity in 2026.

Reforms to the UK’s planning system also bode well for industry growth, although any impact from these measures will largely be felt beyond 2026. The UK construction

industry will continue to face challenges, and risks remain skewed to the downside. These include persistently high construction cost pressures, with labour costs remaining a key driver owing to the increase in employers’ National Insurance Contributions and national minimum wage rates since April 2025, as well as ongoing skills shortages. A cautious approach to interest rate cuts and stricter regulations related to safety in high-rise buildings and improving the energy efficiency of residential and non-residential buildings may also add to construction costs, creating further financial challenges for construction firms in the near term. Delays to project approvals and starts and the prospect of tax rises or capital spending cuts in the Autumn Budget 2025 are also notable downside risks.

Spending growth in the residential construction sector is expected to pick up slightly to 1.8% in 2025 before accelerating to 4.8% in 2026 as higher real incomes and lower interest rates improve housing affordability and demand. Renovation activity should also continue to benefit from various energy-efficiency

schemes and a pipeline of high-rise buildings requiring fire-safety remediation works.

Government housing initiatives and planning reforms also bode well for homebuilding beyond 2026, and monetary easing by the Bank of England will cut interest rates, albeit gradually, improving housing market activity.

In non-residential structures, construction spending is expected to grow by 2.7% in 2025 and 3.0% in 2026 as lower interest rates help restore investor confidence for new developments, while long-term structural changes and a focus on energy efficiency continue to underpin refurbishment activity in offices and commercial.

The government has committed increased funding to build or rebuild schools, hospitals and prisons in the Spending Review 2025 and 10-year Infrastructure Strategy. As interest rates are gradually reduced and capital values recover, this should support a revival in investor confidence and, in turn, investment activity across the commercial real estate market.

That said, uncertainty around global trade and the Autumn

Source: S&P Global Market Intelligence © 2025 S&P Global

Budget, as well as the increase in employer National Insurance contributions from April 2025, which is driving up labour costs, may limit appetite for investment. As such, the focus of construction activity will remain on redeveloping and refurbishing existing commercial space as developers, investors and property owners continue to address environmental, social and governance requirements and minimum energy efficiency standard regulations that are set to tighten further.

The offices subsegment will benefit from investment in data centres to support the rapid growth in AI. In January 2025, three private tech firms committed £14 billion for such projects in the UK as part of the government’s AI Opportunities Action Plan. Growth will additionally be supported by the development of offshore wind farms and nuclear power projects.

Spending on infrastructure construction is forecast to expand by 2.4% in 2025 and by a further 5.2% in 2026, driven by work underway on major projects such as phase one of High Speed 2 (HS2) and five-year spending plans in regulated sectors such as

Business confidence is at its lowest level since 2022.”

roads, rail and water. Transport infrastructure should additionally benefit from increased public funding pledged at the Spending Review 2025 and the recent approval of road and rail projects.

Reforms to the Planning and Infrastructure Bill that aims to fast-track decisions on 150 major infrastructure projects by the end of this parliament should also support growth prospects in the medium to long term.

In the water and sewer subsegment, water companies in England and Wales are set to spend £104 billion to upgrade water infrastructure over the five-year regulatory period, runs from April 2025 until March 2030. This is double the amount that was spent in the previous five-year regulatory period.

In the transportation subsegment, Network Rail’s Control Period 7 will see £42.8 billion invested from April 2024 to March 2029, with increased investment in tackling climate change and improving train performance.

At the Spending Review 2025, the government

announced £24 billion of capital funding to National Highways and local authorities to maintain and improve motorways and local roads across the country between 2026–27 and 2029–30. Other key funding commitments include £15.6 billion of funding for local transport projects in England’s city regions by 2031–32, £2.2 billion of funding for Transport for London’s capital renewals programme between 2026–27 and 2029–30 and £2.3 billion funding for local transport enhancements in smaller cities, towns and rural areas from 2026– 27 to 2029–30.

In addition, the government has allocated funding for major rail projects; £25.3 billion to the deliver HS2 from Birmingham Curzon Street to London Euston, £3.5 billion for the TransPennine Route Upgrade and £2.5 billion for the EastWest Rail, among others. All in all, the government has pledged £92 billion for transport investment at the Spending Review 2025, which is expected to support 50 road and rail upgrades that were given the green light in July 2025.

Europe’s excavator market is shifting fast, driven by precision demands, lowcarbon power and new manufacturing strategies. Mitchell Keller reports

Europe’s excavator market is changing fast. Contractors are asking for machines that work more efficiently with less fuel, deliver repeatable precision, and stay productive for longer between service intervals.

At the same time, the sector is moving toward electric and low-carbon fuels, while manufacturers rethink how and where machines are produced for European customers.

What emerges is an industry reshaping the excavator around time – reducing cycle times, limiting downtime, accelerating operator proficiency and shortening delivery distances.

Manufacturers say the traditional measures of horsepower and breakout force no longer define excavator performance on

their own. Productivity now depends on how effectively a machine converts its power into controlled movement, shorter cycles, and lower operating costs.

Jerome Claret, Market Professional for Excavators, Global Construction & Infrastructure at Caterpillar, says performance should be understood as “its ability to complete a task in the shortest possible time and at the lowest operational cost.” He notes that integrated technologies such as Cat Grade, Cat Assist and Cat Payload are becoming part of that definition as contractors look for consistency across shifts and operators. Develon echoes the shift. “Horsepower is one thing, but most important is how

you use it, in the most efficient way,” says Stéphane Dieu, Product Manager for Develon excavators in Europe. “Without control, Power is nothing.”

Dieu pointed to hydraulic and flow management as the real levers behind faster cycles and lower fuel burn and says the company’s Series 9 excavators manage flow sharing through software to balance engine output and efficiency.

Liebherr says the definition is broader still. “Performance is a multifaceted concept,” the company tells Construction Europe

not only for its power but for its ability to fill large dump trucks quickly, maintain short cycle times and deliver consistent production quality across long shifts. These characteristics, the company says, show how modern performance centres on optimising the entire loading process, reducing waiting times and lowering operating costs.

“Beyond horsepower and digging force, it encompasses productivity, efficiency, operator comfort, and adaptability to challenging environments,” Liebherr adds.

powerful attachments where stability and fine control directly influence output.

For Europe’s mixed fleet of owneroperators, rental firms and large contractors, these shifts align with a practical goal: maximum productivity per litre of fuel or kilowatt-hour of charge.

Precision work – from utility trenching to urban regeneration – is increasingly shaped by the systems built into excavators rather than aftermarket add-ons. Contractors want grading accuracy that reduces rework, cuts material waste and shortens programme durations.

Caterpillar’s approach has centred on automation. Claret says Cat Grade with Assist “automate[s] boom and bucket movements, enabling operators to reach target grades more efficiently, with less effort and greater accuracy.” Tilt Assist maintains bucket angle on slopes or uneven ground, while the Cat Tilt Rotate System reduces the need for repositioning, helping fine-grading performance in tight spaces.

Develon takes a slightly different path. Its Series 9 excavators allow operators to tune hydraulic priority directly, choosing between precision or speed depending on the task. “When using hydraulic attachments, it is possible to prioritise the flow to the arm, or to the attachment,” Dieu says. With the FEH hydraulic system, “for the same joystick movement, you can tune the output.”

Liebherr adds a further layer through embedded assistance systems. Its bucket filling assistant provides real-time feedback to maintain a consistent fill factor and prevent stalling, using sensors and machine learning to adapt to hard or uneven digging.

Liebherr also highlights factory-fitted Leica steering systems and the integration of 2D and 3D-ready controls ex works, saying modern machine control “makes it possible to carry out work even more precisely, quickly, and efficiently and avoid the need for reworking.”

Despite the differing approaches, the direction of travel is consistent: excavators are becoming precision machines as standard. In Europe’s mature markets – particularly Germany, France, the UK and Scandinavia – built-in accuracy and integrated grading conrols reduce reliance on experienced operators, many of whom are in short supply.

The company points to its R 992 crawler excavator working in quarry applications as an example. The machine is valued >

For mobile excavators, Liebherr adds that load capacity and hydraulic power are often the defining elements of performance — particularly when running

Contractors note that productivity gains disappear quickly if machines sit idle for

SANY has delivered its first 80-tonne crawler excavator in the UK with the arrival of the SY750H at Heritage Quarry Group (South) Ltd, a natural stone producer operating multiple quarries in central England. The machine will be used for bulk mineral extraction work across the company’s sites at Rollright, Daglingworth and Great Tew.

The SY750H becomes the third SANY excavator in the Heritage Quarry Group fleet following purchases of the 40-tonne SY390H and 50-tonne SY500H earlier in the year.

“The performance and reliability of the SANY excavators have been exceptional, so when the time came to expand our fleet, the SY750H was the natural next step — and it certainly impressed us,” said Managing Director Julian Veal. He added that the firm’s decision was also influenced by the aftersales support received to date.

maintenance. That has pushed OEMs to rethink service intervals, diagnostic access and the way maintenance tasks are physically carried out.

Develon’s focus has been on physical access. “From the beginning of the project, it was important that filters and maintenance points are easy to reach,” Dieu says. “A machine with easy access maintenance will always be well maintained and always ready to work.”

Back with Liebherr, the company takes serviceability into structural design decisions. It notes that “modular design of components” improves access, while raised final drives reduce wear and exposure to debris. Oscillating idlers and rollers help absorb shocks in tough ground conditions, and cab visibility is engineered to support daily checks.

These measures, Liebherr says, “ensure that the machines work reliably and efficiently even in demanding field conditions.”

For Caterpillar, extending intervals and digitising service support has been a priority. Claret highlighted hydraulic oil change intervals of 6,000 hours and engine oil intervals of 1,000 hours on models from the 313 to the 395. Fewer filters and synchronised service points aim to simplify planned maintenance. Features such as Remote Troubleshooting and Remote Flash allow dealers to diagnose faults and push software updates without stopping work, reducing unnecessary call-outs.

OEMs point to the operator as a central factor in uptime. Claret notes that many machines carry advanced functions that are “highly appreciated” when used, but not always fully adopted. Dieu added that understanding customer behaviour is itself a form of technology: “Maybe it is the collection of voice of customers – this is a really important process to explore machines in all possible applications.”

Improved visibility and human-detection systems are becoming baseline expectations for contractors working in confined European jobsites, where

machines operate close to ground crews, utilities and passing traffic. Major publicsector clients – particularly in Northern Europe – now require 360-degree visibility or active detection technology on machines above certain tonnages, accelerating adoption well beyond premium models.

Volvo Construction Equipment has upgraded visibility on its latest electric excavators to meet these requirements. The EC230 Electric, now in its next generation, incorporates Volvo Smart View with People and Obstacle Classification, giving operators a stitched, 360-degree view of the surroundings with the ability to distinguish between people and objects. For contractors working in city centres or around live services, the ability to classify hazards rather than simply detect movement is becoming increasingly important.

Liebherr reports that these systems have already shifted from optional extras to expected equipment. Camera suites “are no longer optional; they have become standard equipment,” the company says. Panoramic glazing, sloping bonnets and modular lighting concepts support this by improving natural sightlines from the cab – an approach Liebherr describes as part of the machine’s core safety philosophy, noting that “driver safety and situational awareness are among the most essential elements of machine design.”

Caterpillar follows a similar route, starting with physical layout by lowering engine hoods and refining cab geometry. The company offers an optional 360° visibility system integrated into the machine’s 10-inch monitor, alongside Cat Detect –People Detection, which provides visual and audible alerts when a person enters a defined hazard zone. For contractors

A pair of excavators

ADOBE STOCK Without control, power is nothing.”

with mixed-skill workforces or shifting crews, these layered systems provide an additional level of protection that does not rely solely on operator experience.

Develon reports similar customer behaviour in Europe’s rental-heavy market. Rear and right-side cameras are now standard on its Series 9 excavators, and Dieu says demand for 360° systems is rising quickly. Its latest system includes human-versus-object recognition –mirroring a broader industry move toward classification rather than simple detection. “I believe that in the future it could become mandatory on every jobsite,” he adds. With multiple OEMs converging on similar capabilities, visibility and proximity detection are no longer viewed as premium add-ons but as integral to excavator design – particularly in Europe, where dense jobsites, stricter regulations and higher safety expectations are driving rapid standardisation.

Europe’s low-carbon transition is pushing excavator development into multiple parallel paths. Battery-electric machines are expanding into higher tonnages, hydrogen combustion and fuel-cell concepts are in testing, and HVO is emerging as a nearterm drop-in replacement for diesel.

Volvo Construction Equipment recently introduced the updated 23-tonne EC230 Electric excavator, alongside the midsize L120 Electric wheel loader. “Electric construction equipment is still in its early stages of adoption, and the changes are coming fast as we move into new product types and size classes,” says Dr Ray Gallant, vice president – sustainability and productivity services at Volvo CE.

The EC230 Electric features a 600-volt, 450 kWh lithium-ion battery delivering 7–8 hours of runtime in general excavation, with fast-charging capability from 20% to 80% in about one hour using a 250 kW

Develon’s next-generation Series 9 crawler excavators are now fully compatible with Trimble Earthworks 3D systems, allowing operators to move from 2D to 3D functionality without replacing sensors or modifying the machine. The integration is made possible by an open control architecture that shares real-time motion and position data from the excavator’s built-in sensors directly with the Trimble control unit. This approach means operators can use Trimble’s 3D functions while continuing to work with Develon’s standard 2D capabilities, including Virtual Wall for defining safe operating boundaries, the Weighing System for real-time load measurement, and Advanced Lift Assist for improved lifting stability. Because the Series 9 controller manages communication between internal and external systems, the upgrade process is streamlined: installing the Trimble 3D kit is sufficient for the machine to synchronise data automatically and activate 3D operation.

charger. The upgraded model also includes an intelligent electro-hydraulic system for smoother movements and reduced energy loss. For many contractors, particularly in Scandinavia and the Netherlands, these specifications position electric excavators as viable for everyday work.

Caterpillar emphasises fuel flexibility, noting that all its diesel engines can run on 100% HVO. The company’s long-term roadmap also spans alternative fuels, electrification, autonomy and rebuild strategies designed to extend asset life and reduce carbon intensity.

Develon is developing battery-electric excavators, hydrogen combustion engines and fuel-cell systems, and its latest engines are compatible with HVO. OEMs now widely agree that no single technology will dominate. Markets will diverge by geography, grid capacity, jobsite layout and machine class, leading to a mixed lowcarbon future.

Liebherr highlights similar work, stating it develops engines “compatible with HVO and biodiesel” and integrates fuelsaving technologies such as ECO modes to reduce emissions “without compromising productivity.”

Across the industry, OEMs now widely agree that Europe will move toward a mixed low-carbon future defined by geography, grid capacity, jobsite constraints and machine size.

Across all manufacturers, a common thread runs through every innovation now shaping the European excavator market: time.

Machines are being engineered to shorten cycles, improve grading accuracy and reduce rework. Longer service intervals, smarter diagnostics and cleaner layouts are designed to minimise downtime. Integrated control systems aim to speed up operator proficiency, while electric models eliminate idle time altogether. Even manufacturing strategies are shifting toward regional production to shorten delivery distances.

As demand rises for lower emissions, higher precision and more predictable productivity, excavators in Europe are evolving from powerful digging tools into time-optimised systems.

The machines entering the market today are built not only to move material, but to give contractors more control over every minute spent on site. ce

WITH A STRIKING 105KW, THE 4TN101 IS ALL YOU NEED TO GET THE JOB

Having the best in class engine under the hood, the 4TN101 engine is your best excuse to take on any job. Giving you 105kW and a staggering 550Nm of torque, it can handle anything you put it up to. With over 100 years of experience and our renowned Japanese engineering, Yanmar is your partner in high performance engines and true reliability. More info? Visit yanmar.com/eu/industrial

The Colne Valley Viaduct is part of the UK’s pared back High Speed 2 rail project

Dr Alan Manuel of Currie & Brown, on why the global consultant has launched a new Certainty Index

Uncertainty has become one of the defining characteristics of construction.

Whether it’s trade tariffs, political instability or shifting investment appetites, project pipelines in both European and global markets are increasingly clouded by hesitation.

Construction buyers in the Eurozone and UK recently indicated that very point with the HCOB and S&P Global Construction PMIs both recording falling activity in September, and respondents citing client caution and delayed decision-making as central causes.

Renewable energy projects were shown to have the most certainty on the new Index.

This backdrop underscores the relevance of Currie & Brown’s new Construction Certainty Index, a global survey of 1,060 senior construction leaders designed to measure how well the industry manages risk.

The results suggest that uncertainty is not confined to any single geography or sector. Rather, it has become a structural feature of a globalised industry in which disruption in one market quickly ripples across others.

Speaking to Construction Briefing, Dr Alan Manuel, group chief executive of global construction and cost management consultants Currie & Brown, explains why the company developed the index, what it reveals about industry behaviour, and how construction can use data to improve its ability to plan ahead.

‘UNCERTAINTY HAS BECOME THE NORM’

“When I started my career, everything was local,” says Manuel. “We made our own

Dr Alan Manuel is Group CEO with Currie & Brown

materials and used our own labour force. Now, a fire in a chipboard factory in China affects markets in the US, the UK and India. Risk has become global, and there’s no buffer in the system anymore.”

Labour shortages are compounding that lack of flexibility. “Everybody’s working to the maximum,” he says. “Any disruption has a big impact. And as an industry, we’re really good at measuring what’s happened in the past but not nearly as good at looking forward.”

It was this imbalance between retrospective analysis and forwardlooking insight that prompted Currie & Brown to create a more systematic approach to measuring uncertainty.

As with most industries in Europe today, construction is generally lacking certainty.

IMAGE: ADOBE STOCK

“We speak to clients across the world, and every conversation starts with, ‘We live in uncertain times.’ We felt that we needed to quantify that,” Manuel explains. “So we asked over a thousand senior decisionmakers specific questions about where uncertainty lies in their projects.”

The Construction Certainty Index evaluates five key dimensions of project confidence: time and budget, risk, sustainability, technology adoption, and AI impact. These metrics emerged from

consultation with industry participants.

“The pleasing thing,” says Manuel, “was that the list of issues identified by clients was almost identical to what we came up with internally. That told us we were focusing on the right areas.”

The first edition of the Index has found relatively narrow differences between sectors and geographies. Renewables emerged as the most certain sector, with an overall certainty score of 62 out of 100, while healthcare and hospitality were at the lower end with 54.

“The lack of spread is telling,” says Manuel. “Everybody’s facing the same problems - nobody has cracked this. Uncertainty is global.”

Government processes and political cycles remain a major source of uncertainty, particularly for large infrastructure programmes and particularly, according to Manuel, in the UK.

Yet “this isn’t just a UK problem,” says Manuel. “The UK may be at the extreme end when it comes to how long it takes to deliver social infrastructure, but it’s not unique. Germany announced €500 billion of investment, and it doesn’t look like much of that has been spent.”

He adds that public investment in infrastructure should be viewed as a driver of economic stability, not as a political lever. “It sometimes feels like governments don’t understand that construction spend drives the economy. In most developed countries, it’s a huge proportion of GDP, yet few treat it seriously. We need to take social infrastructure away from politics.”

He suggests establishing an independent body that decides national priorities and lets delivery professionals get on with the job.

That lack of long-term certainty in planning has consequences far beyond public works. “Every government has different priorities. You never know

whether a project will be finished just because it’s started,” he says. “That’s not good for anybody.”

Among the Index’s most striking findings was the relationship between technology adoption and project certainty. Companies using artificial intelligence or advanced digital tools tended to report higher levels of predictability in outcomes.

While that might seem intuitive, Manuel says the underlying dynamic is more complex. “The certainty isn’t coming directly from AI,” he explains. “It’s that the organisations which are early adopters of technology tend to be better at managing risk and seeing the bigger picture. Those

who could benefit most from AI are, paradoxically, the least likely to use it.”

He adds that while AI is widely discussed, practical applications in construction remain limited. “We talk a good game about AI, but the tools are still fairly basic. Those who are adopting it are doing so because they have the culture and systems in place to manage uncertainty better.”

Manuel believes that without coordinated action the pressure on construction will only intensify. For now, he hopes the Construction Certainty Index will provide a rare snapshot of how construction leaders view the risks ahead and a foundation for tackling them more systematically. ce

Construction Europe asks some of Europe's most notable off-highway engine makers to describe construction's power mix – and offer a glimpse into the potential future of diesel

Construction equipment must withstand the brutal demands of the jobsite.

The engines that power these machines have to do the same, with the added expectation of delivering maximum uptime, reduced fuel consumption and minimal emissions.

As if that weren’t enough, engine makers today must combine their work on meeting diesel emissions regulations, with research into alternative fuels and battery-electric technologies, as well as ever-improving performance.

The result is a new generation of powertrains that are not just incrementally better, but fundamentally more efficient, easier to maintain, and engineered for longer, more productive life cycles.

Terry Hovis is a new power and technology advisor with the engine maker Cummins. He says it’s important, when designing a new engine, not to overlook the years of work that have gone into developing previous models.

“We start with a base engine that has proven its worthiness in leading markets,” he says, “then we launch product development programmes specific to the ag [agriculture] and construction markets.

“We look at all of the market specific requirements we’ve gathered over 100+ years of experience building offhighway engines into more than

100 specific applications, and we feed those inputs into the product development process.”

Hovis says leaning heavily on these proven learnings also allows designers to map out customers’ future power needs and ensure designs, materials and technologies are the right ones to drive the energy density and duty-cycle requirements of the application.

Engines are then run for tens of thousands of hours in those applications and in a variety of harsh conditions, using what Cummins calls a “seven-step problemsolving process” to ensure any anomalies are addressed before production.

Ensuring an engine is capable of withstanding everything a jobsite environment can throw at it has to be the primary objective for any manufacturer.

Anders Wernersson is

Terry Hovis of Cummins

IMAGE: CUMMINS

product manager for the off-highway engine segment at Volvo Penta Industrial.

He believes mining might be the harshest of these environments and says, “We design and test our engines to make sure they perform in these challenging conditions.”

He says the field tests carried out with Volvo Penta customers are an important part of the verification process. “This allows us to test the engine in real-world conditions, where the engine is doing real work, in a real environment.”

He also highlights the importance of designing and building engines with ease of maintenance in mind, giving consideration to making service points for oil filling or filter changes always easily accessible.

“We take a collaborative, partnership approach and work with OEMs and end customers to tailor the solution to meet their specific needs as every installation is different.

“This could mean locating maintenance points remotely, away from the engine, if necessary.

“We also work to increase service

intervals. We have increased the oil drain interval from 500 hours to 1,000 hours. This not only helps from a serviceability point of view, but also reduces costs as there is less time needed for scheduled downtime.”

The question of maximum reliability and optimal uptime are crucial for contractors who are often working to tight margins with no room for less-than-optimal productivity. Unplanned downtime, for example, is not something that’s generally budgeted for.

With that, and given the increasingly stringent emissions regulations in Europe, what is there left to change in engine design that can improve the situation?

“I think our architectural decisions and system engineering experience have had the biggest impact on reliability,” says Hovis. “What we’ve found, is that our technical ability has allowed us to take a ‘less is more’ approach, whether it’s eliminating the DPF [diesel particulate filter] when meeting Tier 4 Final, or the

Field

removal of EGR on our Stage V engines.

“When regulations call for the full complement of aftertreatment hardware to meet emissions, our aftertreatment system management solutions deliver superior performance regardless of the application or duty cycle.”

For years to come, a significant element of every engine maker’s R&D will be focused on improving both the performance and the ‘green’ credentials of diesel engines. At the same time, the push to examine alternative power is becoming ever stronger.

No one wants to be left behind, but equally no one wants to move at a pace that exceeds market demand or, perhaps more importantly, a workable infrastructure for whichever form that power option will take.

There is a sense that battery power – with technology drip-feeding through from the automotive industry – is approaching a tipping point, in terms of initial cost, runtime, charging time, modularity (which potentially means it’s easier to swap batteries in and out) and perhaps even charging infrastructure.

Yet, engine makers generally agree that it will form only part of the power portfolio for construction in the years ahead.

Philipp Deubel, senior director of sales in the EMEA region with Briggs & Stratton, says, “We’re preparing our manufacturing and support infrastructure for a future in which different powertrains will coexist. Our strategy is built on dual investment, meaning continued advancement of our Briggs & Stratton and Vanguard combustion engines

(synthetic diesel) fuels and biodiesel blends IMAGE: DEUTZ

and rapid expansion of our commercial battery systems.”

Deubel says electrification for his company means an integrated ecosystem and its current portfolio includes swappable and fixed battery units of between 1.5kWh and 70kWh, supported by proprietary battery management systems, chargers, motors and motor controllers.

These developments, he says, will allow OEMs to bring compact electric equipment, such as mini loaders, concrete trowels and floor saws, to market with confidence.

At the same time, Deubel insists Briggs & Stratton will continue to evolve its combustion engine portfolio, particularly for applications that require more power and continuous run-time. This power, however, will not necessarily come from diesel.

For example, he says, “Our Vanguard BIG BLOCK [gas-powered] engines offer a robust alternative to diesel, and we are integrating technologies such as electronic fuel injection and electronic throttle control to enhance fuel efficiency and reduce emissions.”

Deubel’s colleague, Gregor Schreiber is Briggs & Stratton's manager for the Power Application Centre for the EMEA region. He feels the most significant challenge in the construction sector today, and in the future, is preventing costly downtime.

“That is why smart power management and advanced diagnostic systems are becoming essential,” he says. “These tools will increasingly help operators maximise machine uptime by proactively scheduling maintenance based on actual use and monitoring performance – guaranteeing

that every machine delivers maximum sustained value on the job site.”

Germany-based engine maker Deutz is also planning a multipowered future for construction equipment. In fact, its examination of battery-electric and alternative fuels goes back a number of years, but it again highlights that we are some way from a straightforward replacement for

A Deutz spokesperson said key operational challenges remain for all diesel alternatives, including limited fuel infrastructure in remote areas, particularly for hydrogen, synthetic fuels, economic feasibility for operators, and ensuring reliability in tough environments.

“Deutz addresses these through a broad mix of fuels and technologies,” he said, “combining immediately deployable drop-in solutions with medium- and long-term alternatives to meet the diverse demands of off-highway work.

“Hydrogen requires dedicated infrastructure and a specialized storage solution, which is currently a 350 bar pressure tank. Hydrogen has a lower energy density than liquid fuels – meaning larger storage volumes for high-demand applications. Due to the way green hydrogen is produced, the fuel is currently

An engineer undertakes diagnostic checks at Cummins’ CTC test facility IMAGE: CUMMINS

density and suitability for large, high-utilization machines. The main hurdles lie in availability and cost, which are often dependent on quotas and incentive programmes.”

(in Germany) more per litre than fossil diesel and is not yet widely available, with relatively few fuelling stations offering HVO100. In addition, he points out that manufacturer approvals remain necessary before use in all vehicles.

Since last year, DEUTZ has been producing the TCG 7.8 H2 hydrogen engine in series production, together with

FPT says its NEF engines are designed to maximize durability and long service intervals, and to minimize fuel consumption

IMAGE: FPT

INDUSTRIAL

innovative. “For us,” he says, “the power really depends on the duty cycle of the machines. We are of the opinion that there is not one solution that fits perfectly across the industry.

“We recently presented the latest hybrid architecture for our F28 engine, which we see as the perfect first step on the road to electrification in the light duty segment.”

In the sub-3-litre category, the F28 is capable of delivering up to 75 kW and 416 Nm of torque, making it suitable for applications such as irrigation, water and concrete pumps, crushers, drills and other stationary and non-stationary equipment.

Lopez says the engine is currently being used on a telehandler, although not with diesel, but the same version of the F28, running on natural gas.

“If you go to medium duty,” he says, “we offer a natural gas engine, which has been fully industrialised and was initially

consumption applications.”

Diesel’s position on the construction jobsite may be secure for the foreseeable future, but Europe’s net zero focus is unwavering and no engine maker can afford to sit back and see which way the emissions wind is blowing.

As head of off-road portfolio and product management with engine manufacturer FPT Industrial, Michele Lopez has been working with alternative power technologies for a number of years.

And he, like many power experts, understands that being adaptable in this segment is as important as being

TCO in the 6-8 tonne truck

working on the XC13, that is designed with a multi-fuel approach

developing over the engine we’re working with is hydrogen, but is also capable of running on

For FPT as well as the majority of engine makers operating in Europe, there is an understanding that – as important as diesel currently is – alternative power will continue to grow its market share.

Lopez says, “We’re strongly committed to working with alternative fuels, as well as e-powertrains and the advantage we have as a manufacturer is that we work not only on engines for off-road, but also on-road. This adds to our ability to cross-pollinate, as what we learn in one segment can be transferred to the other.

“We want to send a message to OEMs that if you need power support, we have it covered.”

ce

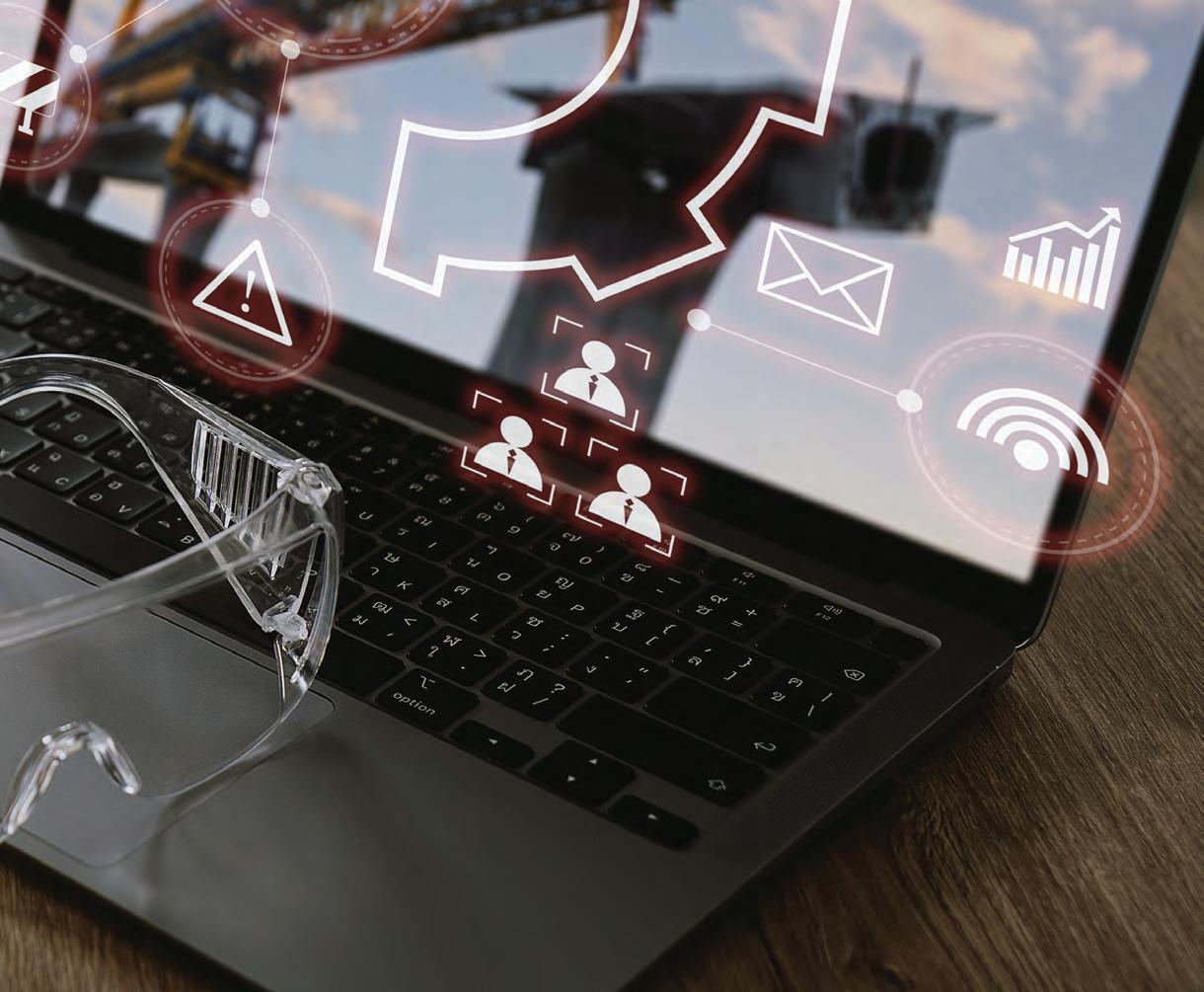

As interoperability becomes the industry’s defining challenge, experts warn that cultural barriers – not technology – are now holding back digital progress, reports Andy Brown

Construction’s digital promise is finally starting to take shape. Software that once existed in isolation is now being linked through open data standards, APIs and cloud-based platforms. The direction of travel is clear: data must flow freely between systems if the industry is to deliver projects that are faster, safer, and more sustainable. What remains less certain is how quickly that connected vision will be realised – and whether people, not technology, will be the bigger obstacle.

While the exact end point of this technological journey may not be known, the path is clear: isolated systems and data are out, and connected data is the gold standard. “The

industry is headed toward a more connected future, but it’s still in a transitional era. Interoperability has become a critical focus for both vendors providing hardware and software construction solutions, and construction businesses relying on technology to work more efficiently and grow,” says Mark Schwartz, senior vice president of AECO Software at Trimble.

“On the vendor side, construction software companies are moving away from inflexible, closed technology suites to

Ryan Kunisch, vice president, global strategy, Oracle Construction and Engineering IMAGE: ORACLE

Graham Twigg, chief technology officer, Multivista, part of Hexagon IMAGE:

more open and connected ecosystems. At Trimble, we continue to expand integrations across our own solutions as well as with third-party platforms. We’re also equipping construction businesses with the tools to build custom connections that address their specific data challenges,” he adds.

Schwartz reveals that the company has more than 100 pre-built, ready-to-use integrations, applications and extensions available for its customers.

Ryan Kunisch, vice president, global strategy, Oracle Construction and Engineering, says that it is not enough anymore for software to just

Construction varies so much by region and vertical that there is no single technology solution.”

connect – more is demanded.

“Interoperability is absolutely essential in today’s construction industry, but the focus is shifting. It’s no longer just about making tools connect; it’s about unifying fragmented systems into a single environment where data moves freely and accurately. In recent years we’ve seen tremendous progress,” he says.

Charlie Sheridan, chief AI and data officer, Nemetschek Group IMAGE: NEMETSCHEK GROUP

serve as connected and secure platforms where data from a host of different sources can be stored and can communicate. “This unified ecosystem helps eliminate data silos, reduce rework, and enable real-time decision-making. This empowers owners with greater transparency and control, while general contractors benefit from less manual reconciliation and more efficient project orchestration.”

Sticking with the theme of real-time data, Gael Basseville, vice president, business development, EMEA, Topcon, is effusive about the importance of it.

“The integration of sensor data, 3D design models, and machine control will allow teams to monitor quality, productivity, and safety simultaneously and in real time, rather than retrospectively. This data is like gold dust and will help teams make the right decisions to optimise their projects,” he asserts.

Basseville says that construction software has become an integrated ecosystem rather than separate solutions and that, in the future, there will be far greater connectivity between design, planning, and execution phases. This will create – to keep the shiny metal comparisons going – a gold standard for construction, a continuous digital thread from concept to completion.

He adds that real-time insights are particularly important for construction.

For a continuous digital thread to exist, all data must be able to communicate seamlessly. Basseville contends that, “The industry has made real progress in interoperability. Open data standards, APIs, and cloud-based collaboration tools are making it easier than ever to integrate across brands.”

“When everyone works from the same structured data, collaboration speeds up, accountability increases, and project outcomes improve.”

Nemetschek Group and its 17 subsidiaries – including Bluebeam and Allplan – have

Kunisch points to industry clouds that >

been a leading player in the open BIM alliance. Charles Sheridan, chief AI and data officer for the group, contends that interoperability is “essential” for seamless data exchange.

“Open BIM and formalised interoperability partnerships have made it easier for professionals to collaborate across brands, reducing workflow bottlenecks and data loss. Recent progress includes API integration, cloud connectivity, and industry-wide collaboration, transforming interoperability from a competitive issue to a shared priority,” says Sheridan.

While progress has been made Mikkel Dalgas, chief product and technology officer, Trackunit, cautions that work remains on this important issue.

“The ISO 15143-3 standard has made a difference and is a step – albeit a small one – in the right direction as it is now possible to share machine data across brands. But, while it opens up a path to getting a complete picture of an entire fleet without jumping between systems, it’s highlighted two key challenges,” he says.

reports. He adds that, “What used to take weeks or months of setup and tuning can now be done quickly.”

Construction is a broad church: it encompasses so many different segments and contractors and sub-contractors that when construction is accused of not being far enough along with the technology journey it is not always fair.

This variety is a point raised by Graham Twigg, chief technology officer, Multivista, part of Hexagon. “The commercial dynamics of every project is different –owners, architects, contractors and subtrades all have bespoke technology stacks, standards and workflows that have evolved with reasons specific to their commercial circumstance.

“Construction varies so much by region and vertical that there is no single technology solution and trying to bend customers to our will when it comes to their business processes is not a recipe for success,” he asserts.

“We have to respect the unique nature of every project and the only way to do so is to assume that our customers will be using not just our tools, but those of our partners and competitors as well. It’s our duty, as those who are providing technology services, to make sure that our customer’s data is not siloed

Mikkel Dalgas, chief product and technology officer, Trackunit IMAGE: TRACKUNIT

“First, we need to focus on the capabilities of the system where the mixed fleet data is brought together (via AI, analytics, strong industry specific capabilities, and others) and ensure we don’t dilute the value of mixed fleet data by selecting a generic data backend.

“Secondly, when we master mixed fleet analytics we will need mixed fleet controls. Collecting data with no bidirectional connectivity back to the machines will provide insights but with limited actionability.”

Despite the challenges, he says that the sector has come a long way and that there are numerous platforms that offer hundreds of ready-made apps and connectors that automatically link equipment data, rental systems, and

The firms that embrace this collaboration model are proving that digital transformation is not just a technology upgrade.”

or otherwise locked down. This starts with robust APIs, which most platforms have now. It also speaks to the need for better data standards, beyond a general agreement that we’ll use this file type or protocol.”

As Twigg says, construction varies vastly from region to region (and often country to country in that region) and depending on the sector (deep pile drilling compared to road building) that there is bound to be a host of different software used, which is why all the data connecting and talking to each other is so key. It is also key because when this software is used by all relevant parties as part of their day-to-day activities then, quite simply, it brings results.

Trimble’s Schwartz gives several examples of the real and tangible benefits that the use of the right software can bring.

These include a steel detailing and fabrication company called Canam Group that increased its engineering process efficiency by 25% by capturing, managing and sharing 3D data, and JE Dunn which achieved a 10% efficiency gain on concrete pouring, improved excavation durations by up to 50% and reduced rework costs from US$2.6 million to $350,000.

These figures are striking, as are ones that he says Bituminous Roadways, a commercial asphalt paving contractor in the US, achieved by adopting a fully connected Trimble workflow. Schwartz says that the company, “achieved a 150% increase in employee production hours and a 170% rise in equipment utilisation.”

He adds that, “Delivering digital data from models to machines enables Bituminous to

grade sites and install aggregates faster and with fewer people. With machine guidance files controlling blade height while operators control steering and speed of dozers and graders, efficiency has increased by 30%.”

Topcon’s Basseville says that advanced software solutions are delivering quantifiable gains across the board – often 20–30% improvements in efficiency. However, this can go even higher – he mentions a site in Denmark where the company Tscherning is using machine control systems and seeing productivity increases of up to 60%.

Construction software can play a big role in boosting construction’s productivity

Software can help make construction tasks more predictable and safer

Despite construction’s great variety the benefits that the right software can bring is emphasised by Oracle’s Kunisch. “Globally, customers are experiencing similar benefits: reduced manual data entry, elimination of duplicate tasks, faster decision-making, and stronger team alignment,” he says. “These productivity gains not only translate into cost savings but also provide greater confidence and control throughout project delivery.”

Overcoming obstacles

Regarding what is stopping the industry from more widespread adoption of software, there seems to be agreement that the issue is mostly one of a human persuasion, rather than technical.

“Cultural resistance and reluctance to change established processes persist as major challenges, particularly in markets with deep-rooted analogue workflows,” says Sheridan from Nemetschek Group.

This viewpoint is echoed by Trackunit’s Dalgas who says that, “The biggest challenges to deployment aren’t the tools, they are about people getting comfortable with them. Workers often need time and support to learn the new systems, and managers need to build trust in the data and see meaningful results.”

Digital training can help in getting workers to fully understand the capabilities of the software that they are using and also – crucially – help them to understand that the software

Gael

Basseville, vice president, business development, EMEA, Topcon IMAGE: TOPCON

is there to make their job more enjoyable and easier and not as a replacement for them. Other barriers remain, with cost and customers being sure on an exact return on investment (ROI) being high up on the list. “Culture and cost are the biggest barriers – but it’s changing fast. The technology itself is ready and more accessible than ever. The challenge lies in shifting long-established ways of working and getting the support needed for contractors to invest in new technology,” says Topcon’s Basseville.

Schwartz from Trimble agrees that the biggest barrier to adoption is “human, not technical” but agrees that cost is an issue. He says that the rise in proliferation of subscriptions has helped with this as it takes away the issue of having a large sum to pay all at once. He adds that subscriptions also offer, “increased flexibility and scalability, allowing contractors to customise offerings to their specific needs while benefiting from lower upfront costs and more predictable ongoing expenses.”

Ultimately, software sits alongside other construction technologies – such as automation and drones – those who embrace it the most will will see the greatest benefits. There are obstacles to be overcome, such as costs and human reluctance, but the pay-off is clear.

As Oracle’s Kunisch neatly summarises, “The firms that embrace this collaboration model are proving that digital transformation is not just a technology upgrade. It is a business advantage that defines who will lead the next decade of construction.”

The thread running through every conversation is clear: the technology is ready, but the people and processes using it must catch up. Software will not transform construction on its own – it requires cultural change, trust in data, and a willingness to collaborate.

Mark Schwartz, senior vice president of

AECO Software

at Trimble IMAGE:

TRIMBLE

Those who make that shift now will not just work more efficiently; they will define the connected, data-driven era reshaping the construction industry. As one of the experts put it, the winners of the next decade will be those who treat software not as a tool, but as a competitive advantage. ce

The tougher the challenge, the more the electronically-steered PST/ES-E (315) self-propelled transporter shines. At 2,430 mm base width, it’s flat rack compatible and delivers up to 60 ton axle loads – achieved with standard pneumatic tires, no TPMS, polyfill or mileage limitations required. Even compact configurations can handle the heaviest payloads. Goldhofer’s PST/ES-E (315) redefines the benchmarks for performance, flexibility, and cost-effectiveness.

Wacker

Construction Europe (CE):

What are the main factors currently driving demand for compact earthmoving and light construction equipment, especially in urban infrastructure and utility projects across Europe?

Alexander Greschner: The urban environment demands low-emission, compact, versatile and operator-friendly equipment.

As European infrastructure undergoes modernization with more sustainability requirements, compact earthmoving and construction equipment are essential tools for modern workflows. We have identified a number of important factors: Firstly, urbanization and infrastructure renewal. Continued urban population growth across Europe has led to rising

Wacker Neuson Group CSO, Alexander Greschner

demand for housing, public transport, utilities and green spaces.

Ageing underground infrastructure in many European cities – including water, gas, electricity and fibre optics – requires regular maintenance, upgrades or full replacement. This boosts demand for compact, manoeuvrable machines that can operate in confined, built-up areas.

Then there are sustainability regulations and low emission zones and many cities, such as Paris, Amsterdam or Munich, have introduced or expanded low-emission zones and noise restrictions.

As a result, electric compact machines are increasingly preferred on urban jobsites and also for night work, indoor projects or residential areas.

Strategies such as the EU Green Deal and Fit-for-55 targets are also pushing contractors toward cleaner, quieter machinery.

The skilled labour shortage across Europe means there’s higher demand for userfriendly, low-fatigue machines that enable fewer workers to do more.

Machines with intuitive controls and automation features as well as well thought-out safety features are especially valuable in urban areas where tight coordination is required.

We’ve also seen growth in utility sectors, with the rollout of fibre optic networks and EV charging stations.

Renewable energy infrastructure creates a lot of small, distributed job sites in cities.

We're expanding our portfolio in line with market requirements.”

These projects need agile and compact equipment that can be quickly relocated. This is definitely one of the strengths of our compact equipment.

Lastly, I’d say the rising use of rental and sharing models is helping us.

Contractors and municipalities increasingly favour equipment rental to stay flexible and cost-efficient, particularly for short-term or project-based work.

This trend favours compact, multiuse machines with low transport and operating costs.

How is Wacker Neuson evolving its compact equipment portfolio – particularly in mini and zeroemission machinery – to meet growing sustainability targets and emissions regulations?

The development of this segment basically reflects the needs of the market: for conventional machines, we rely on efficiency, ease of use and relevant safety features.

We also have a rapidly-expanding zeroemission product portfolio that includes more than 40 battery-powered products, including 12 compact construction machines.