Lenders of first resort

AUSTRALIAN MORTGAGE AWARDS

Celebrating the industry’s finest

PRIVATE LENDING Watchdogs sharpen their claws

How social media fuelled a deeply personal broking journey

Lenders of first resort

AUSTRALIAN MORTGAGE AWARDS

Celebrating the industry’s finest

PRIVATE LENDING Watchdogs sharpen their claws

How social media fuelled a deeply personal broking journey

CONNECT WITH US

Got a story or suggestion, or just want to find out some more information?

x.com/MPAMagazineAU

facebook.com/Mortgage ProfessionalAU

02 Editorial

What’s better than bragging rights?

04 Statistics

The 15 most a ordable housing markets – and more

06 Opinion

Pinpointing the right loan features can be a game changer, says Liberty’s David Smith

Regulatory developments are sowing the seeds for change

12 ’Tis the season for new prospects Now is the perfect time for brokers to o er SMEs their support

Australia’s top mortgage brokers are achieving unprecedented results, driven by experience, trust and performance at scale

BIG INTERVIEW REDOM SYED

The award-winning broker on his social-media fuelled personal journey to national recognition

16 Standing out from the crowd E ective broker marketing starts with the people around you

76 Get your team moving

Integrating exercise into the work day boosts productivity and creativity

How non-banks are becoming first-choice lenders for a

78 Brokerage insight

FirstPoint owns its space with a lean team and a local focus

80 Other life

For Shore Financial’s Edward Ta a, golf is more than just a hobby

Our daily newsletter. Keep on top of property market trends, business strategy, and what industry leaders have to say.

Iworked as a bar manager in a previous life. Perhaps not the most esteemed of professions, but many of the lessons I learned over all those years of serving drinks have stuck with me. Among them was the adage, ‘look after the regulars and the regulars will look after you’. It’s a lesson every small business – bar, bookstore, brokerage – ignores at its peril. Your community can be your greatest advocate and cheerleader and is more often than not a proving ground for your fledgling business as you seek global domination.

Unfortunately, this message can be lost in the age of cringy LinkedIn clout-chasing, as the distorting e ects of social media compel us to inflate our successes beyond what’s actually true.

So it’s always refreshing to meet up with brokers and other small business owners who put status aside to focus on what really matters – building trusted networks, loyal communities and loyal client bases.

Cess Rodriguez, Aira Olgado

EDITORIAL ENQUIRIES tel: +612 8437 4711 william.farrington@keymedia.com

SUBSCRIPTION ENQUIRIES tel: +61 2 8311 5831 • fax: +61 2 8437 4753 subscriptions@keymedia.com.au

ADVERTISING ENQUIRIES claire.tan@keymedia.com

I have got great satisfaction over the past couple of months, hearing about the many ways brokers remain invested in their local communities. Whether they are sponsoring their local football team, organising professional meet-ups with like-minded brokers to share business strategies, or donating their precious free time to charity, it’s clear that the best brokers don’t forget what got them there in the first place.

It also makes perfect business sense. In our Broker Marketing feature on page 16, broking industry experts discuss the importance of thinking local when building a name for yourself. Long-term success is often built on those initial relationships you develop through friends and family.

A self-aggrandising LinkedIn post might get some decent engagement, but the truly great brokers know that bragging rights are shallow. They know the virtue of living by word of mouth of the clients they’ve helped through thick and thin.

Don’t take my word for it. Have a read of MPA’s Top 100 Brokers feature on page 45. You won’t find many of them attributing their success to social media likes. Rather, they understand the basic fact that the clients they look after will look after them.

William Farrington, editor, MPA

www.keymedia.com Australia, Canada, USA, UK, NZ and Asia MortgageProfessionalAustralia is part of an international family of B2B publications and websites for the mortgage industry

AUSTRALIAN BROKER simon.kerslake@keymedia.com

T +61 2 8437 4786

NZ ADVISER alex.knowles@keymedia.com

T +64 9 200 1319

CANADIAN MORTGAGE PROFESSIONAL shane.lakhani@keymedia.com

T +1 720-441-2255

MORTGAGE PROFESSIONAL AMERICA charles.weed@keymedia.com

T +1 720-441-2255

MORTGAGE INTRODUCER (UK) matt.bond@keymedia.com

T +44 203 868 3406

$11.8trn

Total value of Australia’s housing market, the highest on record

Sydney remains the world’s second least a ordable housing market, with prices 13.8 times household incomes, according to Demographia’s 2025 report. Adelaide has overtaken Melbourne and Brisbane as Australia’s second least a ordable city, while Perth remains its most a ordable capital.

2.2%

Quarterly rise in national housing values to Sept 2025, signalling renewed market momentum

Australia’s rental market tightened further in Q3, with national vacancy rates hitting a record low of 1.47%. Cotality reported that rents rose 1.4% in the quarter, pushing

143%

Surge in number of million-dollar suburbs over five years, expanding beyond traditional prestige postcodes

50%

Portion of pre-tax income an average household needs to service a $1 million mortgage

capital city rents above $700 per week for the first time.

MEDIAN WEEKLY RENTAL VALUE, Q3 2025

Roy Morgan’s research shows mortgage stress hits single women hardest, reflecting lower full-time work rates and income inequality –especially among women aged under 34, who earn just 82% of men’s median income.

Darwin dominates the list of suburbs with the biggest dwelling value gains since February’s rate cut, led by Wanguri and Durack at 20.1%. Perth’s Haynes and Mandogalup were the only non-Darwin suburbs to break into the top 10, Cotality reports.

SUBURBS WITH THE

Wanguri, Darwin

Durack, Darwin

Moulden, Darwin

Gray, Darwin

Woodro e, Darwin

Alawa, Darwin

Gunn, Darwin

Haynes, Perth

Mandogalup, Perth

Zuccoli, Darwin

Brisbane tops the nation for new million-dollar property markets, adding 38 suburbs since September 2024, ahead of Sydney’s 36. Cotality reports that one in three Australian suburbs now has a seven-figure median, marking record membership in the once-prestigious million-dollar club.

Brokers could miss opportunities by not fully exploring how certain loan features can benefit specific customers, says Liberty’s David Smith

BORROWING CAPACITY and housing a ordability continue to be key challenges for Australians looking for paths into the property market.

While more borrowers are realising there are alternative options to requiring a 20% deposit to buy a home, there are still misconceptions around some lending features that could be ideal for certain market segments.

Misconceptions around the suitability of specific loan features can arise among both customers and brokers, particularly when

past the typical 30 years. However, for some customers, a 40-year term could be a smart solution for their unique circumstances.

Firstly, longer terms and lower repayments could allow homebuyers to increase their borrowing power and avoid missing out on their dream property. This could be an ideal option for customers who require more borrowing capacity to get into the market.

For other borrowers, the focus might not be on paying down their mortgage as quickly as possible but rather on managing cash flow.

For some customers, a 40-year term could be a smart solution for their unique circumstances

it comes to features that could be game changers for some people.

Broker education is critical. The more information brokers have on loan features and what could work for di erent individuals, the more customers they can help while also facilitating business growth. Customers could find opportunities they might not have been aware of, while broker businesses expand the range of borrowers they’re serving.

Let’s explore some of these misunderstood lending features and what they could o er.

Discussions around 40-year loan terms have increased in the market lately, but there is still some apprehension around extending terms

Forty-year loan terms could be suitable for borrowers who might be able to a ord the requirements of a 30-year loan term but prefer to use their money for other investments.

The key for brokers is to take the time to holistically assess the needs of each customer and find options that align with their goals. Then, if a 40-year term fits their requirements, make sure they are well informed about repayments and other considerations.

The idea of larger loans may feel less comfortable for some borrowers and brokers, particularly when higher LVRs are involved. However, this could be an ideal feature for select people

at certain times in their lives. For example, one property journey could involve buying an ‘entry-level’ home to get a foot in the door. The next step could be upgrading to a larger property or a di erent location before finally buying the dream home down the track.

With each property purchase comes additional costs. From stamp duty to multiple moving expenses, these can amount to a significant extra sum. Higher loan limits could allow borrowers to secure their ideal property with their first purchase, which might be more suitable for some people in the long run.

Brokers who understand the full picture can help customers make informed choices that support their property journey, not just their first purchase. Larger loan sizes can also open up a whole new group of customers that brokers could be missing.

One of the biggest myths in mortgage broking is that custom loans are too hard and not worth the e ort. If a broker is educated on the processes and has good support from BDMs and scenario teams, then ‘complex’ deals can actually be straightforward.

Take low-doc loans, for example. They’re a great option for self-employed borrowers, but the process is di erent due to alternative income verification. Brokers only need to reach out to their BDM and chat through the steps to realise how simple they can be. By passing up custom loans because of perceived complexities, brokers could be missing out on large market segments.

Another example is self-employed borrowers with tax debt. If brokers work with a lender that allows borrowers to consolidate this debt into their home loan, it can save the customer a significant amount of money on interest.

With the right knowledge and lender support, these are the types of scenarios brokers can take on with confidence, allowing them to help more customers and expand their businesses.

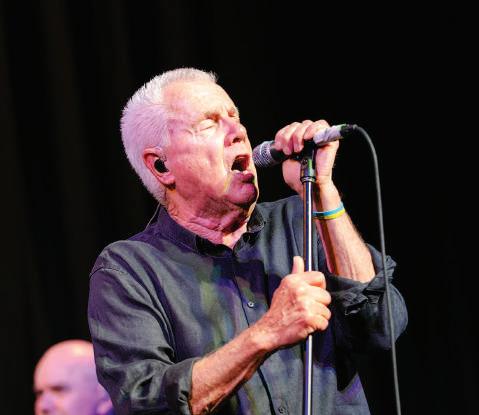

From family

misfortunes to national recognition,

Redom Syed’s deeply personal broking journey has come full circle

THE FOUNDATIONS of Redom Syed’s career in finance were laid at an early stage in life.

Growing up, he saw first-hand how financial stress can devastate hard-working Australians, as his own family lost their home after falling behind on repayments.

While the experience left an indelible mark on Syed, it also gave him a clear purpose in life. “It showed me how deeply financial stress impacts families, and I knew I wanted to spend my life helping people avoid that same pain,” says Syed.

Emerging from the EY graduate program in 2012, Syed spent three good years in Canberra as an economist at the Federal Treasury before establishing a career in mortgage broking. He looks back on his time as an economist fondly, even if it was not the career path he ultimately wanted to take.

“Treasury was an incredible environment,” recalls Syed. “I was surrounded by some of the smartest minds in the country, learning how money, policy and systems work at scale. But it was all theory, numbers on a page. I wanted to bring that knowledge back to the real world – to help everyday Australians make smarter, more confident decisions with their money.”

Syed quickly realised that being a broker is about far more than just securing a loan. It’s about being a trusted partner to Australians making what is often the biggest financial decision of their lives.

“That’s a privilege,” says Syed. “Seeing that trust first-hand made me rethink what broking

could be. It wasn’t about transactions; it was about transformation – about helping people make decisions that change the trajectory of their lives. That realisation became the foundation for everything we’ve built since.”

While he found his calling in mortgage broking, the lessons he learned as a working economist have stuck with him to this day.

Syed understands how incentives drive societal behaviours, “whether that’s in markets or in people”.

Being a trained economist “means I don’t chase noise”, he says. “I focus on cycles, trends

scooped up Finance Broker of the Year NSW and ACT) at the 2025 FBAA Awards of Supremacy, before returning to the stage to accept the biggest gong of the night, National Finance Broker of the Year.

How does it feel to receive this recognition?

“It’s surreal – and honestly emotional. It feels like a full-circle moment. I started this journey after watching my family lose our home. Twenty years later, to stand here with a business that helps thousands of Australians make smarter financial decisions... it’s humbling.

“Be the A-player occasionally, but mostly focus on empowering others to shine. That’s how you turn a business into a movement”

and fundamentals – the patterns that really matter over time. That perspective has been a huge advantage in guiding both clients and the business through changing markets.”

Syed’s experience as an economist also helped him understand how policy, psychology and timing intersect to shape financial outcomes. “That foundation helps me simplify complexity for clients and brokers, breaking big ideas down into something practical and actionable.”

A year of recognition

Syed’s hard work and determination have been handsomely recognised in 2025. He

“It’s also not just my award; it belongs to every person who’s been part of the journey. My family, my team and our clients who’ve trusted us from the start. It’s proof that purpose and consistency beat hype every single time.”

It was undeniably a year of transformation, as Syed merged his brokerage, Confidence Finance, with national brokerage Flint Group, where he now serves as managing director.

Being a leader has been a giant learning curve for Syed. He has had to learn when to be hands o and when to trust others to lead – easier said than done when your hardearned reputation is on the line.

Name: Redom Syed Company: Flint Group Years in the industry: 11

Recent career achievements: FBAA National Finance Broker of the Year; 7 x MPA Top 100 Broker

“When you start out, you do everything yourself because you have to,” Syed says. “But as you grow, holding on too tightly becomes the thing that limits you. The hardest – but most important – shift is learning to trust others to lead. Be the A-player occasionally, but mostly focus on empowering others to shine. That’s how you turn a business into a movement.”

When it comes to bringing a fresh face into the team, Syed looks for “hunger, humility, integrity and growth mindset”. These are the skills that can’t be taught – it’s easy to teach someone how to lodge a loan, but drive and attitude must come naturally.

“It’s shown me that connection beats scale. My channel isn’t the biggest, but people who find it often stay for hours. Watch time builds trust, and trust builds business.”

But flashy content can only go so far in building genuine business partnerships. Syed believes that YouTube, podcasting and the like have “amplified” the human side of finance.

“People want to feel who they’re dealing with before they buy anything, especially when it’s financial. Podcasts and video let people connect with your tone, values and personality before you ever meet.”

Syed’s crystal ball tells him the most

“If you can earn people’s time and teach them something valuable, you don’t need to sell – they’ll come to you. Attention became our way to scale trust at a national level”

“I look for people who are curious, coachable and genuinely want to help clients,” says Syed. “The best people are those who want to grow the pie for everyone – not just themselves. That mindset is what makes teams unstoppable.”

E ective marketing played no small part in this success.

Content does convert

Syed’s journey is as digital as it is personal. To date, he has created nearly 1,000 YouTube videos and a popular property podcast with over 8,000 subscribers.

It’s done wonders for lead generation, with around 80% of warm leads coming through YouTube alone. As a result, Syed is sceptical of brokers who contend that, as the saying goes, “content doesn’t convert”.

“I’d say it doesn’t convert if you don’t commit … In the last nine months alone, over 1,300 people have gone straight from my videos to booking calls with my team. That’s not followers – that’s clients.

successful brokers over the next decade will be the ones who show up consistently online. “The top 10 brokers in 2028 will all have strong personal brands and social presence, because trust will be built long before the first meeting,” he predicts.

For Syed, the benefits of building an online presence clicked when the phone calls changed. “People stopped comparing quotes or shopping around. They were calling because they already knew us. They’d been following, learning and connecting long before that first conversation.

“That’s when I understood that attention is just another word for trust. If you can earn people’s time and teach them something valuable, you don’t need to sell – they’ll come to you. Attention became our way to scale trust at a national level.”

“Don’t wait for perfect – start showing up, and keep showing up,” adds Syed. “You can’t build trust in silence. The brokers who win the future will be the ones who communicate with purpose, not polish.”

SOCIAL MEDIA PRESENCE

1,000+

videos on YouTube

40,000+

monthly podcast downloads

80% warm leads though YouTube alone

Brokers who diversify their business offerings now will have a running start in 2026, says SME specialist Bizcap

AS 2025 winds down, many small and medium-sized enterprises are reviewing their finances and planning for growth in 2026.

This makes it an ideal moment for brokers to open a dialogue with their clients about their business lending needs, especially as a growing number of SMEs are turning to brokers to help secure funding.

“By engaging clients in conversations about their 2026 business plans, brokers can uncover opportunities where additional capital might be required, whether it’s for expansion projects, new equipment, hiring, or simply bolstering cash reserves,” says Nathan Evans, senior business development manager at Bizcap.

Since many SMEs will be reviewing their budgets, growth plans and potential funding

• Fast Business Loans: Bizcap’s go-to product for immediate financing needs provides borrowers with access to between $5,000 and $500,000, making it ideal for bridging sudden cash flow gaps.

• Small Business Loans: For broader business goals, including expansion projects and managing everyday operations, these loans range in size from $5,000 to $4 million and are often available within 24 hours of approval.

• Secured Business Loans: For established businesses seeking larger loans or better rates, this option enables SMEs to provide an asset as collateral for more favourable terms, making it suitable for significant investments like scaling operations, major capital purchases or long-term projects.

“[Brokers] should proactively raise the topic of business lending now – not wait until a crisis arises”

Nathan Evans, Bizcap

needs as the new year approaches, brokers “should proactively raise the topic of business lending now – not wait until a crisis arises”, Evans says.

And by sparking a conversation around what their plans for the new year are and whether they’re expecting a funding gap, brokers can uncover opportunities early.

“This opens the door to discuss solutions like a short-term small business loan or a flexible line of credit,” Evans explains. “Brokers can add real value by informing SME clients of financing options available beyond the traditional bank loan, especially fast, non-bank alternatives.

“Brokers who highlight these fast solutions – and explain that lenders like Bizcap look beyond just credit scores to consider the whole business story – will position themselves as forward-thinking partners.”

Bizcap o ers a suite of tailored financing solutions to meet these needs, including:

• Bridging Finance: With funding of between $150,000 and $4 million available, this temporary funding option can plug cash flow gaps during transitional periods.

• Line of Credit: Bizcap’s revolving credit facility provides continuous, on-demand access to funds at an approved limit of up to $500,000 for qualified businesses.

• Line of Credit (LOC) Ultra: In late 2025, Bizcap launched this enhanced credit o ering with a repayment rate of just 8% for the first month. This is a great option for businesses seeking an alternative to invoice financing or debtor finance.

As the calendar year draws to a close, Bizcap is seeing strong interest in its working capital loan options as businesses need extra liquidity to navigate a period of heightened activity, followed by a potential slowdown right after.

“Key drivers for needing funds include inventory and stock purchasing,” says Evans. “Retailers and wholesalers, in particular, must stock up significantly in anticipation of Christmas and summer sales.

“That means paying suppliers in advance and increasing stock levels, which ties up cash. Similarly, hospitality businesses – restaurants, caterers, event venues – incur higher costs ahead of the holiday rush: ordering extra food and beverages, decor and other supplies to serve the influx of customers.”

Working capital is also being deployed for sta ng and payroll purposes as many businesses hire seasonal sta or pay overtime to handle the peak demand in November and December. Often, wages and associated costs are due before revenue generated from holiday sales is fully realised, creating a “timing gap”.

Evans says, “We’ve seen clients take out short-term working capital loans to cover payroll through January, especially if their receivables won’t be paid until late January or February.

“Some industries experience a temporary slowdown or shutdown over the Christmas/ New Year period, such as construction, where many sites close for a few weeks. For those businesses, revenue pauses but expenses –rent, salaries for core sta , equipment leases – continue, so they may seek funding to bridge that quiet period.”

“The holiday period brings both a boom in sales and a host of cash flow headaches for business owners”

Mendy Ash, Bizcap

Unfortunately, the challenges don’t end there for SMEs.

The tight labour market has been a “doubleedged sword”, says Bizcap’s senior business development manager, Mendy Ash. “While unemployment has ticked up slightly, many sectors report di culty finding skilled sta , and competition for talent drives wages higher. These resource shortages, especially skilled labour, remain a critical challenge.”

Furthermore, consumer spending continues to be patchy at best amid a shallow rate-easing cycle and economic uncertainty. “Weak household spending means many SMEs have seen slower revenue growth than expected,” adds Ash. This makes it all the more important for brokers to guide their clients through these rocky times.

The summer months provide a perfect opportunity for residential-focused brokers to diversify into the SME space. Property markets tend to cool throughout the fourth quarter

as families head o on holiday. Conversely, summer is also the peak season for many SMEs, particularly those operating in the hospitality, retail, logistics and trades industries.

“The holiday period brings both a boom in sales and a host of cash flow headaches for business owners,” says Ash. “This is exactly when a broker with business lending solutions can step in to help.”

While summer can bring with it cash flow lulls for certain businesses, even this provides opportunities for savvy brokers. “Funding solutions can often help businesses cover payroll during seasonal lulls or fill short-term funding gaps so they can keep operations running smoothly,” Ash explains. “By diversifying, brokers can capitalise on these seasonal financing needs.”

Bizcap is seeing a growing number of brokers taking advantage of these diversification opportunities. Because at the end of the day, “it keeps the client from wandering to another broker or lender, positioning the broker as a holistic solution”, says Ash.

Every brokerage wants to take over the world, but when it comes to positioning yourself in-market, good practice starts locally

WHEN YOU’RE up against a 22,000strong army of healthy competition, broker marketing can feel like a Darwinian survival of the fittest. Social media is awash with slickly produced content by brokers at the top of their games, garnering hundreds of impressions on the daily.

Of course, social media doesn’t always reflect reality; but the reality remains that, with so many brokers on the beat, marketing can make or break your business.

Speaking to the experts, it’s clear that, despite living in the social media age,

effective marketing starts with the people around you.

“The right marketing strategy depends on your stage of business,” says Blake Buchanan, general manager of mortgage aggregator Specialist Finance Group (SFG).

New-to-industry brokers are far more inclined to lean on family members, friends and professional networks to help grow their portfolios. “That might mean phone calls, emails and legally obtained marketing lists that feed into CRM-driven newsletters,” says Buchanan.

For its part, SFGconnect gives brokers access to in-built marketing tools that automatically tag and group clients – from first home buyers to investors, renovators or any other type of client – and then place them on targeted communication journeys.

“As a broker matures, so should their marketing,” Buchanan continues. Social media – whether that’s TikTok, Facebook, Instagram or LinkedIn – becomes far more important, but regardless of platform, “the focus should shift towards higher-quality, more polished content.”

“Over time, marketing evolves from ‘getting your name out there’ to positioning yourself as a trusted expert in your niche,” he adds.

Regardless of what stage of your career you’re at, Buchanan stresses the power of using your existing network to your advantage. “Every client, every interaction and every partner connection is a marketing opportunity. A single home loan transaction typically involves a real estate agent, a solicitor or conveyancer, an accountant and of course the client’s own family, friends and workplace.

“When you think about that network, the potential reach of one client multiplies quickly. SFG systems enable brokers to record and tag these associated contacts, allowing automated marketing to extend to the wider circle.

“Don’t just market to your client – market through them by staying visible to the people they already trust.”

Sally Chadwick, executive manager corporate communications, events and franchise marketing at Mortgage Choice, says, “It’s so important that brokers can identify what’s unique about their business and the service they provide. It’s a crowded marketplace, and you need to stand out in a way that’s true to yourself.”

Chadwick stresses the importance of finding ways to showcase your unique skill sets, but you should also show your customers and potential leads “the real you”, she says.

media platforms like Instagram and TikTok will be key to connecting with this audience,” says Chadwick.

LinkedIn, notes Buchanan, works better for targeting high-net-worth and professional clients.

As professionals to which Australian homeowners entrust the largest financial decisions of their lives, brokers are expected to have their own finances in order. This surely doesn’t include investing in

“Too many brokers still view marketing purely as lead generation. In reality, the goal should be reputation, education and trust”

Blake Buchanan, SFG

Chadwick cites examples of Mortgage Choice brokers who speak languages other than English. “Many of them highlight this in their marketing to appeal to different cultural demographics,” she says, although it could be as simple as posting pictures of your beloved pet to project your authentic self.

In a time when 22,000-plus brokers are all jostling for attention, differentiating yourself from your competitors is only becoming more important.

“Being strategic with your marketing is what will help you truly stand out in a competitive marketplace,” says Chadwick. “Brokers aren’t just competing with each other; they’re competing with lenders, including the big banks and their multimillion-dollar marketing budgets. What helps brokers truly stand out is the personal connection they nurture with their customers and local community.”

It’s also essential to be clear on who your target market is and to make sure your content is showing up where they are looking. “For example, if you’re trying to attract younger first home buyers, social

marketing ventures that provide poor returns. Buchanan believes brokers often make the mistake of rushing into marketing without measuring returns or understanding the “cost of noise”.

He says, “Search-engine optimisation [SEO] and paid lead generation can be expensive, and when the big players are also ramping up their ad spend, your own cost per lead can skyrocket.

“Unless you’re playing at a high level in that space, those funds might be better directed towards strategies that are more personal, measurable and community driven. Sponsoring a local sports team, hosting a free-coffee morning or collaborating with nearby businesses can often deliver a far stronger return on both relationships and reputation.”

This community- and/or niche-driven element is where Buchanan is seeing a lot of success across the SFG brokerage network. St Marys-based Mortgage Choice franchise owner Nicole Nation, meanwhile, has found a lot of success in co-hosting seminars with other western-Sydney-based brokers.

Nation explains, “When I brought up the idea to run the webinars, a few other local brokers said they’d love to do something similar. So we started planning our first seminar together, targeted at first home buyers. We split the cost and the workload, which made it easy to manage, and we leaned on each other for support.

“The Mortgage Choice marketing team provided the materials to help us promote our first seminar, including email invites to send to our customer databases, and the seminar deck that we used for our session,” Nation says. “This meant we could focus on local networking, like encouraging customers to bring their adult children. That personal approach was highly e ective.”

The results speak for themselves: Nation settled two loans directly from that first seminar, with another opportunity in the pipeline. “We’re already planning our next seminar – targeted at investors,” she adds.

But while marketing campaigns are inevitably measured in dollar returns, it’s important to understand that it’s not just a numbers game.

“Too many brokers still view marketing purely as lead generation,” says Buchanan. “In reality, the goal should be reputation, education and trust. People researching you online should find a professional, credible presence – great website, helpful videos and genuine client reviews.

“Even before a conversation begins, your online footprint should make clients feel like they already know and trust you. Marketing isn’t just about getting found; it’s about being believed once they do.”

“At Specialist Finance Group, marketing enablement is built into the way we support

their audiences and measure real-world impact”, he adds.

Many SFG brokers are also combining SFG’s in-house tools with professional content-creation support. “Using creative agencies or freelance editors to cut and

“It’s so important that brokers can identify what’s unique about their business and the service they provide”

Sally Chadwick, Mortgage Choice

brokers,” says Buchanan, reiterating the benefits of SFGconnect intelligent tagging and automated campaigning capabilities.

Recent upgrades to SFG’s CRM and analytics systems “have made it even easier for brokers to track engagement, segment

repurpose content can add real polish – and it’s often more a ordable than people think,” Buchanan says.

As franchise owners, Mortgage Choice brokers “benefit from our ongoing investment in one of Australia’s most recognisable

broking brands”, says Chadwick.

Mortgage Choice runs national brand campaigns to boost brand awareness and conducts regular incentive campaigns to drive leads, while national partnerships like its sponsorship of the NBL help brokers connect with new audiences.

“However, our support doesn’t stop there,” adds Chadwick. “The real power of a franchisee’s marketing is at the local level, so we equip brokers with the support and tools they need to run powerful local campaigns and events.”

All in all, while social media has made it easier than ever to reach global audiences, brokers should not forget the power of thinking locally. This is the area where most brokers will succeed or fail in the first place.

As Buchanan says, “Do it well and your marketing will not only generate new leads but cement long-term trust – the kind of trust that turns one client into many.”

Rapid growth of the private credit sector has made industry watchdogs more hawkish than ever. Could this be a good thing?

IT IS a fascinating – possibly nervous – time for private credit. While only representing a sliver of the property lending market, recent regulatory developments are sowing the seeds for change.

As it stands, private credit, encapsulating tax, family office and institutional investors, has less than half a percentage point share of the residential mortgage market, per CBRE Group research published in July. That figure increases to 4.2% of commercial lending and 26% of the residential development segment.

While real estate private credit is currently worth an estimated $50 billion (to put it into context, Australia’s real estate sector is worth over $12 trillion), CBRE estimates that this will increase to $90 billion by 2029, driven primarily by residential development and commercial lending.

Like the wider alternative lending space, brokers often turn to private credit to facilitate riskier, higher-LVR loans not commonly serviced by traditional lenders. But the rapid growth of the private credit sector has brought increased regulatory scrutiny along for the ride.

ASIC has been on a tear, issuing interim stop orders on several top-tier credit funds while promising to increase its oversight and scrutiny of the industry in the year ahead.

Prominent industry experts see this as a challenge as well as an opportunity.

“Yes, regulators are watching the private credit space more closely,” says Royden

D’Vaz, general manager – distribution and partnerships at private lender Assetline. However, from Assetline’s perspective, “that’s not a deterrent; it’s validation”.

“Oversight is likely to target transparency, investor protection and systemic risk, not to eliminate private lending altogether,”

D’Vaz explains.

Matthew Porch, head of distribution at Aquamore Finance, adds, “More transparency is probably the positive force to come out of increased oversight”, although he maintains that “regulation” is the wrong term to use here.

“More ‘regulations’ aren’t necessarily a good thing, but more accountability on the

true risk position that certain deals present –and how these are mitigated properly – will give the space more legitimacy and will benefit everyone from investors through to brokers and borrowers,” Porch explains.

The regulatory spotlight on private credit has indeed been intensifying, with recent enforcement actions taken against some of the biggest players in the private credit space, including La Trobe Financial, which has served as a warning for the wider industry.

ASIC slapped two stop orders on two La Trobe Financial products, with the regulator suggesting the target market for the funds may have implied an “inappropriate

level of portfolio allocation given the risks of the fund”. The stop orders did not relate to the funds’ performance, liquidity, advertising or the product disclosure statements, and the stop orders were swiftly lifted.

While a headache for the company, La Trobe Financial’s response to the stop orders was praised by other players in the industry, who saw it as a benchmark for transparency and compliance.

But such instances serve as a reminder of the regulatory risks at stake for the private credit sector, and the need to be on the front foot as the watchdogs turn their gaze to other players in the industry.

Porch hopes that this increased oversight from ASIC will bring all players into “some kind of benchmarked standard in regard to lending”, which will make some operators “accountable for the decisions they have made in regard to credit risk”.

He adds, “This consistency will also be good for brokers who I am sure can find private lending a bit of a minefield in regard to who is doing what and when.”

However, striking the wrong regulatory balance risks doing damage to an important segment of the lending market for small business and non-standard borrowers locked out traditional financing avenues.

“Oversight is likely to target transparency, investor protection and systemic risk, not to eliminate private lending altogether”

Royden D’Vaz, Assetline

“My biggest concern is that if ASIC starts to overregulate the non-coded commercial lending space, it could make it much harder for small businesses to obtain working capital and make fast, flexible decisions,” says Porch.

“The reason this space has traditionally been unregulated is to keep things accessible for small and medium enterprises. If regulation goes too far, it could really restrict access to funding for these businesses.”

However, “it’s imperative lending standards do not slip or are allowed to degrade to the point credit risk becomes unmanageable and starts to cause a systemic issue”, Porch adds. “I can completely see why ASIC is trying to understand the space a little better.”

Porch notes that Aquamore has a strong credit and operations team, “which ensures compliance with both our institutional ware-

house facility and our Australian Financial Services Licence”.

“We have to undertake a quarterly audit and answer to trustees on every dollar that comes in and out of the business, so our compliance obligations are always top of mind. We undertake hindsight and spotcheck reviews on our files to continue building our experience and understanding of where we might have gone wrong in assessing previous transactions.”

D’Vaz described a similar process, adding, “At Assetline, we proactively adopt bank-like governance and responsible lending frameworks to stay ahead of any formal regulation.”

“Established private lenders like Assetline who have a solid track record and institutional backing tend to have more sophisticated and

diversified funding structures,” says D’Vaz. These often include warehouse credit lines, securitisation, investment funds or institutional partnerships.

“By contrast, smaller or newer private lenders often rely on simpler and more limited funding sources, such as personal or partner capital, joint venture agreements or high-yield capital,” he continues.

“Because their funding base is narrower and more relationship-driven, they may face liquidity constraints and offer smaller loan sizes or higher rates to manage risk and maintain margins.”

When choosing a private lender to work with, D’Vaz recommends brokers ask themselves the following questions:

• How long has the private lender been in business?

• What is their reputation in the industry?

• What is their track record with regulators?

• What is their loan book size?

• Have they done this loan previously? (With an experienced private lender, chances are they have seen this scenario before)

• Who are they affiliated with in the industry? Are they members of industry bodies like the MFAA or FBAA?

In Porch’s view, one glaring red flag is the presence of large upfront fees on transactions payable before an approval is secured.

“Stable sources of funding is also a green flag. Don’t be afraid to ask where the money is coming from to fund the proposal,” adds Porch.

In many ways, private credit is undergoing the same transformation the mortgage broking industry did in the aftermath of the banking royal commission.

The introduction of the best interests duty (BID) following the royal commission was a gigantic wake-up call for the broking industry, ushering in a new era of compliance and regulation.

BID has only been a good thing for brokers: between 2021 (when BID came into force) and 2025, broker market share of new residential home lending has soared from below 60% to nearly 80%, bolstered by renewed trust in the broking industry among the general public.

Could private credit’s turn be next? It remains a small sliver of the Australian mortgage finance space, but history shows that nothing is ever set in stone.

As D’Vaz notes, “Over the past several years, we’ve seen tighter bank lending standards, especially in residential and commercial real estate; higher capital adequacy

“If regulation goes too far, it could really restrict access to funding for these businesses” Matthew Porch, Aquamore Finance

Some lenders, explains Porch, charge due diligence or application fees before they have even looked at the deal, giving a false sense of appetite in order to attract these fees, saying yes before they have even understood the transaction.

As for green flags, “lenders that are aggregator aligned, given the level of compliance aggregators quite rightly put their lenders through, should give you comfort as a broker in who you are dealing with”.

requirements forcing traditional lenders to pull back from non-prime or complex borrowers; and increased demand for bespoke financing, where borrowers need flexibility on structure, speed or security rather than just rate.”

Private lenders like Assetline and Aquamore are helping to plug this gap left by traditional lenders, but growth will only come under the all-seeing gaze of the industry watchdogs.

In times of unprecedented market competition, non-bank lenders are winning trust one broker at a time through innovation, product diversity and sheer people power

IT WAS another packed room for this year’s Non-Banks Roundtable as nine representatives from the biggest and best challenger lenders gathered at Cafe Sydney to discuss the key mortgage broking topics of 2025.

The stacked roster was hardly a surprise, given the remarkable rise to relevance Australia’s non-bank lenders have enjoyed in recent years. No longer shall they be referred to as the lenders of last resort, the non-banks have proudly proclaimed in recent times. Rather, these alternatives to the traditional banks have cemented their place as a mainstay of Australia’s home lending scene, thanks to innovative product o erings, higher risk appetite and a strong focus on delivering through the broker channel.

Yet there is no shortage of challenges for these non-bank lenders. Competition is rife, brokers and customers are becoming more demanding than ever, market share is seeing swings and roundabouts, and artificial intelligence technology is leading the sector into uncharted waters. But as the conversation flowed around the table, it became clear that these industry leaders are tackling these challenges with gusto.

One of the biggest revelations of the day was just how diverse Australia’s non-bank lenders are. Each has managed to carve out its own identity in a saturated market through innovative product structuring and client-centric adaptability.

Joining MPA for the 2025 Non-Banks Roundtable were:

• Belinda Wright, head of partnerships and distribution, Thinktank

• David Smith, chief distribution o cer, Liberty

• Royden D’Vaz, general manager, distribution and partnerships, Assetline

• Tony MacRae, chief commercial o cer, Bluestone Home Loans

• Cory Bannister, chief lending o cer, La Trobe Financial

• Tim Lemon, national sales manager, MA Money

• Jason Arnold, group executive, origination, Pallas Capital

• Siobhan Williams, head of mortgages, retail broker, Pepper Money

• Tim Ford, head of strategic partnerships, ORDE Financial

• Katie Thomas, managing director, Focus Finance – the roundtable’s guest broker

What specialist lending segments will you be pursuing with greater intensity in the year ahead?

The sheer diversity of the non-bank lenders gathered around the table was one of the day’s biggest talking points. But there were also some common themes that ran throughout. Bridging finance, for instance, has gained traction across the non-bank

sector in recent times, while SMSF lending and non-conforming loans remain cornerstone o erings of the industry.

With Thinktank’s residential business “doing really well”, the group’s focus is shifting back to its commercial finance roots and the SMSF space, especially in light of the proposed government changes to superannuation tax treatment recently becoming clearer.

“We’re rethinking the broker experience in the SMSF and commercial spaces, with a strong focus on speed, simplicity and support so they can spend less time on process and more time helping their clients,” Wright said.

Smith added, “Specialist lending is at the heart of what Liberty does best, and it’s where we shine. We will continue to focus on custom solutions and alt-doc options, as well as look for new ways to do things di erently.

“In the year ahead, we’re excited to explore new opportunities in our residential loan o ering. We’ll also look to extend our SMSF loan o ering to help brokers support even

“Brokers are incredibly loyal when you provide competitive pricing, reliable service and genuine support” Belinda Wright, Thinktank

more Australians investing in property to support their future.”

Assetline, with more than a decade-long track record in short-term private credit, remains committed to its core o ering.

“That will always be our focus; it’s in our DNA,” said D’Vaz. However, the business has expanded its reach into term facilities and the SMSF space.

Bridging loans are also attracting greater attention. “As it’s getting out a bit more and brokers are starting to embrace it, I’m starting to see that big growth channel,” D’Vaz explained.

He noted that the perception of bridging finance as expensive is changing, especially

with more brokers embracing this space. Thomas concurred with this assessment of bridging finance. “We’ve definitely seen more interest in the bridging sector than probably before. That’s come from confidence in the market,” she said.

Bluestone’s focus remains on nonconforming and near prime lending, with the team recently strengthened to support this direction. It is also launching alt-doc construction and small-ticket commercial o erings, following a successful pilot. “We see a space in the market to o er brokers extra value and flexibility, and we’re keen to play in that space,” MacRae said.

At La Trobe Financial, Bannister sees

When you join the Mortgage Choice network, you tap into a wealth of experience and resources designed to build your knowledge, skills and confidence. Our franchise structure provides all the support you need, from technology and marketing to compliance and business development.

construction finance as “an enduring tailwind” as it relates to the ongoing housing supply issue. With the government’s house-building targets consistently coming in short, it’s hard to disagree.

MA Money is evolving its alt-doc products with bigger loan amounts and greater risk appetite. The lender is, in Lemon’s words, being “a bit more adventurous” in the space.

“We’ve just launched our commercial offering and our bridging products … The bridging product for us took off quickly, which is surprising, but there seems to be a huge need for it,” added Lemon.

Construction finance remains Pallas’s “bread and butter”, particularly in the mid-tier space. However, Arnold revealed a renewed focus on the $3 million–$10 million low-doc commercial and residential investment segment, with new products in the pipeline in this space.

“That’ll be a heavy focus for us,” he said.

Pepper Money is “really doubling down on the real-life segment”, said Williams, referring to near prime and specialist customers

as well as the non-standard-income segment.

“We think that that sector continues to be largely underserved by banks, creating a great opportunity for non-banks to sort of come in and rescue,” she said. “To complement that, we’re also dialling up the X-factor

there can be a reluctance to pursue them.” However, ORDE sees SME lending as a crossover opportunity for purely residential writers “that want to dip their toe in the water. So that’s our focus, with a comprehensive, flexible product set and strong support model to

“Specialist lending is at the heart of what Liberty does best, and it’s where we shine”

David Smith, Liberty

experience to ensure both brokers and customers get the best experience.”

Ford highlighted SME lending as a major focus for ORDE. “There’s a big opportunity and demand in-market to help brokers diversify into supporting SME customers and writing more commercial deals,” he said. “But the real and sometimesperceived complexity of these deals means

help them with their first deal”. Ford also noted growing broker demand for construction and SMSF financing options.

How are you carving out a competitive advantage in today’s hotly contested mortgage finance industry?

In Ford’s view, “your broker experience is

where you want to be differentiated in the market as a lender”. He explained, “When we’re in a time where Google reviews can make or break your business, their experience of dealing with you becomes more crucial. Just getting the deal approved isn’t enough any more.”

Ford singled out quick turnaround times, education and consistent and clear decisioning as fundamental to delivering the

deliver a competitive edge. “Our focus has been getting local boots on the ground, working with local originators to meet with clients and visit the sites to be able to work out complex solutions,” said Arnold. He referenced new offices in Adelaide, Perth and soon Canberra to underscore his point.

MA Money has doubled down on its 48-hour service level agreements (SLAs), investing heavily in technology and its under-

“I don’t think we’ll ever let AI dominate what we do”

Royden D’Vaz, Assetline Capital

kind of experience brokers and their clients will remember.

While “sharp price is important and speed to yes is important”, Williams said what truly sets Pepper Money and the non-bank segment apart is flexibility for specialist lending customers. “That outside-the-box approach to past credit history, the way we verify their income, and our flexibility is the heart and soul of Pepper Money,” she said.

“We’re always trying to continue to be innovative from a product, policy and experience lens,” Williams continued, highlighting Pepper Money’s investments in digital tools, including the first-in-market AltDoc Xpress.

Wright acknowledged a “race to the bottom” on rates but argued that consistent service and being able to deliver a result is just as crucial as price. “Competitiveness will always be part of the equation, but the real strength lies in providing a consistently high level of support and service that leads to a positive outcome for brokers and their clients,” she said.

Thinktank’s market-leading white label products are a cornerstone of its service offering. “Our focus is on working hand in hand with our aggregator partners to deliver innovative white label offerings that stand up strongly for them and their brokers,” Wright added.

Pallas is investing in local presence to

writing platform. “We make improvements to it on a monthly basis to ensure that we’ve been able to maintain that,” said Lemon.

The non-bank has rolled out 48-hour SLAs for bridging and commercial deals as well. Consistency is also key.

“We’ve put a lot of work at the front before

the loan gets submitted,” Lemon continued. “So we have a dedicated credit person that works with the BDM to ensure that they get that one answer first time.”

Thomas discussed how consistency is a major differentiator in the market, but also a source of disparity. “There’s particular lenders and non-bankers that can maintain a really high level of consistency, especially when you’re dealing with purchases a lot.”

However, she noted that fluctuating SLAs and shifting rates can erode trust. Additionally, there are still a number of nonbank lenders who don’t do fully assessed pre-approvals, making it more difficult to ensure “complex or marginal deals that are time sensitive ... will be processed smoothly, accurately on the lender’s end and efficiently to an approval when it’s time critical”.

D’Vaz was candid about the challenges of differentiation in a commoditised market. “We’re all trying to differentiate, but what we have is a commodity. We all do similar things. We all do things that everybody

o ers, so we’re always trying to fi nd that edge. Or that secret sauce.”

D’Vaz emphasised that the broker is often in the driver’s seat. “The agenda is run by the broker, because they’re trying to do

Bannister said La Trobe Financial’s edge comes from “making a broker’s life easier for when they think outside of a bank solution”. Whether it’s for a specialist product or a genuine bank alternative on a bank-

“We’ve been working with a mantra of ‘eliminate and simplify’. We’re getting the process tighter, eliminating unnecessary forms, and we’re about to move into the digitisation phase”

Tony MacRae, Bluestone Home Loans

what’s in the best interests of the customer.”

For Assetline, D’Vaz said, the goal is to ensure that brokers “shine in front of the customer”, and to perfect the back-end experience to accommodate a “path of least resistance” to achieve that goal.

like product, whether that be a commercial product or a luxury residential development, “we hope they think of La Trobe Financial and know that we have them covered”.

Bannister added that the company’s flexibility gives it an edge when a customer is

weighing up going with La Trobe Financial or a traditional bank.

Bluestone’s strategy is to “keep things relatively simple and really focus on two key areas”, said MacRae – specifically, relationship and service. “That involves getting the right people in the right areas, to provide really great service and support for brokers,” he explained.

Providing the best education resources to let brokers know exactly what Bluestone can provide, while simplifying its origination process, is also vital. MacRae continued, “We’ve been working with a mantra of ‘eliminate and simplify’. We’re getting the process tighter, eliminating unnecessary forms, and we’re about to move into the digitisation phase where we’ll remove a whole heap of manual steps from that process. So that’ll further help streamline the broker’s journey.”

Smith noted that as consumer expectations rise, lenders must strive to meet them. “Every day, brokers are lifting their game, and at Liberty we’re right there with them. We

know that in a competitive market it’s not just about rates or products; it’s about being a reliable partner.

“To that end, Liberty is investing in our people, particularly our BDMs, who are front and centre when it comes to broker engagement and relationships. By equipping them with the tools they need, we’re ensuring brokers have the support they deserve.”

For Smith, “predictability and reliability are paramount”. Speed matters, but brokers and customers value certainty above all.

“We know brokers are under pressure to deliver fast, reliable outcomes, and we’re here to make that easier,” Smith said. “Our goal is to be the lender that brokers can count on for brighter solutions, especially when the clock is ticking or flexibility is required.”

D’Vaz snuck in another comment, as he cautioned against over-reliance on AI, saying, “I think everybody’s expecting this to be the silver bullet for this industry. But we’re

a people business. I don’t think that’ll ever change, especially at the non-banks.”

D’Vaz suggested AI is a natural fit for the higher-volume, conveyor belt-like process at

Some topics cannot be avoided. AI was not on the roundtable agenda, but there’s no skirting around the fact that the technology is having a massive influence on the mortgage finance industry.

While everyone agreed that AI should in no way be a replacement for fundamental human relationships, there was a nuanced discussion around the best practice of implementing it into everyday processes.

“For a business of our scale, Liberty is investing significantly in AI,” said Smith, who sees AI as a powerful tool for streamlining processes and enhancing engagement.

Smith believes AI offers “opportunities to streamline, remove friction and increase speed, while also increasing the engagement quality between broker and lender and hopefully between broker and customer”.

He noted that procedures that once may have taken hours could now take seconds, thanks to automation.

“We see AI as a game changer not only for efficiency but for improving the broker experience, therefore making it possible to better serve more customers,” Smith added.

For Thomas, automation “allows us to have that people engagement”. She emphasised that efficiency through automation in the credit and approval processes makes

“We’ve definitely seen more interest in the bridging sector … That’s come from confidence in the market”

Katie Thomas, Focus Finance

the majors, “but we’re a high-touch business. We want to hold the broker’s hand and walk them through the process. We’re helping them manoeuvre the back end. So I don’t think we’ll ever let AI dominate what we do.”

And thus the AI can of worms was opened as the discussion turned to the very pertinent topic of whether AI risks removing the human elements of the lending business.

time for focusing on meaningful brokerclient interactions.

Williams “couldn’t agree more” that finance is a people business but sees AI as essential for scale without losing the personal touch. “In order to get our people in front of brokers as much as possible, we will need to rely on AI as we scale, agentive AI specifically. All those processes that are easily mapped, that could

be done rather than manually, automated through agentive AI. It’s a no-brainer.”

Coming back to D’Vaz, he acknowledged the operational importance of AI, especially for business development managers. “I think what it does for a BDM is it removes noise, giving them time to see more brokers to build rapport and make a connection. So operationally, definitely, I don’t think it’ll remove that.” He concurred that AI is a tool to enhance, not replace, the human touch.

At Bluestone, AI “definitely has a role”, said MacRae, but he cautioned that “at the core of what we do, we’re a relationship business”.

“We need to really carefully pick the areas that it is going to add value and where you can rely on it,” he continued. “Because we can’t forget at the end of the day we’ve got responsible lending obligations to adhere to. We can’t just fall back and say, ‘AI told me this was the right thing to do’. ”

Bannister sees genuine productivity gains

from automation but is sceptical about its use in credit decisioning for complex loans, where at this stage he “doesn’t expect it will play a meaningful part in the process”. Furthermore, La Trobe Financial does not employ offshoring teams, although he believes this is an area ripe for AI disruption.

For MA Money, AI is about empowering brokers to self-serve 24 hours a day. “We’ve got a lot of brokers that are working weekends, working after hours when BDMs are not available,” noted Lemon.

But he stressed the importance of oversight. “We keep track of everything we do with AI, and we keep a very close eye on it to make sure that the imagination of the AI doesn’t take over. So we try to keep it very strict at the moment.”

ORDE is a solutions-based lender that wants to say yes to as many deals as possible. Ford said, “We’re investing heavily in AI, not just for efficiency but to help with early-

stage assessment, packaging and other parts of the process. It means our One Lending Team can focus on understanding the customers’ stories, sharing knowledge and supporting brokers through the deal.”

A constant internal conversation at ORDE is about “the balance between what our people can do and what digital can do. And it’s equally important in a broker’s role: understanding what are those things that can’t be replaced by technology: building trusted relationships and delivering tailored advice”.

Ford added, “You’ve really got to focus on building strong relationships and adding value beyond just knowing the products.”

Wright noted that the human side of AI adoption is often overlooked. “Many people are understandably anxious about what AI might mean for their roles and the broader industry, but we see it as an opportunity to enhance what people do best. When it’s used the right way, it can actually make

the work we do more efficient and more rewarding,” she said.

She recounted a story of a broker whose credit process dropped per complex deal from 10–12 hours to just 30 minutes with AI, and how experienced brokers were shocked but also motivated by the change.

Wright believes there is a “huge” technological leap that has to be made in the commercial side of the broking business.

For Pallas, AI is “all about increasing eciencies”, Arnold said. “We lean a lot on personal contact, as has been discussed, as well as the education piece and being available to define products.” However, he added that human services and AI “are both complementary” to each other.

How are you getting your message across to customers and the broking community, given lower brand awareness compared to traditional lenders?

Changing direction entirely, the discussion shifted to branding and marketing.

There is no doubt that the big four have

“Being a 100% broker business, our thought process is winning over one broker at a time, giving them a great experience, leveraging them for word of mouth” Tim Lemon, MA Money

a brand awareness advantage, but there is a debate around how important this is for customers in 2025.

In MPA ’s latest Brokers on Non-Banks report, brand trust came in 10th in a survey of what brokers want from non-banks. Credit policy, BDM support, turnaround times, rates, communications, commission structures and product range all ranked higher.

However, nearly 10% of brokers cited ‘lack of brand awareness’ as the main barrier to putting more business through non-bank lenders. So, while brokers tend to prioritise fundamental support over brand identity, the latter can still be a barrier to volume growth.

Smith acknowledged that brand awareness plays a key role and that Liberty is proud of

its continued strong reputation and positive brand awareness in the market.

He said Liberty is also focused on being front of mind for brokers when they have a deal that might fall outside the traditional lending space. “Brokers know Liberty stands for flexibility and free-thinking solutions that go beyond the mainstream.”

Smith also emphasised the importance of “tech-enabled conversations” to ensure brokers remember Liberty when they encounter scenarios that don’t fit standard bank policy – particularly important given the thousands of emails and conversations that brokers are constantly juggling.

While it might not sound glamorous, for Thinktank it’s all about delivering on the

promises you make and building advocacy through connecting with people. Wright challenged the notion that brokers aren’t loyal. “Brokers are incredibly loyal when you provide competitive pricing, reliable service and genuine support – they value lenders

capture those Australians that fall through the cracks,” Williams said.

Regulatory changes that have impacted the banking majors have also spurred growth in the alternative lending space, she added.

Arnold dug into Pallas’s multi-channel

“It’s a dynamic market, so you’ve got to move with the times as quickly as you possibly can”

Jason Arnold, Pallas Capital

who truly partner with them to help them deliver great outcomes for their clients.”

Ford highlighted the unique position of non-consumer brands like ORDE, whose reputation is built almost exclusively through the broker channel as they only work with brokers. “It’s the brokers who carry our message to their customers, largely,” he said, adding that ORDE’s new website is “resourceful, but it’s really the brokers that carry that messaging for us”.

Ford pointed out that trust in big brands only has shifted. It was more di cult to be considered without a big-name brand in pre-GFC times, but things have substantially changed. “People are more open to new players now … but for us broker advocacy is key.”

Williams said the non-bank sector is “doing something right” as it continues to grow year on year. “We are getting the message out there,” she said, but highlighted the need to “grow exponentially, not just at the same rate”.

Williams noted that many of the lenders around the table don’t just offer loans through their brand – they also partner with aggregators and o er white label funding opportunities, which have helped grow the sector.

She also stressed the importance of education, especially when regulatory changes or shifts in bank appetite occur. “We have to continue to diversify our product specs and how we look at rate-for-risk lending to

approach of “building relationships in person and complementing that with technology and social media, to get our message across”.

Listening to the broker market and adjusting products and pricing accordingly is also essential, Arnold added. “It’s a dynamic market, so you’ve got to move with the times as quickly as you possibly can.”

For MA Money, “being a 100% broker

business, our thought process is winning over one broker at a time, giving them a great experience, leveraging them for word of mouth”, said Lemon.

He also echoed Ford’s views on the importance of Google reviews. “If a broker recommends a particular lender that customers have never heard of, I find a lot of customers jump to Google reviews, so having positive interactions there makes a big di erence.”

La Trobe Financial takes a “very bottomup approach” to distribution, said Bannister. “Very much heart by heart, mind by mind.”

La Trobe Financial has made a deliberate e ort to be thought of in the market as the “first bank alternative”.

Briefly switching back to the AI discussion, Bannister contended that as more mainstream lenders adopt automated approaches to lending, this will allow non-banks to di erentiate themselves in the market.

MacRae explained how Bluestone employs a multifaceted approach that puts genuine partnerships at the core. “Having the right

people on the ground, building relationships and talking with brokers about how they can grow their businesses helps us get the message across in a one-to-one approach.”

Bluestone also embraces social media “in a fun way”, running campaigns that involve the whole team and using podcasts, webinars and other digital channels to amplify the company’s message. Not being a traditional bank allows Bluestone to adopt these unique, people-focused digital strategies.

D’Vaz acknowledged the challenge of brand recognition for newer or smaller lenders. He noted, however, that brokers are starting to talk about Assetline and are the business’s “best endorsement”.

“We do the right thing, and our name gets out there,” said D’Vaz. “Three years ago, we wouldn’t be at this table. But we’re better than what we were yesterday, and we’ll continue to do what we have to do.”

Are more non-banks considering leaning into SMARTvals to ensure transparency on deal submissions?

As the roundtable’s guest broker, Thomas pointed out that many non-bank lenders still fall short when it comes to offering upfront valuations.

Without them, she explained, brokers are often submitting deals “blind”, unsure whether the property will value up, which can ultimately land as a waste of time to broker, client and non-bank – especially if the purpose was for an equity release that then isn’t facilitated with a valuation that would support the transaction.

In contrast, Thomas believes banks that provide far greater access to transparency on upfront valuations give brokers confidence at the submission stage. This in turn drives higher submission volumes to these banks as they have accurate information to support the deal.

D’Vaz explained that Assetline’s valuation process is dictated by its funders. “We’re guided by our securitised programs and wholesale funding,” he said. “The covenants

are that a short-form valuation has to be on every deal. They set the agenda for this really, and we don’t have anything to do with it.”

He rejected the assumption that lenders sometimes try to influence the valuation. “We just want what the property is valued at,” said D’Vaz. “It’s an ‘arm’s length’ outsourced task where the lenders have no say in the outcome.”

Arnold described Pallas’s more flexible approach in the commercial and construction space. “We’ve got a pretty extensive panel in each state, and a lot of the experienced commercial brokers know these panels,” he said.

Brokers can engage these valuers up front, Arnold explained, “and they might even get a draft valuation. Then we can redirect that valuation report.”

Lemon highlighted that MA Money allows upfront valuations, noting the lender’s use of automated valuation models (AVMs) for loans

Bluestone, which has also adopted SMARTval, provides “a diverse range of valuations and valuations up front”, said MacRae. “The beauty of SMARTval is that it’s much quicker and it’s treated like short-form full valuation from a funding perspective.”

MacRae added that the industry as a whole needs to get better at accepting automated valuation models (AVMs), seeing digitisation and data-based valuations as a real opportunity for the sector.

Ford explained that ORDE is willing to engage with deals considered too complex for other major lenders. “Alongside being able to handle more complex customers, we also look at the strength of the security. In commercial lending, that means assessing the lease agreement, considering alternate uses of the property and often undertaking more detailed valuations than brokers might be used to in residential.”

Pepper Money is also live with AVMs and

“It’s our responsibility to continue to showcase how we meet the real needs of borrowers that banks often miss”

Siobhan Williams, Pepper Money

up to $2 million and 75% LVR, and desktops up to $2 million and 80% LVR, with shortform valuations for larger amounts.

He added that while smart valuations are not yet fully realised, the industry is moving in that direction, though “we’ve still got our masters that we have to adhere to”, although there is a sense that they’re becoming “a little more relaxed” on the valuation front.

La Trobe Financial is exploring desktop valuations and the SMARTval digital property valuation service, Bannister revealed, finding these suitable for certain scenarios. For larger commercial and development finance deals, La Trobe Financial gives brokers the ability to order full valuations up front, “but expects it will take some time before commercial desktop valuations are adopted”.

recently launched SMARTval. Furthermore, it doesn’t charge for upfront valuations on prime deals, although riskier products require the customer to pay for the valuation. Exceptions are sometimes made for high-conversion brokers, but nonconverting loans won’t have costs covered.

At Thinktank, which has also implemented SMARTval, Wright highlighted the complexity of commercial lending. She outlined the challenge of convincing multiple institutional funders – often up to 16 at a time – to accept changes in underlying arrangements.

“The work that goes on behind the scenes to bring new product features, third party solutions and other innovations to market is often underappreciated, and we have a great

team that works tirelessly on these things to continually improve the experience for our brokers and their clients,” said Wright.

According to the latest MFAA data, non-bank lenders command a 5.9% share of broker-originated lending. How do you all intend to work together as an industry to increase your market share?

To wrap things up, the roundtable gave their thoughts on where the non-bank lending industry is headed next.

MacRae sees healthy competition as a force for industry growth but believes collective advocacy is essential for real progress. “It’s important that we all promote and push competition, but I think there’s an opportunity as a non-bank, non-standard lending group to better lobby and lobby for change.”

He pointed to areas where banks have a competitive advantage – such as with accept-

“When we’re in a time when Google reviews can make or break your business, the experience becomes more crucial for the broker and their end customer”

Tim Ford, ORDE Financial

ance of AVMs and electronic valuations – and called for a united front. “We haven’t done a great job of gelling together and being one group for lobby.”

MacRae also mentioned the need to shift the policy focus from demand-side to supplyside solutions in the housing market: “You never solve a supply problem by fuelling demand. We’ve actually got to shift the focus, and as a group I think we can do it. It’s a battle I’m really keen to forge forward with.”

Lemon reflected on the rapid evolution

of non-bank lending: “In the early days of non-bank lending, things didn’t change as quickly as they do today. With more competition, we’re all looking for that little difference. As we all push our funders to accept more or do more, it just opens up that ability for those non-bank customers to achieve more and do more.”

Lemon noted that increased competition and events like this roundtable help push the industry forward, citing the rise in loan-size caps as evidence of progress.

“We’ve got a lot of catch-up to do here in Australia, and private credit non-bank lenders will have to play a critical role to unlock this growth”

Cory Bannister, La Trobe Financial

Bannister pointed out that non-banks have previously achieved higher market share in times of greater liquidity. “We’ve been there before,” he said, citing pre-COVID stats of 9% or more of market share.

Bannister anticipates that as banks focus on proprietary channels, brokers will need to look externally to protect their customer bases. He sees commercial lending as a “huge opportunity”, noting that broker market share in the commercial space significantly trails broker share of the residential market.

He also highlighted that the domestic market is behind the global curve in private credit. “We’ve got a lot of catch-up to do here in Australia, and private credit non-bank lenders will have to play a critical role to unlock this growth.”

Arnold agreed that competition has driven positive change, “and that can only be made possible in the broking market”. He sees the Australian market maturing, with more institutional capital arriving from offshore and non-banks pushing

boundaries on loan amounts and pricing.

Arnold also sees commercial lending as “a massive opportunity” for the broker market. Certainly, with an estimated commercial lending market share of just 30–40% compared to nearly 80% in the residential market, there is a lot of headroom for brokers to grow in this space.

Williams identified commercial lending and construction as fast-growing segments for non-banks, with SMSF lending also offering significant diversification opportunities. “That is part of our strategic direction into 2026,” she said, noting that it’s the non-bank sector that largely serves these segments.

Williams went on to argue that non-banks are no longer just an alternative to traditional lenders. “Non-bank options can often be the best fit for the client,” she said. “And I think it’s our responsibility to continue to showcase how we meet the real needs of borrowers that banks often miss.”

Ford emphasised the importance of training and education in growing the non-bank segment, particularly for brokers who are not yet active in the space. He added that the competitive landscape has forced everyone to improve, “creating better outcomes for brokers and their customers – and helping a wider range of customers”.