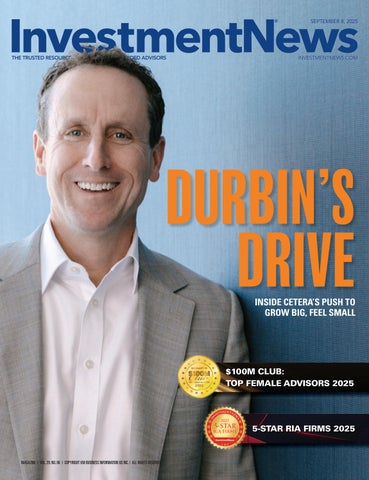

DURBIN’S DRIVE

The path to independence begins with Schwab. We’ve helped thousands of advisors find their path to becoming an independent RIA.

The irreplaceable need for connection

BY ANDY BURT

There is a pattern we fall into when it comes to certain activities. A golf swing, a familiar hike through the mountains, shooting free throws in your driveway, or for the more adventurous, your standard BASE jumping. For me, it is summer fishing. There is something familiar and anchored in history about this pastime that makes it cathartic to go out on a lake or find a local private pond and cast for a few hours, where even catching a fish might be incidental to the experience. The rhythm of the process, coupled with the recognition of an economy of motion, rewarded at times by a fish in the boat, is captured well in some of Winslow Homer’s paintings, or the Robert Redford film A River Runs Through It

However, even these ancient practices have been disrupted by technology. Golf clubs have evolved from local wood, to iron, to steel, to carbon fiber and titanium. Fishing gear has evolved from reeds and horsehair in 2000 BCE to the present, when rods can integrate Bluetooth and sensors to track casting metrics and fish strikes

in a way that would make baseball sabermetrics man Bill James proud.

But golf, fishing, shooting hoops, and many of your other favorite diversions return to the source – the goal is to put the ball in the cup, to cast and catch a fish, to complete the hike. What does this have to do with wealth management? This month’s issue of InvestmentNews examines the state of exchange-traded funds (ETFs)

“The core of the client relationship remains ancient”

and their increasing prevalence in portfolios. Like golf clubs, ETFs have had many iterations – index participation shares in the 1980s, SPDRs in the 1990s, commodity ETFs in the 2000s, and actively managed ETFs today. The disrupted wealth management industry now sees actively managed ETFs surpassing

passive ETFs, based on recent growth metrics. Pair this with recent legislative movement on giving investors even more options, such as alternatives to pack into 401(k) plans, and it is clear the direction of the industry is responding to the desire by investors for more options with varying levels of risk and return.

But we still live in a world where the ball must go in the cup. The line must be cast into the water. The advisor still needs to reach out to prospective clients, to build a trust relationship, be an effective communicator, a strategist and advocate for clients, wherever they may be on their investing journey. Technology makes this easier in some ways through Zoom calls and real-time investment trackers, and the proliferation of ETFs and other innovations offers more for the advisor’s toolbox, but the core of the relationship remains ancient. Perhaps that is a good thing to reflect on as you cast your line again this month.

VP - Editorial: James Burton

Managing Editor: Andy Burt

Senior Columnist: Bruce Kelly

Retirement & Planning Editor,

Multimedia Anchor: Gregg Greenberg

Journalists: Andrew Cohen, Leo Almazora

Senior Sponsored Content Writer: Manal Ali

Contributing Columnists: Joe Duran, Michael Kitces, Ben Henry-Moreland

SALES

Chief Revenue Officer: Dane Taylor dane.taylor@keymedia.com

VP – Global Sales (Wealth): Abhiram Prabhu abhiram.prabhu@keymedia.com

Business Development Managers: Catherine Reale catherine.reale@keymedia.com; Victoria Hamilton victoria.hamilton@keymedia.com; Barry Echavarria barry.echavarria@keymedia.com

Lead - Fulfillment Team: Cole Dizon

Fulfillment Coordinators: Cyrus Arroyo, Pauline Talosig

PRODUCTION

VP – Production: Monica Lalisan

Lead Production Editor: Roslyn

INSURANCE BUSINESS AMERICA cathy.masek@keymedia.com

INSURANCE BUSINESS AUSTRALIA sophie.knight@keymedia.com

INSURANCE BUSINESS CANADA elijah.hoffman@keymedia.com

INSURANCE BUSINESS UK gemma.powell@keymedia.com

BENEFITS & PENSIONS MONITOR WEALTH PROFESSIONAL CANADA abhiram.prabhu@keymedia.com

THE FINANCIAL SECTOR OF THE S&P 500 IN ONE ETF

Sector SPDRs allow you to invest in pieces of the S&P 500. Like Financial. While adding diversification and reducing single stock risk. These ETFs combine the diversification of a mutual fund and the tracking of an index with transparency and liquidity.

FINANCIAL SECTOR SPDR ETF TOP 10 HOLDINGS *

*Components and weightings as of 7/31/25. Please see website for daily updates. Holdings subject to change.

An investor should consider investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus, which contains this and other information, call 1-866-SECTOR-ETF or visit www.sectorspdrs.com. Read the prospectus carefully before investing.

The S&P 500, SPDRs , and Select Sector SPDRs are registered trademarks of Standard & Poor’s Financial Services LLC. and have been licensed for use. The stocks included in each Select Sector Index were selected by the compilation agent. Their composition and weighting can be expected to di er to that in any similar indexes that are published by S&P. The S&P 500 Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. The index is heavily weighted toward stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks. Investors cannot invest directly in an index.

The S&P 500 Index figures do not reflect any fees, expenses or taxes. Ordinary brokerage commissions apply. ETFs are considered transparent because their portfolio holdings are disclosed daily. Liquidity is characterized by a high level of trading activity. Select Sector SPDRs are subject to risks similar to those of stocks, including those regarding short-selling and margin account maintenance. All ETFs are subject to risk, including possible loss of principal. Funds focusing on a single sector generally experience greater volatility. Diversification does not eliminate the risk of experiencing investment losses.

ALPS Portfolio Solutions Distributor, Inc., a registered broker-dealer, is distributor for the Select Sector SPDR Trust.

ADVISORS SUPPORT PRIVATE INVESTMENTS IN 401(K)S

A July survey by Empower found over half of advisors use or favor using private market investments in workers’ retirement plans.

68% currently use private market investments

58% of those familiar with them would recommend in retirement plans

66% say ERISA or regulatory clarity would make them more likely to recommend

59% would limit exposure to private market investments

48% would use advisor-guided solutions or professionally managed accounts

33% would use private market investments within target-date funds

A DEEPLY TILTED BD LANDSCAPE

FINRA’s 2025 industry snapshot showed that as of the end of 2024, only 5% of registered broker-dealer rms quali ed as large – de ned as those with 500 or more registered representatives. But those 149 rms collectively employed more than 530,000 individuals, or roughly 82% of all FINRA-registered reps.

A DYNAMIC DECADE FOR ETFS

Over the past decade, the number of ETFs has grown substantially; 3,720 ETFs were added, while 1,280 ETFs were liquidated or merged in the same period, according to gures from the Investment Company Institute.

IBD ADVISORS EYEING RIA INDEPENDENCE?

Among independent broker-dealer advisors recently surveyed by Cerulli, one in four (26%) said they’ve somewhat considered starting their own independent RIA in the previous 12 months, while another 4% said they’ve seriously considered making the move. Out of those considering launching an RIA, 37% said they may retain af liation with their current rm’s RIA platform but would consider other options.

Source: Empower advisor survey, July 2025

Source: Finra 2025 Industry Snapshot, July 2025

COUNTING THE COSTS OF BAD ONLINE ADVICE

A recent CFP board survey found one in three Americans (33%) reportedly delayed making a signi cant nancial decision, such as a major purchase or retirement, due to online nancial misinformation.

nancial decisions

CYBER WORRIES AND REGULATION HOLDING BACK AI

A joint survey of compliance of cers by Investment Adviser Association, ACA Group, and Yuter Compliance Consulting found 60% holding back AI adoption due to cybersecurity and privacy concerns, while 52% cited uncertainty around regulations.

Source: Investment Company Fact Book, April 2025

C-Suite

INSIDE CETERA’S QUEST TO MAKE ‘BIG FEEL SMALL’

Cetera CEO Mike Durbin explains how he is attracting assets and advisors while keeping a cozy, personalized work environment

BY GREGG GREENBERG

CETERA CEO

Mike Durbin knows what it takes to scale in an industry that demands it.

Just look at his numbers.

When Durbin was introduced as the CEO of Cetera Holdings in the spring of 2023, the San Diego-based wealth manager had approximately 8,000 advisors and $116 billion in AUM. Fast forward two years and a touch and the rm has sprouted to more than 12,000 nancial professionals and over $263 billion in AUM.

Yes, it may sound cheeky, but it’s true: In today’s nancial advisory industry, size matters. (If it didn’t, all those private equity giants wouldn’t be shoveling billions of dollars into it.) And that’s why Cetera lured Durbin to the company over two years ago and named him CEO of Cetera Financial Group this past January. Cetera spent decades watching Durbin grow the wealth businesses of nancial giants Fidelity and Morgan Stanley and realized that if they were ever going to reach those heights, Durbin was the guy to get them there.

Which, as the numbers bear out, he did.

That said, bigger is not necessarily better. It can be eeting if a sturdy foundation for growth is not established. RIAs come and RIAs go in this increasingly mobile environment, and they take their highly portable assets with them.

The key – and the challenge – to long-term success, according to Durbin, is to “make the big feel small” for independent, growth-minded advisors and institutions seeking a home to build their businesses.

“Cetera continues to be a magnet, thanks to our wide-ranging af liation options and exibility, commitment to community and culture, and proven growth resources. Advisors choose their af liation

model – their business should re ect them, not Cetera – and can move between models as their business evolves,” Durbin says.

“We strive to constantly make the big feel small, including by organizing advisors into likeminded communities within ve distinct channels,” emphasizes Durbin.

Approximately $590B in assets under administration*

Approximately $263B in assets under management*

Approximately 3,000 home of ce employees*

nancial advisor and business owner who has created a phenomenal practice lled with great people,” and said her philosophy of “growing by getting better, not just bigger” ts with Cetera’s approach.

Or maybe even ts its mantra.

That’s because Halloran offered a similar sentiment in February after Cetera added Corporate Plans Retirement Strategies, a White Plains, New York-based advisory group overseeing more than $250 million in assets under administration from Equity Services.

“Our value proposition of a small community feel for networking and support along with all of the resources of a major broker-dealer was an attractive differentiator,” Halloran said while welcoming the team.

“Organically, we deliver some of the industry’s best programs, tools, and resources to help our advisors grow their business in meaningful ways. Our recruiting efforts fuel our organic growth as well, and we are seeing great recruiting results and momentum this year,” Durbin says.

“Inorganically, we pursue acquisitions primarily to achieve two key outcomes. The rst is adding scale in the form of more assets and

“We strive to constantly make the big feel small, including by organizing advisors into like-minded communities within fi ve distinct channels”

GETTING BIGGER, FEELING SMALLER

This summer Cetera poached Susan Wilkinson and her 12-person staff at Wilkinson Wealth Management, a group that oversees approximately $380 million in assets under administration, from LPL’s Private Advisor Group. The Charlottesville, Virginia-based Wilkinson joined Summit Financial Networks, one of Cetera’s advisor communities, after more than 17 years with LPL. She cited Cetera’s “white-glove service” and the support from its regional growth teams as key factors in the move.

Cetera advisor channel leader, Tom Halloran, at the time described Wilkinson as a “hard-working

advisors on the Cetera platform. The second is adding capabilities for our existing advisors and institutions,” Durbin adds.

As for examples, Durbin points to the company’s Avantax and Securian acquisitions, where Cetera achieved both scale and new capabilities, adding important tax-focused nancial and wealthplanning expertise from Avantax and trust services from Securian.

A DESTINATION FOR TOP TALENT

In July, Cetera appointed Richard Vogel as the new community leader of Cetera Advisors, part of the

“We embrace the concept that scale and personalized support are not mutually exclusive and think it’s a real differentiator”

rm’s broader strategy to support advisor growth and deepen engagement across its wealth management businesses. Vogel, a veteran of the nancial services industry, previously led an advisor team at Ameriprise Financial Services.

Vogel’s arrival came only a few weeks after Cetera named Jen Hanau to lead its new RIA and branches channel. Hanau joined via Mariner, where she served as national managing director of independent channels.

And Hanau showed up hot on the heels of John Lefferts, who the hybrid RIA named in May as head of Cetera Investors, a role that positions him to lead the company’s national network of more than 40 branch of ces operating under its supported independence model.

“These additions represent a critical step in sourcing the subject matter expertise that our advisors and institutions need as they compete in their respective markets. Attracting demonstrated senior talent across a growing range of capabilities is a core component of our growth planning,” Durbin says.

SIZE MATTERS BUT PEOPLE MATTER TOO

Like many other wealth managers, Cetera is not alone in its battle for scale. In December 2023, Genstar Capital closed a fundamental reinvestment into Cetera, bringing fresh capital to help the rm execute its strategy. For his part, Durbin views Cetera’s private ownership as a distinct competitive advantage and maintains the partners are aligned philosophically.

“Genstar invests with a strategic, growth- rst mindset. The reinvestment signals a high degree of con dence in our industry leadership and the potential of Cetera,” Durbin says.

And speaking of private-market investing, Durbin sees alternative investments in client accounts expanding in popularity thanks to “quality asset managers delivering new and innovative offerings.”

Cetera has been in the space for many years, with its most recent offering being a new alternative investments model portfolio, the Cetera Blended Alternatives Model – Moderate. This includes six alternative investment vehicles that provide access to institutional-quality

Education:

• MBA, Leonard N. Stern School of Business at New York University

• BBA, Finance and Economics, University of Notre Dame

Experience

• Morgan Stanley – 18-year tenure

• Fidelity – 2009–2023

Family

Wife, Julie, and three kids, ages 23, 26 and 28

Hobbies

Hiking and travel with family

strategies across private credit, private equity, and private real estate. The model portfolio was researched and vetted by Cetera’s due diligence and investment management’s research teams in partnership with iCapital.

“High-net-worth clients have complex nancial planning and wealth management needs, and we believe advisors should have access to alternative investments for this segment of the market. Our expectation is that, using our new model and other products, Cetera clients will continue to bene t from allocating a portion of their portfolios to alternative investments,” Durbin says.

Elsewhere, Durbin aims “to make the big feel small” through Cetera’s regional growth teams. These teams function as a bridge between its advisors and institutions and what he describes as “the full power of Cetera.”

“We don’t know of another rm our size that provides this level of personalization. We embrace the concept that scale and personalized support are not mutually exclusive and think it’s a real differentiator,” Durbin says.

MIKE DURBIN AT A GLANCE

MORGAN STANLEY’S DEFERRED COMPENSATION FIGHT

It’s early days in what is shaping up to be a long legal battle between Morgan Stanley and former advisors over who controls valuable deferred compensation money

BY BRUCE KELLY

It’s early days in what is shaping up to be a long, costly slog of a legal battle between Morgan Stanley and former advisors over who controls valuable deferred compensation money, the rm or nancial advisors.

As of the last week of August, Morgan Stanley has defeated ve complaints over the past couple of years, led by former nancial advisors seeking payments of money from the deferred compensation plans, while ex-Morgan Stanley advisors have won two such claims. Those disputes were decided by three-person panels under the aegis of FINRA Dispute Resolution,

the industry forum for lawsuits by advisors and clients against rms.

There’s a long way to go. Morgan Stanley could be facing as many as 80 such claims from former advisors over the next two to three years, according to attorneys for advisors and industry executives.

“The big theme here is that these giant brokerage rms, including Morgan Stanley, are going to ght tooth and nail to prevent their former advisors getting their hands on the deferred compensation money in question,” says Jack Edwards, a partner at the Ajamie law

2019

Solium Capital Inc., a stock plan business that focused on technology startups, for $900 million

2020

ETRADE, a discount broker, for $13 billion

2021

Eaton Vance, a leading active manager of mutual funds, including the Calvert and Parametric brands

rm in Houston. “And they’re ghting because it discourages advisors from leaving to work elsewhere.”

“A lot of these advisors at the largest rms haven’t left because they don’t want to lose all this money,” Edwards says, adding that he represents more than two dozen claims by advisors against Morgan Stanley, and advisors are seeking deferred compensation money of $80,000 to $1 million in those lawsuits.

Big rms like Morgan Stanley take a small amount of an advisor’s gross revenue, call it

“A lot of these advisors at the largest rms haven’t left because they don’t want to lose all this money”

JACK EDWARDS, AJAMIE

deferred compensation, and require advisors to stay for years in order to vest.

Until recently, if a nancial advisor left a rm with a deferred compensation plan, he or she would have automatically forfeited his or her that compensation, which is also known on Wall Street as golden handcuffs.

But some advisors – and their attorneys – have recently changed tactics. They are using ERISA –the Employee Retirement Income Security Act of 1974 – to buttress their claims to take the money with them when they leave, alleging that Morgan Stanley’s deferred compensation plan was in violation of that law.

Advisors with the company are alleging that Morgan Stanley’s nancial advisor deferred compensation program is subject to ERISA; when the rm cancels the plan when advisors leave, the wirehouse violates ERISA’s vesting and antiforfeiture requirements. Advisors allege they are entitled to all of their unpaid deferred incentive compensation.

Morgan Stanley right now has the upper hand in its cases against former nancial advisors.

A three-person FINRA panel on August 21 denied the claims of two former Morgan Stanley advisors, who were seeking a combined $1.28 million in deferred compensation money, plus interest, from the rm.

The two advisors, Bryan J. Schon and Michael Dymkowski, both worked at Morgan Stanley in Bloom eld, Michigan, before moving to Wells Fargo Advisors in 2022, according to their BrokerCheck pro les. Schon had

“What’s at stake is Wall Street’s business model to lock down its most productive and experienced nancial advisors”

10 years of employment at Morgan Stanley, and Dymkowski nine, and they led their claim against their former rm last year.

“We are grati ed that after a comprehensive review of all the evidence, arbitration panels are repeatedly reaching the same correct conclusion based on the facts and the law: Morgan Stanley grants deferred compensation to nancial advisors during their employment to promote retention and good guardianship,” wrote a company spokesperson in an email. “This compensation is not a pension plan.”

Meanwhile, Morgan Stanley has also been ghting legal challenges to advisors citing ERISA to get their hands on plan money in the federal courts.

The rm this July had a setback. According to an article from Law360, on July 10 the Second Circuit Court of Appeals refused to upend part of a lower court’s ruling that former Morgan Stanley nancial advisors’ deferred compensation fell within the reach of federal bene ts law, meaning ERISA, saying the wirehouse could not clear the high bar necessary to undo the decision.

US District Judge Paul G. Gardephe ruled in 2023 that certain anti-forfeiture provisions

of ERISA do apply to Morgan Stanley’s deferred compensation plan. Morgan Stanley has been ghting that decision ever since.

Gardephe last November upheld his decision from the prior year that Morgan Stanley’s deferred compensation plan

should be governed by federal pension laws, a promising development for advisors looking to get their hands on deferred compensation that may have been forfeited under current rules.

“What’s at stake is Wall Street’s business model to lock down its most

productive and experienced nancial advisors,” says one industry executive, who spoke privately to IN about the matter. “Just look at Silicon Valley − at tech rms, who pay their engineers well. And they give them perks, all in the attempt to tie people to their desks.”

RIA M&A BOOMS, BUT MISSTEPS AFTER CLOSING CAN DERAIL SUCCESS

From delayed communication and client attrition to cultural clashes, neglected next-gen talent, and integration mis res, industry leaders share risks of M&A that emerge once the ink has dried

BY ANDREW COHEN

M&A activity in the RIA arena continues to reach new highs. Fidelity says the rst half of 2025 produced 132 transactions, totaling $182.7 billion in assets, the most transactions recorded by Fidelity since it began tracking in 2015.

As RIAs embrace these changes, early communication is critical, says CW Advisors CEO Scott Dell’Orfano. His Boston-based $13.5 billion RIA holds a unique vantage point on M&A transitions, having made nearly 20 deals to buy rms over the past couple of years before CW was acquired by Osaic in June.

Osaic’s ownership − including non-purpose lending, a proprietary trust company, and added estate planning support.

“When we’ve acquired rms or us being acquired, the questions from the clients are always the same,” says Dell’Orfano. “Does my advisor stay the same? Yes. Do my fees stay the same? Yes. Does the management team say the same? Yes.”

CW Advisors kept its brand and now operates as a separate entity af liated with Osaic, Dell’Orfano says. This subsidiary model is commonly used by the largest RIA aggregators and is one of four strategy models for integration, according to Phil Kerkel of the nancial

“One piece of advice I would give that makes transitions go smoother is as soon as you know you’re going through a process, I would make sure you begin communication with your employees as to what’s happening and why”

SCOTT DELL’ORFANO, CW ADVISORS

“As soon as you know you’re going through this process, I would make sure you begin communication with your employees as to what’s happening and why,” says Dell’Orfano. “I think one mistake rms make is, they wait until they actually sign an agreement and then start to communicate.”

Dell’Orfano says CW Advisors “ended up getting almost 100 percent of our clients consenting to the transaction,” as the advisors effectively explained the new offerings for clients upon shifting under

services consultancy Capco. Kerkel outlines the other three models as the full absorption strategy, where a larger RIA completely absorbs a smaller RIA; the best of breed, where top traits of each rm are selected to form a combined new rm; and the least common transformation approach, where the merged rms build a new business model without relying on existing infrastructure.

“A lot of small RIAs and advisors break away from a wirehouse to start their own business and want

to operate independently,” Kerkel says. “If they start getting absorbed into a much bigger business, they start feeling like it’s corporate again, and not what they were looking for in the rst place. So that’s always the risk with advisors.”

Emily Blue, co-founder of the RIA M&A advisory rm Hue Partners, nds that the early days of rms adapting to their new transaction can feel like “stepping into a change box.”

“Suddenly, the tough conversations they postponed − discussing about integration planning, support structures, compensation grids, transition logistics, and life after the deal − become urgent,” Blue says. “Avoiding these discussions before the ink dries sets the stage for

“A lot of your next-gen advisors are establishing relationships with the retail clients. If, post-close, they’re not happy, there’s probably not anything to tie them to stay at that firm, and you could see them leave”

EDDIE ROLLINS, BRIDGEPORT FINANCIAL SOLUTIONS

frustration, disappointment, and misalignment from the very beginning.”

Advisors who don’t hold equity in their firm and thus miss out on the financial windfall of being acquired face heightened risk of dissatisfaction, which could result in the acquirer losing client AUM, explains 55ip’s head of client solutions Mike Camp. The tax automation fintech was acquired by J.P. Morgan Asset Management in 2020.

“At times, depending on the size of the firm, you have to think about advisor attrition and the clients that are loyal to them,” Camp tells InvestmentNews. Sellers should be“looking to take care of their staff and properly incent them as they go through this transition to minimize client attrition.”

The Advisors in Transition: Challenges and Best Practices report from Cerulli Associates and 55ip found approximately 10 percent of advisors anticipate transitioning their practice in 2025. The research

shows advisors who switch between broker/dealer firms typically lose about 22 percent of their assets, while those who move from a B/D to an independent firm lose around 18 percent. Advisors jumping from one independent firm to another achieved the smallest loss, 11 percent of their assets on average.

55ip is part of the tech stack for six of the 12 largest RIAs in the US, according to Camp. A leading pitfall from RIA aggregator acquisitions is the juggling of a firm’s existing model portfolios with hundreds of new ones that come from the acquiring firm.

“I call it the Island of Misfit Toys,” says Camp. “All of a sudden the aggregator turns around and they look across their platform, and they’ve got 2,500 different model portfolios and realize ultimately the ability to maintain and scale those is very limited.”

Eddie Rollins emphasizes the importance of “cultural fit” becoming part of the due diligence

10% OF ADVISORS PLAN TO TRANSITION PRACTICE THIS YEAR

Switch between broker/dealers: 22 percent asset loss

Switch from broker/dealer to independent firm: 18 percent asset loss

Switch from one independent to another: 11 percent asset loss

process , which goes beyond matching numbers and services. Rollins is the managing director of BridgePort Financial Solutions, a fee-only RIA advising on $2 billion in client assets since it was launched by Cambridge Investment Research in 2024. During RIA acquisitions, Rollins stresses that the seller needs to discuss career growth plans for junior level advisors to keep them engaged as next-gen leaders of the firm.

“A lot of your next-gen advisors are establishing relationships with the retail clients. If, post-close, they’re not happy, there’s probably not anything to tie them to stay at that firm, and you could see them leave,” says Rollins. “I think, up front, the seller needs to be really communicating with their next gen as to what his or her motivation is for selling, and what’s in it for the next gen from a career standpoint.”

InvestmentNews Awards 2025

Winners shine at red-carpet extravaganza

The star-studded affair brought friends and peers together to highlight the industry’s best

This past June, the financial services industry celebrated its second annual InvestmentNews Awards inside the Edison Ballroom in New York City. Wealth management firms and financial advisors were honored with awards. Wealth management firms and financial advisors were recognized and honored throughout the evening. For a full list of winners and Excellence Awardees: https://investmentnews awards.com/winners-and-excellenceawardees/2025-winners-excellenceawardees.

One of the central themes of the night was the impact advisors have on their communities and their advocacy for leading social causes. Jordan Toma of Prudential Advisors, winner of the Excellence in Philanthropy and Community Service Award, said it best: “When I meet my clients, I get connected with their community and I get connected with their schools, so it all comes together.”

Even though competition was fierce, the camaraderie was prevalent. “It’s too small an industry, and an event like this you get to see people that you work with and their peers. It’s a friendly competition, but it’s fun,” Jeff Vivacqua of Cambridge Investment said.

CHAMPIONING CHANGE:

REWRITING THE RULES

THERE’S NO DANGER of celebrating women who succeed in the industry becoming cliché while they still face systemic barriers to earn a seat at the table. That’s why the achievements of InvestmentNews’ $100M Club: Top Female Advisors 2025 deserve even greater respect, with women estimated to make up less than 30 percent of the total national advisor body. Together, the $100M Club represents a cohort of female advisors transforming the landscape of wealth management with their qualities, achievements, and forward-thinking strategies. They are setting new standards for client service, leadership, and innovation.

It’s not simply about making money for clients in the short term, as a snapshot of the S&P 500 since 2024 to mid-2025 shows a steady rise, bar a two-month plummet due to political interference.

The point being IN’s prestigious list showcases advisors who stand out even in an environment where asset prices have increased across the board, underlining their soft skills and ability to connect trust with clients as true difference makers.

CORE QUALITIES

A detailed analysis of the pro les of the members of IN’s $100M Club illustrates what sets these women apart and how they are driving their careers, and the industry, forward.

INTEGRITY, EMPATHY, AND VISION

At the heart of the Top Female Advisors’ success is a blend of technical expertise and human qualities. They exemplify preparedness, organization, and ethical integrity, consistently putting clients’

METHODOLOGY

To compile the inaugural list, InvestmentNews rst solicited nominations from advisors, industry professionals, and clients. Only female advisors who were nominated and had a minimum $100 million individual AUM were eligible for the list. All information on the nominees had to be veri ed by their compliance team before it could be accepted. The nal list was determined based on each advisor’s overall AUM between January 1 and December 31, 2024.

needs rst. These women are recognized for their analytical acumen and market knowledge, but equally for their ability to listen, empathize, and build trust.

Many are praised for guiding clients through life’s most vulnerable moments – widowhood, divorce, or loss – offering not just nancial advice but emotional support and advocacy. This clientcentric approach, where pro tability is secondary to building lasting relationships, has earned them industry-wide respect and loyalty.

The ability to connect on a personal level is a recurring theme, with the Top Female Advisors being described as “cheerleaders” and “advocates” who spend countless hours educating clients and ensuring they feel supported. This extends to their teams as well, with a strong emphasis on mentoring, collaboration, and fostering inclusive environments.

PATHWAY TO SUCCESS

The achievements of these advisors are as diverse as they are impressive. Many hold advanced credentials – CFP®, CFA, CPA, CEPA – demonstrating a commitment to technical excellence. Their trajectories often involve breaking through barriers, from starting as interns or client associates to rising to executive leadership.

Success is also measured by the impact on clients and the community. Those on the list routinely go

SIZE OF SELECTED ASSET MARKETS

“I’ve learned that while gender bias still exists in the industry, it doesn’t define your path. Your values, work ethic, and the community you build around you do”

MEGAN DORN, DORN WEALTH MANAGEMENT

beyond investment management, offering holistic nancial planning, tax and estate strategies, and even concierge-level services. They are recognized for driving organic growth through referrals, expanding into new markets, and many are active in their communities, serving on boards, volunteering, and leading nancial literacy

DRIVING THE INDUSTRY FORWARD

initiatives, particularly focused on empowering women and underserved groups.

Innovation is yet another hallmark of the Top Female Advisors, many of whom have been early adopters of technology, integrating advanced tools to enhance client experience and streamline operations. They embrace new service models such as outsourcing administrative tasks to focus on high-value planning or launching specialized teams and initiatives.

What truly distinguishes these women is their commitment to shaping the future of wealth management.

They are not only leaders within their rms but also thought leaders in the broader industry, frequently speaking at conferences, publishing books, hosting podcasts, and mentoring the next generation. Their leadership is evident in initiatives to recruit and develop female talent, create succession plans, and foster diversity and inclusion at all levels.

Many have spearheaded strategic acquisitions, led successful mergers, or launched new business lines, demonstrating entrepreneurial vision and adaptability. Perhaps most importantly, these advisors are changing the face of the industry by proving not only that women deserve a seat at the table but that they excel when given the opportunity. They lead with authenticity, resilience, and a collaborative spirit, building rms that are exible, client-focused, and poised for sustainable growth.

Standing out from the stereotypical white, grayhaired guy has been a driver for Katie Pickler.

She also has the added challenge of being seen in her own right and not as the daughter of David, the founder of the eponymous rm located in Tennessee.

“It’s been an evolution and I’m continuing to mimic what my dad has created by making sure that the people get the same level they get with him, but they’re also getting something different because I’m not him,” Pickler says.

“He is a human calculator and I can get you the same numbers, but I can’t rattle it off like he can. However, I’m really good at relationship building and making sure that I empathize with someone.” What has allowed Pickler to make her own name is realizing that not all clients are going to suit her. She has developed discipline and focus since starting in the business.

“At rst, I wanted to asset grab. I wanted to be everyone’s advisor, but I realized you’re not a t for everybody. There are some people who just want to waste your time and are never really going to do anything with you,” explains Pickler.

$100M CLUB: TOP FEMALE ADVISORS 2025

Megan DornDorn Wealth Management

AUM (end of 2024):

$279,279,300

Being a specialist enables Megan Dorn to offer a different perspective than most other advisors. With a strong foundation in tax, and due to preparing returns for years, her default setting is how decisions will impact the client’s bottom line.

She says, “I began expanding my nancial knowledge in a more formal way. I completed my CFP designation in just eight weeks – a fast and focused deep dive that re ects how seriously I take this work. I also pursued my CLTC designation to better serve clients planning for long-term care needs.”

Dorn’s learning hasn’t stopped, as she invests by participating in mastermind groups, working with personal development coaches, taking advanced classes, and attending webinars.

Despite being so resolute in her dedication, Wisconsin-based Dorn did have a dif cult start.

“I was a young woman – one of the few in a room full of middle-aged white men. At many industry events, I was often assumed to be someone’s assistant or secretary. It was a clear reminder that I didn’t t the traditional mold of what a nancial advisor was ‘supposed’ to look like,” she says.

However, colleagues had a more progressive attitude and supported Dorn to nd her voice.

She adds, “They’ve championed me and my journey as a business owner, a mother, and a woman in nance. I’ve also built strong networks with other women advisors who are equally committed to lifting each other up.”

Angela Brill –Prosperity Advisors

AUM (end of 2024): $279,279,300

While a succession plan had been put in place, Angela Brill stepped up to the CEO role unexpectedly in March. The rm’s founder stood down ahead of schedule due to ill health, handing over the reins.

“One of the question marks was how the organization would react to a changing of the guard, even though I was at his right-hand side for many years,” she says.

The extra responsibility was coupled with Brill also dealing with the loss of her sister.

She adds, “I’m pretty proud that the business didn’t suffer and that I didn’t suffer.”

The challenge has been to transition clients with whom she has a strong bond to another advisor in the rm without feelings of abandonment and without risking breakage to the rm.

Brill continues to be involved in client affairs when executive duties allow.

“I told them you can lean on the other advisors for the day-to-day blocking and tackling, but I’m going to be there for the big, important

“Clients may not always need me, but when they do, I’m there”

KATIE

PICKLER, PICKLER WEALTH ADVISORS

conversations,” she says. “My clients have been overwhelmingly positive and I would say there’s a lot of high ves from the ladies. They think it’s absolutely awesome to see a woman rise up the ranks.”

She is also well aware that the wider industry now looks at her as a role model, as it’s rare to have a female CEO. This responsibility is something that Brill, who has a specialty as a Certi ed Divorce Financial Planner, embraces.

“Within my organization, I am looking to bring in and help younger women who want to be in the career and help them navigate it because it’s still a very male-dominated environment and, typically, young ladies aren’t raised steeped in money and nances.”

Even to those outside Prosperity Advisors, Brill is there to shine a light. “It’s like a ladder – somebody helped you up, so you reach down and help somebody else. I think that’s important, I really do,” she says.

WINNING MINDSET

A common attribute of the female advisors in the $100M Club is being able to connect and create empathy with clients.

Dorn, for example, didn’t start out in nance. She has a degree in psychology with a concentration in clinical counseling. This training, along with her passion for numbers, has enabled her to thrive.

“One of the biggest challenges I face is working in an industry where not all advisors

put their clients’ best interests rst. That can create skepticism and confusion for people who genuinely want help but don’t know who to trust,” she says. “I’m deeply committed to changing that by focusing on education, empowering people with the knowledge they need to make informed decisions and feel con dent about their nancial future, whether they work with me or not.”

Dorn demands the same ethical standards from her team members and her understanding of psychology means she doesn’t pressure or singlemindedly focus on sales.

She explains, “Creating and maintaining client trust is the foundation of everything I do, and honestly, it’s not something that can be rushed or forced. I don’t believe in sales tactics or tracking closing rates. My philosophy is simple: do the right thing for people, and trust will grow naturally from that. When clients know your intentions are genuine, they feel safe and that’s when real relationships begin.”

Brill also displays an ability to forge connections that enable her rm to operate better. Prosperity Advisors has grown from a single of ce in Kansas City to having six locations nationwide.

“For me, it’s how you expand the business while making people who aren’t at the headquarters feel part of the culture, have a sense of belonging, and feel incorporated into the business,” Brill says. “That’s a challenge I’m going to continue to face and lean into.”

Behavioral nance was an important part of Pickler completing her master’s degree in nancial planning, which has given her an insight into the mindset behind investing. Some clients have even joked that meetings can sometimes be like enjoyable therapy sessions. However, Pickler is aware of where that line begins and ends.

She says, “We’re not therapists, but at the end of the day, it’s about what they are saying that they’re not saying. As advisors, we need a bit of a psychology background to really understand that.”

Again, playing to Pickler’s edge as an advisor is her previous experience at a nonpro t raising funds for type 1 diabetes. She has embraced a different dynamic but has pursued the drive to be a positive in uence.

HIGHLIGHTS OF THE TOP FEMALE ADVISORS 2025

“I was worried I was going to miss that feelgood of making a difference. But quickly, I realized I can still have those wins by helping somebody save money for their kid’s college, be able to afford to buy the house or to make their nancial goals happen,” she explains.

PUSHING FORWARD

Since stepping into the CEO role, Brill has leveraged her data-driven mindset, which her predecessor was not as attuned to.

Prosperity uses a selection of tech, including anti-fraud platform Carefull, estate planning tool Wealth.com, and Jump as an AI notetaker.

Brill also brought on board a data analyst to integrate the information the rm receives from Cetera and Redtail.

“We have what we call a data warehouse, where I’ve got a tremendous number of reports available at the click of a button,” she says.

These changes enable Brill to see how pro table certain clients are and who’s serving them.

That insight extends to any decisions to acquire other rms.

She explains, “If they are within our OSJ, I can see right into their practice and know everything I want to know about that rm. Whereas before, the data gathering was incredibly cumbersome as I’ve always been front and center on both the decision-making and the implementation of acquisitions.”

“We need more female advisors, as women control a lot of money and it’s surprising how the industry finds it so difficult to give advice to women”

ANGELA BRILL, PROSPERITY ADVISORS

Pickler is similarly pioneering by extending her services to widows. For many advisors, they are an afterthought or an ignored demographic.

“Being a female is a huge asset because we still have a lot of people in society where their husband did all the nances, and when that husband passes away, they are helpless. They do not know what to do,” she says.

Megan Dorn

Dorn Wealth Management

Phone: 608 960 7273

Email: megan@dornwealthmanagement.com

Website: dornwealthmanagement.com

Angela Brill

Prosperity Advisors

Phone: 913 451 4501

Email: angela@prosperityadvisors.com

Website: prosperityadvisors.com

Katie Pickler

Pickler Wealth Advisors

Phone: 901 316 0160

Email: kpickler@picklerwealthadvisors.com

Website: picklerwealthadvisors.com

Rachel Biggerstaff

Wood Financial Group

Key Capital Management

Phone: 615 826 5749

Email: rachel@wood nancialgroup.com

Website: wood nancialgroup.com

Amy Miller Wealthspire Advisors LLC

Phone: (860) 561 1162

Email: amy.miller@wealthspire.com

Website: wealthspire.com

Ashley Iddings Wealthspire Advisors LLC

Phone: 301 564 9500

Email: ashley.iddings@wealthspire.com

Website: wealthspire.com

Donna Levy Wealthspire Advisors LLC

Phone: (800) 994 3766

Email: donna.levy@wealthspire.com

Website: wealthspire.com

Laura Barry Wealthspire Advisors LLC

Phone: 414 509 1321

Email: laura.barry@wealthspire.com

Website: wealthspire.com

Instead of a male advisor acting as a surrogate husband or a father gure, Pickler stands shoulder to shoulder with these clients.

“With me, they have a female who’s empowering them and telling them they can do this.”

Pickler also uses her EQ inside the rm and leads an unreasonable hospitality workshop. The concept is to listen and be aware of little details and preferences that make a difference to clients.

“The biggest thing from the seminar is that we do not ever let someone know, ‘That’s not my job’. Instead, it should be, ‘How can I help you? I will get this done.’”

TAKEAWAYS

What truly sets the $100M Club apart is not the numbers but the diversity in their approaches, as some focus on high-value relationships and others on client volume or organic growth. There is no single formula for success, and the lack of direct correlation between assets managed, client base, and new client acquisition underscores the importance of adaptability and client-centricity.

These women are changing the face of wealth management by championing diversity, inclusion, and a client- rst mindset. They prove that leadership is about forging authentic connections and driving meaningful impact.

As more women rise to prominence in wealth management, the industry as a whole stands to bene t from their vision, leadership, and unwavering commitment to making a difference.

$100M CLUB: TOP FEMALE ADVISORS 2025

Lauren Williams, CFP®, CRPC®, MBA ProsperPlan Wealth NewEdge Advisors

Phone: 808 469 2223

Email: lauren@prosperplan.com

Website: prosperplan.com

Linda Cook Gilbert & Cook Private Wealth Management Gilbert & Cook

Phone: 515 270 6444

Email: info@gilbertcook.com

Website: gilbertcook.com

Martha Staniford

Wealthspire Advisors LLC

Phone: 800 994 3766

Email: martha.staniford@wealthspire.com

Website: wealthspire.com

Megan Rosenstiel Gilbert & Cook Private Wealth Management Gilbert & Cook Inc.

Phone: 515 270 6444

Email: info@gilbertcook.com

Website: gilbertcook.com

$100M CLUB: TOP FEMALE ADVISORS 2025

Robyn Walker River Birch Wealth Management

LPL Financial

Phone: 540 655 4400

Email: robyn@riverbirchwm.com Website: riverbirchwm.com

Sarah Yakel Meridian Financial Partners

Phone: 540 878 5416

Email: sarah@meridian nancialpartners.com Website: meridian nancialpartners.com

Susan C. Washburn

ProVise Management Group LLC

Phone: 727 441 9022

Email: washburn@provise.com Website: provise.com

Adele Gipson CPC Advisors

Alexandra Quitko Baranski Perigon East Perigon Wealth Management

Alison Dorsman Brandywine Oak Private Wealth

Allison Schmidt Higgins & Schmidt Wealth Strategies

Amy Sabin Valiant Private Wealth Steward Partners

Amy Sturtevant The Sturtevant Group RBC Wealth Management

Barbara J. Maitland

Maitland Financial Group LPL Financial

Beth Norman

Norman Fletchall Team RBC Wealth Management

Beth Rosenwald

Rosenwald Private Wealth RBC Wealth Management

Brittany Kalsky Brandywine Oak Private Wealth

Brynn Morris

Doege & Morris Wealth Management Group RBC Wealth Management

Cameron Irvine The Taylor Group Morgan Stanley

Cary Carbonaro Ashton Thomas

Christian Ofner Ofner Wealth Management Group RBC Wealth Management

Christie Whitney Rebalance

Claire Shifren Summitry LLC

Courtney Mahoney Kerrigan Mahoney Investment Group RBC Wealth Management

Crystal Garrett Tiras Wealth Management Ameriprise

Cynthia Duncan Summitry LLC

Cynthia McHugh The Clemens McHugh Financial Consulting Group RBC Wealth Management

Darcy Smoot Nelson Capital Management

Darla Kashian Nicollet Investment Group RBC Wealth Management

Eden Lopez LSS Group RBC Wealth Management

Eileen O’Connor Hemington Wealth Management

Elizabeth Thorley Thorley Wealth Management

Emily Boothroyd Merit Financial Advisors

Emily Hazelroth Summitry LLC

Heather

Heather

Jennifer Capo Generate Wealth NewEdge Advisors

Kimberly Kelly Flagship Harbor Advisors LPL Financial

Kristie Svejda The Hollub & Svejda Group RBC Wealth Management

Kylie Strum The Buzzell Strum Group RBC Wealth Management

Laura Gilman Wealth Enhancement Group Gilman-Waltzer Team

Leslie Schwartz LSS Group RBC Wealth Management

Letizia Carlisto Navis Wealth Advisors

Lily Ku, CFP, MBA Wealth Enhancement Group

Linda Donovan RBC Wealth Management

Lisa Knutson Bay Area Wealth Management RBC Wealth Management

Lisa Quadrini Brandywine Oak Private Wealth

Lynne Wiggins ARIV Wealth RFG Advisory

Mallory Kretman Laurel Wealth Planning

Mandy (Thao) Pham Mandy’s Team Summitry LLC

Margarita Perry RBC Wealth Management

Mary Ballin Walnut Creek Perigon Wealth Management

Mary Elizabeth Dale The Dale Group RBC Wealth Management

Michelle Katzen Ritholtz Wealth Management

Michelle Magner Socium Advisors

Michelle Maton The Planning Center

Misty Garza, CFP®, MBA Bogart Wealth

Nikki Haskins The LOSAP Group RBC Wealth Management

Nora Yousif Empower House Financial Group RBC Wealth Management

Paula Steinberg LSS Group RBC Wealth Management

Rebecca Glasgow The ESOP Group RBC Wealth Management

Reva Shakkottai Pier View Group RBC Wealth Management

Robyn E. Jameson, CFP®, CLTC® Merit Financial Advisors

Sandy Adams, CFP® Center for Financial Planning

Sarah B. Kaplan Kaplan Financial Group LLC

Sarah J. Amey JFS Wealth Advisors

Shari Moxley Investor’s Resource RFG Advisory

Sharon Nassir AIRE Advisors

Stephanie A. Petrosini Morgan Stanley

Stephanie Groschup GM Wealth Group

Susan Hovanec The Winslow Group RBC Wealth Management

Susan McCormick Fingerlakes Wealth Management

Susan Moore-Bommarito Bommarito Wealth Management Raymond James

Tanya Mathews Meridian Wealth Management LPL Financial

Tania Kvakic Imperial Wealth Management Group RBC Wealth Management

Tanya Walliser Condor Capital Wealth Management

Theresa Gregory Jackson Jackson Financial Group LPL Financial

Valerie Ramo HTH Wealth Management Group RBC Wealth Management

$100M CLUB: TOP FEMALE ADVISORS 2025

Teresa Soppet AWM, Senior Vice President, Branch Director, Financial Advisor Senior Portfolio Manager, Portfolio Focus RBC Wealth Management

NewsAnalysis

ALL ABOARD THE ACTIVE ETF TRAIN!

Active ETFs are on a roll as advisors load them into client portfolios

BY GREGG GREENBERG

Financial advisors are getting active. And no, we’re not talking about a new health craze taking over the wealth management industry.

It’s actually an old investing idea that says markets can indeed be beaten, and investors won’t skimp on trying to do it.

That’s right, everybody on Wall Street is doing the active ETF, and the good times are only getting started.

A report released by Bloomberg Intelligence this summer showed roughly 51 percent of the nearly 4,300 US-listed exchange-traded funds are overseen by fund managers who have more discretion to pick stocks or other securities, eclipsing index-following products for the first time. The Bloomberg data also revealed the number of active ETFs has more than doubled in the past five years, from just 23 percent in 2020.

Active ETF assets AUM reached $1.21 trillion in July 2025, according to JP Morgan Asset Management. Active ETFs absorbed a record share of the nearly $462 billion sent to ETFs in 2025 through July. At year-end 2024, equity, bond, and hybrid mutual funds had total net assets of $21.7 trillion, and ETFs, active and passive, posted assets of $10.3 trillion. BlackRock forecasts global active ETF AUM to reach $4 trillion by 2030.

Since active ETFs are generally more costly than traditional passive ETFs, one would think their attractiveness would be limited. Active ETFs, particularly those with complex strategies, often sport expense ratios of 0.75 percent or higher, compared to passive ETFs, which can have expense ratios as low as 0.10 percent or even less.

That clearly has not been the case, though. The difference in cost has not held back supply – or demand – for active ETFs, which were introduced in 2008, almost two decades after the first passive ETFs hit the market. It admittedly took a while for active ETFs to pick up market traction, with the big turning point being a slew of regulatory advances in 2019.

Now that active ETFs have the market’s imagination and regulators’ blessing, however, financial advisors like Corey Voorman, president and founder of Voorman Investment Counsel, are finding more and more uses for them in client portfolios.

“Investors in active ETFs may be able to avoid certain capital gains distributions sometimes caused

by redemptions, that a similar offering in a mutual fund wrapper may generate. A simple analogy comparing an active mutual fund offering versus a similar active ETF offering is an ice-cream analogy. Would you prefer your ice cream in a waffle cone or a bowl with a spoon? It’s the same ice cream held by each, but a moderately different and important distinction in the end presentation,” Voorman says.

WE ALL SCREAM FOR ACTIVE ETFS

The tax advantages of the ETF wrapper, passive or active, are well known by now, and are the reason why ETFs have steadily chipped away at the once-indomitable mutual fund market.

But there’s more to the story than tax efficiency when it comes to active ETFs, according to Andrew Moss, founder and managing partner at Fortage Capital Advisors, an Elevation Point partner firm.

In July 2025, the number of US-listed active ETFs surpassed passive ETFs for the first time, reaching 2,069 funds.

Active ETF AUM expanded significantly from $81B in 2019 to $631B in 2024.

BlackRock forecasts global active ETF AUM to reach $4T by 2030.

AUM

in fixed income, where there’s less transparency and more room for skilled managers to add value, Kenney says he is more open to using active ETFs.

“In those cases, the flexibility to go beyond the benchmark, into areas like high yield or emerging markets, can enhance risk-adjusted returns,” he says.

Similarly, Sue Gardiner, founder of South County Wealth Planning, follows a disciplined, passive approach for the core of her client portfolios. That said, the growth in active ETFs has opened up opportunities for her to use more targeted exposure and risk management depending on client preferences.

For example, she can use an active ETF for a portion of the small-cap portfolio because the underlying firms are more sensitive to interest rate changes. And for some of her clients who want to be more valuesoriented, she might include a values-focused ETF, like a women’s empowerment-focused fund.

“We’ll consider swapping a passive ETF for an active one if we believe the asset class is one where indexing falls short – like certain segments of fixed income or more nuanced thematic exposures”

TIMOTHY KENNEY, SEAWISE FINANCIAL

“There are now active ETFs that closely track separately managed accounts (SMAs), and these SMAs have minimums greater than funds available in accounts within larger households. So, it is a great way to get exposure to a manager without having enough funds to meet the manager minimums,” Moss says.

Moss adds that some clients also prefer the simplicity of active ETFs when it comes to reporting.

“They do not like seeing pages of individual holdings in an SMA. The active ETF is just one line item on the screen or statement,” Moss says.

Timothy Kenney, founder and financial advisor at Seawise Financial, has also started incorporating active ETFs into client portfolios, but only in certain areas. He generally avoids active ETFs in the US large-cap-equity space, where the market is highly efficient and low-cost indexing works well. But

WHEN TO GO PASSIVE – AND CHEAPER

One of the original selling points of traditional passive ETFs was their low cost. The skeptical among us may claim that the introduction of active ETFs was Wall Street’s clever maneuver to get some of those lost fees back.

Without wading too deep into that debate, financial advisors do say there are times when it makes sense to opt for a cheaper, passive ETF over an active one – and vice versa. Put simply, they like the flexibility of having both at their disposal, and ultimately it comes down to client goals, tax positioning, and risk management.

“We opt for passive ETFs when seeking lowcost exposure to highly efficient markets, like US large-cap equities, whereas active managers often struggle to consistently outperform. However, we

Source: JP Morgan Asset Management

will substitute active ETFs when the cost premium is justified by downside protection, income generation, or access to niche strategies,” says Bryan Bibbo, president and CFO at JL Smith Holistic Wealth Management.

Emphasizes Bibbo: “We view active and passive ETFs as complementary tools rather than an either-or choice.”

Seawise Financial’s Kenney, meanwhile, maintains “cost is always a factor.” And in efficient markets like US large-cap or developed international equities, he sticks with low-cost passive ETFs.

“We’re not in the business of paying more for active management where it doesn’t consistently deliver. That said, we’ll consider swapping a passive ETF for an active one if we believe the asset class is one where indexing falls short – like certain segments of fixed income or more nuanced thematic exposures. It goes both ways. We’ve also replaced

BENEFITS OF ACTIVE ETFS

Active ETFs have historically distributed fewer capital gains.

Portfolio managers of active ETFs can react in real time to evolving market conditions.

Greater potential opportunity for managers to generate returns above benchmarks.

ETFs as a category have many benefits, including tax-efficiency, low cost, transparency, and ease of trading.

director at McCormick Wealth Management at Steward Partners, is careful to research and select active ETFs from fund managers he already has experience with, and he understands their philosophy.

“We’re not interested in being the guinea pig and testing a new fund with our client’s portfolios, no matter how impressive the story is. So, the first round of inquiries goes to those firms who already invest in the space we’re looking at but have introduced an active ETF complement to a long-standing and tested mutual fund,” McCormick says, adding that “extra credit” goes to those firms where the management team is the same in both the mutual fund and active ETF versions.

Fortage’s Moss also prefers to go with larger more experienced operators, as their ETFs are more actively traded.

“I prefer to use ETF operators whose investment philosophy and processes we have researched and understood over time. Our familiarity with a manager’s approach helps us determine if a particular solution is appropriate for our clients,” Moss says.

Since some of these active ETFs are new, Kenney looks to see if the manager has a track record in a comparable 40 Act fund. He also likes to check the

“We view active and passive ETFs as complementary tools rather than an either-or choice”

BRYAN BIBBO, JL SMITH HOLISTIC WEALTH MANAGEMENT

active funds with passive ETFs when the results didn’t justify the higher cost,” Kenney says.

CHECKING UNDER THE ACTIVE ETF HOOD

Generating alpha is not paramount or even relevant when it comes to passive ETFs. That’s by definition: you can’t beat the benchmark when you are the benchmark.

Performance is, however, a major motivation for wealth managers on the active ETF side. That’s why Wayne McCormick, wealth advisor and managing

underlying liquidity of newer funds.

“We want to make sure that there’s enough AUM in the strategy and look at things like bid/ask spreads to ensure the fund can handle larger buy and sell orders,” Kenney says.

Meanwhile, South County Wealth Planning’s Gardiner uses Morningstar to review manager tenure, risk-adjusted returns, cost, and performance. She also looks at the underlying holdings to “ensure the fund is doing what it says it’s doing and that it’s not overlapping too much with our passive core.”

SectorFocus

ETFS SURPASS U.S. STOCKS; ADVISORS MUST PIVOT

With more ETFs than US stocks now trading, strategists say cybersecurity, energy infrastructure, and animal care rank among the most viable themes for ETF investing

BY ANDREW COHEN

US exchanges now consist of more exchangetraded funds (ETFs) than individually listed stocks for the rst time ever. There are now more than 4,300 ETFs, while the number of listed company stocks hovers under 4,200, according to data compiled by Morningstar.

As investor appetite for ETFs grows, Hightower Advisors chief investment strategist and portfolio manager Stephanie Link tells InvestmentNews that cybersecurity, animal care, and energy stand out as three ETF themes that advisors should look to invest in.

“[Cybersecurity] is probably my favorite theme for the next 10 years. And I almost encourage advisors to focus on an ETF on this theme, because the stocks are so volatile,” says Link. “I think AI is going to create more need for cybersecurity.”

Amplify’s HACK was mentioned by Link as an attractive cybersecurity ETF, given its exposure to rms such as Broadcom, CrowdStrike, Cisco, and Palo Alto Networks. “I think you’re going to see massive consolidation in the industry − there are 4,000 cybersecurity companies that are public and private in the world, and I think that’s going to dwindle down to much, much less, and the big ve are going to get bigger and bigger,” says Link.

“When you think about what could really bring down a country or bring down an organization,

it’s the threat to data, the threat to their systems. I think people need to pay more attention to cybersecurity,” says Themes ETFs chief revenue of cer, Paul Marino. “Even in lean times, when the market wasn’t doing well, we weren’t hitting new highs − cybersecurity always has a place. Because when organizations cut spending, they rarely cut to cybersecurity. They can’t afford to do that.”

Just as the rise of arti cial intelligence (AI) leads to greater need for cybersecurity, booming AI data centers also fuel the need for various energy sources to support that infrastructure. “If you believe in AI, you have data centers, you need data centers, you need a grid upgrade. We haven’t had a grid upgrade in 50 years,” says Link. “The ETF of GRID, I have a lot of advisors that own that.”

Philip Blancato, who serves as both the chief market strategist at Osaic and CEO of Ladenburg Thalmann Asset Management, highlights the “electrification of America” as a key investing theme for ETFs

“Buy high-quality utility names that are in the process of having a multi-diversi ed energy process. They’re using gas, using nuclear, and then they’re retro tting their grids to become more ef cient. And you also want that same utility to have data centers being built in their area,” says

“[Cybersecurity] is probably my favorite theme for the next 10 years”

STEPHANIE LINK, HIGHTOWER ADVISORS

Blancato, who references the Southern US as being a hot spot for building data centers.

“Datacenter ETFs speci cally seem to be heavy in data center REITs and cellphone tower stocks, which are both mature and interest-rate dependent,” adds Rob Haugen, chief investment of cer of River1 Asset Management. “We think the supply and demand dynamic for energy is about to be heavily tilted towards demand. Given energy is a slow process to add, we think all energy sources will have to be used and likely do well.”

“Active ETFs continue to grow significantly faster than the broader ETF market”

DAN ARONSON, JANUS HENDERSON

and affordably, we aren’t going to give it as much credit as the best solution like the public stock market is clearly doing.”

“It’s great exposure because it’s health and wellness, but it’s also food and it’s also clothing, so it’s a nice diversification,” Link says of PAWZ holdings. “I think animal health is going to be such an incredible winner over the long term, because we’re going to spend $150 billion a year on our pets between now and 2030.”

Running parallel to these thematic ETF demands is the growth of active ETFs, which for the first time started outnumbering passive US-listed funds as of June. The number of active ETFs has more than doubled in the past five years, from just 23 percent in 2020.

Haugen, who also serves as CIO for Wisconsinbased energy infrastructure firm Michels Corporation, is most skeptical of nuclear energy as an investment “Nuclear is very hot as a potential solution,” he says, “but until we see the ability to build it quickly

If they’re looking to diversify beyond the technology sector, advisors could consider animal healthcare ETFs. Link particularly recommends the ProShares Pet Care ETF (PAWZ) to capitalize on society’s growing love affair with our furry friends.

“Active ETFs continue to grow significantly faster than the broader ETF market, with just under 40 percent of YTD flows into active ETFs, despite being only about 10 percent of the total ETF AUM,” says Dan Aronson, managing director, ETF client product specialist at Janus Henderson.

“In general, we have seen RIAs more willing to adopt active ETF strategies in areas such as fixed income and small caps,” Aronson says.

Column

Anthropic’s enterprise-grade ‘Claude for Finance’ threatens independent startups offering AI-driven investment research tools

Although the explosion in AI meeting note providers has gotten most of the attention among AdvisorTech industry observers over the past couple of years, one category of the Kitces AdvisorTech Map that has also quietly seen a proliferation of new tools since the beginning of the AI boom has been investment data/analytics.

OPINION BEN HENRY-MORELAND AND MICHAEL KITCES

Although it was already a crowded category before AI, investment data/ analytics has since grown from 35 providers at the beginning of 2023 to 49 today. And while not all these new tools are explicitly AI-driven, most of the newcomers, including tools like Brightwave, Fiscal.ai, Boosted.ai, and ARQA, use AI to trawl through reams of corporate and economic data to generate investment insights on assets like stocks, bonds, and ETFs.

So far, these indy AI investmentresearch tools have been budding because, other than Morningstar and its “Mo” investment-research chatbot, few of the existing investment-research-platforms tools have rolled out substantive AI-driven research features. However, the newness of AI-driven investment research, and of the handful of startup providers offering it, has meant that there has so far been little traction for any of these tools among independent advisors. Among advisors who do conduct their own investment research (rather than outsourcing it to third-party investment managers via TAMPs or SMAs or using available models from model marketplaces), the vast majority tend to go with established providers like Morningstar, YCharts, and Kwanti, which don’t use (or at least don’t emphasize) AI in their research tools.

Put more simply, while AI investmentresearch tools have proliferated, they show little sign of significant adoption among independent financial advisors. Which is likely not as bad as it seems, because independent financial advisors aren’t necessarily their only target market. Instead, they may be more interested in pursuing institutional investment managers, like mutual fund

managers, separate account managers, and hedge funds, that will pay enterprisetier prices for their solutions, and where a relative few mega-large asset manager clients can make the whole AdvisorTech company sustainable.

This month, however, the standalone AI investment research tools gained a major new competitor with the release of Anthropic’s Claude for Financial Services. The new platform is an extension of Anthropic’s enterprise-grade Claude specialized for financial research and analysis, plugging into data from sources like FactSet, Morningstar, and S&P, which users can access through Claude’s chat interface either by entering their own prompts or by using a financial servicesspecific prompt library.

The rollout of Claude for Financial Services won’t directly affect independent advisors much since it’s clearly targeted at the enterprise tier of financial services – as Anthropic’s own executives state it, it’s meant for organizations on the level of giant hedge funds like Bridgewater or national sovereign wealth funds

as an alternative to solutions they might build in-house, rather than for independent RIAs.

However, the indirect effect could be a disruption of the smaller and more specialized AI investment research tools that have come onto the market as of late. Institutional investment firms will no doubt prefer the stability and enterprise-level support that Anthropic can provide compared to smaller and newer startup vendors, which will leave those smaller providers increasingly squeezed out of the institutional market.

The only option for those firms, then, might be to go “downmarket” to serve smaller independent RIAs by adapting their capabilities to RIAs’ needs (e.g., by focusing more on ETF research, risk modeling, or proposal generation).

The caveat there, however, is that pivoting to RIAs would put those AI investment-research tools in head-tohead competition with providers like Morningstar, YCharts, and Kwanti, which currently dominate the market in that space.

All in all, the crop of relatively new AI investment-research startups appears to already be in a tough spot, being caught between what seems likely to be an enterprise-dominant Claude and the independent RIA-leading Morningstar/ YCharts/Kwanti triumvirate. This is reminiscent of the ongoing developments in the AI meeting-note space, where an initial glut of standalone AI notetaker providers has been subsequently squeezed by the confluence of established AdvisorTech providers rolling out their own tools (e.g., Wealthbox, Altruist, and, most recently, Nitrogen) and established “generic” providers rolling out their own finance-specific versions (e.g. Fireflies for Finance). And as AI becomes more established and embedded across other categories of technology, it seems that the same situation will continue to play itself out, with AI increasingly seen as a feature to be included in the tools that advisors already use, rather than a standalone product in its own right.

INDEPENDENT AND CLIENT-FOCUSED RIAs OUTPACE WIREHOUSES

WHEN ALL is said and done, the reasons behind the growing dominance of Registered Investment Advisors (RIAs) are obvious. Clients sign up with advisors because they know they are more likely to get them to their financial targets rather than going it alone.

And the real incentive of deciding to go with an RIA rm is the attractiveness of having a team composed of captains of their own destiny, able to pull the levers they wish and not hindered by the draconian shackles of a wirehouse.

What’s not so obvious and easy to master is how to become a top-performing RIA that stands out

in a competitive landscape. This question has been answered by the 5-Star RIA Firms 2025 recognized by InvestmentNews, with only those managing over $1 billion being considered along with only new clients that were delivered organically rather than by acquisition.

Lisa Salvi, managing director of advisor services, business consulting, and education at Schwab Advisor Services, discusses how three elements can separate the top performers:

• documented ideal client persona

METHODOLOGY

The 5-Star RIA Firms list recognizes the nation’s top-performing wealth management rms, setting a benchmark for excellence in the industry. Firms are selected based on objective criteria including assets under management (AUM), AUM growth, and the number of new clients acquired organically over the past 12 months. All submitted data undergoes a rigorous veri cation process. To qualify for inclusion, rms must manage a minimum of $1 billion in AUM in 2024. This recognition highlights best-in-class Registered Investment Advisors across the country who demonstrate consistent growth, strong client engagement, and overall excellence in wealth management.

• client value proposition

• marketing plan

According to Schwab’s RIA Benchmarking Study, having these in place resulted in RIAs getting 67 percent more new client assets. In conclusion, it’s clear that the leading RIAs are those who know what clients they can serve and can demonstrate to those investors what they can offer them.

ANALYZING IN’S 5-STAR RIA FIRMS 2025

Comparing the data and gures across the prestigious list of winning rms reveals a series of takeaways.

QUANTITATIVE

TRENDS

• Median AUM growth across rms was about 21 percent from 2023 to 2024.

• Typical (middle 50 percent) AUM growth ranged from about 14.7 percent to 27.6 percent.

• Median client growth was about 7.6 percent, with the middle 50 percent of rms growing between 3.2 percent and 17.8 percent.

CORRELATIONS

• There is a weak negative correlation (-0.16) between AUM growth and client growth. This suggests that rms growing their AUM the fastest are not necessarily those growing their client base the fastest, implying that some rms are increasing AUM by deepening relationships or acquiring larger clients, rather than simply adding more clients.

INSIGHTS

• Client focus: Firms with high client growth often emphasize personalized service, technology-enabled solutions, and advisor enablement.

• Advisor headcount: Most rms increased their adviser headcount, but not always in proportion to AUM or client growth, suggesting ef ciency gains or different business models.

INDUSTRY EXPERTS’ VIEW

A major driver of clients ocking to RIAs is the use of data to understand where they need to be with their nances.

“Retail investors are aware of the need for nancial planning and it’s de nitely an opportunity for RIAs who are built around that mindset,” says Stephen Caruso, associate direct wealth management at Cerulli Associates.

“We’re going to continue to see that shift as more retail investors recognize there’s a lot of uncertainty and different levers in their nancial picture. For clients, it’s about, ‘Who can help me navigate that the best way? Who can help pull the right lever at the right time?’”

Outside of acquisitions, IN’s 5-Star RIA Firms 2025 have an average client growth rate of 23 percent for the last 12 months. This is no mean feat, as underlined by Michael Kitces of nancial advisory website Kitces.com.

“It’s really hard to do that with referrals, networking, and seminars because you only have so much time to show up for events,” he says. “Building organic marketing successfully is extremely dif cult, which is why very few rms are doing it especially well. But when we look at the leading rms that are actually growing organically, they have all found some way to scale a digital marketing effort.”

This is in reference to the innovative ways RIAs are attracting clients. Examples include rms that have scaled up via YouTube video marketing to drive tremendous lead ow success and similarly with Google-driven marketing. Other tactics include leveraging SEO with a particular content marketing focus on white papers that lead to a funnel.

Kitces adds, “When you do a video on YouTube, you can reach 50 people or a million people. The scale of the distribution is basically unlimited.”

Embracing tech goes beyond simply attracting clients – it is a game changer for advisors.