GLOBAL NEWS RenewableUK Publishes Latest EnergyPulse Insights for Offshore Wind P.8 WIND ENERGY Interview with Claire Mack – CEO of Scottish Renewables P.18 HYDROGEN & CCS Interrview with PhilipPe Kavafyan, Executive Director at Aker Horizons P.28 READ ONLINE AT RENEWABLES PUBLICATION IN ASSOCIATION WITH GLOBAL NEWS PROJECTS MAP WIND ENERGY HYDROGEN & CCS GEOTHERMAL MARINE & TIDAL ELECTRIFICATION SOLAR CONTRACTS ON THE MOVE EVENTS ISSUE 3 - MAR 2023 READ ON PAGE 4 INVESTMENT IN WIND PROPELS STRATEGIC GROWTH

COVER FEATURE

REGIONAL NEWS

PROJECTS MAP

WIND ENERGY

HYDROGEN & CCS

GEOTHERMAL MARINE & TIDAL ELECTRIFICATION SOLAR CONTRACTS ON THE MOVE EVENTS

ANA MUSAT, EXECUTIVE DIRECTOR, POLICY & ENGAGEMENT, RENEWABLEUK

The UK has led the way in renewables for some time, making it an appealing market for investment. However, changes to policy, taxes and global energy security have created new challenges in our sector that have created uncertainty and hesitancy among new investors. Reversing this recent trend to boost the UK’s competitiveness with regards to resources, supply and workforce is essential for the future of our green energy market.

So, what are some of the immediate challenges? The energy price and the Electricity Generator Levy (EGL) have both had an impact on the growth of energy production, including those in the green energy sector. These factors have destabilised the policy and regulatory environment, discouraging new investment and putting the viability of projects in development into question at a time when we should be pushing ahead. The EGL also created an unlevel playing field, giving fossil fuels an unfair advantage, as oil and gas operators with a wind turbine on their installation receive a tax break of 80%, while the capital allowance deduction rate for renewable generators is limited to 18%.

On a wider scale, the effects of Liz Truss’s mini-Budget continue to be felt in renewable energy, as in several other industries. The on-going difficulties surrounding energy security – magnified by the Ukraine conflict with Russia – means that governments are looking to boost the production of homegrown energy. A third of the global economies are estimated to be in recession this year due to the combination of problems faced in the past couple of years.

Many investors are turning their attention to the US market, with the Inflation Reduction Act making this particularly attractive by offering substantial financial incentives – and the European Union is following suit. There is also significant growth predicted in China within the offshore wind market.

To restore confidence in the UK and encourage new investment, we need to take collective action. Firstly, we need sustainable pricing in order to support growth of our supply chains, job opportunities and economic activity. This should be accompanied by continually ambitious deployment, creating demand and facilitating investment in our manufacturing industries. The Crown Estate has suggested that a single 10MW wind turbine uses over £880,000 worth of steel – which has positive ramifications for industries across the UK as the capacity of wind energy expands.

CONTENTS

WISH TO CONTRIBUTE TO OUR NEXT PUBLICATION? Contact us to submit your interest daniel.hyland@ogvenergy.co.uk

P.26 P.30 P.32 P.34 P.36 P.38 P.40 P.42 3

P.4 P.8 P.14 P.16

Three60 Energy are ready to facilitate the rapid growth of renewable energy

The expanding energy sector requires know-how and dedication to meet its global goals, writes

Scott

Roy, Strategic Development

Director with energy life-cycle service company THREE60

Energy.

Energy.

The proven experience and pedigree of established energy sector specialists will play a crucial role in meeting renewables targets across Scotland, the UK and globally during the energy transition. Both onshore and offshore wind have a significant role to play, as do enabling technologies including energy management systems and carbon capture, utilisation and storage (CCUS).

A range of capabilities will be required, including – for the offshore wind sector – marine geoscience, engineering, procurement, construction, commissioning (EPCC) and facilities management for operations and maintenance.

Also key, when looking at onshore wind, will be feasibility and site studies, design and contestable works, grid connection and contractor support.

Commitment to the energy transition will be the common denominator, and service provider and specialist energy contractor THREE60 Energy have positioned themselves well to deliver on this, offering a mix of ambition and appetite alongside a proven pedigree in the energy sector.

Solution-focused

Life-cycle solutions for the wind industry will be crucial for the significant roll-out of both onshore and offshore infrastructure, to facilitate the ambitions of the ScotWind licenses and deliver against industry targets established at both Holyrood and Westminster.

Combined market offerings are few and far between, which is why THREE60 Energy was proud to have acquired Scottish renewable company BJRE (Electrical), now THREE60 Energy Renewables, and strategically position itself to provide multi-sector capability.

Onshore wind operations and maintenance will be a major target market following this acquisition and the company's recent recognition as an ORE Catapult ‘Fit for Offshore Renewables’ provider reflects an ongoing commitment to providing sustainable resources, particularly in the face of heightened energy security needs.

Onshore project development is also important and the lifecycle of large-scale

Scott Roy Strategic Development Director

projects requires expertise through site identification, feasibility studies, surveys, substation design, contestable works, grid connection and balance of plant support. End-to-end support will provide a seamless project delivery process and, for THREE60 Energy, demonstrate a commitment to the ongoing transition to renewable energy.

Beyond wind

The carbon reduction challenge necessitates a range of inter-dependent solutions that can bring together different technologies in order to help reduce greenhouse gas emissions in their own right.

CCUS is crucial in this regard and comes with a shopping list of required technical expertise, including knowledge in subsurface, wells, EPCC and operations management. The combination of this capability portfolio will contribute significantly to the development and implementation of sector strategies through detailed studies, including licensing support, across multiple geographies.

THREE60 Energy have made it a key objective to provide a truly global solution to their clients and with offices in the UK, Norway, Malaysia, Singapore, Philippines, Australia, Taiwan and the USA, they now have the perfect base from which to drive the widespread rollout for CCUS strategies.

As the demand for renewable energy sources continues to grow, the development of ‘smart grid’ solutions will become increasingly important –allowing the energy generated by wind, wave and tidal to be stored in batteries and/or utilised in the production of green hydrogen.

THREE60 Energy’s partnership with the European Marine Energy Centre (EMEC) is a good example of the collaboration required going forward. Innovation leveraged by the technical expertise necessary to support testing and development of new energy technologies.

Better energy, together

The energy industry is moving towards cleaner and more sustainable solutions and established companies with experience in large-scale energy projects are being recognised as the perfect partners to help the industry deliver on these objectives.

This recognition is being put to the test in onshore and offshore wind and other emerging industries such as CCUS, Hydrogen and energy storage, which is very good news for experienced supply chain companies with a global capability. These organisations can work across multiple energy markets to help their clients reduce carbon emissions while safely running offshore infrastructure into late life, ultra late life and full decommissioning, reducing the environmental impact and facilitating the shift towards a cleaner energy mix.

THREE60 Energy have positioned themselves well to make a significant contribution to a cleaner and more sustainable future across multiple energy markets and with a truly global offering, that can benefit the national and the international decarbonisation journey.

COVER FEATURE

4 www.ogv.energy - Issue 3

5

three60energy.com

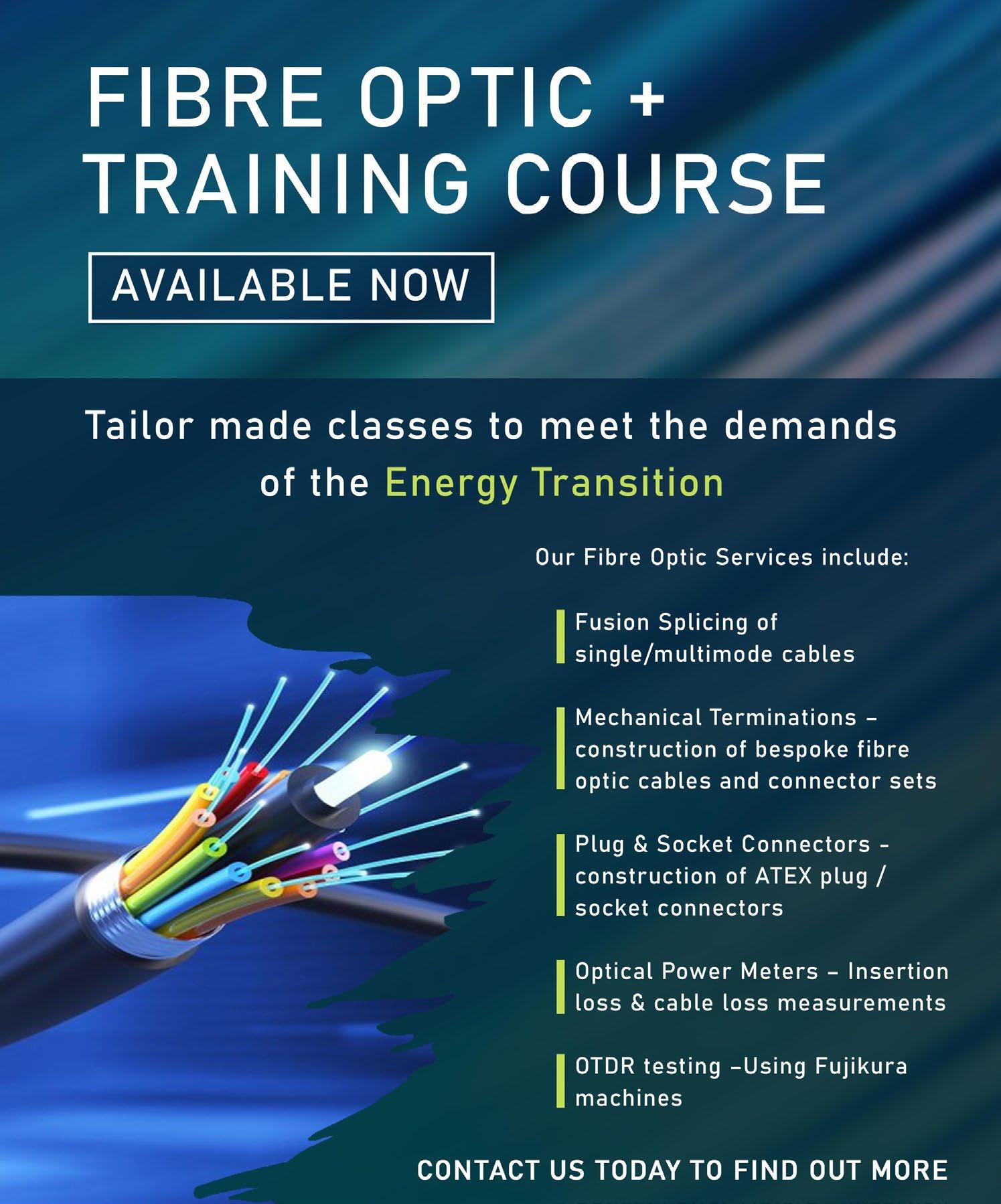

FIBRE OPTIC TRAINING for

the onshore, offshore and renewables markets

RCP - Instrumentation and Control System specialists have made significant investment in fibre optic equipment such as fusion splicing machines, mechanical splicing kits, fibre optic ovens, optical power meters, optical microscopes and polishing equipment to terminate and test fibre optic cables, connectors junction boxes and patch panels to a very high standard.

In 2021 a dedicated fibre optic workshop was set up at our Blackburn facility to provide fibre optic training to the onshore, offshore and renewables markets.

Fibre Optic Training includes

Fusion Splicing of single mode and multimode cables using Fujikura fusion splicers, construction of bespoke fibre optic cables and connector sets, construction of circular plug/socket connectors for hazardous area use. ATEX/IECEx zone 1 connectors, cables made up with pre-potted glands and tails to facilitate ease of fitment to drilling platforms, rigs offshore and renewable assets.

Mechanical splicing – Corning and Huber + Suhner connectors, ST, SC and LC, insertion loss and cable loss measurements, testing connectors and cables for insertion loss and return loss. OTDR testing using Fujikura machines.

The format of the course starts with the theory of Fibre Optics. Safety when using Fibre Optics, FO cable selection and connector types. Stripping fibre optic cables and preparation including the use of fan out kits, the use of fibre breakout boxes and fibre optic plug socket connectors and an understanding of loss budgets for fibre optics.

Delegates will learn how to manually splice using a Corning Kit with ST, SC and LC connectors. They will learn how to measure insertion loss of splices, connectors and cables. The delegate will use a fibre optic power meter. There will also be an introduction to fusion splicing.

The training course consists of both theoretical and practical elements with approximately 75% of the course being practical exercises where the delegates get to practice the skills taught.

By the end of the course each delegate will be able to identify different types of fibre cable for use on/offshore, select the correct type of cable and connector for the application in hand, prepare and manually splice a connector onto a fibre optic core(mechanical splice), test the integrity of the connector and measure the insertion loss of the cable or cable system.

The delegates will be able to fault find and repair fibre optic cables and connectors, prepare and splice a connector onto a fibre optic core known as fusion splicing.

The course material can be created bespoke to a company’s specific requirements. The course runs over 2 days.

A certificate of competence will be issued to the delegate's employing company on successful completion of the course.

RCP provide the following site services on or offshore

Fusion Splicing of single mode and multimode cables – Fujikura fusion splicers, Construction of bespoke fibre optic cables and connector sets, Mechanical splicing –Corning and Huber + Suhner connectors, ST, SC and LC. Construction of bespoke fibre optic cables and connector sets – Insertion loss and cable loss measurement, testing connectors and cables for insertion loss and return loss.

Editorial

newsdesk@ogvenergy.co.uk

+44 (0) 1224 084 114

Advertising office@ogvenergy.co.uk

+44 (0) 1224 084 114

Design

Ben Mckay

Journalist Tsvetana Paraskova

Design

Ben Mckay

Journalist Tsvetana Paraskova

CONTRIBUTORS

The key to faster, better decisions

RenewableUK’s EnergyPulse is the industry’s go-to market intelligence service, providing comprehensive and accurate energy data, insights, and focussed dashboards for the wind, marine, storage and green hydrogen sectors in the UK and offshore wind globally.

OUR PARTNERS

Connected to our 400+ member network our experienced team of experts research industry news, contracts, and ownership to ensure you keep grow your business agility by leveraging a suite of user-friendly, intuitive, configurable, and highly-interactive tools.

Sign up and keep your finger on the pulse of the UK and global renewable energy markets, accelerating towards a net-zero future.

We offer a wide range of competitive subscription levels that can be tailored to suit your business needs.

Contact our Head of Membership, Jeremy Sullivan or call +44(0)20 7901 3016 for a personalised consultation.

TRAVEL MANAGEMENT PARTNER

Corporate Travel Management (CTM) is a global leader in business travel management services. We drive savings, efficiency and safety to businesses and their travellers all around the world.

LOGISTICS PARTNER

Pentagon have moved freight for the oil and gas industry for nearly 50 years. This has given us an unmatched breadth of experience that allows us to implicitly understand your requirements because we know oil and gas. Whether your requirement is onshore or offshore, or drilling, oilfield services, EPC, or E&P, we can solve your logistics problem.

Disclaimer: The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes.

OGV ENERGY

scan de

VIEW our media pack at www.ogv.energy/advertise-with-us or

QR code ADVERTISE WITH OGV

in

RenewableUK EnergyPulse

numbers* www.renewableuk.com *Number of projects tracked as of 04/08/2022

www.renewableuk.com

RenewableUK members are enabling a just transtion to a net zero future. Focusing on continuous improvement around the three pillars of our Just Transition Tracker - People, Place and Planet These inspiring companies are a true showcase of the best that our industry has to offer.

RENEWABLEUK PUBLISHES LATEST ENERGYPULSE INSIGHTS FOR OFFSHORE WIND

RenewableUK has recently published its latest EnergyPulse Insights for Offshore Wind. It offers an invaluable overview of the market today, including forecasts of project commissioning, component demand, foundation types and ownership. Given the ongoing energy crisis and the continuing uncertainty around both energy costs and security, this is an important time for the offshore wind sector and a prime opportunity for growth. Though the UK has led the way in renewables for some time, it is vital that we maintain or even accelerate the current rate of development through further investment and innovation to retain our position at the top.

Looking at how the UK performed in 2022, it is encouraging to see that 90% of all offshore wind capacity commissioned globally was either in the UK (41%) or China (49%).

Following on were France (6%), Vietnam (2%), Japan (1%) and Italy (1%). Worldwide, offshore wind capacity reaching a final investment was down in 2022 compared to previous years. Though somewhat unsurprising given the market uncertainty and changing commodity prices, it is hoped that this trend reverses again soon.

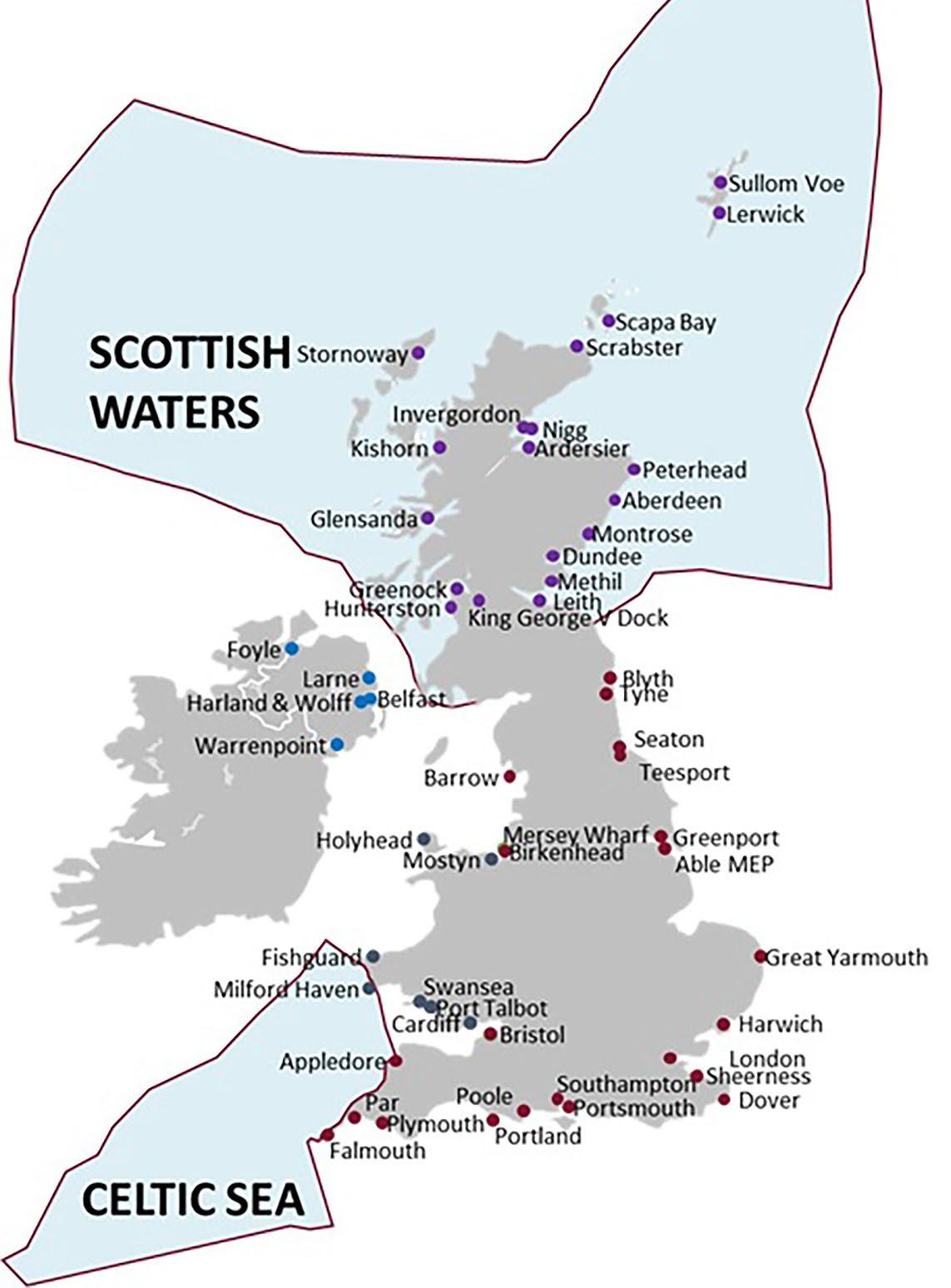

In 2022 the UK commissioned 3.2GW of offshore wind energy, which includes the full commissioning of key sites: Hornsea Project Two, Moray East and Triton Knoll. Among all operational and future projects tracked by EnergyPulse around Britain, most of the capacity is, or is planned to be, in the North Sea off the Scottish (43,945MW) and English (33,855MW) coasts. 8,659MW of capacity will be the Irish Sea, 7,335MW in the North Atlantic, 4,428MW in the Celtic Sea and 1,600MW in the English Channel.

Looking ahead, there is the potential to deliver nearly 100GW of offshore wind energy in the UK, once projects have been fully constructed and are operational. This is an increase of 14GW from just a year ago. We are seeing developers expand capacity of their leased areas and refine areas for floating wind to create a really exciting project pipeline. As such, the average project size in the UK

continues to grow for both fixed bottom and floating offshore wind sites – the largest fixed site is predicted to exceed 4,000MW by approximately 2032. Top players in the UK market include SSE, Ørsted, Iberdrola, RWE, Vattenfall and Ocean Winds.

Shifting the spotlight onto the CfD/ICR schemes, we find 22 projects with 33 owners totalling 19.95GW in capacity already with contracts in the scheme. Approximately 7,006MW are fully commissioned from ICR, AR1 and AR2. Key projects from AR3 are either partially operational, under construction or in pre-construction. There are 5,690MW of capacity eligible for the next round, AR5, including 1,700MW at Iberdrola’s East Anglia Two and One North, as well as 2,800MW at Vattenfall’s Norfolk Zone.

Ørsted owns 4,596MW of capacity awarded between ICR and AR4, with the Hornsea Project Three secured – the company then sold 50% of Hornsea Two’s capacity to AXA IM Alts and Crédit Agricole Assurances last year. The second largest CfD portfolio is with RWE thanks to the addition of Sofia following AR3.

Of course, all this is only a snapshot of what’s happening in offshore wind around the world. EnergyPulse is tracking a total of 616 projects across Europe, 603 projects in Asia, 70 in

North America, 80 in South America, 4 in the Middle East and Africa, and 44 in Australasia. The global portfolio incorporates 1,417 projects with a total capacity of 1,174,388MW throughout 38 countries. With the majority of these projects in development, the industry is poised for a boom in operations in the not-too-distant future. This highlights the need for growth of the workforce, transferring of skills from other sectors and continued investment to facilitate even the most ambitious of net zero targets.

For further insight into the current offshore wind landscape and what the latest developments could mean for you, check out the full EnergyPulse report. Scan the QR code.

EnergyPulse - Global Offshore Wind - February 2023 - RenewableUK. RenewableUK members can access the report for free and non-members can purchase the full report for £475.

A free preview is also available. Scan the QR code below.

EnergyPulse is an exceptional resource for RenewableUK members. It provides real-time insight into the latest market trends, project achievements and more, with easy-to-use interactive dashboards.

Find out more by visiting renewableuk.com

CORPORATE PARTNER

GLOBAL news 8 www.ogv.energy - Issue 3

FIRST MINISTER OPENS SCOTTISH RENEWABLES’ OFFSHORE WIND CONFERENCE

More than 800 delegates attend ‘world class’ event Scotland is a global leader in offshore wind which is at the forefront of our energy transition.

With a short-term pipeline of 6.9GW of projects, last year’s staggering ScotWind Leasing results will see a further 28GW of projects added to our offshore timeline which has outlined the scale of things to come.

We know that offshore wind is going to transform our coastlines and the opportunities this presents are enormous. But we must put innovation at the heart of everything to ensure we have a supportive policy and planning environment, a rapid acceleration of current timescales and the infrastructure required to maximise the economic benefits for Scotland.

That’s why Scottish Renewables’ Offshore Wind Conference, sponsored by SSE Renewables, is a big deal and it’s why last month (January 25 and 26) our industry’s movers and shakers descended on the SEC in Glasgow to review the state of this thriving sector and its ambitions for the years ahead.

The sell-out event welcomed more than 800 delegates from across the UK and beyond for a fascinating two days of discussions exploring the big challenges facing the industry and how it can deliver successful projects with positive impacts for the economy, the environment and local communities.

A key date in the event calendar, this year’s twoday conference brought together a diverse set of voices to explore the future of offshore wind. From thought leadership to practical supply chain advice, the conference welcomed industry experts, developers, suppliers and stakeholders to review the state of our offshore wind aspirations.

For the first time, our new supply chain focused sessions and events allowed companies to spend invaluable and exclusive time with offshore wind tier one developers which we hope has given them a platform to grow their businesses in offshore wind. The annual Offshore Wind Conference

Dinner, sponsored by Crown Estate Scotland, saw more than 450 renewable energy professionals come together at Glasgow’s iconic Kelvingrove Art Gallery & Museum for a traditional three course Burns Supper and relaxed evening of networking.

First Minister Nicola Sturgeon opened the conference and in her ministerial address told the conference that The Scottish Government will do all it can to support the success of offshore wind and its priority must be to intensify the work it is doing together with industry to achieve our shared ambitions of a "greener, fairer, more resilient energy system".

First Minister Nicola Sturgeon speaking at the conference said: “The Scottish Government has just published our draft Energy Strategy and Just Transition Plan which reflects our commitment to accelerating the transition away from fossil fuels, and towards renewable energy.

“Your industry, and the issues you’re focusing on, could not be more important to our country’s future. For Scotland, offshore wind and the hydrogen industry offer huge industrial and economic opportunities.

“The need to accelerate our energy transition has never been more urgent and so our priority must be to intensify the work we are doing together, to achieve our shared ambitions. The Scottish Government will continue to do all that we can to support your success. The prize – if we get this right – is a greener, fairer, more resilient energy system.”

Claire Mack, Chief Executive of Scottish Renewables said: “Scottish Renewables’ Offshore Wind Conference 2023 is a world class must-attend event for anyone keen to play a role in the deployment of offshore wind.

“It’s exciting to see such a diverse set of voices coming together to look at the big challenges facing offshore wind, exploring how we can deliver our offshore wind ambitions and ensuring it is the technology at the forefront of the energy transition.

“I’m really pleased that our innovative ‘Meet-the-Buyer Business Booths’ have been a huge success and this exclusive one-to-one access will bring a new dynamic to how the supply chain is able to engage with developers and Tier 1 suppliers.

“It is clear that 2023 is going to be another huge year for offshore wind in Scotland and I’d like to thank the First Minister for taking time out of her busy schedule to give a ministerial address at today’s conference.”

GLOBAL news

OVERVIEW VIDEO

renewable news SPONSORED BY 9

Scotland is a global leader in offshore wind which is at the forefront of our energy transition.

By Tsvetana Paraskova

UK REVIEW

UK ACCELERATES DECARBONISATION EFFORTS

The UK is pushing to decarbonise industry and install more renewable energy capacity, especially from offshore wind. Renewable power generation is rising and so is support for other clean energy technologies, including hydrogen production and nuclear fusion.

The Offshore Wind Prize

Scotland’s First Minister Nicola Sturgeon said at the end of January that the Scottish Government would do all it can to support the success of offshore wind. Energy transition needs to be accelerated and priority should be put on working together with industry for achieving the shared just transition ambition, Sturgeon said at the Scottish Renewables Offshore Wind Conference in Glasgow.

“We live in a world right now where it's not difficult to see and be reminded - almost on a daily basis - of all of the challenges crowding in on us,” the first minister said.

“But we have every reason to be hopeful, optimistic and upbeat about the future - because the prize, the massive prize, if we get this right is a greener, fairer, more resilient energy system; our country here in Scotland that successfully, fairly and justly makes that transition to zero; and a country, albeit relatively small in scale, that plays a disproportionate part in helping the world save the planet for future generations.”

Offshore wind and the green hydrogen industry offer “enormous industrial and economic opportunities” for Scotland, Sturgeon said, but added that those opportunities could be maximised if there is greater collaboration across government, developers, and the supply chain.

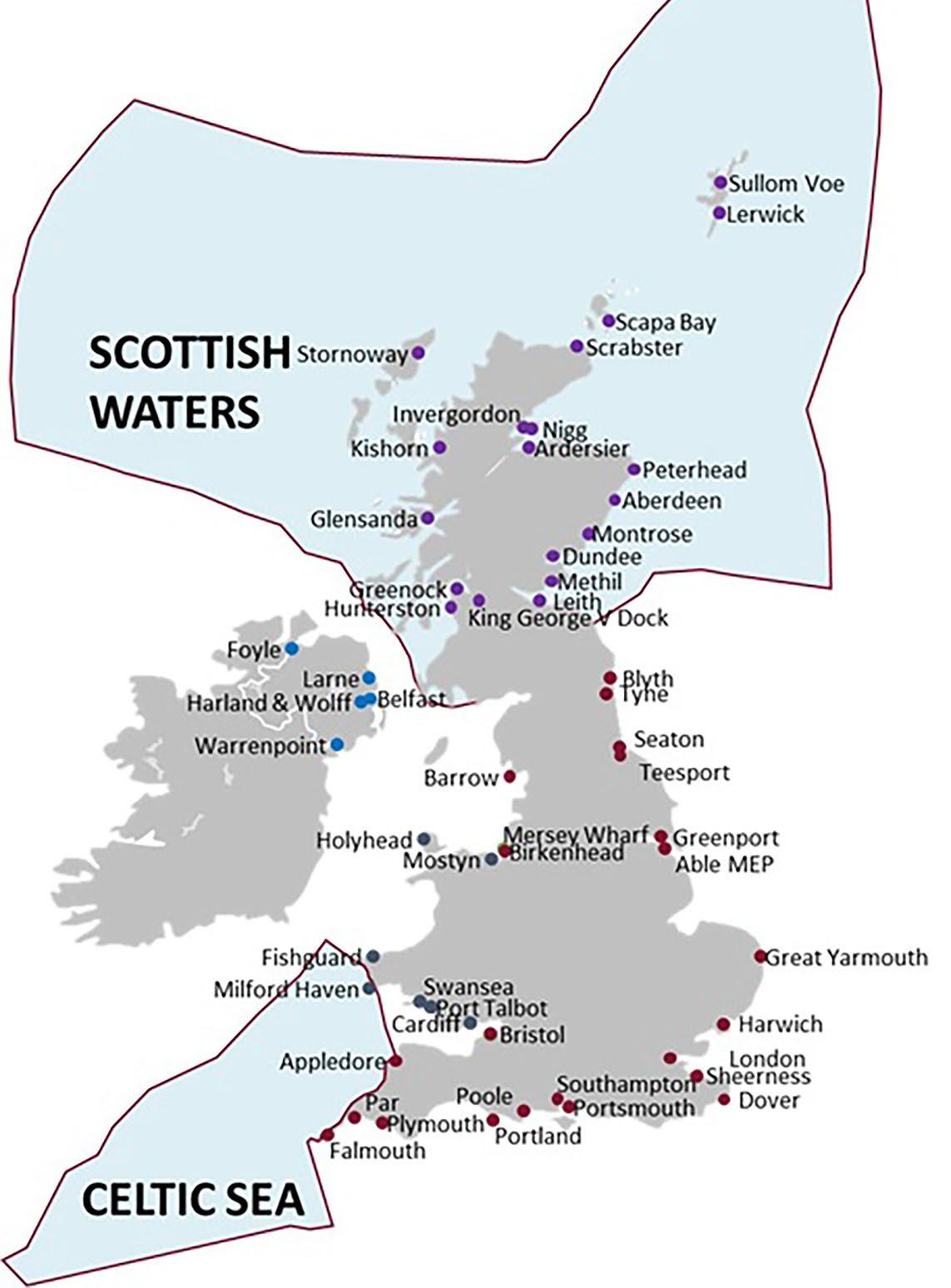

A lot of the opportunities in the supply chain will be connected with manufacturing, therefore, Scotland needs to invest in ports to support fabrication, the first minister noted.

“The need to accelerate our energy transition, that we all recognise, and secure the benefits of our renewables assets and success, has never been a more urgent imperative. And so, our priority – our shared and collective priority - must be to intensify the work we do together to achieve those shared ambitions, for the benefit of our own generation, but also for the benefit of the generations who will come after us,” Sturgeon concluded.

Meanwhile, The Crown Estate announced in January it had signed Agreements for Lease for six offshore wind projects which could begin to generate green electricity by the

Minister for Energy and Climate Graham Stuart said:

“Offshore wind is at the heart of our goal to secure clean, affordable and resilient energy supply for all in the UK, while bringing major business, investment and job opportunities along with it.”

Offshore Wind Capacity Additions and Renewable Generation Hit Records

end of the decade and have the potential to generate around 8 gigawatts (GW) of renewable electricity, enough for more than seven million homes. Three of the six projects are located off the North Wales, Cumbria and Lancashire coast, and three are located in the North Sea off the Yorkshire and Lincolnshire coast.

The signing of the agreements and the projects planned have the potential to make a major contribution to the UK Government’s target of 50 GW of offshore wind capacity by 2030, The Crown Estate said.

“The UK’s offshore wind achievements to date are nothing short of remarkable, and this next generation of projects point to an even more exciting and dynamic future,” said Dan Labbad, CEO of The Crown Estate.

The UK government’s latest available statistics for the July-September 2022 period showed that renewable generation grew by 18% compared to the same period of 2021, due to both capacity growth – as wind generation grew by a record 2.8 GW — and more favourable weather conditions. Wind, solar, and hydropower output rose due to more favourable weather conditions for all renewable technologies, as well as increased wind and solar capacity, the Department for Business, Energy & Industrial Strategy said in December. Over one year to September, 3.4 GW in new renewable capacity was added, up by 6.9%. Most of the new capacity was in offshore wind, at 2.8 GW, continuing strong year-on-year growth that began in the first quarter of 2022.

UK wind capacity grew by 3,511 MW last year – enough to power more than 3.4 million UK homes a year, according to research by RenewableUK based on its EnergyPulse data. Offshore wind additions hit an annual high of 3,193 MW, while onshore wind capacity added 318 MW, ten times lower than offshore wind, RenewableUK said.

“Just two small turbines went operational in England in 2022, so we need to see substantial changes to enable consumers

GLOBAL news

"The need to accelerate our energy transition, that we all recognise, and secure the benefits of our renewables assets and success, has never been a more urgent imperative."

10 www.ogv.energy - Issue 3

and local communities to benefit fully from the benefits that this popular low-cost technology offers,” RenewableUK’s Chief Executive Dan McGrail said.

“That means changing the rules which skew the planning system unfairly against onshore wind in England, putting it back on a level playing field so that it can compete fairly against other clean technologies.”

Industry Calls For Budget Measures To Secure Green Growth

The low-carbon energy industry warns that the UK could lose its competitiveness in clean technology deployment and supply chain if the government does not introduce new measures to preserve Britain’s key role in renewable energy development.

The UK needs a clear government plan to continue attracting clean energy investment, five energy trade associations representing more than 750 companies wrote in a letter to the Chancellor Jeremy Hunt in early February 2023.

“Despite our industry’s commitment to the low carbon energy transition, we are concerned that there is no clear government plan to deliver green economic growth and continue attracting clean energy investment into the UK,” the chief executives of RenewableUK, Energy UK, the Nuclear Industry Association, Scottish Renewables, and Solar Energy UK wrote in the joint letter.

Currently, inflation, unfavourable exchange rates, and rising costs of raw materials and labour are pushing up prices across all sectors of the economy, including for clean energy projects, they said.

“Many developers and supply chain companies were seeing very small margins before, which will now disappear completely without a more sustainable approach to pricing clean energy solutions, and a reformed capital allowances regime,” the associations warned.

They are calling for key steps in the Spring Budget to address the potential loss of competitiveness compared to the US and the EU.

“The UK can no longer take its competitive advantage as a mature market for granted. The passage of the Inflation Reduction Act (IRA) in the US, the REPowerEU package and further interventions on state aid rules expected in the EU offer an attractive proposition for clean energy investors.”

By contrast, the UK’s Electricity Generators Levy has 0% relief for clean power generators.

“If the UK is to stay ahead in the global race for clean energy, it needs to adopt bold measures to retain and boost private investment in the energy transition,” the trade associations say.

RenewableUK’s CEO Dan McGrail said, “Investments in renewable energy and new supply chains may dry up unless the Chancellor takes decisive action and implements the key measures which we have set out in our letter to secure tens of thousands of high quality jobs and attract billions in private investment.”

Hydrogen, Industry Decarbonisation and Nuclear Fusion

The Environment Agency published on 3 February regulatory guidance on the production of hydrogen from methane with carbon capture, otherwise known as ‘blue’ hydrogen. Operators wishing to produce ‘blue’ hydrogen in England will need an environmental permit from the Environment Agency. As well as providing permitting advice to operators, the guidance gives an insight to the public on how environmental regulations and standards are being applied in order to protect communities from risk of harm, the UK government said.

The government also said it would make available £32.5 million funding to support British industry in efforts to cut fossil fuel use. The funding will back industrial sectors –including construction, mining, and quarrying –in their plans to develop greener technologies and low carbon fuels and move away from gas oil, otherwise known as red diesel.

“This latest round of funding will help to speed up industrial decarbonisation, providing industry and consumers with effective low-carbon alternatives to red diesel while boosting green investment to future-proof the resilience of British industry,” said Minister for Energy and Climate Change Graham Stuart.

The UK government has also established a new delivery body for the UK’s fusion programme, named UK Industrial Fusion Solutions Ltd (UKIFS), to deliver a prototype fusion energy plant at West Burton in Nottinghamshire. The Spherical Tokamak for Energy Production (STEP) plant will be constructed by 2040 to demonstrate the ability to use fusion energy to generate electricity for the UK grid.

Nuclear fusion is still years and many breakthroughs away from achieving the promised potential of limitless carbon-free energy, due to significant technical hurdles, including achieving net energy gain in the fusion reaction.

The UK government’s announcement comes shortly after a major breakthrough for fusion in the US where the US National Ignition Facility in California conducted fusion experiments which released more energy than was put in by the lab’s high-powered lasers.

said Minister for Energy and Climate Change Graham Stuart.

GLOBAL news

“Just two small turbines went operational in England in 2022, so we need to see substantial changes to enable consumers and local communities to benefit fully from the benefits that this popular low-cost technology offers,”

RenewableUK’s Chief Executive Dan McGrail said

"This latest round of funding will help to speed up industrial decarbonisation, providing industry and consumers with effective low-carbon alternatives to red diesel while boosting green investment to future-proof the resilience of British industry"

renewable news SPONSORED BY 11

By Tsvetana Paraskova

EUROPEAN REVIEW

EUROPE AIMS TO BECOME ATTRACTIVE DESTINATION FOR CLEAN ENERGY INVESTMENTS AGAIN

Europe looks to put its net-zero technology industry in the lead as the competition with the United States for attracting investment in technologies and products required to meet the climate targets has intensified since the US passed the Inflation Reduction Act at the end of 2022.

The European Commission presented in early February a so-called Green Deal Industrial Plan, which is aimed at boosting the competitiveness of Europe’s net-zero industry and support the fast transition to climate neutrality.

Support for the EU Net-Zero Technology Industry

The Plan is designed to provide a more supportive environment for the scaling up of the EU’s manufacturing capacity for the netzero technologies and products required to meet the EU’s ambitious climate targets.

The EU is considering temporary amendments in the state aid rules relating to green technology manufacturing, in a move to prevent EU-based industries from relocating to the US where they could take advantage of the incentives in the US Inflation Reduction Act (IRA).

Consultations with EU member states have so far revealed that “part of the Inflation Reduction Act is a threat to the competitiveness of specific key sectors for the green transition of the European industry,” Margrethe Vestager, Executive Vice-President of the European Commission for Competition, said on 1 February.

Still, the European response should be based on facts, and address only those specific problems triggered by the IRA, Vestager added.

Moreover, any action the EU will take in temporarily amending the state aid rules must preserve the integrity of the Single Market, and finally, the EU “should nurture rather than damage our relationship with the US,” the Executive Vice-President said.

The adoption of new state aid rules should rest on three “Ts”—temporary, targeted, and transparent, she noted.

The potential amendments in the rules would be temporary, until the end of 2025; targeted – relating only to strategic green sectors that are at risk of relocation to the US or other third countries; and transparent - so that taxpayers know where their money is going.

“The Green Deal Industrial Plan focuses on the competitiveness of the European industry. The aim is for Europe to be a leader in the green and digital transitions. That is the aim of the Industrial Policy that we devised after the pandemic. It is based on four pillars - regulation, skills, trade and financing, including private financing,” Vestager said.

The Green Deal Industrial Plan will include a predictable and simplified regulatory environment, speeding up of investment and financing for clean tech production in Europe, developing skills for the green transition, and open trade for resilient supply chains. In view of fair trade, the European Commission will continue to develop the EU’s network of Free Trade Agreements and other forms of cooperation with partners to support the green transition.

“It will also explore the creation of a Critical Raw Materials Club, to bring together raw material 'consumers' and resourcerich countries to ensure global security of supply through a competitive and diversified industrial base, and of Clean Tech/Net-Zero Industrial Partnerships,” the Commission said.

The EC also vows to protect the Single Market from unfair trade in the clean

tech sector and will use its instruments to ensure that foreign subsidies do not distort competition in the Single Market, also in the clean-tech sector.

“Europe is determined to lead the clean tech revolution. For our companies and people, it means turning skills into quality jobs and innovation into mass production, thanks to a simpler and faster framework. Better access to finance will allow our key clean tech industries to scale up quickly,” European Commission President Ursula von der Leyen said in a statement.

Solar and Wind Power Installations Jump Despite Challenges

Last year, wind and solar generated a record one fifth of EU electricity – or 22 percent, for the first time overtaking fossil gas, which had a 20-percent share in EU power generation, and remaining above coal power at 16 percent, environmental non-profit think tank Ember said in a report at the end of January.

Yet, the shift away from fossil fuels was put on hold due to the energy crisis in Europe in 2022, the think tank said.

According to Ember, Europe is set to witness in 2023 a huge fall in fossil fuels — of coal power, yes, but especially gas power.

“The energy crisis has undoubtedly sped up Europe’s electricity transition. Europe is hurtling towards a clean, electrified economy, and this will be on full display in 2023. Change is coming fast, and everyone needs to be ready for it,” said Dave Jones, Head of Data Insights at Ember.

Estimates from industry associations showed that new capacity additions in solar and wind energy in the EU jumped in 2022 despite some challenges in the supply chain, especially for wind capacity installations.

GLOBAL news

12 www.ogv.energy - Issue 3

The EU solar market saw 41.4 gigawatts (GW) of new solar PV capacity connected to grids in 2022, a jump by 47 percent compared to 2021, according to estimates by SolarPower Europe.

“We are confident that further annual market growth will beat all expectations, exceed 50 GW deployment level in 2023, and more than double from today to 85 GW in 2026,” the association said in its annual EU Market Outlook.

“2022 was the year when solar power displayed its true potential for the very first time in the EU, driven by record high energy prices and geopolitical tensions that largely improved its business case,” SolarPower Europe noted.

Like in 2021, Germany was again the EU’s biggest solar market in 2022 with 7.9 GW of newly installed capacity, followed by Spain (7.5 GW), Poland (4.9 GW), the Netherlands (4.0 GW), and France (2.7 GW).

The rise in installations is an encouraging result given the overlapping challenges the industry faced in 2022, as well as a contribution to strengthening Europe’s energy security ahead of next winter, the association added.

However, WindEurope warned that the EU needs to continue to simplify permitting and invest heavily in its wind energy supply chain to deliver its energy and climate targets.

The EU solar market saw 41.4 gigawatts (GW) of new solar PV capacity connected to grids in 2022, a jump by 47 percent compared to 2021, according to estimates by SolarPower Europe.

“Less encouraging is the slowdown in investments in new wind farms. Confusion about electricity market rules is turning investors away. The EU must make Europe an attractive place for renewables investments again,” said WindEurope CEO Giles Dickson.

“The EU needs to set up the mechanisms and get the money moving asap.. Clean energy industries are debating now where they should invest and need clear signals now if it’s going to be Europe.”

The European wind industry and the European steel industry have called on the EU to ensure in its upcoming EU Critical Raw Materials Act in March access to all critical materials for wind and steel, including rare earths, nickel, manganese, copper, aluminium, ferrous scrap, and glass-fibre fabrics.

“The Critical Raw Materials Act is a crucial opportunity to reduce Europe’s dependency on China – and to step up the supply of the materials Europe needs to boost its energy security,” said WindEurope’s Dickson.

Axel Eggert, Eurofer Director General, noted, “The Critical Raw Materials Act must deliver targeted market measures boosting local, sustainable supply chains and offering incentives to invest at least comparable to the U.S. Inflation Reduction Act.”

For the first time, all Top 10 markets are also GW-scale markets. In 2022, as many as 26 out of 27 EU Member States deployed more solar than the year before, the association said.

In wind power, the EU installed 15 GW of new wind farms in 2022, which is one third more than in 2021, WindEurope said. Germany, Sweden, and Finland led in new capacity installations, followed by Spain and France. A total of 90 percent of the additions were onshore wind, and nearly all the new onshore wind farms were in new greenfield sites.

Inflation and national interventions in electricity markets have discouraged investments over the past year, WindEurope said at the end of January, noting that investments in wind energy in Europe dropped in 2022 and orders for new wind turbines slumped by 47 percent compared to 2021.

“Last year’s market interventions have made Europe less attractive for renewables investors than the US, Australia and elsewhere. They impacted the business case for renewable energy projects across Europe. The figures for wind turbine orders in 2022 should ring an alarm bell: Europe’s energy and climate targets are at risk if the EU fails to ensure an attractive investment environment for renewables,” WindEurope’s Dickson said in a statement.

EU Ambition To Expand Offshore Renewable Energy

The EU member states agreed in January on non-binding but more ambitious new longterm goals for the deployment of offshore renewable energy until 2050. The combined figures give an overall ambition of installing around 111 GW of offshore renewable generation capacity by the end of this decade, which would be nearly twice as much as the objective of at least 60 GW set out in the EU Offshore Renewable Energy Strategy in November 2020. This then rises to around 317 GW by 2050.

GLOBAL news

renewable news SPONSORED BY 13

UK

Offshore Wind Farm Atlantic Shores Ocean Winds

$1.8bn

Development of an 882MW offshore wind farm, located approximately 22.5km from Caithness in the Moray Firth of eastern Scotland. The site will comprise of 60 x SG 14-222 DD units. Boskalis recently secured a €50-150 million multidisciplinary contract, for the transport and installation of the monopiles and two substations with their respective transition pieces.

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

renewable PROJECTS RENEWABLE PROJECTS

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

Australia

Floating Offshore Wind Farm Eastern Rise BlueFloat Energy $3bn

BlueFloat Energy has announced plans to construct a 1,700MW floating offshore wind farm, located within the offshore wind zone in the Pacific Ocean, off the Hunter region of New South Wales.

The development of the wind farm is anticipated to take around seven years.

USA

Offshore Wind Farm Revolution Wind 2 Ørsted & Eversource Energy

$2.5bn

Ørsted and Eversource Energy have plans to build the 884MW Revolution 2 wind farm, off the coast of Rhode Island and Massachusetts. The proposal was announced as part of Rhode Island’s second offshore wind solicitation, and was the sole bidder in the auction.

Brazil

Atobá Offshore Wind Farm Equinor

$7.5bn

The 2.49GW proposed wind farm, off the coast of Rio Grande do Sol, is one of the seven wind farms that falls under Equinor and Petrobras’ recently signed Letter of Intent (LoI). The two companies will work together to assess the proposals, with the LoI being effective until 2028.

2 3

renewable projects SPONSORED BY

www.eicdatastream.the-eic.com 1 4 14 www.ogv.energy - Issue 3

Portugal

Floating Offshore Wind Farm Botafogo

IberBlue Wind

$37.5m

Proposal of a 990MW floating offshore wind farm located off the coast of Figueira da Foz, featuring 55 x 18MW wind turbines. The wind farm is planned to be in the 4GW Figuera da Foz area, one of the five designated drafting areas in Portugal’s first offshore wind auction in 2023 totalling 10GW. However, Copenhagen Infrastructure Partners has also proposed a 2GW wind farm in the same site.

Jordan

Kulanak Hydro Power Plant

Government of Kyrgyzstan $117m

Construction of a 100MW hydroelectric power plant on the Naryn River, village of Kulanak in the Naryn Region. The Eurasian Development Bank (EDB) and Naryn Production Enterprise have reached an agreement to fund its construction and operation of the project. The Russian-Kyrgyz Development Fund (RKDF) also intends to contribute to the project’s financing.

South Korea

5

6

Offshore Wind Farm Wando (Geumil-do) Korea South-East Power Co (KOEN)

$503bn

A 600MW offshore wind farm off the coast of Wando county, Jeonnam / South Jeolla Province, South Korea. The project will first build phase I totalling 200MW, and for this phase, Vestas has been chosen as the preferred turbine supplier. The phase will feature 40 x V236-15.0MW wind turbines.

Canada

Williston Basin

Geothermal Power Plant DEEP Earth Energy Production Corporation

$200m

A 25MW geothermal plant in Williston Basin, Saskatchewan. The project will source energy from the geothermal reservoir in the Deadwood Formation and will have ten horizontal wells (6 producers and 4 injections) that will be drilled to a vertical depth of approximately 3.5km and a horizontal length of approximately 3km. The developer has reportedly finalised the EPC contractor hiring, with these works to commence in Q3 2023.

Tonga

Tongatapu Wave Power Project Seabased Industry AB $100m

Development of a 10MW wave power park in Tongatapu, in the South Pacific island country of Tonga. Seabased Industry AB, the government of the Kingdom of Tonga and SIDS DOCK, have signed a Memorandum of Understanding for the project. The project will be developed in two phases, with phase I and II featuring 2MW and 8MW, respectively.

Scotland

SwimmerTurbine

Flex Marine Power $1m

Flex Marine Power has secured a little over €1 million (£968,000) that will be used for the development of a lowercost tidal turbine for coastal power generation within a microgrid, which will be tested with community partners on the island of Islay.

Indonesia

Cirata Reservoir Floating Solar Plant PT Pembangkit Jawa-Bali & Masdar $192m

Development of a 192MW floating PV plant on the Cirata Reservoir in West Java province: reportedly the world’s largest floating solar project. Sungrow FPV has received a contract to supply the floating equipment, with the systems’ delivery to commence in Q1 2023. The project will install 700,000 floats and will also include a 150kV high voltage transmission line and a 150kV power substation.

South Africa

Onshore Wind Farm

Koruson 1 Complex

EDF Renewables $750m

An onshore wind complex comprising of three 140MW wind farms: Phezukomoya, San Kraal and Coleskop. The complex will be in the vicinity of Middelburg, in the Umsombomvu Local Municipality, and comprise of 78 turbines in total. The Coleskop site recently secured financial close, and construction of all three wind farms are now underway.

1 5 3 8 2 9 6 10 11 12 7 4

8

9

12

11

10

renewable PROJECTS PROJECTS MAP SPONSORED BY 15

7

OFFSHORE WIND THEMES TO WATCH IN 2023

By Bahzad Ayoub, Senior Analyst Offshore Wind, Westwood Global Energy Group

The offshore wind sector witnessed another year of high growth despite global financial uncertainties. Although 2022 did not match 2021’s record of over 19.5GW of online capacity, which was mainly driven by the expiration of national feed-in-tariffs in Mainland China (MC), 2022 witnessed the second highest amount of global online capacity with almost 8.5GW. Final investment decisions (FIDs) were taken on over 11.5GW of projects, making it the fourth highest year for FIDs.

2023 capacity additions are forecast to be 55% higher than 2022 levels, keeping the offshore wind sector busy. This continued growth is expected to take place in a year where the sector will also need to deal with several issues to keep up the momentum. Some of the key themes that Westwood expects to see this year include the continued awarding of lease areas as well as the launch of auctions in new markets, investment in newbuild vessels, development uncertainties, the fallout of losses faced by turbine OEMs, the emergence of Chinese EPC supply chain companies entering markets outside of MC and the integration of offshore wind with other forms of energy. We explore these further below.

THE FUTURE OF RENEWABLE ENERGY

Flotation Energy and Vårgrønn are leading the way in the development of offshore wind projects. Determined to support the global movement to Net Zero and sustainable energy consumption, our core strengths lie in finding and developing sites for floating projects in deeper waters globally. Together we have harnessed our expertise to deliver reliable oil and gas electrification and decarbonisation projects that will pioneer the future of renewable energy.

AUCTION RESULTS AND NEW AUCTIONS TO BE LAUNCHED

A total of 54.9GW of offshore wind leases were awarded in 2022. The ScotWind lease round accounts for most of this capacity, with over 24.8GW of project capacity being awarded in the initial round and a further 2.8GW in the clearing round. Several offshore wind lease rounds are scheduled to be launched and potentially conclude in 2023. These include the 4GW Celtic Sea floating wind auction in the UK, the 500MW A06 (Floating Mediterranean) auction in France and the Central Atlantic, and the Gulf of Mexico and Oregon auctions in the US.

Offshore wind auctions are also planned to take place for the first time in new markets that are aiming to develop projects. Up to 10GW of floating wind projects are planned to be auctioned in Portugal, 4GW are planned to be auctioned offshore Tamil Nadu State in India and Lithuania is also planning to launch its first lease auction for a 700MW wind farm.

Alongside these lease auction rounds being launched, the results of auctions that are currently taking place are also expected to be revealed in 2023. The results of 6.2GW INTOG Leasing round in the UK is scheduled to be announced this year. Poland is planning to conclude its auction for up to 11GW of lease areas and France is also expected to announce the winners of the 250MW Brittany Floating Wind and the 1GW Normandy fixed bottom tenders. Elsewhere in Taiwan, the floating wind tender, which was scheduled to be released in 4Q 2022, was delayed until 1Q 2023, although Westwood predicts it remains scheduled be awarded in 2023.

Some recent lease auctions have witnessed the implementation of qualitative criteria when it comes to selecting the winning bidders. The Hollandse Kust West Site VI tender in the Netherlands included a criterion for bidders to demonstrate how their proposal would contribute to the ecology of the North Sea. Qualitative measures are being implemented in future auction rounds and their importance is expected to increase. The Utsira Nord auction in Norway highlights this shift as the lease areas will be allocated to bidders on the bases of qualitative criteria such as proposed projects contribution to innovation and technology development.

INVESTMENT IN NEWBUILD VESSELS

Offshore wind production targets that have been set by various countries, means there will be a lot more offshore construction activity taking place globally from the mid-2020’s. In turn this will translate to increasing demand for construction vessels in the offshore wind sector. Separately, the Jones Act creates a situation in the US whereby newbuild vessels will be required for the US offshore wind market, as under the Act only US-built vessels can be used in US waters. Vessel suppliers have identified this demand and several orders have been placed for newbuilds in 2022.

Starting with wind turbine installation vessels (WTIVs), Cadeler has placed an order for two F-Class WTIVs. Separately, a consortium of ONP Management & Renewable Resources has ordered a Jones Act-compliant WTIV, while Bleutec Industries placed an order for a Jones Act-compliant hybrid vessel. The Binary Marine Installation Solution (BMIS) will consist of two construction vessels –one for foundation installation and one for wind turbine installation. Moving onto heavy lift vessels (HLVs), Vallianz placed an order for a turbine foundation transport vessel. Finally, in terms of newbuild cable lay vessels, two orders have been placed and these have come from Prysmian and Cecon Contracting respectively.

Outside of these 2022 firm orders, letters of intent/option agreements have been signed for several offshore wind construction vessels. There are currently five WTIVs under these agreements and three of these have been signed by Havfram, whilst the remaining two have been signed by Van Oord and Subsea 7 respectively. The transition of these agreements to firm orders will be dependent on how quickly offshore wind projects progress globally, as this will be the key determining factor on when a vessel demand crunch will occur.

WIND

1 2

16 www.ogv.energy - Issue 3 WIND ENERGY

SPONSORED BY

DEVELOPMENT UNCERTAINTIES

2022 was a year in which the offshore wind sector faced several risks, which have the potential to impact decisions of developers investing in their forward-looking pipeline. Factors such as price volatility, cost inflation, political unpredictability and supply chain bottlenecks will continue to make commercial decisions increasingly difficult and uncertain in 2023.

Cost inflation from raw materials and rising energy prices have resulted in a reduction of the financial viability of projects. As a result of this, developers may seek to renegotiate financing agreements, potentially resulting in delays in the development of projects or even causing them to cancel projects.

Some developers of offshore wind projects in the US have already expressed their concerns. In December 2022, Avangrid filed a motion with the Massachusetts Department of Public Utilities (DPU) to dismiss the review of power purchase agreements (PPAs) issued to its 1.2GW Commonwealth Wind offshore windfarm in 2019. Avangrid has declared that it wants to submit a revised bid that reflects economic changes since late 2021. Mayflower Wind Energy LLC, a joint venture between Shell New Energies US LLC and Ocean Winds has also expressed worries regarding the financing challenges for its project in Massachusetts. Despite these worries, the PPAs for both projects have been approved by the Massachusetts DPU.

Elsewhere in Taiwan, Orsted cited “high inflation and increasing interest rates”, together with limitations set by current regulation, is making projects “uninvestable at this stage” – the developer declined to bid in Taiwan’s Round 3.1 lease auction.

Reactive political policies with regards to high inflation have also created uncertainties for project developers. In the UK, for example, a windfall tax with a temporary levy of 45% on profits has been introduced for electricity generators and this includes offshore wind farms. Although this only applies to wind farms that are not supported by the Contracts for Difference (CfD) subsidy mechanism, it still impacts project developers who operate these wind farms, and it will have them questioning their future investments.

FALLOUT OF LOSSES FACED BY TURBINE OEMS

International turbine manufacturers have had a difficult 2022, with Vestas, Siemens Gamesa and GE reporting financial losses. Vestas reported a loss of EUR1.031 billion (approximately US$1.068 billion) in the first nine months of 2022. GE has announced losses of US$1.786 billion in the first nine months of 2022 from its renewable energy division, whilst Siemens Gamesa reported an annual loss of EUR940 million (approximately US$975 million) in its FY2022 results. Siemens Gamesa also announced that it is planning a 10% reduction of its workforce by FY2025 as part of its long-term cost cutting strategy.

Although most of these losses can be attributed to the onshore wind side of these companies, they will have knock-on effects on their offshore wind segments. Outside of the aforementioned issues that each of these OEMs are facing, the offshore wind sector is grappling with several challenges, such as rising material costs and increased energy prices. As a result, turbine OEMs are facing significant losses as the pricing for the turbines have already been agreed upon, meaning that any price rises or additional costs incurred upon delivery, are absorbed by the OEM.

The likely fallout of these losses will be increased pricing from the turbine OEMs, which in turn will impact project developers, potentially leading to delays in projects as the developers may have to prioritise their project investments. As Vestas, GE and Siemens Gamesa are currently the only OEMs that supply the market outside of MC, and these companies are facing financial difficulties, there is now ample opportunity for new players to enter the field.

CHINESE EPC SUPPLY CHAIN COMPANIES ENTERING NEW MARKETS

After experiencing huge capacity growth in 2021 adding 16.4GW, driven by the termination of central government subsidies, 2022 and 2023 installed capacity is still forecast to remain higher than the average 2-3GW levels of 2019-2020. Mainland Chinese EPC contractors have begun making inroads outside of MC and this is expected to increase. Although a small number of Chinese supply chain companies have managed to secure contracts, they are aiming to increase their market share by investing in the development of factories in international markets. Ming Yang Smart Energy and Dajin Heavy Industry are examples of companies that are pursing markets outside of MC, with both companies signing contracts whilst developing and pursing plans to establish local manufacturing centres.

Ming Yang’s turbines have been operating offshore Italy at the Taranto wind farm since April 2022. The turbine OEM has also been awarded a contract to supply a turbine at the Nyuzen wind farm in Japan and it has also been selected to supply four turbines for the TwinHub Demonstrator floating wind project, offshore the UK. In terms of operating outside of MC, Ming Yang has selected the UK as its first new market. The OEM listed on the London Stock Exchange in July 2022 and has also signed a Memorandum of Understanding (MoU) with the UK Department for International Trade (DIT), focusing on MingYang investing in a blade manufacturing factory, a service centre and potentially a turbine assembly factory in the UK.

Dajin Heavy Industry has had a banner year outside of MC. The fabricator has been awarded a contract to supply turbine towers and turbine foundations at Moray West in the UK. It has also been awarded a contract to supply turbine foundations at the Noirmoutier project, offshore France. Dajin also announced that it is planning to open a European turbine foundation manufacturing factory capable of manufacturing XXXL monopile turbine foundations, jacket turbine foundations and floating turbine foundations.

INTEGRATION OF OFFSHORE WIND WITH OTHER FORMS OF ENERGY

Hydrogen production, electrification of oil and gas (O&G) platforms and the joint development of offshore wind projects with other renewables are some areas in which offshore wind projects are starting to combine with other forms of energy.

The world’s first O&G electrification project via offshore wind, Hywind Tampen, began operating in November 2022 and this is scheduled to be fully commissioned in 2023. Net-zero targets, increasing carbon prices and higher energy costs are driving increased investment in the electrification of O&G assets. The results of the INTOG leasing round in Scotland are scheduled to be announced by the end of March 2023 and this will be a major first step in transforming offshore wind electrification from a demonstration scale concept to commercial scale projects.

The offshore wind sector will also witness an increase in projects being combined with other sources of renewable energy. A recent example of this is Hollandse Kust West Site VII wind farm in the Netherlands. RWE Renewables won the lease rights to this site in November 2022. The project developer is planning to provide surplus electricity to power green hydrogen production on land and to incorporate floating solar panels to allow a more efficient use of ocean space. SolarDuck will build a 5MW floating solar power demonstrator at the site of the wind farm, and this is scheduled to come online in 2026.

The world’s first hydrogen-producing offshore wind turbine project received funding in May 2022. The UK government awarded Vattenfall £9.3 million (US$11.5 million) in innovation funding from the Net Zero Innovation Portfolio Low Carbon Hydrogen Supply 2 fund for the Hydrogen Turbine 1 (HT1) project. An electrolyser will be installed directly onto an existing operational turbine which is currently producing power at the 96.8MW Aberdeen Bay wind farm located offshore Scotland, UK. The turbine will be used to produce hydrogen, and this will then be transported via a pipeline to shore at the Port of Aberdeen.

WIND

3 4 5 6 wind energy SPONSORED BY 17

Hi Claire, Welcome and can you introduce yourself and Scottish Renewables, please?

Of course, I’m Claire Mack, the Chief Executive at Scottish Renewables and Scottish Renewables is the voice of the renewable energy industry here in Scotland. We've been around for about 20-odd years, and represent the industry and work with the supply chain to devise policy positions and to advocate on their behalf to create the best possible environment for us to develop projects.

The offshore renewables industry in Scotland has really been hitting the headlines over the last year or so, can you provide us with an overview of what’s been going on?

Absolutely, as you say the industry has been all over the news and for a really positive reason, which is just the scale of the development opportunity that is available around the coast of Scotland. If we'd been talking just over a year ago, we would have been talking about 11 gigawatts of offshore projects in Scotland, but now what's happened is that we are now sitting with a target of around 28 gigawatts for Scotland, which is huge. A number of these projects are going to be floating projects, so really, we've got one of the largest commercial floating opportunities in the world, right here in Scotland, which is really, really exciting to see a pipeline like that!

Brilliant, and is that level of growth sustainable?

Demand for green electricity is only going to grow. We know that and we've certainly seen a real impetus behind that and the real reason behind it comes from the debate around energy security. So the demand will grow and our pipeline at the moment takes us out too well beyond 2030.

The need then is to balance that development opportunity with the environment, to balance that with supply chain growth and various other elements as well, such as the underlying infrastructure growth. Clearly, grid and networks are hugely important. For the first time we've got a really strong pipeline that is multi-decade long, which is great.

That's something that we've not really ever had as an industry before. Energy policy has tended to be a little bit stuttering in the past. So now, to have this opportunity is really, really brilliant and it gives us something to work towards

beyond what we do in our own country. We've obviously got huge opportunity for export as well, because the rest of the world are going on the same journey as we are.

In addition, we are starting to see the development of other fossil-fuels based economies like China. What they've been doing is building wind and solar at an enormous rate and we have that exciting opportunity to be able to contribute to that from an export position as well, so, yes, I would see growth as sustainable.

Great. You mentioned briefly there about energy policy. Is there a significant energy policy or event that's resulted in this acceleration offshore?

There was already quite a strong impetus, brought around by the Johnson government here in the UK. He was a very firm supporter of the offshore wind sector and also started to lay the foundations for onshore wind to reenter the energy mix through making sure that it was included within the policy framework that we've got in place at the moment. We have started to see a real step change. It started, I guess, with COP. There was a lot of interest in that net zero conversation. It's shifted somewhat over the last couple of years and over the last year or so to be much more focused on energy security and also on economic growth as well.

So I think there's that recognition from the government that actually we can do more than one thing here. We're not just about producing green electrons. You can actually reinvent the energy system here and also recognising that this is a huge industrial opportunity for the UK.

Can you tell us anything about the number of jobs that are sustained in Scotland through the renewable energy industries and how that outlook is?

We've done some work recently at Scottish Renewables with the Fraser of Allander Institute at the University of Strathclyde, which is showing us that we've got 27,000 jobs in the industry today, which is great. We want to see that grow and it will grow because we have that phenomenal pipeline not just of offshore wind, but of onshore wind and the various other technologies as well. So we think that the outlook is certainly for job growth over time.

How do we go about maximising the involvement of Scottish companies in this industry?

We've already got a huge number of companies working within the industry. We've got a very long and wide and deep supply chain, and that helps us to deliver our projects. But one of the ways to really maximise that involvement is for us to understand what we're good at. And there's been a lot of work that's going on with industry, particularly in the offshore space, to have a look at the capacity and the capabilities of the supply chain, because we're looking to grow that, to make sure that we can meet the demand that's going to come from that huge pipeline that I talked about earlier.

So understanding what we're good at and investing in new technology and new processes. We've done a lot of work, again, you know, through deployment where we've learned loads of lessons that we've been able to pull together to maximise our effectiveness and efficiency, but also being able to ensure that we can create better opportunities as well for the supply chain in this country.

Do you think there's more can be done to ensure we're adding value to the supply chain in Scotland?

There is always more that can be done. I think what we need to be mindful of is the supply chain in general are small to mediumsized enterprises, you know, there's a real concentration of those sizes of business in there, and they need help with different things. So I think if you want to ensure greater value add, then its about focusing the efforts of our enterprise agencies, for example, focusing the efforts of our economic growth strategies on those particular bodies of business. Because in order for them to really grow and to invest, we need to be quite clear about how we help them do that. I think using them to collaborate with each other, but also building better engagement between the different tiers of layers of supplier and subcontractor and developer and commissioner of work is really, really important as well to ensure that we can really drive better value through the supply chain.

Brilliant. You mentioned earlier on, Claire, that there's opportunities for Scotland to export some of this knowhow. So, are there specific areas of competence where you believe Scotland can grow and can export those technologies worldwide?

WIND

Claire Mack – CEO of Scottish Renewables

18 www.ogv.energy - Issue 3

Interview by Moray Melhuish – Founder of Annet Consulting, an Offshore Wind and Subsea Specialist

Yes. I think in terms of exporting worldwide as I said, there's a huge opportunity particularly for floating offshore wind. That's one of the key areas of competence that we've got that opportunity to grow here domestically with our domestic projects and then export that across the globe. Its, really important and I think there are some elements that we need to look at.

Finance is absolutely huge, so making sure that we've got finance available for some of these smaller companies as well as the larger companies to be able to get into that export market. We did some research again at Scottish Renewables into the export space - the story there is that you've got quite a narrow base of exporters but a huge reach and that means that you've got brilliant potential for growth if we can use what we've got already in peer to peer networks, for example, to help other companies understand how to access export markets and to get that foot in the door.

High tech, high value is very much the watchwords of what we'll be thinking about in terms of export, you know, and also we've got the advantage of working in the North Sea in some of the most difficult development conditions. Therefore, again, we're going to be gaining expertise, which is going to be useful wherever you want to go in the world.

So, we know that the offshore wind industry is growing brilliantly, and the pipeline is substantial and only getting bigger. Can you give us some insight into some of the other renewable industries and how they're fairing?

Yes, we've come through some pretty tough times as a sector and certainly even in my time at SR. I've been at Scottish Renewables for about six years and our fortunes have changed beyond recognition in that particular period of time because of that step change in government policy.

It's really boosted interest in things like solar for people to be able to self-generate power, businesses in particular. To help them selfgenerate too. Onshore wind, is clearly now back in the energy mix too through the contracts for difference auctions.

But you know whilst it was sitting outside of that particular framework they were working very hard on merchant models, merchant models to market, new merchant routes to market, and private wire type arrangements which have become really, really interesting as well, that kind of firm PPA type market really grew in that period of time.

You've also got hydro, so pump storage hydro, is a really important part of the integration story and needs to be part of that mix. We've been working really hard with the government to help them understand the benefits that pump storage hydro brings, not just as a tool, a systems tool, but also to gain, you know, huge socio-economic benefits in that civil engineering market as well.

Where things aren't so good I guess the outlook is quite poor for smaller scale projects

and that's a real disappointment because particularly through that prism of the cost of living crisis, you know, we know that householders are really, really keen to be able to get help with self-generation, help to understand how to do this for themselves, how to set themselves up at home.

But there is capital expense in there and also, you know, no type of freedom tariff has made it incredibly difficult for householders to be able to really join the renewables revolution.

You mentioned onshore wind briefly there. The UK legislation changed recently, didn't it? Can you take us through that and also how it'll affect Scotland?

There was a policy change which was to enable onshore wind to compete again in the power auctions that are held now annually by government. There's a huge opportunity for onshore wind in Scotland, particularly in Scotland, because our planning system has also been going through a bit of a refresh and it has become very open and positive about the development of onshore wind here in Scotland, which is great because the scale of the resource here is also good in other areas of the country.

Its less easy in other areas of the country and I'd certainly say it is less easy down in England. But one thing that is happening here in Scotland is that we're working with industry and government on an onshore wind sector deal which could see up to 20 gigawatts of onshore wind come out of Scotland, which

is a phenomenal figure and an opportunity for us to look at new pipeline as well as repowering some of our existing sites. This is because of our early movement on renewables here in Scotland, actually coming to the end of their first phase of life and are actually going to be prepared for their next phase of life, which will involve taller turbines, with more efficient technology and really bringing onshore wind back into its next iteration in the energy market.

www.ogv.energy/play

WIND

full interview

watch

wind energy SPONSORED BY OR LISTEN TO THE PODCAST 19

Hi Alan, welcome to podcast, how long have you been in offshore wind?

I've been in offshore wind since about 2001.

I was working in Talisman Energy and I was asked to have a look at this concept that we had been approached about and it grew over the next six or seven years, until we actually built the turbines in the Moray Firth, which were at the time the biggest turbines, furthest from shore, in the deepest water, and the first to go on jackets and the first to go on the continental shelf. And that was how I ended up in the wind business!

Wow, that really is some really pioneering stuff, what observations have you made about how the industry has changed since then?

It's really interesting, it was an idea just coming to fruition. Onshore wind was sort of taking shape, but even then, it was subsidised and meeting lots of resistance. The concept of going offshore was just being talked about and I think as we got into it, they had put two machines off Blyth and some on the harbour and there'd been some work done in the Scandinavian countriesDenmark and Sweden, and that really was it.

We decided that we needed electricity for our oil platform and for various reasons, which are now lost and mired in time, Talisman ultimately decided to sanction, in partnership with SSE, the construction of the two turbines at Beatrice.

Tell us about your projects at Flotation Energy?

Well, Flotation Energy is a follow-on not just from the Beatrice Project, but from Sea Energy, which was the first company we set up and then from the Kincardine project. Flotation Energy was a concept that my colleague said we should pursue in early 2018.

We develop fixed and floating wind projects, depending on what's available and what the opportunities are. We have built and been part of that business model for ten years now since we first started Kincardine.

The idea that this would grow into a major industry and over the next ten or 15 years, the dominance of floating wind would come to pass. There will be more floating wind in this world than there will be fixed wind because there's more deep waters than there are shallow waters.

You mentioned there that you had some investment from TEPCO (Tokyo Electric Power Company). How has that affected the business and its plans?

TEPCO are the largest utility company in Japan and the fourth biggest utility company in the world. We are part of TEPCO Renewables. The team has around 100 people in Japan who specialise in wind. Its largest objective is floating wind because of the nature of Japan, they have no continental shelf and you can very quickly find yourself in 1000m of water and the Pacific. Fixed structures are not going to work there.

Does this mean we will see Flotation Energy setting up in Japan. Or how does it affect your international footprint?