OFFSHORE WIND

GLOBAL ENERGY NEWS

WORLD PROJECTS MAP

MONTHLY THEME

INNOVATION & TECH

RENEWABLES

CONTRACT AWARDS ON THE MOVE

DECOMMISSIONING

STATS & ANALYTICS

LEGAL & FINANCE EVENTS

FEATURING

JBS Group I The Impulse Group

Ashtead Technology I Dräger

Offshore Solutions I Proserv

Global Maritime I QHSE Aberdeen

Decom-Mission

www.jbsgroupglobal.com

JUNE 2023 - ISSUE 69

Welcome to the June edition of ‘OGV Energy Magazine’ where we will be exploring the theme of ‘Offshore Wind’.

A big thank you to our front cover partner JBS Group, who are supporting multiple engineering projects in the renewables sector and have recently won a ‘Going Global’ award at the coveted ‘Northern Star Business Awards’.

In a bumper publication, we also have contributions from Proserv, Global Maritime, Offshore Solutions Group, Ashtead Technology, Dräger, QHSE Aberdeen, HFI, Sword Group and Norman Broadbent.

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, the Middle East and the USA along with industry analysis and project updates from Westwood Global Energy Group, the EIC and Renewables UK.

Daniel Hyland, Sales and Operations Director, OGV Energy Media Group

3 CONTENTS FOLLOW US VIEW THE OGV MAGAZINE ONLINE AT www.ogv.energy/magazine @OGVENERGY OGVENERGY @OGVENERGY OGV-ENERGY WISH TO CONTRIBUTE TO NEXT MONTH'S PUBLICATION? Contact us to submit your interest daniel.hyland@ogvenergy.co.uk OGV COMMUNITY NEWS GLOBAL ENERGY NEWS WORLD PROJECTS MAP MONTHLY THEME OUR DIGITAL INDUSTRY RENEWABLES CONTRACT AWARDS ON THE MOVE DECOMMISSIONING STATS & ANALYTICS EVENTS LEGAL & FINANCE P.06 P.09 P.18 P.20 P.32 P.36 P.38 P.40 P.42 P.46 P.49 P.50 A WORD FROM OUR EDITOR 6 20 28 26 30 32 44 36 24

STATS GROUP

Managing Pressure, Minimising Risk

Mechanical Pipe Connector

Piping Repair, Tie-In or Capping

seal vertification port

DNV TYPE APPROVAL

Permanent pipe to flange connection where welding may be undesirable. The slipover design and external gripping assembly enables a quick and cost-effective solution, with no specialist installation or testing equipment required.

dual graphite seals

taper lock grips

dual graphite seals

taper lock grips

The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes.

Disclaimer:

CONTRIBUTORS

MANAGEMENT PARTNER

PARTNER Leading provider of logistics services to this industry, offering its customers airfreight, road freight, sea freight, project forwarding, customs compliance, training and consultancy, packing, crating, lashing & securing services warehousing, distribution, freight management, rig relocation and mobilisation services and offshore logistics. Corporate Travel Management (CTM) is a global leader in business travel management services. We drive savings, efficiency and safety to businesses and their travellers all around the world. Editorial newsdesk@ogvenergy.co.uk +44 (0) 1224 084 114 Advertising office@ogvenergy.co.uk +44 (0) 1224 084 114 Design Ben Mckay Jen McAdam Journalist Tsvetana Paraskova www.quanta-epc.co.uk YOUR ASSET IN SAFE HANDS Safe, efficient and low-cost delivery of Asset Management projects, ensuring best value every time. Operations Maintenance Repair orders Technical support VIEW our media pack at www.ogv.energy/advertise-with-us or scan de QR code ADVERTISE WITH OGV

OUR PARTNERS TRAVEL

LOGISTICS

Booth Welsh Managing Director, Martin Welsh, along with the senior leadership team, are delighted to announce the successful completion of their Management Buyout. This marks an exciting new chapter for the business.

As of April 2023, the full umbrella business, Booth Welsh Holdings, is now fully owned by the senior leadership team. This returns the business to its independent roots under which they successfully operated for the first twenty-five years in operation from 1989 to 2014.

Booth Welsh, and their subsidiary iTech, will continue to develop a strong brand and culture, operating as an agile and responsive business with a 300+ workforce. Operating throughout the UK and beyond, Booth Welsh will remain headquartered at their existing premises in Irvine.

ModuSpec success in MENA region

ModuSpec has recently been awarded a series of new contracts for various clients in the Middle East and North Africa (MENA) region, worth over £1 million.

In Egypt, work covering seven rigs has commenced for two existing clients, providing

continuous rig assurance and verification services for operational units both on and offshore. One project is for shared jack-up rig intake where two operators are utilising ModuSpec to provide a collaborative approach, sharing resources and delivering a focussed and engaged service. Elsewhere, ModuSpec has also been selected by a local joint-venture partnership to deliver rig inspection and acceptance services for a land rig being reactivated.

In the Middle East, ModuSpec has been supporting an international oil company with the reactivation of a land rig that was mobilised from Continental Europe to the UAE. The rig had previously been cold stacked for several years and has been contracted for a high-profile exploration well with significant risk of H2S gas during the drilling programme.

STC INSISO secures contracts to provide risk and assurance software to water utilities in England

The team at Appetite for Business is celebrating after being named in the prestigious Sunday Times Best Places to Work 2023 list alongside household names such as David Lloyd Leisure, FatFace and Pizza Express.

The annual Top 100 identifies UK organisations with the highest employee engagement and wellbeing levels, which in turn helps retain and recruit employees. The award is based upon the organiser’s trust index employee survey and culture audit.

In addition to being featured in the rankings, Appetite was also highly commended in the Best Places to Work for Women category. The winner was OVO Energy.

Environmental energy service company, Legasea, the first subsea company built around circular economy principles, today announced the launch of its apprenticeship programme.

The programme will offer two positions for Circular Economy Engineering Apprentices and one position for a Business Administration Apprentice.

“We are excited to launch our apprenticeship programme and to help create the next generation of circular economy leaders,” said Ray Milne, Operations Director at Legasea. “These apprenticeships will provide young people with the skills and knowledge they need to make a real difference in the world. We are committed to creating a sustainable future for the subsea industry and these apprenticeships are a key part of our strategy to achieve this goal.”

Aberdeen-headquartered, STC INSISO has announced two significant software agreements with water utilities covering South West England, the Midlands and Wales.

Severn Trent Water has signed an 18-month SaaS (software as a service) contract to use STC INSISO’s audit and investigation tool, COMET Investigate, and this could potentially be extended to a three-year deal. Meanwhile South West Water, has renewed its contract for the product, with both deals totalling over £70k.

South West Water, and parent company Pennon Group, have been COMET customers for several years. STC INSISO created content for the company’s HomeSafe programme previously, which was designed to improve safety performance through the delivery of e-learning modules.

FutureOn expands its reach into Latin America with multi-year contract award from Petrobras

Dales Marine Services are delighted to launch its 2023 apprenticeship recruitment campaign, with training opportunities across its Aberdeen, Leith, and Greenock dry dock facilities. Applications are now open and close at the end of June; interviews will be held in July, and new apprentices will commence with Dales Marine during August.

Dales Marine, a well-established ship repair and marine specialist, continues its commitment to developing young workers and works closely with local schools and colleges to inspire pupils to consider entering the maritime/ship repair industry as a future career. Currently, Dales Marines has thirty-four apprentices across their dry dock sites.

FutureOn, the global energy software company, has secured a multi-year contract with Petrobras to license its groundbreaking digital design and decision-making platform, FieldTwin. The major Brazilian oil and gas company will leverage the platform to spearhead the digital transformation of its subsea operations.

FieldTwin will disrupt the current subsea workflow, enabling Petrobras’ teams to accelerate project delivery from concept to operations. The platform –used by a number of global operators – has a proven track record of achieving cost and time efficiencies across the life cycle of assets.

6 www.ogv.energy I June 2023 OGV COMMUNITY NEWS

FIND ALL THE FULL COMMUNITY NEWS ARTICLES ON OGV ENERGY'S WEBSITE DO YOU WANT YOUR NEWS FEATURED ON OUR MAGAZINE, WEBSITE & DIGITAL PLATFORMS? JOIN THE OGV COMMUNITY TODAY!

Booth Welsh Holdings Returned to Original Ownership

It’s official! Appetite for Business named one of Britain’s best places to work

Legasea Launch Circular Economy Apprenticeships

Dales Marine Services Apprenticeship applications window is now open.

Specialists in Flexible Pipe Riser and Flowline Integrity Management. TIG are also dedicated to developing a knowledge hub for flexible pipe understanding and research by utilising joint ventures with operators.

theimpulsegroup.com

Kloeckner Metals UK is the largest mill independent multi-metal stockholder & distributor in the UK, and a key member of the Klöckner & Co. group, one of the largest independent distributors of steel and other metal products as well as one of the leading steel service centre companies worldwide.

www.kloecknermetalsuk.com

At Apollo, we engineer smart, sustainable solutions for the energy sector, working across oil and gas, hydrogen and carbon capture, nuclear, and offshore renewables.

Fuelled by a diverse and talented workforce, we deliver transformational engineering projects. At Apollo, we’re not afraid of a challenge, because impossible only means not possible yet.

www.apollo.engineer

Sentinel Subsea specialises in providing advanced passive integrity monitoring solutions for subsea infrastructure and equipment. Operating assets in a marine environment can often be complex and challenging. With transformative passive technologies, Sentinel Subsea delivers continuous subsea monitoring solutions that lower risk, reduce costs and protect the environment.

sentinel-subsea.com

Engineering, design, fabrication, installation, service and maintenance of offshore assets and comprehensive project management across all phases of energy projects.

www.semcomaritime.com

OceaneeringWe provide engineered services and products to the oil and gas, defense, entertainment, logistics, aerospace, science, and renewable energy industries.

www.oceaneering.com

Revolutionising your Supply Chain Management with Digital Inventory Systems. A Platform which enables Operators and their Global Suppliers to collaborate through a trusted network, in order to minimise lead items, reduce supply chain complexity in support of local and regional manufacturing.

www.fieldnode.com

A leading provider of innovative Living Quarters Refurbishment, Architectural Outfitting, HVAC, Piping, Electrical and Modular new build to the International Marine, Offshore, Renewables and Defence sectors.

www.modutec.com

www.ogv.energy/register

Providing E2E Corporate Training, Compliance & Education Solutions in Virtual & Augmented Reality. IoT Integration with predictive AI models, leveraging best-in-class data analytics and visualisation for collaboration and Actionable insights.

riiot.digital

Caledonia Competence is a Competence and Learning & Development Consultancy providing specialist services in the area of personnel assessment and development. Core services included are the set-up, auditing and health checks of client Competence Management Systems.

caledoniacompetence.com

Wintershall Dea is Europe’s leading independent natural gas and oil company with more than 120 years of experience as an operator and project partner along the entire E&P value chain.

wintershalldea.com

Your worldwide Supply Chain partner. With a large network all over the world, GEODIS is a true growth partner to its clients offering end-to-end solutions based on its knowhow, its infrastructure, processes and information systems that ensure operational excellence and the best service quality.

geodis.com

JOIN THE OGV COMMUNITY FOR JUST £30 A MONTH

LATEST OGV COMMUNITY SIGN-UPS

UK NORTH SEA Energy Review

By Tsvetana Paraskova

Offshore Energies UK (OEUK) says that decarbonisation is ‘one of the greatest challenges of our time’, and announced a conference on the topic in Aberdeen in October. At the conference, the leading representative body for the offshore energy sector will also publish its annual Emissions Report, highlighting the progress the sector continues to make while supplying the energy the country needs in a more sustainable way.

According to OEUK, for the energy sector, decarbonisation means reducing greenhouse gas emissions from the production of the energy the UK needs while also cutting the emissions from the usage of that energy.

The UK’s offshore oil and gas industry operating in the North Sea was one of the first industrial sectors to commit to the UK’s Government net zero target of 2050, and the 2045 such target in Scotland.

“Offshore energy companies are already scaling up the solutions needed to fight climate change, expand our energy mix, and position the UK as a future world-leader in low-carbon solutions,” said OEUK Sustainability and Policy Director Mike Tholen.

“By the mid-2030s, oil and gas will still provide 50% of our energy needs, so we must make sure the UK can continue supplying its own demand in a sustainable and cleaner way instead of increasing our reliance on costly, higher-carbon imports.”

Since the start of last year, the North Sea Transition Authority (NSTA) has given the go-ahead to seven projects with potential to produce 100 million barrels of oil and gas, the authority said after a meeting of major North Sea energy operators.

Seven projects capable of producing nearly 100 million barrels and requiring about £1.1 billion of expenditure have been approved by the NSTA since the start of 2022. Those projects can significantly boost the UK’s security of supply amid the energy transition.

Operators in the North Sea currently plan to progress 22 projects in the coming years which, subject to robust emissions checks, would target 1.5 billion barrels of oil and gas resources, according to the NSTA.

Stuart Payne, NSTA Chief Executive, said,

JUNE 2023 ENERGY NEWS

Continues >

Decarbonisation and net zero, decommissioning contracts, and operational updates on oil and gas fields in the North Sea were the key themes in the UK oil and gas industry over the past weeks.

9 Repair, Conversion & New Build of Marine and Offshore Living Quarters & Technical Buildings Aberdeen | Blyth | Las Palmas | Dubai | Abu Dhabi | Qatar | Bahrain | KSA | Baku Proud Sponsor of the UK North Sea Review modutec.com

“The North Sea boasts a vast array of oil and gas, wind and storage resources which can secure the UK’s supply of cleanly-produced energy, rapidly reduce its greenhouse gas emissions, and support hundreds of thousands of skilled jobs. The NSTA will lead the way on efforts to integrate these resources, optimising their enormous potential.”

North Sea operators held open and constructive discussions with the NSTA representatives and placed “a sharp focus on actions and projects which accelerate the transition to net zero,” Payne added.

In the middle of May, the NSTA revoked offshore petroleum licences P.108, P.313 and P.340 insofar as they relate to Fujairah Oil and Gas UK 12 Limited (UK12). Consequently, UK12 is no longer a party to any of these licences. The licences remain in force as they relate to the other licensees.

Notices were served on UK12 in January 2023 and as no further change of control was arranged the NSTA used its powers to partially revoke the licences.

This was the first time in which the NSTA has used its power to partially revoke a licence, and the action has been taken because UK12 did not meet regulatory requirements, the authority said.

In company news, Neptune Energy and its partner, Spirit Energy, announced production had started from the 11th well at its operated Cygnus gas field in the southern North Sea.

The new well is expected to produce around 4,000 barrels of oil equivalent per day (boepd), enough gas to heat around 200,000 UK homes. Together with the 10th well which started up earlier this year, the Cygnus facility is expected to produce enough gas per day to meet the needs of around 1.9 million UK households, Neptune Energy said.

“Cygnus plays an important role in supporting UK energy security and has the capacity to supply around 6% of the country’s gas demand,” Neptune Energy’s UK Country Director, Alan Muirhead, said.

Service provider for the energy industry, Petrofac, said in its 2022 results release that performance last year was negatively affected by challenges in the legacy engineering and construction (E&C) portfolio.

“Petrofac’s performance for 2022 was severely impacted by the challenges in the Group’s legacy E&C portfolio, which continues to feel the direct and indirect effects of pandemic delays,” said Tareq Kawash, Petrofac’s Group chief executive since 1 April 2023.

The asset solutions and Integrated Energy Services (IES) divisions are performing well, Kawash added.

“The outlook for new awards in E&C remains robust, supported by high energy demand and increased focus on energy security and the energy transition. E&C is well positioned on a number of other near-term prospects

as evidenced by the recent multi-year, multiplatform Framework Agreement award in support of TenneT’s 2GW offshore wind programme,” the CEO noted.

Reabold Resources said that its analysis had identified on PEDL 183 licence a significant potential discovery, Crawberry Hill, which was drilled by Rathlin in 2013. Reabold’s priority now is to develop plans with the aim of making this a drill-ready appraisal opportunity.

In addition, a Competent Person’s Report (CPR) has highlighted the potential across all of Reabold’s key central and northern North Sea assets, namely: the Inner Moray Firth, East Shetland Basin, and the North West of Shetland. The opportunities comprise a number of play types of both gas and oil with proven potential from analogue fields.

IOG plc said in an operational update in midMay that first gas from the Blythe H2 well is still expected to commence by the end of the second quarter this year. Production from Blythe H2 will be initially ramped up to safely and efficiently manage the production of the resident pipeline fluids into Bacton, then expected to build up to 30-40 mmscf/d rate post ramp-up, IOG said.

The Blythe H1 well is initially planned to be shut in once the H2 well is fully onstream to reduce water production into the pipeline; however, the H1 well will remain available for production, the company added.

Ithaca Energy has signed an agreement with Shell which defines a marketing process for Shell’s 30-percent working interest in the Cambo field in the West of Shetland region.

The project could progress to a final investment decision if Shell sells part of its interest or the entire 30-percent stake, Ithaca Energy said.

In all sale scenarios, Ithaca Energy would retain at least a 50-percent working interest in Cambo and will remain the operator of the asset.

“Our agreement with Shell represents a meaningful step towards the development of Cambo, the second largest undeveloped field in the UKCS and a key asset in helping maintain the UK’s future energy security. Securing a new owner for Shell’s stake is an important step in Ithaca Energy progressing to Final Investment Decision,” said Ithaca Energy’s CEO Alan Bruce.

“We are actively engaging, in a constructive manner, with the UK government in pursuit of the fiscal stability required to make critical investment decisions that will support the UK’s long-term energy security,” Bruce added.

Neptune Energy has received its best environmental, social and governance (ESG) rating to date from Sustainalytics, putting it in the top 3 percent of all global oil and gas companies rated by the organisation.

In its latest ESG rating report, Sustainalytics stated Neptune’s ESG reporting “is in line with best practice standards. It has an executivelevel ESG committee responsible for ESG issues. Furthermore, management integrates climate transition risks into the wider business processes,” Neptune Energy said.

In announcing the Q1 2023 results, Neptune Energy said that the Seagull development offshore the UK is close to completion with start-up expected in July.

Harbour Energy said in its Q1 results release that as far as capital allocation is concerned, the company reduced UK activity in certain areas due to the Energy Profits Levy (EPL), including partner cancelled programmes at Elgin Franklin and Beryl and rephasing of certain decommissioning activities.

Harbour Energy’s review of the UK organisation is on track to complete in the second half of 2023 and expected to result in a reduction of around 350 onshore positions. This is forecast to deliver annual savings of approximately $50 million from 2024, following an estimated $15 million one-off charge to be taken in Harbour’s 2023 interim financial statements.

Hartshead has completed the farm-out agreement with RockRose Energy for the divestment of a 60-percent equity interest in its UK Southern Gas Basin License P2607. The farm-out materially de-risks the project and provides a clear pathway to full financing and subsequent project development of the previously producing gas fields.

A Final Investment Decision (FID) for Phase 1, which includes the redevelopment and drilling of the Anning and Somerville fields, will be taken in the third quarter of 2023, Hartshead said.

Shearwater has been awarded two 4D surveys by TotalEnergies over the Laggan, Tormore, and Edradour fields with an option to extend to the Glenlivet field. The surveys, beginning in May, will last around two months.

Diamond Offshore has been awarded a contract for the harsh environment semisubmersibles, Ocean Patriot, Ocean Endeavor, and Ocean GreatWhite in the UK North Sea, the service company said Energy services provider Expro has secured a new contract with Harbour Energy for a well abandonment campaign as part of the decommissioning project for the Balmoral area in the UK Continental Shelf. The multiyear contract, valued at more than $20 million, will utilize Expro’s Subsea Well Access technology with a combination of open-water and in-riser applications deployed from a semi-submersible rig.

Saipem has been awarded a contract for decommissioning activities in the North Sea by EnQuest Heather Limited, the Italybased energy services provider said in the middle of May. Saipem will work on the decommissioning of the Thistle A Platform, around 510 kilometres northeast of Aberdeen, in a water depth of 162 meters. Saipem’s activities entail the engineering, preparation, removal and disposal of the jacket and topsides, with possible extension to further subsea facilities.

www.ogv.energy I June 2023 10 ENERGY NEWS UK NORTH SEA UK NORTH SEA REVIEW SPONSORED BY

Stuart Payne, NSTA Chief Executive

BRENT OIL PRICES OVER THE YEARS

THE DIGITAL MEDIA STRATEGIST

DIGITAL MEDIA AND YOUR BOTTOM LINE

By Eric Doyle

What does Digital Media mean to you and your business?

Driving internet results: Making sure that your organisation, your team and all of your digital content is head and shoulders above anyone else in your sector.

BRENT OIL PRICE 2022 - $128.44

Oil prices rose in June as tight global supplies outweighed worries that demand would be pressured by a flare up in COVID-19 cases in Beijing. Oil supplies were tight as OPEC and allies were unable to fully deliver on pledged output increases because of a lack of capacity in many producers, with sanctions on Russia and unrest in Libya slashing outputs.

Is it something you do because you think you should?

Do you see it as a necessary evil?

Or is it core to your commercial success?

Most businesses have a website and do some sort of Digital marketing, whether that's some advertising or posting content on Social Media, but why do we do it? What is it really for, what does it do for you and, more importantly, what could it be doing?

Making a definable and measurable commercial impact to our bottom line.

Not once or twice…consistently.

It all starts with creating a detailed digital commercial strategy. Defining exactly what you need to do and where you need to be in order to affect the results you want.

Whilst many are simply posting the odd bit of content every now and then because they feel it's good for ‘visibility’, others have realised the weight of the opportunity if they take a strategic approach to the digital aspects of their commercial strategy.

BRENT OIL PRICE 2018 - $72.02

Major-oil producing countries agreed to jointly raise exports. Officials from OPEC, as well as other major oil producers like Russia, were set to increase their total output by around 1% of the global oil supply. Despite it being a relatively small addition to the world energy market, the move nevertheless signalled a willingness to address rising prices.

We talk about the ‘Digital Twin’ of your sector, how over the last 10 years a curtain has appeared that separates the traditional, analogue commercial processes we've all utilised for many years, from the modern digital commercial world. This applies to all of us, regardless of which sector we work in, the Digital Twin of your commercial sector is growing.

Some have noticed this evolution in Marketing, Sales and Business development and have developed effective strategies and applications to allow them to flourish in the Digital Twin of their sectors. Others are curious but have not yet fully bought in and the remainder are unaware of the opportunity.

One of the fundamentals is that the strategies and plays are very different in the Digital Twin of your sector, to that of which we know as traditional demand generation tactics and techniques. The modes of operation are different, the language is different and it requires a shift in mindset and process.

We always start with a question: Who are the leading technical and commercial digital influencers in your sector..?

Being a technical and commercial influencer may not be something you've ever considered and the concept doesn't sit well with everyone, but as the digital commercial evolution continues to grow, it's important for all professionals, of all ages, all disciplines to realise that this is important.

I often advise business leaders who tell me that they don't like social media “you may not like social media but I'm sure you like revenue, profit, ebitda and growth…” - the digital mindset shift.

As the digital commercial world grows, those that are leading in digital are soaking up all of the attention, the connections, the conversations and the commercial interaction in your sector.

So, imagine if the leading technical and commercial influencers in your sector were you and your team…

BRENT OIL PRICE 2013 - $105.80

Oil demand in developing countries surpassed that of wealthy nations for the first time. This was a demonstration of how rapid growth in Asia was changing trade and increasing competition for resources. Rising demand had boosted global oil prices but also encouraged countries to increase supplies, helping to keep a lid on prices.

With Digital Media we focus on 4 main areas: Creating influence within important business communities: How you and your team provide consistent proof that you understand the challenges of your prospect base and can provide the correct solutions to those challenges.

Creating demand for your products and services: Allowing your digital audience to buy into you, your team and how you can help them.

Gaining algorithmic favorability: Working in a way that means that digital channels are working with you, to support you.

Whether you are an engineering company, a service company or make widgets…the Digital Twin of your sector is open for business and growing.

We are in the midst of the biggest shift in modern commerce since the industrial revolution - the digital transformation. The question is, are you leading the digital charge in your sector and taking all of the benefit, or are you playing in the margins..?

We run an ‘Introduction to Digital Commercial Strategy’ session that unpacks all of this, and we would be happy to walk you and your team through it.

Eric

Live Digital ‘23 Eric Doyle F.ISP OGV Studio

Doyle is the Managing Director of The OGV Studio, a Digital Media Strategy company whose mission is to Energise your Media for growth. Eric is a Fellow of the Institute of Sales Professionals.

10 YEARS AGO 5 YEARS AGO 1 YEAR AGO BRENT OIL PRICE May 2023 $77.96

“GOOD MEDIA MAKES PEOPLE VISIBLE, GREAT MEDIA MAKES THEM THE LEADERS IN THEIR SECTORS...”

Europe Energy Review

By Tsvetana Paraskova

Equinor made a gas and condensate discovery near the Kristin field in the Norwegian Sea, but the primary exploration target for the wildcat well was to prove petroleum in Middle and Lower Jurassic reservoir rocks. Preliminary estimates place the size of the discovery in the Garn Formation between 0.2 and 1.1 million Sm3 of recoverable oil equivalent. The licensees will assess the discovery alongside other nearby discoveries/prospects, as regards further followup, the Norwegian Petroleum Directorate said.

In the middle of May, Equinor officially opened the Njord field, which had undergone extensive upgrades in the past years. Following the upgrades on the platform and the floating storage and offloading vessel (FSO), they are now ready for doubling the field life – and more than doubling production, the Norwegian energy giant said.

The Njord field started production in 1997 and was originally supposed to produce until 2013. Work with increased recovery means that there are still large volumes of oil and gas left, while new discoveries in the area can also be produced and exported via Njord. The field is now ready to produce and export oil and gas for another 20 years.

Neptune Energy and its partners, Vår Energi, Sval Energi, and DNO, began production from the Fenja oil and gas field in the Norwegian Sea. Fenja is expected to produce 35,000 barrels of oil equivalent per day (boepd, gross), via two oil producers, with pressure support from one water injector and one gas injector. Total reserves at the field are estimated between 50 and 75 million boe, of which 75 percent is oil and 25 percent is gas.

Oil & Gas

Norway’s Ministry of Petroleum and Energy announced the tender for the Awards in predefined areas (APA) 2023 on 10 May, encompassing the predefined areas with blocks in the Norwegian Sea, Norwegian Sea, and Barents Sea. Since the tender in 2022, the predefined areas (APA acreage) have been expanded by 78 blocks in the Barents Sea and 14 blocks in the Norwegian Sea. The deadline to apply for APA 2023 is 23 August 2023, while awards are expected during the first quarter of 2024.

Neptune Energy has also awarded a more-than-$100 million contract to Tenaris to provide equipment and services to support drilling activities on the Norwegian Continental Shelf. The contract covers the manufacture, transport, handling, and repair of a broad range of casing materials used in offshore drilling activities. Initially this will include support for one exploration well and one appraisal well in the Neptune-operated Gjøa area in the Norwegian Sea in 2023. The five-year contract has two two-year extension options.

Subsea7 was awarded a major contract by Turkish Petroleum for the second phase of the Sakarya gas field development offshore Turkey in the Black Sea. Subsea7 defines a major contract as being one where Subsea7’s share of revenue over $750 million. The contract is awarded to a consortium including Subsea7 and its partner in Subsea Integration Alliance, OneSubsea, as well as SLB and Saipem. The integrated project scope of the engineering, procurement, construction, and installation (EPCI) contract will cover the subsurface solutions including subsea production systems (SPS), subsea umbilicals and flowlines (SURF). Offshore activities are expected between Q2 2025 and Q3 2025, with optional scope between Q4 2026 and Q4 2027 subject to final investment decision by the client, Subsea7 said.

12 www.ogv.energy I June 2023 ENERGY NEWS

New hydrocarbon discoveries and project start-ups offshore Norway, opportunities to power offshore oil and gas platforms with wind power generation, and a number of projects and government awards in wind, solar, carbon capture, and green hydrogen marked the European energy scene this past month.

Drone photo of the Njord field in the Norwegian Sea. (Photo: Even Kleppa / Lizette Bertelsen – Equinor)

Low-Carbon Energy

Hywind Tampen, the world’s first project to deliver renewable power for offshore oil and gas, is already delivering power to the Snorre field, Equinor said in mid-May. This is a great milestone for the world’s largest floating offshore wind park, following first power to the Gullfaks field in 2022, the Norwegian firm said.

Another oil and gas operator offshore Norway, Vår Energi, has entered into a collaboration with Odfjell Oceanwind and Source Galileo to pursue a pilot project, GoliatVind, for floating offshore wind at the Goliat platform.

In a setback for a similar project, Equinor said on 22 May it would postpone a further development of the Trollvind offshore wind initiative indefinitely, due to rising costs and a strained timetable to deliver on the original concept.

“Trollvind was a bold industrial plan to solve pressing issues concerning electrification of oil and gas installations, bringing much needed power to the Bergen-area, while accelerating floating offshore wind power in Norway. Unfortunately, we no longer see a way forward to deliver on our original concept of having an operational wind farm well before 2030,” said Siri Espedal Kindem, vice president of renewables Norway.

In the UK, the North Sea Transition Authority (NSTA) offered for awards 20 carbon storage licences at offshore sites, including some near Aberdeen, Teesside, Liverpool, and Lincolnshire.

Once the new storage sites are in operation, they could make a significant contribution to the aim of storing up to 30 million tonnes of carbon dioxide (CO2) per year by 2030, approximately 10 percent of total UK annual emissions, NSTA said.

Land will be the crucial resource in the European Union’s energy transition, McKinsey & Company said in a report in May.

The amount of land required to meet the wind and solar PV capacity targets in Europe is significant. For example, in France, Germany, and Italy, where roughly 50 percent of the EU renewable energy sources (RES) installations are expected, meeting 2040 RES capacity targets would require an additional 23,000 to 35,000 square kilometers of land—an area equivalent to the size of Belgium, McKinsey’s analysts say. In addition, land will be needed to serve as a source of biogenic CO2 for bioenergy with carbon capture and storage and the production of e-fuels.

On top of that, technical, regulatory, and environmental constraints often reduce the amount of land available for RES development.

“Technical limits include existing RES installations and areas with limited natural wind or sun intensity. And regulatory and environmental limitations, which acknowledge local communities’ concerns about land use, can reduce the land available for RES development,” according to McKinsey.

A report from RenewableUK in early May urged the UK Government to work closely with the domestic green hydrogen industry to implement new policies to enable the UK to accelerate the rate at which it builds major projects as fast as possible.

“If the UK does not step up, it risks being left behind due to ambitious tax incentives and subsidies offered abroad, such as the United States Inflation Reduction Act, which may attract investment and prospective suppliers away from this country,” RenewableUK noted.

In company news, Cerulean Winds and partner Frontier Power International plan to build the North Sea Renewables Grid (NSRG), an offshore integrated green power and transmission system, powered by floating wind, that oil and gas platforms will plug into for clean power. Cerulean and Frontier Power International will develop three sites of hundreds of floating turbines, producing multiple GW of electricity, after being offered the lion’s share of seabed leases in the recent Crown Estate Scotland INTOG round.

Nova and consortium partners The University of Strathclyde, Shetland Islands Council, and Ricardo Energy have been awarded funding from the Scottish Government’s Emerging Energy Technologies Fund – Hydrogen Innovation Scheme for their Green Hydrogen and Oxygen Supply from Tidal Energy (GHOST) project. GHOST will look at the potential of producing green hydrogen and oxygen from Nova's tidal energy projects in Shetland.

TGS, a provider of energy data and intelligence, on 23 May announced the start of Norway’s first-ever LiDAR buoy measurement campaign to support offshore wind development. The first floating LiDAR buoy will be deployed in the Utsira-Nord zone and conduct wind, metocean, and environmental measurements to enhance decision-making for the three floating wind project areas to be awarded in Norway’s first floating wind lease round.

Repsol will develop renewable projects in Italy totalling 1,768 MW, the Spanish energy group said in mid-May. Repsol has a portfolio in the country that, once fully operational, will add 943 MW of wind and 825 MW of photovoltaic solar projects to the company's portfolio of renewable projects. More than 60 percent of the projects in Italy are at an advanced stage of development.

Aker Carbon Capture has been awarded a large-scale carbon capture project by Ørsted, a global leader in renewable energy, for the Ørsted Kalundborg Hub in Denmark. As the carbon capture provider, Aker Carbon Capture will deliver five Just Catch units, additional equipment such as liquefaction systems, and temporary CO2 storage and on-/offloading facilities. The carbon capture facilities will have an installed design capture capacity of 500,000 tonnes CO2 per year.

Aker Carbon Capture’s project award follows the 20-year contract award to Ørsted by the Danish Energy Agency (DEA) for its carbon capture and storage (CCS) project.

Irish wave energy developer OceanEnergy has signed up to demonstrate its OE35 floating wave energy converter at the European Marine Energy Centre (EMEC) in Orkney, Scotland. OceanEnergy intends to demonstrate the OE35 over two winter periods from 2024 at EMEC’s Billia Croo wave energy test site off the west coast of Orkney.

Germany-based specialist for water electrolysis, thyssenkrupp nucera, and Swedish industrial start-up H2 Green Steel have entered into an agreement to develop one of the world’s largest electrolysis plants. The deal secures capacity of more than 700 MW for H2 Green Steel’s electrolysis plant in Boden – making it one of the world’s largest electrolysis plants announced to date. The agreement with thyssenkrupp nucera will cover alkaline water electrolysis technology (AWE) and large-scale electrolysis plant engineering.

13 EUROPE EUROPE NEWS SPONSORED BY

Photo: akercarboncapture.com

digitisingreality.com

Assets Digitised. Savings Realised.

From flare tip to the jacket, Digitising Reality can create a digital twin of your offshore asset so you can efficiently manage your resources effectively.

Energy Review

By Tsvetana Paraskova

A total of 16 upstream deals for a combined $8.6 billion were announced in the first quarter. Of those, more than $5 billion in deals took place in the Eagle Ford shale play, in “a surprising resurgence in that mature play,” Enverus noted.

The value of the M&As was down by around 20 percent compared to the first quarter average since 2016, while deal volume also continued its multi-year collapse with a disclosed volume of 80 percent less than the Q1 average. That resulted in an average deal size of more than $500 million.

largest chemical makers, UK-based INEOS, which entered US oil and gas production after agreeing to buy Eagle Ford assets from Chesapeake Energy for $1.4 billion. This agreement was the fourth-biggest in terms of value in the US upstream in the first quarter, according to Enverus’ estimates.

The US oil and gas industry continues to call on legislators to enact a permitting reform, which, the sector says, is crucial for securing a reliable and affordable energy supply in the future.

Slow US Deal-Making in Q1

The US shale patch still has opportunities for mergers and acquisitions (M&As), despite the fact that upstream deals fell in terms of both volume and value in the first quarter, Enverus Intelligence Research (EIR) said in a report in early May.

“Last quarter was an outlier in terms of the deal targets and types for upstream transactions,” said Andrew Dittmar, director at Enverus.

“Rather than public E&Ps focusing on buying undeveloped inventory in the Permian Basin from private companies, most of the deals targeted mature assets in the Eagle Ford and included more public-to-private transactions plus a corporate merger.”

The Eagle Ford has producing assets whose proximity to the US Gulf Coast has drawn buyers from outside the US in recent months. Such a deal was agreed by one of the world’s

However, if buyers look for undeveloped assets, the top shale-producing play, the Permian, is the place to go, the analysts at Enverus say. Yet, rising prices for undeveloped acreage in the Permian have been weighing on the deal-making market in recent months.

“M&A may have slowed, and shale may be in its later innings, but there are still opportunities to be had,” Enverus’ Dittmar said.

“The scramble for dwindling inventory is on, and oil prices are in a good place for M&A where both buyers and sellers feel comfortable transacting.”

But deals in the gas sector could continue to be challenged in the near future by volatile and low US benchmark natural gas prices, according to Enverus.

14 www.ogv.energy I June 2023 ENERGY NEWS SPONSORED BY

The US oil and gas sector saw major projects approved over the past month while the industry continues to call for a lasting, bipartisan permitting reform that would unlock more domestic energy resources.

Natural Gas Production and LNG Exports Set for Long-Term Growth

Despite the current low gas prices and the slowdown in drilling activity, US natural gas production is set to grow by 15 percent and LNG exports are expected to surge by 152 percent between 2022 and 2050, the US Energy Information Administration (EIA) forecasts in the reference case in its Annual Energy Outlook 2023.

The EIA expects natural gas production to rise to 42.1 trillion cubic feet (Tcf) by 2050, largely driven by LNG exports. Natural gas production growth on the Gulf Coast and in the Southwest reflects increased activity in the Haynesville Formation and Permian Basin, which are close to infrastructure connecting natural gas supply to growing LNG export facilities, the US administration said.

“We project continued rising global demand for natural gas, which makes it economical to build additional LNG export facilities in the United States,” the EIA said in the outlook.

First Major US Refinery Expansion since Pandemic

The US also saw earlier this year the first major refinery capacity expansion come online since the COVID-19 pandemic. ExxonMobil raised the capacity of its Beaumont refinery on the US Gulf Coast by 250,000 barrels per day (bpd), bringing total processing capacity to more than 630,000 bpd and making it one of the largest refineries in the United States.

The pandemic has led to several refinery closures, and US refinery distillation capacity decreased from 19.0 million bpd at the start of 2020 to 17.9 million bpd at the start of 2022, the EIA notes

Beaumont’s added capacity is the largest of a cluster of new capacity expected to come online in 2023 and 2024, much of it concentrated on the Gulf Coast. The region has historically been the largest refining hub in the United States and hosts 8 of the 10 largest refineries in the country, the EIA said.

US Oil and Gas Industry Delivers $1.8 Trillion in Economic Benefits

The US oil and natural gas industry supported 10.8 million jobs and contributed nearly $1.8 trillion to the US economy in 2021, a new study commissioned by the American Petroleum Institute (API) and prepared by PricewaterhouseCoopers (PwC) showed in the middle of May.

The jobs the industry supported accounted for 5.4 percent of total U.S. employment, while the oil and gas sector generated an additional 3.7 jobs elsewhere in the US economy for each direct job in the natural gas and oil industry.

The industry produced $909 billion in labour income, or 6.4 percent of the US national labour income, the study showed.

Oil and gas activities also supported nearly $1.8 trillion in US gross domestic product, accounting for 7.6 percent of the national total GDP.

Naturally, Texas is the biggest driver of economic contributions from oil and gas, generating $454.5 billion for the state’s economy.

While highlighting the benefits of the industry to the US economy, API continued to call on lawmakers to pass a durable permitting reform.

In early May, US Senators Shelley Moore Capito (R-W.Va.), Ranking Member of the Senate Environment and Public Works (EPW) Committee, and John Barrasso (R-Wyo.), Ranking Member of the Senate Energy and Natural Resources (ENR) Committee, introduced two pieces of legislation to substantively reform the permitting and environmental review processes.

API President and CEO Mike Sommers commented on the introduction of the bills, “Modernizing our permitting process will speed up approvals, create American jobs, and enable the faster movement of energy where it is needed most. Thanks to new bills from Senators Barrasso and Capito we are another step closer to bipartisan permitting reform, and we will continue to work with lawmakers to achieve durable reform for the benefit of all Americans.”

Days before that, API had joined with other members of the Natural Gas Council in sending a letter to US Senate leadership urging them to advance policies that would expedite the permitting process by creating clear timelines, clarifying the scope of agency review, and reducing the uncertainty around judicial review.

“Clear, predictable infrastructure permitting processes remain instrumental to achieving our shared energy, economic, security, and climate-related goals,” the Natural Gas Council wrote in the letter

“Unfortunately, the current processes to site and approve new and expanded infrastructure remain cumbersome, often stalling projects for years with duplicative reviews, unnecessarily burdensome approvals, and unending legal challenges. These inefficiencies hamper access to domestic natural gas resources, creating reliance on imports, raising energy costs in certain regions, and, in the worst cases, limiting access to energy during periods of extreme weather,” the letter reads.

US Oilfield Services Employment Rises To The Highest Since March 2020

Employment in the US oilfield services and equipment sector increased by 5,143 jobs to its highest level since March of 2020, preliminary data from the Bureau of Labor Statistics (BLS) and analysis by the Energy Workforce & Technology Council showed in May.

Employment in April reached 662,454, and the increase continues to bring the sector closer to the pre-pandemic numbers of 706,528 in February 2020, Energy Workforce said.

“The April job increases are significant and show the resilience of our sector through a slowing overall economy. The oilfield services sector is thriving and welcoming new talent across numerous specialties,” said Leslie Beyer, CEO, Energy Workforce & Technology Council.

“Our sector continues to exceed expectations by meeting spikes in demand while developing new technology and deploying innovative production processes that are lowering emissions.”

15 UNITED STATES US NEWS SPONSORED BY

“Modernizing our permitting process will speed up approvals, create American jobs, and enable the faster movement of energy where it is needed most."

API President and CEO Mike Sommers

Photo: Beaumont Refinery - ExxonMobil

MIDDLE EAST Energy Review

By Tsvetana Paraskova

OPEC expects China’s economic rebound to lead global oil demand growth this year, Saudi Aramco reported lower first-quarter profits as oil prices declined, and demand for onshore drilling rigs in the Gulf is expected to jump over the next five years—these were the highlights in the oil and gas sector in the Middle East over the past month.

OPEC Leaves Oil Demand Forecast Unchanged

OPEC, the Organization of the Petroleum Exporting Countries dominated by the biggest producers in the Middle East, left its global oil demand forecast for 2023 broadly unchanged in its monthly report for May. OPEC sees the world’s oil demand growing by 2.3 million barrels per day (bpd) this year, with the OECD projected to grow by nearly 100,000 bpd and the non-OECD expected to grow by about 2.3 million bpd.

Minor upward adjustments were made due to the better-than-expected performance in China’s economy, while other regions are expected to see slight declines, due to economic challenges that are likely to weigh on oil demand, according to OPEC.

SPONSORED BY

www.craig-international.com

For 2023, the forecast for non-OPEC liquids production growth also remained unchanged from the previous month’s assessment, at 1.4 million bpd year over year. The main drivers of liquids supply growth are expected to be the US, Brazil, Norway, Canada, Kazakhstan, and Guyana, while declines are expected primarily in Russia, OPEC said.

“Uncertainties remain, primarily related to the potential of US shale oil output and unplanned field maintenance in 2023,” the organization noted.

Specifically for the US, crude oil and condensate production is forecast to grow by 700,000 bpd in 2023 compared to 2022, according to OPEC’s estimates.

The cartel, however, cautioned that there are a lot of uncertainties on the oil market, which could affect supply and demand going forward.

“Uncertainties to the forecast remain large, especially given ongoing geopolitical developments in Eastern Europe. Moreover, high inflation levels, coupled with supply chain issues and monetary tightening by major central banks may also impact the cost of oil production and upstream sector investment levels,” OPEC said.

The Chinese economy is rebounding after the re-opening, although recent macroeconomic data suggest a more nuanced picture. Still, OPEC expects China’s higher economic

Smart Procurement

At Craig International, procurement isn’t just about processes, products and numbers. We promote a culture of ownership among our people, who are trusted to get on with the job on your behalf. We’re proud of how we serve clients.

We’re always looking for new ways to add value and routinely introduce new technological solutions to make service delivery even simpler, smoother, faster.

growth this year compared to the low growth pace in 2022 to support oil demand.

“Fuelled by the growth dynamic that was unleashed by reopening effects, China’s economy is forecast to considerably rebound from last year’s COVID-19-impacted low growth of only 3% y-o-y,” OPEC said in its report.

China’s oil demand growth surged by 1.4 million bpd year-over-year in March, up from the annual growth of 900,000 bpd in February. The strong rebound in economic and social activity amid feedstock requirements for the petrochemical sector supported oil product demand, OPEC noted.

For the second quarter of 2023, Chinese oil demand is set for 1 million bpd growth, thanks to rising international airline activity and improving petrol demand amid a strong rebound in mobility. Diesel consumption is also expected to recover due to infrastructure expansion and fiscal stimulus.

Third-quarter demand is also expected to rise, by 800,000 bpd year over year, due to jet fuel demand growth, an increase in light distillates demand, and continued expansion of the petrochemical industries. Increased mobility and rising construction activity will boost demand for petrol and diesel, OPEC said.

16 www.ogv.energy I June 2023 ENERGY NEWS

Gulf Onshore Drilling Rig Demand Set for 25% Growth by 2027

The Middle East GCC region is expected to see 25-percent demand growth for land rigs in the over the 2023-2027 period, as Saudi Arabia and the United Arab Emirates (UAE) pump billions of US dollars into reaching their higher production capacity targets, Westwood Global Energy Group said in a new report, MENA Onshore Drilling Rig Market Forecast.

The Middle East and North Africa (MENA) region currently hosts a fleet of 1,159 identified land drilling rigs. The Gulf Cooperation Council (GCC) leads supply with 526 units, or 45 percent of the MENA fleet. North Africa and Other Middle East contain 27 percent and 28 percent, respectively. The largest fleets are hosted by Saudi Arabia, Algeria, and Kuwait, while Iraq and Iran also host fleets of over 100 units, Westwood says.

Analysts at Westwood expect that the GCC will continue to grow strongly throughout the five-year forecast. Demand in 2027 is expected to be 53 percent higher than 2019, driven by production capacity increases at all major onshore producers, with many of the projects required already having passed final investment decision (FID), said Todd Jensen, Senior Analyst – Onshore Energy Services, at Westwood.

Saudi Aramco Profit Slides on Lower Oil Prices

Saudi Aramco, the biggest oil company in the world in terms of both production and market capitalisation, reported in May a decline in its first-quarter net income, due to lower crude oil prices. Aramco’s net income stood at $31.9 billion, down from $39.5 billion for the same period of 2022, but still above the analyst consensus of $30.9 billion in profits. Cash flow from operating activities rose to $39.6 billion from $38.2 billion, while free cash flow inched up to $30.9 billion, from $30.6 billion for the first quarter of 2022.

In the first quarter of 2023, Saudi Aramco’s average realized crude oil price fell to $81.0 per barrel, from $97.70 for the same period last year.

“We are also moving forward with our capacity expansion, and our long-term outlook remains unchanged as we believe oil and gas will remain critical components of the global energy mix for the foreseeable future,” President and CEO Amin Nasser commented, reiterating Aramco’s view that oil and gas will be in demand for decades to come.

Apart from the regular dividend of $19.5 billion for the first quarter, the world’s largest oil firm announced its intention to introduce a mechanism for performance-linked dividends in addition to the base dividend it currently distributes.

“The Company intends to target such performance-linked dividends to be in the amount of 50-70% of the Group’s annual free cash flow, net of the base dividend and other amounts including external investments, to be determined with the annual results,” Aramco said.

Projects & Other News

Aramco also announced in May new leadership positions and appointments. The company has appointed Nasir K. Al-Naimi as President of its Upstream business, and Mohammed Y. Al Qahtani as President of the Downstream business, both reporting along with Aramco’s Executive Vice Presidents to the Company’s President & CEO. The newly created positions and appointments, approved by the Board of Directors, will be effective from July 1, 2023 and will replace the previous Upstream and Downstream Executive Vice President positions, respectively. These appointments will help drive Aramco’s long-term strategy across its global portfolio and value chain, the oil firm said.

“We expect this decision to help drive operational and financial performance, supporting our upstream capacity growth and our downstream expansion, together with our ambition to achieve net-zero Scope 1 and Scope 2 greenhouse gas emissions across wholly-owned operated assets by 2050,” President and CEO Amin Nasser commented.

In the UAE, ADNOC announced in early May that its low-carbon LNG growth project would move forward in the Al Ruwais Industrial City, Al Dhafrah, Abu Dhabi. The project will help ADNOC to more than double its LNG production capacity to meet increased global demand for natural gas. The plant, which is designed with electric-powered processing facilities, will run on renewable and nuclear grid power, making it one of the lowest carbon-intensity LNG facilities in the world.

As an operational hub for ADNOC and its operating companies, the selected location offers significant synergies and existing infrastructure that will be leveraged to deliver project efficiencies, unlocking additional value for ADNOC, its partners and the UAE, the Abu Dhabi company said.

The proximity of Al Ruwais to ADNOC’s current operations, as well as its future growth projects, in addition to a well-established local supplier base, were important considerations in the company’s decision.

QatarEnergy awarded in the middle of May the engineering, procurement, and construction (EPC) contract for the North Field South (NFS) project, which comprises two LNG mega trains with a combined capacity of 16 million tons per annum (MTPA). The announcement was made during a ceremony held to mark the award of the EPC contract for the two LNG trains and associated facilities with a joint venture of Technip Energies and Consolidated Contractors Company (CCC).

NFS, together with the North Field East (NFE) project, will increase Qatar’s LNG production capacity from the current 77 MTPA to 126 MTPA.

QatarEnergy holds a 75-percent interest in the NFS project and has already signed partnership agreements with TotalEnergies, Shell, and ConocoPhillips for the remaining 25 percent.

17 MIDDLE EAST MIDDLE EAST NEWS SPONSORED BY

"We are also moving forward with our capacity expansion, and our long-term outlook remains unchanged as we believe oil and gas will remain critical components of the global energy mix for the foreseeable future"

President and CEO Amin Nasser commented

“Demand in 2027 is expected to be 53 percent higher than 2019, driven by production capacity increases at all major onshore producers, with many of the projects required already having passed final investment decision (FID)"

Todd Jensen, Senior Analyst –Onshore Energy Services, at Westwood.

ENERGY PROJECTS MAP

CHINA

Weizhou 10-3W Oil Field

Roc Oil Company Ltd

$100 million

Roc Oil is advancing its plan to develop the Weizhou 10-3W oil field. It is stated that the development will include a new wellhead platform and a central processing platform, along with a subsea pipeline and cable. The project is formally in the Basic Design Phase to detail facilities, drilling and completion, subsurface program, and EIA report. The FID is planned for 2023.

SPONSORED BY

www.eicdatastream.the-eic.com

Equinor

Equinor has reached a final investment decision on the project. The $9 billion investment will feature a new FPSO, with commercial production expected in 2028. Modec has confirmed a contract award for the BM-C-33 FPSO following an FID by Equinor. The two-phase turnkey contract includes both FEED and EPC work. TechnipFMC has been awarded the EPCI contract for the project's SURF scope.

GUYANA

Uaru Oil Field

$12.7 billion

ExxonMobil ExxonMobil, following government approval, reached a final investment decision on the project. The project is targeting the production of 800 million barrels of oil. Offshore Frontier Solutions, a Modec-Toyo joint-venture, will be responsible for the EPCI of the Errea Wittu FPSO. Saipem has confirmed a contract award for the design, fabrication and installation of subsea umbilicals, risers and flowlines associated for the development. TechnipFMC has been awarded a contract for the provision of project management, engineering, and manufacturing services to deliver the overall subsea production system.

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

ANGOLA

Cameia-Golfinho Field Development Project

$5 billion

TotalEnergies

ANPG, TotalEnergies and Sonangol have inked a head of agreement (HOA) on the future development of the Cameia and Golfinho fields. The HOA marks an important milestone towards FID scheduled for 2023 after receiving the partner's and authorities' approvals.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

18 www.ogv.energy I June 2023

BRAZIL

Block BM-C-33Pão de Açucar Gas Field $9 billion

3 9 6 10 1

1 7 3 2 4 5 12 2 8 11 4

5 USA

BRAZIL Bijupirá-Salema Field Decommissioning Project

$50 million

Shell

Modern American Recycling Services Europe (MARS) has received a limited notice to proceed (LNTP) for the dismantling and recycling of the Fluminense FPSO. A formal contract award will take place in 2023. The FPSO is expected to arrive at the MARS Europe yard in Denmark in 2024.

USA

Kaskida Offshore Oil Field

$15 billion

BP

BP has decided to move forward to the concept selection process for the Kaskida project following positive results at the Mad Dog Phase 2 project. BP's plan is to issue a FID in 2024. Development costs are estimated at US$15-20 per barrel.

Sparta Offshore Oil Field

$5.5 billion

Shell

Worley has been awarded another FEED contract to provide engineering and design services for the project. Under the agreement, Worley will provide engineering, design, procurement support, construction and commissioning support for the FEED work and detailed design on various phases of the project. The FID of the project has been postponed to Q4 of 2023.

PAPUA NEW GUINEA Elk-Antelope Gas Field

$1.5 billion TotalEnergies

A consortium consisting of PT Tripatra Engineers, Saipem and Daewoo Engineering & Construction has been awarded a FEED contract for the PNG LNG's upstream facilities. The contract covers phase 2 of FEED from the central processing facility (CPF) and well pad construction for ElkAntelope, which will supply natural gas for PNG LNG.

8

EGYPT Raven Infill Drilling Project

$100 million BP

Subsea7 has been awarded a contract for the two-well tie-back at Raven. The scope of the contract encompasses engineering, procurement, transportation, and installation of approximately six kilometres of flexible pipes, umbilicals, and related subsea structures in water depths of approximately 800 metres. Project management and engineering will be overseen from Subsea7 offices located in France, the UK, and Portugal.

AUSTRALIA

Rafael Gas Discovery

$500 million

Buru Energy

Buru Energy is looking to proceed with FEED phase for the project following delineation drilling in 2024.

It is mentioned that the pre-feasibility study has been completed and found that 1.6mtpa FLNG facility is technically, commercially and economically feasible option to commercialise the Rafael gas development project. However, the operator is still keeping the development options open via in-house and third party studies.

QATAR

North Field Production Sustainability (NFPS) Compression ProjectPhase 1 & 2

$5 billion

Qatargas Ranhill Worley has stated that it has been awarded the contract by Saipem to provide detailed engineering design for the two compression complexes. The value of the contract is $50 million. The work is expected to be completed by Q3 2024.

12

MEXICO

Block 30 – Kan Oil Discovery

$250 million

Wintershall DEA

Wintershall Dea has announced an oil discovery at Block 30 following the drilling of the Kan-1EXP exploration well. Drilled by the Borr Ran jack-up rig, well was drilled to a total depth of 3,317m and identified more than 170 metres of net pay of good quality oil in the Upper Miocene formation. An updip sidetrack was carried out to a depth of 3,087m, identifying about 250m of net pay across the main reservoir sands. Wintershall Dea and partners plan to present an appraisal plan to Mexican authorities by the end of July 2023.

19 WORLD PROJECTS WORLD PROJECTS SPONSORED BY

9

6

10

11

7

OFFSHORE WIND SET FOR LONGTERM GROWTH DESPITE NEAR-TERM HEADWINDS

By Tsvetana Paraskova

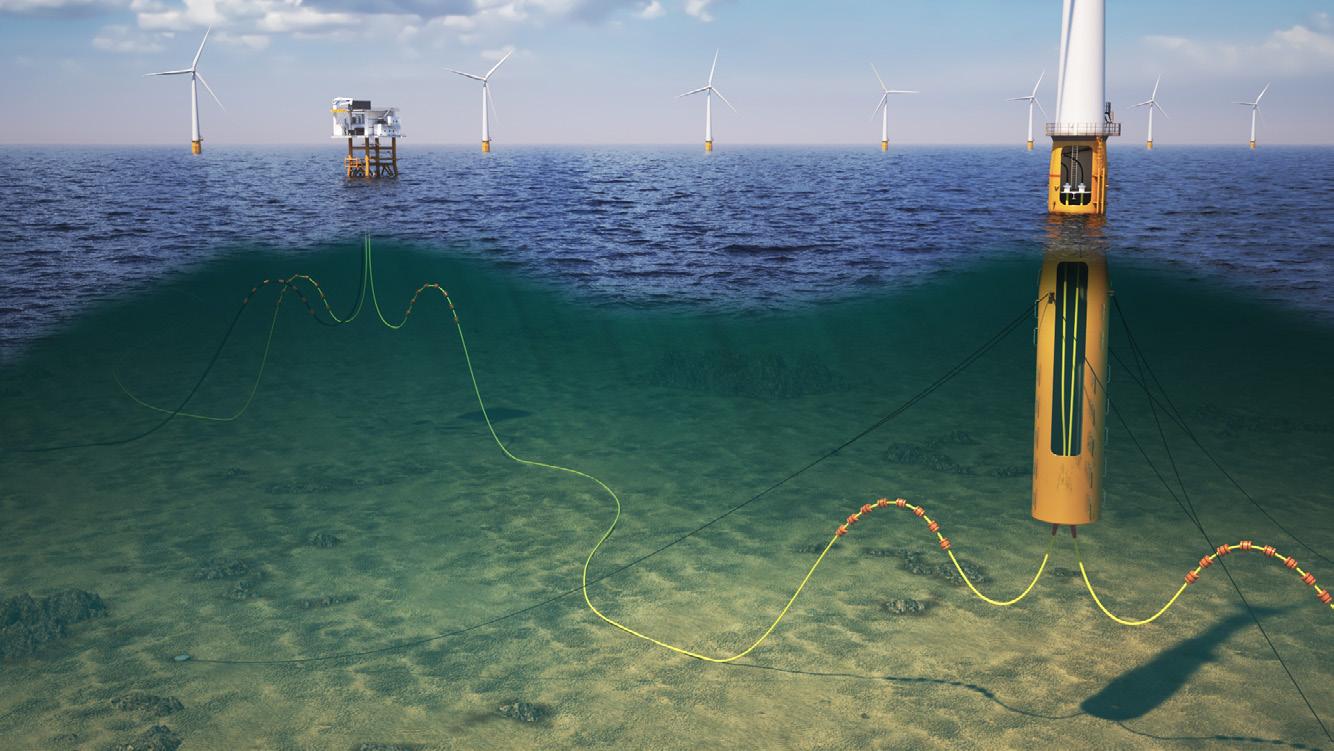

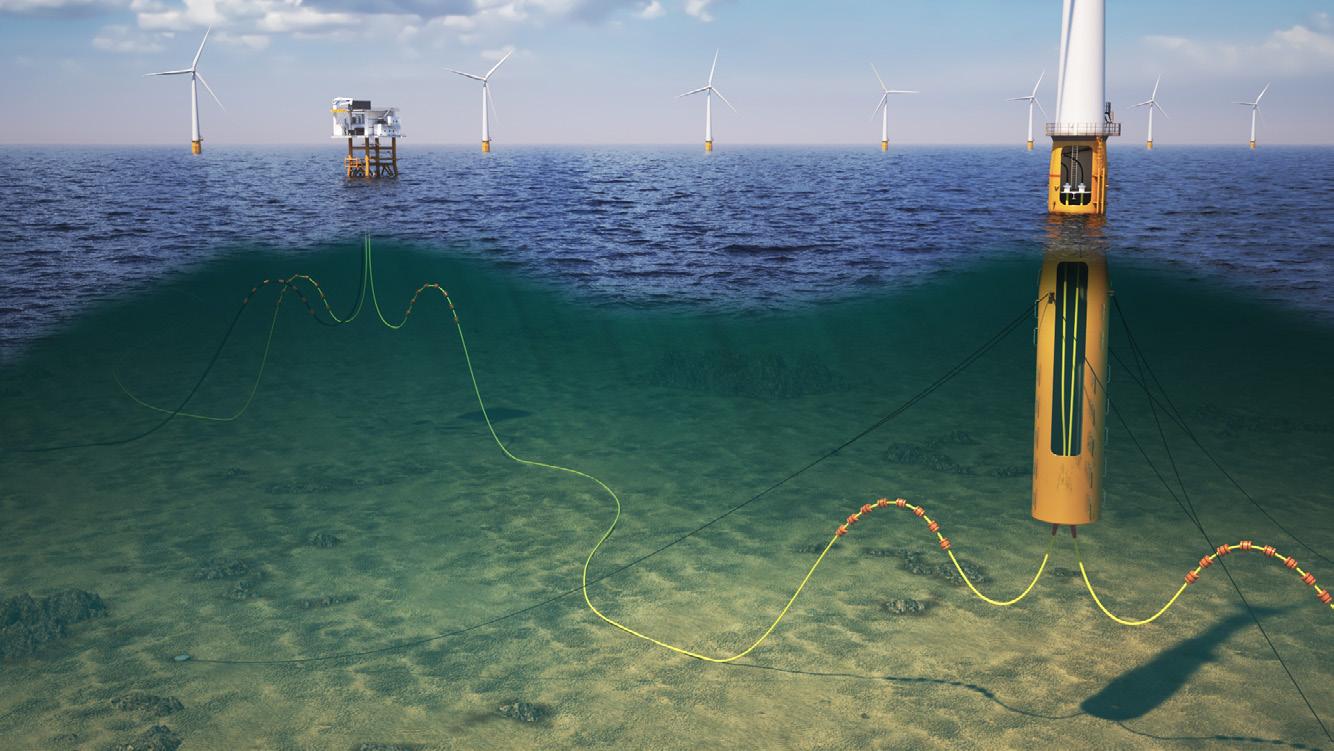

The offshore wind industry is poised for exponential growth over the next decade amid expected technology and supply-chain development and policy support that will make offshore wind more accessible in more regions around the world.

Despite current setbacks in installations in wind energy – including onshore and offshore – due to supply chain issues and cost inflation, the wind power sector will be a key driver of global renewable capacity additions, with increased focus on offshore wind, analysts say.

Wind Energy Market To Top 1 TW by Year-End

Global wind energy installations are set to exceed one terawatt (TW) by the end of 2023, Wood Mackenzie said in its latest outlook on the industry in April.

Growth will accelerate significantly this decade. It took wind energy 40 years to reach the first TW, but the next TW of installations will need only eight years, Wood Mackenzie Research Director Luke Lewandowski said.

“The next decade will also see an intensified focus on offshore wind as the sector matures and technology innovation and supply chain development help make offshore development more accessible in different regions,” WoodMac noted.

“The global offshore wind sector will experience sevenfold growth by 2032 and account for a 26% share of total capacity over the ten-year outlook.”

Over the next decade, offshore wind capacity will be added in 30 countries, with Europe and China leading global offshore capacity additions with an 81-percent share, according to WoodMac.

Despite near-term setbacks due to supply chain issues, the long-term outlook for offshore wind installations is bright, the energy consultancy says.

Europe, where countries have boosted capacity targets in the wake of the energy crisis, is expected to add more than 343 GW of offshore and onshore wind capacity over the next ten years. Offshore wind is expected to account for 39 percent of new capacity, although onshore growth in emerging markets in Eastern Europe and Uzbekistan, and the repowering of ageing fleets in more mature markets, including Germany and Spain, will also contribute, WoodMac said.

Short-Term Headwinds

Despite the current headwinds with supply chain and cost inflation, the wind power industry should be optimistic about the longer-term prospects, the consultancy said in a separate analysis this year.

“Despite the recent inflationary pressure, onshore wind remains one of the cheapest energy sources globally, while offshore wind leads the cost reduction race by 2050, due to capex and opex improvements and economies of scale,” Wood Mackenzie noted.

Global commissioning of wind turbines declined by 15 percent to 86 GW in 2022, as supply chain constraints and uncertainty around subsidies hit project development, BloombergNEF said in its Global Wind Turbine Market Shares report earlier this year.

Commissioning of new offshore turbines fell to 9.1 GW, which was down by 46 percent compared with 2021. The drop was partly offset by strong activity in the UK which commissioned more than 3 GW of offshore wind for the first time, BloombergNEF said.

“We expect the drop in offshore wind to be short-lived,” said Oliver Metcalfe, head of wind research at BloombergNEF.

“Germany and the Netherlands will install major projects again in 2023, while the industry will also ramp up in newer markets like France and Taiwan.”

Last year, Europe invested 17 billion euros in the construction of new wind farms, the lowest investment level since 2009, industry association WindEurope said in its Annual Financing and Investment Trends report at the end of March. The investment financed wind farms with a total capacity of 12 GW in all of Europe, including 10 GW in the EU. These wind farms will be built over the next few years and must not be confused with

OFFSHORE WIND

20

annual installations. In 2022 the EU installed 16 GW and WindEurope estimates that the EU will build on average 20 GW of new wind farms over the next five years, the association says.

Yet, Europe needs to add more capacity each year to reach the targets, WindEurope said.

In 2022, there were no Final Investment Decisions (FIDs) for large-scale offshore wind farms. France was the only country to finance two small floating offshore wind projects with a total capacity of 60 MW, the report found. At least three commercial-scale offshore wind farms were projected to reach FID in 2022 but delayed the decision, and WindEurope now expects them to reach FID this year.

Permitting delays and emergency measures in some EU electricity markets deterred investors last year, according to the association. In addition, the rising interest rates impacted the economics of wind energy projects in 2022.

“Especially big and CAPEX-heavy offshore wind projects are sensitive to interest rate changes and financing risks,” WindEurope noted.

Industry Calls for Acceleration of Offshore Wind Installations

At the WindEurope Annual Event 2023, the industry called for acceleration of the permitting process, support and expansion of the supply chain, acceleration of grid build-out, and optimisation of the use of the electricity grid.

Sven Utermöhlen, CEO Offshore Wind at RWE, said, “It’s time to ramp up the European offshore wind supply chain on a large scale. What we need is a targeted action plan and cost-reflective offshore wind auction designs. Only with the right investment framework can offshore wind create valuable jobs in the future and deliver long-term low-price electricity.”

Rasmus Errboe, Executive Vice President and CEO Europe at Ørsted, commented, “It’s time for a new societal contract in offshore wind and renewable energy.”

“The complexity we face should not stop us from taking the next step forward. Together, let’s open the path to progress,” Errboe added.

The supply chain needs to rapidly expand for Europe to meet its wind energy capacity targets by 2030, Rystad Energy said in a recent report produced in cooperation with WindEurope.

“While the energy crisis and postCovid-19 recovery spurred renewable energy commissioning, materials and components price inflation has put the wind energy supply chain under severe financial pressure,” according to the report published in April.

The estimated supply-demand balance shows that for wind energy capacity targets to be met by 2030, there would be a need to rapidly expand capacities across the supply chain unique to wind, including turbines, towers, foundations, and wind turbine installation vessels (WTIVs), among others, the authors of the report wrote.

UK Offshore Wind Generation Sets Record

Offshore wind farms in UK waters generated enough power to meet the electricity needs of 41 percent, or 11.5 million, of the nation’s homes in a new record year in 2022, the latest Offshore Wind Report from The Crown Estate showed at the end of April.

Offshore wind generated 45 TWh of electricity last year, up from 37 TWh in 2021 and a six-fold increase over the past 10 years. Offshore wind is estimated to generate enough electricity to meet the needs of nearly half (47 percent) of UK homes by the end of this year.

The new record in 2022 was achieved despite wind speeds coming in lower than the longterm average. In 2022, Hornsea 2, the world’s largest offshore wind farm with capacity to power 1.1 million homes, became fully operational, as did Moray East off the North East coast of Scotland.

There are now 50 wind farms in UK waters which are either operating or under construction, with another seven that have secured a Contract for Difference (CfD),

The Crown Estate said. The average size of an operating wind farm stands at 0.3 GW, while the average size of a wind farm under construction is 1.1 GW, according to the report.

Last year, UK offshore wind capacity accounted for 24 percent of global capacity, second only to China, with continued progress to push hard to meet the Government’s target of 50 GW of offshore wind capacity by 2030.

“With more demands than ever on the nation’s invaluable seabed, we must work across sectors to carefully plan how to unlock its full potential whilst supporting a thriving natural world for the benefit of the nation,” said Gus Jaspert, Managing Director for Marine, The Crown Estate.

US Offshore Wind Market Grows Rapidly

In the US, the offshore wind market is rapidly growing, with projects across 32 leases totalling 51,377 MW of expected capacity, which would be enough electricity to power the equivalent of more than 20 million US homes, the American Clean Power Association (ACP) said in a report in early May.

Currently, just 42 MW of offshore wind capacity is online in the US.

The East Coast dominates the projects, with 84 percent of the project pipeline, accounting for 43,115 MW.

The US domestic supply chain for offshore wind is also expected to see significant growth, with 14 facilities announced or under construction. Investment announcements for major offshore wind components have exceeded $1.7 billion, and with three state solicitations pending, more supply chain investments are anticipated, bolstering the sector’s expansion, ACP said.

Still, project costs are rising, due to disruptions in the current supply chains, increases in commodity prices, inflation, and higher interest rates, the association noted. These near-term challenges add to the currently lengthy and unclear permitting and regulatory timelines.

“A strong, collaborative approach between industry stakeholders and government bodies will help us tackle obstacles – like clarifying permitting processes – and realize the full potential of offshore wind as a key component of our clean energy future,” said John Hensley, ACP’s VP of Research & Analytics.

21 OFFSHORE WIND

Offshore wind is estimated to generate enough electricity to meet the needs of nearly half (47 percent) of UK homes by the end of this year.

For the borehole inspection work scope, we used our in-house design and assembly expertise to develop a bespoke inspection tool that could be deployed from a vessel to inspect, survey, and verify successful completion of the drilled sockets. In addition, utilising existing in-house tooling, we engineered solutions for dredging the socket base, jet cleaning the upper socket casing, and removing any debris remaining inside the casing anulus prior to grouting operations commencing. The grout monitoring scope involved the development of a bespoke autonomous monitoring system with sacrificial grout sensor arrays to enable real time monitoring of the grouting process taking place below seabed level. The system provides remote positive verification of grout level to the correct elevation to ensure foundation integrity is met.

More recently, Ashtead Technology was approached to provide an engineered solution for a specific challenge our customer had on installed wind turbine generator jacket foundations. Using our extensive in-house expertise and rapid response capability, we designed, manufactured, and successfully tested a custom tooling solution for honing the internal bore of the j-tube within four weeks of order confirmation. For this project, we provided a fully integrated service supply including the design, manufacture, test, mobilisation, and provision of offshore operation personnel helping to reduce overall project cost and time.

Proven and innovative marine technology solutions for the offshore renewable energy industry

With 38 years’ experience in the energy services sector, Ashtead Technology has a long-established reputation as the go-to partner for underwater operations.

Using our technology and know-how, needed to solve underwater survey, mechanical and asset integrity challenges, Ashtead Technology supports offshore renewables projects from consent & planning and project development, through to construction & installation, operations & maintenance, and repower & decommissioning work scopes.