SKILLS & TRAINING

GLOBAL ENERGY

ENERGY

GLOBAL ENERGY

ENERGY

The OPITO Open Learning portfolio, accredited by City & Guilds, allows learners to tailor their learning around their personal and work commitments while gaining an industry-recognised certification.

Oil & Gas Electrical Engineering Systems

Subsea Technology Series

Petroleum Processing Technology Series

Oil and Gas Well Technology Series

Introduction to the Oil and Gas Industry

Helicopter Publications

Explore more here

Welcome to the July issue of OGV Energy Magazine, where we explore the theme of ‘Skills & Training’

A big thank you to our front cover partner Comet, you can read how Comet continues to be a leading provider of risk intelligence software and technology solutions for organisations to continually improve and be risk-aware on pages 4-5 .

We also have contributions from Solab IT Services, Brimmond Engineering, Drift Offshore, Brodies LLP and Leyton. The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, Middle East, and the USA along with industry analysis and project updates from Westwood Global Energy Group, the EIC and Renewables UK.

Warm regards Dan Hyland - Director

Whilst COMET continues to be a leading provider of risk intelligence software and technology solutions, our wider Learning & Development services also offer meaningful opportunities for organisations to continually improve and be risk-aware.

Through many years of application, COMET has learned that in order to effect lasting performance improvement, you must first understand what works well and what doesn't when it comes to the influences that affect culture, morale, leadership, and inclusivity.

Change that comes as a surprise is rarely welcomed and is often challenged in an operational environment by a range of stakeholder groups.

COMET collaborates extensively with organisations worldwide and operates within a range of different industries to help develop and provide long-lasting change across a variety of desired outcomes.

In order to achieve success, COMET implements its unique 3 Ds methodology: Diagnose, Design, Deliver.

Before diving into delivery mode, fundamentally understanding existing challenges and identifying future opportunities is crucial.

Looking at numbers simply isn't enough— activities such as 'deep dive' health checks, talking to a large cross section of the employees, observing operations across different shifts, and reviewing the allimportant documentation and processes are all critical tasks to fully diagnose the current state.

Health checks are structured around the spectrum of organisational root causes so that positive and negative influences affecting each can be explored, evidenced and presented alongside achievable improvement measures:

• Communication (verbal, written, formal, informal, etc.)

• Operating Environment (roads, facilities, amenities, infrastructure)

• Management (systems, processes, standards, etc.)

• Equipment (PPE, tools, machinery, etc.)

• Training (provision, quality, relevance, competence, etc.)

The 'Diagnose' stage doesn't always require full-scale activities such as the above; however, it's crucial that a level of diagnosis and discovery, pre-design, and delivery takes place.

Based on diagnostic findings and real company scenarios, blended learning tools (such as the creation of custom materials), and best practice activities will all be in the mix for creating the L&D experiences that will serve the organisation in its efforts to meet and exceed the desired outcome. Examples include:

• Senior leadership workshops designed to ensure that leaders' walk the talk'.

• A supervisory & front-line leadership programme designed to develop key skills and tools for the all-important Supervisory function who play such an important role in delivering key responsibilities and absolutes for the organisation.

• Operative/front line involvement captured within short, punchy and engagement workshops delivering accessible resources that are available at the point they need them.

All utilise the proven Listen, Do, Discuss, Action methodology that COMET has finetuned over many years of experience, and all integrate existing organisation tools and processes where appropriate. This is about building on what was already in place, not replacing it.

Execution is meticulously planned and executed in collaboration with organisational L&D teams, offering in-person, online, and hybrid delivery solutions. COMET's delivery team is well-balanced between content creators, design specialists and lead facilitators.

Ongoing delivery review, check-ins, and evaluations take place to ensure continual improvement and ongoing effectiveness of delivery programmes.

Our tried and tested 3 Ds philosophy ensures that an organisation's desire to improve through meaningful Learning & Development can come to life with an approach and structure that delivers success.

About the author

Craig Smith, Head of Learning and Development at COMET

Craig leads the COMET Learning & Development suite of products and services, helping organisations improve and develop their people and culture.

Craig has been in position since 2018 and has experience delivering leadership programmes to a range of clients globally across multiple sectors.

If you would like to learn more about COMET's training services visit - www.cometanalysis.com/services

Engage and empower your teams with meaningful and enjoyable training for maximum success

Our suite of leadership training solutions is designed to get right to the heart of challenges and opportunities.

Discover the UK’s premier ECITB accredited supervisor’s programme, trusted by industry leaders like Wood, Petrofac, AKER Solutions, and more.

Courses include:

• Taking the Lead (Module 1)

• Achieving Performance (Module 2)

• Sustaining Success (Module 3)

Challenging yet enjoyable workshops exploring the key fundamentals of safety leadership and behavioural safety. We specialise not in ‘off the shelf’ generic training, but diagnosing, designing and delivering relevant and tailored training for organisations to benefit from.

Bespoke modules to enhance crossfunctional communication and relationship management, vital for driving business success. Topics include Business and Money, Managing Self and Others, Projects and Change, Value and Markets, and The Final Challenge.

An engaging programme designed to foster effective equity, diversity, and inclusion practices in organisations.

Comprising practical tools, great communication devices and thoughtprovoking learning that is nationally accredited by the ECITB.

Integrate Human & Organisational Performance (HOP) principles into your learning and improvement strategies. Our Learning Teams toolkit promotes a blame-free culture, making error a learning opportunity rather than a setback.

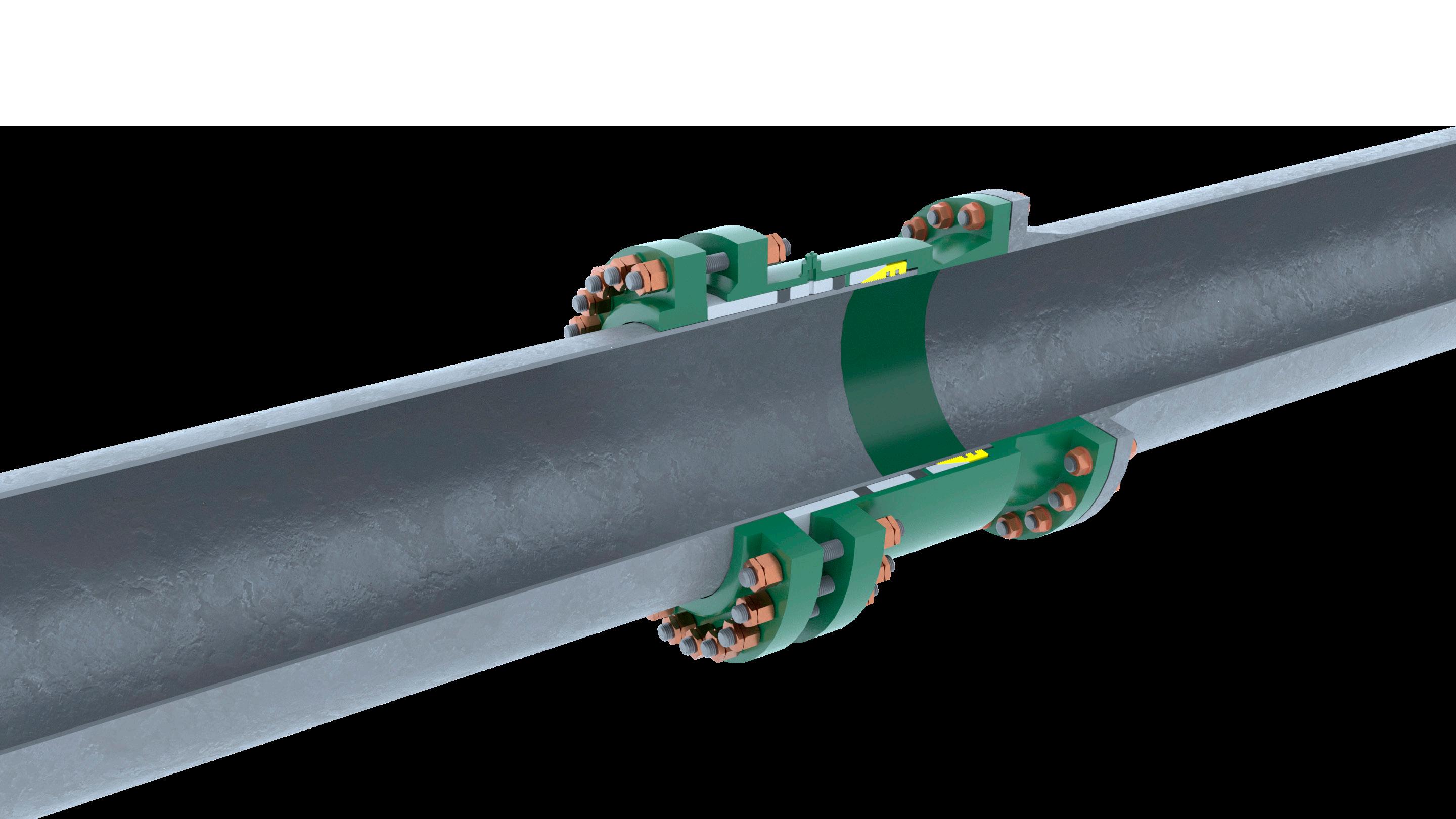

1” to 36”

Permanent pipe to ange connection where welding may be undesirable. The slipover design and external gripping assembly enables a quick and cost-e ective solution, with no specialist installation or testing equipment required.

20 year design life

Editorial

+44 (0) 1224 084

Advertising

+44 (0) 1224 084

Design

Editorial

Oceaneering (OII) Clinches

$120-$183M Contracts With Petrobras

Oceaneering International, Inc. OII, a leading supplier of offshore equipment and technology solutions to the energy industry, declared that its Manufactured Products segment won two major contracts with Petrobras PBR, Brazil's state-run oil and gas company, through a competitive bidding process.These contracts are expected to generate net revenues between $120 million and $183 million. Let’s delve into the details of these contracts, the significance of the products being supplied and the broader impact on Oceaneering and the offshore energy sector.

Overview of the Contracts

Scope and Scale of the Contracts: Per the terms of the contracts, OII would supply up to 362 kilometers or approximately 225 miles of steel tube and thermoplastic electro-hydraulic umbilicals.

Knight Property Group completes deal double with Rovco at Kingshill Park, Aberdeen

Knight Property Group has completed a deal double at Pavilion 10, Kingshill Park in Westhill, Aberdeenshire.

Rovco, a leading provider of tech-powered offshore wind geophysical survey and ROV/AUV projects, has successfully secured six and five-year leases for two office suites situated in Knight's modern office development.

These leases collectively span 10,774 sq ft, with the first floor encompassing 5,384 sq ft and the ground floor comprising 5,390 sq ft. These agreements were reached swiftly, strategically aligning with Rovco's ambitious plans for future growth.

Wood completes the Preliminary Engineering for the world’s largest carbon capture and sequestration hub in Saudi Arabia

Wood, a global leader in consulting and engineering, has completed the front-end engineering and design (FEED) scope for the first phase of Aramco’s Accelerated Carbon Capture and Sequestration (ACCS) project in Saudi Arabia, expected to be the world’s largest carbon capture and sequestration (CCS) hub, upon completion.

With an ambition to further reduce carbon emissions from its upstream operations, the first phase of the ACCS project intends to capture carbon emissions from Aramco gas plant facilities near Jubail, on the east coast of Saudi Arabia, as well as from thirdparty emitters.

RenQuip Unveils World’s Most Powerful Flange Spreader

RenQuip, a pioneering manufacturer of hydraulic and mechanical equipment, proudly announces the launch of the Viper-28, a groundbreaking flange spreading wedge that sets a new benchmark for the global flange tool market.

The Viper-28 is set to be the most powerful flange spreader in the world, boasting an unrivalled spreading force of 28 tonnes and a precision tip measuring just 5 millimetres. This revolutionary tool offers extraordinary performance and a wide range of applications for flanged joint maintenance, installation, and commissioning.

Despite its immense power, the Viper-28 weighs only 5 kilograms, combining lightweight design with formidable strength. Its innovative single-pin mechanism allows the entire tool to be disassembled by hand for simple and efficient maintenance.

MacArtney's GreenLink enhances wave energy testing at world-class marine site

MacArtney's GreenLink terminations will connect innovative technology at PacWave South. This cutting-edge platform, run by Oregon State University, is for testing and optimising marine energy devices in open-ocean environments, driving the application of wave energy as a reliable power source. Through PacWave South (PWS), a full-scale test facility featuring four offshore test berths, Oregon State University (OSU) provides the necessary infrastructure for U.S. and international wave energy innovators to feed the electricity grid with alternative power sources. The project received significant investment from the U.S. Department of Energy to support the development of carbonfree wave energy conversion (WEC) technologies. PWS covers an area of 2 square nautical miles and is licensed to support testing up to 20 commercialscale WECs.

JBS Group: Embracing diversification and global outreach is key to success

We have long recognised the necessity of diversifying beyond our traditional stronghold in the North Sea energy sector.

While this has been a cornerstone of our operations, the unpredictable nature of that market underscored the importance of expanding our horizons both geographically and industrially. The plan to step outside our comfort zone and head to broader horizons started a little over three years ago.

The results have been there for all to see. Our commitment to diversification has not only strengthened us as a business but also propelled us to new heights. In the past year, we have recorded a remarkable 38% increase in turnover, reaching £11.5m, up from £8.3m. This is a testament to our strategic efforts to enter and thrive in new markets and, in turn, generate enough profit to re-invest in the business.

ModuSpec provides a combination of in-depth rig-technology inspection services coupled with operator-minded services to put the rig in the context of well operations.

Established by the founder and original senior management of the independent rig inspection company, who first introduced rig inspection services to the industry in 1986, it supports the upstream industry in drilling wells more safely and efficiently reducing non-productive time and establishing a safe work environment.

www.moduspec.com/

As a trusted global partner with 26 years of experience, we have worked on more than 700 assets globally. With a focus on Health, Safety, Environment and Quality (HSEQ), we are dedicated to helping our clients achieve their goals of maximum production uptime, zero harm and operational efficiency.

www.axessgroup.com/

Cygnus Instruments Ltd is the leading manufacturer of multiple-echo ultrasonic thickness gauges used for measuring remaining metal thickness without the need to remove protective coatings.

www.cygnus-instruments.com

Field Engineering Services LTD Value and supply to meet customers’ requirements. From Hire, Sales Service along with all works designed and supplied, through to Installation and commissioning of complete turnkey generator packages from 5kVA till 2000kVA packaged projects by our team.

www.field-engineering-services.co.uk

Rampart Products was born from a desire to provide great customer service with a reasonable delivery time to those in need of HPHT electrical connectors. Rampart Products’ team is comprised of individuals who offer decades of engineering experience in the oil and gas industry. Skill sets range from designing complete downhole tool systems to creating efficient manufacturing processes, along with in-depth knowledge of engineering design and manufacturing of HPHT electrical connectors.

www.rampartproducts.com

Unique Group is founded as an equipment rental, sales and service organisation supporting the oil & gas and maritime industries in the Middle East, India and Singapore.

Unique Group has become a global player, offering multiple products and services to customers in a range of industry sectors. It has more than 500 employees and operational bases around the world.

www.uniquegroup.com/

We are an Aberdeen-based valve maintenance and testing facility, providing the highest levels of expertise and service to ensure your probes are repaired and returned with minimum disruption to your operations. We have the facility to carry out a thorough test and inspection of your probes and have access to a robust supply chain should any replacement parts be required.

www.valvetec-services.com

We are specialists in hydraulic and electrical systems from design to manufacture and refurbishment.

With over 70 years’ combined experience in oil & gas / marine / petrochemical / industrial / renewables and infrastructure sectors, we provide product supply, design & manufacture. Specialised site services, system fault finding, hot oil flushing, instrument pipework installation and testing, as well as complete overhauls of all hydraulic and mechanical equipment.

www.pts-services.co.uk/

KYSTDESIGN delivers a wide range of products for various industries as oil & gas, survey, fish farming, ocean research, search/rescue and navy.

Our strength is multidisciplinary knowledge of technical issues at every level, from system level down to component level, from definition and design to prototyping and qualification.

www.kystdesign.no

By Tsvetana Paraskova

and gas was 19 kg of CO2 per barrel on the UKCS. Across the marine border, in Norwegian waters, it is 6 kg of CO2 per barrel—more than two thirds cleaner in the same basin.

the findings of the report, with Mike Tholen, Offshore Energies UK sustainability and policy director, stating,

The future of the UK’s energy policy and energy transition in view of the general election featured in the North Sea oil and gas industry over the past month.

The UK still needs oil and gas, Stuart Payne, chief executive of the North Sea Transition Authority (NSTA), said in a keynote speech and presentation during the Energy Industry in Transition Conference in Aberdeen in May.

At present, fossil fuels provide around three quarters of the UK’s energy needs and government data suggests that even in 2050 it will still meet around 20 percent of the country’s energy needs, Payne said at the event hosted by the University of Aberdeen’s Business School.

Going forward, feedstock for the chemical industry and advanced manufacturing, areas in which the UK has strong competitive advantage, will be a major element of demand.

The NSTA’s projections for future oil and gas production, even with new field developments, show that domestic output will fall much faster than domestic demand, the authority’s chief executive added.

Data has shown that in 2022 the average carbon intensity of producing one barrel of oil

“This is a gap we at the NSTA are intent on closing,” Payne said.

“In a world where low carbon products will hold more value, or cross border carbon taxes become more common place, failing to decarbonise becomes a threat to competitiveness,” he added.

The NSTA, as a regulator, is taking action to support the UK offshore industry’s decarbonisation with a focus on maximising economic recovery and on supporting the UK achieving net zero, the authority’s CEO said.

Robert Gordon University (RGU) published a new report, Delivering Our Energy Future, which calls for urgent alignment across the political spectrum to sustain thousands of UK offshore energy industry jobs, supply chain investments, and the economic contribution of the workforce.

In the research, RGU has analysed 6,561 pathways to the UK’s energy future and transition and highlighted that of all these pathways, fewer than 15, or less than 0.3 percent, meet the ‘just and fair’ transition principles.

“The ongoing decline in the oil and gas industry needs to be offset rapidly by identifiably greater levels of activity and higher UK content in renewables if any of the pathways to a ‘just and fair’ transition are to remain open,” the report’s authors wrote.

The analysis also found that Scotland’s supply chain and workforce would be disproportionately impacted without intervention to support a fair transition and offshore energy jobs.

“The research reinforces the need for urgent alignment across the political spectrum to agree the short-term actions that will deliver a ‘just and fair’ transition, while maintaining the workforce to 2030 to deliver a long-term net zero future and the associated economic benefits for the country to which we all remain committed,” the authors wrote.

Offshore Energies UK (OEUK) has endorsed

“The UK energy transition has the potential to provide tens of thousands of new jobs in the next few years and many of them will require the skills and expertise of the UK’s oil and gas sector.”

“Our message is simple. Support homegrown energy and recognise the critical role of our existing industries. We need to unlock greater investment to secure jobs, energy security and economic growth,” Tholen added.

Ahead of the general election OEUK has challenged every candidate standing in Election to back UK-based energy firms and their workers. OEUK’s industry manifesto, “Unleash our Potential. Power our Future”, calls on all candidates to choose a homegrown energy transition. It asks them to engage with and back offshore energy firms and their workers across the UK ahead of launching party manifestos.

“Stable, long-term policies that enable fair returns are critical to ensure UK firms and their people can compete in the global race for energy investment. OEUK says over £200 billion can be unlocked and ploughed into our energy future this decade, but only if firms, skilled people and capital stay here in the UK,” the industry body said.

OEUK has also commented on the Labour leaders’ address to their party in Scotland on the Great British Energy plans.

“It was good to hear again from Labour that if they win this General Election, they won’t turn off the taps and revoke oil and gas licences and they recognise the need for oil and gas in the UK for many decades to come,” OEUK’s chief executive David Whitehouse said.

“We now need to understand how they plan to work with the sector, to safeguard oil and gas jobs and build a sustainable and secure energy future that leaves no one behind.”

Whitehouse continued, “A successful path can only be one that recognises that in the journey to net zero we need both renewables and our homegrown oil and gas sector. You cannot protect jobs and communities, safeguard our

energy security, create enduring economic value, and deliver on our climate goals without embracing our existing industrial strengths.”

Aberdeen Grampian Chamber of Commerce said in its 39th survey report that the next government has 100 days after an election to change course and convince industry that the North Sea is still a viable and investible basin.

Confidence in the North Sea has plunged to an alltime low, and it is clear from the survey and focus groups that companies will exit the UKCS under the tax regime being proposed by the Labour Party.

Investment of up to £30 billion is at risk, and for many of the basin’s key pieces of infrastructure, the UK is rapidly approaching the point of no return, the report said.

“If key production hubs close, we lose the ability to tie back, and vast swathes of our natural resources will become locked in and economically unviable,” the authors of the report, focused on the energy transition, wrote.

One of the recommendations in the report is that the UK needs a new body, entirely independent of government, to set a policy direction for the next 40 years.

“We have further potential projects in our portfolio which we continue to assess, including the possible re-development of the Kyle field, which could, like Belinda, be another low emissions tie-back candidate to the Triton FPSO,” said David Latin, Chairman and Interim CEO of Serica.

“We look to the UK government to implement tax and licensing arrangements that support investments like Belinda, thereby creating UK jobs, earnings and tax receipts instead of increasing reliance on energy imports.”

Subsea7 has been awarded a contract by Serica Energy for the Belinda field development. The contract scope includes project management, engineering, procurement, construction and installation (EPCI) of a 5-kilometre 8” production pipeline with a 3” piggy-backed gas lift line and an electro-hydraulic controls (EHC) umbilical.

Subsea7’s scope also includes associated subsea structures and tie-ins to the Triton Floating Production Storage & Offloading (FPSO) vessel operated by Dana Petroleum, via an existing production manifold near the Triton riser base and for controls at the Evelyn valve skid.

“If nothing changes, and we get five more years of the same muddled policy, then nothing will change"

Project management and engineering work will commence immediately in Aberdeen, while the offshore activities are scheduled for the third quarter of 2025.

“If nothing changes, and we get five more years of the same muddled policy, then nothing will change. Discretionary capital will continue to move overseas, the transition will stall, and a world class supply chain built up over decades will go,” the report’s authors noted.

In company and project news, the North Sea Transition Authority granted at the end of May a Development and Production Consent for the Belinda oil and gas field in the Central North Sea, which allows the owner to proceed with the project.

“The project will support the UK’s energy production and make use of existing infrastructure to minimise emissions. It will also create jobs and provide investment in the supply chain,” an NSTA spokesperson said.

Serica Energy plc is the operator and 100-percent owner of the field, which will be tied back to the Triton FPSO following the drilling of the development well scheduled to take place in the first half of 2025.

The Belinda well is the fifth well in Serica’s Triton area drilling campaign, which commenced in April this year using the COSLInnovator drilling rig. All these wells are designed to enhance production via the Triton FPSO. Proven and probable reserves in the Belinda field are estimated at about 5 million barrels of oil equivalent, of which 80 percent oil, Serica said. Production is scheduled to begin in early 2026 following the tie-back work to the Triton FPSO.

Ithaca Energy announced at the end of May a number of changes to its Board of Directors and Executive Management team as it embarks on its next phase of growth, having recently announced its proposed transformational business combination with substantially all of the upstream assets of Eni in the UK.

The combination will result in a UKCS powerhouse with the single largest resource base in the UK North Sea, creating a strategic platform for longterm growth in the basin and the pathway to becoming the largest producer in the UKCS by 2030, Ithaca Energy said.

Petrofac issued on the last day of May its financial results for the year ended 31 December 2023 and an update on the progress with respect to its review of strategic and financial options.

The Group, which delayed its results release and saw its shares suspended for a prolonged period of time in May, is seeking to implement a comprehensive financial restructuring to materially strengthen its balance sheet, improve liquidity, and secure bank guarantees to support current and future EPC contracts.

“The challenges in obtaining guarantees for our new EPC contracts, and the impact on liquidity, resulted in the business seeking to deliver a critical financial restructure, which is ongoing and has the full focus of the Board,” said Petrofac’s Group Chief Executive Tareq Kawash.

By Tsvetana Paraskova

New investments, contracts, and sales of field stakes offshore Norway, the UK’s renewable energy policy amid the general election, and many new solar and wind projects were the highlights of Europe’s energy sector over the past month.

Equinor and its partners in the Troll field have decided to invest just over 12 billion Norwegian crowns ($1.14 billion) to further develop the gas infrastructure in the Troll West gas province. This will accelerate production from the reservoir and maintain the current high gas export levels from the Troll and Kollsnes value chain leading up to 2030, the Norwegian energy major said.

Stage 2 of the Troll Phase 3 project includes eight new wells from two new templates with subsea controls extended from existing templates. A new gas flowline will be laid as a tie-back to the Troll A platform, and the project will also perform modification work on Troll A. The first wells are scheduled to come on stream at the end of 2026.

“This is a highly profitable project that will secure high gas production from the Troll field,” said Geir Tungesvik, Equinor's executive vice president, Projects, Drilling Procurement (PDP).

Separately, Equinor said in June it was selling 19.5-percent interests in production licenses PL 048E, which is the Eirin field, and PL 1201, to PGNiG Upstream Norway AS (PGNiG). With this, the ownership between Equinor and PGNiG in these licences will be balanced with the Gina Krog field.

“Balanced partnerships will make it easier to coordinate decisions in the licences to optimise production and enhance value creation from the area,” said Camilla Salthe, Equinor’s senior vice president for late-life fields.

The plan for development and operation (PDO) for Eirin was approved in January 2024, and the field will be developed as a subsea facility tied back to the Gina Krog platform. The subsea template is under construction in Egersund and is scheduled for installation this summer.

Vår Energi ASA has signed an agreement with Concedo AS to sell a 20-percent interest in the Bøyla field for $24 million.

Bøyla is a mature producing field located in the North Sea operated by Aker BP with an 80-percent interest. The field started production in 2015 and is developed with a subsea template tied-back to the Alvheim FPSO.

Concedo will assume full decommissioning liabilities for the acquired field. The transaction does not impact Vår Energi’s previously announced production guidance for 2024, year-end 2025, and beyond, the company said.

Odfjell Drilling Ltd has announced that Equinor has exercised an option for a batch of eight wells to extend the use of the Deepsea Aberdeen on the Norwegian Continental Shelf.

Engineering firm Kent has been awarded a key Front-End Engineering Design (FEED) contract for the INEOS Hejre project, an offshore High Pressure High Temperature (HPHT) development, which is located in the Danish sector of the North Sea.

The Crown Estate in the UK has launched a Supply Chain Accelerator to catalyse earlystage investment in the UK offshore wind supply chain.

The Accelerator is a new £50-million fund created to accelerate and de-risk the earlystage development of projects linked to offshore wind, helping to grow the UK’s domestic supply chain.

An initial £10-million round of funding is now open for Expressions of Interest for businesses looking to establish UK projects that could support the development of a new UK supply chain capability for floating offshore wind in the Celtic Sea, The Crown Estate said at the end of May.

Industry associations RenewableUK and OEUK have aligned on a roadmap for a prototype ‘energy skills passport’ to enable cross-sector recognition of energy industry expertise and training. The passport is intended to show both workers and employers how skills and qualifications can be recognised by employers across sectors such as oil and gas and offshore wind, RenewableUK and OEUK said in a joint press release at the end of May.

RenewableUK also released polling results which showed strong support for prorenewables policies. Polling by Opinium, commissioned by RenewableUK, revealed high levels of support for renewables among voters who are concerned about tackling the cost of living crisis and securing the future economic prosperity of the UK.

Out of 10,021 people questioned, 75 percent say the development of renewable energy is a significant factor for the next government to consider in decisions about driving economic growth outside London and the south east of England, as well as in decisions about increasing jobs in the UK (83 percent), tackling climate change (81 percent), energy bills (88 percent), and energy security (84 percent).

In addition, more voters want the next UK government to prioritise green jobs than any other key sector of the economy to drive economic growth – more than advanced manufacturing, digital technology, life sciences, or performing arts industries.

RenewableUK Cymru, for its part, is calling on the next UK Government to fast-track Wales’ transition to renewable energy.

Wales must quadruple its wind power capacity—from both onshore and offshore—

within the next decade to meet the rising demand for clean electricity.

“A shift to renewable energy will bolster energy security, lower electricity costs, enhance the competitiveness of Welsh businesses, and create thousands of jobs nationwide,” RenewableUK Cymru said in early June.

A survey was carried out by the Offshore Renewable Energy (ORE) Catapult on behalf of Crown Estate Scotland in 2023, and found that there was a significant appetite for development of both tidal energy and wave energy in Scotland, but with each sector increasingly focused on differentiating their market positions, there is a need to reflect their differing priorities and challenges.

The report highlights that tidal energy is focused on utility scale (large-scale supply to grid) and community scale (local supply for local demand) developments, whilst the wave sector views its future development in more offshore applications, including decarbonisation of oil and gas and colocation opportunities.

The Highland Council has approved the onshore plans of the West of Orkney Windfarm, which is advancing a major offshore wind project off Scotland’s northern coast. The council’s North Planning Applications Committee approved in early June the project’s onshore application for planning permission in principle. This is a significant milestone for the two-gigawatt West of Orkney Windfarm project, which aims to commence construction in 2027 and begin generating electricity in 2029. Once fully operational, the project will provide enough green energy for around two million homes.

“A shift to renewable energy will bolster energy security, lower electricity costs, enhance the competitiveness of Welsh businesses, and create thousands of jobs nationwide,”

In company news, Rovco has been selected for site characterisation work on the Outer Dowsing Offshore Wind project in the southern North Sea.

The project is a joint venture between TotalEnergies, Corio Generation (a portfolio company of Macquarie Asset Management operating on a standalone basis), and Gulf Energy Development. With a planned installed capacity of 1.5 GW, it will be one of the UK’s largest offshore wind farms upon completion.

Rovco will be responsible for carrying out a full geophysical investigation of several key sites at Outer Dowsing Offshore Wind off the Lincolnshire coast. This will involve mapping both the seabed & sub-seabed conditions to identify hazards that may affect the future installation of wind turbines & subsea cables.

Ridge Clean Energy has received planning approval to construct the 39-MW Three Oaks Renewable Energy Park (REP), located between Thornholme and Haisthorpe, north of the A614. Three Oaks REP will combine solar generation with battery storage, providing reliable renewable energy to power the equivalent of over 8,600 homes.

SSE has taken a final investment decision to proceed with Aberarder Wind Farm in the Scottish Highlands, in an about £100-million investment boost for its onshore wind portfolio. Construction of the 12-turbine, 50-MW wind farm, which is wholly owned by SSE Renewables, will begin before the end of the year, with completion scheduled for the end of 2026.

German energy giant RWE has made the investment decision for its Nordseecluster project, involving offshore wind projects with a total capacity of 1.6 GW. The wind farms will be built in the German North Sea, about 50 kilometres north of the island of Juist. Construction of Nordseecluster A with a capacity of 660 MW is due to start in 2025 with full commissioning planned for the beginning of 2027, while construction of Nordseecluster B with a capacity of 900 MW is set to begin in 2027 with full commissioning to take place in early 2029.

RWE also plans to build hydrogen-ready gasfired power plants at its power plant sites in Germany to contribute to a successful coal phase-out by 2030. An H2-ready combinedcycle gas turbine (CCGT) power plant with a nominal capacity of around 800 megawatts may be built at the Gersteinwerk power plant.

The wind blade recycling plant ‘Waste2Fiber’, spearheaded by Spain’s ACCIONA, has been declared “a project of regional interest” by the Government of Navarra, which will accelerate its permitting process and development. Construction of the recycling facility will begin in the first half of this year in Lumbier (Navarra). Once in operation, the plant will have a processing capacity of 6,000 tonnes of material per year, covering all stages of the production process, from the dismantling and breaking down of the blades to the output and quality control of the final products.

In early June, the European Commission approved, under EU State aid rules, an Italian scheme to support a total of 4,590 MW of new capacity for electricity production from renewable energy sources. The scheme will support the construction of new plants running on innovative and not yet mature technologies, namely geothermal energy, offshore wind power (floating or fixed), thermodynamic solar, floating solar, tidal, wave and other marine energy as well as on biogas and biomass.

By Tsvetana Paraskova

US oil and gas companies continued to announce mergers and acquisitions in May as the consolidation trend rolls on, with analysts expecting more deals in the coming months.

In the middle of May, Crescent Energy said it would buy SilverBow Resources in a deal valued at $2.1 billion to create a major player in the Eagle Ford shale formation.

The transaction is subject to customary closing conditions, including approvals by shareholders of each company and typical regulatory agencies. It is targeted to close by the end of the third quarter of 2024.

“The combination with SilverBow, which is expected to be immediately accretive to all key per share metrics, solidifies Crescent as a leading operator in the Eagle Ford and strengthens the company’s growth platform with increased scale,” Crescent CEO David Rockecharlie said.

Marathon Oil shareholders will receive 0.2550 shares of ConocoPhillips common stock for each share of Marathon Oil common stock, representing a 14.7-percent premium to the closing share price of Marathon Oil on May 28, 2024, and a 16.0-percent premium to the prior 10-day volume-weighted average price.

“This acquisition of Marathon Oil further deepens our portfolio and fits within our financial framework, adding high-quality, low cost of supply inventory adjacent to our leading U.S. unconventional position,” said ConocoPhillips chairman and CEO Ryan Lance.

“The transaction is immediately accretive to earnings, cash flows and distributions per share, and we see significant synergy potential.”

At the same time, the Biden Administration is looking to keep US petrol prices in check this summer, ahead of the presidential election in early November.

US Democratic lawmakers continued to press for investigation into whether the world’s largest oil companies deliberately misinformed the public about the climate consequences of their carbon emissions.

“The combined company will have an attractive and balanced portfolio of stable, low-decline and highly cash-generative production with a deep inventory of proven drilling locations, wellpositioned for flexible capital allocation through commodity cycles,” Rockecharlie added, noting that “This combination creates a leading mid-cap company with significant value creation potential and the stability of a large-cap operator.”

The biggest deal in May in the US oil and gas industry was announced at the end of the month, when ConocoPhillips said it would buy Marathon Oil in an all-stock deal with an enterprise value of $22.5 billion, inclusive of $5.4 billion of net debt.

Under the terms of the definitive agreement,

The deal is expected to close in the fourth quarter of 2024, subject to the approval of Marathon Oil stockholders, regulatory clearance, and other customary closing conditions. Analysts say that the Federal Trade Commission (FTC) could examine closely the proposed transaction, especially the position of the combined company in the Eagle Ford, where it would become the top producer.

ConocoPhillips will add scale and produce 2.3 million barrels of oil equivalent per day (boe/d) with the addition of Marathon Oil’s 390,000 boe/d, analysts at Wood Mackenzie said, commenting on the announced deal.

This is more than TotalEnergies and nearly the same oil and gas output as bp. About 1.5 million boe/d of ConocoPhillips’ output will come from the US Lower 48, making it the third largest producer behind ExxonMobil and Chevron/Hess, WoodMac’s analysis showed.

“The addition of Marathon further solidifies ConocoPhillips in a league of its own, with few true peers,” said Alex Beeker, research director, corporate research for Wood Mackenzie.

“For ConocoPhillips, this is a diversified and balanced move across multiple geographies.”

Beeker added, “Upon closing, ConocoPhillips will become the largest Eagle Ford producer, a top three Bakken operator and remain a top five Delaware Basin player based on gross operated production.”

The increase in the base dividend at ConocoPhillips is set to be welcomed by investors as “The market is likely to reward companies with a higher base dividend as it gives confidence to investors in the longevity and stability of cash flows,” WoodMac’s Beeker noted.

The ConocoPhillips-Marathon Oil deal came days after ExxonMobil completed its $60-billion acquisition of Pioneer Natural Resources. The combined company’s more than 1.4 million net acres in the Delaware and Midland basins have an estimated 16 billion barrels of oil equivalent resource, Exxon said.

Chevron also marked a milestone in its planned acquisition of Hess Corporation after Hess received the necessary approval of its stockholders for closing the merger with Chevron. At the special meeting of Hess stockholders held on 28 May, a majority of the outstanding shares of Hess common stock were voted in favor of the adoption of the merger agreement.

The completion of the deal remains subject to regulatory clearance and the satisfactory resolution of ongoing arbitration proceedings regarding Exxon’s claim to preemptive rights in the Stabroek Block joint operating agreement offshore Guyana, where Hess is Exxon’s minority partner.

The upstream M&A wave is not over yet, Rystad Energy says.

Last year upstream merger and acquisition activity hit a record $258 billion, and continued its momentum at the start of this year. With $64 billion-worth of upstream deals announced in the first quarter of this year, deal value reached its highest first-quarter levels since 2019 and a near 145-percent jump compared to the opening quarter of 2023. Notably, deal value so far this year has already surpassed the total deal value of $69 billion recorded for the entire first half of 2023, Atul Raina, Vice President of Upstream M&A Research at Rystad Energy, wrote in a special

insight article at the end of May.

The US has emerged as the growth engine behind the robust M&A activity, accounting for just over 83 percent of the total deal value in the first quarter of 2024, driven by the ongoing US shale consolidation. The Permian Basin’s dominance within the shale sector continued, with the core shale patch accounting for more than $29 billion worth of deals, which represents around 63 percent of total shale-focused M&A activity in the US.

“However, with a limited number of opportunities available in the Permian coupled with high commodity prices, we expect increased M&A activity outside of the Permian,” Raina said.

So far in the second quarter of 2024, the majority of shale-focused M&A activity has taken place in the Eagle Ford (47 percent), Marcellus (25 percent), and Utica (12 percent), while the Permian has accounted for just 6 percent of total shale-focused M&A activity.

North America is set to continue driving deal-making, with opportunities worth nearly $80 billion on the market, including nearly $41 billion-worth of non-Permian shale opportunities, Raina said.

“Furthermore, portfolio rationalization plans from ExxonMobil, Chevron, Occidental Petroleum and Diamondback could also contribute to increased M&A levels in the short term,” Rystad Energy’s analyst said.

“Having announced significant acquisitions recently, these companies are expected to part ways with non-core assets, which would create growth opportunities for regional exploration and production players.”

US Democratic Lawmakers Urge Investigation into Fossil Fuel Disinformation

At the end of May, US Senate Budget Chairman Sheldon Whitehouse and House Oversight and Accountability Ranking Member Jamie Raskin called on US Attorney General Merrick Garland to investigate Big Oil “for its decades-long disinformation campaign to mislead the public about the climate effects of fossil fuels and obstruct climate action.”

seeking to lock in continued fossil fuel production for decades into the future,” wrote Whitehouse and Raskin.

Following the investigation, the lawmakers wrote to the Department of Justice, saying “we formally refer this matter to DOJ and request that you launch an investigation into the fossil fuel industry’s decades-long history of engaging in deceptive practices to determine whether the entities violated any applicable federal statutes.”

US Administration Wary of Rising Petrol Prices ahead of November Election

With the start of the US driving season with the Memorial Day weekend at the end of May, concerns about high petrol prices in the US resurfaced among the Biden Administration, which is keen to keep prices as low as possible ahead of the November presidential election.

The Administration announced it “is taking action to lower gas prices” with the sale of one million barrels of gasoline from the Northeast Gasoline Spply Reserve. The Biden administration is releasing 1 million barrels of gasoline from reserves held in the Northeast to reduce prices at the pump ahead of the Fourth of July holiday and summer driving season.

“While Congressional Republicans fight to preserve tax breaks for Big Oil at the expense of hardworking families, President Biden is advancing a more secure, affordable, and clean energy future to lower utility bills while record American energy production helps meet our immediate needs,” White House Press Secretary Karine Jean-Pierre said in a statement on 22 May.

“The Biden-Harris Administration is laser focused on lowering prices at the pump for American families, especially as drivers hit the road for summer driving season,”

“By strategically releasing this reserve in between Memorial Day and July 4th, we are ensuring sufficient supply flows to the tri-state and northeast at a time hardworking Americans need it the most,” Energy Secretary Jennifer Granholm said.

“The Biden-Harris Administration is laser focused on lowering prices at the pump for American families, especially as drivers hit the road for summer driving season,” Granholm added.

The House Oversight Committee has completed a nearly three-year-long investigation initiated by House Oversight Democrats.

“Our investigation revealed how Exxon, Chevron, Shell, BP, API, and the Chamber worked in concert to mislead the public, policymakers, and investors with public promises to reduce emissions and meaningfully contribute to the transition away from oil and gas, while privately

Analysts feel that emptying the Northeast reserve will have minimal impacts on petrol prices nationally but may put some downward pressure on prices in the northeast, Tim Tarpley, Energy Workforce President, said, commenting on the news of the release.

“The impacts will be minimal as the reserve only amounts to about 2.7 hours of total U.S. gasoline consumption,” Tarpley noted.

By Tsvetana Paraskova

The oil production policy of the OPEC+ group, the new share sale from Saudi Arabia’s state oil giant Aramco, and the UAE’s energy firm ADNOC growing its international LNG business emerged as key topics in the Middle East’s oil and gas sector over the past month.

Separately, Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman met in person in Riyadh, Saudi Arabia. These producers had announced additional voluntary cuts in April 2023 and November 2023.

“The meeting was conducted to reinforce the precautionary efforts of OPEC+ countries, aiming to support the stability and balance of oil markets,” OPEC and the Saudi Energy Ministry said.

The producers decided to extend the additional voluntary cuts of 1.65 million barrels per day that were announced in April 2023, until the end of December 2025.

However, these countries will extend their additional voluntary cuts of 2.2 million barrels per day, which were announced in November 2023, until the end of September 2024. After September, the 2.2 million barrels per day cut will be gradually phased out on a monthly basis until the end of September 2025 to support market stability.

“This monthly increase can be paused or reversed subject to market conditions,” the producers said.

So, the OPEC and non-OPEC producers part of the OPEC+ alliance decided to roll over part of their current cuts well into 2025, but the producers with extra voluntary reductions announced only extended those by the end of September 2024.

The OPEC+ meeting decided in early June to extend the level of overall crude oil production for OPEC and non-OPEC Participating Countries in the Declaration of Cooperation, as the deal is officially known, starting 1 January 2025 until 31 December 2025.

The group postponed the decision on new quotas and decided to “extend the assessment period by the three independent sources to the end of November 2025, to be used as guidance for 2026 reference production levels.”

The signal to the market was that the producers, led by the world’s top crude exporter, Saudi Arabia, would begin to gradually unwind some of the additional voluntary cuts from October 2024 until September 2025.

Moreover, OPEC gave the UAE, the thirdlargest producer in the organisation, an extra 300,000 barrels per day (bpd) to its quota for 2025, which will also be gradually implemented next year.

The market anticipated a rollover of all cuts until the end of this year, and was left disappointed with OPEC’s announcement from June 2.

ICE Brent prices slumped in the two days following the OPEC+ meeting by more than $5 per barrel, plunging to below $80 a barrel for the first time in four months.

The OPEC announcement also coincided with a more bearish market sentiment that potential economic weakness could impact global oil demand growth.

As a result, many analysts and investment banks see the OPEC+ announcements from early June as bearish for oil prices as a gradual unwinding of some of the cuts would leave the oil market well-supplied and in surplus in the first half of 2025.

It is not a given that OPEC+ will start bringing back supply as early as October 2024—the planned gradual easing of the cuts depends on market conditions and could be stopped or reversed at any moment.

In the days following the OPEC+ announcement, many analysts said that it is unlikely that market conditions in the fourth quarter would allow the producers to begin easing the cuts as soon as October.

Mukesh Sahdev, Senior Vice President and Head of Oil Trading/Downstream Solution at Rystad Energy, commented that “The bottom line is that the OPEC+ math does appear to be an OPAQUE math.”

“It is fair to acknowledge that OPEC+ effort is commendable in keeping oil prices in a stable range despite geopolitical rifts in a super election year,” Sahdev added.

Yet, OPEC+ will likely factor in fundamentals beyond the third quarter, and it is “unlikely to find support to unwind cuts in near term.”

“While third quarter balances could be tempting, the group will factor in the fourth quarter numbers when demand growth is projected to be flat, refinery crude demand is forecast to drop by 1.5 million bpd and nonOPEC+ supply growth is anticipated to be close to 1 million bpd, as per Rystad Energy estimates,” Sahdev said.

“2025 fundamentals do not provide a strong signal for an OPEC+ strategy reversal.”

Also in early June, the Kingdom of Saudi Arabia and Saudi Aramco announced the launch of a secondary public offering of ordinary shares of the Saudi oil giant, expected to raise about $12 billion.

Saudi Aramco made its debut on the Saudi Stock Exchange in December 2019 and raised around $30 billion in a share listing which became the world’s largest ever.

Since the IPO, Saudi rulers, including Crown Prince Mohammed bin Salman, have said on several occasions there would be more Aramco shale sales in the future.

The offering launched on 2 June comprises a secondary public offering of 1.545 billion shares of Saudi Aramco, representing approximately 0.64 percent of the company’s issued shares.

The price range for the offered shares has been set at between 26.70 Saudi riyals ($7.12) and 29.00 riyals ($7.73) per share.

The Government of Saudi Arabia currently holds 82.19 percent of the company’s issued shares. Upon closing of the Offering, the Government will hold approximately 81.55 percent of Aramco’s issued shares if the Over-allotment Option is not exercised, or approximately 81.48 percent assuming the Over-allotment Option is exercised in full, Aramco said.

The Government will receive all of the net proceeds of the offering and will reimburse the company for all fees, costs and expenses it incurs in connection with the offering. Accordingly, the company will not receive any of the proceeds of the offering and the offering will not result in any dilution of the shares of the other shareholders of the company, Aramco added.

The share offer sold out in hours after opening on 2 June, reports had it as early as on 3 June.

While preparing for the secondary share offer, Aramco signed an agreement with Pasqal, a global leader in neutral atom quantum computing, to install the first quantum computer in the Kingdom of Saudi Arabia.

The agreement will see Pasqal install, maintain, and operate a 200-qubit quantum computer, which is scheduled for deployment in the second half of 2025.

“In a rapidly evolving digital landscape, we believe it is crucial to seize opportunities presented by new, impactful technologies and we aim to pioneer the use of quantum computing in the energy sector,” Ahmad Al-Khowaiter, Aramco EVP of Technology & Innovation, said in a statement.

Wellpro Group & Omega Well Intervention provide a complete Thru Tubing, Inflatable Packer & Well Intervention portfolio including operational design, project management, service, rental & sales.

The deals complement ADNOC’s efforts to expand its lower-carbon LNG portfolio to meet growing gas demand, the Abu Dhabi oil and gas giant said.

ADNOC also acquired Galp’s 10-percent interest in the Area 4 concession of the Rovuma basin in Mozambique, marking a major milestone in the company’s international growth strategy.

The Area 4 concession includes the operational Coral South Floating LNG (FLNG) facility, the planned Coral North FLNG development and the planned Rovuma LNG onshore facilities.

“In a rapidly evolving digital landscape, we believe it is crucial to seize opportunities presented by new, impactful technologies and we aim to pioneer the use of quantum computing in the energy sector,”

In May, during a visit of US Secretary of Energy Jennifer Granholm to Saudi Arabia, Aramco signed three Memoranda of Understanding (MoUs) with leading American companies to advance the development of potential lower-carbon energy solutions. Aramco signed agreements with the companies Aeroseal, Spiritus, and Rondo to explore opportunities in technology, direct air capture, and the potential deployment of heat batteries in Aramco’s global facilities, respectively.

Abu Dhabi’s ADNOC bought an 11.7-percent stake in Phase 1 of NextDecade Corporation’s Rio Grande LNG export project in Texas, in its first strategic investment in the United States. Additionally, ADNOC and NextDecade have entered into a 20-year LNG offtake agreement from Rio Grande LNG Train 4, subject to a Final Investment Decision (FID).

“Natural gas plays an important role to meet growing global demand with lower emissions compared to other fossil fuels and this acquisition supports our efforts to build an integrated global gas business to ensure we continue providing a secure, reliable and responsible supply of natural gas,” said Musabbeh Al Kaabi, ADNOC Executive Director for Low Carbon Solutions and International Growth.

Qatar’s state giant QatarEnergy has signed a farm-in agreement with ExxonMobil to acquire a 40-percent participating interest in two exploration blocks offshore Egypt.

At the Qatar Economic Forum in May, Saad Sherida Al-Kaabi, Qatar’s Minister of State for Energy Affairs and President and CEO of QatarEnergy, said that Qatar’s LNG expansion projects were moving ahead on track towards an increased production capacity of 142 million tons per annum, adding that “with 18 million tons per annum coming from our LNG project in Texas, Qatar will be doubling its LNG production capacity in the next few years.”

LNG will remain in demand for a very long time, Al-Kaabi noted, adding “LNG is not going away any anytime soon, as was recently made clear by the G7 as well as by many countries around the world, who have changed their position of moving away from fossil fuels.”

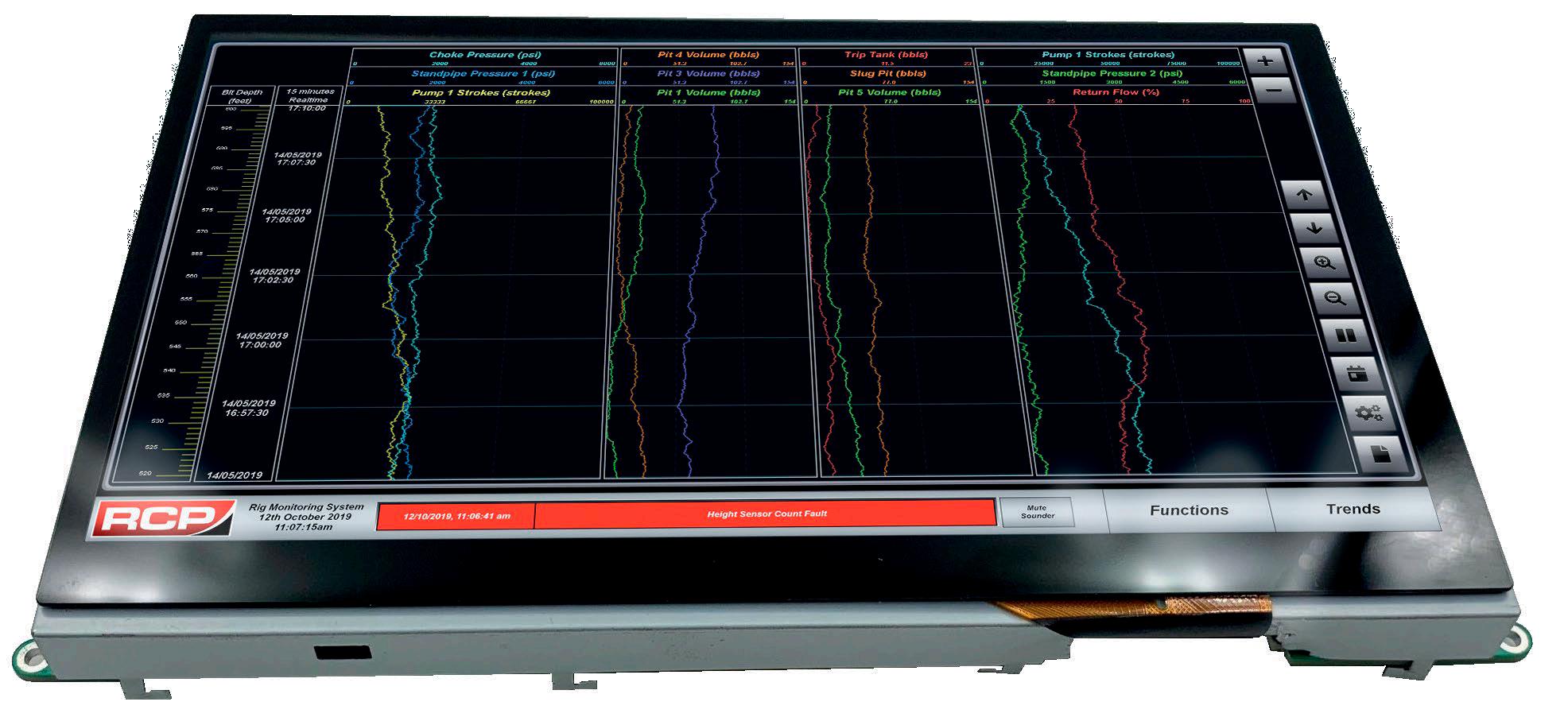

The new RMS is designed to give operators a clear, unambiguous overview of critical drilling and mud data processes. The system has been developed by RCP to greatly improve how information is presented using the latest industrial technologies and user-friendly interfaces

The RCP EDR offers a quick and cost-effective solution for clients considering a new installation or a partial upgrade to their existing drilling instrumentation systems Our highly experienced engineers and software developers allows us to tailor each new system to meet your exact needs meaning that you do not pay for functionality you will never use

The RCP EDR utilizes a variety of sensing technologies to monitor the drilling processes, (typically: Level, Pressure, Height, Temperature and Flow). Sensor output signals are received by the distributed I/O racks and are then processed by the EDR.

Processed information is then transmitted through network communication modules to each of the user interfaces including remotely networked PC’s and local HMI’s System and operator interface communications may utilize either: Fibre-Optic, Profinet, Profibus or Industrial Ethernet connection

Brent Oil Column July 2024 Today's Price $82.978*

1 YEAR AGO

1 Year Ago - $83.31

Oil prices climbed about 3% to a nine-week high as supply concerns and technical buying outweighed fears that further interest rate hikes could slow economic growth and reduce demand for oil. Top oil exporters Saudi Arabia and Russia announced fresh output cuts bringing total reductions by OPEC and its allies to around 5 million barrels per day.

5 YEARS AGO

5 Years Ago - $61.04

Russia was finding that its future as a producer of oil was increasingly dependent on OPEC’s, and vice versa. OPEC countries, Russia and other oil-producing nations signed what was described as an openended “charter of cooperation” for managing the global oil market. The deal brought 24 countries that together produce about 47 barrels of oil per day

10 YEARS AGO

10 Years Ago - $108.04

Brent crude oil reversed losses jumping back above $108 as fighting in Ukraine and deteriorating relations between Russia and the United States ignited new fears of supply disruptions in the market. Continued violence in Libya and Israel provided further support for oil prices.

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

The project reached a final investment decision during May 2024, with first production at the field scheduled for 2028. Saipem has picked up the FPSO, O&M and SURF contracts that are worth $3.7 billion.

A final investment decision was reached on the project in May 2024. Seatrium has signed two EPC contracts with Petrobras covering the delivery of the P-84 and P-85 FPSOs. A 20% local content requirement will apply in the present project, to cover the P-84 FPSO. Construction is expected to start in Q1 2025.

A new discovery was announced through the drilling of the Tangkulo-1 exploration well. Drilled to a depth of 3,400 metres in water depths of 1,200 metres, the well discovered an 80 metre gas column. The well flowed at a production rate of 47 MMcf/d of gas and 1,300 boe/d of condensate. Production from the new discovery could commence as early as 2028.

BP and EOG Resources are discussing the formation of a joint venture to develop the Cononut field, with first gas expected by late 2026. The field holds about 1Tcf of reserves and its development could tap a total of 1.5Tcf of gas should it be tied back to another undisclosed BP discovery.

SOCAR is currently in negotiations with TotalEnergies and ADNOC on the final investment decision (FID), which is now expected by Q4 2024. It is estimated that Absheron, located in water depths of around 500 metres, contains over 12.4Tcf of gas and over 733 MMboe of condensate.

JV partner, Rockhopper, has recently stated that discussions with long lead equipment contractors are advancing, as well as the environmental impact analysis and planning of a viable financing scheme. FID is estimated between late 2024 and Q2 2025.

PTSC M&C has been awarded the EPCI contract for the LDV-A platform that is expected to be commissioned in H2 2026. The contract covers project management, detailed engineering, procurement, construction, transportation, installation, hookup, and commissioning for the LDV-A Platform, with the topside weighing over 6,000 metric tonnes and the substructures (jacket and piles) over 5,000 metric tonnes.

TotalEnergies and APA Corporation have stated that FEED studies are progressing. An ocean bottom node (OBN) campaign covering 900km² will be carried out in the second half of 2024 aiming to optimise the placement of development wells and to identify resource upsides. Staatsolie has the option to enter the project with up to 20% equity upon FID, estimated by late 2024.

Larsen & Toubro has been awarded the EPCI contract to construct four new wellhead platforms and 140km of infield pipelines. The development could produce up to 350MMcf/d of gas from the field that is located in Mumbai offshore area.

Carnarvon Energy, partner in the field, has announced that in Mid-2024 FEED work will be re-entered and an assessment of FPSO redeployment options will undertaken. FEED work is to be completed by the end of 2024, with a view of a final investment decision being reached upon receipt of regulatory approval at the same time.

Saipem has been awarded a contract to provide engineering, fabrication, transportation, and installation of approximately 60 kilometres of rigid pipelines as well as subsea facilities at a depth of around 1,100 metres. The work also includes transporting and installing flexible flowlines, jumpers, and 17 kilometres of umbilicals. The contract is valued at $850 million.

Subsea Integration Alliance has been awarded a contract to upgrade BW Offshore’s Opportunity FPSO. The scope of Subsea 7 will include riser installation and integration, as well as hooking up activities for the FPSO's mooring systems.

By Tsvetana Paraskova

Safety and skills have always been and will be crucial for the energy industry and the people responsible for the design, construction, operation, and delivery of all forms of energy to consumers.

As the sector is starting to transition to cleaner energy sources and the involvement of artificial intelligence (AI) is growing, the role of the people and their skills and the transferability of these skills in the oil and gas industry to similar jobs in renewables are becoming even more crucial.

Skills and safety, along with sustainability, have always put people at the forefront of the energy business. All industrial revolutions and now the energy transition have been driven by people, Alex Spencer, chief operating officer at OPITO, the global skills body for the energy industry, wrote in Energy Voice at the beginning of 2024.

In 2023, OPITO’s global network of more than 230 centres across 52 countries trained nearly half a million people to its standards.

Many people in the current offshore industry workforce have the skills and competency to move effortlessly between different sectors of the energy industry, Spencer said.

“There is a great deal of hard-earned competency in our offshore oil and gas supply chain. From floating offshore wind and hydrogen to CCUS and solar, it will serve the clean energies sector well,” he wrote.

“Many in the current workforce already have the skills and knowledge needed to transition. But these skills must be recognised and transferred,” OPITO’s Spencer noted.

The skills body has already shown that remote learning and training also works, through a combination of virtual learning platforms, live instructor-led webinars, e-learning products, and video tutorials.

As the energy transition progresses, skills, upskilling, and training will be crucial to have

talent transfer their competence and hardearned skills to the clean energy industry and emerging technologies.

“The world’s population looks to the energy workforce to make life safe and sustainable. Delivering on this means retaining those hydrocarbon skills whilst nurturing the skills and diversity of the next generation,” says Spencer.

“To create a pipeline of talent, we must present a career in energy as an attractive proposition for our brightest and best young people.”

AI and other new technologies could attract more people of the younger generations to the energy industry. Newer sectors use more AI and digitalisation compared to the oil and gas industry, which is the least advanced energy sector when it comes to AI adoption, according to the eighth annual Global Energy

Talent Index (GETI) report for 2024 released by Airswift.

“As a mature sector with significant skills and sunk costs in traditional technologies, AI uptake will be slower than newer, nimbler sectors such as renewables,” Ian Langley, Chairman of Airswift, says.

“AI could help power the latest technologies from carbon capture usage and storage to green hydrogen, but these are still nascent and attract a small share of investment.”

The report showed that AI is expected to boost workforce productivity and job satisfaction and drive demand for new skills across the entire industry.

In contrast to popular perceptions of automation replacing human jobs, 95 percent of energy workers expect AI to increase demand for human skills, particularly technical skills such as programming, software engineering and IT, and soft skills such as critical thinking, problem solving, and creativity.

A total of 92 percent of workers believe AI will prompt them to acquire new, in-demand skills ranging from cybersecurity to creativity, according to the GETI report.

Amid accelerating automation in the energy industry, almost two-fifths, or 38 percent, of energy workers are already using AI or will begin to do so within six months, and 82 percent are optimistic about its impact.

Most workers, 74 percent, believe automation will boost their productivity, 60 percent say it will improve career prospects and job satisfaction, and 54 percent believe it will even improve their work/life balance by freeing up more time for family and friends, the report found.

“AI is increasing the demand for skills in the energy industry in everything from data security to software engineering,” Janette Marx, CEO of Airswift, said.

“Meanwhile automating repetitive, logical tasks is unlocking the opportunity for greater use of human skills such as critical thinking and creativity, while freeing up time for workers to develop these skills,” Marx added.

Industry organisations in both oil and gas and the renewables sector emphasise the crucial role that a skilled workforce would play in keeping supply of conventional energy sources and accelerating the energy transition.

Many skills acquired in oil and gas industry roles could apply to job descriptions in roles in the clean energy sector.

In the UK, home to one of the most mature oil and gas offshore basins and one of the top offshore wind destinations, two major sector organisations have teamed up to support a roadmap for energy skills transition.

RenewableUK and Offshore Energies UK (OEUK) released at the end of May a joint statement, saying they had aligned on a roadmap for a prototype ‘energy skills passport’ to enable cross-sector recognition of energy industry expertise and training.

Delivery on the commitment to a ‘skills passport’ was set out in both the North Sea Transition Deal and Offshore Wind Sector Deal struck between industry and the UK government.

A cross-sector partnership comprising Offshore Energies UK, RenewableUK, OPITO, Global Wind Organisation (GWO), and representatives from oil and gas and offshore wind energy sector employers alongside government, trade union, trade and skills bodies, have contributed expertise to the skills passport project.

The focus of the passport project is on the alignment of technical qualifications and the mapping of safety standards, the creation of career pathways for relevant roles, and a mechanism for employers and employees to understand recognised standards.

The so-called ‘energy skills passport’ is intended to show both workers and employers how skills and qualifications can

be recognised by employers across sectors such as oil and gas and offshore wind.

“The ability for workers to move smoothly around all parts of the energy mix, from jobs in the oil and gas sector to specialist roles in wind and other areas of the energy transition, can help preserve and expand the UK’s homegrown energy industry and speed the transition process,” RenewableUK and OEUK said.

Research commissioned by OEUK has shown that 90 percent of oil and gas industry workers have skills which can be transferred to new offshore jobs in renewable energy.

“The UK’s energy future hinges upon the expertise of our exceptional offshore workforce,” OEUK Supply Chain and People Director Katy Heidenreich said.

“A skilled future, secure energy, and a sustainable journey to net zero – that is what our people represent. That is what our people can deliver with the right support and crosssector mobility.”

Jane Cooper, RenewableUK’s Executive Director of Offshore Wind, said,

“Offshore wind companies need to attract oil and gas workers with valuable experience and transferable skills into our sector. We will continue to work with a wide range of partners and colleagues from other organisations to achieve this, enabling highly skilled people to find new career opportunities in the transition to clean power.”

“Onboard Tracker™ was the one system that stood head and shoulders above anything else on the market. It has completely transformed how we operate.”

Whether SME, Service Provider, or Operatorwhen it comes to managing workforce skills and training, having the right data in the right place at the right time is the ultimate tool for unlocking operational efficiency.

Onboard Tracker™ is an agile, scalable crew management software enabling a growing number of global clients to achieve 360° visibility of their workforce, and its capability. The tool tracks over 100,000 energy, renewables and marine employees in over 100 countries, across 8000+ sites and empowers clients to own, structure and visualise their data to make targeted, more cost effective and safer crewing decisions, empowered by easily accessible skills and training data, which is complete, current and correct.

By listening carefully to clients, Onboard Tracker™ has been built by industry for industry to solve real crewing challenges and

shape industry standards. Streamlining and automating the accrual of all company-wide training, competence and skills data are core to Onboard Tracker™. Enabling the automation of key integrations with users’ training, competence, e-learning and skills providers means Onboard Tracker™ acts as the master system of record for clients who are assured that centrally held data is accurate, up-to-date and mirrors all other systems and databases. What’s more, by providing self-service log in to direct employees or contractors, the whole workforce is engaged and empowered to own their personal development.

Complex training and competence matrices also allow users to assess the workforce’s ability to mobilise to different sites, into different roles and even to transition into different sectors meaning that knowledge and skills transfer opportunities sit front and centre when decisions are being made.

The scalability of Onboard Tracker™ makes it easy for the system to grow in step with its users, such as Harbour Energy who sought a user-friendly, functionality-rich training and competence software to meet the dynamic needs of a growing workforce. Internally coined ‘MyTrac’ it manages data for 3000 personnel which is held centrally in the single, powerful, connected system and is linked to external LMS and TMS partners for seamless upload of externally attained courses.

For clients like UTEC, tasks which would previously have taken days now take minutes with around 25 manhours saved on data entry every month while Global E&C were able to have Onboard Tracker™ supporting its workforce efficiently and accurately in just four months, consolidating legacy processes into a single software application.

“Nothing comes close to Onboard Tracker™ in terms of operational visibility and efficiency.”

•

How we foster a culture of continuous learning and development

By Lisa Glenday Murdoch

With the Brimmond team working at the forefront of technology and engineering, it’s in our DNA to be curious and continuously learning.

Combine this with our core value of prioritising people in a culture of trust, respect, and collaboration; it’s not surprising that we champion training and upskilling across the company.

We encourage and support members of our team who wish to pursue further qualifications or training, at all stages of their careers, and actively nurture their development. After all, it’s our team’s talent, knowledge and experience which sets us apart, and has earned us a reputation for high-quality, highend products and services.

Our graduate program is a case in point. Laura Grant is nearing the end of her first year and is thriving here at Brimmond! After achieving a first-class Honours Degree in Mechanical Engineering from Strathclyde University, the Huntly native secured her place on the program as a graduate project design engineer. In the past year she has

spent over six months in our workshop, gaining valuable knowledge and hands-on experience, including diesel engine servicing and overhead crane training. Laura said:

“I’m now in the design stage of the program and really enjoying putting into practice everything I have learned during my stint in the workshop. It’s incredibly satisfying to apply my engineering expertise to the challenge of designing projects to clients’ specifications, which simultaneously meet all the standards required.

“I'm constantly developing and learning from people here. Being the only girl in the workshop was a daunting thought to begin with, but after just a few minutes I quickly realised that everyone was very supportive and wanted me to learn as much as possible. I felt part of the team immediately!”

Shaun Booth is another member of the team who has flourished in one of our training programmes. Shaun is set to complete the

third year of his four-year hydraulic and mechanical apprenticeship.

The first two years of the programme were split between studying for his NC in Mechanical Engineering at Tullos College, Aberdeen and working at Brimmond. He has spent time across a variety of different departments, including hires, projects and welding. At the moment Shaun is working in our cranes servicing department, helping to refurbish and rebuild cranes. He said:

“I have relished the opportunity to combine my college studies with the hands-on experience of working with the talented engineers and technicians here at Brimmond. They’re a really supportive bunch, but equally they give me the responsibility to make decisions independently too.”

Shaun credits his time at Brimmond with giving his confidence a massive boost, particularly after he’s been given the opportunity to travel and work on some high-profile projects, such

as the RRS British Antarctic Survey vessel –the Sir David Attenborough.

“The best work-trip I’ve ever been on!” he said.

“Just a car mechanic” is how our Lead Technical Support Engineer, Bruce Cowie, describes himself. While he is undoubtedly a highly skilled car mechanic, having previously been a Master Technician with Audi, Bruce is being very humble here!

Bruce came on board with Brimmond over 10 years ago as a mobile technician in the workshop, travelling the UK and repairing marine cranes. Since then, he has worked offshore and around the world, progressing to a valued member in our office team as Lead Technical Support Engineer.

Within his new role as Lead Technical Support Engineer, Bruce looks after all offshore and

crane department technicians, and project manages all repairs and refurbs in the workshop.

Bruce is also in charge of managing the BAS onsite annual refit scope with a team of technicians. This year he will head up the team of ten technicians attending to cover seven marine cranes, hydraulic systems and PLC systems. He said: