Meet Your Real Estate Team Community: Closings for Classrooms - The Military Move What We Do For You!

Testimonials

Buyer Agency and Disclosures The Home Shopping Puzzle What Are Your Goals? New Home Wish List 10 Step Buying Process

Getting your Finances in Order Monthly Budget

Home Loan Tips

Mortgage Ready Types of Loans

16 Questions to Ask Your Lender

Money You Need Upfront Resale VS New-Construction Contingencies, Exit Doors and Protections Inspection VS Appraisal, What is the Difference? Appraisal Gap, How Does it Work?

07

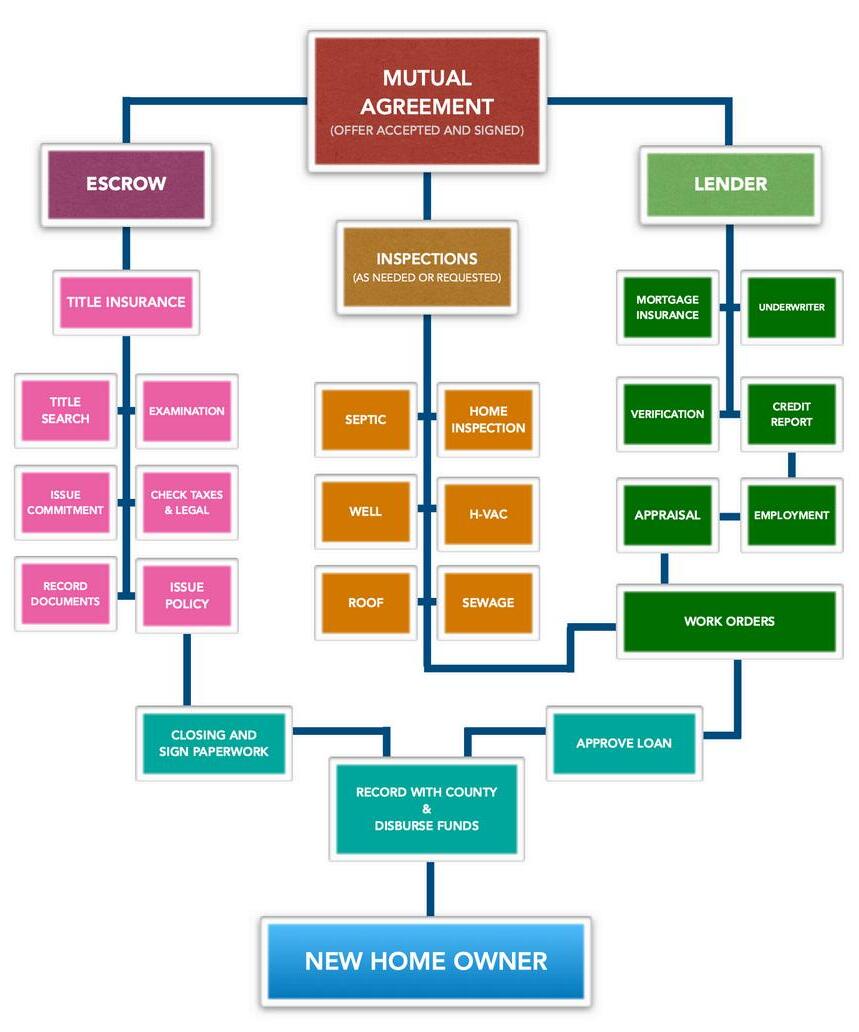

The Life of a Real Estate Transaction

Title and Escrow - Understanding Their Roll Time is of the Essence

You Bought a Home! What is Next?

Move Out Checklist

Yearly Home Maintenance Checklist

08 Definitions Vendor List Notes

Closings for Classrooms™ is an innovative, multi-state initiative founded by our team that transforms every property transaction into a celebration of education! By adopting a Kitsap teacher and their classroom with each home we help buy or sell, we extend our commitment beyond real estate to fostering educational excellence. This exciting program builds on our annual "Teacher Supply Drive," collaborating with local businesses to equip North Kitsap teachers and students with vital supplies. Join us in this mission to empower educators and ignite futures, where every closing contributes to nurturing the minds and dreams of our children and revitalizing our community.

Let's build a brighter tomorrow together!

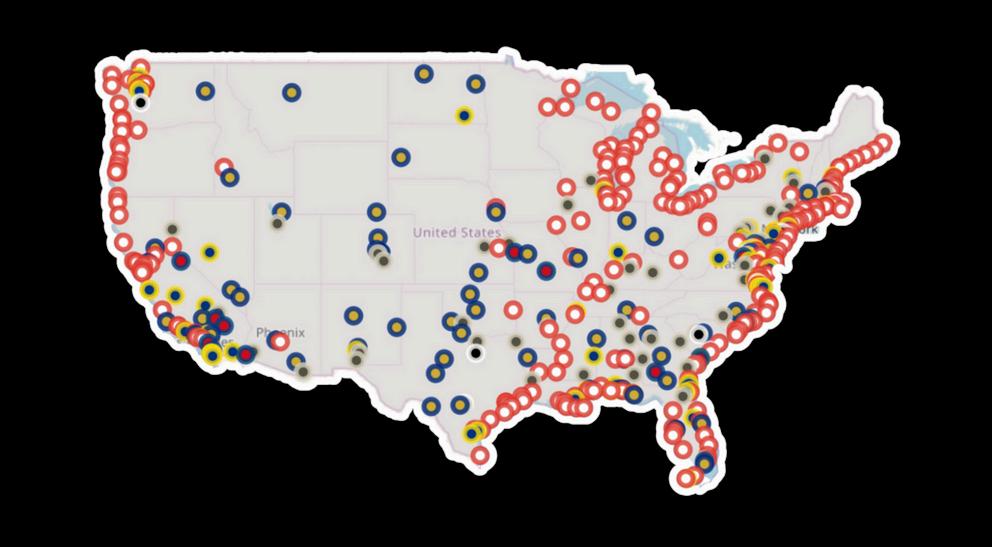

The Military Move initiative serves as an essential guide for military personnel undergoing Permanent Change of Station (PCS) moves. Designed to streamline the process, it offers an array of tips and resources to facilitate a smooth and stress-free relocation. Our site not only provides valuable information for both novices and experienced movers but also connects users with military-affiliated real estate agents located at their new bases. These connections help ensure that military families can find homes that offer both comfort and community. Additionally, we offer special housing credits to help alleviate financial burdens associated with moving. By choosing us, military families receive tailored support that meets the specific demands of military relocations, allowing them to transition into their new chapters with confidence and ease.

PrepareBuyer’sPresentationwithmaterials

PresentPresentationtobuyers

Discussbuyer’sgoalsandpriorities

Discussdifferentlendingoptions

ReferQualifiedlenders

Explaintheloanprocess

Explainearnestmoneytobuyers

Discussmarketstatstodeterminetimelines

Confirmmortgagelender

Obtainmortgageloanpre-approvalletter

Demonstrateagentappandadvantagesofusing

Explaintheproblemswiththirdpartymarketing(Zillow,Trulia)

Createcustomizedhomesearches

ExplainBuyer’sAgencyAgreement

Explainthelawofagencywithbuyersandsellers

Provideapamphletonthelawofagency

Providelocalinformationonareas

Provideinformationonlocalschools(ifapplicable)

Explainthevalueofschoolsonthemarket

Providecurrentlistofhomeforsale

Pre-screenhomesforbuyers

Callagenttocreateshowingappointmentsandimportantinformation

Scheduleappointmentswithtenants(ifapplicable)

Createbuyer’stourguide

Mapouthomesforshowings

Tourpropertieswithbuyers

Takevideoofpropertiesforout-of-townbuyers

Verifykeysandhomeareproperlysecuredforeachlisting

Gathercomparablesoninterestedhomes

DoareverseCMAtodeterminestartingpricetooffer

Explainmarketingstrategiesversusreality

Keeptrackofshowingsandinterest

Researchpropertytaxinformation

ResearchCCRs

Researchzoningrestrictions

ResearchneighborhoodHOA

ResearchMLSdata

Explainaveragedaysonmarket

Adviseonpropertyconditioninrelationtoprice

Adviseaboutpropertylocation

ExplainhowtheMLSworks

Explainterms(active,pending,pendingfeasibility,etc)

Maintainelectroniclockboxapp

Workaroundbuyer’sschedule

Answerallphonecallspromptly

Updatebuyersonpricechanges

Reviewmarketdataweeklyandpricingtrends

Explainthetermsofthepurchaseandsaleagreement

Counselbuyersonofferstrategiesandpricing

Explainalladdendumandcontingencies

Explaintheconsequencesofnotincludingcontingenciesormissing deadlines

Preparethepurchaseandsaleagreement

Obtainsignaturesforthepurchaseandsaleagreement

Transmitoffers/counter-offerstolistingagent

Relaycounterofferstobuyers

Explaincounterofferstobuyers

Negotiatetermsofpurchaseandsaleagreement

Negotiatesellerconcessions

Providepre-approvalstolistingagent

ExplaindisclosureformsincludingForm17

Obtainsellersdisclosuresoninterestedproperties

Explainwirefraud

Provideinformationtocontactescrowcompany

Verifyallsignaturesarecomplete

ForLand–inaddition

Researchcountyzoning

Researchsiteevaluations

Researchwetlanddelineationsandhigh/moderatehazardareas

Researchcontours

ResearcheasementsandCCRs

Researchsepticandwellinformation

Providelistofcertifiedwelldrillers

Providelistoflanddevelopers

Providelistofsepticdesigners/installers

Provideinformationforcountypermits

Providelistofbuilders

Openescrow

Deliverearnestmoneytoescrowagent

Verifytitlecompanyreceivedcontract

Verifylistingagenthasreceivedcopies

Delivercopiesofcontracts/addendumstobuyers

Provideevidenceoffunds–Form22EF

Verifyhomeassociationfees

ObtaincopyofHOAbylaws

Obtainseller’sdisclosure(ifnotalreadyprovided)

Obtainform22K–IdentificationofUtilities

Confirmwatersourceandstatus

Verifynaturalgasavailability

Askforaverageutilityusage/billing

Askfortransferablewarranties

Providehomewarrantyinformation(ifapplicable)

Determineneedforlead-basedpaintdisclosure

Determineleasedequipment

ConfirmFIRPTAstatusforsellers

Communicatewithbuyersonaweeklyschedule

Schedulehomeinspections

Scheduleadditionalinspections(well/septic)

Attendhomeinspection

Attendseptic/wellinspections

Discusspossiblehomerepairswithbuyers

Negotiationsolutionsforhomerepairs

Keeptrackofrepairschedules

Contacttitlecompanyforunderlyingdocuments

Discussappraisalprocess

Negotiateappraisaldeadlines

Contactlenderaboutappraisal

Verifyanyappraisalconditions

Negotiateanyunsatisfactoryappraisals

Refercontractorstobuyers

Coordinatesigningtimesandlocation

Ensureallrepairshavebeenmade

Verifytitlecompanyhasalldocumentsneeded

Solveanytitleproblemsbeforeclosing

Verifypowerofattorneyifnecessary

Reviewclosingfigureswithbuyer

Remindbuyerstoscheduleutilities

Performfinalwalk-throughwithbuyers

Reviewclosingdocuments

Attendclosing

Uploadallsigneddocumentstoappropriate

systems

Closeoutbuyersfile

Verifystatusofhomeischangedtosold

Checkinwithbuyer’safterclosing

T E S T I M O N I A L S

MAGGIE L. - POULSBO

REVIEWING

WesoldourhousethispastfallwithKelsey andJorgehelpingusthroughtheprocess Wefacedchangingtimelines,various inspections,andotherhurdlesandwere guidedthroughitallwithoutanydoubtsor hesitation.Thankyousomuch,Kelseyand Jorge!

RONALD O. - POULSBO

REVIEWING

Couldn’t of ask for a better team to sell our home. Kelsey & Jorge had incredible organization, communication, and transparency that made the sell of our home a pleasant and stress free transaction

JESS D. - PORT ORCHARD

REVIEWING

Kelsey and Jorge are an amazing team and we loved working with them! They helped us purchase a wonderful first home and the process was smooth from start to finish They were extremely responsive, knowledgeable about the area, kept all the moving pieces on track, and had an educational approach which was very helpful for us as first time homebuyers They are also kind and genuine people and we really felt supported throughout the whole process We are so happy with our home and we couldn't have done it without them If you are looking for a home in Kitsap I highly, highly recommend Kelsey and Jorge!

ALAN M. - POULSBO

REVIEWING

IworkedwithKelseyandJorgeonboth buyingahomeandsellingahome Icannot imagineanyonebeingmoreprofessionaland competentthanthesetwopeople Abig thumbsupandthankyousomuchKelsey andJorge.

RAVEN R. - POULSBO

REVIEWING

JorgeandKelseyaregreat theywentabove andbeyondmyexpectations.Wehadto leavetownbeforethehousewassold Jorge andKelseyorganizedallthethingswe couldn't.Theymadethewholeprocessready andstressfree Icouldn'trecommendthen more

ELIZABETH W. - BREMERTON

REVIEWING

We sold our house this past fall with Kelsey and Jorge helping us through the process We faced changing timelines, various inspections, and other hurdles and were guided through it all without any doubts and were so thankful to have Kelsey and Jorge as our Realtors for selling our home They made it so easy and took the time to explain everything which made selling our home easy and less stressful I really appreciated their honest feedback and advice prior to listing our home. Its no surprise that we had multiple offers and sold quickly at much higher than we anticipated If you need a Realtor go with this team. They will get you what you want and be there when you need them Thank you so much, Kelsey and Jorge!

DISCLOSURES - THE BASICS - WHAT TO EXPECT

In Washington State, as agents we are required to provide legal disclosures to every client. A new law which became effective Jan 2024 now requires agents to have a signed Buyer Agency Agreement BEFORE touring homes or provide real estate brokerage services Here is a quick explanation on the agreement and other disclosures

The NWMLS (Northwest Multiple Listing Service) Buyer Agency Agreement (BAA) form in Washington State is essentially a contract that outlines the professional relationship between YOU (buyer) and US (agents). Here’s what it typically includes in straightforward terms:

It specifies how long the agreement will last, during which we will assist you find your next property.

If applicable, the agreement will mention if the agent can also represent the seller, which is known as limited agency, and requires the buyer’s consent

It details whether the agreement is exclusive or non-exclusive An exclusive agreement means the buyer agrees to work only with that agent for properties in the area, while a nonexclusive agreement allows the buyer to work with multiple agents

It explains how much our compensation amount is, as well as what happens with seller paid compensation above our listed rate

The form outlines what the agent is responsible for, such as showing properties, providing market information, and assisting in negotiation and transaction processes

This includes compensation terms, showings with no compensation, VA terms, fair housing, and any additional terms specific to the transaction details

Equally as important as the BAA are the other documents attached in your disclosure package. These help you understand the laws that we are bound by, our relationship with inspectors, information about potential hazards in your home as well as the dangers of wire fraud.

The first step is to determine how much you can afford so you don't waste any time You want to ensure you don't look above your budget. Often this frustrates buyers In today's market, many sellers will not even entertain and offer without a preapproval. With homes selling in days, this is essential

The final stage of the process is receiving keys and becoming the new homeowner

After you move in and decorate, be sure to set aside some time to create a maintenance schedule for your roof, gutters, HVAC, exterior, and interior

Looking for the right home is the most hand's-on part of the process. You will look for homes that meet your needs and determine which home is right for you Acreage? Neighborhood? One-story or two? This is where you get to explore what will work best for you!

You will work together with us to create strong offers that make sense for you. There are lots of different strategies that we will work together on to make an offer that works for you, but keeps you competitive in this market. We always work hard to negotiate strongly on your behalf

The process of signing starts with signing documents Usually this occurs about 2448 hours prior to closing day On closing day, we wait for funds to wire, and official recording numbers, and then we are able to deliver keys Congratulations!!

During the contract, you will be in contact with your lender and escrow Be sure to sign all documents quickly Inspections will occur, you will be reviewing documentation on the home, and providing assets and income verification to ensure you can proceed to closing.

When venturing into the housing market, understanding your primary goals for purchasing a home is crucial. These goals not only shape your approach to house-hunting but also influence your financial planning and overall satisfaction with your investment. Here's a breakdown of different priorities to consider, whether you're looking for an investment property, planning a short-term residence, moving due to a Permanent Change of Station (PCS), or buying your very first home

With the Kelsey and Jorge Real Estate Team by your side, we carefully determine how to best choose your first or next home. Learning your goals for home ownership is just as important as the home itself. During our consult, we will discuss why you are looking to move and buy a home. This information helps us select the right types of properties for you (and even those you may not have considered)

Before you begin looking for a home, know what you're looking for. Create your own wishlist to help you identify all the things that you absolutely must have as well as those items that would be nice, but that you could live without. Print out the checklist, fill it in, and share with your realtor.

Price Range

Approx. Square Footage

Newer Home

Two Stories

Master Bedroom Upstairs

Family Room

Family Room Fireplace

Formal Dining Room

Gas/Heat

Central Air

Eat-in Kitchen

Tub & Separate Shower

Refrigerator

Electric Range/Cook top

Den/Office

Built-In Range/Oven

Self-cleaning Oven

Hardwood Floors

Microwave Oven

Disposal

Dishwasher

Laundry Room

Newer Roof

Automatic Garage Door

Basement

Security System

Landscape Sprinklers

Swimming Pool

Step 1. Start Your Research Early

Start looking at real estate listings Make a note of particular homes you are interested in and see how long they stay on the market.

Step 6. Mutual Agreement

Once you and the seller have reached agreement on a price, the house will go into escrow, which is the period of time it takes to complete all of the remaining steps in the home buying process

Step 2. Find a Lender

Look for a lender that is open past business hours, (available evenings and weekends if need be) and willing to communicate - especially with us If you have a unique loan type, such as VA or bridge loan, ask them how many they typically close a year

Get Pre-approved for Credit for Your Mortgage

Before you start looking for a home, you will need to know how much you can actually spend Ask the lender of a loan cost estimate.

Step 4. Communicate with Your Agents - Us!

At this point, we can use our preapproval to set up searches and go shopping to find you the right home. We will set up appointments or you can view open houses

A home inspection is one of the most important things to learn all about your new home. Home inspections usually cost around $500 and will give you a good idea of the things that need to be fixed, replaced, or maintained during your ownership This also allows you the opportunity to get out of the contract if you don't find it satisfactory

Lenders will arrange for an appraiser to provide an independent estimate of the value of the house you are buying The appraiser is a member of a third party company and is not directly associated with the lender

9. Coordinate the Paperwork

There is a lot of paperwork involved in buying a house Your lender will arrange for a title company to handle all of the paperwork and make sure that the seller is the rightful owner of the house you are buying.

Step 5. Make an Offer Step 10. Close the Sale

In a competitive market - we often have to strategize on how to make our offer attractive to the seller

At closing, you will sign all of the paperwork required to complete the purchase, including your loan documents

As soon as you can, start browsing web sites, newspapers, and magazines that have real estate listings. Make a note of particular homes you are interested in and see how long they stay on the market. Also, note any changes in asking prices. This will give you a sense of the housing trends in specific areas

Local mortgage brokers are typically more available to you as a client after hours and on weekends. They are available to chat about your loan and provide pre-approvals over big banks that work business hours. Make sure to ask them about their fees (origination fees, points, etc ) This will directly affect how much closing costs you are responsible for at signing.

Before you start looking for a home, you will need to know how much you can actually spend. The best way to do that is to get prequalified for a mortgage To get prequalified, you just need to provide some financial information to your mortgage banker, such as your income and the amount of savings and investments you have. Your lender will review this information and tell you how much they can lend you. This will tell you the price range of the homes you should be looking at. Later, you can get preapproved for credit, which involves providing your financial documents (W-2 statements, paycheck stubs, bank account statements, etc.) so your lender can verify your financial status and credit.

nt partners with you when you’re buying or selling a rovide you with helpful information on homes and that are not easily accessible to the public. Our e home buying process, negotiating skills, and familiarity u want to live in can be extremely valuable And best of oesn’t cost you anything to use us as an agent – they’re om the commission paid by the seller of the house.

e range It might be helpful to take notes on home shopping notebook, provided You hard to remember everything about them, es or video to help you remember each details of each house.

the faucet to see how strong the water kes to get hot water urning switches on and off and doors to see if they work properly

rhood and make a note of things maintained?

amily and visitors?

interest to you: schools, nd public transportation?

After you and the sellers agree on the terms of the offer, you are officially under contract. We will open up escrow for you to deposit earnest money, you will apply for your formal loan application providing them all the necessary documentation, and complete all paperwork that title and escrow request. We will provide you home inspectors if necessary and you will order your home inspection to be conducted within the provided timeline. Be sure to look for your buyer schedule that will provide all the necessary items you will need to complete

Typically, purchase offers are contingent on a home inspection of the property to check for signs of structural damage or things that may need fixing. We usually will help you arrange to have this inspection conducted within a few days of your offer being accepted by the seller. This contingency protects you by giving you a chance to renegotiate your offer or withdraw it without penalty if the inspection reveals significant material damage Only you will receive a report on the home inspector’s findings. You can then decide if you want to ask the seller to fix anything on the property before closing the sale or request a credit. Before the sale closes, you will have a walk-through of the house, which gives you the chance to confirm that any agreed-upon repairs have been made

Lenders will arrange for an appraiser of the value of the house you are buy third party company and is not directly associated with the lender The appraisal will let all the parties involved know that you are paying a fair price for the home.

As you can imagine, there is a lot of paperwork involved in buying a house. Your lender will arrange for a title company to handle all of the paperwork and make sure that the seller is the rightful owner of the house you are buying and that title issues are clear and marketable.

At signing, you will sign all of the paperwork required to complete the purchase, including your loan documents. It typically takes a couple of days for your loan to be funded after the paperwork is returned to the lender Once the check is delivered to the seller, you are ready to move into your new home on closing day.

A credit score is a way of measuring how likely you are to pay your bills. It’s one of the key factors that lenders look at when deciding if they will lend you money to buy a home and at what interest rate. The higher your credit score, the better interest rate you can get.Your credit score is based on a credit report that contains information on your credit history, such as the amount and type of debt you have and whether you’ve made any late payments. Credit scores range between 300 and 850.

Depending on your lender and the type of loan you choose, your required down payment can range from 3% to 20% of the purchase price of the home For example, the down payment on a $200,000 home would range between $6,000 and $40,000 With a significant lump sum due at the time of closing, you will need to build your savings before you buy a home

Earner #1:

Earner #2:

Child Support Received:

Additional Income:

TOTAL:

Mortgage Payment:

Property Taxes:

Home Owners Insurance:

PMI (If Applicable):

HOA Dues (If Applicable):

TOTAL:

PERCENT OF INCOME:

Proposed Housing Expenses:

Car Payment/Lease:

Child Support (You Pay):

Student Loan(s):

Credit Card(s):

Home Equity Loan/Line of Credit:

Other Real Estate Owned:

Other (Co-Signed Loans):

TOTAL:

DEBT TO INCOME RATIO:

Earner #1:

Earner #2:

Child Support Received:

Additional Income:

TOTAL:

Phone/Cable/Internet:

Gas/Electric:

Water:

Groceries:

Dining Out:

Cell Phone:

Gas (Car):

Car Insurance:

Car Maintenance:

Medical/Dental/Eye Insurance:

Child Care/School:

Entertainment:

Shopping:

Travel:

Personal/Hobbies:

Charity/Donations:

MISC:

Total Income:

& Expenses:

While a downpayment is not always necessary, it can aid in reducing your loan size, paying down an interest rate, or providing you the ideal monthly payment

Having a good credit score puts you in a position to attract the best deal on your home loan So it’s a good idea to obtain a copy of your credit report before starting the home buying process You will see what your credit profile looks like to potential lenders and can then take steps to improve your credit score if necessary. You get one free report from each credit burea each year.

Mortgage calculators are great tools for helping you understand how much home you can afford. They are very easy to use and can show you how much your monthly mortgage payment would be under different home price, down payment and interest rate scenarios.

The interest rate will be one of the biggest factors in determining the cost of your mortgage. Interest rates for mortgages change almost every day and it is helpful to know which way they are heading.

The mortgage pre-approval process is fairly simple, usually just requiring some financial information such as your income and the amount of savings and investments you have. Once you are pre-approved, you will have a better sense of how much you can borrow and the price range of the homes you can afford. This is crucial in a fast moving market.

When choosing a lender, try to pick a local one. They can work with your agent, make personal phone calls to listing agents to discuss your financing in a competitive situation, and they are reputable in the community on getting work completed on time.

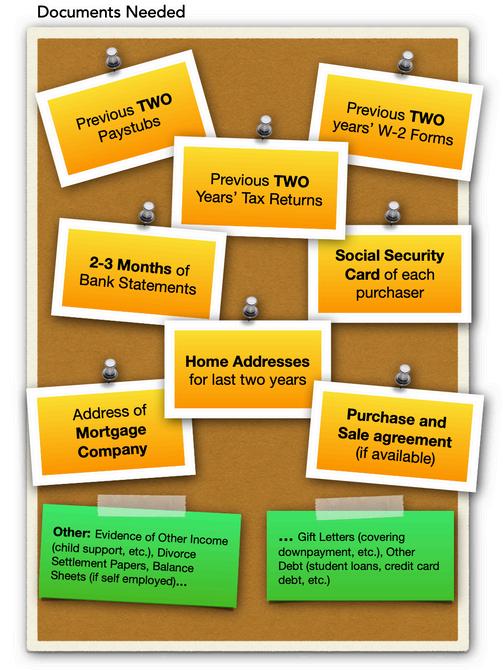

Speed up the loan process when speaking to your lender by having these documents ready.

- Previous paystubs (last 60 days)

- Evidence of other income (child support, alimony, self-employment)

- Previous tax returns (last 2 years)

- Previous W-2s/1099s (last 2 years)

- 2-3 months of bank statements, retirement accounts, stock accounts

- Social security cards of all borrowers

- Driver’s license of all borrowers

- Installment debt (student loans, credit card debt)

Each lender will provide your interest rates, loan term, mortgage insurance, and downpayment amounts. There are different types of loans that you can get from your lender. Specifically check with them to see all of your options. However, there are four common loan types: FHA, Conventional, VA, and USDA Rural.

Allows those with low credit score options to qualify for loans with a high loan-to-value ratio (lower downpayment). Using an FHA loan, you must occupy the residence (or one unit of a multi-family home) that the loan is used to purchase

Allows more financing options with more flexible occupancy types, moderate to higher credit scores needed.

The

What types of mortgage loans do you offer?

The right type of loan for you depends on many different factors – including your income,downpayment,homeprice,creditscore,andmore.

What mortgage loans do I qualify for?

It’s important to find out whether the lender you ’ re considering offers the right type of mortgageforyourneeds Eachlendercanchoosewhichmortgagesitwillorwon’toffer

Can you walk me through my Loan Estimate?

The Loan Estimate is a 3-page document that provides you with important information; including the interest rate, monthly payment, and total closing costs for your proposed loan While it is generally easier to follow, you’ll still want your lender to help you understandtheinformationprovidedonthisform

Discountpointsareavailabletohomeownerswhowanttopayanupfrontfeeinorderto obtain a lower interest rate. They are not mandatory, however. Sometimes, the lowest ratebeingofferedisn’tthebestdealifyouhavetopayalotoutofpockettogetit. Does your interest rate include loan discount points?

Do you charge an application, credit report, or any other upfront fees?

Some lenders charge application fees They are meant to cover the cost of processing your request for a new loan and typically include costs such as credit checks and administrative expenses It varies depending on the lender and the amount of work it takestoprocessyourloanapplication.Somelenderschargenofeeatall.

What costs or fees will I be required to pay prior to closing?

There may be costs you’ll need to cover before closing day Make sure you know about thesesothatyouhavethecashonhandandreadytogo

Do you charge for a rate lock?

A rate lock is an agreement between you and your lender that the interest rate will stay the same until closing, regardless of market fluctuations. Many lenders offer rate locks for30or60daysatnocharge Somelenderschargeforanextendedlockperiod

Do you have an interest rate “float-down” option?

The mortgage rate float-down option allows borrowers to lock in their mortgage rate with a caveat: if rates fall during the underwriting process, you can opt to lower yours Be sure to inquire about float-down options, as not all lenders offer them Others may offerthembutwithdifferentcriteriatoqualify

How long will it take to get my loan from application to closing?

Closing times can vary quite a lot depending on how busy a lender is at the time you apply. Knowing how long it will take to close can help you find the best lender for your needs If your lender is quoting a rate that is good for 30 days, but they need 45 days to getyourloanclosed,you’llwanttounderstandhowthismayaffectyou

Will I be required to pay rate lock extension fees?

Rate locks for a traditional 30–year mortgage are typically good for 30 or 45 days, though some lenders will go up to 60 days If your rate lock needs to be extended beyondthat,chargesmaybepassedalongtoyou

Do you have any mortgage options where I can avoid paying PMI?

PrivateMortgageInsurance(PMI)ismeanttoprotectthelenderincaseofborrower default.It’srequiredonmostloanswherethehomebuyerputslessthan20%down.Itoften costsacouplehundreddollarspermonthontopofyourmortgagebill Fortunately,many lendershavespecialloanprogramswithoutamonthlymortgageinsurancefee(VApays noPMI)

Will I be able to cancel mortgage insurance later on?

Ifpayingformortgageinsuranceisoneofyourmainconcerns,you’llwanttoaskabout howitworkswitheachloantype Somemortgageloanproducts,notablytheFHAloan, comewithmortgageinsuranceregardlessofthedownpayment.Thiscan’tbecanceled unlessyourefinancetoadifferentloanlateron

Do your loans have any prepayment penalties?

Amortgageprepaymentpenaltyisafeethatsomelenderschargewhenyoupayallorpartof yourmortgageloanoffearly Itmayapplyifyoueverdecidetorefinanceforalowerrate Its anincentiveforborrowerstopaybacktheirprincipalslowlyoverafullterm,allowingmortgage lenderstocollectmoreinterest WhilelenderscannotchargeearlypayoffpenaltiesonFHA,VA, orUSDAloans,otherloantypesmayhavethem

How often should I expect to receive updates about my loan process?

Mostlendershavesomesortoffollow–upmethodformortgageborrowers.Besuretoask aboutthissothatyouandyourlenderhavethesameexpectations

Do you work with any down payment assistance programs?

Somelendersmayhaveaccesstocertaindownpaymentassistance(DPA)programsthat othersmaynot And,somemayhavemoreexperienceworkingwithDPAandmaybeable tohelpyouthroughtheprocessmoreseamlessly Ifyouneedit,besuretoresearchthe optionsthatareavailableinyourarea.

Will my loan be sold after closing?

Somehomeownersarecaughtoffguardwhentheyfindouttheirmortgagewassold shortlyafterclosing Thegoodnewsisthatthisisverycommon Nothingwillchangewith regardtoyourloanterm,yourrate,oryourpayment Thelenderhassimplysoldtheloanto generateincomesoitcanmakemoremortgages

Earnest money is a "good faith" deposit for the seller taking the home off the market It goes towards your final closing costs at settlement, or the seller can retain if you breach the contract We will work with you to determine an amount

Inspections are a typical process of home-buying They help you evaluate what issues may arise with the home or are already present. Typically home inspections cost between $400-600. Additional inspections if called out can cause more (scoping sewer lines, electricians, well inspections, contractors). We have great inspectors.

Closing costs are the costs associated with creating the loan to purchase and transfer title into your name These costs may include title insurance, appraisal, title and escrow fees, lender fees, prepaid insurance, prepaid taxes, prepaid HOA fees Buyers typically do not cover agent commissions This could range between $6,000-$10,000 You can roll these into the loan or have seller cover possibly.

If you have a loan program that requires a down payment (Conventional or FHA), this would be the amount that you and the lender agree to Many loan programs will allow you to put 3-5% of the purchase price down; however, you can always choose to put more. VA loans are 0% down to eligible borrowers.

Moving into your new home can also cost you money that you should consider when you move - hiring movers, a moving van/truck, boxes, and turning on new utilities. It's best to budget a few hundred dollars for these last minute items.

Most homes that are purchased in today's market are resale. This is where an individual seller is putting their home on the market and select a buyer to purchase.

Typical closing times are 30-45 days Contingencies are available Changes in pricing - negotiations Closing date is known

New construction homes are built in two ways - spec homes and custom. Custom homes are where everything can be customized (floorplans, position of home, landscaping, finishes, etc.). Spec home are most new construction where the builder has a few plans with some finishing options that a buyer can select.

Builders protect themselves with site agents and addendas

Building retainers (large sum up front)

Upgrades add to expenses (paid up front)

Closing dates can change often so MUST be flexible (30-180 days) What to expect:

In a real estate transaction, contingencies are conditions that must be met for the sale to proceed to closing. These conditions protect both the buyer and the seller by allowing certain actions or outcomes before the final sale When buying these can be seen as exit doors through the contract where if not met by a certain timeline, your Earnest Money Deposit can be at play. Common contingencies include:

Gives the buyer the right to have the property inspected within a specified period. If the inspection reveals significant issues, the buyer can negotiate repairs, a price reduction, or even withdraw from the sale

Allows the buyer to back out of the deal if they cannot secure a mortgage. It also ensures that the property is valued at a minimum, agreed-upon amount. If the appraisal is lower than the sale price, the buyer can renegotiate or cancel the contract.

Allows the buyer to make the purchase contingent on selling their current home. If the buyer cannot sell their home within a specified period, they can back out of the contract

Applicable for properties with septic systems and/or wells This contingency allows for inspections to ensure the septic system is functioning properly and the well water quality and quantity are satisfactory If issues are found, the buyer can negotiate repairs or cancel the sale

Various other contingencies may be included in a real estate transaction. These can include ensuring the seller can provide a clear and marketable title, free of liens and encumbrances; allowing for an inspection of homes built before 1978 for lead-based paint and mandating remediation if lead is found; allowing the buyer to review Homeowners Association (HOA) rules, regulations, and financial statements to ensure they are acceptable We will guide you through the sea of contingencies so you can make a sound decision when purchasing your next home.

Process:

Purpose:

To assess the condition of a property. Identifies potential issues or repairs needed

Conducted By: A licensed home inspector.

The inspector conducts a thorough examination of the home, including its structure, roof, foundation, plumbing, electrical systems, heating and cooling systems, and other components. Provides a detailed report on the condition of the home and any issues found.

Who Benefits:

Primarily benefits the buyer by providing detailed information about the home's condition. Can also help sellers identify issues to address before listing the property.

Outcome:

A detailed report that highlights existing or potential problems, necessary repairs, and maintenance issues.

aappraiser: ppraiser:

Process:

Purpose:

Determines the fair market value of a property. Identifies potential issues or repairs needed before funding.

Conducted By: A licensed appraiser.

The appraiser assesses the home based on its condition, location, size, and recent sales of comparable properties in the area.

The appraisal is often required by lenders to ensure the loan amount is appropriate for the value of the property.

Who Benefits:

Primarily benefits the lender by ensuring the property's value justifies the loan amount. Also provides buyers with a value estimate to avoid overpaying.

Outcome:

A report that provides an estimated market value of the property.

In summary, a home inspection focuses on the physical condition of a home and identifies any potential issues, while an appraisal determines the home's market value. Both processes are important in a real estate transaction but serve different roles and provide different types of information.

An “appraisal gap” is the difference between the appraised value of a home and the purchase price in the sales contract. An “appraisal gap clause (Form 22AD)” is used in a sales contract to guarantee that the home buyer will cover the monetary gap between the appraisal and the sales contract if an appraisal gap becomes an issue. In this "Seller's Market, " we are seeing the majority of homes going above listing price. To ease the seller's concerns (and to make your offer stronger) buyers are including an appraisal gap coverage in most offers presented.

$450,000 $475,000

$500,000

1) 2) 3) 4)

There are 4 basic ways to offer an appraisal gap to sellers with your offer and they go as follows:

Offer NO COVERAGE - If you don't have the funds necessary to do so, this is your only direction; however, this will be a "roll-of-the-dice" for the seller to accept the offer if other offers are on the negotiating table

Cover PART OF IT - Some is better than none! This shows the seller you are unable to cover the entirety of the GAP but you are willing to cover part of it in the event the appraisal comes in low

Cover ALL OF IT - If funds are not a concern, this is the route to go. This shows the seller you are willing to cover the full GAP, so they will be getting the amount written in the offer.

WAIVE APPRAISAL - This option is the riskiest and strongest of the 4 You are basically telling the seller you don't care what the appraisal will be, you have the funds to cover it even if it appraises below the listing price

It verifies property ownership through a title search, issues title insurance to protect against ownership disputes, and ensures a clear title transfer by resolving any issues, preparing necessary documents, and facilitating the closing process.

they conduct an indepth search of public records to verify the property's ownership history and identify any existing liens, claims, or legal issues that could affect the property's title.

They examine the results of the title search, analyzing documents and records to confirm the property's rightful ownership and ensure there are no undisclosed issues that could impact the transaction.

they conduct an in-depth search of public records to verify the property's ownership history and identify any existing liens, claims, or legal issues that could affect the property's title.

They prepare a detailed title report that outlines the findings of the title search, including any issues or encumbrances, providing a comprehensive overview of the property's title status to all parties involved.

issues title insurance policies for buyers and lenders, protecting them from financial losses due to title defects, encumbrances, or disputes that were not identified during the title search.

The title company coordinates with all parties to facilitate a smooth closing process, ensuring that all title-related documents are accurate and properly executed, and that the title is transferred correctly.

They are the unbiased 3rd party They securely holds funds and documents, manages the transfer process, ensures all conditions of the sale are met, coordinates with all parties, disburses funds appropriately, and facilitates a smooth closing by handling necessary paperwork and compliance.

They hold funds from the buyer, such as earnest money, in a secure account, ensuring that the money is safely managed and only disbursed according to the terms of the agreement.

They collect, manage, and verify all necessary documents, including contracts, disclosures, and title reports, ensuring that everything is in order and ready for the closing process.

The escrow closer coordinates with all involved parties—buyers, sellers, lenders, and real estate agents—to ensure that all conditions of the sale are met and everyone is informed throughout the process.

Upon closing, the escrow company disburses funds to the appropriate parties, including the seller, real estate agents, and any other entities owed money, ensuring a smooth financial transaction.

They ensure that all contractual obligations and legal requirements are met before closing, including verifying that inspections, appraisals, and contingencies are completed satisfactorily.

The escrow company organizes the closing process, scheduling document signings, and ensuring that all paperwork is accurately completed and filed, enabling a successful transfer of ownership.

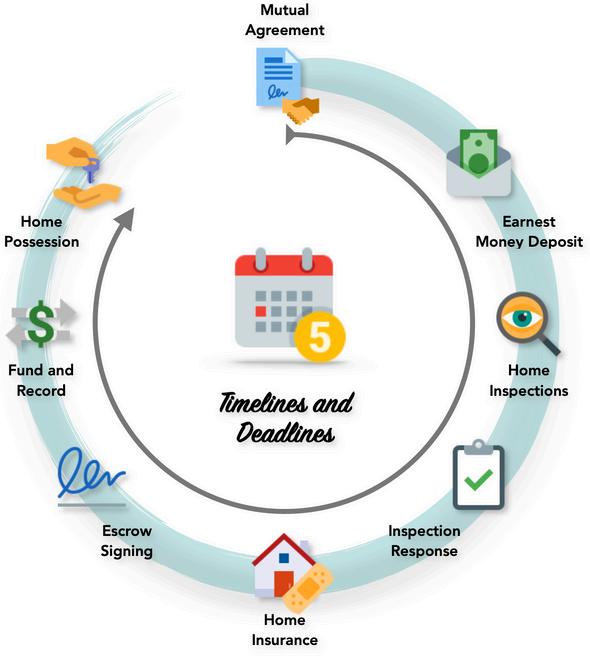

A contract is filled with deadlines in order for both parties to move forward in a timely manner. From beginning to end, we ensure you meet them all to keep you on the track and out of hot water.

Under NWMLS (North West Multiple Listing) contracts timelines expire at 9 pm the day of expiration.

if a deadline is 5 days or less they are counted as business days, If it's 6 days or more they are consecutive

Earnest Money - 2 business days

Home Inspections - Up to 10 days or as agreed on contract

Home inspections Response - 3 business days each side

Lender financing - 5 days to make application

Home Insurance - Get binder after inspections negotiated

Other timelines - As needed

It is recommended you keep all records pertaining to your home together in a safe place, including all purchase documents, insurance, maintenance and improvements.

Change the locks

Now that you got your keys to your new home To ensure security, change the locks upon moving in You don't know how many copies might be spread around.

If you have not already done so, contact the local service providers to make arrangements for electricity, gas, water, phone and cable or satellite services While some providers may need as little notice as a day to activate your services, it’s best to give them a few weeks’ notice setup utilities

You may have received a Title Owner’s Policy at the closing table. If this service is not available in your area, you will receive your policy by mail in four-to-six weeks

Once recorded in the official county records, the original deed to your home will be mailed directly to you, generally within four-to-six weeks

At the closing, written instructions were provided with details for making your first loan payment You should receive your loan coupon book before your first payment is due If you don’t receive your book, or if you have questions about your tax and insurance escrows, please contact your closing agent or attorney

At the closing, property taxes were prorated between the buyer and the seller based on occupancy time in the home

You may not receive a tax statement for the current year on the home you buy; however, it is your obligation to make sure the taxes are paid when due Check with your lender to find out if taxes are included with your payment and if the tax bill will be paid by the lender from escrowed funds

If the home you purchased is in a homestead state, you may be required to declare homestead or file a homestead exemption A homestead exemption reduces the value of a home for state-tax purposes. Please check with the local county recorder’s office to determine eligibility, filing requirements and deadlines

Your local Post Office can provide the necessary Change of Address forms to expedite the delivery of mail to your new home You can speed up the process by notifying everyone who sends you mail of your new address and the date of your move Many bills provide an area for making an address change

You are required by law to notify your state Department of Motor Vehicles (DMV) after any relocation so a new driver’s license can be issued You will also need to have your auto registration transferred to your new address and depending on your state, submit to a driving test and vehicle inspection. Check with your state DMV to determine requirements

Allocate a budget for your move

Organize, declutter & clean

Schedule movers / rental truck

Make inventory of household items

Transfer medical records and refill prescriptions

Get school records & register at new schools

Arrange time off work/ childcare for moving day

Make a plan for moving vehicles, pets & plants

Dispose of hazardous & flammable items

Measure furniture for placement at new home

Defrost freezer, clean refrigerator & oven

Pajamas and clean clothes

Toiletries

Any medications needed

Towels

Toilet paper

Pet food & supplies

Cell phone charger

Important documents

Cash & valuables

Cleaning supplies

Light bulbs

Basic tools

Paper plates, cups & utensils

Coffee & snacks

Hand soap

Remote controls

Kids toys

Plan to be home when mover arrive

Protect floors and carpets

Contain pets in a safe place during movers

Make sure all boxes are labeled accurately

Do a final cleaning and dispose of trash

Take a final walk-through of your home

Leave all owner & household appliances manuals

Leave labeled keys & garage door openers

Turn off lights & lock windows and doors

Check gutters for ice dams & icicles

Inspect fire extinguishers

Clean behind refrigerator & stove

Change HVAC filter (every 30-60 days)

Deep clean oven

Check caulking in bathroom & kitchen

Test smoke detectors (monthly)

Check whole house humidifier for maintenance

Ensure all railings & steps outside are secured

Check and clean range hood filter

Have trees pruned/trimmed away from house

Touch up exterior paint as needed

Spring cleaning-purge and declutter

Check all gutter downspouts & splash blocks

Replace batteries in smoke detector

Have air conditioner serviced

Check for proper grading around exterior

Test garage door auto reverse

Clean gutters of leaves & debris

Check brick, siding, exterior for any damage

Have septic system cleaned & serviced

Pressure wash/clean deck, siding, outdoor areas

Reseal or stain deck

Switch ceiling fans to counterclockwise

Run water & flush toilet in unused bathrooms

Clean garbage disposal (monthly)

Check basement for water intrusion

Clean out/defrost freezer & refrigerator

Vacuum registers and vents

Clean inside & outside windows

Tighten any loose handles/door knobs

Check driveway for any cracks

Flush out water heater to remove sediment

Test GFCI outlets

Have roof inspected for any needed repairs

Clean gutters of leaves & debris

Test sump pump

Check attic for water intrusion

Clean outdoor grill

Have carpet professionally cleaned

Oil any squeaky door hinges

Replace caulking around exterior windows

Tighten any loose nails/screws on deck

Inspect fence for any needed repairs

Replace batteries in smoke detector

Have furnace serviced

Remove hoses from outside spigots

Reverse ceiling fans (clockwise direction)

Check attic for adequate insulation

Winterize outdoor lawn equipment

Create/Practice Emergency escape plan

Shut off supply for exterior spigots

Have fireplace inspected & cleaned

Clean and cover outdoor furniture

Test smoke detectors (monthly)

Have dryer vent cleaned or replaced

Run water & flush toilet in unused bathrooms

Change HVAC filter (every 30-60 days)

Inspect weather-stripping by doors & windows

Clean faucet aerators to remove buildur

Letter from a lender that states they have checked and approved your credit situation in order to purchase a home up to a specified amount.

When all parties have agreed to all the terms of the offer/counteroffer and a legal contract exists.

MLS

MLS stands for multiple listing service It is the housing for all listed transactions Each home is given a unique MLS number to identify it

An evaluation completed by the bank to ensure the home value and that the home is safe

An good faith upfront deposit that shows you are serious about the transaction that is credited towards closing costs or potentially given to seller in the event of a buyer breach escrowmoney

Third party who follows the contract and prepares the paperwork to transfer ownership from seller to buyer

All of the recorded documents against a property including vested ownership (who owns the property), CCRs, easements, etc title

A one time expense at closing that pays for protection against unknown title discrepancies

Opportunities in the contract to further investigate and provide the ability to exit if unfavorable terms are found

The day that you sign all county and loan documents to officially transfer ownership The day that the funds are transferred to seller and the deed is recorded in the buyer's name at the courthouse

When a potential buyer creates a legal offering to a seller to purchase a property

encumberance

Something that burdens the property (a lien, a rental agreement, or a physical item such as a shop/barn/fence)

A statement of credits and debits to show how much is owed or due back to buyer and seller to close the property transaction.

A VA (veterans) loan term that indicates there was a low appraisal on the property and provides the opportunity to give the appraiser additional comps

A legal point of access over a property It can be for ingress/egress (in or out), utilities, or personal access

The process with the lender where the financial file gets a thorough verification of all documents provided with the loan application.

Covenants, conditions, and restrictions that are placed on a piece of property. Typically they are found in neighborhoods or tracts of land cc&rs

Another property that compares to the subject property in similar characteristics

National Bank of Kansas City

Kelsey Brahl - 913-302-7638 kelsey brahl@nbkc com

Crosscountry Mortgage

Shawn Guerrero - 360-990-0637 shawn guerrero@ccm com

Evergreen Home Loans

Amber Page - 360-731-1163 apage@evergreenhomeloans com

Fairway Mortgage

Kerri Selby - 360-930-1694 kerris@fairwaymc com

Local Inspections

Bruce Hansen

360-865-2336

Local inspections@outlook com

ClearPoint Home Inspections

Mitch Sudy

360-552-5060

info@clearpointhi com

Pillar to Post Home Inspections

The Jarquin Team

360-919-6667

justin jarquin@pillartopost com

Cloise & Mike Roofing

360-769-0141

www cloiseandmike com

Port Orchard Roofing

Riley Ragan

360-649-7801

Rileyr@poroofing com

Hanley Construction

800-593-7663 hanleyroofing com

Queen Bee Cleaning

360-868-7272

nikki@queenbeecleankitsap com

Details Cleaning Company*

360-260-9736

info@detailscleaningco com

White Rose Cleaning Services

360-620-2518

jacquiswhiterose@hotmail com

Good Scents Carpet Cleaning

360-394-5326

Goodscentscarpetcleaning com

Centurion Carpet Cleaning

360-633-6789

www centurioncarpet com

His Touch Carpet Care and Detail Services

360-908-2153 Histouchcarpetcare com

Carpet Recovery

360-856-9829

www carpetrecoverykitsap com

Dana’s Heating and Cooling

360-876-7670

happyday@danasheating com Danasheating com

Sullivan Heating & Air

360-405-0723 info@sullivanheating com sullivanheating.com

Peninsula Heating and Cooling

Nathan

360-613-5866

peninsulaheatingandcooling.com

Kitsap Paint and Home Repair

360-271-6087

kitsappainting.com

Jefferson Fine Home Builders

206-842-1123

http://jeffersonfinehomebuilders com

West Sound Plumbing Services

360-697-9900

www westsoundplumbing com

Swift Plumbing and heating

360-297-9592 www swiftplumb com

MD Electrical - Poulsbo and surrounding areas

360-779-6388

http://www mdelectricalkitsap com/

Mathews Electric

360-598-1850

www mathewselectriccorporation com

Matias General Services, LLC

360-801-1192

Lic#MATIAGS777LT

McClain Landscape Services*

Design - Build - Maintain

360-638-0888

www mcclainlandscaping com

Sweetwater Septic

360-930-2127

https://mysweetwaterseptic com/

Olympic Glass

206-880-7443 olyglass com

Kitsap Septic

360-871-5258

https://www kitsapseptic net/

*owner related to Broker, no financial interest Can’t